Markets

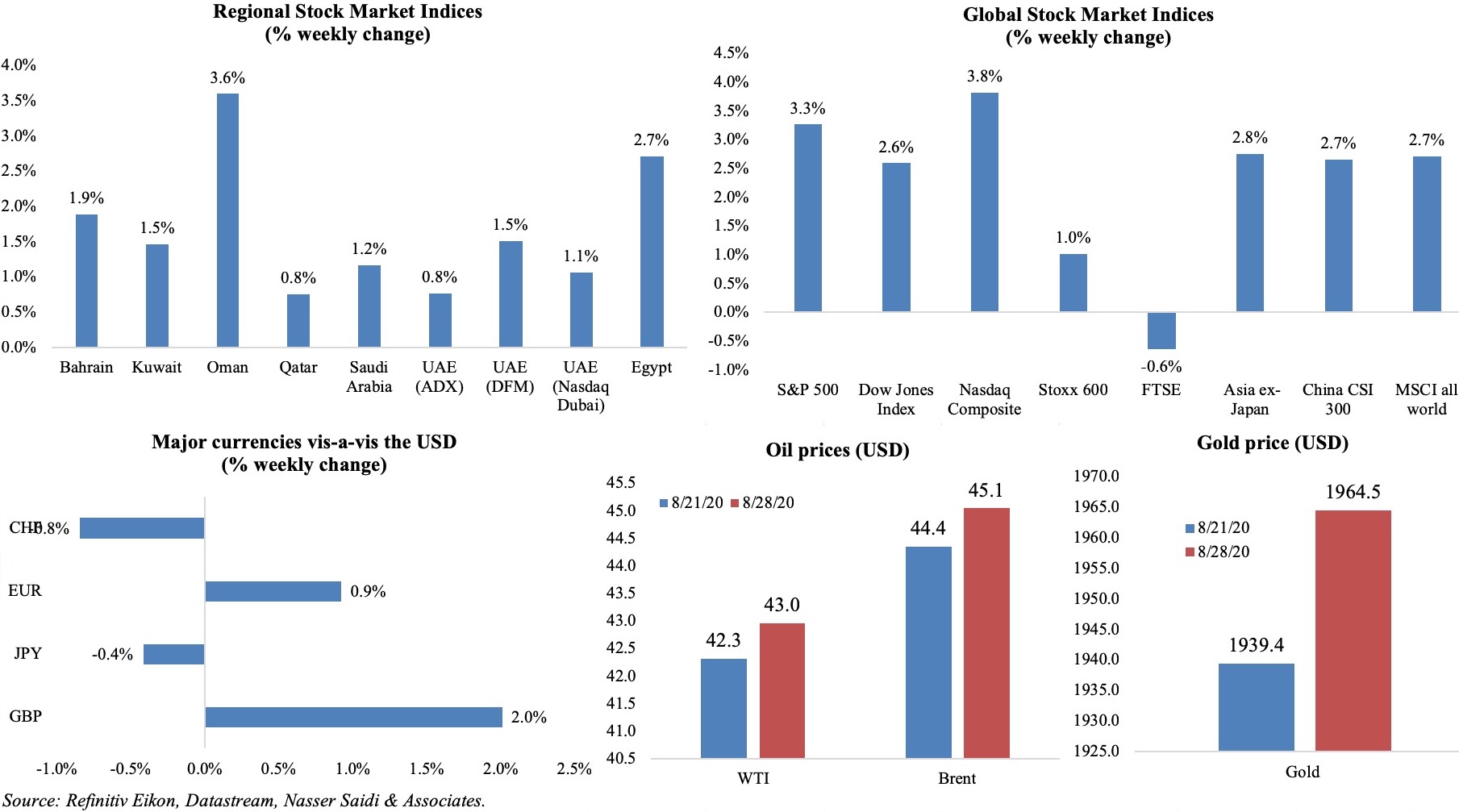

US stocks rallied, supported by tech stocks and the Dow close to an all-time high. European stocks recovered from earlier losses and ended the week up 1% and the MSCI global index gained, after setting intraday highs. In Japan, stocks fell on the announcement of the PM’s resignation and the yen strengthened (biggest one-day jump since Mar). In the region, markets remained upbeat, with Oman gaining the most. The dollar weakened, approaching lows previously seen in May 2018 while euro gained (forex rates year-to-date 2020: tmsnrt.rs/2egbfVh). Oil prices picked up on fears of damage from Hurricane Laura, but subsided after the storm passed through with minimal damage; gold price increased by 1.3%.

Weekly % changes for last week (27-28 Aug) from 20th Aug (regional) and 21st Aug (international).

Global Developments

US/Americas:

- At the Jackson Hole meeting, the Fed chair indicated a strategy change that would allow rates to be kept near zero even when inflation exceeds its 2% target in order to make up for past bouts of low inflation.

- US GDP plummeted by 31.7% on an annualized basis in Q2 this year – the worst decline since records began, but revised down from the 32.9% initial estimate. Both private inventory investment and personal consumption expenditures (PCE) decreased less than previously estimated. The PCE price index decreased 1.8% in Q2 (Q1: +1.3%) while core PCE price index, excluding food and energy prices, decreased 1.0% (Q1: +1.6%).

- Consumer spending in the US inched up by 1.9% in Jul, while income edged up by just 0.4% after two months of declines.

- Durable goods orders surged by 11.2% mom in Jul (Jun: 7.7%), thanks to a 35.6% rise in orders for transport equipment. Non-defense capital goods orders, a proxy for business spending, increased by 1.9% following a 4.3% pick up the month before.

- US Chicago Fed National Activity Index slipped to 1.18 in Jul from a record high reading of 5.33 in Jun. The index’s 3-month moving average rose to +3.59 in Jul (Jun: –2.78) – the first expansion since Jan.

- S&P Case Shiller home price indices moved up by 3.5% yoy in Jun, down from 3.6% in the previous month. Unsold inventory is at a 3.1-month supply at the current sales pace, down from 3.9 months in Jun and from a 4.2-month supply in Jul 2019.

- New home sales increased by 13.9% mom – the quickest pace in 13 years – to 901k units in Jul, supported by a rise in demand after the lockdown, need for more work-from-home space and record low mortgage rates. Pending home sales grew by 5.9% mom in Jul, following the 15.8% surge in Jun; sales were 15.5% higher annually.

- Initial jobless claims touched 1.006mn in the week ended Aug 21, taking the 4-week average to 1.068mn. Continuing claims eased to a pandemic-low of 14.54mn in the week ended Aug 14, from 14.8mn a week ago.

Europe:

- Germany’s GDP plummeted by 9.7% qoq and 11.3% yoy in Q2 – the worst ever documented, but a tad lower than the previously estimated 10.1% contraction. Consumer spending shrank by 10.9% in the quarter, capital investments by 19.6% and exports by 20.3%, while construction activity fell by 4.2%.

- Germany recorded its biggest deficit (EUR 51.6bn) in a decade in H1 this year: for the first time since 2010, revenues were down yoy (with taxes dropping 8.1%) while government spending increased by 9.3%.

- German Ifo business climate improved to 92.6 in Aug from Jul’s downwardly revised 90.4 – the 4th consecutive monthly increase. Both current assessment and expectations were more optimistic versus Jul’s reading.

- The Gfk consumer confidence survey showed a dip in sentiment to -1.8 in Sep (Aug: -0.2), led by the drop in the income expectations index that fell to 12.8 in Aug (Jul: 18.6).

- Euro area business climate indicator increased to -1.33 in Aug (Jul: -1.8), up from a decade low recorded in May (-2.39). Consumer confidence remained almost unchanged at 14.7 in Aug (Jul: -15), having recovered from Apr’s -22 reading.

Asia Pacific:

- Japan leading economic index was revised down to 84.4 in Jun – the highest reading in 3 months – from the initial estimate of 85, but higher than May’s 78.3. The coincident index increased slightly to 76.6 from the preliminary figure of 76.4 and May’s 72.9.

- Japan’s all industry activity index rose by 6.1% mom in Jun (May: -4.1%), after 4 months of monthly declines, supported by tertiary activity (+7.9% mom).

- Tokyo CPI eased to 0.3% in Aug (Jul: 0.6%); core CPI (which excludes fresh food prices) fell 0.3% yoy in Aug.

- Singapore inflation fell to 0.4% yoy in Jul (Jun: -0.5%); core inflation fell to -0.4% (Jun: -0.2%), driven by a steeper decline in the cost of electricity and gas, as well as lower food inflation.

- Industrial production in Singapore inched up by 1.6% mom in Jul (Jun: 0.6%), after electronics surged by 24% mom alongside a 39% mom plunge in pharmaceuticals. In yoy terms, production was down by 8.4%.

Bottom line: The Fed’s strategy change, and Japanese PM’s resignation were major news affecting markets last week. The market-economy divide continues unabated (especially evident in the US where weekly jobless claims are still above 1mn) while repercussions of the Covid19 outbreak are becoming evident in the latest global Q2 GDP numbers – Turkey and Brazil Q2 GDP numbers will be out this week, as well as some PMI numbers. Meanwhile, according to the Netherlands CPB World Trade Monitor, global trade rebounded in Jun: up 7.6% mom, it was the fastest monthly increase (as demand picked up) since records began in Jan 2000. Though, the current resurgence in cases (taking total confirmed cases to above 25mn) is likely to subdue activity again, including trade (where volumes are still way below the pre-pandemic levels).

Regional Developments

- Bahrain raised its debt ceiling to BHD 15bn (USD 39.79bn) from BHD 13bn before (last raised in 2017) to finance spending and cover upcoming debt installments during 2020-2022.

- The value of Bahrain-origin exports declined by 12% yoy to BHD 202mn (USD 533mn) in Jul. Saudi Arabia, Oman and Bahrain were the top three export markets, together accounting for 40% of total Bahrain-origin exports.

- Egypt approved in principle a VAT incentive scheme: this includes in-kind and in-cash rewards in addition to a periodic withdrawal system. No further details were provided.

- Oil imports into Egypt plunged by 76.7% yoy to USD 191mn in Apr this year; non-oil imports also dropped by 35.2% to USD 6.179bn.

- Bilateral trade between Egypt and China stood at USD 5.2bn in Jan-Jul this year. China had also invested a total of USD 7.2bn in 1736 projects as of end-2018 in Egypt.

- All travelers into Egypt need to carry a negative PCR certificate for Covid19, issued not more than 48 hours prior to arrival, starting Sep 1st.

- Only one-fourth of funding for the 2020 Jordan Response Plan (response to the Syrian refugee crisis) has been secured since the beginning of the year. Funding stood at USD 597mn in Jan-Aug 2020, with no allocations towards institutional capacity-building projects.

- Iraq has frozen a 20-year oil-for-projects agreement with China – not officially annulled, but suspended implementation – as it withdrew nearly USD 1bn deposited in the joint fund to pay its civil servants, reported Aliqtisad News.

- Kuwait’s Ministry of Finance is waiting to recover the KWD 2.05bn transferred recently to the future generations fund – subject to the government’s approval of the new amendment to the law governing the fund. The amount will be returned to the public reserve fund.

- Kuwait will rebuild Lebanon’s 120k tonne large grain silo that was destroyed during the Beirut blast.

- Kuwait will extend residency and visits visas that expire at end-Aug automatically for 3 months (till Nov 30th).

- Discussions to designate a new PM in Lebanon will begin from tomorrow (Aug 31st). According to the Lebanese sectarian system, post of PM must go to a Sunni Muslim.

- A new central bank circular in Lebanon asks banks to provision for a 45% loss on their Eurobond holdings and a 1.89% loss on their hard currency deposits with the central bank, but no loss on their holdings of Lebanese pound certificates of deposit. It gave banks 5 years to make the provisions. In addition, it called for banks to recapitalize, by urging depositors who transferred more than USD 500k abroad as of Jul 1st 2017, to deposit funds in a special account in Lebanon frozen for five years and equivalent to 15% of the transferred amount to boost liquidity. The amount is raised to 30% for “politically exposed persons”.

- Inflation in Lebanon surged to 112.4% yoy in Jul; in mom terms, prices were up 11.42%. Last week, the central bank governor revealed that the BdL could not use the banks’ obligatory reserve to finance trade once it reaches its minimum threshold, while assuring that other means of finance was being created.

- Expats in Oman’s government sector dropped by 15.1% mom and 18.8% yoy to 44,558 in Jul 2020. Overall number of expats in the country slipped by 3.0% mom to 1.54mn.

- Fitch cut ratings of several Omani banks and companies: it downgraded by one notch HSBC Bank Oman, Ahli Bank, and Bank Muscat assigning a negative outlook to all. Bank Dhofar and National Bank of Oman ratings were affirmed, but assigned a negative outlook.

- Saudi Arabia is set to launch the derivatives market from today (Aug 30th). Separately, Tadawul approved the listing of USD 133.33mn worth government debt instruments.

- The value of assets held by Saudi public and private investment funds increased by 17.85% yoy to SAR 380.66bn in Q2 this year, supported by a 44% growth in the assets of public investment funds.

- Oil exports from Saudi Arabia plummeted by 55% yoy in Jun – a drop of USD 8.7bn (in May, exports fell by nearly USD 12bn yoy). Total exports grew by 19.1% mom.

- Saudi Arabia’s crude oil exports to China fell 39% mom and 23.3% yoy to 5.36mn tonnes – equivalent of 1.26mn barrels per day – in Jul. This dropped Saudi to the 3rd biggest supplier in China behind Russia (7.38mn tonnes) and Iraq (5.79mn tonnes).

- Trucks from Bahrain are now allowed to transit through Saudi Arabia.

UAE Focus

- The UAE abolished the 1972 Israel boycott law, allowing individuals and companies in the country to enter into agreements, also enabling trade, tourism and investment.

- UAE inflation declined by 2.36% yoy in Jun, with the costs of recreation and culture down by 18.66% while the largest increase was seen in textiles, clothing and footwear (+10.7%).

- Abu Dhabi returned to the bond market, with the longest-ever Gulf bond, offering 3% on the longest tranche maturing in 2070. It raised USD 5bn from a 3-part offering, having received more than USD 23bn in orders for the debt sale. The emirate’s debt had increased to USD 39.2bn as of end-Jun, from USD 29.4bn last year, according to the prospectus.

- S&P expects Dubai GDP to shrink by 11% yoy this year, before rebounding to 5% next year. It therefore lowered credit ratings of two entities – Emaar and DIFC Investments – to BB+ “junk” rating from an investment grade BBB- score citing lowered ability to provide “extraordinary financial support to its related entities”.

- Abu Dhabi’s non-oil trade with the GCC nations (excluding Qatar) totaled AED 21.74bn in Jan-Apr 2020, and accounted for almost one-third of the total trade value during the period. Saudi Arabia topped the list of with a total value of AED 15.95bn, or 73.4% of trade with the 4 GCC nations.

- The value of exports and re-exports to China of Dubai Chamber’s members grew by 27% yoy to AED 283.2mn in May. During Jan-May, about 1100 certificate of origin documents were issued for china-bound shipments – double the number issued a year ago.

- Dubai ranks third globally in greenfield FDI projects and fourth globally in FDI capital inflows during H1 this year, according to a Dubai FDI official. Medium and high technology investments in Dubai also increased by 53% during this period.

- UAE left fuel prices unchanged again in Sep; prices have remained the same since Apr.

- Oil product stockpiles in Fujairah stood at 26.681mn barrels as of Aug 24th, up 11% from the previous week – the biggest weekly gain since Feb and highest total since Jul 13th.

- Ras Al Khaimah will lower trade licence renewal fees on certain commercial activities by up to 50%, while firms whose establishments were used for quarantine purposes will get a 25% reduction – these exemptions will be in place for a year.

- Commercial cases filed at the DIFC Courts surged by 96% yoy in H1 this year. Total value of the cases is estimated at AED 2.2bn (USD 598mn), with each case estimated to be worth AED 88.5mn on average.

Media Review

How important is the dollar for global trade?

https://www.economist.com/schools-brief/2020/08/29/global-trades-dependence-on-dollars-lessens-its-benefits

Leave public debt worries for another day

https://www.ft.com/content/691cb9f4-b53d-4429-bba4-03ca623c0077

How will business behave in the New Normal?

https://www8.gsb.columbia.edu/articles/ideas-work/how-will-business-behave-new-normal

Forget other models. Aramco should carry on being … Aramco

https://www.arabnews.com/node/1725651

Can Lebanon avoid the Venezuela meltdown scenario?

https://www.arabnews.com/node/1724021/business-economy

Nasser Saidi’s article in AnNahar: A Practical Plan to Rescue Lebanon; Time to Uproot Corruption (Arabic)

https://bit.ly/32x0WCm