Download a PDF copy of this week’s insight piece here.

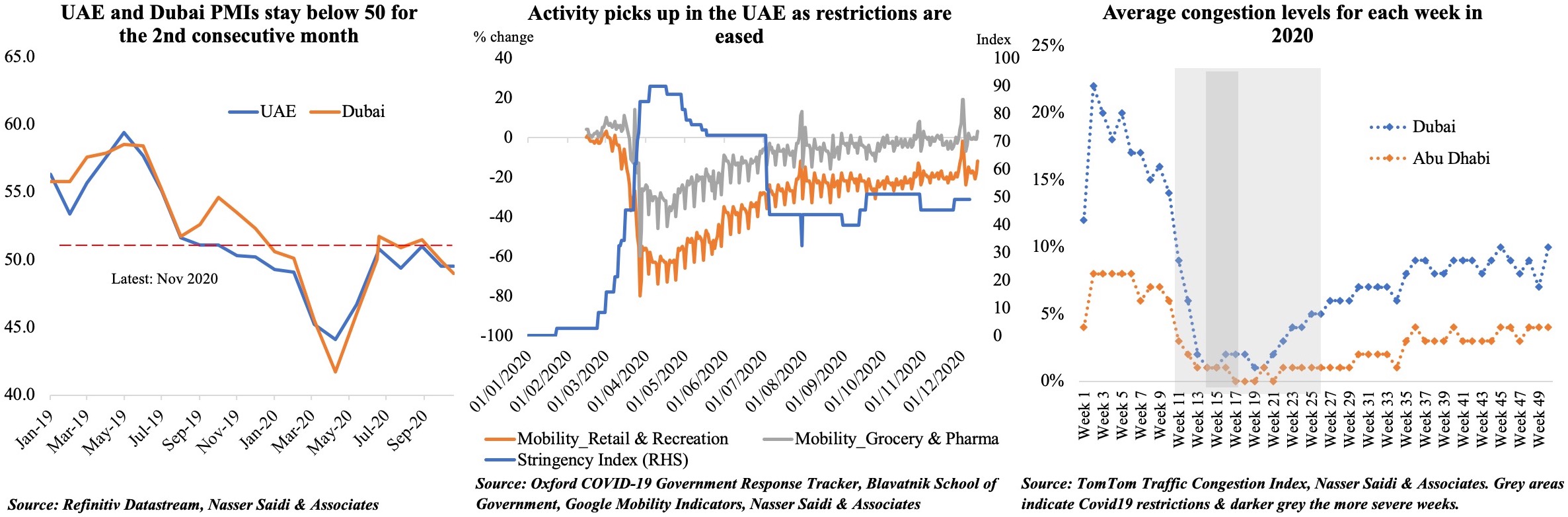

Chart 1: PMIs in UAE/ Dubai remain below-50 for the 2nd consecutive month; mobility & traffic pick up though demand remains weak

Though UAE is one of the more “open” economies across the Arab world (in the Covid19 era), the PMI readings in both UAE and Dubai stayed below the 50-mark for two consecutive months. Vaccine exuberance seems to have been overshowed by the decline in business, as business expectations turn negative for first time ever in Dubai.

Demand weakness remains the main reason for the dip following an uptick after the initial lockdowns were lifted; with the recent surge in Covid19 cases in Europe & Asia, recovery has been slow in tourism and travel sector. There is some signs of optimism: flight bookings in the London-Dubai sector accelerated by 112% after the UAE-UK corridor was announced in early Nov; Israeli tourists are flocking to the city after the normalization of relations (& travel corridor) so much so that flydubai is now offering 4 Dubai-Tel Aviv flights daily.

UAE’s recent liberalisation measures (rights of establishment, visas & immigration) add to the medium-term optimism and potential acceleration in the rollout of vaccines by next year offers hope for visitor arrivals in time for Expo in Oct next year. However, the extent of business closures/ rising NPLs as an aftermath of the Covid19 crisis remains to be seen.

Mobility data from Google shows the pace of recovery at grocery and pharmacy stores was much faster than that for the retail and recreation outlets (restaurants, cafes, malls, theme parks etc); congestion levels are still about 33% below 2019 levels, though certain days in Nov-Dec showed positive readings (i.e. congestion this year at a higher rate than that day a year ago).

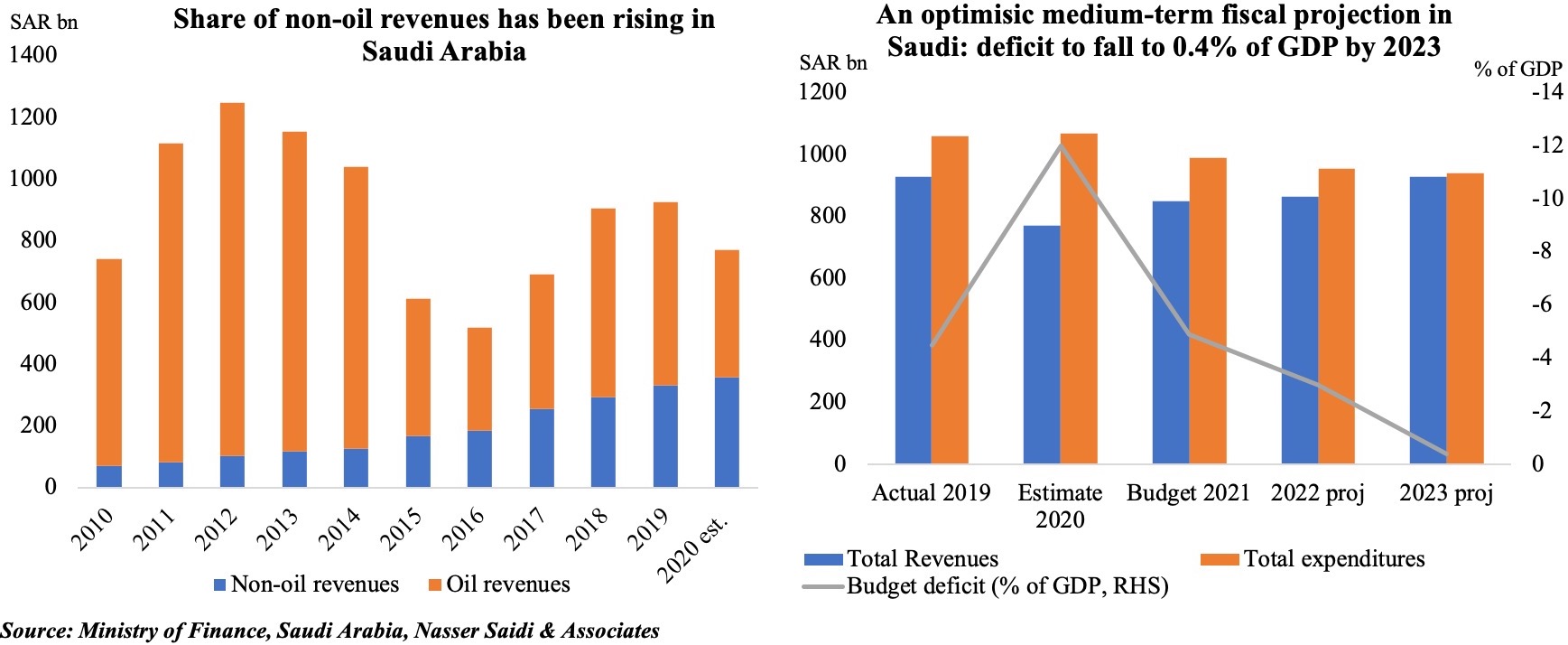

Chart 2: Saudi Arabia’s plans to diversify away from oil needs to be accelerated

Global demand for oil is recovering but remains weak given the impact of Covid19 and ongoing lockdown restrictions, therefore, plans to diversify away from oil dependence will need to be accelerated. In this regard, accelerated privatisation of state-owned assets is an essential structural reform: it is promising that the government estimates the sale of government companies and assets to double to about SAR 30bn in 2021. This will also encourage private sector investment and attract capital inflows.

Is the Saudi target to achieve a balanced budget by 2023 realistic? It depends on how fast both the global economy, Asia/China (critical for the growth of oil and gas demand) and the Saudi economy can recover from the effects of Covid19, in addition to how the OPEC decision to raise production pans out. On the domestic front, rationalising spending by phasing out subsidies and lowering public sector employment/ wages will likely support the move towards a balanced budget.

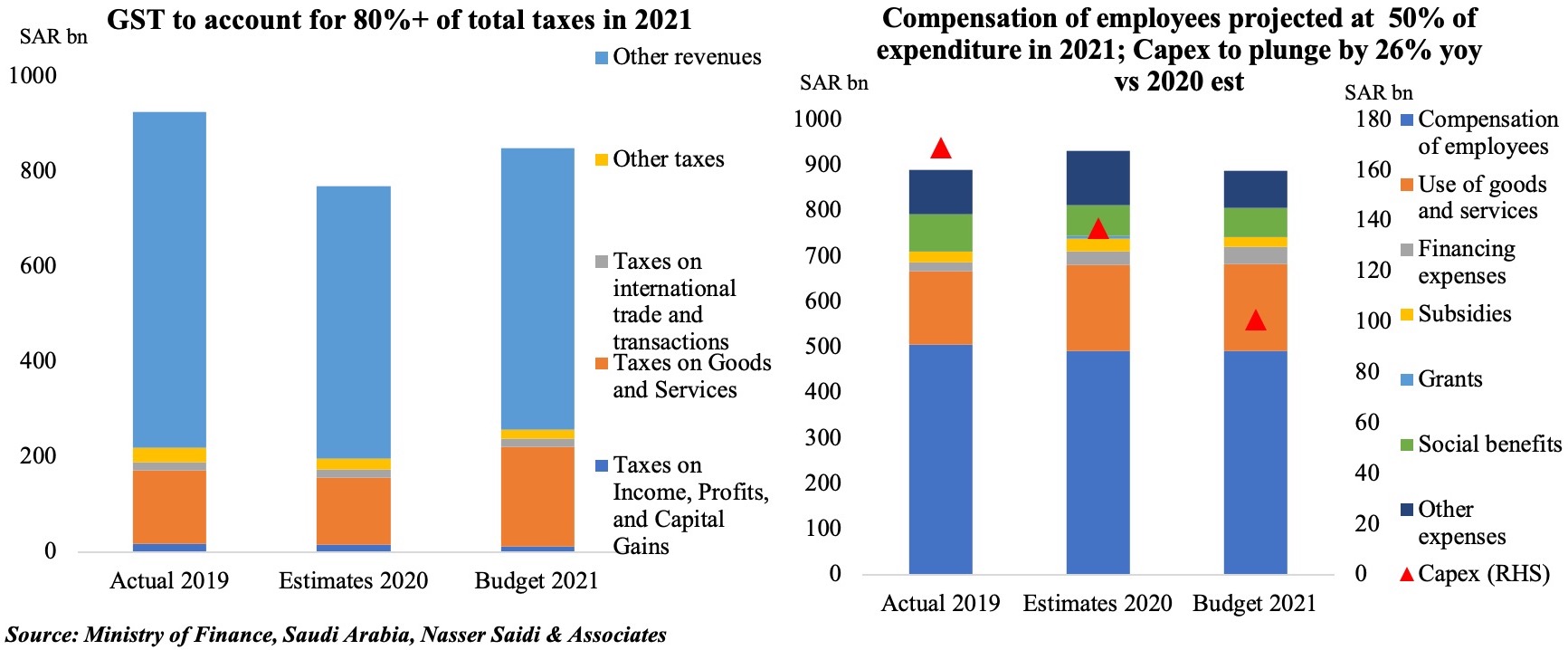

Chart 3: Saudi Arabia’s tax revenue supported by VAT, while capex spending is scaled down

The estimated rise in non-tax revenues is likely due to a combination of the recent rise in oil prices (+33% since Nov) and OPEC’s decision to resume oil production (plans to add 500k barrels a day to crude markets starting in Jan, with subsequent moves decided at monthly meetings). VAT hikes will contribute to the uptick in tax revenues, assuming there are no deferrals/ exemptions on taxes on goods & services next year. The Aramco dividend – of which 98% will accrue to the government – will also add to the government’s coffers (though the allocation between PIF/ reserves at SAMA or MoF is not clear).

Though the government’s capex spending has been significantly scaled down (-26.6%), it is a positive move, with the private sector being given more opportunities to execute infrastructure and developments projects (the massive NEOM project and others) and PPP, thereby supporting private sector growth and job creation (outside of the public sector).

Powered by:

Weekly Insights 17 Dec 2020: Green shoots (of recovery) in the UAE & Takeaways from Saudi 2021 Budget

17 December, 2020

read 3 minutes

Read Next

publication

Weekly Insights 25 Jul 2024: GCC are adjusting to lower oil revenues

Dubai GDP & inflation. Saudi foreign trade. Kuwait 2023-24 fiscal deficit. GCC US Treasury holdings.

25 July, 2024

publication

Weekly Economic Commentary – Jul 22, 2024

Download a PDF copy of the weekly economic commentary here. Markets Major equities

22 July, 2024

publication

Weekly Insights 19 Jul 2024: MENA growth projections lowered by the IMF; GCC’s non-oil sector growth will stay robust

IMF growth downgrades. UAE monetary stats. Abu Dhabi GDP. Saudi consumer & wholesale price indices.

19 July, 2024