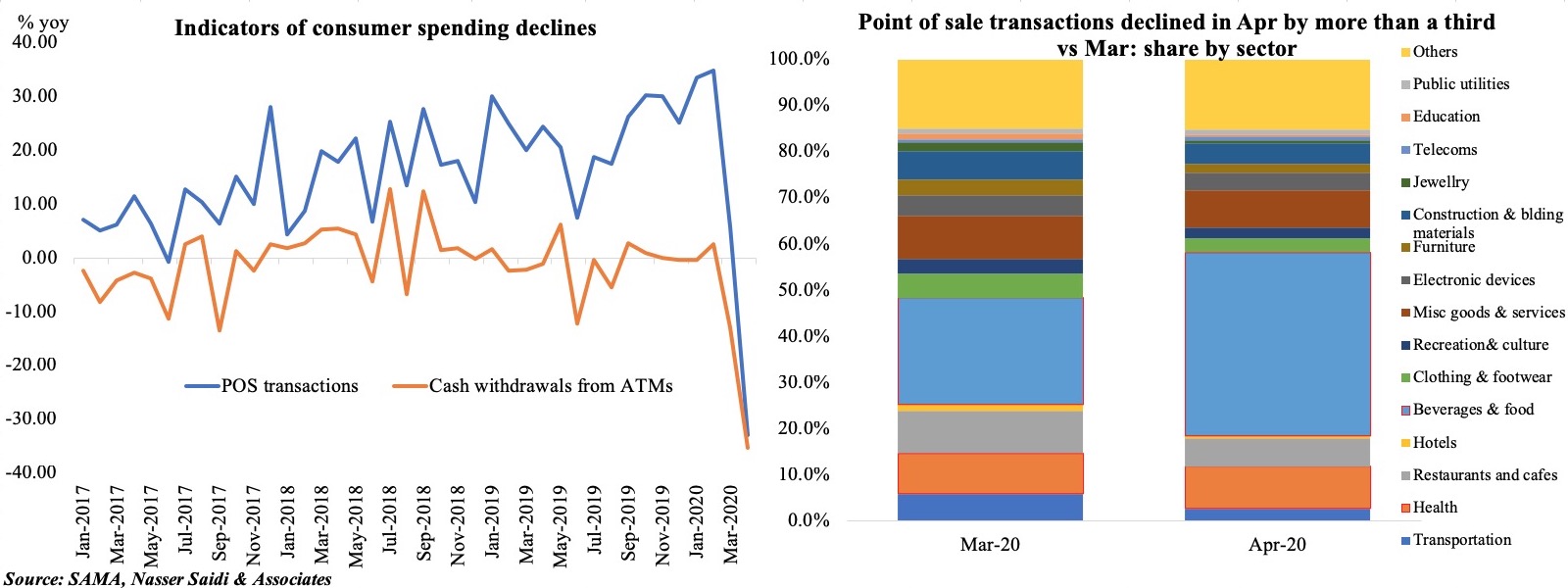

Weekly Insights: PMI releases dominated the news and our updated heat-map paints a not-so-rosy picture; some food for thought from an analysis of the UAE and Saudi Arabia’s latest credit and spending data.

Markets

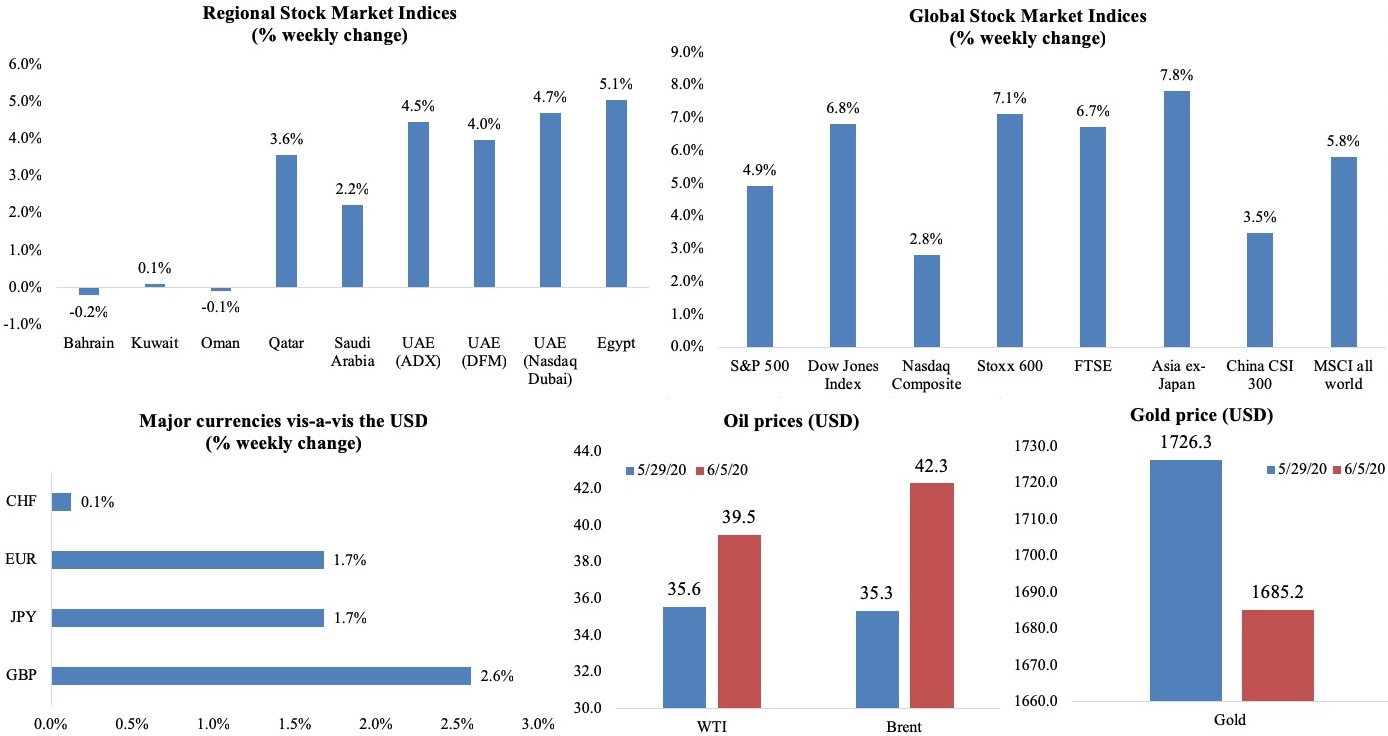

Global stock markets continue to rally, holding near 3-month highs, with the US supported by the unexpected pickup in non-farm payrolls, while Asia and emerging market stocks posted the best weekly gains in 9 years. Regional markets were mostly higher as lockdowns were slowly eased and businesses reopened partially. The euro gained 1.7%, also touching the highest level since Mar 10th. Oil prices gained for a 6th consecutive week, on expectations of OPEC output cut amid recovering demand. Gold price declined for the 3rd consecutive week. (Graphs in the last section.)

Global Developments

US/Americas:

- Non-farm payrolls unexpectedly added 2.5mn jobs in May (Apr: -20.7mn) – the biggest one-month gain since at least 1939 – and the jobless rate declined to 13.3% (Apr: 14.7%). Leisure and hospitality workers gained the most – with 1.2mn going back to work after a reported loss of 7.5mn in Apr. As more low-wage workers reported back to work, average hourly earnings clocked in at 6.7% yoy in May versus Apr’s 8%.

- Initial jobless claims eased to 1.88mn in the week ended May 29, pushing total applications to almost 43mn. The 4-week moving average rose to 2.284mn, a decline from 2.609mn the previous week. Continuing claims rose by 437,072 to 19.3mn in the week ended May 23.

- Private payrolls declined by 2.76mn in May, a sharp drop from the previous month’s downwardly revised 19.557mn loss. The sharpest losses were in the trade, transportation, and the utilities sector, where 826k jobs were cut during May.

- US factory orders plummeted by 13% mom in Apr, following the 11% dip the month before. Transportation equipment orders tumbled by 48.3% in Apr (Mar: -43.2%) while orders for non-defense capital goods excluding aircraft declined 6.1%.

- ISM manufacturing PMI eased from an 11-year low of 41.5 in Apr to 43.1 in May, with new orders sub-index rising to 31.8 (Apr: 27.1) and the production metric up to 33.2 from 27.5. Non-manufacturing PMI recovered to 45.4 in May (Apr: 41.8), with new orders rising 9 points to 41.9 and employment sub-index up to 31.8 (Apr: 30).

- Markit manufacturing PMI touched 39.8 in May, unchanged from initial estimates, and higher than Apr’s record low of 36.1. With the rate of contraction easing, both services PMI and Composite PMI recovered, rising to 37.5 and 37 respectively (Apr: 26.7 and 27).

- The US trade deficit widened to USD 49.4bn in Apr (Mar: USD 42.3bn), with both exports and imports declining. Exports fell by 20.5% to USD 151.3bn – the lowest since Apr 2010 – while imports dropped by a record 13.7% to USD 200.7bn – the lowest since Jul 2010.

Europe:

- ECB meeting boosted its pandemic emergency support program to EUR 1.35trn in total, and also extended the scheme until at least June 2021.

- German factory orders plunged by 25.8% mom – the largest ever monthly decline -following a 15% dip in Mar. Germany also agreed on EUR 130bn in stimulus measures, including a temporary lowering of VAT, a EUR 300 payment per child and subsidies for buying electric vehicles on top of the already announced relief measures.

- German Markit manufacturing PMI was revised lower to 36.6 in May from an initial estimate of 36.8: both output and new orders declined sharply while the rate of job losses continued to accelerate. Services PMI stayed low at 32.6 in May – higher than a preliminary estimate of 31.4 and recovering from a record low of 16.2 in Apr – while the composite index moved up to 32.3 (from a preliminary estimate of 31.4 and Apr’s record low 17.4).

- EU Markit manufacturing PMI moved to 39.4 in May (Apr: 33.4, but lower than the initial estimate of 39.5). Services PMI was revised higher to 30.5 (initial estimate: 28.7; Apr: 12) while the composite PMI touched 31.9 (30.5; Apr: 13.6).

- UK Markit manufacturing PMI edged up to 40.7 in May, from Apr’s record low of 32.6, while services PMI inched up to 29 – the second lowest reading since the series began – from the previous month’s record low 13.4%.

- Unemployment rate in Germany increased to 6.3% in May – the highest level since 2016 – from Apr’s 5.8%, after jobless numbers rose by a seasonally adjusted 238k between Apr-May. EU’s jobless rate increased to 6.6% in Apr from Mar’s 12-year low of 6.4%; in the Eurozone, the jobless rate rose to 7.3%, up from 7.1%.

- Eurozone’s retail sales dived by 19.6% yoy and 11.7% mom in Apr (Mar: -8.8% mom and -11.1% yoy), with online sales reporting a significant increase. Countries with softer restrictions fared better (Germany’s -5.3% decline vs Spain’s around 20% dip).

Asia Pacific:

- China Caixin manufacturing PMI improved to 50.7 in May (Apr: 49.4), the highest reading since Jan; though output grew the most since Jan 2011, export orders continued to fall. Caixin services PMI surged to 55 in May (Apr: 44.4), the fastest pace of growth since Oct 2010: new orders rose the most since Sep 2010 though new export orders fell as did employment.

- Japan’s leading economic index eased to 76.2 in Apr – the weakest reading since Mar 2009 – from an upwardly revised Mar reading (85.1). The coincident index also posted the weakest reading since Nov 2009, slipping to 85.1 (Mar: 88.8).

- South Korea’s Q1 GDP shrank by -1.3% qoq from the previously reported -1.4% estimate: this was the largest on-quarter drop since Q4 2008. The full year growth outlook has been cut to -0.2% this year.

- Inflation in South Korea fell by 0.3% yoy in May (Apr: +0.1%) –only the second time annual inflation has fallen below zero – largely due to a decline in oil prices (-18.7% yoy) while utility prices fell by 0.7%.

- Singapore PMI rose to 46.8 in May (Apr: 44.7) and the electronics sector PMI rose 3.4 points to 46.2. Slower contractions in the sub-indices of new orders, export orders, factory output and employment supported the uptick though readings remained in contractionary territory.

- Retail sales in Singapore plunged by 31.7% mom and 40.5% yoy in Apr, following Mar’s dip by -1.3% mom and -13.3% yoy, after non-essential businesses remained closed during the circuit breaker period starting from Apr 7.

Bottom line: PMI numbers across the globe improved from record lows, as countries eased restrictions, though the outlook for the coming 12 months remains subdued. New export orders remain weak highlighting weak global demand alongside some respite in domestic orders. Stock markets continue to climb on hopes of a V-shaped economic recovery (that businesses are not yet anticipating) and more central bank stimulus. While easing restrictions have seen work-related domestic travel resume as well as retail activity, a key point to watch out for is spending patterns i.e. are households back to spending at pre-Covid19 levels or are they saving on worries about jobs/ economic uncertainty? US data has already shown an increase in personal savings to a historic 33% high in Apr, in spite of the one-time payment of USD 1200 from the government. The Fed meets this week and investors are likely to look for some guidance after the latest payrolls surprise to the upside.

Regional Developments

- The Bahrain Bourse has rolled out an ijara-Sukuk based murabaha service, with the aim to support the creation of an Islamic debt market in the country.

- Bahrain plans to reopen schools in Sep: students will return to the public schools on Sep 16th while private schools will open starting mid-Aug to Sep. The education minister also stated though that the decision would be reviewed periodically. Separately, the resumption of Friday prayers was postponed given the status of the outbreak.

- Exports from Bahrain declined by 9% yoy to BHD 186mn in Apr, with Saudi Arabia the top destination (BHD 37mn) followed by UAE (BHD 20mn) and Egypt (BHD 18mn). Value of imports dipped by 19% to BHD 362mn while re-exports plummeted by 42% to BHD 38mn.

- Egypt’s PMI increased to 40.7 in May, up from Apr’s record-low of 29.7, with declines in output and new orders while export sales remained weak. Employment levels declined for the 7th consecutive month and at the quickest pace since Jan 2017.

- The IMF reached a staff-level agreement with Egypt for a one-year, USD 5.2bn standby arrangement loan. This comes on top of the USD 2.77bn emergency IMF financing obtained to maintain economic stability during the Covid19 outbreak.

- Egypt plans to reduce the overall budget deficit to EGP 415.2bn or 5% of GDP in the fiscal year 2020-21. Revenues are estimated to be EGP 1.351trn, with tax revenues at EGP 1.059trn while expenditures clock in at EGP 1.758trn.

- Money supply in Egypt accelerated by 15.62% yoy and 1.64% mom to EGP 4.35trn (USD 274.27bn) in Apr. Local currency deposits at banks grew by 23% yoy and 1.33% mom to a record high of EGP 3.13trn in Apr.

- The manufacturing and extractive industries production index in Egypt declined by 8.7% mom to 123.87 in Feb. Manufacture of pharmaceuticals rose by 3.9% to 118.2 while manufacture of clothing and tobacco products declined by 8.9% and 4.5% respectively.

- Egypt’s Suez Canal revenues fell by 9.6% yoy in May, as trade movements slowed: number of ships remained the same as a year ago, while payloads decreased.

- The new customs facilities approved by Egypt’s finance ministry will reduce production costs and stimulate investment: facilities include simplified procedures, reduced release times, rationalised customs clearance costs, and reduced commodity prices in local markets.

- In a bid to support local industries during the Covid19 outbreak, Egypt cancelled EGP 5.31bn (USD 330mn) in outstanding natural gas debt owed by factories up until 31 Dec 2019.

- Egypt’s hotels which reopened at a reduced capacity of 25% occupancy are almost full, according to a tourism ministry official. The government aims to raise capacity to 50% in Jun.

- Egypt announced a new oil discovery in Western Desert: The new discovery has been put on the production plan at a rate of 4,100 barrels of crude oil per day and 18mn cubic feet of natural gas per day.

- Jordan’s “most-damaged” economic sectors can deduct 30% from employee’s salaries based on a mutual agreement for the months of May-Jun. It also stipulates that workers not performing any work can have 60% of their salaries deducted, with no consent required by the worker or the Labour Ministry.

- Tourism revenues in Jordan declined by 10.7% to JOD 784mn in Q1, after posting a 13.6% growth in Jan-Feb this year followed by a 56.5% dip in Mar.

- Expatriates’ remittances into Jordan declined by 5.4% yoy to JOD 600mn in Q1 this year; remittances dropped by 6.8% in Mar alone.

- Kuwait will cut government entities’ budget for fiscal year 2020-2021 by at least 20%. The ministry of finance to coordinate with government entities to review public services and the value of government subsidies.

- Kuwait plans to reduce the expat population to just 30% of the total, revealed the PM. Currently, there are nearly 3.34mn foreigners in a total 4.8mn population. MPs have proposed a quota system in addition to replacing expat government employees (~100k) with Kuwaitis.

- The central bank of Kuwait issued bonds and related tawarruq worth KWD 360mn last week, with a 1.37% return rate.

- Lebanon’s PMI edged up to 37.2 in May, up from a record low of 30.9 in Apr, largely due to the reduction in new business. Meanwhile, cost burdens increased on higher purchase prices.

- The government and central bank figures on financial system losses in Lebanon will be reconciled this week at a meeting involving the President, Prime Minister, Minister of Finance and Central Bank Governor, to facilitate negotiations with the IMF.

- According to a new decree, Oman will set up an investment authority to own and manage most of the sovereign wealth fund and finance ministry assets. Exclusions are the Petroleum Development Oman company and government stakes in international institutions.

- Oman set the retirement age for staff of government companies (including state-owned enterprises) at 60.

- Qatar’s central bank sold QAR 600mn (USD 159.89mn) of Treasury bills in an auction.

- Saudi Arabia’s PMI remained below-50 for the 3rd consecutive month, but improved to 48.1 in May from Apr’s 44.4, supported by slower declines in output, new work and employment; business closures and constrained operating capacity were oft cited as reasons holding back activity.

- Saudi Arabia will raise import duties by between 0.5-15ppts on products ranging from meat, dairy and vegetables to vehicles and building materials. Effective from June 10th, this move follows plans to hike VAT to 15% from Jul.

- Saudi Arabia reinstated Covid19 restrictions in Jeddah for 15 days effective Sat (Jun 6th) – this includes curfew from 3pm to 6am as well as work from home policies and gatherings limited to less than 5 persons. Domestic flights will continue operations and people are permitted to enter and exit the city.

- About 8787 businesses will stay closed in Riyadh till Jun 20th – this includes businesses where social distancing cannot be applied effectively like barber shops, beauty salons, gyms/ health clubs, cinemas, recreational centres and shisha cafes.

- New residential mortgage loans for individuals in Saudi Arabia surged by 95% yoy to 89,435 until Apr 2020, valued at nearly SAR 40bn (+85% yoy).

- The Saudi Contractors Authority expects value of projects awarded during the year to touch SAR 120bn only if lockdown continues for 6 months; projects awarded in Q1 amounted to SAR 97.5bn.

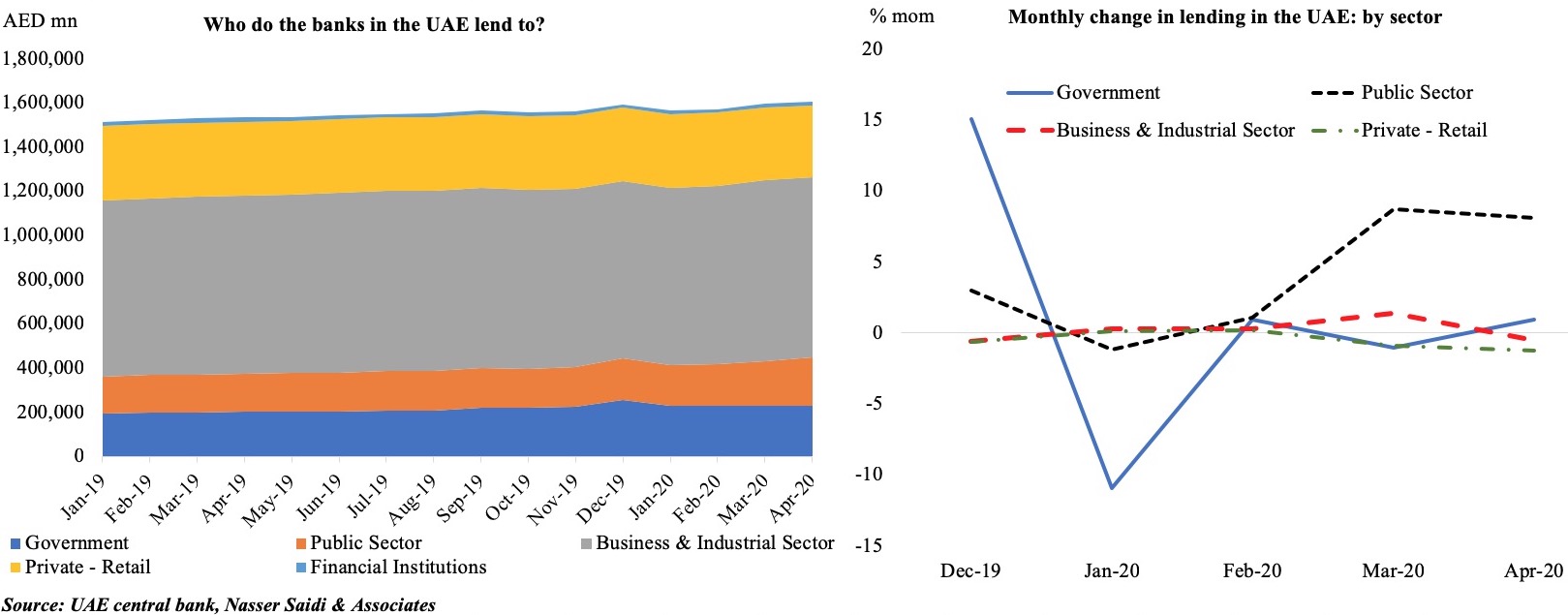

- Saudi Arabia’s points of sales transactions dropped by 33% yoy and 34.7% mom to SAR 16.17bn in Apr. Food and beverage dominated the highest value in POS transactions with SAR 6.44bn, almost doubling from SAR 3.23bn.

- SAMA disclosed that it had provided SAR 50bn (USD 13.32bn) to support liquidity, banks’ assets in Saudi Arabia grew by 14% yoy to SAR 2.7trn in Q1 this year while credit to the private sector grew by 12%.

- Expat remittances in Saudi Arabia grew by 2.3% yoy to SAR 43.65bn (USD 11.62bn) in Jan-Apr 2020. In Apr alone, remittances declined by 8.7% yoy and 20% mom to SAR 9.79bn.

- The IIF forecast a decline in hydrocarbon revenues to USD 200bn this year in the GCC from USD 326bn last year. With oil price estimated at USD 40 per barrel, aggregated fiscal deficit is expected to widen to 10.3% of GDP in 2020 from 2.5% in 2019.

- Middle East air cargo demand declined by 36.2% yoy in Apr (Mar: -14.1%), according to IATA.

- OPEC+ members extended its output cuts of 9.7mn barrels per day till Jul: producers that had not fulfilled their quotas will have to compensate for that until Sep. Compliance among the group averaged 86% in May: Nigeria and Iraq cut less than the allotted quotas.

UAE Focus

- UAE PMI increased to 46.7 in May from a record low of 44.1 the month before: output sub-index remained below-50 (45.7 in May from Apr’s 39.9), demand remained weak and employment declined. Outlook for the next 12 months of activity worsened still, reaching the joint-lowest since the series began. About 20% of businesses said they expected activity to expand while 8% said they expected it to decline.

- Total banking assets in UAE touched AED 3.156trn in Apr: gross assets of banks operating in Abu Dhabi and Dubai rose to around AED 2.897trn, accounting for 92% of the total.

- 50% of UAE government staff will return to work from Jun 7th: this follows the return of federal staff by 30% last week.

- Private sector and malls in Dubai are now permitted to operate at 100% capacity from Jun 3rd. Working hours should fall within 6am to 11pm.

- Sharjah’s Finance Department confirmed the Sharjah Liquidity Support Mechanism (SLSM) Sukuk – issued as 12-month dirham denominated paper – as the first rated short-term local currency tradeable instrument in the UAE which can be used for liquidity management by banks. The first tranche of the SLSM was subscribed to by Bank of Sharjah with AED 2bn participation; subsequent tranches are estimated to expand SLSM to AED 4bn. Separately, Sharjah sold a 7-year USD denominated Sukuk last week.

- The total number of business licenses issued in the UAE inched up by 0.16% mom to 648,684 in May, according to the National Economic Register.

- The Dubai Electricity and Water Authority disclosed that the share of clean energy in Dubai’s energy mix increased to around 9%.

- UAE’s minister of community development disclosed that a total of 12,653 nationals are jobless across the country: Abu Dhabi accounted for more than 1/3rd (4461), followed by Dubai (3812) and Northern Emirates (4810).

- The UAE will allow transit flights to resume: Emirates will operate transit flights to 29 destinations by Jun 15th and Etihad will fly to 20 destinations from Jun 10th. Separately, airlines continue to feel the pressure: Air Arabia has made further job cuts, without mentioning the number affected. Emirates president stated it would take up to 4 years to resume flying its entire network.

- UAE pumped 2.4mn barrels of crude per day in May, in line with its commitment under the OPEC+ oil supply cut pact, reported Reuters citing an industry source.

Weekly Insights

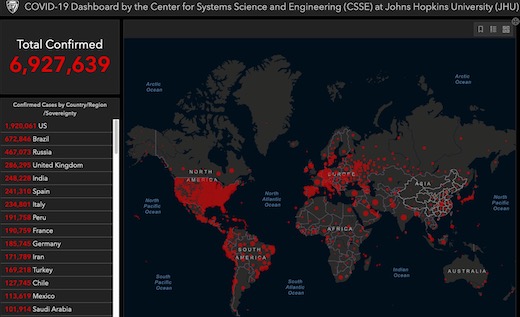

As nations ease restrictions and lockdowns, economic activity is slowly picking up: this is evident from the latest PMI numbers out of Europe, Asia and the Middle East (below). While China is still the only nation reporting growth (i.e. above-50 mark), Japan remains an outlier by reporting worse than Apr numbers last month. The main factor of concern for businesses remain the Covid19 pandemic though in the Middle East, respondents were also concerned about the rising US-China tensions. Global trade is forecast to decline by a record 27% in Q2 this year, according to UNCTAD, as exports slump.

Chart 1: Heatmap of Manufacturing/ Non-oil sector PMIs – the Covid-19 effect

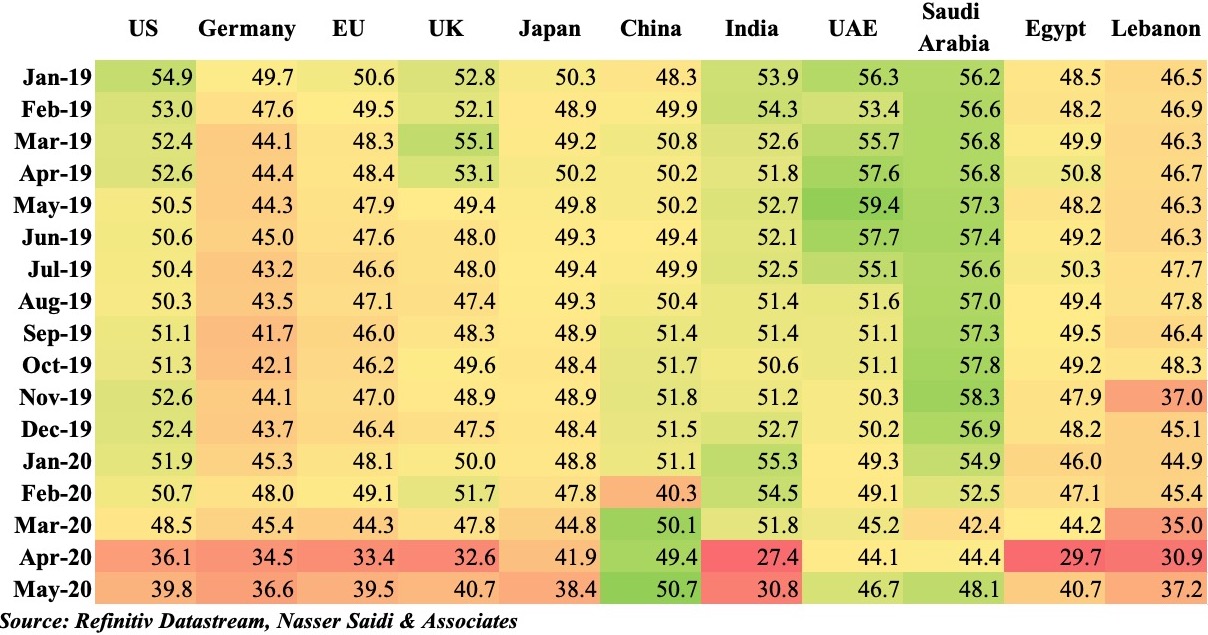

Chart 2: UAE banks’ lending patterns

The UAE central bank released its latest monthly statistics with data for Apr. The two panels above indicate the sectors banks lend most to: not surprisingly, the business and industrial sector for about 50% of total loans disbursed in Apr this year. However, the monthly change shows an interesting picture: the public sector entities (i.e. state-owned enterprises/ GREs) have seen an 8%+ mom increase in loans in both Mar and Apr. While the central banks announced multiple stimulus packages to the benefit of businesses (and more specifically to SMEs), it does not seem to have filtered down to the intended recipients, as loans to both the business and industrial sector as well as retail declined in month on month terms (-0.5% and -1.2% respectively).

Chart 3. Saudi Arabia’s spending patterns during the Covid19 outbreak

Lockdowns in Saudi Arabia have pushed both point-of-sale (PoS) transactions and cash withdrawals from ATMs to double-digit year-on-year declines in Apr: movements have been restricted and online shopping has been picking up versus visits to shops/ malls. Breaking down PoS transactions by sector, only the “food and beverages” and “health” show an increase during the lockdown. As restrictions are lifted from this month, we can expect a slight rebound (e.g. white goods), especially as VAT is also scheduled to increase to 15% (from 5% currently) from Jul. In the months prior to the introduction of VAT in 2018, there was a significant increase in the PoS transactions in electronic devices, furniture, jewelry as well as construction and building materials. In comparison to 2017-18, this month’s uptick (if any) might be relatively muted given the pressures on cost of living – customs fees on various products are also scheduled to rise from this week.

Media Review

Deglobalization Will Hurt Growth Everywhere

https://www.project-syndicate.org/commentary/deglobalization-threat-to-world-economy-and-united-states-by-kenneth-rogoff-2020-06

The Long Economic Hangover of Pandemics

https://www.imf.org/external/pubs/ft/fandd/2020/06/long-term-economic-impact-of-pandemics-jorda.htm

Bank of England Says Lenders Must Prepare for No-Deal Brexit

https://www.bloomberg.com/news/articles/2020-06-03/bank-of-england-tells-lenders-to-prepare-for-no-deal-brexit

The world must seize this opportunity to meet the climate challenge

https://www.theguardian.com/commentisfree/2020/jun/05/world-climate-breakdown-pandemic

Market Snapshot as of 7th June 2020

Weekly % changes for last week from 29th May (international) and 28th May (regional).

Source: Refinitiv Eikon, Datastream, Nasser Saidi & Associates.

Powered by: