Weekly Insights 26 Apr 2024: GCC’s non-oil sector driven GDP growth to continue into 2024

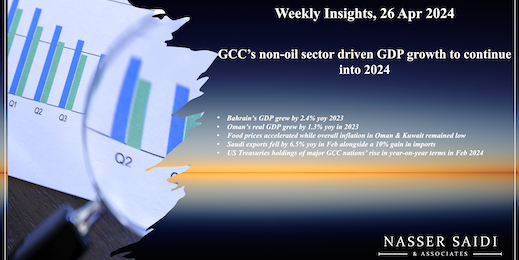

1. Bahrain’s GDP grew by 2.4% yoy 2023, supported by a robust increase in non-oil sector growth (3.4%); FDI rose in 2023, mostly into the financial sector

- Real GDP in Bahrain grew by 2.4% in 2023, with Q4 growing at the fastest pace (3.5%) during the year. Non-oil sector supported growth (3.4% in 2023) while oil sector activity contracted (-2.5% yoy in 2023).

- Among the non-oil non-government sector, growth was fastest in hotels & restaurants (8% yoy), thanks to a 25% yoy uptick in tourist arrivals to 12.4mn in 2023. Financial corporations grew by 6% last year, following closely.

- In terms of contribution to growth to real GDP in 2023, financial sector tops the list (17.8%), followed by crude petroleum & natural gas (16.1%), manufacturing (13.6%) and government services (13.3%).

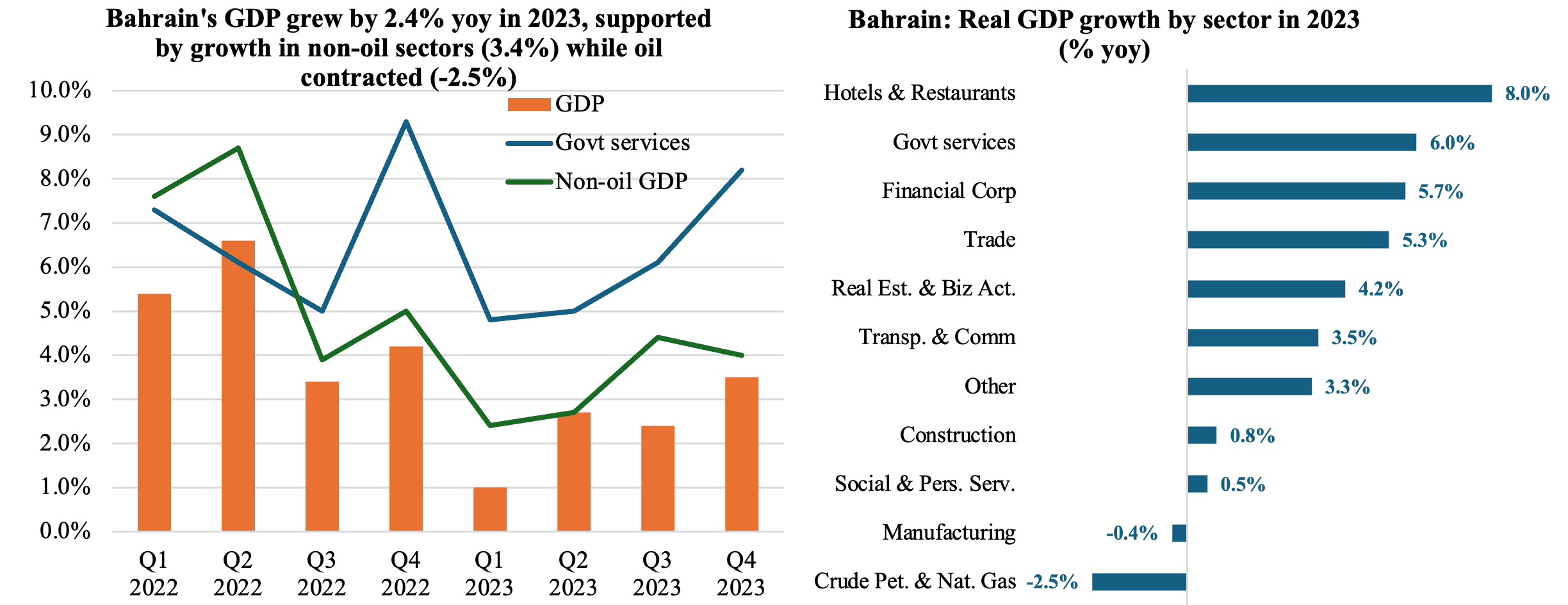

- Separately, total inward FDI stock grew by 18.9% yoy to BHD 16.2bn in 2023 while FDI flows touched BHD 2.6bn (+147.8%), according to the Information & eGovernment Authority. While financial and insurance activities accounted for close to two-thirds of Bahrain’s inward FDI stock in 2023, by country, Kuwait, Saudi Arabia and the UAE occupied the top ranks – each with a share of 36.5%, 23% and 10.5% respectively of total FDI stocks.

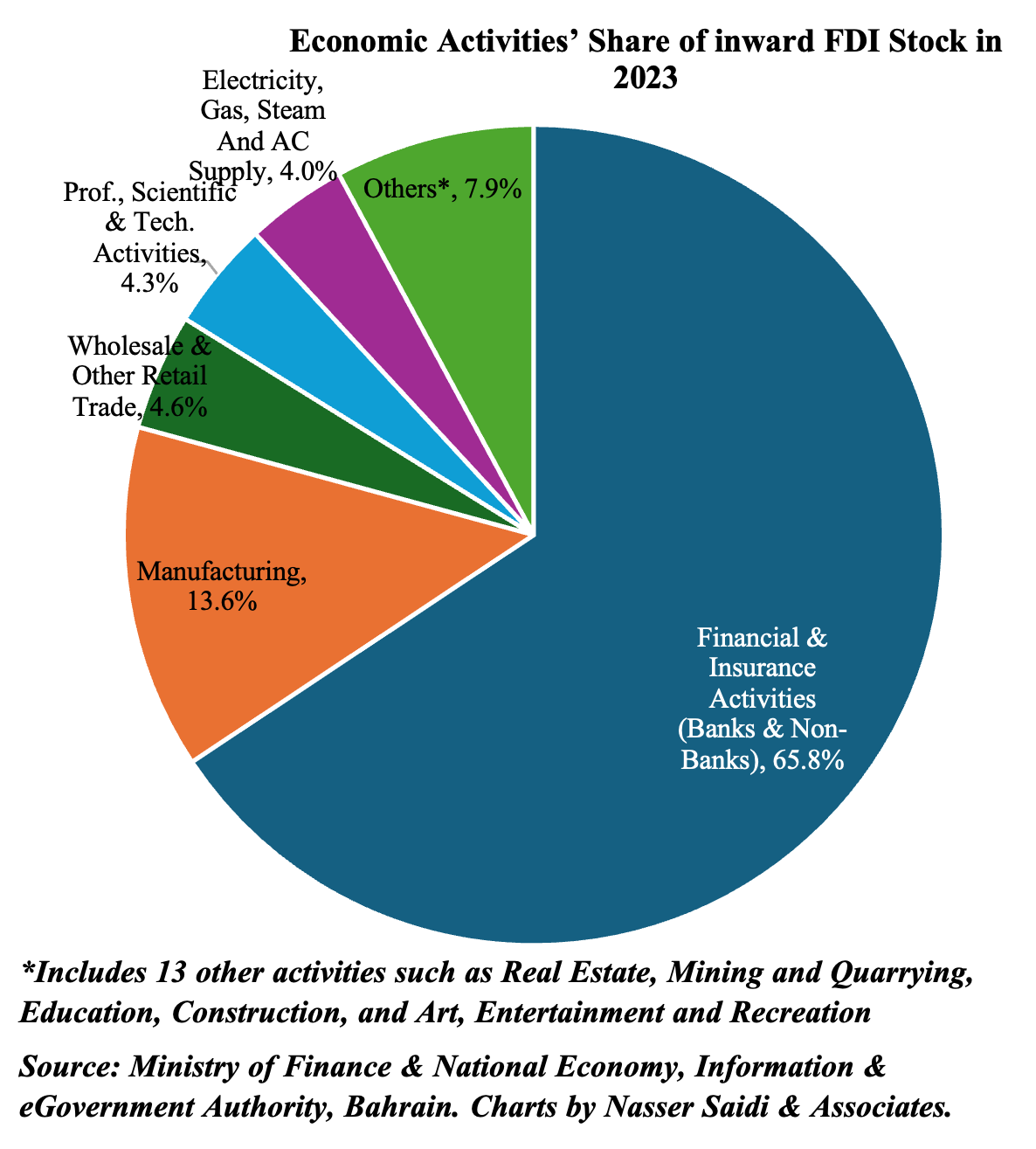

2. Oman’s real GDP grew by 1.3% yoy in 2023, aided by non-oil sector expansion; FDI continues to flow into the O&G sector

- Real GDP in Oman grew by 1.3% yoy in 2023, with non-oil sector growing at a faster pace (1.3%) than oil sector (0.35% respectively). This follows last year’s strong expansion in the hydrocarbon sector.

- Oil sector accounted for almost one-third of GDP while the share of government and construction sectors stood at 9.2% and 9.1% respectively followed by manufacturing (8.8%).

- Services sector grew by 3.5%, with telecoms and financial sectors posting growth rates of 8.4% & 8.1% respectively. However, both trade and hospitality sectors ended in the red for the full year 2023.

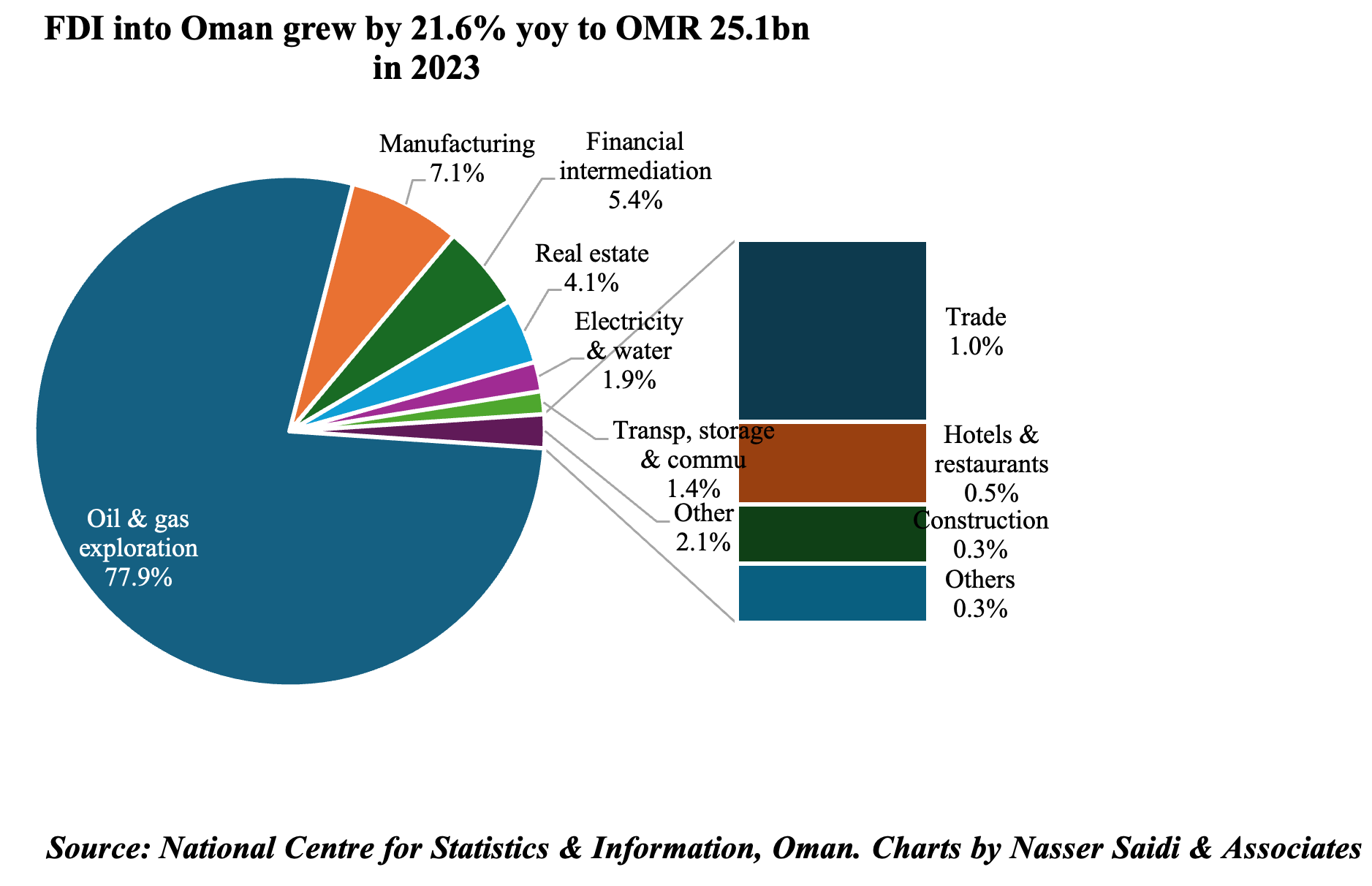

- The volume of FDI into Oman grew by 21.6% yoy to OMR 25.1bn in 2023, with more than 3/4-ths of the FDI going into oil and gas exploration activity (growing at the fastest pace of 33% yoy to OMR 19.5bn). Along with O&G, manufacturing, financial intermediation and real estate rounded up the top 4 sectors together accounting for 95% of total FDI inflow in 2023.

3. Inflation in Kuwait eased to the lowest since Aug 2021 while Oman saw prices rise slightly; food prices edged up in both nations in Mar

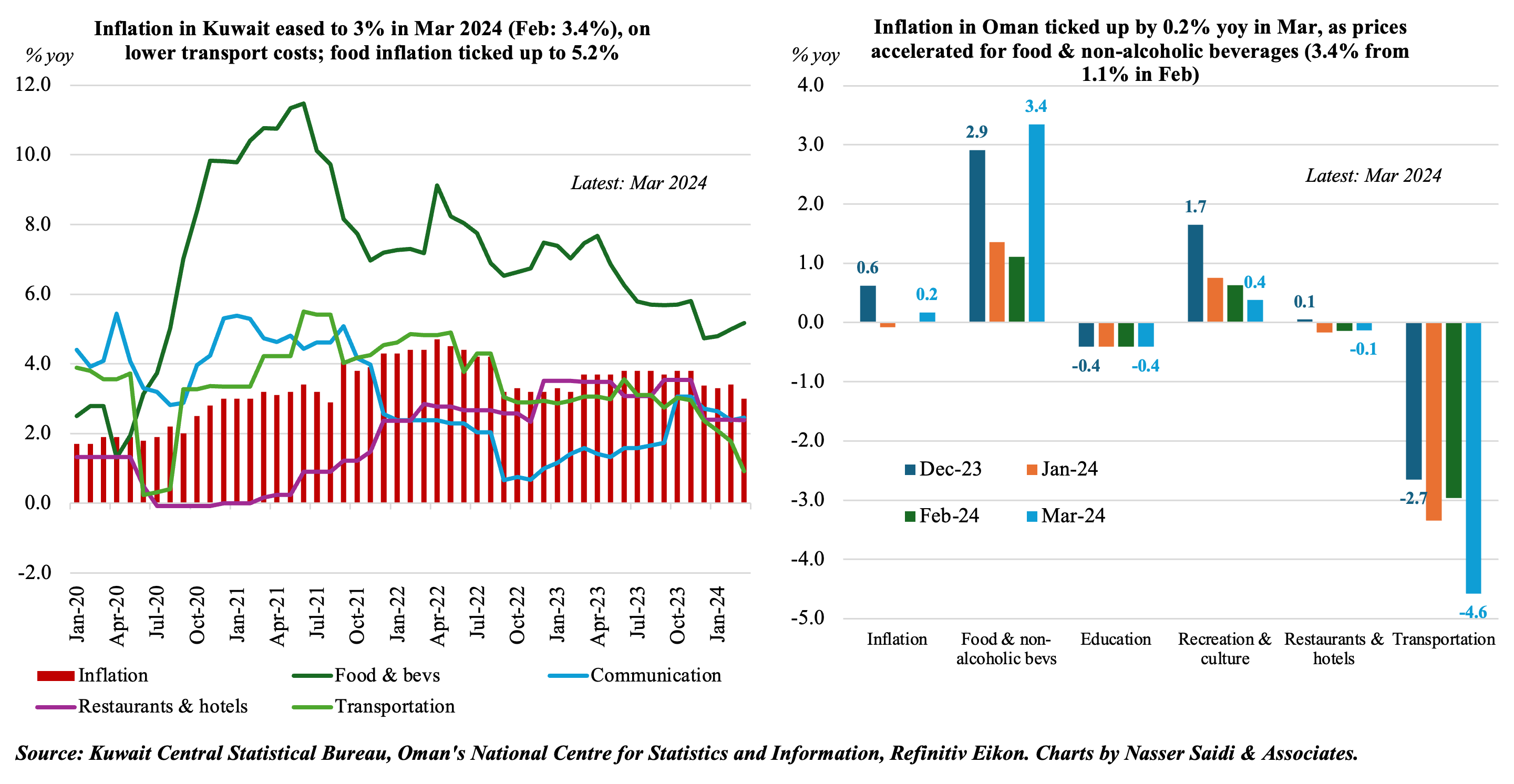

- Inflation in Kuwait slowed to 3.0% in Mar (Feb: 3.4%), the lowest reading since Aug 2021, due to lower transportation prices (0.9% from 1.8%) and housing (1.4% from 2.4%) among others. Food prices, however, inched up for the third month in a row to 5.2% (Feb: 5.0%). Other categories that posited increases during the month were services & miscellaneous (4%), furnishings (3.9%) and health (3.4%).

- Kuwait’s core inflation, that excludes both food and housing, slipped to 3.2% (Feb: 3.3%). Average inflation in Q1 2024 stands at 3.2%.

- Oman’s inflation, calculated on a base year 2018, rose to 0.2% yoy in Mar, following Feb’s flat reading. Inflation in Q1 averaged only 0.03%. On a monthly basis, prices increased by 0.1%, following a 0.3% deflation in Feb.

- Food costs in Oman increased by 3.4% (Mar: 1.1%) while declines were reflected across multiple categories, including education (-0.4%), transport (-4.6%) and restaurants & hotels (-0.1%).

4. Saudi exports fell by 6.5% yoy in Feb alongside a 10% gain in imports

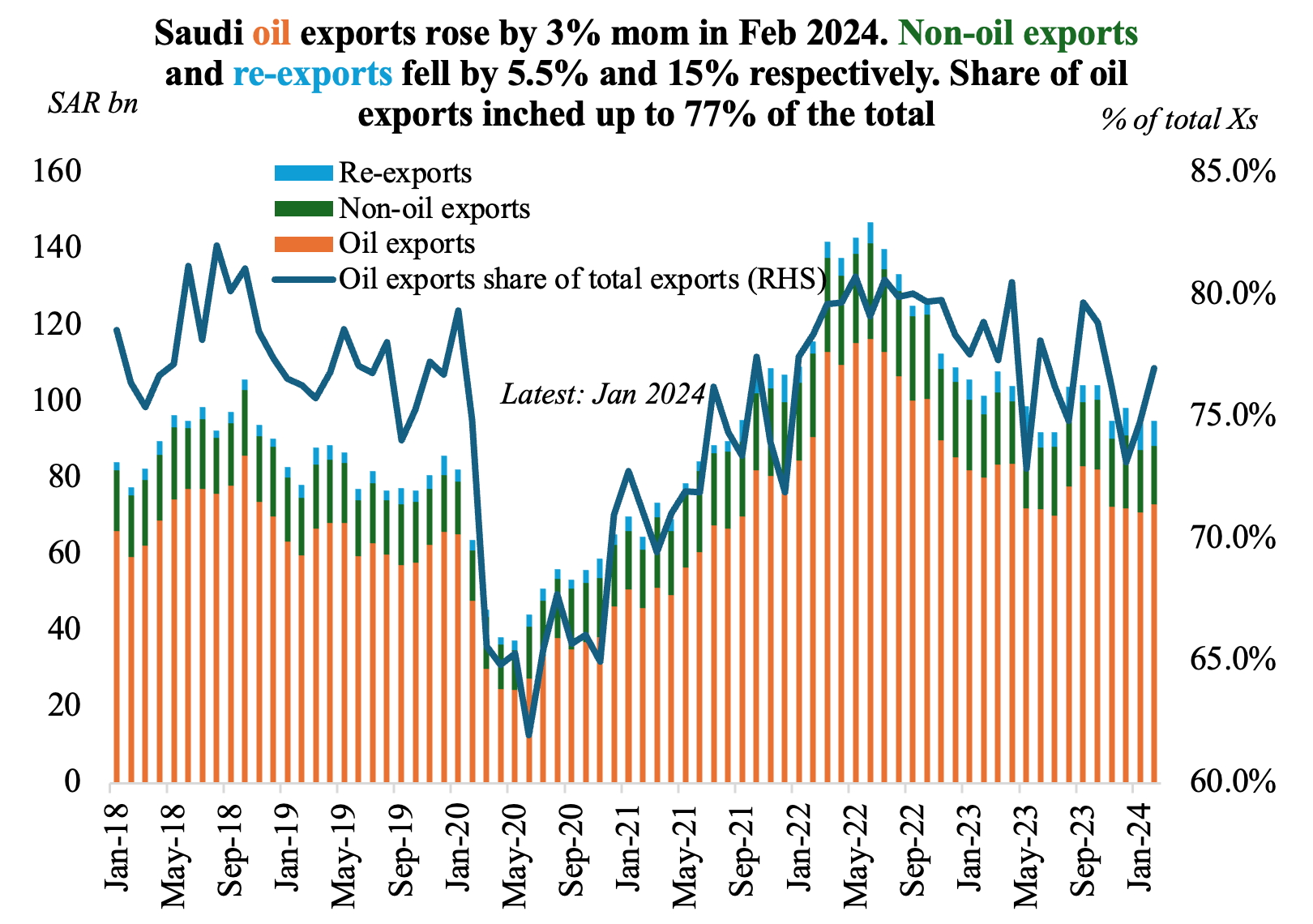

- Saudi Arabia’s exports declined by 6.5% yoy to SAR 95.0bn in Feb 2024. Oil exports fell by 8.8% yoy to SAR 73.1bn, taking its share in overall exports to 77%.

- Non-oil exports fell by 7.2% yoy to SAR 15.4bn in Feb while re-exports, which accounts for 6.8% of total exports, grew by 32.8% yoy. Monthly, both non-oil exports and re-exports fell, by 5.5% mom and 15% respectively.

- Imports grew by 10.1% yoy to SAR 63.1bn, thereby widening trade surplus to SAR 31.9bn (compared to Jan’s SAR 28.2bn).

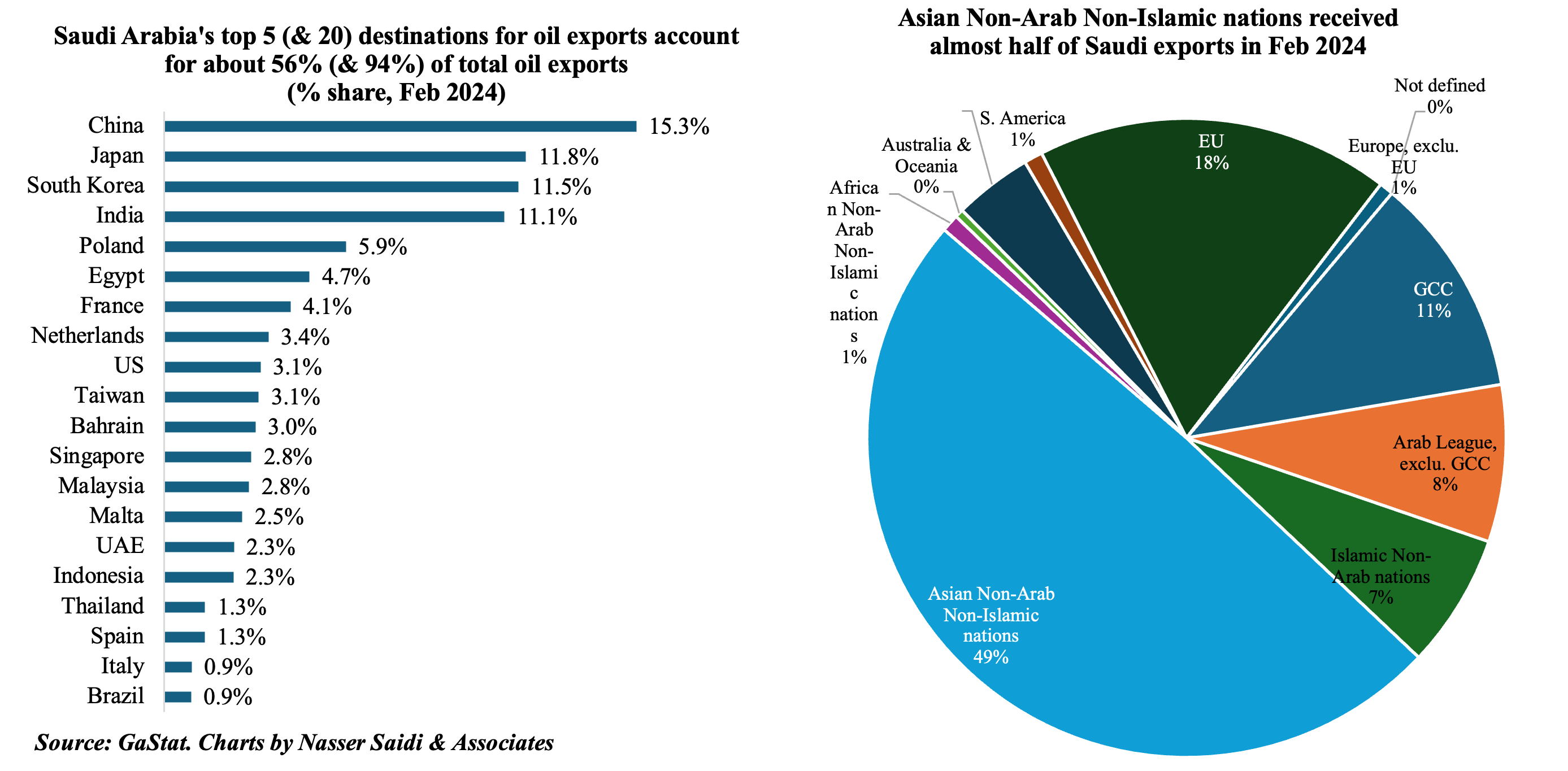

- China continues to be the top trade partner in Feb: accounting for 13.2% of overall exports and 20% of total imports.

- Oil exports to the top 5 destinations (China, Japan, South Korea, India & Poland) accounted for 55.6% of total oil exports in Feb. Notably, US (usually in top 5 destinations) slipped to ninth on the list. Share of the top 25 nations stood at 94.1%.

- Asian Non-Arab Non-Islamic nations received around half of Saudi exports in Feb 2024 & GCC 11%.

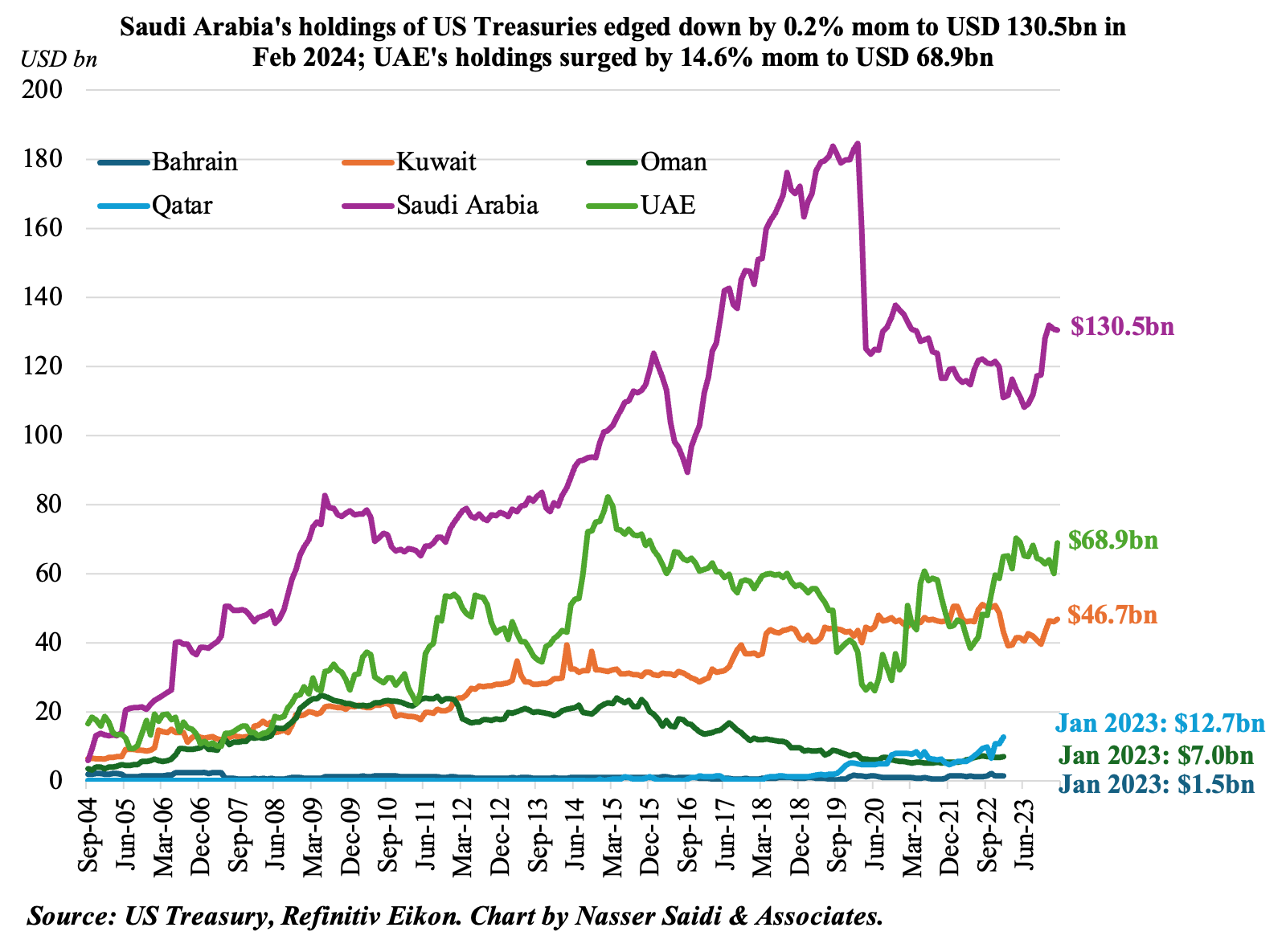

5. US Treasuries holdings of major GCC nations’ rise in year-on-year terms in Feb 2024

- Foreign holdings of US Treasuries surged to a record USD 7.965trn in Feb 2024: a list topped by Japan, China and UK. China’s holdings continued to decline, down by USD 22.7bn to USD 775bn, the lowest since Mar 2009.

- GCC holdings of US Treasuries grew by 3.9% mom and 13.9% yoy in Feb 2024, thanks to a sharp jump in UAE’s holdings to USD 68.9bn (+14.6% mom).

- Saudi Arabia was the 17th largest investor in US Treasury bonds in Feb: USD 130.5bn. This was the 2nd consecutive month of decline (-0.23% mom). KSA’s holdings touched USD 132bn in Dec.

- Kuwait and Saudi holdings gained 19.4% and 16.8% compared to Feb 2023 readings; UAE’s holdings were also up by 5.7% yoy.

- Yields on long-dated Treasury notes and bonds climbed in Jan-Feb, closing at around 4.3% at end-Feb, and seems to have had an impact on GCC holdings. Given persistent inflation, the yield is inching closer to 5%, last seen in Oct 2023.

Powered by: