Download a PDF copy of the weekly economic commentary here.

Markets

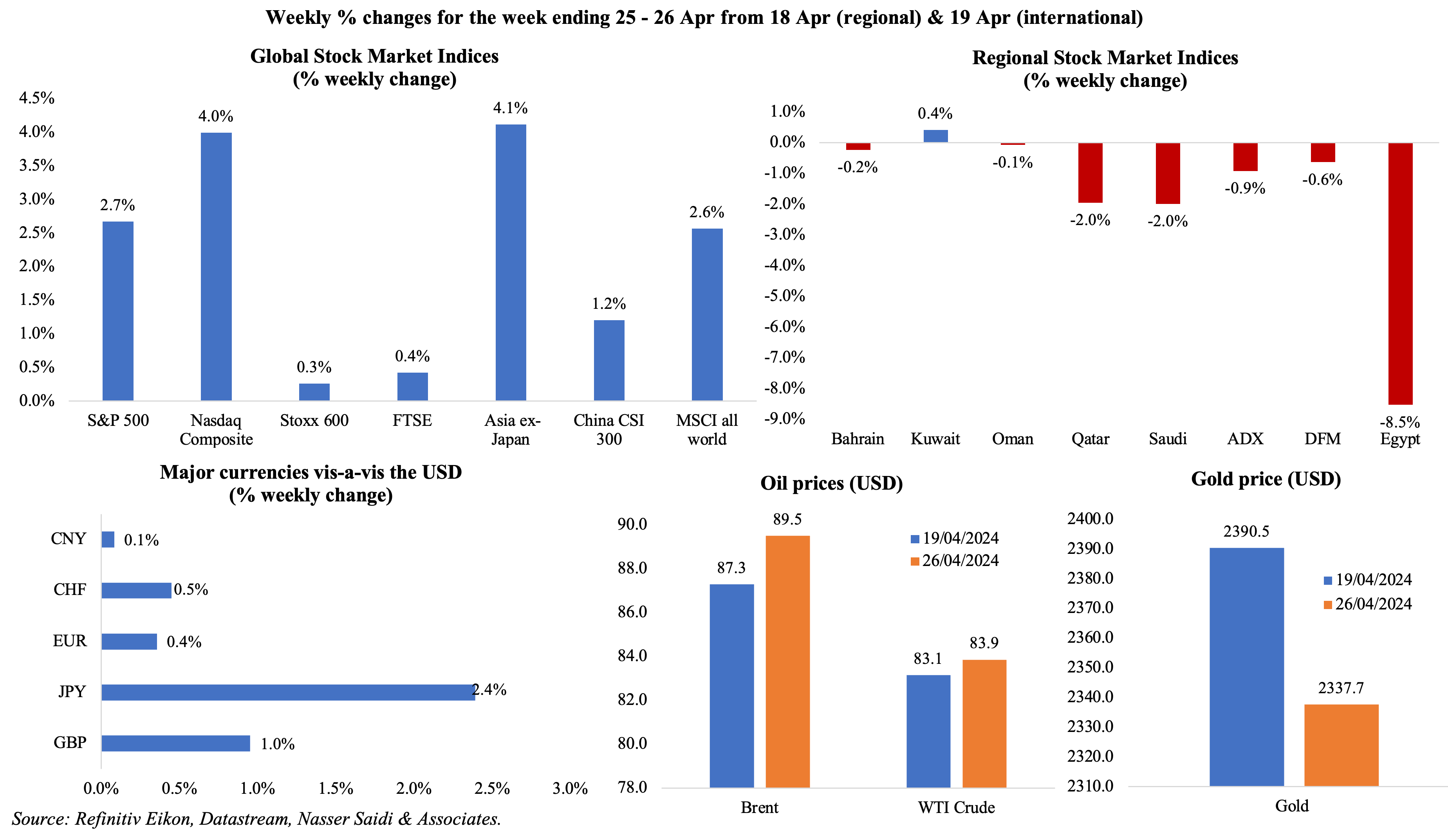

Major equity markets gained last week following robust earnings reports: S&P 500 and Nasdaq posted weekly gains close to that seen in Nov 2023, and US Big Tech gains boosted sentiment across global markets. In contrast, Middle East shares were mostly down on geopolitical concerns and earnings, with Egypt dragging the most; Abu Dhabi’s Bayanat-Yahsat merger (more in UAE Focus section) drove the index higher on Fri, though it closed in the red compared to a week ago. The yen tumbled to a fresh 34-year low near 158 to the dollar on Friday (partly due to US inflation data supporting interest rates remaining higher) after the BoJ kept interest rates on hold; both the euro and GBP gained weekly (the most since early-Mar). Oil prices inched up from a week ago while gold price slipped lower.

Global Developments

US/Americas:

- US GDP grew by an annualised 1.6% in Q1 (Q4: 3.4%), the slowest pace in 2 years, reflecting “decelerations in consumer spending, exports, and state and local government spending”. PCE prices index in Q1 accelerated at a 3.4% annualized rate, nearly double Q4’s 1.8% pace; core PCE inflation climbed 3.7% in Q1, up from Q4’s 2% reading.

- PCE price index rose by 0.3% mom and 2.7% yoy in Mar (Feb: 0.3% mom and 2.5% yoy), with energy prices rising by 1.2% mom amid a drop in food prices by 0.1%. Core PCE climbed by 0.3% and 2.8% yoy (unchanged from Feb) while PCE services inflation (excluding energy and housing) increased by 0.4% mom and 3.4% yoy.

- Personal income in the US expanded by 0.5% mom in Mar (Feb: 0.3%), supported by a 0.7% increase in wages. Spending grew by 0.8%, following a similar gain in Feb. Saving rate fell to a 16-month low of 3.2% (Feb: 3.6%).

- Durable goods orders in the US grew by 2.6% mom in Mar (Feb: 0.7%), largely due to the increase in orders for transportation (7.7% from Feb’s 1.8% gain). Non-defence capital goods orders excluding aircraft gained by 0.2% (Feb: 0.4%).

- Trade deficit in the US widened to USD 91.8bn in Mar (Feb: USD 91.4bn), the largest deficit since Apr 2023. Exports fell by USD 6.1bn to USD 169.2bn alongside a drop in imports (down by USD 4.6bn to USD 261bn).

- Richmond Fed manufacturing index improved to -7 in Apr (Mar: -11), thanks to increases in shipments (-10 from -14) and new orders (-9 from -17); firms were also more optimistic about local business conditions (6 from -1). Kansas Fed manufacturing activity fell to -13 in Apr (Mar: -9).

- Chicago Fed national activity index rose to 0.15 in Mar (Feb: 0.09), the highest since Nov 2023, with employment indicators adding +0.04 to the index (Feb: -0.01) while production related indicators added +0.11.

- Michigan consumer sentiment index dropped to 77.2 in Apr (Mar: 79.4), as both current conditions and expectations declined (to 79 and 76 respectively). The 1-year inflation expectation was revised higher to 3.2% while the 5-year expectation was confirmed at 3%.

- US preliminary manufacturing PMI slipped to a 4-month low of 49.9 in Apr (Mar: 51.9), with input cost inflation rising to a 1-year high. Employment declined for the first time since early Jun 2020, stemming mostly from the services sector.

- New home sales rebounded by 8.8% mom to 693k units in Mar, the highest reading since Sep; median house price fell by 1.9% yoy to USD 430,700. Pending home sales increased by 3.4% mom in Mar (Feb: 1.6%), the best performance in a year despite high mortgage rates (back to above 7%).

- Initial jobless claims unexpectedly declined by 5k to 207k in the week ended Apr 19th, the lowest in 2 months, while the 4-week also moved lower by 1.25k to 213.25k. Continuing jobless claims edged down by 15k to 1.781mn in the week ended Apr 12th. Indicator and data driven central banks are likely to review rate settings in June, looking for confirmatory readings.

Europe

- Flash manufacturing PMI in the eurozone slipped to a 4-month low of 45.6 in Apr (Mar: 46.1), as output fell for a 13th straight month and new orders fell at an increased rate. Services PMI inched up to 52.9 (Mar: 51.5), with output and new orders rising alongside a 10-month high employment growth while input costs re-accelerated (driven by wage and energy costs).

- Consumer confidence in the euro area improved to -14.7 in Apr (Mar: -14.9), the highest since Feb 2022. In the EU, confidence was steady at -15.2, below its historical average.

- Germany’s flash manufacturing PMI rose to 42.2 in Apr (Mar: 41.9): though new orders fell the most in 5 months, output fell at a slower pace and employment improved while factory prices declined at the steepest rate since Sep 2009.Services PMI grew to a 10-month high of 53.3 in Apr (Mar: 50.1), causing the composite PMI to move into expansionary territory after 10 months (505.5 in Apr from Mar’s 47.7).

- German Ifo business climate index increased to 89.4 in Apr (Mar: 87.9), the highest since May 2023, on expectations of interest rate cuts and lower inflationary pressures. Both current assessment and expectations moved up to 88.9 and 89.9 respectively (Mar: 88.1 and 87.7).

- German GfK consumer confidence survey climbed to a 2-year high of -24.2 in May (Apr: -27.3), thanks to income expectations rising to 10.7 (highest since Jan 2022) from Apr’s -1.5.

- UK flash manufacturing PMI rose to 48.7 in Apr, down from Mar’s expansionary 50.3 reading, as new orders declined while input costs rose the most in 14 months (given higher materials and transport costs). Services PMI increased to 54.9 in Apr (Mar: 53.1), rising for the 6th month in a row, with wage costs increasing cost pressures.

- GfK consumer confidence in the UK improved to -19 in Apr (Mar: -21): though four of its five indicators posted gains in Apr, only the index for personal financial situation in the next 12 months had a positive reading.

Asia Pacific:

- China’s PBoC hinted at the possibility of resuming treasury bond trades in the secondary market, “as a liquidity management method and a reserve of monetary policy tools”, in an article published in the Financial News citing an unnamed senior official. Beijing plans to issue CNY 1trn (USD 138.01bn) in special ultra-long term treasury bonds to support some key sectors.

- The Bank of Japan voted unanimously and left policy rates unchanged within a range of about zero to 0.1%. The apex bank projected that core-core inflation (excluding food and energy prices) would stay near its 2% target in the next 3 years.

- Inflation in Tokyo eased to 1.8% in Apr (Mar: 2.6%). Excluding food and energy, prices slipped in Apr, 1.8% (Mar: 2.9%), the slowest pace of increase since Sep 2022. Excluding fresh food, prices were up 1.6% (slower than Apr’s 2.4%).

- Japan flash manufacturing PMI inched closer to the 50-mark in Apr, clocking in at 49.9 (Mar: 48.2), with output and new orders declining the least in ten months, and slower pace of decline in new export orders declining less. Services remained the primary driver of growth, with PMI up by 0.5 points to 54.6, thanks to faster new business inflows while output costs rose to the highest in 10 years (as service providers passed on cost burdens with clients).

- Leading economic index in Japan clocked in at 111.8 in Feb (Jan: 109.5), the highest reading since Aug 2022; the coincident index stood at 111.6 (prelim: 110.9 and Jan: 112.3), the lowest level since May 2022.

- India’s flash composite PMI output index rose by 0.4 points to 62.2 in Apr, thanks to increased new orders. Private sector sales expanded for the 33rd successive month and at the quickest pace in just under 14 years. Manufacturing PMI remained unchanged at 59.1 in Apr, while services PMI rose to 61.7 (Mar: 61.2).

- GDP in South Korea accelerated by 1.3% qoq and 3.4% yoy in Q1 (Q4: 0.6% qoq and 2.2% yoy), supported by a rebound in construction activity (2.7% qoq from Q4’s 4.5% drop) and higher private spending (0.8% from 0.2%) alongside an uptick in government consumption (0.7%).

- Inflation in Singapore eased to 2.7% in Mar (Feb: 3.4%), the lowest since Sep 2021, as prices eased for food (3% from 3.8%), housing & utilities (3.7% from 3.9%) and transport (0.9% from 2.3%). Core inflation also slipped to 3.1% from Feb’s 7-month high of 3.6%.

- Industrial production in Singapore plummeted by 16% mom and 9.2% yoy in Mar (Feb: 14.6% mom and 4.4% yoy). In yoy terms, a plunge in electronics (-11.3% from 3.9%) and biomedical manufacturing (-34.3% from 26.8%) contributed to the decline.

Bottom line: Rate cuts are on the cards across US and EU, but the question remains one of timing. While it is looking more likely that the Fed would need to see more weakness in the labour market before lowering rates, this week’s data on inflation and economic growth in the eurozone could firm calls for the rate cut timing in the EU. Meanwhile, flash PMI estimates indicated a positive momentum in Europe and Japan versus subdued readings in the US though cost pressures are intensifying across the board (due to wage costs, especially in services, alongside an inching up in manufacturing input costs). Indicator and data driven central banks are likely to review rate settings in June, looking for confirmatory readings.

Regional Developments

- Bahrain’s Gulf Air disclosed that it would resume flights to Iraq after for 4 years of being suspended during the Covid pandemic.

- Egypt received USD 820mn, as the second tranche of the IMF loan programme. Separately, IMF’s reviews concluded that Egypt met seven commitments out of 15 pledges under its ongoing USD 8bn Extended Fund Facility (EFF) loan programme. The report estimated that the anticipated proceeds from the divestment of state-owned assets would contribute 0.4% of GDP to the increase in the primary surplus. It also stated that authorities have committed to limiting the government’s overdraft account at the central bank and to prevent further central bank lending to public agencies outside the finance ministry, according to the report. Access the report: https://www.imf.org/en/Publications/CR/Issues/2024/04/26/Arab-Republic-of-Egypt-First-and-Second-Reviews-Under-the-Extended-Arrangement-Under-the-548335

- Asharq Business reported that Egypt raised its funding needs for the draft budget of fiscal year 2024-25 by 33% to EGP 2.849trn. Allocations for petroleum and food subsidies are estimated at EGP 154.5bn (+33% increase) and EGP 134.15bn (+5%) respectively.

- Egypt’s minister of international cooperation stated that Egypt will receive USD 400mn from the UK over two years, with the first USD 200mn expected by Jul.

- Egypt’s external debt increased by USD 3.5bn to USD 168.03bn by end-Dec, according to the central bank, with long-term external debt accounting for 82.5% of the total. external debt owed by the Egyptian government increased by 2.9% qoq to USD 84.849bn by end-2023.

- Mortgage finance for the low-income sector in Egypt stood at EGP 66.448bn from 22 banks in Q1 2024, benefitting 544,626 customers. Five banks accounted for 74.2% of the total: shares of National Bank of Egypt and Banque Misr were 25.9% and 24.1% respectively.

- Egypt and the UAE discussed potential cooperation in the fields of trade, storage, and distribution of petroleum products, leveraging on the petroleum potential in Fujairah, according to an official statement.

- Inflation in Kuwait slowed to 3.0% in Mar(Feb: 3.4%), the lowest reading since Aug 2021, due to lower transportation prices (0.9% from 1.8%) and housing (1.4% from 2.4%) among others. Food prices, however, inched up for the third month in a row to 5.2% (Feb: 5.0%). Other categories that posited increases during the month were services & miscellaneous (4%), furnishings (3.9%) and health (3.4%).

- Real GDP in Oman grew by 1.3% yoy in 2023, with non-oil sector growing at a faster pace (1.3%) than oil sector (0.35% respectively). Oil sector accounted for almost one-third of GDPwhile the share of government and construction sectors stood at 9.2% and 9.1% respectively followed by manufacturing (8.8%). Services sector grew by 3.5%, with telecoms and financial sectors posting growth rates of 8.4% & 8.1% respectively. However, both trade and hospitality sectors ended in the red for the full year 2023.

- India and Oman are expected to sign a trade deal in the coming months after a national government is announced post-elections, reported Reuters, citing two Indian officials. Bilateral trade stands at under USD 13bn currently: the agreement will eliminate duties on Indian exports worth an annual USD 3bn and India will reduce duties on some petrochemicals, aluminium and copper from Oman.

- Oman’s inflation, calculated on a base year 2018, rose to 0.2% yoy in Mar, following Feb’s flat reading. Inflation in Q1 averaged only 0.03%. On a monthly basis, prices increased by 0.1%, following a 0.3% deflation in Feb. Food costs in Oman increased by 3.4% (Mar: 1.1%) while declines were reflected across multiple categories, including education (-0.4%), transport (-4.6%) and restaurants & hotels (-0.1%).

- The volume of FDI into Oman grew by 21.6% yoy to OMR 25.1bn in 2023, with more than 3/4-ths of the FDI going into oil and gas exploration activity (growing at the fastest pace of 33% yoy to OMR 19.5bn). Along with O&G, manufacturing, financial intermediation and real estate rounded up the top 4 sectors together accounting for 95% of total FDI inflow in 2023.

- Oman National Oil and TotalEnergies finalised the construction of a USD 1.6bn Marsa LNG bunkering project at Sohar Port. The plant will have a production capacity of 150mn cubic feet per day of gas, and will be fully electrically driven, emitting less than three kilogrammes of carbon dioxide for every oil equivalent barrel.

- The Saudi Fund for Development in Oman signed an OMR 25mn (USD 67mn) deal with the Oman Development Bank to finance start-ups and create more jobs, as part of an earlier announced USD 150mn package.

- Qatar launched a National Renewable Energy Strategy, with aims to expand its renewable power generation capacity to approximately 4 gigawatts by 2030, with distributed solar generation contributing around 200 megawatts. This also projects a reduction in the average cost of electricity generation by 15% by 2030 through cost-effective renewable solutions.

- Qatar and Philippines signed 9 agreements to boost trade and investment, also including cooperation in developing tourism and business events as well as in facing climate change. Bilateral trade between the two nations stood at QAR 979mn (USD 270mn) in 2022.

- US Treasuries holdings of major GCC nations’ rose in year-on-year terms in Feb 2024: Saudi Arabia was the 17th largest investor in US Treasury bonds (USD 130.5bn) while UAE posted a sharp jump in holdings to USD 68.9bn (+14.6% mom).

- GCC’s national oil companies in are expected to increase capex by USD 15-25bn per year from 2023 to 2030 as investments in sustainable projects increase, according to a report from S&P Global Ratings. Low-carbon investments average about 20% of total investments of globally listed oil companies over 2024-2026 though variations exist across companies.

- A report from the IEA highlighted the rising share of EV sales in Jordan (45%+) and UAE (13%) in the Middle East. The influx of Chinese EV car models could drive regional sales further, alongside production of vehicles domestically.

- UAE, Iraq, Qatar and Turkey signed a cooperation agreement on the USD 17bn “Development Road” project that provides a road and rail alternative to the Suez Canal. Tying South Iraq to Turkey, the project has a tentative completion date in 2029 if work begins in early 2024.

Saudi Arabia Focus

- Saudi Arabia’s exports declined by 6.5% yoy to SAR 95.0bn in Feb 2024. Oil exports fell by 8.8% yoy to SAR 73.1bn, taking its share in overall exports to 77%. Non-oil exports fell by 7.2% yoy to SAR 15.4bn in Feb while re-exports, which accounts for 6.8% of total exports, grew by 32.8% yoy. China continues to be the top trade partner in Feb: accounting for 13.2% of overall exports and 20% of total imports.

- Saudi Press Agency reported that 87% of the 1064 initiatives that are part of Saudi Vision 2030 are either complete or on track. Improvements were evident in visitor numbers, Umrah performers, home ownership rates, life expectancy and health services coverage among others.

- Industrial private sector investments in Saudi Arabia more than doubled to SAR 7bn (USD 1.8bn) in Q1 2024, according to a report by MODON (Saudi Authority for Industrial Cities and Technology Zones). The number of constructed factories surged 13.4% yoy to 6,683 in Q1 2024.

- Fakeeh Care Group, a family-owned business and one of the largest private hospital groups in Saudi Arabia, announced its decision to procced with an IPO via a 21.47% stake sale. This came hot on the heels of an IPO announcement from Saudi Arabian water and wastewater infrastructure company Miahona that plans to offer a 30% stake.

- Saudi PIF and STC Group signed a deal for the former to buy a 51% stake in Telecommunication Towers Company Ltd (TAWAL), creating the region’s largest telecom tower company. The new company, including the Golden Lattice Investment Company as minority shareholder, will have around 30k mobile tower sites and estimated annual revenues of around USD 1.3bn.

- Saudi Aramco disclosed being in talks for a 10% stake in China’s Hengli Petrochemical – which operates a 400k barrels a day refinery and integrated chemicals complex in Liaoning Province, as well as several facilities in the provinces of Jiangsu and Guangdong.

- NEOM disclosed that it had secured a new revolving credit facility worth SAR 10bn (USD 2.67bn) from local lenders. The amount will be used towards short-term financing requirements in the major projects that are part of NEOM.

- Saudi Arabia’s Social Development Bank disclosed that it had provided financing worth SAR 1.85bn (USD 493mn) in Q1 2024: assistance for small businesses and start-ups amounted to SAR 606mn to over 1700 firms.

- The cinema sector in Saudi Arabia generated SAR 3.7bn (USD 986mn) in revenue, with the sale of over 61mn tickets from Apr 2018 to Mar 2024. Currently there are 66 movie houses, with around 618 screens and 63k+ seats.

- Airports in Saudi Arabia reported a record 18% jump in flights and passenger numbers during the Ramadan and Eid holidays period. More than 86k flights were handled during the period, flying more than 12.5mn passengers.

- Diriyah Gate, one of Saudi’s giga projects, revealed it was on track for completion by late-2027, with the first hotel scheduled for opening this year.

- A report from the Stockholm International Peace Research Institute (SIPRI), Saudi Arabia spent USD 76bn on arms (+4% yoy) in 2023, crowning it one of the biggest spenders behind US, China, Russia and India. Saudi’s arms spending was just over 7% of GDP.

UAE Focus![]()

- UAE GDP grew by 3.3% yoy in Jan-Sep 2023: according to preliminary data from the FCSC, non-oil GDP grew by 5.9% in the 9 months, accounting for 74% of overall GDP contribution.

- Dubai’s ruler approved a new AED 128bn (USD 35bn) passenger terminal at the Al Maktoum International airport. The terminal will have a total capacity of 260mn passengers and be five time the size of the Dubai International Airport with 400 gates and 5 runways. Emirates airlines and Flydubai will eventually move to the new airport along with its airline partners.

- UAE announced that CEPA negotiations have been completed with the Republic of Chile. Bilateral trade between the two nations stood at USD 305.1mn in 2023, up 23.6% from 2019.

- Spinneys’ supermarket franchisee in Oman and UAE will offer 900mn shares, or 25% of its issued share capital in an IPO: the indicative price range was set between AED 1.42-1.53, and the firm announced having attracted two cornerstone investors (Emirates International Investment Company and Franklin Templeton).

- Non-oil trade in Abu Dhabi grew by 8% yoy to AED 282bn in 2023: imports surged by 19% yoy to AED 136bn while re-exports expanded by 11% to AED 52bn.

- Abu Dhabi initiated USD 5bn in a three-tranche USD-denominated bond after three years (last issuance was in Sep 2021). The issuance was oversubscribed by 4.8 times, and the pricing was set below fair value.

- UAE signed an investment MoU with Kenya covering collaborations in the mining and technology sectors. Separately, Abu Dhabi’s ADQ announced a finance framework agreement with Kenya, to explore and facilitate investments (of up to USD 500mn) in priority sectors in the country.

- Dubai Chamber of Digital Economy successfully attracted 9 MNCs into the emirate last year, with a combined value of AED 304bn (USD 82.84bn).

- Bayanat AI and Al Yah Satellite Communications Company (Yahsat), combinedly worth USD 1bn, merged to create a space organisation named Space42. The merger will be effective mid-2024 and the entity will have a combined revenue of USD 760mn and net income of USD 174mn based on 2023 financial results.

- Abu Dhabi Ports Group revealed that it had secured a 20-year concession agreement (extendable by another 10 years) and committed to invest USD 251mn over the next 3 years in a project to upgrade the port terminal at Luanda in Angola.

- UAE’s travel & tourism sector is set to grow to over AED 236bn (USD 64.26bn) in 2024 (2023: AED 220bn), according to WTTC’s 2024 Economic Impact Research report, supporting more than 23,500 new jobs (to a total 833k). International visitor spending is projected to rise by 10% to AED 192bn and domestic visitor spending by 4.3% tot AED 58bn.

- The Ras Al Khaimah freezone reported a 61% yoy surge in new company registrations in Q1 2024. Nearly 3k firms joined the freezone last quarter, in addition to over 23k firms.

- The UAE announced that AED 2bn (USD 545mn) would be set aside to pay for and rebuild flood-damaged homes of citizens. Additionally, an AED 80bn sewerage system was announced as part of Dubai Economic Agenda D33. Separately, the central bank has instructed banks to defer personal and car loan instalments for 6 months (without additional fees) for customers affected by the flooding.

- UAE accounts for more than 40% of total silver imports to India in Q1 2024: with the implementation of CEPA, silver imports via the UAE pay only an 8% duty versus other routes’ 15%. This route would only gain further prominence as the duty differential on imports from UAE will continue to widen with 1% reduction every year.

- The UAE is planning to issue tenders for the construction of a new nuclear power plant, reported Reuters. Award for the plant and its construction is expected this year itself, with the plan for it to be operational by 2032 – to meet projected energy demand.

Media Review

OPEC excited about Namibia partnership, offers support

https://www.reuters.com/business/energy/opec-excited-about-namibia-partnership-sec-gen-says-2024-04-24/

Navigating Major Transitions in an Uncertain Economy

https://www.project-syndicate.org/commentary/us-growth-slows-while-inflation-remains-fueling-deeper-global-uncertainty-by-mohamed-a-el-erian-2024-04

Investors bet global central banks will be forced to delay rate cuts

https://www.ft.com/content/123dd179-baf5-4f15-b979-c12b0695c33d

Climate change is slowing Earth’s rotation

https://www.economist.com/science-and-technology/2024/04/24/climate-change-is-slowing-earths-rotation

Powered by: