Charts of the Week: As confirmed cases of Covid19 crosses the 25 million mark, we look at the World Pandemic Uncertainty Index – needless to say, it is at its peak. But, the trade uncertainty index has come down from recent peaks. So, has trade managed to recover after the month(s)-long shutdowns? Who is recovering, and who’s lagging behind? Lastly, we look at the Middle East and the historic UAE-Israel accord, which opens up a new bilateral trade and investment link.

- Global Pandemic and Trade Uncertainty

Covid19 confirmed cases crossed 25mn yesterday, with India posting a record daily toll (ahead of Unlock 4.0). As countries try to balance the fine line between human toll and economic recovery/damage, new surges across the globe are raising doubts about the V-shaped recovery. The World Pandemic Uncertainty Index is a measure of uncertainty based on discussions about pandemics/outbreaks at the global and country level. Needless to say, this index is at its peak in Q2 this year – much higher than in past outbreaks like SARS and Ebola.

Separately, World Trade Uncertainty Index – measures trade uncertainty in 143 countries based on the frequency with which the word “uncertainty” appears in EIU country reports – shows that the surge in trade uncertainty in late 2018 peaked in Q4 2019 (when the two top global exporters were at loggerheads) and has since then dropped. The index remained low and stable, even during times of the global financial crisis – when global trade had dropped substantially. Of course, protectionist rhetoric was not common then as it is now. Come Covid19, and trade “uncertainty” seems to have slipped back to relatively lower levels: not because trade is picking up, just that trade wars are no longer the primary concern for many countries! But beware: China-US tensions are bubbling up, given the buildup to the US Presidential elections.

- Are production and exports back on track in major Asian export-oriented nations?

So, how has trade performed during Covid19? In yesterday’s weekly commentary, the latest Netherlands CPB World Trade Monitor was referred to: global trade has rebounded by 7.6% mom in Jun. While it was the fastest monthly increase (as demand picked up) since records began in Jan 2000, volumes are still way below pre-pandemic levels. Apr-May were the hardest hit as lockdowns measures disrupted production, led to breaks in supply chains/ logistics services and demand dropped across the globe. Eurozone seems to have been the hardest hit during this period, given the drop in its industrial output as well: the gradual re-openings and latest PMI readings indicate some respite, but it remains to be seen if the momentum will continue.

Asia has recovered much faster compared to its global counterparts. Shipping/ aviation data point to a gradual rise, albeit from very low levels. The chart below tracks export recovery of a few Asian nations: exports from India dropped the most during Mar-Apr given the extended lockdown, but has since been rising as production resumed; other than Japan, where exports are still declining, major exporters are recovering (China is closest to Dec 2019 export levels and Japan the farthest; South Korea and Singapore have benefited from demand for electronics/ pharmaceuticals).

- UAE-Israel: mutual gains

In the context of trade, the UAE-Israel accord can act as a boost during the times of Covid19 and lower oil prices. Where are the major opportunities? Trade and tourism top the list (as mentioned in a previous edition of the Weekly Insights), in addition to the banking and financial services sector. Investment and capital flows are also likely to increase as the countries allow for market access and establishment. Today (Aug 31) sees the first commercial passenger flight taking off from Israel to Abu Dhabi in the UAE.

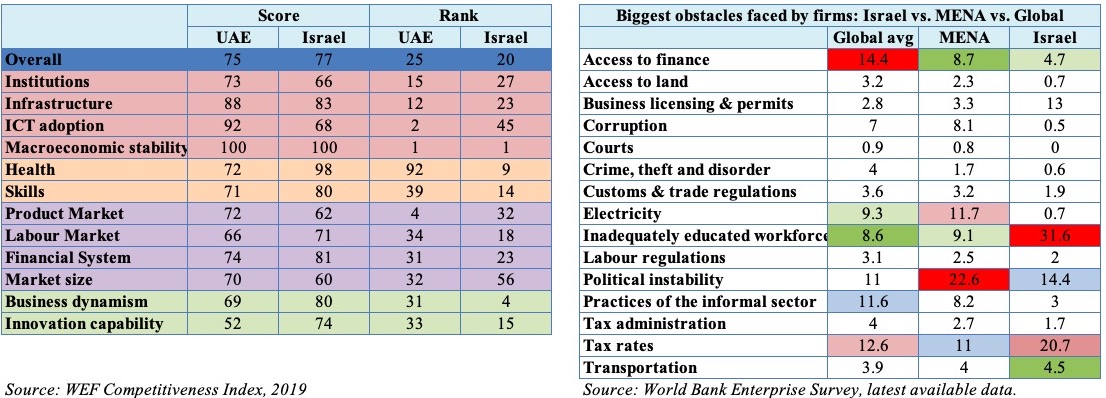

Above are two tables: one, outlining the WEF Competitiveness Index 2019 scores and ranks – Israel is ranked 20th globally, vs UAE’s 25th ranking. The UAE can offer Israel a better enabling environment – institutions, infrastructure and ICT adoption – and can benefit from Israel’s human capital component (labour market, health and skills) and innovation ecosystem (technology startups, business dynamism and innovation capability). Interestingly, firms in Israel identify an “inadequately educated workforce” as their biggest obstacle to doing business (table on the right)! This in spite of being one of the top three nations with the highest number of university degrees per capita. The table on biggest obstacles (on the right) are as identified by firms based in the country: the top five are highlighted in each column. From the table, Israel can benefit from UAE’s tax rates and political stability. Overall, the opening up process implies potential bilateral gains from trade and investment for both nations, especially during these trying times.