Download a PDF copy of this week’s insight piece here.

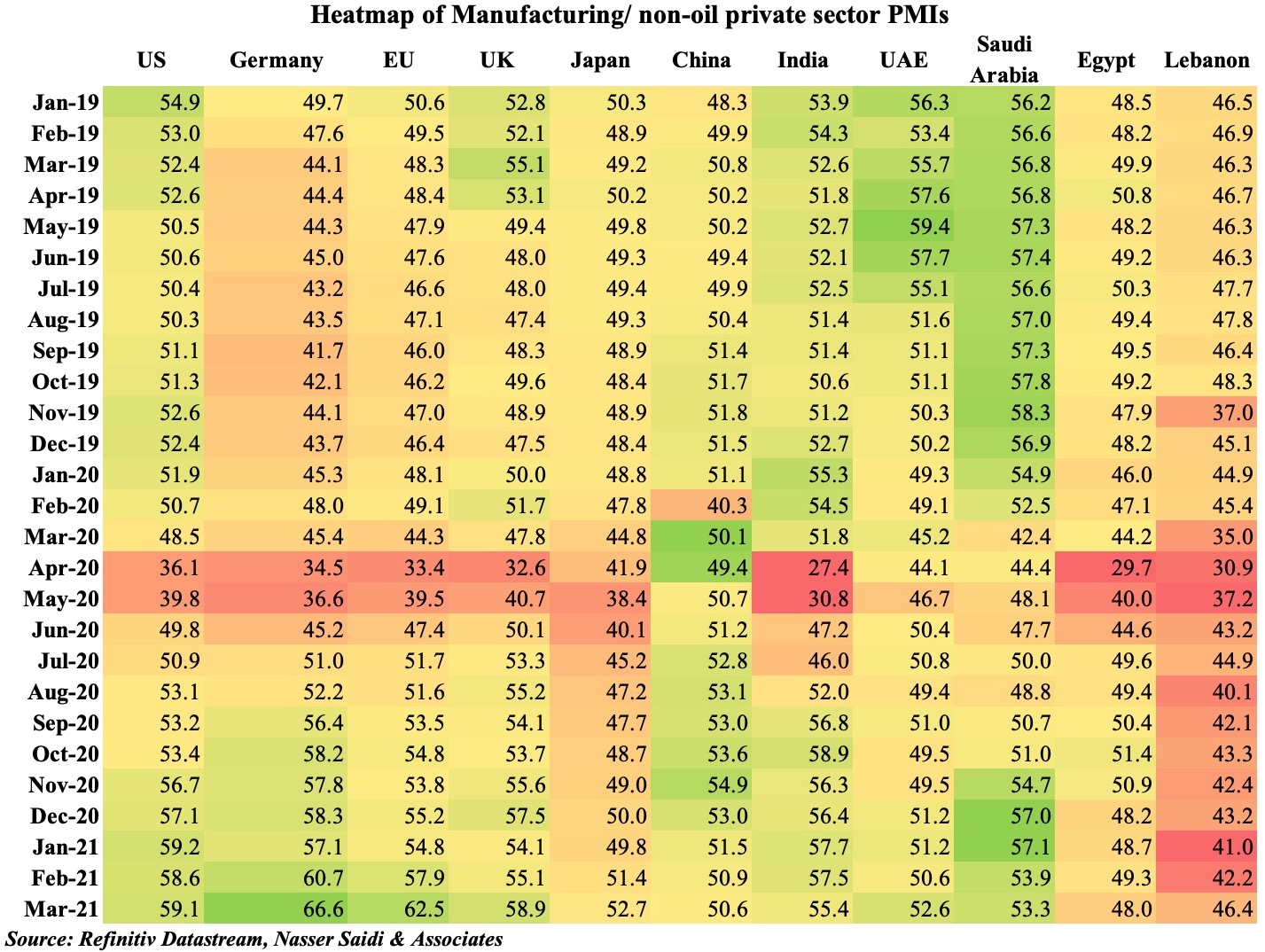

Chart 1. Inspite of battling new Covid19 restrictions, PMIs run high

Chart 1. Inspite of battling new Covid19 restrictions, PMIs run high

- Global manufacturing PMI touched a 10-year high in Mar: the uptick happened inspite of increased restrictions in late-2020/ early 2021, suggesting less severe impact of the recent lockdowns vs. the one in Apr-May.

- Preparedness for disruptions to production & supply chains as well as online demand & delivery likely improved.

- However, overall conditions are still affected by supply chain disruptions and inflationary pressures.

- Global Services PMI grew to a 33-month high of 54.7 in Mar, supported by inflows of new work.

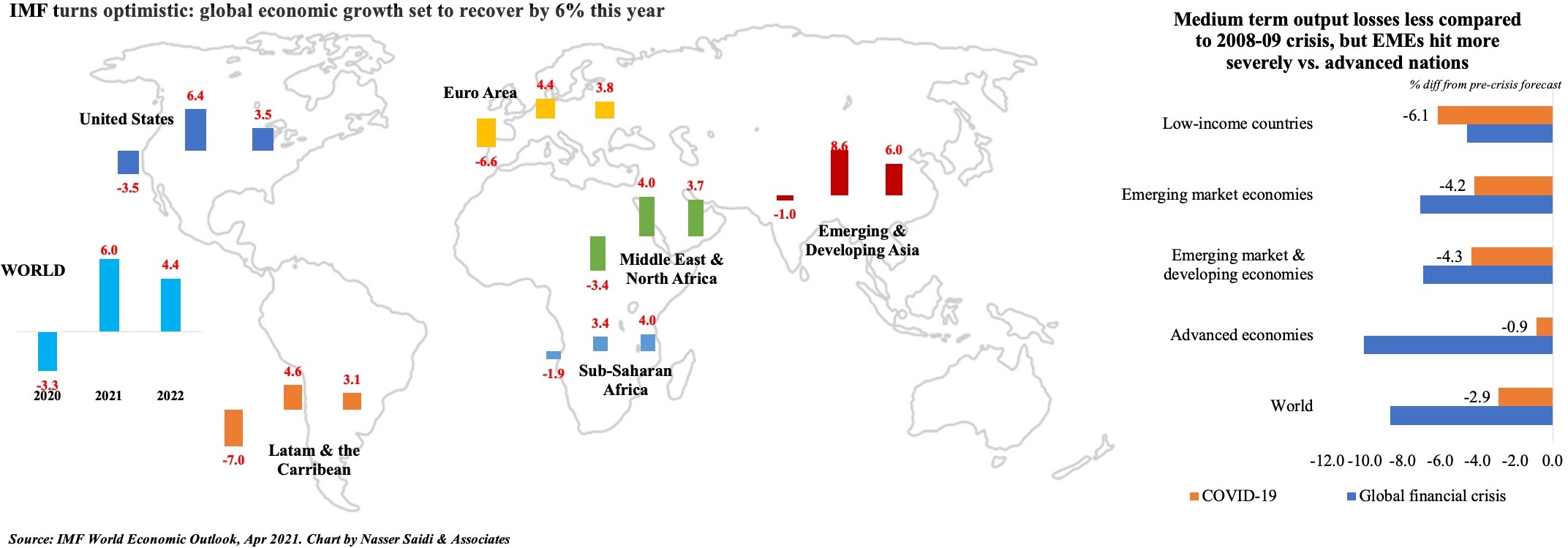

Chart 2. Optimism spills over into IMF’s growth forecasts amid uneven recovery caution

- The IMF projects 6% yoy growth in 2021, up from the 3.3% contraction last year. If the forecast is realized, it would mark the fastest rate of global growth since 1976. While China returned to pre-pandemic GDP levels in 2020 itself (+2.3%), many are unlikely to recover till 2023 – depending on new virus variants, pace of vaccination rollout and extent of fiscal/ monetary stimulus.

- The average medium term output loss over 2020-24, relative to pre-pandemic forecasts, is projected to be 6.1% in low-income countries versus 4.1% and a smaller 0.9% in emerging and advanced nations respectively. This is much lower than the losses seen during the 2008-09 financial crisis (when advanced nations suffered the most).

- The Middle East’s growth forecasts have remained broadly unchanged though recovery prospects of the GCC (where vaccination pace is quite high) are miles apart from many of the war-torn nations.

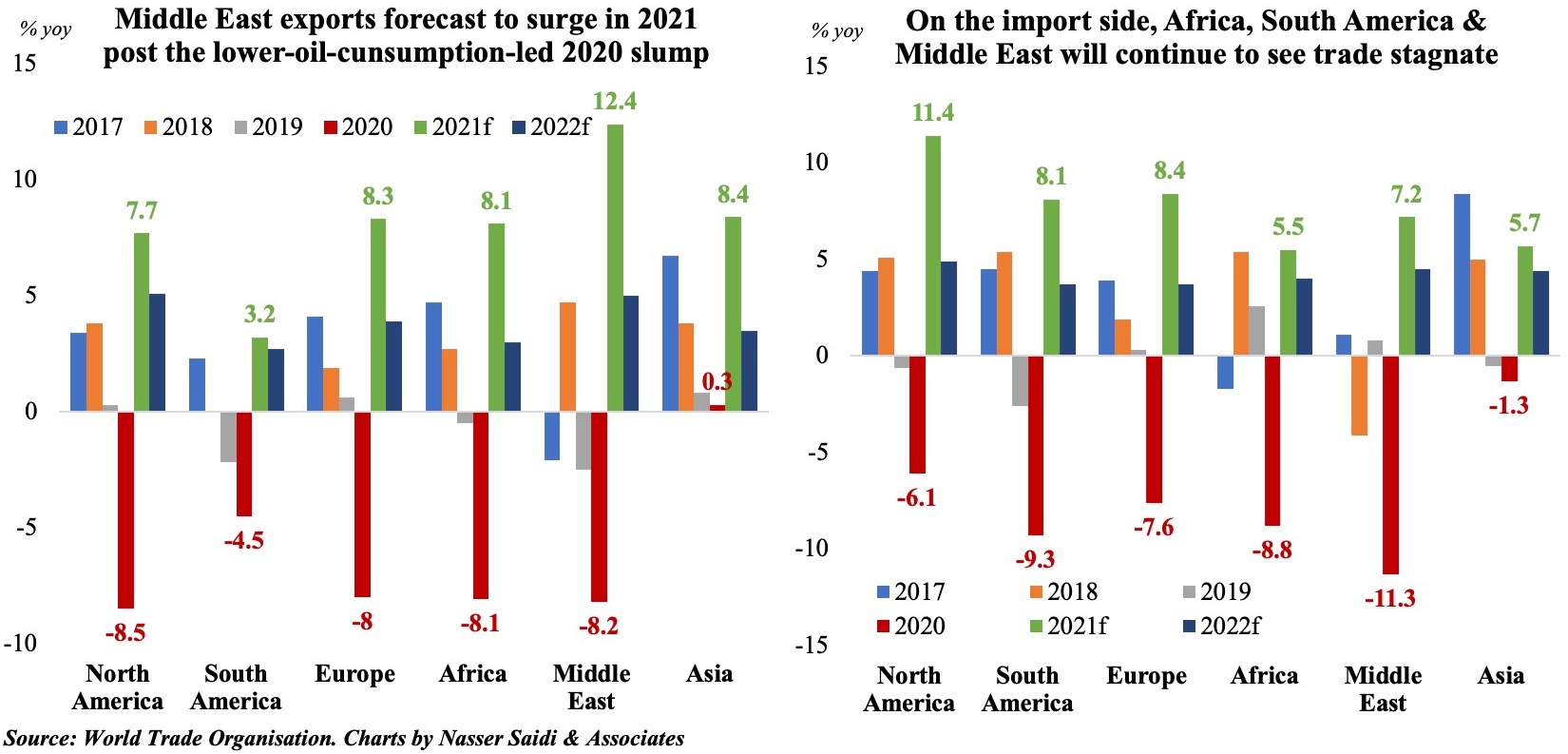

Chart 3. Merchandise trade poised for recovery in 2021, before slowing in 2022: WTO

- Strong, but uneven recovery is the story in merchandise trade volumes as well. Trade volume is projected to increase by 8% this year and then slow to 4% in 2022. Cross-border trade in services remains subdued and new waves of infection could easily reverse course of trade.

- Falling oil prices led to a 35% contraction in trade in fuels in 2020: it had a significant impact on Middle East exports (-8.2% slump in 2020), also resulting in a massive 11.3% plunge in imports. As travel picks up post-vaccine drives, demand for oil will likely strengthen, causing a 12.4% rise in exports in the Middle East this year.

- Asia, the export hub: the region’s limited impact and faster recovery from the virus + supply of medical supplies & consumer goods supported their export growth last year. This will enable the 8.4% rise in exports this year.

Chart 4. Risks to the Rosy Outlook

- Pandemic-related risks:

- New strains of vaccine-resistant Covid19 => prolonged pandemic

- Highly unequal global roll out of vaccines could reverberate on advanced nations, when lockdowns are relaxed

- Supply chain disruptions: one leading COVID-19 vaccine includes 280 components sourced from 19 different countries. Any constraint would impact production and distribution

- Insufficient production of vaccines + vaccine nationalism affecting global rollout of vaccines

- Financial risks:

- Avoid a repeat of 2013 “taper tantrum”. Rise in US rates => repricing of risk + tighter financial conditions => negative impact on highly leveraged nations/ businesses (heavy borrowings in 2020, supported by low interest rates: EMEs borrowed 9.8% of GDP & low-income nations 5.5%)

- Impact of corporate sector when stimulus measures are rolled back: potential bankruptcies/ insolvencies (& job losses), profitability => financial risks & effect on banks’ bottom line

- Long-lasting effects from the pandemic:

- Poverty: an additional 95mn people likely entered the category of “extreme poor” in 2020 versus pre-pandemic projections => rising food prices & social unrest (Lebanon as an example)

- Labour markets: youth, women & low-skilled workers more affected + impact on productivity

- Inequality within nations & across economies: not limited to income. Think education, technology

- Climate change risks: methane & CO2 levels surged to record amounts in 2020 + stranded assets + preparedness for a low-carbon transition

- Geo-political risks: US-China tensions led suppliers to shift away from China (one of the reasons behind the current shortage of computer chips), reshoring and “Made at home” policies