Weekly Insights: Charts this week focus on Google’s latest mobility reports, changes in US treasury holdings and FDI flows into the MENA region.

Markets

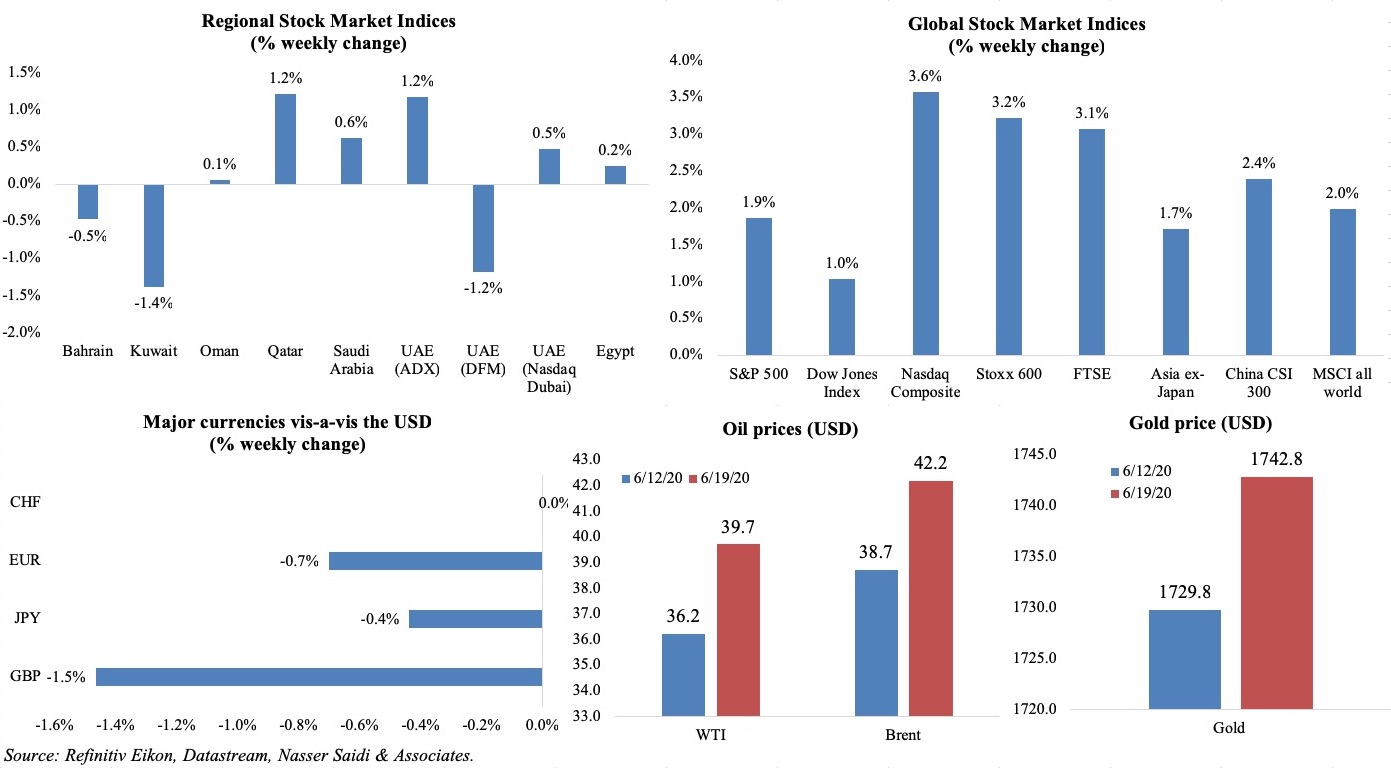

Stock markets performed well last week in spite of the spike in Covid19 cases as economic activity resumed with the easing of restrictions (& resurgence of cases in nations that had successfully “flattened the curve”) and given unprecedented liquidity support from central banks. Markets across Europe – Stoxx600, FTSE – gained on better than expected macro data as well as on expectations that the stimulus package would be passed soon. China’s stocks ended higher after Beijing pledged reforms and liquidity support. Regionally, most markets were up as economies gradually eased restrictions and kickstarted economic activity. UK pound had its worst week in a month against the dollar while the euro also edged down. Oil prices increased on reports of demand recovery while gold price was up almost 1% on safe-haven demand. (Graphs in the last section.)

Global Developments

US/Americas:

- US industrial production edged up by 1.4% mom in May (from Apr’s record 12.5% drop) as factories resumed operations. Motor vehicles and parts posted the largest gain (+120.8%), as manufacturing rose by 3.8%. However, capacity utilisation is still at just 64.8% (though higher compared to Apr’s 64%).

- US retail sales surged by 17.7% mom in May from a depressed -14.7% the month before as states reopened; control sales, which strip out more volatile items such as food, petrol and building materials, rose 11% mom. But, overall purchases are still down 6.1% yoy.

- Housing starts increased by 4.3% to a seasonally adjusted rate of 974k units in May; in yoy terms, the reading is down 23.2%. Building permits rebounded by 14.4% mom to 1.22mn units in May. Separately, record-low mortgage rates are leading to a surge in mortgage applications to purchase a home: it rose by 4% in the week ended Jun 13 from the prior week, also up 21% yoy – to the highest level since Jan 2009.

- Initial jobless claims fell for the 10th week in a row to 1.508mn in the week ended Jun 12, with the previous reading upwardly revised to 1.566mn, pushing the 12-week total to around 49mn. Continuing claims declined to 20.544mn in the week ended Jun 5 (prev: 20.606mn).

Europe:

- Eurozone CPI slipped to 0.1% mom in May (Apr: 0.3%) – the lowest since Jun 2016 – while core CPI remained steady at 0.9% yoy.

- Germany CPI declined for the 3rd consecutive month, down to 0.6% yoy in May, thanks to lower energy prices while food prices were up 4.5%. Wholesale price index slipped by 0.6% mom (Apr: -1.4%) and 4.3% yoy. PPI dropped by 0.4% mom in May (Apr: -0.7%).

- German ZEW economic sentiment improved to 63.4 in Jun (May: 51), rising for the first time since Jan 2020, while the current situation reading was -83.1 (May: -93.5).

- The ZEW economic sentiment for the wider Euro Area mirrored the improvement in Germany, with the reading up 12.6 points to 58.6 – the highest reading since May 2015. Hourly labour costs rose 3.4% yoy in Q1 after a downwardly revised 2.3% increase in Q4 – this was the biggest increase in labour costs since at least 2009.

- At the latest BoE meeting, interest rates were held unchanged at a record low of 0.1%; it increased its bond-buying programme by GBP 100bn to GBP 745bn, with the additional amount used to buy only government bonds.

- UK CPI eased to a 4-year low of 0.5% yoy from Apr’s 0.8% reading, driven by decline in fuel costs and prices of clothing while core CPI reduced to 1.2% (Apr: 1.4%). Retail price index was down to 1% yoy from 1.5% in Apr while the PPI core output also eased to 0.6% from 0.7% the month before.

- UK ILO unemployment rate remained unchanged at 3.9% in the 3 months to Apr while average earnings including bonus slipped to 1% from 2.3% the period before. The number of people “temporarily away” from paid employment surged during lockdown to 8.4mn by end-Apr. Hours worked each week tumbled by a record 8.9% yoy in the 3 months to Apr.

- UK retail sales increased by 12% mom in May, following a 18% dip the month before. Sales were boosted by a 42% rise at household goods stores (e.g. hardware, furniture and paint shops). However, in yoy terms, sales declined by 13.1% yoy from 22.7% drop in Apr.

Asia Pacific:

- China fixed asset investment declined by 6.3% yoy in Jan-May vs 10.3% the month before. Investment in manufacturing dropped 14.8% in Jan-May, with a 6.3% drop in infrastructure investment. Property investment seems to be rebounding, with a contraction of just 0.3%.

- China’s FDI increased by 4.2% yoy to USD 9.87bn in May, though narrowing from the 8.6% rise in Apr. Overall, FDI into China fell 6.2% yoy to USD 51.21bn in Jan-May.

- China industrial production increased by 4.4% in May, up from Apr’s 3.9% rise, supported by a 5.2% pickup in manufacturing. Retail sales continued to remain negative but improved to -2.8% in May from a 7.5% slump the month before.

- The Bank of Japan kept its short-term interest rate unchanged at 0.1% and maintained long-term borrowing costs around zero. It increases the size of its lending packages for companies to USD 1trn from the previously announced USD 700bn announced last month.

- Japan exports and imports growth slumped in May, falling by -28.3% and -26.2% yoy respectively (Apr: -21.9% and -7.1%) – the largest yoy drops in more than a decade. car exports decreased 64.1%, posting the biggest fall since Apr 2011, following a 52.6% dip in Apr. Trade balance remained in the red for the 2nd consecutive month, though narrowing to JPY 833.4bn from the previous month’s JPY 931.9bn.

- Japan inflation was 0.1% yoy in May (Apr: 0.1%); core prices (including oil but excluding food prices) fell 0.2% yoy while core-core prices (i.e. excluding food and energy) increased by 0.4% yoy from Apr’s 0.2% reading.

- Whole sale price index in India fell by 3.21% yoy in Apr, from a 1% rise in Mar, but food prices picked up by 1.13%.

- India’s trade deficit narrowed to USD 3.15bn in May from Apr’s USD 6.76bn, as exports declined by 36.47% yoy and imports plunged by 51%. Oil imports in May were 71.98% lower vs a year ago while gold imports dropped by 98.4%.

- Singapore unemployment touched the highest in a decade, with Q1’s reading at 2.4%. Retrenchments rose to 3,220 in Q1 (Q4: 2,670), largely due to sectoral downturns while an additional 4,190 employees were placed on shorter work hours – a five-fold increase from Q4.

Bottom line: The WHO’s warning of a “new and dangerous phase” of the Covid19 pandemic, a potential second wave of Covid19 in many nations that re-opened (Germany, New Zealand, China, Iran to name a few) amid a surge continuing in many US states (US on Thursday recorded its largest one-day increase in coronavirus cases since early May) raises important questions regarding the pace of economic recovery. While central banks have reiterated liquidity support, there are signs of improvements in USD funding conditions – the ECB, BoE, BoJ and the Swiss National Bank stated that the frequency of their 7-day dollar funding operations (via the Fed’s swap lines) would be reduced to thrice a week instead of daily. Be prepared for central banks to exit stimulus measures should economies show signs of recovery and the pace of activity picks up faster than expected: Norges Bank signaled that rates could be raised as early as 2022. Meanwhile, UNCTAD estimates global FDI flows to plunge by 40% this year to below USD 1trn (for the first time since 2005) due to Covid19, with worse expected in 2021. Geopolitical risks are also on the radar – be it the clash between Indian and Chinese troops, tensions between South and North Korea or the contradictory messaging from the US regarding the trade deal (and wider “Cold War”) with China.

Regional Developments

- Bahrain’s cabinet agreed to add up to BHD 177mn (USD 470mn) to this year’s budget to tackle emergency expenses related to the Covid19 outbreak.

- A survey report titled “The Economic Impact of Coronavirus on Business Owners” which recorded responses from 1180 firms in Bahrain revealed that a majority expect economic recovery to take at least a year while 59% expect a high risk of closure of business within the next 6 months. About 71% of businesses in the tourism and hospitality industry fear closure within the coming months while in education it is 63% and the lowest is in finance, insurance and tax (27%).

- Job losses in the Bahrain Petroleum Company will be limited to only expats (whose contracts have expired and not renewed), reiterated the company.

- The Bahrain Association of Banks plans to set up a banking court or arbitration body with an aim to resolve quickly and efficiently disputes from financial and banking transactions as well as quickly settle and implement its provisions which taking into account privacy concerns.

- Egypt’s ministry of finance approved EGP 3bn (USD 185mn) credit guarantees to cover loans for tourism firms (to be provided with a declining interest rate of 5%). The central bank allocated EGP 3bn (from its EGP50bn for tourism support) for salary payments in the tourism sector.

- Egypt increased allocation to the health sector in the 2020-21 budget by 28% yoy to EGP 93.5bn (USD 5.8bn), with government investment in the sector surging by 72% to EGP 21.1bn.

- Reuters reported that Egypt is planning to raise a loan of more than USD 1bn, with lenders in the UAE being tapped for financing.

- Egypt posted an initial surplus of EGP 40.4bn in H1 2019-2020 vs EGP 35.6 during the same period a year ago. Tax revenues from non-sovereign firms grew by 7% yoy to EGP 412bn. The petroleum sector contributed a surplus of more than EGP 20bn during the period.

- Bilateral trade between Egypt and China increased by 3.2% yoy to USD 3.2bn in Q1 2020; China’s investments in Egypt however declined during the period by 12% to USD 35bn.

- Egypt’s trade deficit narrowed by 38.6% to USD 2.69bn in Mar, as the slump in imports (by 30.6% to USD 4.93bn) eclipsed the decline in exports (down 18% to USD 2.24bn).

- Foreign employees in the private and investment sectors edged up by 1.2% yoy in 2019 to a total of 14,950 persons.

- From 2021, individuals in Egypt will need to submit tax returns electronically via the Tax Authority’s website (vs being optional currently).

- Egypt plans to reopen its airports for international flights by the beginning of Jul, disclosed the aviation minister. International tourists will be permitted to visit only 3 governorates – the Red sea, South Sinai and Matrouh.

- Natural gas consumers in Egypt’s industrial sector have been exempted EGP 5.3bn of debts owed to the ministry, disclosed the minister of petroleum.

- Egypt Parliament approved an amendment to allocate 25% of seats to women, reported Egypt Today. Approval was also given to increase the presidential terms to 6 years from 4.

- In Jun, Iraq seems to be complying with its pledge to compensate and meet its oil production quota, after overproducing 570k barrels per day (bpd) in May: Southern Iraqi exports in the first 14 days of Jun averaged 2.93mn bpd, down 170k bpd from May’s official figures.

- Jordan announced new measures to support its tourism sector: this includes potentially refunding bank guarantees (to the tune of JOD 30mn) submitted by tourism offices during this period, as well as a social security programme for tourism employees. Furthermore, service and sales tax imposed on hotels and restaurants will be halved to 5% and 8% respectively.

- Effective Jun 21st, curfew in Kuwait will be eased to 10 hours, from 7pm to 5am. While the total lockdown on Hawally area has been lifted, its phase 1 of the 5-phase recovery plan will be extended for one more week. Kuwait has made wearing of masks mandatory and public sector employees will not be allowed to return to offices from this week.

- The IMF’s talks with Lebanon continue, according to its spokesperson. He stated that not only was it necessary to understand the source and size of the financial losses, but that the government also needed to implement comprehensive, equitable reforms. Separately, an adviser in the IMF talks quit, citing “no genuine will” for reforms (https://twitter.com/henrichaoul/status/1273639282809462789).

- Lebanon’s central bank governor stated that the daily volume of banknotes being injected into Lebanon’s markets averaged USD 4mn (last Mon-Tues), while assuring that the money was not from BDL’s reserves. However, its effectiveness is questionable, with black market exchangers selling the dollar for around LBP 5,100 on Wed.

- The head of the Beirut Traders Association stated that as many as 50% of Lebanon’s shops and businesses could close by end-2020. He also revealed that 25% had already closed this year in Beirut alone.

- JPMorgan expects Lebanon to contract by 14% this year, following declines of 6.9% and 1.9% in 2019 and 2018 respectively. The bank expects no quick agreement to be reached with the IMF given the ongoing uncertainty regarding debt restructuring plans and scope for structural reforms.

- Oman formed a committee last Sun to study the economic impact of the Covid19 outbreak. Separately, Oman Airports revealed that their readiness to open airports whenever required.

- Though the lockdown in Oman has been lifted, restrictions are still in place on gatherings (of more than 5 individuals) on beaches and other public places.

- Qatar Airways will layoff some pilots while others’ salaries could be cut by 15-25%. Bloomberg reported, citing an internal letter, that Qatari citizens were exempt from wage cuts.

- Qatar Airways disclosed that Boeing and Airbus had been informed that it would not take delivery of new planes in 2020 or 2021. Orders to be delivered within the next 2-3 years will be pushed to nearly 8-10 years, with plans instead to shrink its fleet of around 200 jets.

- In spite of the rising number of confirmed Covid19 cases, Saudi Arabia will initiate the 3rd phase of its recovery plan by opening most commercial activities from today (Jun 20). Mosques in Makkah are also set to reopen with social distancing measures in place.

- The Saudi Industrial Development Fund revealed a SAR 3.7bn (USD 1bn) stimulus package for industrial sector companies. Initiatives will include support for SMEs via deferring or restructuring loans and offering a line of credit to finance up to 3 months of operating expenses.

- Saudi Aramco will use cash and debt to pay Q1 dividends, revealed the company’s chief executive. Aramco completed its purchase of a 70% stake in petrochemicals company SABIC from PIF last week; the payment period has been extended by 3 years to 2028.

- Saudi Arabia’s crude oil exports increased to 10.237mn barrels per day (bpd) in Apr from 7.391mn bpd in Mar.

- FDI flows into Saudi Arabia increased by 7% yoy to USD 4.6bn in 2019, according to UNCTAD’s latest report: this is more than three times the levels reported in 2017.

- Saudi Arabia’s holdings of US treasury bonds declined by 29.05% yoy and 21.2% mom to USD 125.3bn.

- Consumer spending in Saudi Arabia accelerated by 142% in the first week after the curfew was lifted to SAR 7.85bn from SAR 3.25bn (this also includes Eid holidays). More: https://www.arabnews.com/node/1690796/saudi-arabia

- Saudi Arabia’s real estate financing firm Amlak disclosed plans to float 30% of its shares. A book-building process will start on Jun 22, with the final offer price announced on Jun 30.

- Business sentiment in the region seems to be waning: according to PwC’s Covid19 CFO pulse survey, nearly 72% of CFOs in the region believe that the economy will take at least three months or more to recover from the pandemic, up from 66% five weeks ago. About 42% expect recovery to take 6 or more months, compared to 37% globally though UAE is relatively more optimistic (33%).

- IMD’s World Competitiveness report places UAE as top in the region and 9th most competitive globally. Saudi Arabia ranked 24th globally (up from 26th last year) and is the only Middle East nation to improve its ranking. Singapore topped the list, followed by Denmark, Switzerland and Netherlands.

UAE Focus

- UAE’s central bank disclosed that 26 banks had availed 88% of the AED 50bn liquidity facility (with 17 banks drawing down 100%). Overall, more than 180k customers have benefitted, with the total deferral value estimated at AED 8bn.

- In Ajman, around 1,884 economic establishments benefited from exemption of license renewal fees.

- Dubai allowed the resumption of more activities (including visits to public libraries, private museums etc.) as well as allowing children under the age of 12 and those above 60 to visit malls and other public areas. Social distancing measures remain in place as well as the recommendation of wearing face masks. However, a travel ban is still in place in Abu Dhabi (till Tues this week) for the 3rd consecutive week with permits required to enter the emirate.

- Abu Dhabi refunded AED 8mn (USD 2.1mn) to 220 businesses, as part of the initiative to refund 20% of the annual rental value on their commercial property leases worth AED 1bn. About 8,000 business units currently qualify to apply.

- Money supply (M3) in the UAE increased by 1.8% to AED 1.748bn as of end-May. The central bank’s current account balance touched AED 34bn with banks’ required reserves at AED 194.3bn.

- Inflation in Dubai declined by 3.49% yoy in May, with utilities and transport costs down by 6.26% and 12.4% respectively while food and beverage costs were up 5.47%.

- Abu Dhabi’s newly structured Musataha agreements will provide opportunities for private sector companies to develop land owned by government agencies.

- Ship fueling activity in UAE’s Fujairah fell in May: ship refueling, or bunkering, volumes shrank to about 200k-300k tonnes, down from average volumes of about 700k-800k tonnes.

- Islamic economy sectors in Dubai grew by 2.2% yoy in 2018, contributing AED 41.8bn (USD 11.38bn) to the emirate’s GDP.

- Emirates airlines will be providing connections via Dubai for 40 destinations’ travelers, after the addition of 10 new cities from 20th Jun onwards.

Weekly Insights

Charts of the Week

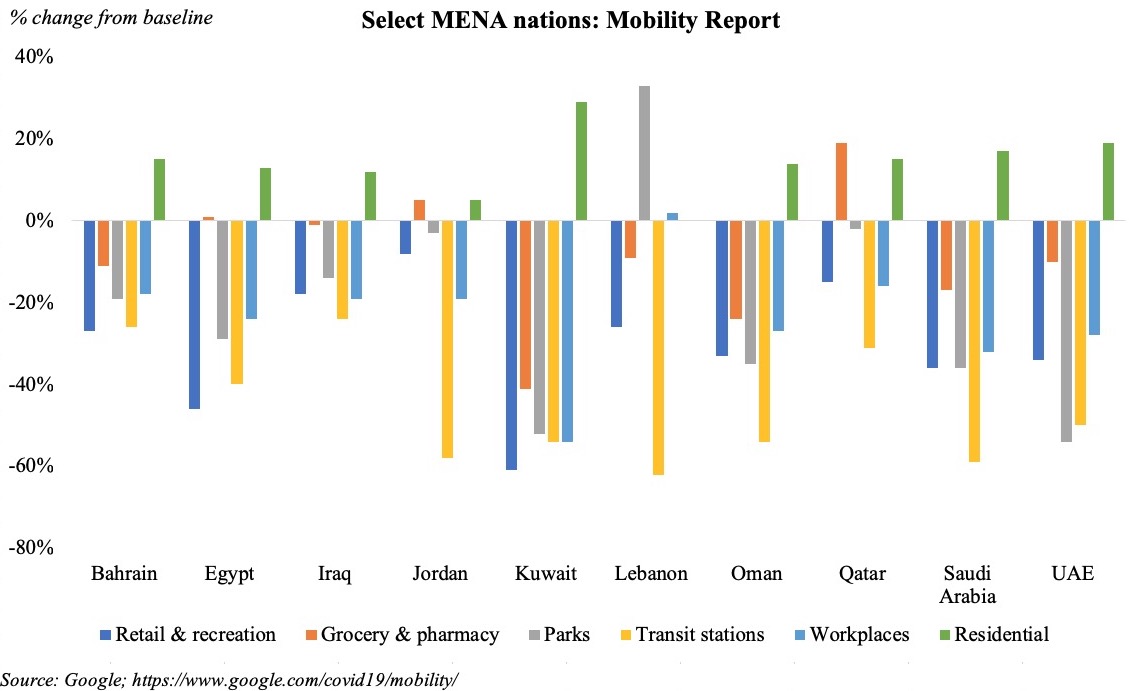

Fig 1. Google mobility reports show an increase in activity as nations in the Middle East ease restrictions

Notes: The reports show trends over several weeks with the most recent data representing approximately around June 14th. Changes for each day are compared to a baseline value for that day of the week: The baseline is the median value, for the corresponding day of the week, during the 5-week period Jan 3–Feb 6, 2020.

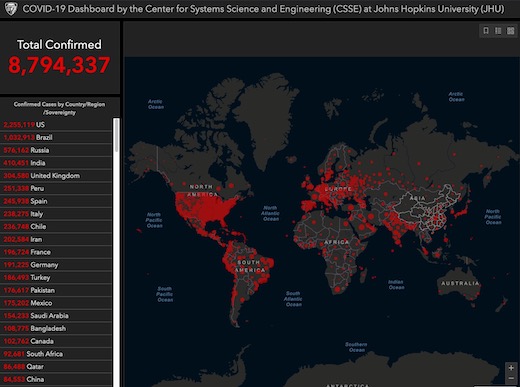

Covid19 confirmed cases in the Middle East crossed 645k, with GCC and Iran accounting for around 55% and 30% of the cases respectively. With restrictions easing, number of visitors to grocery and pharmacy are inching closer to (or surpassing) the period before the pandemic (see Qatar, Jordan, Egypt, Iraq, Lebanon UAE) while the ‘residential’ category (which shows a change in duration of time spent at home) has declined compared to a few weeks ago indicating that people are no longer as confined to home as during the lockdown period. Other than in Kuwait (which is still in Phase 1 of the recovery plan), more employees are returning to work (and hence a move closer to the baseline). Recovery in retail and recreation seems to be slower in comparison: Kuwait is still 61% lower compared to the baseline while Egypt and Saudi Arabia are down 46% and 36% respectively.

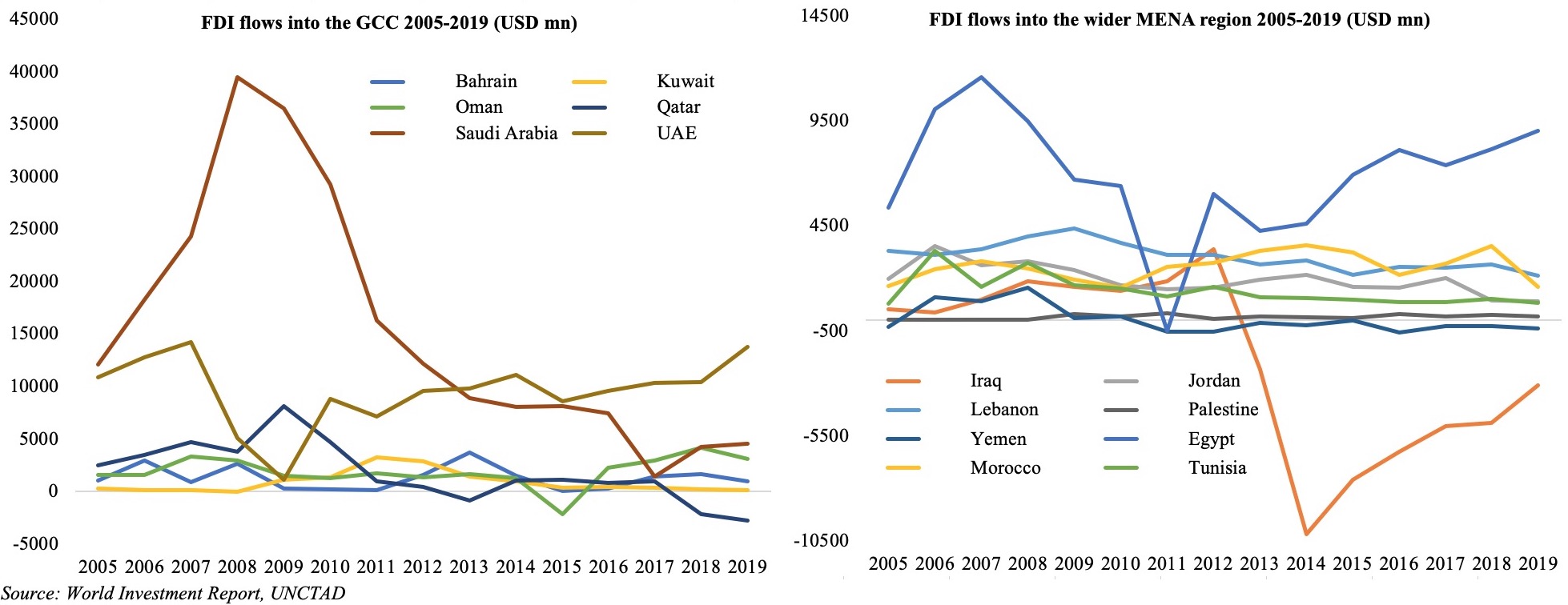

Fig 2. Foreign Direct Investment in the Middle East and North Africa

Both UAE and Saudi Arabia witnessed a pickup in FDI last year while the West Asia region as a whole reported a 7% dip in FDI inflows (to USD 28bn). In the North Africa region, Egypt was the largest recipient – attracting USD 9bn in 2019 (+11% yoy). FDI inflows into the MENA region saw a sharp decline in 2009-10 (after a strong decade) a result of the financial crisis and regional turbulences (the Arab “Spring”) and hit lows again in 2015 during the period of declining oil prices. With the onset of the Covid19 pandemic, FDI inflows are likely to be negatively affected: the value and number of announced greenfield projects in Q1 2020 declined, by 56% yoy and 34%, respectively, compared with the quarterly average of 2019. The saving grace could be announcements of new infrastructure projects (to mitigate the impact of Covid19) and recent regulatory changes (e.g. permitting 100% ownership and easing of investor licenses in Saudi Arabia).

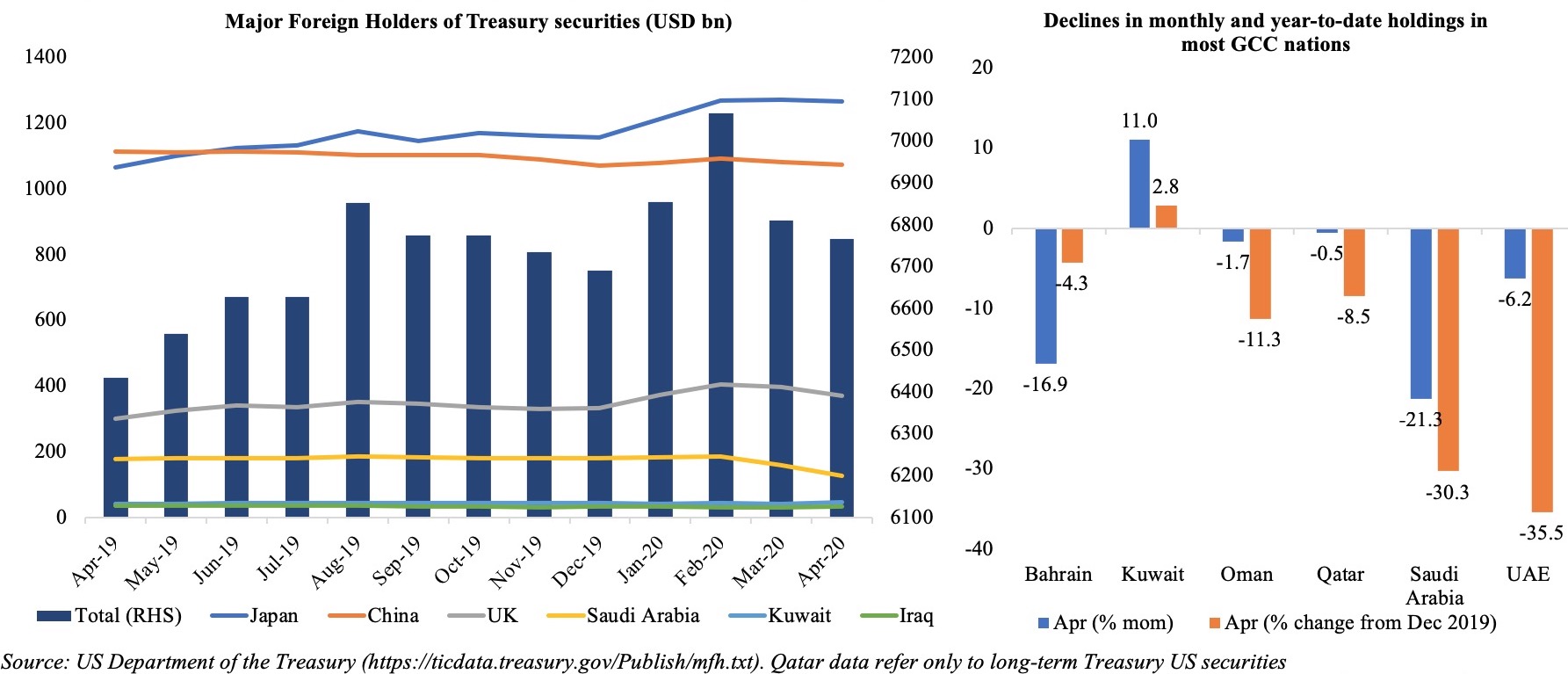

Fig 3. Saudi Arabia, Kuwait and Iraq are among the largest foreign holders of US Treasury securities; holdings are declining in most GCC nations

As oil prices stay low, recycling of petrodollars has reduced and there has been a substantial decline in holdings of US Treasury securities by Saudi Arabia. At USD 125.3bn in Apr 2020, its share has fallen to just 1.85% of total in Apr, from 2.74% a year ago. Decline in holdings are visible across all the oil exporting GCC nations (except Kuwait).

Media Review

IMF: The Great Lockdown through a Global Lens

https://blogs.imf.org/2020/06/16/the-great-lockdown-through-a-global-lens/

Six things to know about India-China economic relations

https://www.bloombergquint.com/economy-finance/six-things-to-know-about-india-china-economic-relations

JP Morgan’s roadmap toward an oil ‘supercycle’

https://www.arabnews.com/node/1690446

Covid-19 has squeezed migrants’ remittances to their families

https://www.imf.org/external/pubs/ft/fandd/2020/06/COVID19-pandemic-impact-on-remittance-flows-sayeh.htm

https://www.economist.com/finance-and-economics/2020/06/15/covid-19-has-squeezed-migrants-remittances-to-their-families

Saudi Arabia’s Peaking Virus Cases Aren’t Slowing Its Reopening

https://www.bloomberg.com/news/articles/2020-06-19/saudi-arabia-s-peaking-virus-cases-aren-t-slowing-its-reopening

Economic and Political War in Lebanon (Arabic)

https://www.independentarabia.com/node/114961

The Fallout of the War: The Regional Consequences of the Conflict in Syria

https://www.worldbank.org/en/news/press-release/2020/06/17/fallout-of-war-in-syria

https://openknowledge.worldbank.org/bitstream/handle/10986/33936/The-Fallout-of-War.pdf

Market Snapshot as of 21st June 2020

Weekly % changes for last week (18-19 Jun) from 11th Jun (regional) and 12th Jun (international).

Powered by: