Weekly Insights 29 Jul 2021: Global growth & inflation outlook + credit & inflation (GCC/ UAE)

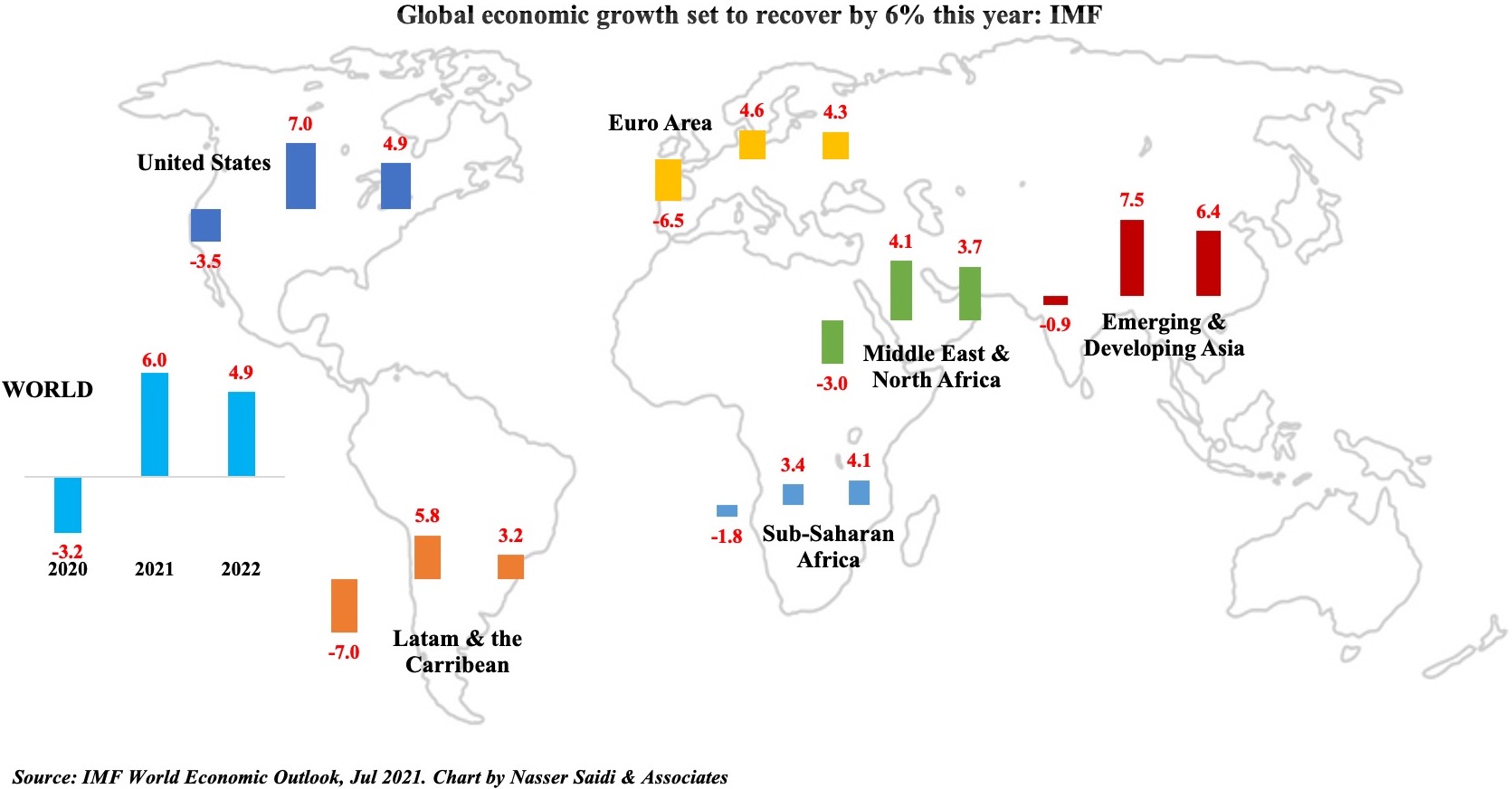

1. Global growth forecast at 6% in 2021: IMF

- The IMF’s World Economic Outlook, updated this week, forecasts global growth at 6% this year (unchanged from the Apr 2021 estimate).

- However, the underlying forecasts show greater divergence: an uptick in advanced nations growth estimates (+0.5 ppt from Apr 2021 forecast) was offset by a 0.4 ppt drop in emerging markets growth.

- Multiple risk factors to growth: dealing with new variants amid an uneven vaccine rollout globally (in low income nations less than 1% of the population have recived one dose), continuation of supply-demand mismatch and steady increase in inflation, earlier-than-expected tightening of interest rates in the US, early withdrawal of fiscal support etc.

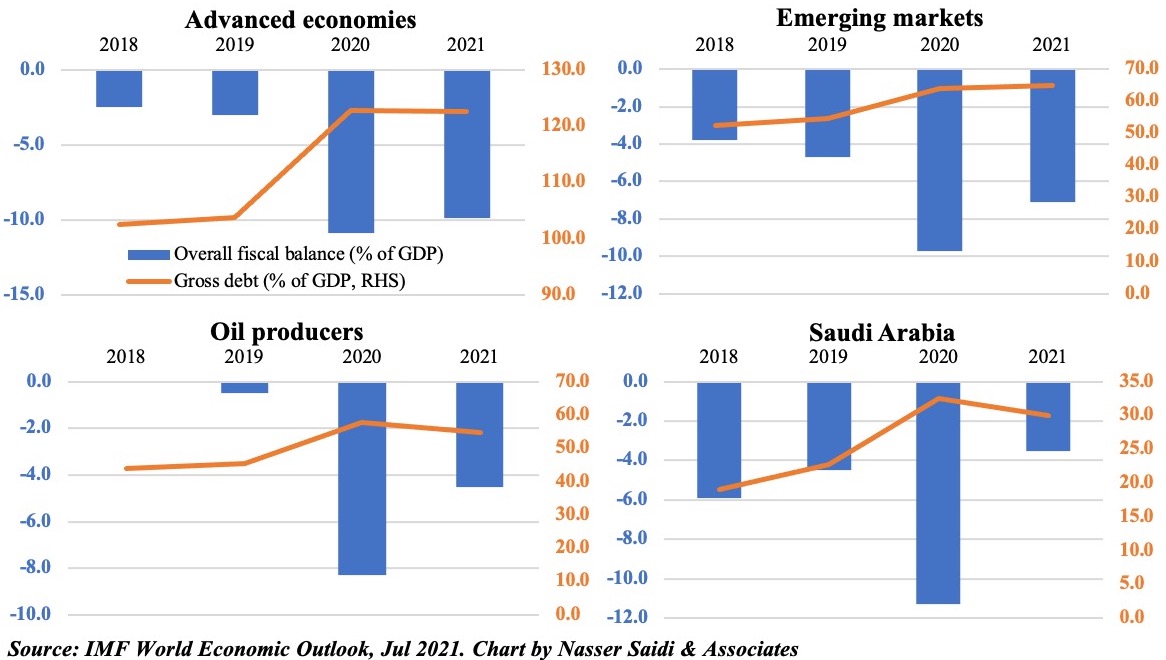

2. Global government debt was close to 100% of global GDP in 2020

- IMF: fiscal measures rolled out to support during Covid19 estimated at $16.5trn as of early July 2021 => fiscal deficits across all regions in 2020

- Much of these funds have already been utilised in EMEs, while advanced economies (AEs) have $4.6trn still to be used. Deficit narrows in 2021, in all regions except Euro Area

- Fiscal deficit will fall to 4.5% of GDP in oil-producing nations in 2021 (2020: -8.3%); reflected clearly in KSA as well

- Government debt rose to 122.8% last year in AEs (vs 2019’s 103.7%); in Saudi, it rose to 32.5% (22.8%)

- As inflation rises, some emerging markets have started to hike interest rates => less policy space

- If the Fed hikes rates earlier-than-expected, then fiscally constrained nations with high debt levels will be more vulnerable => further increasing fiscal risks/ corporate bankruptcies etc.

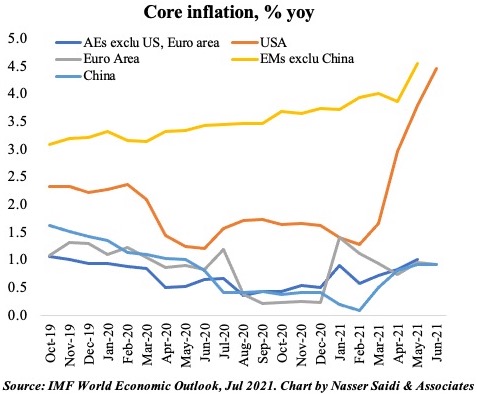

3. IMF calls inflation “transitory”, but PMI survey responses mention shortages & rising costs…

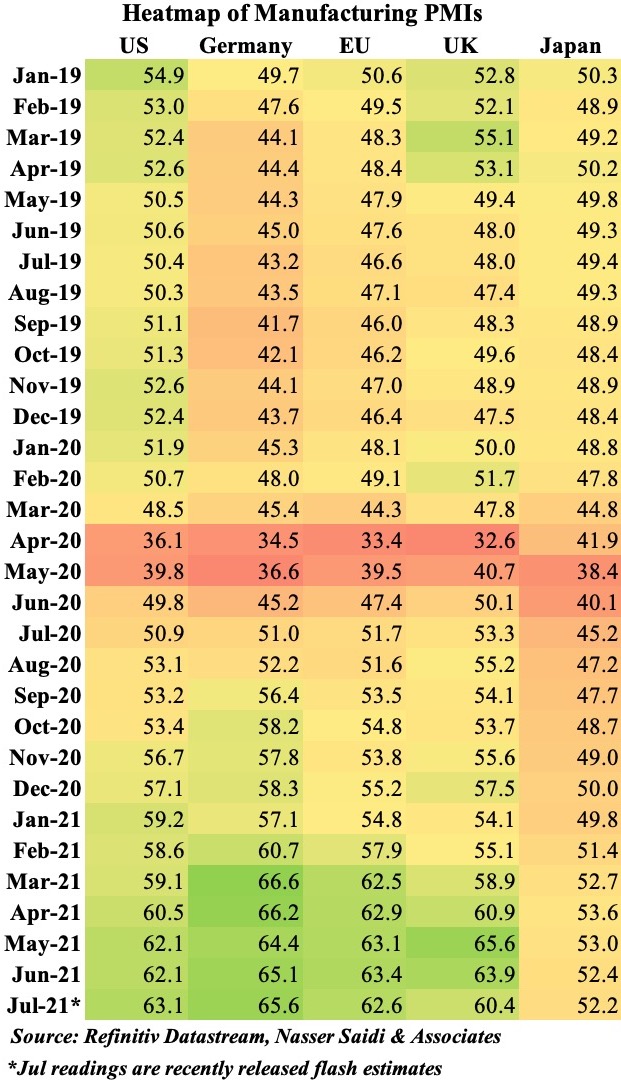

- Latest flash PMI readings show expansion in economic activity as restrictions are eased

- However, with shortage of materials and supply chain risks, firms are struggling to keep up with demand and higher costs are on the cards

- Food prices have been rising for 12 straight months before falling by 2.5% mom in Jun; but still up 33.9% yoy

- Higher oil prices are also affecting major importers; oil price is now closer to pre-pandemic levels

- Inflationary risks: pent-up demand amid long-drawn-out supply bottlenecks, earlier-than-expected rate hikes (leading to rise in risk premiums, borrowing costs)

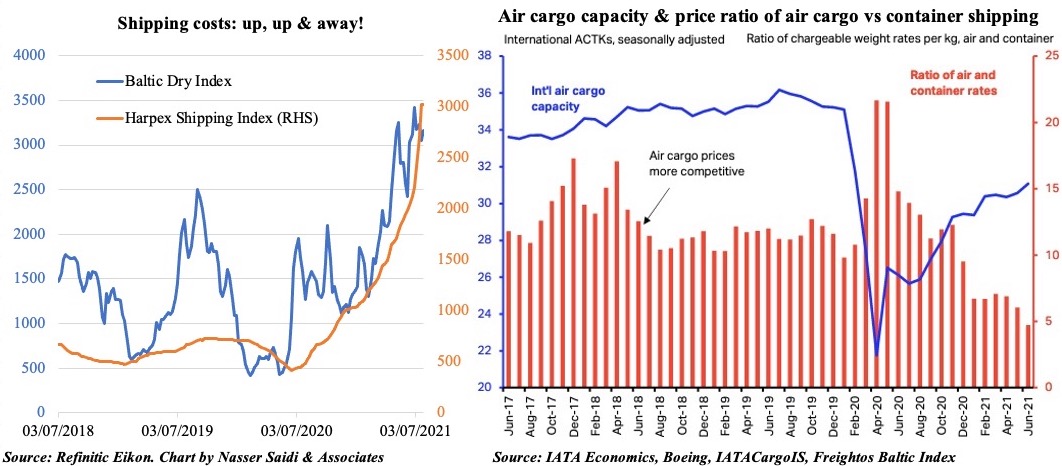

4. … as evidenced by rising shipping costs; air cargo costs to become more competitive, soon?

- Shipping costs are at multi-year highs and freight rates are likely to stay high the rest of this year given factors like lack of containers & shipbuilding capacity, Covid19 related delays

- Compared to congested container shipping and given the attractive speed of air cargo, the latter is becoming increasingly more advantageous price-wise.

- Nearly 60% of respondents in IATA’s passenger survey (Jun 2021) plan to take a flight within 1-2 months => air cargo capacity is growing => resulting in relatively cheaper air cargo fares

- Within the Middle East, cargo capacity was up by 17.1% in Jun (vs 2019), supported by strong ME-Asia and ME-North America trade lanes

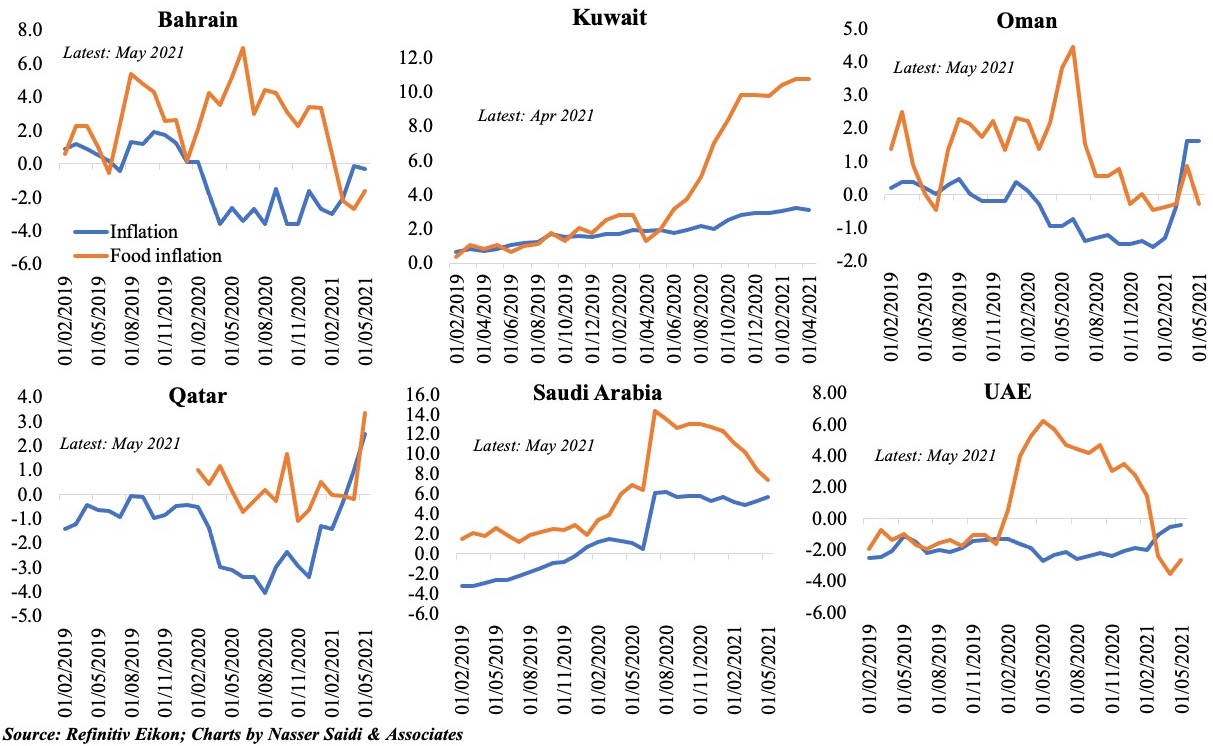

5. Closer home, a mixed GCC inflation picture: High food prices in Kuwait, Qatar & deflationary trends in others

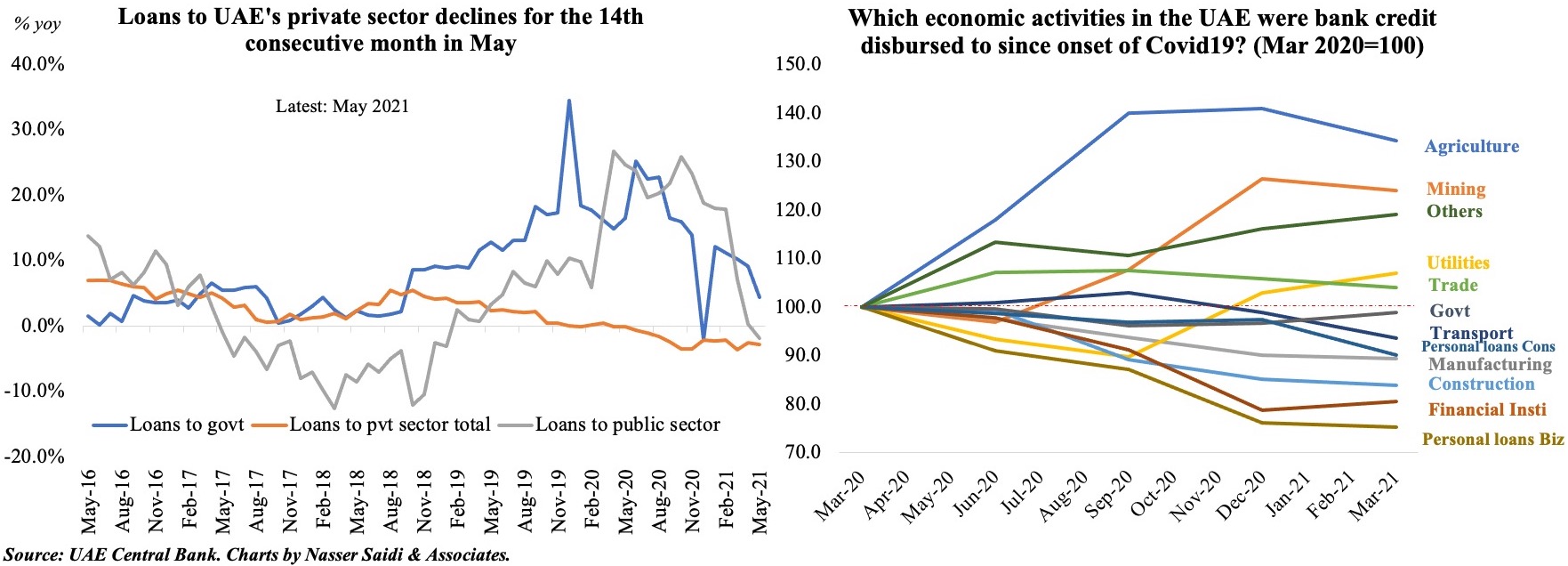

6. Credit disbursed in the UAE dragged down by private sector slump

- Overall domestic credit disbursed in UAE fell by 1.6% yoy and 0.8% mom in May 2021

- Loans to the private sector have been declining since Apr 2020, with the latest reading down by 2.8% yoy (and -0.3% mom). Since Apr 2020, loans to both the business sector and overall private sector has declined by an average 2.1%, while loans to the government and public sector have gained 13.7% and 17.5% respectively

- Interestingly, the central bank’s credit sentiment survey for Q2 2021 showed that banks expect demand for business loans to increase for the Sep quarter (net balance of +28), with economic activities retail & wholesale trade, manufacturing, construction, transport & communications, and others dominating demand.

- In Mar 2021, construction (20.5%), personal loans for consumption (20.4%), government (15%), others (9%) and trade (8.7%) accounted for 65% of total loans. However, if one tracks loans disbursed since the onset of Covid (taking an index with Mar 2020 as 100), the biggest “gains” accrued to the agriculture, mining, others, utilities and trade activities.

Powered by: