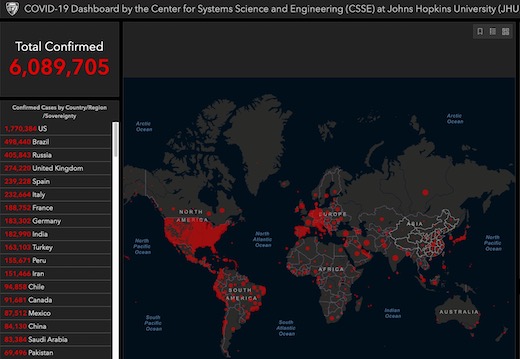

As countries in the GCC slowly ease restrictions, this week’s Insight section charts how countries are coping with Covid19, its impact and stimulus packages.

Markets

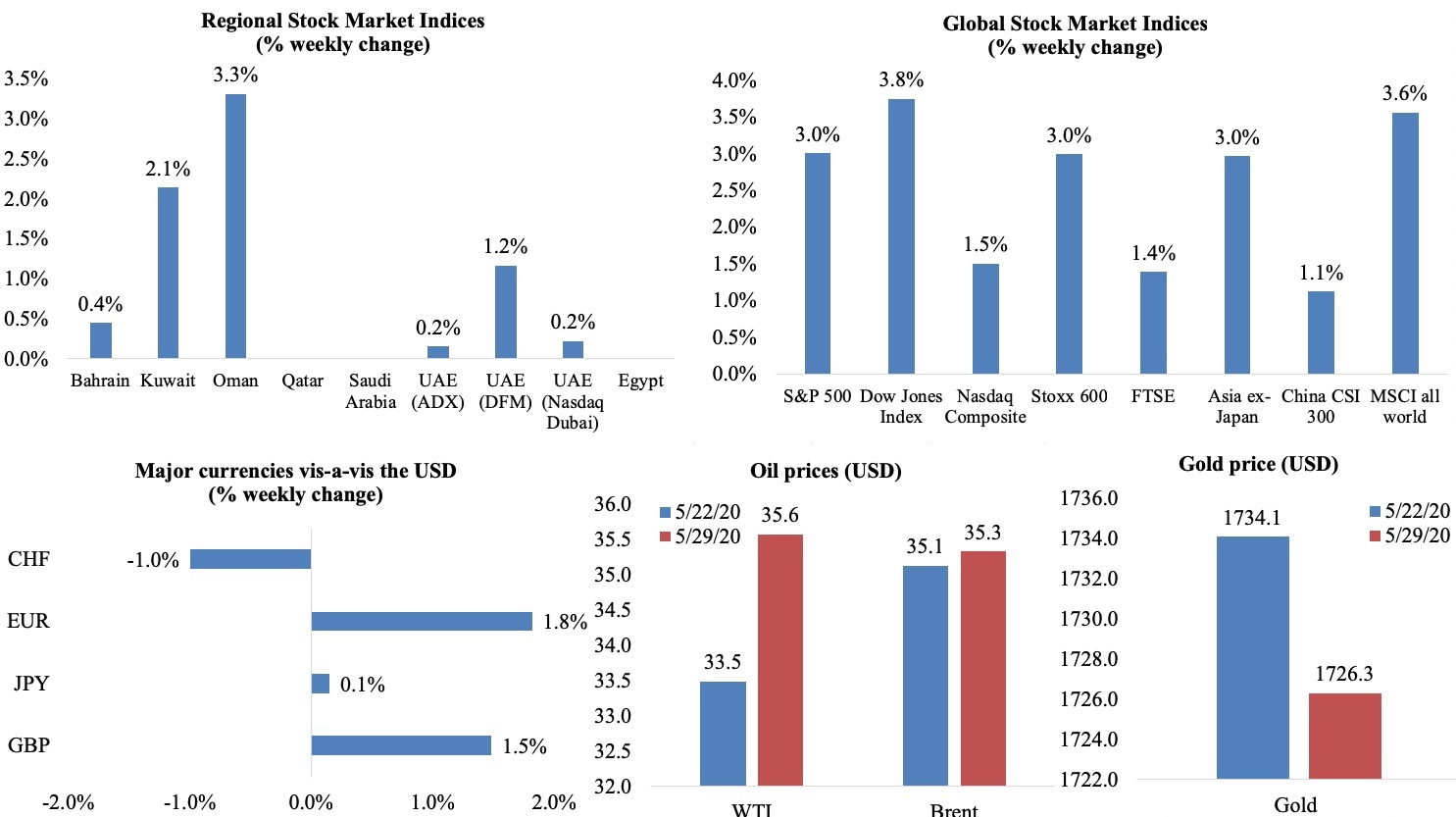

Global stock markets had a good week (MSCI World index was up around 3.6%) and a better-than-expected month of May (S&P gained 4% this month). A few regional markets were closed for the Eid holidays, while the others were mostly up. The euro hit a 2-month high on optimism after the EU recovery fund was announced while the Japanese Yen rose to a 2-week high. Oil prices rose to above USD 35, touching the best levels since early Mar. Gold price continues to be supported by its safe haven status. (Graphs in the last section.)

Global Developments

US/Americas:

- US GDP shrank by 5% in Q1 2020, a larger decline than the initial estimate of a 4.8% drop and the biggest quarterly dip since Q4 2008. This was a result of drops in personal consumer expenditures (PCE), private inventory investment and non-residential fixed investment.

- Several indices across the US point to declining activity: the Chicago Fed National Activity Index slumped to 16.74 in Apr (Mar: -4.97); the Dallas Fed manufacturing business index eased to -49.2 in May (Apr: -74) while the Richmond Fed manufacturing index improved to -27 in May (Apr: -53).

- Inflation, as measured by an index for personal consumption expenditures (PCE), fell 0.5% mom in Apr while the core PCE index, which excludes food and energy, was down 0.4%.

- Personal income soared by 10.5% thanks to the government’s CARES Act package (Mar: -2.1%). Personal spending plunged by a record 13.6% in Apr (Mar: -6.9%) despite the rise in income and personal savings rate reached a record 33% in Apr (Mar: 12.7%).

- US durable goods index declined by 17.2% mom in Apr (Mar: -16.6%), with demand for transportation equipment down 47.3% and orders for motor vehicles and parts collapsing 52.8%. Non-defense capital goods orders excluding aircrafts dropped by 5.8% (Mar: -1.1%).

- US housing price index inched up by a marginal 0.1% mom in Mar (Feb: 0.8%) while the S&P Case Shiller home price index posted a 0.5% mom and 3.9% yoy gain in Mar (Feb: 3.5% yoy).

- New home sales unexpectedly grew by 0.6% mom to a seasonally adjusted rate of 623k units in Apr, after posting a 13.7% mom decline the month before. The median price of a newly built home dropped5% annually to USD 309,900 (the lowest since Jul 2019).

- Pending home sales fell by a steep 21.8% mom and 33.8% yoy to 69 in Apr – the largest decline since NAR begin tracking such transactions in Jan 2001.

- Chicago PMI weakened to 32.2 in May – the lowest level since May 1982 – from Apr’s 35.4, with the order backlogs and supplier deliveries sub-components showing the largest declines.

- Initial jobless claims eased to 2.12mn in the week ended May 23: though this is the lowest total since the Covid19 crisis began, it pushed total applications past 40mn. The 4-week moving average rose to 22.72mn, an increase of 760,250 from the previous week. Continuing claims plunged by 3.86mn to 21.05mn.

Europe:

- The EU proposed a EUR 750bn recovery fund, which would offer EUR 500bn in grants and EUR 250bn in loans to help its economies recover.

- German GDP growth declined by 2.2% qoq in Q1 (Q4: -0.1% qoq) – the sharpest qoq decline since Q1 2009. Already in technical recession entering the Covid19 outbreak, it was not surprising to note that Q1 saw private consumption fall by 3.2% qoq and investment by 7% qoq. Construction sector (+4.1%) and government consumption (+0.2%) supported growth.

- German Ifo business climate index improved to 79.5 in May (Apr: 74.2) while the current assessment declined to 78.9 from 79.4 the month before. Expectations were more optimistic, with the index rising to 80.1 from 69.4. The Ifo Institute expects German growth to shrink by 6.6% this year as businesses are likely to take around 9 months to return to normal.

- Inflation in Germany eased to 0.5% yoy in May (Apr: 0.8%), largely due to the decline in oil prices. In the EU, annual inflation stood at 0.1% in May – the lowest in 4 years – with food prices rising alongside a 12% decline in energy prices. Core CPI was 0.9%.

- EU’s economic sentiment indicator climbed by 2.6 points to 67.5 in the eurozone in May.

Asia Pacific:

- China’s official manufacturing PMI slowed to 50.6 in May (Apr: 50.8), remaining above 50 for the 3rd consecutive month: total orders improved to 50.9 (Apr: 50.2) while export orders contracted to 35.3, suggesting that domestic demand could be recovering faster. Employment sub-index fell to 49.4 from 50.2 in Apr.

- The official non-manufacturing PMI in China rose to 53.6 in May (Apr: 53.2); the sub-index for construction activity edged up to 60.8 in May from 59.7. The composite PMI remained flat at 53.4 from Apr.

- Japan lifted its nationwide state of emergency and approved a second JPY 117trn (USD 1.1trn) stimulus package, bringing the total stimulus to about 40% of GDP.

- Tokyo’s core CPI rose by 0.2% yoy in May (Apr: -0.1%) while the headline CPI rose from 0.2% to 0.4%.

- Japan’s industrial production declined by 9.1% mom in Apr, posting the largest drop since 2013. Automaker production fell by a third from the previous month on weak global demand.

- Japan retail sales tumbled by 13.7% in Apr – the fastest pace since Mar 1998 – on weak demand for general merchandise, clothing and motor vehicles.

- Japan’s all-industry activity index fell sharply by 3.8% mom in Mar (Feb: -0.7%); March’s decline was the steepest since last October’s tax hike.

- Jobless rate in Japan rose to 2.6% in Apr, the highest since Dec 2017, while job availability slipped to 1.32 – the lowest since Mar 2016.

- India announced an easing of its national lockdown, even as the latest numbers show a record daily rise (8k cases on Sat). While areas with a high number of Covid19 cases will continue to remain under lockdown, from Jun 8, hotels, restaurants, shopping malls and places of worship are expected to reopen as part of a 3-phase plan.

- India’s GDP growth slowed to 3.1% yoy in Jan-Mar (Q4 of the 2019-20 fiscal year), the weakest quarter in 11 years; overall growth rate for the 2019-20 year eased to 4.2% (the lowest since 2008-09) after growth estimates for all previous quarters were revised down. The quarterly growth – which saw manufacturing and construction dip by 1.4% and 2.2% respectively and gross fixed capital formation decline by 6.4% – does not capture the decline in activity after the economy was shut down in late-Mar in response to the Covid19 outbreak.

- Singapore announced a fourth stimulus package worth SGD 33bn, rolled out as the “Fortitude Budget”: more than half the stimulus will be funded by drawdowns from past reserves. Overall stimulus now stands at SGD 92.5bn or about 19% of GDP.

- Singapore GDP declined by 4.7% qoq and 0.7% yoy in Q1 this year, from the 0.6% qoq expansion the quarter before. There were “pockets of resilience” in finance and insurance (+8% yoy) and manufacturing (+6.6%, thanks to the biomedical manufacturing cluster) amidst substantial declines in accommodation and food services (-23.8%), transportation and storage (-8.1%) and wholesale and retail (-5.8%).

- Industrial production in Singapore increased by 13% yoy and 3.6% mom in Apr, easing from the previous month’s surge of 16.5% yoy and 21.7% mom. Pharmaceuticals expanded by 100.5% yoy in Apr, thanks to the increased demand for medical goods.

- Inflation in Singapore turned negative in Apr, falling to 0.7% yoy after remaining flat in Mar. The drop (first time since end-2016) was due to larger declines in the cost of private transport, services as well as retail and other goods.

Bottom line: Over the past month, government stimulus across the globe and accompanying positive investor sentiment have driven stock markets up, offsetting the depressing macroeconomic data – the S&P 500 was up 4% this month, the best performance in May since 2009! Countries in Europe are slowly easing restrictions with some inter-EU travel expected after Jun 15; a few like Estonia, Latvia and Lithuania have formed “travel bubbles,” lifting restrictions for each other’s citizens. With businesses in a “new normal”, governments continue to roll out support – be it new rounds in Japan and Singapore – and central banks are expected to support further – ECB is likely to introduce fresh stimulus as the current bold EUR 750bn proposal is not a done deal (yet!). A second-wave impact is not too far-fetched a thought (like in Korea), while cases are still rising in many like Brazil, Mexico and Indonesia. Add to this, a lot of the past issues continue to crop up in the midst of the pandemic: be it the China-US tensions (trade deal) or Brexit (yes, that is still chugging along, with Jun 18-19 EU summit the date by when an extension could be requested).

Regional Developments

- Bahrain will invite companies to support national firms in its oil exploration plan: the ministry will be holding a virtual roadshow enabling companies’ access to its virtual data room (which includes information about a few appraisal wells and deep gas resources).

- Bilateral trade between Saudi Arabia and Bahrain grew by 15.3% yoy to USD 819mn in Q1 this year. Saudi Arabia was the largest trade partner, accounting for 49.1% of total trade, followed by the UAE (33.81% share, USD 550.4mn). The value of non-oil exports from Bahrain to the GCC stood at USD 1.126bn.

- Economic growth in Egypt declined to 5% yoy in Jan-Mar 2020 (Q3 of the fiscal year 2019-20), after substantial declines in the contributions of tourism (2.7% from 3% during the same quarter last year), industry (12.2% from 12.8%) as well as wholesale and retail (11.7%).

- Egypt will deduct 1% from public salaries and 0.5% from state pensions for a year beginning Jul 1st, to support state coffers during the ongoing Covid19 crisis.

- Egypt’s central bank will provide up to EGP 100bn (USD 6.36bn) in loan guarantees to support lending to businesses. These loans will carry an interest rate of 8%, below the central bank’s key overnight lending rate of 9.25%.

- Egypt sold USD 5bn in bonds in three tranches (in the week ended Mar 23) with maturities of four, 12 and 30 years. Attracting interest from investment funds and international institutions, the deal attracted more than USD 6bn in demand for each of the 4- and 12-year tranches and more than USD 7.6bn for the 30-year bonds, reported Reuters.

- Foreign employees in Egypt’s government and public business sectors increased by 42.2% yoy to 1,388 in 2019. Of those working in the public business sectors, 50.9% were working with the Egyptian Natural Gas Holding Company and another 37.5% in the Egyptian General Petroleum Corporation and Ain Shams University.

- Daily natural gas production capacity in Egypt reached an average of 7.2 billion cubic feet (bcf) compared to 6.8 bcf by end-Jun 2019 and 7bcf in Sep.

- Jordan’s request for emergency financial assistance from the IMF (Rapid Financial Instrument) amounting to about USD 396mn was approved. This is expected to cover about a quarter of Jordan’s external financing needs.

- Public sector employees in Jordan began a phased return to work last week, after a state of emergency was declared mid-Mar. About 60% are expected to return to work in this phase.

- Jordan plans to reopen the aviation sector gradually: initial operations will cover cargo transport and resuming passenger travel will be the next stage given “appropriate conditions”.

- Kuwait eased its full-time curfew to a 12-hour one (from 6pm to 6am) and will last 3 weeks before the next phase of easing is introduced.

- Lebanon’s discussions with the IMF continue: the Daily Star, citing an unnamed source, revealed that the IMF wants the capital control law to be passed before discussing financial assistance. Meanwhile, MPs want to include recommendations from the IMF in a draft law which blocks capital transfers from the country for all but limited reasons (including medical bills, loans, foreign taxes and purchase of essential goods).

- Oman ended the lockdown of Muscat governorate (in place since Apr 10) on May 29th. At least 50% of employees in government entities will work from the offices starting this week.

- Real estate deals in Oman increased by 24% yoy to OMR 629.2mn (USD 1.63bn) in Jan-Feb this year. The number of plots issued however declined by 5.7% to 36,523.

- Funding raised by Oman’s capital market for various projects and economic initiatives grew by 75% yoy to OMR 3.14bn (USD 8.2bn) in 2019, according to the Capital Market Authority.

- Qatar’s central bank swap agreement with Turkey has been tripled to USD 15bn, according to the latter’s central bank.

- Saudi Arabia will lift bans on domestic travel, holding prayers in mosques and workplace attendance in both the government and private sector from this week. Sixty domestic flights are expected to resume each day in the first phase. Public sector will resume normal operations as of June 14. It is expected that the curfew will be fully phased out by Jun 21 (except in Mecca).

- Saudi Arabia transferred SAR 150bn (USD 40bn) to the PIF from SAMA reserves in Mar-Apr, revealed the finance minister. He also stated that “returns on PIF investments [would] be available to support public finances when needed”.

- Inflation in Saudi Arabia inched up by 1.3% yoy in Apr, on higher food prices. In mom terms, prices declined by 0.1%.

- Wholesale prices in Saudi Arabia edged up by 0.6% yoy in Apr – the lowest level in a year. Prices of refined petroleum products declined by 11.9%. In mom terms, prices dipped 1.8%.

- Saudi Arabia reported a trade surplus of SAR 75.73bn in Q1 this year, with total trade amounting to SAR 320bn. In Mar alone, trade surplus dipped by 81.43% yoy and 68.24% mom to SAR 7.814bn.

- Foreign investor licenses in Saudi Arabia increased by 19% yoy to 348 in Q1 this year, according to the minister of investment. This included 37 US companies and 32 UK firms.

- The Saudi Program for Social Development in the Regions (Tanmiah) began procedures of disbursing financial compensations to owners of real estate properties located within the first stage of the NEOM project.

- Saudi Arabia’s Ministry of Umrah and Hajj enabled the return of as many as 450k Umrah performers safely to their countries amid the Covid19 outbreak and preventive measures.

- Airlines globally continue to be affected adversely by the pandemic: in the GCC, Kuwait Airways laid off 1500 expats of a total 6000; Etihad Airways slashed salaries and laid off hundreds of employees across various departments.

UAE Focus

- UAE is resuming “normal” activities: the curfew timing has been reduced to 10pm to 6am (Dubai from 11pm to 6am); beaches, parks, cinemas, museums and tourist attractions (Dubai Frame, Ski Dubai etc.) have reopened, with social distancing rules in place. All public sector employees will return to their physical offices starting Jun 14, starting with smaller numbers from May 31st (35% and 50% respectively in Abu Dhabi and Dubai government offices). Emirates airlines opened bookings for 16 destinations in 12 Arab nations starting from Jul 1st.

- According to the UAE Central Bank, total loans provided to SMEs grew by 4.3% qoq to AED 93.4bn in Q1 this year. This accounted for 8.1% of total credit to the private sector.

- Foreign currency assets held by the UAE Central Bank edged up by 1.6% yoy to AED 371.6bn (USD 101.2bn) in Apr 2020, as both current account balances and deposits with foreign banks strengthened.

- Inflation in Abu Dhabi increased by 0.9% mom in Apr; in yoy terms, CPI fell by 1.4%.

- Abu Dhabi’s non-oil trade grew by 10% yoy to AED 17.85bn in Mar 2020. Non-oil exports were up 14.4% yoy to AED 5.51bn while imports surged by 27.6% to AED 9.04bn.

- Real estate transactions in Abu Dhabi rose by 34% yoy to AED 6.3bn in Apr, from 2617 property deals.

- Abu Dhabi DED introduced a new programme to support import and export companies negatively impacted by the Covid19 outbreak: this includes help with facilitating procedures, improving efficiency of local export activities and addressing logistical constraints. Abu Dhabi DED is also implementing a new initiative encouraging SMEs to promote locally-made products, especially in the healthcare sector.

- Abu Dhabi’s private sector benefitted from the cancellation of fines: within 2 weeks of the announcement, more than AED 246mn of fines on expired licenses were cancelled from close to 50k firms; penalties of over AED 5.6mn were written off for other violations including improper storage of goods or misuse of commercial facilities.

- Dubai SME allocated AED 20mn to a capital guarantee scheme backing peer-to-peer loans made to SMEs. The scheme by Dubai SME and lending platform Beehive allows Dubai-based SMEs to seek funding – of upto AED 420k (firms that are 50% owned and managed by Emiratis) and upto AED 780k (fully owned by Emiratis) – backed by a 50% capital guarantee.

- Inflation in Dubai fell for the 17th consecutive month, down 3.34% yoy as costs of clothing, utilities and transport sector dropped by 6.44%, 6.3% and 12.34% respectively.

- A senior Mashreq Bank official stated that close to a quarter of the bank’s retail customers have availed the support packages provided as relief measure during the pandemic.

Weekly Insights

Economies in the GCC are slowly opening up their economies after months of lockdown. The resumption of activities is being planned in phases, initially with the reduction in night curfew timings to passed opening of malls/ private and public sector offices. Domestic travel resumes in Saudi Arabia from this week though the religious tourism destination of Makkah remains cordoned off. The UAE is preparing for re-entry of its overseas residents starting Jun and entry of persons from 12 Arab nations starting Jul, and tourist destinations within the country are already opening up (hotels, restaurants, museums, malls and entertainment facilities).

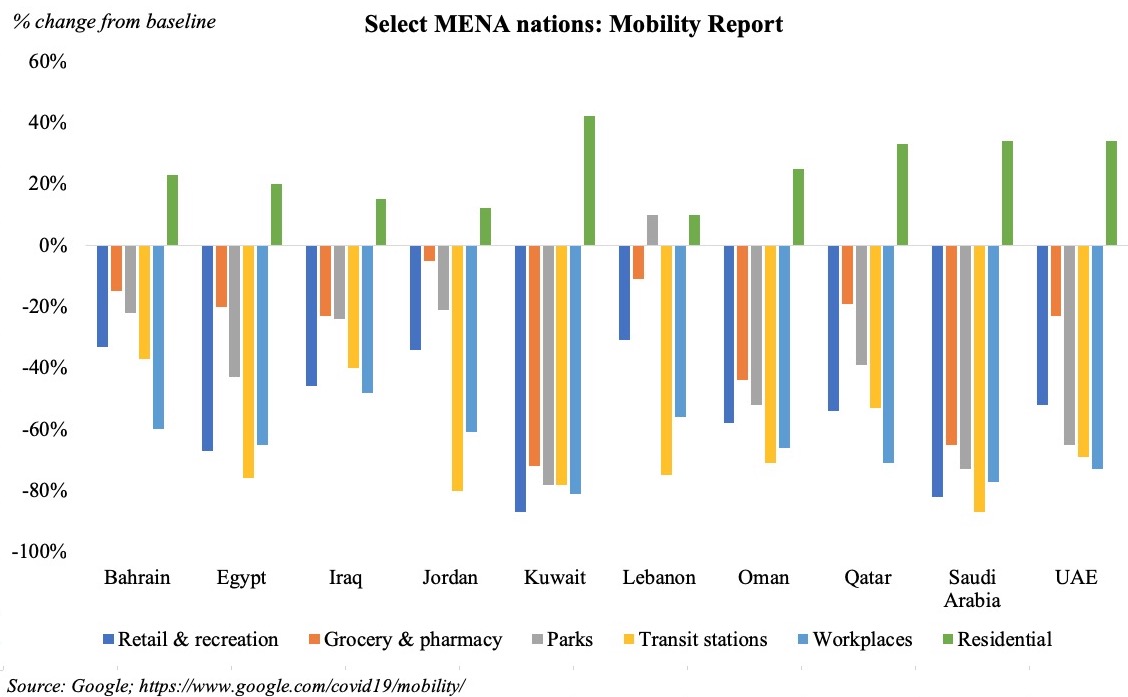

Some initial indications are already visible in the Google Mobility reports. Nations like Kuwait and Saudi Arabia have seen a significant drop in activity level given the extreme lockdowns while the UAE and Jordan have seen some pickup in activity as restrictions were eased.

Chart 1: Mobility report of select MENA nations

Notes: The reports show trends over several weeks with the most recent data representing approx. 2-3 days before May 25th. Changes for each day are compared to a baseline value for that day of the week: the baseline is the median value, for the corresponding day of the week, during the 5-week period Jan 3–Feb 6, 2020.

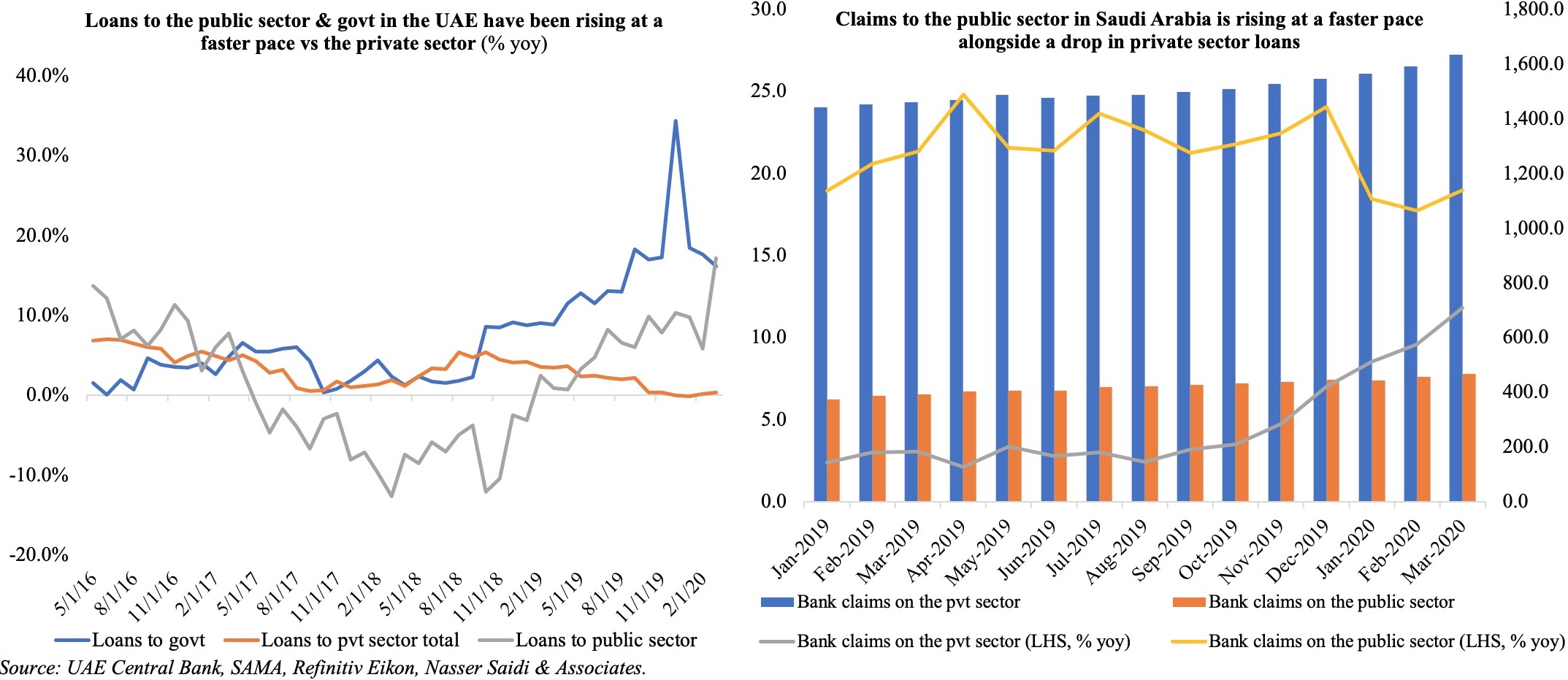

Chart 2: Claims to the private sector in UAE & Saudi Arabia: have the packages come through?

With the lockdowns initiated mid- to end-Mar, it is probably too early to see the impact of the stimulus packages introduced by the central bank, most of which was directed as support to the private sector and businesses (especially SMEs) in the region. March data shows that the loans to the public sector entities/ governments have increased at a faster pace than to the private sector. Will the Apr-May data sing a different tune? Central bank statistics will tell, soon. In the meanwhile, anecdotal evidence suggests that people are trickling into open spaces like parks and beaches, preferring that to indoor areas. Will tourists be back as and when international travel resumes? A recent IATA survey suggests that about 30% of respondents preferred waiting at least six months after the virus is contained before flying again while an additional 10% expects not to travel before a year or so.

Media Review

Equity Investors Must Pay More Attention to Climate Change Physical Risk

https://blogs.imf.org/2020/05/29/equity-investors-must-pay-more-attention-to-climate-change-physical-risk/

How China emerges from lockdown will affect global tourism

https://www.economist.com/international/2020/05/28/how-china-emerges-from-lockdown-will-affect-global-tourism

Covid19: What Should We Be Preparing For?

https://www.project-syndicate.org/commentary/covid19-response-needs-financing-for-developing-countries-by-ricardo-hausmann-2020-05

As a global economic crisis wreaks havoc on Saudi Arabia, the kingdom should reduce military spending

https://www.brookings.edu/blog/order-from-chaos/2020/05/27/as-a-global-economic-crisis-wreaks-havoc-on-saudi-arabia-the-kingdom-should-reduce-military-spending

Lebanon’s IMF rescue plan fails to set reform roadmap

https://en.brinkwire.com/news/lebanons-imf-rescue-plan-fails-to-set-reform-roadmap/

Open letter to the IMF: https://english.alarabiya.net/en/features/2020/05/31/The-IMF-should-not-give-Lebanon-funding-without-deep-governance-reforms-Petition

Market Snapshot as of 31st May 2020

Weekly % changes from 22nd May (international) and 21st May (regional). A few regional stock markets were closed last week for Eid holidays.

Source: Refinitiv Eikon, Datastream, Nasser Saidi & Associates.

Powered by: