Main highlights from the Weekly Insights are: Google Mobility results from the MENA region as lockdown restrictions are phased out; a comparison of Bahrain’s Q1 GDP with its peers reveals interesting facts; as Kuwait proceeds with the expat quota bill, we look at how extensive remittance outflows are from the region.

Markets

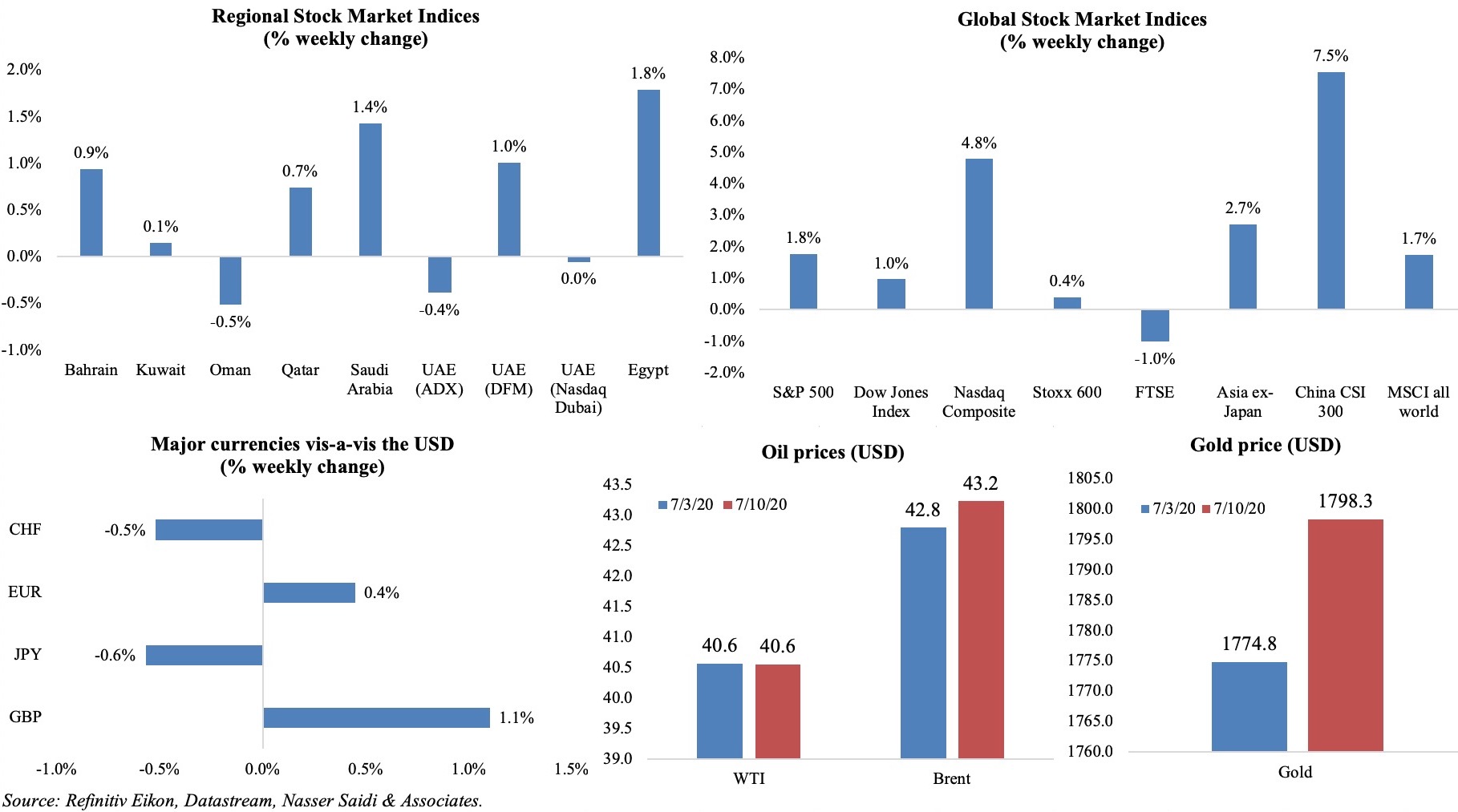

Most global stock markets closed in the green last week (except for FTSE which closed 1% down in spite of the extra stimulus) as the virus count continued to rise and ahead of the Q2 earnings season. Chinese shares touched a 5-year high after state media called on local investors to pour money into markets; daily turnover soared by nearly 80% compared to a week ago. Regional markets were mostly up, with Oman and Abu Dhabi down by 0.5% week on week. Safe haven assets were in demand: US Treasury yields dipped to their lowest levels since late Apr while yield on the 10-year German Bund touched -0.5%; the yen rose against the dollar; gold prices hit a 9-year high, rising 1.3% versus a week ago. Oil prices increased on news of IEA raising its oil demand forecast, with WTI unchanged and Brent up 1% from the prior week. (Graphs in the last section.)

Global Developments

US/Americas:

- US PPI declined by 0.2% mom in Jun, after rebounding 0.4% in May: rising costs for energy goods (+7.7%) was offset by a decline in wholesale food prices (-5.2%) and weak services costs (-0.3%). Excluding food, energy and trade services, producer prices rose 0.3% in Jun.

- US ISM non-manufacturing moved into expansionary territory, with the Jun reading at 57.1 from 45.4 the month before, supported by business activity (at the highest since Feb 2011) and new orders (61.6 vs May’s 41.9).

- US Markit Services PMI increased to 47.9 in Jun, from May’s 37.5 reading, with exports rising for the first time this year, amid a stabilization of new business inflows and slower drop in employment.

- Initial jobless claims fell by 99k to a 4-month low of 1.31mn in early Jul while continuing claims declined to 18.1mn in the week ended Jun 27. With Covid19 cases still rising and many states rolling back reopening plans and businesses preparing for job cuts later this year (after federal aid expires), this number is likely to rise in the coming weeks.

Europe:

- German factory orders rose by 10.4% mom in May (Apr: -26.2%). Though the lockdown was eased starting Apr 20th, the May number is still 30.8% lower than orders in Feb 2020 (prior to the restrictions). Domestic orders (+12.3%) and orders from the euro area (+20.9%) have supported growth, while new orders from other countries edged up by only 2% mom.

- Industrial production in Germany increased by 7.8% mom in May, following 2 consecutive months of declines (Apr: -17.5%), led by production of capital goods (+27.6%) and orders for industrial goods (+10.4%).

- Germany exports grew by 9% mom in May, following two months of declines (Mar: 11.6% & Apr: 24%) while imports also picked up by 3.5% (after dropping by 5.3% and 16.6% in Mar and Apr respectively), bringing the trade surplus totaled EUR 7.6bn (USD 8.59bn). Separately, the government announced measures to ease the financing of exports, including reduced fees for export guarantees and improved financing conditions for new export business.

- Eurozone retail sales surged by 17.8% mom in May, the steepest rise since records began in 1999. Automotive fuel sales rose by 38.4% while non-food product sales were 34.5% higher. A breakdown by country showed Germany’s (which eased lockdown earlier) sales recovered to pre-Covid19 levels while in countries like France and Spain sales were still subdued.

- UK unveiled a new stimulus package worth GBP 30bn (USD 37bn) to support jobs: this includes a “job retention bonus” of £1,000 per worker paid to companies that bring staff out of the government’s furlough scheme, program to create and support new jobs for people under the age of 25 as well as a temporary 6-month reduction in VAT to 5% for the tourism and hospitality industry among others. The latest move is estimated to raise deficit to 18% of national income.

Asia Pacific:

- Money supply in China accelerated by 11.1% yoy in Jun, unchanged from the pace of expansion in May; new yuan loans surged by 22% mom to CNY 1.81trn (USD 258.23bn) in Jun. Annual outstanding yuan loans grew by 13.2%, the same as in May. China foreign reserves grew for a 3rd straight month, inching up 0.3% mom to USD 3.1123trn in Jun.

- China inflation gained by 2.5% yoy in Jun (May: 2.4%), with food prices driving the rise (11.1% yoy). Excluding food and energy, core CPI posted a 0.9% yoy rise in Jun (May: 1.1%). Producers price index fell by 3% yoy in Jun, narrowing from the 3.7% dip in May.

- Japan overall household spending slumped by 16.2% yoy in May (Apr: -11.1%) – the fastest rate of decline since 2001 – with substantial declines in spending on hotels, transport and eating out (as people stayed home) while spending increased on meat, alcohol and face masks. Separately, May inflation-adjusted real wages dropped at the quickest pace since Jun 2015 – more signs of stress in the labour market.

- Japan’s leading economic index unexpectedly increased in May, rising 1.6 points to 79.3. The coincident indicator index fell by 5.5 points to 74.6, suggesting the economy is worsening.

- Current account surplus in Japan narrowed by 27.9% yoy to JPY 1.18trn (USD 10.97bn), given the impact on the tourism sector. Exports fell by 28.9% yoy (3rd straight month of decline) to JPY 4.2trn and imports were down by 27.7% (13th month of decline) to JPY 4.75trn.

- India’s foreign exchange reserves surged by USD 6.4bn to a record high USD 513.25bn in the week ended July 3; gold reserves were up by USD 495mn to USD 34.02bn.

Bottom line: Economic data improves across the globe: reiterating the need to be aware that the “recovery” is still far below the pre-Covid19 numbers. With the WHO reporting record daily surge in global Covid19 confirmed cases, it is time to reassess any cautious optimism related to recovery. This week look forward to details of EU’s EUR 750bn post-Covid19 recovery fund ahead of the ECB meeting while UK was the latest to add GBP 30bn to its stimulus package: expect more as nations battle the outbreak, though global public debt is also rising – reaching its highest level in recorded history, at over 100% of global GDP, according to the IMF. Meanwhile, IEA nudged up its oil demand forecast raised its demand forecast to 92.1mn barrels per day (bpd), up 400k bpd from its outlook last month, though Covid19 still poses a risk (e.g. with easing of lockdown measures, fuel demand is slowly resuming in India, up 11% mom in Jun – still down 7.8% compared to a year ago).

Regional Developments

- Bahrain’s GDP shrank by 1.1% yoy in Q1, with declines registered across hotels and restaurants (-36%), transport and communication (-6.3%), government services (-2.9%), real estate (-0.4%) while the oil sector edged up by 1.8% and manufacturing picked up by 4.8%.

- Bahrain’s cabinet approved a 50% cut in work permit fees for 3 months, for the issue and renewal of work permits for businesses most affected by the pandemic.

- Bilateral trade between UK and Bahrain increased by 10% yoy to USD 1.6bn as of end-2019.

- Egypt’s PMI stayed below 50 in Jun, though rising to a 4-month high of 44.6 (May: 40.7), as decline in new businesses slowed while output and new orders also clocked 4-month highs.

- Urban inflation in Egypt inched up to 5.6% in Jun (May: 4.7%), as food prices went up by 0.4%; core inflation fell to 1% yoy from 1.5% the month before.

- Net foreign reserves in Egypt increased to USD 38.2bn in Jun (May: USD 36bn), probably a result of the first tranche of IMF’s standby loan. Reserves had been dropping since Mar.

- Egypt’s parliament approved a law to waive late payment interest and penalties on taxes (including VAT). 90% of the fees will be waived if taxes are paid within 60 days from the date the law comes into effect. Separately, the Egyptian Tax Authority decided to extend the decision of unfreezing assets in tax disputes until end-Sep: taxpayers can pay 1% of due taxes to unfreeze their assets.

- Fuel prices in Egypt will be kept unchanged for 3 months: the decision was taken by the fuel pricing committee after reviewing prices from Apr-Jun.

- Revenues from Suez Canal fell by 0.52% yoy to USD 5.72bn in the fiscal year 2019-20. The decline was attributed to the slowdown in international trade in Q2 this year (-18.5% yoy)

- Egypt’s tourism investments are likely to decline by 28.8% to EGP 5.2bn in the fiscal year 2020-21, according to the minister of planning and economic development. Private investments’ share is estimated to fall to 84% vs 90% a year ago.

- The Central Bank of Egypt’s Industry, Agriculture, and Contracting Support Initiative has used funds amounting to EGP 69bn (USD 4.3bn) as of end-Jun.

- The Labour Emergency Fund in Egypt disbursed EGP 331.65mn (USD 2.7mn) to workers hit by the pandemic, paying 100% of basic salary of ~288k workers across close to 2900 firms.

- Egypt plans to implement 691 green projects this fiscal year at a total cost of EGP 447.3bn; only EGP 36.7bn has been allocated for these projects, with the rest to be financed using green bonds.

- Investment in metro projects in Egypt will continue: the plan is to implement 22 projects by 2024 at a combined cost of EGP 512bn (USD 31.92bn).

- Egypt set Aug 11-12 as the date for inaugural elections for a new second parliamentary chamber; results will be announced Aug 19.

- Iraq has partially opened its border crossings with Iran for trade exchanges; borders were closed in Mar following the Covid19 outbreak.

- Jordan resumed the import of Iraqi crude oil, according to the former’s energy minister. Iraq had suspended oil exports to Jordan after oil prices dropped to less than USD 20 per barrel.

- Kuwait will distribute KWD 240.5mn (USD 780mn) to citizens working in the private sector to compensate for Covid19 related declines in income.

- Foreign reserves in Kuwait increased by 14.41% yoy and 7.39% mom to KWD 13.67bn (USD 44.52bn) as of end-May. The book value for gold reserves stood at KWD 31.7mn.

- FDI into Kuwait edged up by 2.03% yoy to KWD 4.52bn (USD 14.72bn) in 2019, according to the central bank.

- Lebanon’s central bank set a fixed exchange rate of 3900 Lebanese pounds per dollar for importers and manufacturers of essential food items. Black market rates are currently near 7.5k per dollar.

- A new board of directors were appointed at Lebanon’s state-owned Electricite du Liban: losses at the EDL run upto USD 2bn a year. However, without a regulatory body to oversee the EDL, the appointments are unlikely to bring about any reform.

- Lebanon’s Capital Control Law – to regulate the transfer of capital out of the country – will be sent to the Parliament’s Finance and Budget Committee for approval.

- In the backdrop of power rationing due to fuel shortages, the energy minister disclosed that Lebanon is not negotiating with Iran for the import of fuel while stating that discussions were underway with Iran.

- Lebanon’s economic woes and currency depreciation are weighing on the results of UAE and GCC bank subsidiaries: Bank of Sharjah posted its first ever loss of AED 488mn in 2019 from its Lebanese subsidiary. Disputes with auditors on provisions are likely to dominate 2019-2020 results.

- S&P lowered its ratings to D from CC on Lebanon’s government bonds which had coupon payments due in May and Jun.

- Oman’s Bankruptcy Law came into effect from July 7th: this will provide businesses an opportunity to attempt restructuring vs termination.

- Given the Covid19 outbreak and impact, Oman’s Tax Authority announced suspension of fines for non-submission of declarations and accounts for fiscal year 2019 as well as additional tax due to non-payment of income tax for last year till Sep 2020. Payments can also be rescheduled or made in instalments.

- Petroleum production in Oman declined by 9.8% yoy in May while the total sales of gasoline picked up by 24.3% to 530.9 thousand barrels.

- Qatar’s cabinet approved a draft resolution that aims to raise the percentage of Qataris working at state-owned companies or where the state is an investor to 60%.

- Qatar awarded 9 new contracts for road and infrastructure development projects worth QAR 3.6bn (USD 981mn) to local companies.

- Industrial production in Saudi Arabia declined by 15.5% yoy in May, largely due to the 11.98% dip in mining and quarrying alongside a 25.9% plunge in manufacturing activity.

- Saudi Arabia’s Ministry of Industry and Mineral Resources issued 118 new industrial licenses in Jun: employing 5609 persons, the factories have a total capital of SAR 2.18bn.

- SAMA disclosed that government initiatives to support the financing of the private sector during the Covid19 outbreak exceeded SAR 51bn (USD 13.6bn). Separately, the Saudi Press Agency reported that the government spent SAR 214bn (USD 57bn) on 142 initiatives.

- Saudi Arabia will proceed with plans to double the size and population of Riyadh in the next decade: the government has already committed USD 266.6bn for ongoing and new projects as part of total investments of around USD 800bn over the next decade.

- Saudi Capital Market Authority (CMA) will launch a derivatives exchange in Q3 this year, reported Asharq Al-Awsat newspaper, citing the Chairman of the CMA. Separately, Tadawul’s CEO disclosed that three companies have been approved to list on Nomu.

- The Amlak IPO was completed, with retail coverage at 2690%: 266,821 retail investors subscribed to invest SAR 1.17bn at a share price of SAR 16. The total offer comprised 27.18 million shares (or 30% of Amlak International’s share capital), of which 10% were allocated to retail subscribers.

- Saudi Arabia completed the first batch of its flour milling sector privatization, with the sale of 2 companies. The first milling company was awarded to Raha AlSafi consortium at SAR 2.027bn (USD 540.1mn) and the third mill went to Alrajhi-Ghurair-Masafi consortium for SAR 750mn.

- FDI into Saudi Arabia increased to SAR 469.7bn (USD 125.25bn) in Q1 this year – its highest annual and quarterly levels since 2007 – rising for 9 consecutive quarters.

- Unemployment in Saudi Arabia fell in Q1 to 11.8% from 12% the quarter prior, unlikely to have captured the impact of the Covid19 pandemic.

- Gold production in Saudi Arabia increased to its highest level in 2019: rising 5% yoy to 12.35 tonnes. With more than 323 tonnes of gold, Saudi Arabia also has the largest gold reserves among Arab states.

- Non-Saudi residents will account for 70% of this year’s Hajj pilgrims, with priority given to those aged between 20 and 50 who do not suffer from chronic diseases, who have not performed Hajj before and those who show a negative Covid19 test.

- Saudi Arabia will extend the validity of final exit visas for expats at no charge, while extending the validity of expired residency visas, visit visas and entry visas for residents stuck abroad for 3 months free of charge.

- About 756,644 passengers passed through Saudi Arabia’s airports between May 31-Jun 30, after domestic flights restarted operations.

- Inbound tourism into Saudi Arabia increased by 8.8% yoy to SAR 154bn (USD 41.06bn) in 2019: this includes both domestic and inbound tourists, with the latter accounting for 65.6% of total spending.

- MENA’s startups secured USD 659mn in funding in H1 this year from 251 deals, with UAE receiving the largest share of funds (59% of total, but down 3% yoy) and Egypt the largest number of deals (25% of total), according to Magnitt’s MENA Venture Investment Report.

- M&A activity in the Middle East and Africa totaled 130 deals valued at USD 59.8bn in H1 this year, according to Mergermarket. With 15 deals, M&A in the energy, mining and utilities sector reached USD 32.1bn in H1, surpassing all annual totals in this sector in MEA.

- Saudi Arabia and Kuwait resumed oil production from shared oil fields Wafra and Khafji, after having halted operations 5 years ago.

- EY’s Future Consumer Index survey indicates that 58% of MENA consumers shopping habits will change over the next 1-2 years, given the pandemic. About 44% and 39% of the respondents stated that they value health and affordability, respectively, while shopping.

UAE Focus

- The UAE central bank will introduce a new overnight deposit facility (ODF) from today (Jul 12th), allowing banks to deposit overnight their surplus liquidity at the central bank. This replaces the issuance of one-week certificate of deposits, and the interest rate on the ODF will be the main policy rate or base rate.

- Dubai government announced a further AED 1.5bn worth of economic stimulus measures including an extension of the halving of municipality fees, tourism fees as well as waiving fees charged to private schools for license renewals. The latest round increases the total stimulus from the Dubai government to AED 6.3bn.

- UAE’s banking sector can withstand any shocks, stated the central bank, based on stress testing results, the high capital adequacy ratio (16.9% as of end-Mar) and eligible liquid asset rate of 16.6% as of end-May.

- Dubai’s PMI moved up to 50 in Jun from May’s 46 reading, as lockdown measures were eased: however, many telling signs remain including a sharp decline in employment for the 4th month in a row as well as subdued rise in new work.

- Producer price index in Abu Dhabi edged up by 1.9% qoq to 77% in Q1 2020, with the “manufacture of coke and refined petroleum products” accounting for 80.8% of overall change. Separately, construction costs in Abu Dhabi declined by 0.4% qoq in Q1.

- Dubai’s DMCC free zone extended its “Business Support Package” to all registered companies till Aug 31 including waiver of penalties, 2 month rent holidays and discounts on license reinstatement fees and license issuance among others. Separately, DIFC announced that its Presidential Directive – which introduced new measures for employees and businesses related to their workforce – will end on Jul 31st.

- S&P downgraded the ratings of 3 major Dubai-based real estate companies to +BB from -BBB – DIFC Investments (stable outlook), Emaar Properties (negative outlook) and Emaar Malls (negative outlook) – citing economic pressures due to Covid19 amid lower oil prices. The ratings firm, which expects Dubai’s GDP to shrink by 11% this year, also warned of fiscal risks arising from the performance of GREs exposed to the pandemic (Emirates Group, DP World, Jumeriah Group etc.).

- Tourists were permitted into Dubai from Jul 7: with Emirates and flydubai resuming flights to multiple destinations across the globe, Dubai tourism’s chief remained optimistic that related businesses would recover as “things normalize towards year-end”. However, a divergence was evident on the aviation front: Emirates continues to layoff pilots and cabin crew (the company’s President estimates a rise to upto 15% of total workforce, or 9k jobs) while a new budget airline Air Arabia Abu Dhabi (UAE’s 5th airline) will begin operations from Jul 14 (initial flight to Egypt’s Alexandria).

- All business tenants in properties owned by Dubai Developments Group will be exempt from paying rent for six months, up from three months previously. An estimated 1500 businesses are likely to benefit from this move.

- The Dubai Financial Market’s trading floor and customer affairs counters opened to serve customers from last week, after temporarily closing mid-Mar. Investors are still encouraged to trade remotely.

- UAE plans to conduct over 2 million Covid19 tests in the next two months, focusing on employees in the services and government sectors.

- Route 2020, the 15-km extension of the Dubai Metro, leading to the Expo 2020 site will open to the public in Sep.

Weekly Insights: Charts of the Week

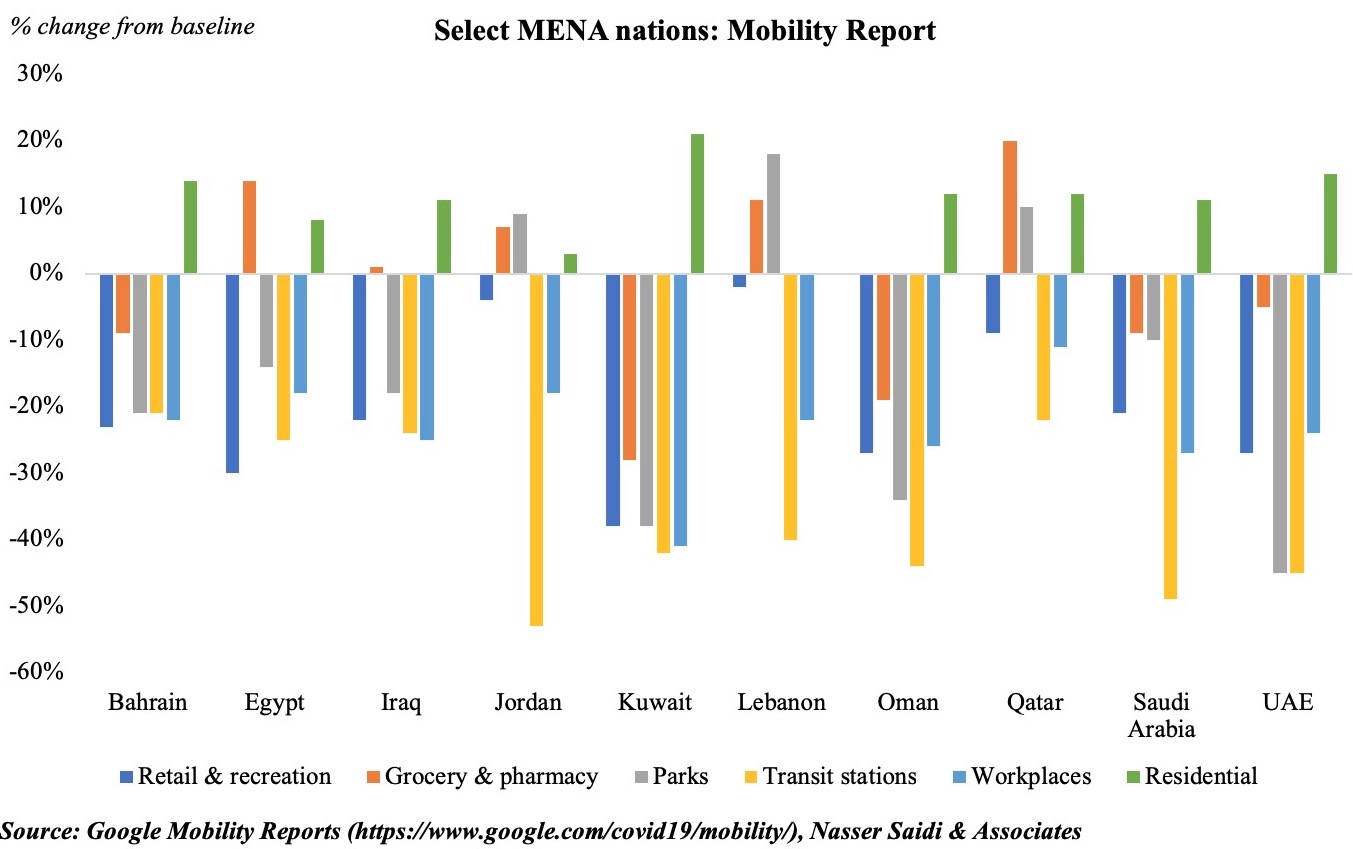

Fig 1. Google Mobility registers increase in activity as lockdown restrictions are phased out

Notes: The reports show trends over several weeks with the most recent data representing approximately around June 9th. Changes for each day are compared to a baseline value for that day of the week: the baseline is the median value, for the corresponding day of the week, during the 5-week period Jan 3–Feb 6, 2020.More: https://www.google.com/covid19/mobility/

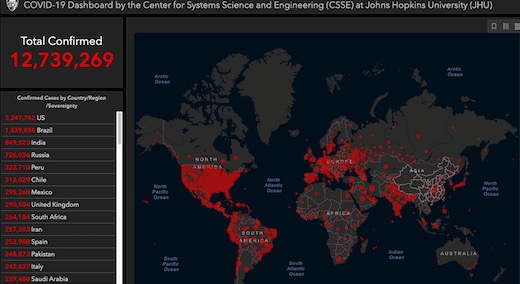

Covid19 confirmed cases in the Middle East and North Africa inch closer to 1 million, with GCC accounting for around 54% of the cases. All GCC nations have begun opening their economies in phases, and this is clearly reflected in the Google Mobility numbers: visitors to grocery and pharmacy are inching closer to (or surpassing) the period before the pandemic (see Qatar, Egypt, Lebanon, Jordan and Iraq) while the ‘residential’ category (which shows a change in duration of time spent at home) declined compared to a few weeks ago indicating that people are no longer as confined to home as during the lockdown period. Kuwait is still most restrictive in terms of employees returning to work (and hence a move closer to the baseline). Interestingly, the numbers for workplace in Saudi Arabia and UAE are still 27% and 24% respectively lower than the baseline. Recovery in retail and recreation is still below the baseline across the nations: the most divergence in Egypt and Kuwait and the UAE (in spite of Dubai’s shopping malls back to 100% operating capacity while theatres and recreation facilities open with social distancing measures).

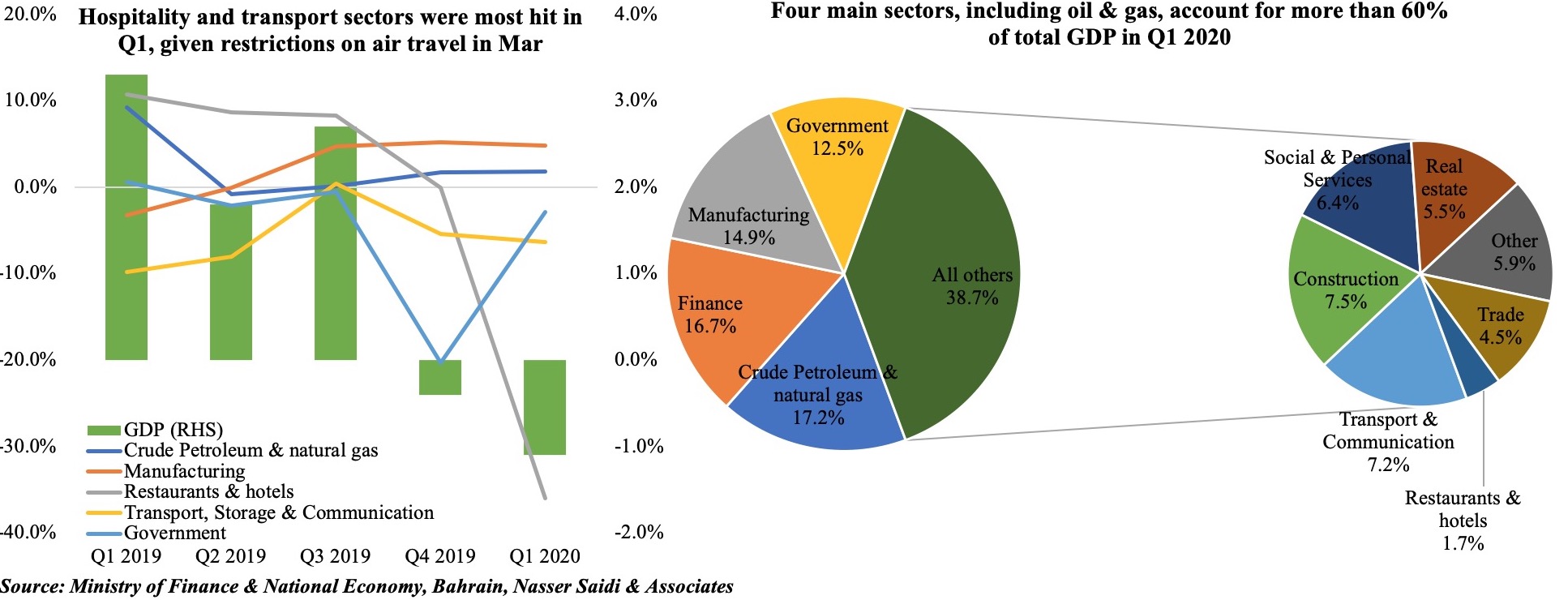

Fig 2. Bahrain’s Q1 GDP: a quick comparison with Saudi Arabia and Dubai

Bahrain is the latest to release its Q1 GDP numbers, with overall GDP contracting by 1.1% and non-oil GDP falling by 1.7% yoy. In terms of sectors, it is no surprise that the hospitality and transport sectors were most hit, with passenger traffic restrictions in place since Mar. Q2 numbers are likely to be worse given the near-complete lockdowns. The oil sector continued to perform well, with its share of overall GDP at 17.2% in Q1.

In comparison to Saudi Arabia and Dubai GDP, the hospitality sector in Bahrain seems to be significantly more affected (-36% vs Dubai’s 14.8% dip). Also different was a decline in financial sector activity: drops of 1.6% and 1.1% in Q1 2020 and Q4 2019 respectively, versus Saudi Arabia and Dubai’s 1.0% and 0.32% rise in Q1 2020. Bahrain’s government sector witnessed a 2.9% drop in Q1, following a more severe 20.3% decline the quarter before: this is likely to be more significant in the coming quarters given ongoing fiscal consolidation efforts including the directive for ministries and government agencies to reduce spending by 30% this year.

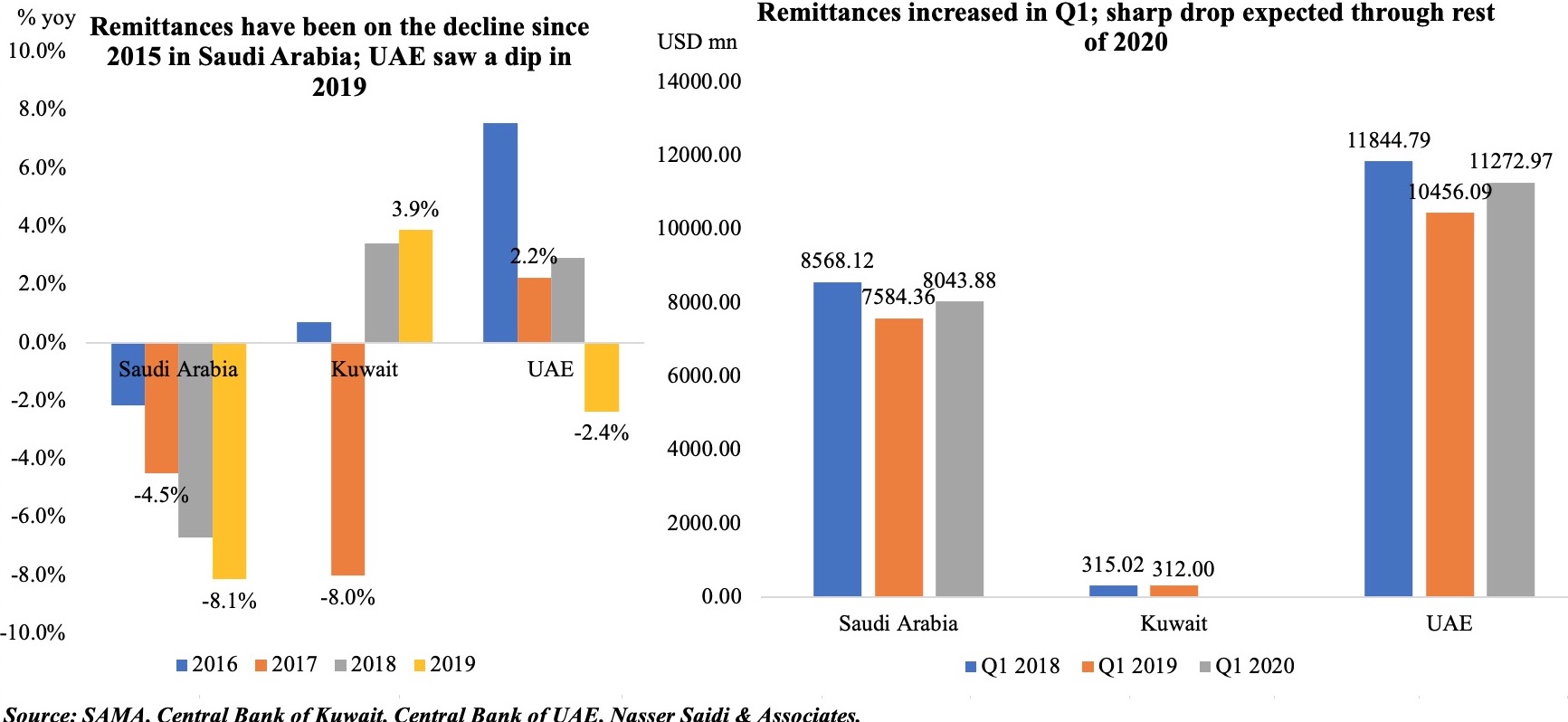

Fig 3. Remittances across the GCC

The UAE is the second largest outbound remitter country in the world, with remittances touching AED 165.2bn in 2019, as per the latest annual report from the central bank. Though remittances in Q1 this year have been released only in Saudi Arabia and UAE (yet), both have posted a year-on-year increase. The Covid19 lockdown highlighted the transitory nature of work in the region. Job losses are forcing many skilled expat residents to leave the country given the linkages of the residency visa with jobs/ sponsors. Add to this lower oil prices, resulting in a substantial reduction in economic activity (with associated declines in salaries and/or job losses), it seems unlikely that there will be an uptick in remittances for the full year. The World Bank already estimates remittances globally to drop by 20% this year.

Considering the example of UAE, India was the top destination for remittances in Q1 this year, accounting for 37.8% of the total. With close to 500k Indians registered to leave on repatriation flights, a dip in remittances this year is inevitable. Saudi Arabia, where remittances have been declining since 2019, this year is unlikely to be any different – especially given the additional VAT hike and removal of cost of living allowances alongside a dip in overall economic activity. In Kuwait, meanwhile, if the expat quota bill is passed, close to 800k Indians might need to leave, thereby leading to a gaping hole in overall remittances to India.

On the other hand, allowing for a permanent residency program in GCC would attract and retain foreign human capital, which would generate significant economic gains (retained earnings, higher consumption levels, investments in the real estate sector etc.) for the domestic economy.

Media Review

What’s in a name? Banks count cost of loans in NMC collapse

https://www.reuters.com/article/us-nmc-health-administration-banks-analy/whats-in-a-name-banks-count-cost-of-loans-in-nmc-collapse-idUSKBN24B0MK

Fiscal policies for a transformed world

https://blogs.imf.org/2020/07/10/fiscal-policies-for-a-transformed-world/

Why Is the Fed Spending So Much Money on a Dying Industry?

https://www.nytimes.com/2020/05/28/opinion/fed-fossil-fuels.html

How NOT to Punish China

https://www.wsj.com/articles/how-not-to-punish-china-11594249525

Water wars is on the horizon in MENA: Nile Dam row

https://www.bbc.com/news/world-africa-53327668

Market Snapshot as of 12th Jul 2020

Weekly % changes for last week (9-10 Jul) from 2nd Jul (regional) and 3rd Jul (international).

Powered by: