Weekly Insights 15 Jul 2021: Covid19 cases, vaccination & beyond (MENA & UAE) + Saudi-Omani cooperation

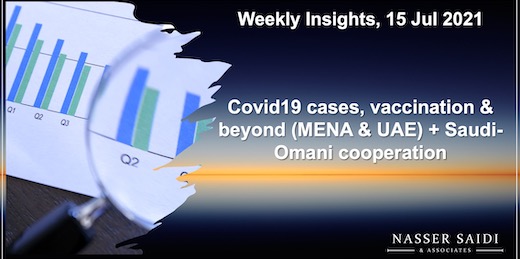

1. Covid19 outbreak continues to rise in parts of the Middle East and North Africa (MENA)

- Cumulative Covid19 cases in the MENA region have surpassed 10mn.

- The GCC, which accounts for 14% of the population accounts for just over 1/5th of the cases; Iran, home to 21% of the region’s population, accounts for just over 1/3-rd of cases.

- Bahrain, which had seen a massive spike in cases (reaching close to 2k daily cases per mn persons) towards end-May, has come down significantly. Kuwait, Oman and UAE have the highest readings as of this week.

- At least 14 out of the 22 countries in the region have now logged the new, more infectious variant (WHO) & surges are visible in many nations including the UAE, Libya, Iraq, Morocco and Tunisia among others.

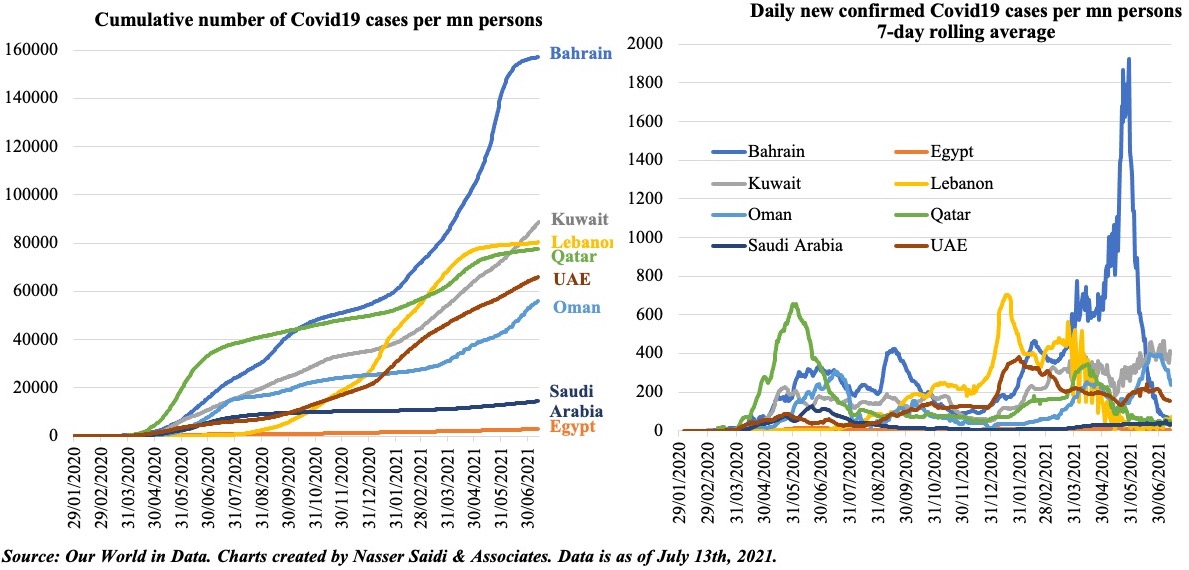

2. Vaccination is the best way out of the pandemic amid adoption of Stringent Policy Measures

- As the Delta variant spreads, empirical evidence shows that vaccine are key in preventing hospitalizations – hence the urgency to increase vaccination pace across the MENA region.

- Egypt and Saudi Arabia are the least stringent in the MENA region; Lebanon, after weeks of high stringency levels, seemed to have its cases under control (from near 3,500 daily cases in mid-Mar to just 150 end-Jun).

- Oman, where cases are currently 44% down from the peak in Jun, continues to remain cautious: it has announced lockdowns during the Eid holidays next week & remains the most stringent. Its vaccination pace is the slowest among the GCC nations, with only 5.3% of the population fully vaccinated.

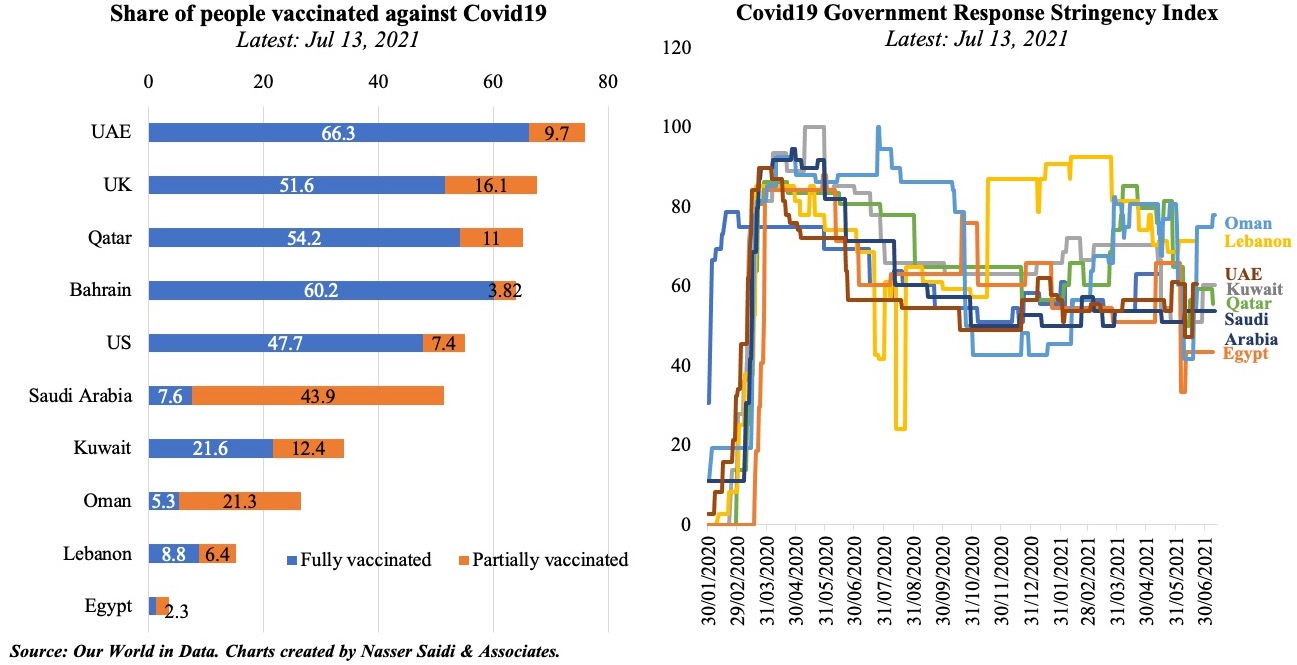

3. Vaccination pace in the Middle East has quickened, but with wide disparities

- There has been a significant vaccine divide across the Arab world, with the richer oil producing/ exporting GCC nations running successful campaigns versus the relatively poorer parts of Yemen.

- UAE and Bahrain are top ranked at the global level, having successfully administered 162.2 and 129.8 doses per 100 persons respectively; these nations have also started providing a booster shot to those that have been vaccinated for more than 6 months. However, the region is also home to Yemen where only 1 dose has been administered per 100 persons (vs 0.06 in mid-May) and 2.7 doses in Iraq (vs 0.07 in end-Mar).

- Vaccination pace has substantially quickened compared to mid-Mar and is likely to continue as more production comes online, including from the region’s economies: UAE’s Hayat-Vax and Egypt’s Sinovac.

- Faster the vaccination pace, shorter the path to herd immunity and return to near-normalcy in terms of economic activity – albeit with social distancing and masks.

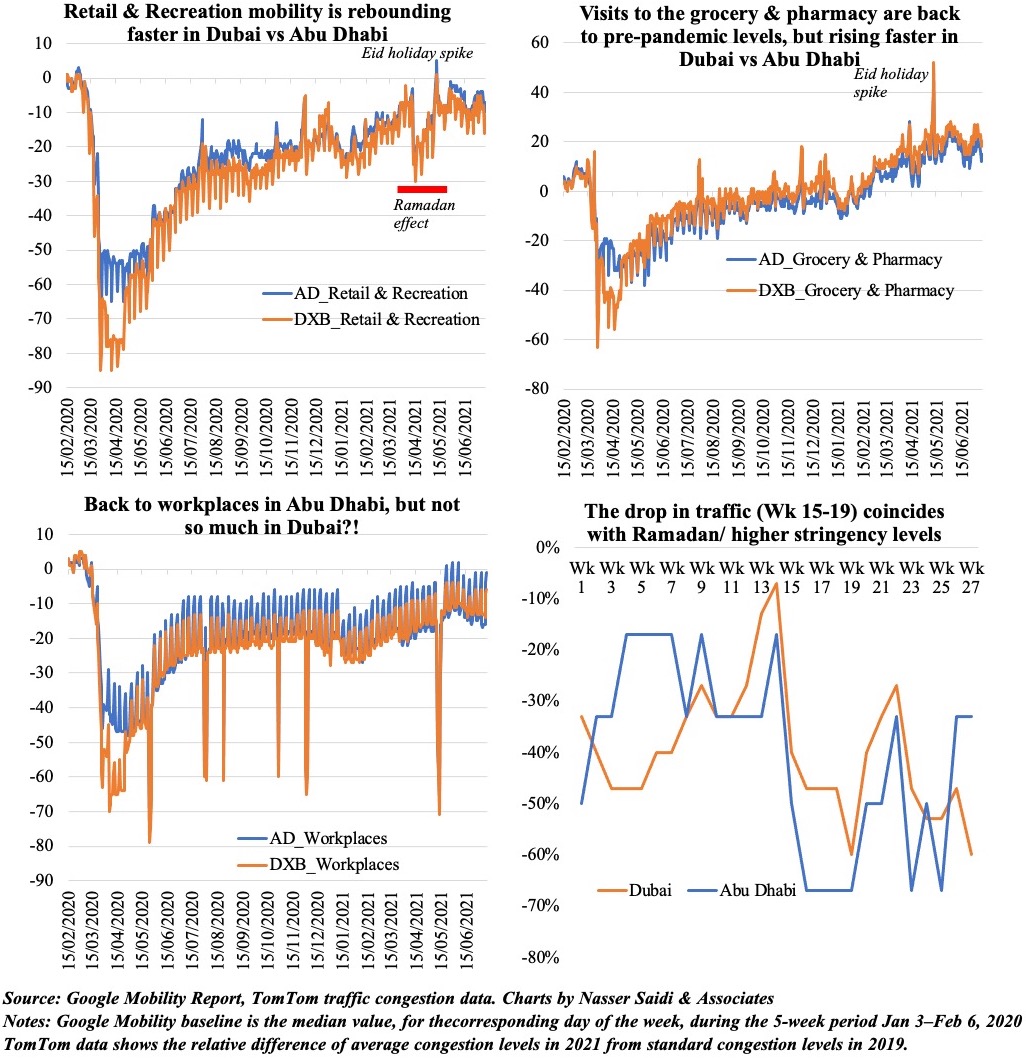

4. Mobility improves in the UAE

- Given its relatively lower stringent levels, it is no surprise that both Dubai and Abu Dhabi (within the UAE) report a rise in mobility across different categories

- Retail & recreation remains below pre-pandemic levels: with a significant drop during Ramadan and a spike for Eid

- Interestingly, grocery and pharmacy visits have crossed to pre-pandemic readings, though Dubai has higher footfall than Abu Dhabi

- Weekly traffic congestion moves in line with stringency, though Abu Dhabi is picking up faster vis-à-vis Dubai – also reflected in workplace mobility

- With Eid holidays next week, anecdotal evidence suggests high levels of domestic & international tourism –latter limited to neighbouring nations (flights to India are still suspended; UAE stays on the UK’s red list)

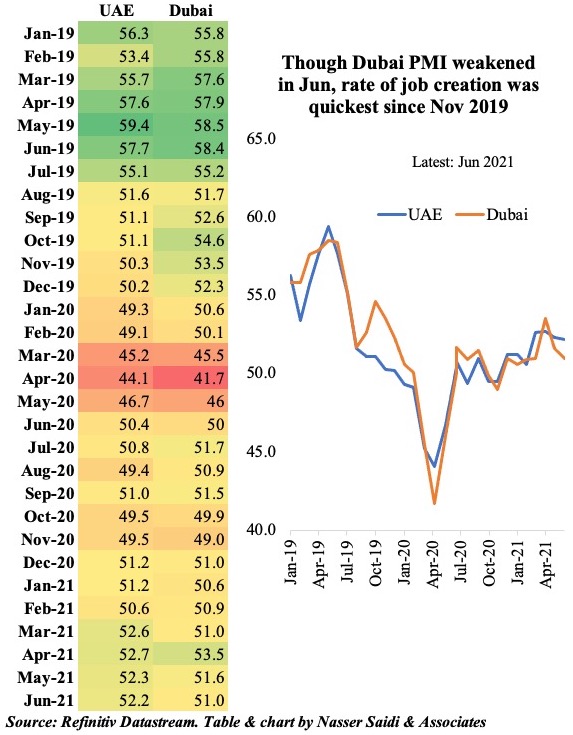

5. Both UAE & Dubai PMIs show expansion, though pace has slowed

- UAE PMI edged down by 0.1 points to 52.2 in Jun; Dubai PMI eased by 0.6 to 51.6

- The silver lining was employment in both: increased at the fastest pace since 2019; but it is slower than the long-run series average. Expo starting in Oct will also add create new employment opportunities

- Raw material shortages were widely reported, affecting output growth

- Supply chain problems + rising freight costs + lengthened delivery times meant rise in purchasing costs => input cost inflation

- Survey respondents highlighted low sales; export sales fell in UAE given flight cancellations

- Vaccination pace + less stringent measures + “open for tourism” + reforms (100% foreign ownership, long-term visas) implies that a recovery is underway, but high number of daily cases (~1500) & new variants are cause for concern

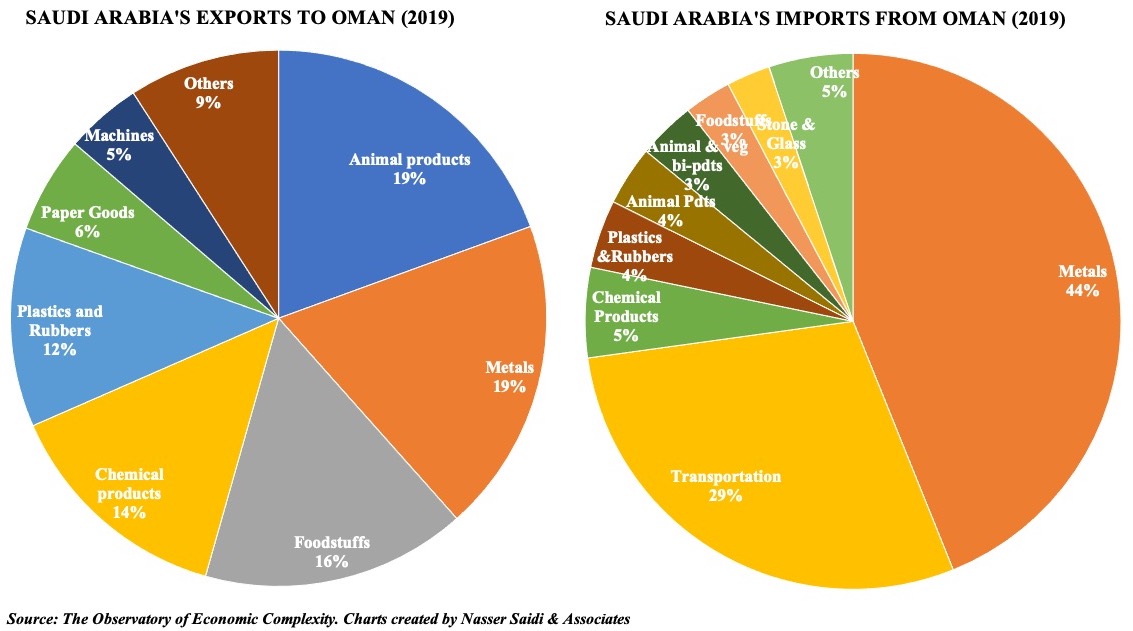

6. Saudi Arabia & Oman: long-term cooperation

- Oman’s Sultan visited Saudi Arabia this week: his first foreign trip since his ascension.

- Economic cooperation on many fronts likely to benefit from the discussions: trade, investment and infrastructure among others (in addition to security, cultural & other diplomatic discussions)

- Trade: Oman’s exports to Saudi Arabia stands at roughly 5% of total exports, but in the recent years, transportation materials have accounted for a substantial part of its exports to Saudi (chart)

- Investment: Saudi Arabia is considering developing an industrial zone in Oman; last month, an Omani delegation presented around 150 investment opportunities worth an estimated OMR 1.5bn across multiple sectors including real estate, tourism, food security as well as renewable energy among others

- Infrastructure: the Omani-Saudi road connection will reduce cost of transport, travel time & facilitate movement of goods.

- Other opportunities abound (non-exhaustive list):

- Though oil remains a major export item for both nations, there is a conscious effort to move to cleaner energy including solar, wind & now green hydrogen.

- Privatisation programs/ stakes in state-owned entities (including monetization of energy assets)

- Saudi Tadawul/ Nomu could offer attractive listing / cross-listing opportunities

Powered by: