The article titled “Why nations must diversify their economies to avoid stagnation” appeared in the print edition of The National on 22nd February 2023 and is posted below.

Why nations must diversify their economies to avoid stagnation

Nasser Saidi & Aathira Prasad

The Global Economic Diversification Index tracks, measures and compares progress in diversification based on 25 indicators

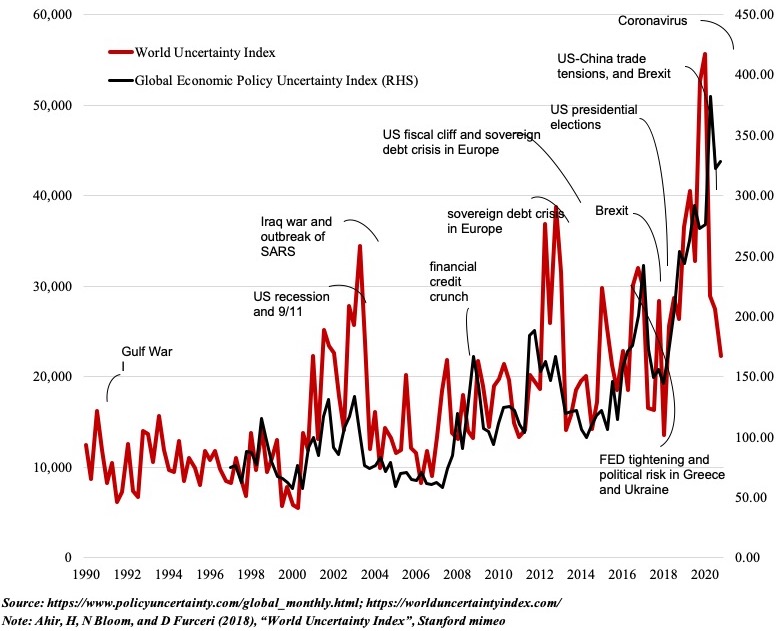

Economic growth in nations with an abundance of natural resources tends to be lower and more volatile.

Diversifying activity from an over-dependence on natural resources — such as oil, minerals or commodities — allows countries to harness resource rents as an engine of growth, rather than a barrier to economic development, avoiding the “resource curse”.

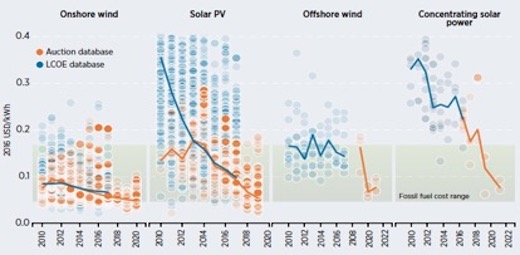

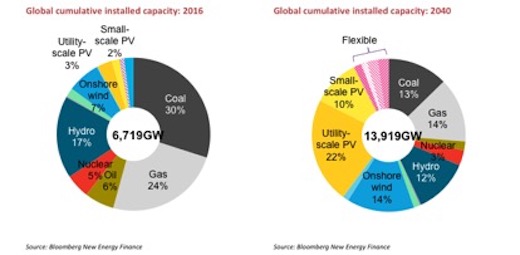

For fossil fuel-dependent countries, ambitious global decarbonisation commitments (UN Cop climate summits, net zero emissions) and energy transition plans to address climate change have added to the urgency of economic diversification, given that oil and gas accounted for 31.89 per cent and 21.34 per cent of global greenhouse gas emissions in 2021.

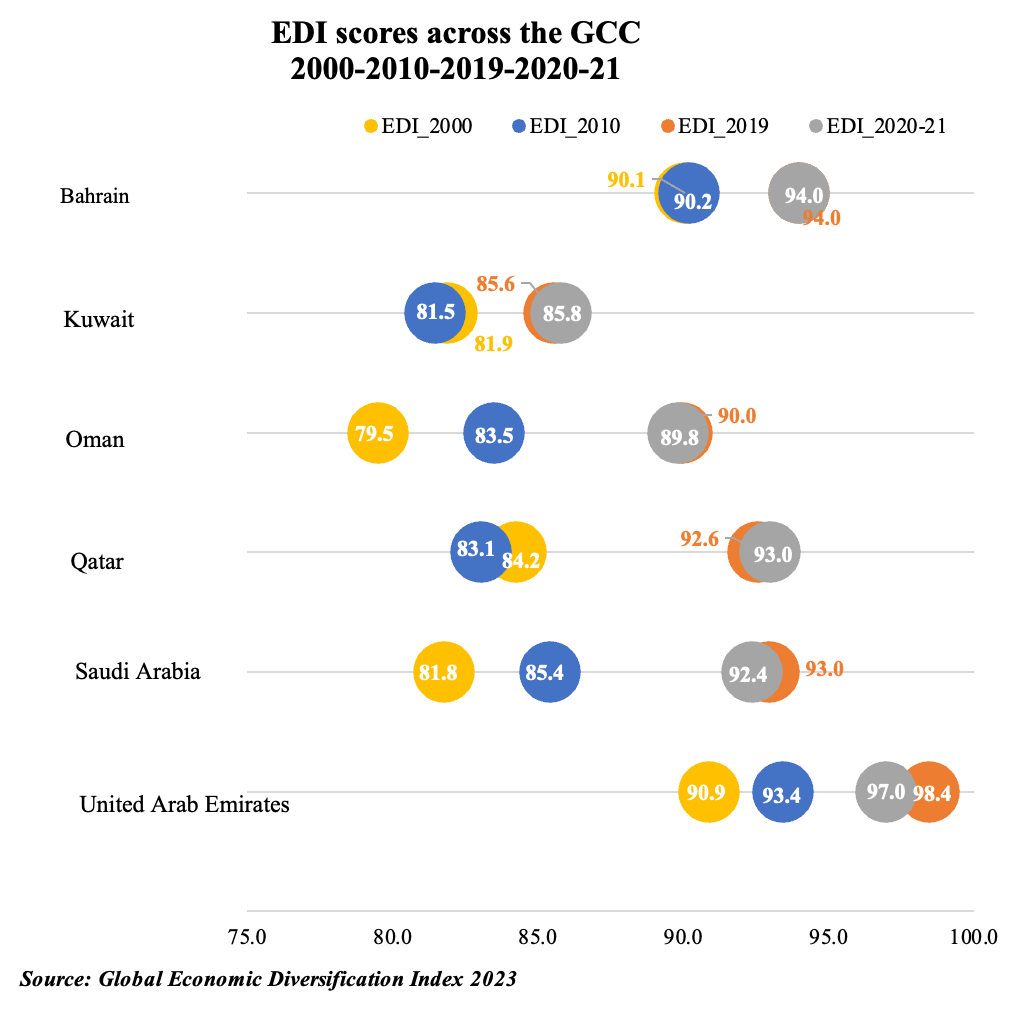

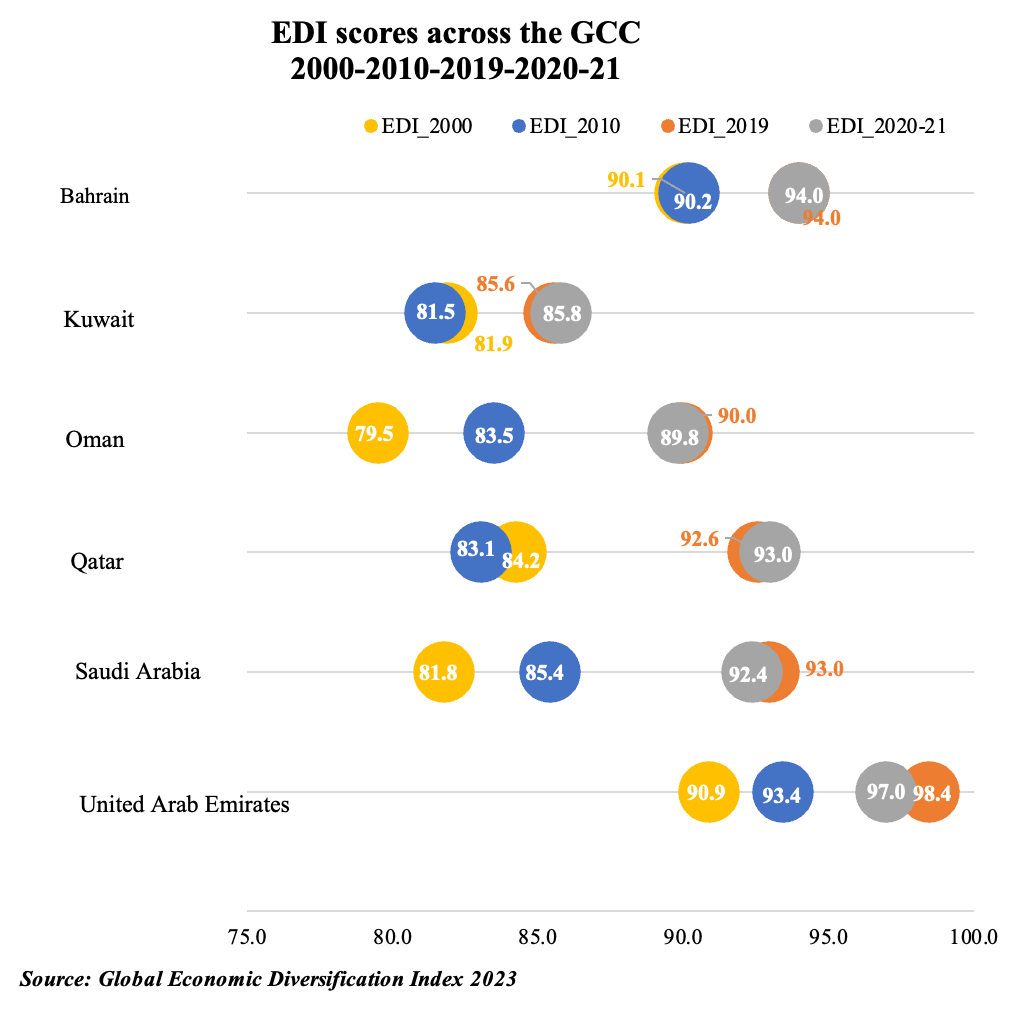

With economic diversification a policy imperative in the Middle East, nations can turn to the Global Economic Diversification Index (EDI) to track their performance over time, undertake peer comparisons and measure the gap with higher-ranked nations.

The EDI identifies and examines 25 economic indicators, analysing and combining three main dimensions of diversification — output, trade and government revenue — across 105 nations for the period 2000-2021.

The top-ranked nations have maintained their standing over time, with the US, China and Germany ranking highest in 2021.

What are the major lessons and outcomes? First, there is a positive correlation between EDI and gross domestic product per capita (but being a high-income country does not imply a high economic diversification score) and, secondly, the higher the share of resource rents in GDP, the lower the EDI score.

Third, countries do not need to take a traditional industrialisation route: services and financial services led Singapore and Switzerland to rank highly alongside industrialised nations such as Germany and the UK.

Fourth, innovation and adoption of new technology is an essential ingredient for greater diversification, with many top performers also in World Intellectual Property Organisation’s [WIPO’s] Global Innovation Index, and, finally, size need not be an impediment to economic diversification (“small” Ireland, the Netherlands and Singapore rank high).

GCC economic diversification

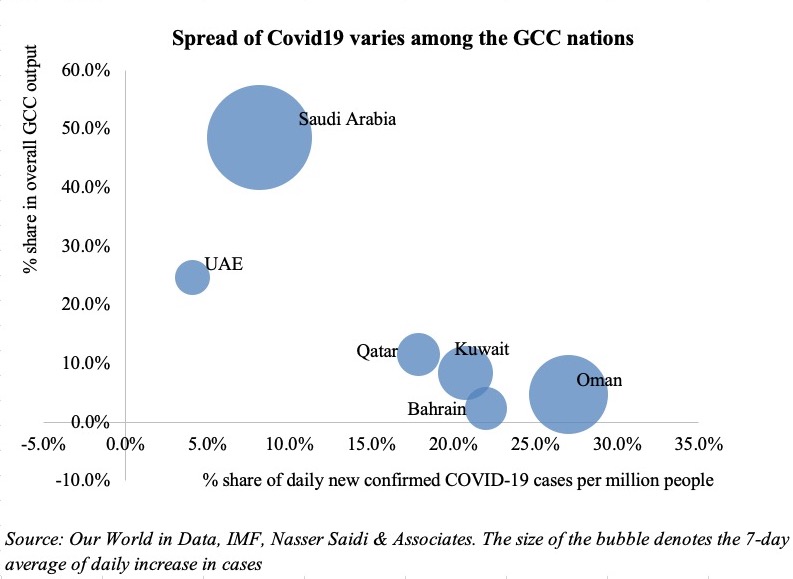

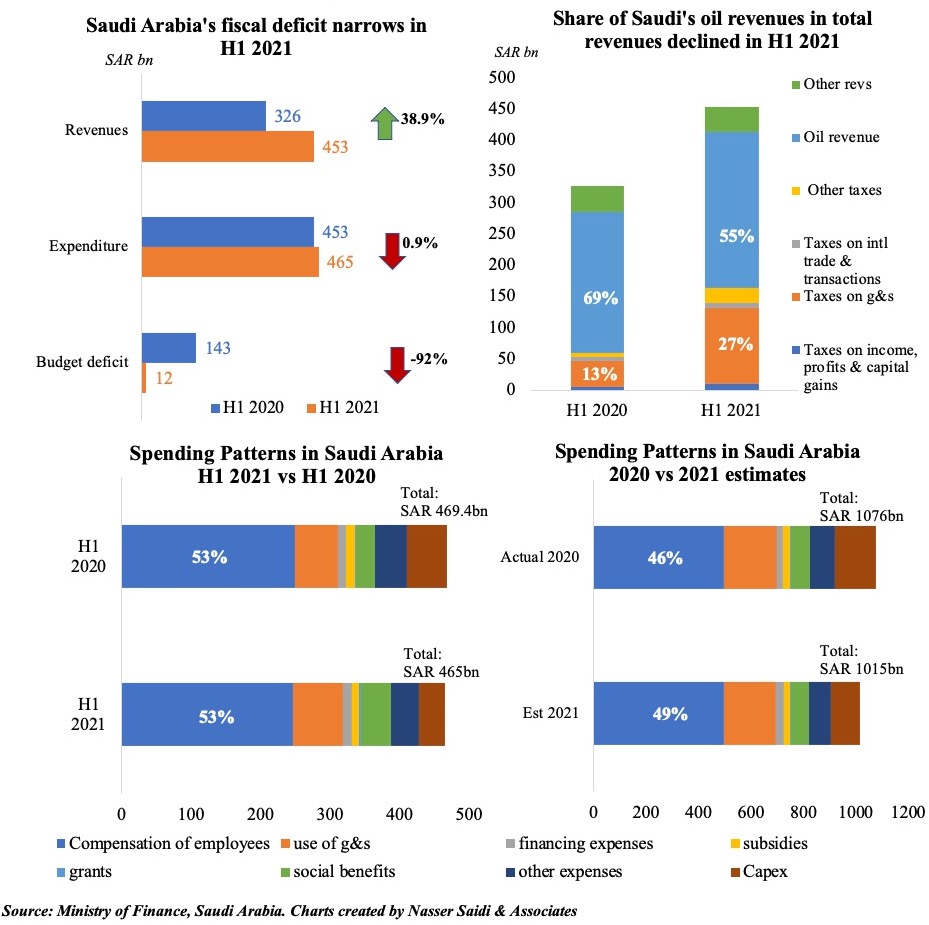

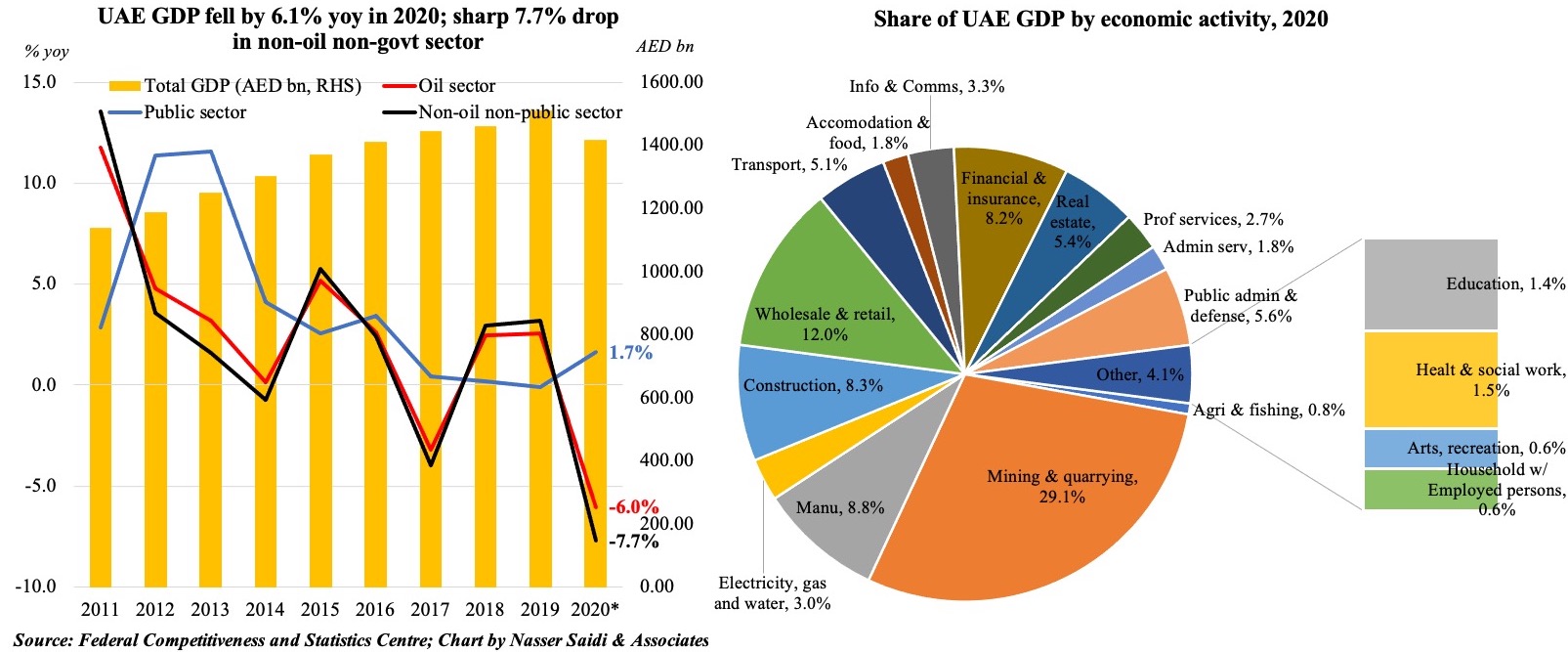

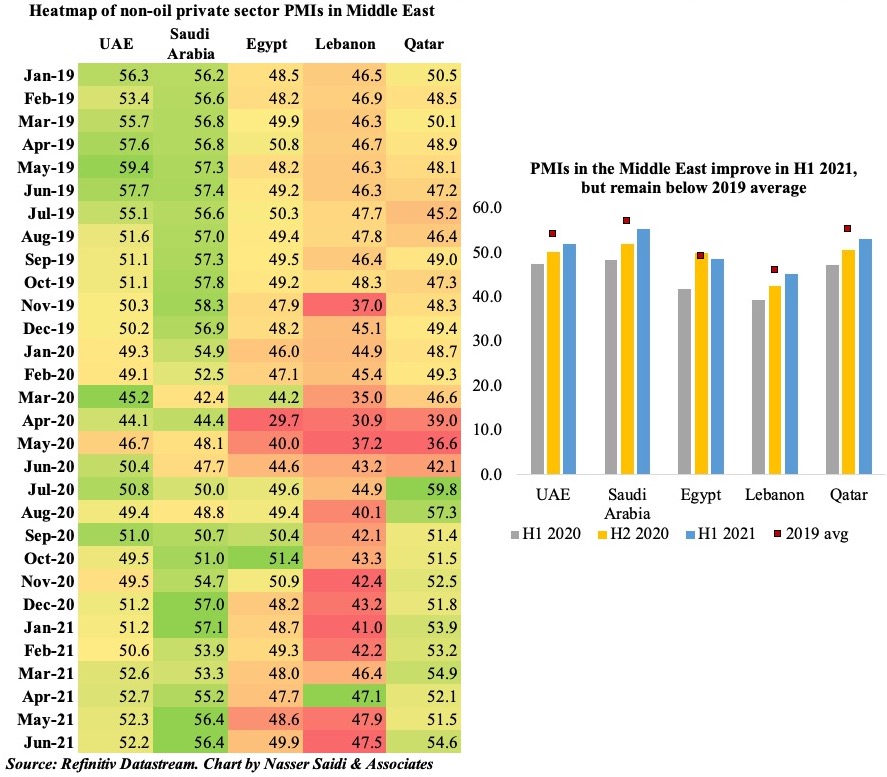

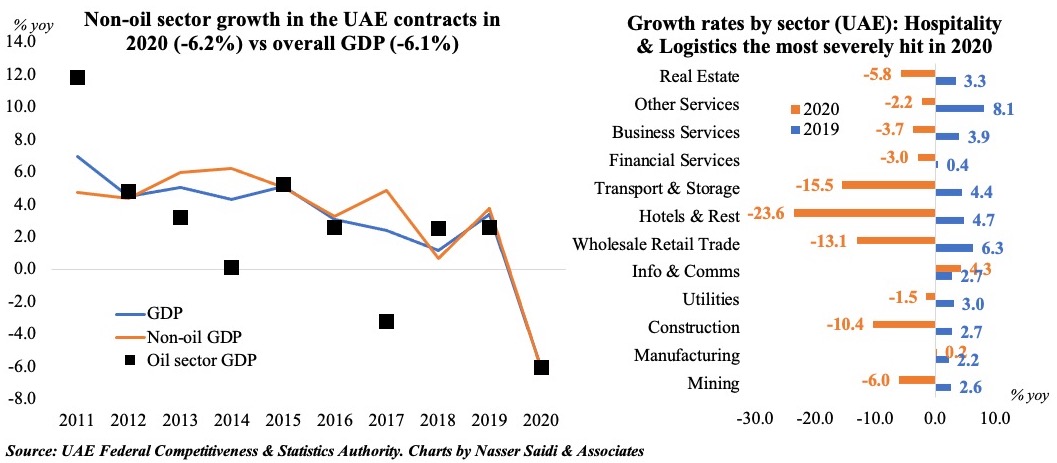

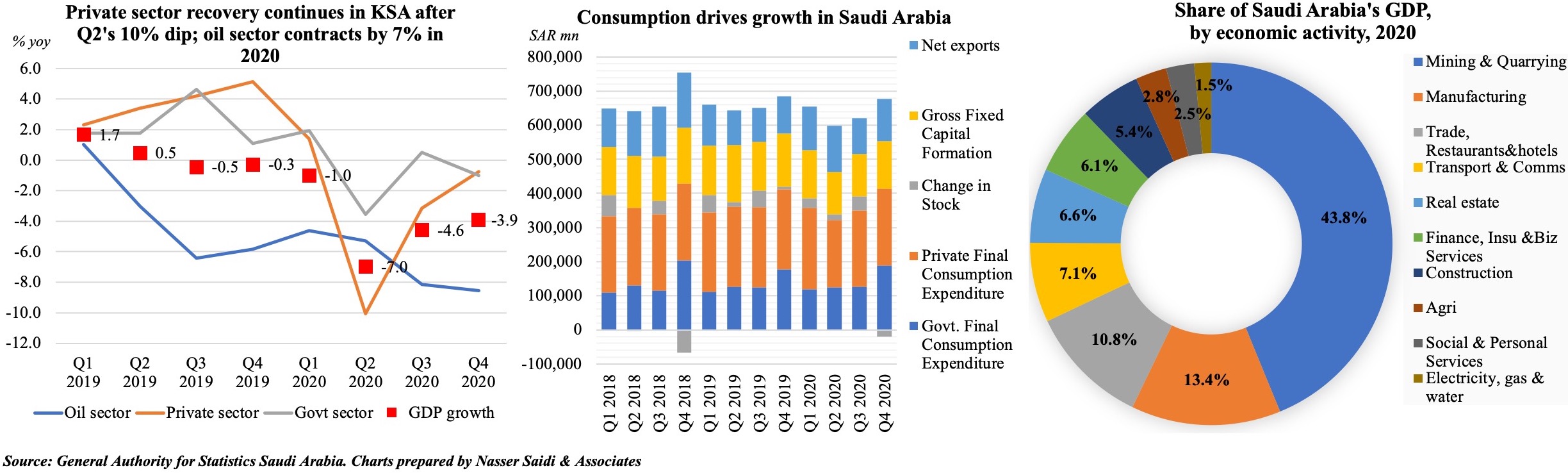

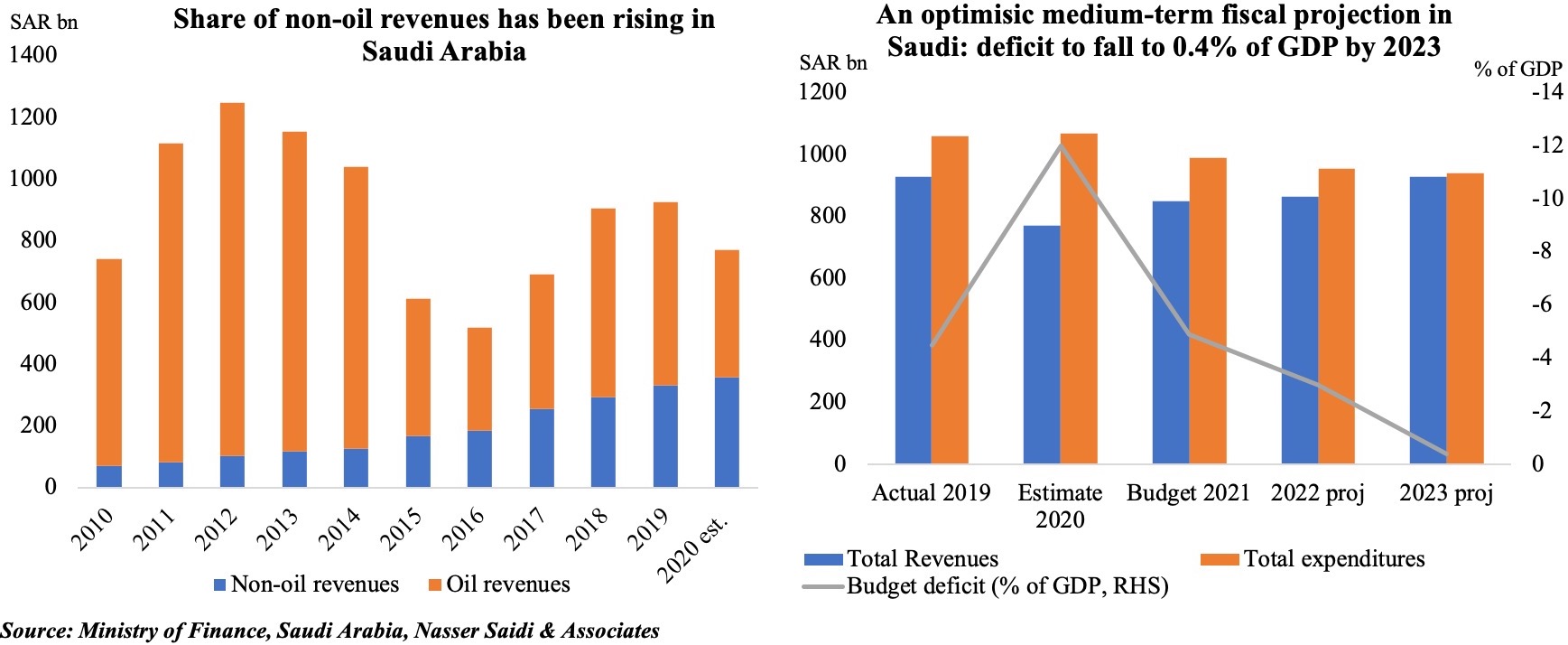

While the non-oil sector has grown in the GCC, the oil sector continues to dominate, accounting for more than 40 per cent of GDP in most countries.

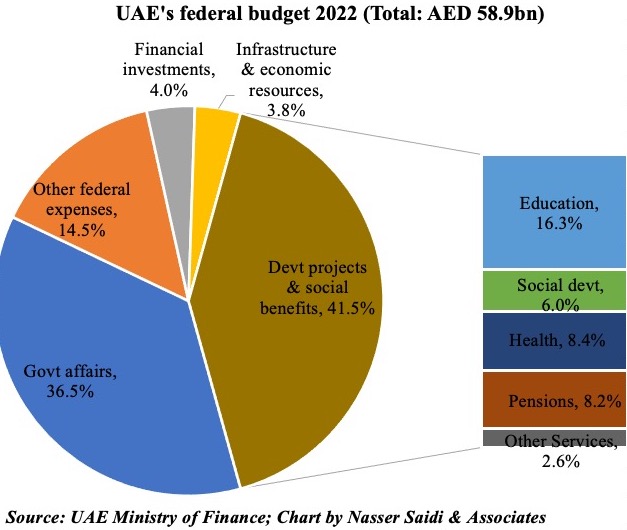

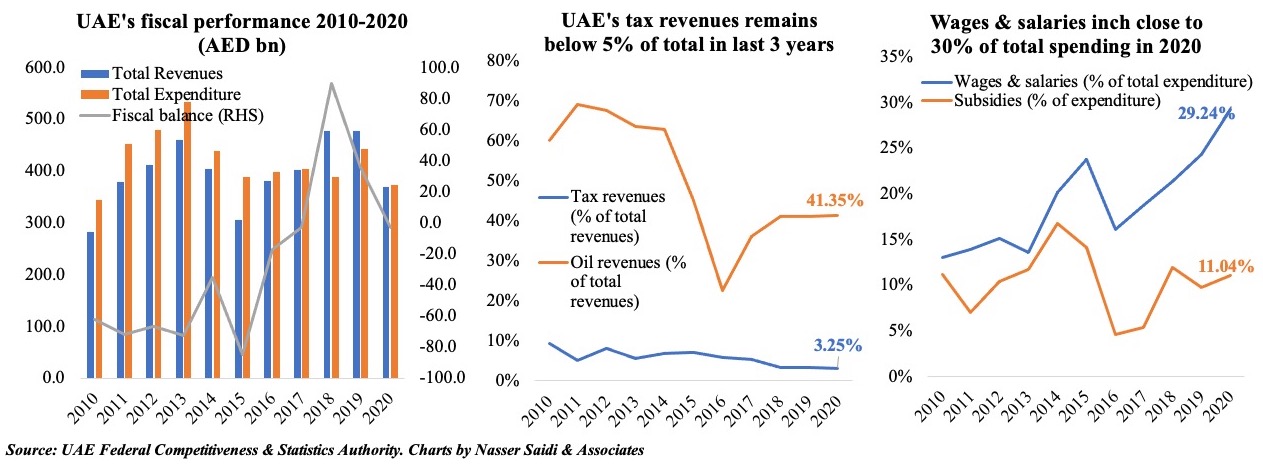

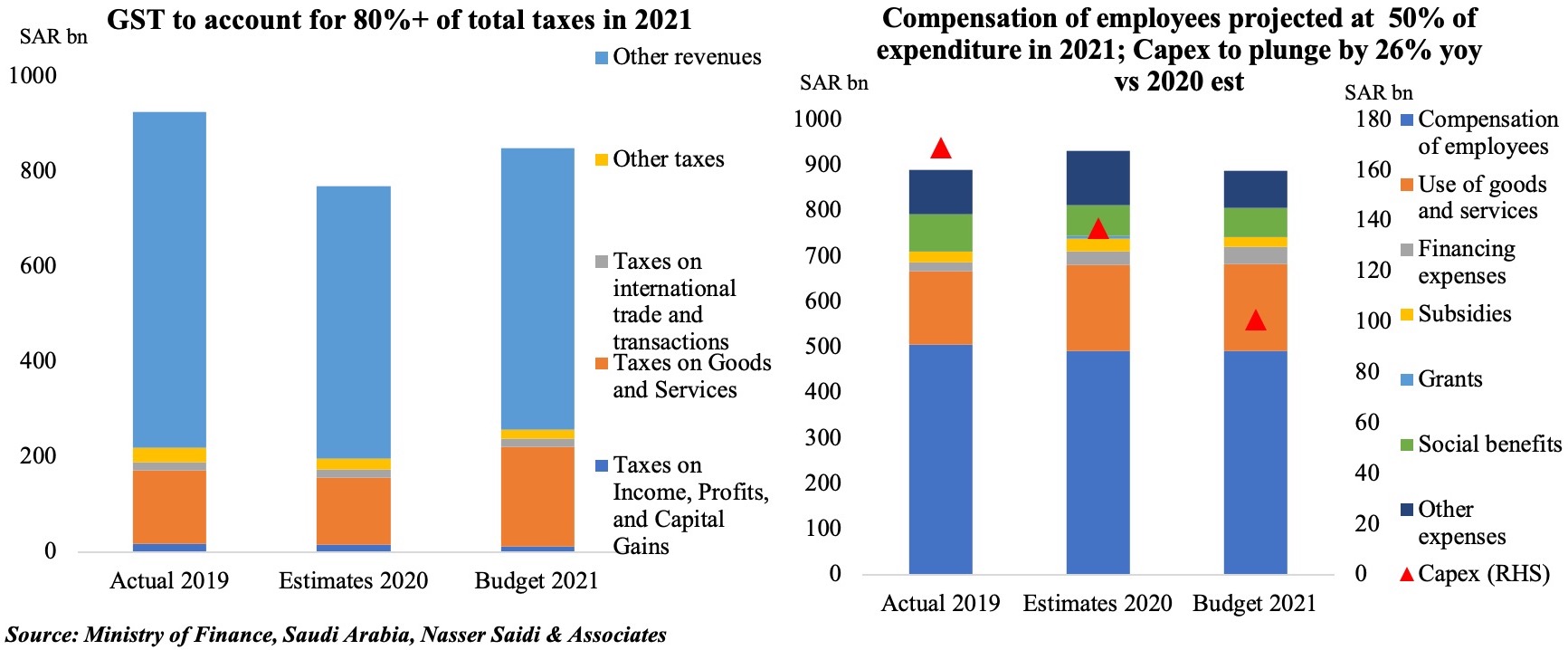

In the past decade, there has been a concerted effort to diversify revenue and support fiscal sustainability, with the introduction of VAT and excises taxes (with the UAE introducing corporate tax this year and Oman studying a proposal for income tax).

However, consumption taxes remain a small share of total revenue in comparison to oil and gas in the nations that have introduced VAT, while Qatar and Kuwait have yet to introduce consumption tax.

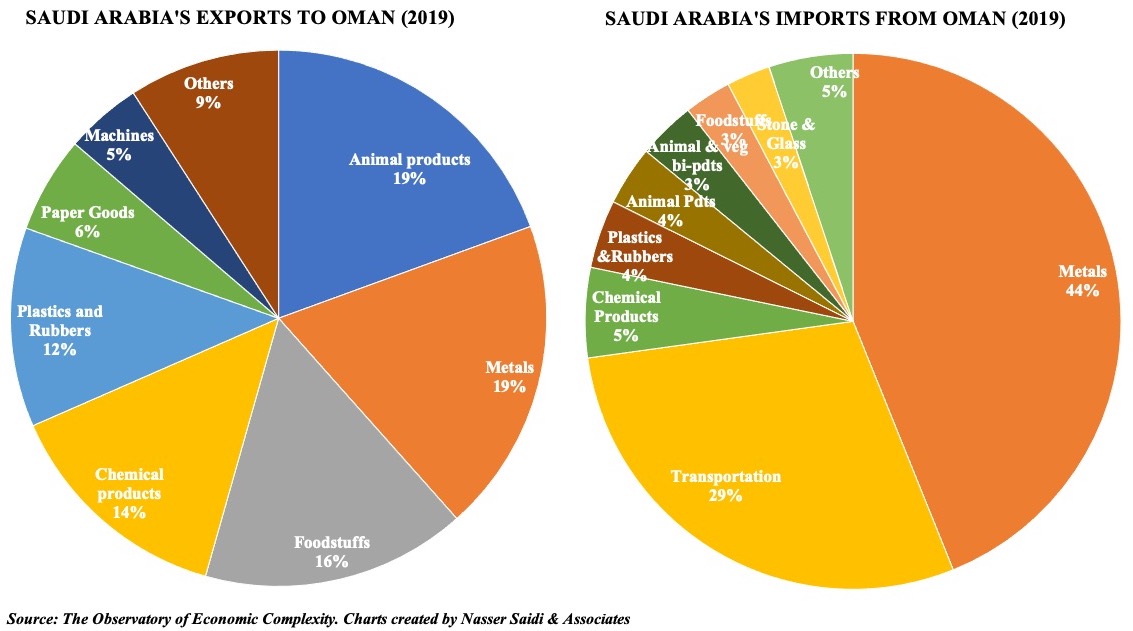

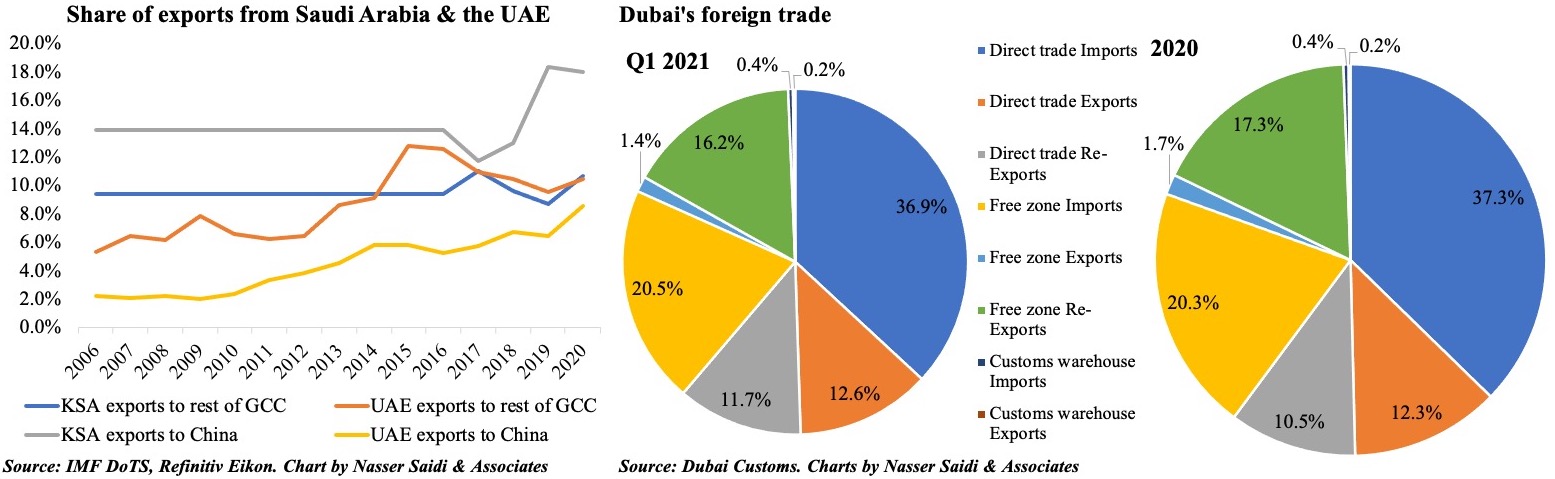

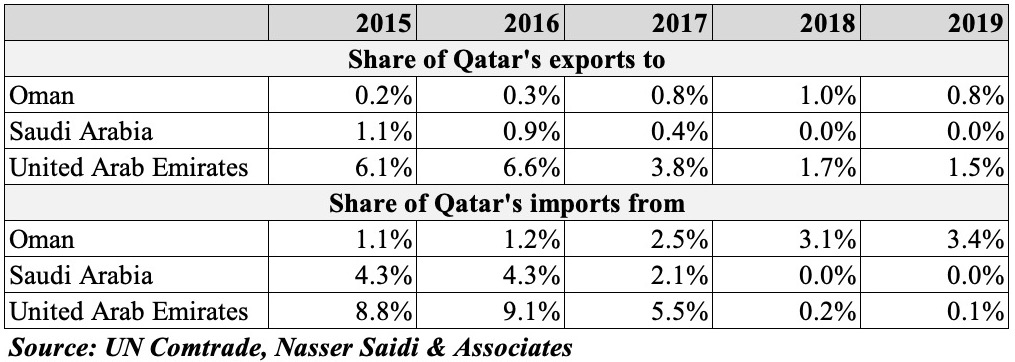

At present, trade is also heavily reliant on exports of oil and gas and their derivatives such as petrochemicals.

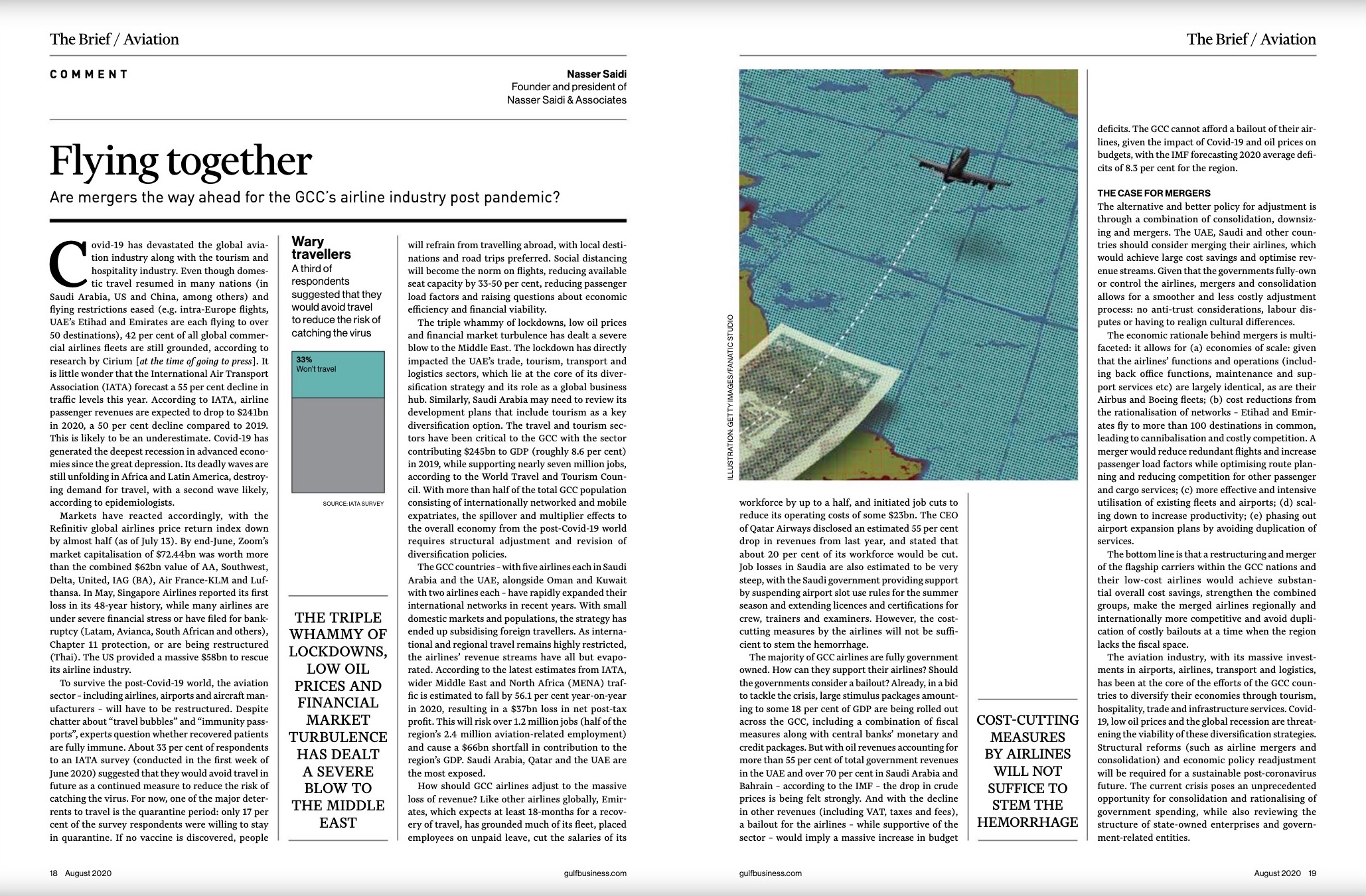

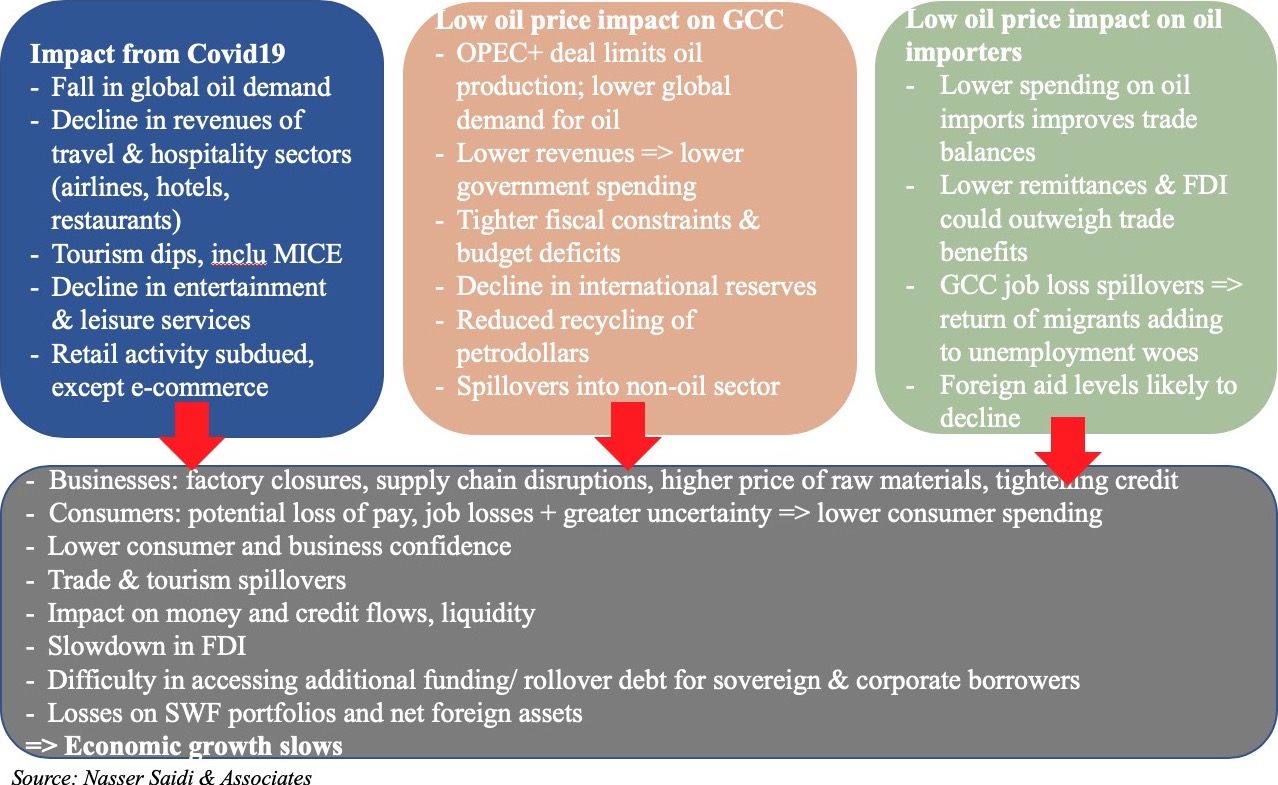

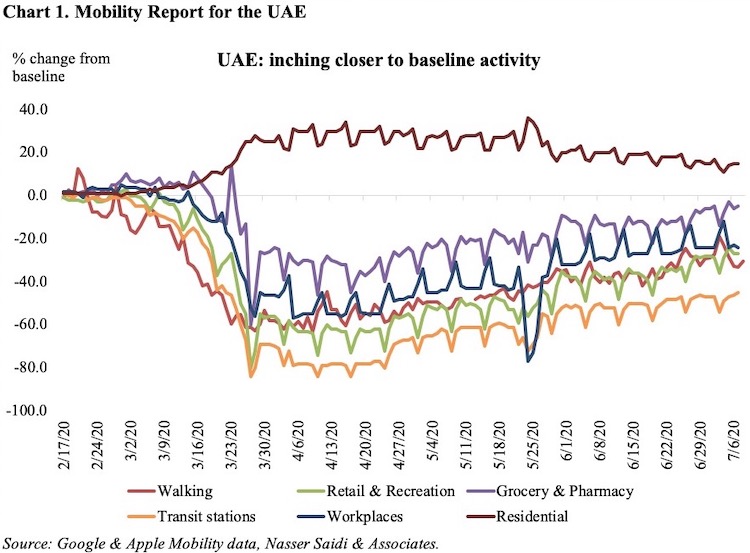

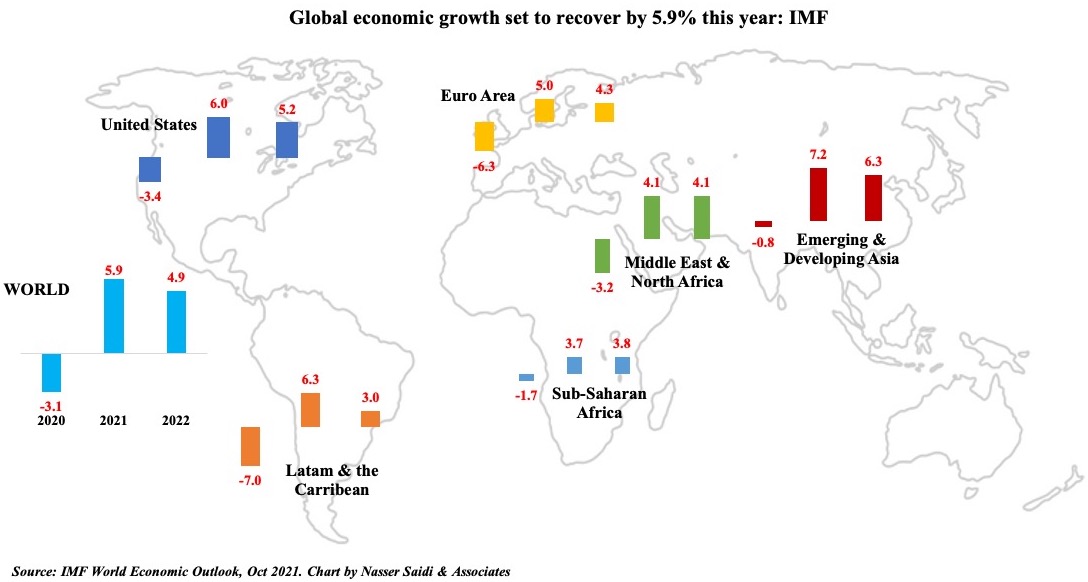

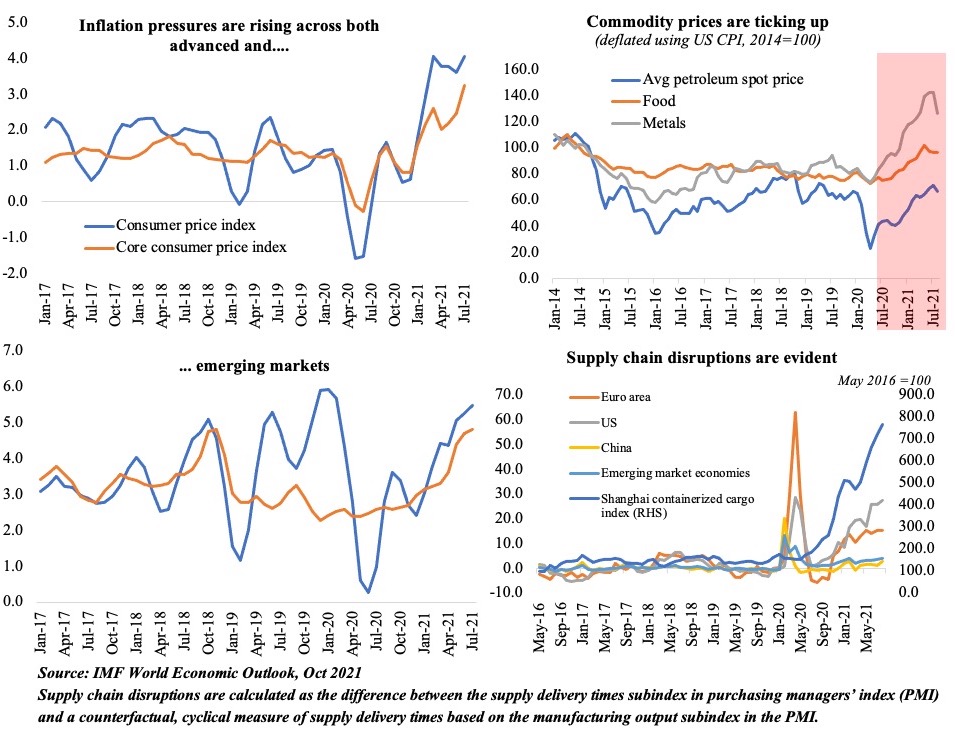

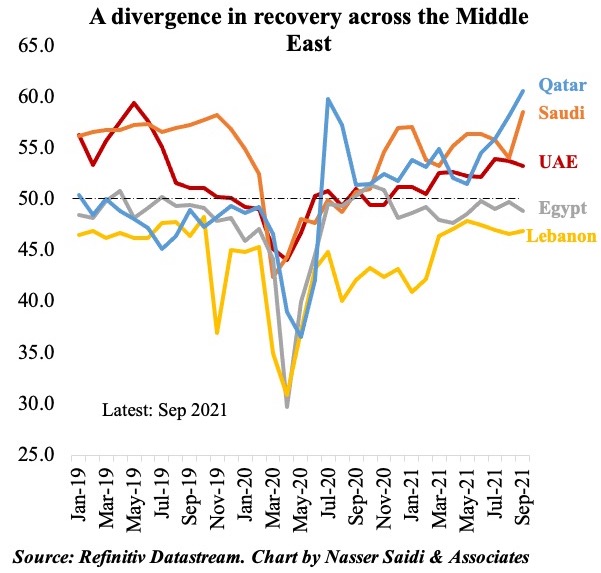

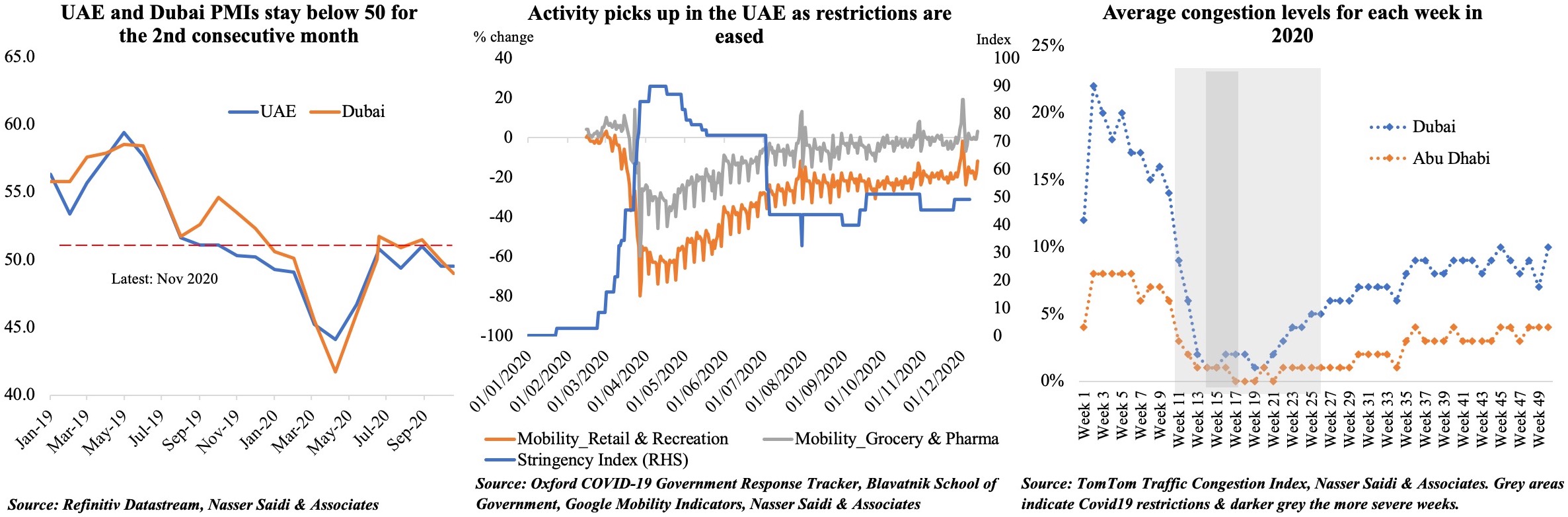

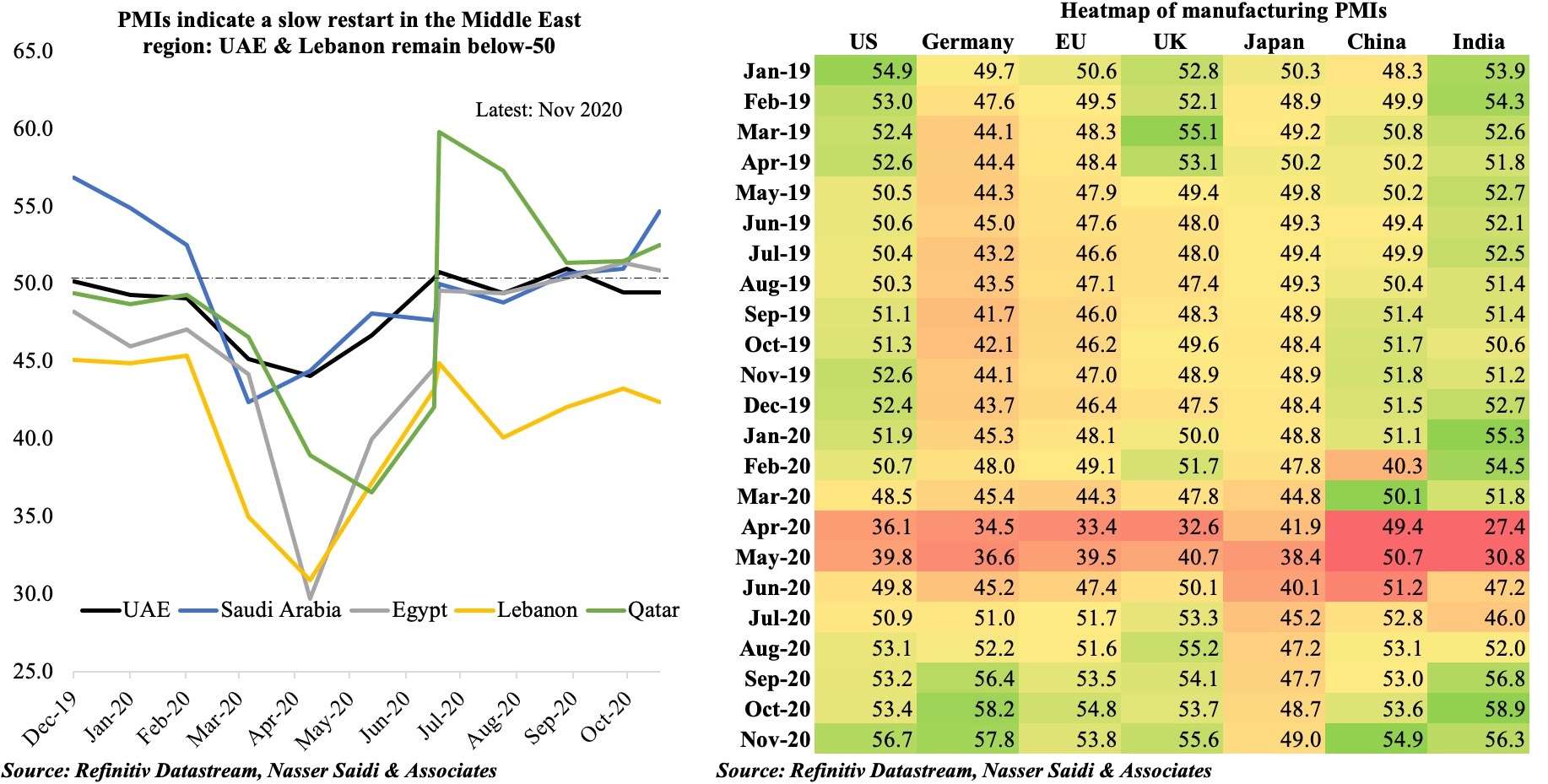

The coronavirus was a game-changer. To shift from over-dependence on commodities, the GCC (and others) have diversified into services-based sectors such as tourism, trade, logistics and transport. But these were affected in the initial Covid-19 year, leading to a reassessment of diversification strategies.

The pandemic has galvanised policymakers into action to support FDI flows, labour mobility liberalisation, privatisation and structural reforms.

Economic diversification 2.0

On the output side, there is greater opportunity in moving towards knowledge-based and innovation-led activities, creating space for private sector activity (especially in the tradables sector), and developing industrial policies and clusters, with local procurement strategies fostering job-creation at small and medium enterprises.

Incentivising policies supporting the diffusion of new technology (such as electric transport systems or robotics), alongside a push for investment into new sectors, including digital economy, clean energy and climate technology, and increasingly general purpose tech such as artificial intelligence, will also support diversification.

The continuing privatisation of state-owned assets and enterprises allows for the opportunity to “de-risk” fossil fuel assets, with the added advantage of raising revenue, developing and diversifying financial markets, and attracting both domestic and foreign investment and technology.

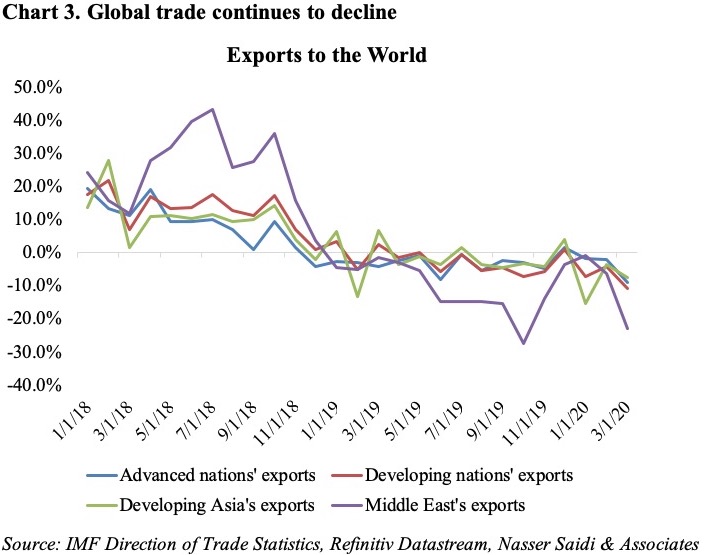

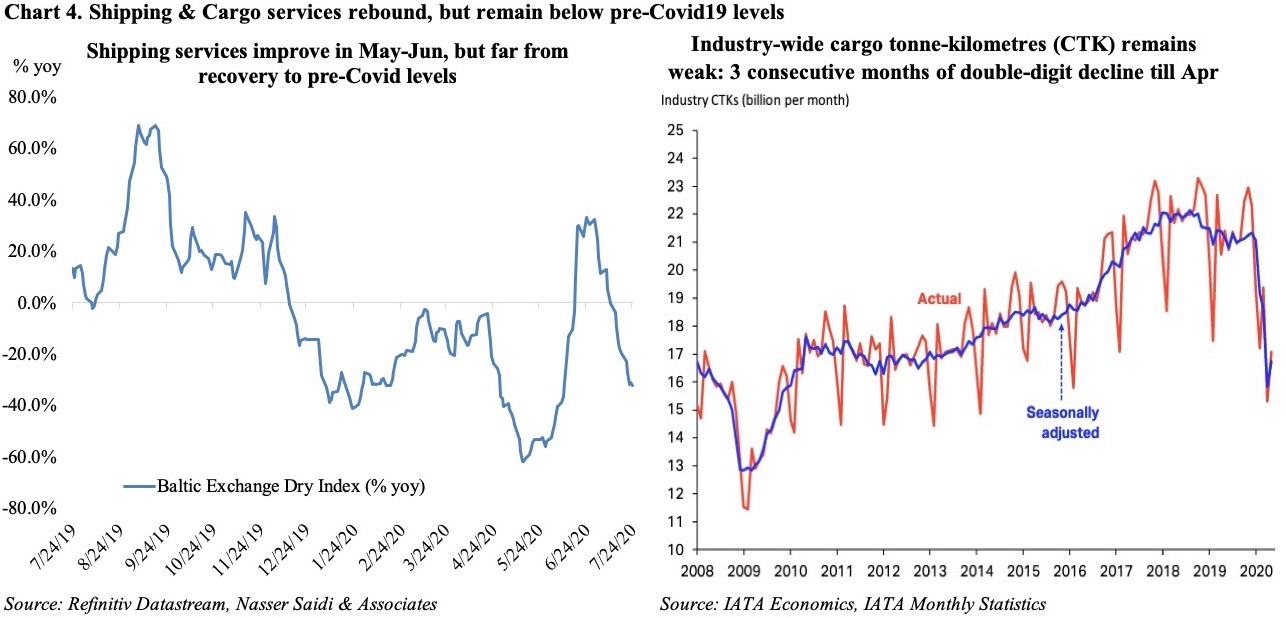

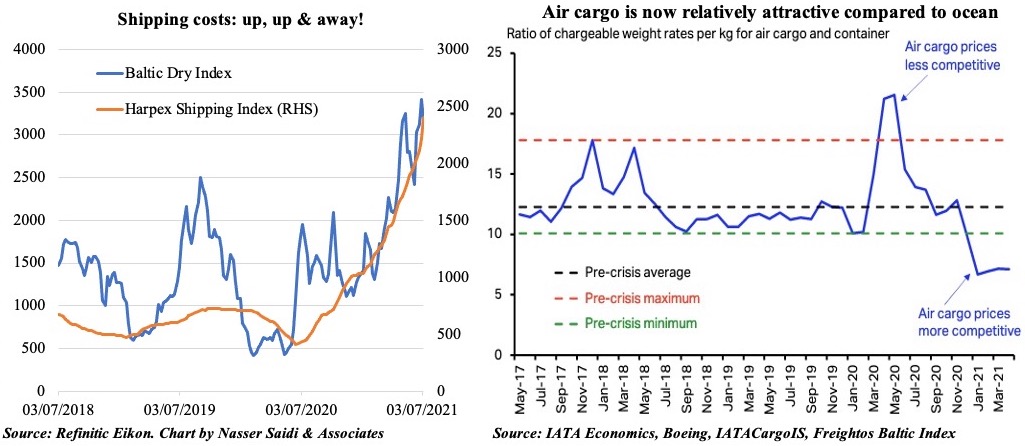

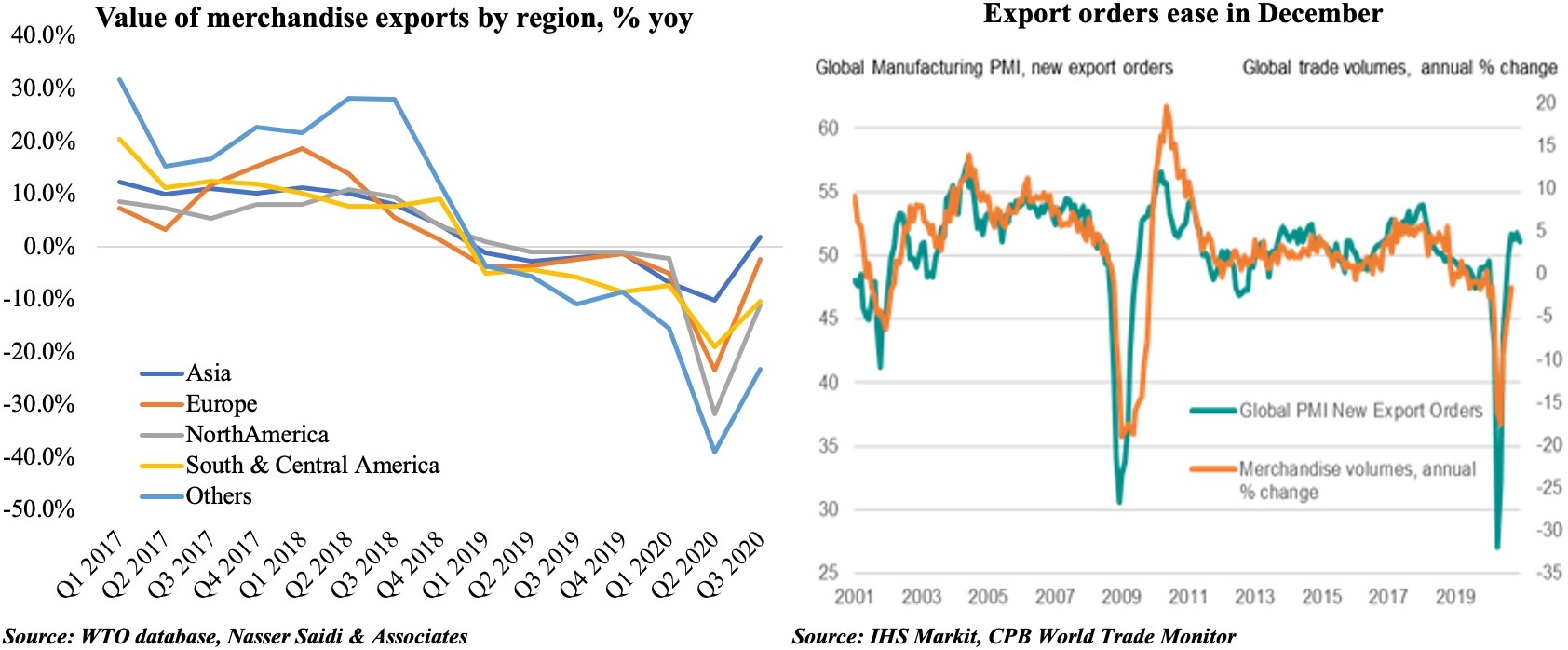

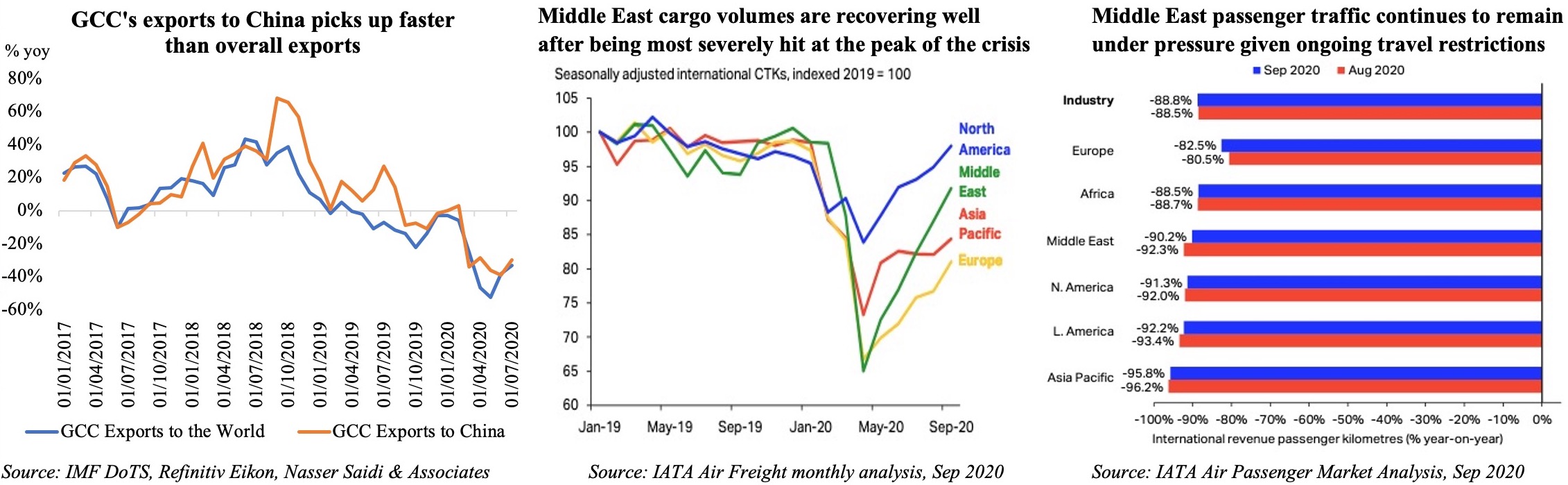

The pandemic underscored the need for trade diversification — both in terms of products and trade partners — and of supply chains.

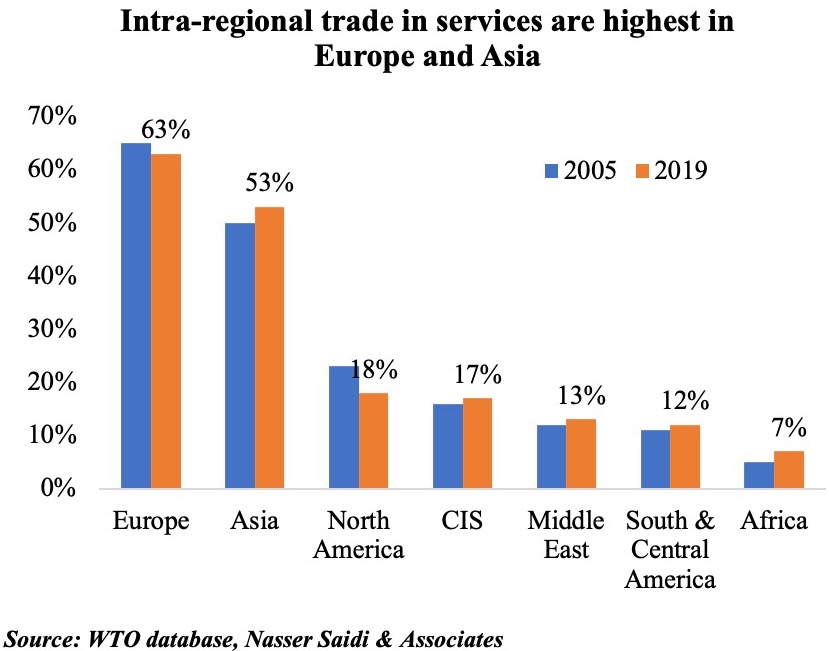

The GCC will also benefit from the enactment of new “deep trade agreements”, including the broad category of services, such as digital services (e-services, e-commerce and digital finance), beyond the limited scope of trade in goods.

With the shift in global economic geography towards Asia, a China-GCC free-trade agreement (under negotiation since 2004) is a strategic priority, given that China is the main trade and economic partner of the region and would integrate the GCC into Asian supply chains.

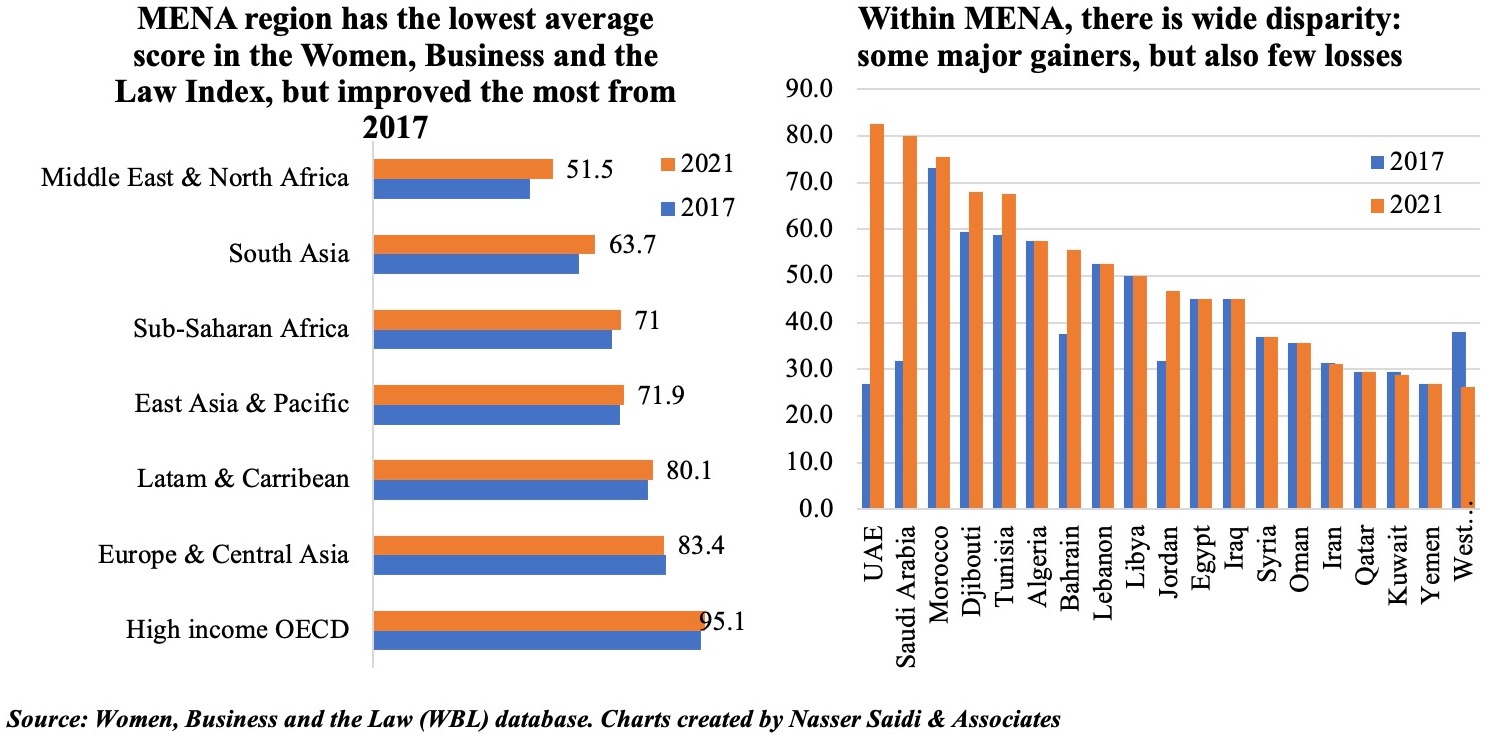

Trade reforms, when complemented by structural reform, including in the labour market, will lead to greater skill diversity in the workforce, enabling mobility and lower transition costs, job creation and raising productivity growth.

The pandemic has galvanised policymakers into action to support FDI flows, labour mobility liberalisation, privatisation and structural reforms

Additionally, policy reforms will encourage private sector activity by lowering the costs of conducting business, thereby encouraging private and foreign investment, and promoting competitiveness and capital market development (including the development of a yield curve, a domestic corporate bond market), with a focus on climate finance and funding the green economy as part of energy transition policies.

Economic diversification leads to more balanced and stable economies, and is key to inclusive economic development and sustainable job creation.

The EDI is a tool that enables evidence-based policymaking and informs the design of strategy and policy measures, allows for the evaluation of policies’ impact and effectiveness, and enables monitoring of policy outcomes, as well as helps to identify problem areas. It enables policy research aimed at identifying strategies and policies that foster and those that hinder diversification.

Resting on current diversification achievements is insufficient. Commodity dependent nations need to sustain economic/structural reforms and innovate to catch-up faster with the frontrunners.

The Global Economic Diversification Index 2023 was released last week by the Mohammed Bin Rashid School of Government (MBRSG) at the World Government Summit. The report was developed in cooperation with Salma Refass and Fadi Salem (MBRSG) and Ben Shepherd (Developing Trade Consultants).

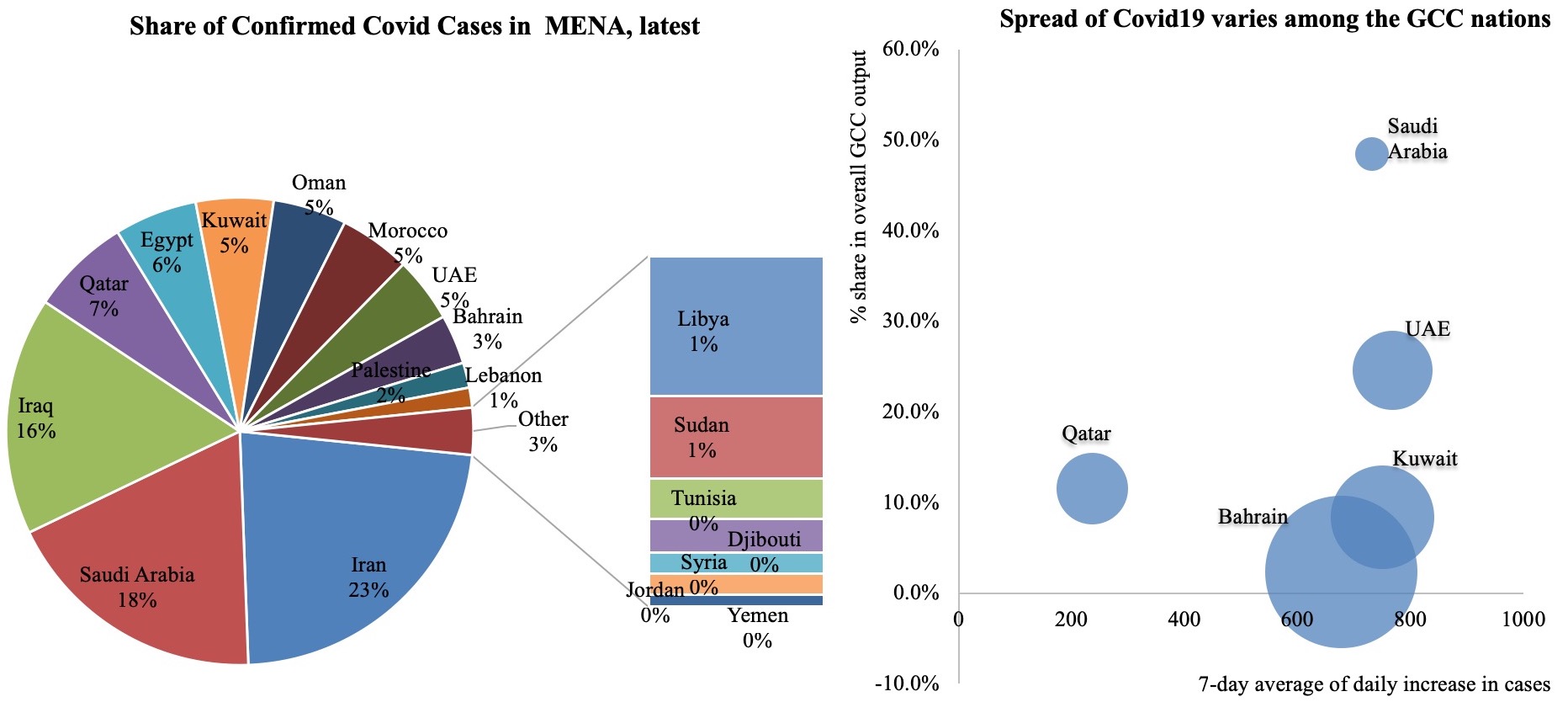

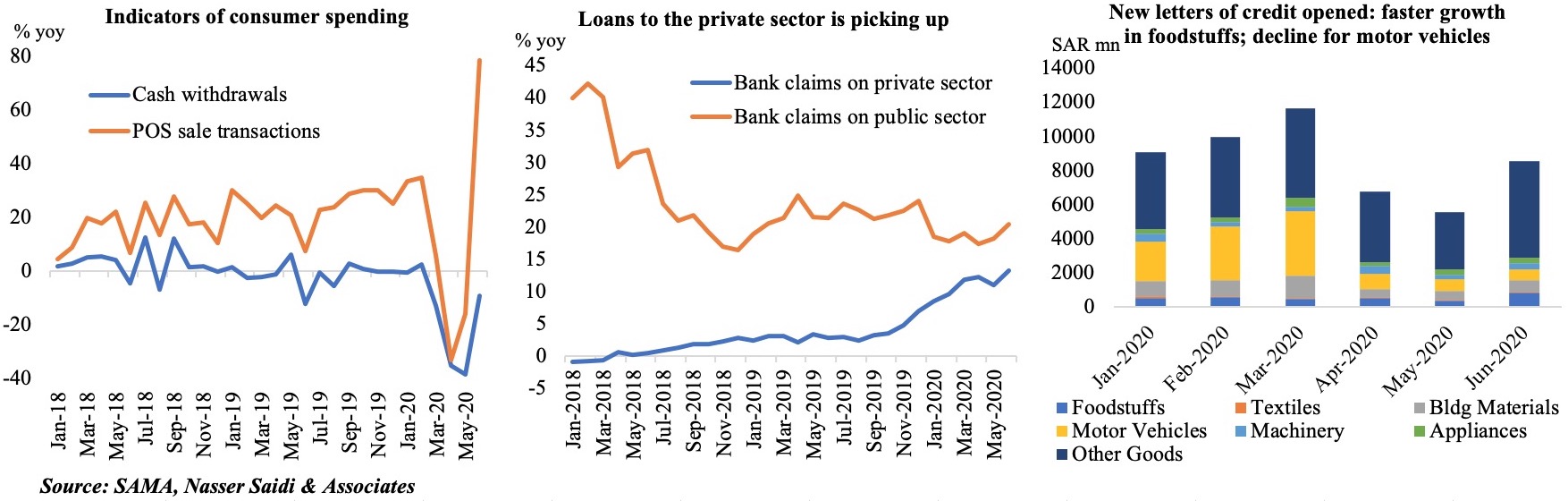

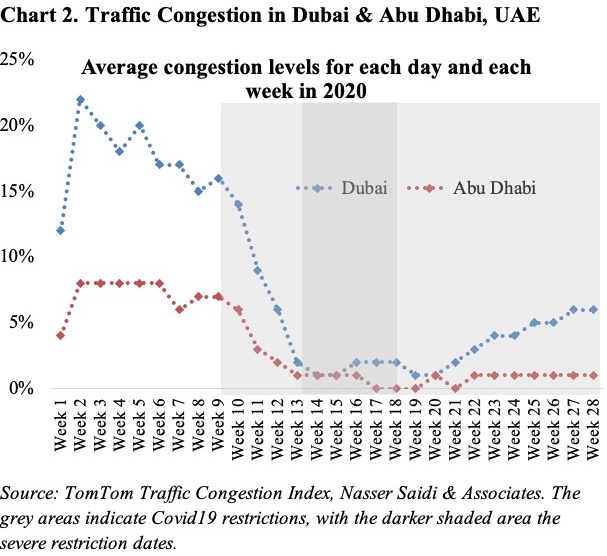

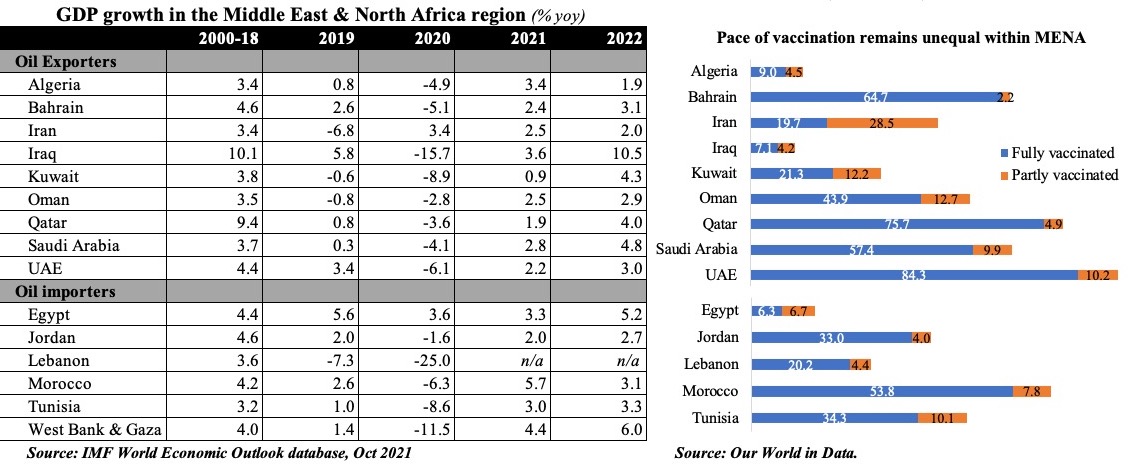

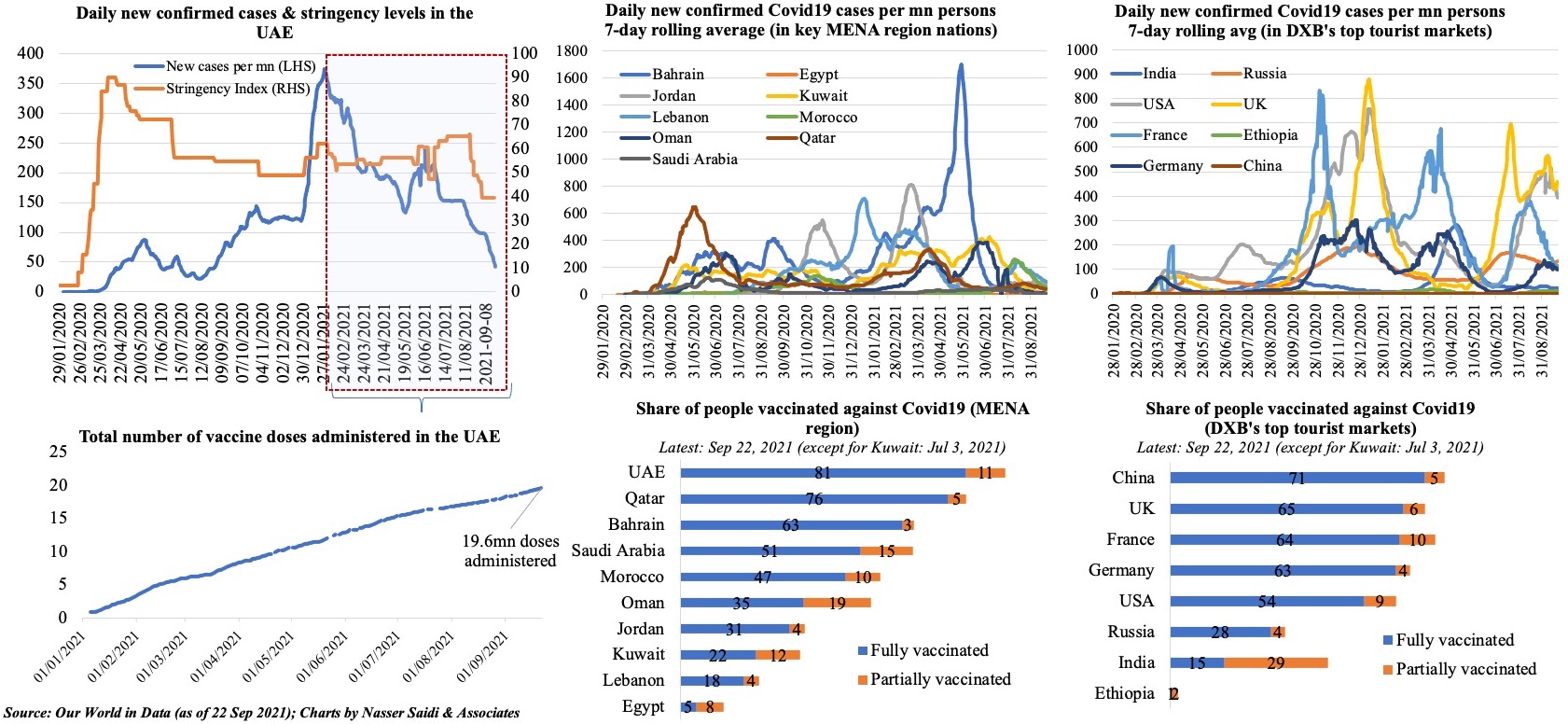

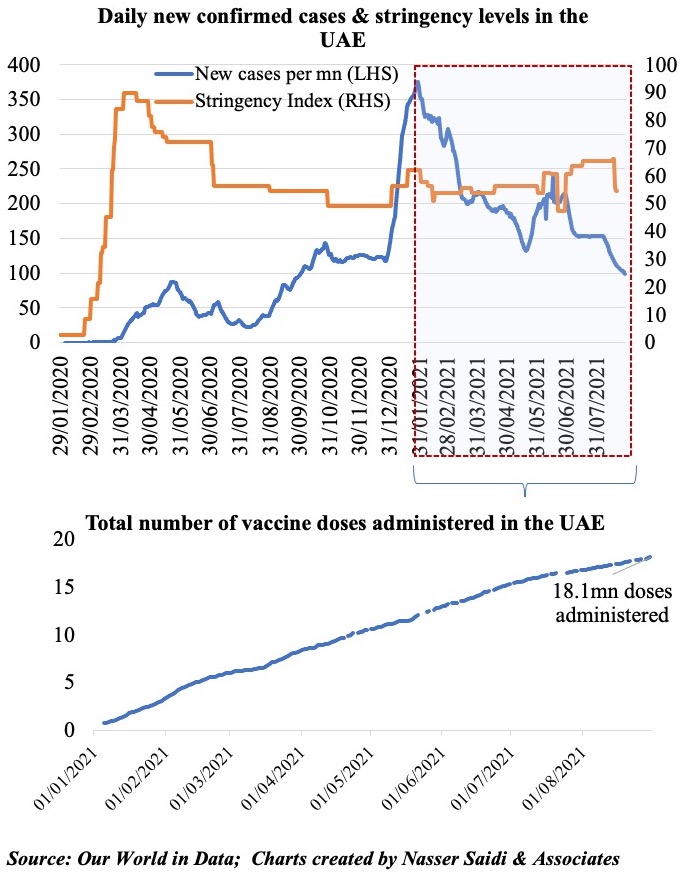

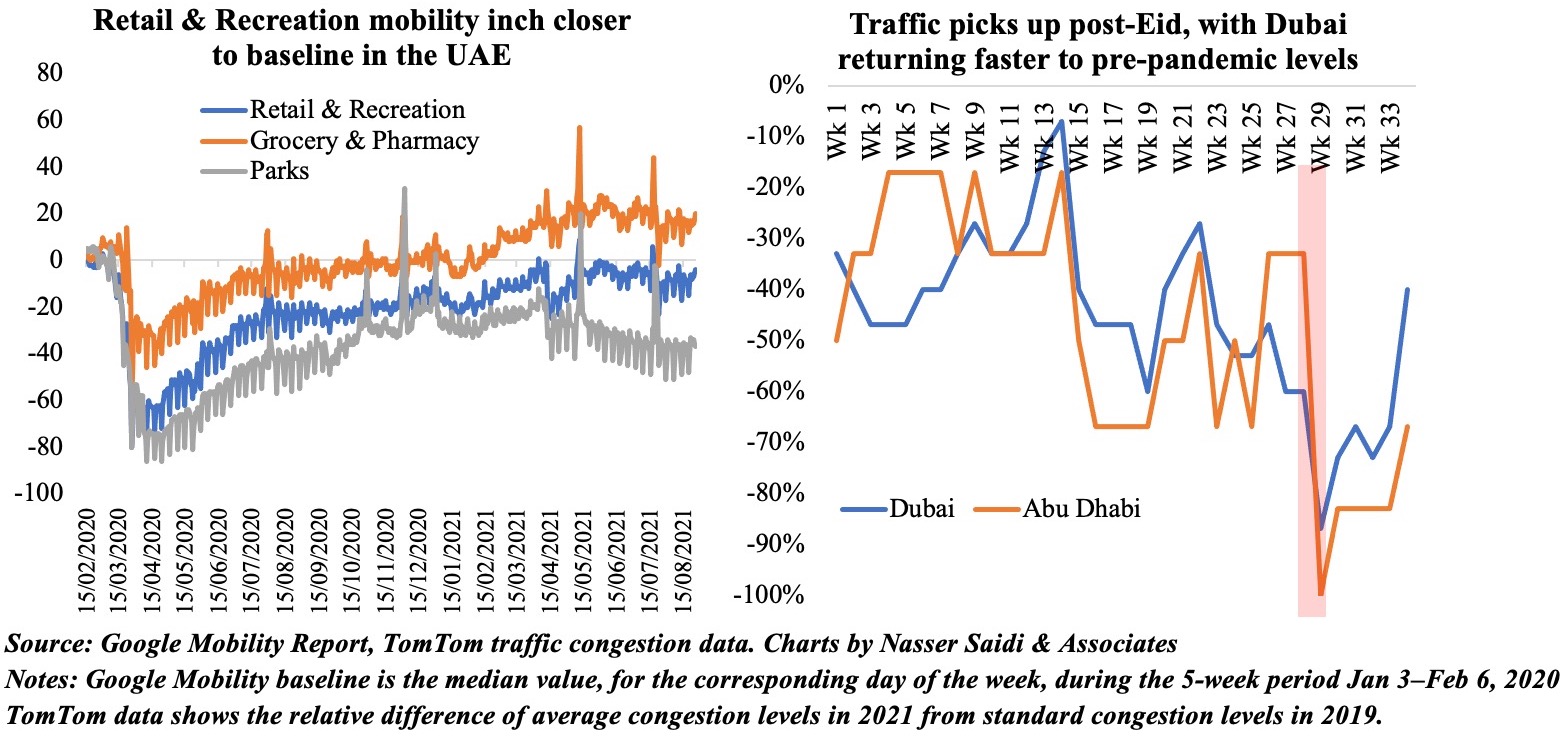

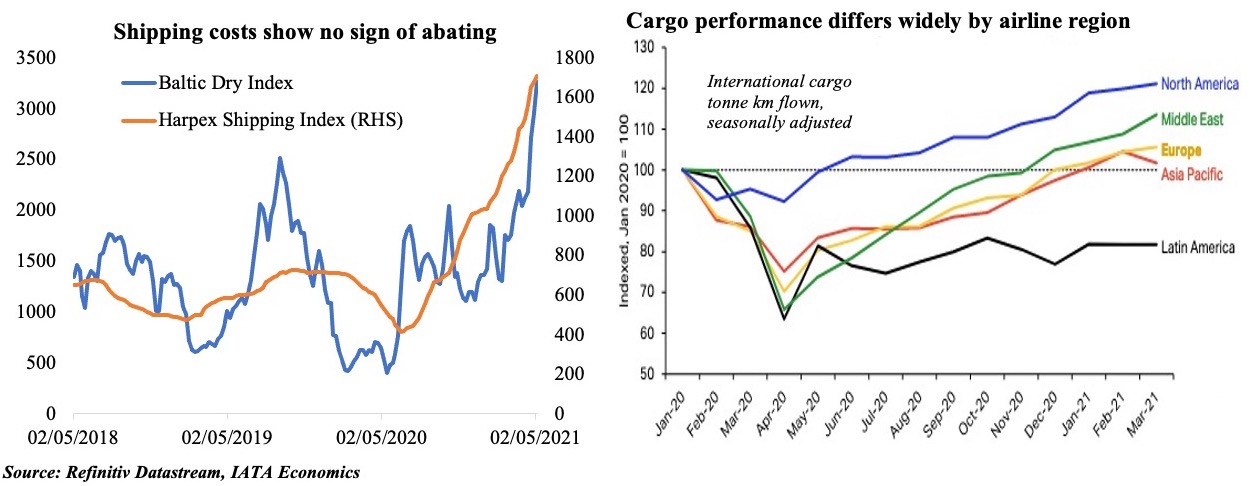

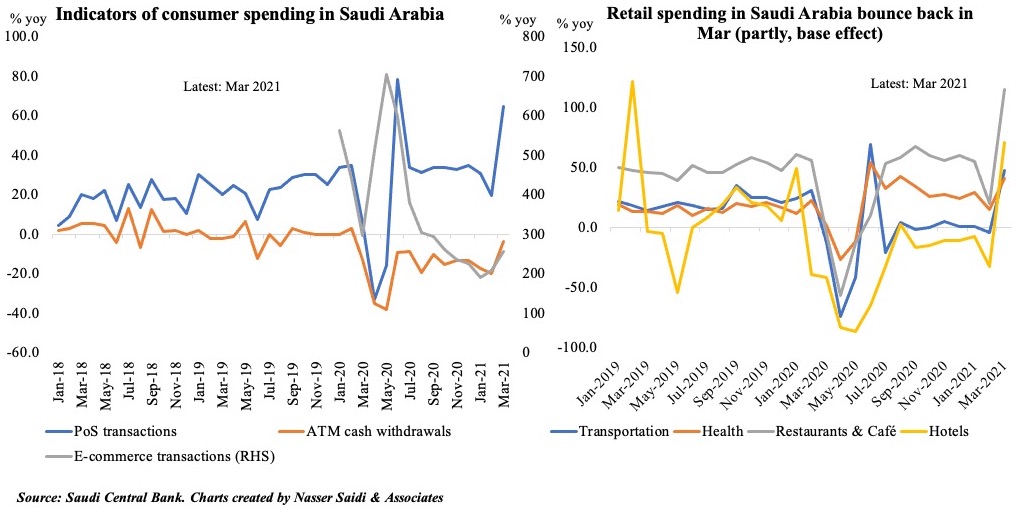

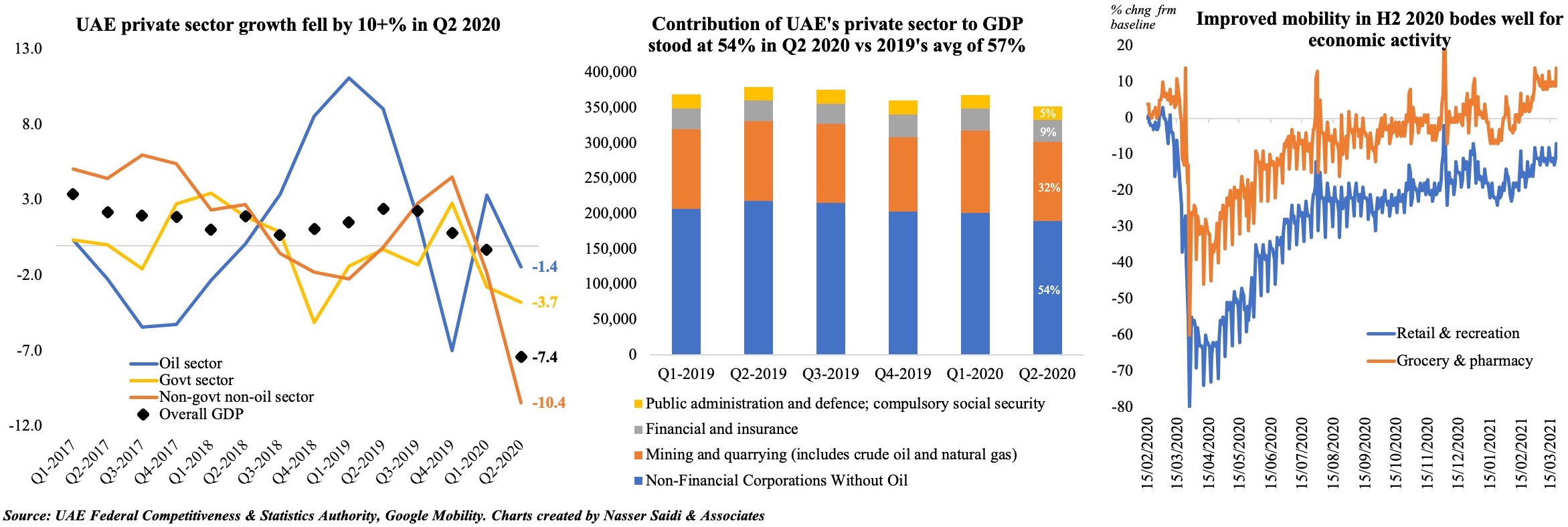

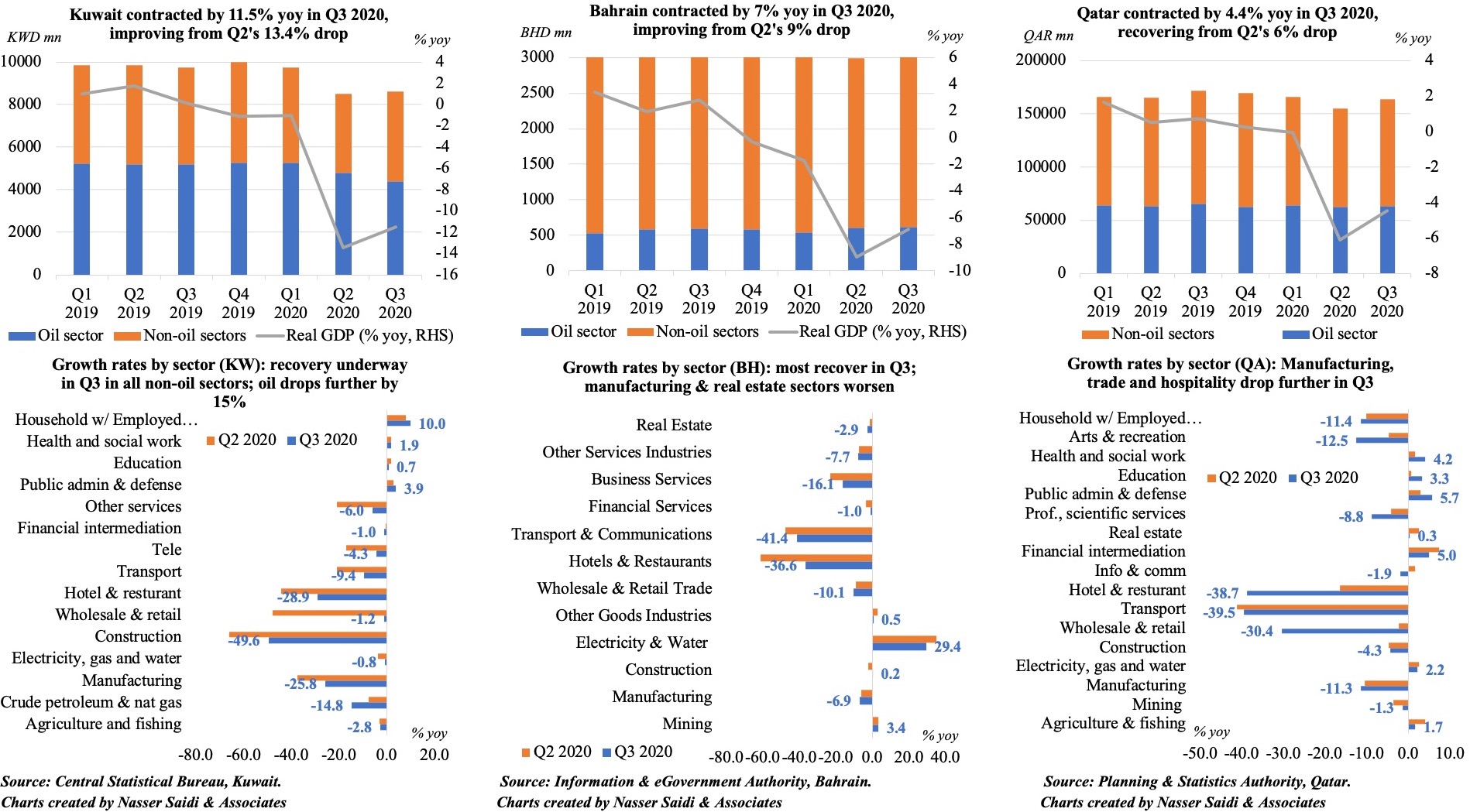

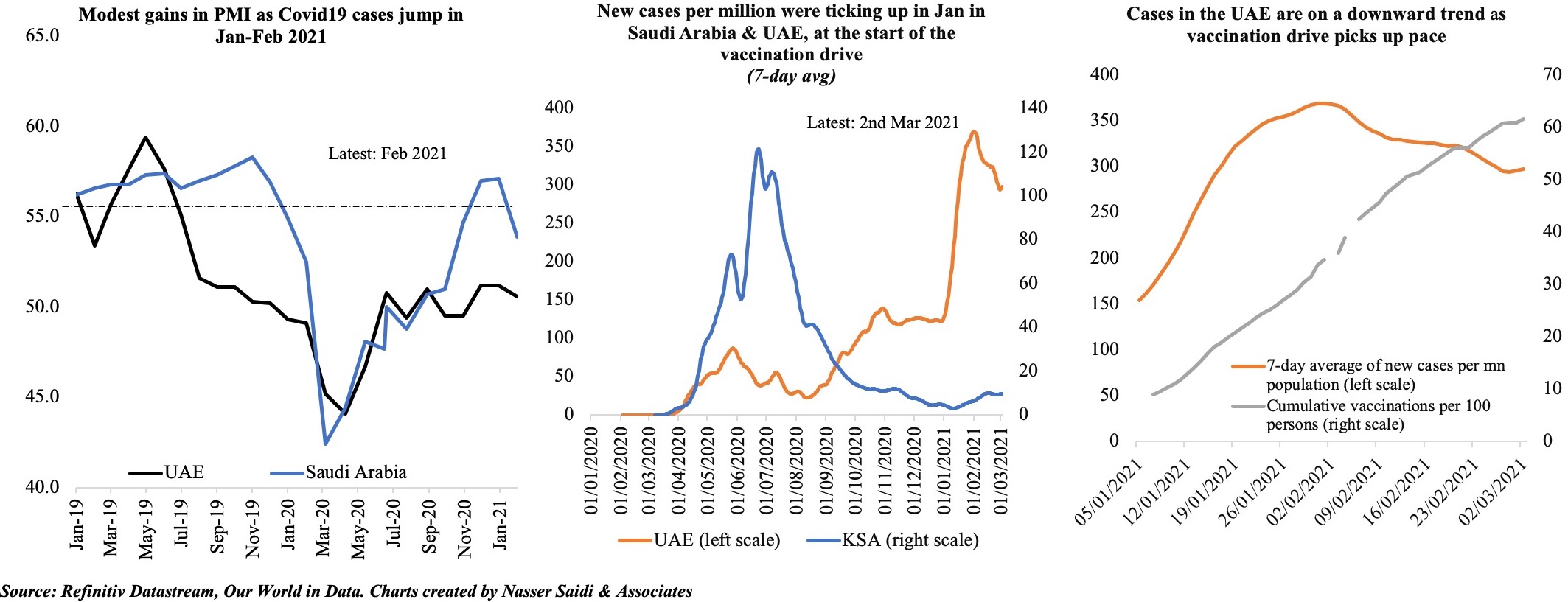

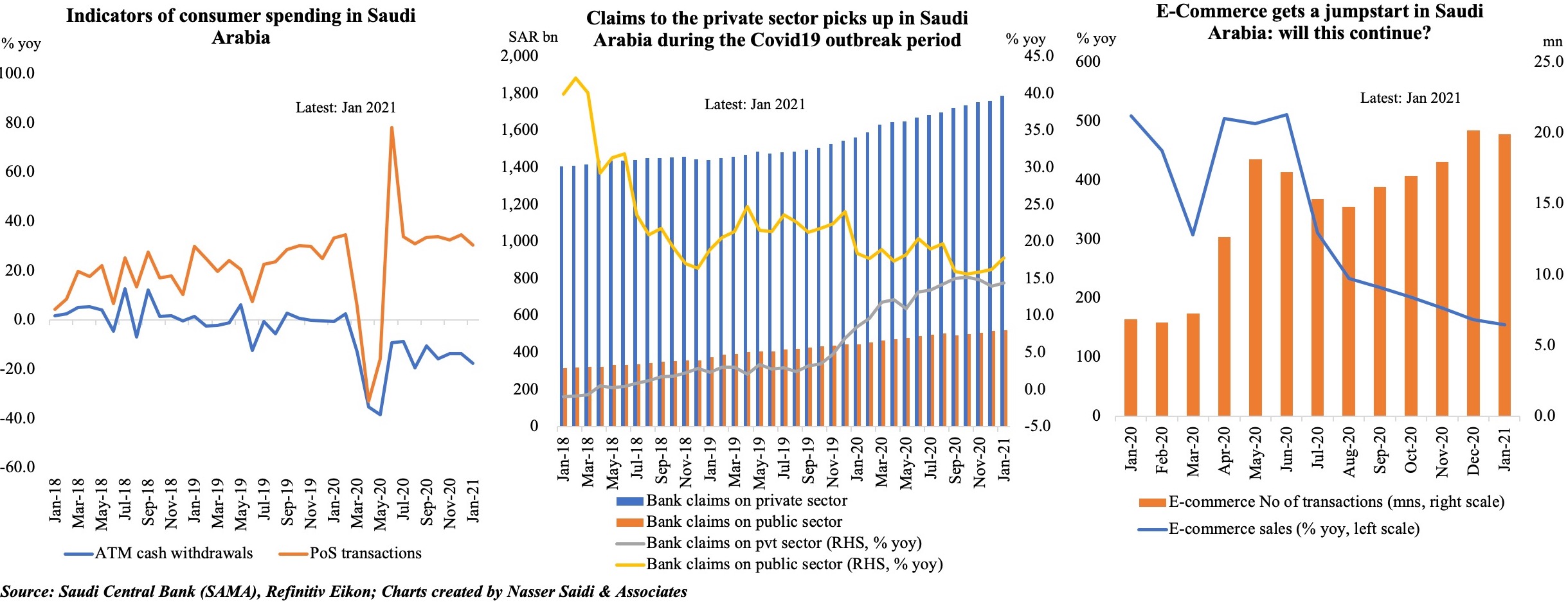

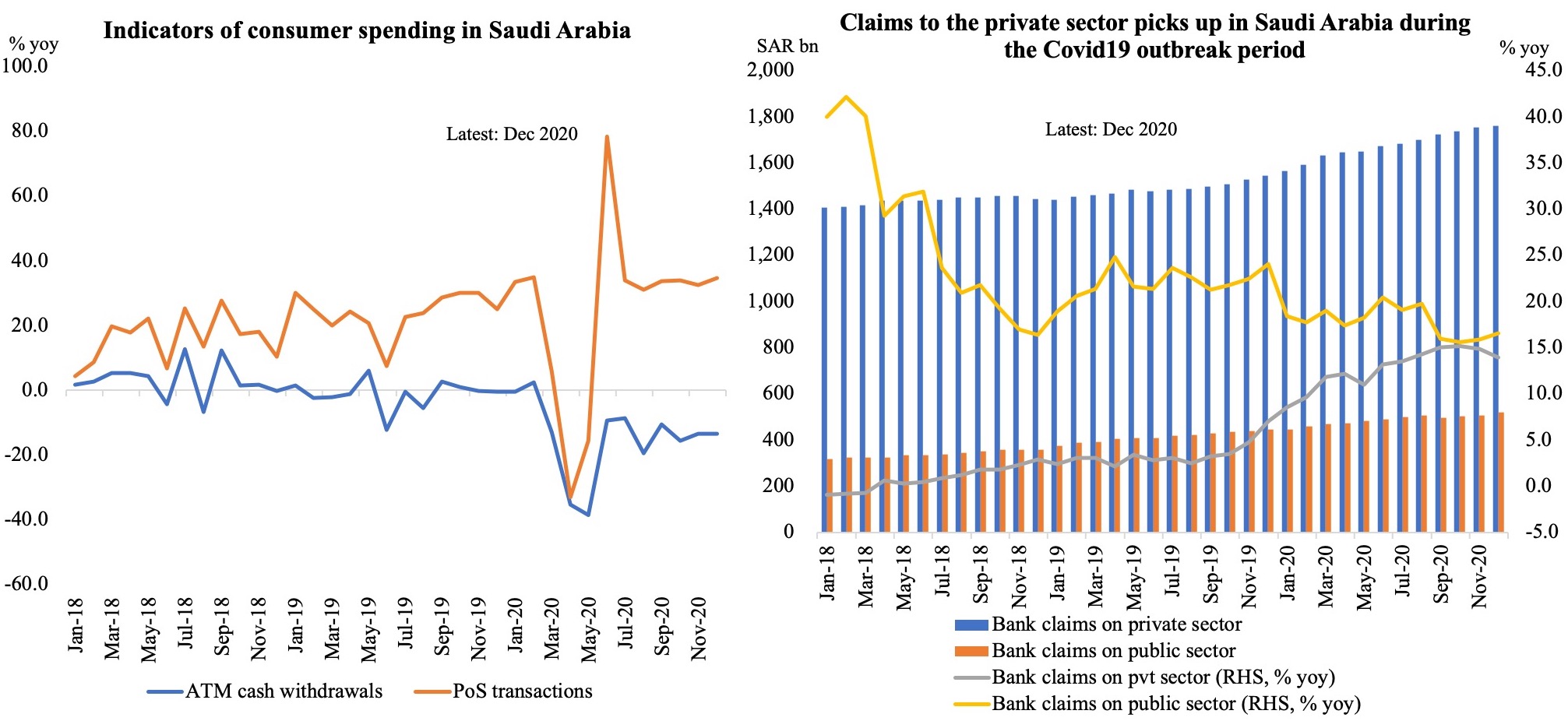

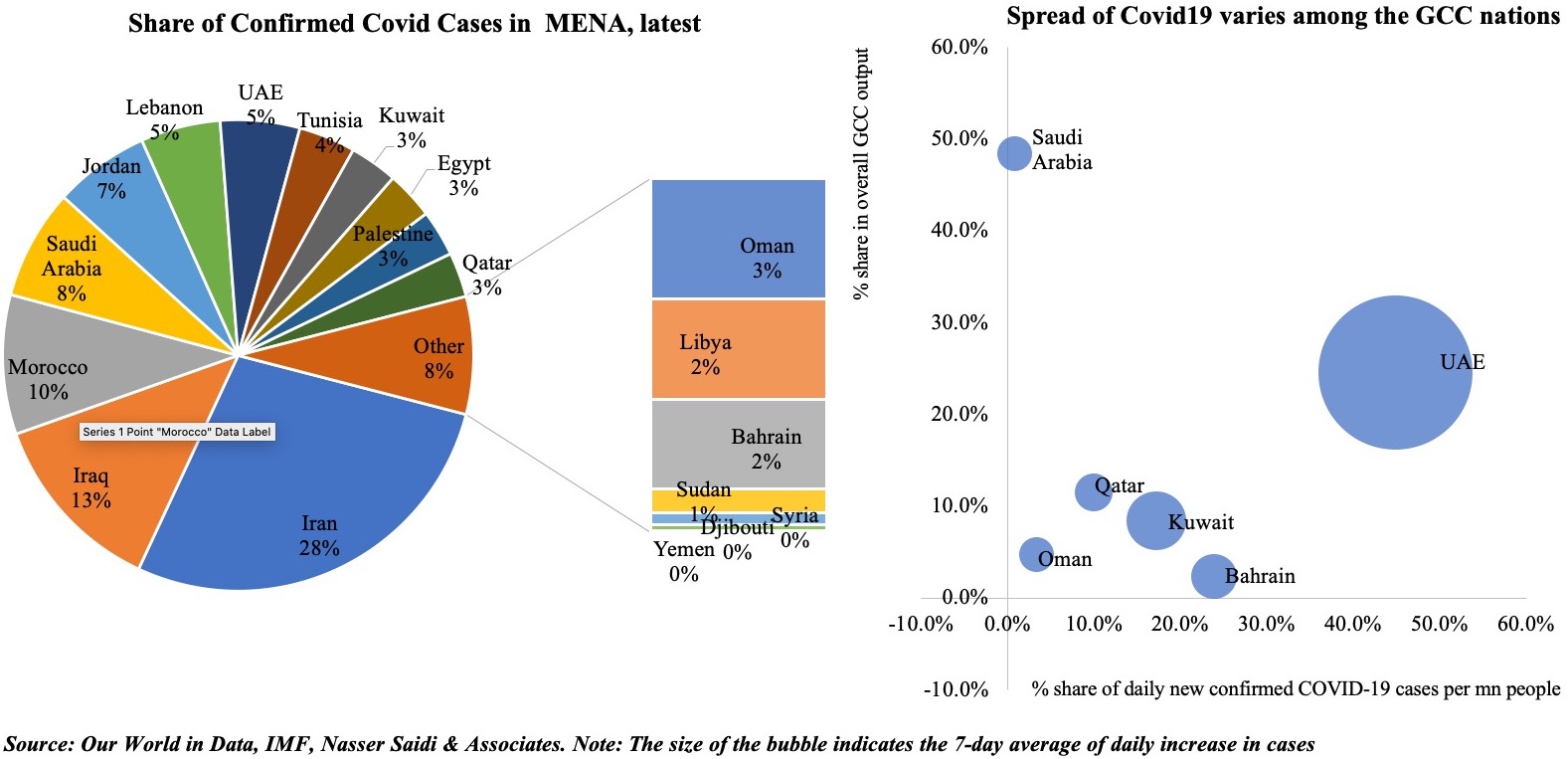

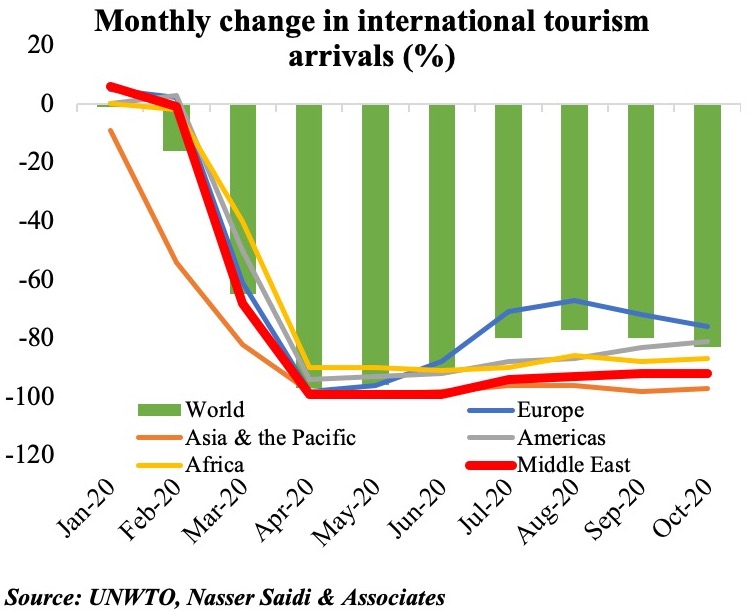

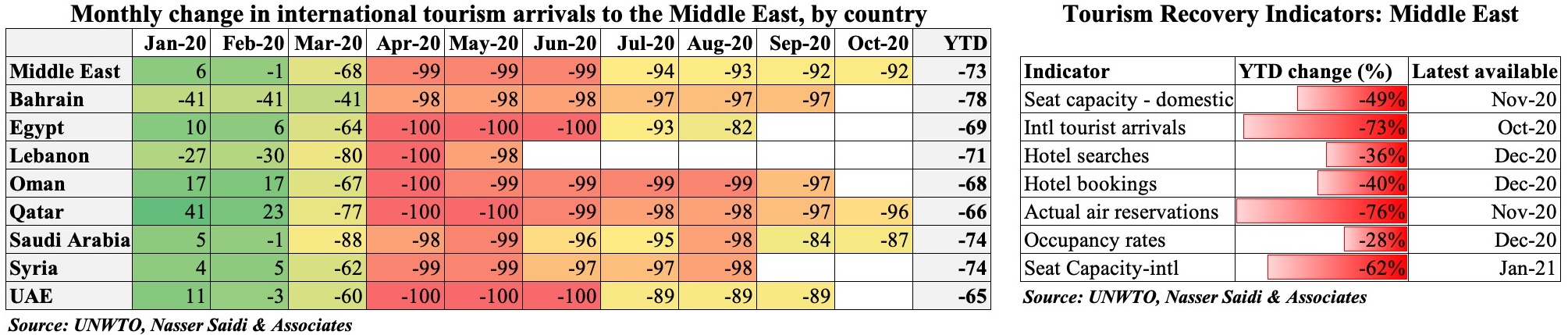

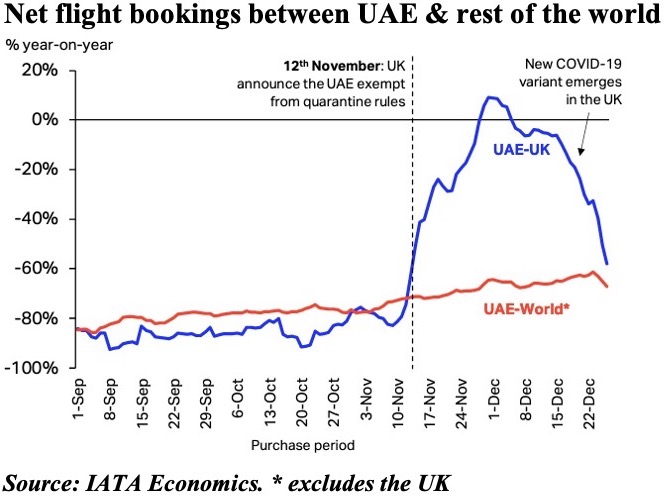

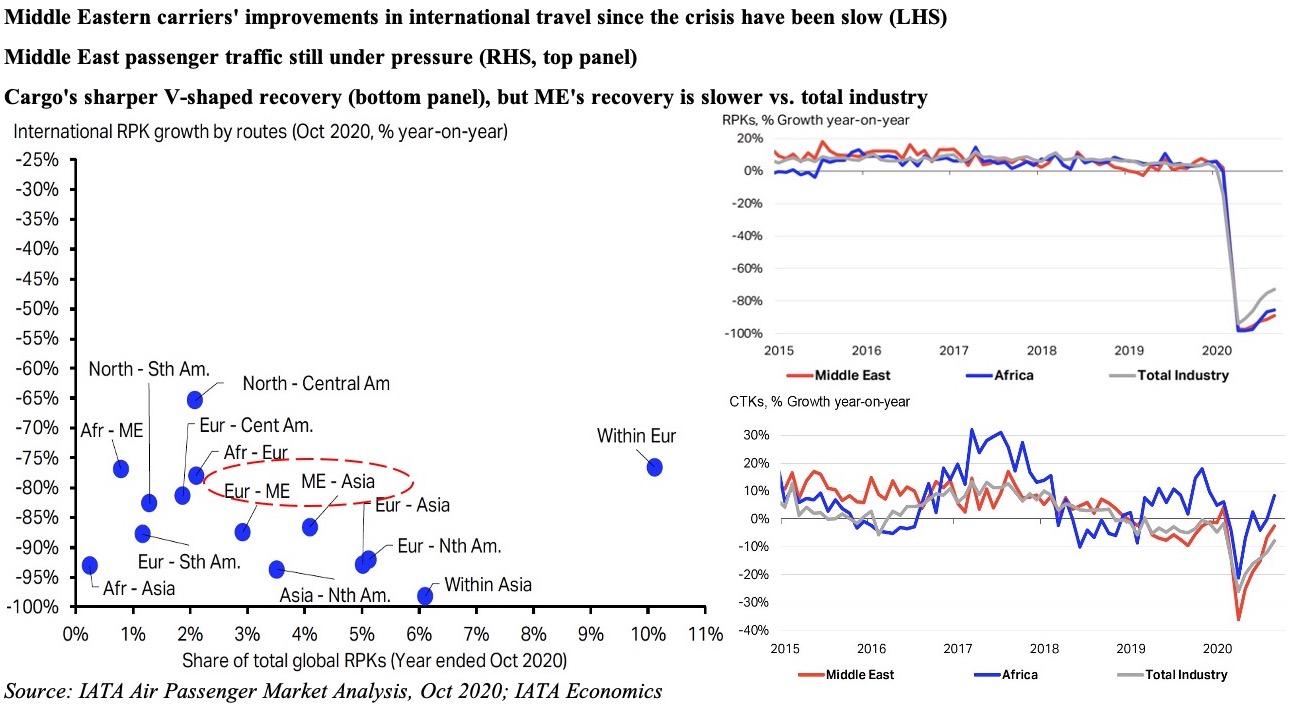

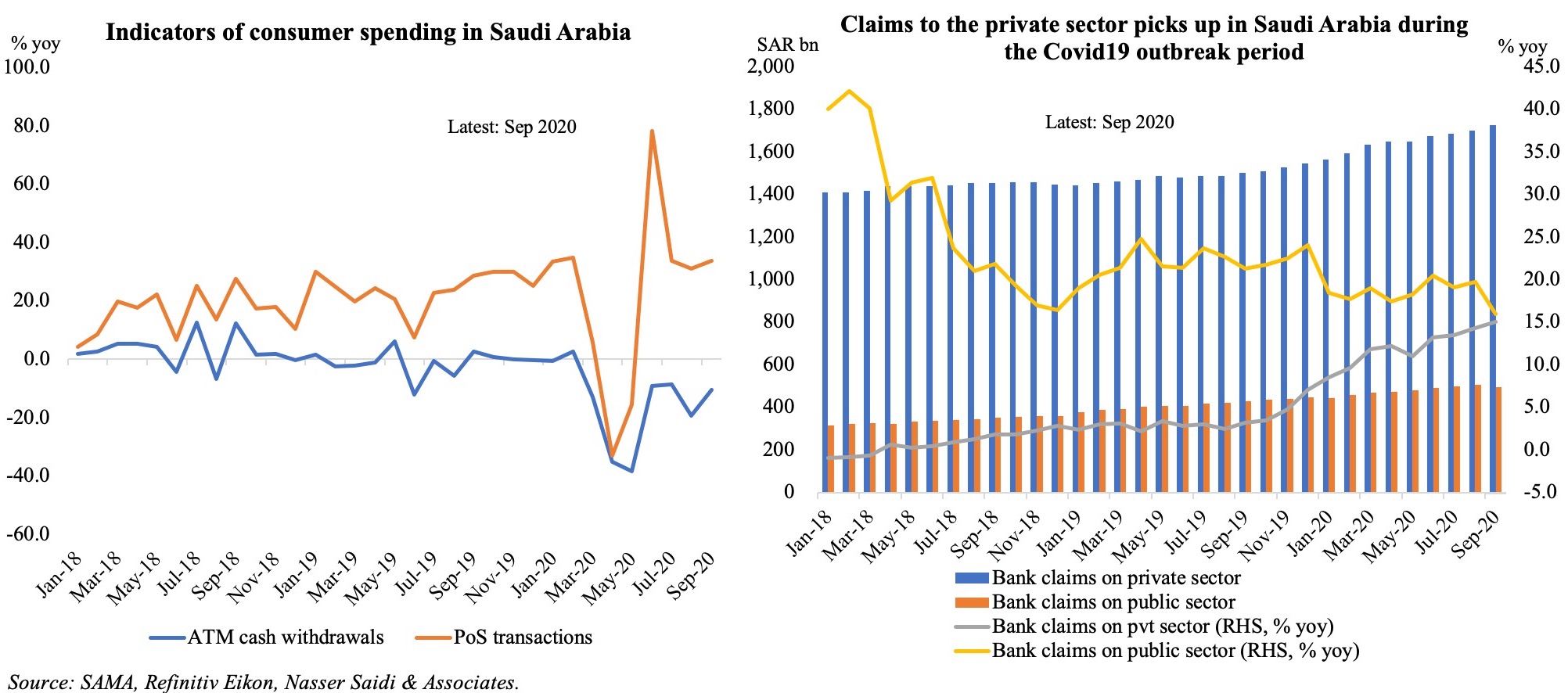

The UNWTO reported a 72% drop in international tourist arrivals during the Jan-Oct period, with the Middle East region continuing to lag its global counterparts in tourism arrivals (-73% year-to-date). International tourism as a share of total tourism is significantly high in Bahrain (97%) and UAE (83%), making these nations more vulnerable than say, Saudi Arabia, with its share at 26%. With air travel restrictions still in place in many nations, and hotels either closed or open at lower capacity, the road to recovery will be long.

The UNWTO reported a 72% drop in international tourist arrivals during the Jan-Oct period, with the Middle East region continuing to lag its global counterparts in tourism arrivals (-73% year-to-date). International tourism as a share of total tourism is significantly high in Bahrain (97%) and UAE (83%), making these nations more vulnerable than say, Saudi Arabia, with its share at 26%. With air travel restrictions still in place in many nations, and hotels either closed or open at lower capacity, the road to recovery will be long.

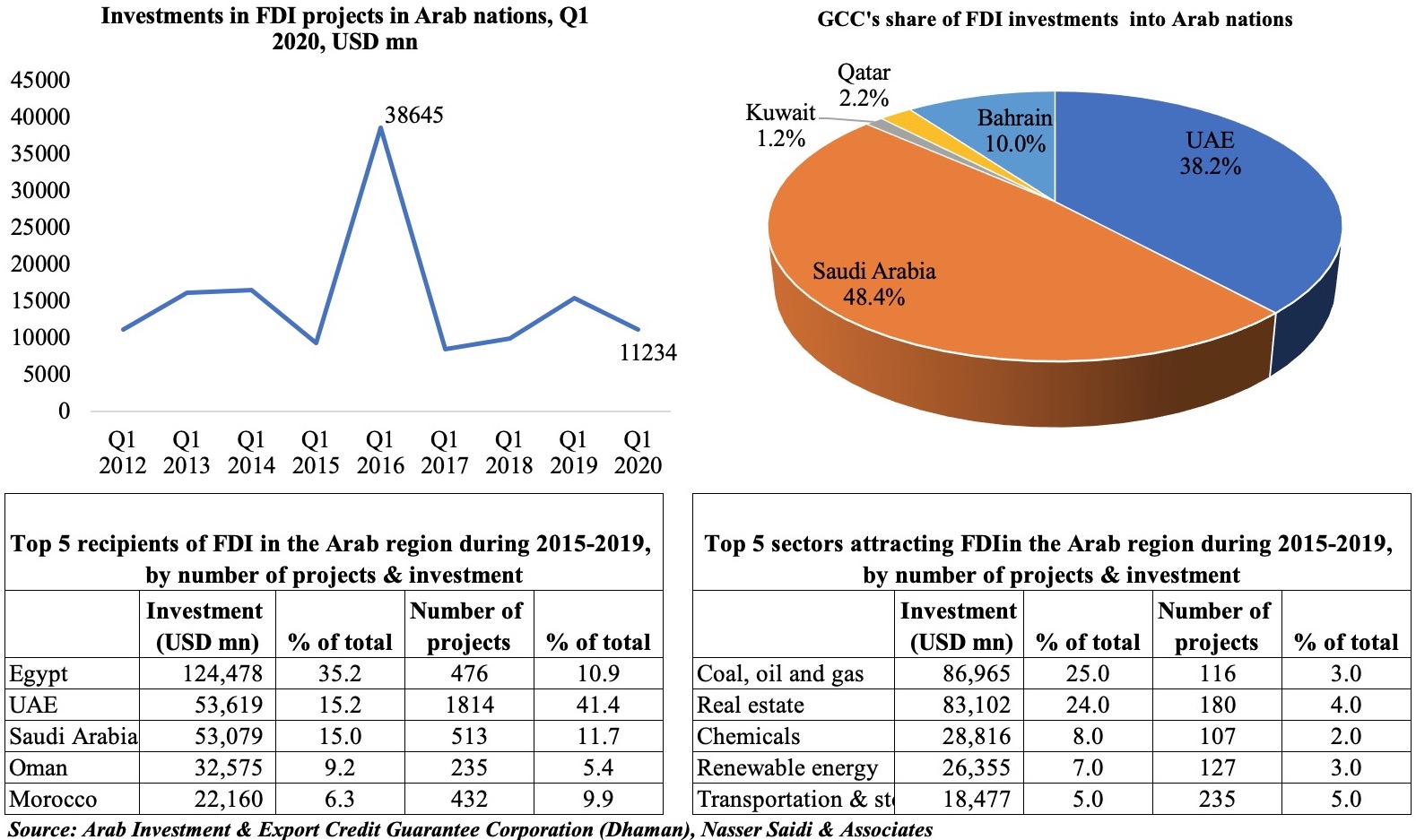

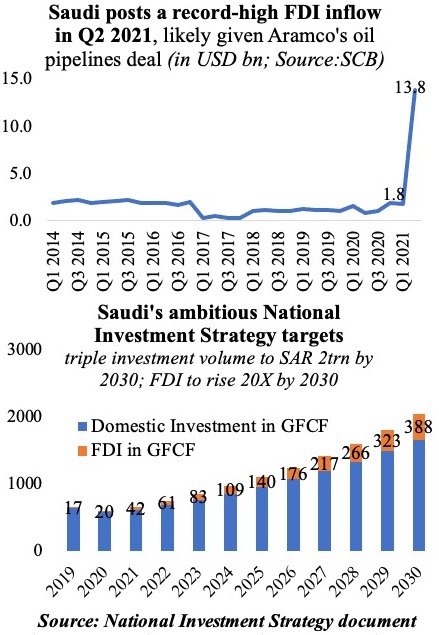

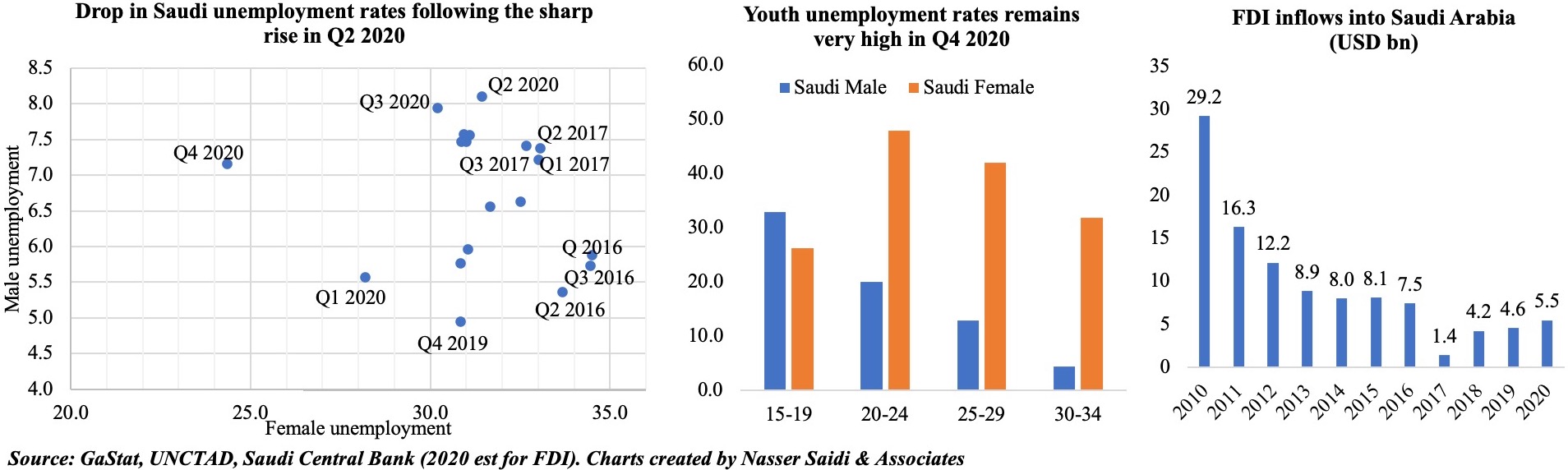

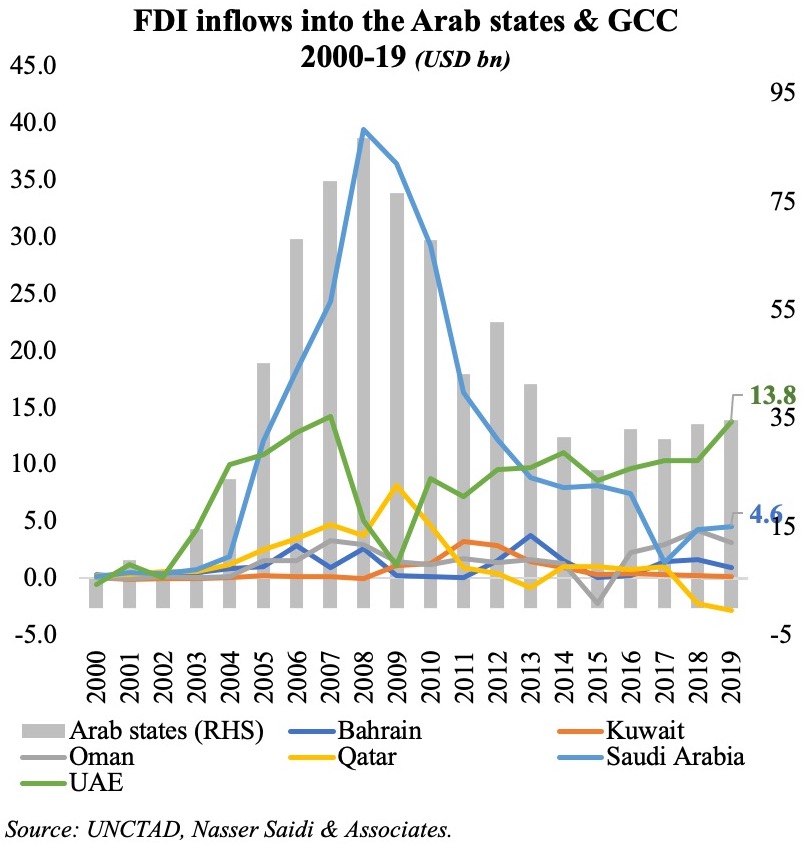

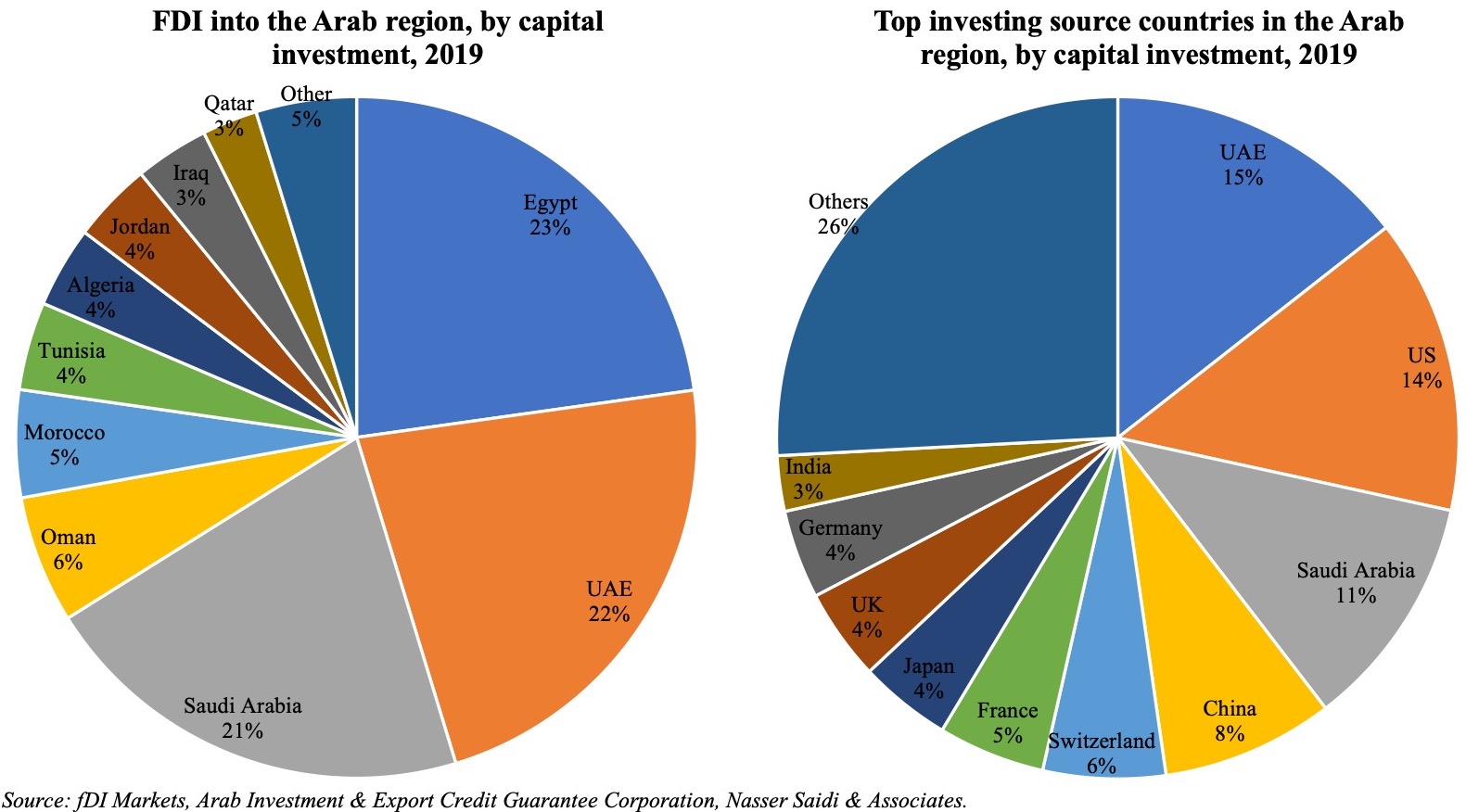

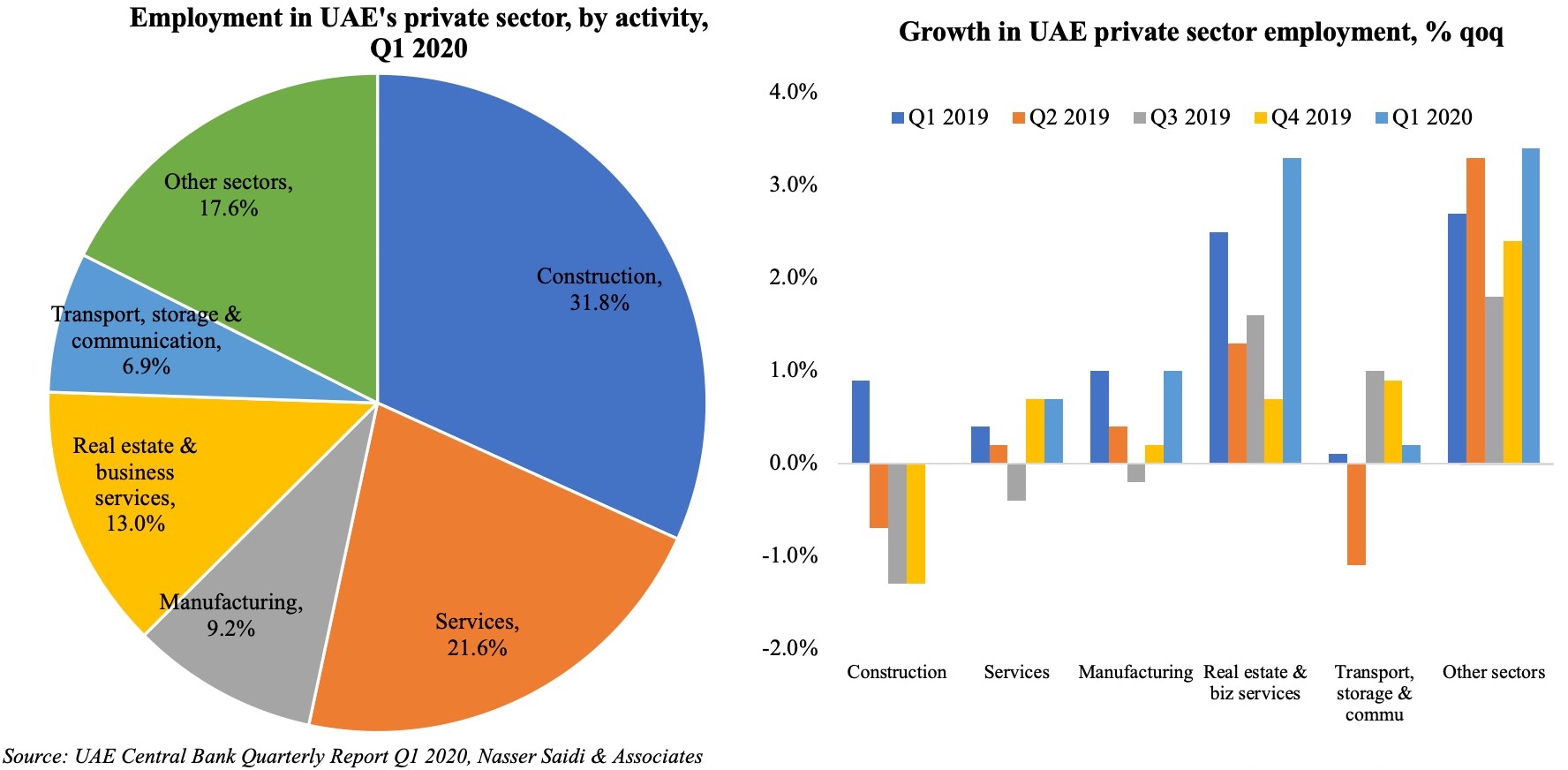

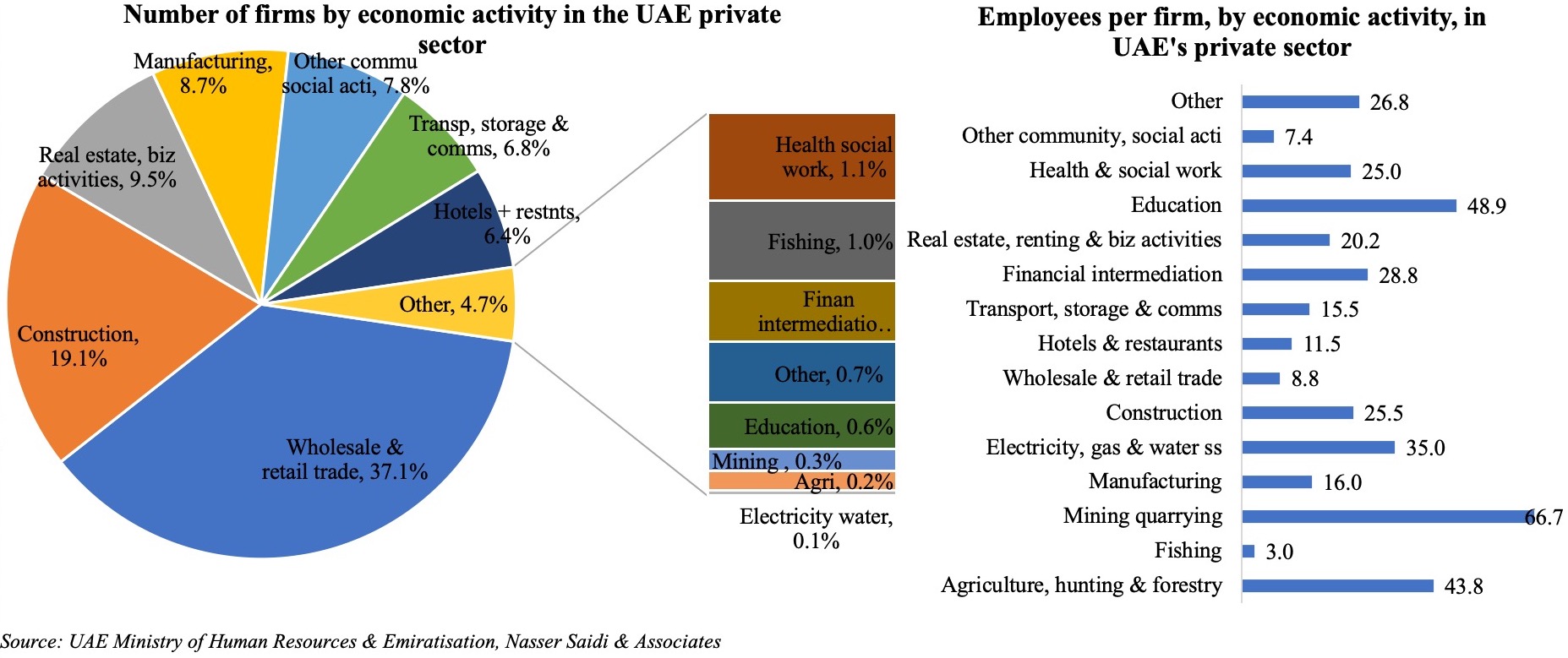

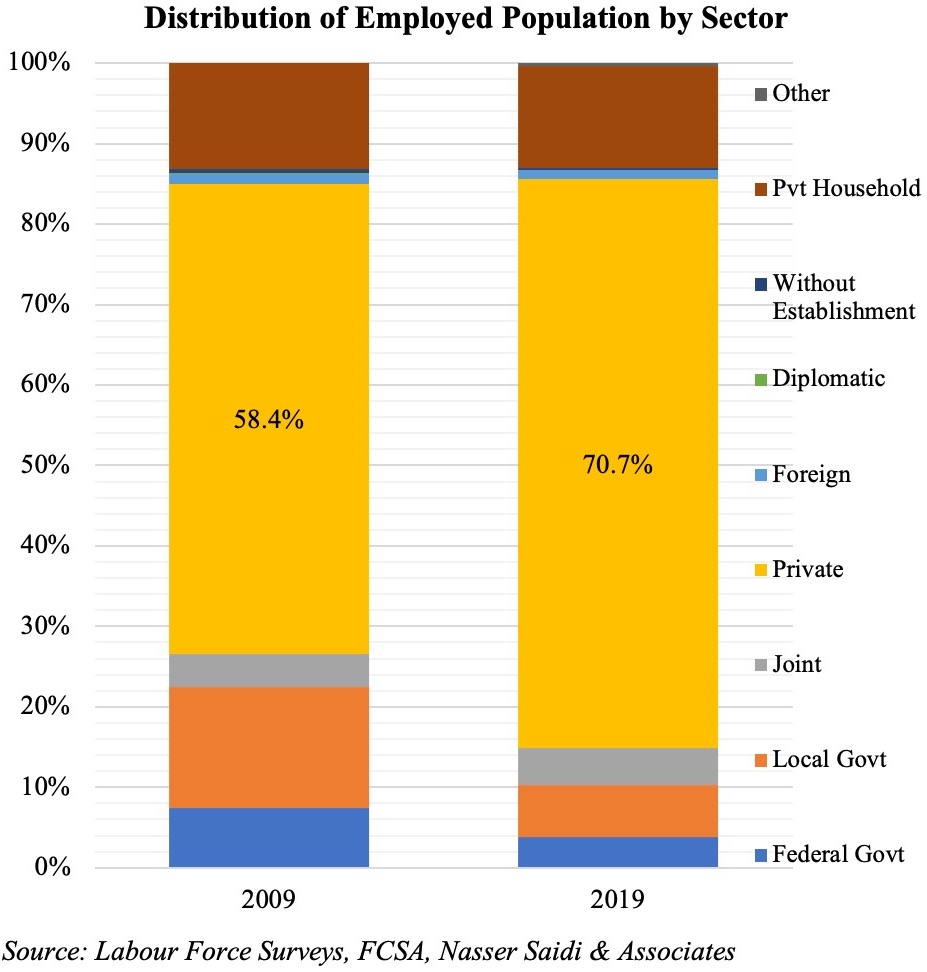

We focus on FDI in this Weekly Insight piece. FDI inflows are essential to the UAE’s diversification efforts, as it would not only create jobs, raise productivity and growth, but could also lead to transfer of technology/ technical know-how and promote competition in the market. According to the IMF, closing FDI gaps in the GCC could raise real non-oil GDP per capita growth by as much as 1 percentage point.

We focus on FDI in this Weekly Insight piece. FDI inflows are essential to the UAE’s diversification efforts, as it would not only create jobs, raise productivity and growth, but could also lead to transfer of technology/ technical know-how and promote competition in the market. According to the IMF, closing FDI gaps in the GCC could raise real non-oil GDP per capita growth by as much as 1 percentage point.

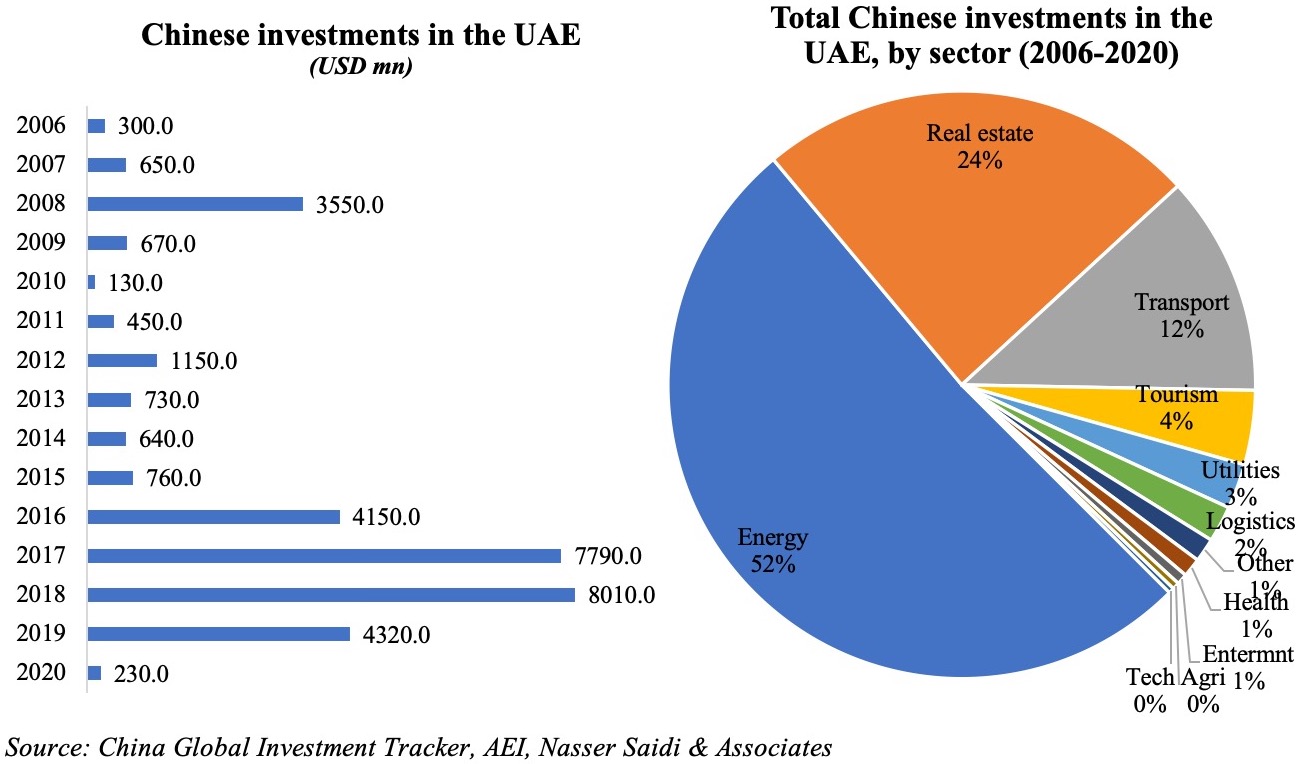

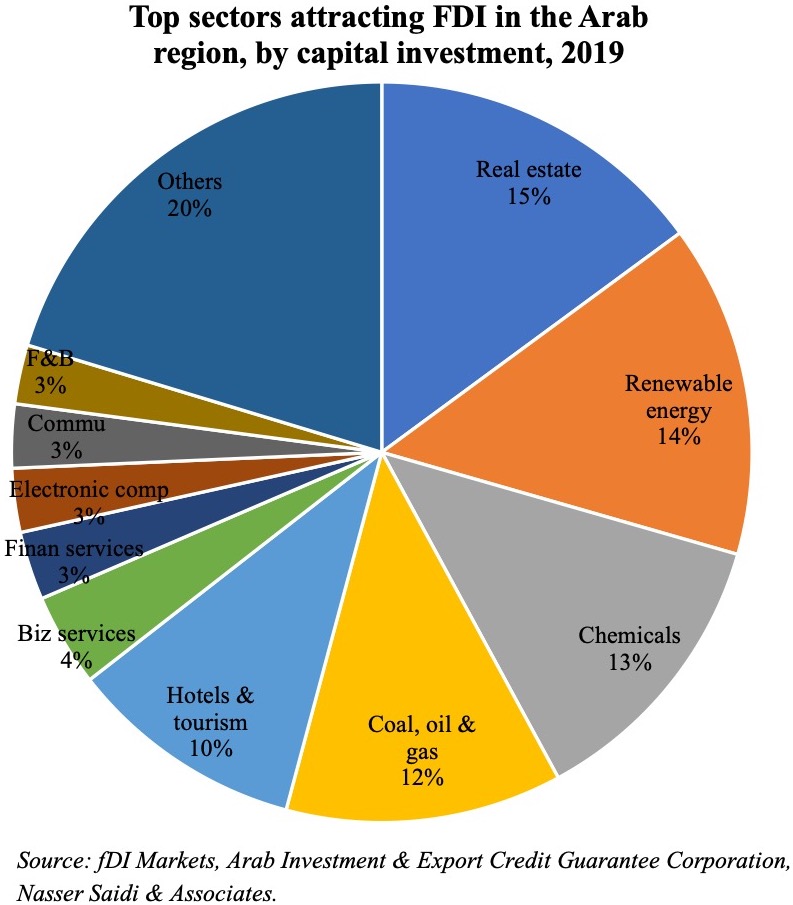

hinese projects tracked during Jan 2003-Mar 2020 (with the number of projects in double-digits in 2018 and 2019). According to AEI’s China Global Investment Tracker, the value of Chinese investments touched a high of USD 8bn in 2018, thanks to a handful of large projects (including with ACWA Power and Abu Dhabi Oil). Sector-wise, investments were concentrated in energy (both oil and gas as well as renewables), real estate and transport – together accounting for 87.8% of total investments during 2016-2020. This is largely in line with FDI inflows into the Arab region as well, with the top 5 sectors (real estate, renewables, chemicals, oil & gas and travel & tourism) accounting for close to two-thirds of total inflows in 2019.

hinese projects tracked during Jan 2003-Mar 2020 (with the number of projects in double-digits in 2018 and 2019). According to AEI’s China Global Investment Tracker, the value of Chinese investments touched a high of USD 8bn in 2018, thanks to a handful of large projects (including with ACWA Power and Abu Dhabi Oil). Sector-wise, investments were concentrated in energy (both oil and gas as well as renewables), real estate and transport – together accounting for 87.8% of total investments during 2016-2020. This is largely in line with FDI inflows into the Arab region as well, with the top 5 sectors (real estate, renewables, chemicals, oil & gas and travel & tourism) accounting for close to two-thirds of total inflows in 2019.

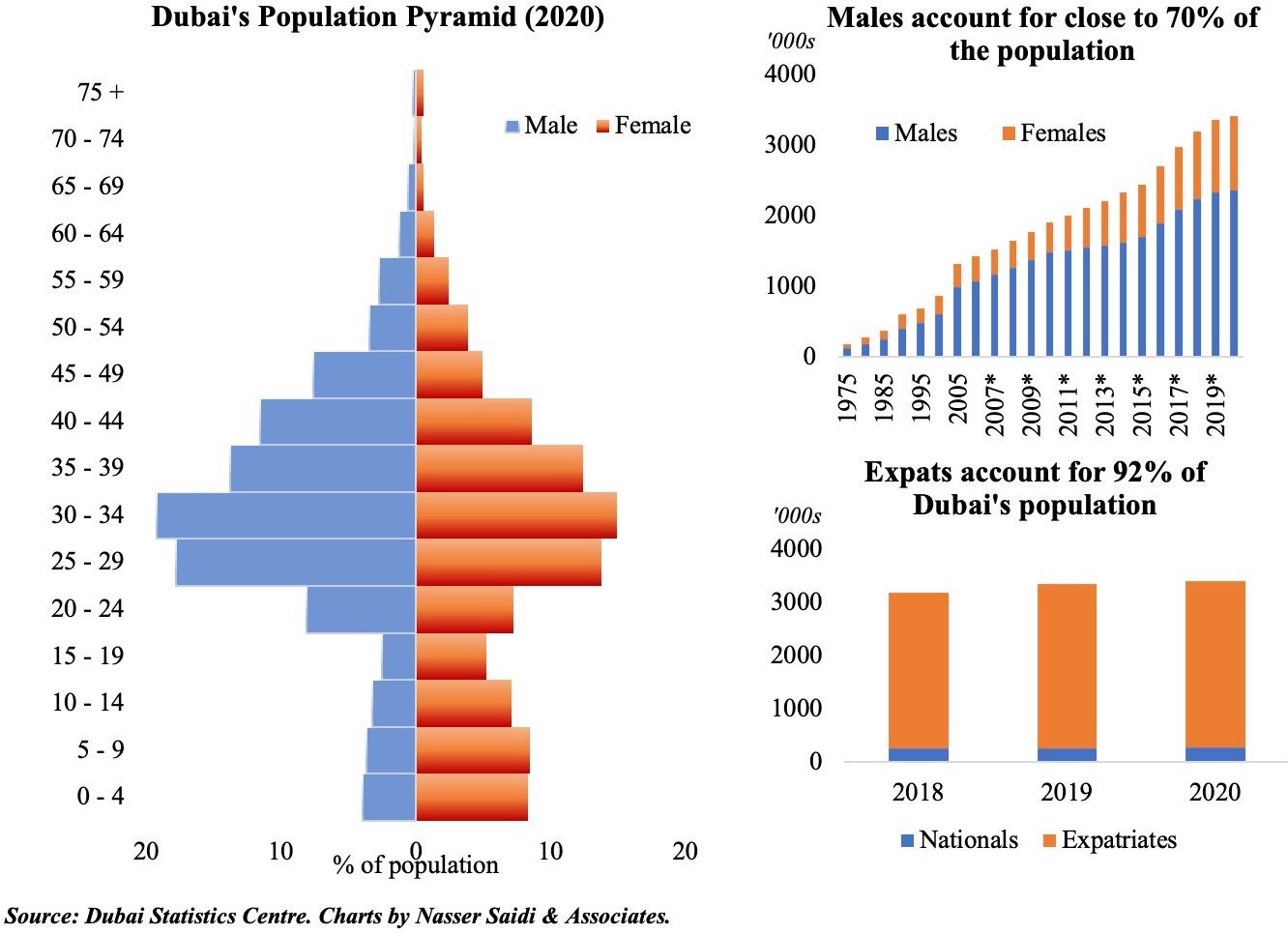

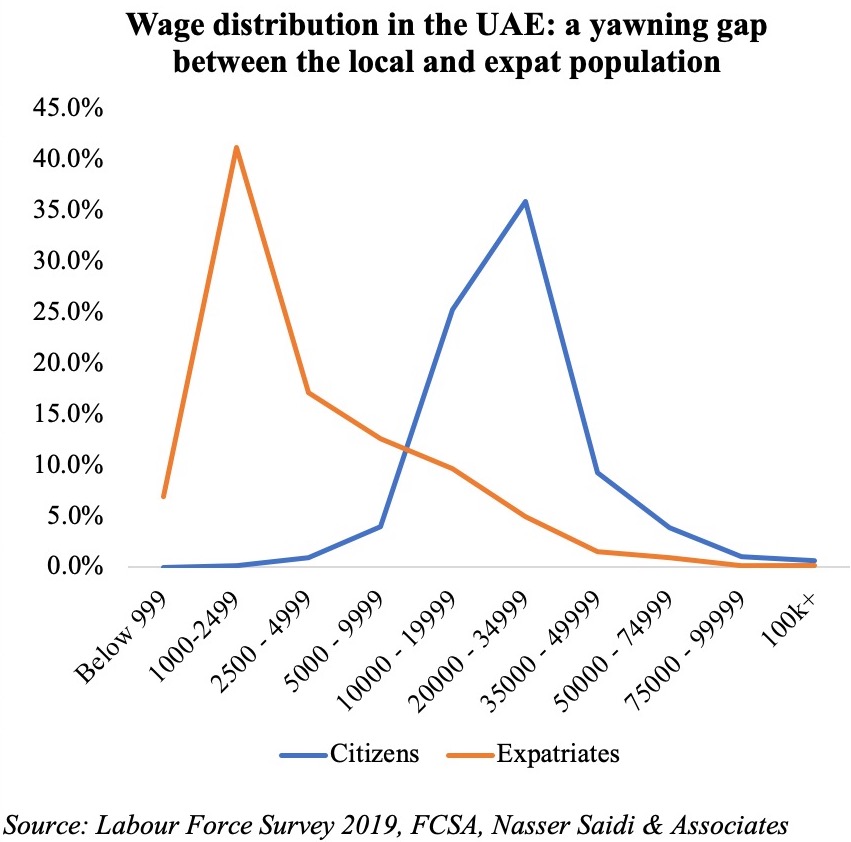

The Survey also confirms the disparity in wages between local and expat population: more than one-third of Emirati respondents disclosed receiving monthly wages between AED 20-35k (versus just 5% of expats in the same income bracket). This brings to the forefront two issues:

The Survey also confirms the disparity in wages between local and expat population: more than one-third of Emirati respondents disclosed receiving monthly wages between AED 20-35k (versus just 5% of expats in the same income bracket). This brings to the forefront two issues:

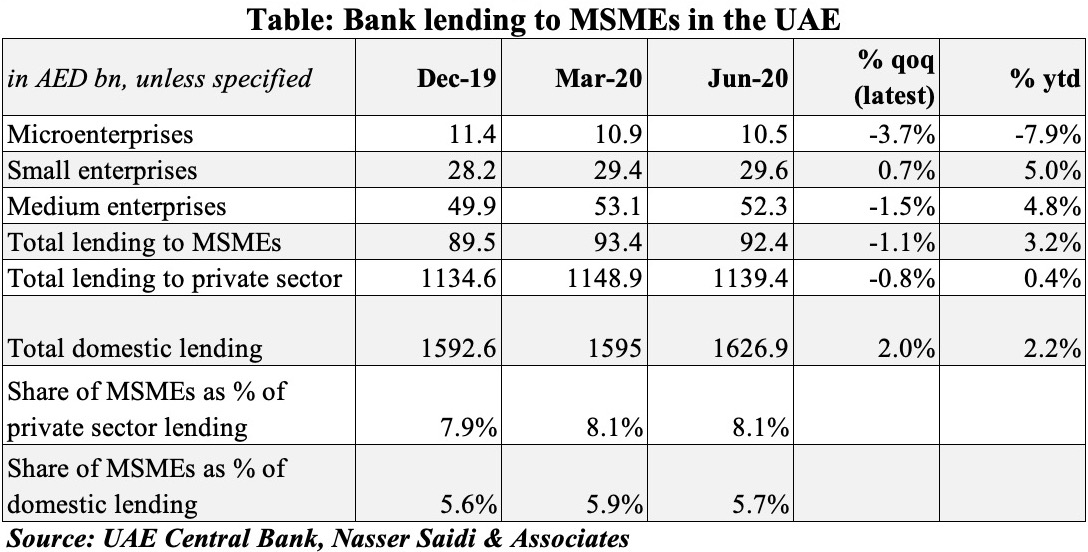

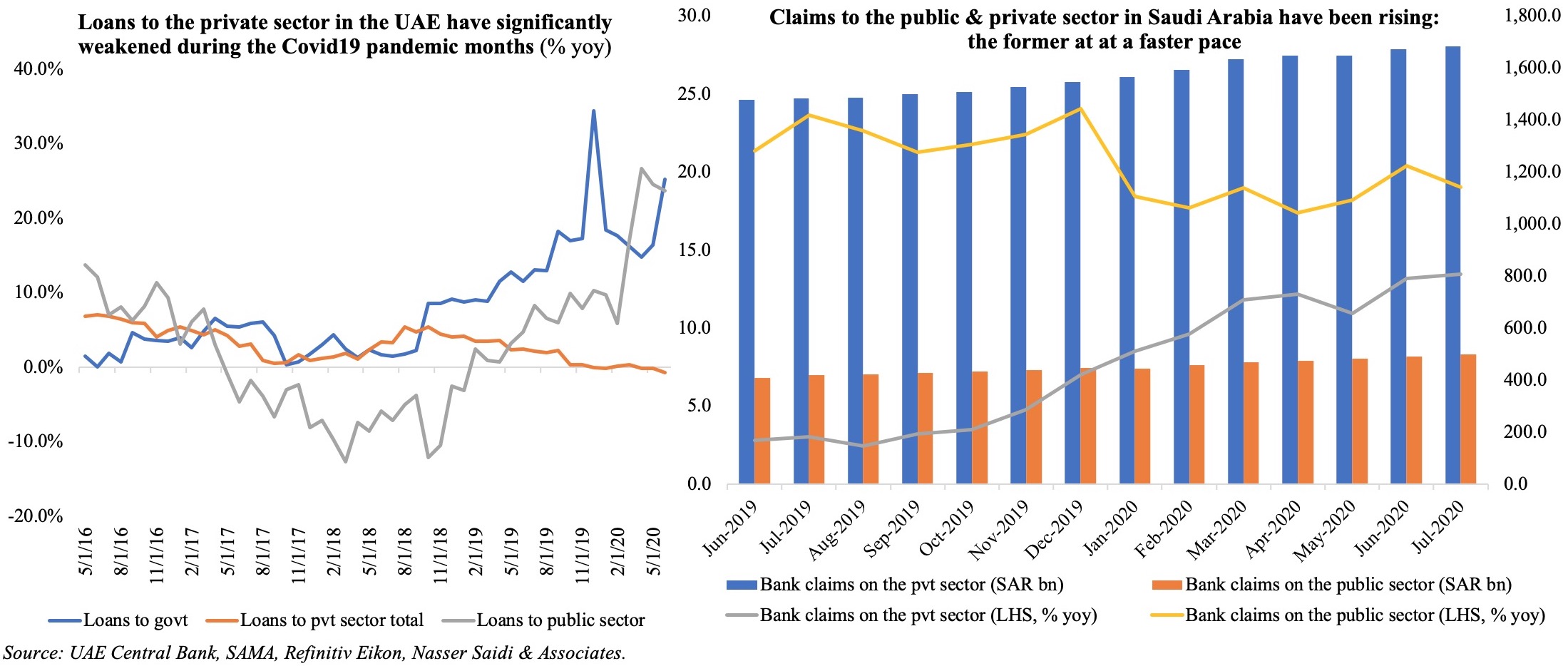

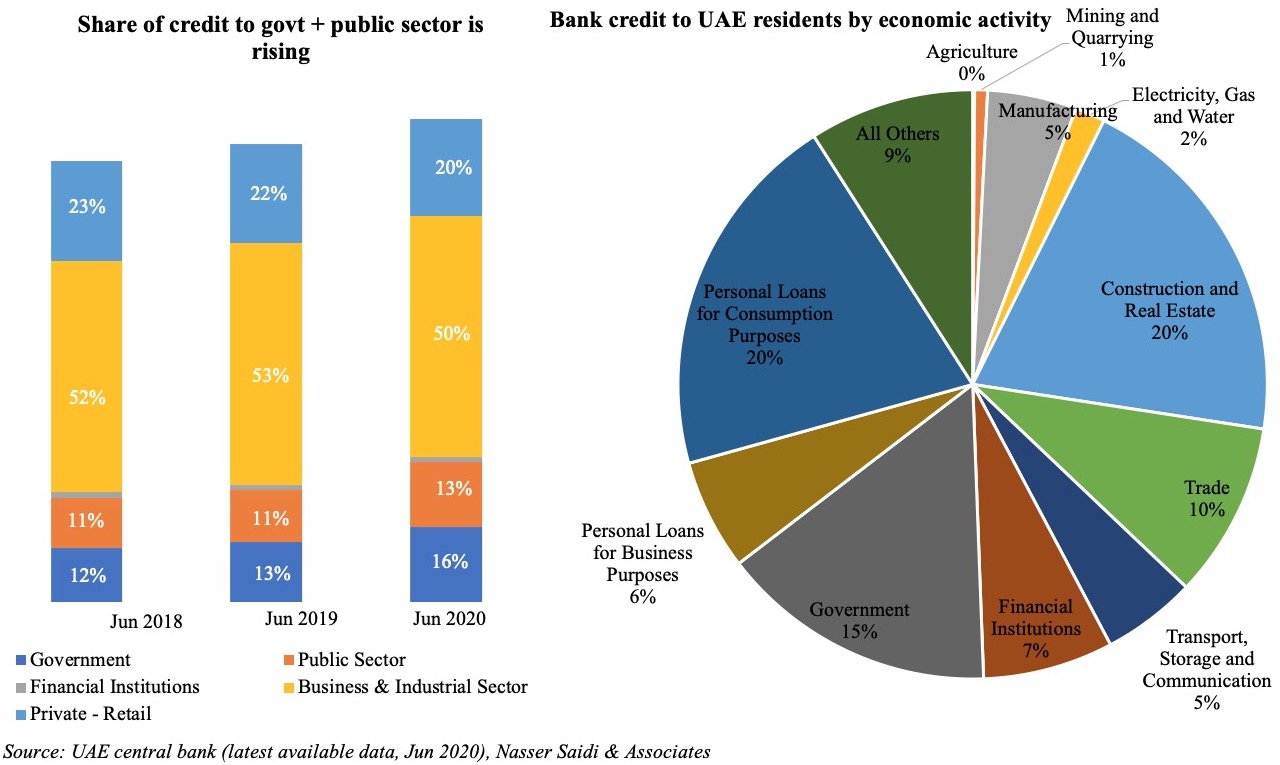

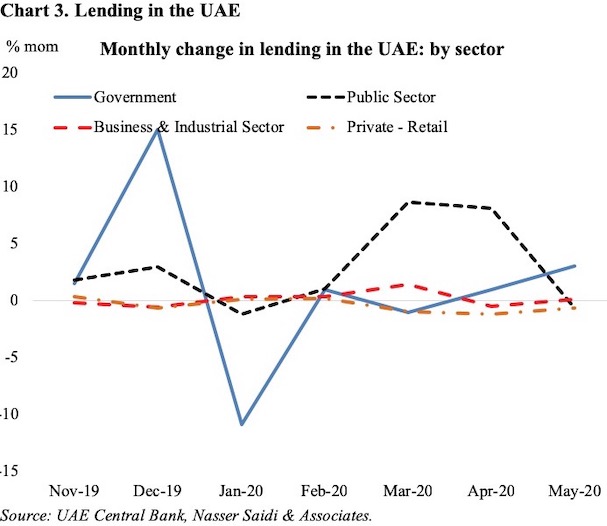

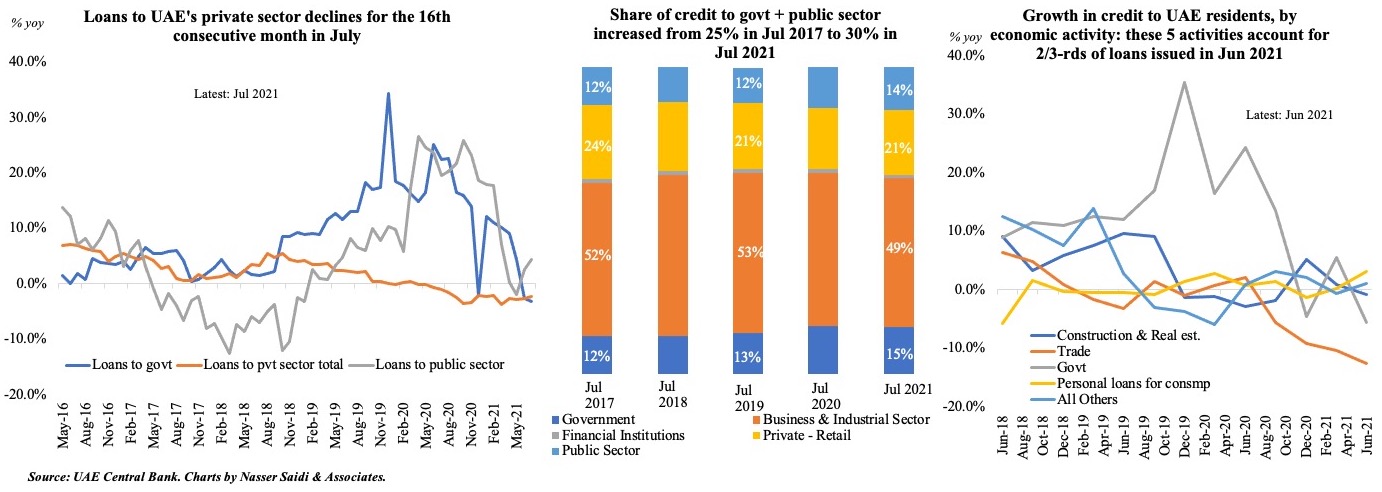

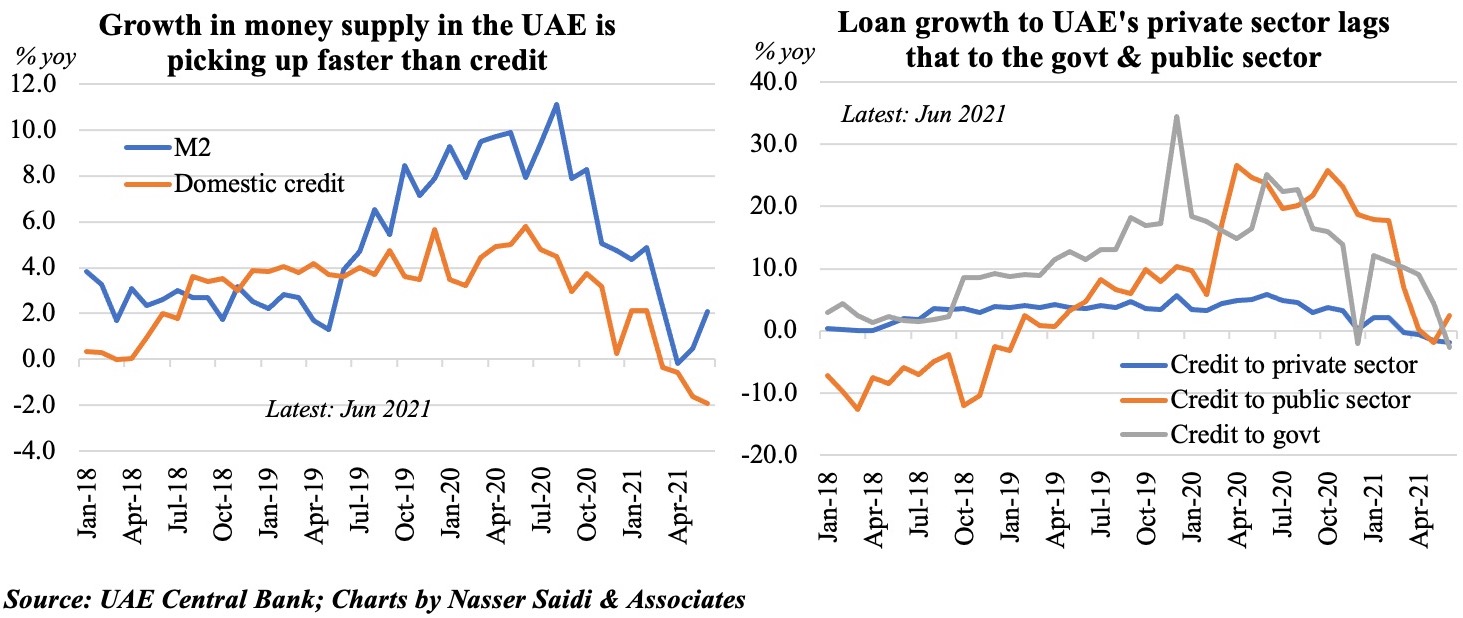

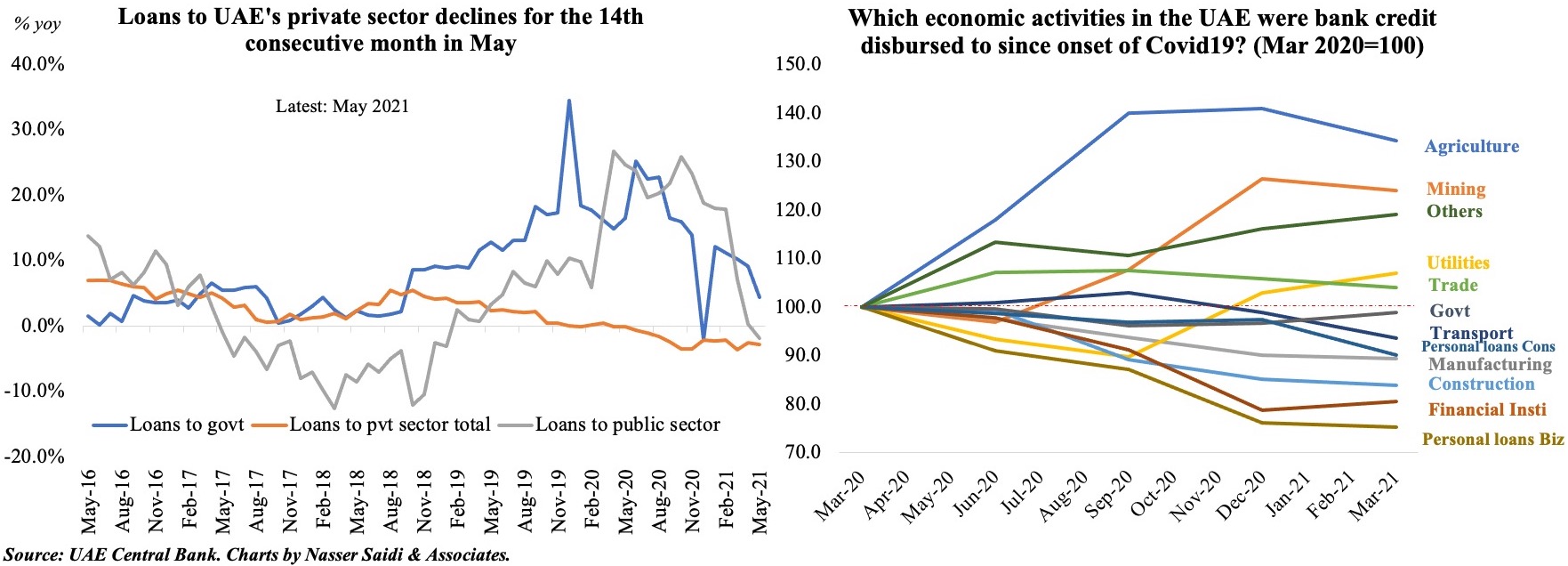

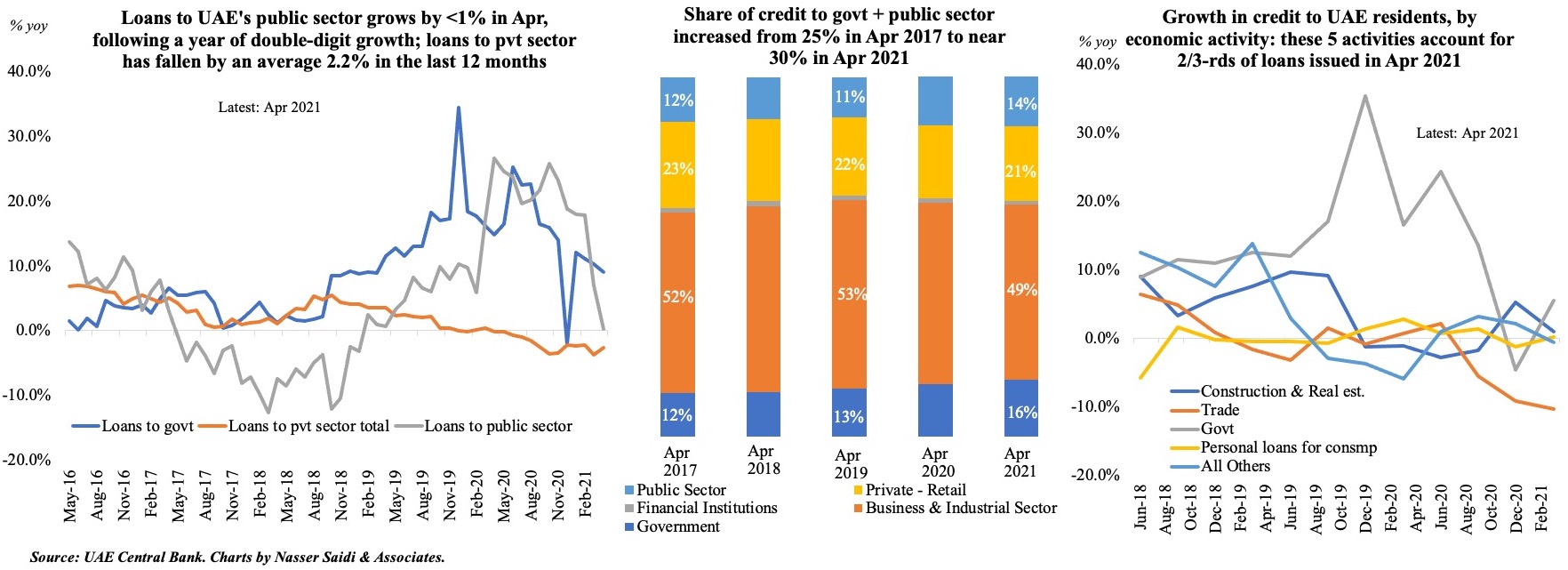

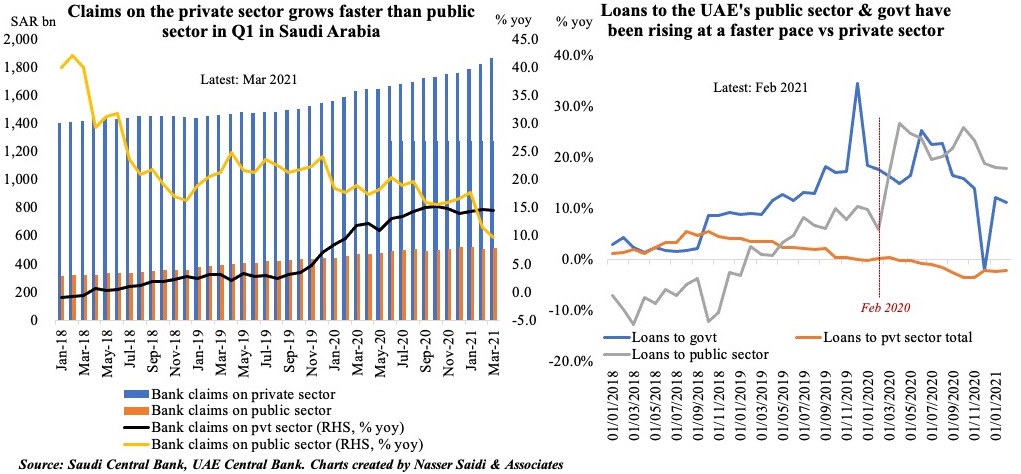

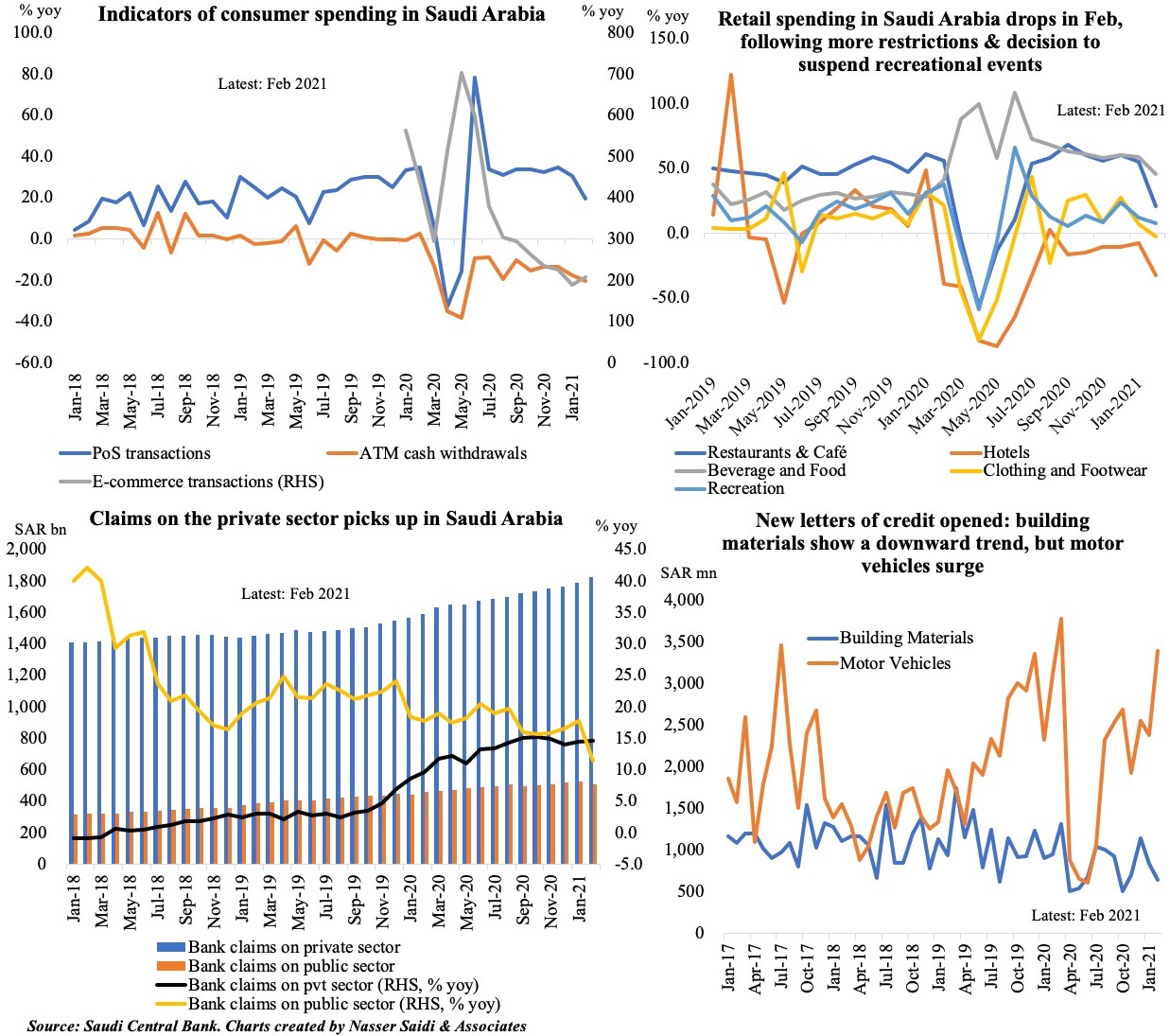

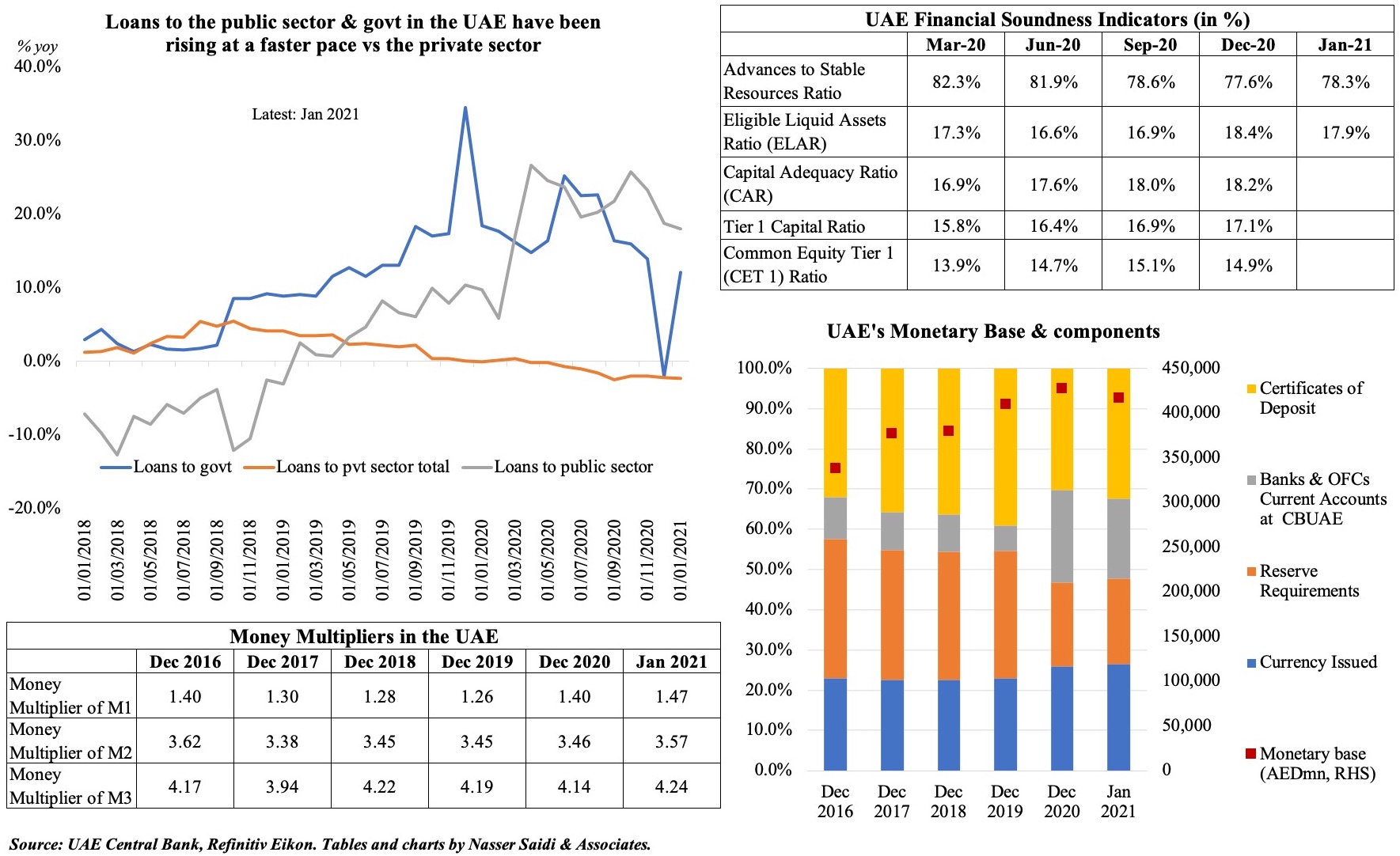

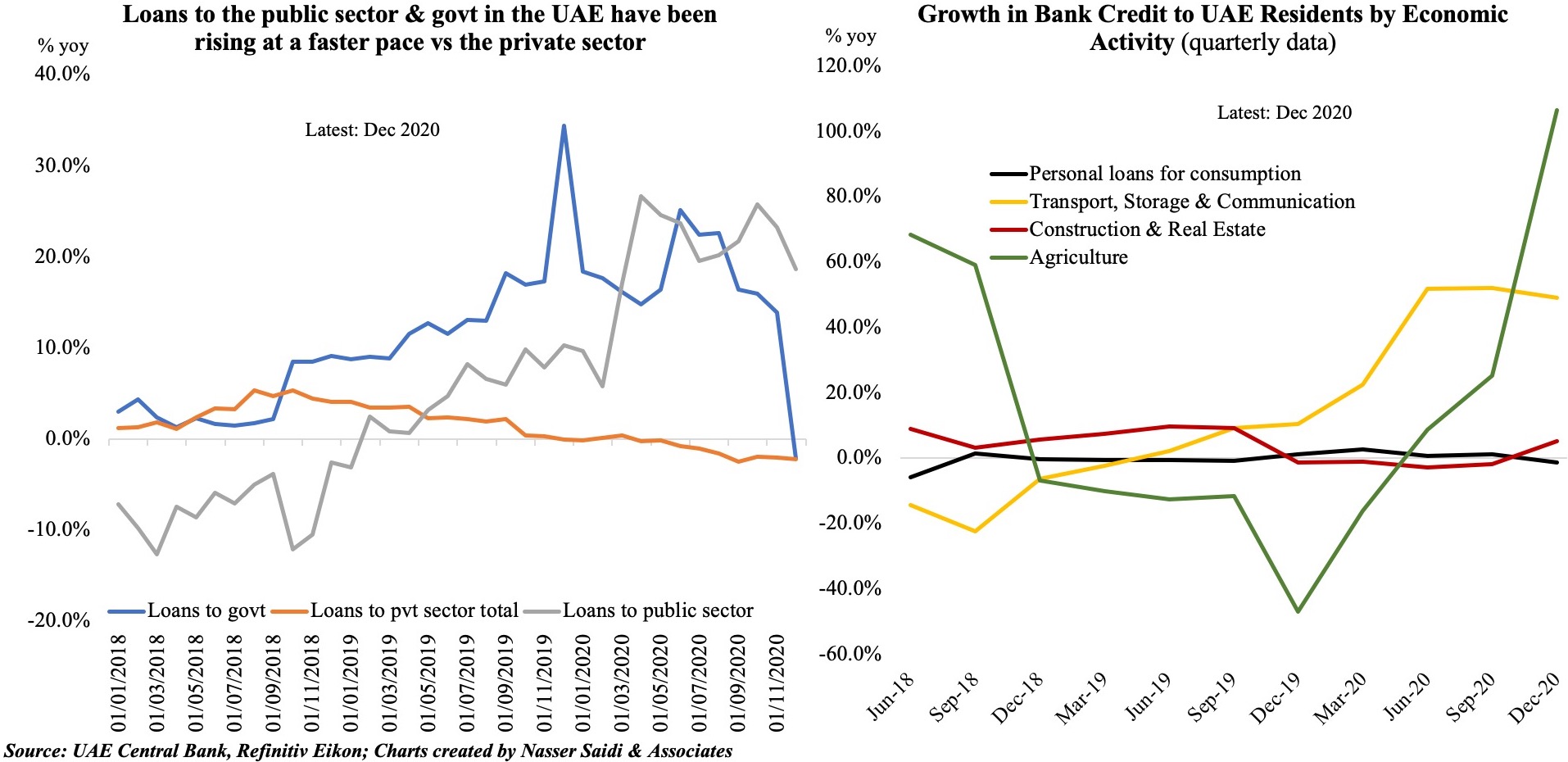

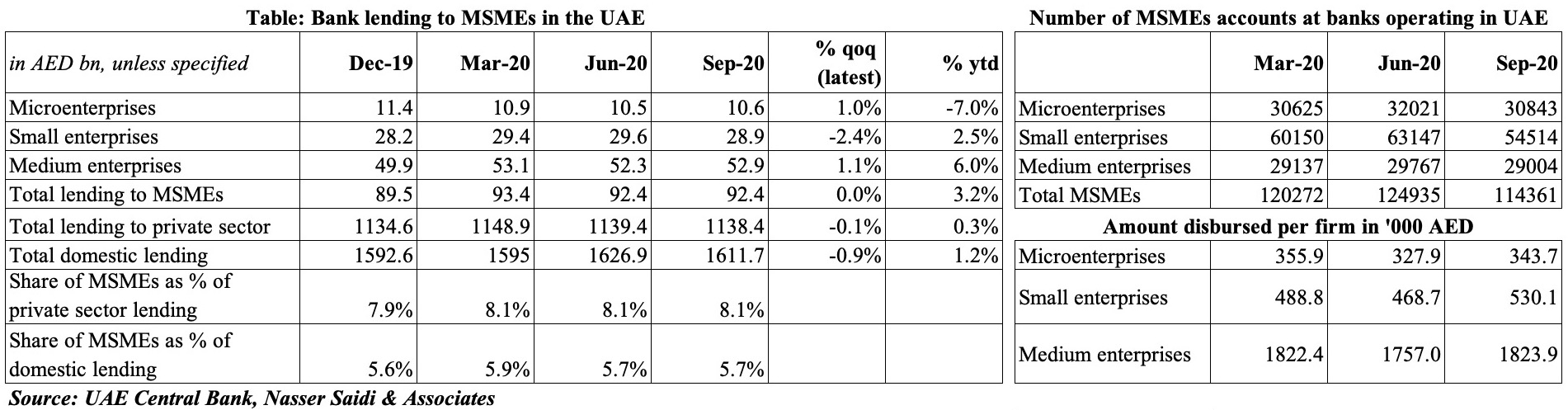

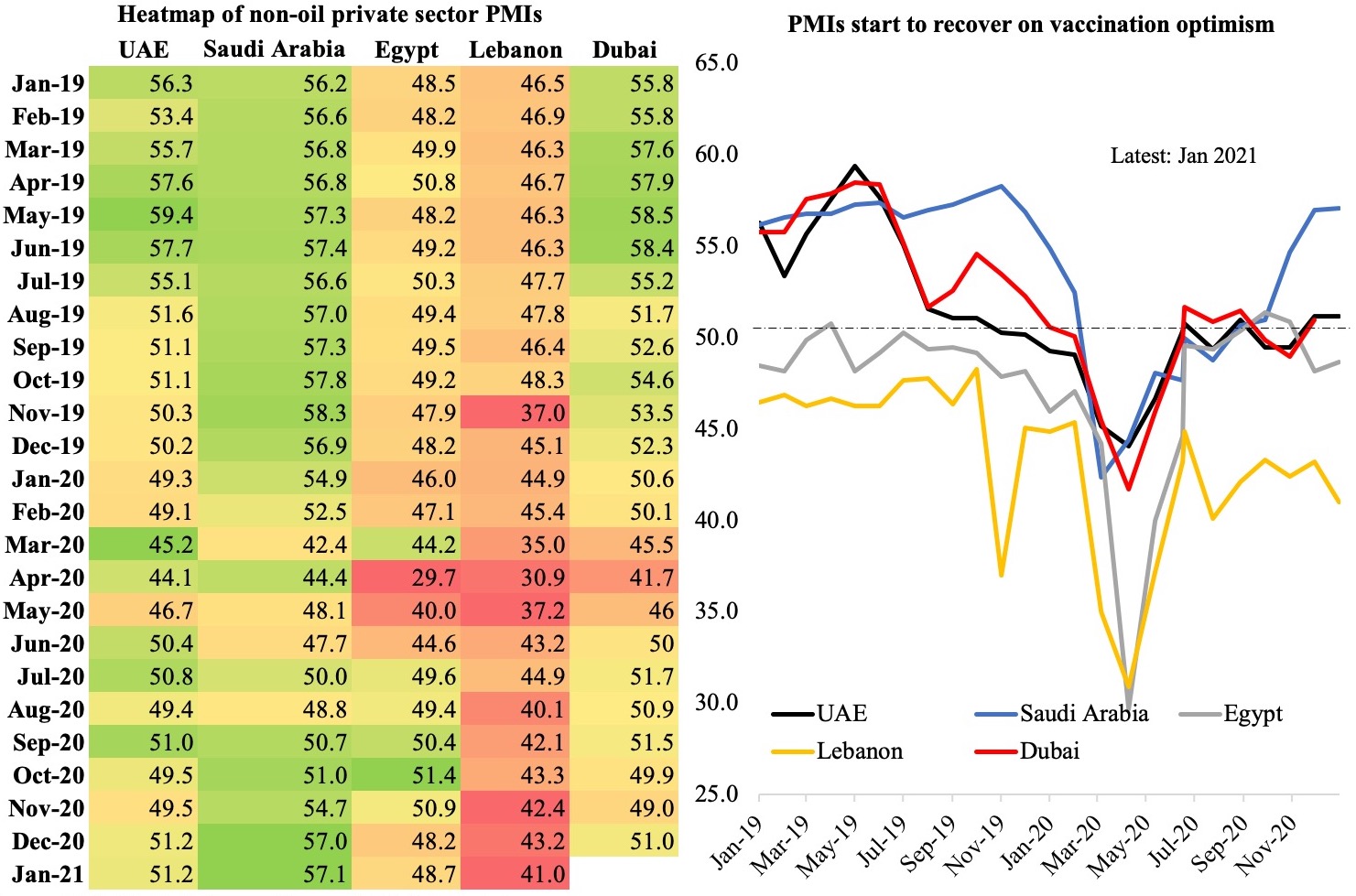

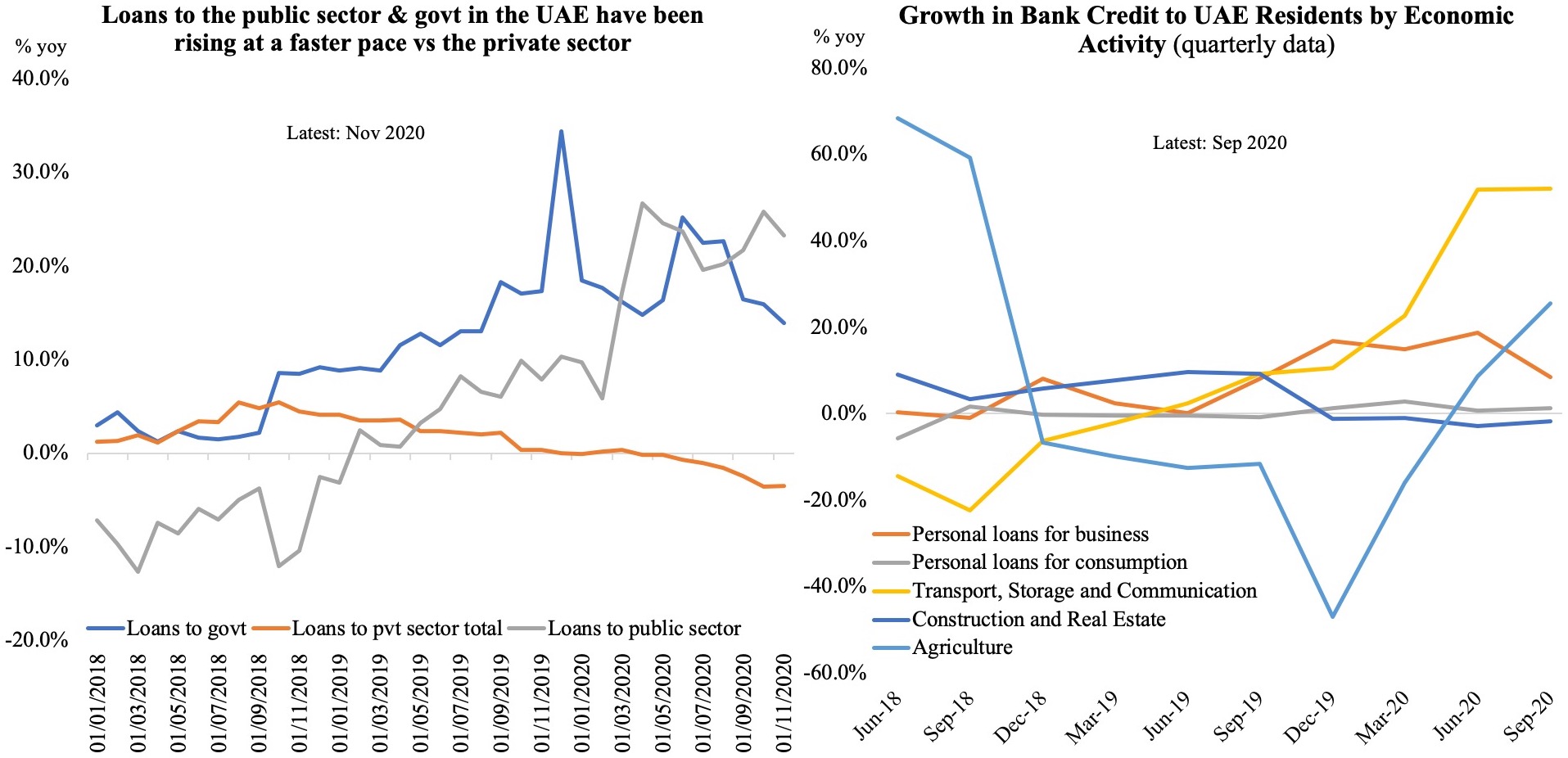

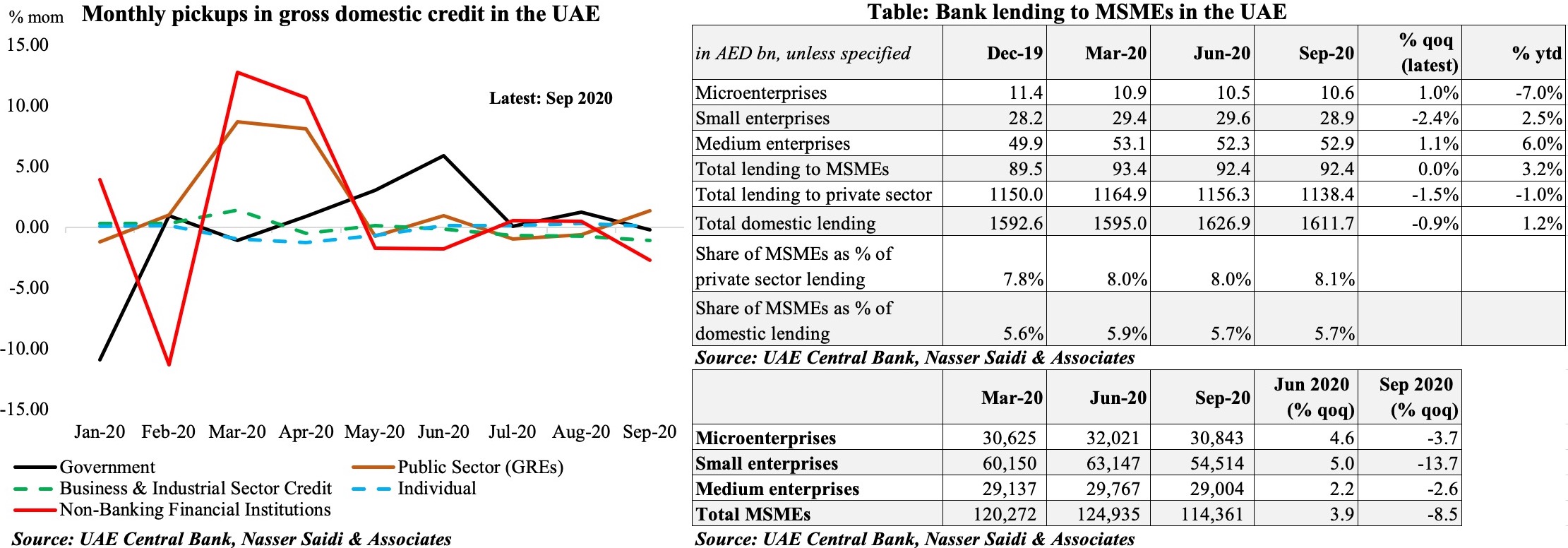

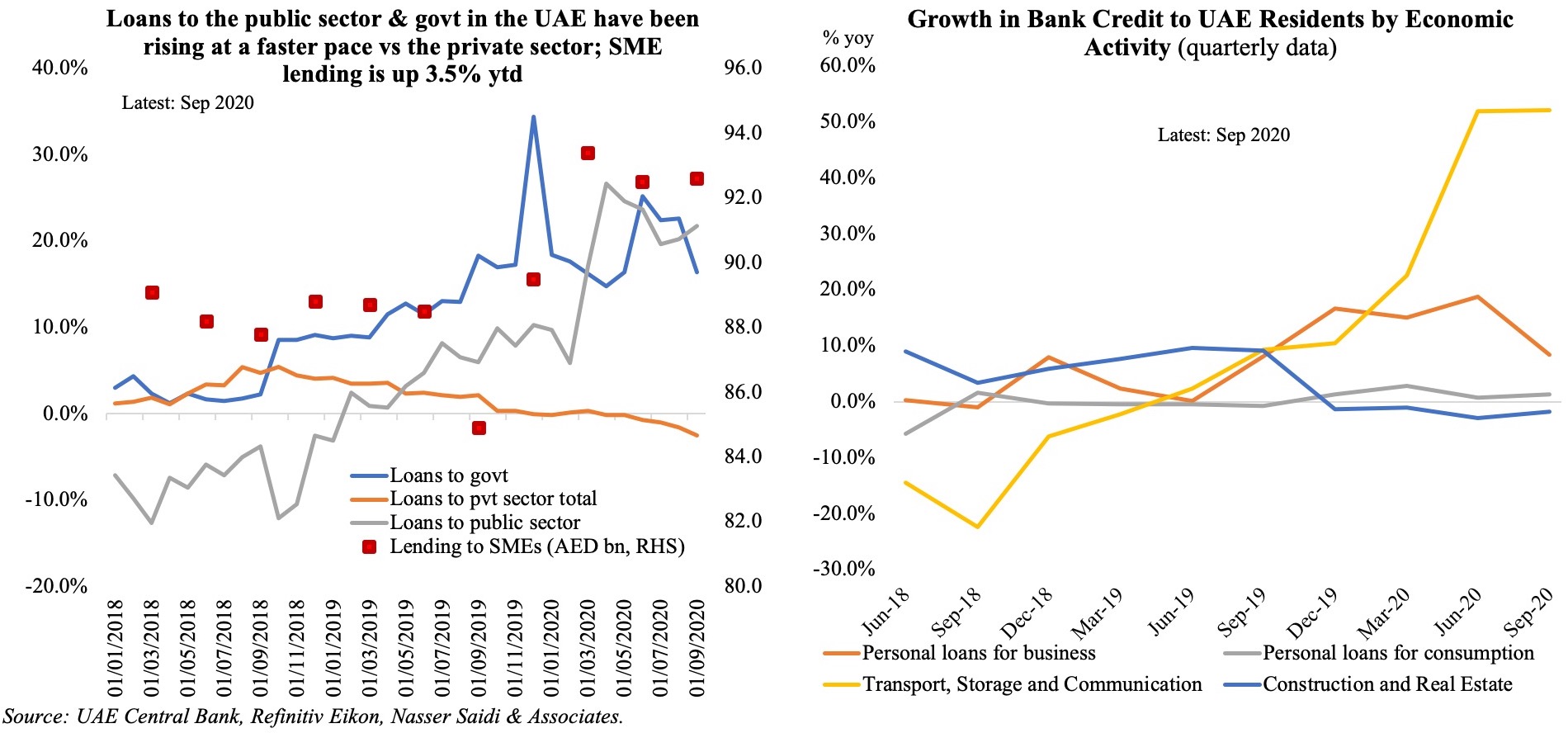

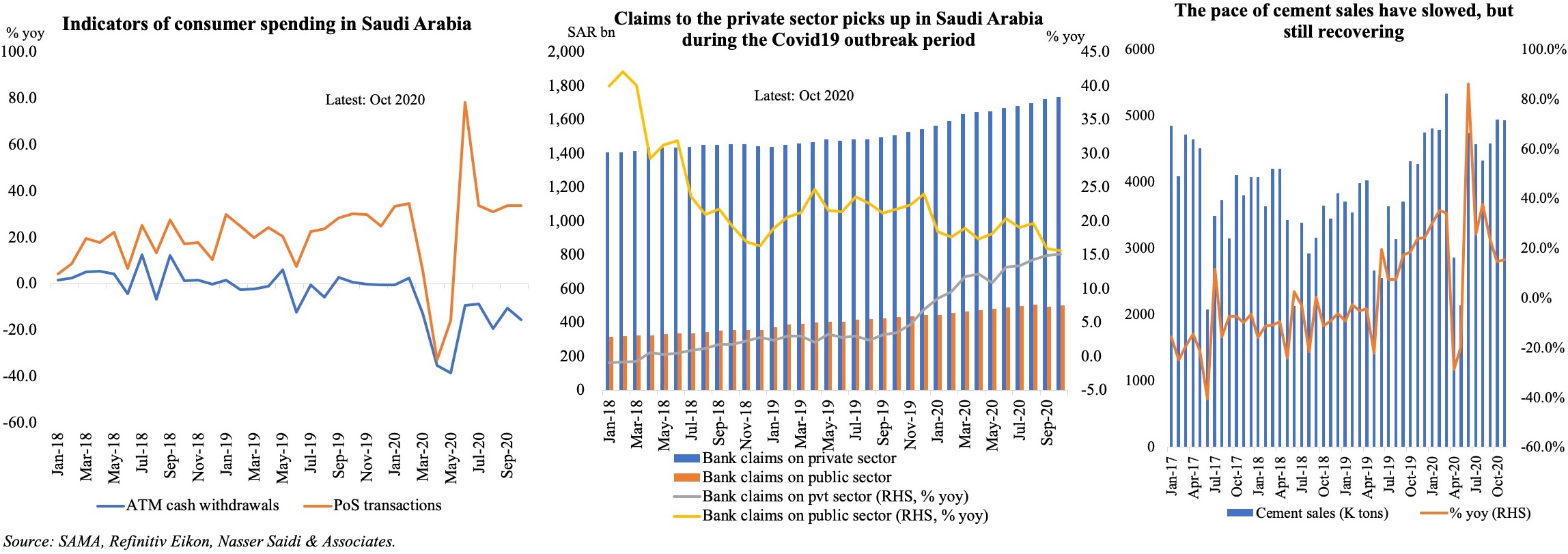

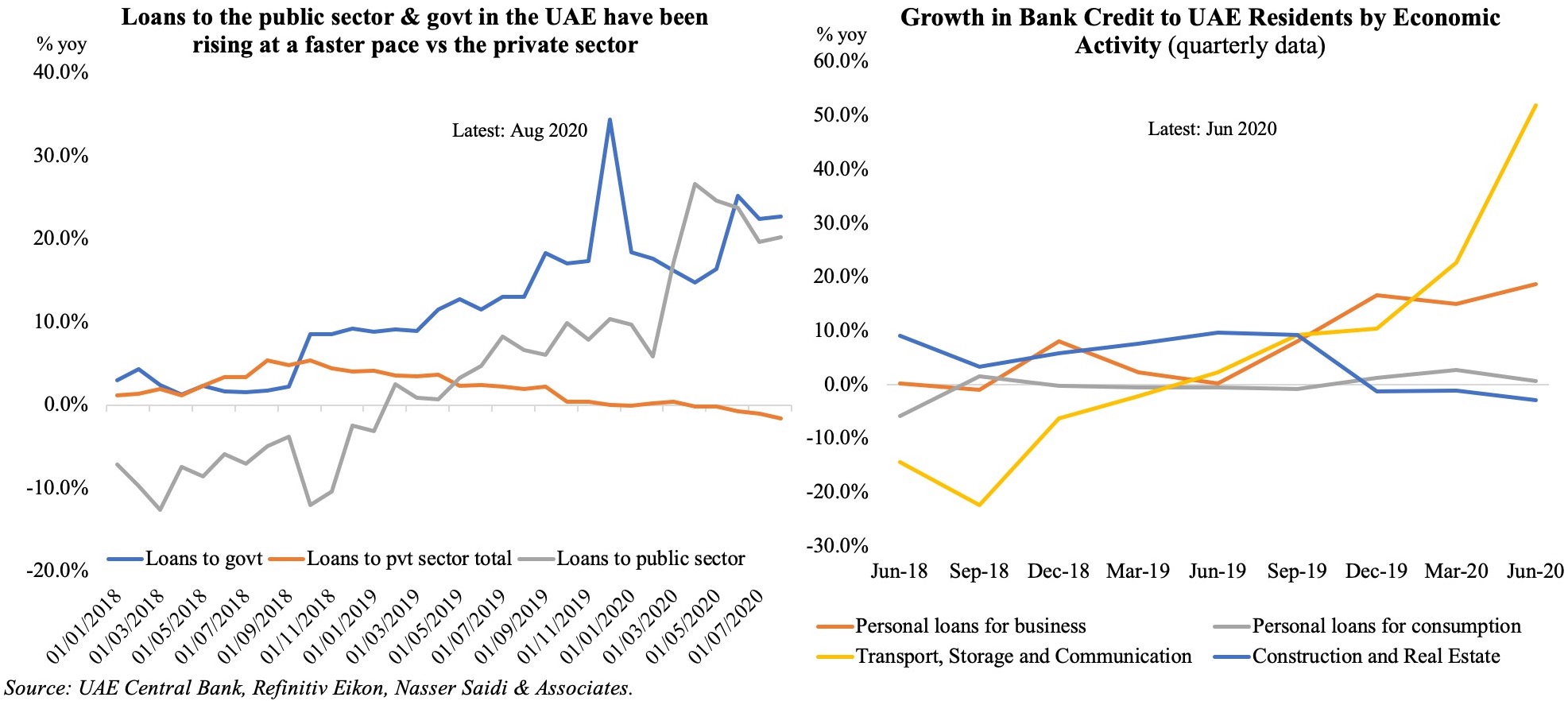

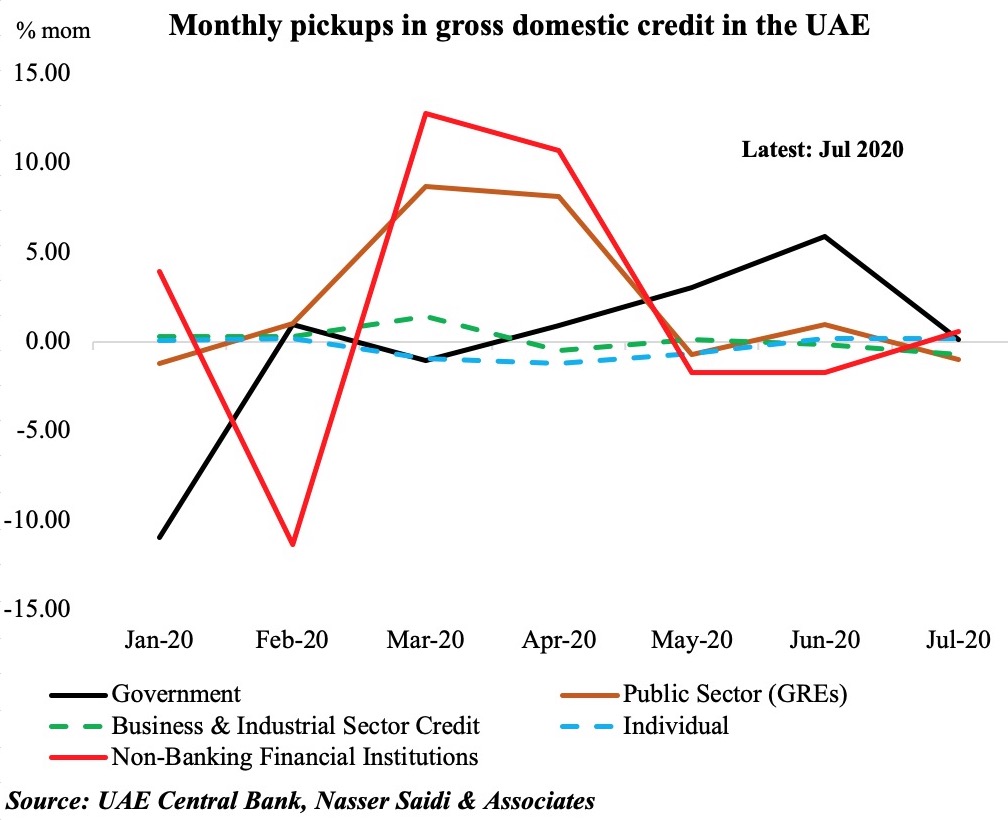

ral bank shed some light on the broader credit movements: the accompanying chart shows the monthly changes in gross domestic credit. The dotted lines are credit to businesses and individuals (the private sector) which show no substantial increases – in fact, it increased by an average 0.9% year-to-date (ytd) for businesses and dropped by 2.1% ytd for individuals. The uptick in lending to the public sector (government related entities) and government have been discussed previously

ral bank shed some light on the broader credit movements: the accompanying chart shows the monthly changes in gross domestic credit. The dotted lines are credit to businesses and individuals (the private sector) which show no substantial increases – in fact, it increased by an average 0.9% year-to-date (ytd) for businesses and dropped by 2.1% ytd for individuals. The uptick in lending to the public sector (government related entities) and government have been discussed previously