Download a PDF copy of the weekly economic commentary here.

Markets

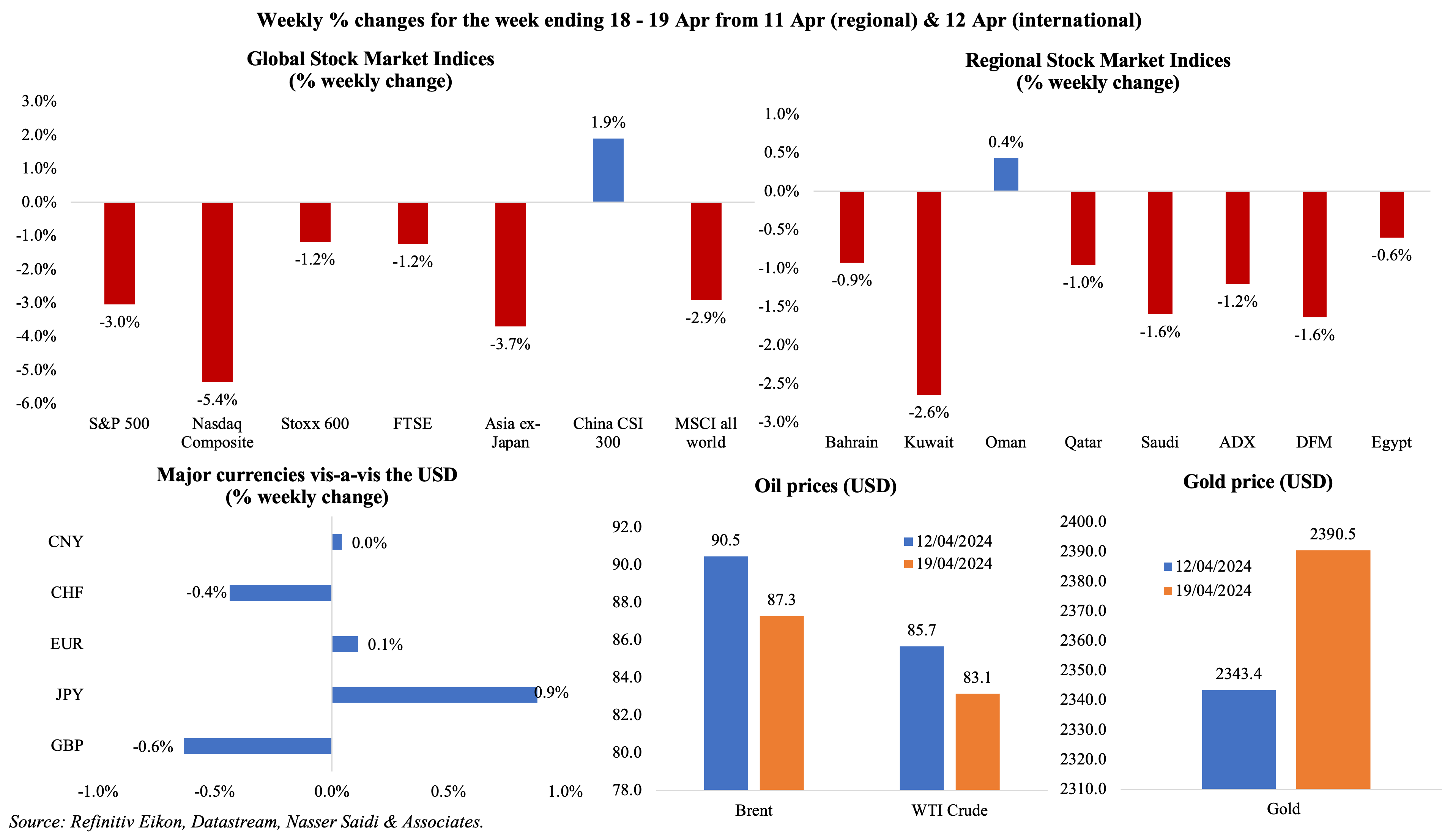

Major equity markets ended the week in the red, on rising geopolitical tensions in the Middle East alongside concerns about monetary policy: S&P 500 and Nasdaq posted the steepest weekly declines since Mar 2023 and Nov 2022 respectively, while European markets were at the lowest levels in a month and markets in the Middle East were also mostly down. Among currencies, the USD was strong, while JPY fell to its weakest level since 1990 before coming off the high as tensions between Iran and Israel simmered (a similar pattern was observed with the CHF); the India rupee touched record lows. Oil prices settled lower compared to a week ago, but concerns remain about oil supply and potential disruption should the situation in the Middle East worsen. Gold price meanwhile ticked up for the fifth week in a row on its safe haven status.

Global Developments

US/Americas:

- Industrial production in the US inched up by 0.4% mom in Mar, following a similar gain the month before, thanks to gains in manufacturing (+0.5%) while mining output fell by 1.4%. Capacity utilisation moved higher to 78.4% (Feb: 78.2%). In Q1, IP fell by 1.8% yoy while manufacturing edged down at a 0.1% annualised rate (Q4 2023: -0.9%).

- US retail sales grew by 0.7% mom in Mar (vs. Feb’s upwardly revised 0.9%, the largest gain in over a year), with sales rising at non-store retailers (2.7%) and gas stations (2.1%) while online sales grew by 2.7%. Excluding sales at gas stations, retail sales were up 0.6%.

- NY Empire State manufacturing index improved to -14.3 in Apr (Mar: -20.9), though remaining negative for the 5th month in a row. While new orders and shipments fell, delivery times shortened alongside weak labour market conditions.

- Philadelphia Fed manufacturing index jumped to a two-year high of 15.5 in Apr (Mar: 3.2), thanks to strong new orders (12.2, highest since Aug) and shipments (19.1, highest since Aug 2022) readings. Factory employment (-10.7) fell to its lowest level since May 2020.

- Building permits in the US fell by 4.3% mom to a seasonally adjusted 1.458mn in Mar, the lowest since Jul 2023. Single-family permits declined by 5.7% to 973k (a 5-month low).

- Housing starts tumbled by 14.7% mom in Mar, the biggest drop since Apr 2020, to 1.321mn. Single-family starts fell by 12.4% to a seasonally adjusted 1.022mn units while housing starts for 5-units or more plunged 20.8% to a rate of 290k units.

- Existing home sales in the US dropped by 4.3% mom to 4.19mn in Mar. The median existing home price increased 4.8% yoy to USD 393,500 in Mar, a record high for the month of Mar.

- Initial jobless claims stayed put at 212k in the week ended Apr 12th while the 4-week also remained unchanged at 214.5k. Continuing jobless claims edged up slightly to by 2k to 1.812mn in the week ended Apr 5th.

Europe

- Industrial production in the eurozone rebounded by 0.8% mom in Feb (Jan: -3%): capital and durable consumer goods production grew by 1.2% and 1.4% respectively (Jan: -15.5% and -1.2%). In yoy terms, IP fell by 6.4% (Jan: -6.6%).

- ZEW’s economic sentiment indicator in Germany rose to 42.9 in Apr (Mar: 31.7), the highest since Mar 2022, while the current situation index improved only marginally (-79.2 from -80.5). The Economic Sentiment Index in the eurozone also rose by 10.4 points to 43.9 in Apr while the current situation reading climbed 6 points to -48.8.

- Germany’s producer price index fell by 2.9% yoy in Mar (Feb: -4.1%), the ninth month in a row of deflationary readings, largely due to lower energy costs (-7%) while prices of intermediate goods also shrank by 3.7%. In mom terms, prices edged up by 0.2%, rebounding after a 0.4% drop in Feb.

- UK inflation eased to 3.2% yoy in Mar (Feb: 3.4%), the lowest since Sep 2021, thanks to a decline in food prices (4%, the weakest since Nov 2021). Core inflation slipped to 4.2% (Feb: 4.5%), lowest since Dec 2021, while services inflation was marginally lower (6% from 6.1%).

- Retail sales in the UK remained flat in Mar (Feb: 0.1%), with sales in food stores down by 0.7% mom and 3.9% below the Feb 2020 levels. Excluding fuel, sales were up by 0.4% in Mar (Feb: -0.4%). Sales in Q1 were up by 1.9%, the fastest quarterly growth since 2021, thanks to the strong reading in Jan.

- Producer input price in the UK fell by 2.5% yoy in Mar (Feb: 2.2%) while output prices posted a 0.6% yoy uptick (Feb: 0.4%). Retail price index grew by 0.5% mom and 4.3% yoy. Services producer prices grew by 3.6% yoy in Q1 2024, from a revised rise of 3.5% Q4 2023.

- UK unemployment rate inched up to 4.2% yoy in the 3 months to Feb while the number of employed individuals fell by 156k to 32.98mn. Average earnings including bonus remained strong, unchanged at 5.6%, while pay growth excluding bonus eased (6% from the previous month’s 6.1% reading).

Asia Pacific:

- China’s GDP expanded by 1.6% qoq and 5.3% yoy in Q1 2024 (Q4: 1.2% qoq and 5.2% yoy). Industrial production grew by 4.5% yoy in Mar, lower than Feb’s 7% gain, thereby clocking in a growth rate of 6.1% in Q1. Retail sales increased by 3.1% in Mar (Feb: 5.5%), recording 4.7% growth in Q1.

- Fixed asset investment in China grew by 4.5% in Q1 (Jan-Feb: 4.2%). Property investment fell by 9.5% yoy while new property sales plunged by 27.6% amidst an ongoing real estate shakeout.

- Foreign direct investment into China slumped by 26.1% yoy to CNY 301.7bn in Q1 2024 (Jan-Feb: -19.9%). Investment grew by 41.7% in qoq terms while FDI into manufacturing accounted for 26.9% of total FDI.

- Exports from Japan grew by 7.3% yoy in Mar (Feb: 7.8%), with gains recorded by automakers (7.1%) and semiconductor and electronic parts (11.3%) sectors. Exports to China surged by 12.6% while that to the US and Europe was up by 8.5% and 3% respectively. Imports fell by 4.9% (Feb: 0.5%), causing a surplus JPY 366.5bn (Feb: deficit JPY 377.8bn).

- Inflation in Japan eased slightly to 2.7% yoy in Mar (Feb: 2.8%). Excluding food and energy, prices slipped to under 3% for the first time since Nov 2022, recording a 2.9% reading (Feb: 3.2%). Excluding fresh food, prices were lower(2.6% from Feb’s 2.8%).

- Wholesale price inflation in India inched up to a 3-month high of 0.53% in Mar (Feb: 0.2%). Wholesale food inflation accelerated, up by 4.7% vs Feb’s 4.1% gain.

- Trade deficit in India narrowed to an 11-month low of USD 15.6bn in Mar (Feb: USD 18.71bn). In the fiscal year 2023-24 (ending in Mar), goods exports fell 3% yoy to USD 437bn – the first yearly decline since the Covid-affected 2020-21. Imports also fell by 5% to USD 677bn causing overall trade deficit to touch USD 240bn in 2023-24 (2022-23: USD 265bn).

Bottom line: The IMF expects global economic growth to remain at a steady 3.2% for three years till 2025, rising from 2.3% in 2022. Growth in emerging market economies (EMEs) is projected to be steady at 4.2% in 2024 and 2025, driven by India (6.8% and 6.5% in 2024 and 2025) and China (4.6% and 4.1%, affected by a property sector downturn). The world Economic Outlook report also cited a scenario wherein an escalation in the Middle East could lead to a 15% surge in oil prices and higher shipping costs, which would in turn tick up inflation by 0.7 percentage points. Such a surge would hurt emerging markets, that are already battling a strong dollar. Stability of currencies in Asia has been talked by many policymakers – there was a joint statement by the US, Japan and South Korea last week to limit the dollar’s surge; China set a stronger renminbi reference rate to discourage sales of the RMB vis-à-vis the USD. This week sees US Q1 GDP data releasing alongside flash PMI readings across major economies. The BoJ meets on policy, and will keep rates unchanged, but it is likely to reaffirm that future rate hikes will be very slow in coming.

Regional Developments

- IMF expects economic growth to edge up to 2.7% in the MENA region in 2024, from an estimated 1.9% growth in 2023, but with wide disparity between the GCC nations and the resource-poor MENA nations. Voluntary oil production cuts and lower oil prices have affected growth in the GCC though non-oil sector activity has been robust. Growth prospects in 2025 (projected at a strong 4.2%) and beyond will be affected by geopolitical developments while inflation has started to ease, partly due to monetary policy tightening and lower energy costs.

- Egypt’s economic growth is expected to rise in the financial year starting in July to 4.2%, disclosed the finance minister, from the 2.8% in the fiscal year 2023-24. He stated that the main priority for the government is to reduce inflation to the central bank’s target, and also that plans are underway to sell more state assets within 3-5 years in a bid to reduce the state’s role in the economy.

- The EU announced that it would provide “urgent” EUR 1bn in short-term aid to Egypt, to be provided through loans made available in one instalment. This funding is part of the larger EUR 5bn macro-financial assistance package.

- Egypt’s foreign debt increased by USD 3.5bn to USD 168bn in Q4 2023, with about 81% of debt assigned as long-term.

- Exports from Egypt grew by 5.3% yoy to USD 9.61bn in Q1 2024, revealed the Trade and Industry Minister, with Turkey, Saudi Arabia and the UAE top destinations.

- The central bank of Egypt raised the daily maximum limit for cash withdrawals by individuals and companies from bank branches by 67% to EGP 250k, as per a circular on Apr 15th. ATM withdrawal limits were also raised to EGP 30k.

- Egypt agreed with private sector representatives to reduce the prices of unsubsidised commercial bread by 25% to 40% from this week. The reduced fixed prices for flat, round bread have been set at EGP 1.50, 0.75 and 0.50 (USD 0.0104) for loaves weighing 80, 40 and 25 grams respectively.

- Egypt plans to establish seven integrated logistics corridors to link production sites to seaports or ports on the Red Sea to those on the Mediterranean, and also connect through a railway and road network, in a bid to become a regional hub for logistics and trade.

- Kuwait’s surplus with Japan narrowed to JPY 106.2bn in Mar (USD 685mn, down by 12.4% yoy) as exports slowed (-14.2% to JPY 128.4bn). Japan’s trade surplus with the wider Middle East also narrowed by 3.4% to JPY 796.8, as exports inched lower by 0.9%.

- Banque du Liban announced an agreement with Visa and Mastercard for lower card fees on transactions, especially for people with accounts outside Lebanon. This will potentially “reduce the use of cash” and prevent money laundering in Lebanon, stated BDL.

- The head of Lebanon’s Middle East Airlines disclosed that daily arrival rate at Beirut was down by 4% yoy in Q1, and that about 95% of arrivals were from the Lebanese diaspora followed by Iraqis, Syrians and Jordanians.

- Inflation in Oman inched up by 0.2% yoy in Mar (from a flat reading in Feb), as a result of an uptick in food and beverages (3.4% from Feb’s 1.1% gain) while transport and restaurants & hotels costs fell by 4.6% and 0.1% respectively.

- Revenues of Oman’s three star to five-star hotels rose by 18% yoy to OMR 52mn by end-Feb 2024, partly due to the 18% uptick in hotel guests to 433,856. Room bookings by Omanis grew nearly 6% to 141,335 while GCC hotel guest numbers jumped 14% to 25,607.

- Inflation in Qatar eased to 0.98% yoy in Mar (Feb: 2.7%), the lowest since Mar 2021, thanks to a slowdown in prices of food and beverages (2.7% vs 6.6% in Feb). Deflationary readings were recorded in both housing & utilities (-2.7% from -1.7% in Feb) and transport costs (-0.9% from -0.6%).

- Qatar’s industrial production fell by 8.2% mom in Feb, dragged down by the mining sector (-9.5%) while “other mining and quarrying” ticked up by 2.1%. In yoy terms, IP grew only by 0.4%, following Jan’s 4.8% gain.

- The value of debt issuance in the MENA jumped up by 52% yoy to USD 41.6bn in Q1 2024, with Saudi Arabia the most active issuer (issuing bonds & sukuk worth USD 22.78bn) followed by UAE (USD 2.8bn), according to Refinitiv data.

- Capex of GCC oil companies are forecast to grow by 5% this year to touch USD 115bn, according to S&P. The report also projects oil prices to average USD 85 for the rest of 2024.

- At the Skytrax World Airport Awards, Qatar’s Hamad International Airport claimed the title of the world’s best aviation hub for the year while Saudi Arabia’s Prince Mohammad bin Abdulaziz International Airport in Madinah was awarded the title of the best regional airbase in the Middle East for 2024.

Saudi Arabia Focus

- Consumer price inflation in Saudi Arabia eased to 1.65% yoy in Mar (Feb: 1.8%), thanks to lower food and recreation costs (0.9% and 0.7% respectively). Meanwhile, the “housing, water, electricity, gas and other fuels” category (which account for one-fourth of total weighting of the basket) accelerated by a further 8.8% in Mar (Feb: 8.5%), with housing rents alone surging 10.5% (from 10%). Inflation in Q1 averaged 1.7%, much lower than 3% a year ago; housing costs during this period rose by 8.4% from 7% a year ago.

- Wholesale prices in Saudi Arabia jumped up by 3.8% in Mar (Feb: 3.1% and Jan’s 15-month high 4.3%), largely due to the surge in the “other transportable goods” category (9.2% from 7.5% in Feb). Deflation increased in ores & minerals category (-2.2% vs -2% in Jan) as well as in metal products, machinery & equipment (-0.7% from Feb’s -0.6%). Prices in Q1 averaged 3.7% this year, with most categories showing deflationary readings alongside a decline in food cost inflation (2.3% from 6.3% in Q1 2023) while other transportable goods price surged.

- Saudi crude oil production climbed to a 7-month high of 9.01mn barrels per day (bpd) in Feb, according to the Joint Organisations Data Initiative, up 0.61% mom. Crude exports were up by 0.32% to 6.32mn bpd.

- Saudi Arabia invested SAR 682.5mn in exploration initiatives by end-2023, and wealth from the mining sector has topped USD 2.5trn.

- Saudi issued 37,188 certificates of origin in Mar, up by 0.5% yoy. About 118 industrial licenses were issued in Feb, up 72% yoy, with the volume of investments rising to SAR 1.88bn (USD 500mn): the permits were distributed across five sectors, with the food product production domain securing 23 licenses.

- Saudi Arabia’s housing program Sakani saw 32,343 families benefiting in Q1 2024, up 15% yoy. The program also provides support for first-time buyers such as non-refundable financial assistance of SAR 100k (USD 26,659) or SAR 150k.

- NEOM’s workforce is expected to cross 200k by 2025, a 43% increase on the current level, according to the CEO.

- More than 28,100 Saudi citizens joined the private sector for the first time in Mar 2024, taking the total number of citizens employed in the private sector to more than 2.3mn out of a total 11.2mn+ persons; male employees in the private sector stood at 9.9mn.

- Saudi imports of EVs rose to a total of 779 EVs in 2023, after importing 210 EVs in 2022, with cars coming mainly from US, Germany, and China.

UAE Focus![]()

- UAE and Costa Rica signed a Comprehensive Economic Partnership Agreement (CEPA), disclosed the UAE President. Bilateral trade between the two nations grew by 7% yoy to USD 65mn in 2023.

- UAE’s President announced a day later that a CEPA had also been signed with Colombia. Bilateral trade grew by 43% yoy to USD 553.1mn in 2023, and more than the total in 2021.

- Inflation in Dubai inched lower to 3.34% in Mar (Feb: 3.36%), as prices slipped in the food and transportation sectors. Prices increased by 8.67% yoy in insurance and financial services, by 6.34% in housing and utilities, and by 3.62% in education.

- Non-oil foreign trade passing through Abu Dhabi border crossings grew by 8% yoy to AED 281.903bn in 2023. Imports grew by 19% to AED 136.45bn last year while re-exports grew by 11% to AED 52.394bn.

- UAE-based supermarket chain Spinneys announced plans for an IPO on the Dubai bourse, with the shareholder Al Seer Group planning to sell 900mn shares (equal to a 25% stake). The book-building process will open on Apr 23 and close on Apr 29 for UAE retail investors and other investors, and on Apr 30 for professional investors.

- Abu Dhabi’s Taqa is in talks with the three largest shareholders of the energy firm Naturgy for a possible takeover.

- Visitors into Dubai grew by 18.4% yoy to 3.67mn in the first two months of 2024:this was 12.2% higher compared to Jan-Feb 2019. GCC & MENA regions together accounted for 997k visitors (or about 27% of the total) this year while Western Europe and South Asia accounted for the largest shares at 21% and 16% respectively.

- Travel and tourism sector in the UAE will see the creation of 23,500 jobs in 2024 taking the total to 833k, according to the CEO of the World Travel and Tourism Council. The sector’s contribution is expected to increase to 12% of UAE’s GDP to AED 236bn.

- Property sales for homes in Dubai worth USD 10mn+ grew by 6% yoy to USD 1.73bn in Q1 2024, from a total of 105 homes. Cash buyers accounted for 36.3% of total sales value.

- Microsoft is investing USD 1.5bn in UAE-based AI firm G42: Microsoft will get a minority stake and take a seat on G42’s board while G42 would use Microsoft cloud services to run its AI applications.

- Binance revealed that it had secured a licence from Dubai’s regulator VARA to target retail clients. The license allows the firm to extend its current services beyond spot trading and fiat services by offering margin trading products – for qualified users – and staking products.

- Trademark registrations in the UAE grew by 64% yoy to 4610 in Q1 2024: Jan and Feb collectively saw 2,592 trademarks being registered.

- Abu Dhabi plans to generate more than 50% of its electricity from renewable and clean energy by 2030, according to a senior official from the Emirates Water and Electricity Company.

- Dubai International maintained its status as the world’s busiest international airport for the 10th consecutive year, ahead of London and Amsterdam, according to the Airports Council International. Passengers flying into Dubai grew by 32% to nearly 87mn in 2023, while it grew to 75mn and 62mn passengers respectively in London and Amsterdam.

Media Review

IMF Middle East & Central Asia Regional Economic Outlook, Apr 2024

https://www.imf.org/en/Publications/REO/MECA/Issues/2024/04/18/regional-economic-outlook-middle-east-central-asia-april-2024

Why our world needs fiscal restraint in biggest-ever election year

https://www.imf.org/en/Blogs/Articles/2024/04/17/why-our-world-needs-fiscal-restraint-in-biggest-ever-election-year

Explore our prediction model for Britain’s looming election: The Economist

https://www.economist.com/britain/2024/04/15/explore-our-prediction-model-for-britains-looming-election

Navigating supply chain risks in the GCC’s industrial sector

https://www.oliverwyman.com/our-expertise/insights/2024/apr/industrial-supply-chain-resilience.html

Sukuk takes bigger slice of Oman’s shrinking debt market

https://www.agbi.com/banking-finance/2024/04/sukuk-takes-bigger-slice-of-omans-shrinking-debt-market/

Powered by: