Weekly Economic Commentary – Oct 24, 2021

Markets

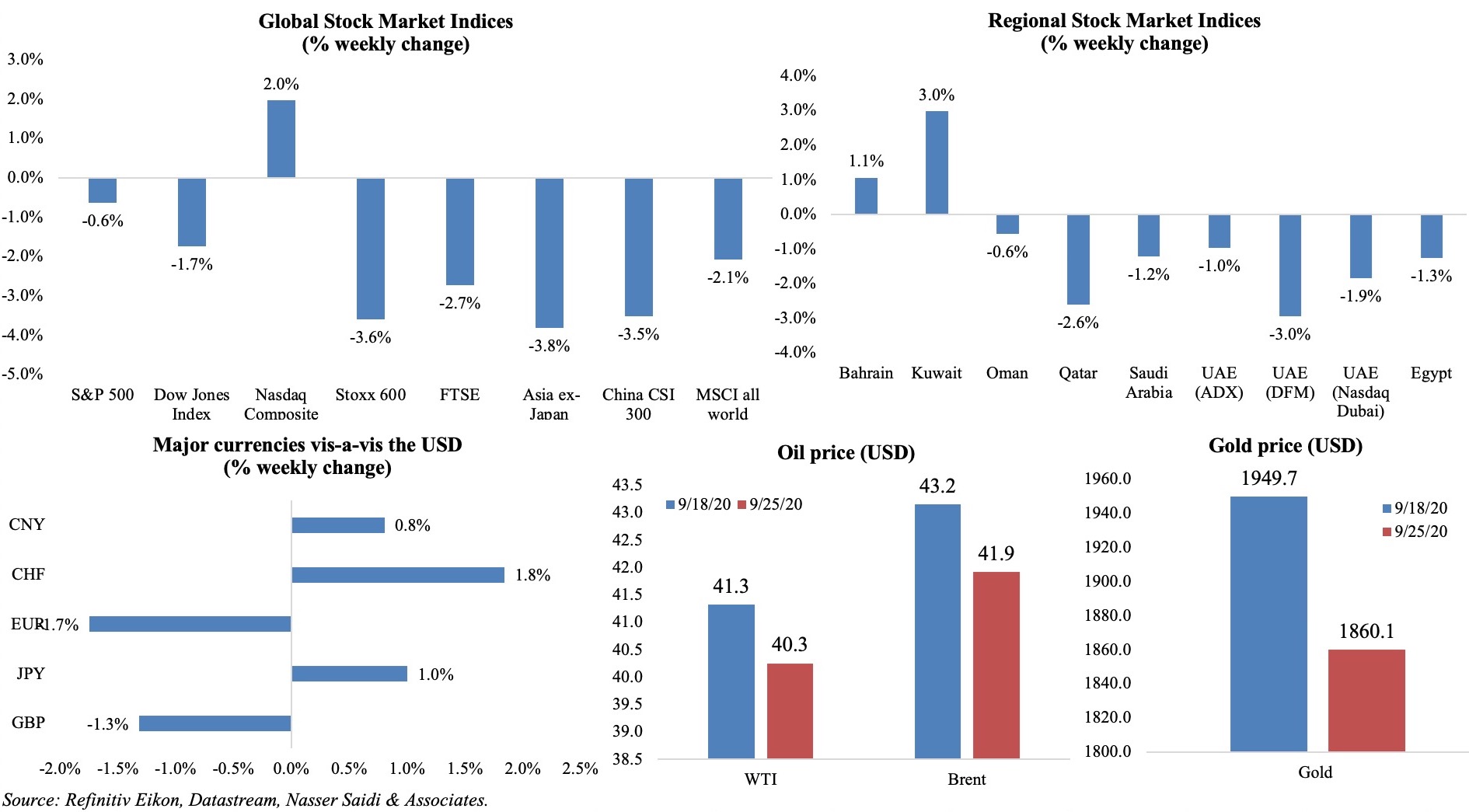

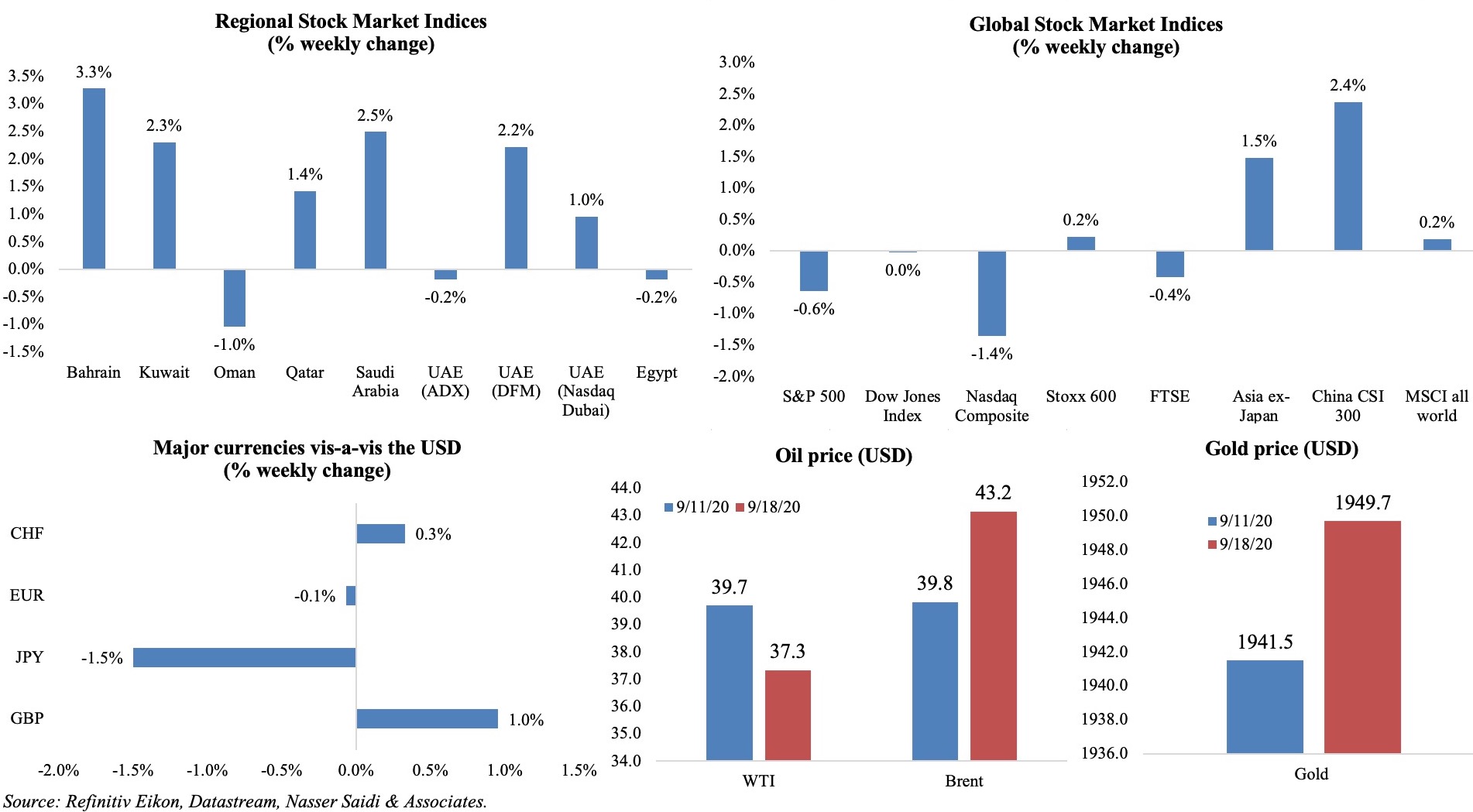

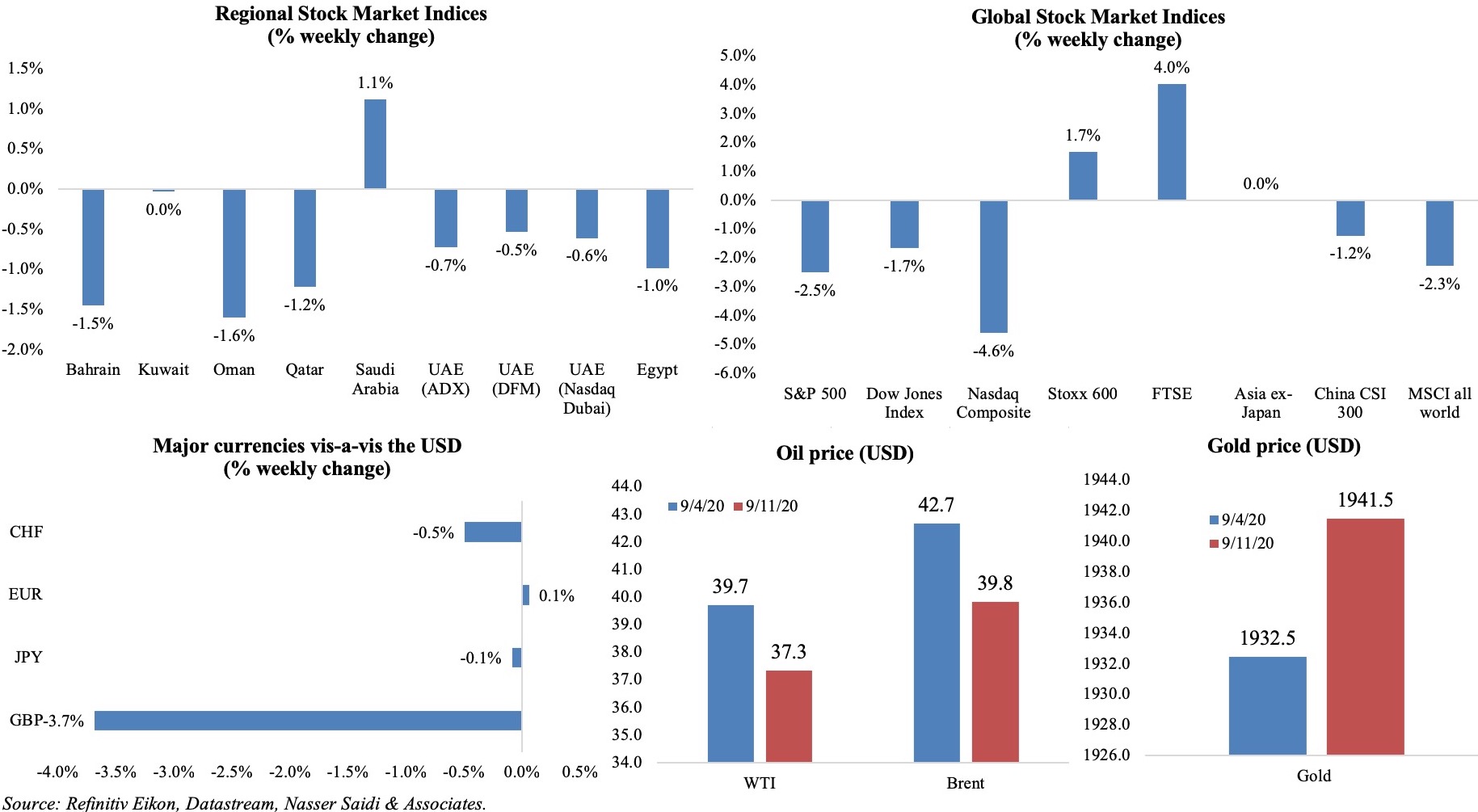

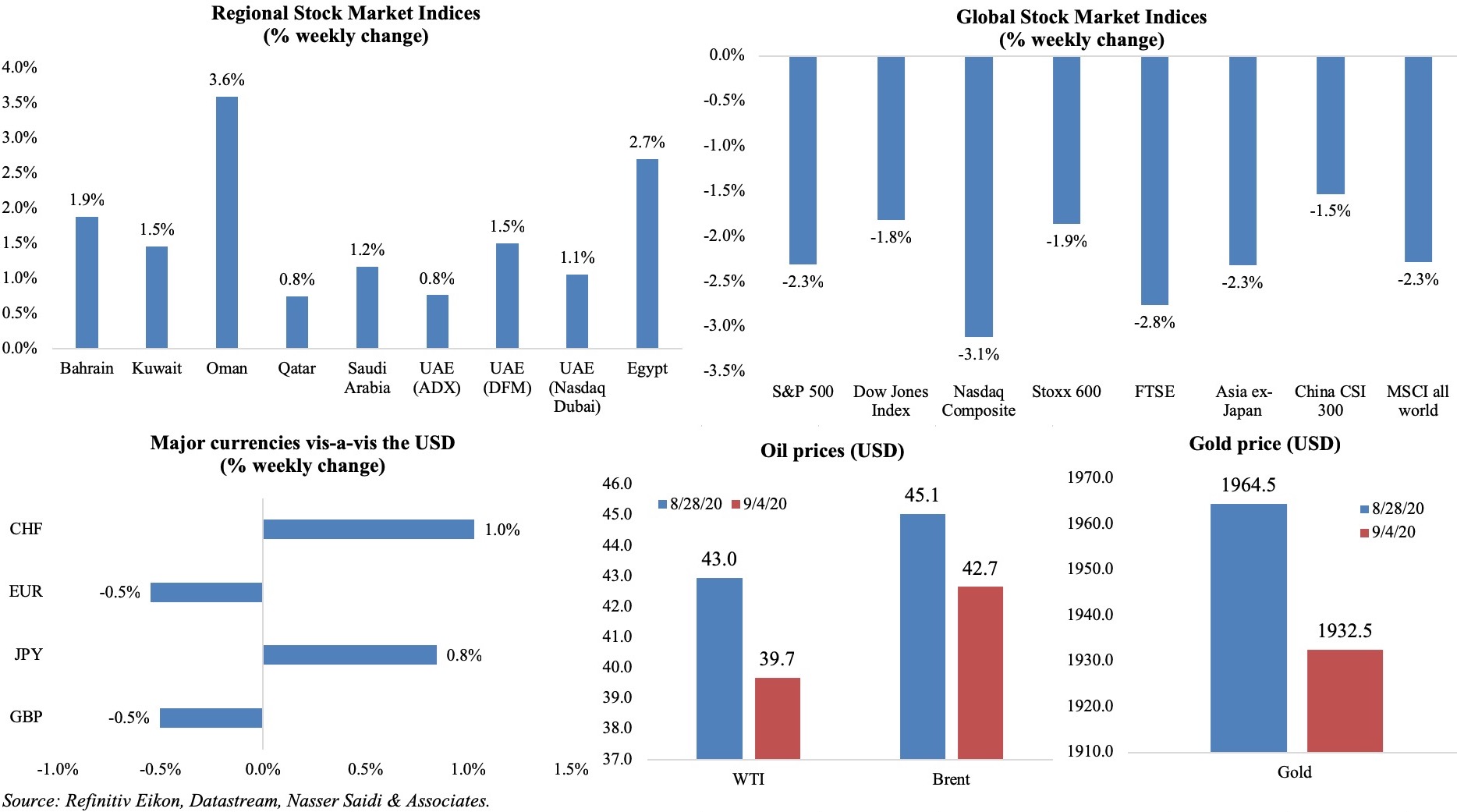

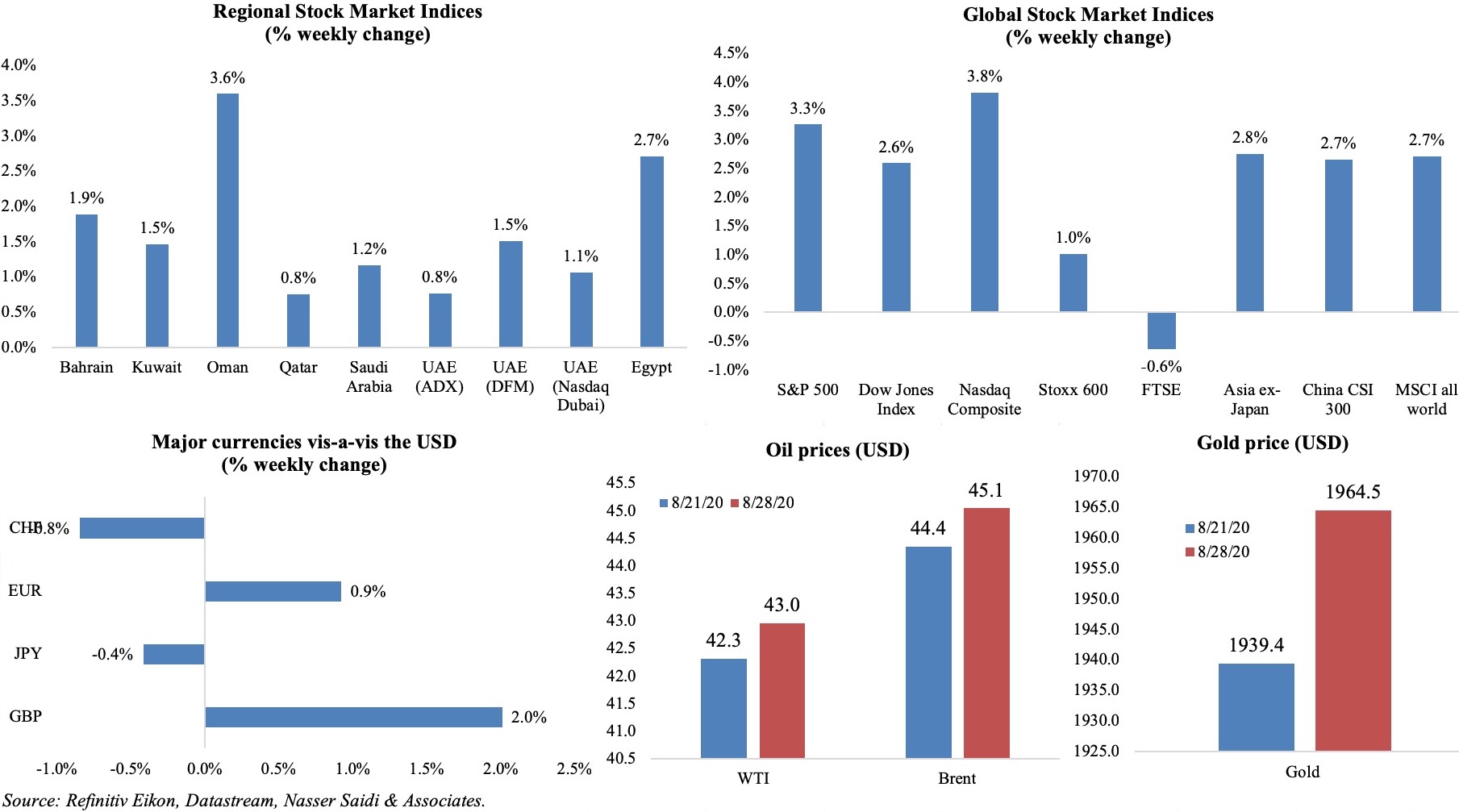

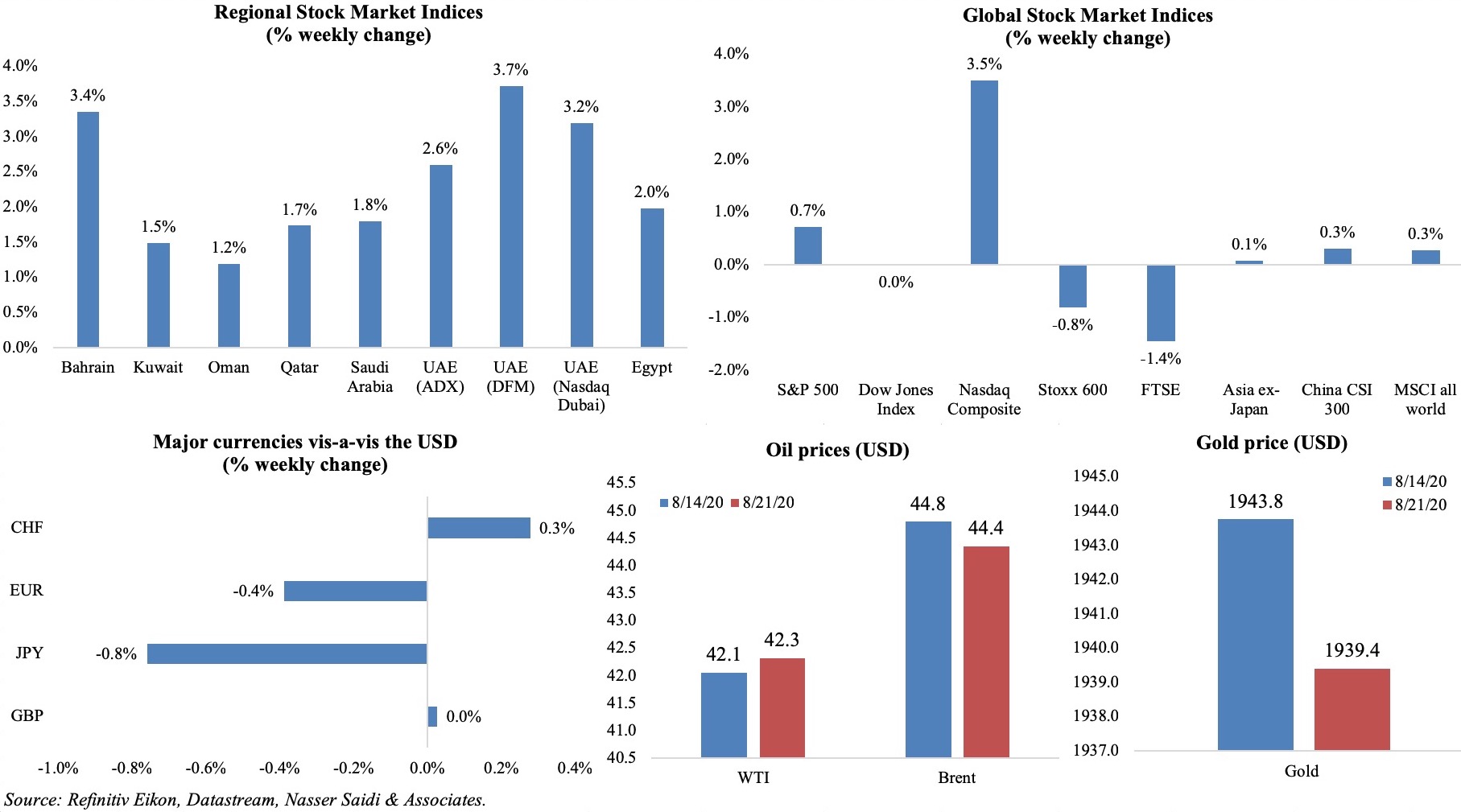

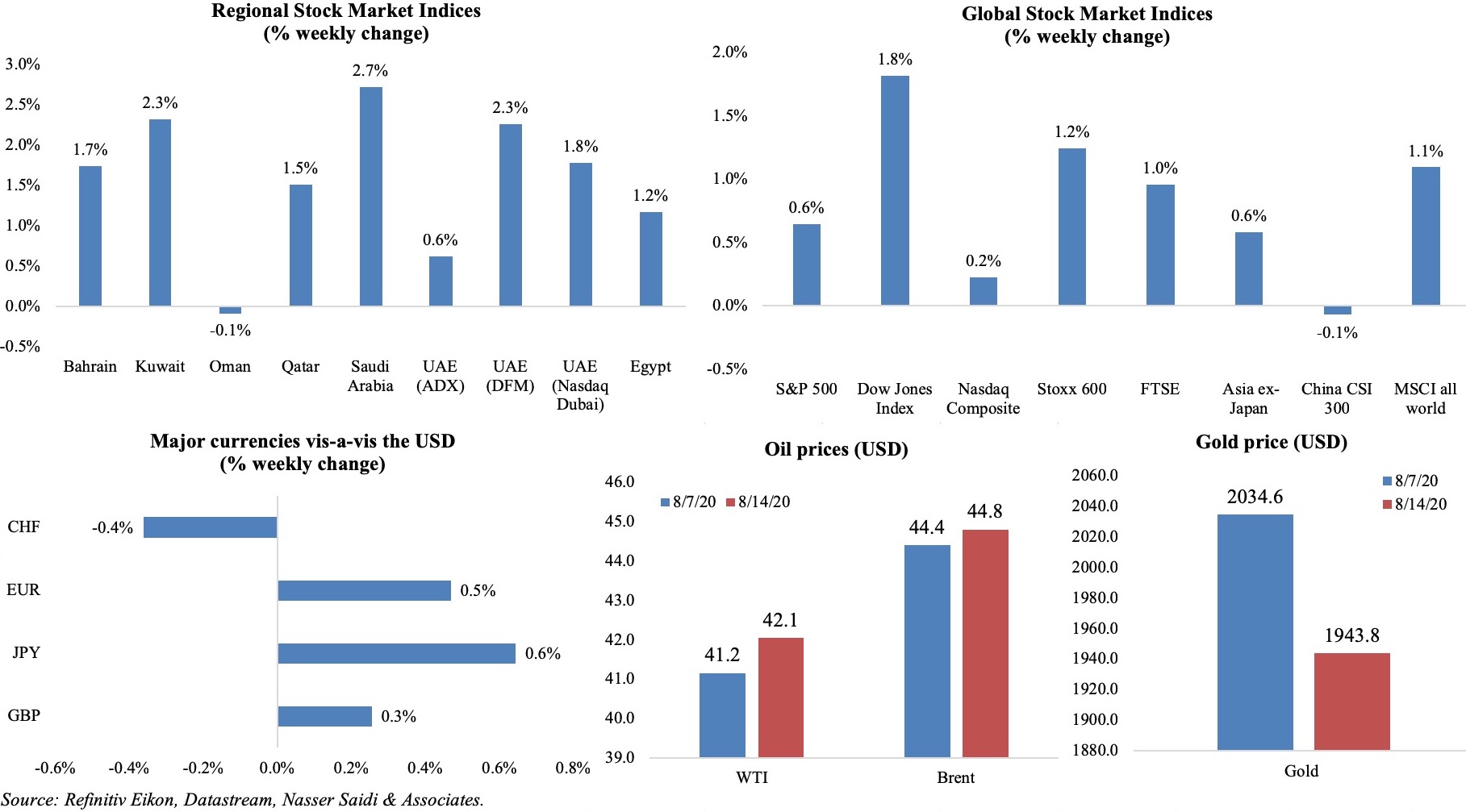

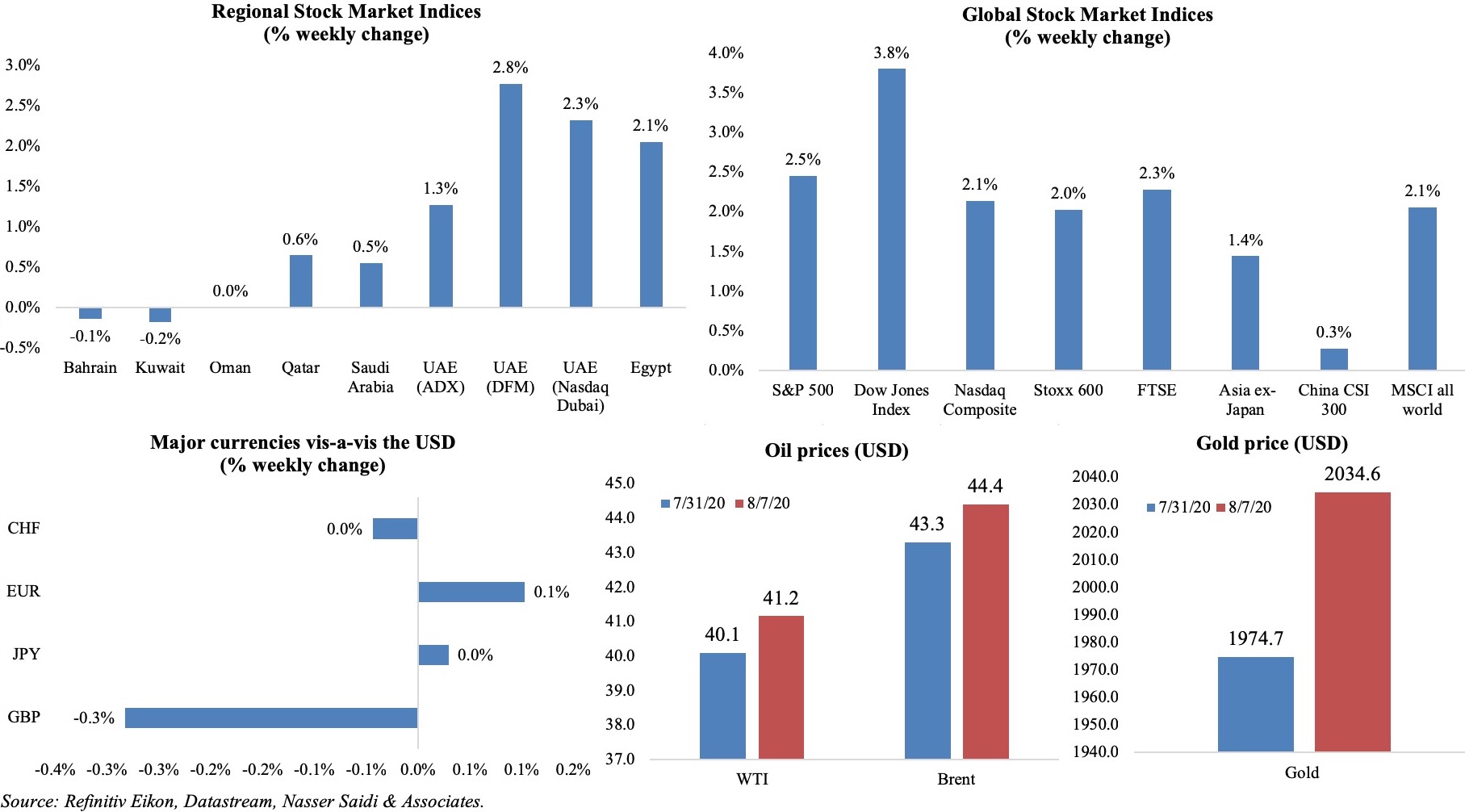

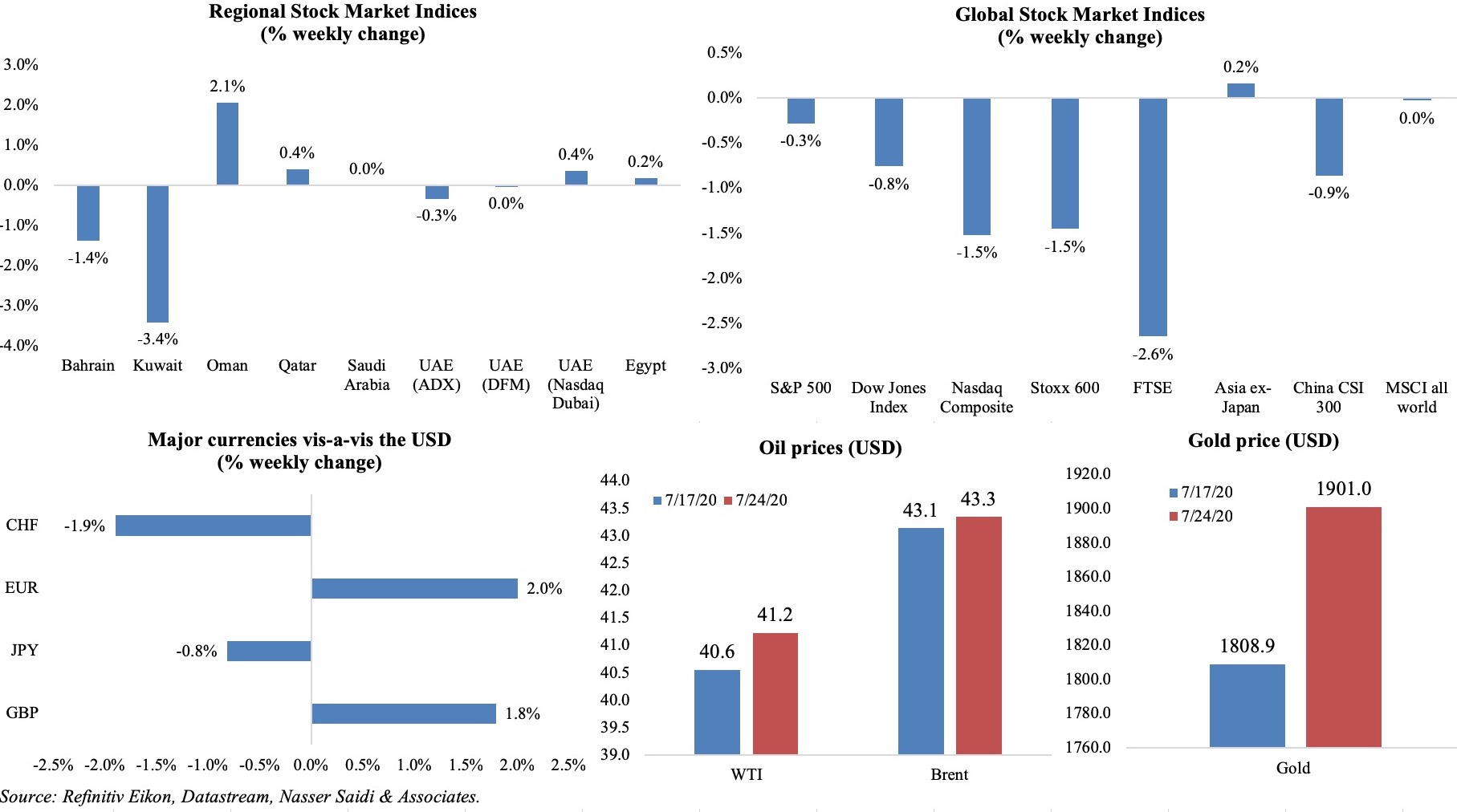

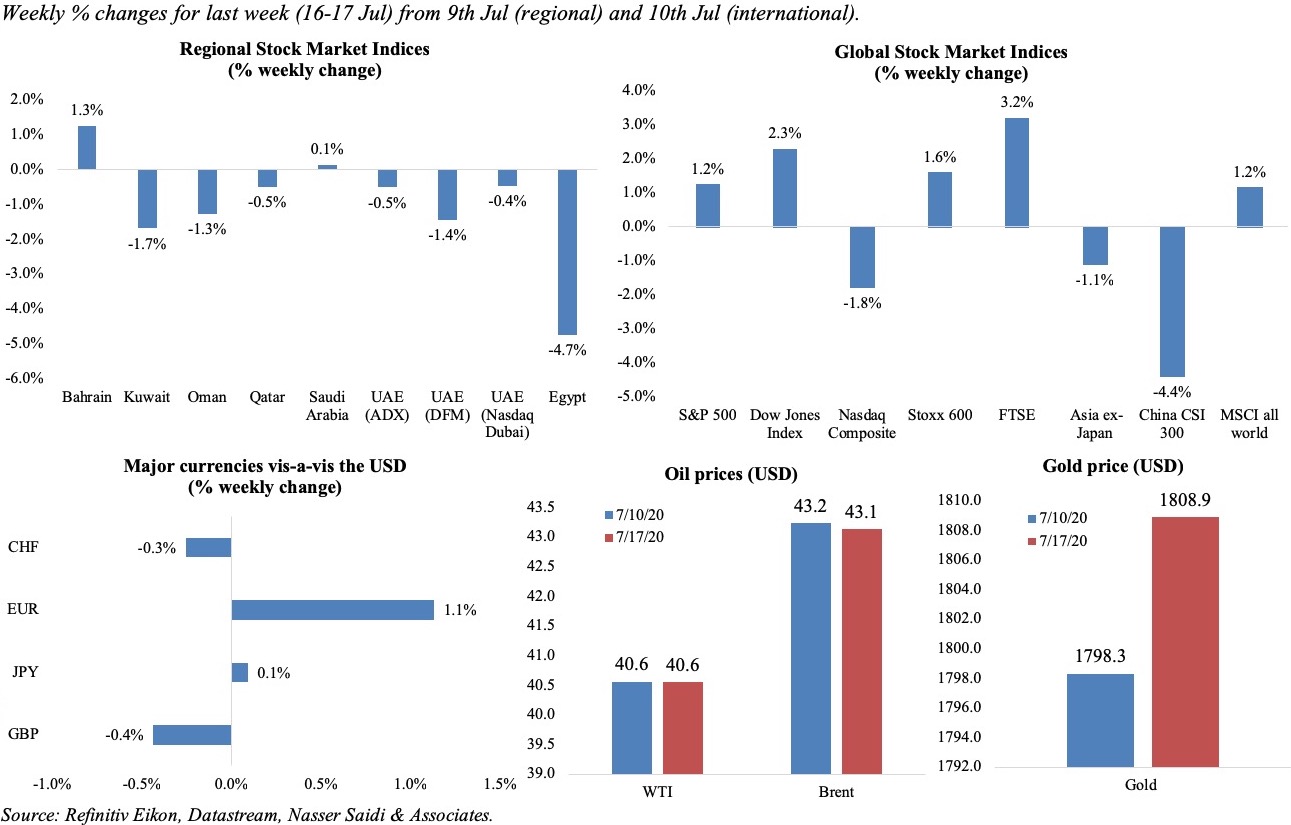

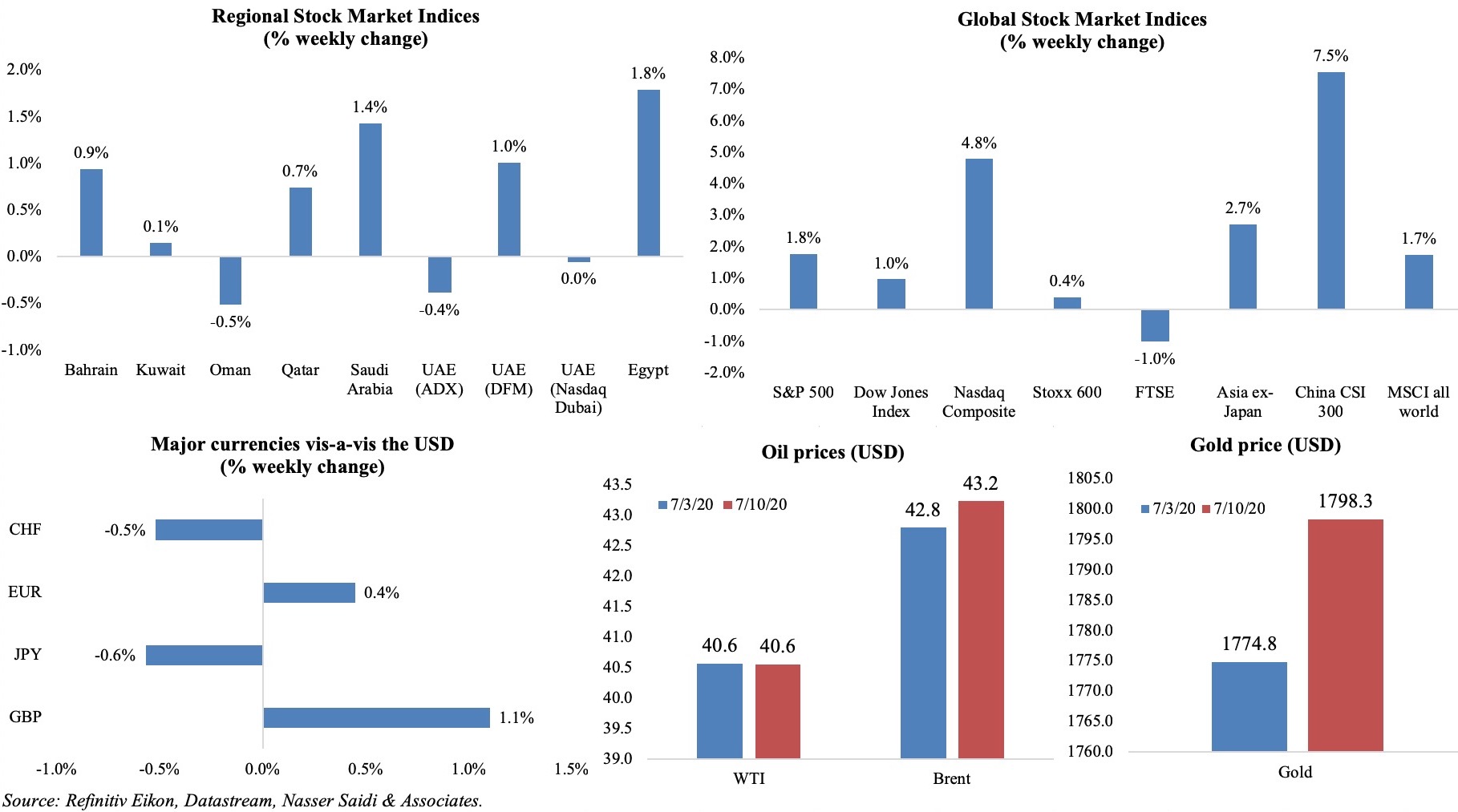

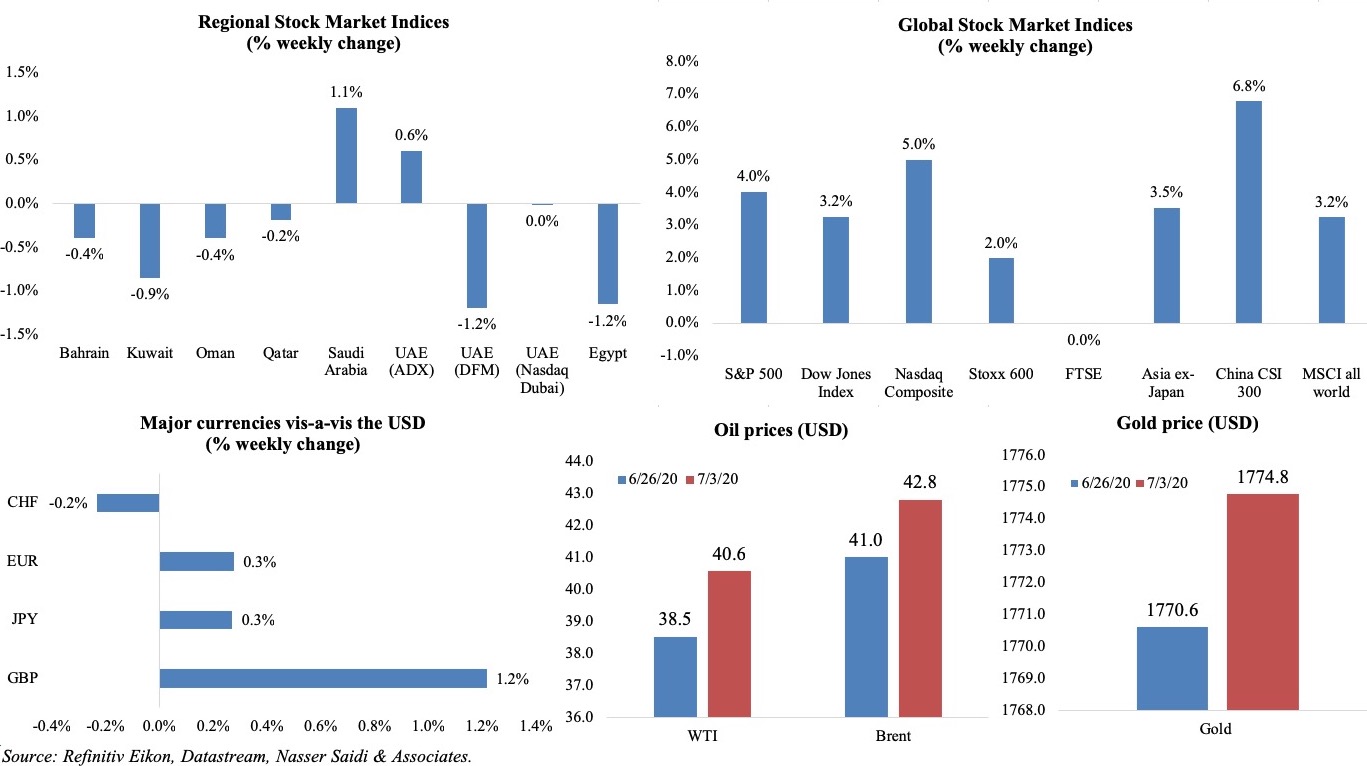

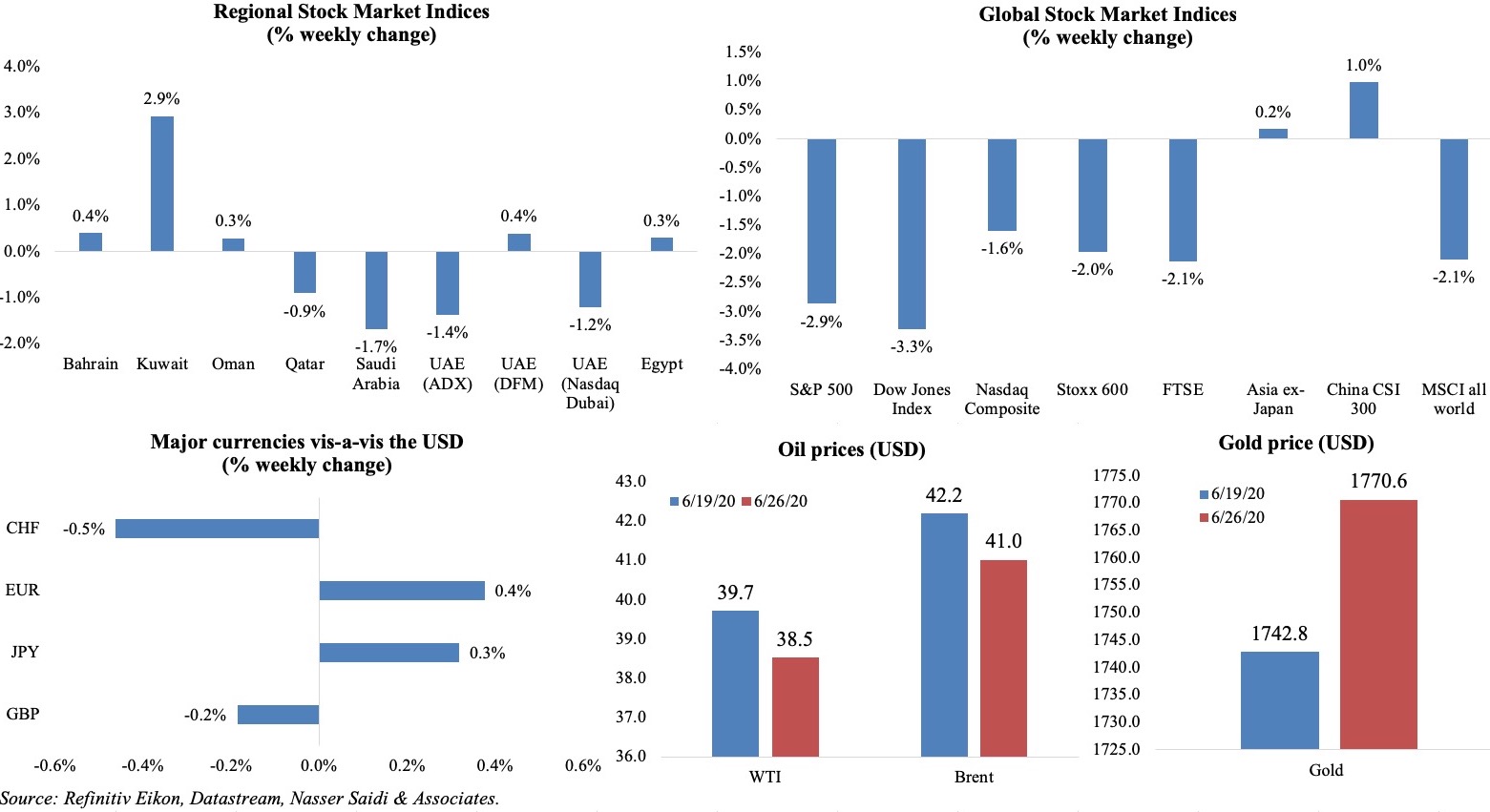

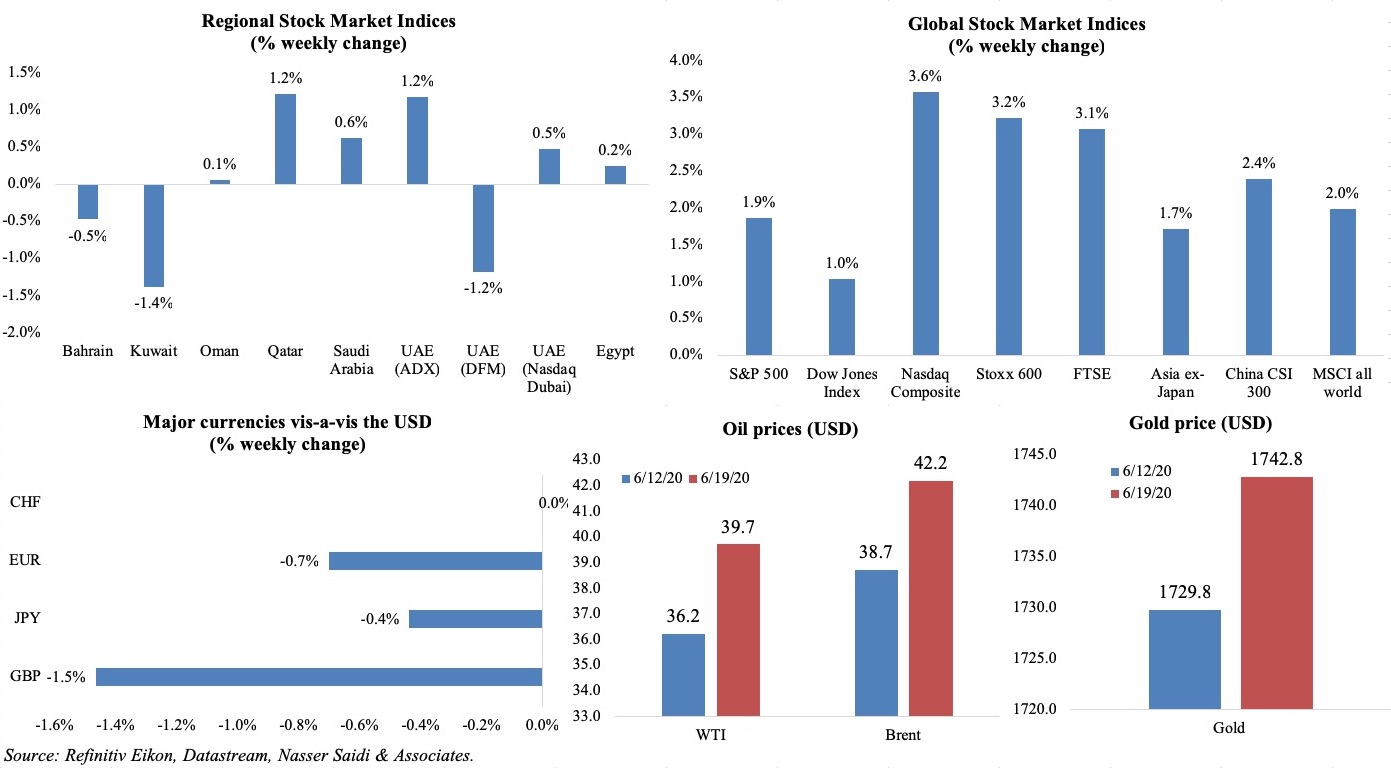

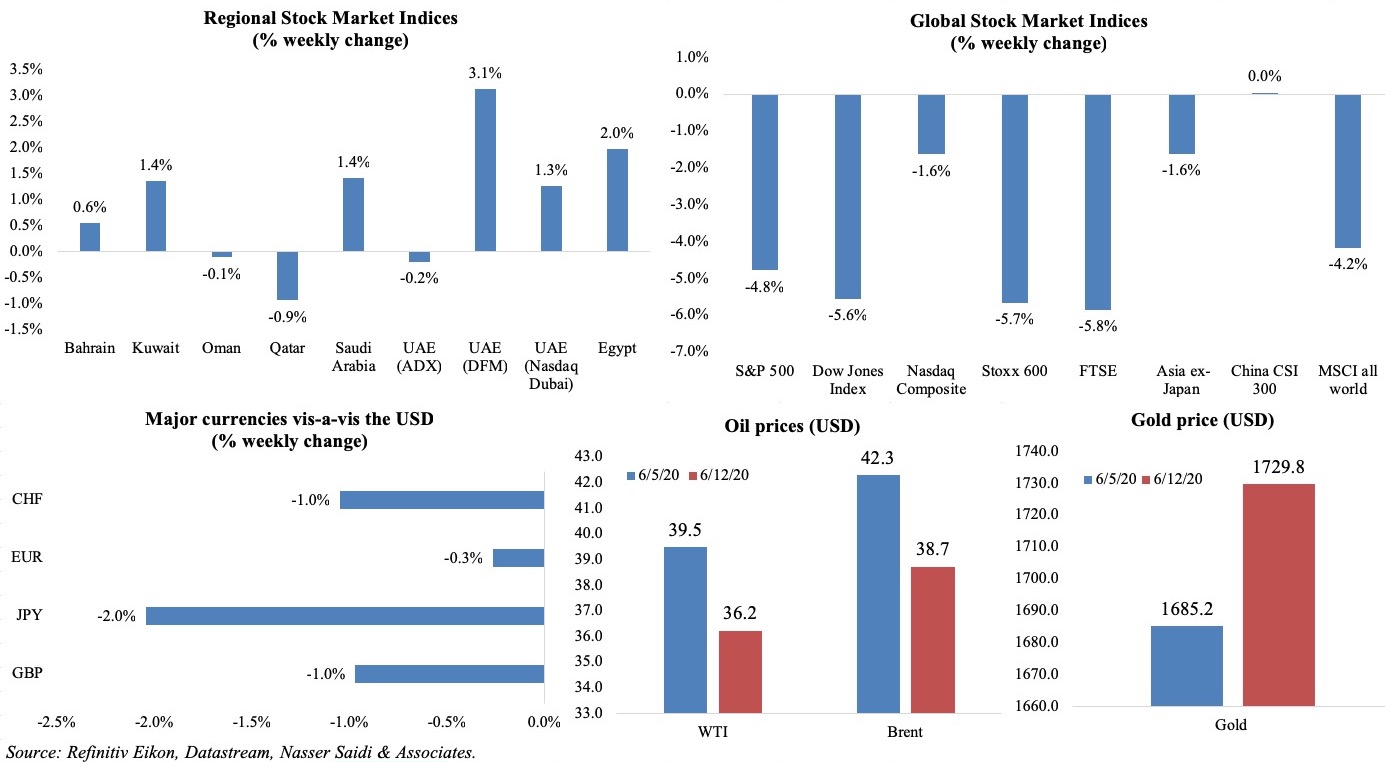

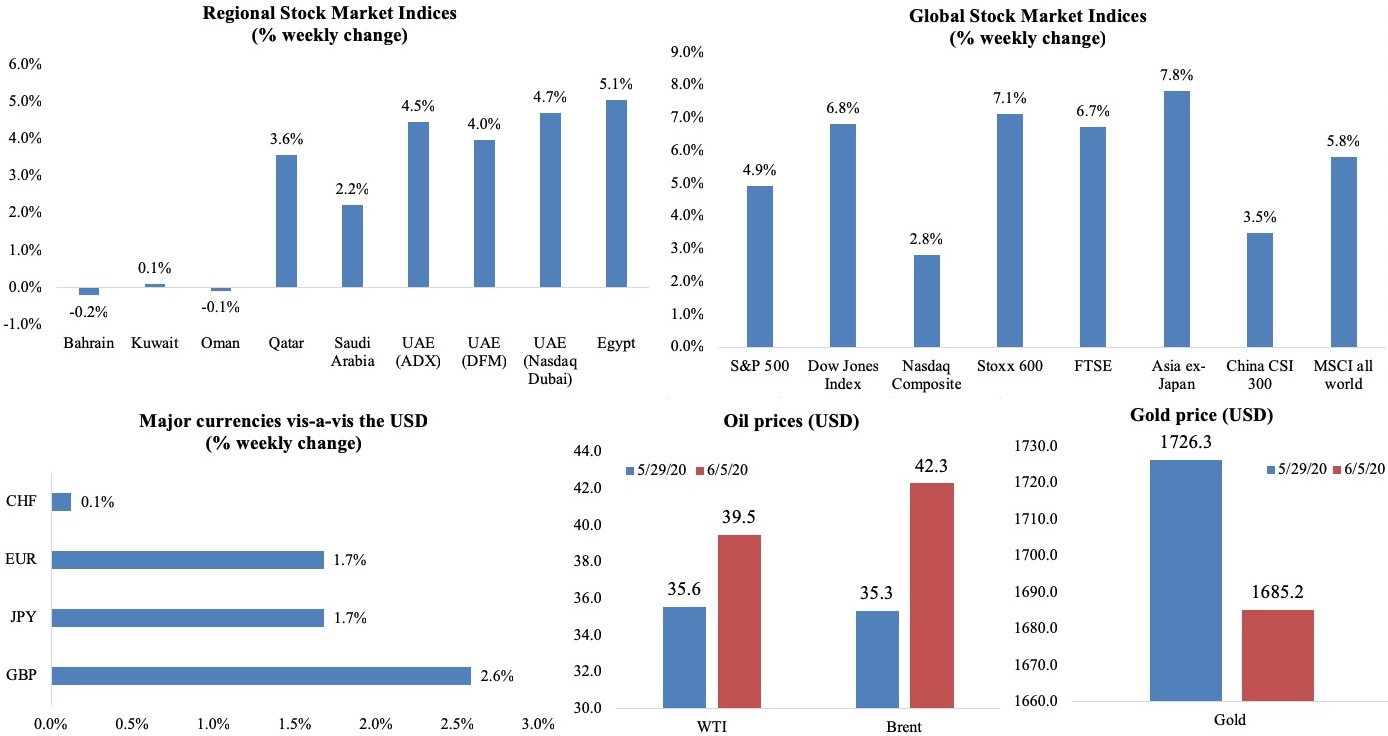

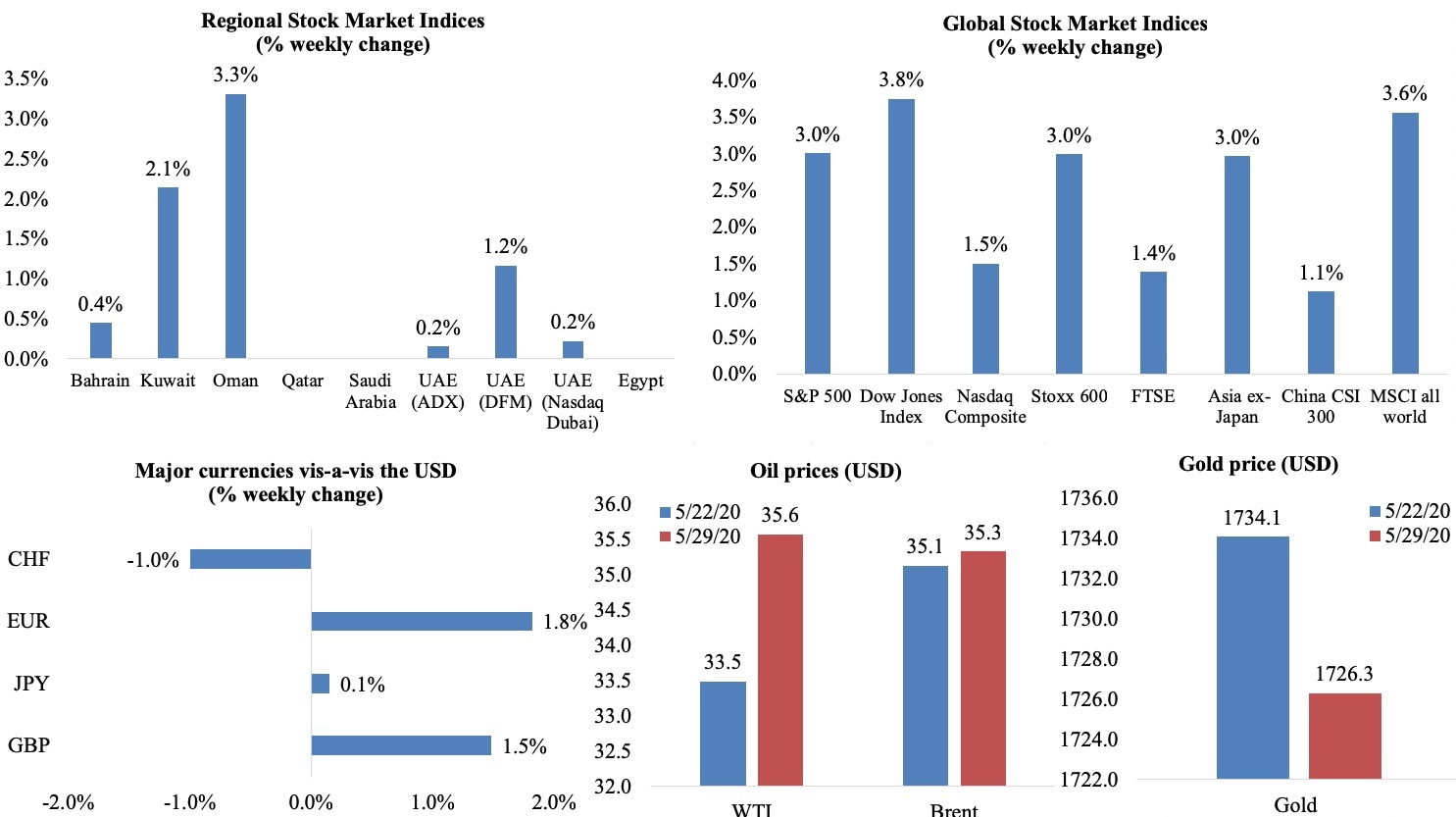

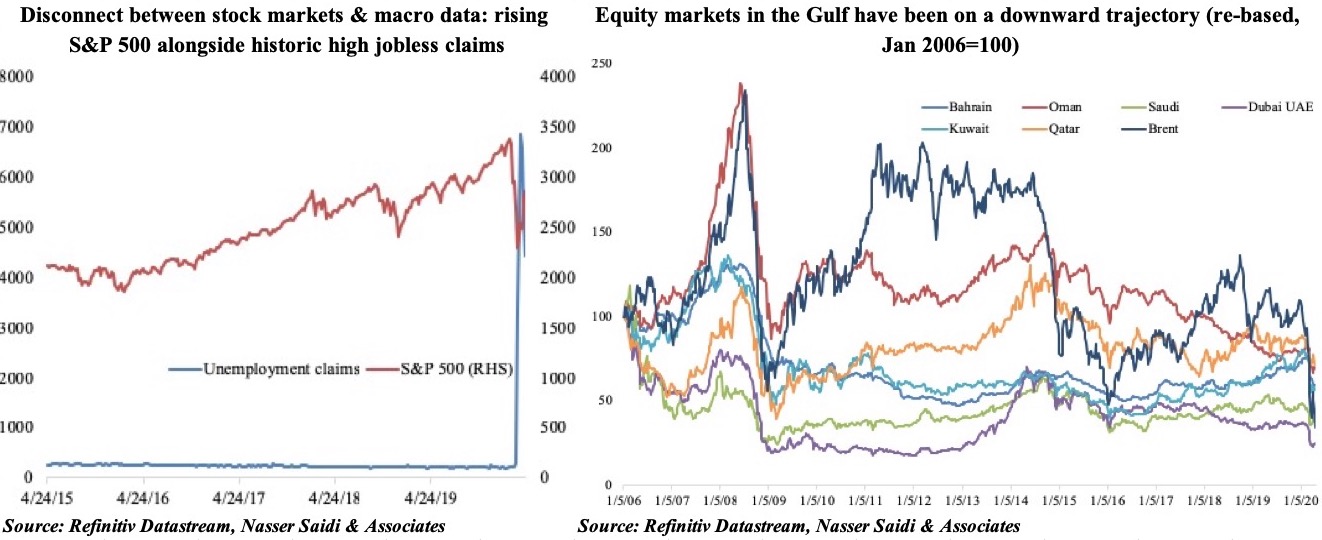

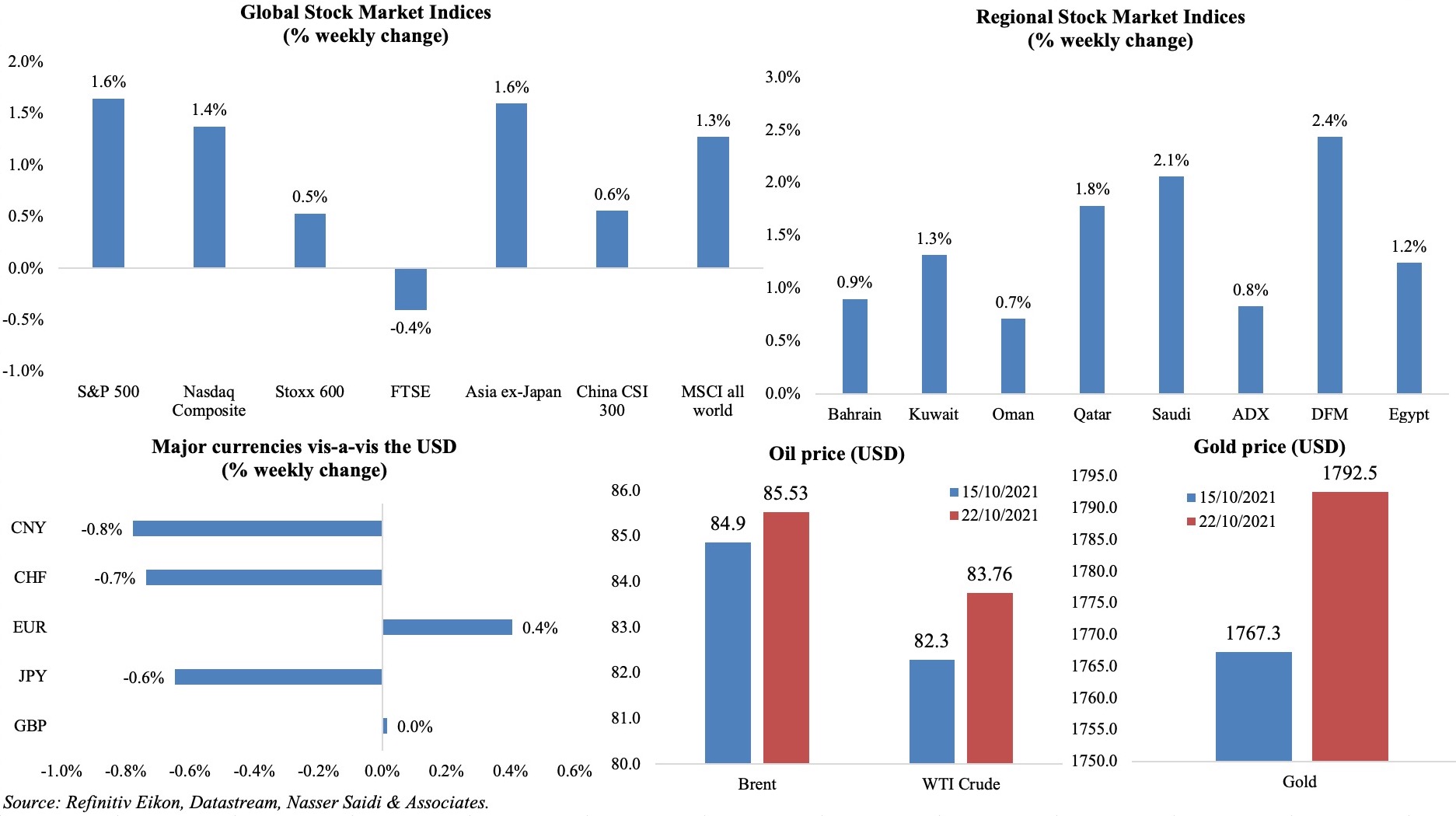

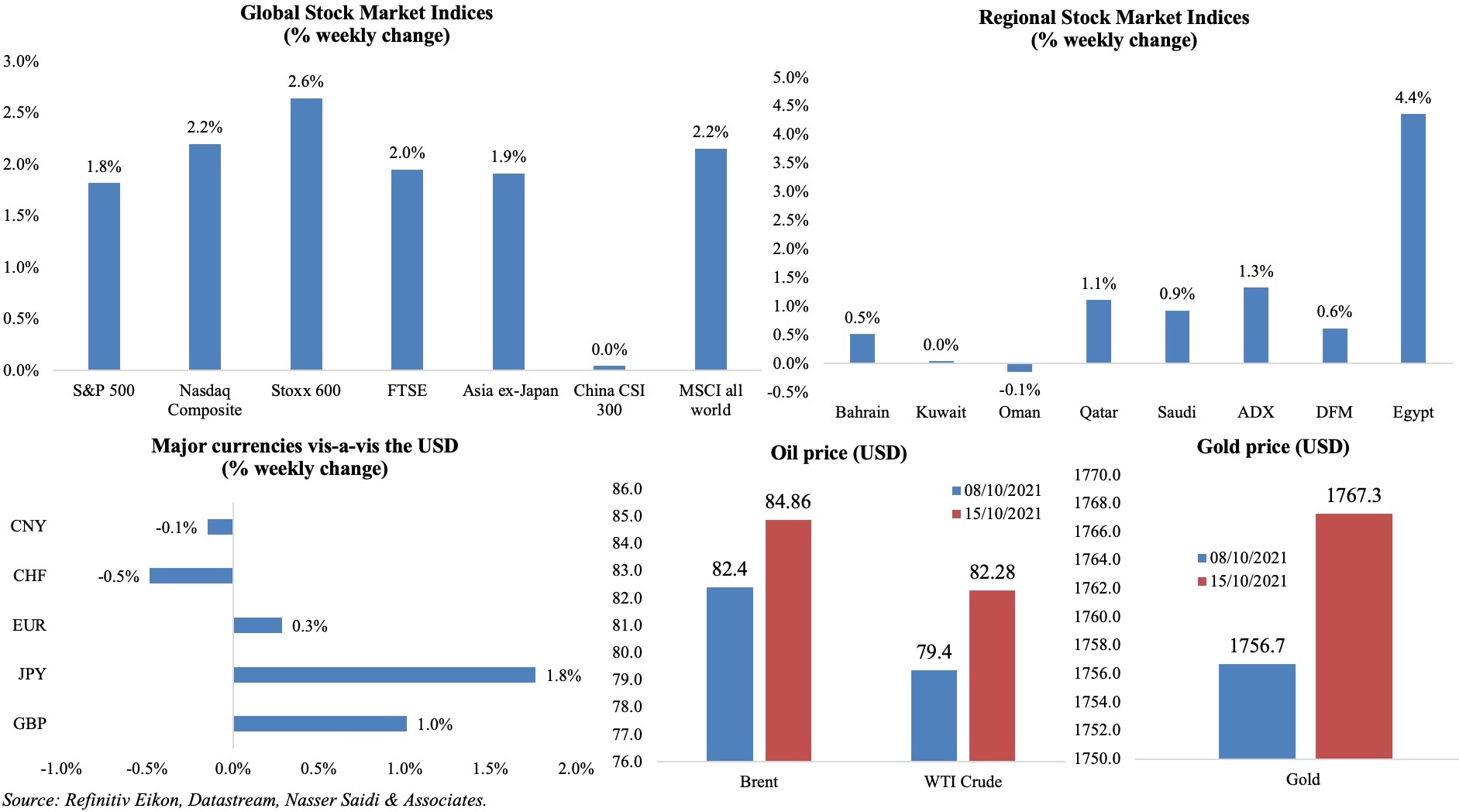

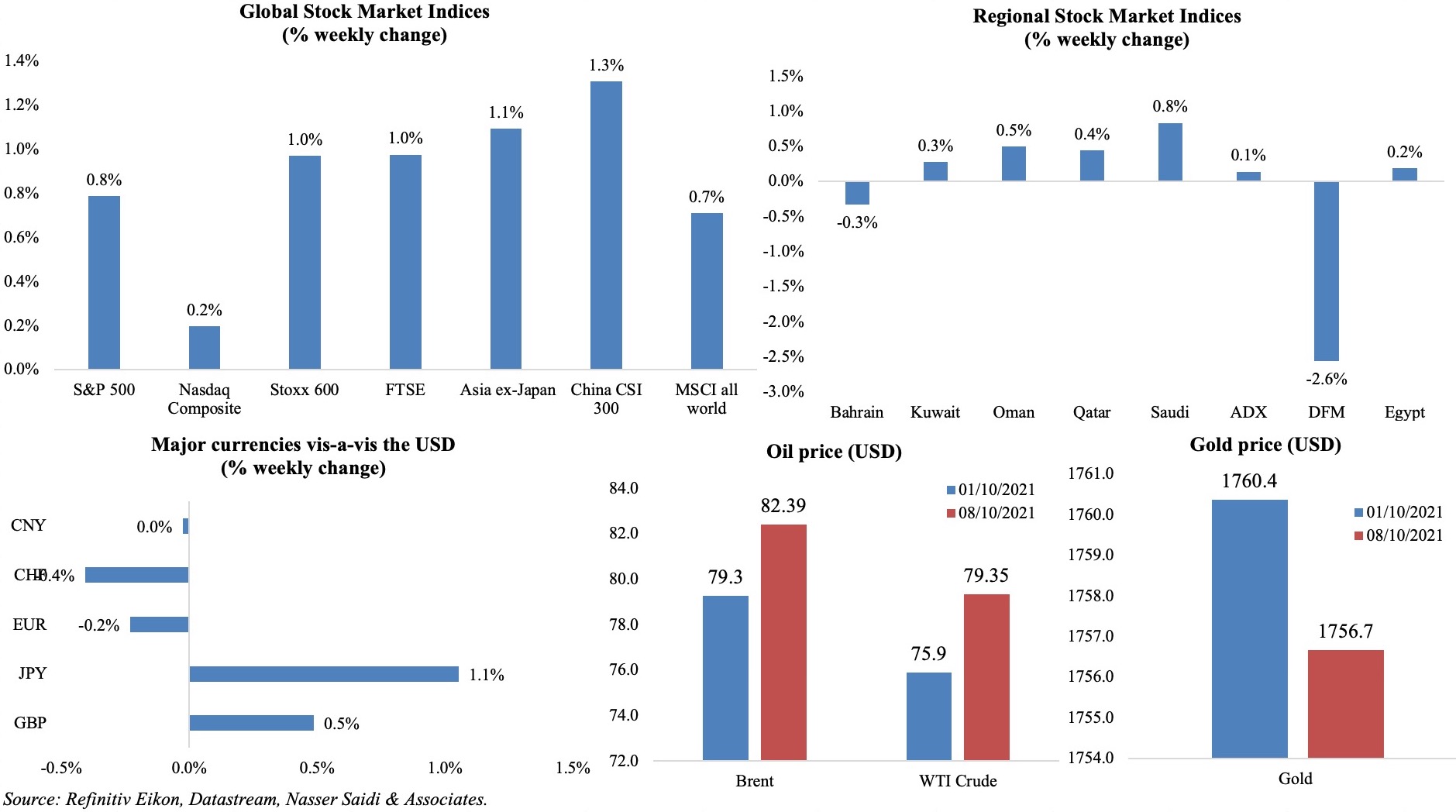

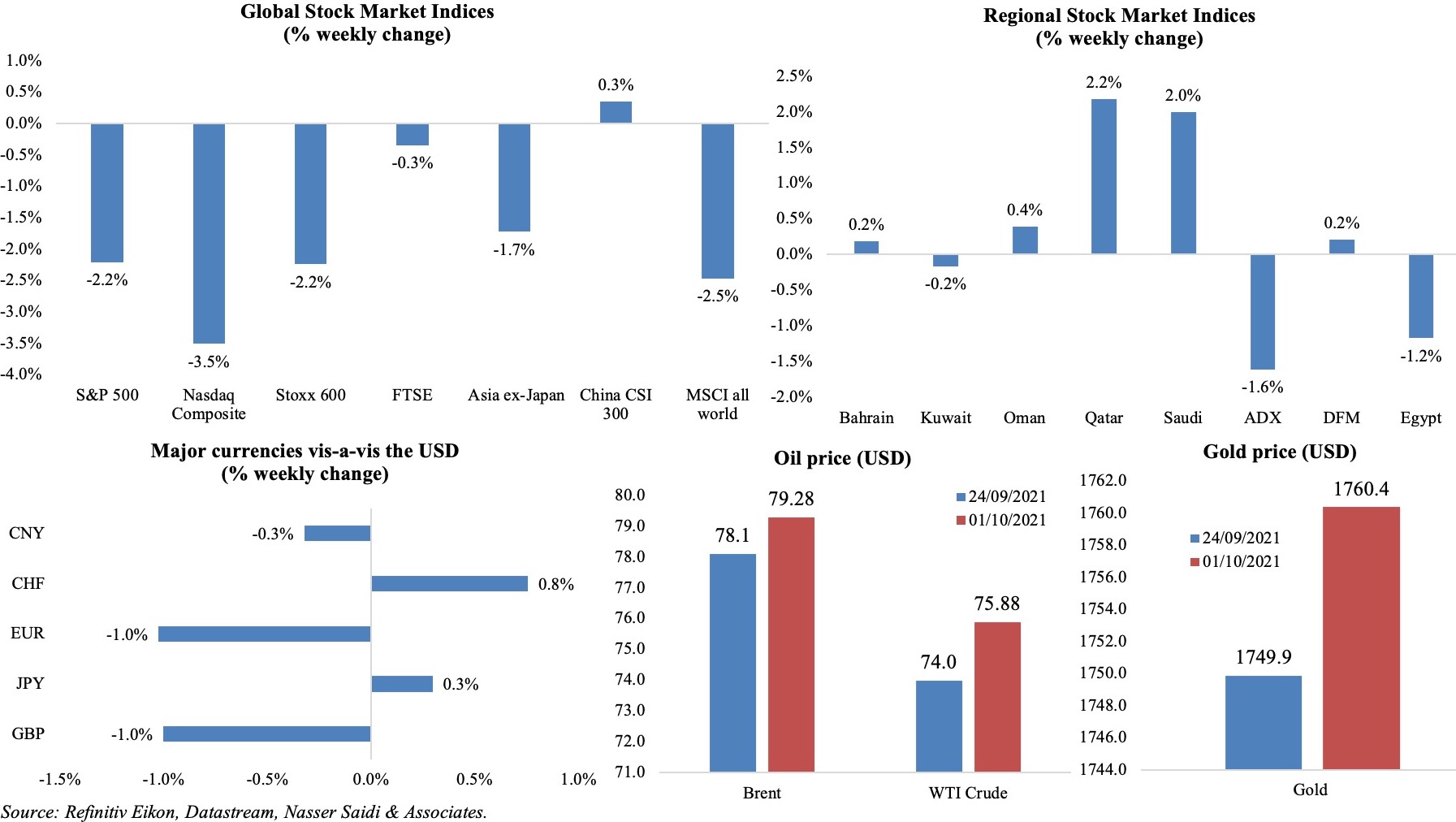

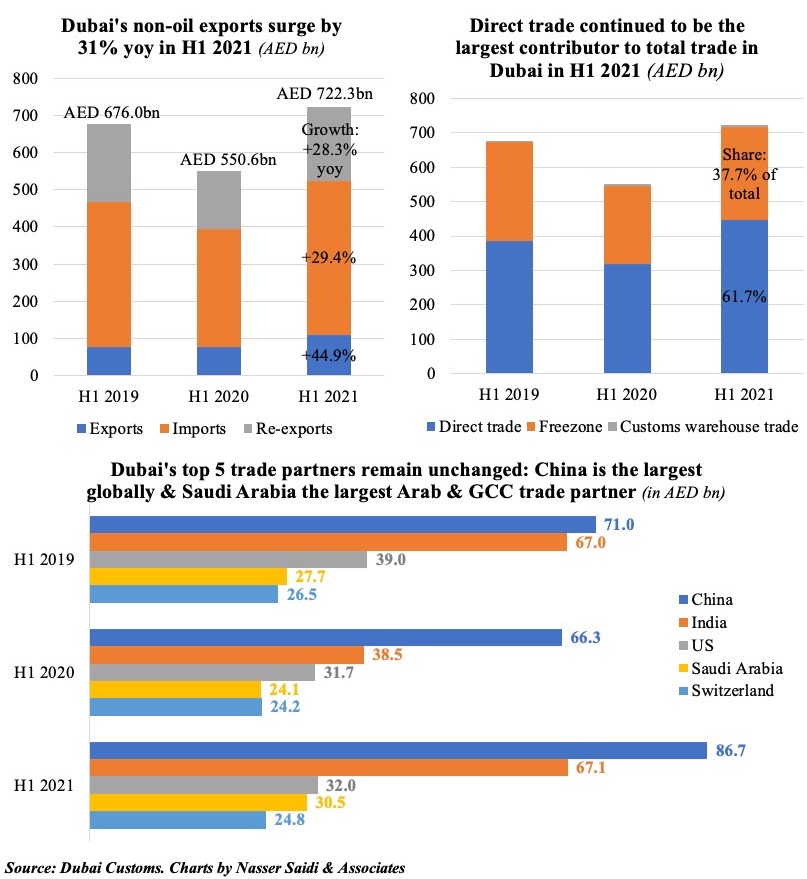

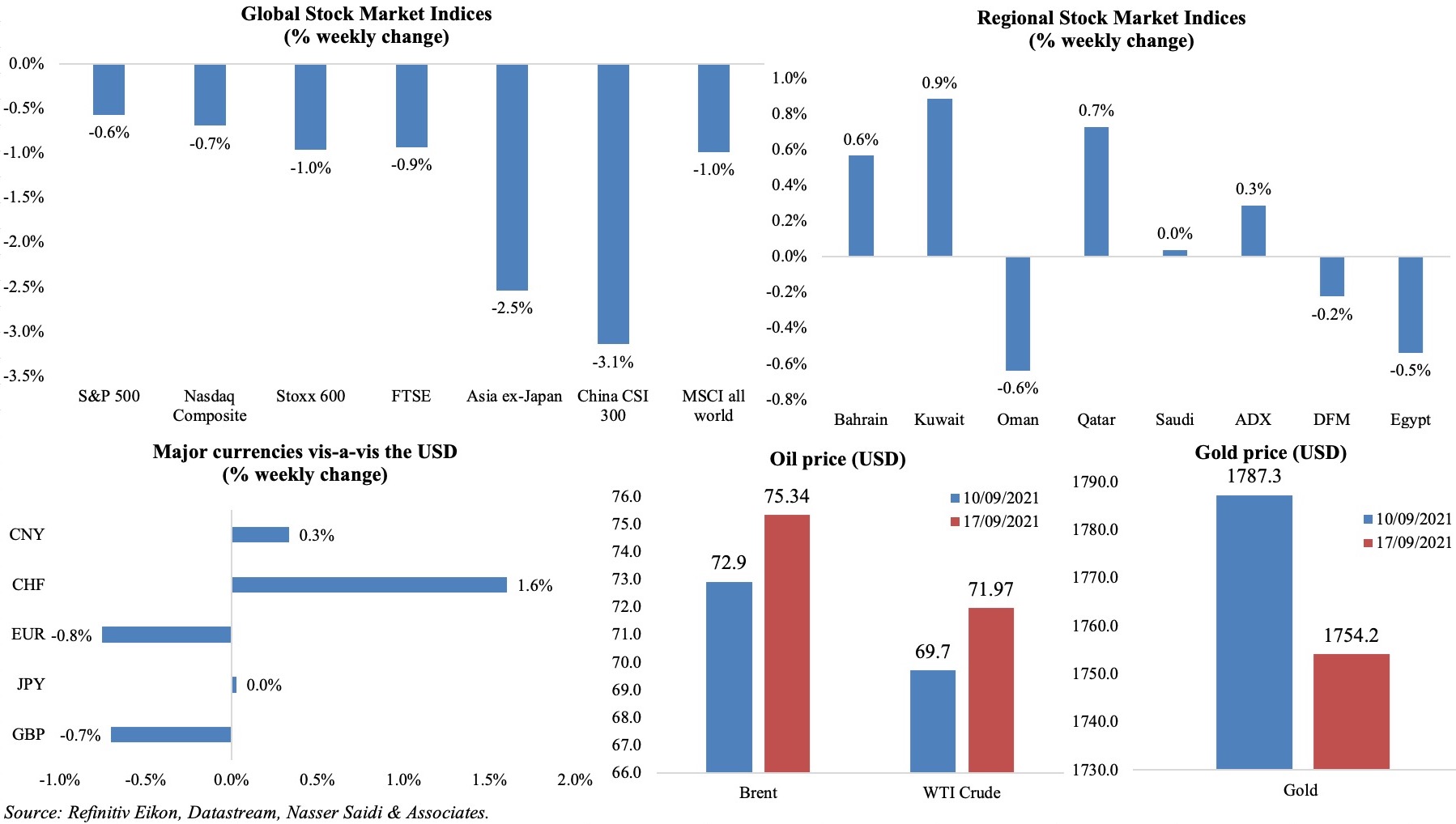

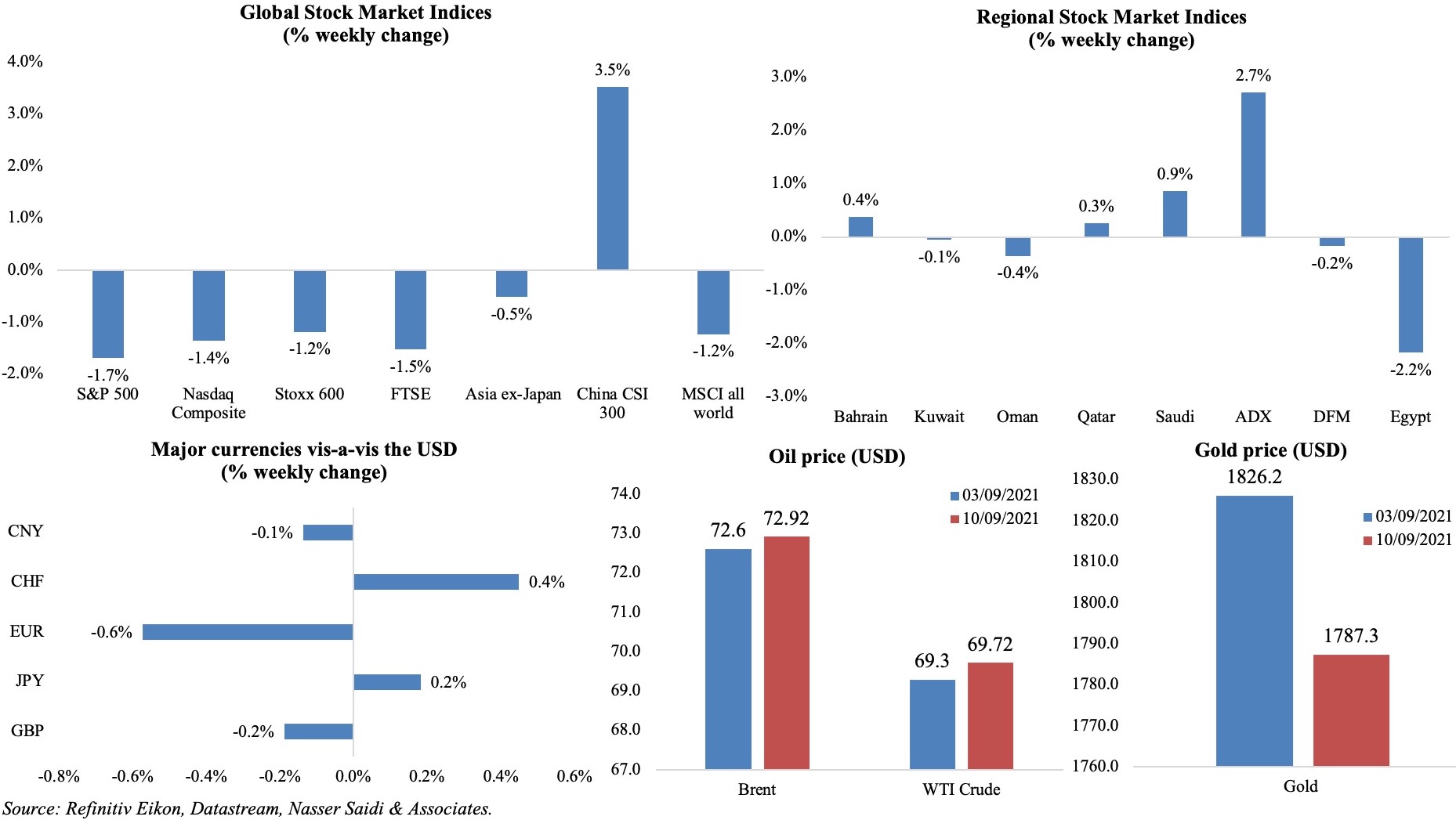

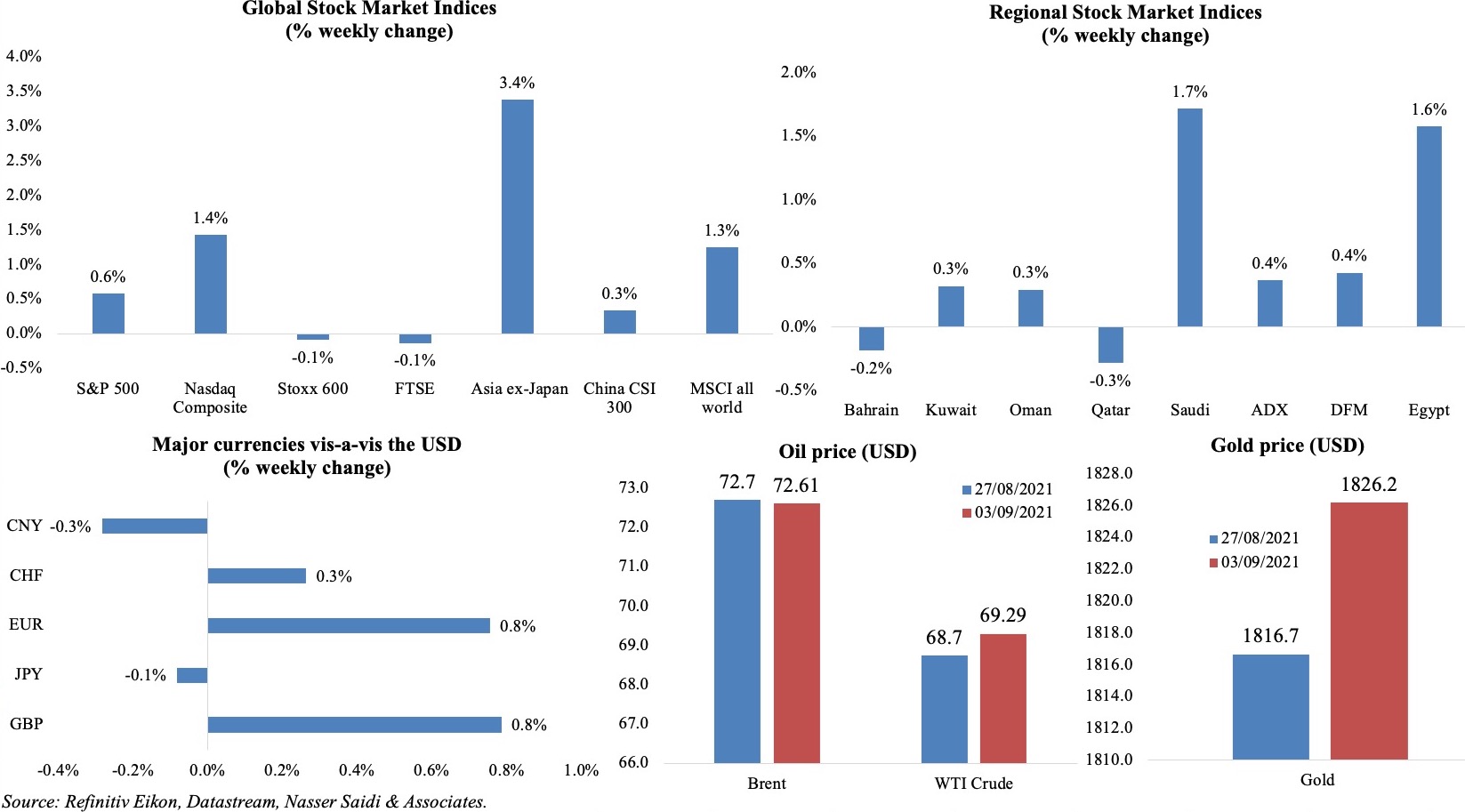

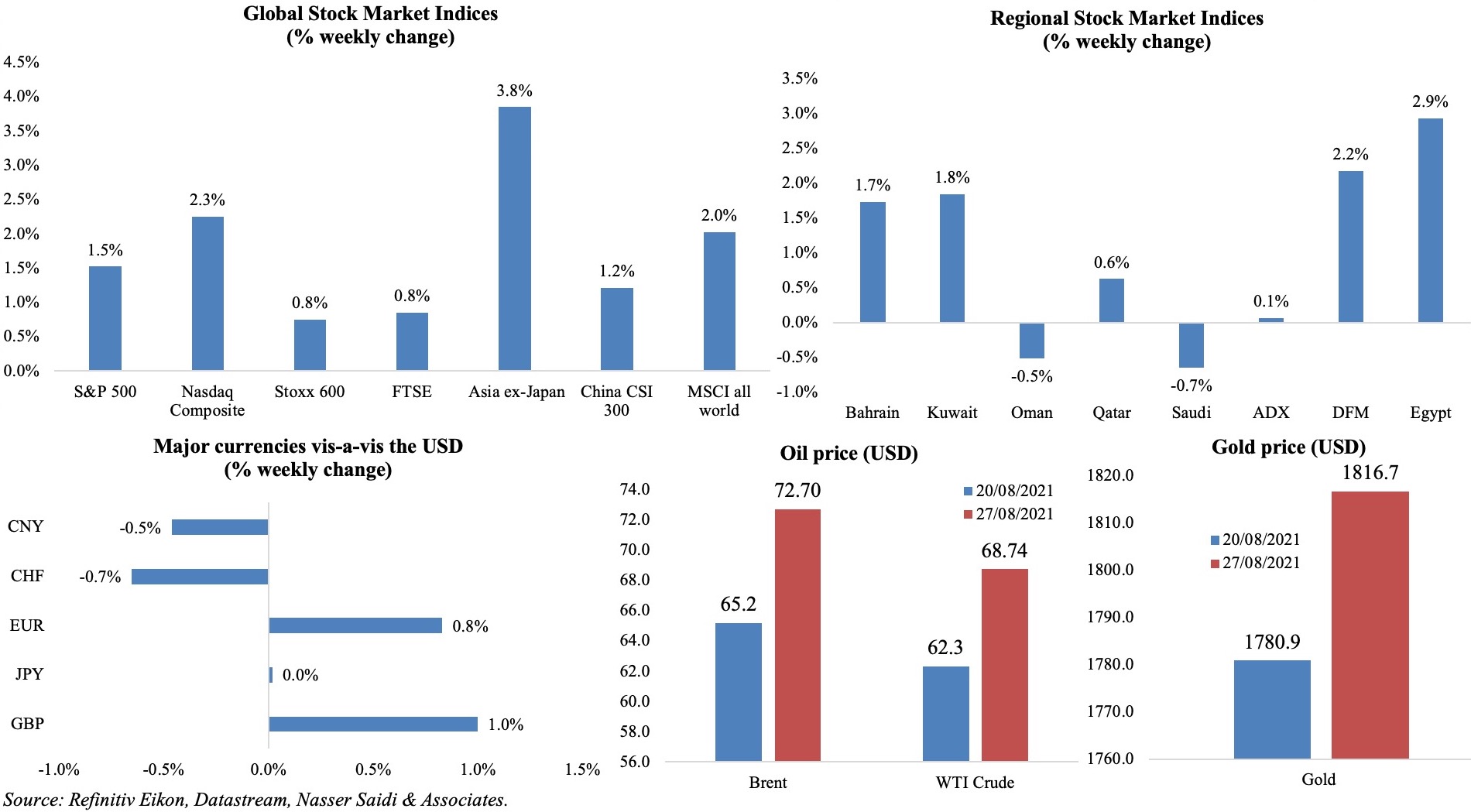

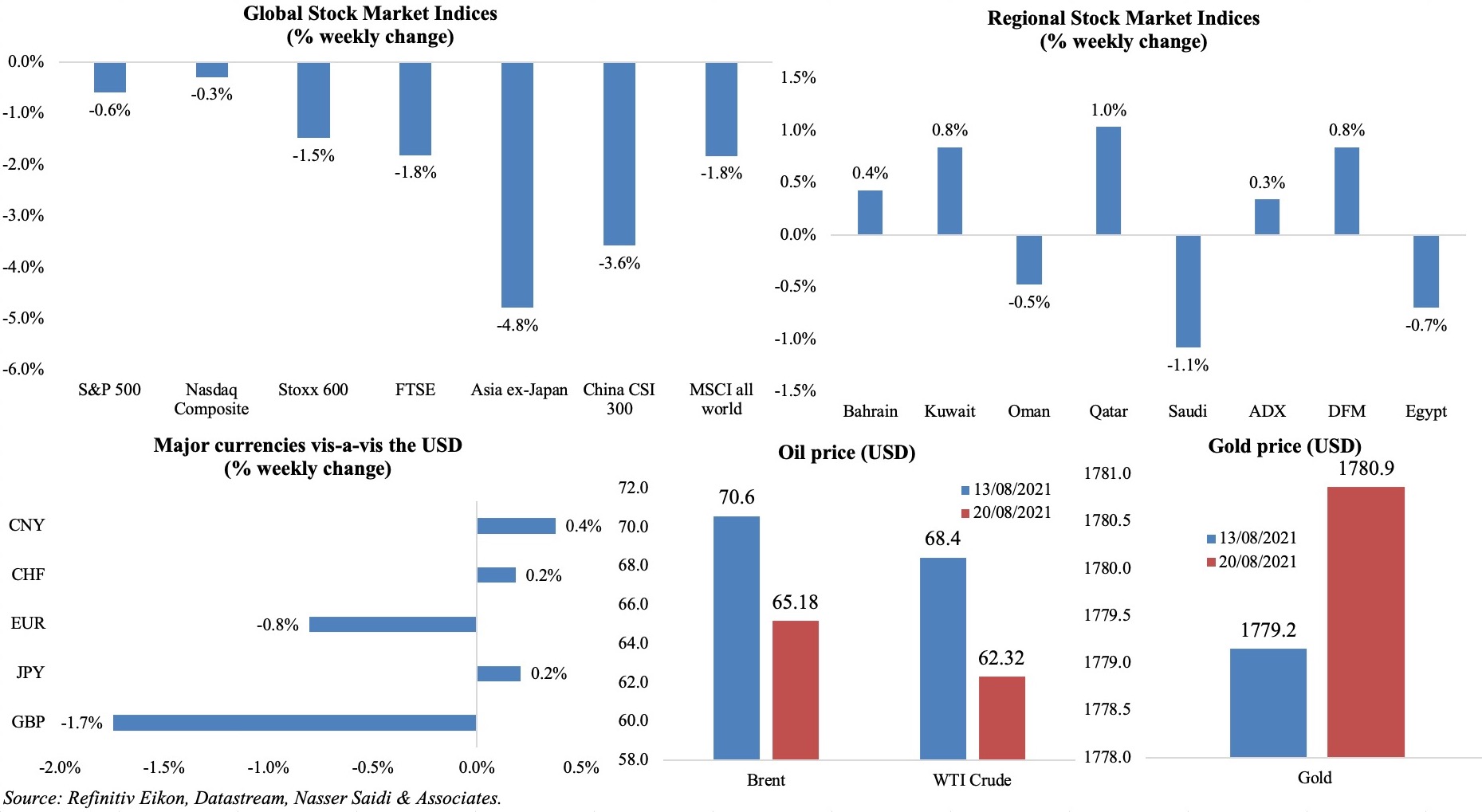

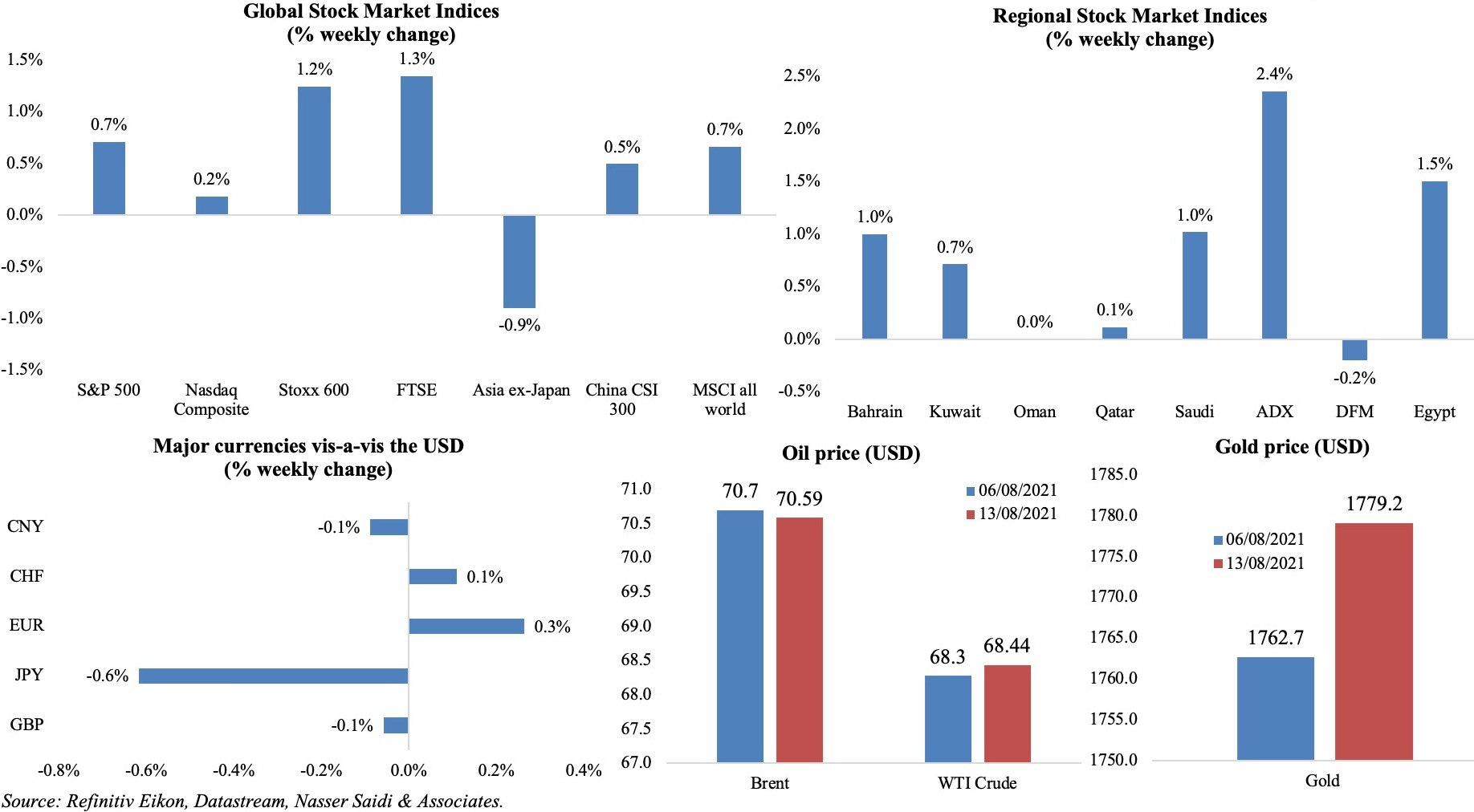

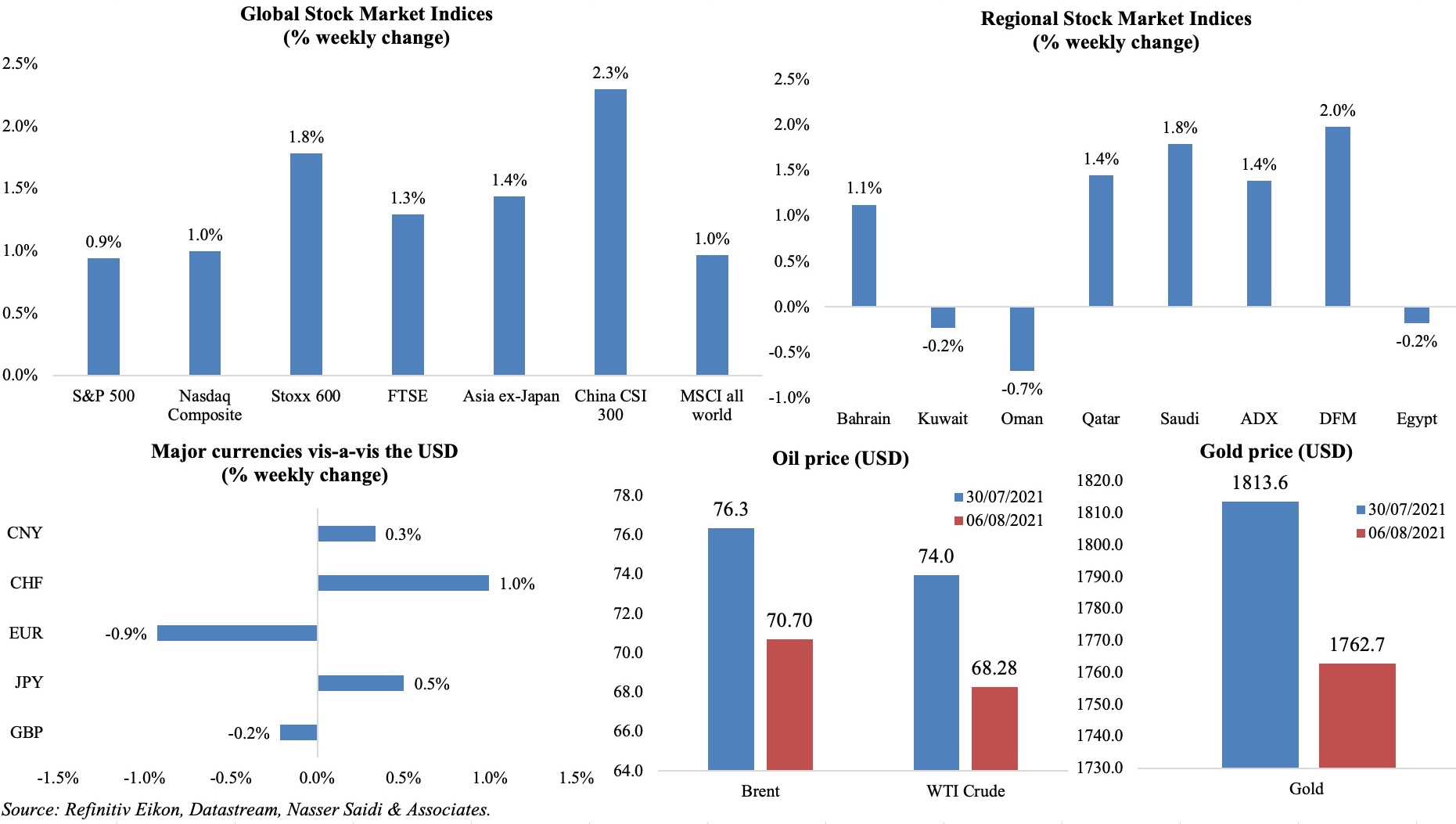

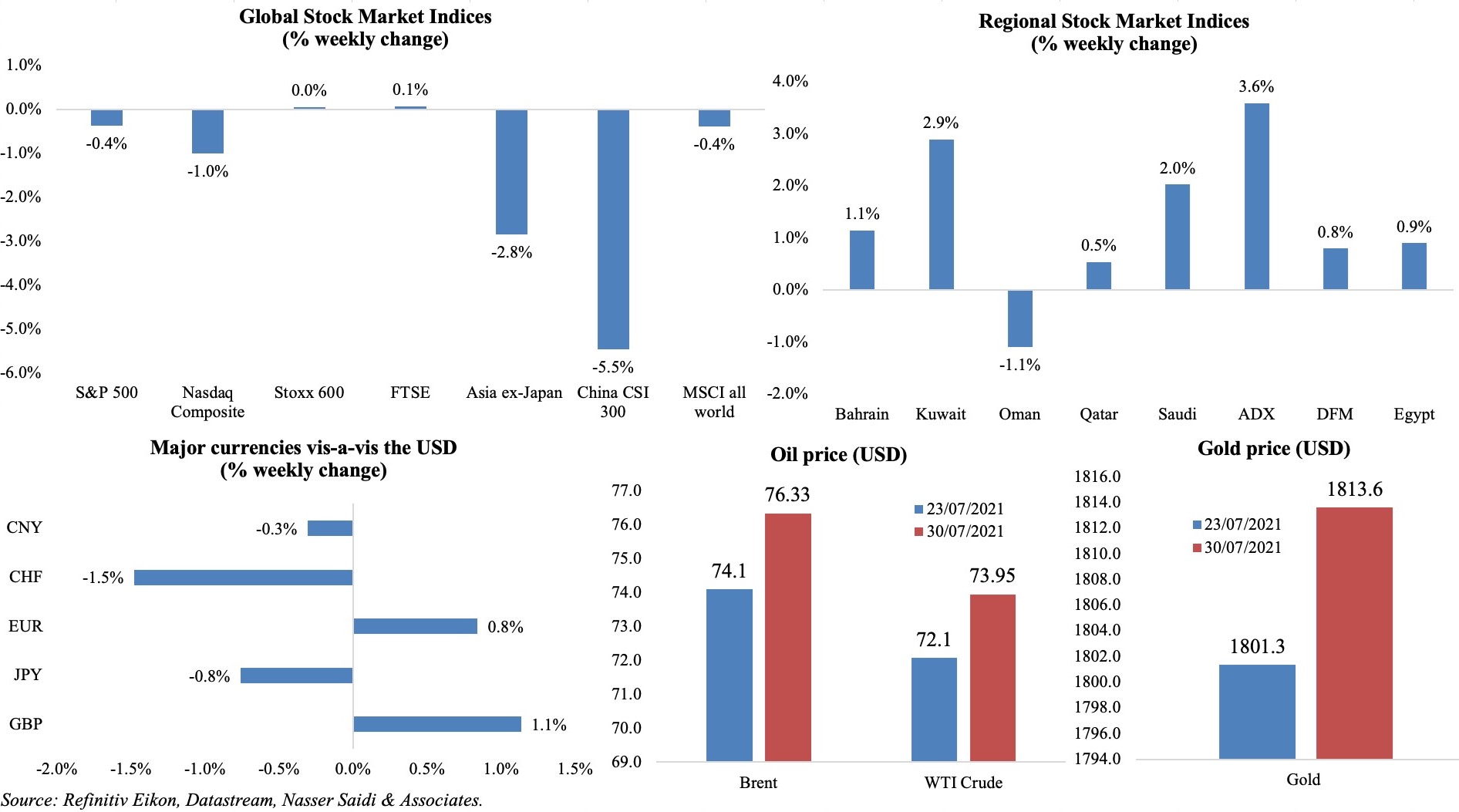

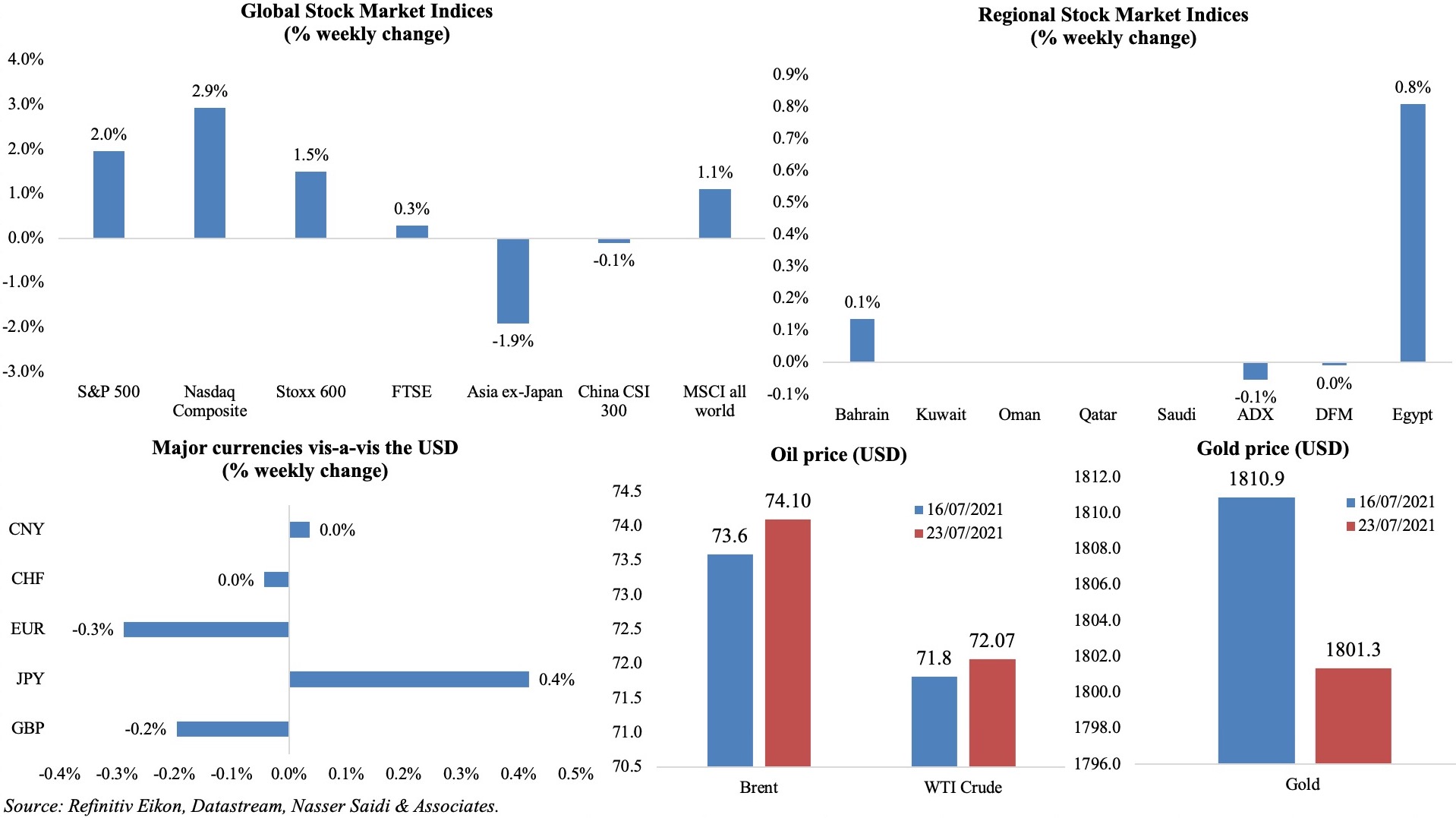

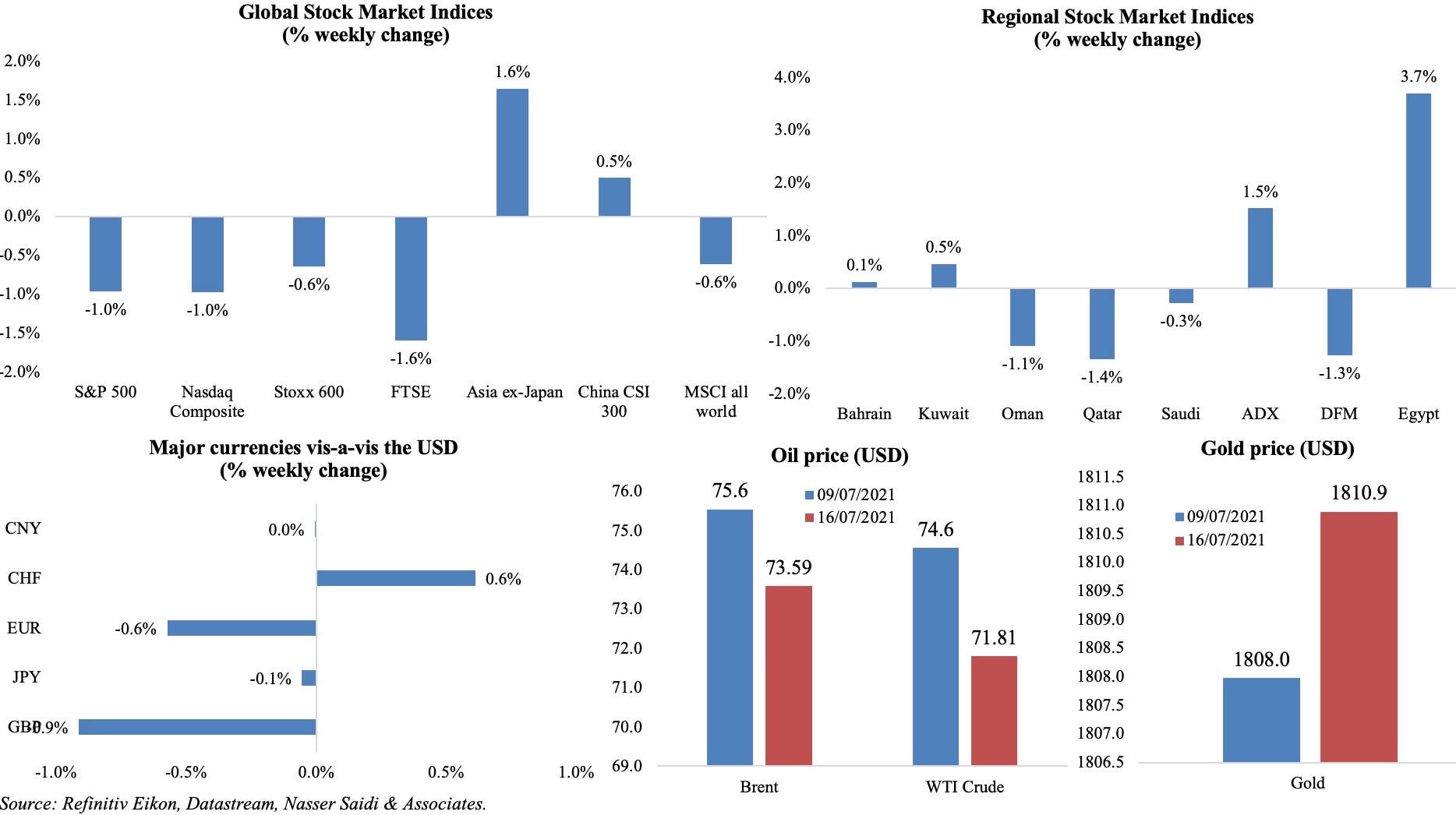

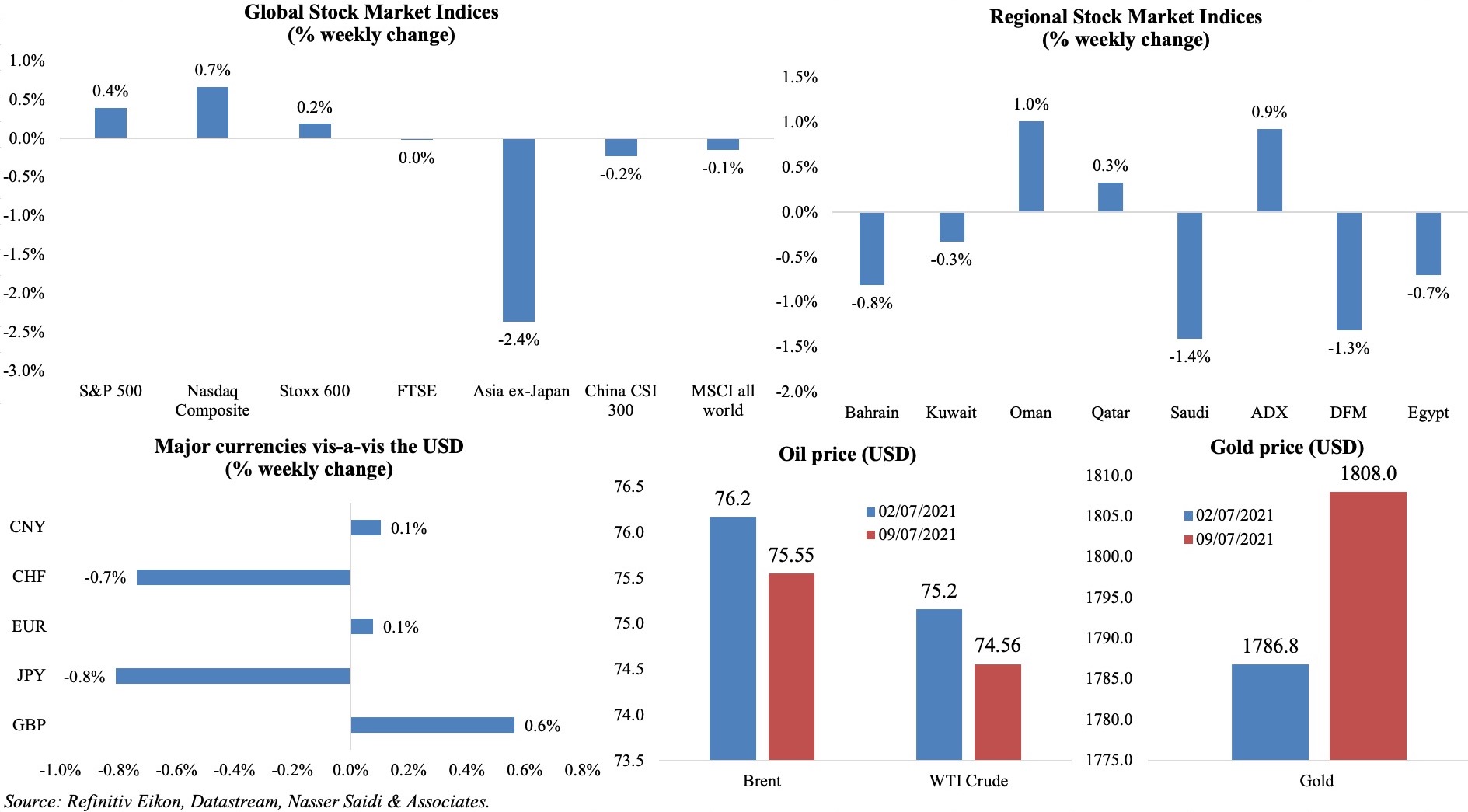

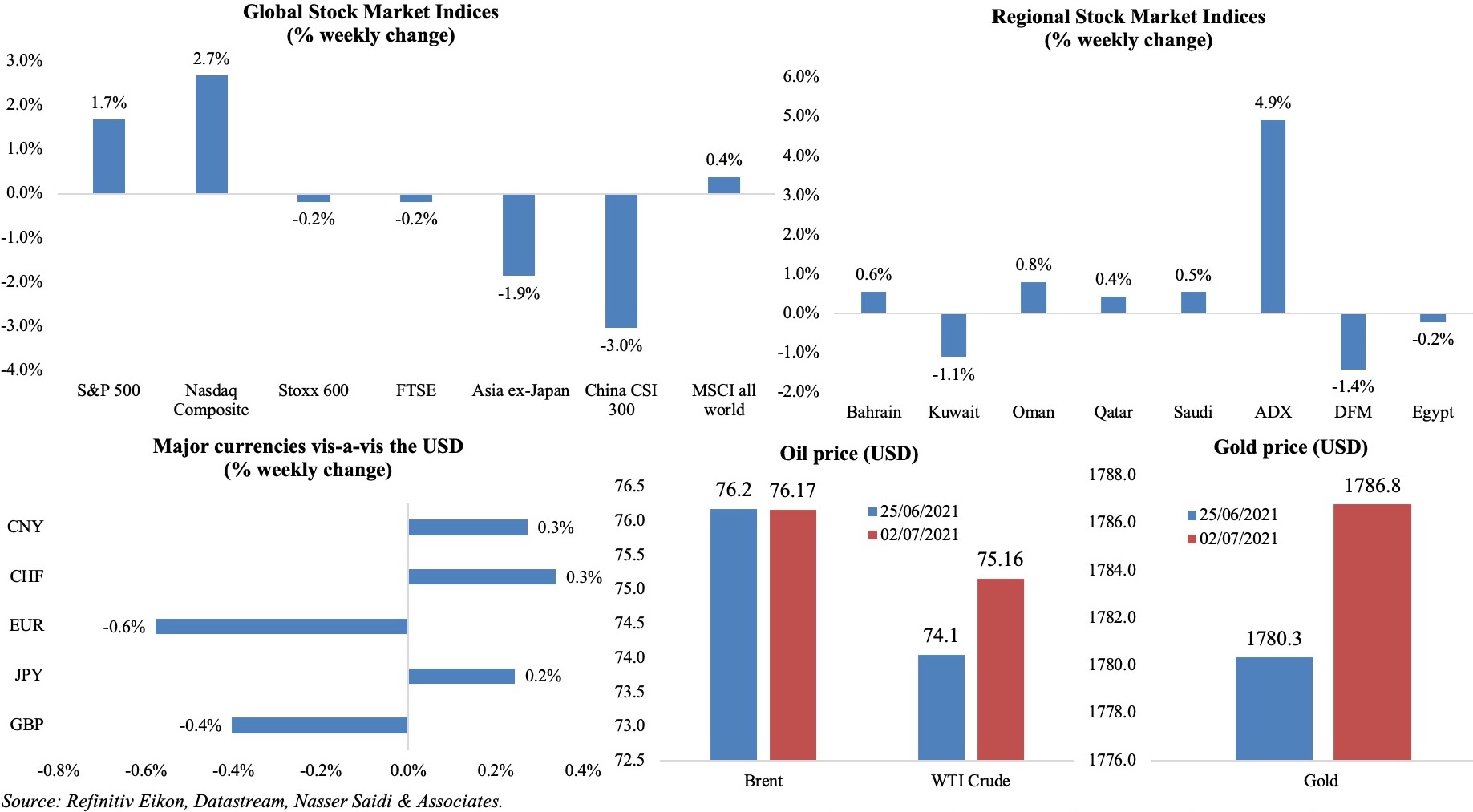

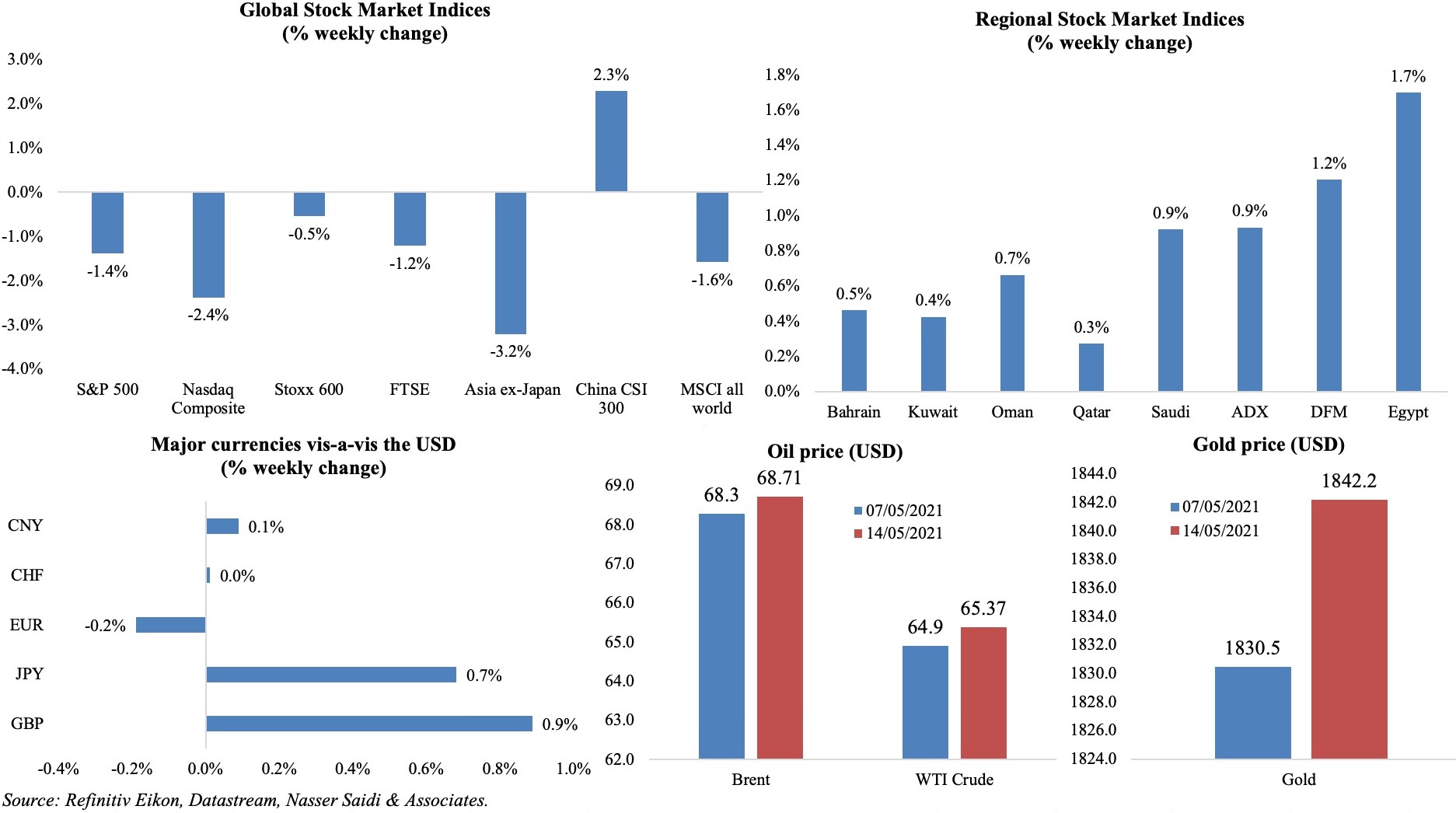

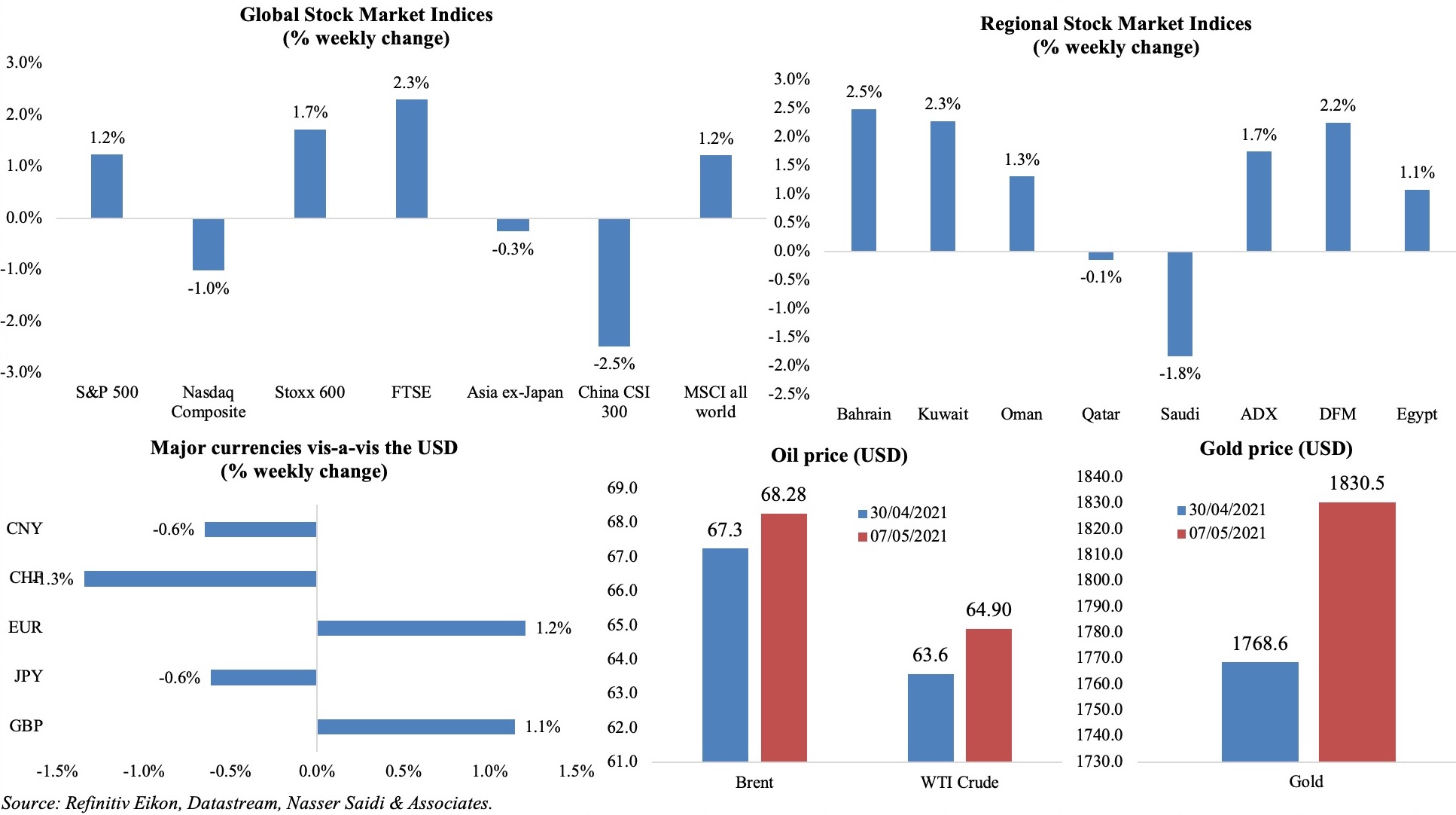

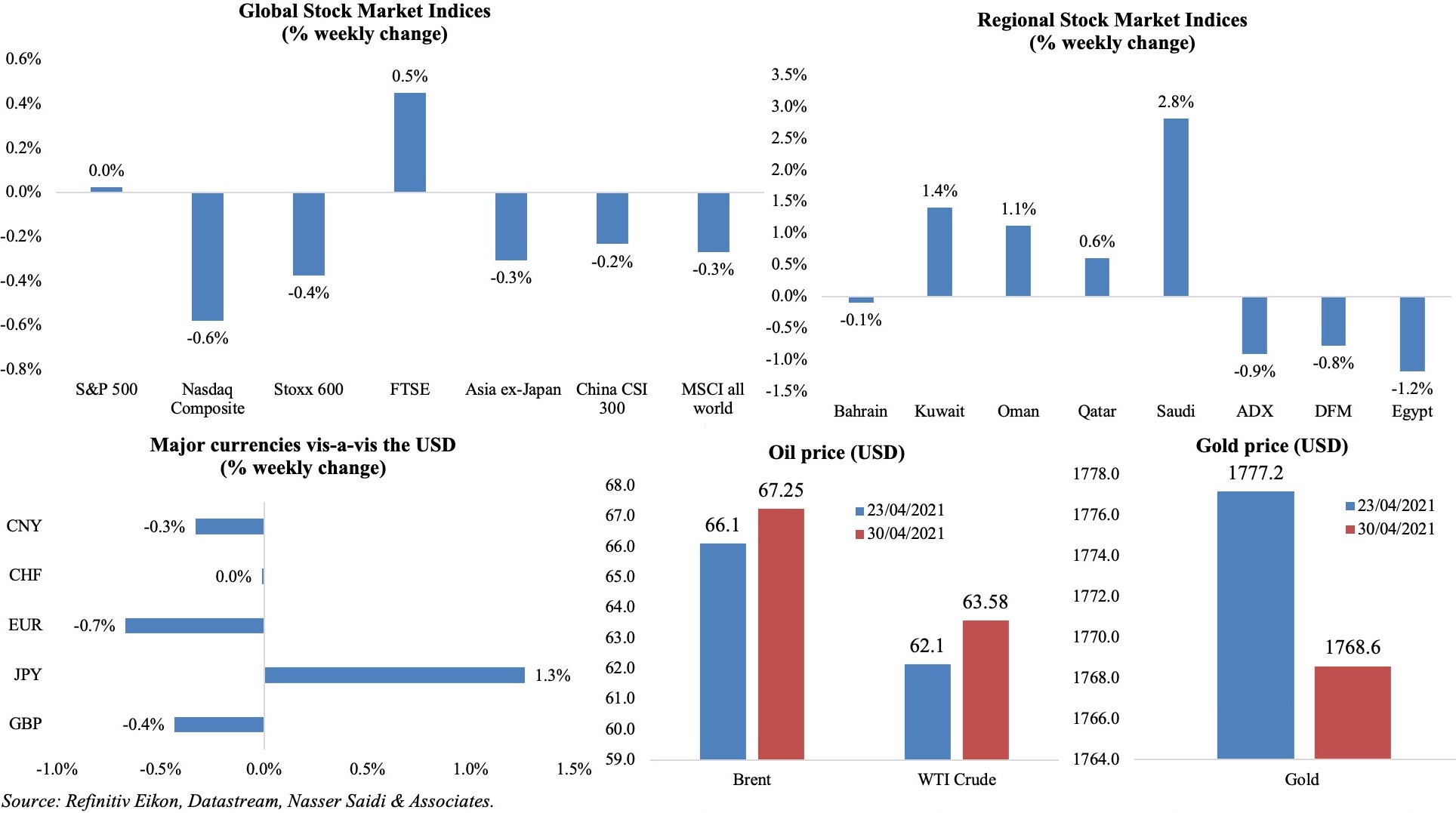

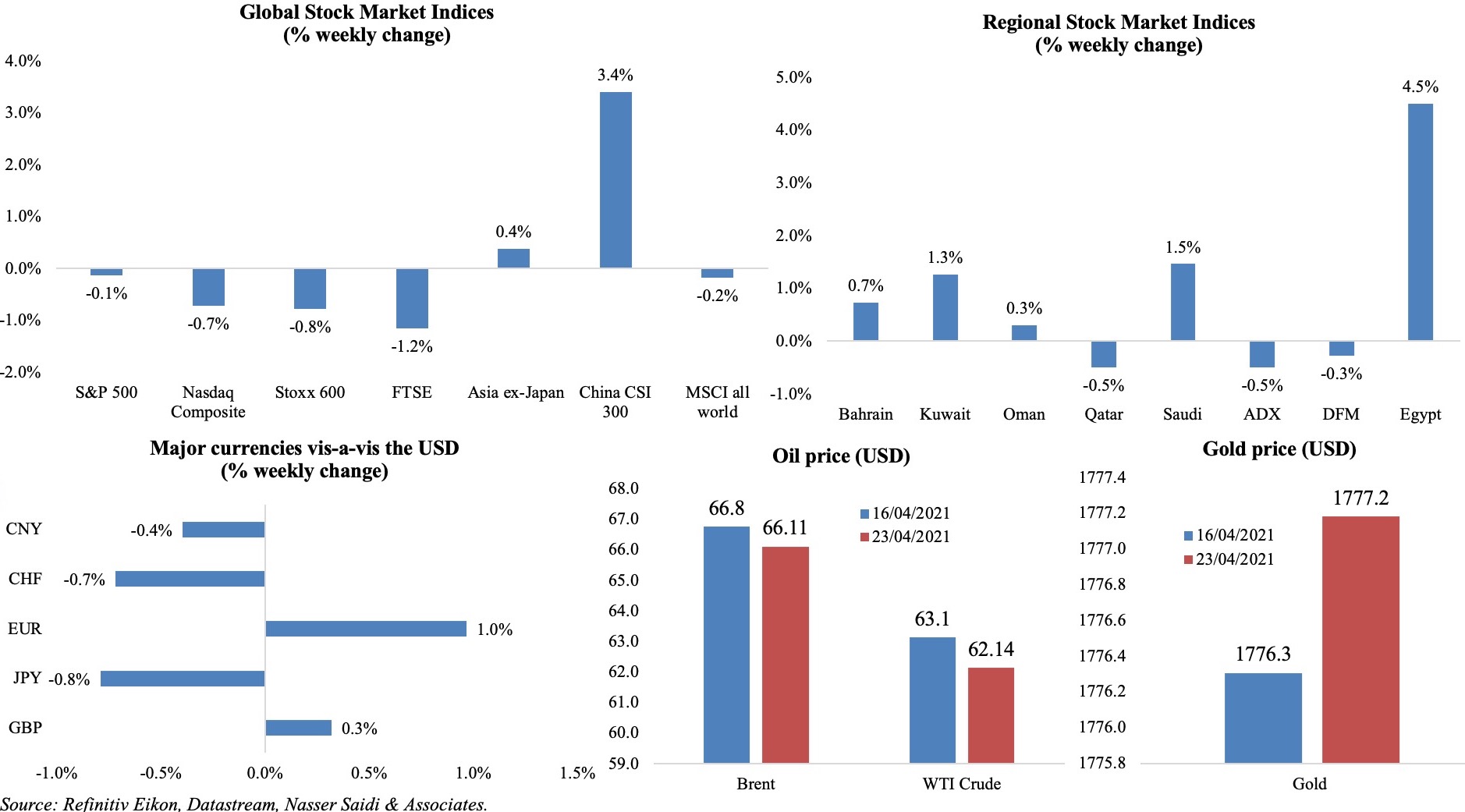

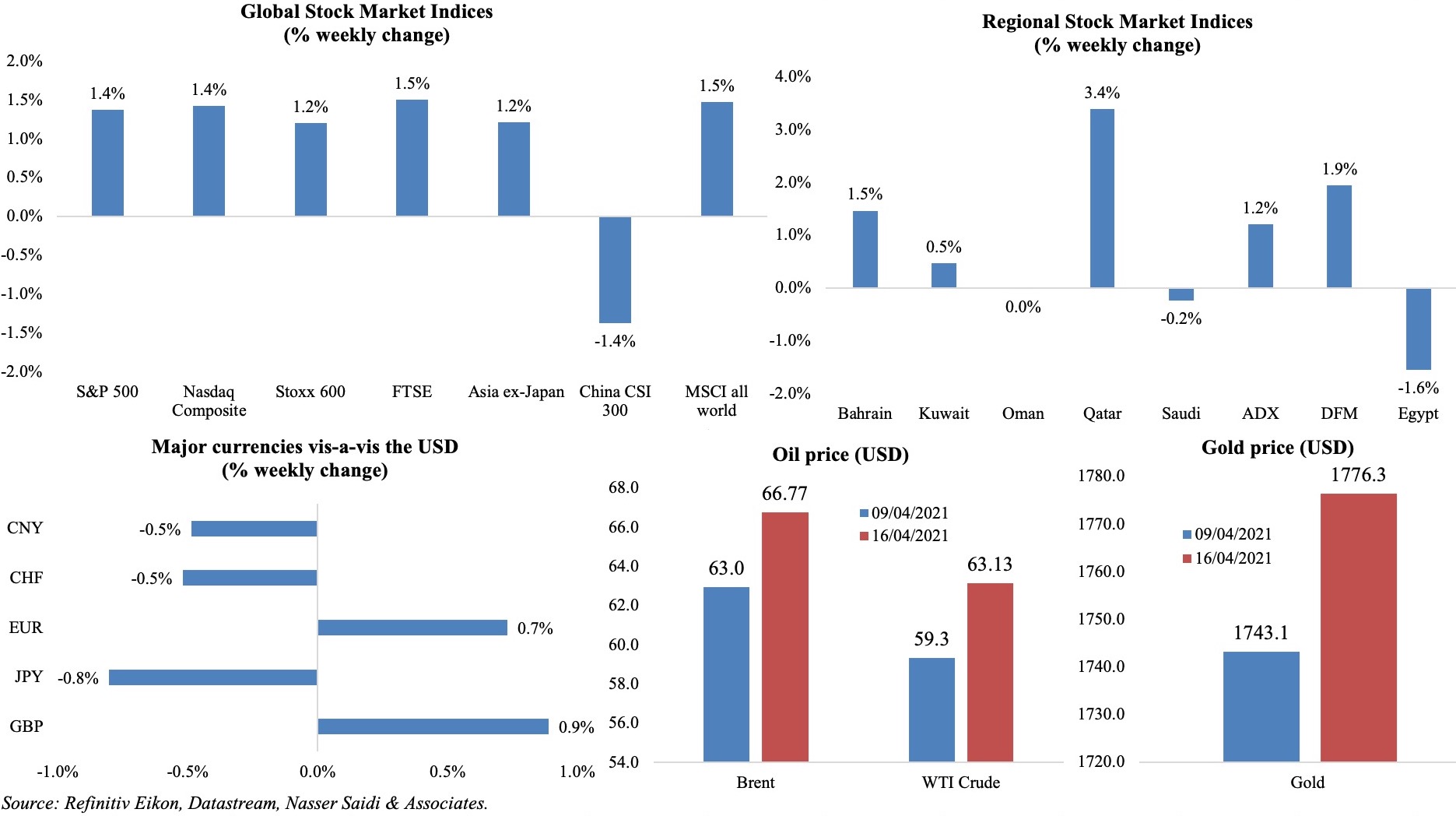

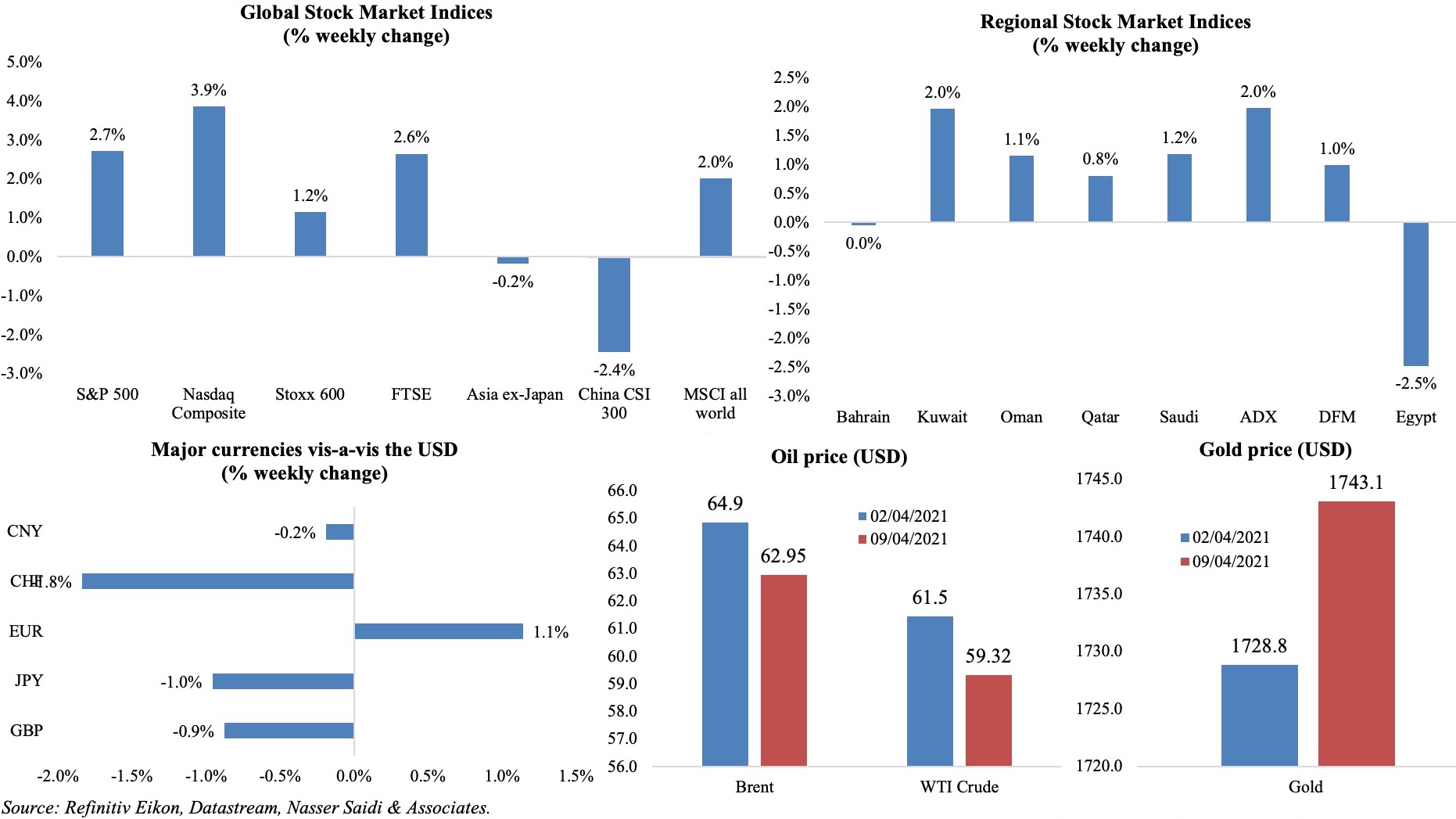

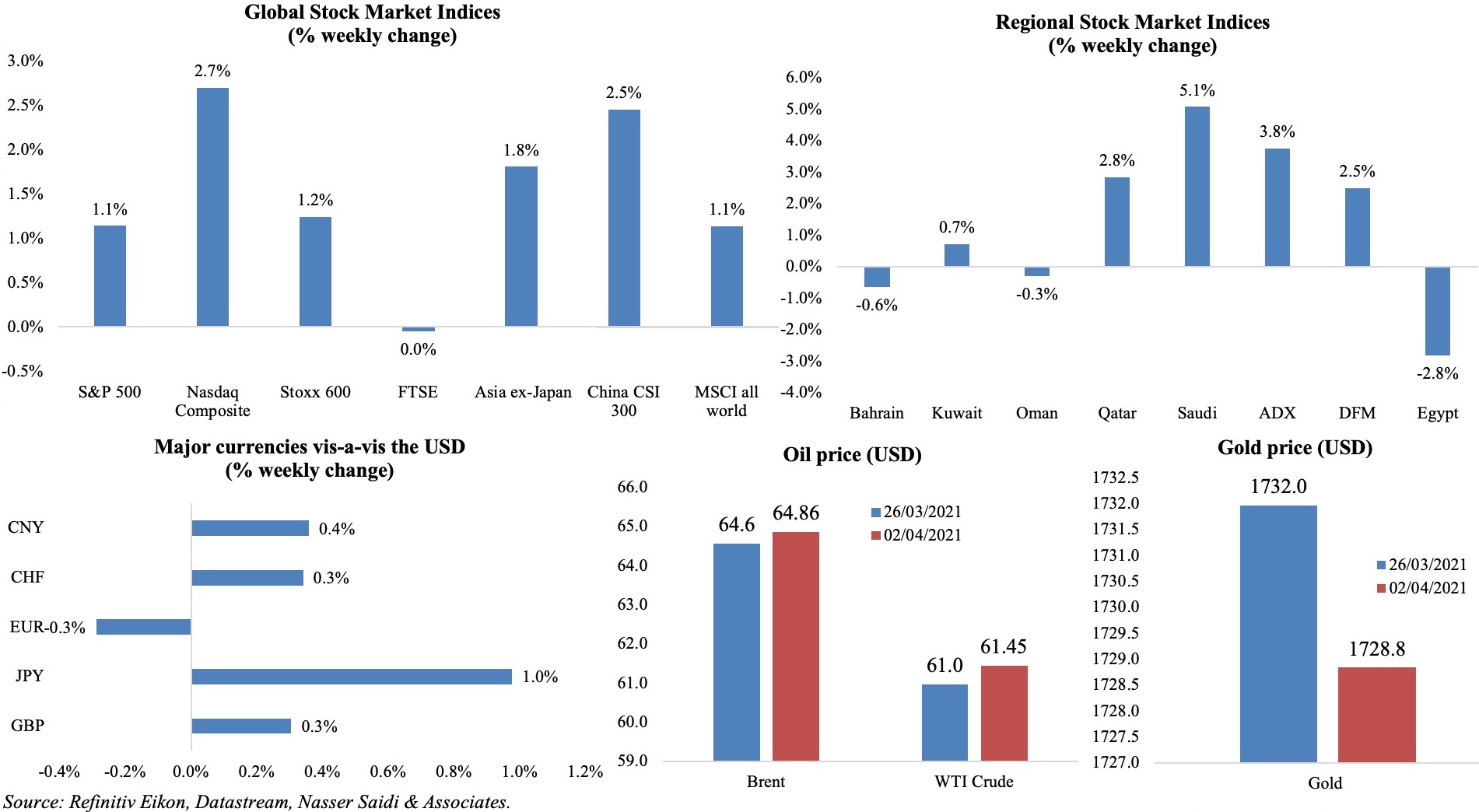

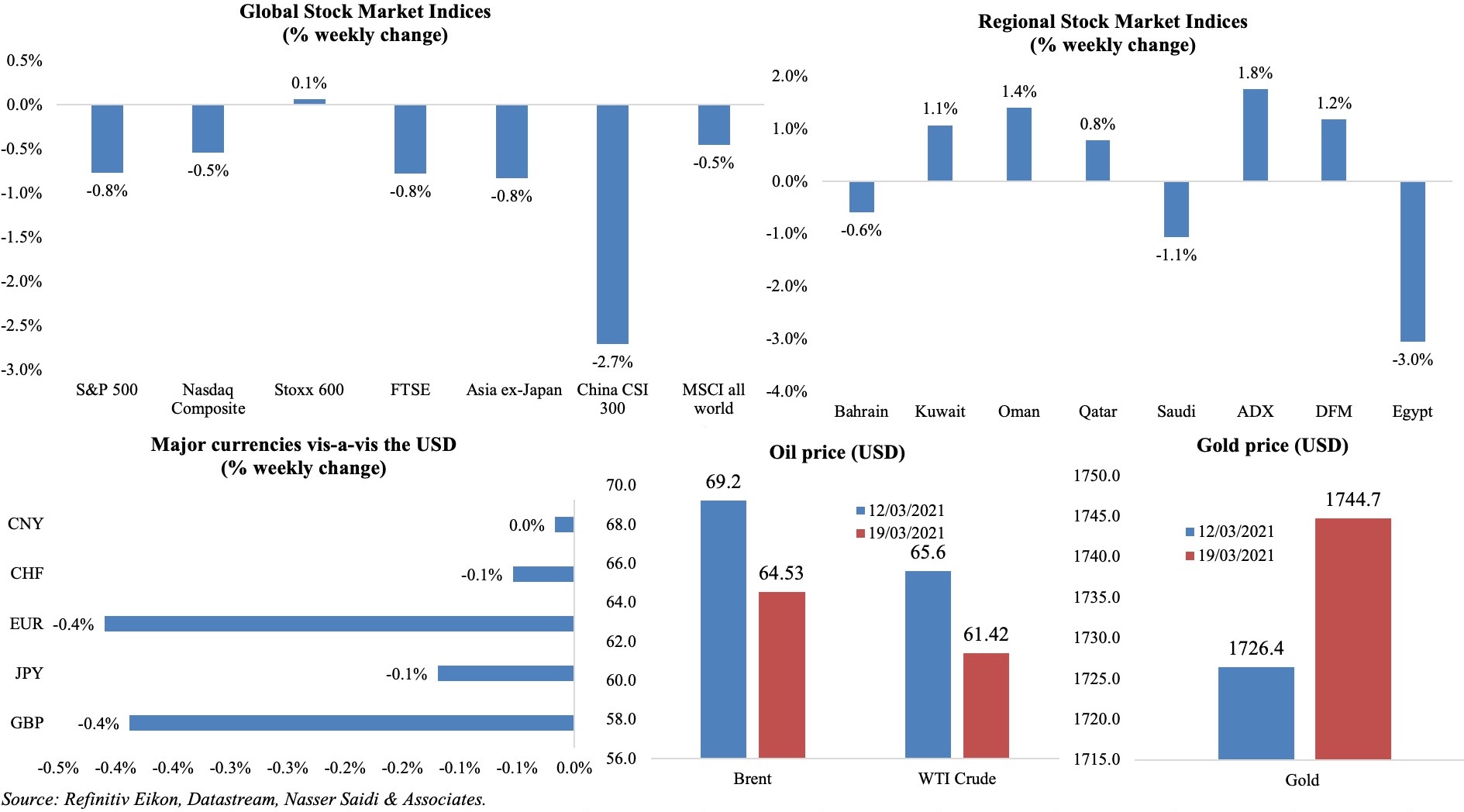

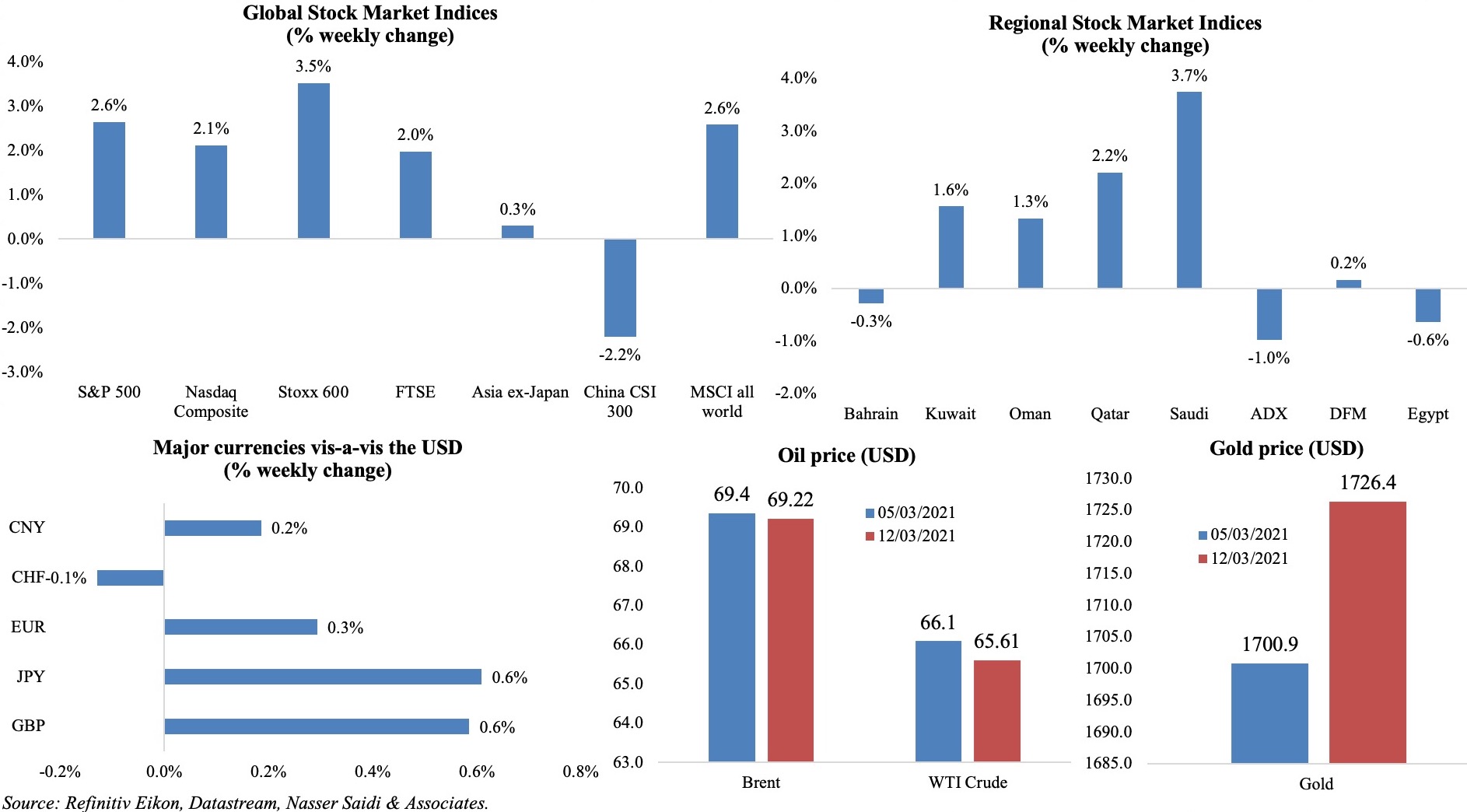

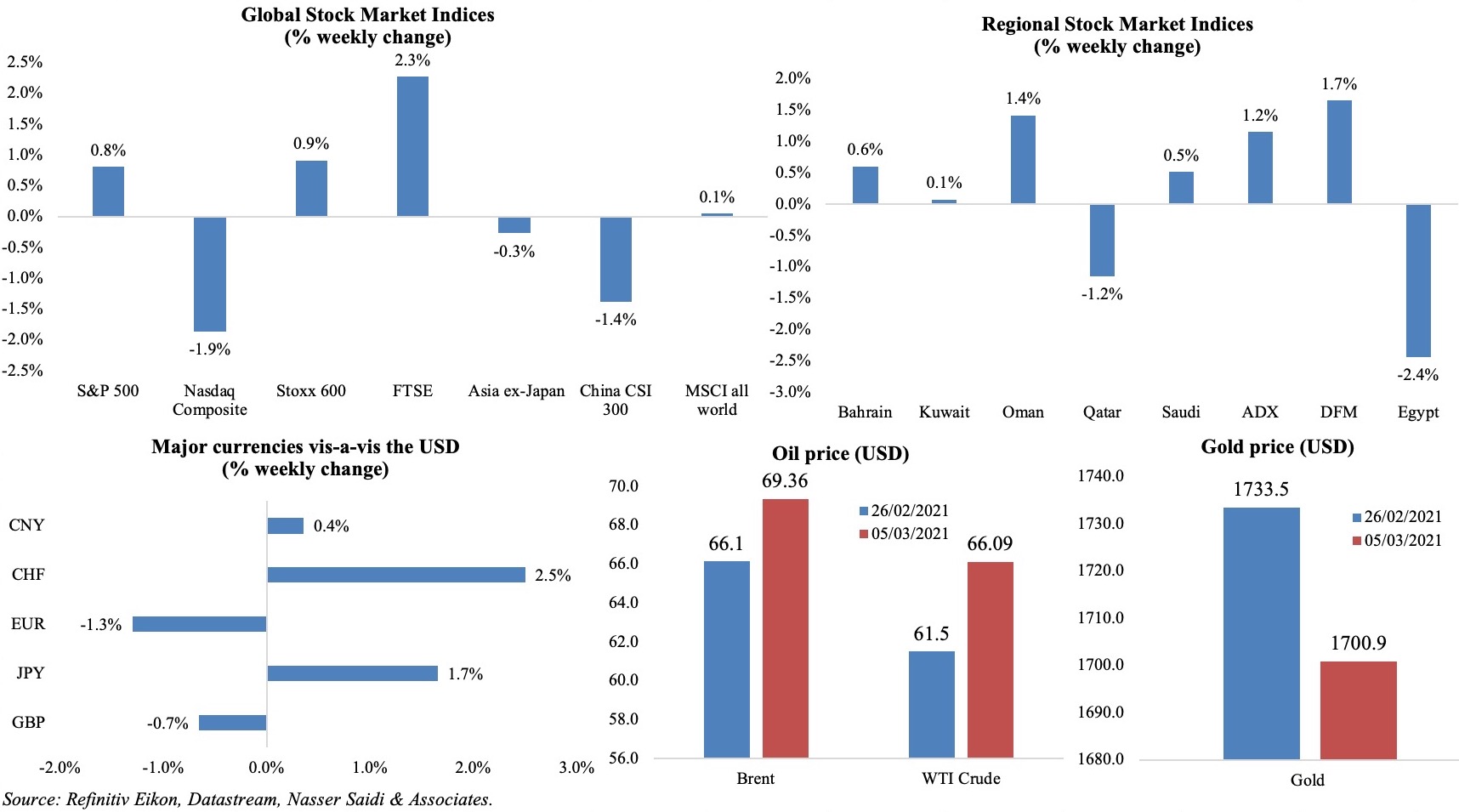

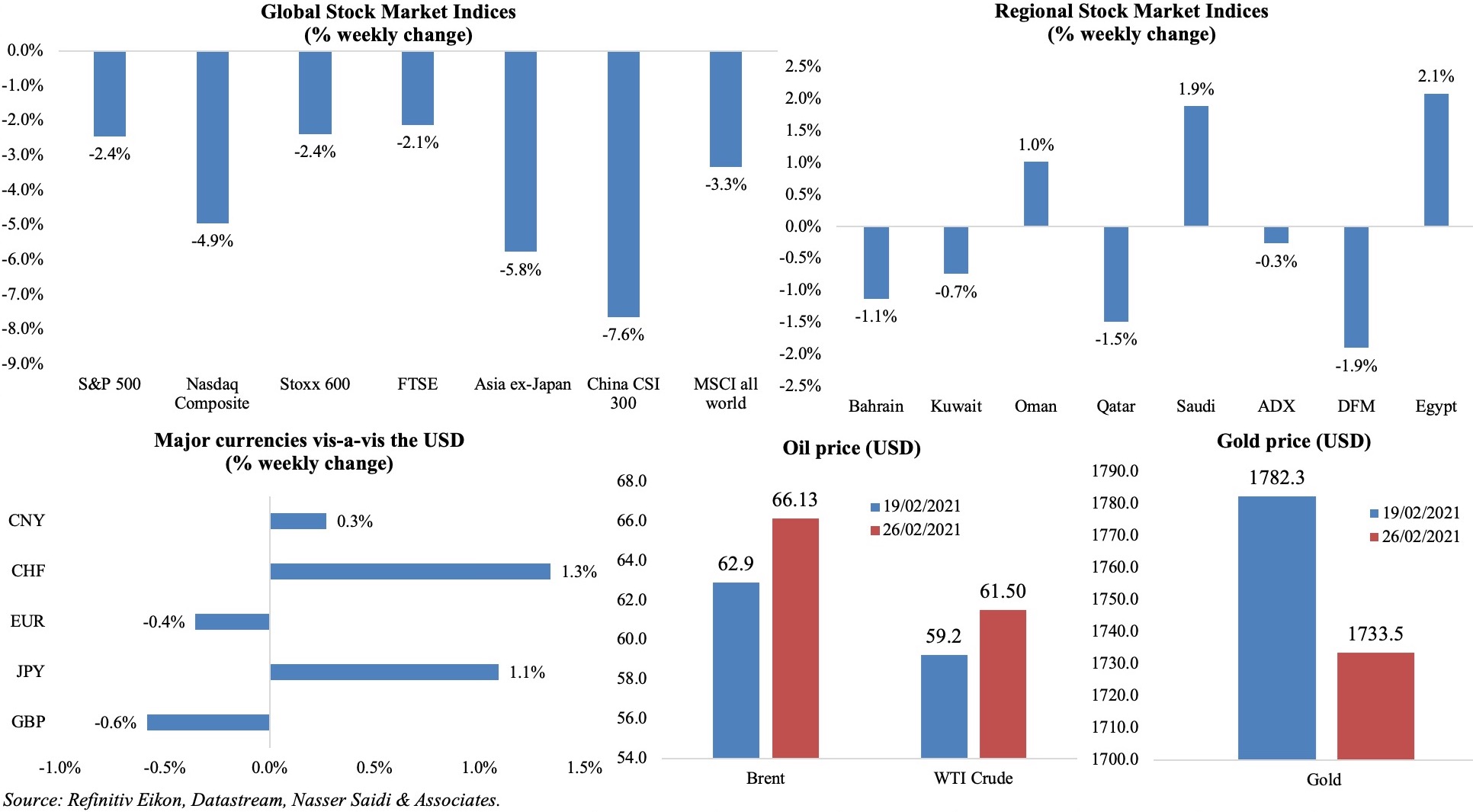

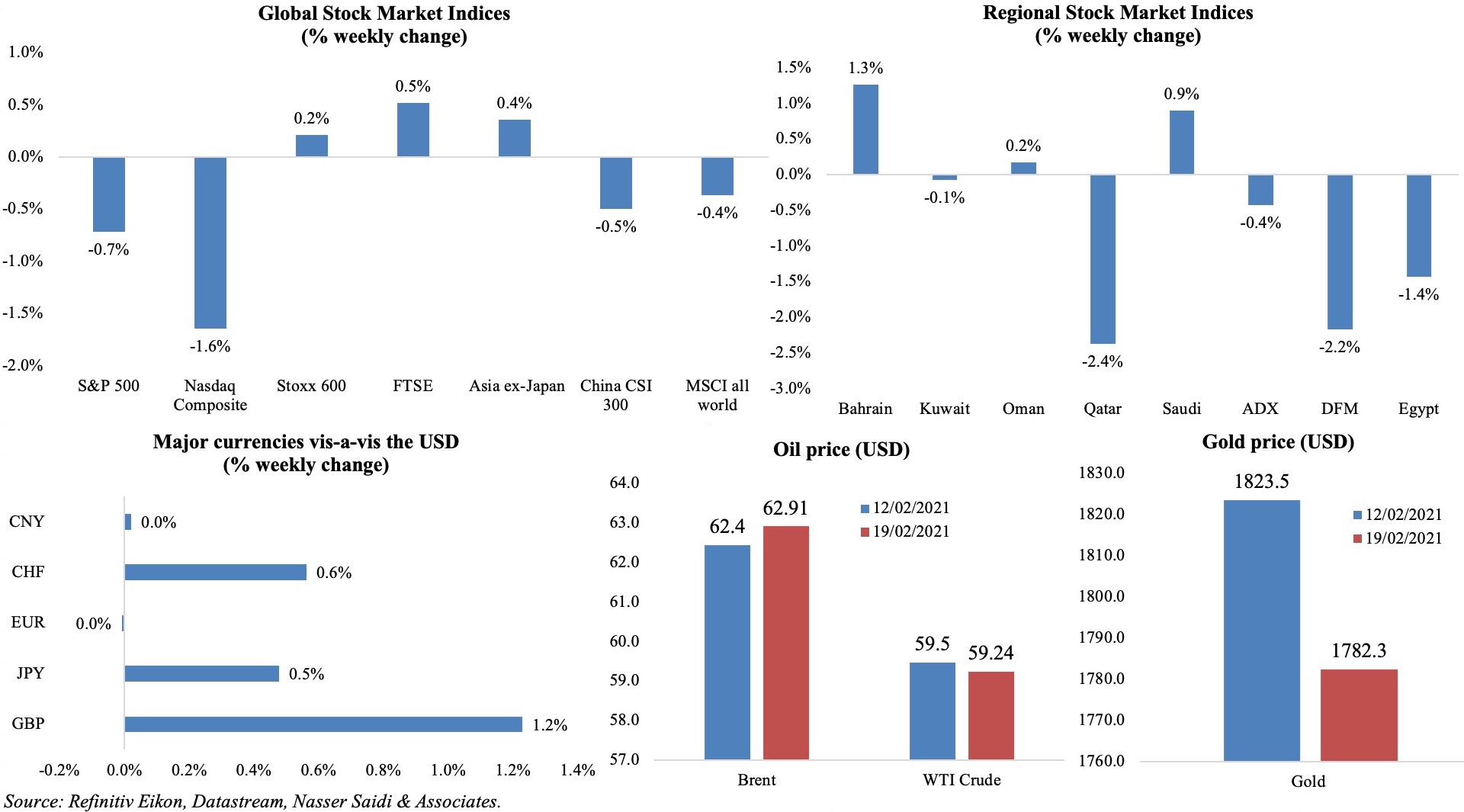

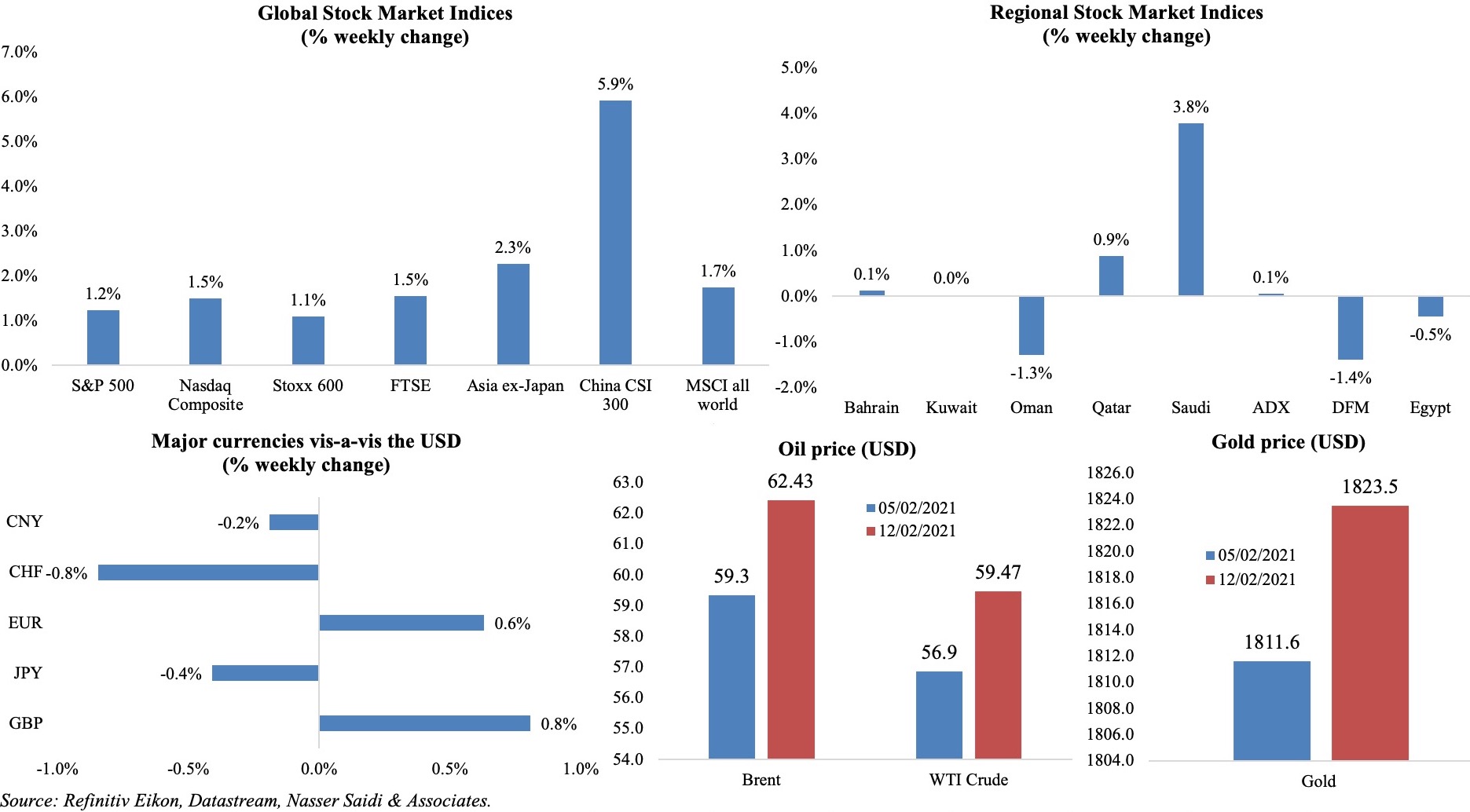

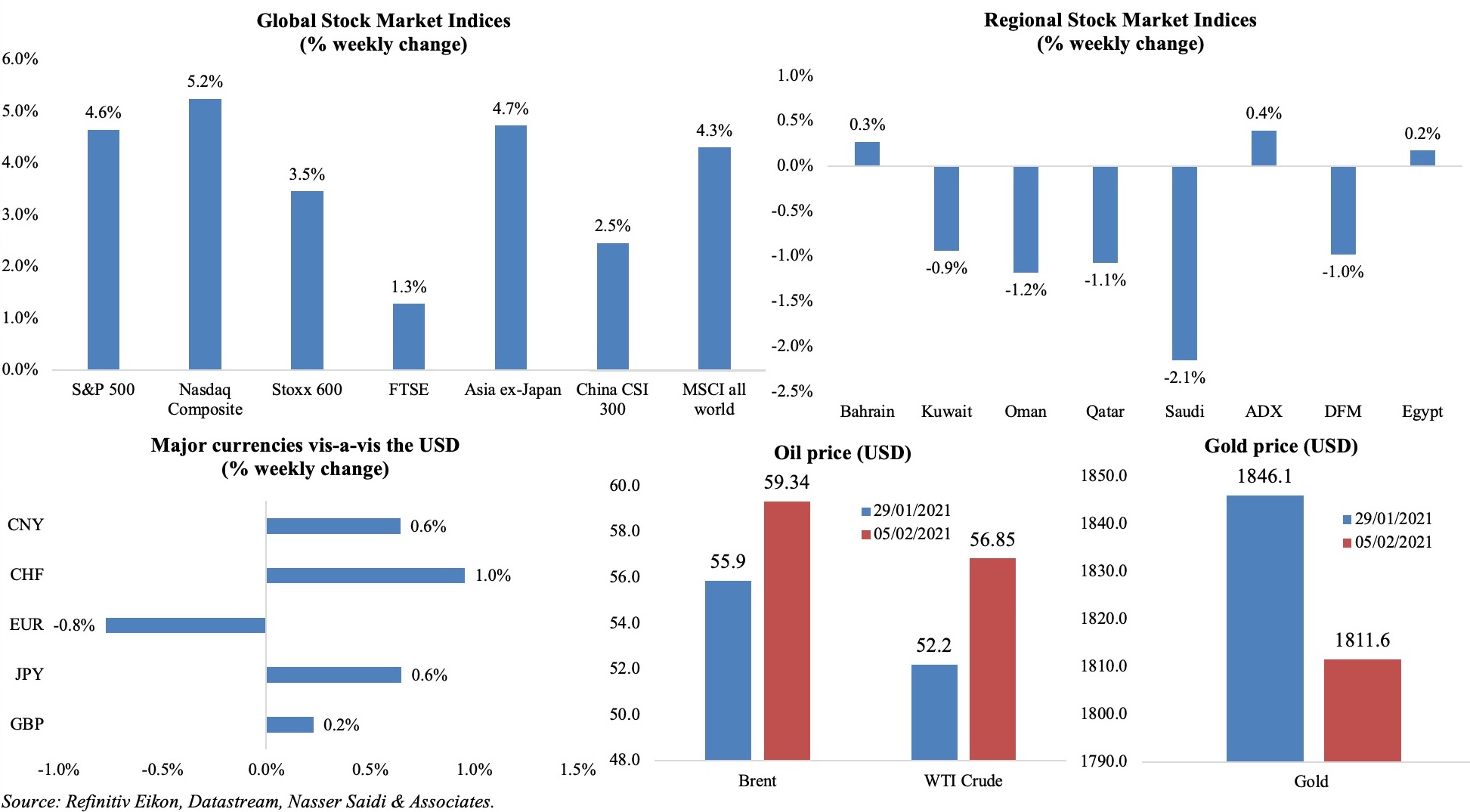

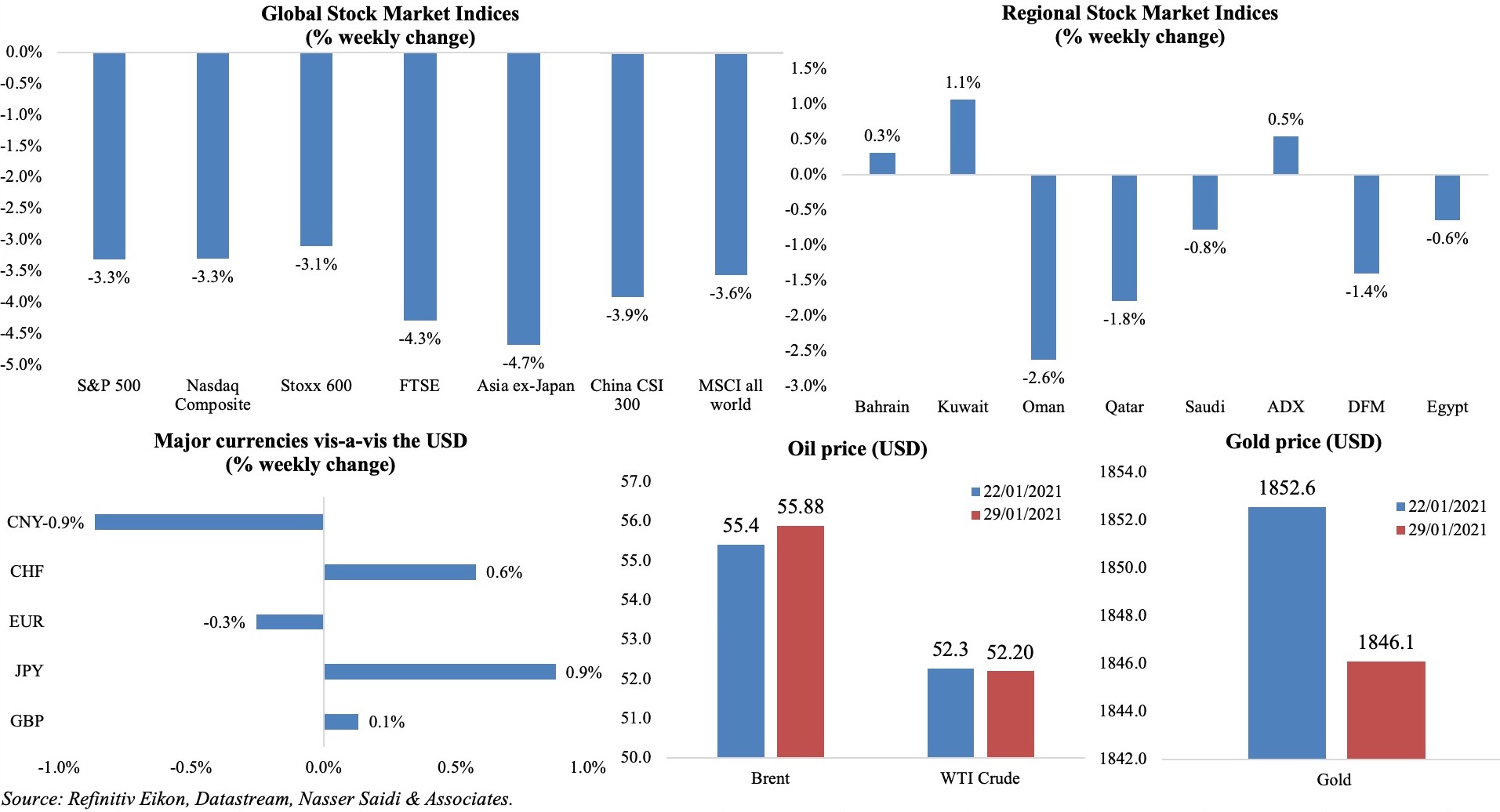

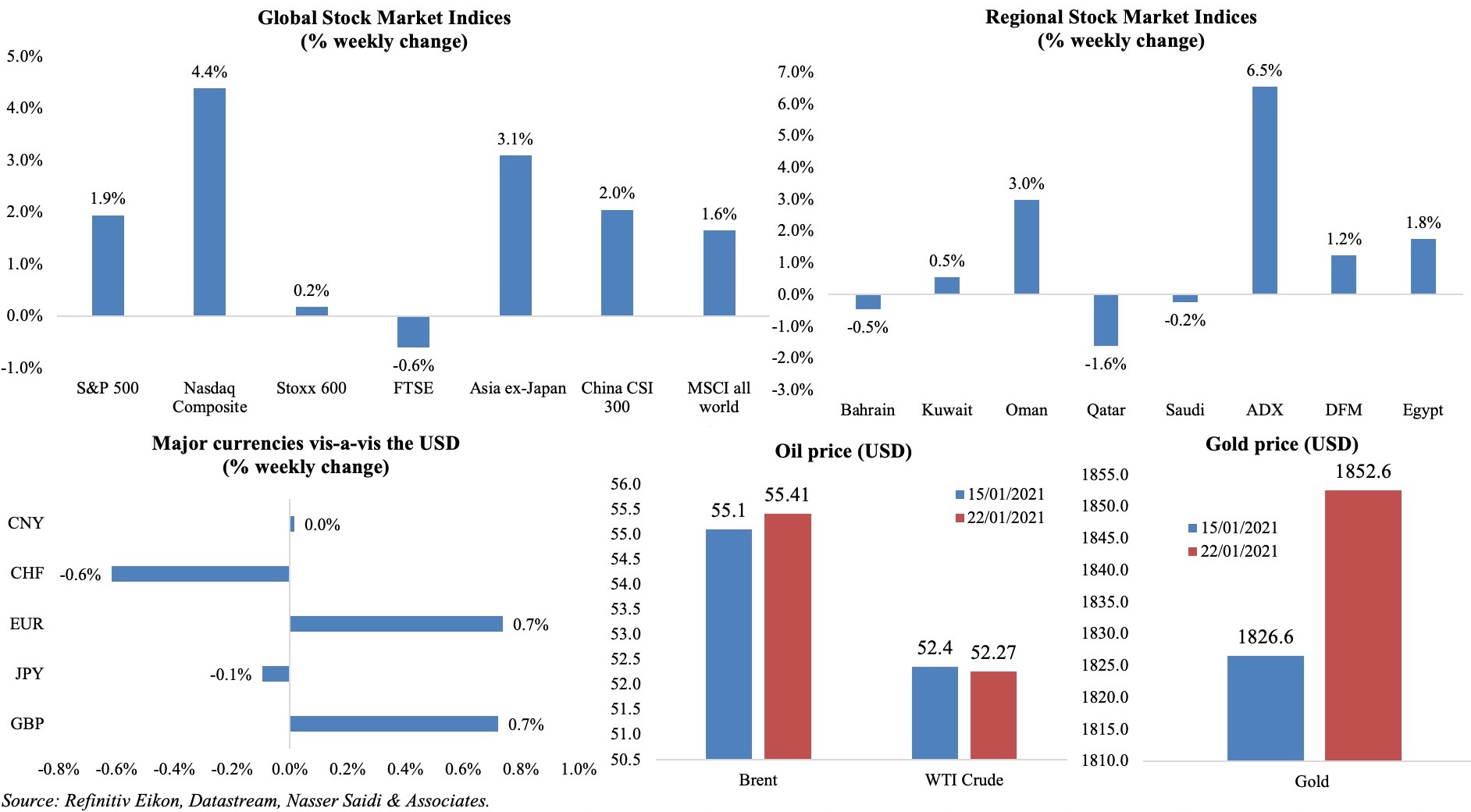

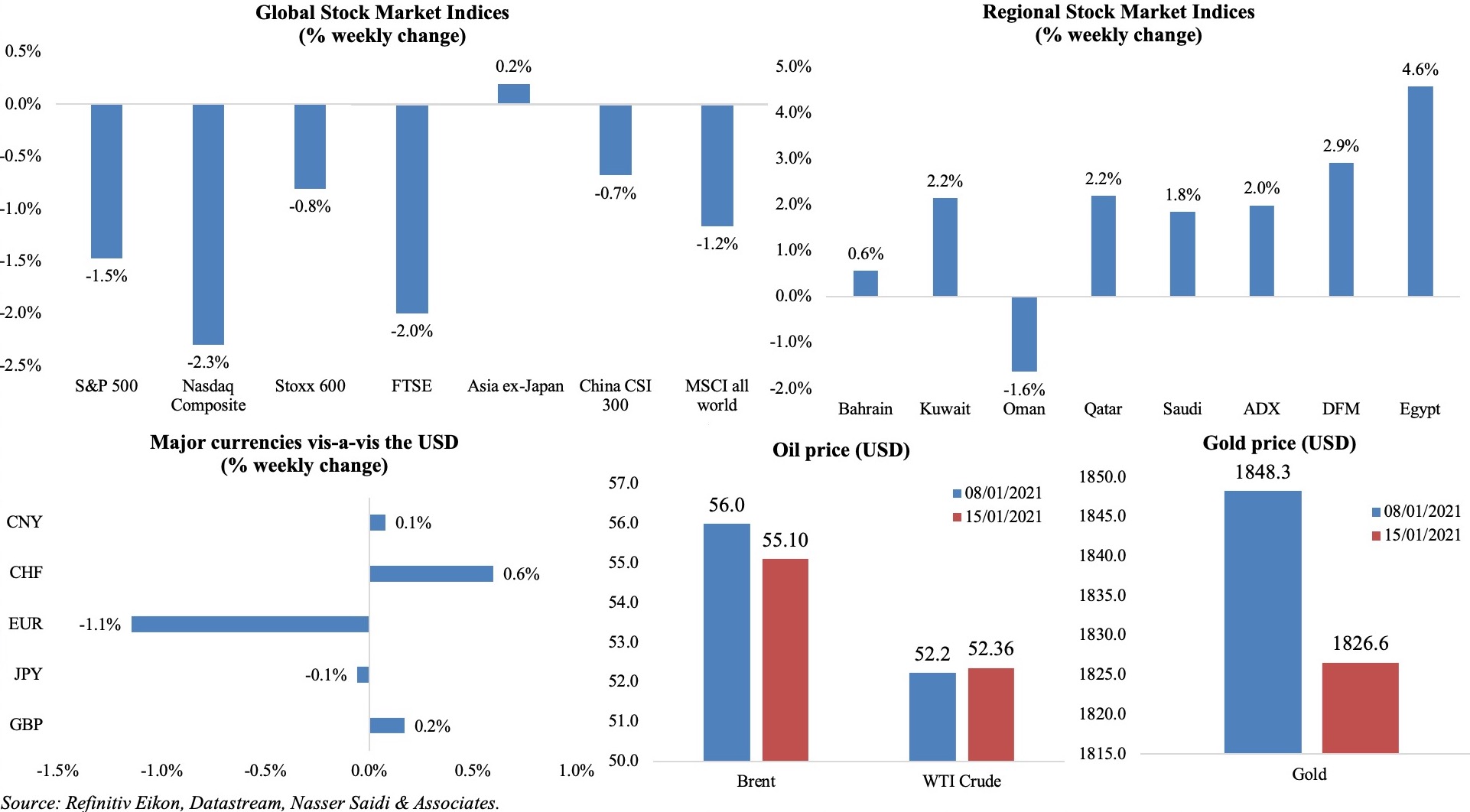

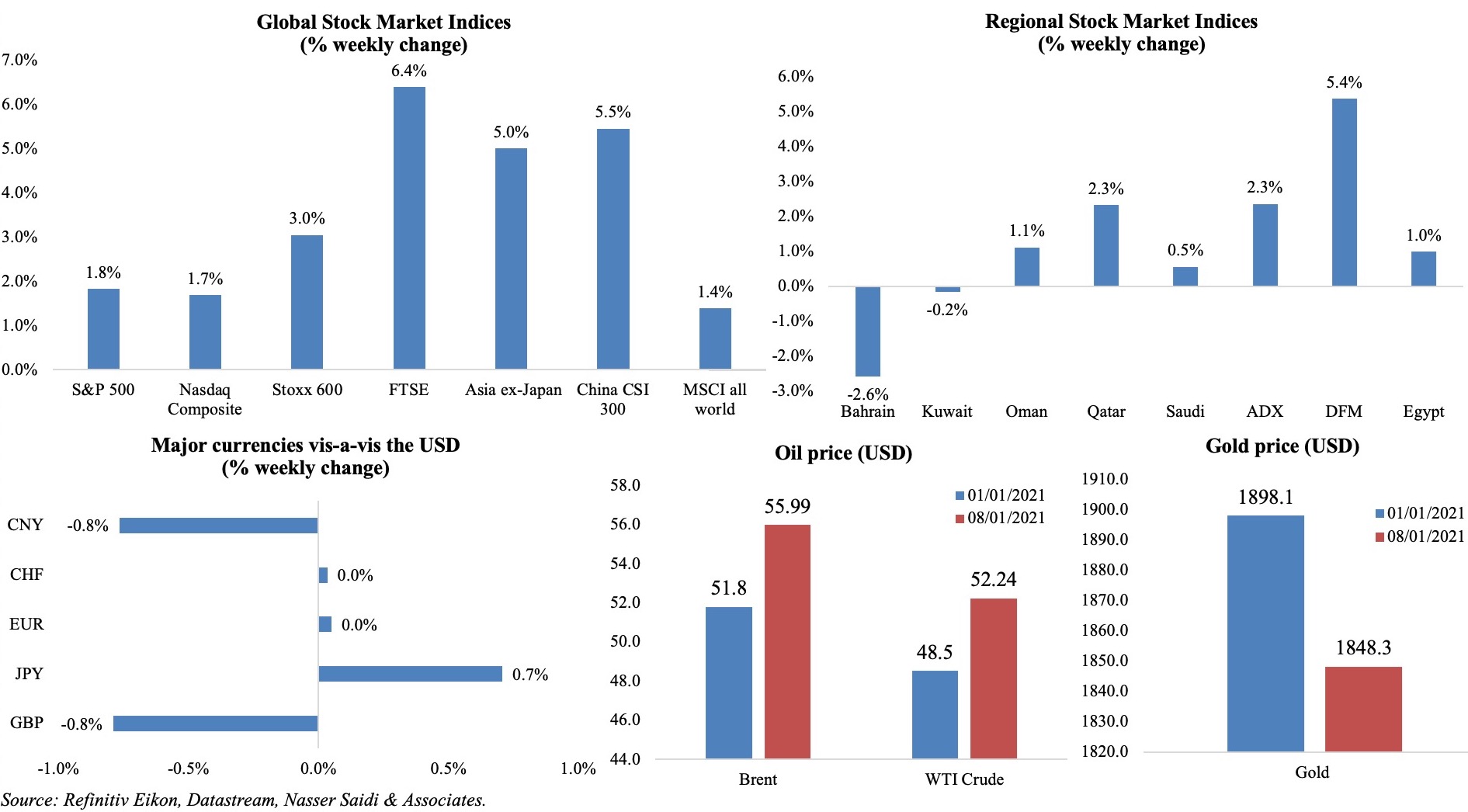

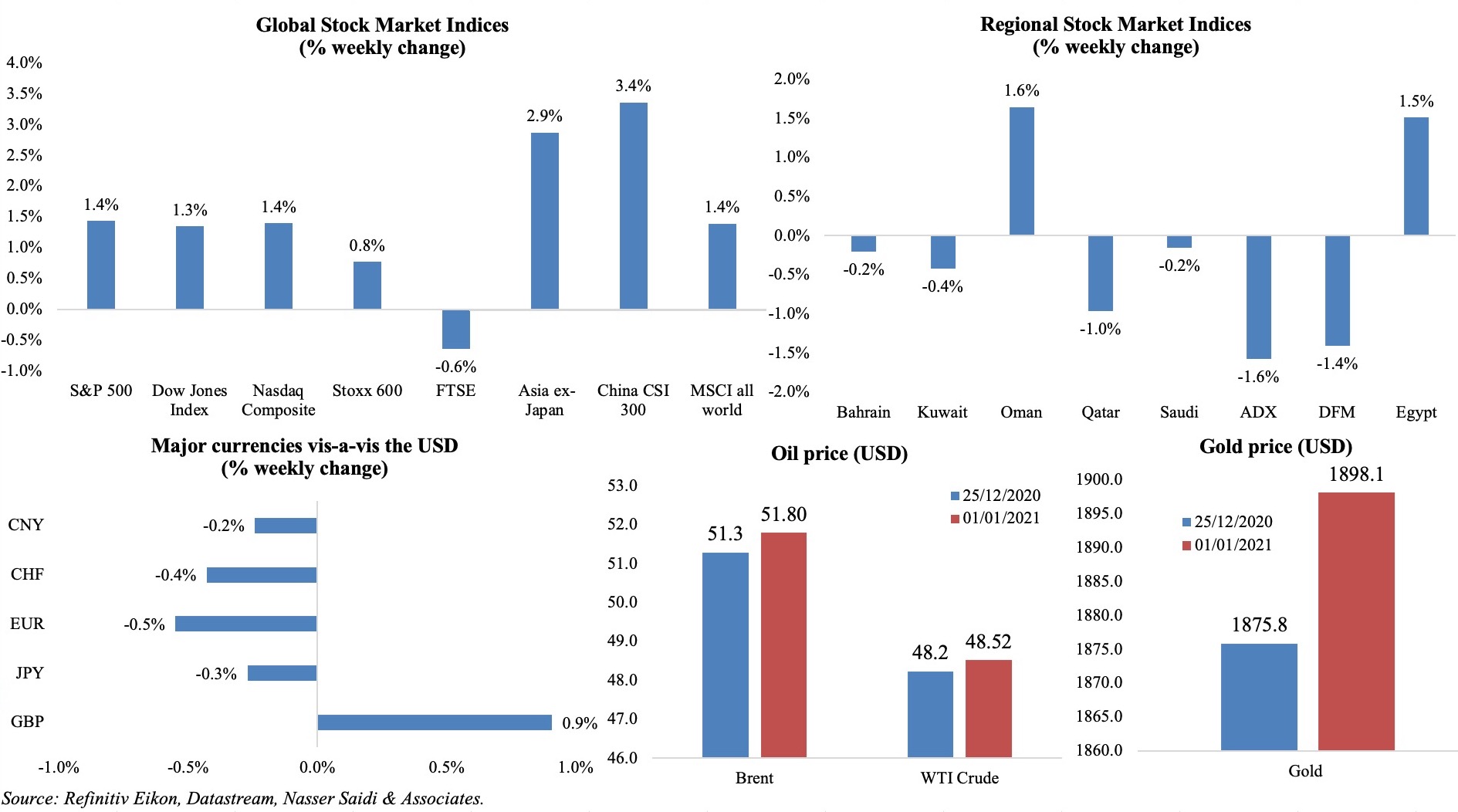

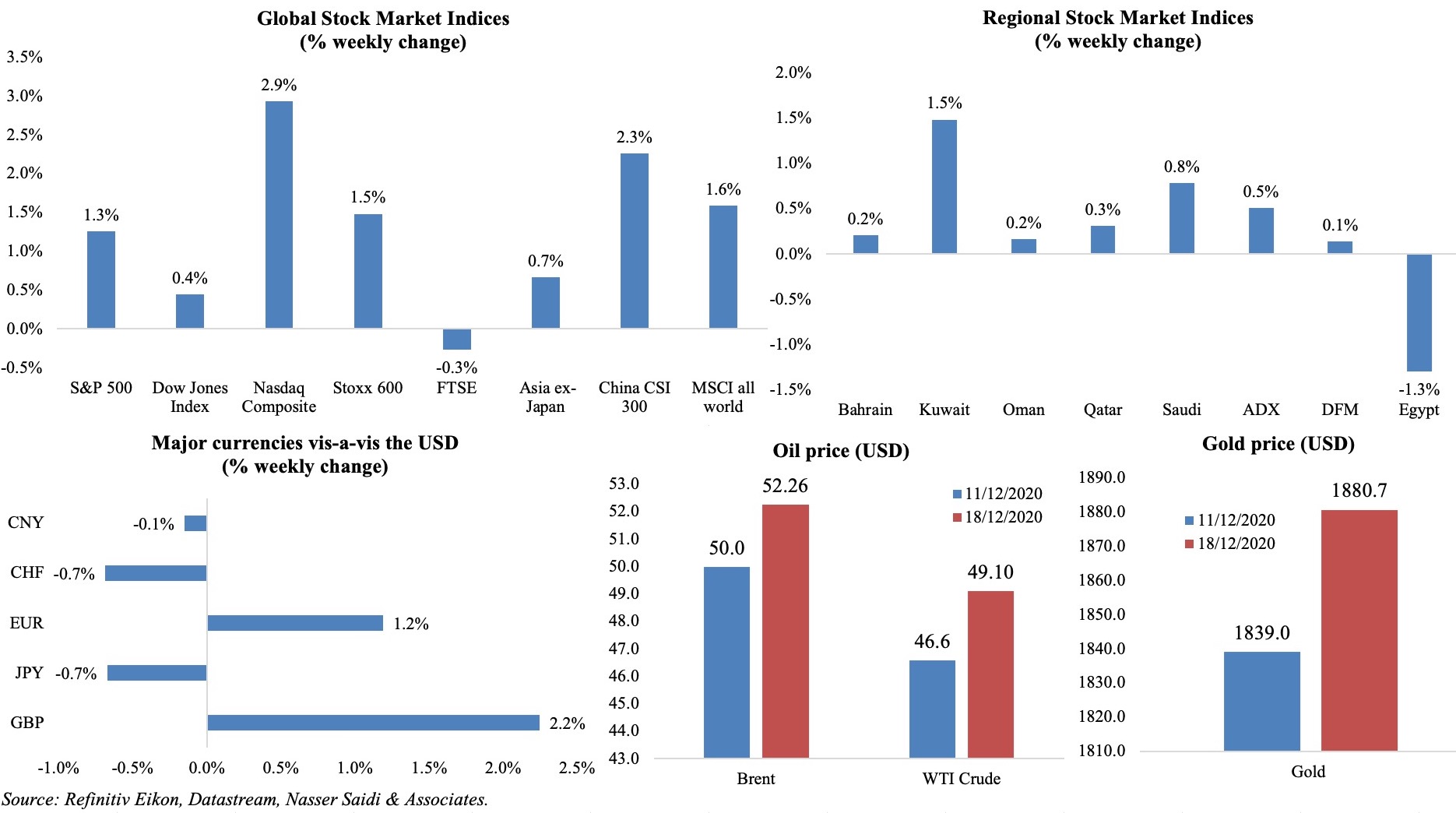

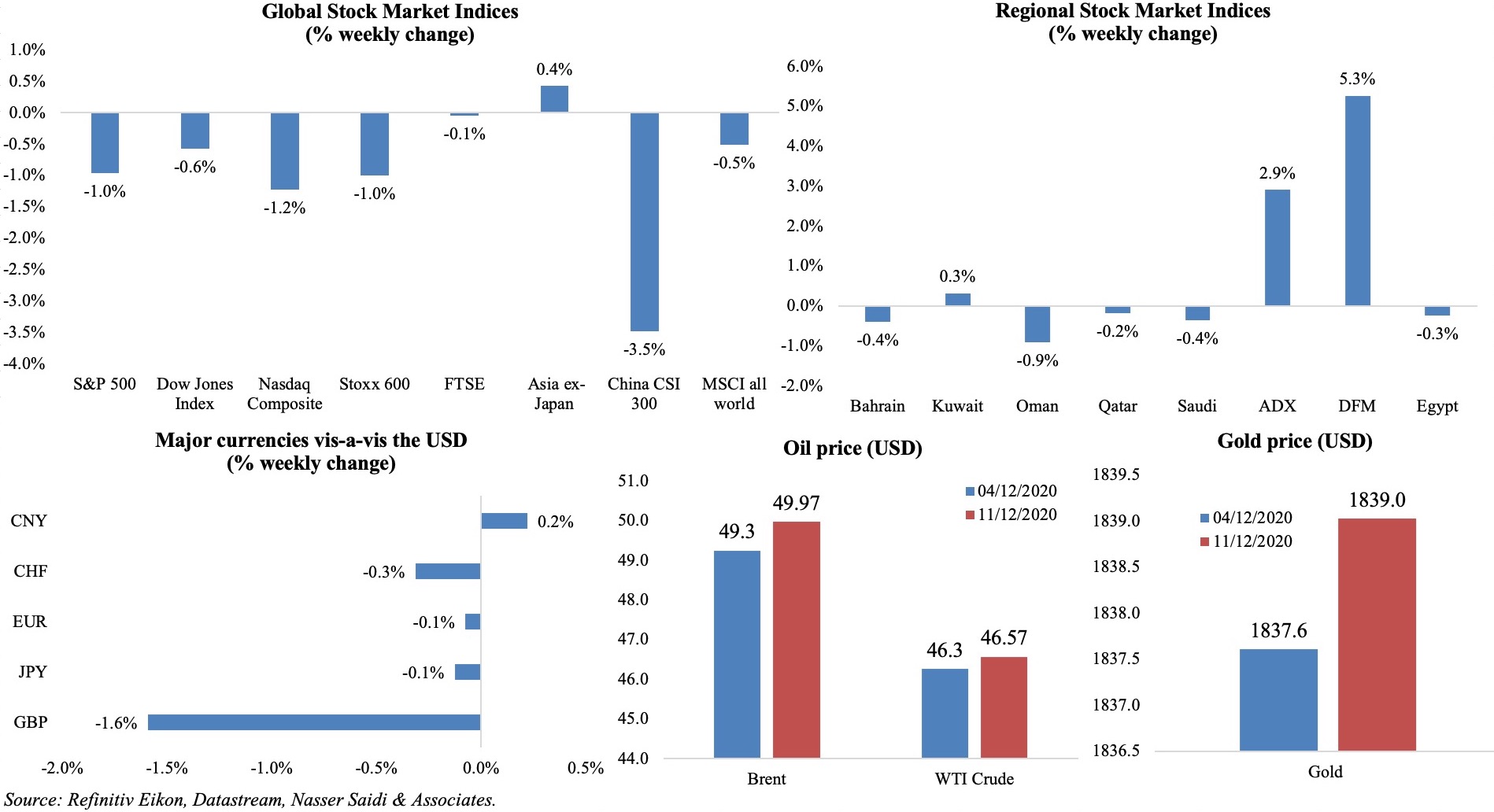

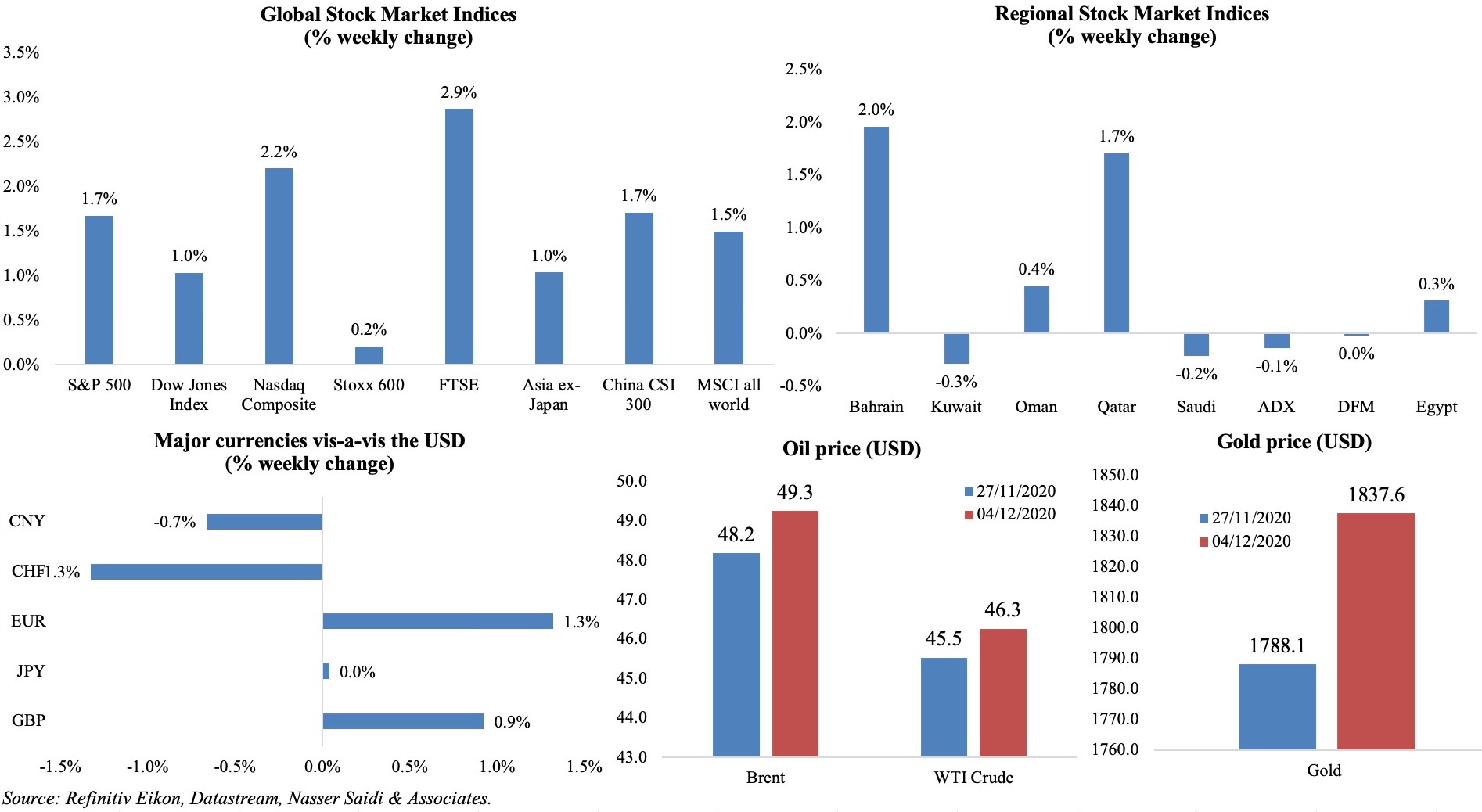

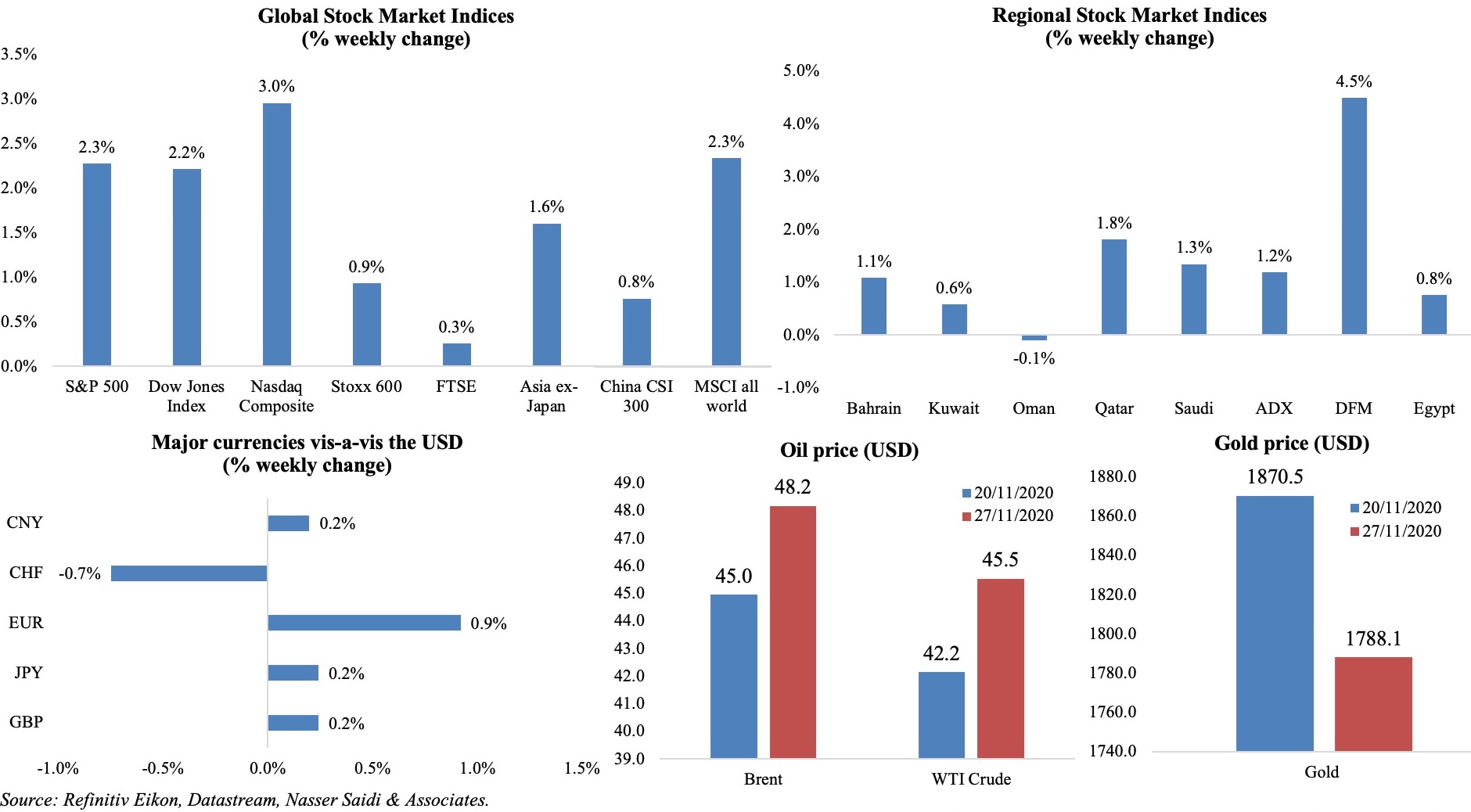

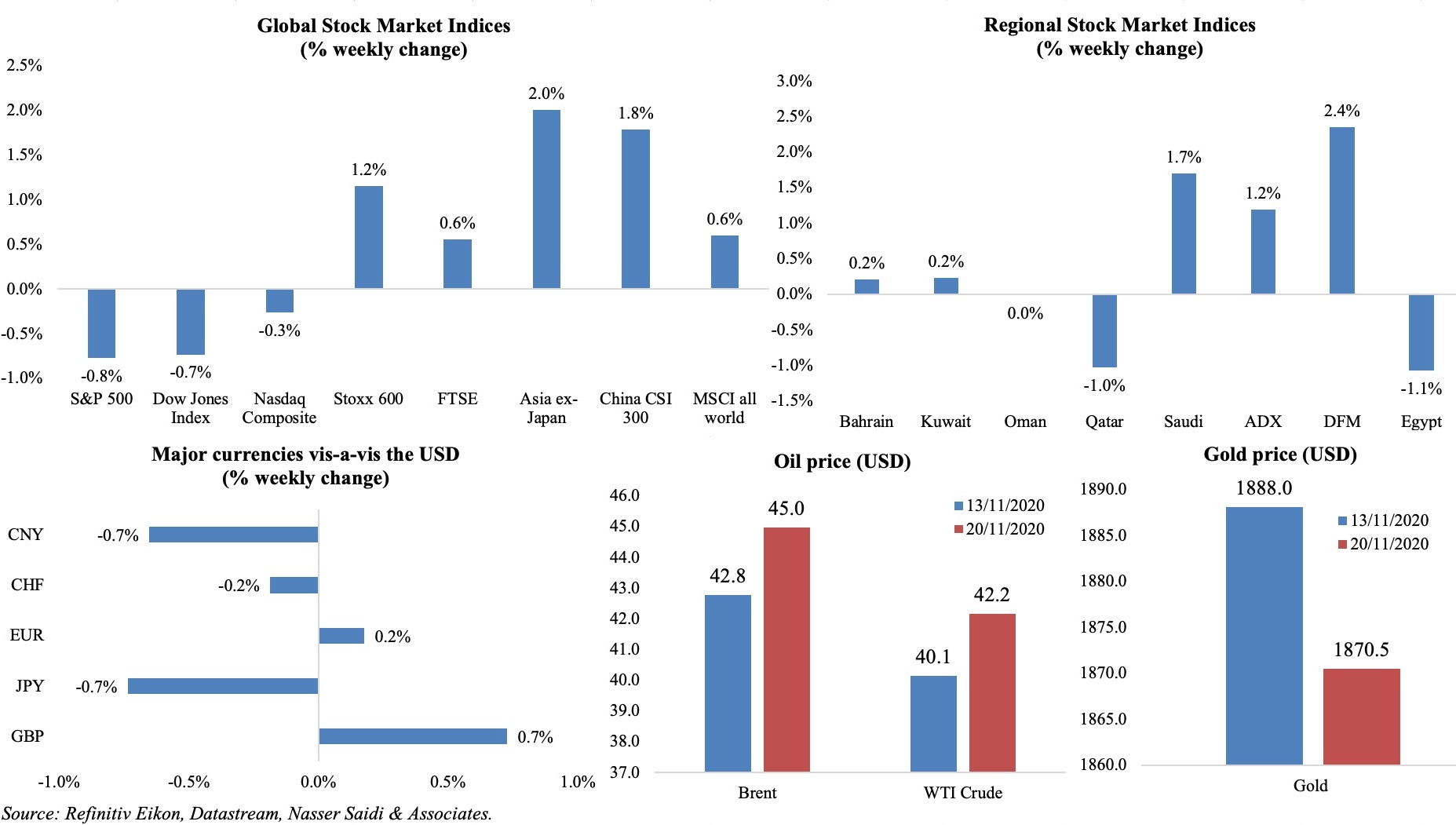

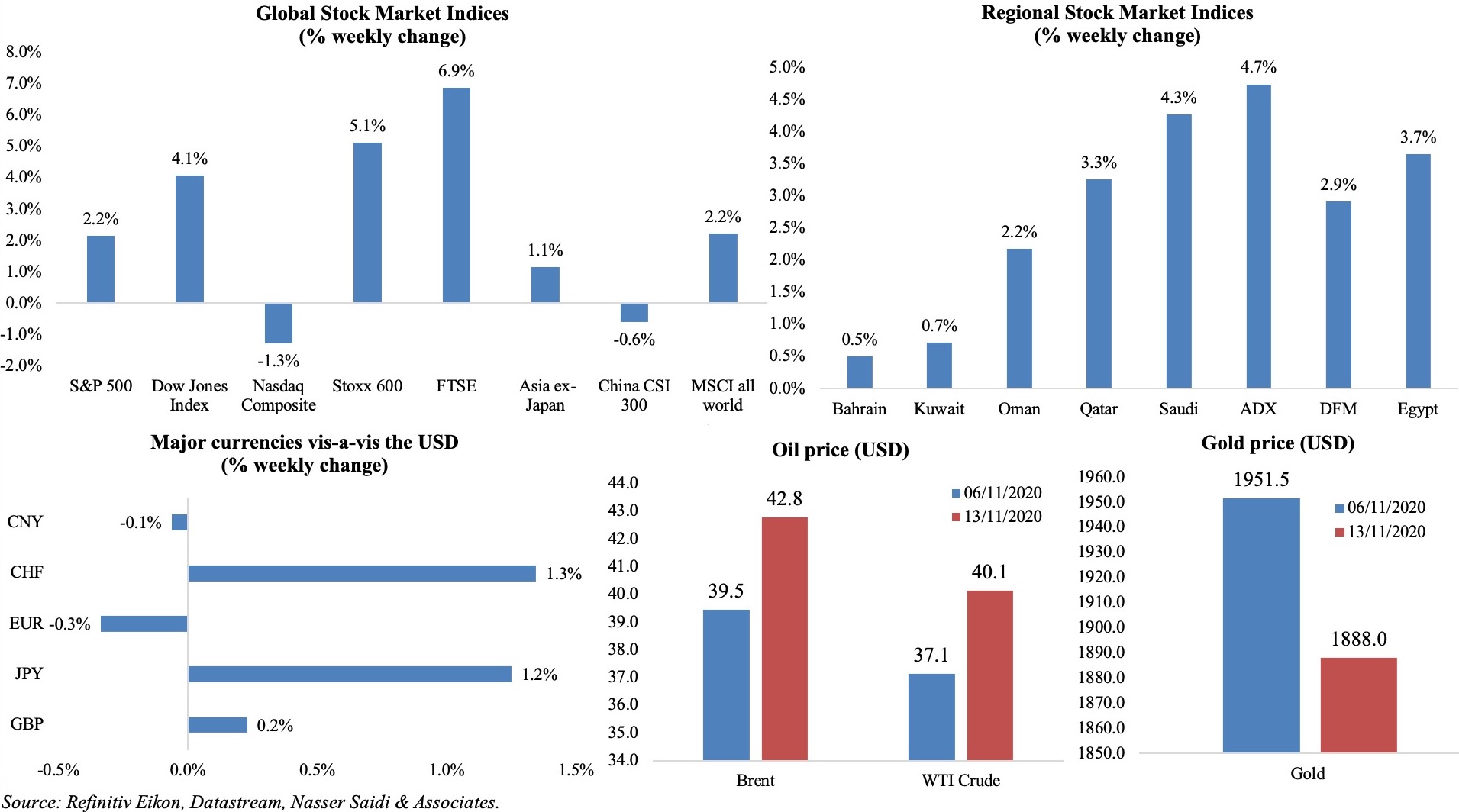

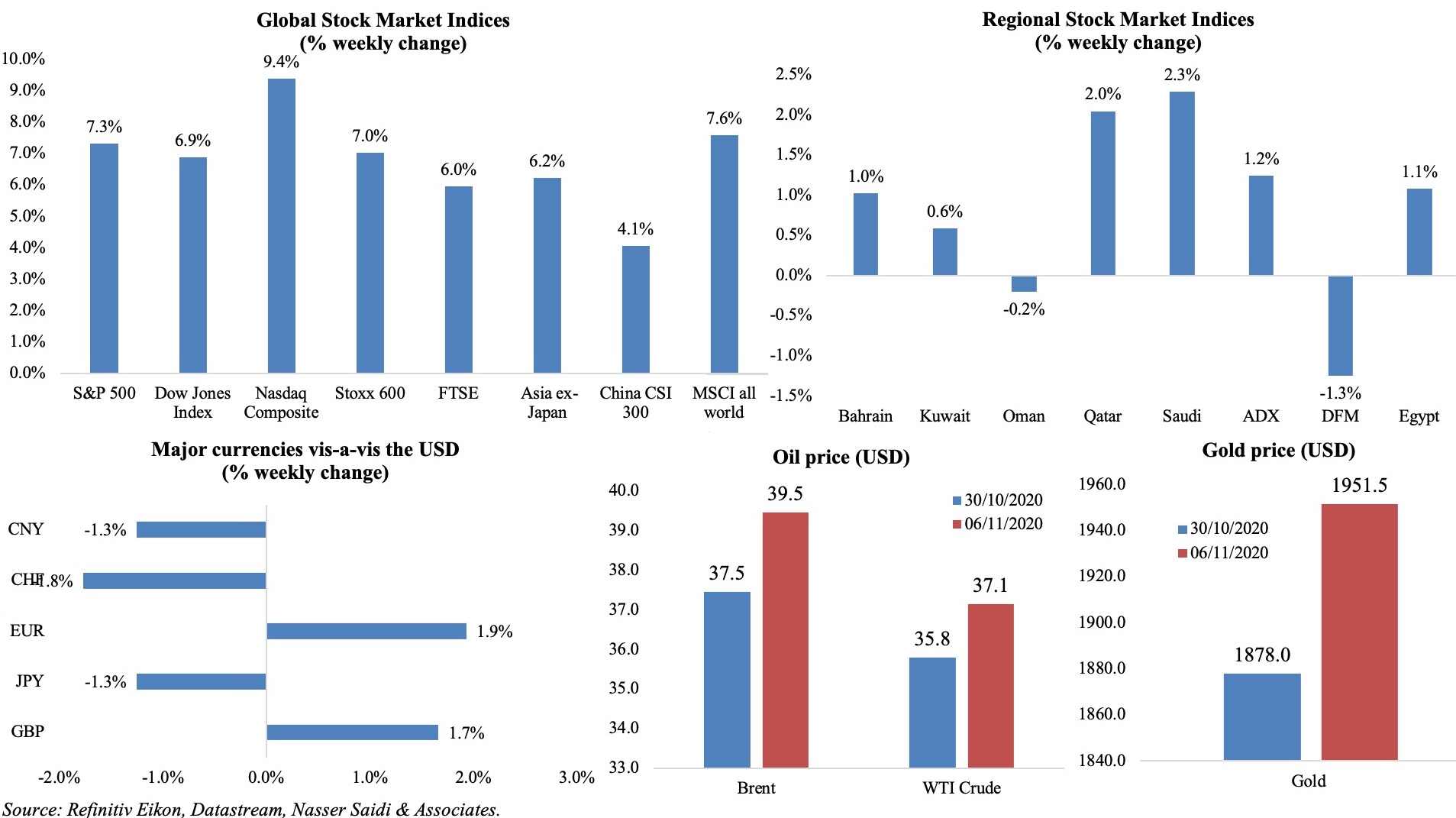

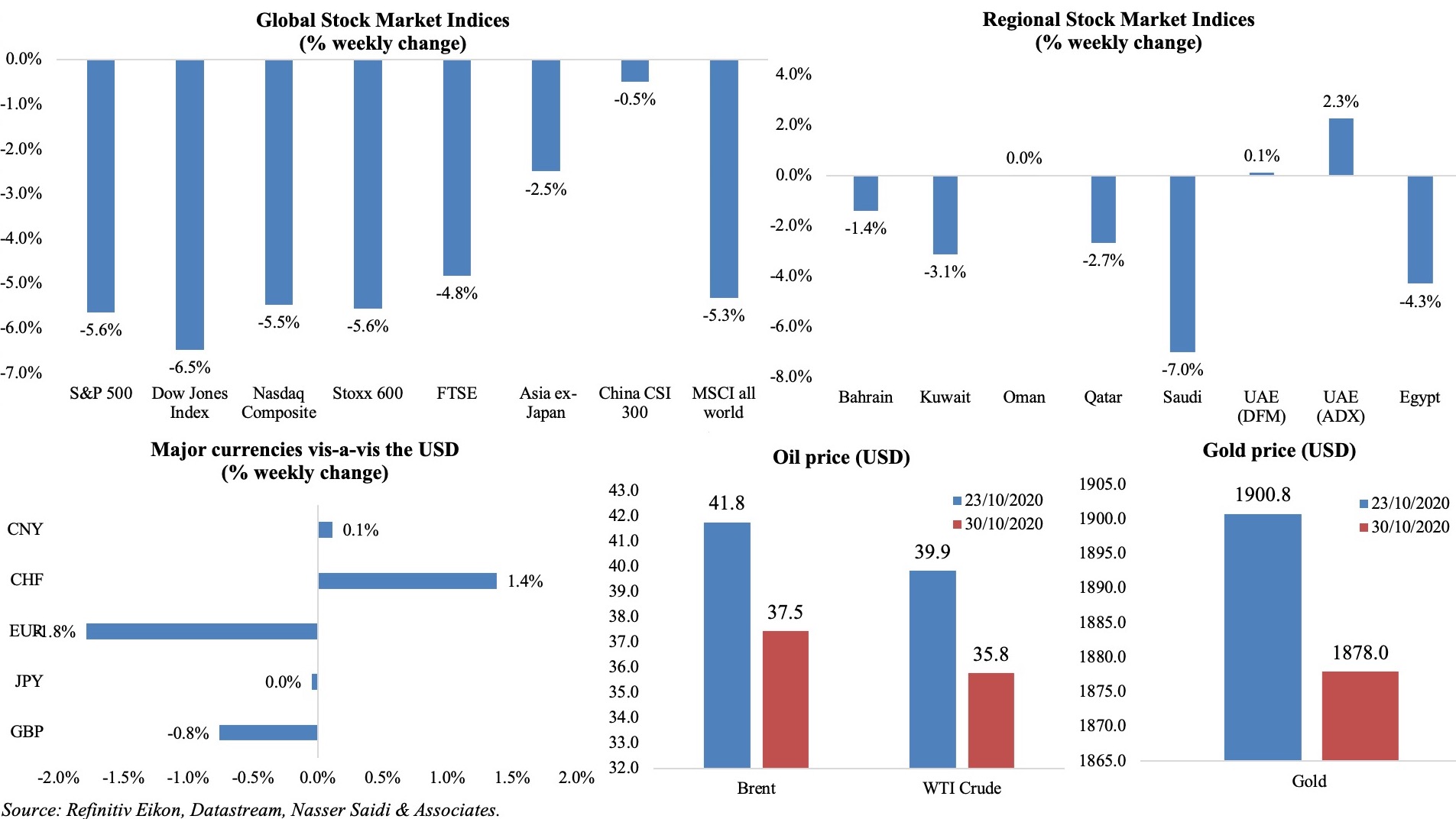

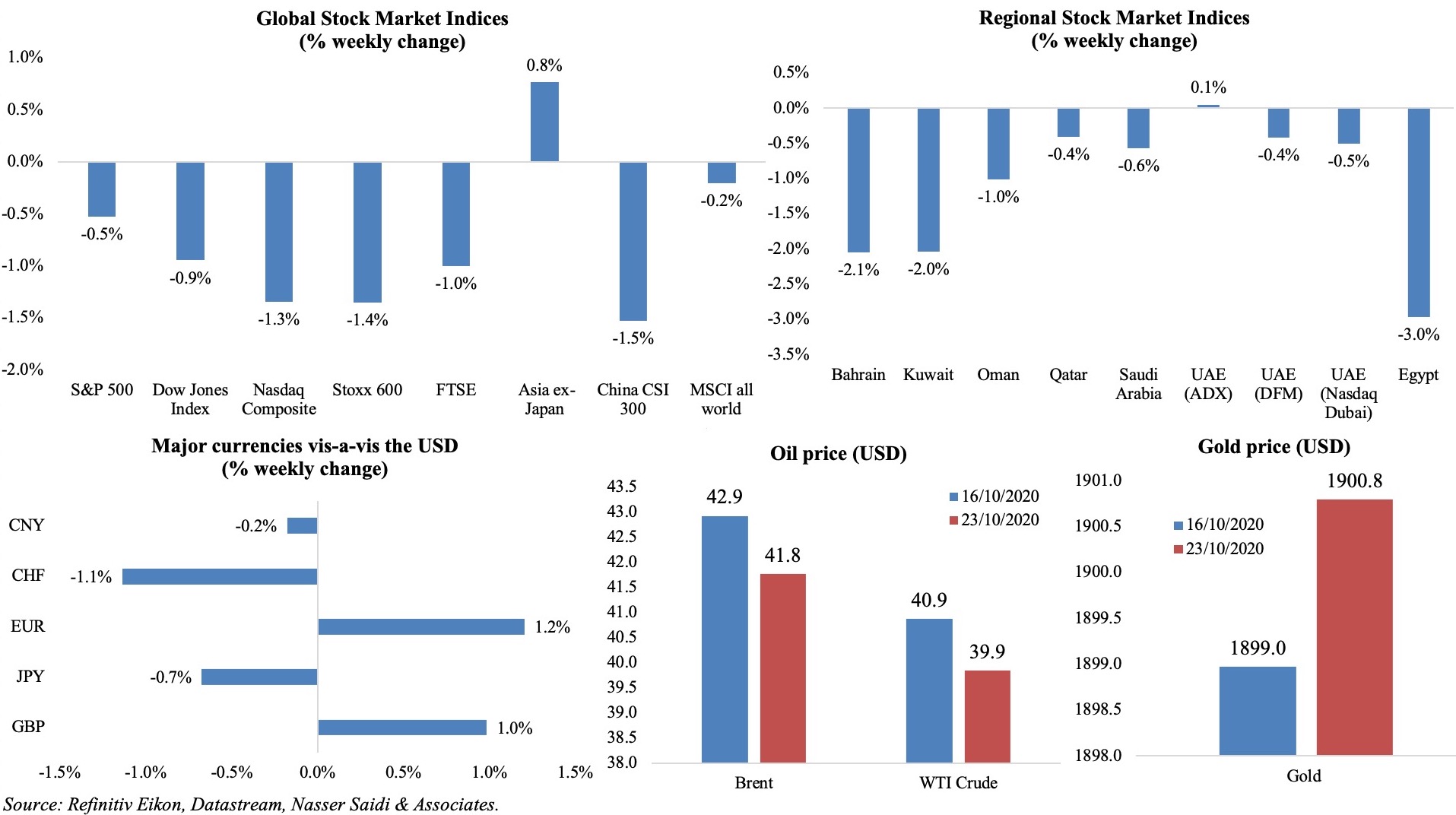

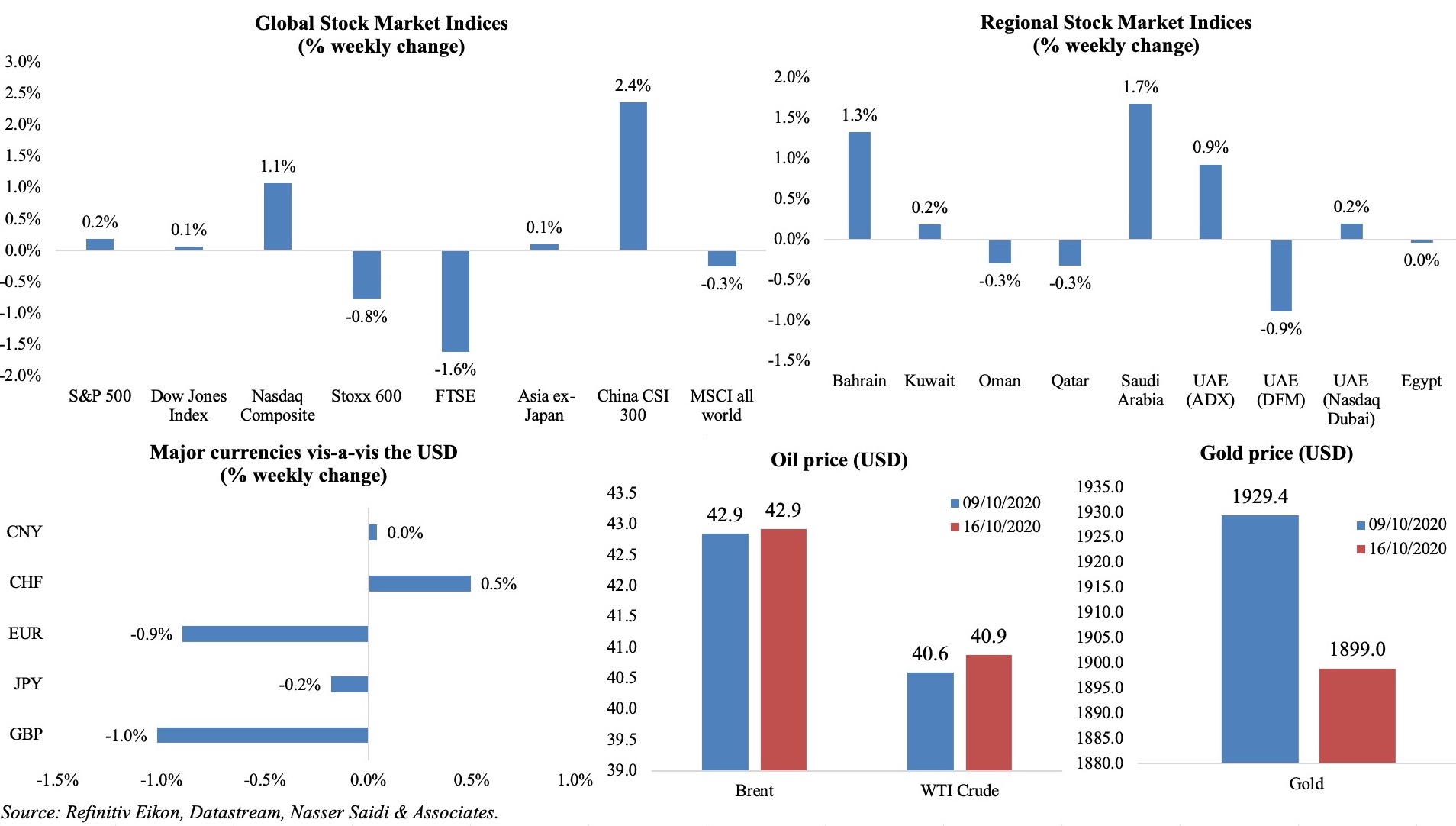

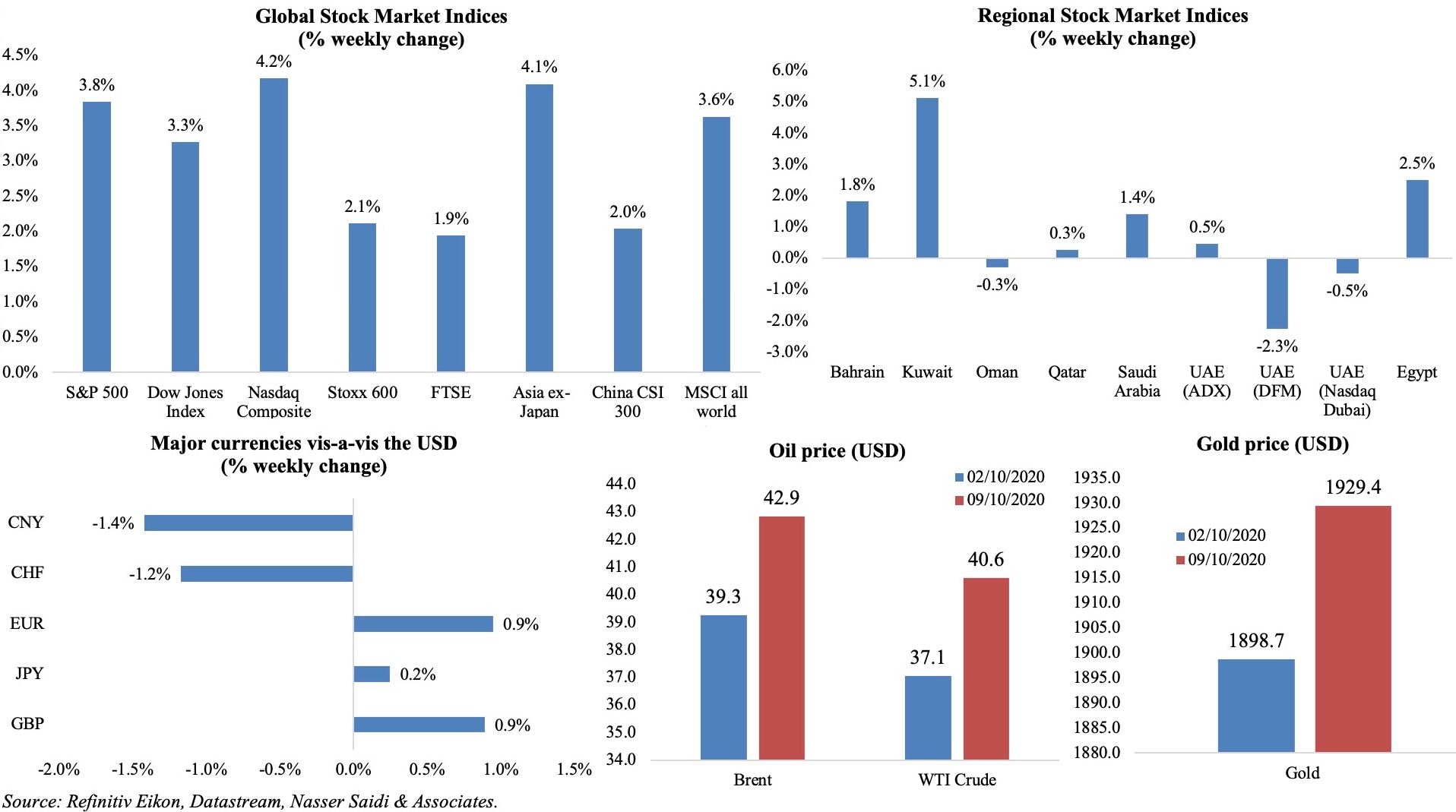

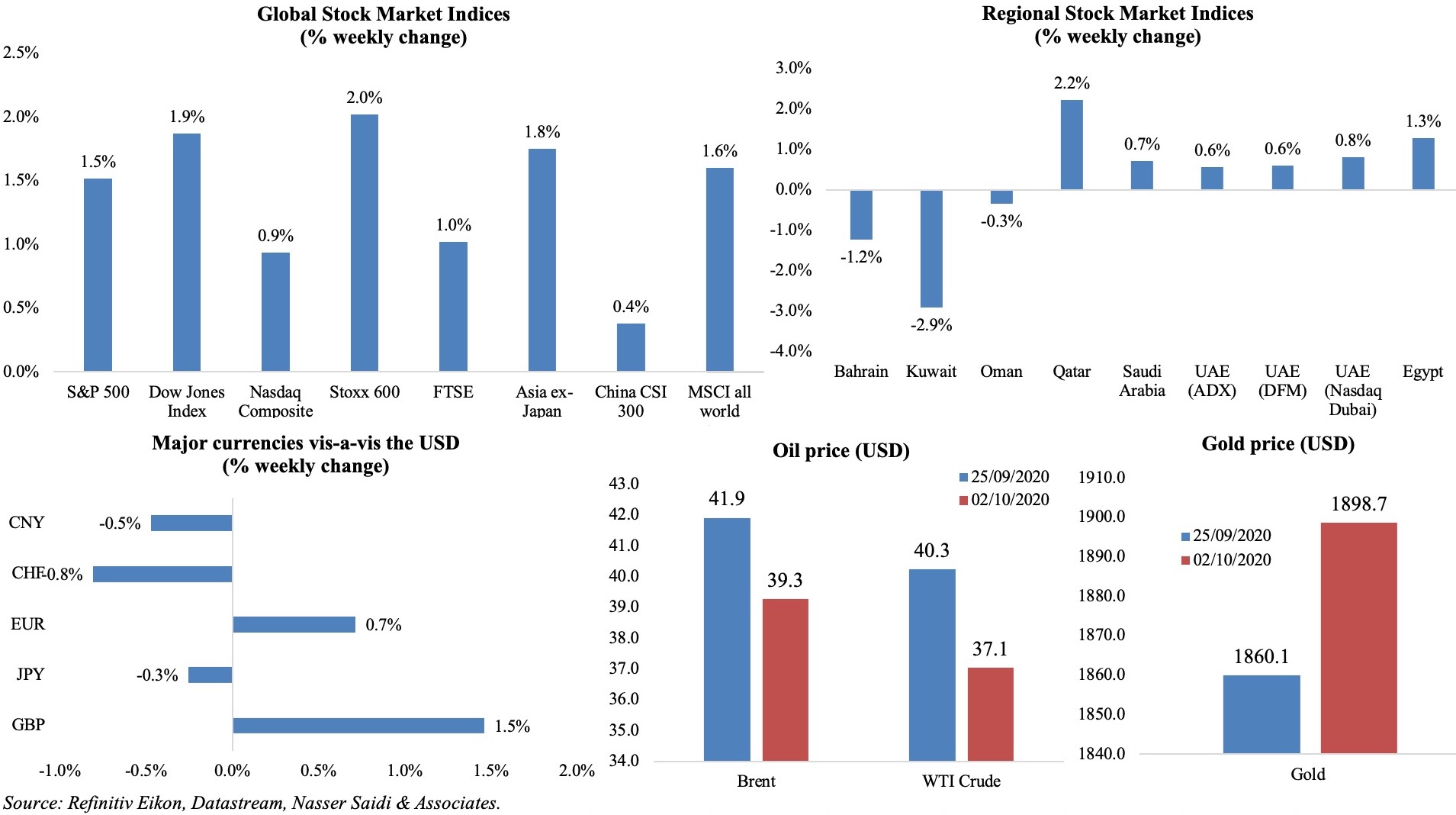

Another week of strong equity performance across global markets thanks to better-than-forecast corporate earnings while news about Evergrande averting a default supported gains in Asia; slowing recovery amidst higher Covid cases and rate hike fears saw FTSE post a weekly loss. In the region, Saudi Tadawul touched a 15-year high, while Dubai logged its biggest intraday gain since Jan 2009 on Wednesday. Oil prices stayed near 3-year highs posting its 7th weekly gain, with Brent and WTI up by 0.8% and 1.8% respectively. Gold prices gained for a second week, supported by a weaker dollar. Meanwhile, Bitcoin touched a record high of USD 67,017 after the launch of the first US bitcoin futures ETF.

Weekly % changes for last week (21 – 22 Oct) from 14 Oct (regional) and 15 Oct (international).

Global Developments

US/Americas:

- Fed Beige book revealed “modest to moderate” economic growth alongside “significantly elevated prices” and wage pressures given supply chain disruptions and labour constraints.

- Industrial production in the US tumbled by 1.3% mom in Sep (Aug: -0.1%), with manufacturing output down by 0.7% (and a 7.2% drop in motor vehicles). According to the Fed, about 0.6% of the overall decline in IP was a result of the effects of Hurricane Ida. Capacity utilization slipped to 75.2% in Sep, from Aug’s 76.2% reading, and is about 4.4% below average.

- Housing starts in the US declined by 1.6% mom to 1.555mn in Sep – the lowest level since Apr. Meanwhile, building permits plunged by 7.7% mom to 1.589mn in Sep (a 12-month low) as multi-segment fell by 18.3% to a rate of 548k. Costs of building materials have been rising as has mortgage rates.

- Existing home sales grew by 7% mom to an 8-month high of 6.29mn in Sep. First-time buyers accounted for only 28% of sales last month, the smallest share since Jul 2015.

- Philadelphia manufacturing survey index slipped to 23.8 in Oct (Sep: 30.7): new orders index improved (30.8 in Oct from Sep’s 15.9) and employment edged up (30.7 from 26.3) while the shipments index held steady (30).

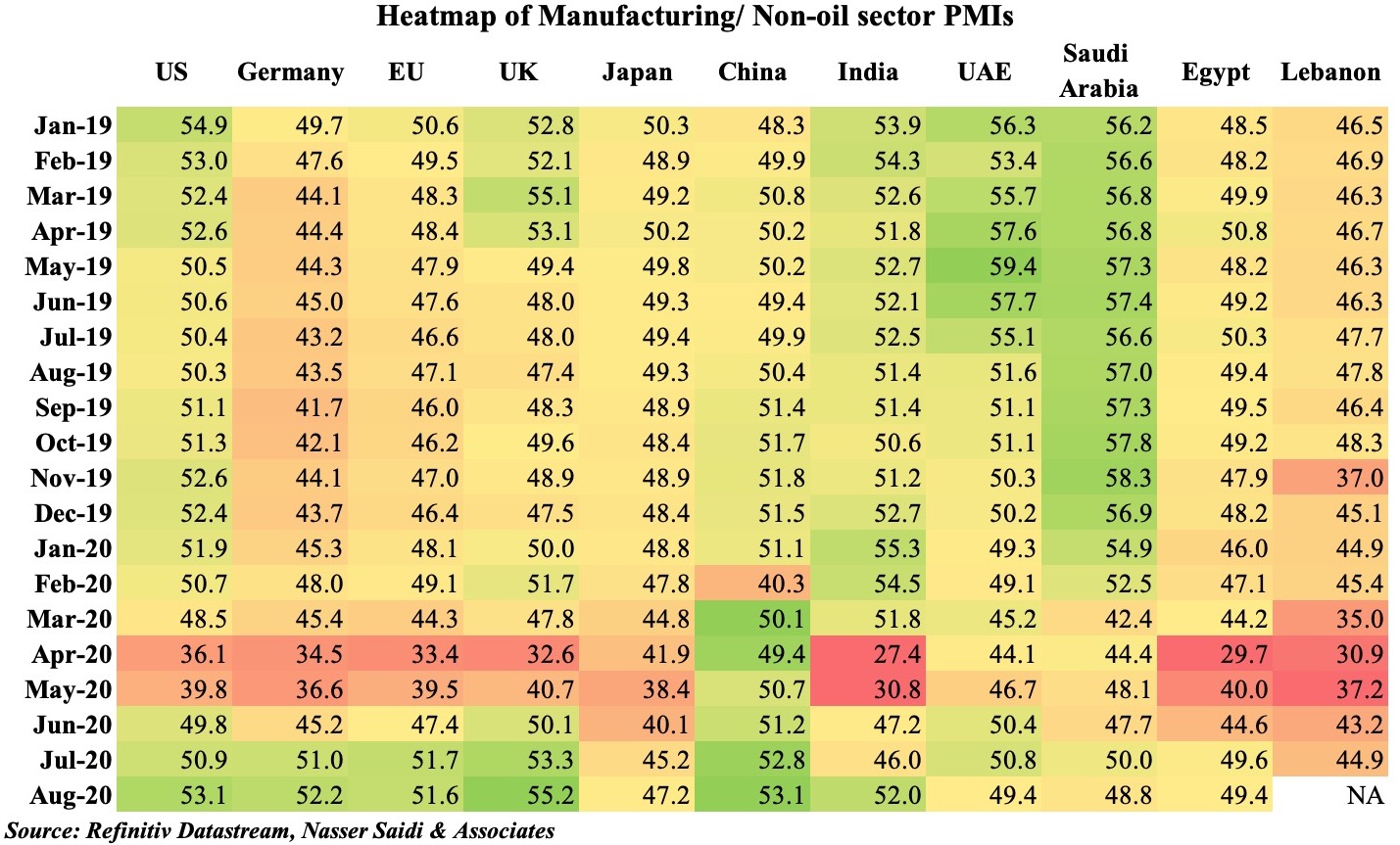

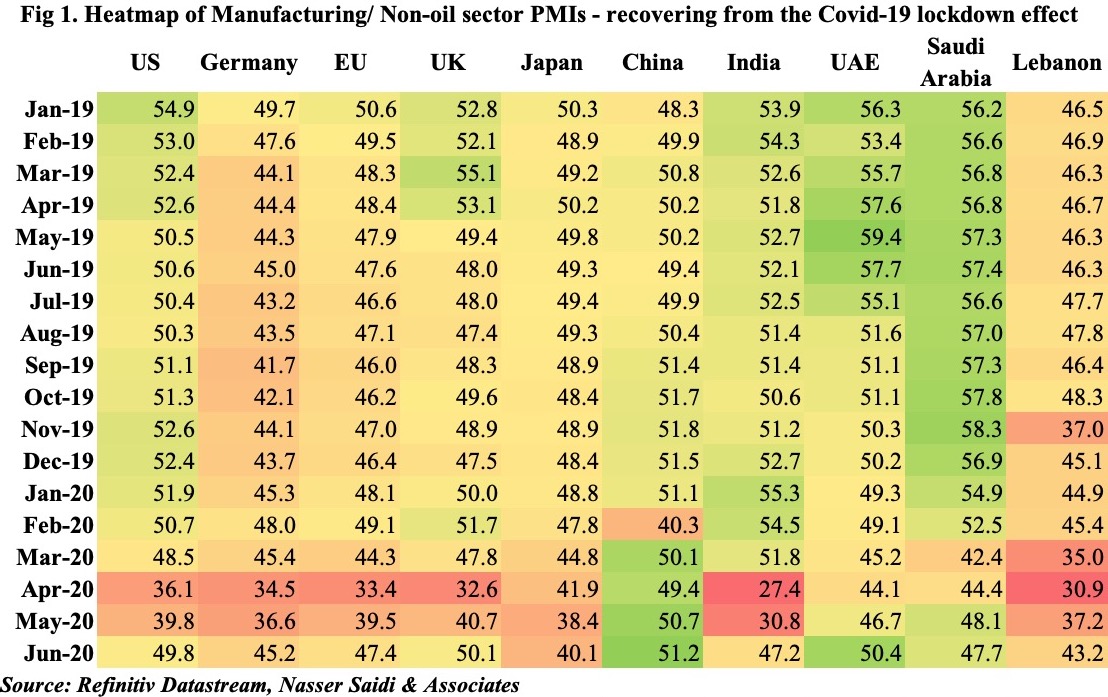

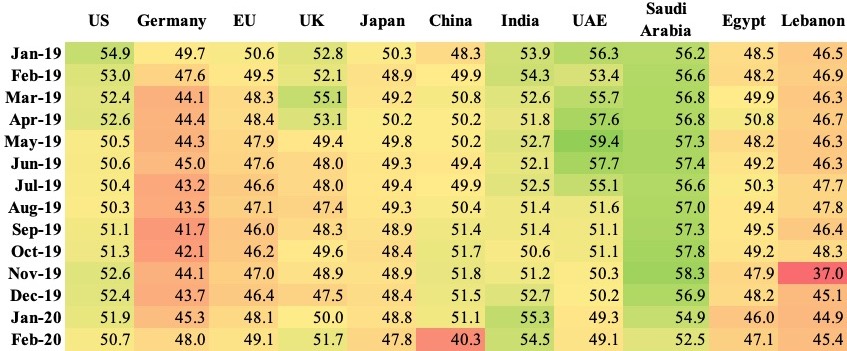

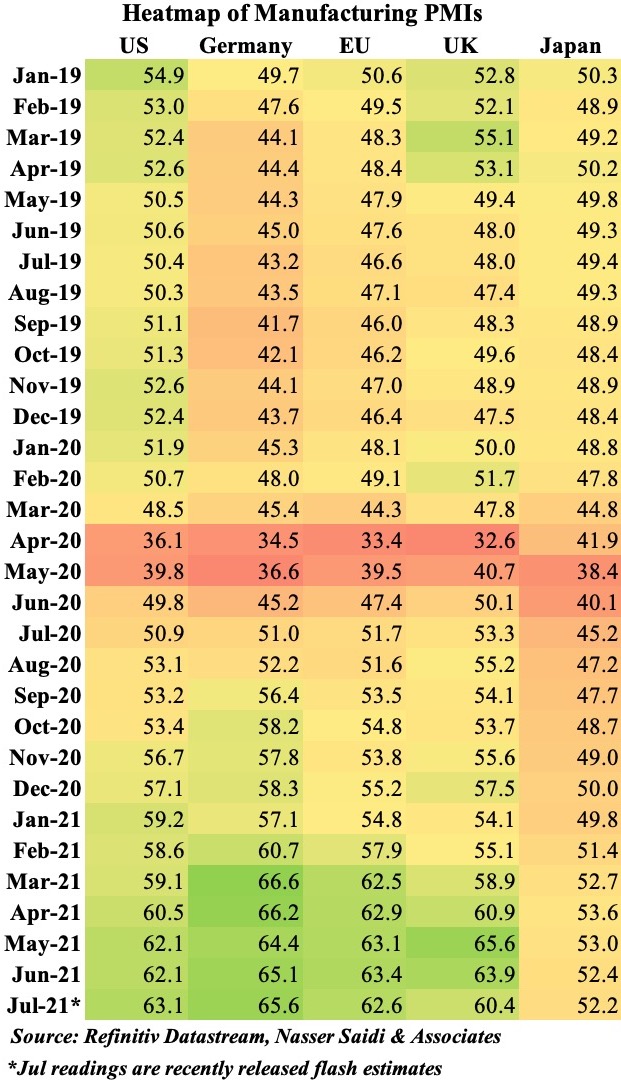

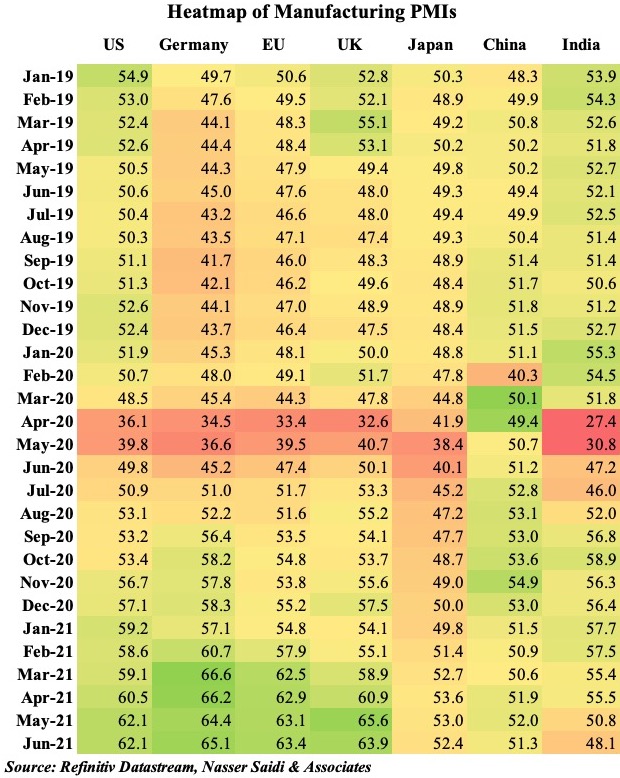

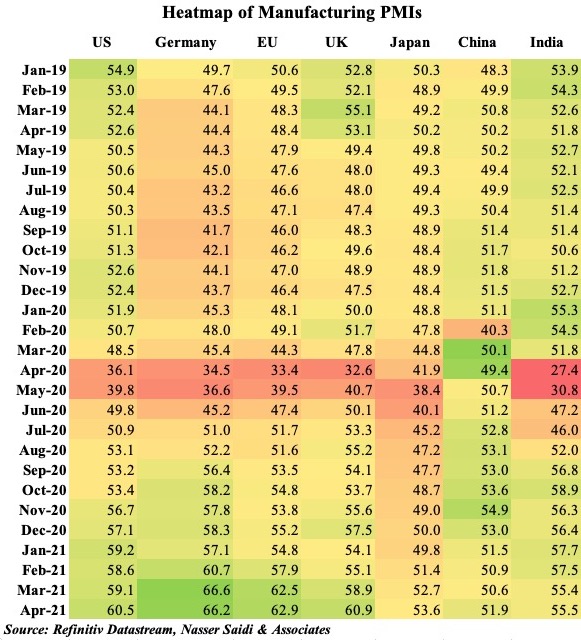

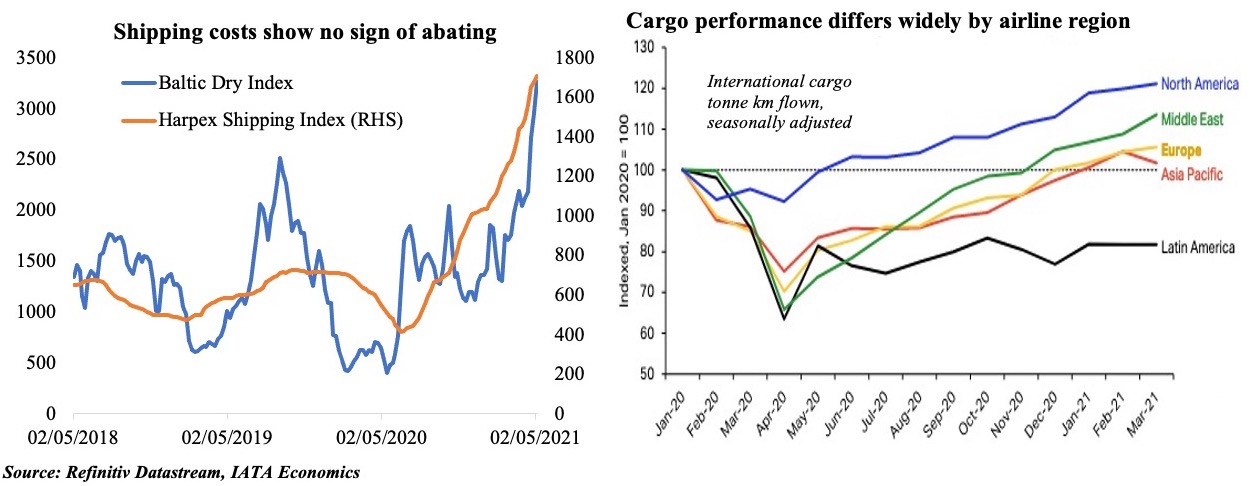

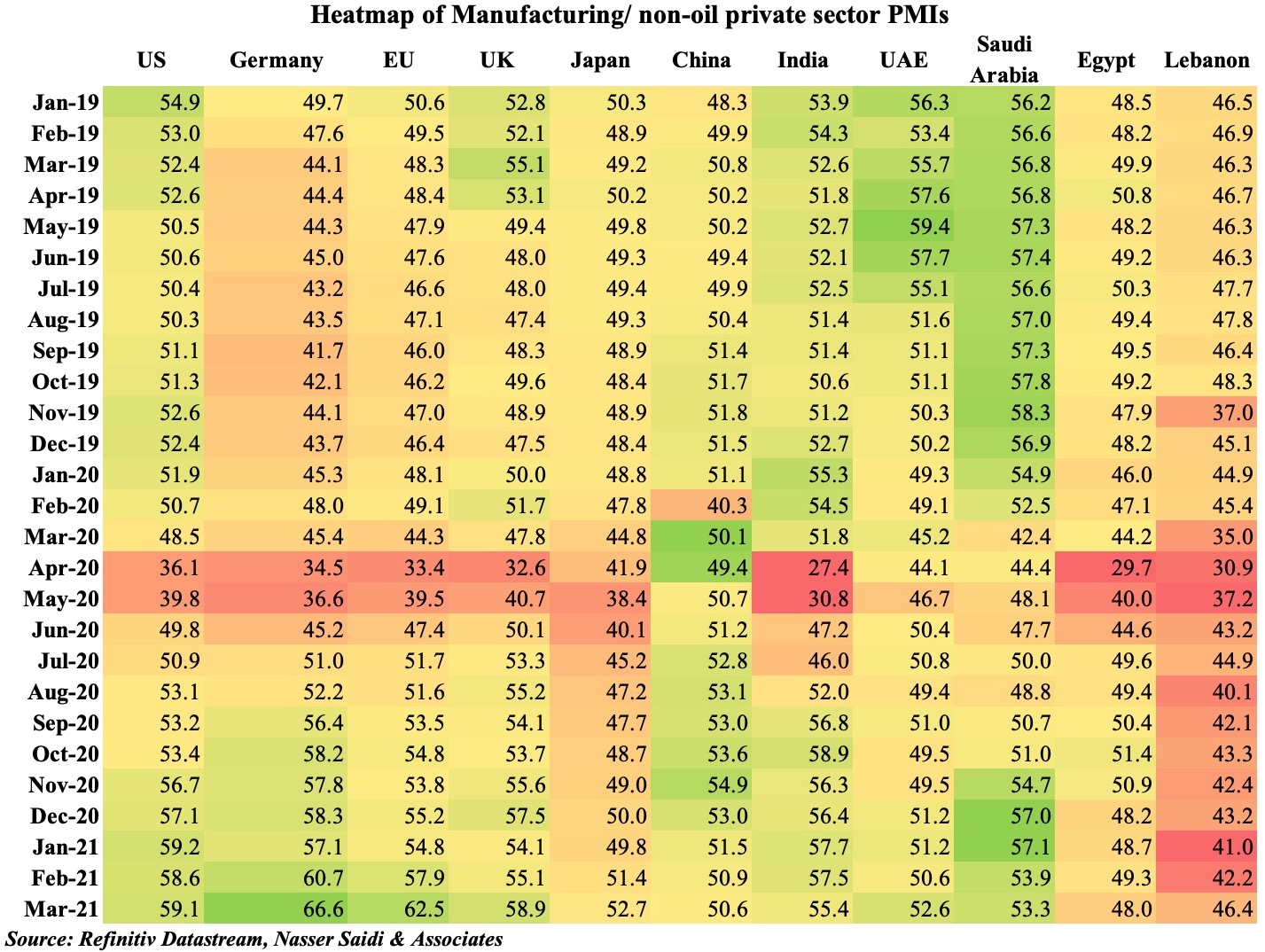

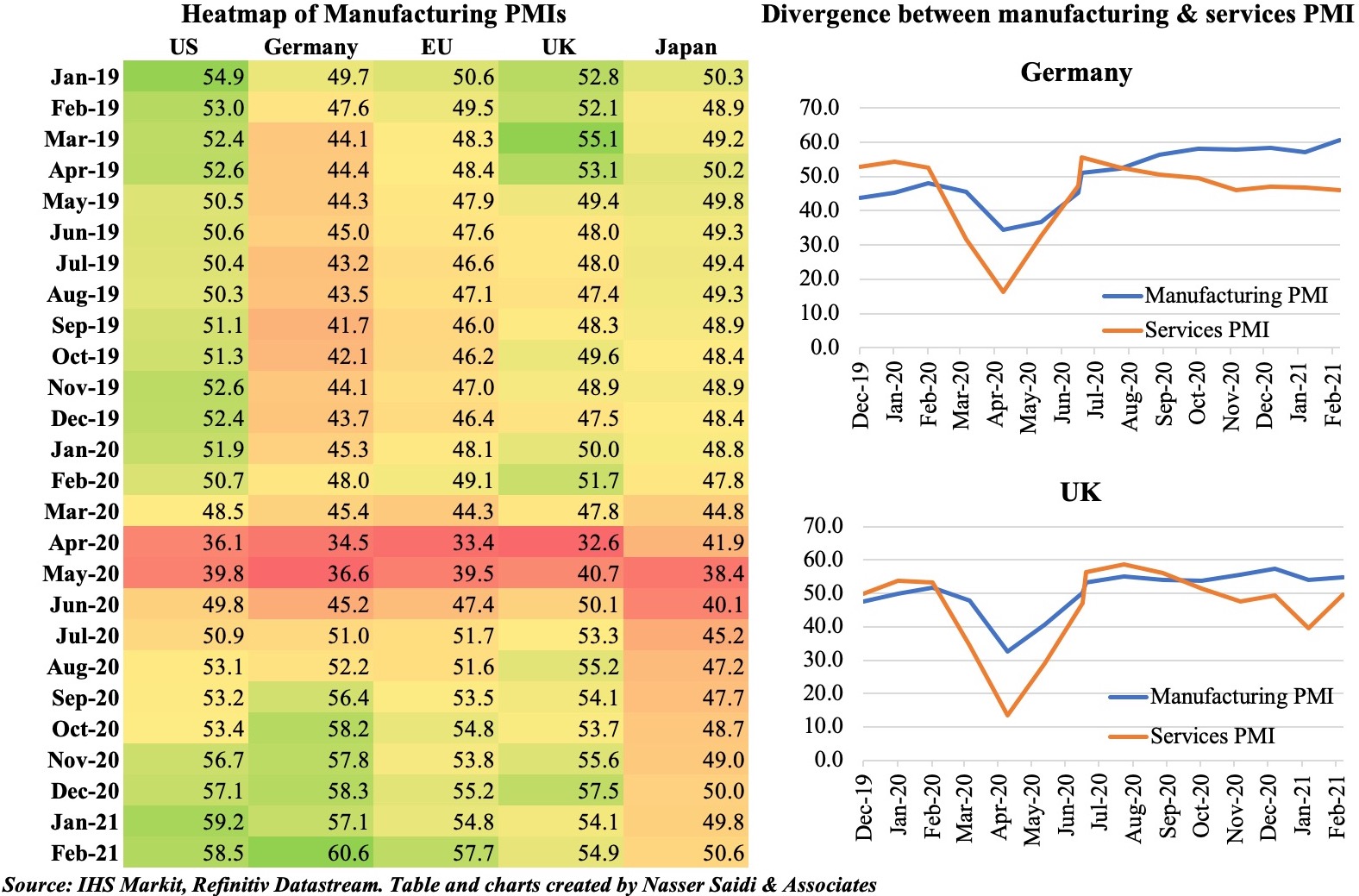

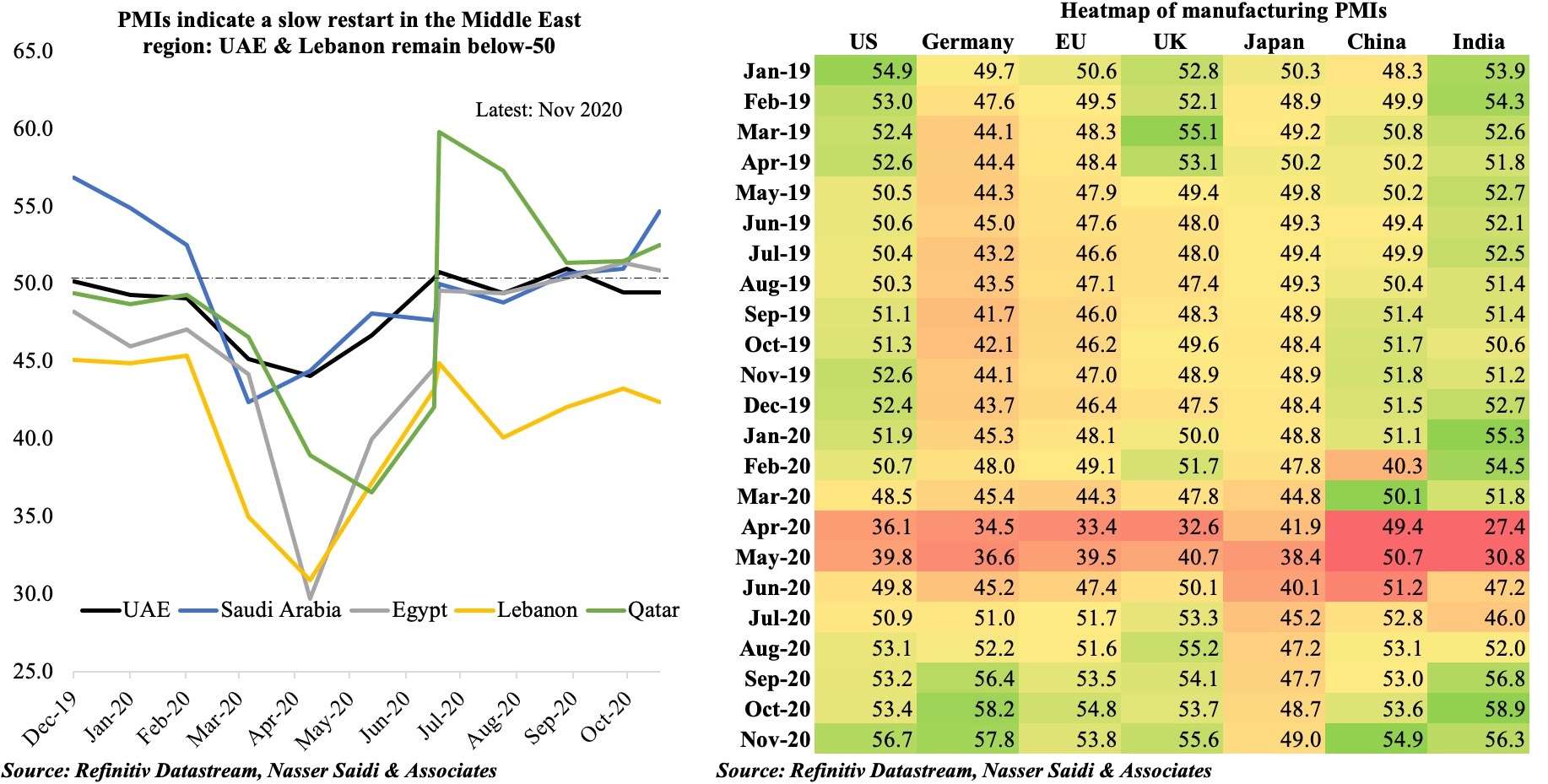

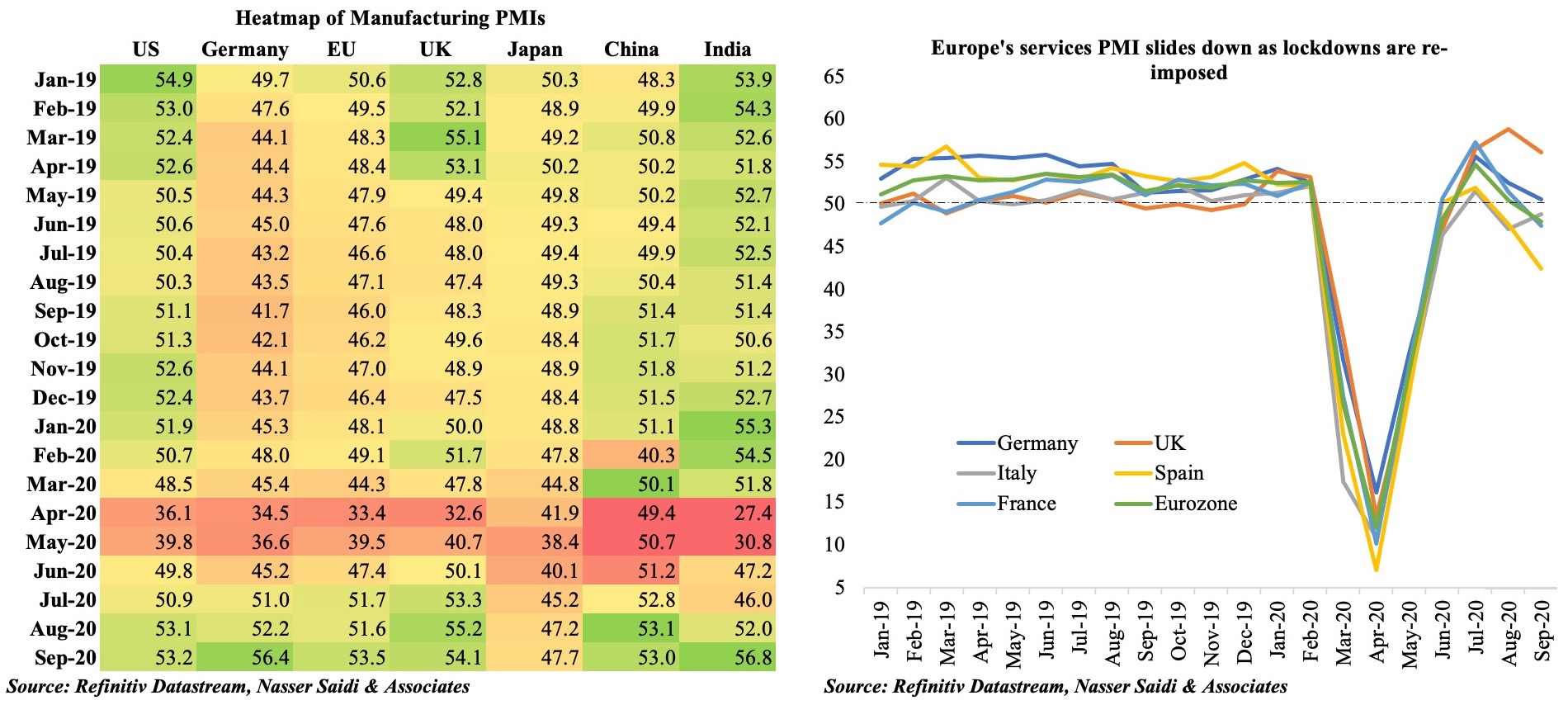

- US preliminary composite PMI output index stood at a 3-month high of 57.3 in Oct (Sep: 55), supported by the services sector boost (58.2 from Sep’s 54.9) as manufacturing PMI dropped to a 7-month low of 59.2. The “upward rise in inflationary pressures also shows no signs of abating”, according to IHS Markit.

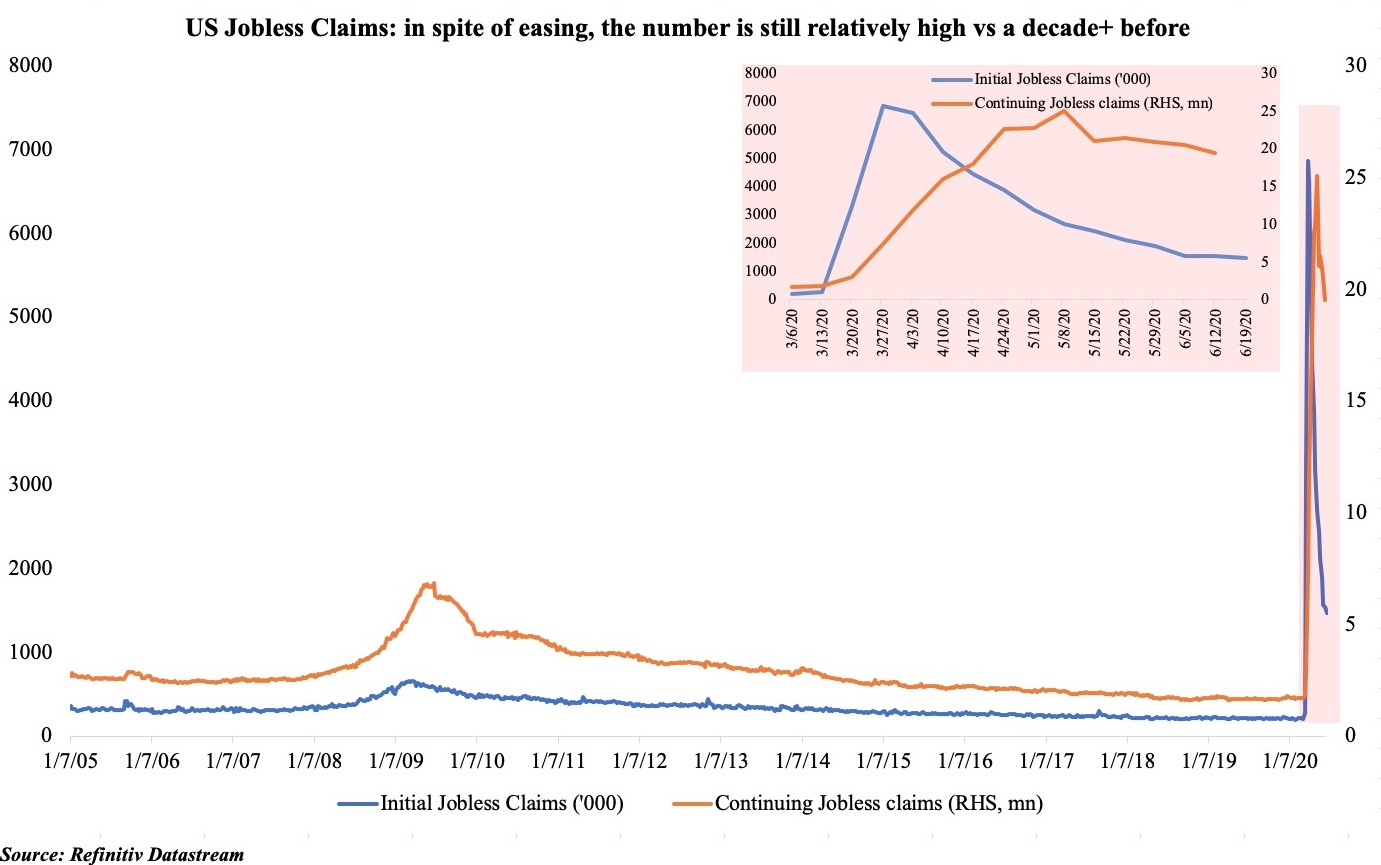

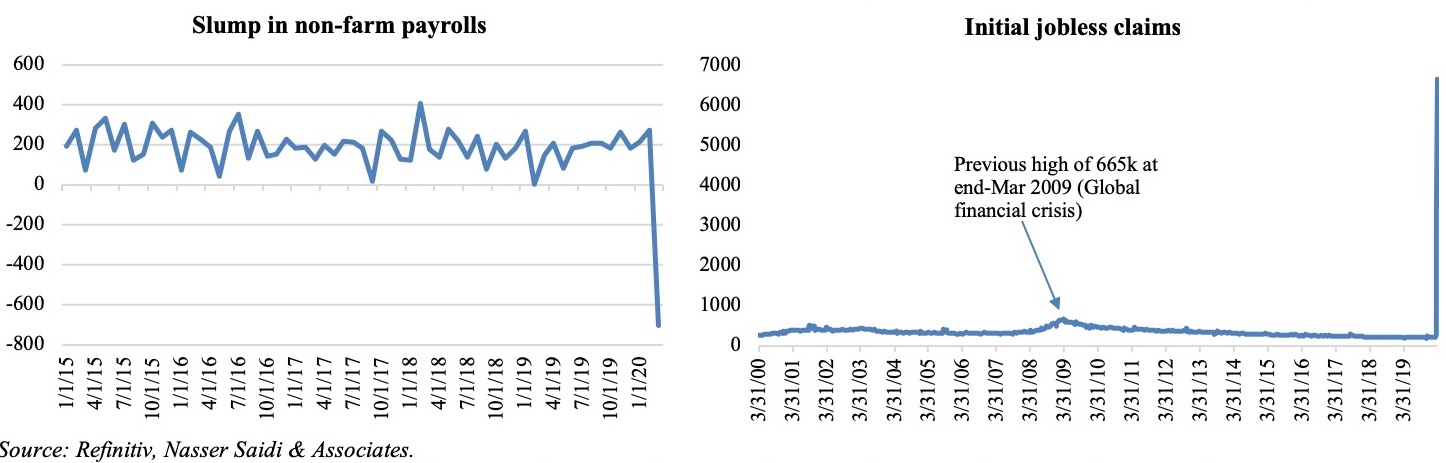

- Initial jobless claims fell to a new pandemic-low of 290k in the week ended Oct 8th from an upwardly revised 296k the previous week; the 4-week average fell to 319.75k. Continuing claims slipped by 122k to 2.481mn in the week ended Oct 1st, the lowest level since the pandemic began.

Europe:

- Producer price index in Germany increased 14.2% yoy in Sep (Aug: 12%), the highest growth since 1974; prices were up 2.3% mom. Energy prices surged by 32.6% yoy and intermediate goods prices grew by 17.4%.

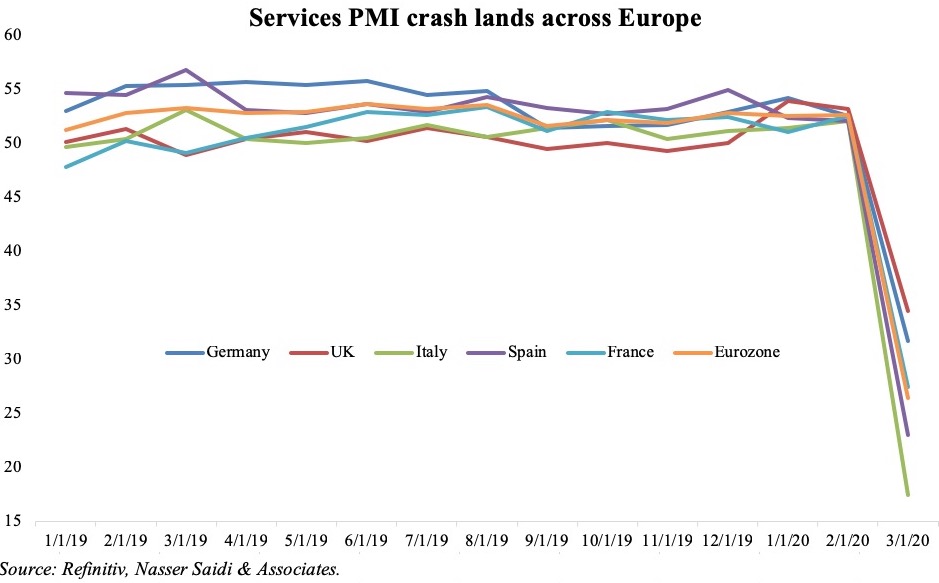

- Preliminary PMI reading for Germany showed a sharper decline in services (to 52.4 in Oct from 56.2 in Sep) while manufacturing PMI inched lower to a 9-month low of 58.2 (Sep: 58.4). Manufacturing output index fell to a 16-month low of 51.1 and new orders showed the smallest increase in 8 months, with setbacks in the automotive sector given chip shortages.

- The eurozone flash manufacturing PMI slipped to an 8-month low of 58.5 in Oct (Sep: 58.6), with autos and parts sector reporting the worst performance while services PMI slipped to a 6-month low of 54.7 (Sep: 56.4) though healthcare, media and financial services reported strong growth. Alongside record high price increases due to widespread shortages, job creation accelerated to the joint-highest in 21 years.

- Consumer confidence in the eurozone declined in Oct, with the preliminary reading falling to -4.8 (Sep: -4) – the reading is still above its pre-pandemic level.

- Inflation in the UK dipped to 3.1% yoy in Sep, from Aug’s 3.2% rise, with prices in the restaurant and hotel sector rising less than a year ago. Core CPI eased to 2.9% in Sep (Aug: 3.1%). The cost of manufactured products leaving UK factories climbed by 6.7% (Aug: 6%) while input prices into factories jumped by 11.4%; PPI core output increased to 5.9% yoy (Aug: 5.4%). Retail price index ticked up by 0.4% mom, after a 0.6% increase in Aug.

- UK retail sales dropped for the 5th month in a row, down by 0.2% mom (Aug: -0.6%). Compared to Feb 2020, sales volumes are 4.2% higher but are down by 1.3% from a year ago. Petrol sales exceeded pre-pandemic levels for the first time in Sep, but overall sales were dragged down by sales of household goods. Excluding fuel, retail sales fell by 0.6% mom.

- GfK consumer confidence in the UK dipped further to -17 in Oct (Sep: -13), the lowest since Feb and dropping for the 3rd consecutive month.

- UK’s flash manufacturing PMI inched up to 57.7 in Oct (Sep: 57.1), boosted by “faster rates of new order and employment growth”. Strong domestic demand for business and consumer services supported the uptick in services PMI (58 in Oct vs Sep’s 55.4).

Asia Pacific:

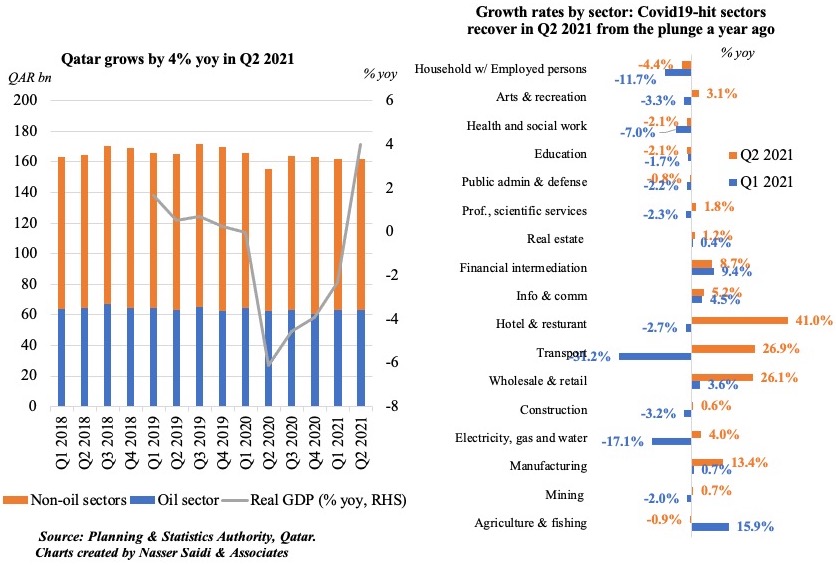

- China’s GDP grew by 4.9% yoy and 0.2% qoq in Q3 (Q2: 7.9% yoy and 1.3% qoq), affected by the power crisis, Covid outbreaks as well as the regulatory crackdowns on various sectors.

- Industrial production in China grew by 3.1% yoy in Sep, easing from Aug’s 5.3% uptick: this was the weakest pace of increase since Mar 2020. IP grew by 11.8% in the period Jan-Sep. Fixed asset investment increased by 7.3% yoy during Jan-Sep compared to 8.9% in the year till Aug. Retail sales grew by 4.4% in Sep, faster than Aug’s reported 2.5% pace.

- FDI into China increased by 19.6% yoy to CNY 859.51bn (USD 134.7bn) in the period till Sep this year (Jan-Aug: 22.3%).

- Urban unemployment rate in China stood at 4.9% in Sep; but those aged 16-24 saw a much higher unemployment rate of 14.6%.

- China’s parliament approved plans to introduce pilot real estate taxes in some regions of the country: it will apply for both residential and non-residential property as well as land and property owners, though it will not apply to legally owned homes in the countryside.

- Inflation in Japan climbed to 0.2% yoy in Sep (Aug: -0.4%), the first gain in 13 months, driven up by fuel, utilities and raw material costs. Excluding fresh food, prices were up to 0.1% (Aug: 0%), rising for the first time in 18 months. Excluding food and energy prices remained unchanged at -0.5%.

- Exports from Japan increased by 13% yoy in Sep (Aug: 26.2%), posting the slowest gain since Feb, as car shipments tumbled by 40.3% (first drop in 7 months); imports expanded by 38.6% yoy (Aug: 44.7%), rising for the 8th consecutive month, resulting in the 2nd straight month of a trade deficit of JPY 622.8bn.

- Preliminary PMI reading for Japan showed a massive improvement across all sectors: manufacturing moved up to 53 in Oct (Sep: 51.5) with the manufacturing output sub-index crossing into expansionary territory (50.7 from 48.1) and the service sector registered an increase in activity for the first time since Jan 2020 (50.7 from 47.8 in Sep).

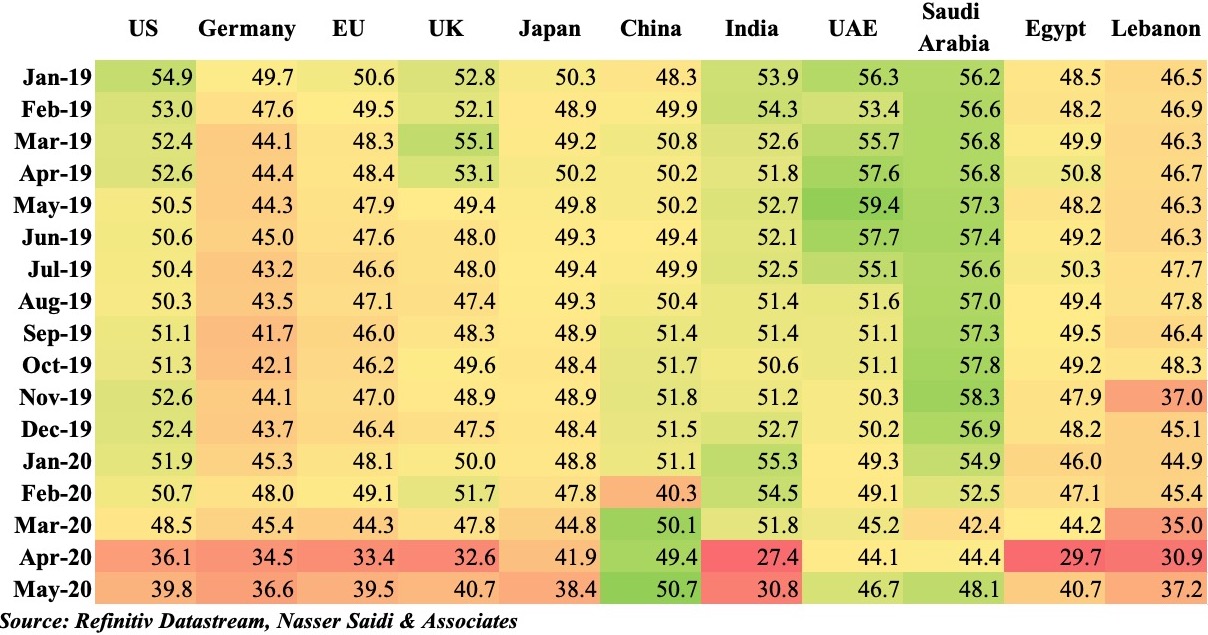

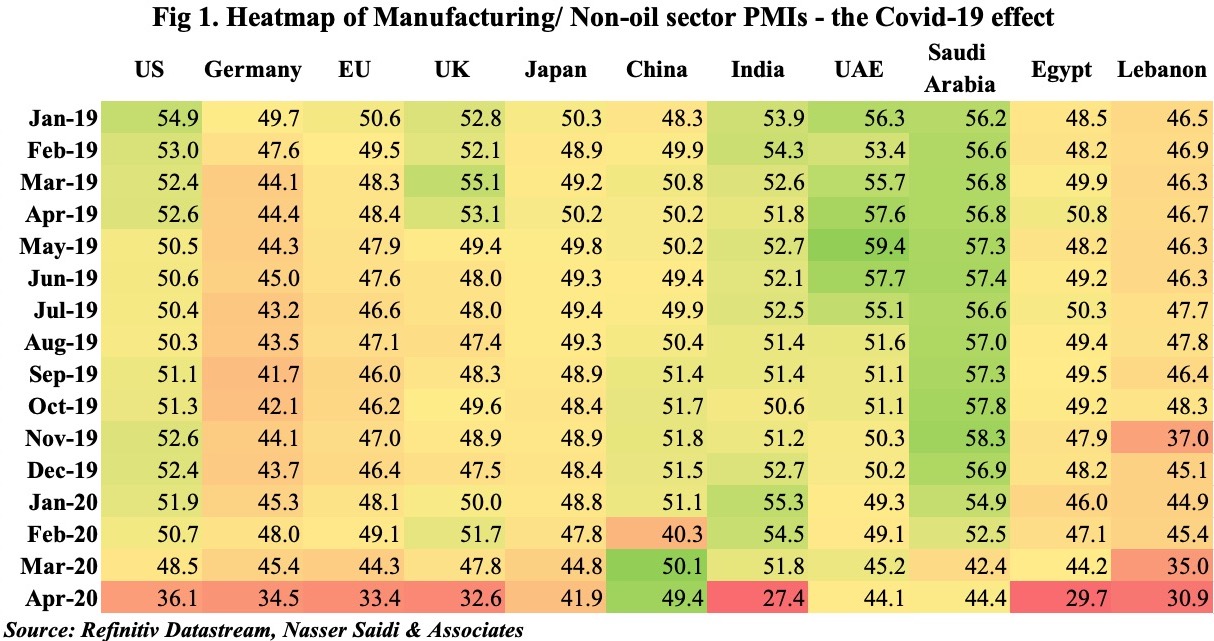

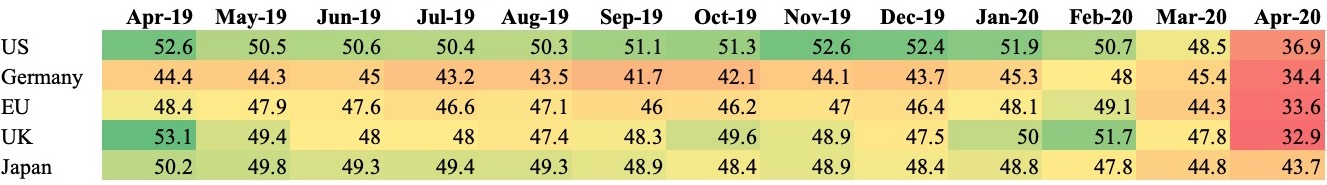

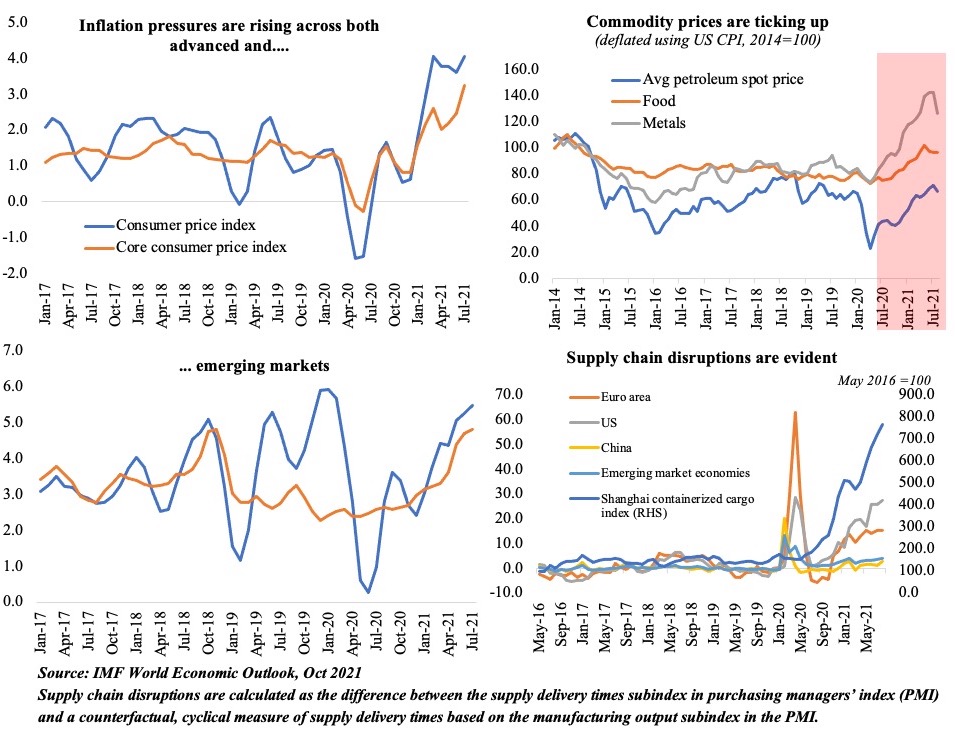

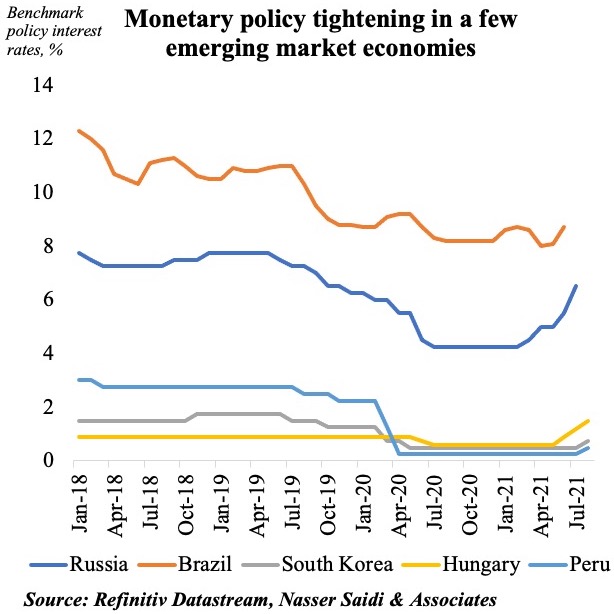

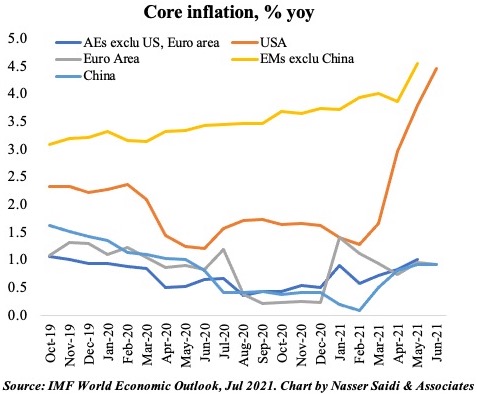

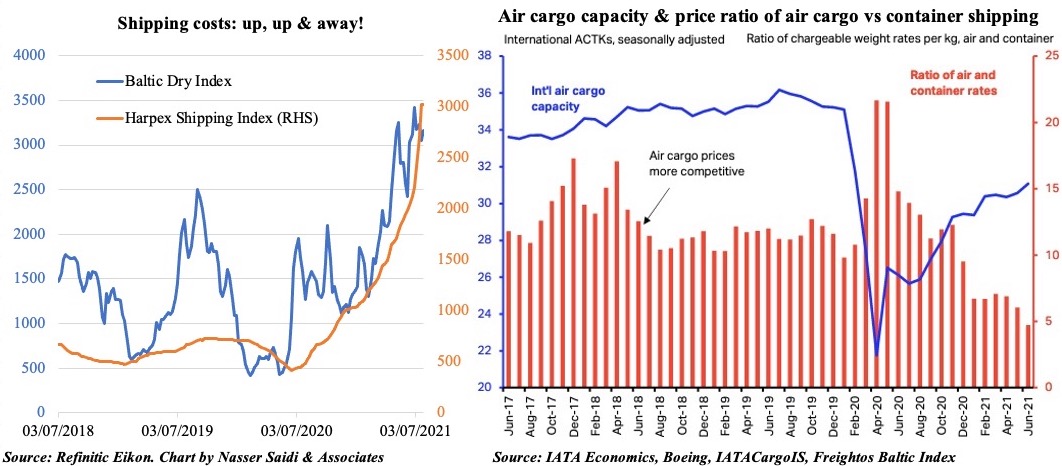

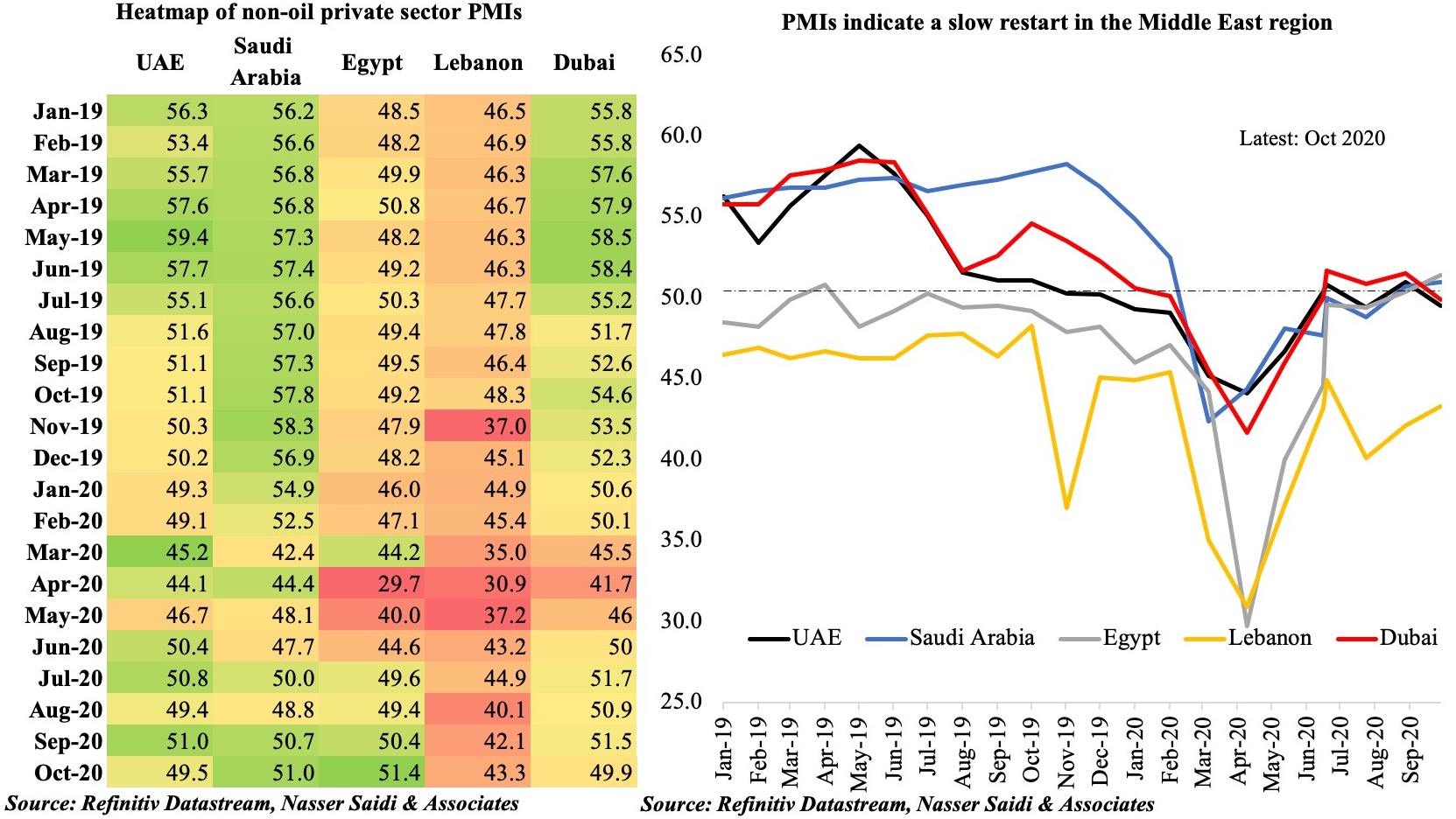

Bottomline: Preliminary estimates for October PMI confirmed a slowdown in business activity (especially in manufacturing), amidst rising prices thanks to supply chain constraints and labour shortages/ wage pressures. There were two diverging central bank moves last week: Russia hiked rates by 75bps and signaled further hikes as inflation stayed high at 7.8% (as of Oct 18); in contrast, Turkey’s key rate was lowered to 16% from 18% under political pressure, in spite of inflation at nearly 20%, causing lira to tumble to a new all-time low of 9.66. While the Fed is “on track” to slow down its asset purchases, the ECB meeting this week will be watched to gauge whether inflation is still being considered as “transitory” or stickier than expected. The BoE’s governor last Sunday signaled that a rate hike was imminent stating worries about medium-term inflation expectations, but with rising Covid cases, ongoing shortages (spillovers from the Brexit deal), higher energy costs and lower retail sales numbers, it is possible that the hike will be pushed to early 2022 than later this year.

Regional Developments

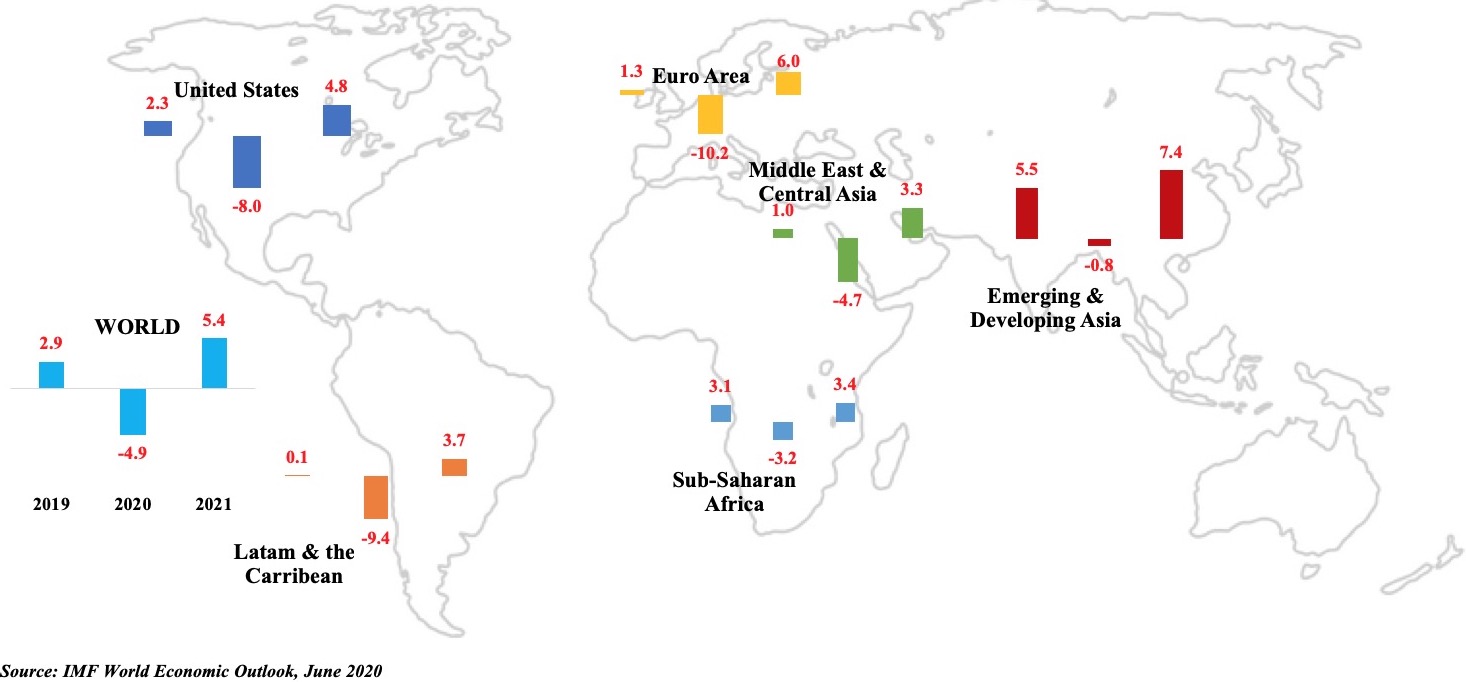

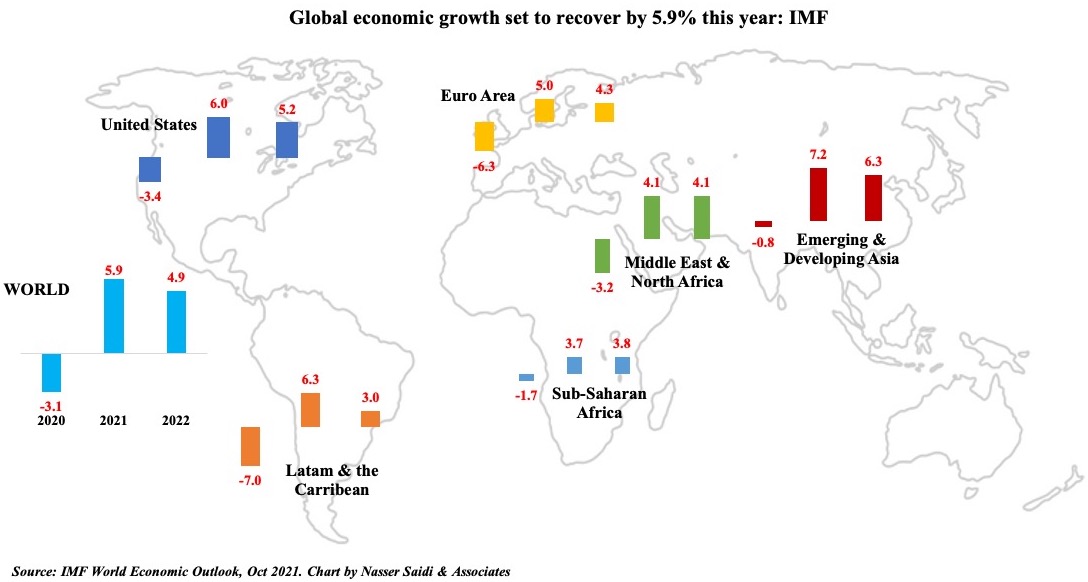

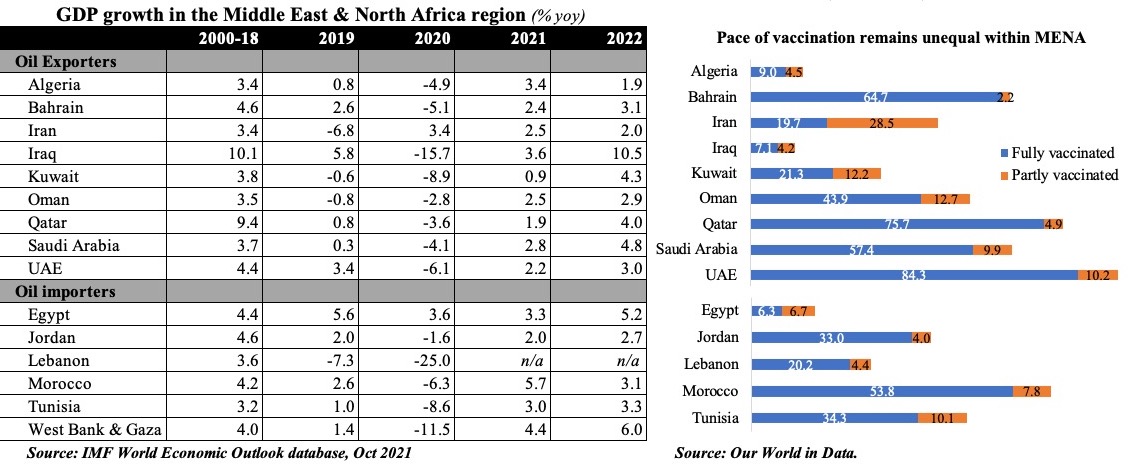

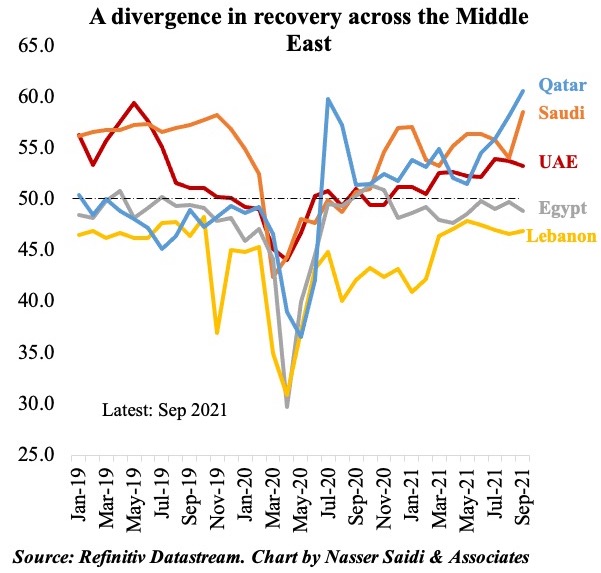

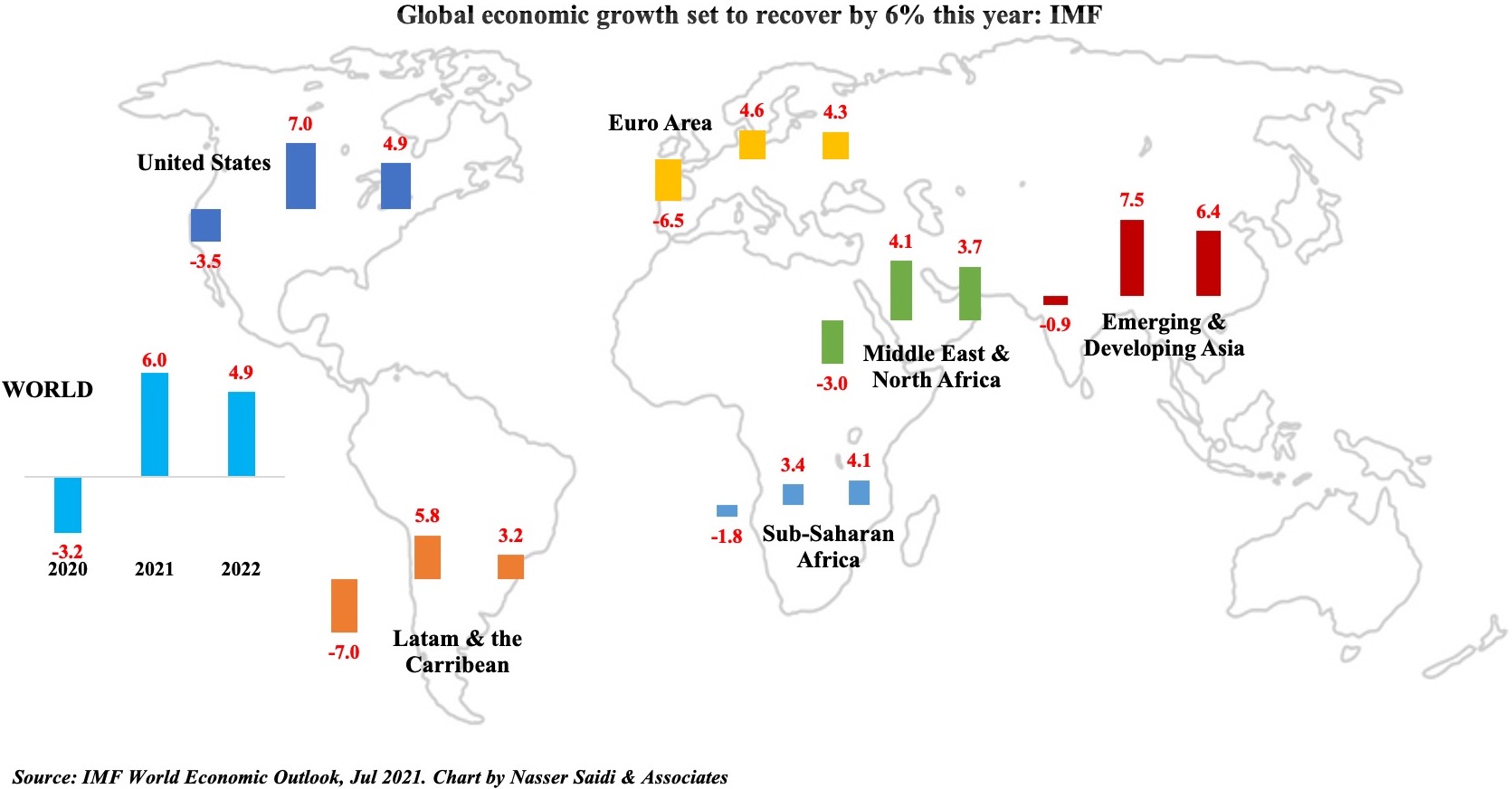

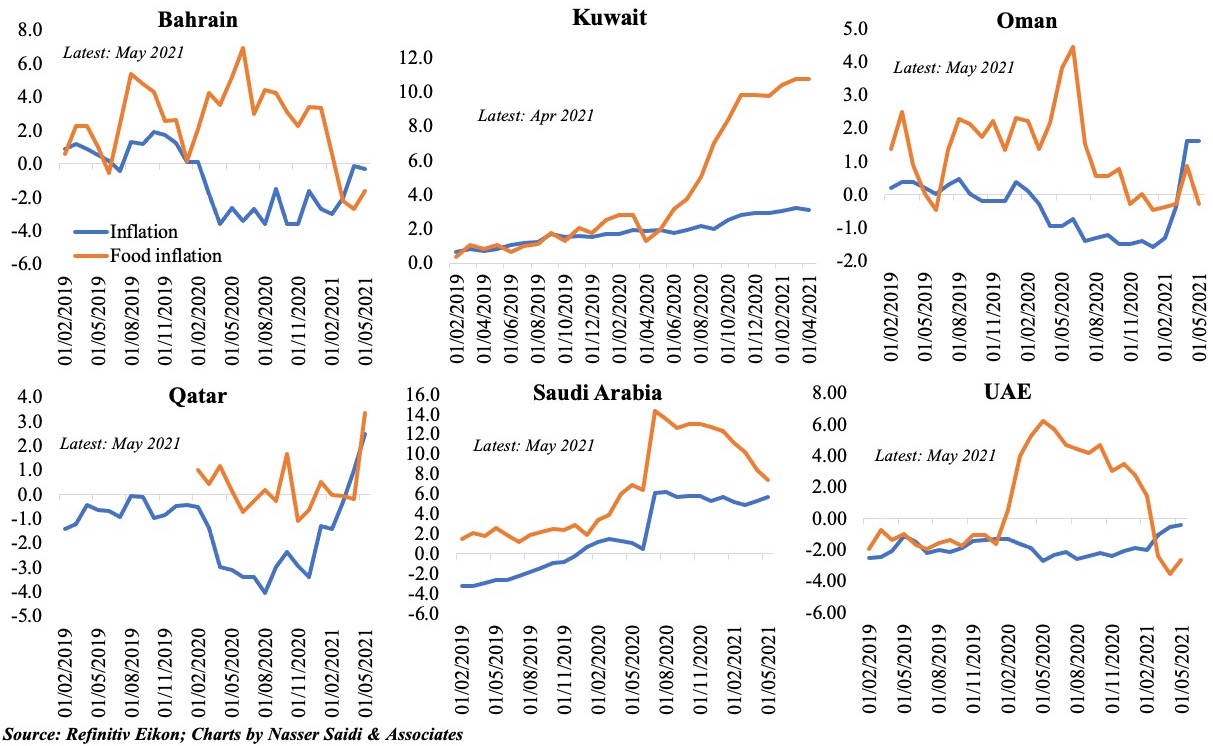

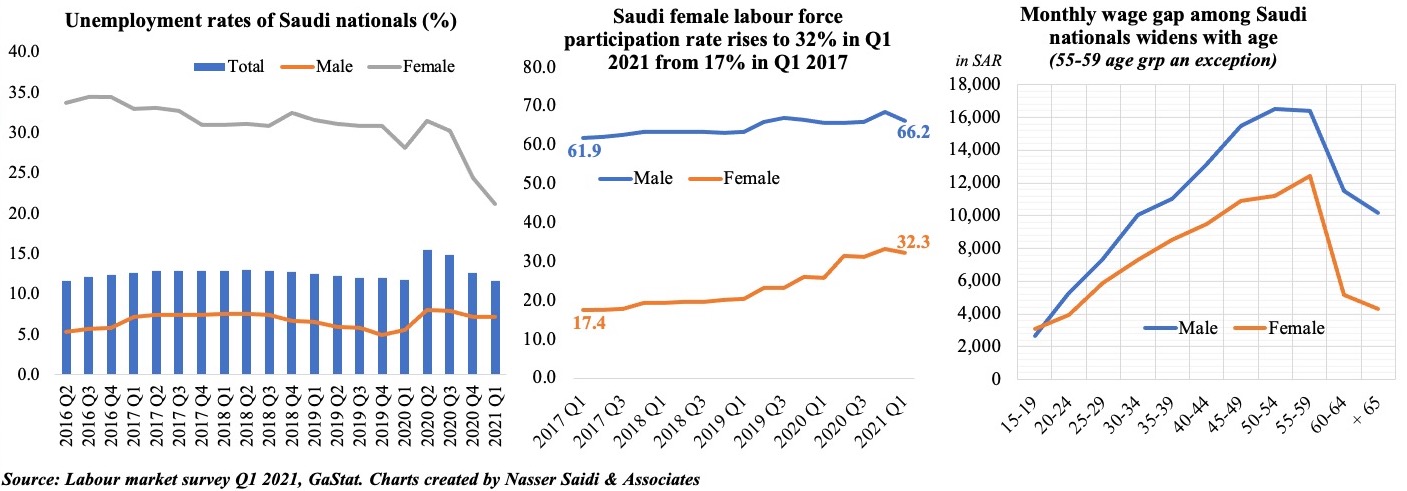

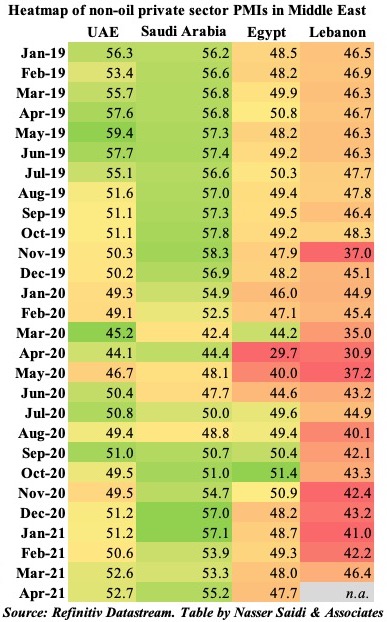

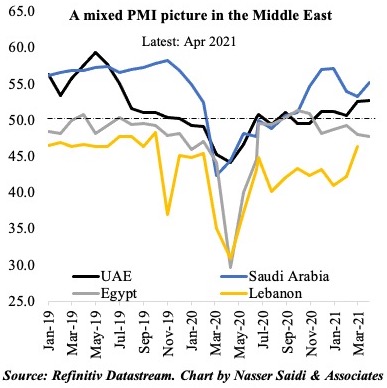

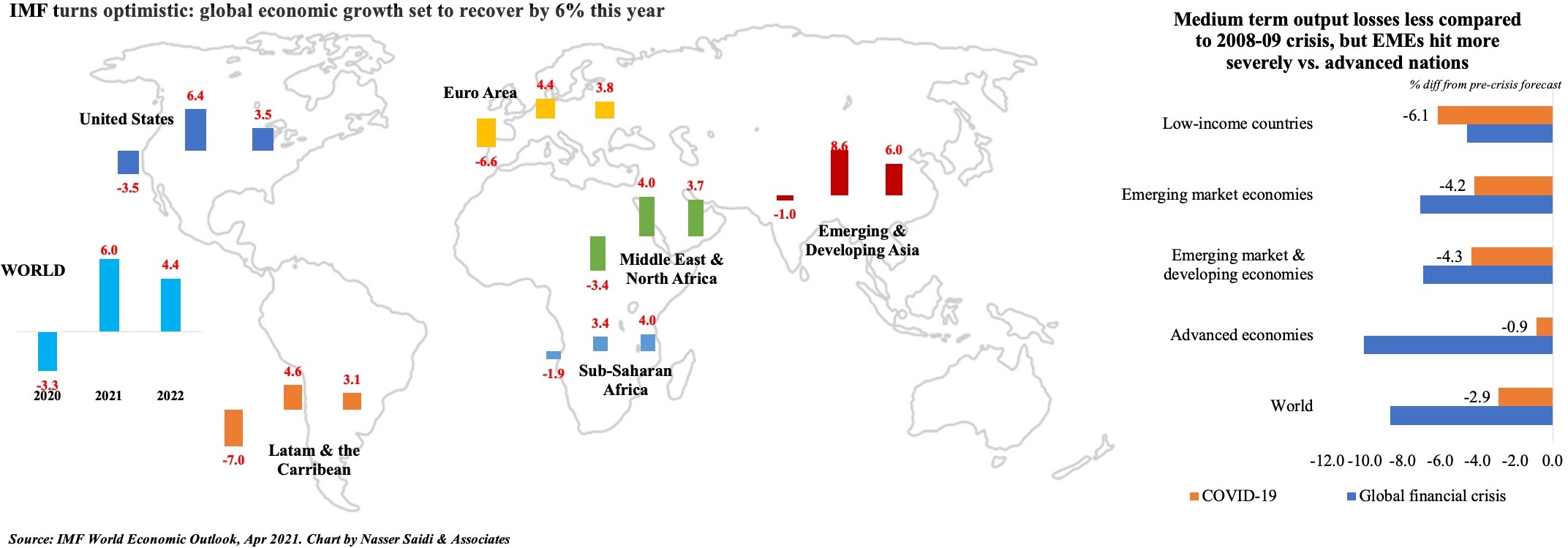

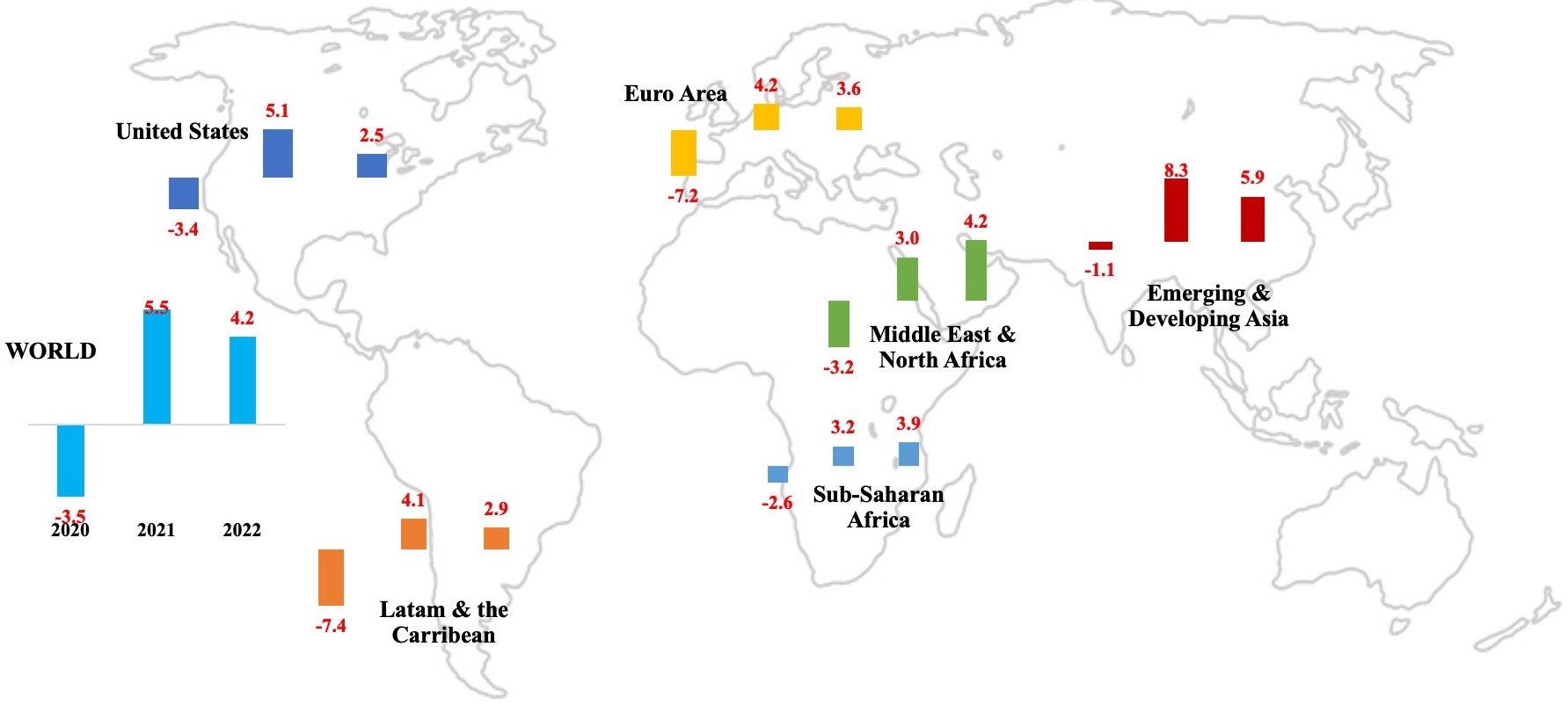

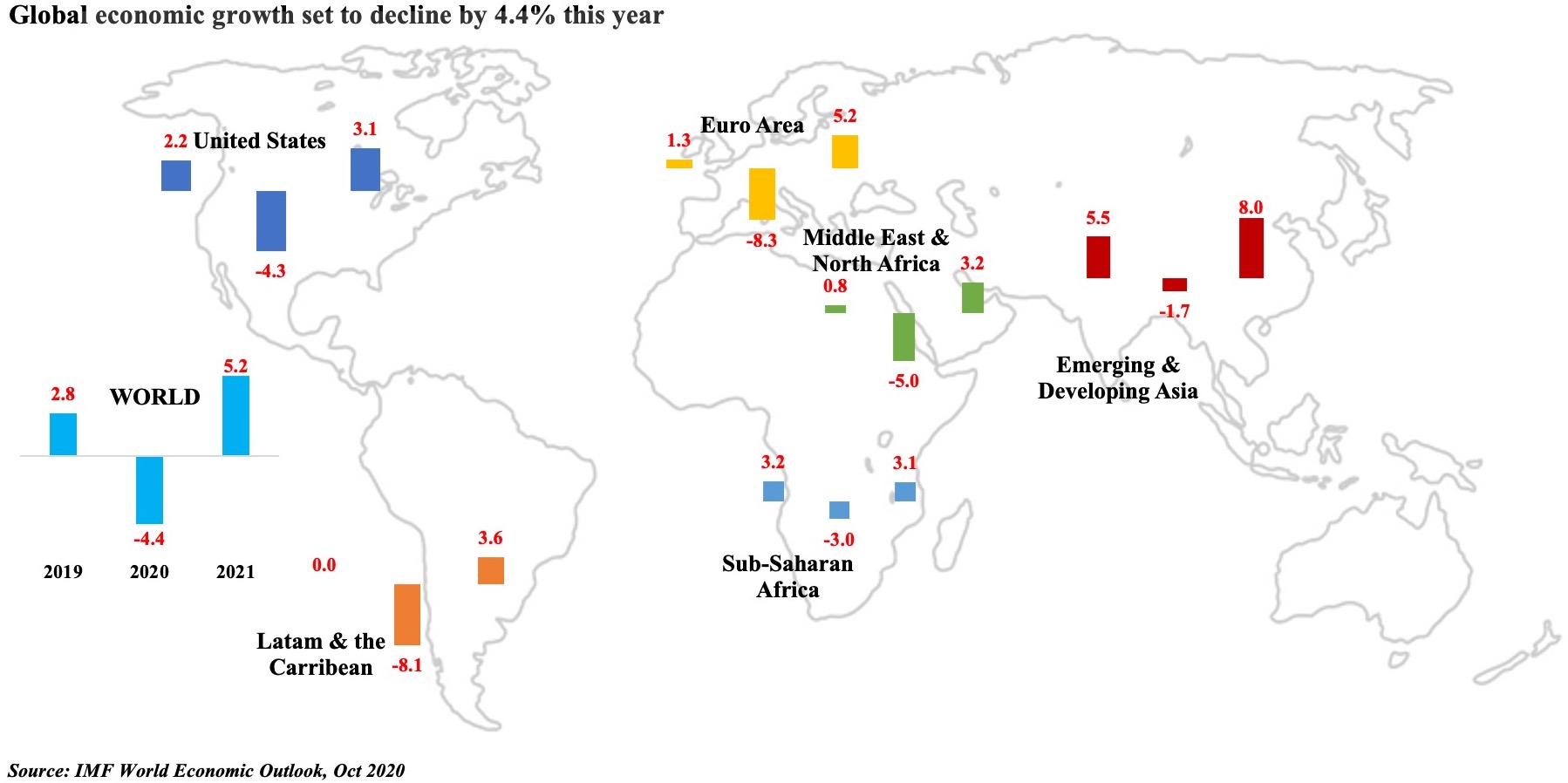

- The IMF estimates growth in the MENA region to rebound to 4.1% this year, following a 3.2% drop in 2020. The Regional Economic Outlook report highlighted the region’s uneven recovery, while urging nations to continue reforms and job creation (youth unemployment ranged between 25-27% this year) amid rising food prices and energy costs. Gross financing needs increased to USD 390bn in 2021-22, up by 50% versus 2018-19.

- Saudi Arabia, UAE and Kuwait will continue to support Bahrain’s Fiscal Balance programme, according to the finance ministers of the nations. A balanced budget is being targeted by 2024, after Covid19 derailed plans to achieve this goal by 2022.

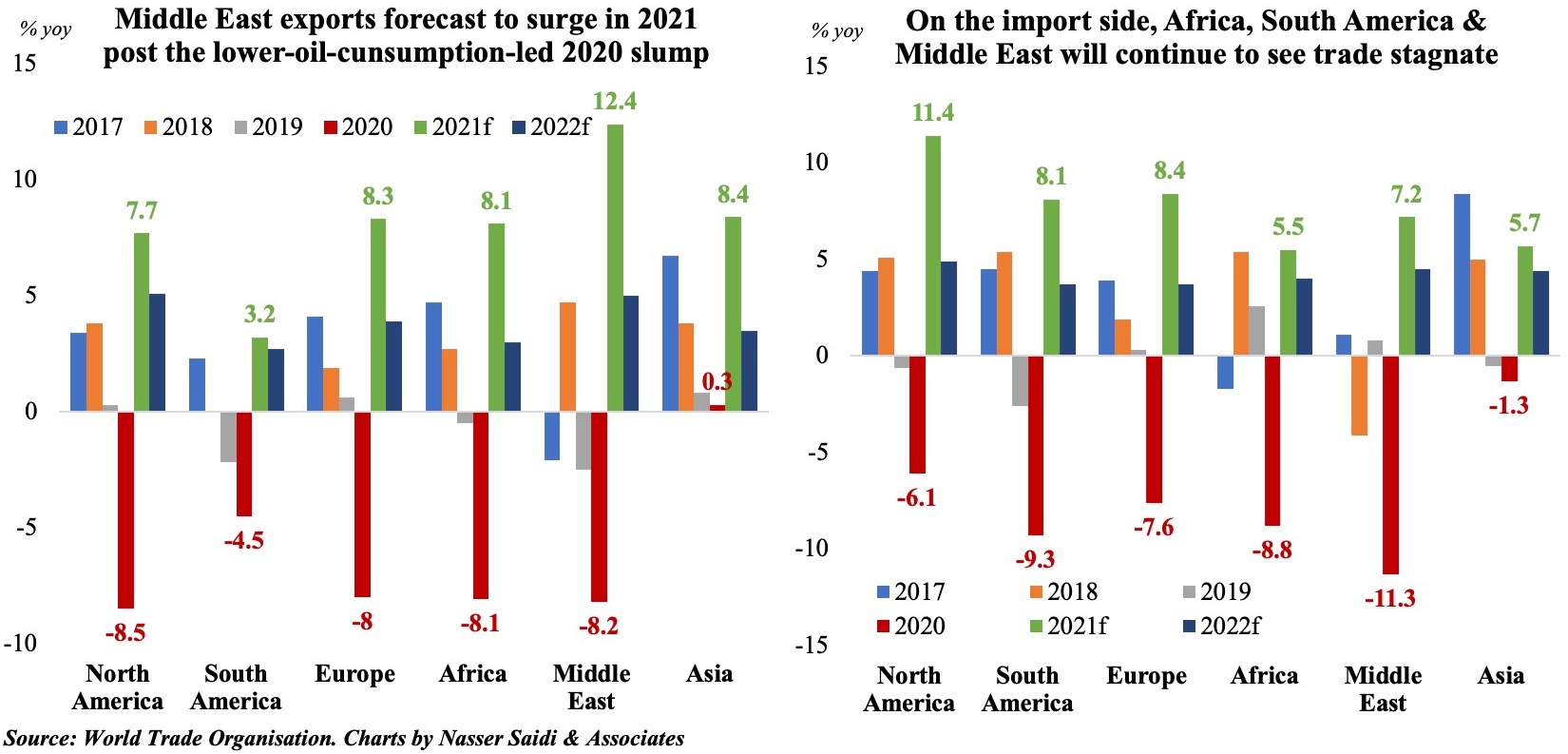

- Egypt’s non-oil exports increased by 16% yoy to USD 2.56bn in Sep while imports declined by 7% yoy to USD 4.9bn hence narrowing trade deficit by 24% to USD 2.3bn. Exports to the US and the EU surged by 52% (to USD 205mn) and 60% (to USD 739mn) respectively.

- The Egyptian Exchange’s new rules for the temporary trading suspension limit state that trading will be halted if the EGX100 moves up or down by 10% within the day’s trading session (compared to a previous limit of 5%).

- Egypt’s e-finance increased by 40% on its stock market debut last week. The initial price of EGP 13.98 per share gave the IPO a deal size of EGP 5.84bn (USD 371.7mn) and valued the company at EGP 22.4bn.

- Foreign investments in Egypt’s oil sector fell by 26.02% to USD 5.4bn in 2020-21, revealed the oil minister.

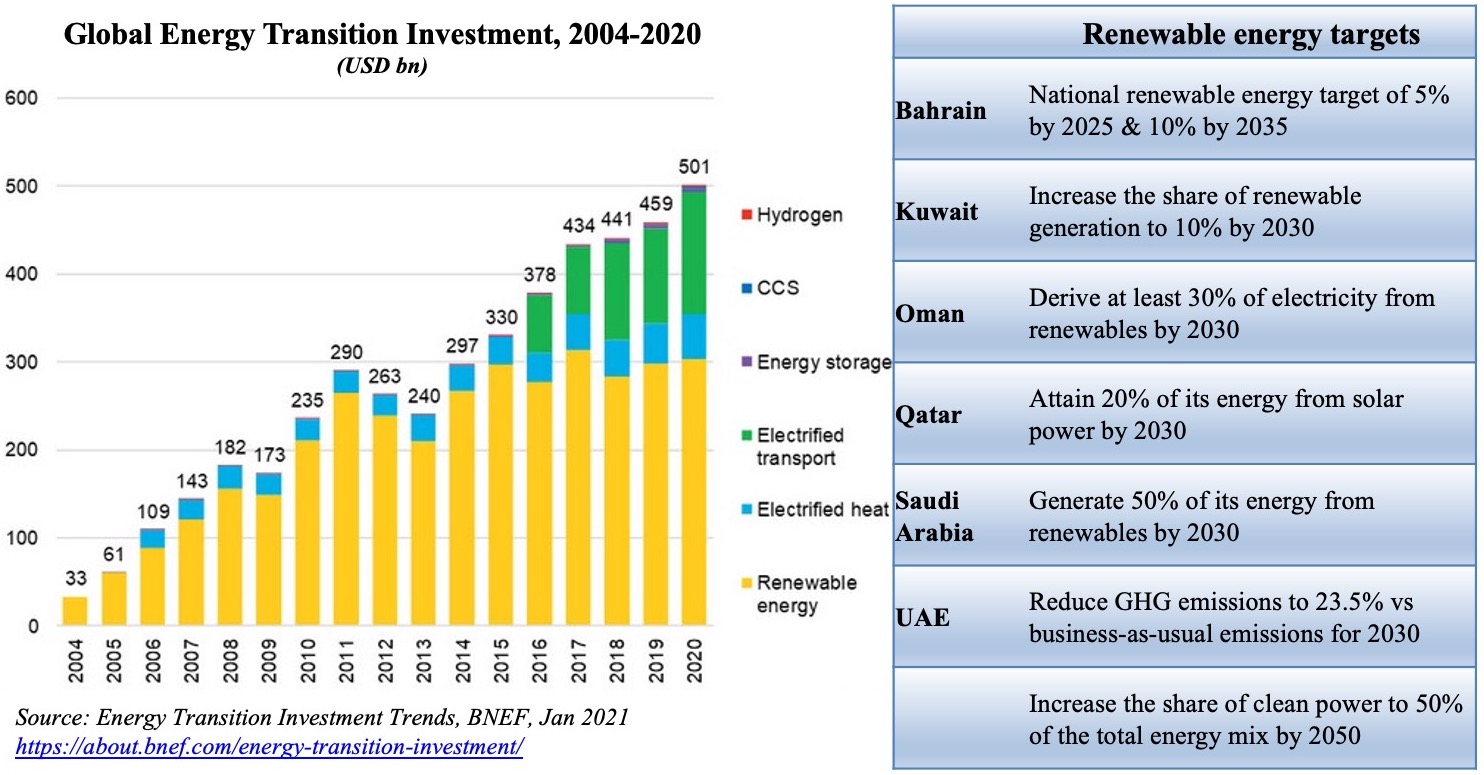

- Egypt plans to boost share of renewable energy to over 42% by 2035: the country already crossed its 2022 target of 20% early this year.

- Egypt issued tenders for 17 new desalination plants, with an aim to more than quadruple desalination capacity over the next 5 years. The new plants will produce a combined 2.8mn cubic metres per day vs current installed capacity of 800k cubic metres per day.

- Egypt and Israel are in discussions about the construction of a new onshore pipeline: expected to cost USD 200mn, the pipeline could be operational within 24 months and supply an additional 3-5 billion cubic metres (bcm) per year.

- Iraq and the UAE signed an agreement to promote and protect mutual investments. The agreement protects both nations’ investments from all non-commercial risks including nationalisation, confiscation, judicial seizures, and freezing.

- Iraq plans to reduce its winter crop planting area by 50% in 2021-22 due to a water shortage. Current water availability can irrigate around 250k hectares of land.

- Kuwait has started increasing its crude oil production in line with the OPEC+ agreement, according to the oil minister. He also disclosed that Kuwait’s plans to increase output includes production from the shared zone with Saudi Arabia.

- Kuwait’s PM revealed that all COVID-19 restrictions had been lifted for vaccinated people, without giving further details. The airport will operate at full capacity starting today (Oct 24).

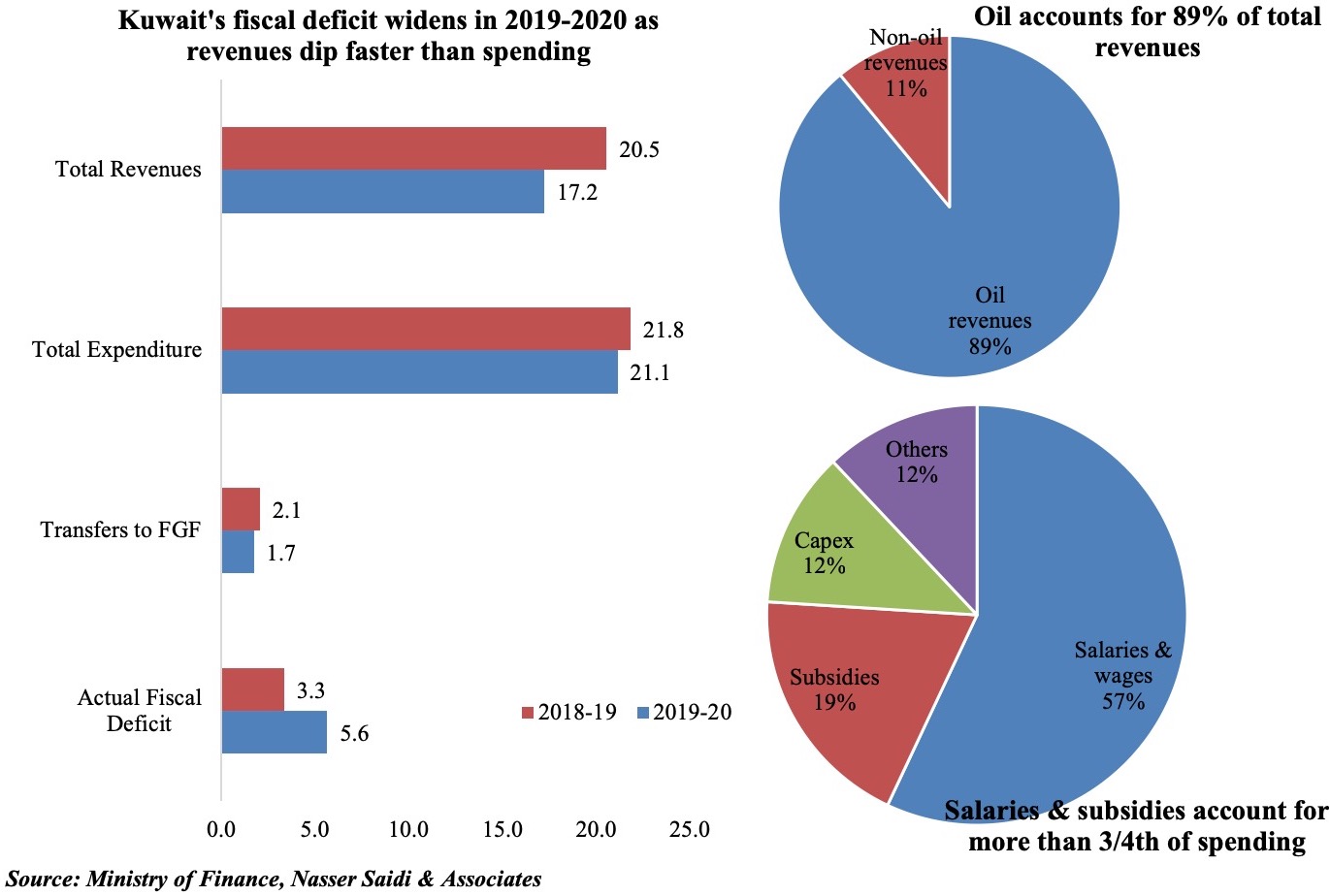

- The IMF in its concluding statement of Kuwait’s Article IV mission revealed that “sustained political gridlock has impeded progress in addressing fiscal risks”. Non-oil GDP growth is projected to rise by 3% this year, and overall GDP growth is expected to around 2.7% over the medium term. Rising oil prices will improve fiscal balance to a surplus of 2% of GDP in 2021-22 from a deficit of 15.4% of GDP in 2020-21. More: https://www.imf.org/en/News/Articles/2021/10/20/mcs102021-kuwait-staff-concluding-statement-of-the-2021-article-iv-mission

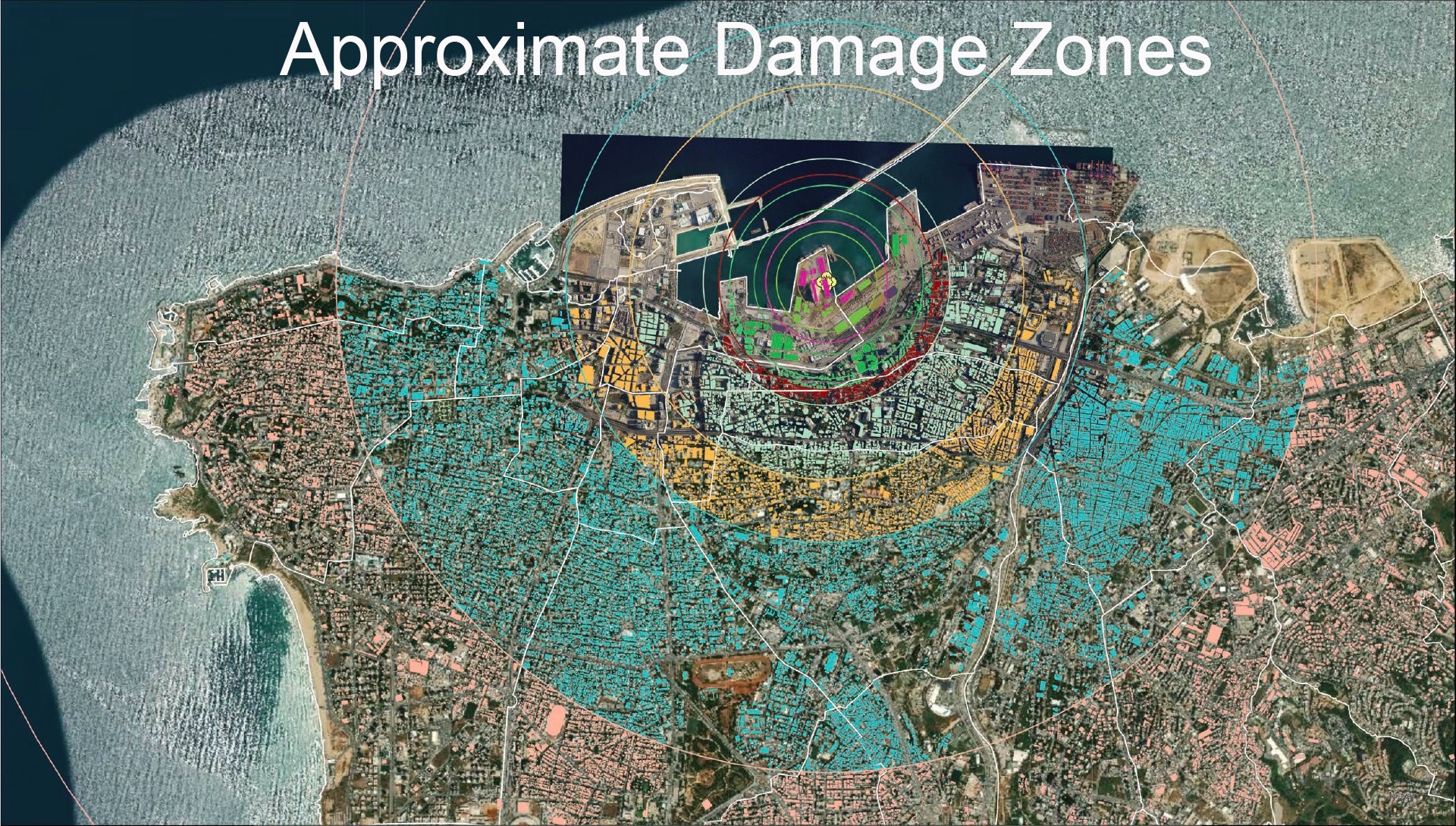

- Lebanon’s parliament voted for legislative elections to be held on March 27th; the new parliament will select the new PM to form a government. However, on Friday, the President sent a law amending legislative election rules back for reconsideration, potentially affecting the proposed election date.

- Reuters reported, citing the economy minister, that Lebanon met with IMF officials this week to start technical discussions. Though data required by the IMF (including estimate of losses in the financial system) will be sent this week, full negotiations for an IMF deal are likely to begin by end of the year or early next year. Separately, the President disclosed that a forensic audit of the central bank had begun last Thursday.

- Oman’s Data Protection Law is currently in draft stage, according to the Executive President of the central bank. He also revealed that the apex bank is “working on a comprehensive customer protection framework for customers of our licensed institutions”.

- Moody’s has upgraded its outlook on 7 Omani banks to stable from negative before, on expectations of an improvement in banks’ operating environment.

- A new law issued in Qatar mandates all employers to provide mandatory health insurance coverage for expats and their families.

- In a recent government reshuffle, Qatar announced the formation of a new ministry for environment and climate change.

- Qatar signed a comprehensive air transport agreement with the EU, allowing it easy access to markets, with fewer restrictions, replacing existing bilateral agreements.

- The World Bank will donate USD 80mn to support economic welfare for Palestinians. The grant will be transferred to the dedicated trust fund for Gaza and the West Bank and used as cash-for-work opportunities while supporting social protection and strengthening resilience.

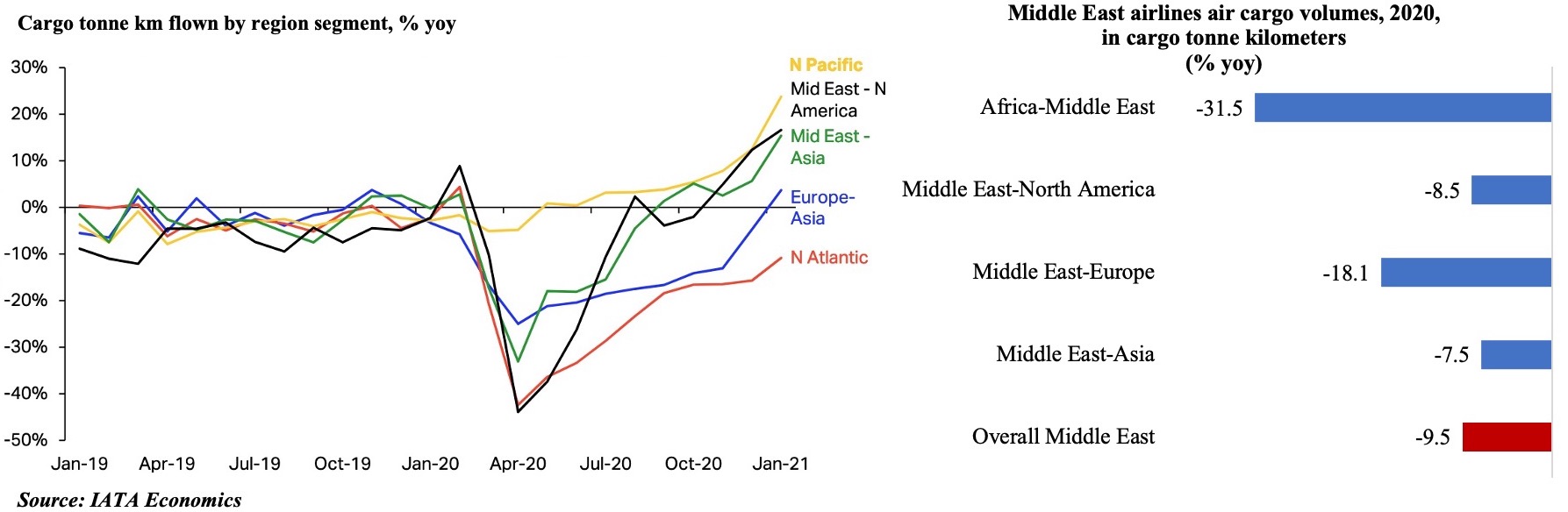

- Boeing predicted that airlines in the Middle East would require 3000 new aircrafts by 2040, valued at USD 700bn, to accommodate increased passenger and cargo traffic.

Saudi Arabia Focus

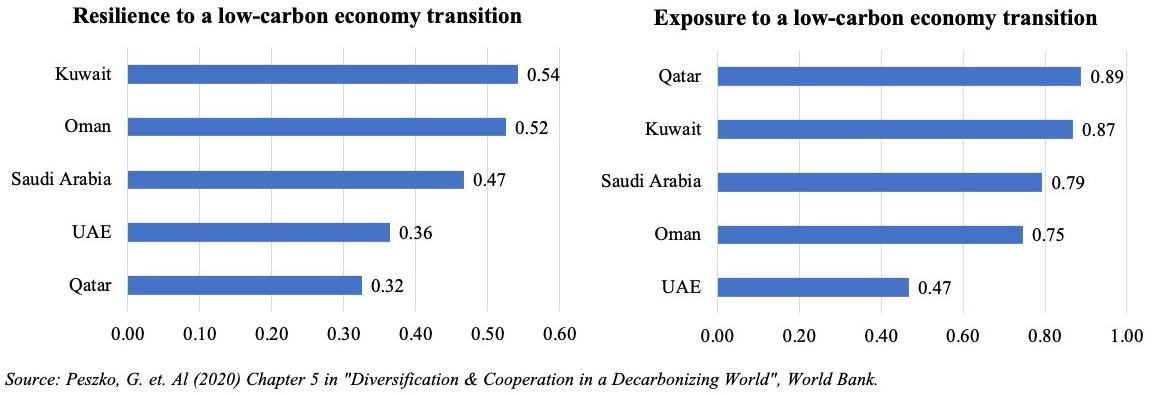

- Saudi Arabia set a target of net zero emissions by 2060, also announcing that it would eliminate 278mn tonnes of CO2 by 2030 (previous target: 130mn tonnes) and slash methane emissions by 30% by 2030 (vs 2020). The initiative will involve investments of over SAR 700bn (USD 187bn) over the period. Separately, Aramco announced that a goal to reach net-zero emissions by 2050: this applies to emissions from the company’s own operations and does not refer to emissions generated by its consumers (via oil exports).

- Saudi Arabia does not want high oil prices stymieing recovery, disclosed the finance minister in a TV interview. He stated: “we need to see a price that is good for investors, good for producers so that they can continue investing because the world needs the energy”.

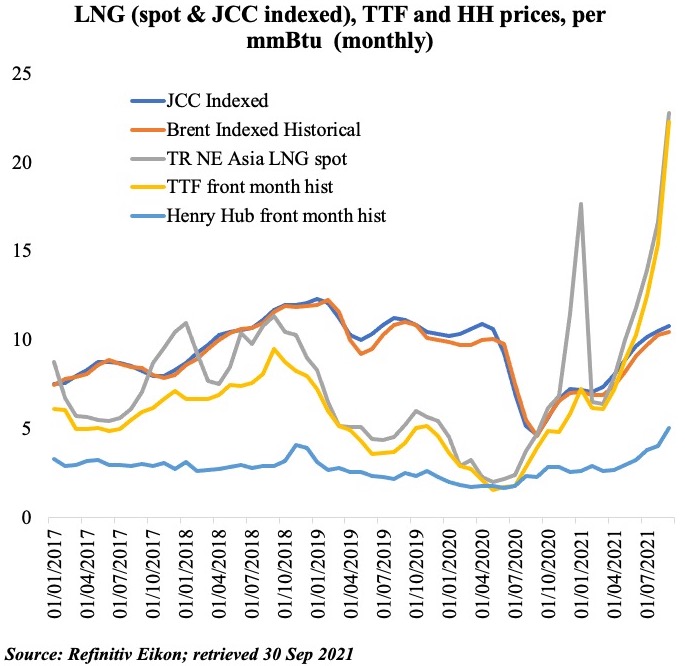

- According to Saudi Arabia’s energy minister, users switching from gas to oil could see demand of 500-600k barrels per day; the pace of the switch will depend on both weather (how severe winter could be) and alternative energy prices. He also called for greater attention to energy supply security.

- Mergers and acquisitions in Saudi Arabia are rising. In Jan-Sep 2021, M&A applications rose by 68% to 237 – led by IT, healthcare and petrochemical sectors – and this trend is expected to continue into H1 2022.

- More than 80% of the 670 new industrial licenses issued in Saudi Arabia since the start of 2021 has been SMEs. Together, these firms have launched operations in 477 factories, providing more than 31k jobs and with investments’ crossing SAR 74bn (USD 19.7bn).

- Bloomberg reported that Tadawul is planning to introduce regulatory incentives for tech startups that are backed by VCs and technology firms to speed up listing.

- The Saudi Capital Market Authority launched its fifth round of fintech sandbox licenses and will accept applications until Dec 15th.

- Saudi Central Bank issued draft insurance fintech (InsurTech) rules – covering fair competition, obligations for practitioners, the accuracy and preservation of customer information as well as other consumer rights for public consultation until Nov 16th. https://istitlaa.ncc.gov.sa/ar/Finance/SAMA/financialtechnology/Pages/default.aspx.

- Saudi SMEs have raised SAR 100mn this year through crowdfunding, according to the President of the Saudi Capital Market Authority.

- The energy minister stated that Saudi Arabia plans to produce 29 million tons of blue and green hydrogen annually by 2030.

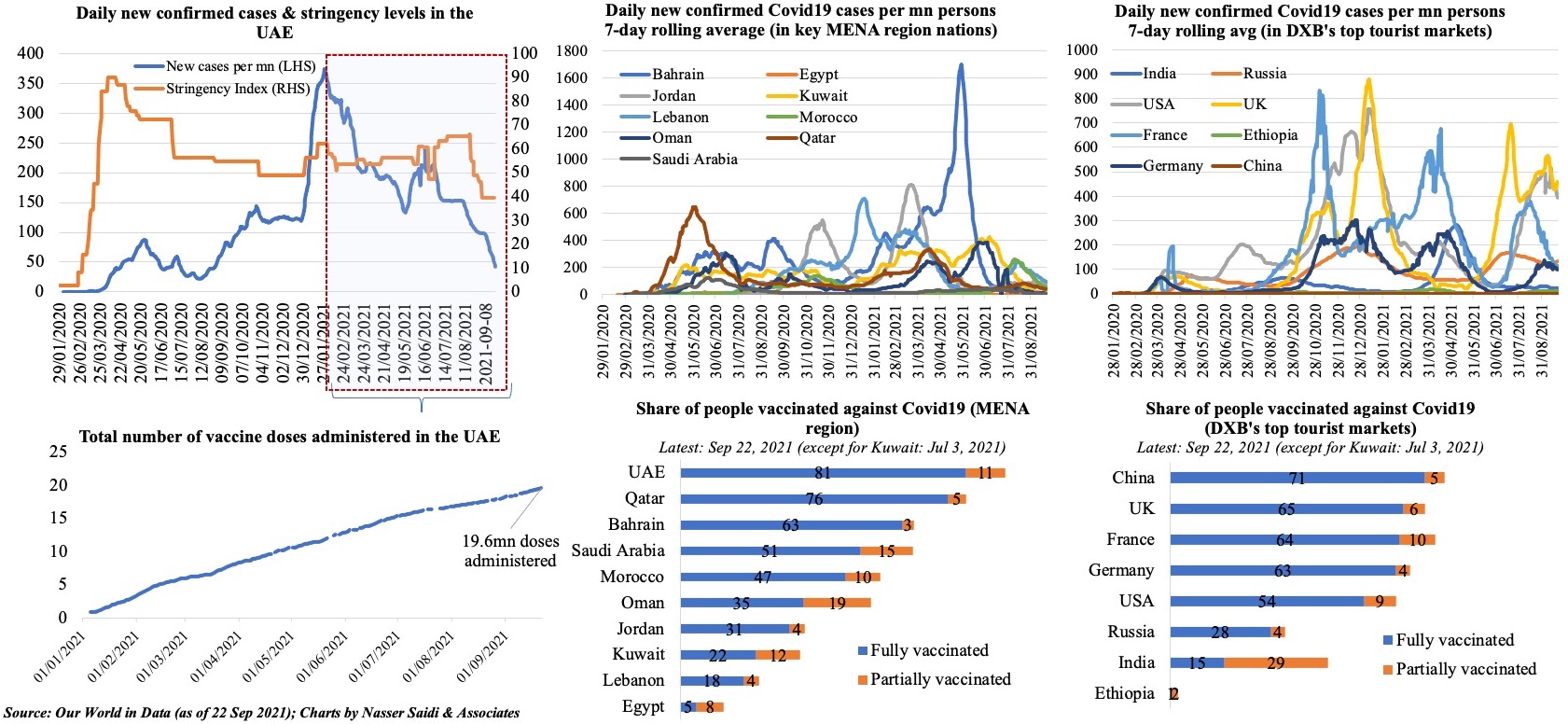

UAE Focus![]()

- UAE will create a new taskforce to develop a next generation economy for 2050-60: the economy minister disclosed that the plan will be digitally driven and be based on the highest levels of innovation, building on discussions around digitalization, diversification and tourism.

- Abu Dhabi announced a “virtual” license for non-resident foreign investors, allowing them to conduct business from outside the UAE and within the emirate. Permits cover 13 economic sectors including agriculture, manufacturing, repair, contracting, maintenance, installations, retail, transport, services, leasing, health and entertainment and companies can either be a limited liability company or a sole proprietorship.

- The Abu Dhabi DED introduced a “Smart Manufacturing Project” to encourage transformations of factories that manufacture electronics, food and pharmaceutical products (to more automated, safer and more efficient using technology) by tapping new financing opportunities from local banks and banks specialised in industrial financing. Abu Dhabi’s Industrial Development Bureau is overseeing the Smart Manufacturing Project.

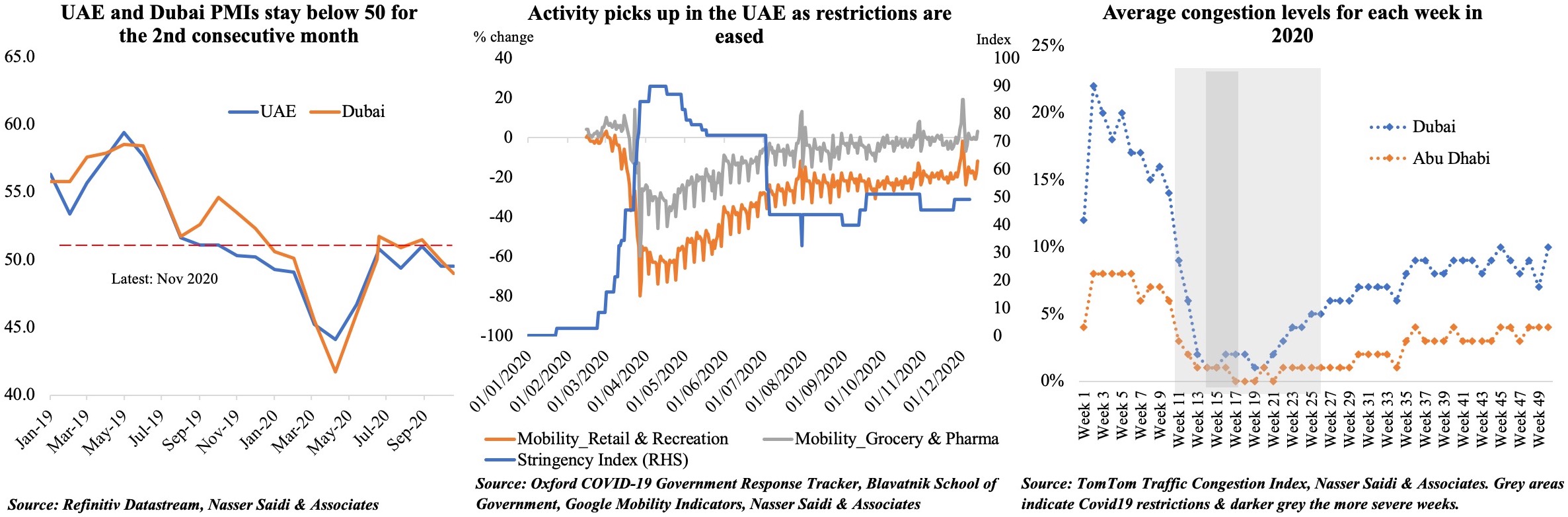

- Consumer confidence index in Dubai rose to 153 points in Q3 2021, two points up from Q2 and 21 points up from Q3 2020. About 73% of consumers were positive about the jobs market (vs 46% last year) while 88% were optimistic about finding a job in next 12 months.

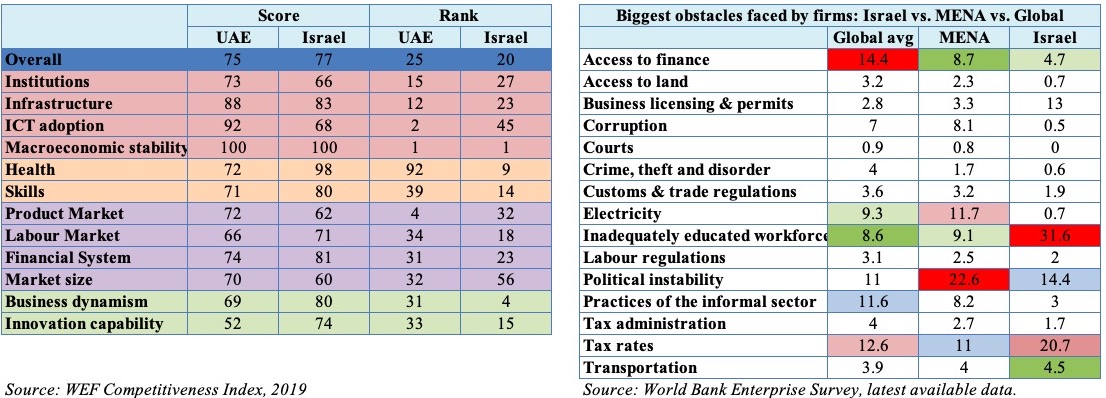

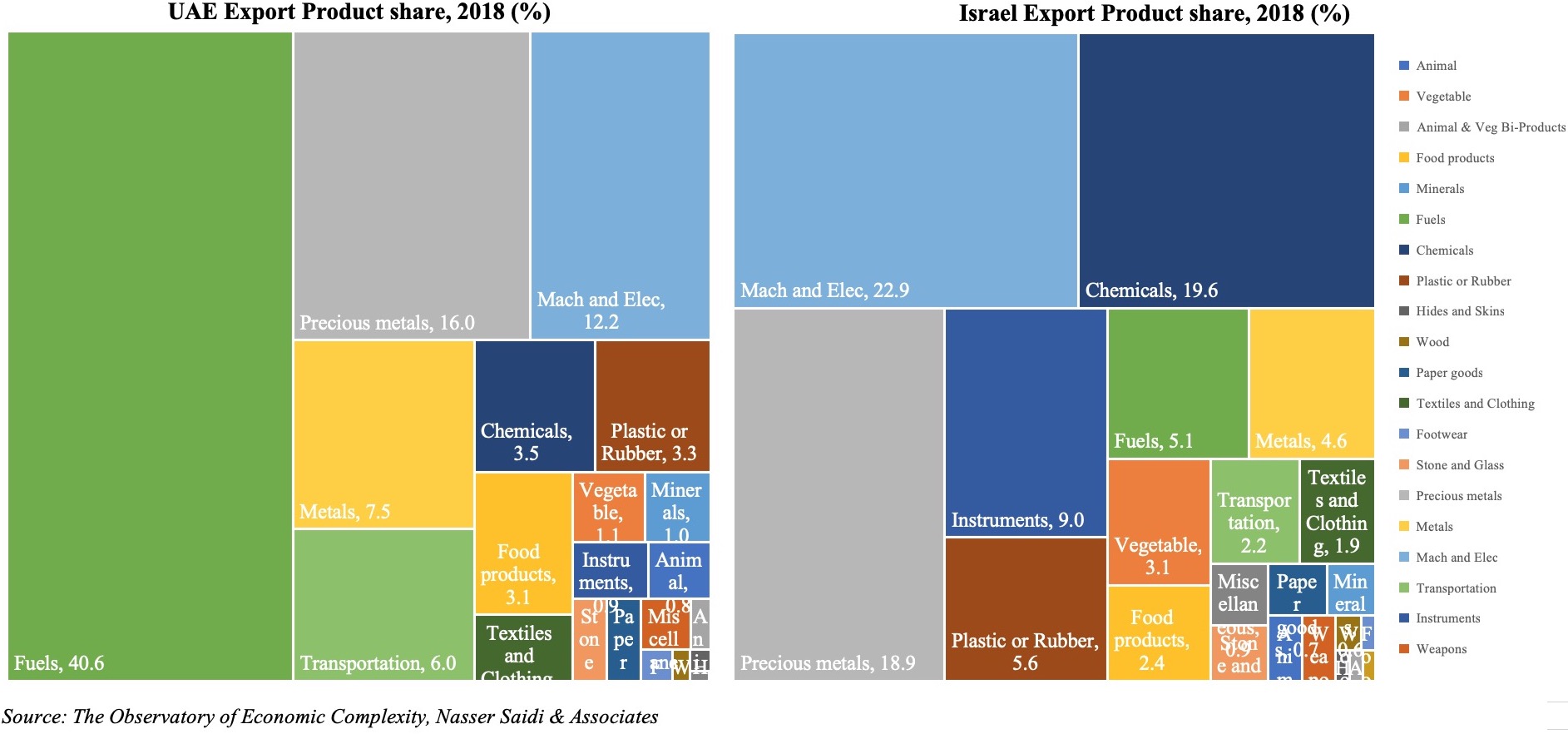

- UAE and Israel’s negotiations on a Comprehensive Economic Partnership Agreement are progressing as scheduled; it will be signed within the 9-month timeframe set in Jun 2021.

- According to the COO of Abu Dhabi’s Hub 71, the technology hub which has accepted 100 startup firms since 2019, has brought in around 19 venture capital funds with a combined USD 2-2.5bn of assets under management to support its companies.

- Dubai Silicon Oasis launched a Sandbox programme to support early-stage tech startups: it is a 1-year programme for startups that have only a minimum viable product; the application process will be a rolling one.

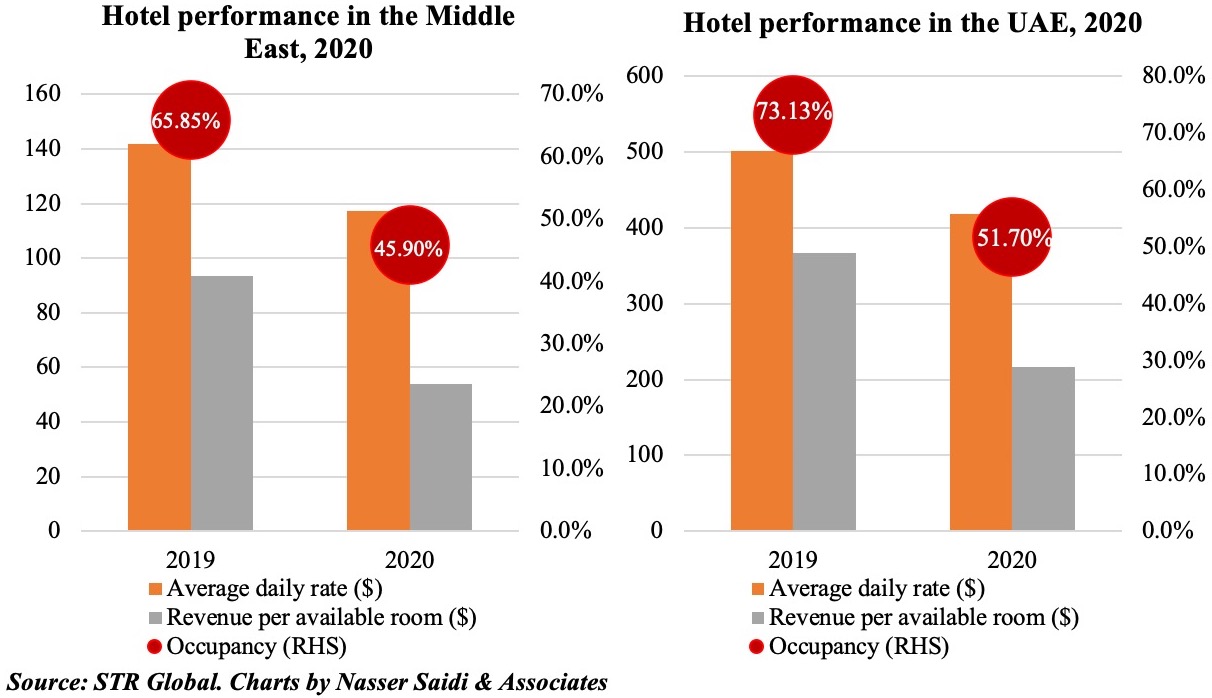

- Occupancy rates at Dubai’s hotels increased to 67.2% in Sep (+51% yoy), following 58% and 53.9% recorded in Aug and Jul respectively, according to STR data. Revenue per available room surged by 117% yoy to AED 271.85 (USD 74) in Sep.

Media Review

IMF’s Regional Economic Outlook: MENA region

https://www.imf.org/en/Publications/REO/MECA/Issues/2021/10/14/regional-economic-outlook-october

The Inflation Catch-Up Game

https://www.project-syndicate.org/commentary/us-federal-reserve-slow-inflation-response-by-mohamed-a-el-erian-2021-10

Saudi Arabia flexes its economic muscles (subscription)

https://www.ft.com/content/79abe724-0e42-4933-8305-61524f24e1ae

Vaccinated Singapore shows zero-COVID countries cost of reopening

https://www.reuters.com/world/asia-pacific/vaccinated-singapore-shows-zero-covid-countries-cost-reopening-2021-10-22/

All manner of industries are piling into the hydrogen rush

https://www.economist.com/business/2021/10/23/all-manner-of-industries-are-piling-into-the-hydrogen-rush

Powered by:

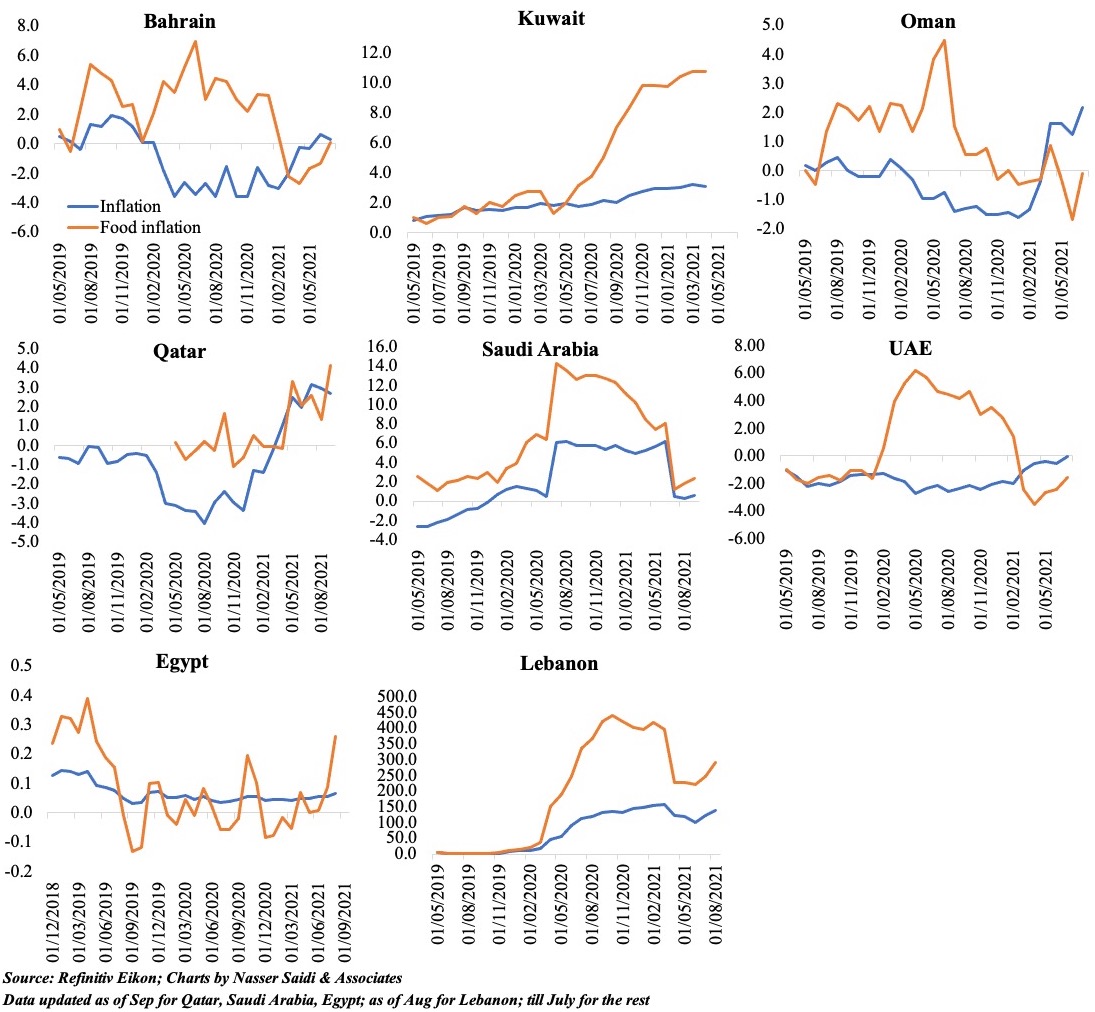

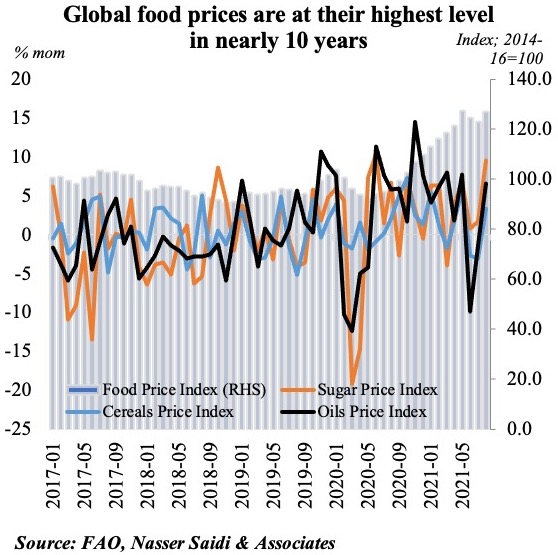

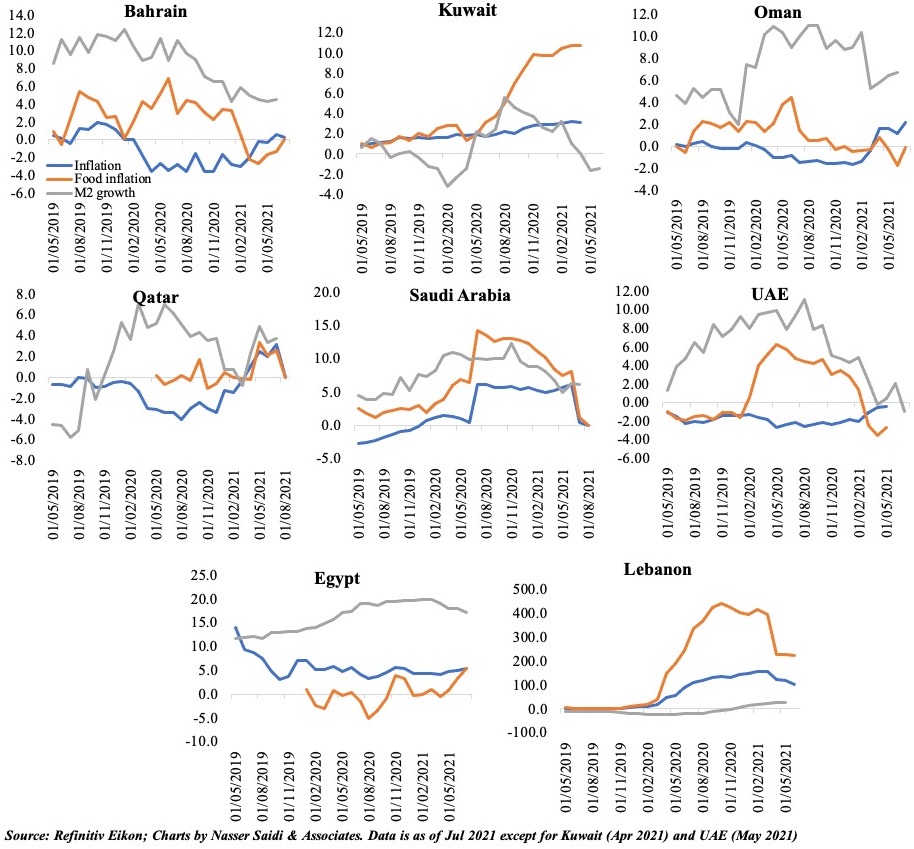

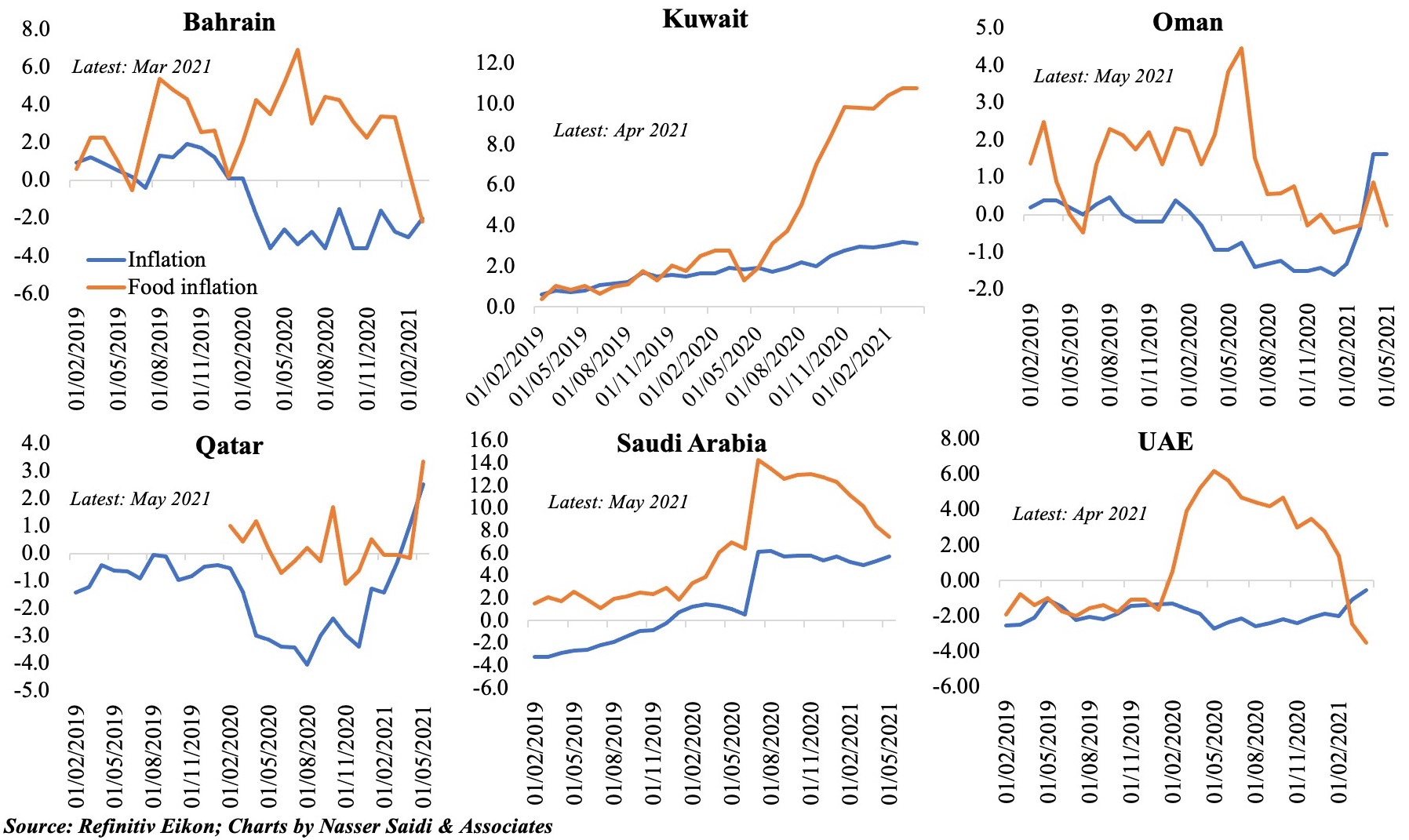

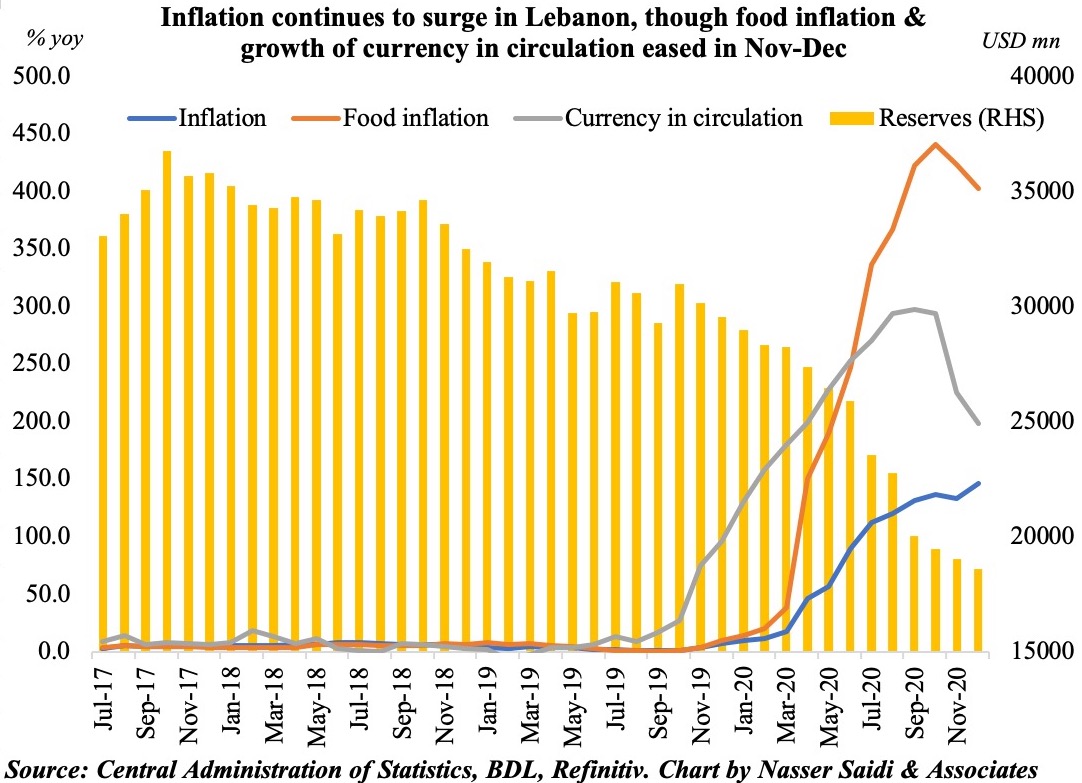

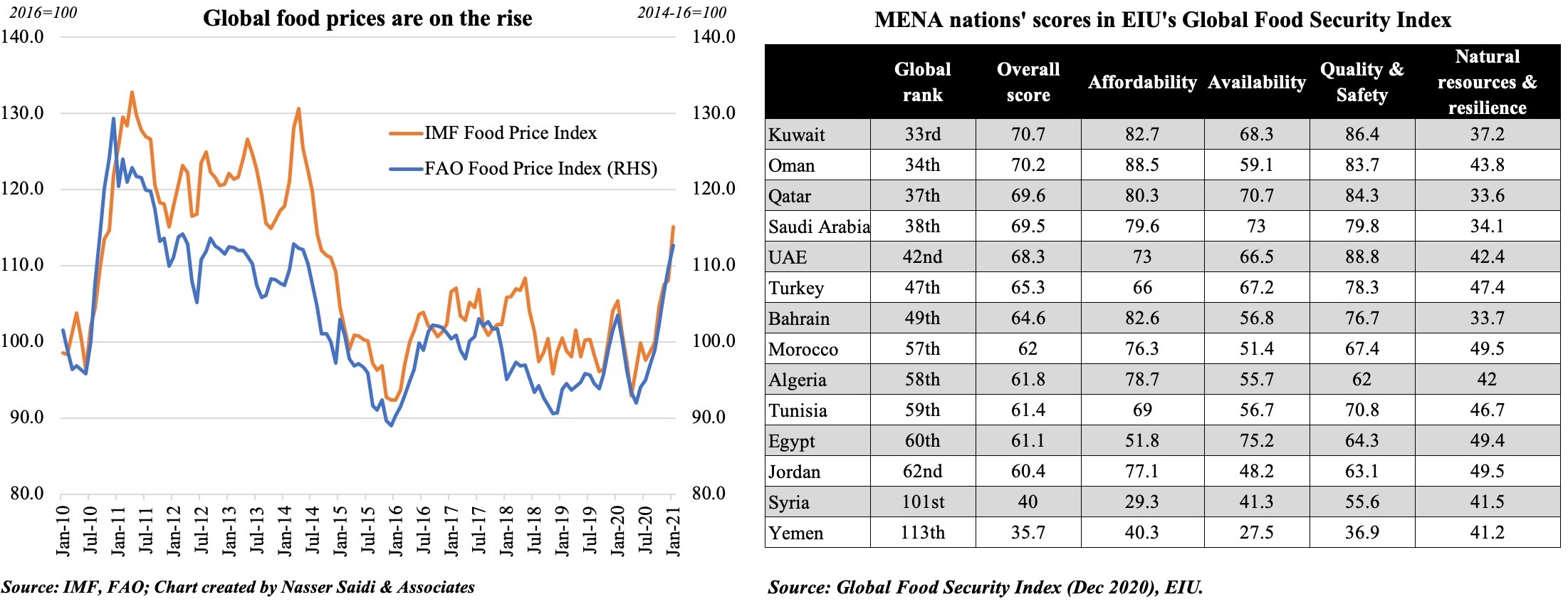

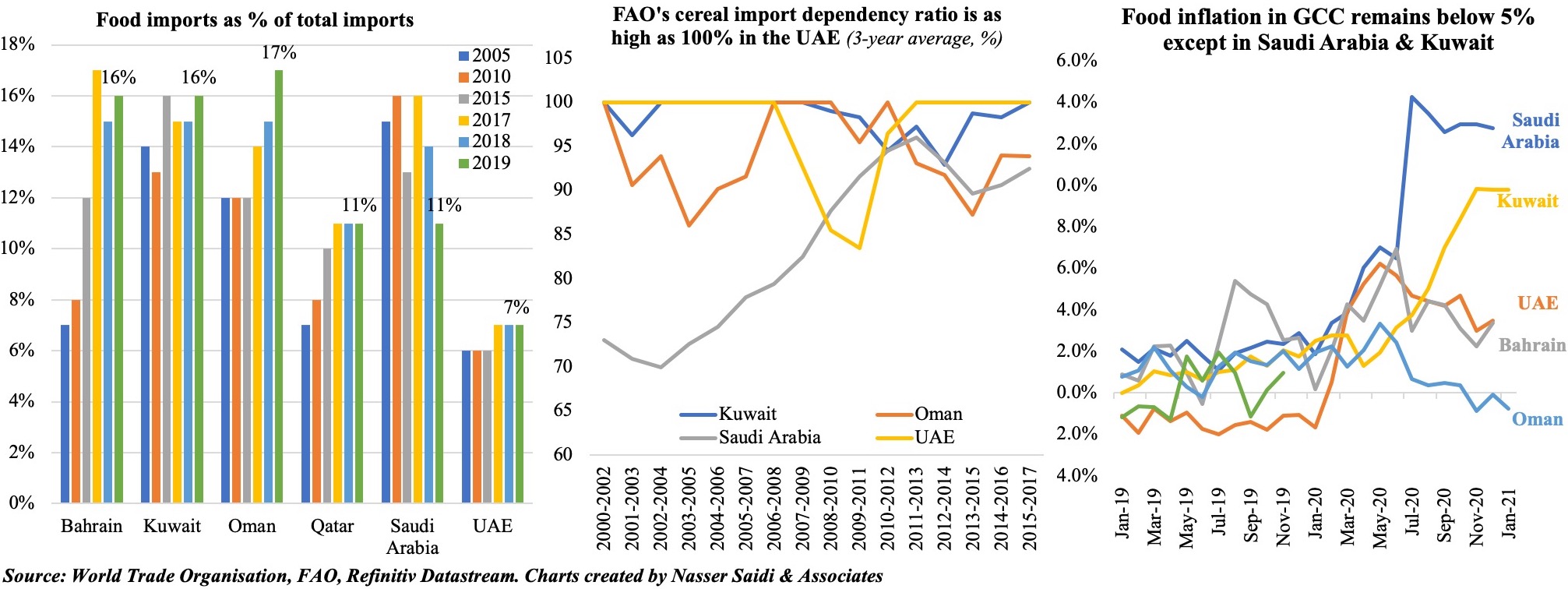

Both food and energy prices have been rising the past few months. The FAO food price index for Aug showed a 3.1% mom and 32.9% yoy increase, rebounding after 2 consecutive months of declines. Since prices had been subdued during the initial stages of the pandemic, the year-on-year surge can be associated with base effects, but the month-on-month prices have been creeping up as well. For countries highly dependent on food and other staple goods imports (especially the MENA region), the inflationary pressure will grow if this persists and also affect poorer countries disproportionately. It is worthwhile to remember that social unrest leading up to the Arab Spring a decade back came after months of rising food costs (food price inflation in Egypt had hit ~19%)!

Both food and energy prices have been rising the past few months. The FAO food price index for Aug showed a 3.1% mom and 32.9% yoy increase, rebounding after 2 consecutive months of declines. Since prices had been subdued during the initial stages of the pandemic, the year-on-year surge can be associated with base effects, but the month-on-month prices have been creeping up as well. For countries highly dependent on food and other staple goods imports (especially the MENA region), the inflationary pressure will grow if this persists and also affect poorer countries disproportionately. It is worthwhile to remember that social unrest leading up to the Arab Spring a decade back came after months of rising food costs (food price inflation in Egypt had hit ~19%)!

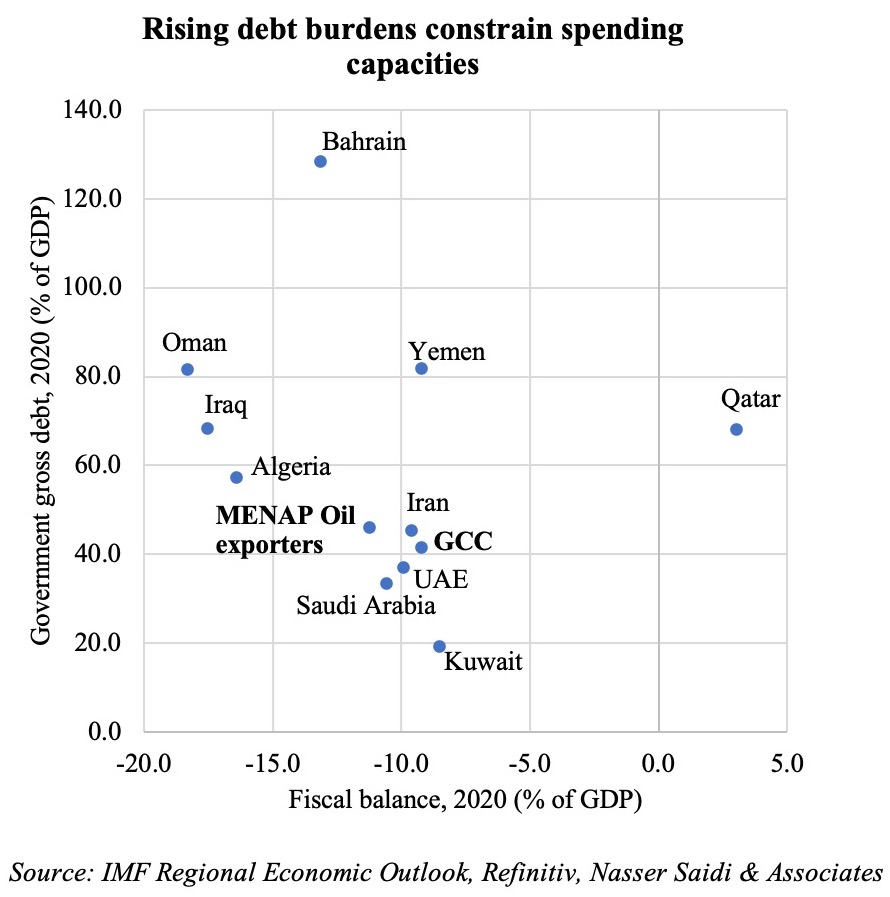

Public and external debt have risen significantly for the median emerging market economy, reaching 59 and 44% of GDP, respectively, in 2020, and gross financing needs are projected to stay above 10% of GDP in 2020–21, according to

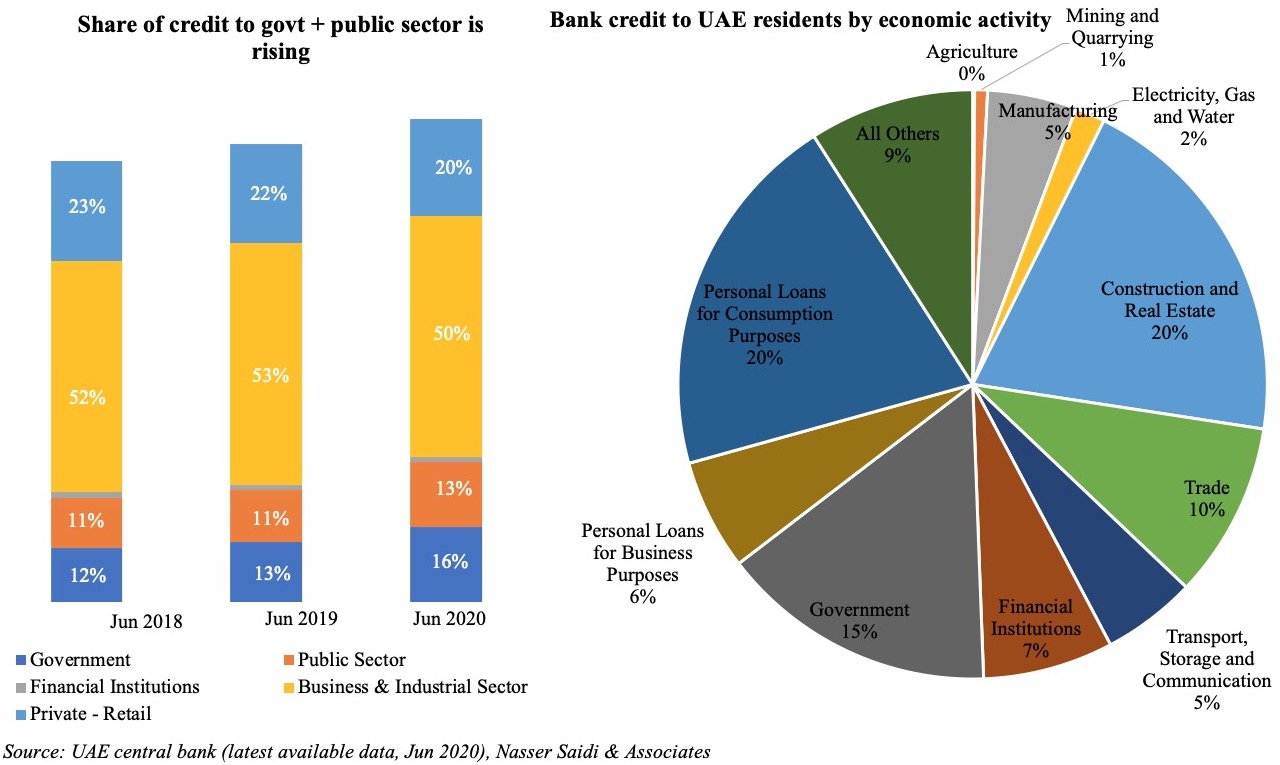

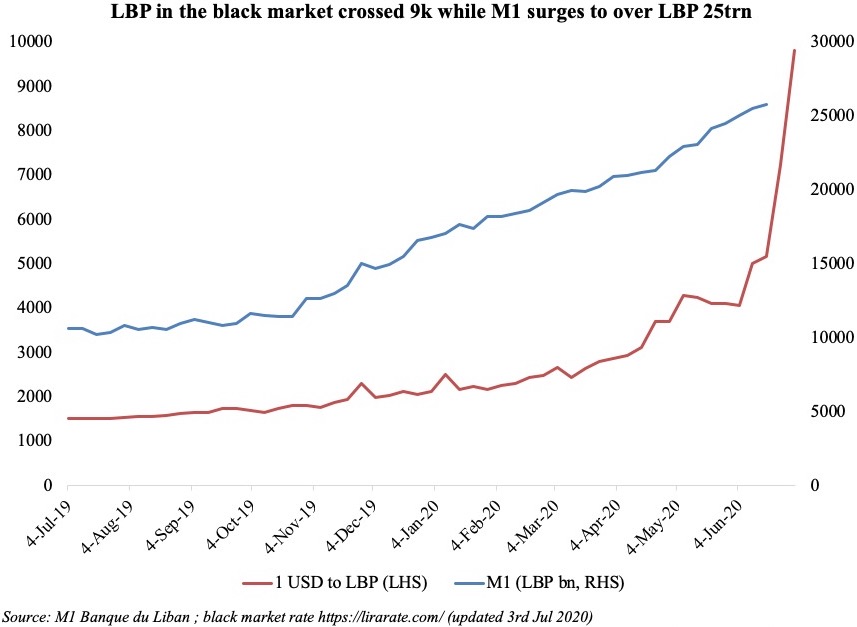

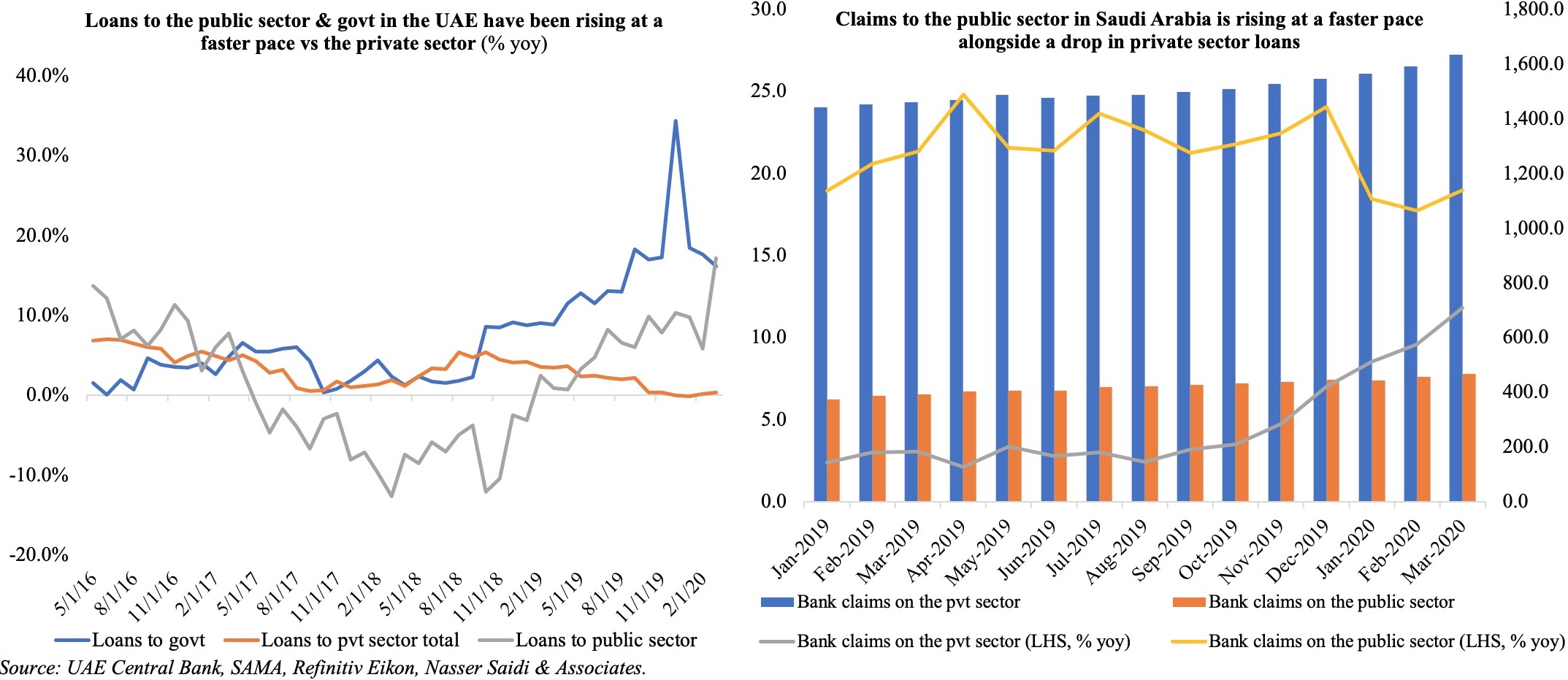

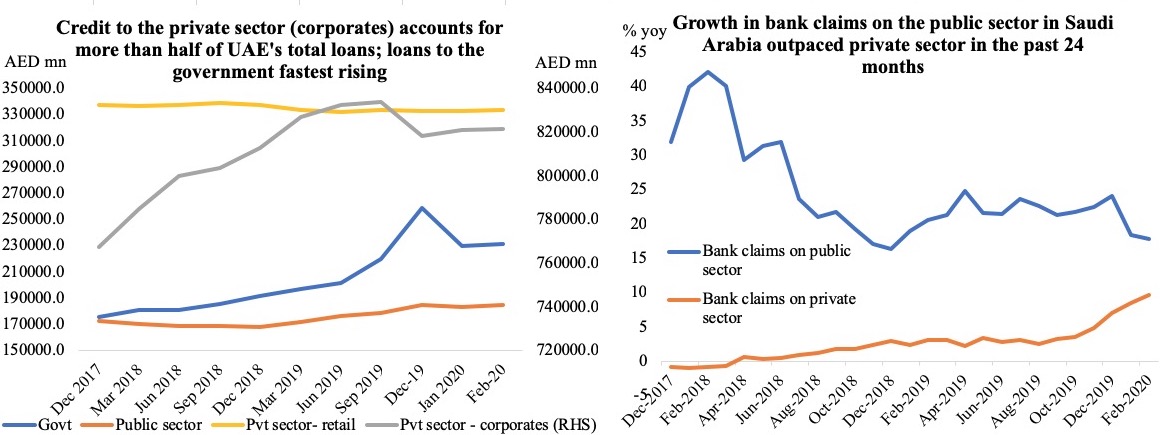

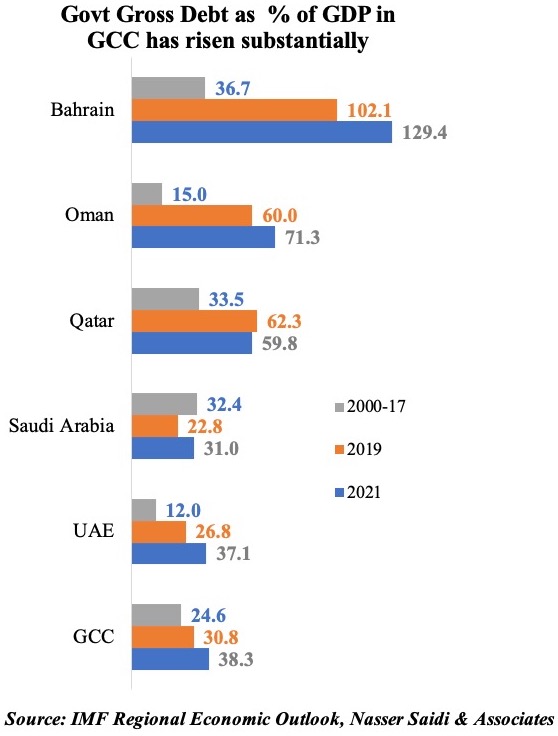

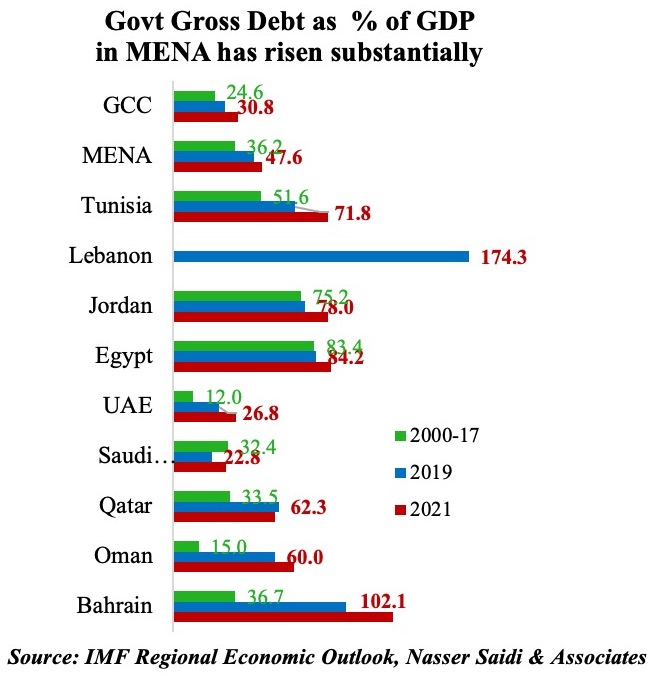

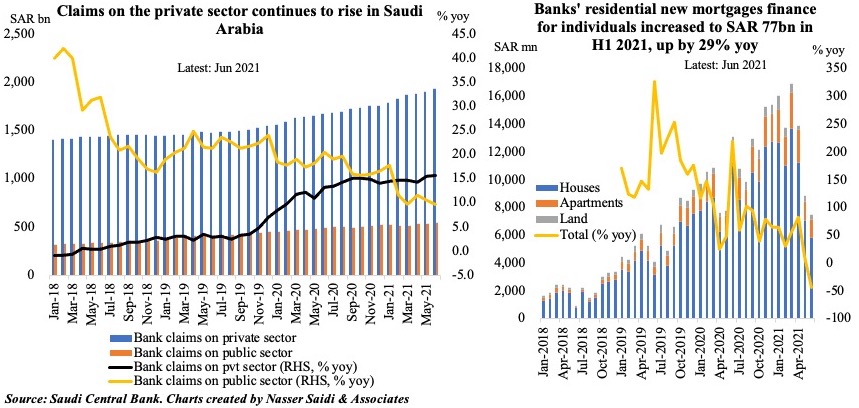

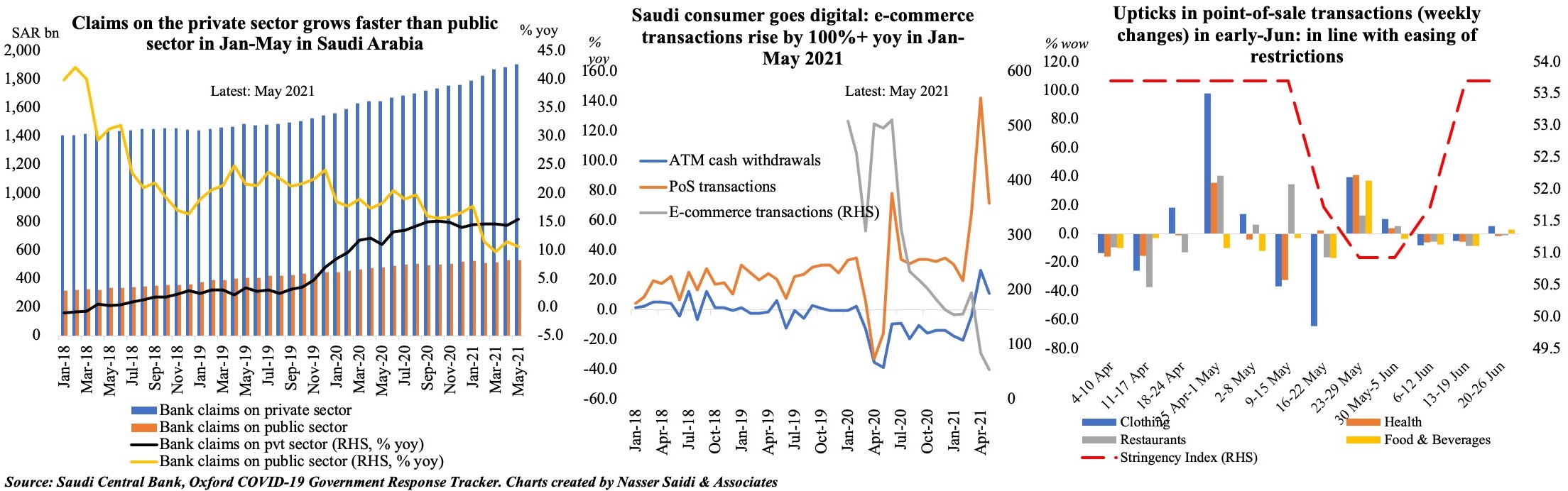

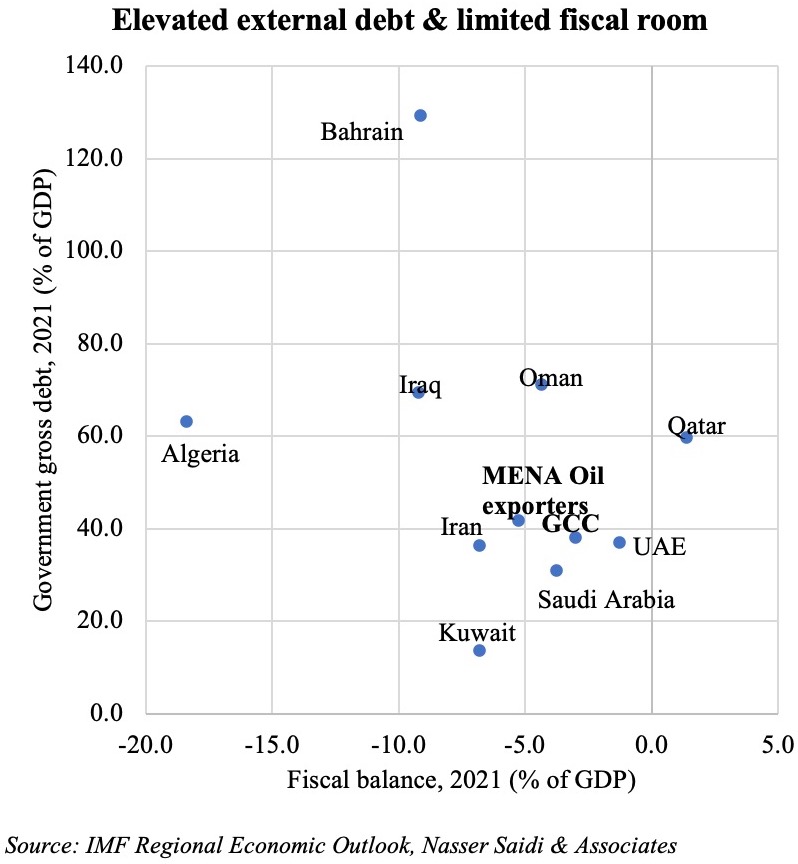

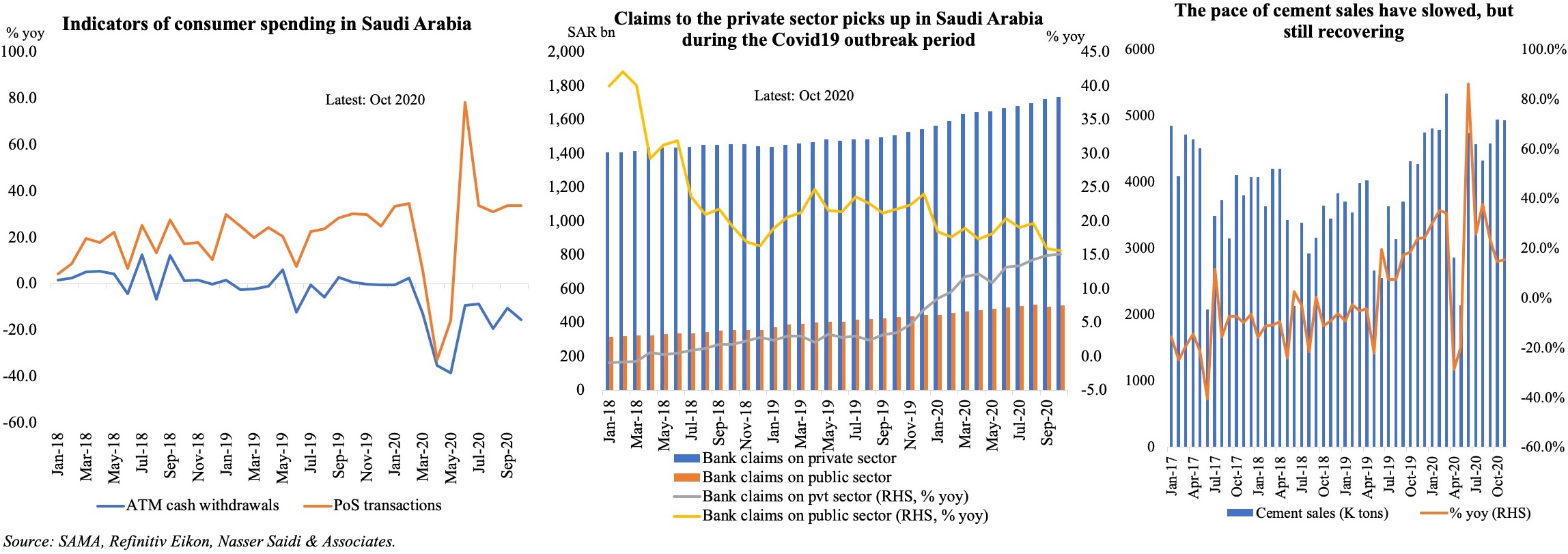

Public and external debt have risen significantly for the median emerging market economy, reaching 59 and 44% of GDP, respectively, in 2020, and gross financing needs are projected to stay above 10% of GDP in 2020–21, according to  In the MENA region, almost half the nations have gross government debt above 70% of GDP and one in 4 had public gross financing needs above 15% of GDP by end-2019. The pandemic led to a significant loss in revenues (both oil and non-oil) and though international financial markets were tapped, domestic financing increased. According to the IMF, governments in Egypt, Jordan, and Tunisia covered more than 50% of their public gross financing needs with domestic bank financing in 2020. Such bank exposure to the public sector could also crowd out the private sector at a time when a private activity push is required for higher economic growth and job creation. A surge in inflation can lead to a reduction in the real value of domestic debt – Lebanon is a good example, but the sharp currency depreciation makes the debt burden unsustainable.

In the MENA region, almost half the nations have gross government debt above 70% of GDP and one in 4 had public gross financing needs above 15% of GDP by end-2019. The pandemic led to a significant loss in revenues (both oil and non-oil) and though international financial markets were tapped, domestic financing increased. According to the IMF, governments in Egypt, Jordan, and Tunisia covered more than 50% of their public gross financing needs with domestic bank financing in 2020. Such bank exposure to the public sector could also crowd out the private sector at a time when a private activity push is required for higher economic growth and job creation. A surge in inflation can lead to a reduction in the real value of domestic debt – Lebanon is a good example, but the sharp currency depreciation makes the debt burden unsustainable.

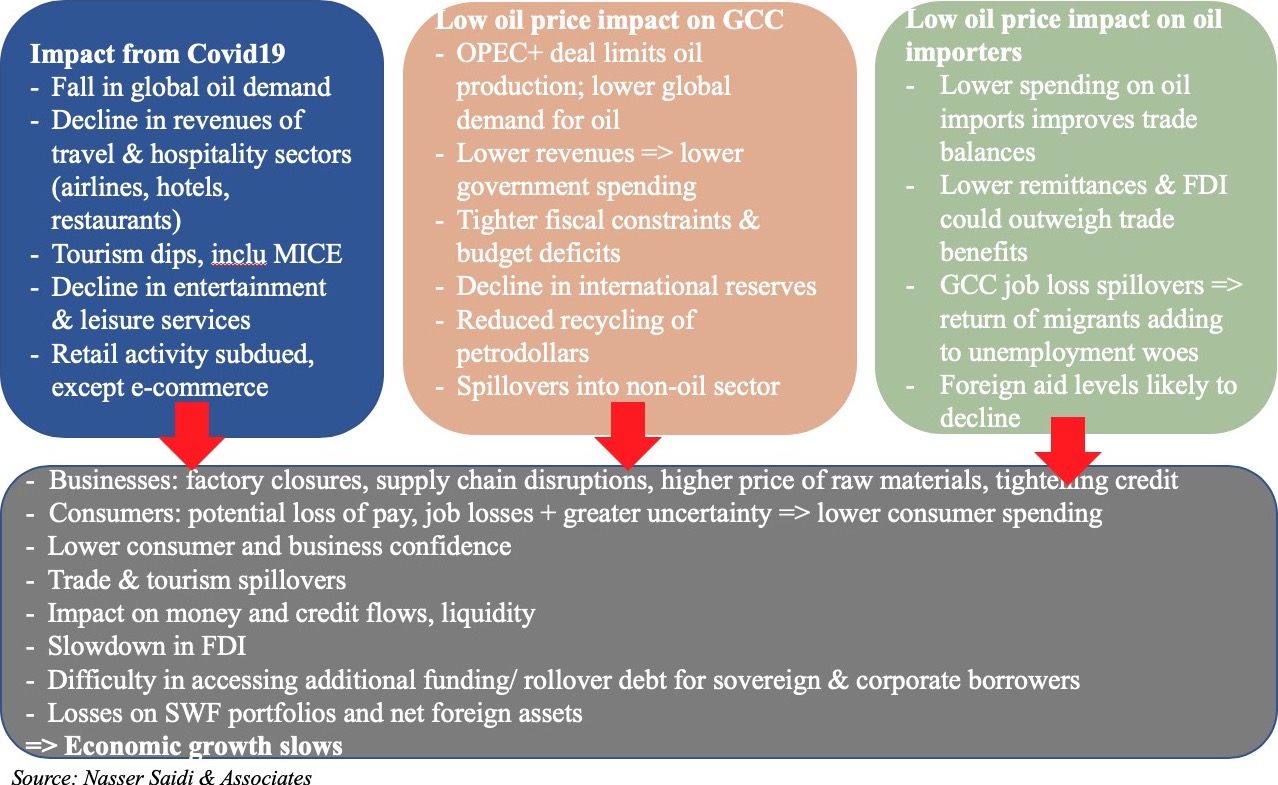

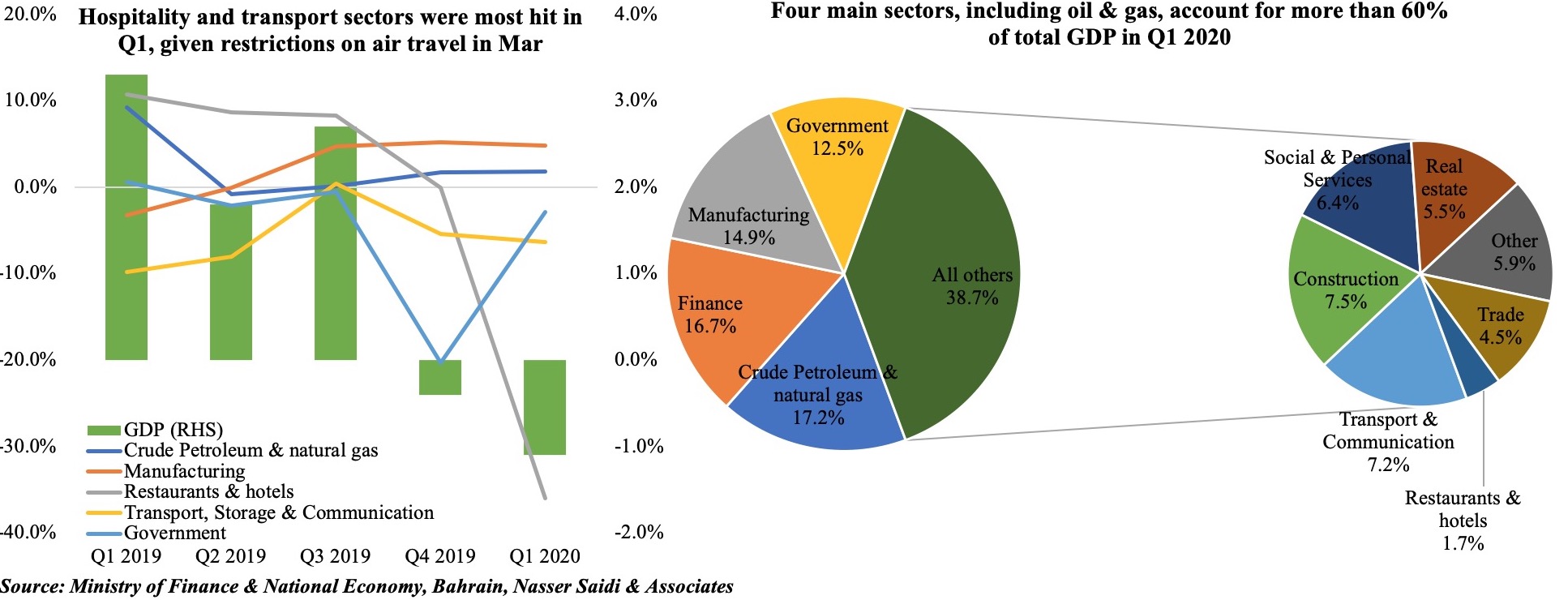

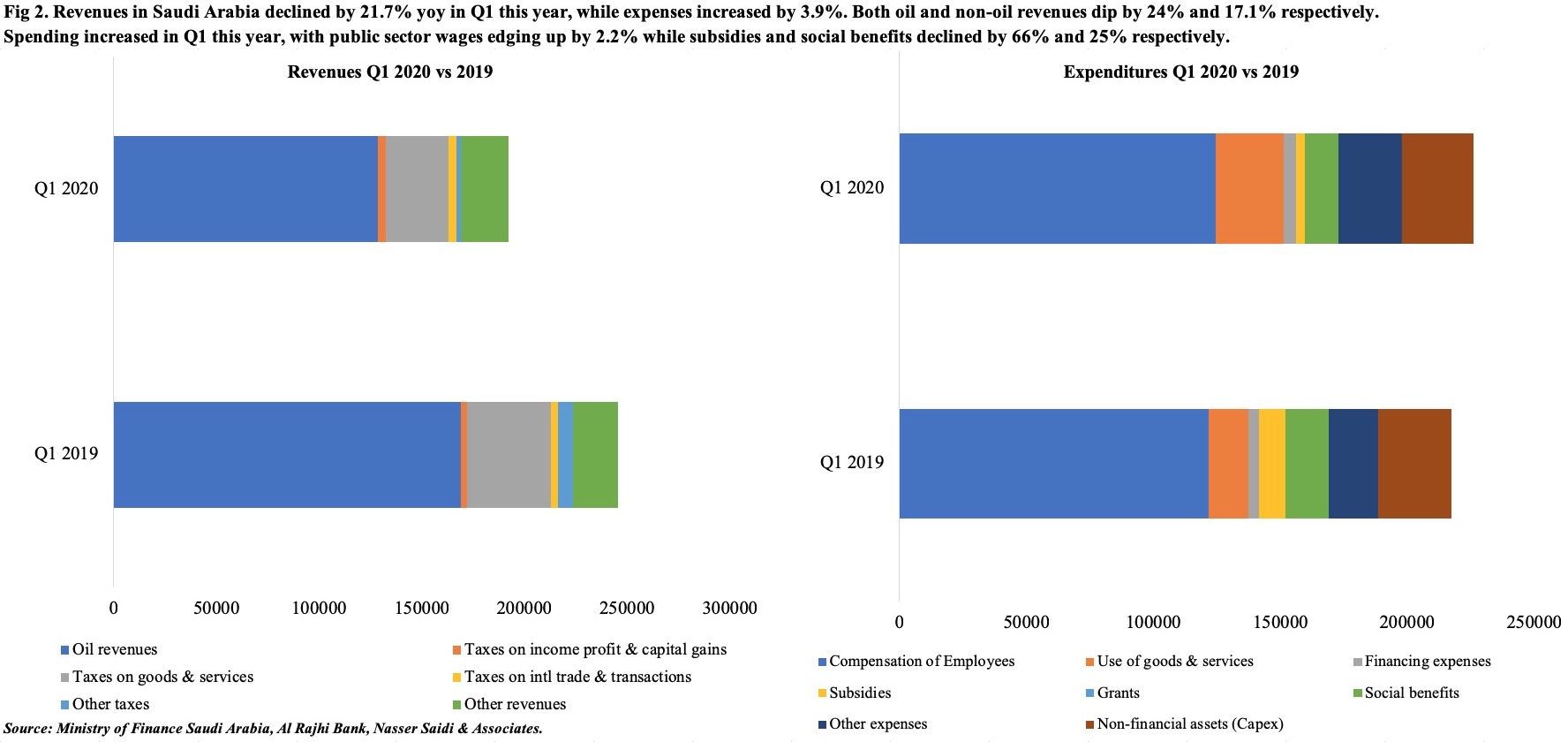

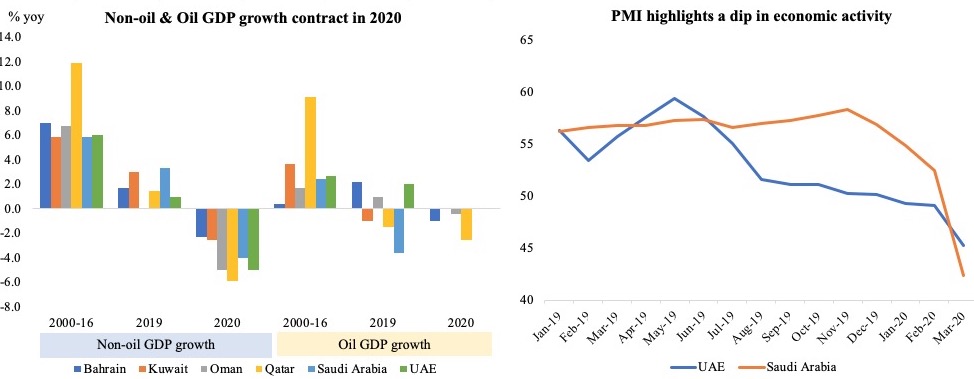

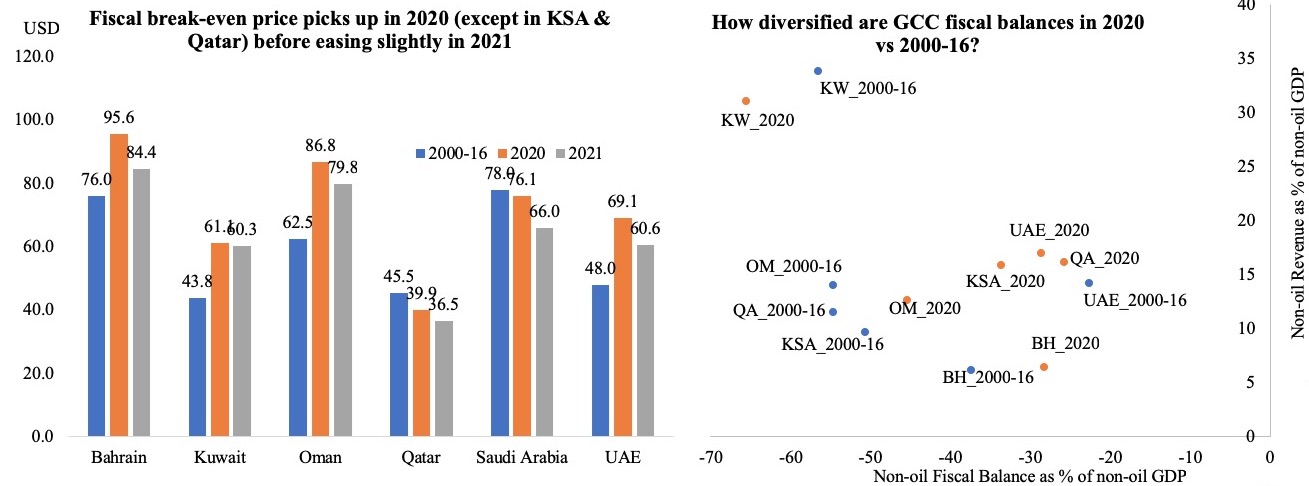

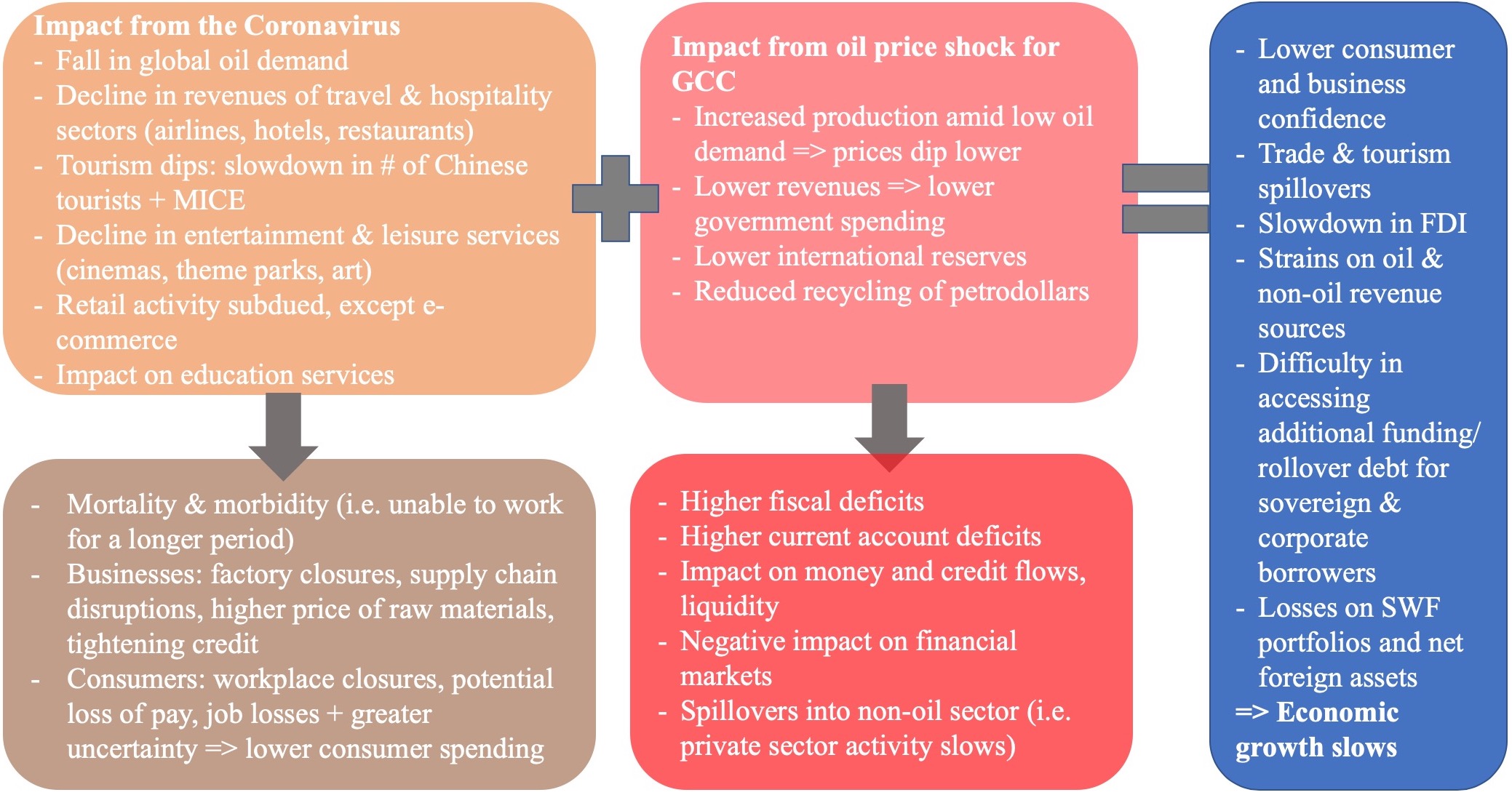

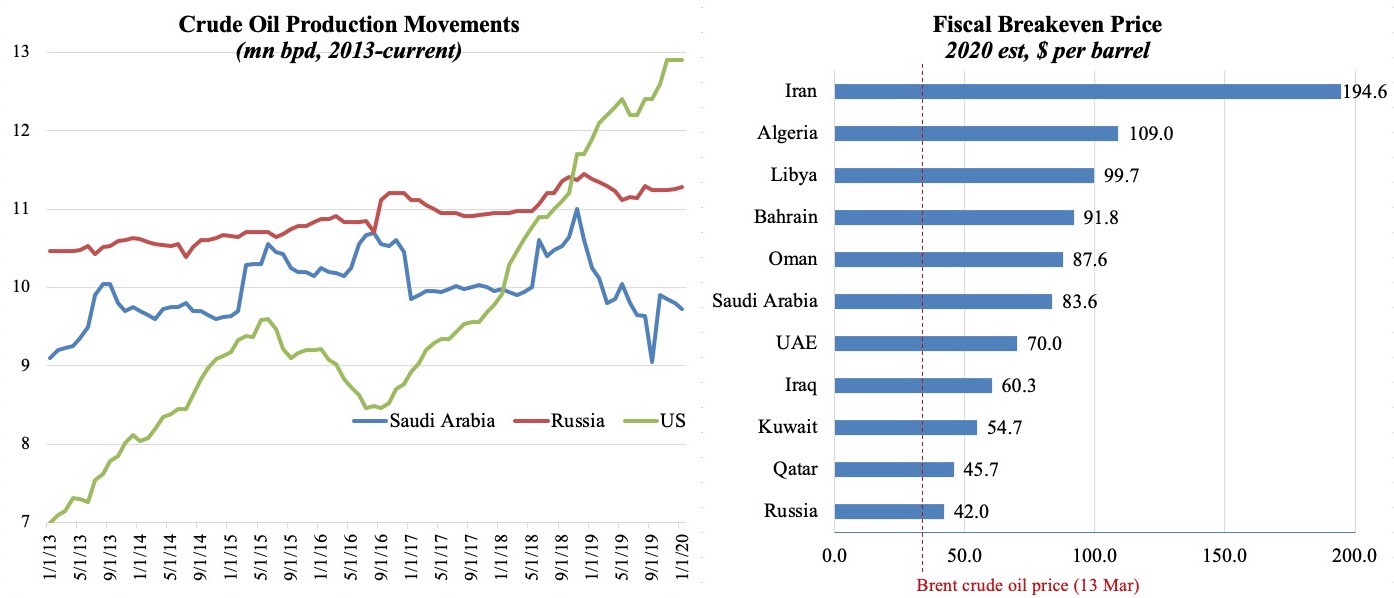

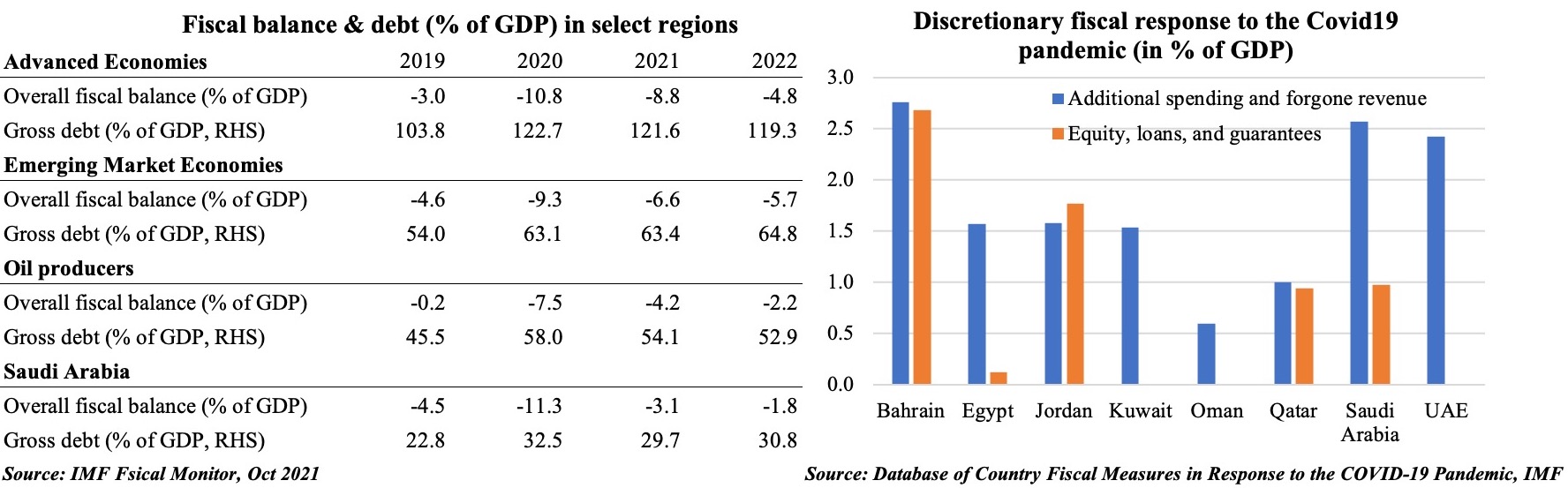

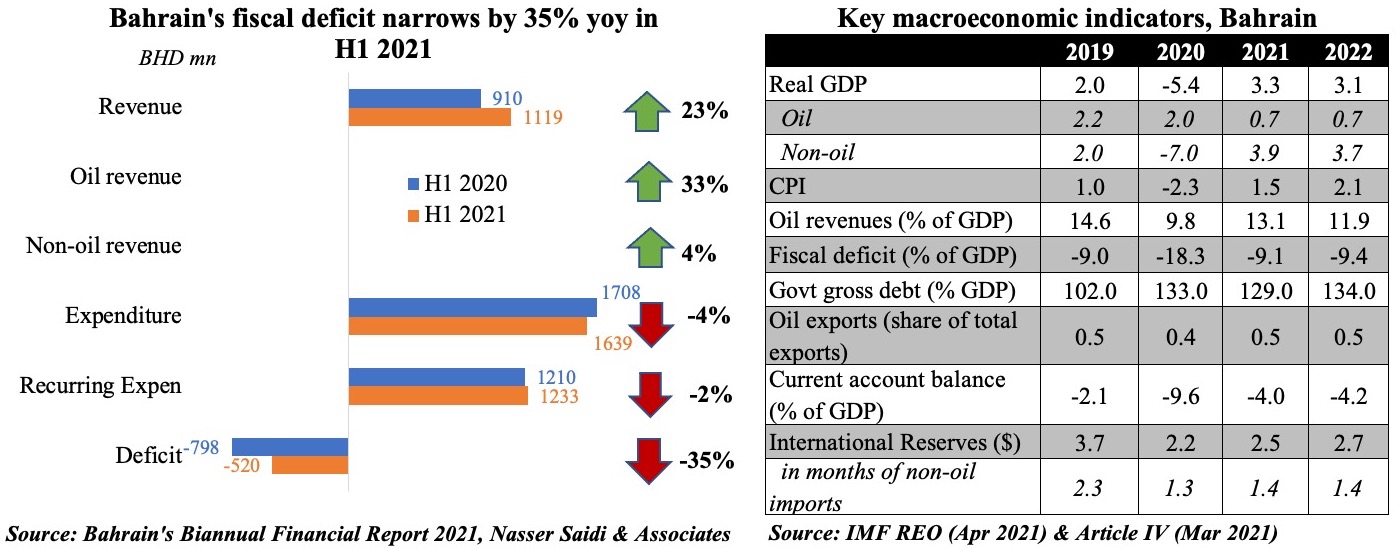

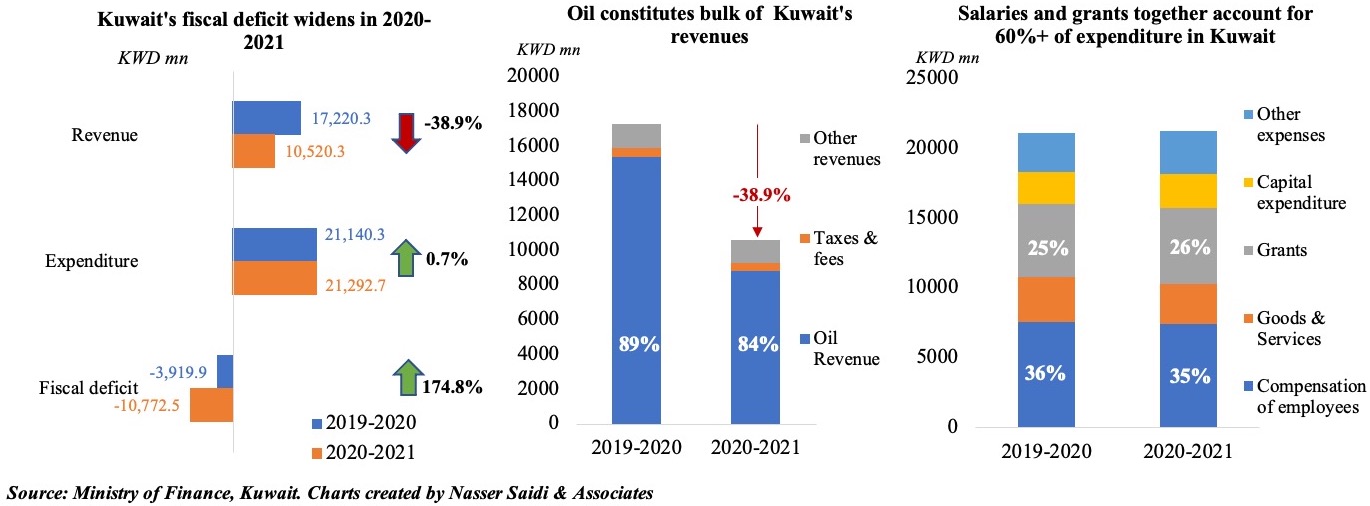

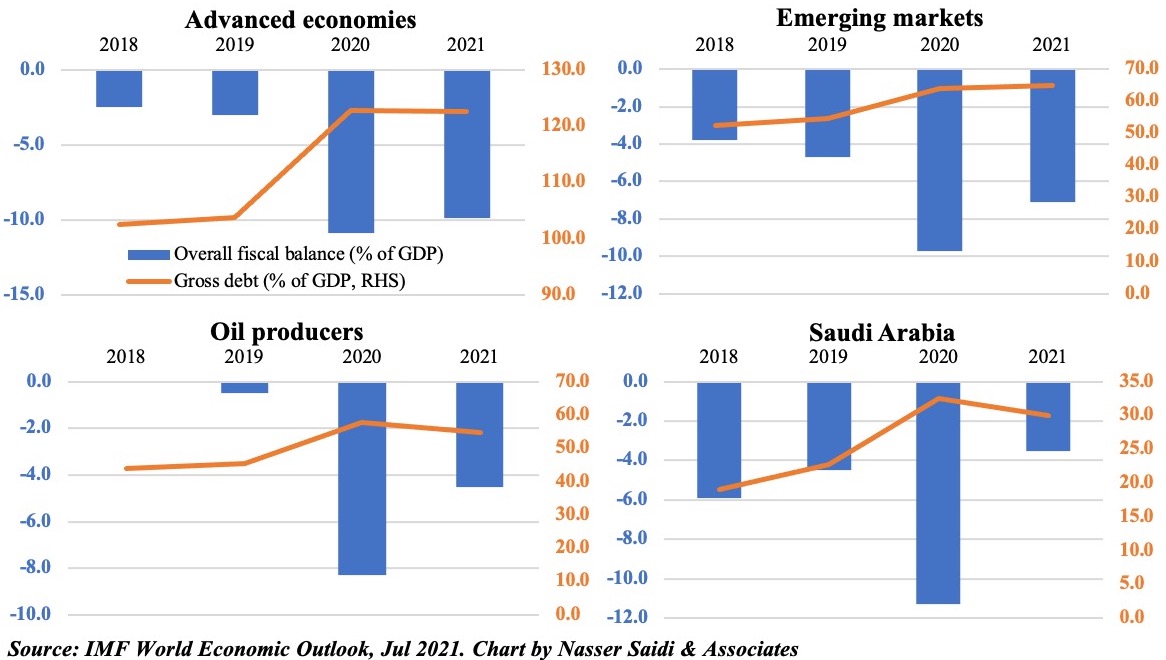

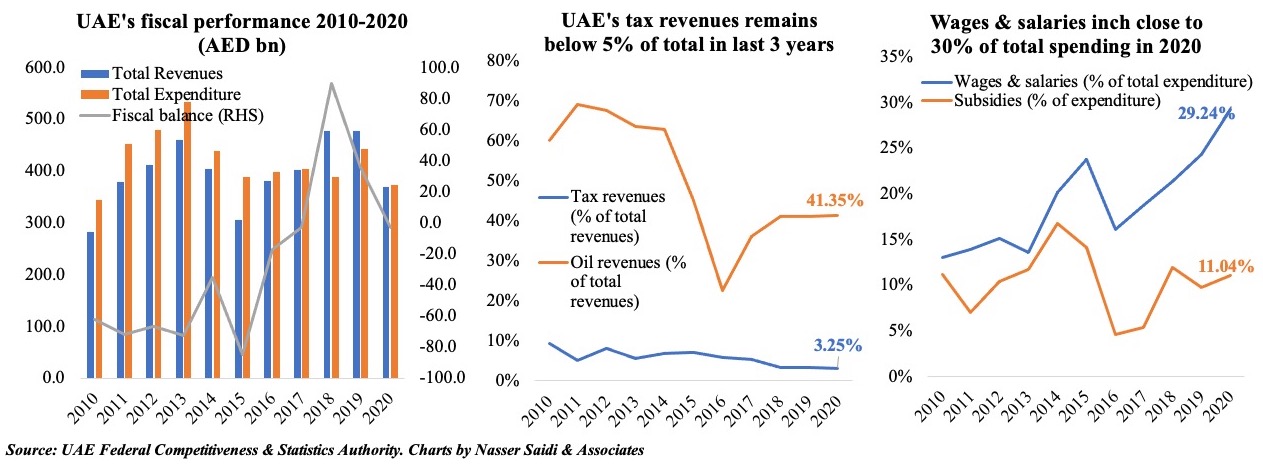

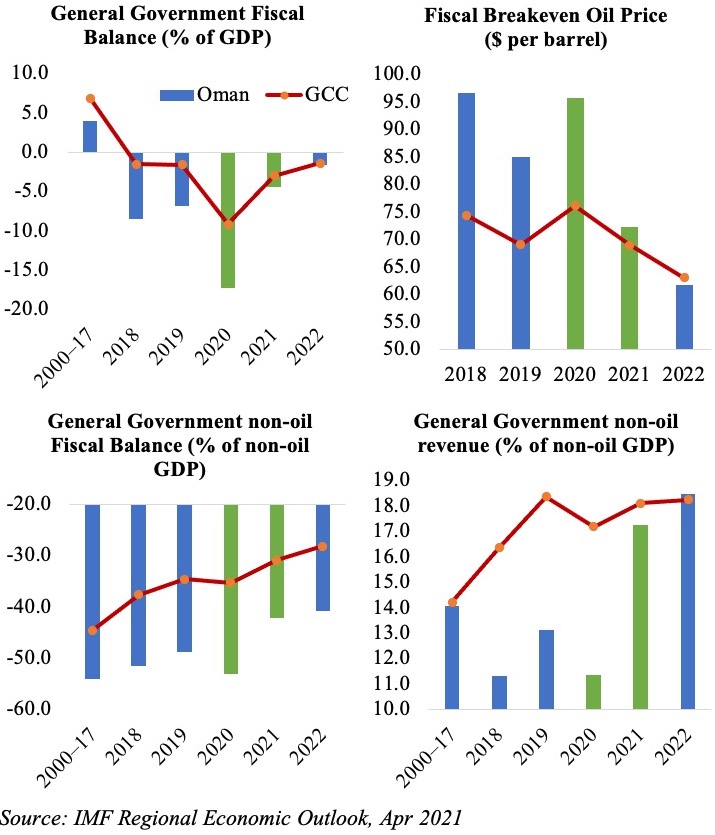

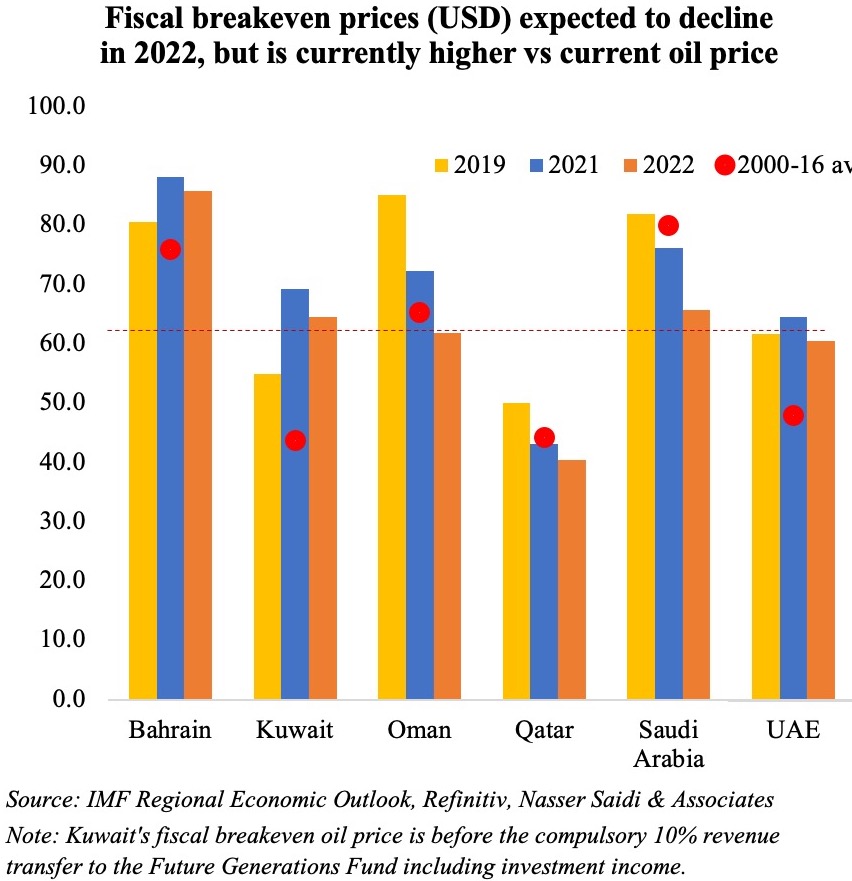

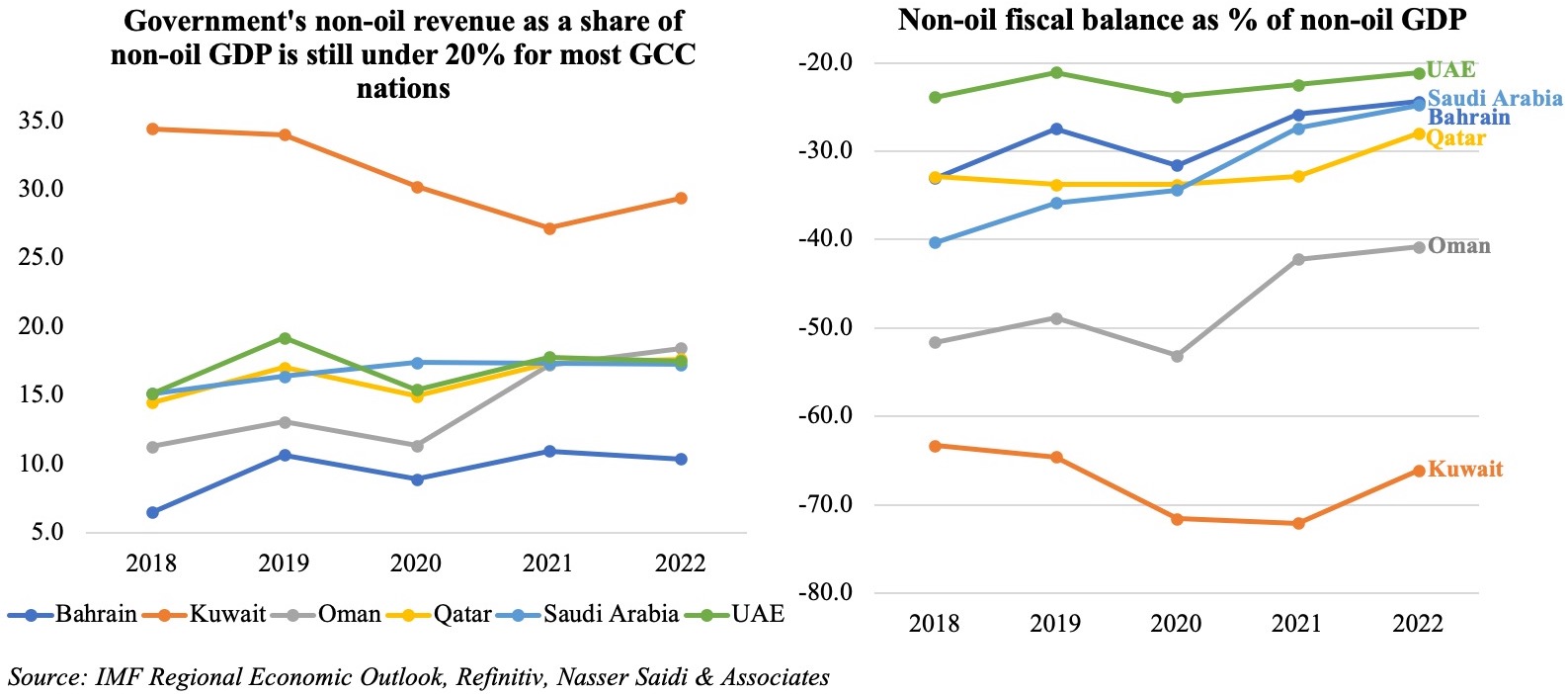

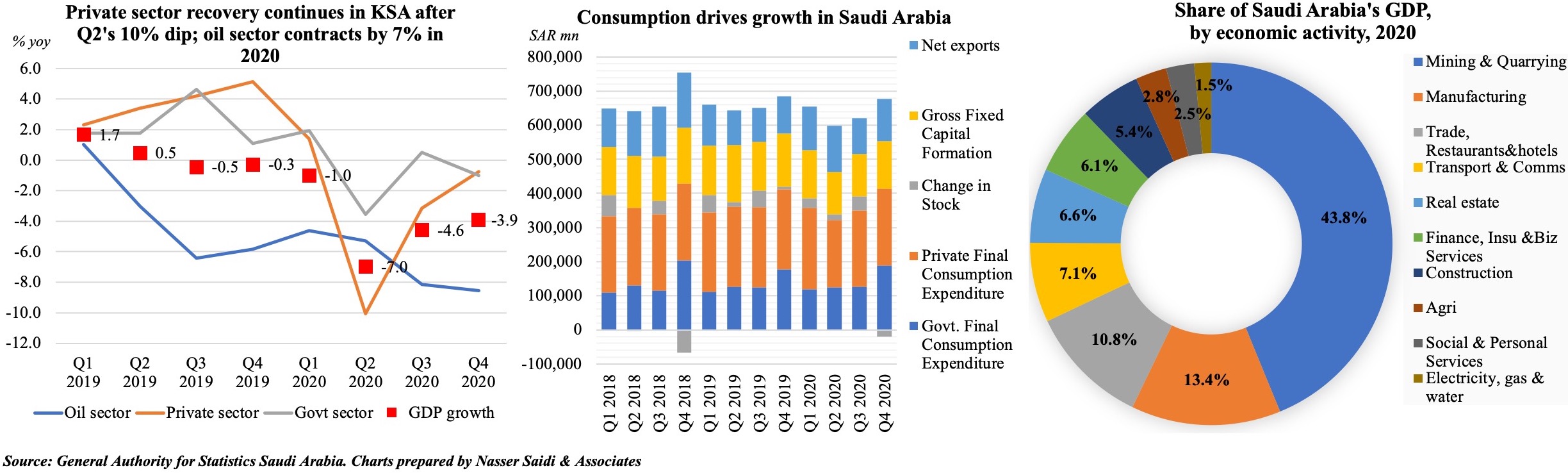

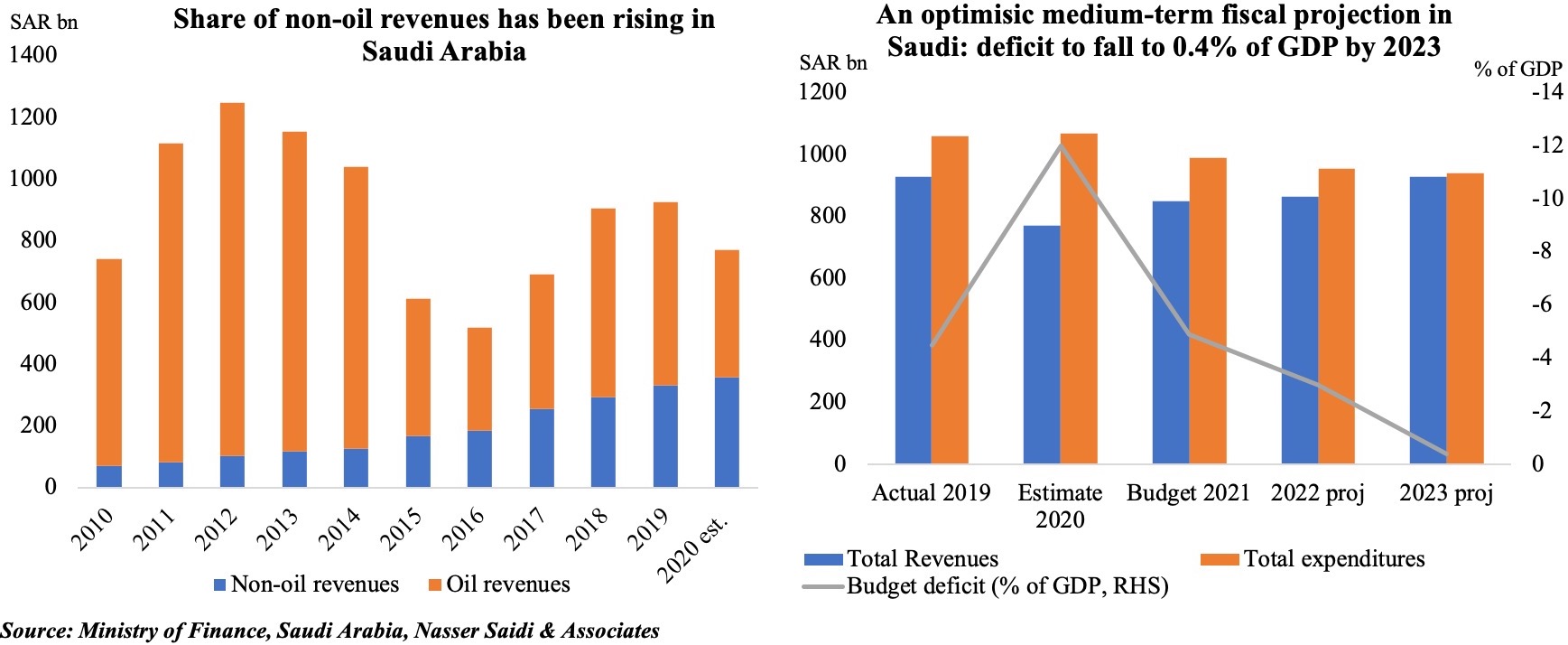

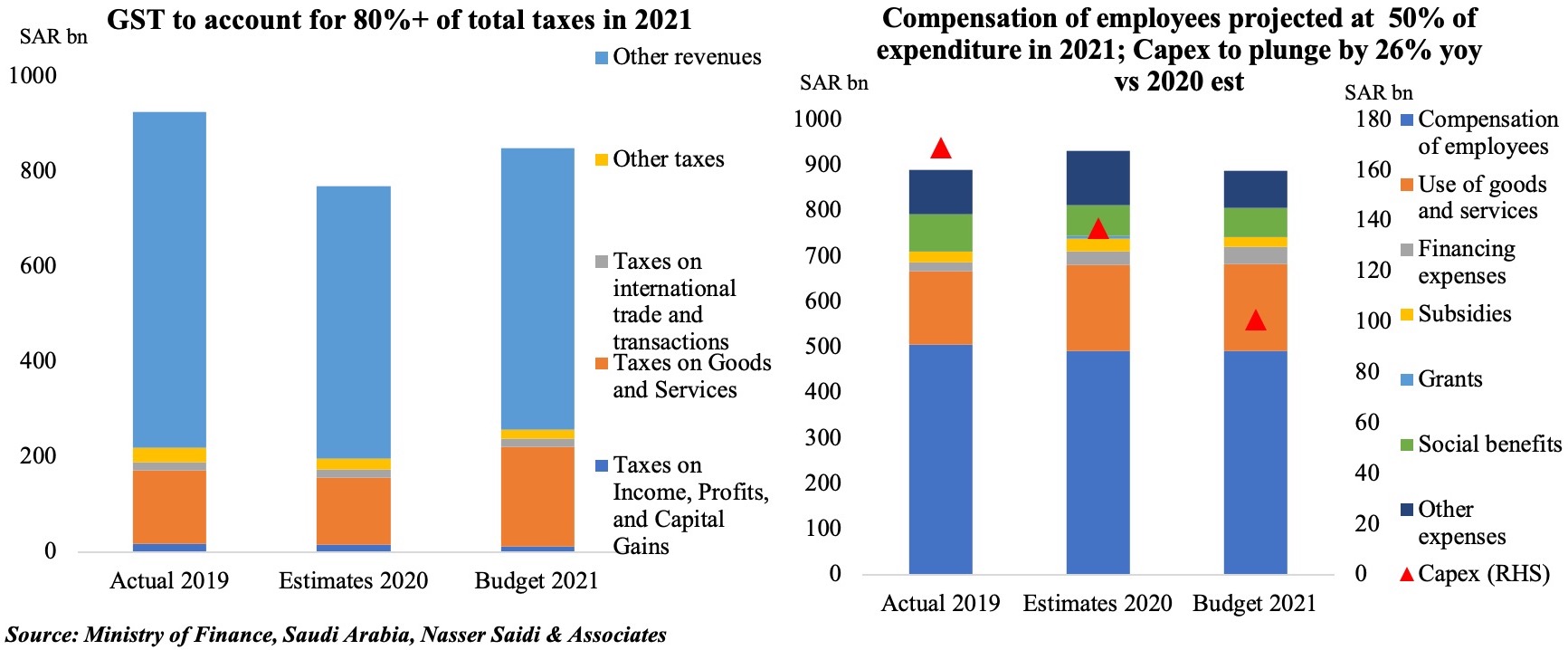

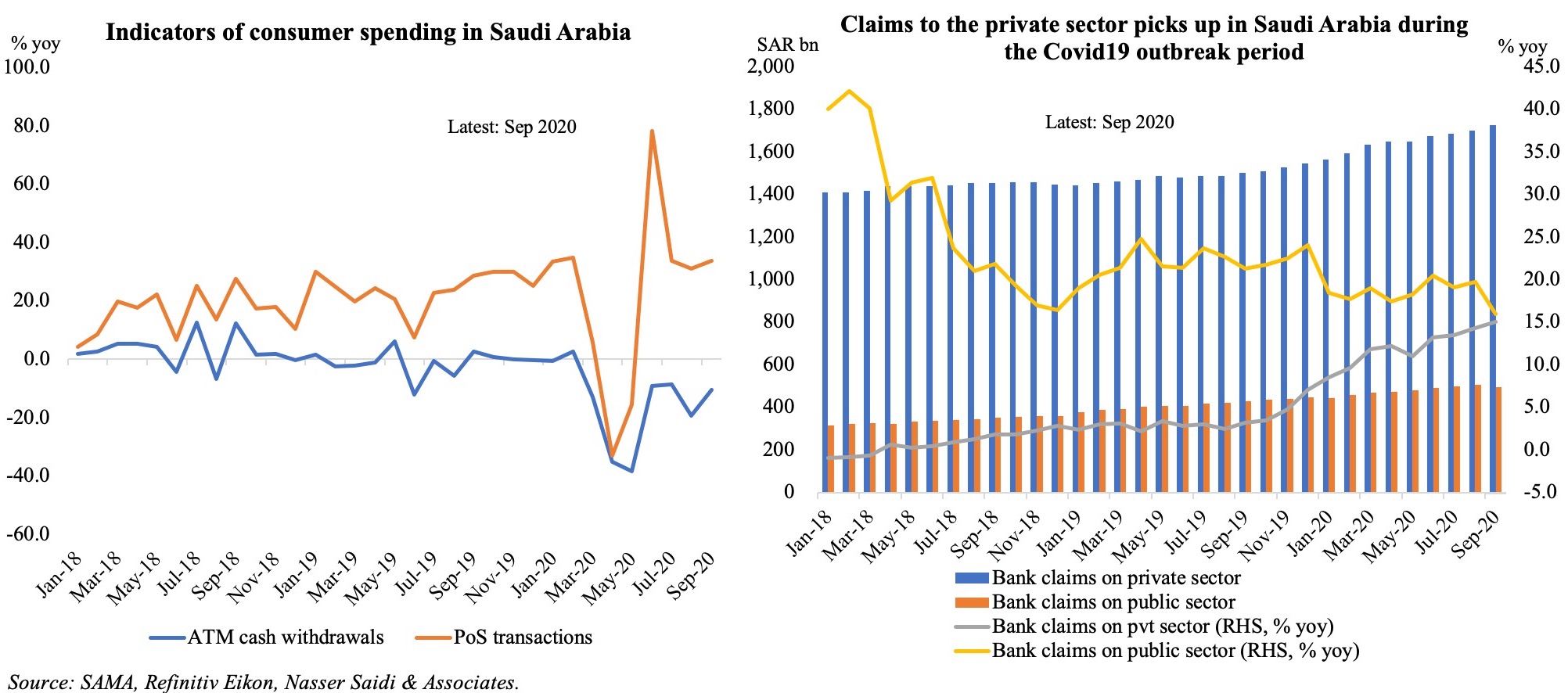

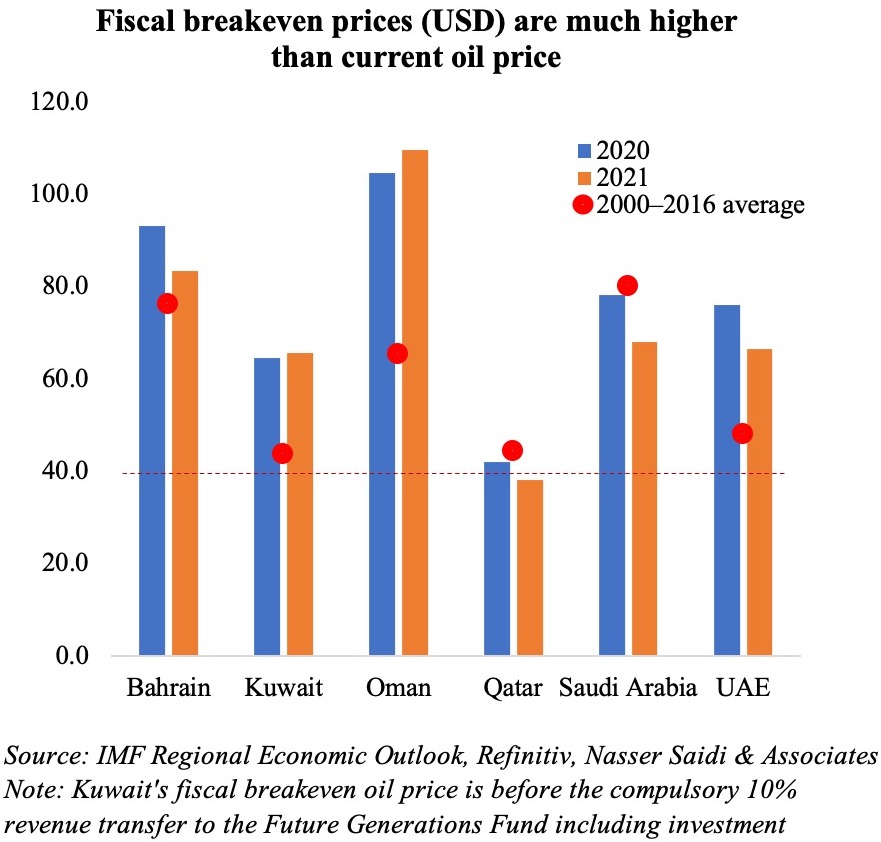

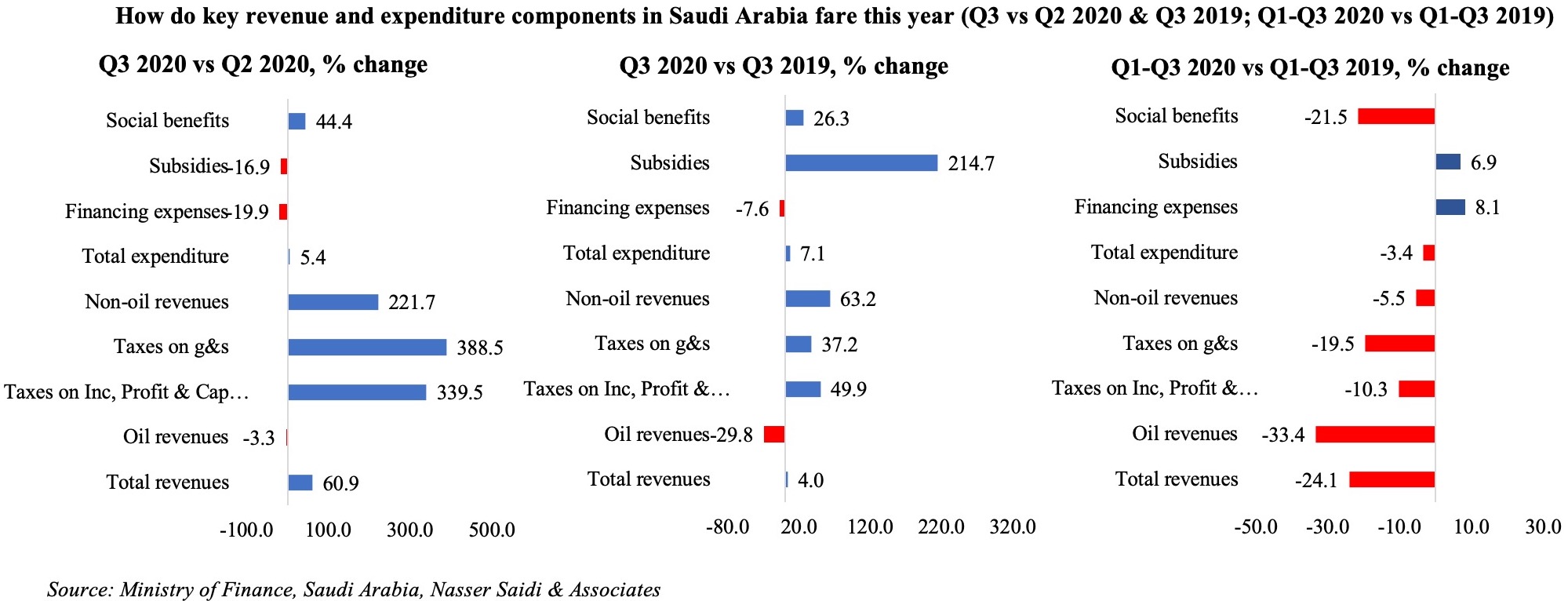

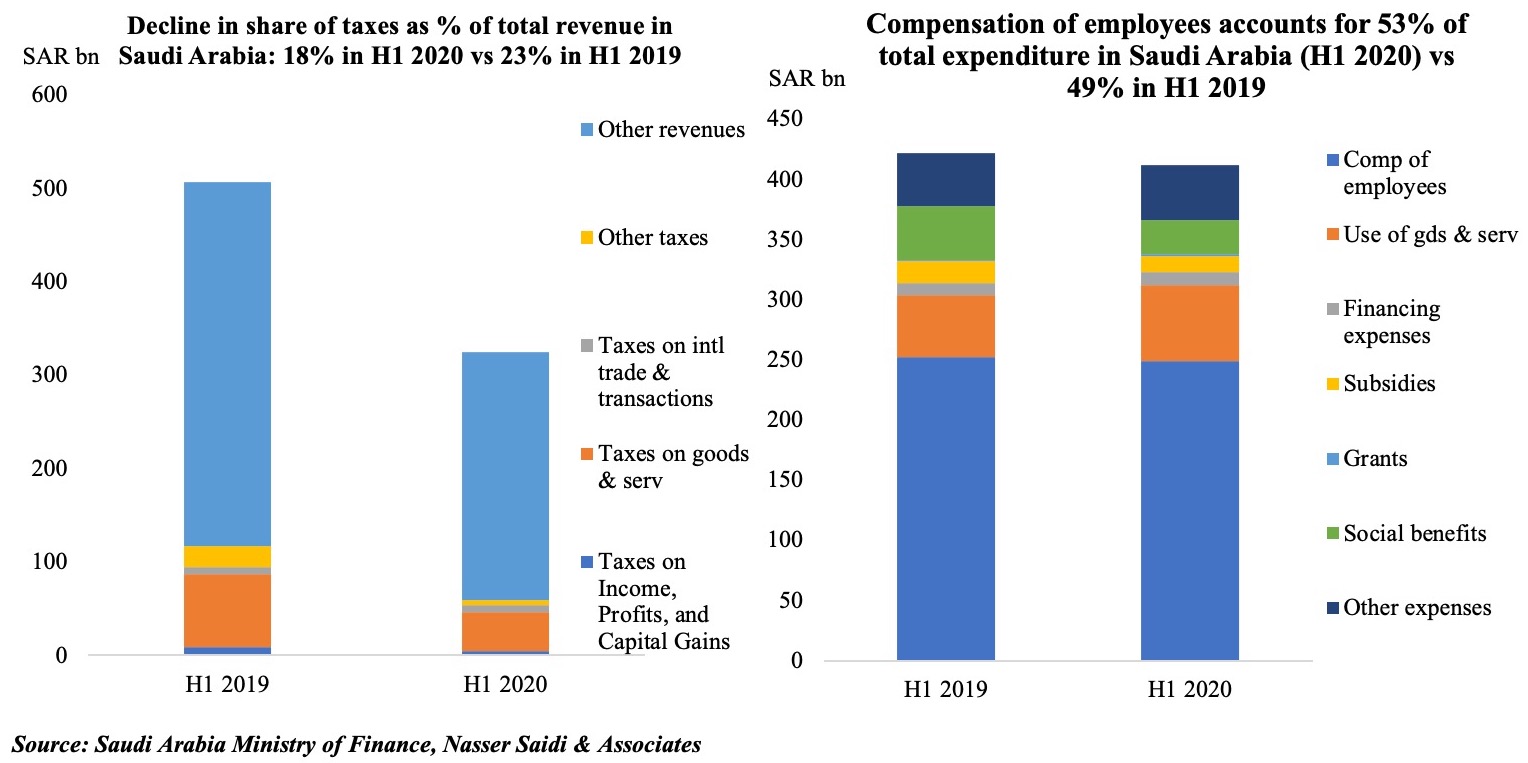

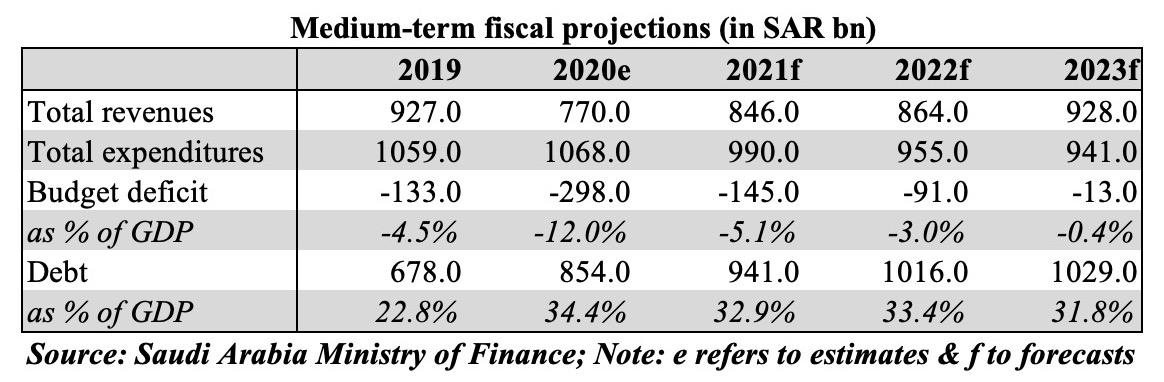

However, policy measures introduced to support the economy during the pandemic is creating immense fiscal strain. Fiscal deficits widened to 10.1% of GDP in 2020 in the MENA region from 3.8% in 2019. It was severe in the GCC as well: fiscal deficit widened to 7.6% of GDP last year (2019: -1.6%), as the impact was from both lower oil and non-oil revenues. The fiscal breakeven price this year ranges from a high USD 88.2 in Bahrain to a low USD 43.1 in Qatar. While, it is expected to decline across the board next year, it still remains higher than the current oil price levels for most nations. Given new rounds of restrictions and with oil demand not yet at pre-pandemic levels, the OPEC+’s recent decision to roll back production cuts are likely to depress oil prices. As real oil prices trend downward, fiscal sustainability becomes increasingly vulnerable.

However, policy measures introduced to support the economy during the pandemic is creating immense fiscal strain. Fiscal deficits widened to 10.1% of GDP in 2020 in the MENA region from 3.8% in 2019. It was severe in the GCC as well: fiscal deficit widened to 7.6% of GDP last year (2019: -1.6%), as the impact was from both lower oil and non-oil revenues. The fiscal breakeven price this year ranges from a high USD 88.2 in Bahrain to a low USD 43.1 in Qatar. While, it is expected to decline across the board next year, it still remains higher than the current oil price levels for most nations. Given new rounds of restrictions and with oil demand not yet at pre-pandemic levels, the OPEC+’s recent decision to roll back production cuts are likely to depress oil prices. As real oil prices trend downward, fiscal sustainability becomes increasingly vulnerable.

Higher deficits and negative economic growth resulted in governments resorting to multiple financing options: borrowing from commercial banks, tapping international and regional markets (bond issuances, commercial loans) as well as drawing down from international reserves at the central banks/ sovereign wealth funds. Government debt levels increased to 56.4% and 41% in the MENA and GCC regions last year. Though it is forecast to fall slightly this year, it still remains higher than the 2000-17 average of 36.2% and 24.6% respectively. The IMF estimates financing needs in the MENA to touch USD 919bn for this year and next. Public-financing requirements were likely to stay above 15% of GDP in most parts of the region through end-2022.

Higher deficits and negative economic growth resulted in governments resorting to multiple financing options: borrowing from commercial banks, tapping international and regional markets (bond issuances, commercial loans) as well as drawing down from international reserves at the central banks/ sovereign wealth funds. Government debt levels increased to 56.4% and 41% in the MENA and GCC regions last year. Though it is forecast to fall slightly this year, it still remains higher than the 2000-17 average of 36.2% and 24.6% respectively. The IMF estimates financing needs in the MENA to touch USD 919bn for this year and next. Public-financing requirements were likely to stay above 15% of GDP in most parts of the region through end-2022.

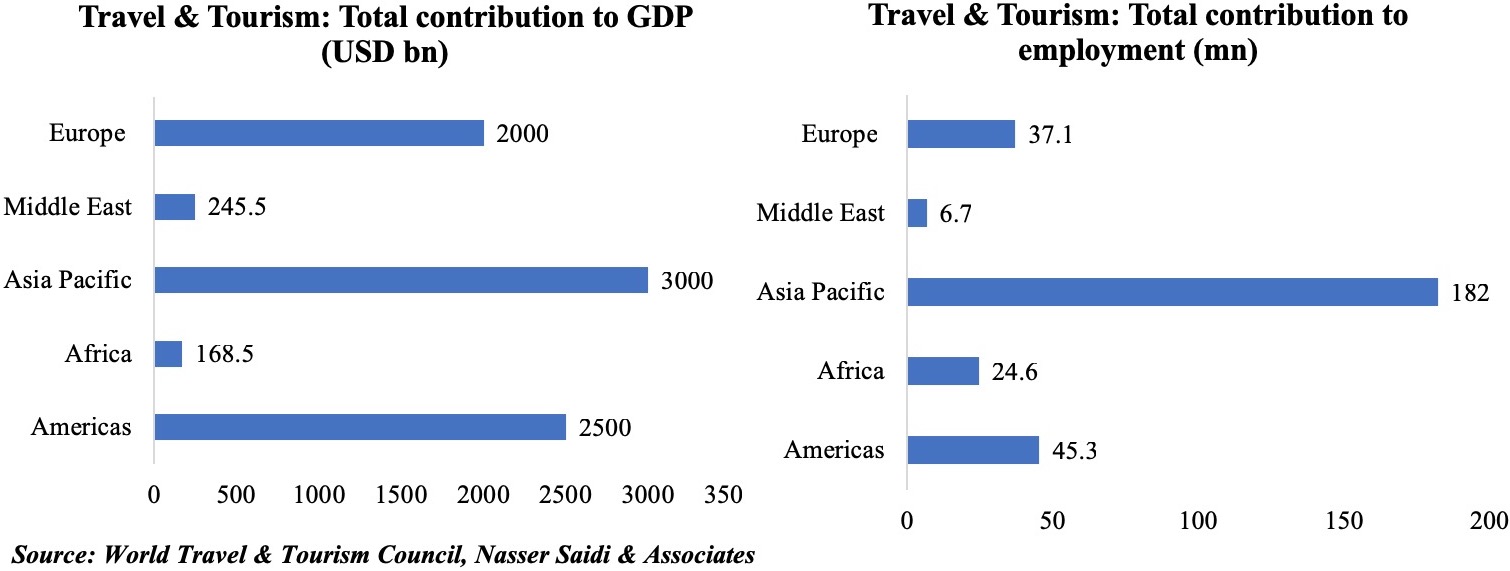

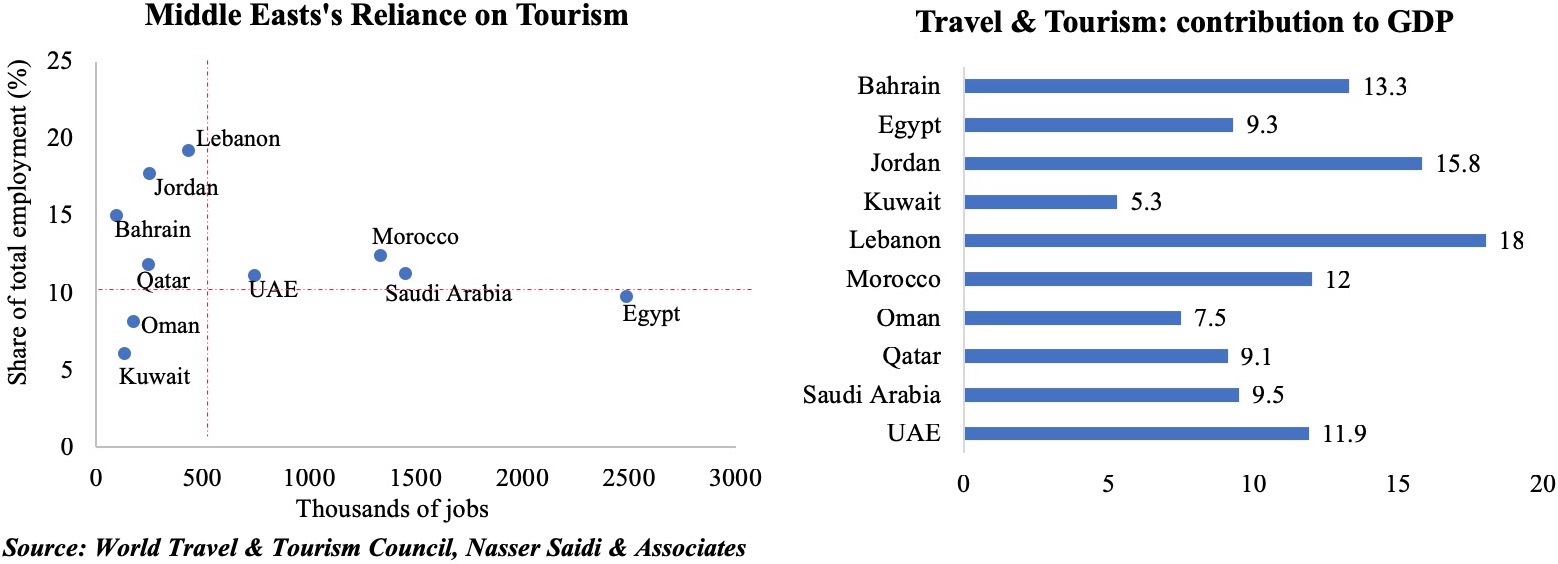

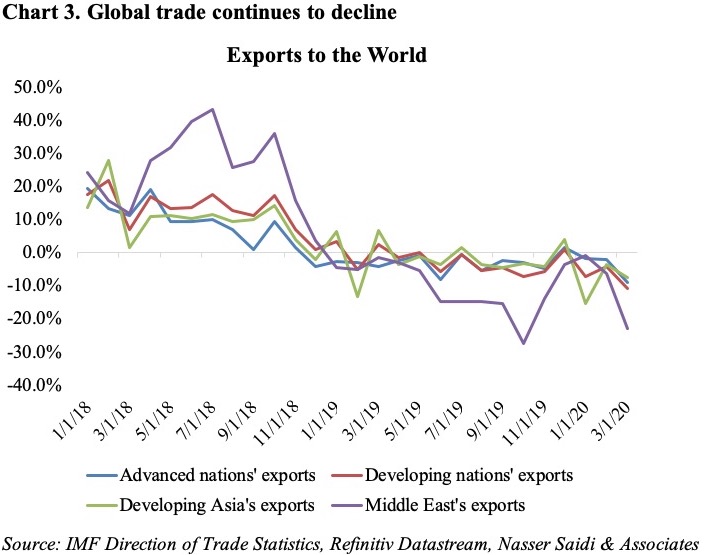

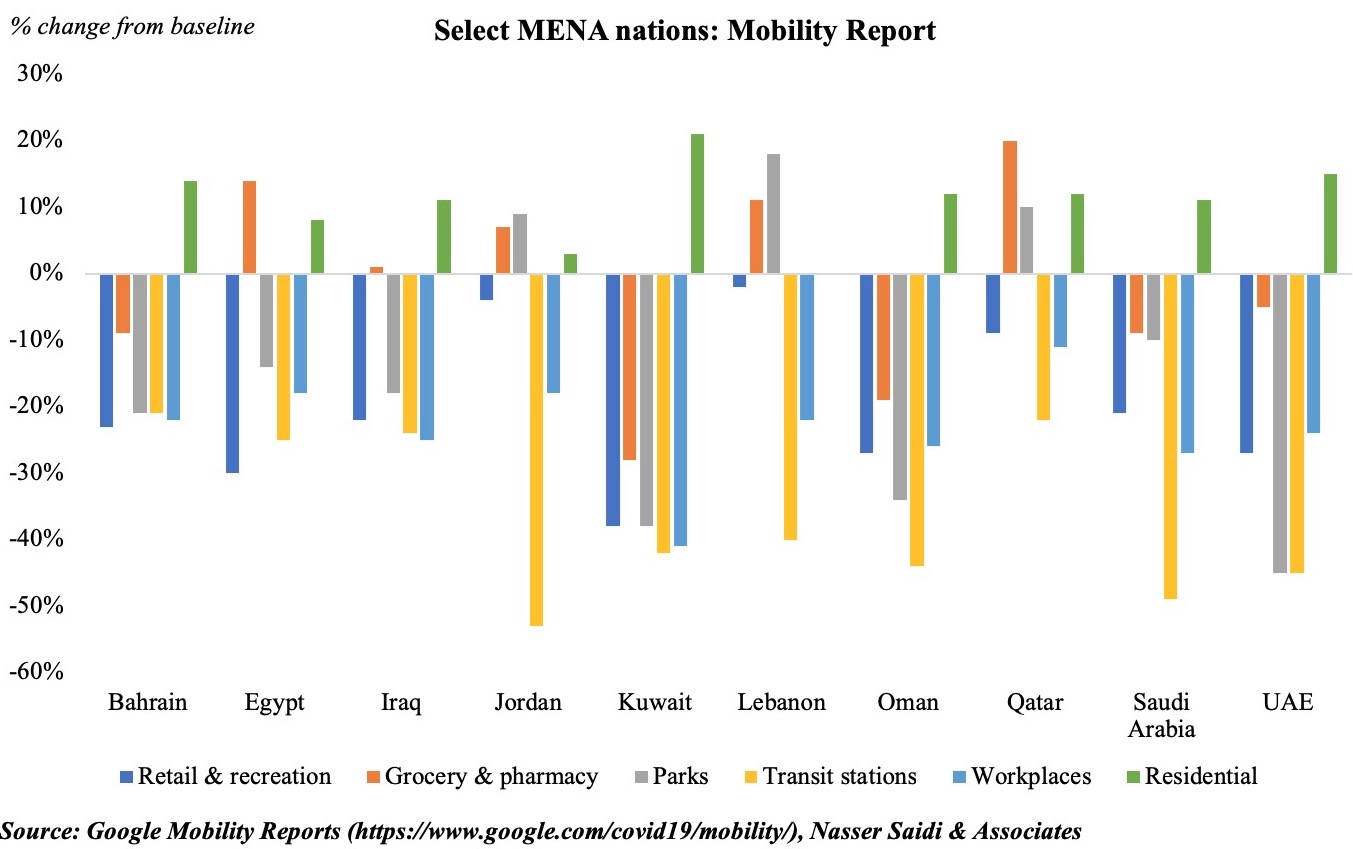

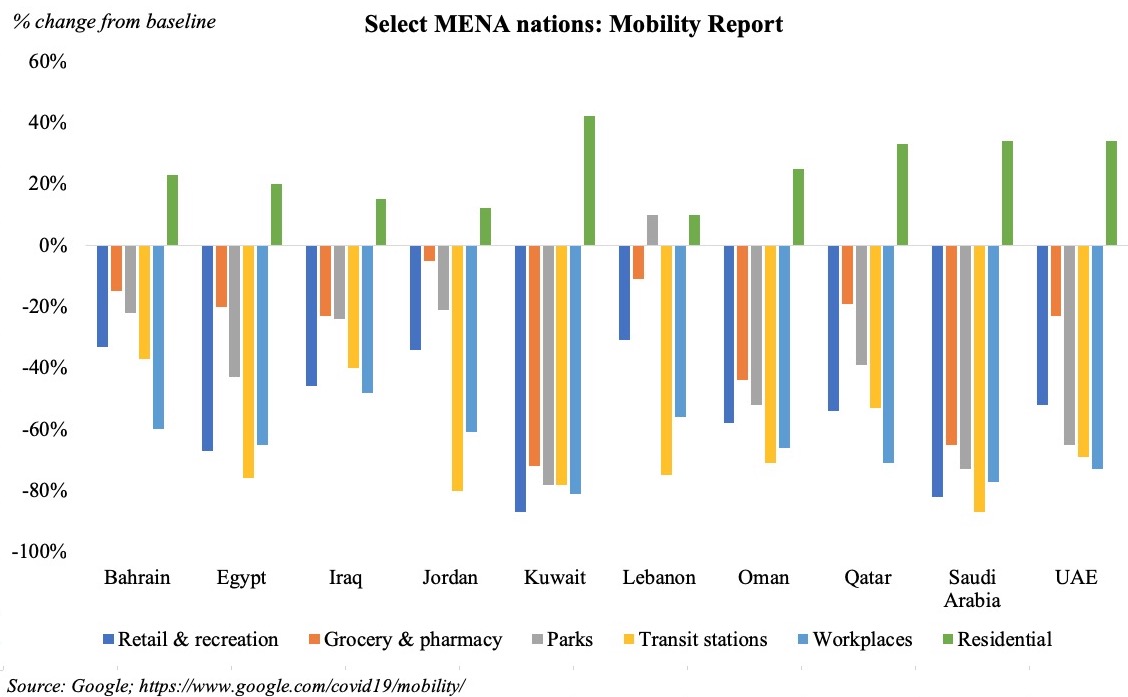

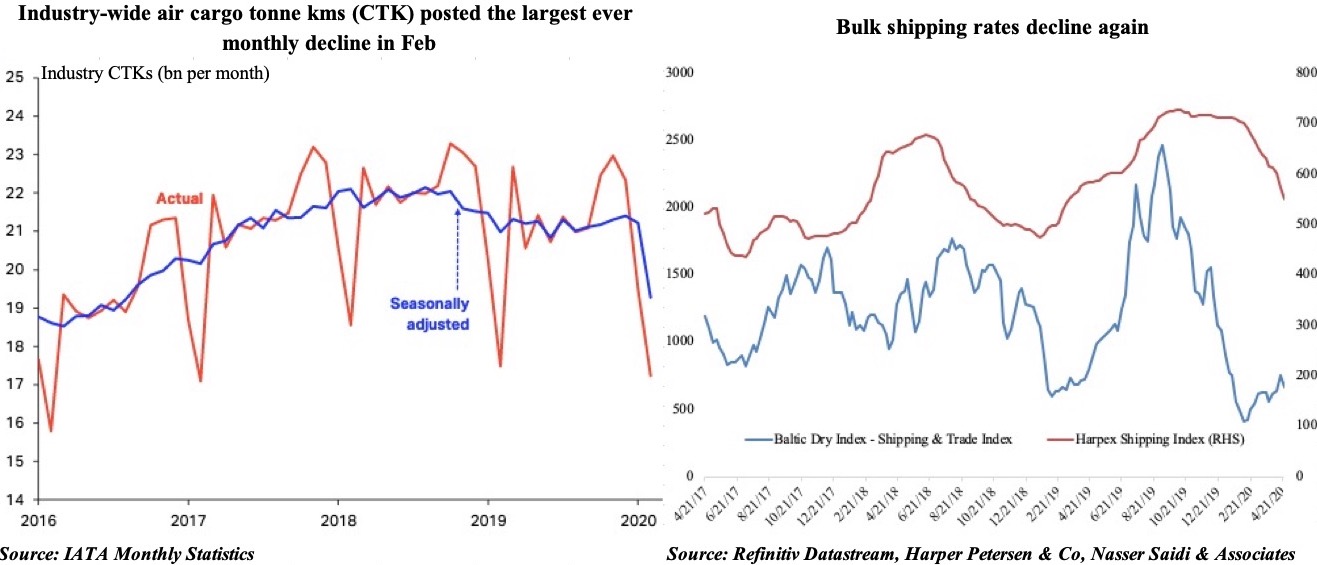

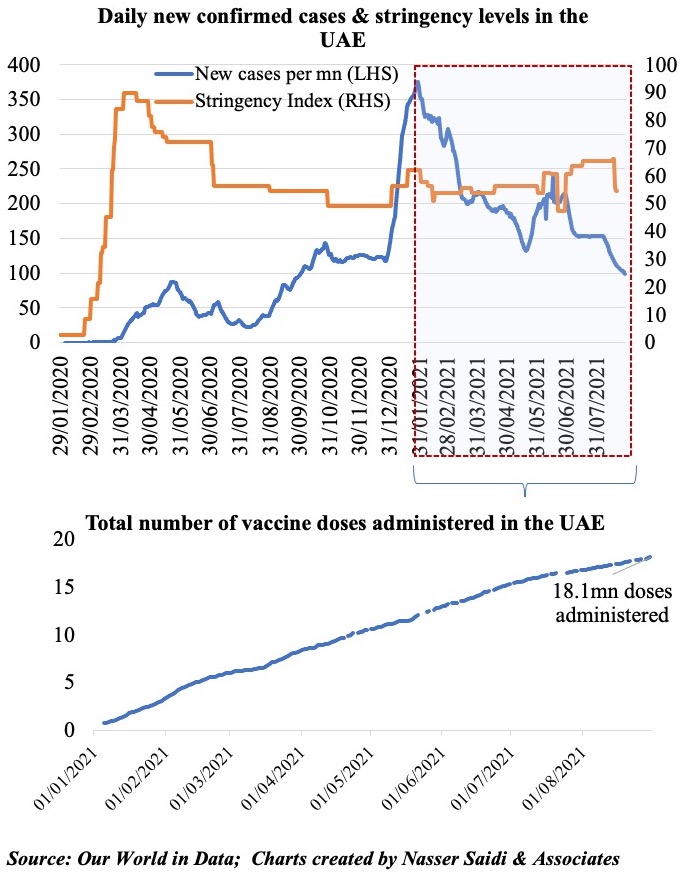

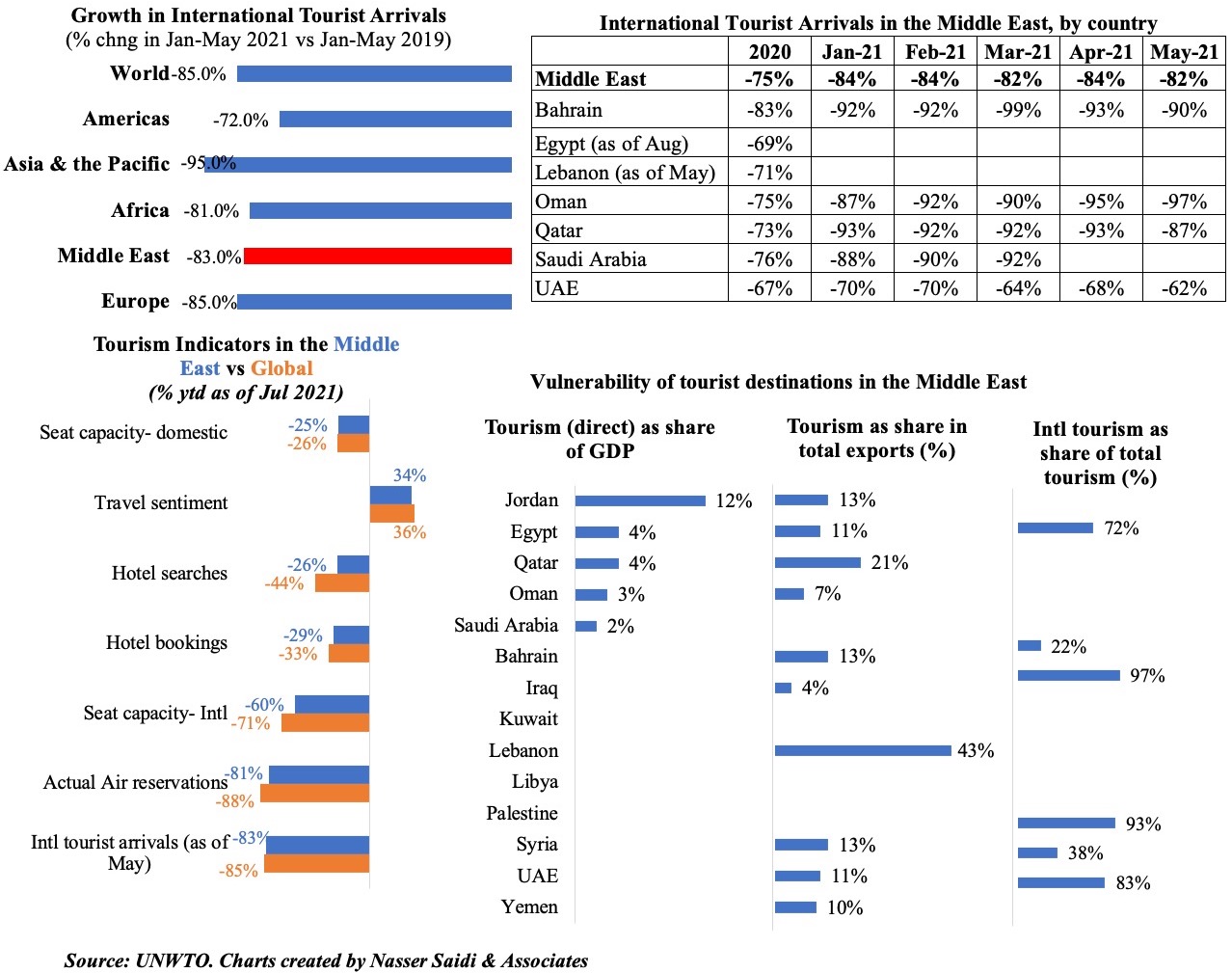

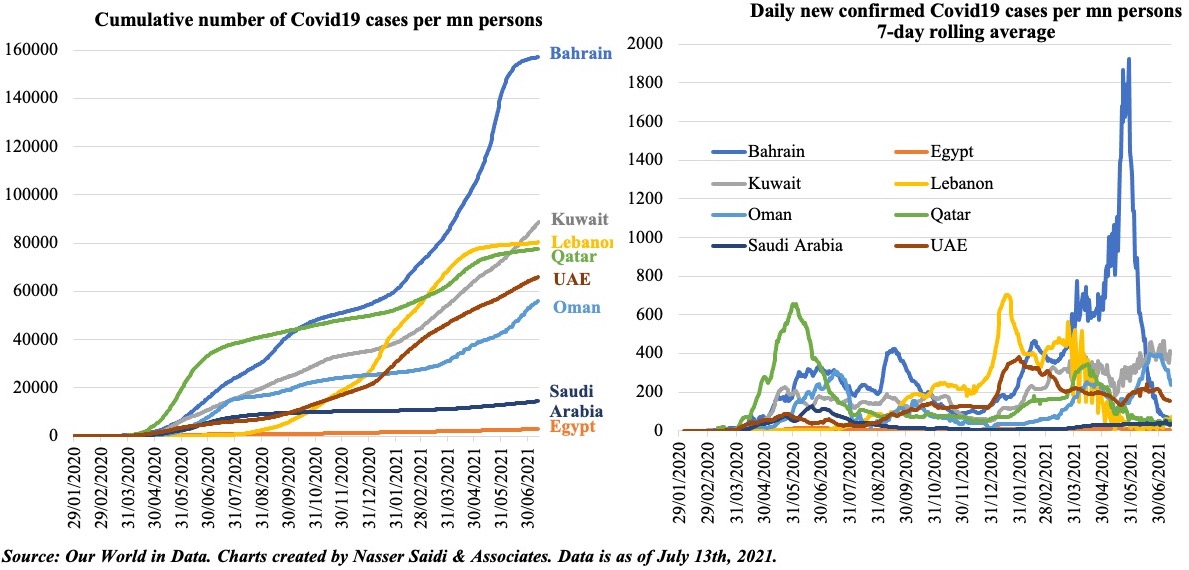

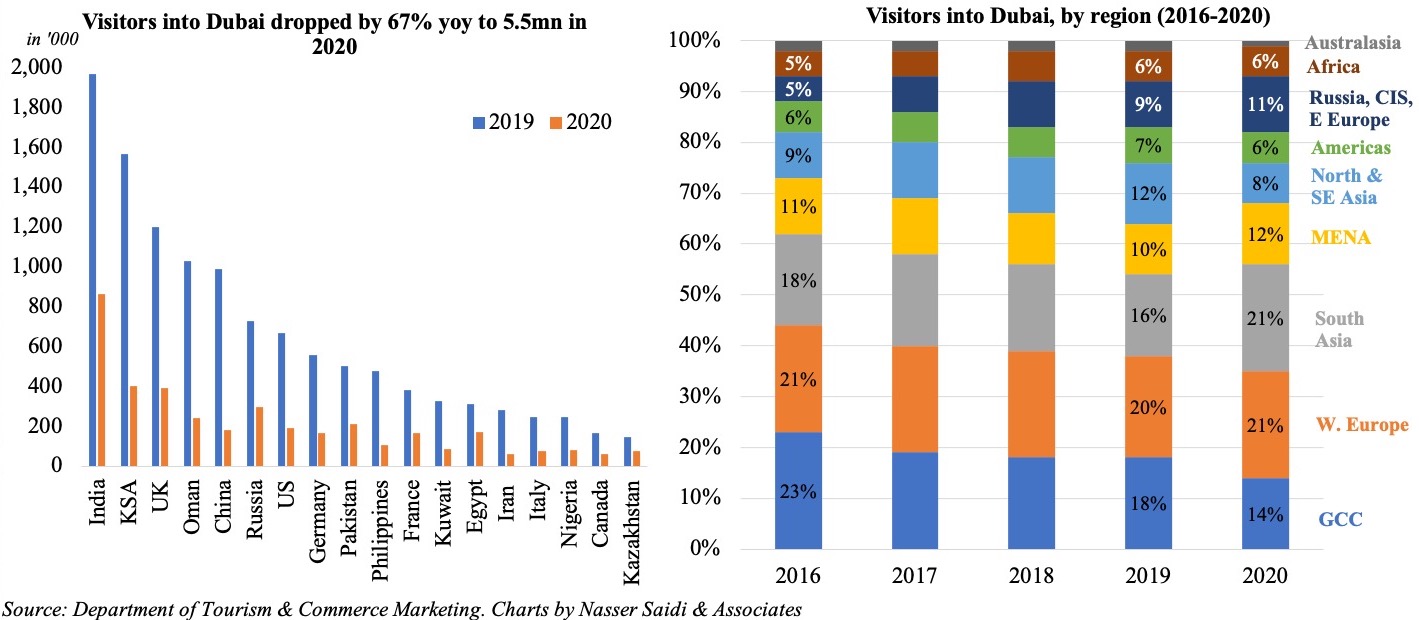

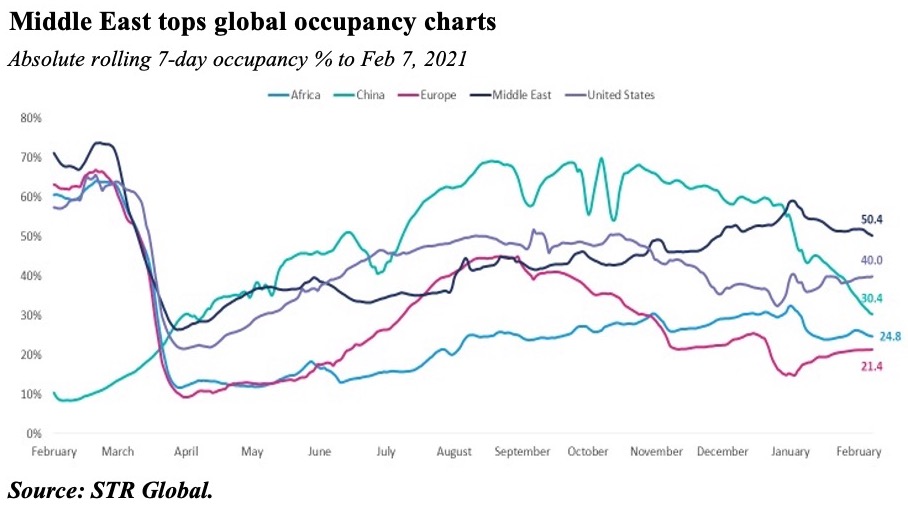

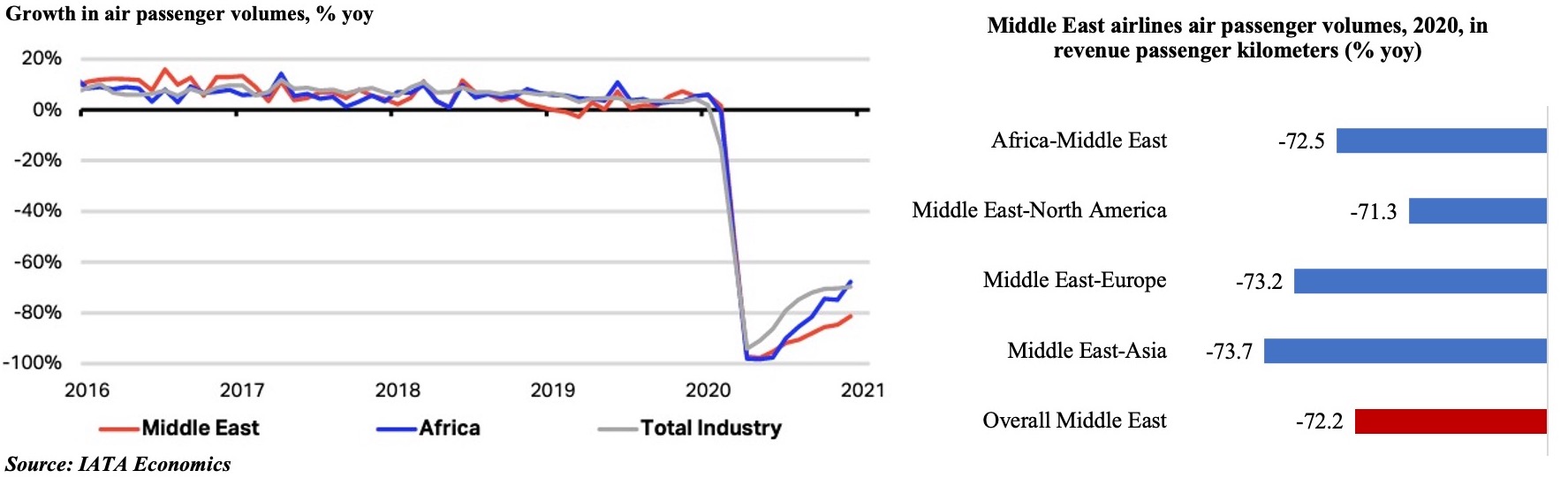

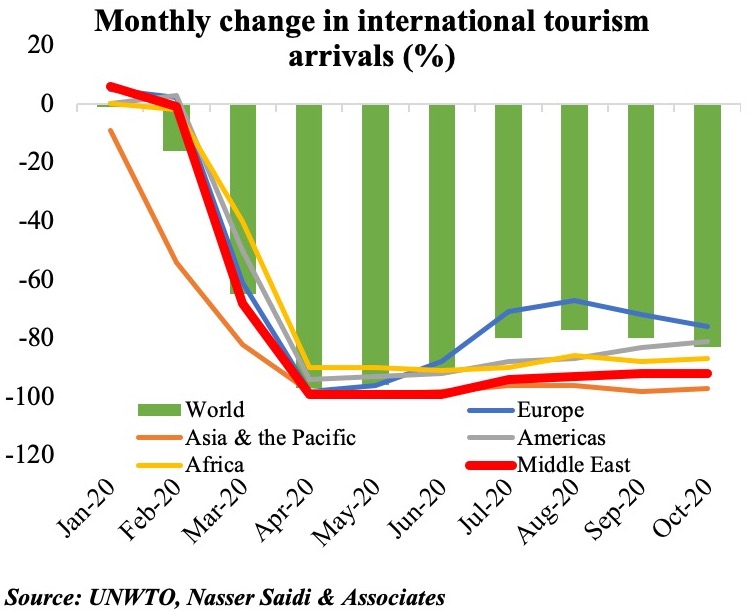

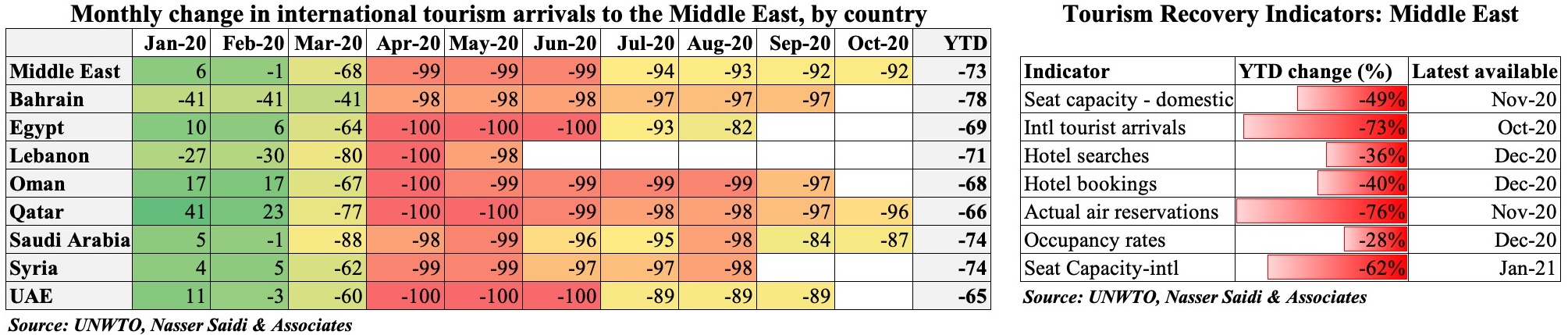

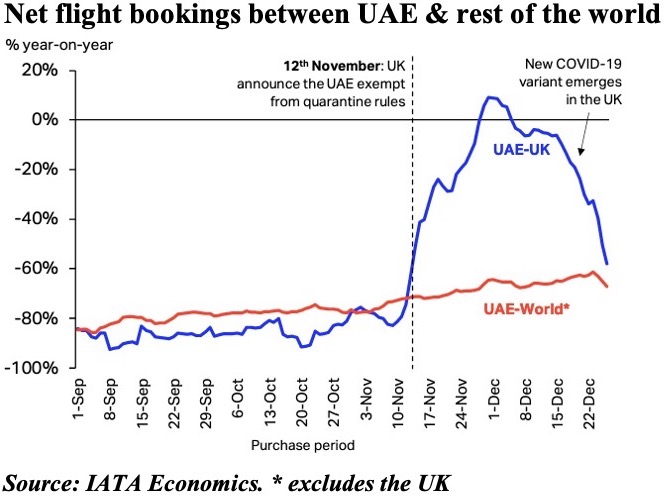

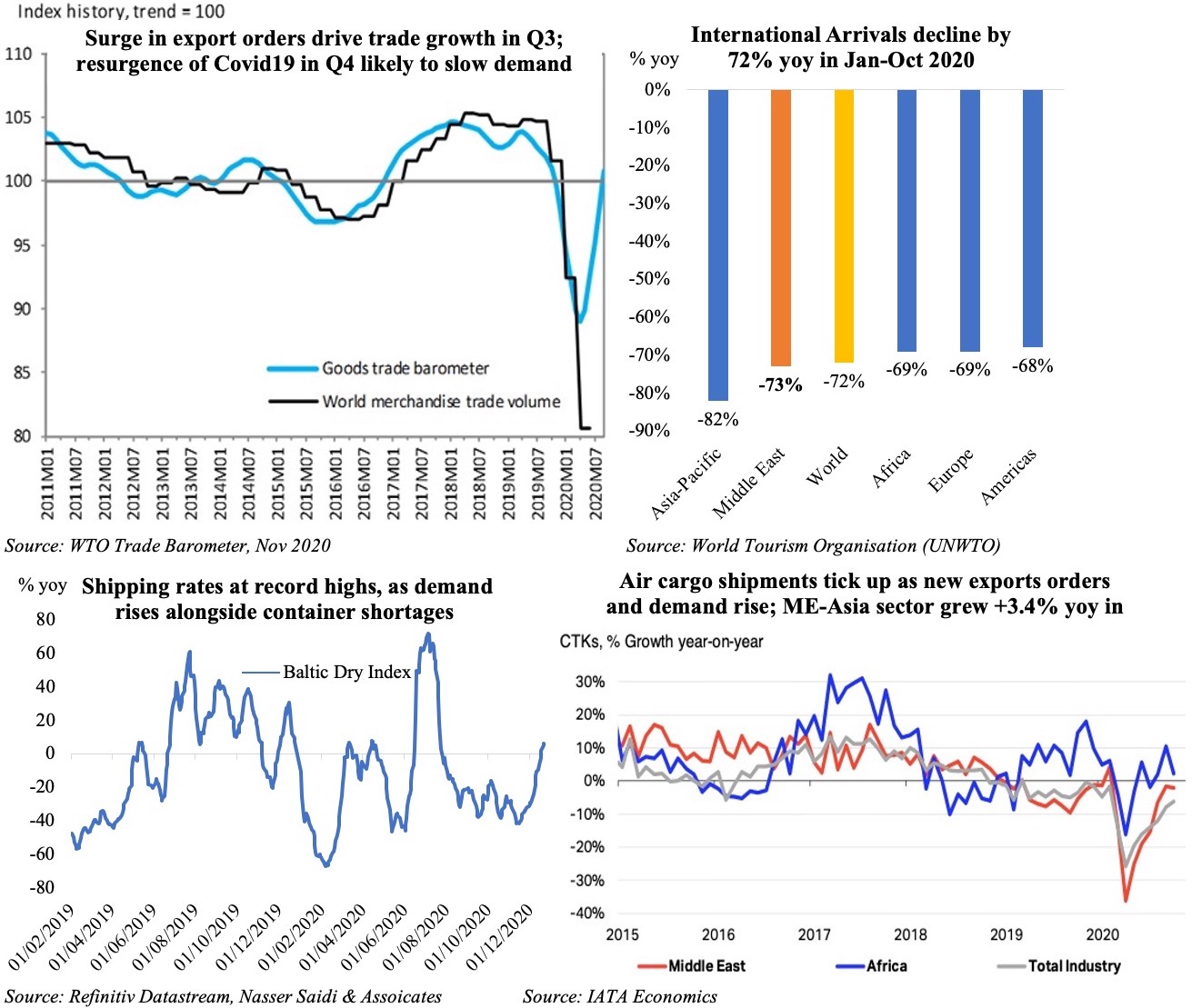

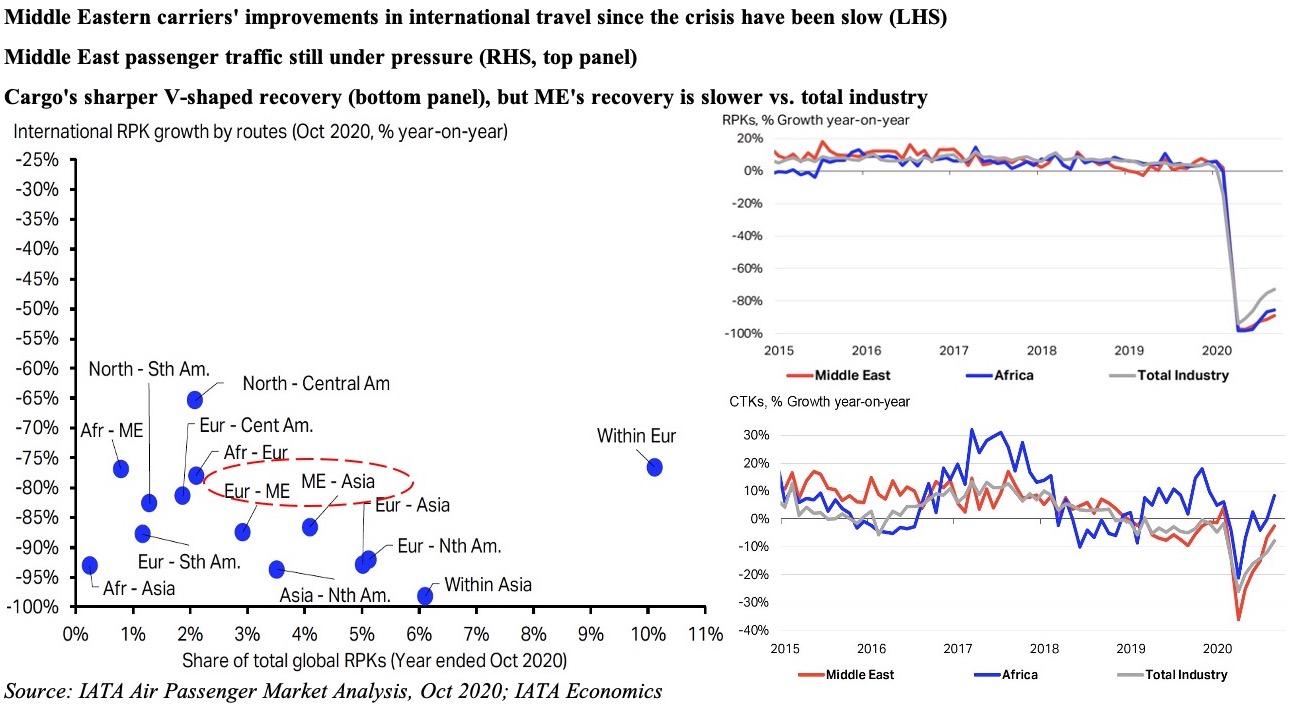

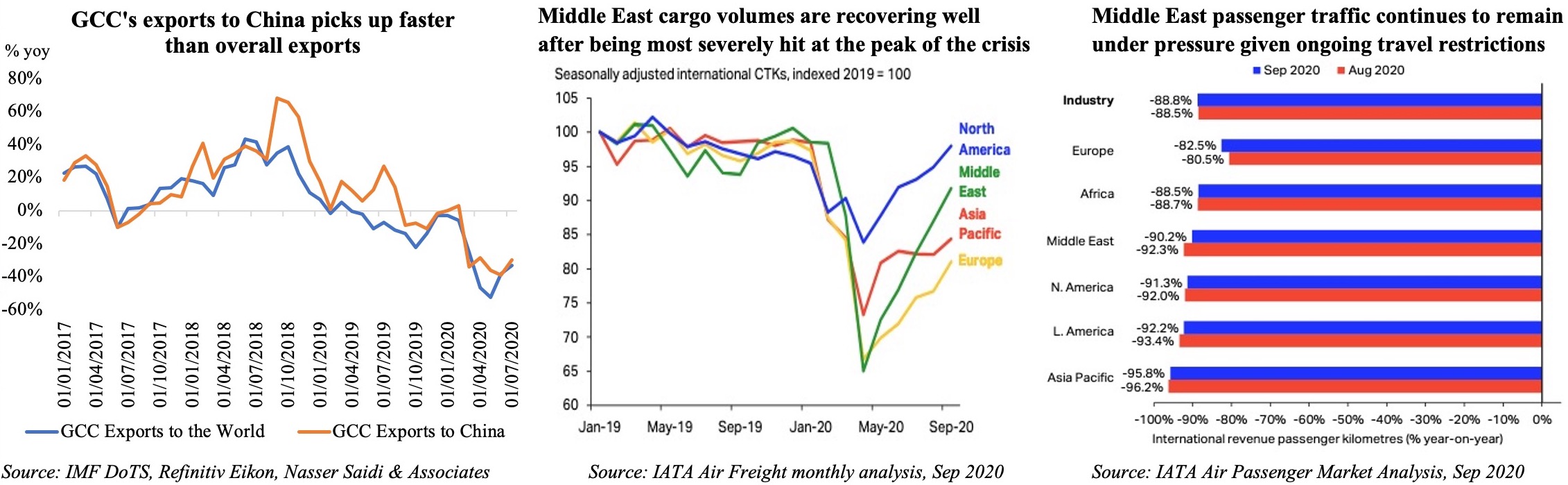

The UNWTO reported a 72% drop in international tourist arrivals during the Jan-Oct period, with the Middle East region continuing to lag its global counterparts in tourism arrivals (-73% year-to-date). International tourism as a share of total tourism is significantly high in Bahrain (97%) and UAE (83%), making these nations more vulnerable than say, Saudi Arabia, with its share at 26%. With air travel restrictions still in place in many nations, and hotels either closed or open at lower capacity, the road to recovery will be long.

The UNWTO reported a 72% drop in international tourist arrivals during the Jan-Oct period, with the Middle East region continuing to lag its global counterparts in tourism arrivals (-73% year-to-date). International tourism as a share of total tourism is significantly high in Bahrain (97%) and UAE (83%), making these nations more vulnerable than say, Saudi Arabia, with its share at 26%. With air travel restrictions still in place in many nations, and hotels either closed or open at lower capacity, the road to recovery will be long.

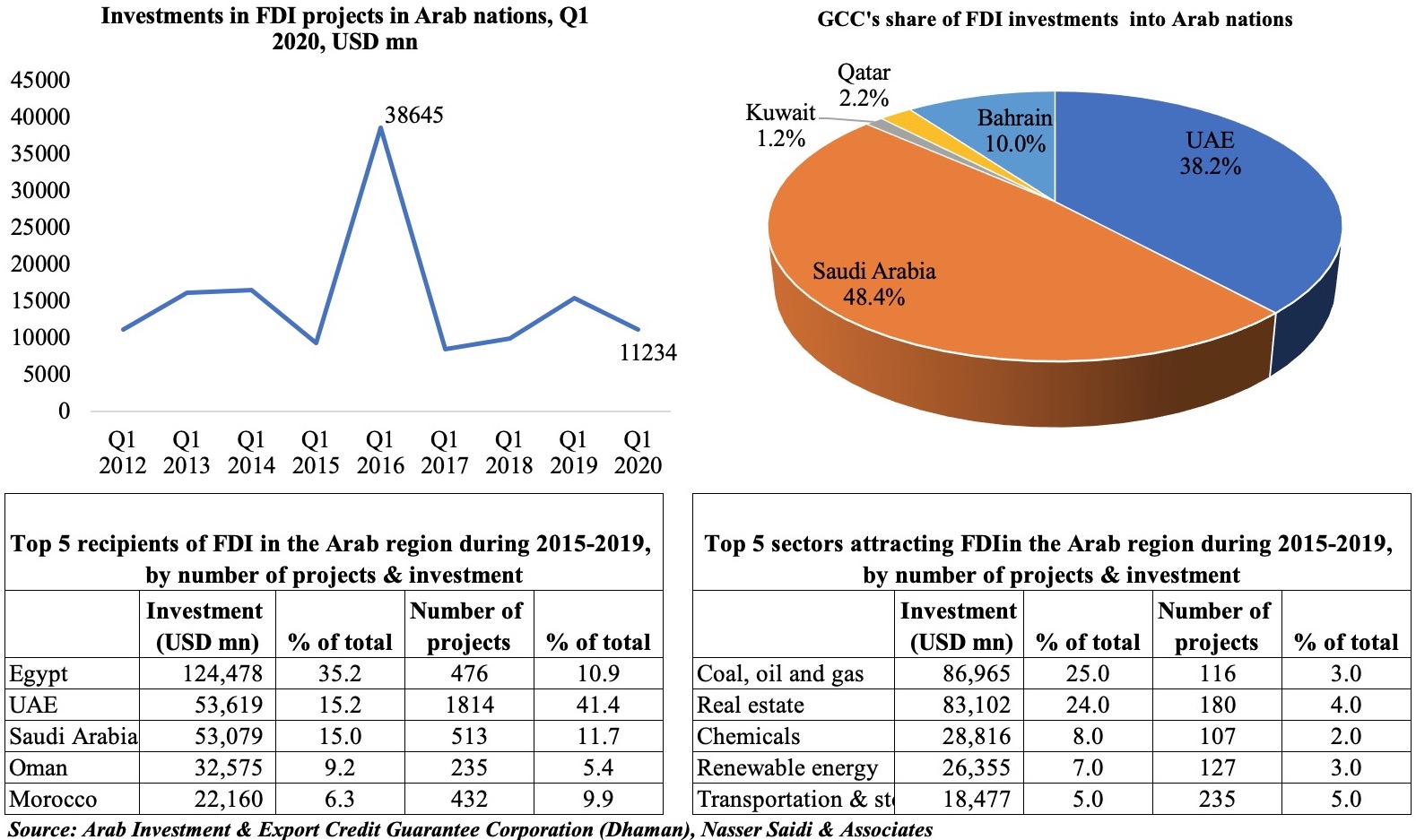

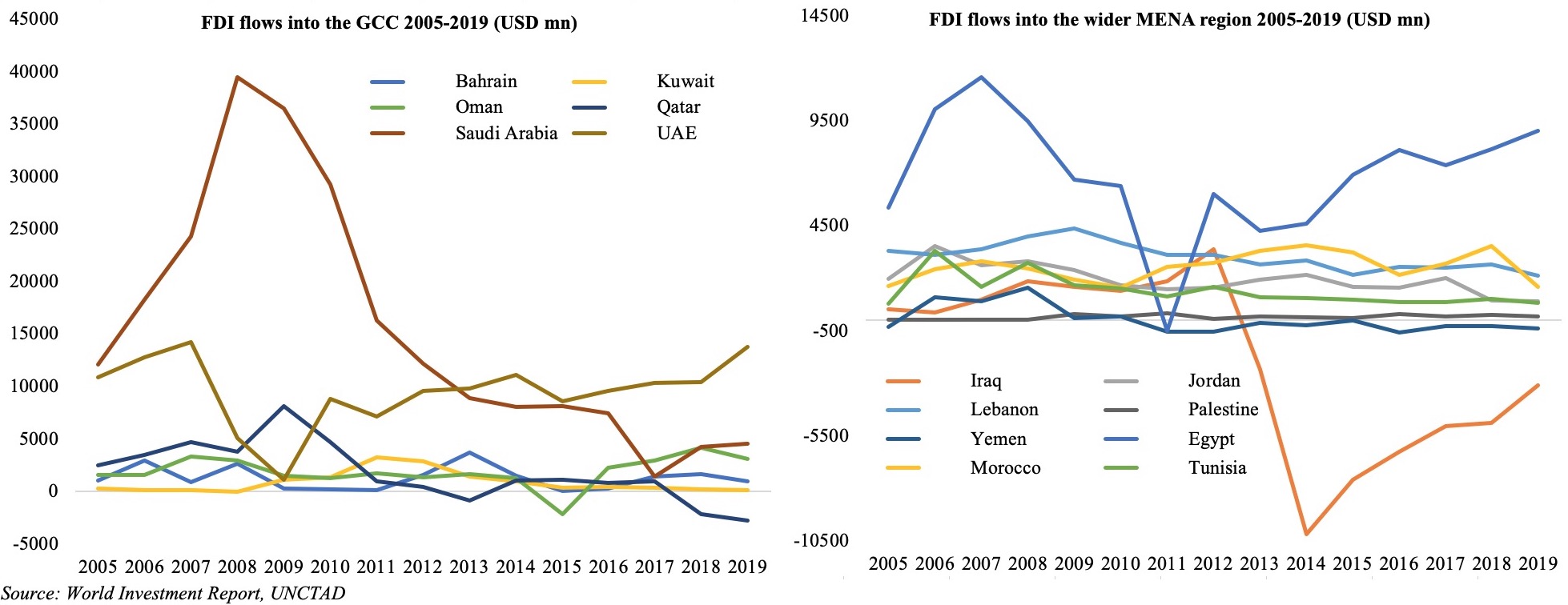

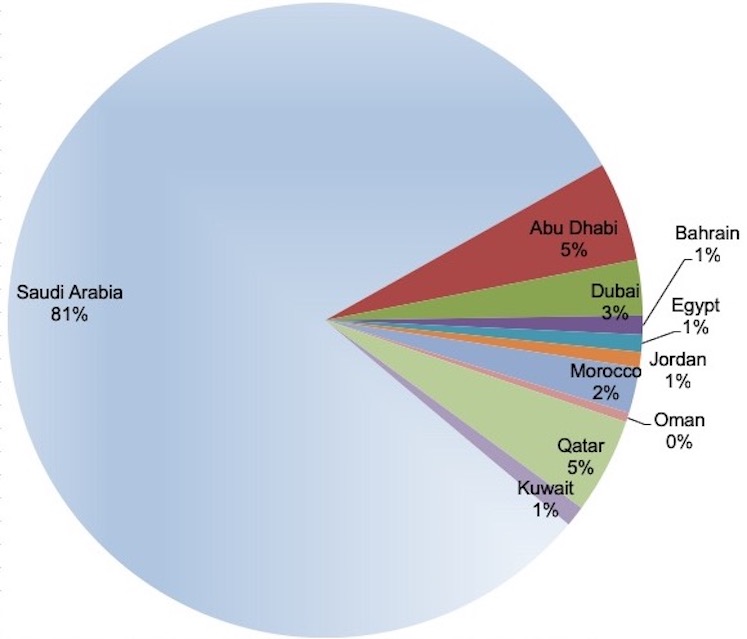

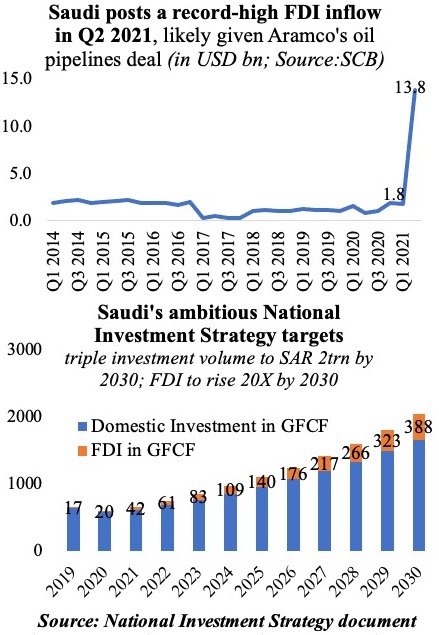

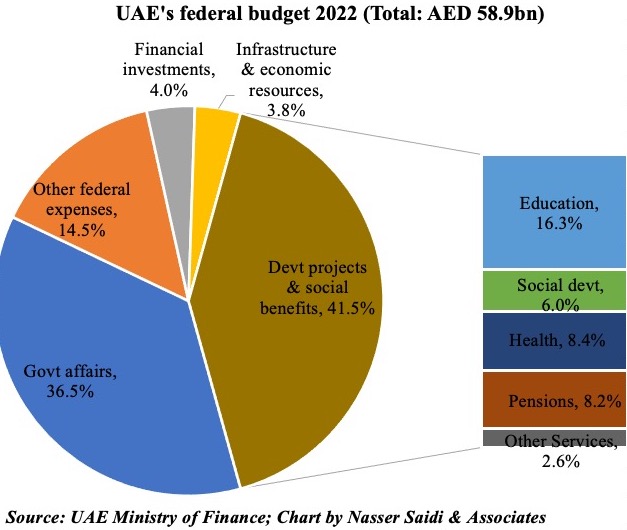

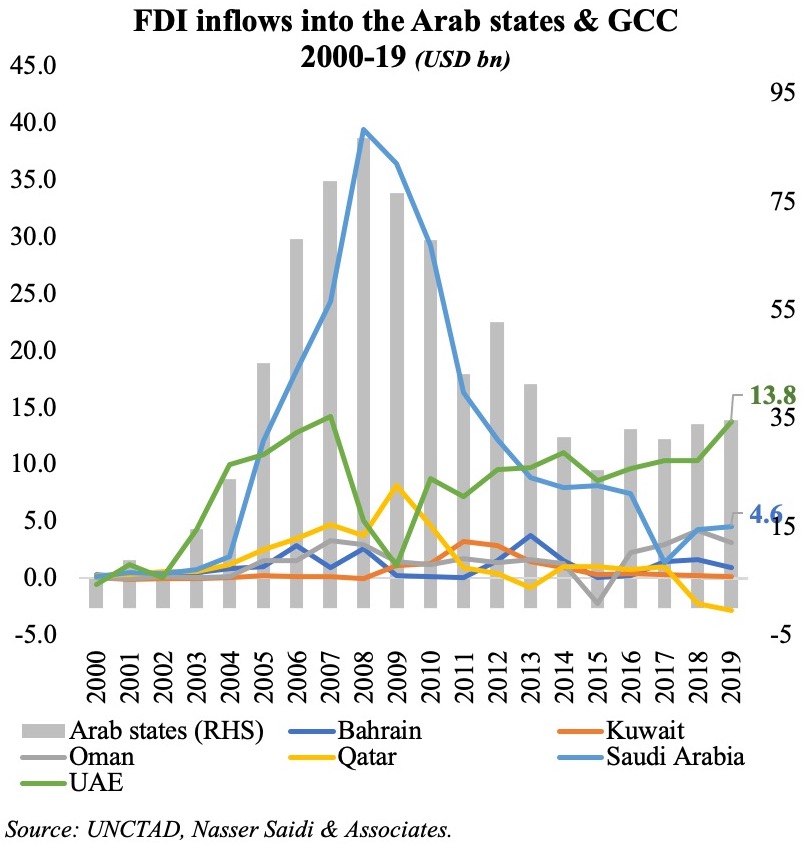

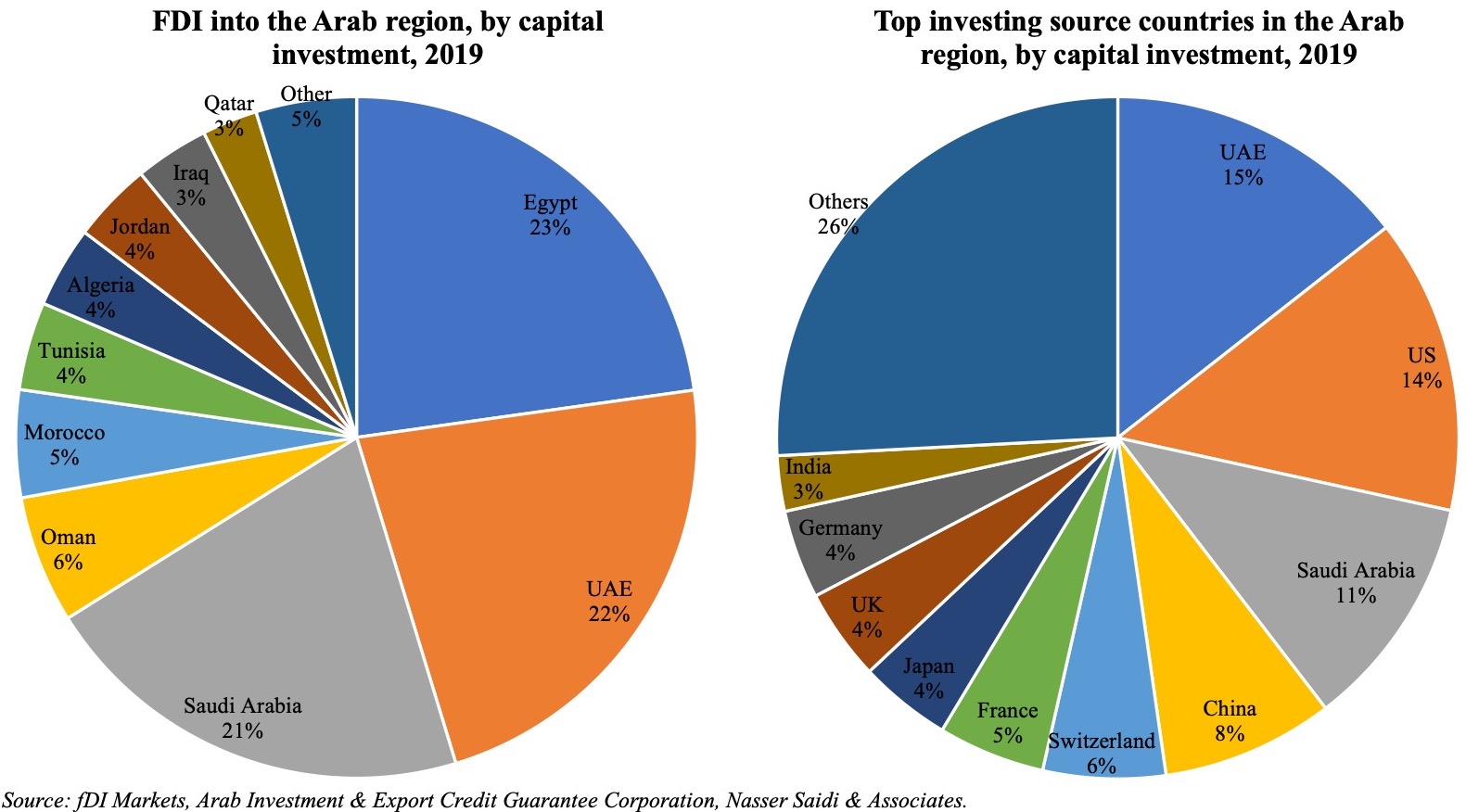

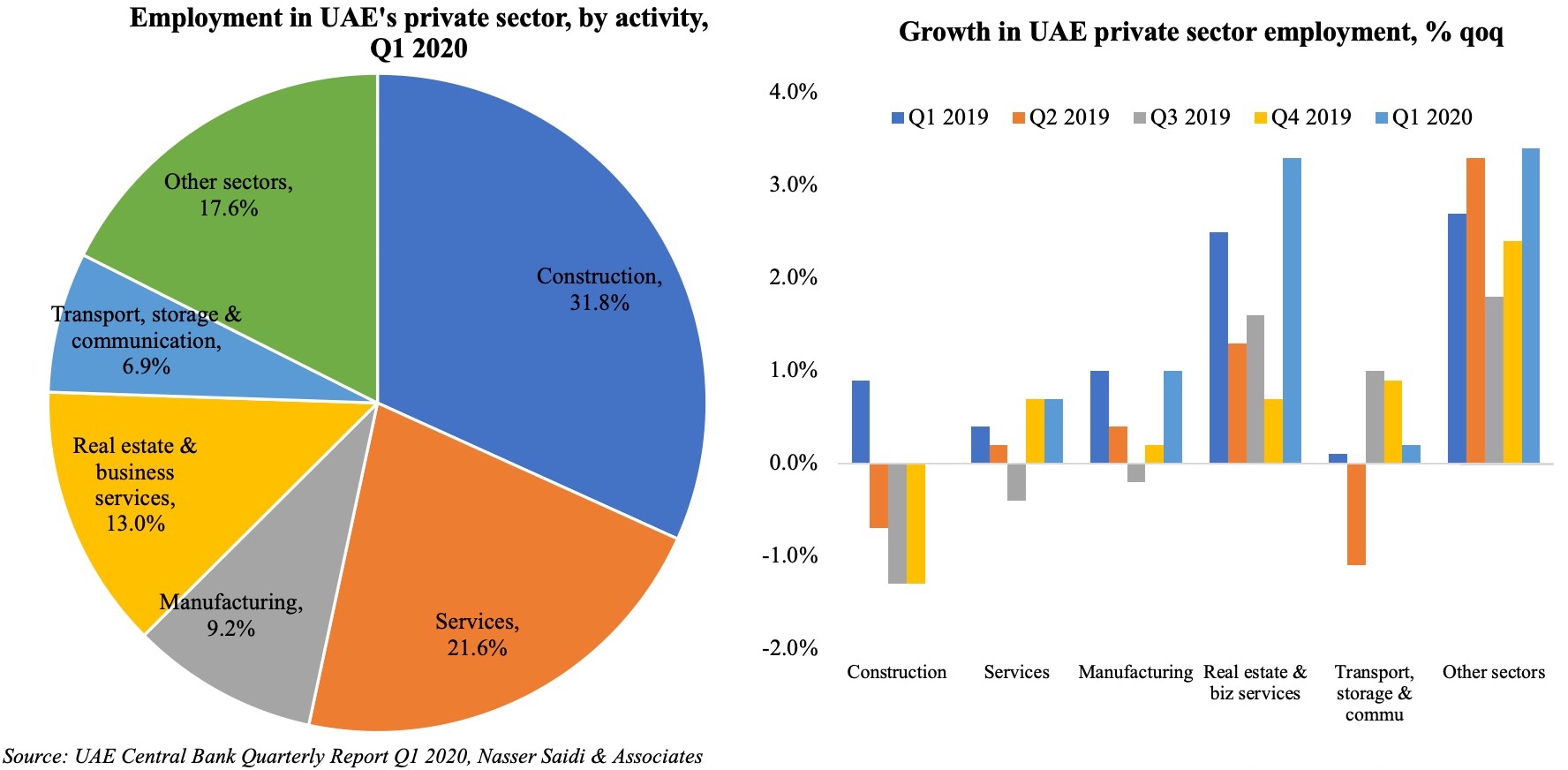

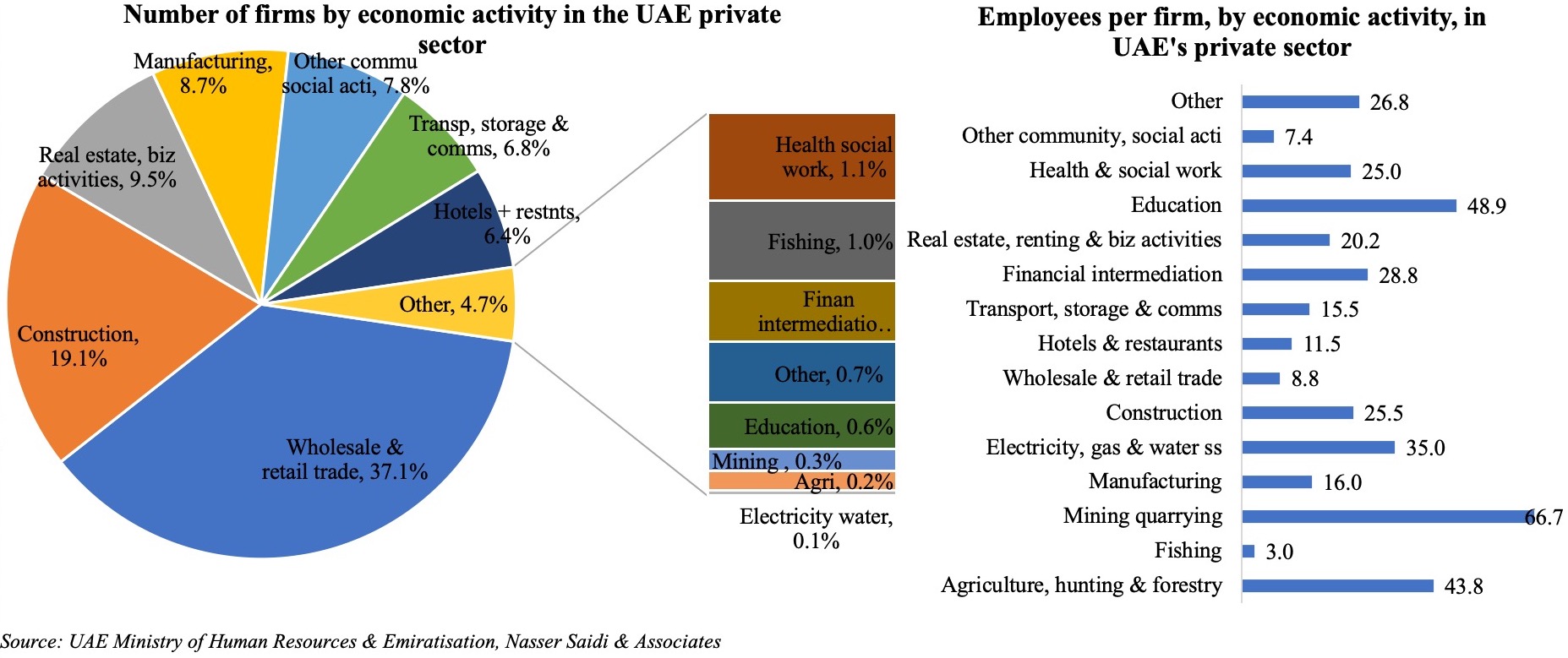

We focus on FDI in this Weekly Insight piece. FDI inflows are essential to the UAE’s diversification efforts, as it would not only create jobs, raise productivity and growth, but could also lead to transfer of technology/ technical know-how and promote competition in the market. According to the IMF, closing FDI gaps in the GCC could raise real non-oil GDP per capita growth by as much as 1 percentage point.

We focus on FDI in this Weekly Insight piece. FDI inflows are essential to the UAE’s diversification efforts, as it would not only create jobs, raise productivity and growth, but could also lead to transfer of technology/ technical know-how and promote competition in the market. According to the IMF, closing FDI gaps in the GCC could raise real non-oil GDP per capita growth by as much as 1 percentage point.

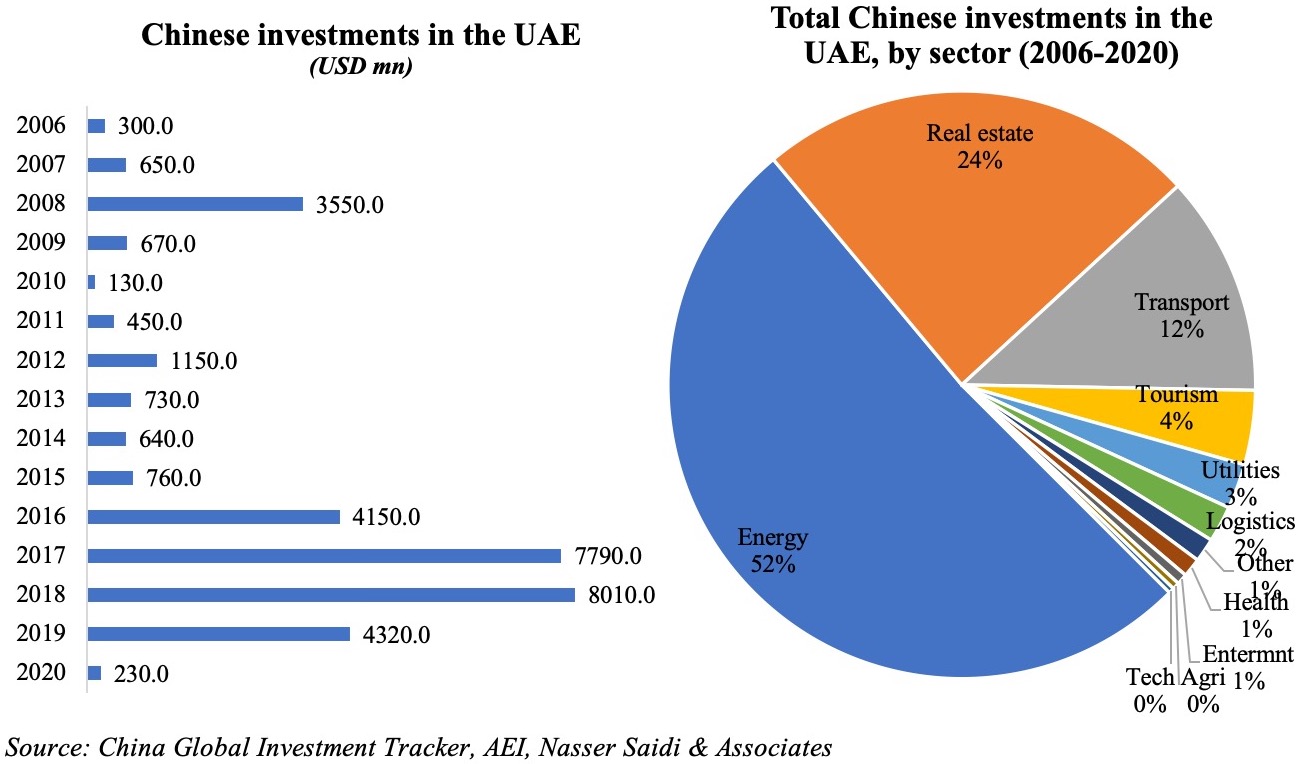

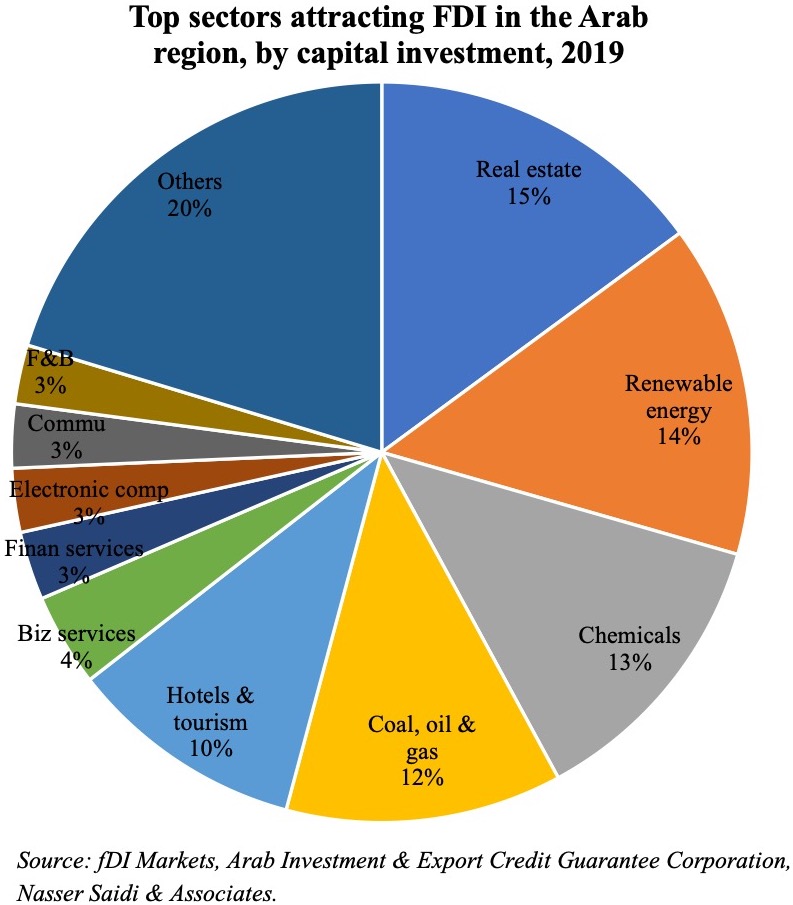

hinese projects tracked during Jan 2003-Mar 2020 (with the number of projects in double-digits in 2018 and 2019). According to AEI’s China Global Investment Tracker, the value of Chinese investments touched a high of USD 8bn in 2018, thanks to a handful of large projects (including with ACWA Power and Abu Dhabi Oil). Sector-wise, investments were concentrated in energy (both oil and gas as well as renewables), real estate and transport – together accounting for 87.8% of total investments during 2016-2020. This is largely in line with FDI inflows into the Arab region as well, with the top 5 sectors (real estate, renewables, chemicals, oil & gas and travel & tourism) accounting for close to two-thirds of total inflows in 2019.

hinese projects tracked during Jan 2003-Mar 2020 (with the number of projects in double-digits in 2018 and 2019). According to AEI’s China Global Investment Tracker, the value of Chinese investments touched a high of USD 8bn in 2018, thanks to a handful of large projects (including with ACWA Power and Abu Dhabi Oil). Sector-wise, investments were concentrated in energy (both oil and gas as well as renewables), real estate and transport – together accounting for 87.8% of total investments during 2016-2020. This is largely in line with FDI inflows into the Arab region as well, with the top 5 sectors (real estate, renewables, chemicals, oil & gas and travel & tourism) accounting for close to two-thirds of total inflows in 2019.

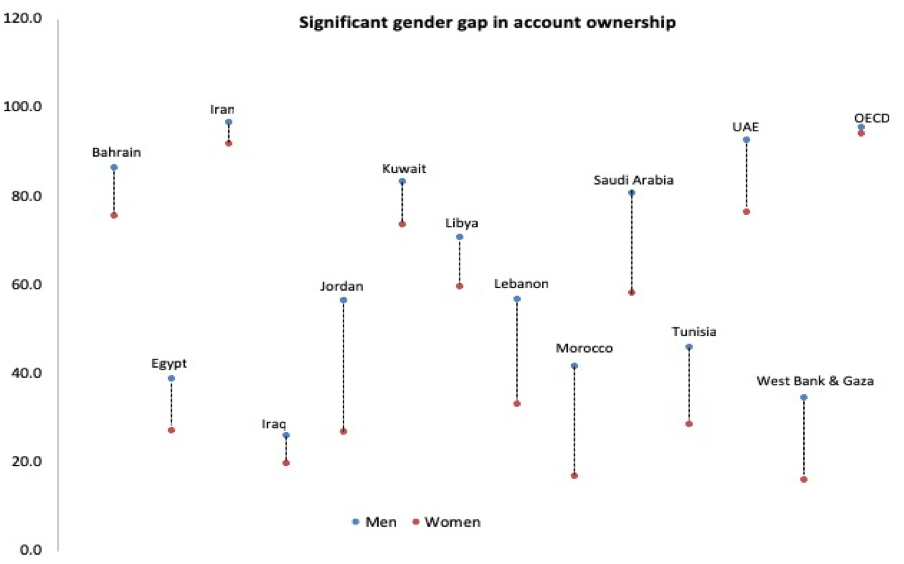

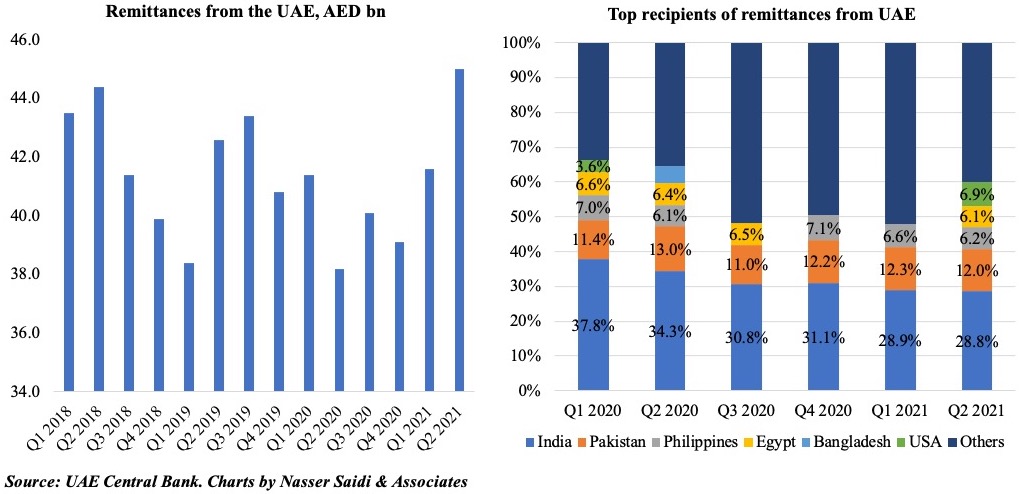

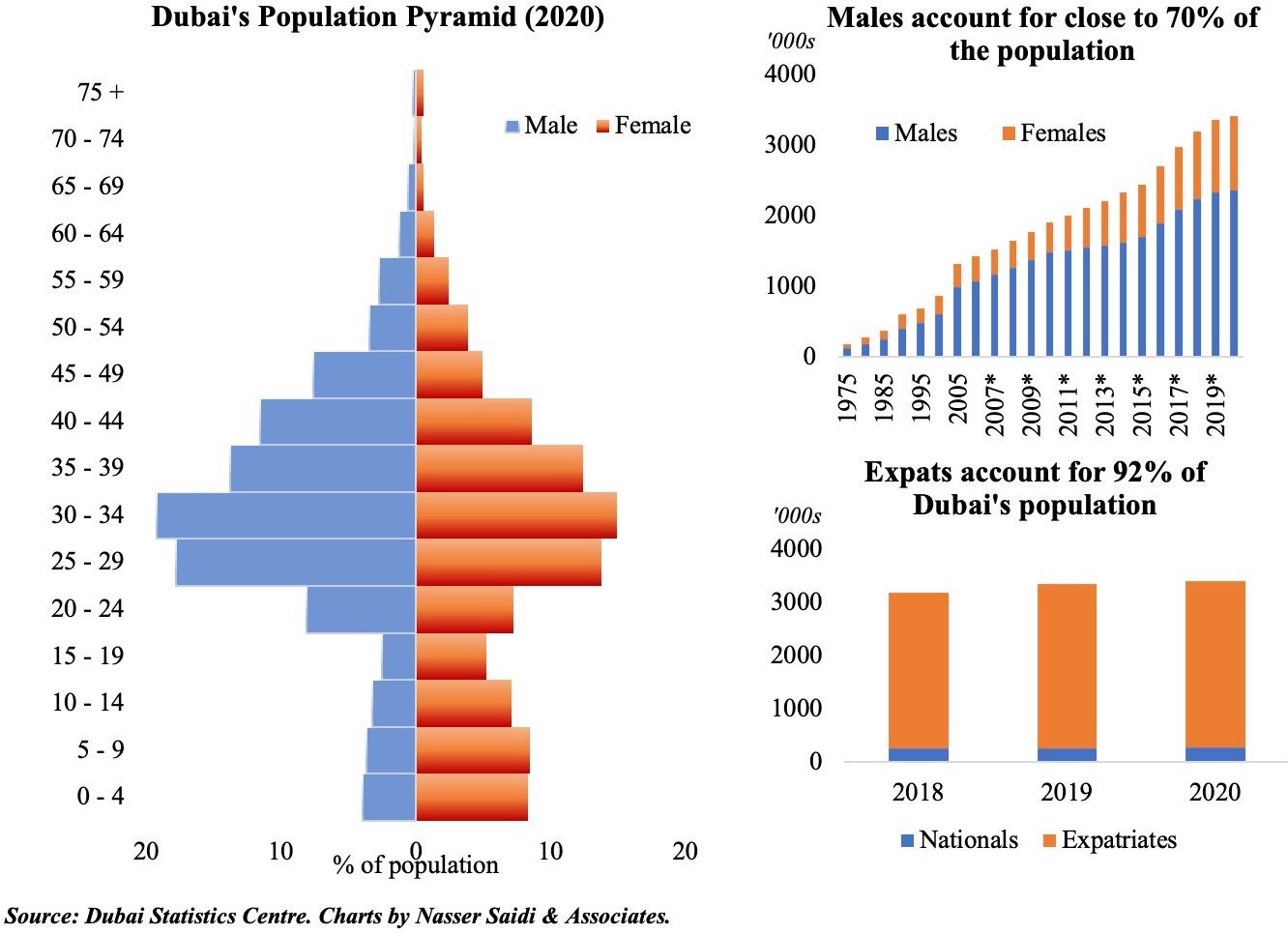

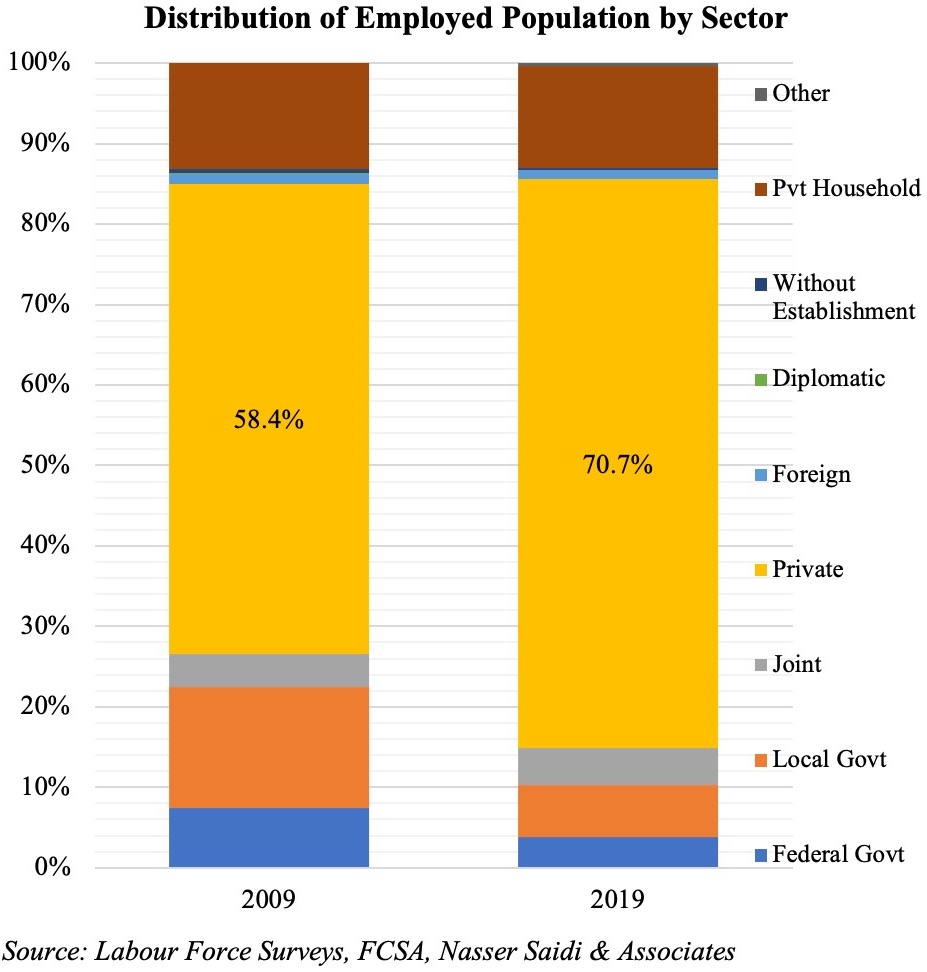

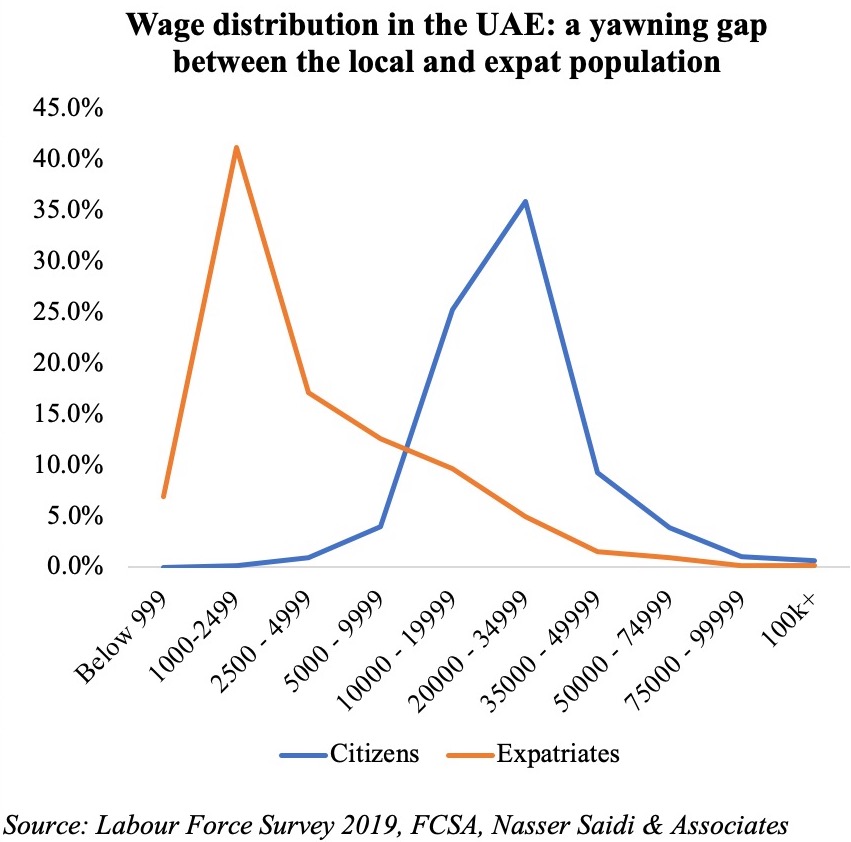

The Survey also confirms the disparity in wages between local and expat population: more than one-third of Emirati respondents disclosed receiving monthly wages between AED 20-35k (versus just 5% of expats in the same income bracket). This brings to the forefront two issues:

The Survey also confirms the disparity in wages between local and expat population: more than one-third of Emirati respondents disclosed receiving monthly wages between AED 20-35k (versus just 5% of expats in the same income bracket). This brings to the forefront two issues:

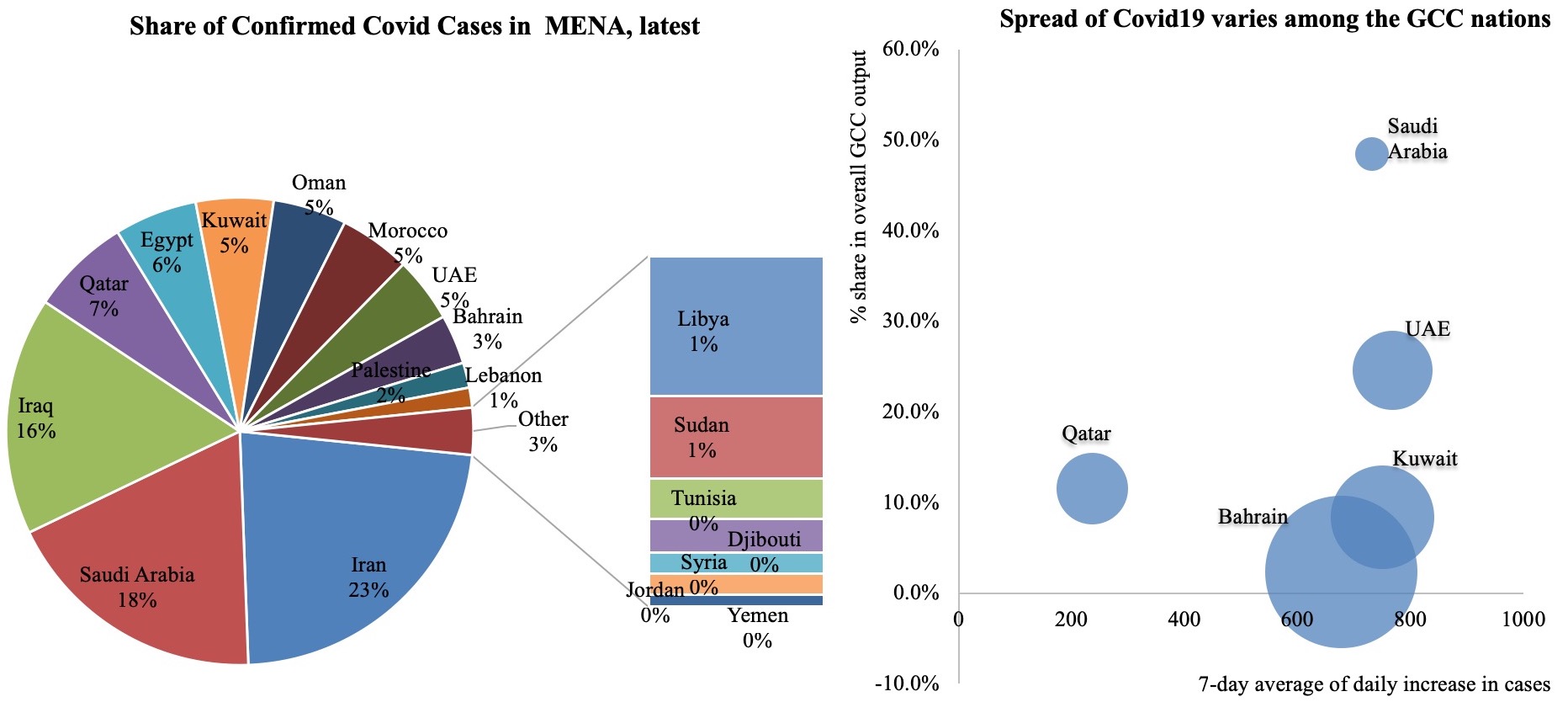

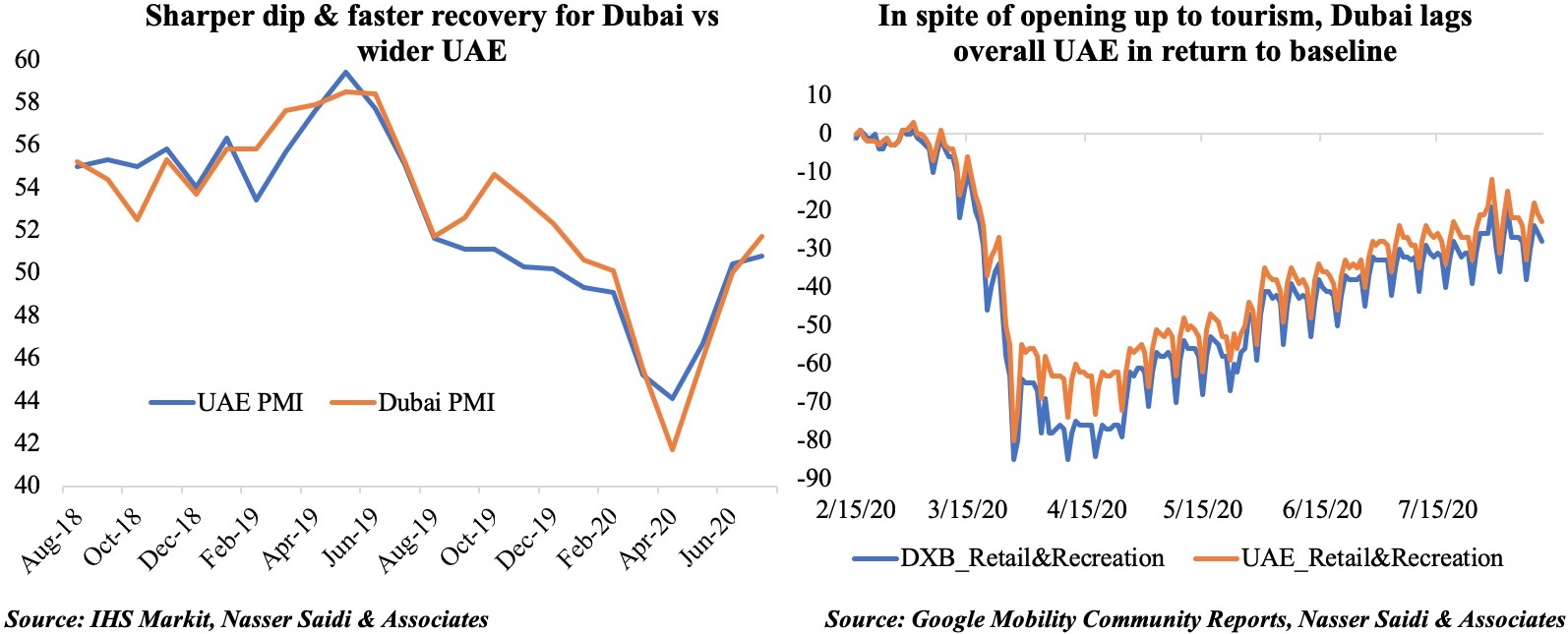

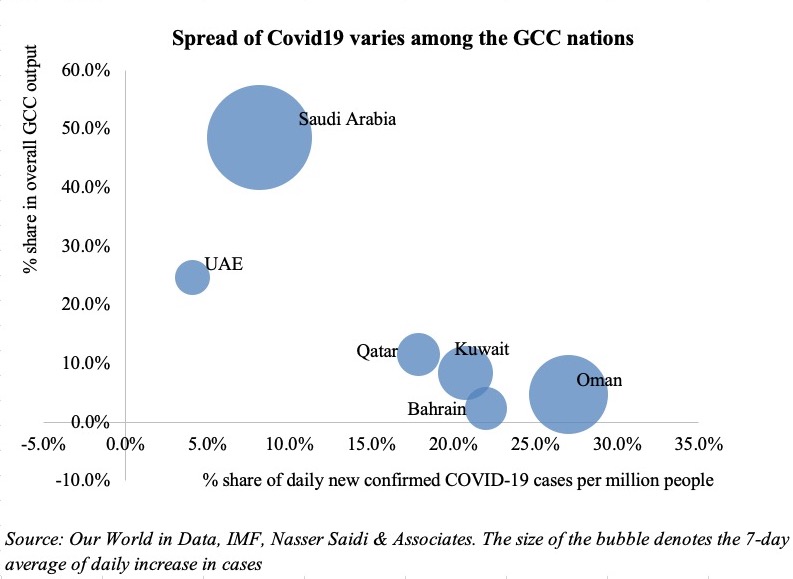

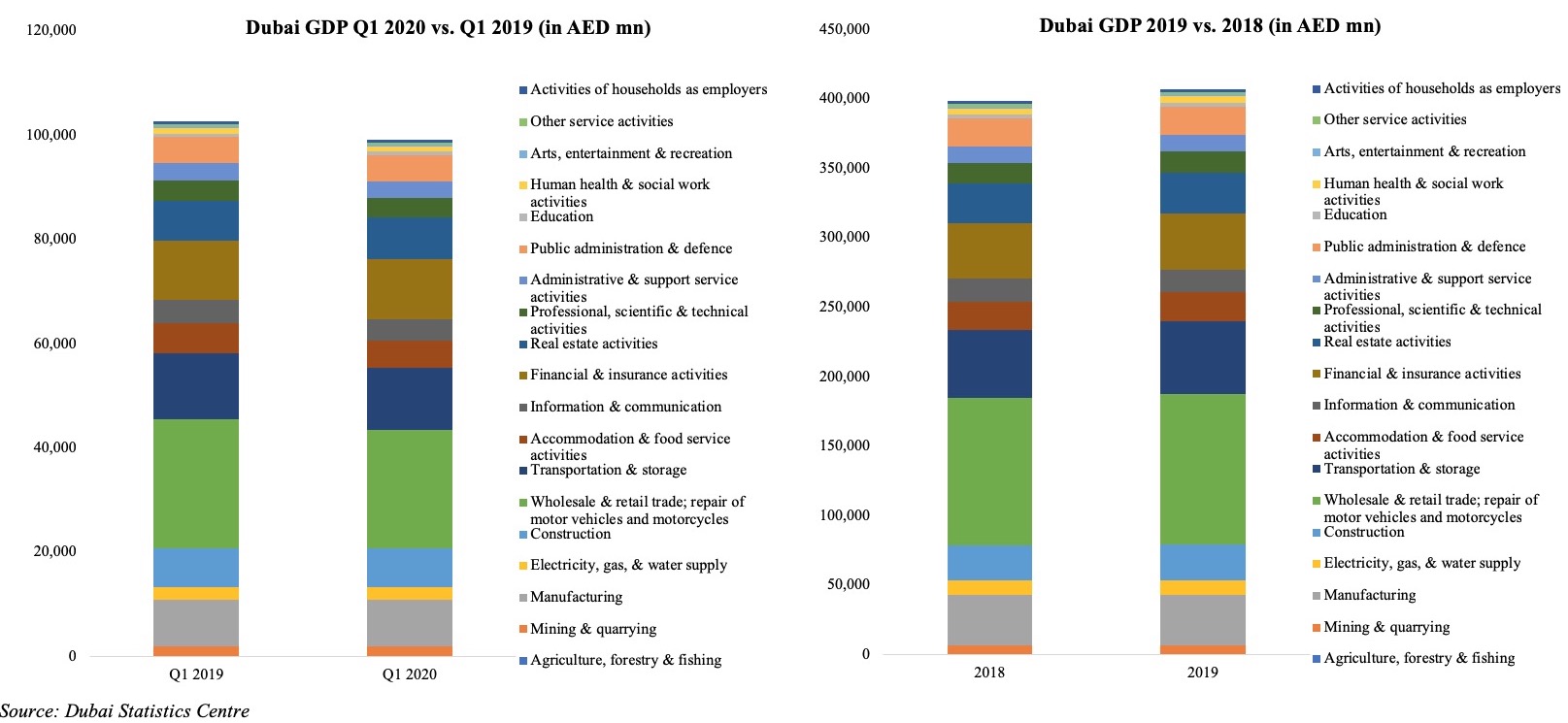

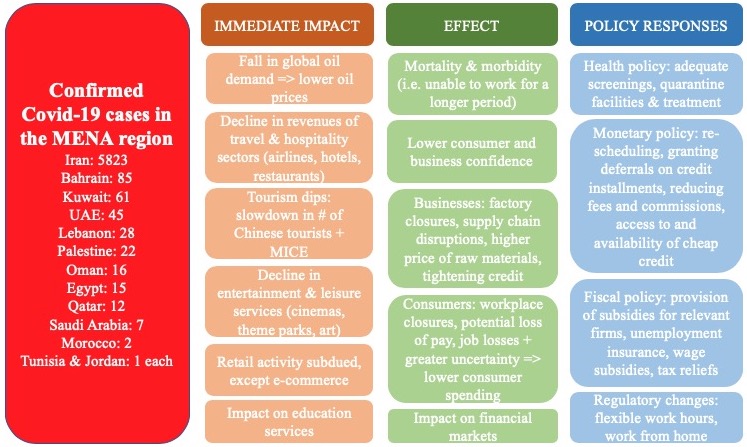

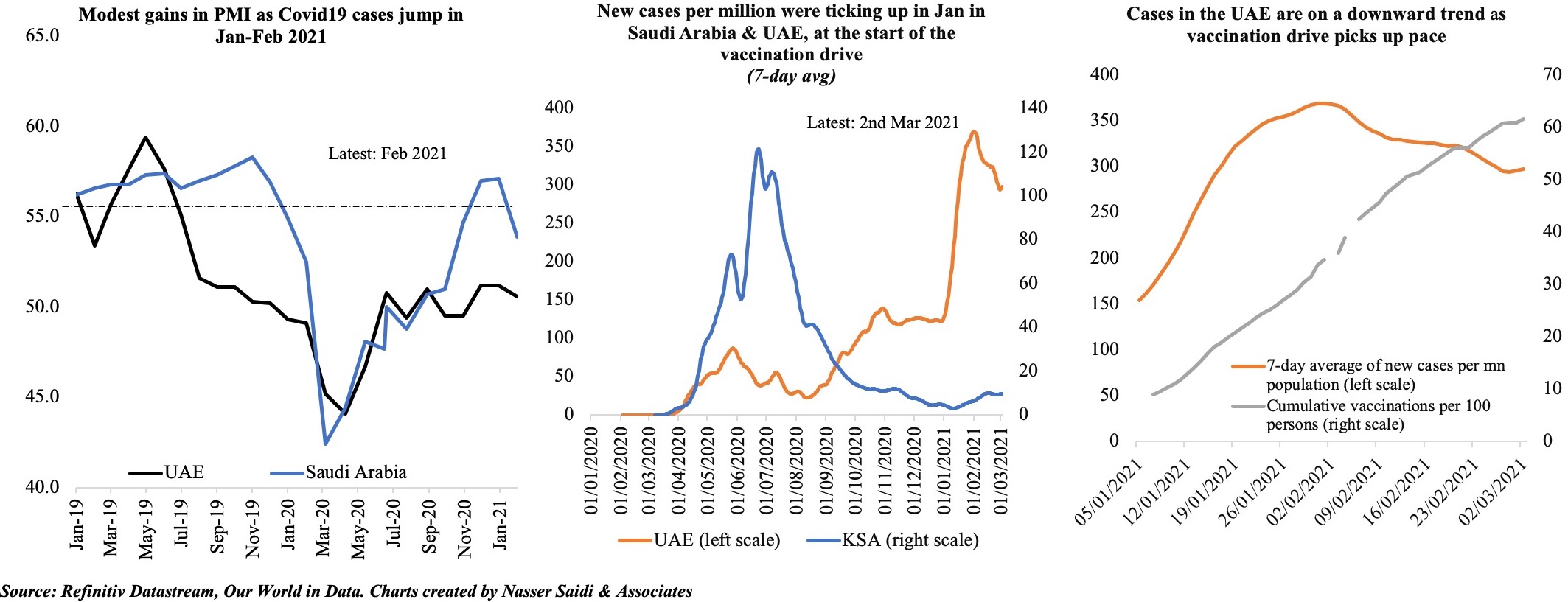

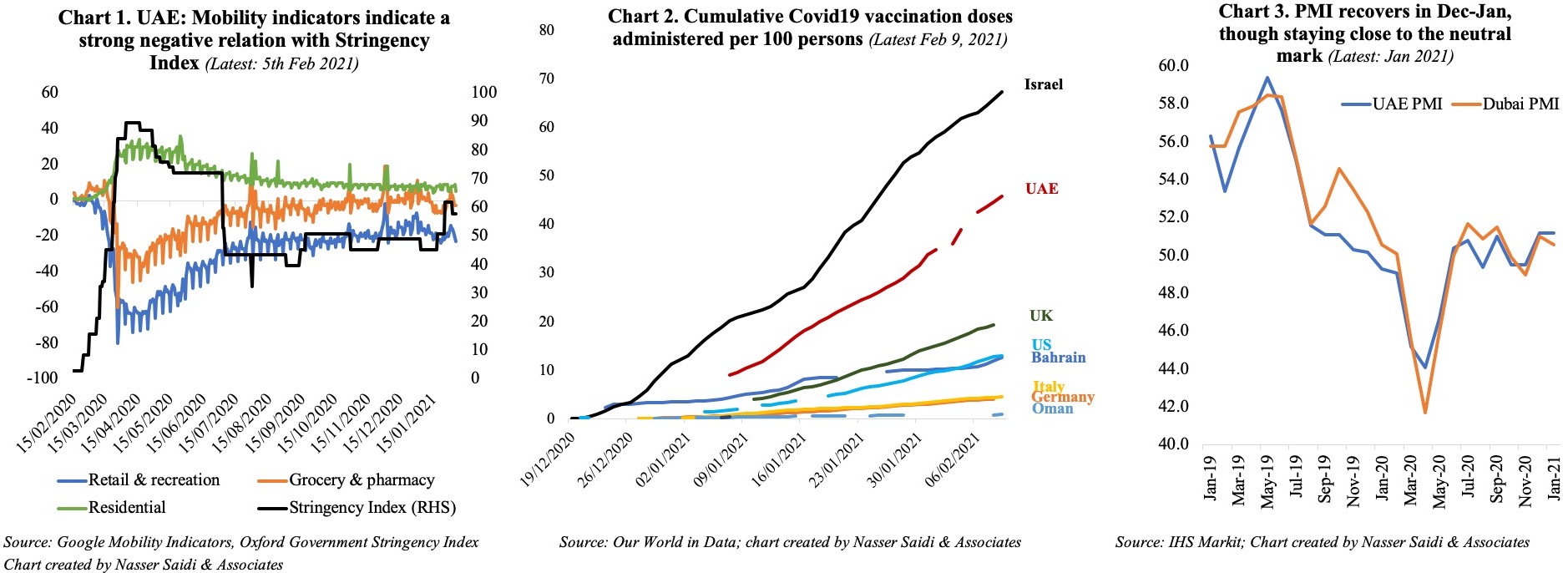

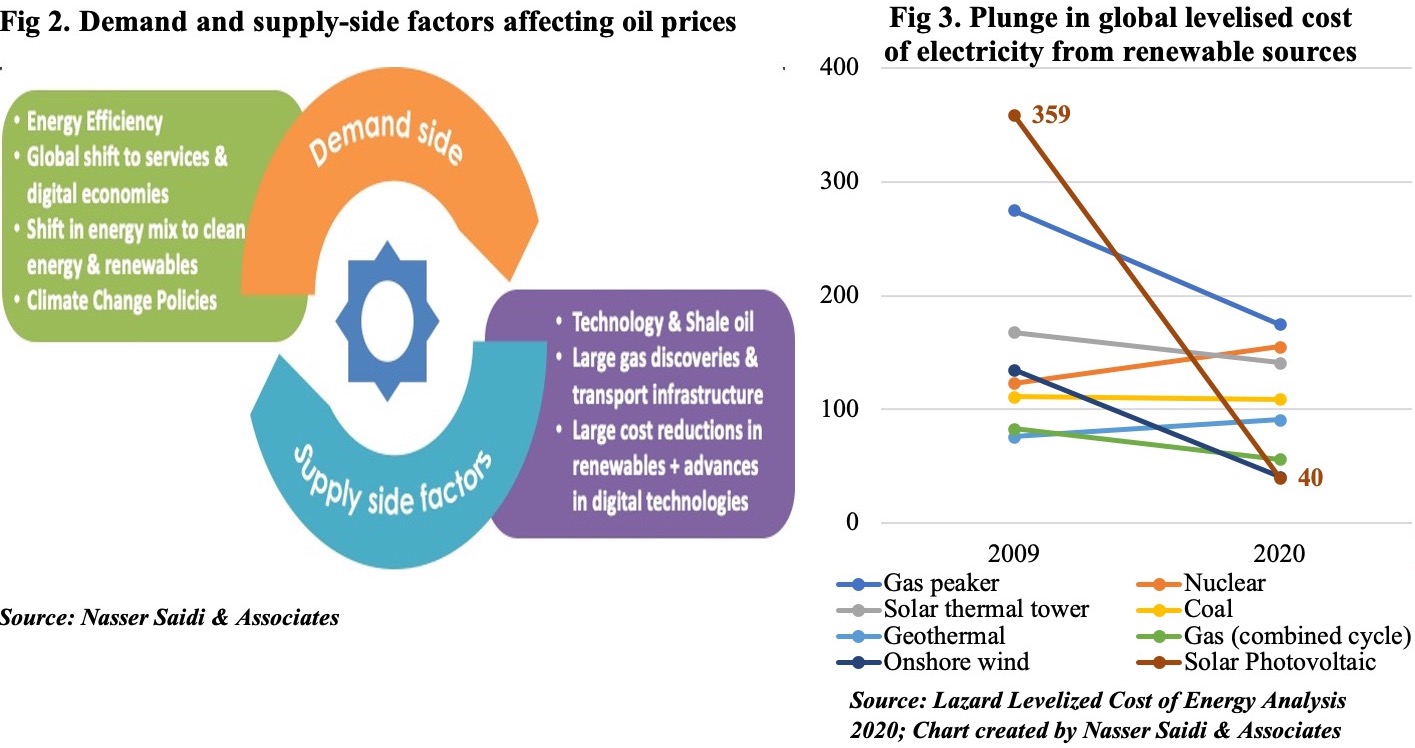

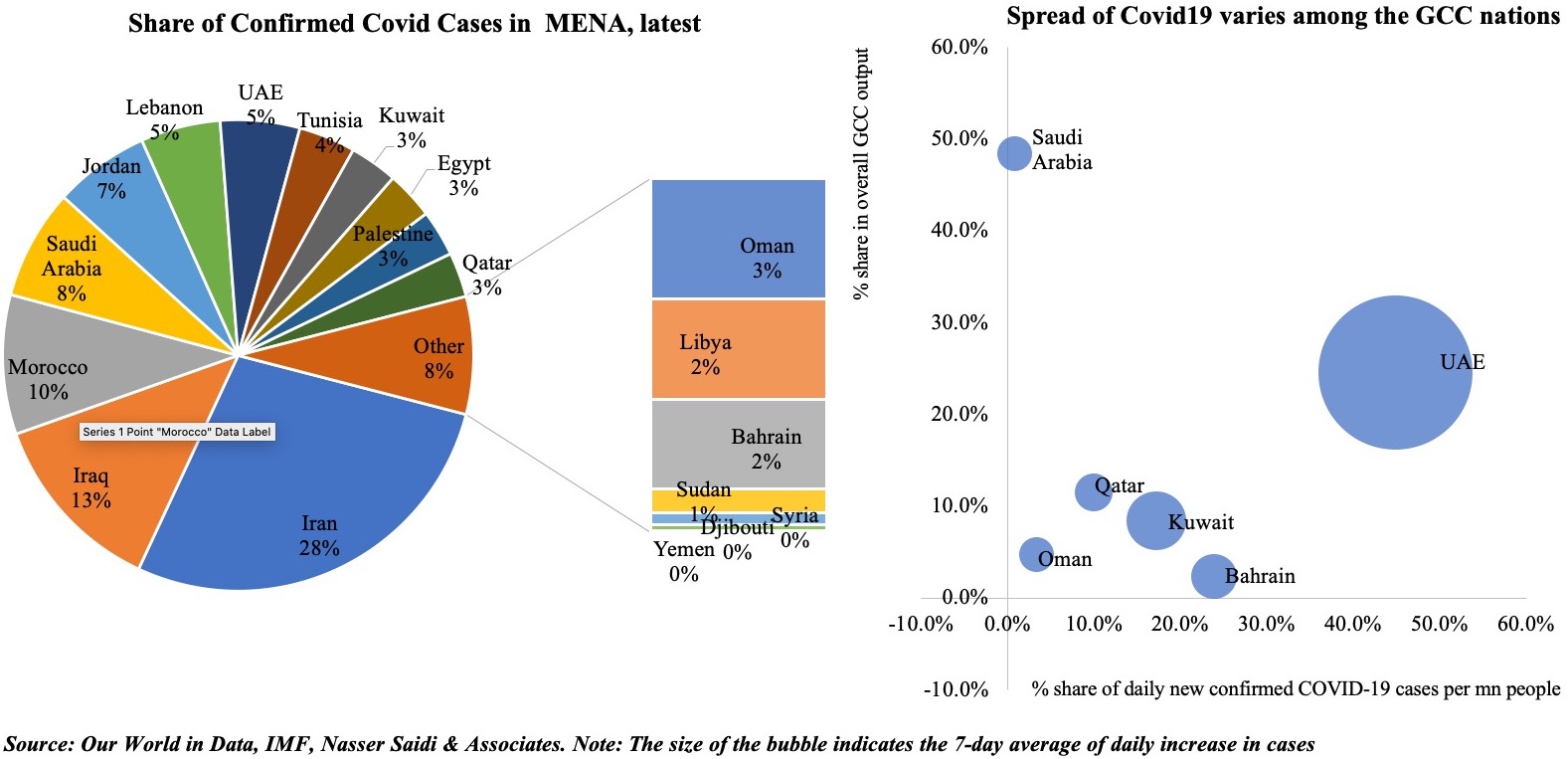

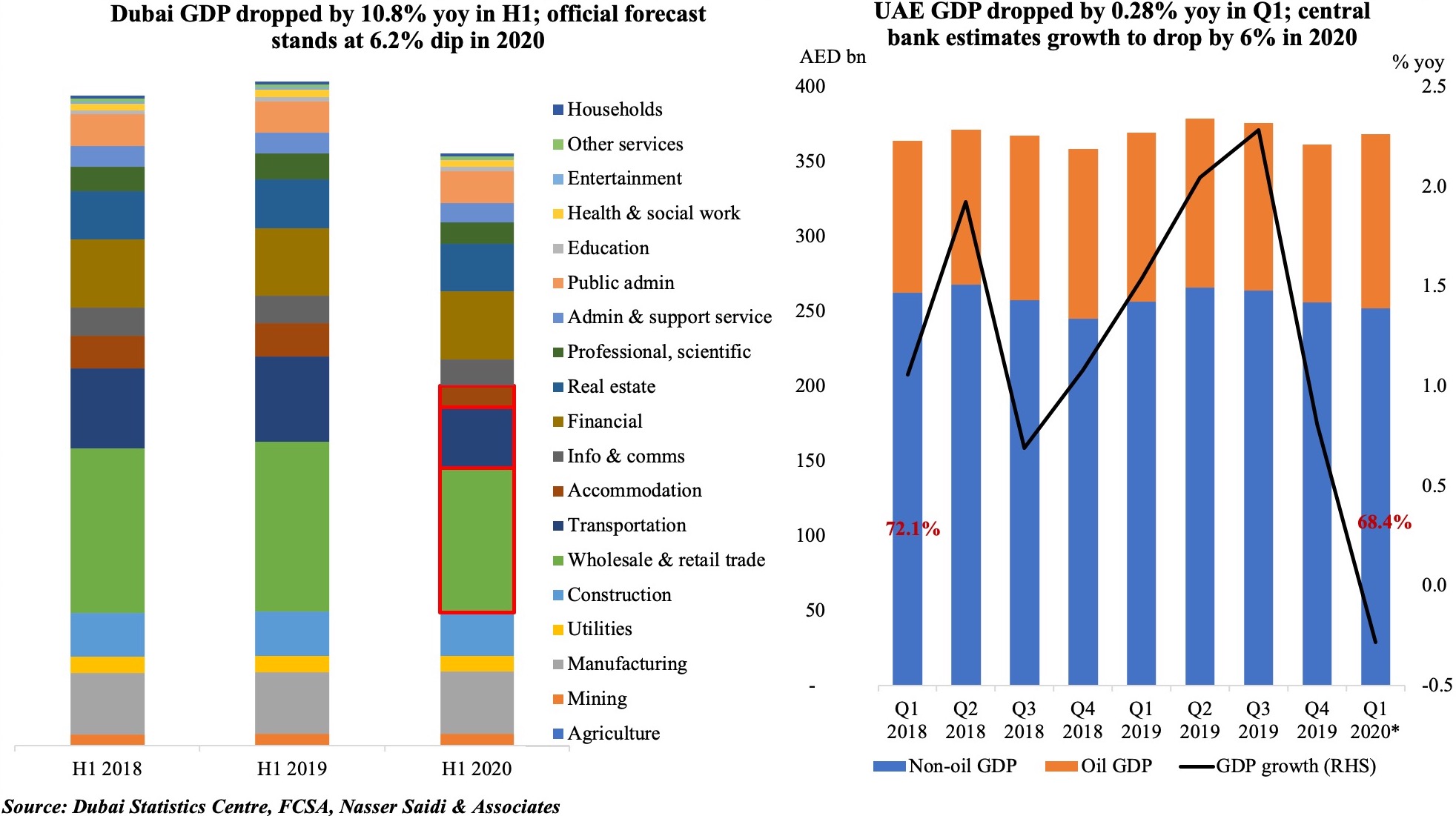

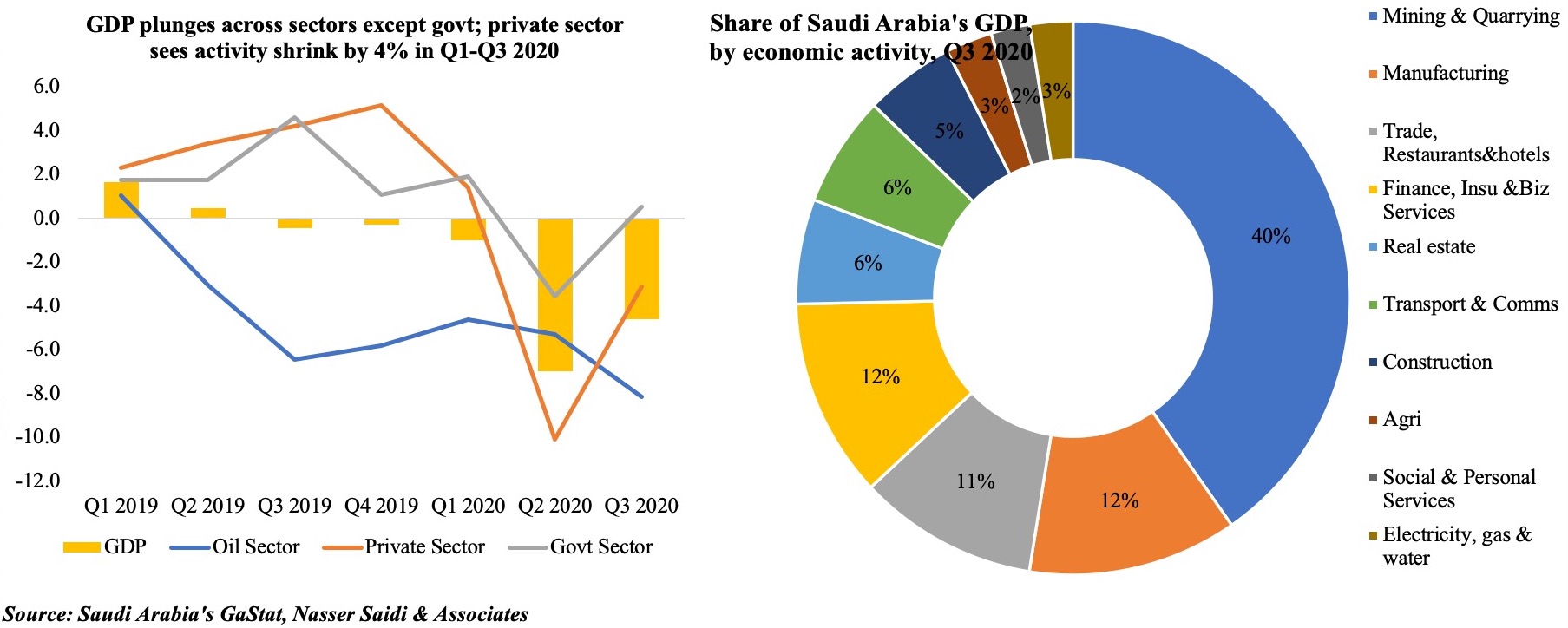

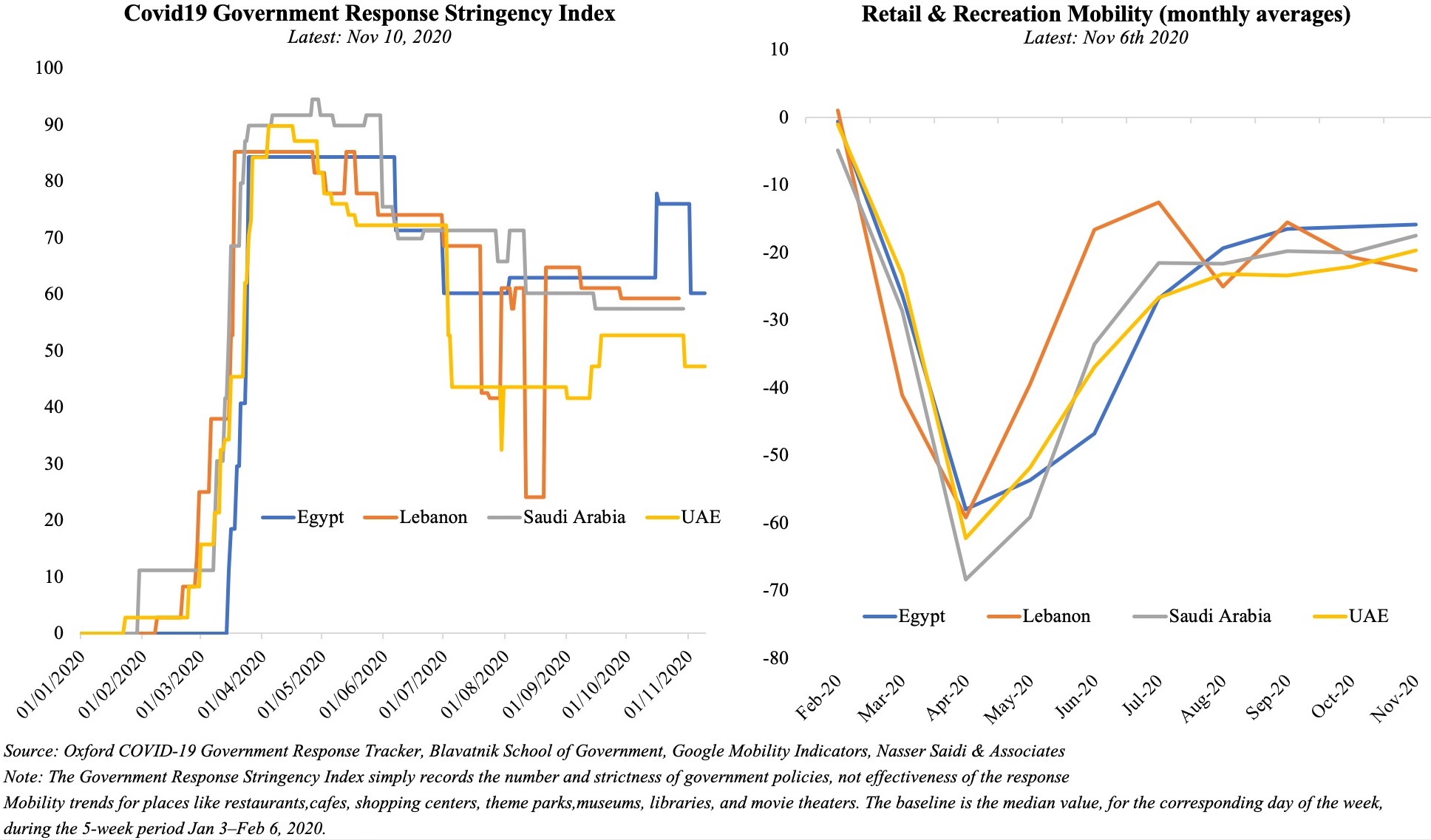

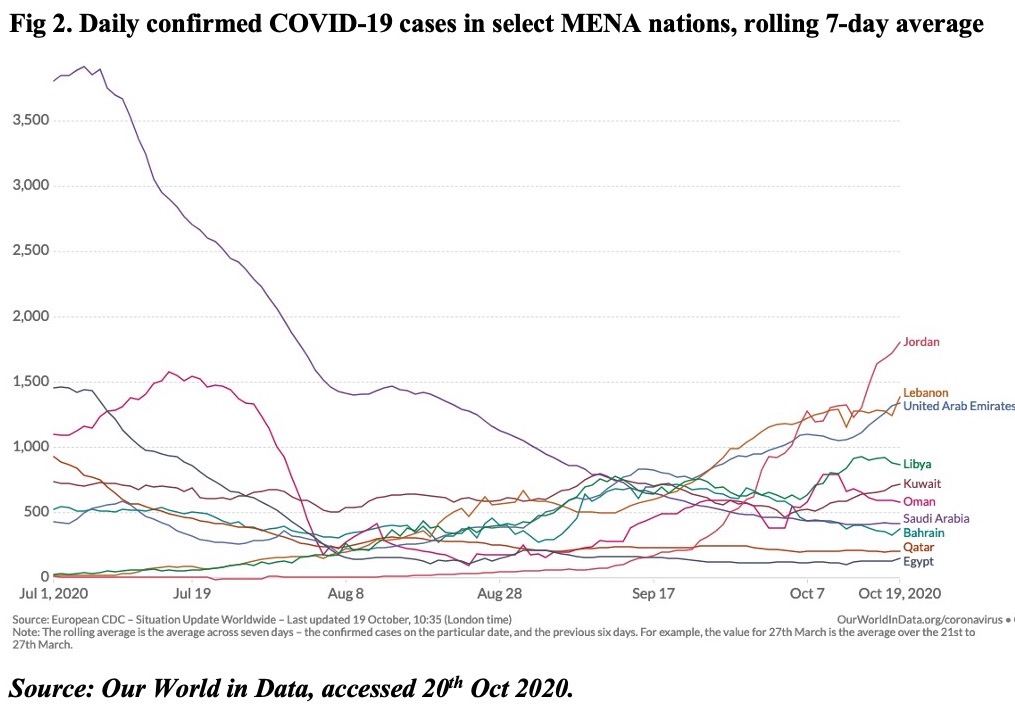

Given the resurgence in Covid19 cases and renewed lockdown measures and the global energy transition away from fossil fuels, it is unlikely that oil prices will revert to the levels seen a few years ago, given weaker demand – the IMF’s latest World Economic Outlook puts oil prices, based on futures markets at USD 41.69 in 2020 and USD 46.70 in 2021 (versus an average price of USD 61.39 last year). Fiscal breakeven oil prices in the GCC range between USD 42 for Qatar to USD 104.5 for Oman this year, exerting additional pressure on most oil producers as they ramp up spending to support the economy (UAE’s emirates Dubai and Sharjah announced USD136Mn and USD139Mn respectively in additional stimulus in the last few days).

Given the resurgence in Covid19 cases and renewed lockdown measures and the global energy transition away from fossil fuels, it is unlikely that oil prices will revert to the levels seen a few years ago, given weaker demand – the IMF’s latest World Economic Outlook puts oil prices, based on futures markets at USD 41.69 in 2020 and USD 46.70 in 2021 (versus an average price of USD 61.39 last year). Fiscal breakeven oil prices in the GCC range between USD 42 for Qatar to USD 104.5 for Oman this year, exerting additional pressure on most oil producers as they ramp up spending to support the economy (UAE’s emirates Dubai and Sharjah announced USD136Mn and USD139Mn respectively in additional stimulus in the last few days).

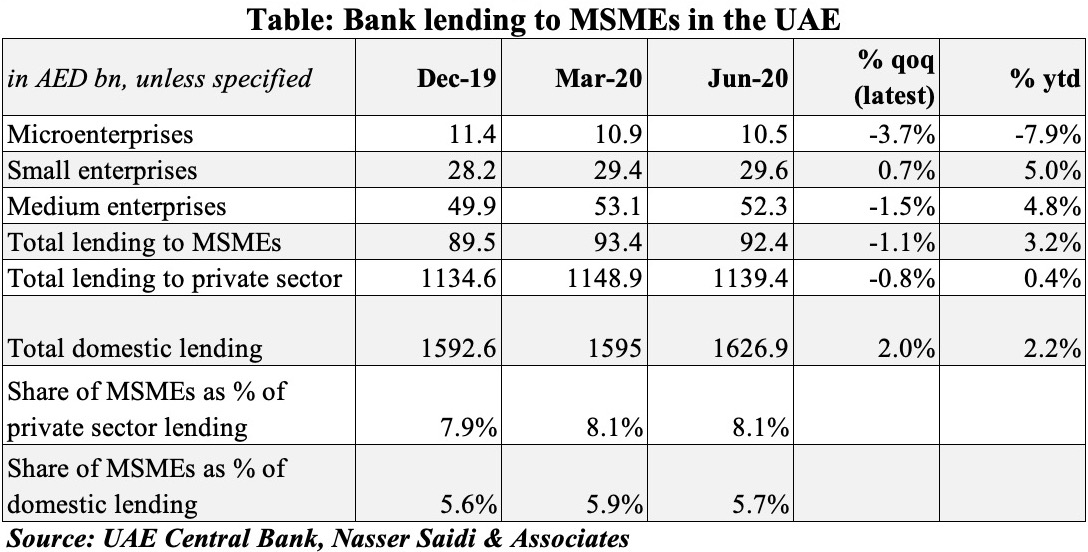

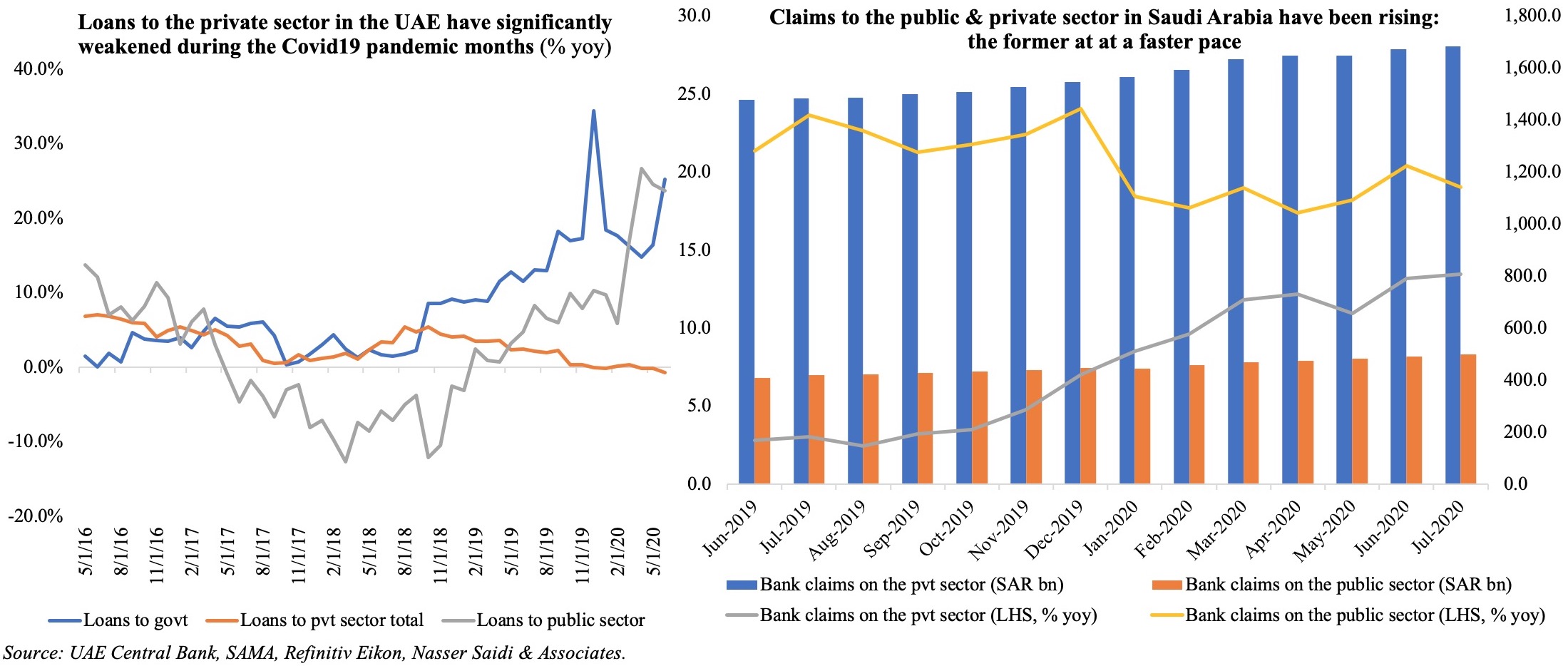

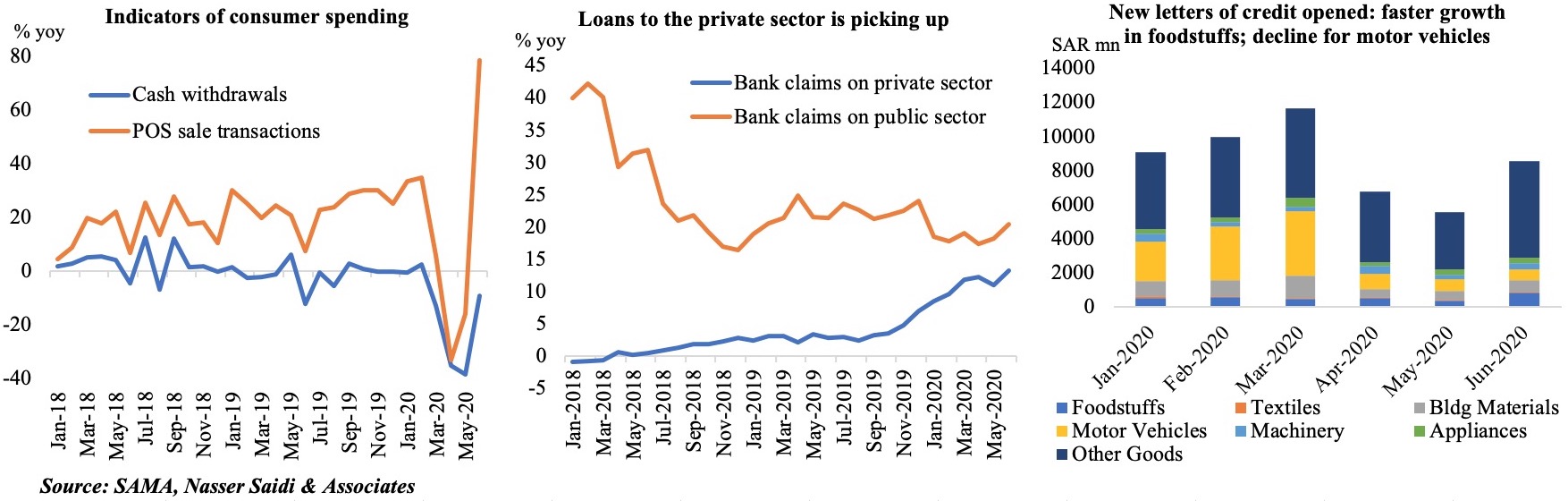

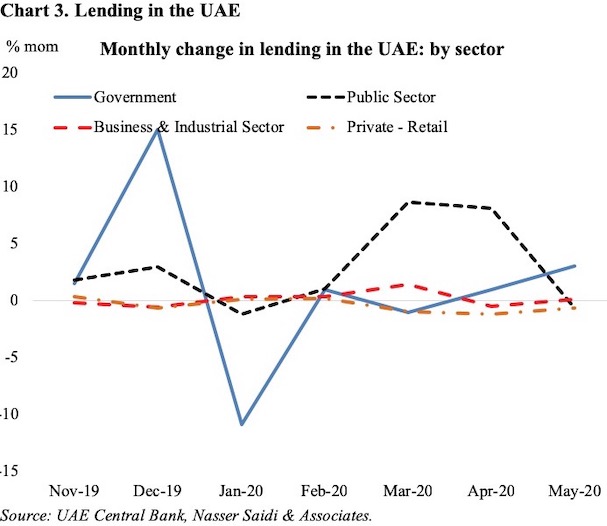

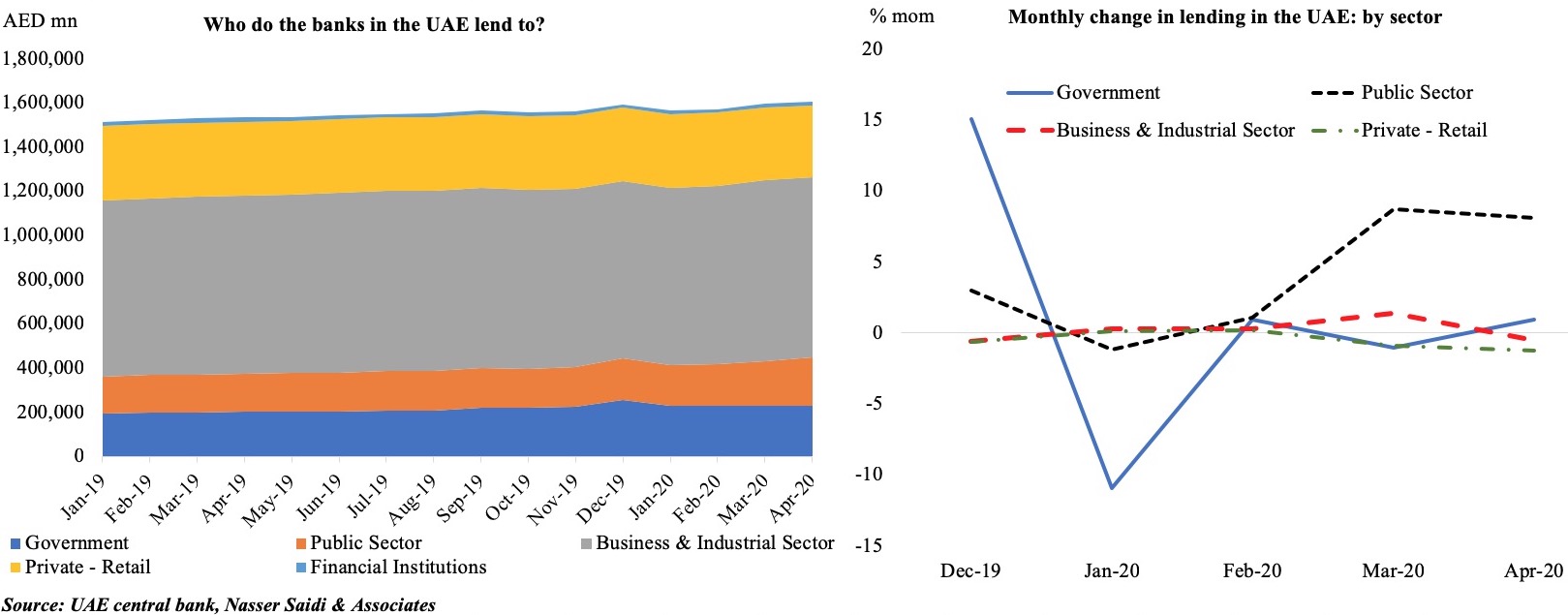

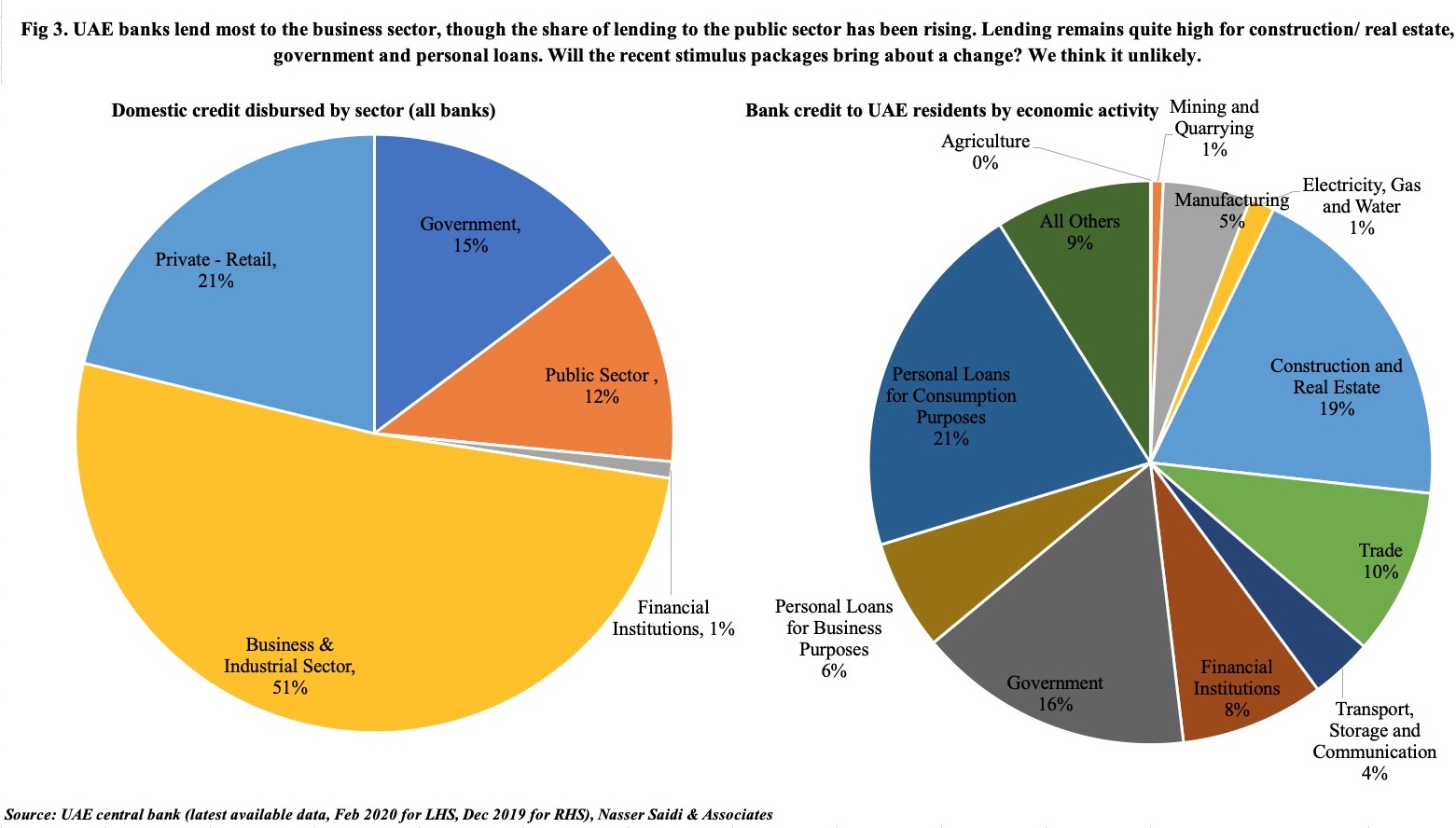

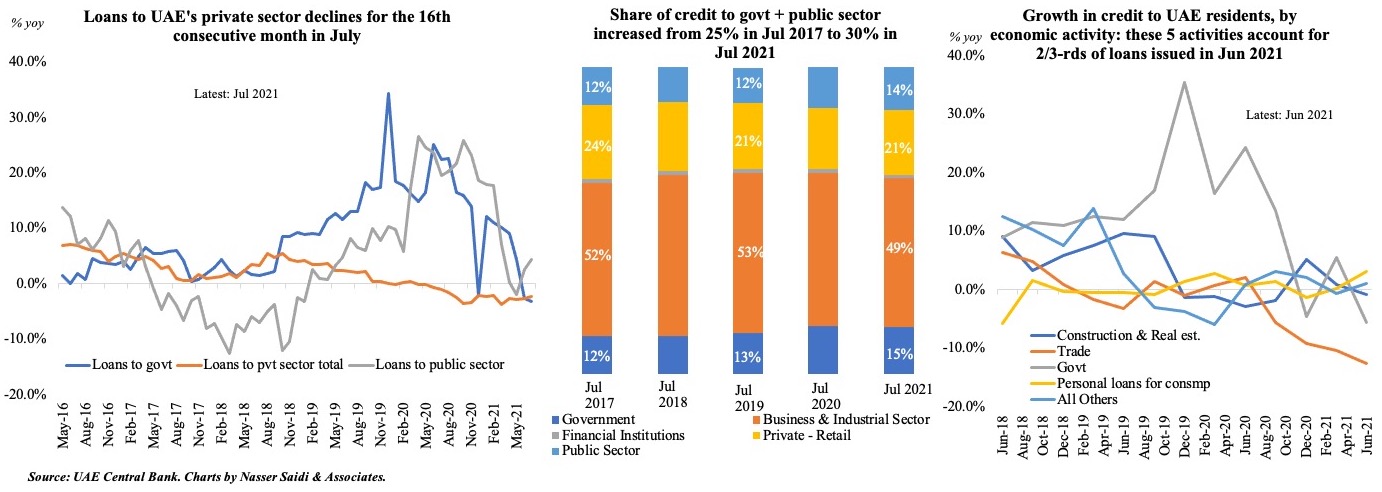

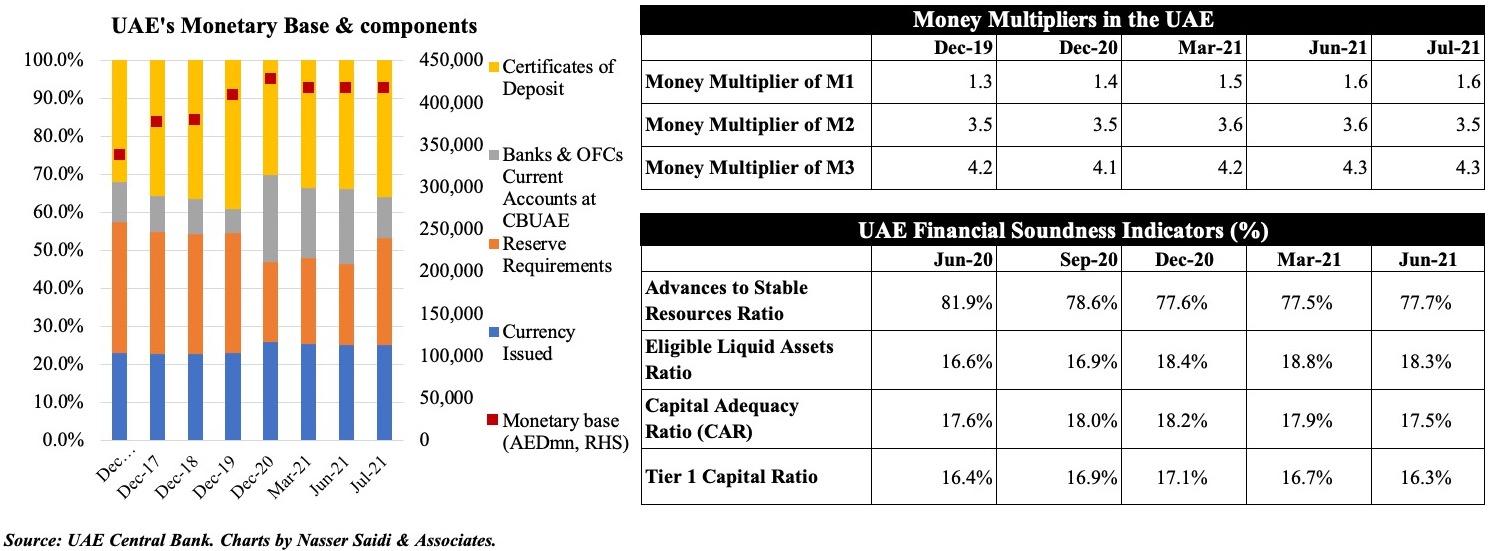

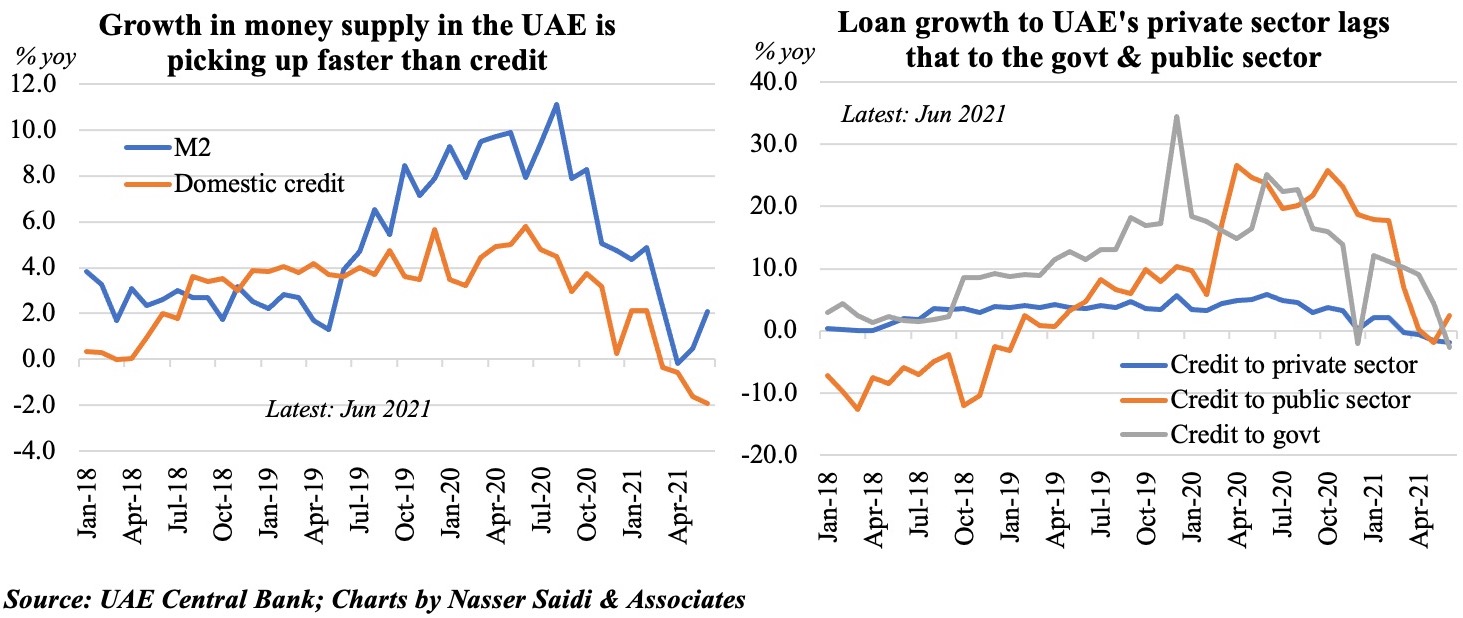

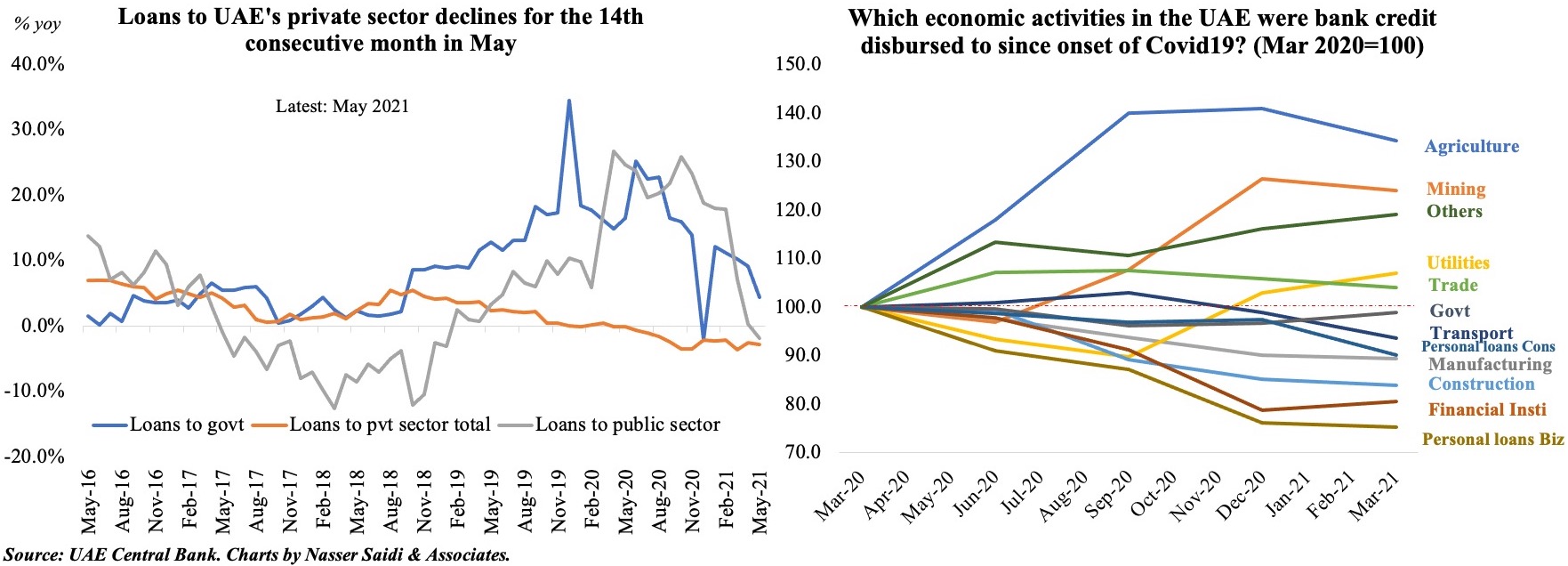

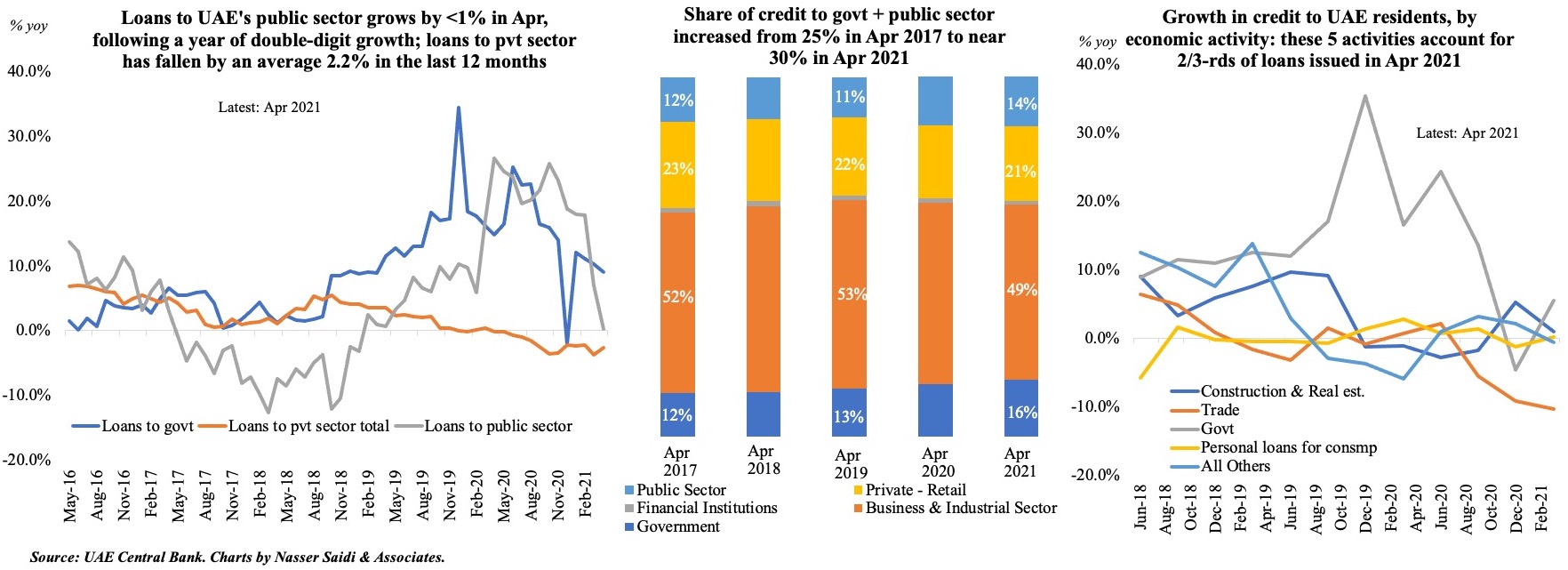

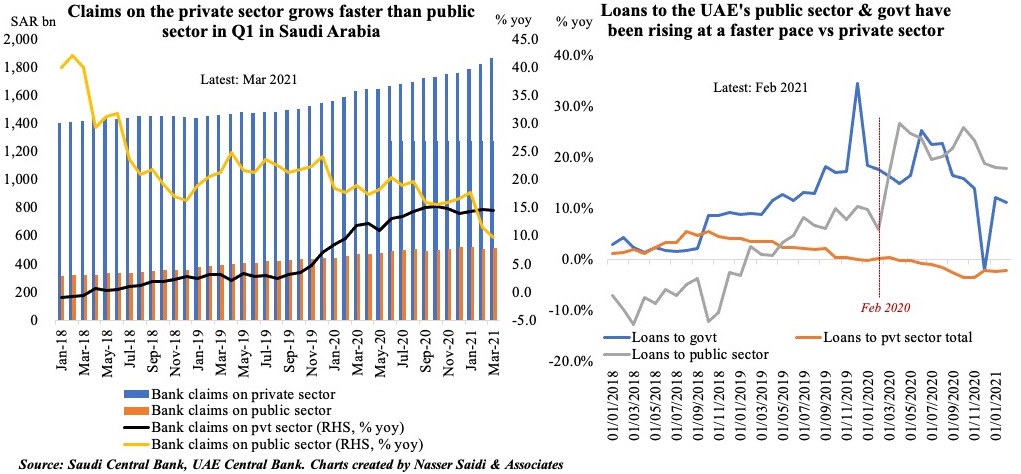

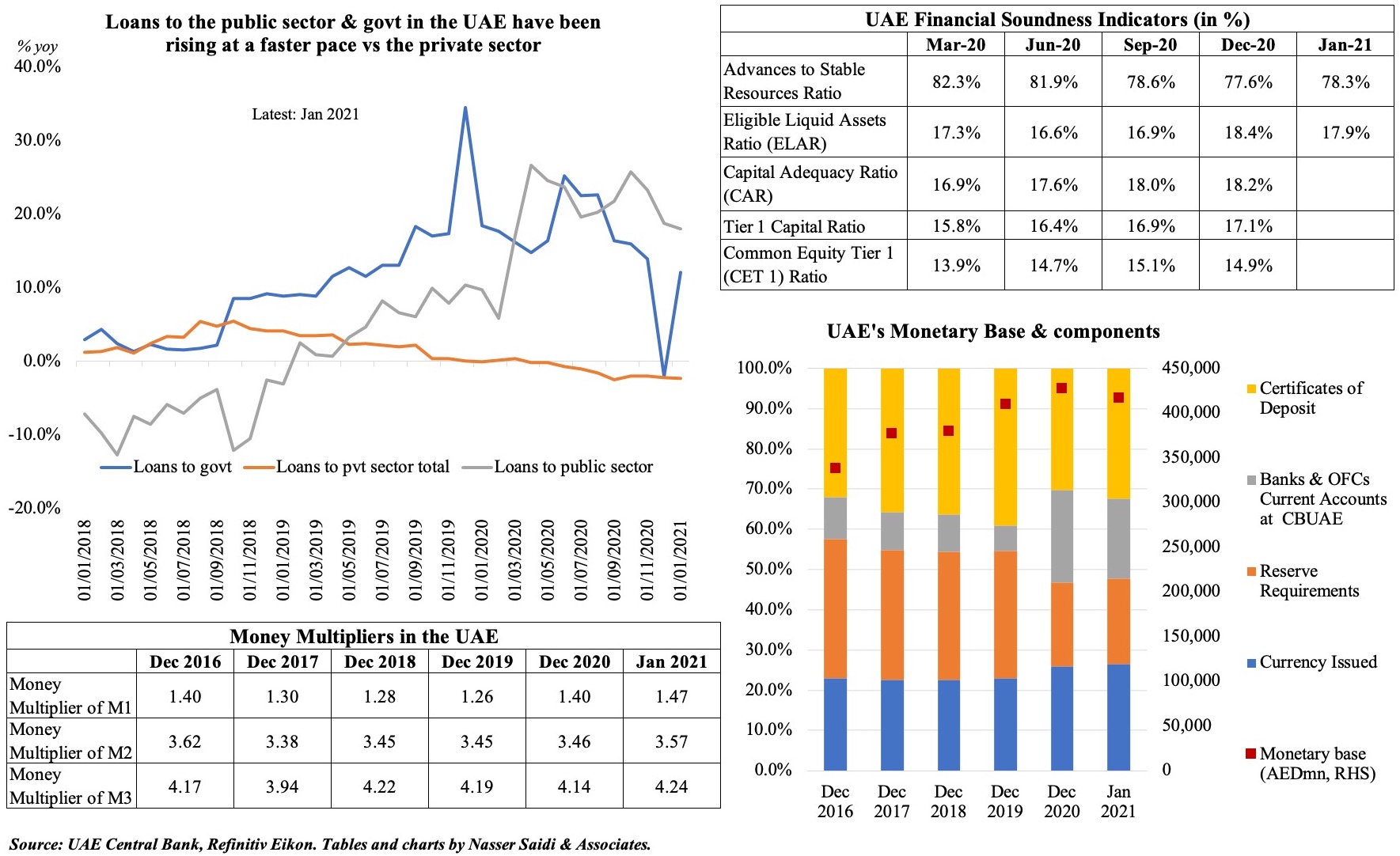

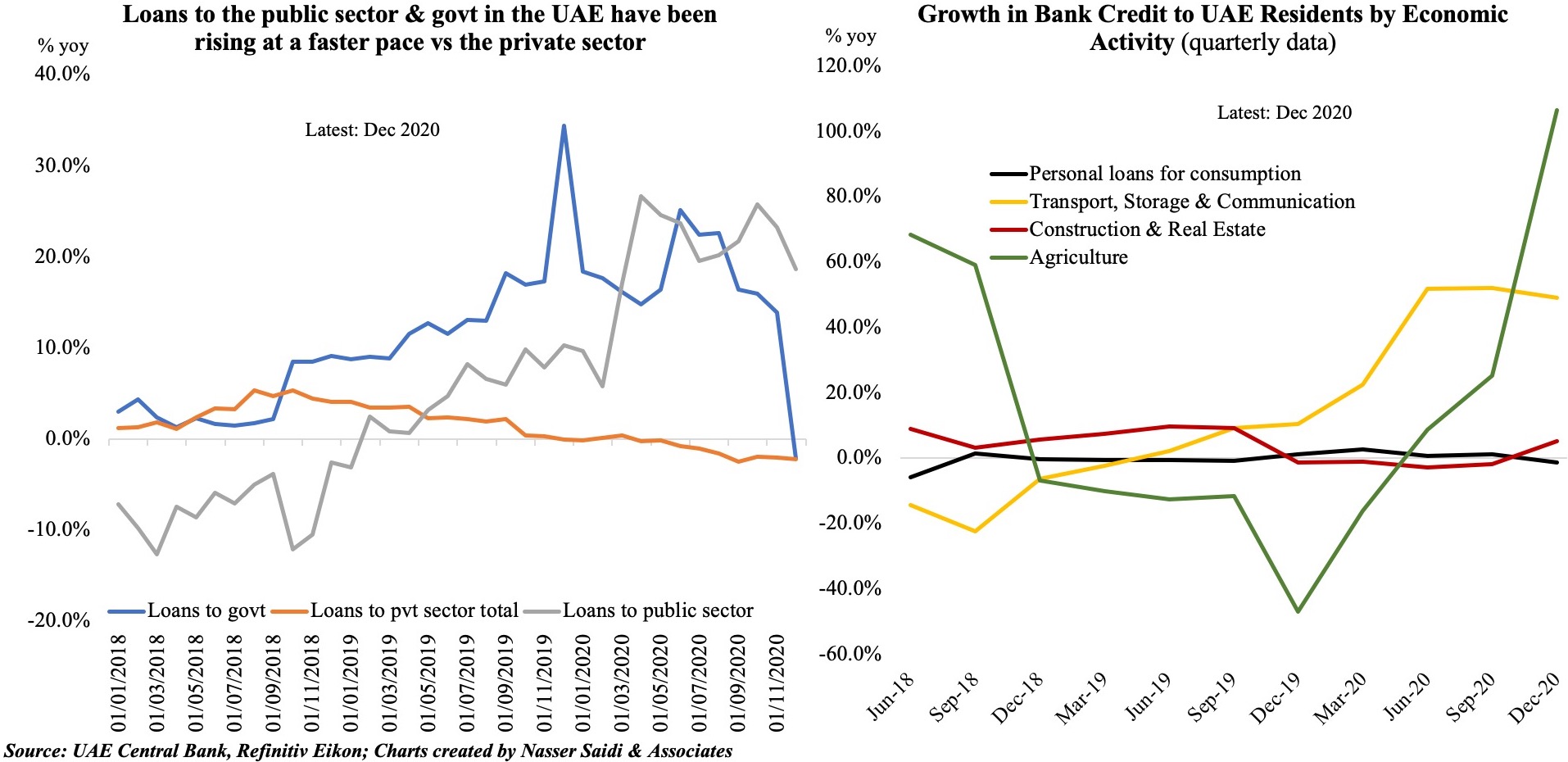

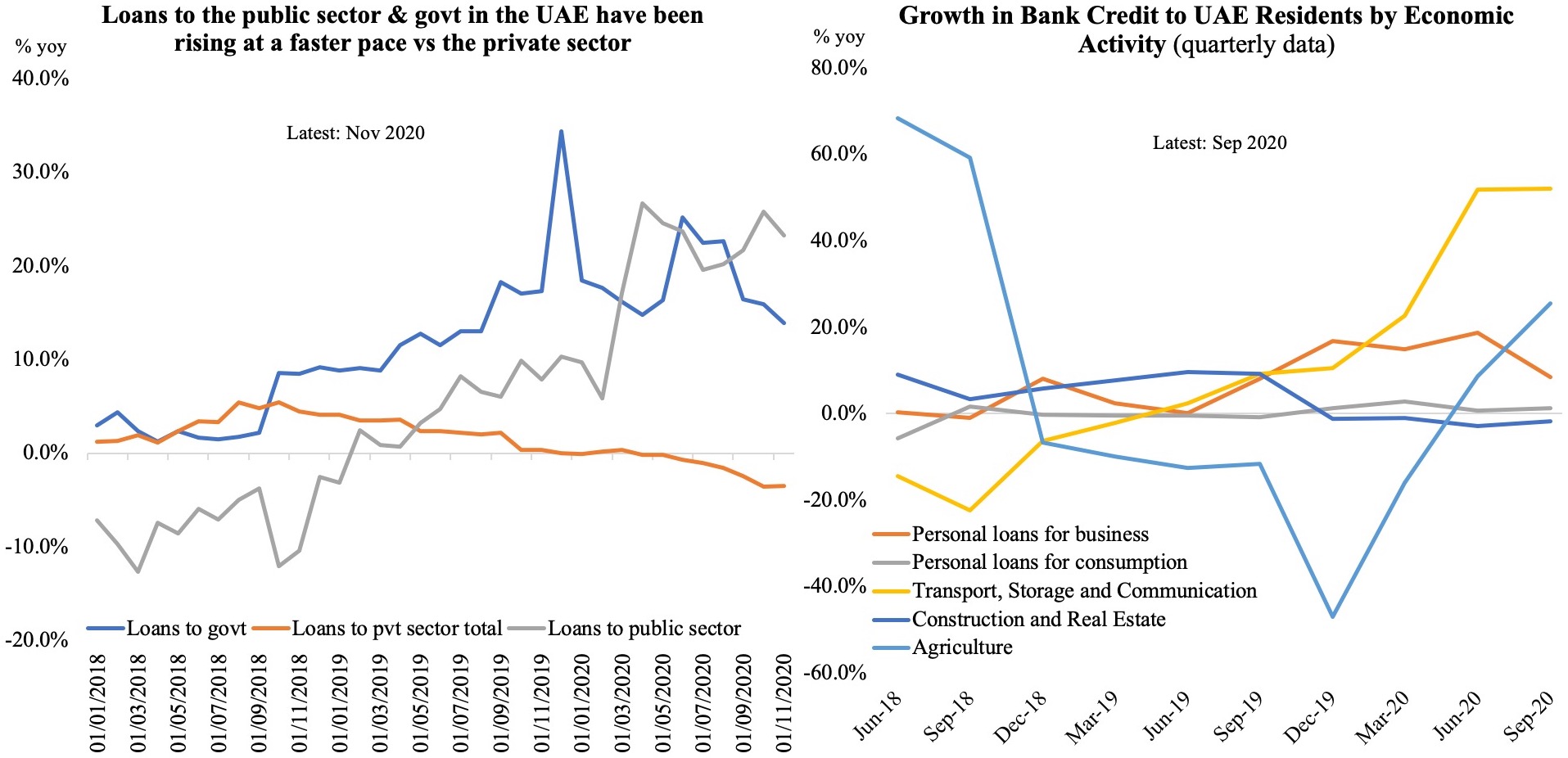

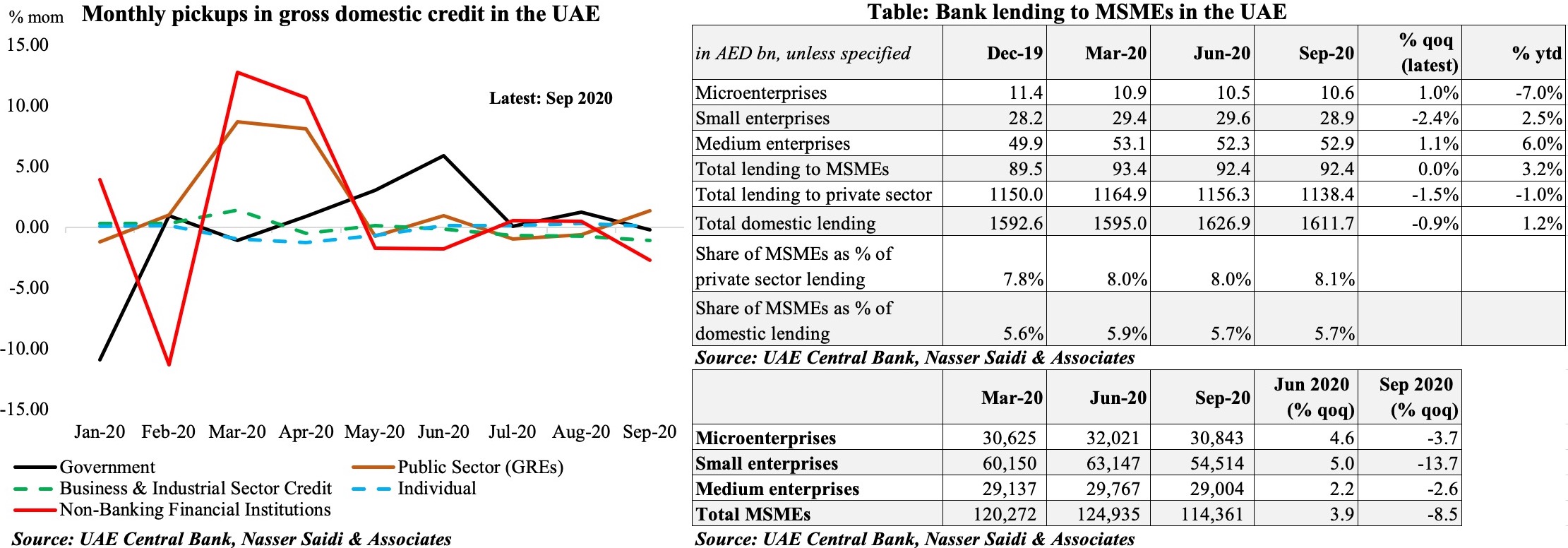

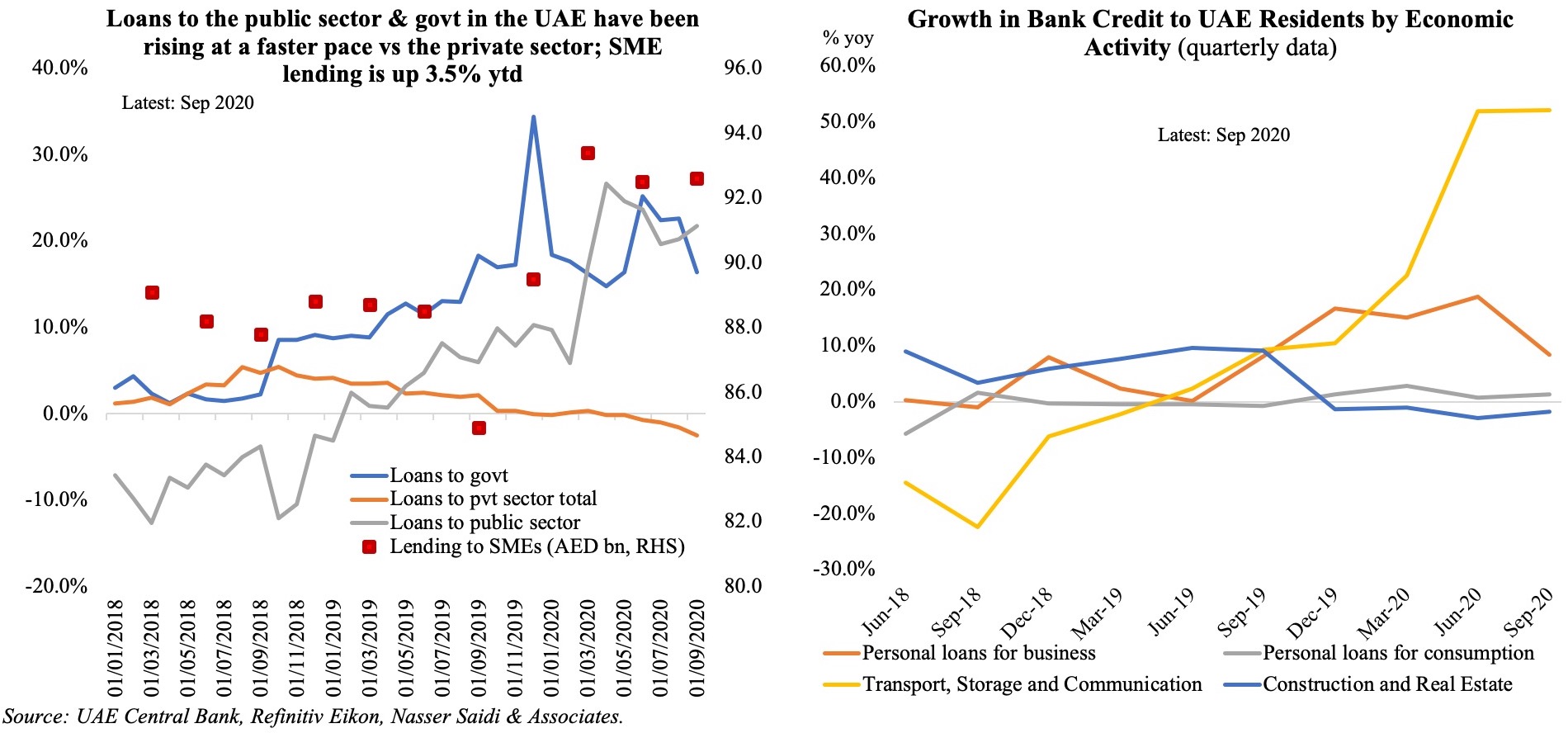

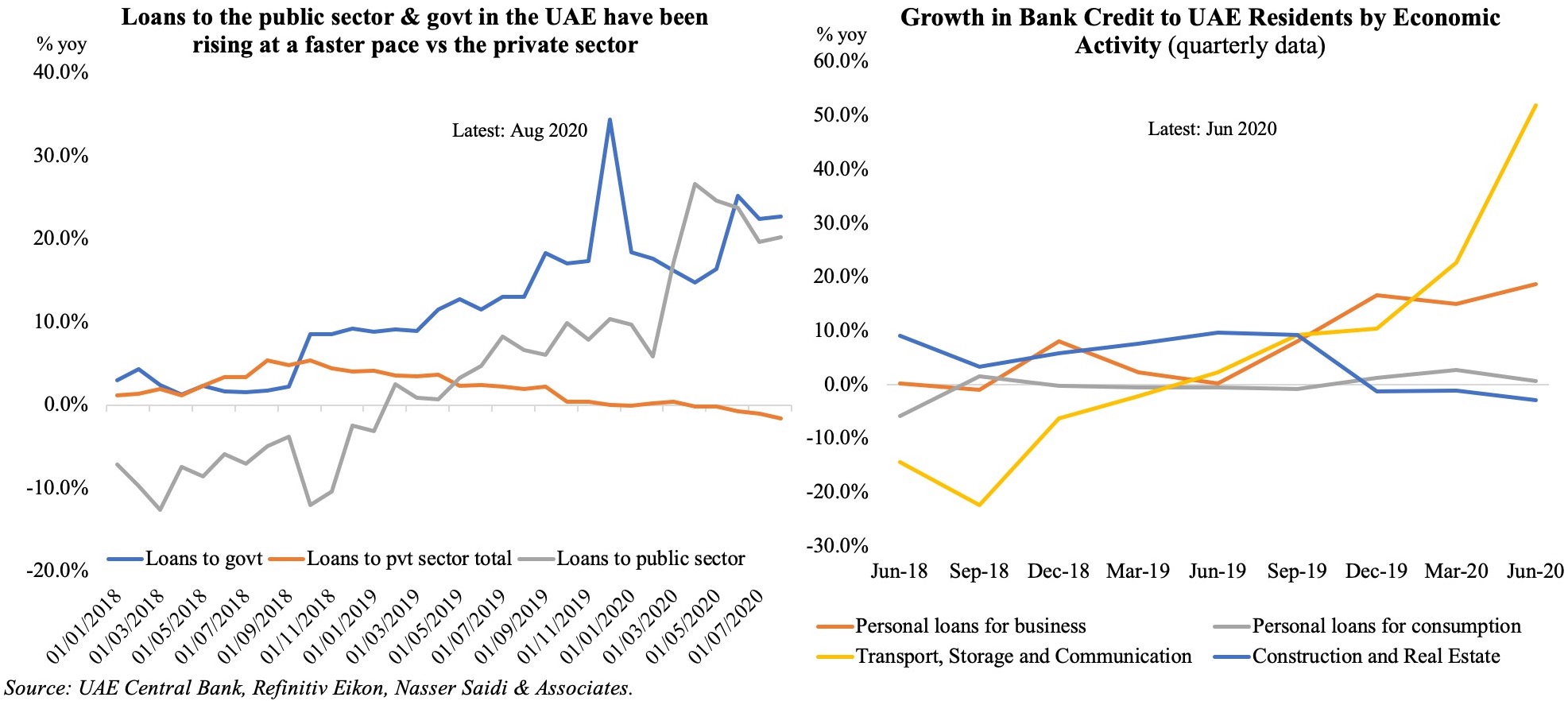

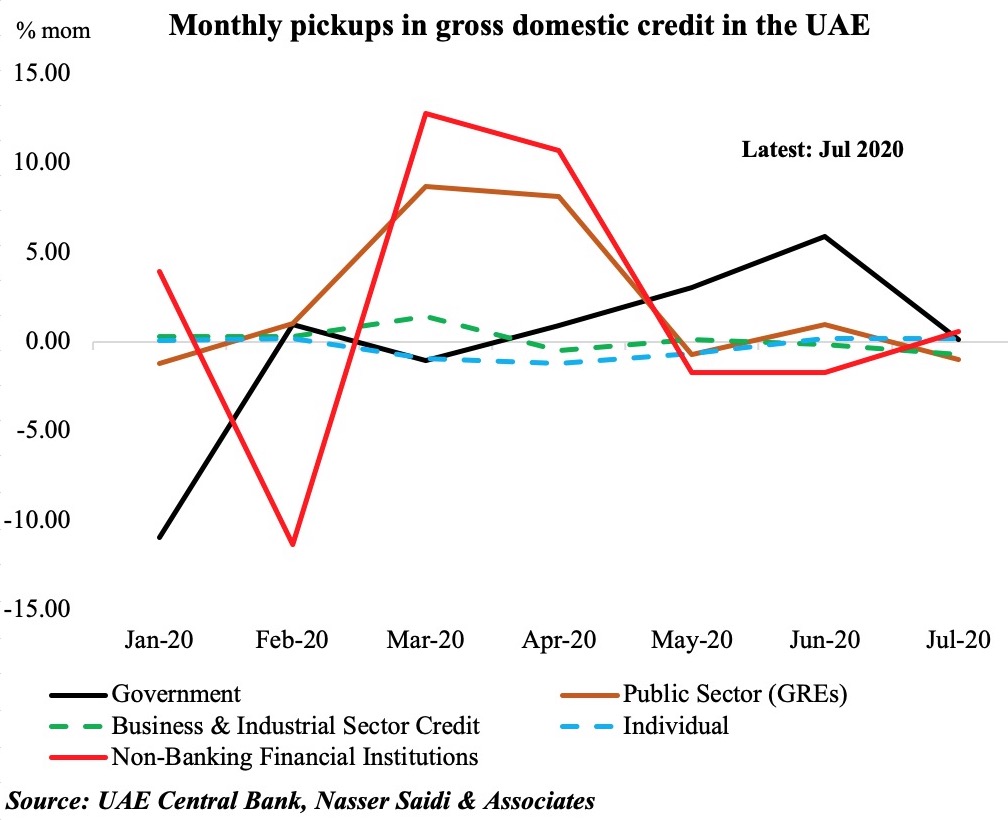

ral bank shed some light on the broader credit movements: the accompanying chart shows the monthly changes in gross domestic credit. The dotted lines are credit to businesses and individuals (the private sector) which show no substantial increases – in fact, it increased by an average 0.9% year-to-date (ytd) for businesses and dropped by 2.1% ytd for individuals. The uptick in lending to the public sector (government related entities) and government have been discussed previously

ral bank shed some light on the broader credit movements: the accompanying chart shows the monthly changes in gross domestic credit. The dotted lines are credit to businesses and individuals (the private sector) which show no substantial increases – in fact, it increased by an average 0.9% year-to-date (ytd) for businesses and dropped by 2.1% ytd for individuals. The uptick in lending to the public sector (government related entities) and government have been discussed previously