Weekly Insights 8 Jul 2021: Diverging PMI readings, Saudi’s new import rules & Oman’s IMF TA request

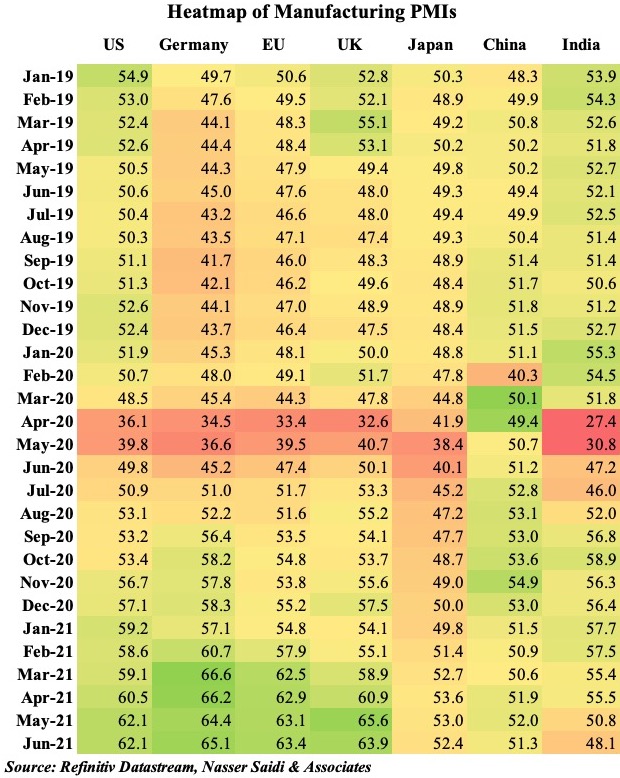

1. Global Manufacturing PMI near multi-year highs; PMIs slow in Asia as a more severe wave of the pandemic hits

- Global manufacturing PMI slipped to 55.5 in Jun, easing from the 11-year high of 56 in May, with Europe the “bright spark” while Asia paled in comparison (India fell into contractionary territory after 10 months; PMIs in Vietnam and Malaysia plunged to 44.1 and 39.9 respectively).

- Supply disruptions continued, and average vendor lead times “lengthened to the greatest extent in the near 24-year survey history”; average input prices “rose to one of the greatest extents in the survey history”.

- Asia is witnessing a more severe wave of Covid19 cases in the past weeks: of every 100 infections last reported around the world, about 35 were reported from countries in Asia and the Middle East. The region is currently reporting a million new infections about every 7 days.

- While new orders are rising, lockdowns/ restrictions are causing delays and disrupting shipping, with some estimating that the impact could affect shipments as far out as Christmas this year.

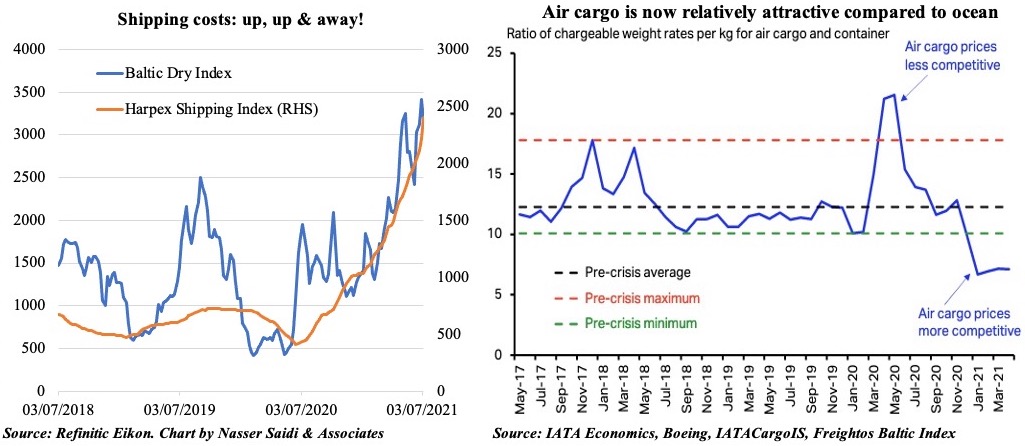

2. Shipping costs are still on the rise => air cargo relatively attractive

- Global shipping costs (especially on long-distance routes) continue to rise, as demand recovers amid shortage of containers. According to Sea-Intelligence, Feb 2021 marked the height of container congestion, with almost 12% of global container capacity (around 2.8m TEU) absorbed in vessel delays. In Apr 2021, the congestion figure was at 8.6% or 2.1mn TEU. Increase waiting times at the Yantian port in Jun imply more congestion.

- So, air cargo is now relatively attractive compared to containers price-wise (vs. Q2 2020 when aircrafts were grounded & hence air cargo fares spiked): IATA. Furthermore, the speed of air cargo provides another competitive edge. Cargo tonne km (CTKs) flown in May 2021 were 9.4% above pre-crisis level (May19), though slowing from Apr’s 11.3% reading.

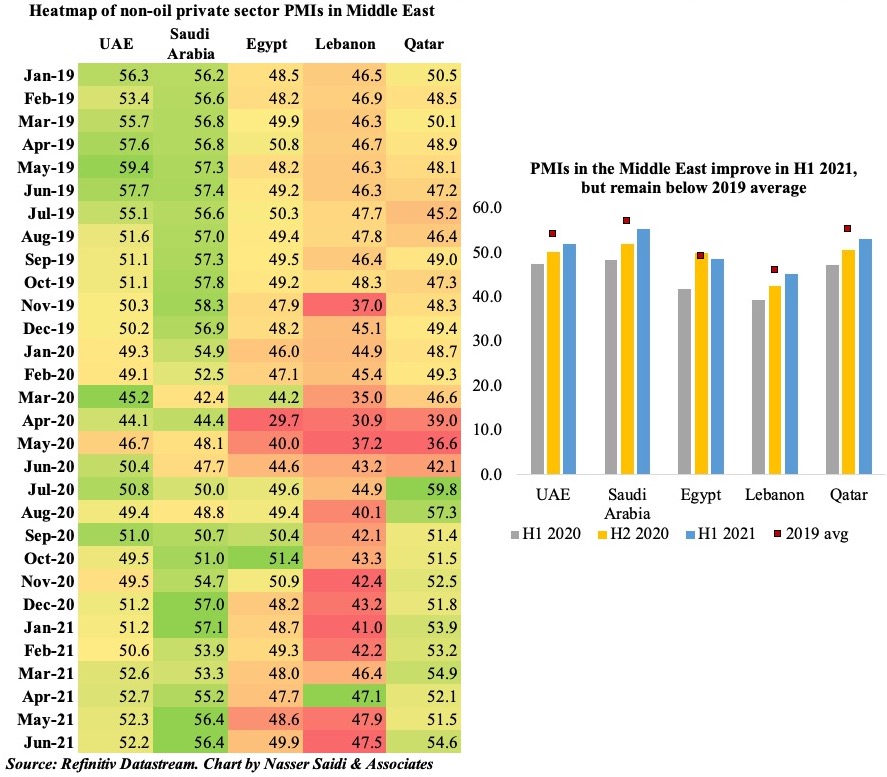

3. Mixed PMI readings in the Middle East: Lebanon and Egypt stay below-50

- While PMIs improved in H1 2021 vis-à-vis last year, it still remained well below the 2019 average

- Though UAE PMI edged down slightly in Jun, as foreign sales dropped amid supply delays, employment rose for the first time since Jan and at the quickest pace in more than two years. In Saudi Arabia as well, job creation rose at the fastest pace since late 2019

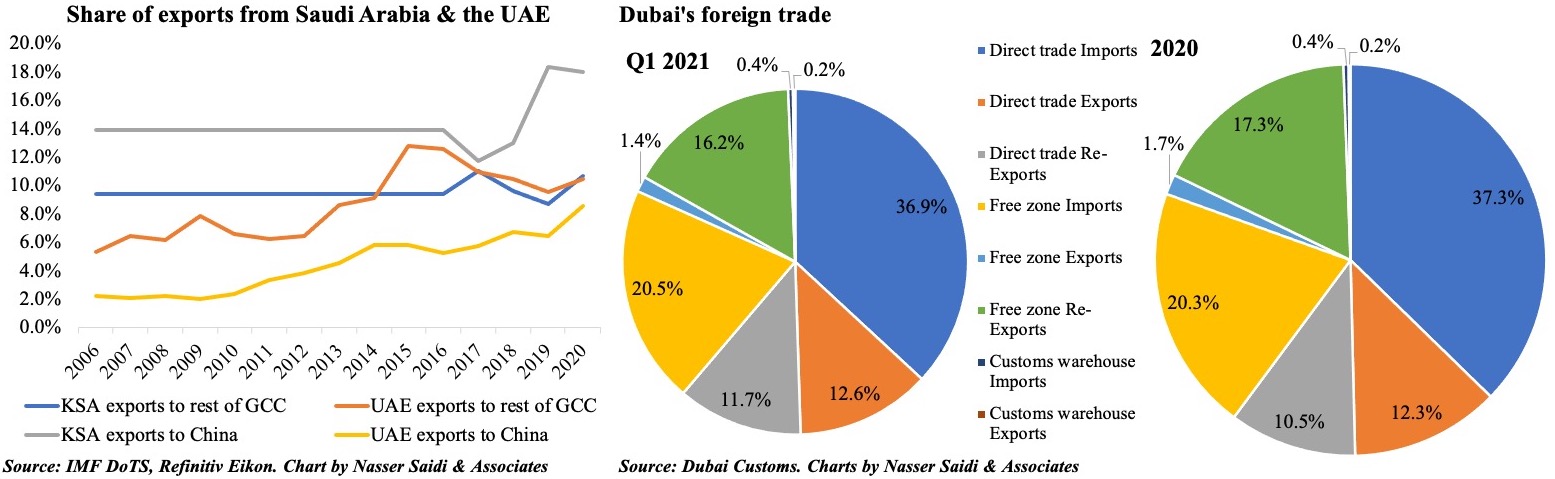

4. Saudi Arabia’s rules on local content, labour & value-added: impact on GCC trade?

- The GCC customs union agreement (Jan 2003) was designed for highly oil-dependent economies and importing goods and services from the EU, US & Japan to a lesser extent.

- Since 1973 there has been a tectonic shift in global economic geography towards Asia with China the main trade partners for most GCC nations. At end-2020, China accounts for around 1/5th of Saudi’s total exports; for the UAE, it stands at around 10% of total exports. In contrast, intra-GCC trade stood at just above USD 90bn as of end-2019 (GCC Secretariat), a trivial 5.5% of GDP.

- The GCC agreement & subsequent amendments also did not account for the rapid growth of production and exports from the free zones and/ or special economic zones leading to the current dispute concerning the domestic content of trade.

- Free zone trade is significant for UAE/ Dubai, given the operations of Jafza: in 2019, Jafza generated trade worth USD 99.5bn (roughly about the value of intra-GCC trade!)

- The GCC agreement and subsequent limited amendments also did not account for the rapid growth of production and exports from the free zones and/ or special economic zones leading to heightened competition between Saudi products & UAE FZ/SEZ exports.

- The GCC nations have not adapted to these changed domestic and external structural changes, hence the pressure on the customs union and on trading rules (such as domestic content).

- The GCC needs to move to a new trade and investment agreement (replacing the customs union) and moving to a true common market that allows for deep integration (including for trade in services and labour mobility), allowing the GCC to benefit from economies of scale resulting from more open and greater market size, which would be a magnet for FDI.

- A new GCC-wide deep trade & investment agreement would also allow the GCC to negotiate as a bloc with the EU, China, ASEAN, USMCA and emerging African trading blocs, a must for participation in global value chains.

- Short-term impact: certain goods will be excluded from preferential tariffs implying an increase in customs duties and consequently the cost of doing business. UAE, a major re-exporting hub, is Saudi Arabia’s second largest trade partner after China (w.r.t import value).

- The current dispute, while disruptive in the short-term, can open the door to a more efficient, modern, trade & investment framework and agreement that would boost growth prospects and allow for greater diversification, higher value-added regional trade (rather than re-exports from the rest of the world) and integration into evolving global value chains.

5. Is Oman’s technical assistance (TA) request timely?

- Oman has requested for Technical Assistance from the IMF to help it develop a medium-term debt strategy and strengthen its fiscal structure, given high budget deficits & jump in debt to GDP in 2020.

- Oman’s non-oil economy grew by 5.7% to USD 14.8bn in Q1 2021: NCSI. However, with a 20.6% plunge in oil sector activity, overall GDP contracted by 2.5%. The IMF forecasts 2.5% growth this year, given a recovery in aggregate demand post-vaccine rollout (21.5% of population has received at least one dose).

- There have been several recent positive policy developments

A.On the fiscal side: (a) 5% VAT introduced; (b) expected to phase out water and electricity subsidies by 2025; (c) ongoing discussions re the introduction of income taxes for high-income earners

B.Institutional reforms: two new agencies were established: (a) the Oman Investment Authority to improve management of public assets and maintain oversight of State-owned Enterprises; and (b) Energy Development of Oman to manage and finance investments in energy

- However, Oman’s debt-to-GDP ratio surged to 80% in 2020, from about 15% in 2015 & given fiscal/ financial support during Covid19, budget deficit widened to 19.3% of GDP. The latter is esitmated to ease this year, to 2.4% of GDP. Fiscal reform is required to ensure fiscal & debt sustainability.

- Oman has been tapping the international debt markets in 2021: raised USD 1.75bn in nine-year sukuk in Jun (2nd transaction in international debt markets, following USD 3.25bn in 3-part bonds in Jan).

- Other than fiscal, another major issue is that of unemployment: unemployment in Oman was estimated at 4.97% by ILO in 2020 (2019: 1.8%). More importantly, in 2019, youth unemployment was at 11.6% & female youth unemployment at a massive 36.3%. Covid19 last year would only have further exacerbated this.

- Oman’s request for TA could be the precursor for an IMF-sanctioned reform programme. Egypt has seen the benefits of reform measures, being the only MENA nation to post a positive growth in 2020

Powered by: