As a region, the Middle East is a small player compared to its global counterparts. However, within the region, some key players are highly dependent on tourism for economic activity and growth. With the drastic reduction in travel as a result of restrictions during Covid19, which economies are stressed and how can they recover? Will the UAE-Israel accord support tourism?

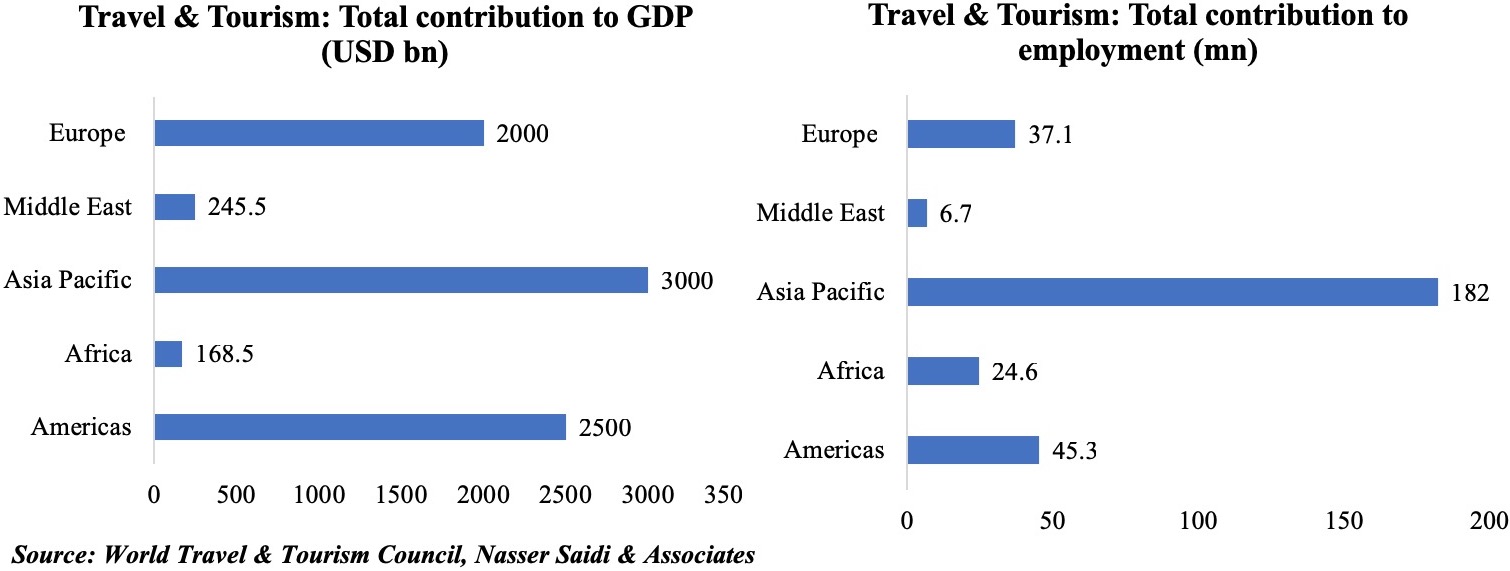

Travel and tourism contributed to 10.3% of global GDP in 2019, also accounting for 1 in 10 jobs across the globe, according to the World Travel and Tourism Council (WTTC). In comparison to its counterparts, the Middle East does not feature among the top regions for tourism (be it contribution to GDP or employment). However, it did register as the 2nd fastest growing region last year, behind Asia-Pacific. Thanks to Saudi Arabia, which was identified the fastest growing nations in terms of travel and tourism GDP last year (+14% yoy growth) as the nation opened up to international tourists (not limited to religious tourism). Fastest growth was also recorded in Tunisia (+12.9% growth) and Kuwait (+11.6%).

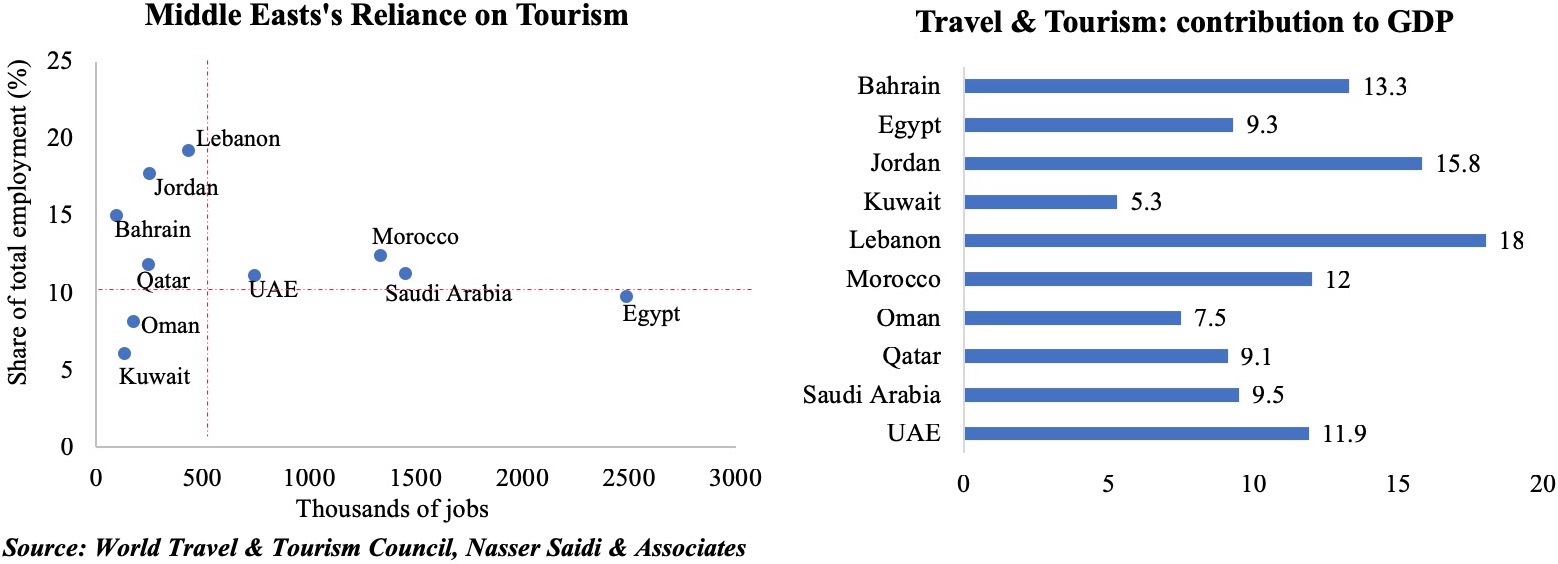

Within the Middle East, countries vary in its dependence on the travel and tourism sector: ranging from Lebanon’s high dependence (close to 20% of GDP) to the UAE (11.9% of GDP) to a lower 5%+ for Kuwait. For the GCC nations, with plans of greater diversification came a rising dependence on tourism. The UAE was one of the earlier adaptors of this model, Saudi Arabia is the latest. Oman is a good example of balanced domestic and international spending (42% and 58% respectively) while the dependence on international tourists is higher in Lebanon (89% of total spending), Qatar (84% of total) and UAE (77% of total).

With the outbreak of Covid19, international travel had come to a standstill (42% of total global fleets are parked vs. 6% in the start of 2020[1]) and the travel and tourism sector took a drastic hit. Middle East’s full year air traffic is expected to plunge by 56% yoy in 2020, with job losses at an estimated 1.5mn (of a total 2.4mn aviation-related employment, according to International Air Transport Association (IATA). Nations that permit domestic tourism are likely to recoup some losses, as international visitor arrivals are likely to remain muted in the near-term. A recovery in business travel will also lag compared to leisure travel – a recent research paper however states that this could have a much larger and durable impact on economic growth. If UAE-based businesses stopped travelling, it would result in an estimated 0.06% loss in global GDP and the impact would be felt most in Oman, Saudi Arabia, Kuwait, Lebanon and Iraq.

The WTTC estimates travel and tourism sector job losses to range between a low of 2.7mn (best case scenario, i.e. domestic travel from Jun, intercontinental travel resumes in Aug) to a high 4.9mn (worst case, i.e. domestic travel from Sep, intercontinental travel resumes in Nov) in the wider Middle East. The share of tourism related employment is higher than 10% for a majority of the nations, implying that potential job losses would have a significant impact on overall growth.

It is little wonder then that many nations are scrambling to re-attract tourists: be it Egypt opening its borders for international tourists to its seaside resorts or UAE’s Dubai opening up to international tourists (from July 7th, subject to negative Covid19 test results & no quarantine period) or Jordan opening its doors to domestic travel (for its citizens and resident expats).

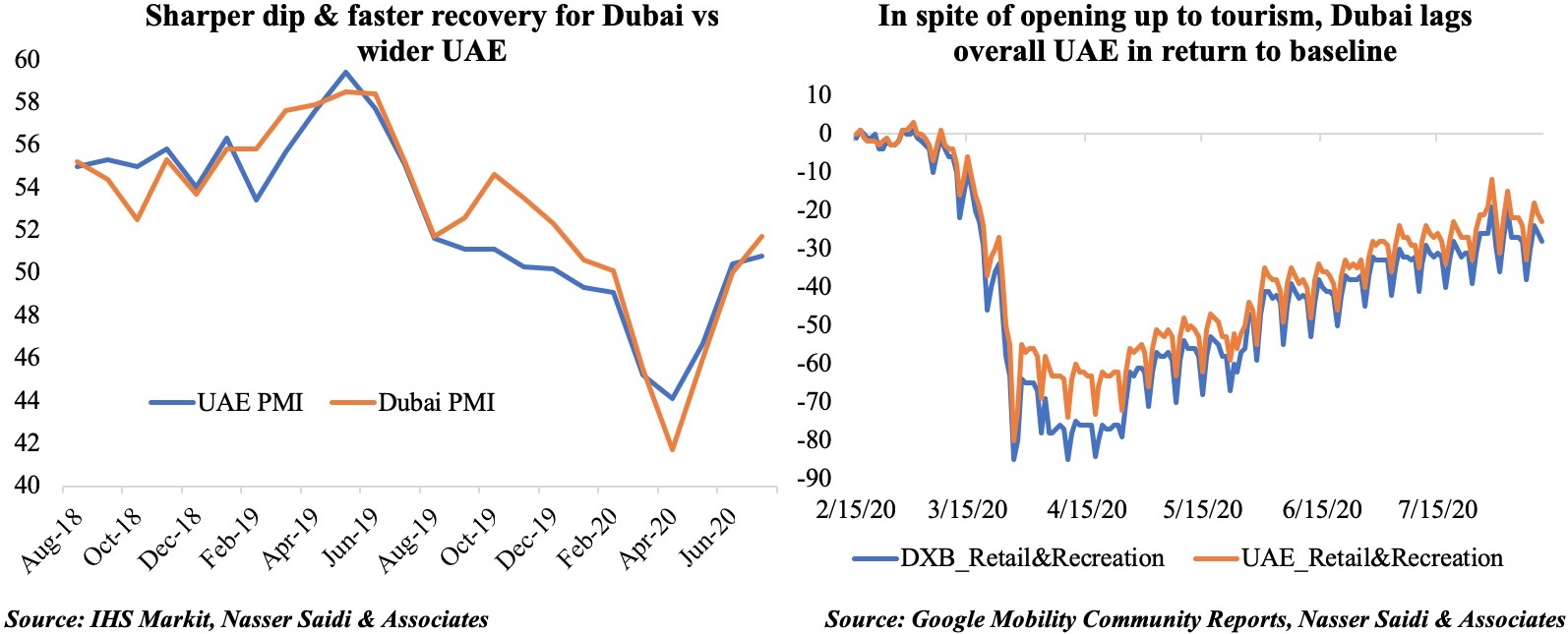

Did the opening up of Dubai lead to an improvement in economic activity? Data is a significant limitation to understand tourist arrivals[2], spending and the like. However, we take two proxies to analyse the situation: one, Dubai PMI (which includes travel and tourism) and two, the retail and recreation indicator from Google Mobile Community reports (data till 11th Aug 2020). Dubai PMI moved into expansionary territory in Jul (51.7 from June’s neutral 50-reading), with business activity rising across all sectors and travel and tourism posting the first rise in activity in 5 months as tourism restarted. Dubai PMI’s plunge was more severe than the UAE PMI during the outbreak, but it also seems to have recovered at a relatively faster pace. However, this optimism doesn’t seem to have translated into the retail and recreation indicator.

Dubai still lags the overall UAE in terms of return to the baseline[3]. Potential explanations could be a permutation-combination of the following:

(a) International tourism has not recovered by much. Dubai’s top source markets last year were India (visit visa holders from the country have been permitted into Dubai only a few days back), Saudi Arabia (international flights haven’t resumed yet), UK (flights are open, but Britons need to quarantine for 14 days on return), Oman (visits permitted since Jun 2020) and China (international flights growth are down 74% yoy during the period 1 Jan 2020-16 Aug 2020);

(b) International tourists have entered, but not spending as much as before;

(c) Movement restrictions between Abu Dhabi – Dubai have resulted in the former’s residents opting to visit retail/recreation centres within the emirate than destinations in Dubai;

(d) Job losses (resident expats have moved back to their home countries) and salary cuts (tightening of belts) has meant a slow pace of pickup in activity.

What can be done to support and improve economic activity in the travel & tourism sector?

- The new normal: social distancing policies and new hygiene standards (e.g. hygiene kits at airports, no-touch lift buttons) are likely to stay till an effective vaccine is administered across the globe. This will restore tourists’ confidence.

- Encourage, market & promote domestic/ regional tourism, thereby supporting the hospitality sectors. An example is the strategy of Singapore encouraging locals to “discover hidden gems”. Once regional borders open up, driving to nearby regional (less-crowded) destinations might be preferred to flying. An aggressive pricing strategy (e.g. discounts on flight tickets, entry prices to tourist sites) could see a substantial difference in the pace of recovery.

- Continued support for the sector: governments need to support SMEs in this sector. Most used options have been addressing liquidity issues by deferring payments, increasing availability of credit, reduction in/ removal of government fees; firms could also encourage upskilling to improve staff quality.

- A digital transformation and rethink of tourism strategy: to include no-queue direct immigration to hotel check-in, virtual/ remote tourism experiences (e.g. Lourve Abu Dhabi’s permanent collection to go online by end-2020 or Instagram live sessions by local tour guides), online/ hybrid MICE events (shift to smaller scaled/ local functions & cost-effective). In addition, health components should be integrated with travel (e.g. to enable track and trace, digital health profiles) and availability of good health facilities in tourist destinations might also provide peace of mind to travelers.

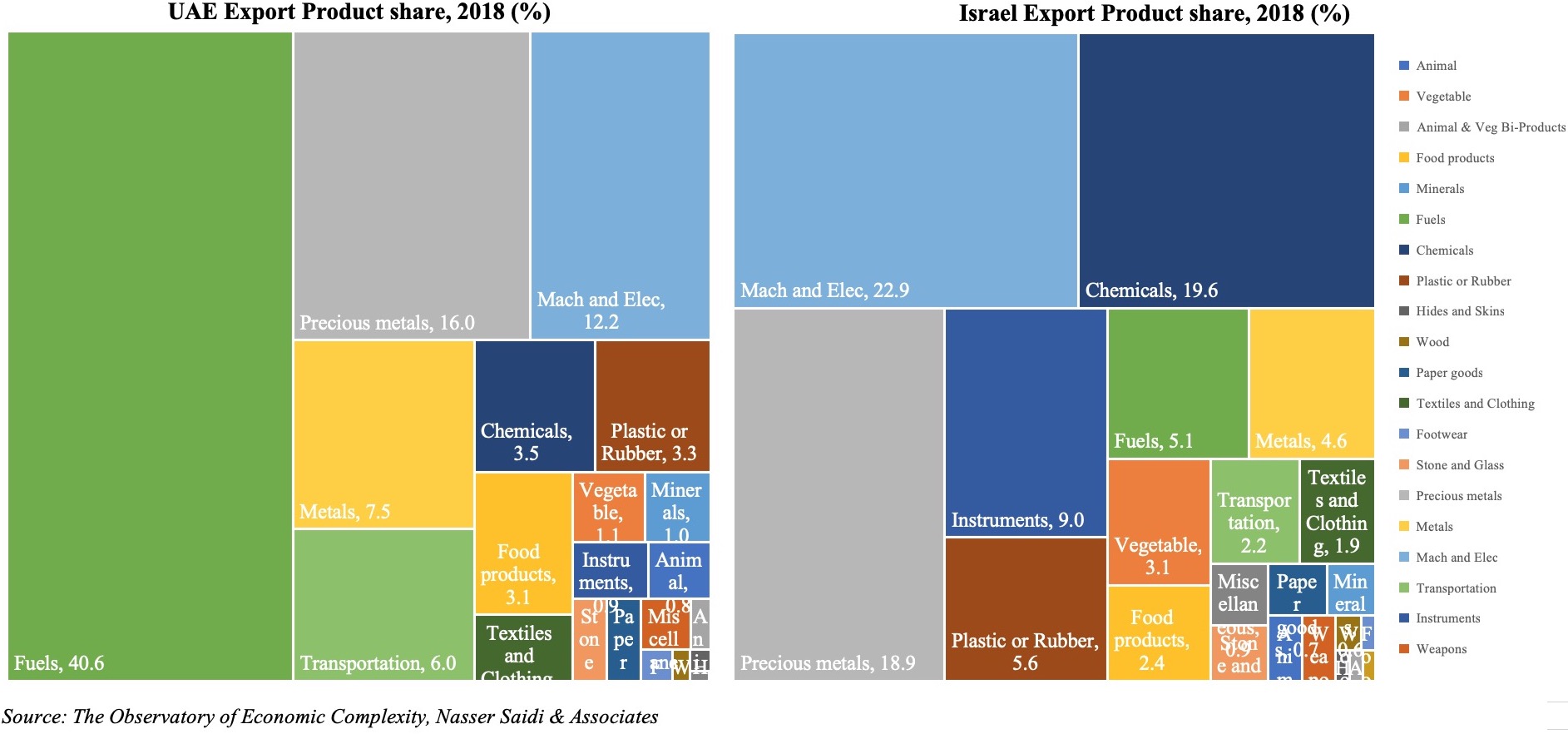

Last, but not the least, the opening up of UAE-Israel relations will support the tourism sector. The main beneficiary sectors are likely to be trade (see chart below) and travel (new destinations for UAE’s Emirates and Etihad airlines, allowing entry of new set of tourists), with additional opportunities in the high-tech sector (where Israel has a comparative advantage).

[1] Source: “Impact of Covid19” infographic, Cirium, Jun 2020.

[2] Anecdotal evidence from Jumeirah hotels suggest a doubling of online bookings week-on-week the week after allowing entry to international visitors.

[3] Changes for each day are compared to a baseline value for that day of the week: The baseline is the median value, for the corresponding day of the week, during the 5-week period Jan 3–Feb 6, 2020.

Powered by: