Weekly Insights: A strange week of sorts – from World Bank and OECD’s growth projections to a new group of Robinhood investors playing the stock markets, to the equity sell-off on Jun 11th to Fed’s “not even thinking about thinking” about rate hikes, to massive layoffs closer home in the UAE – we pen some forward-looking “positive” thoughts on how the GCC economies can refocus, regroup and push forward its diversification agenda in a Covid19-co-existing world.

Markets

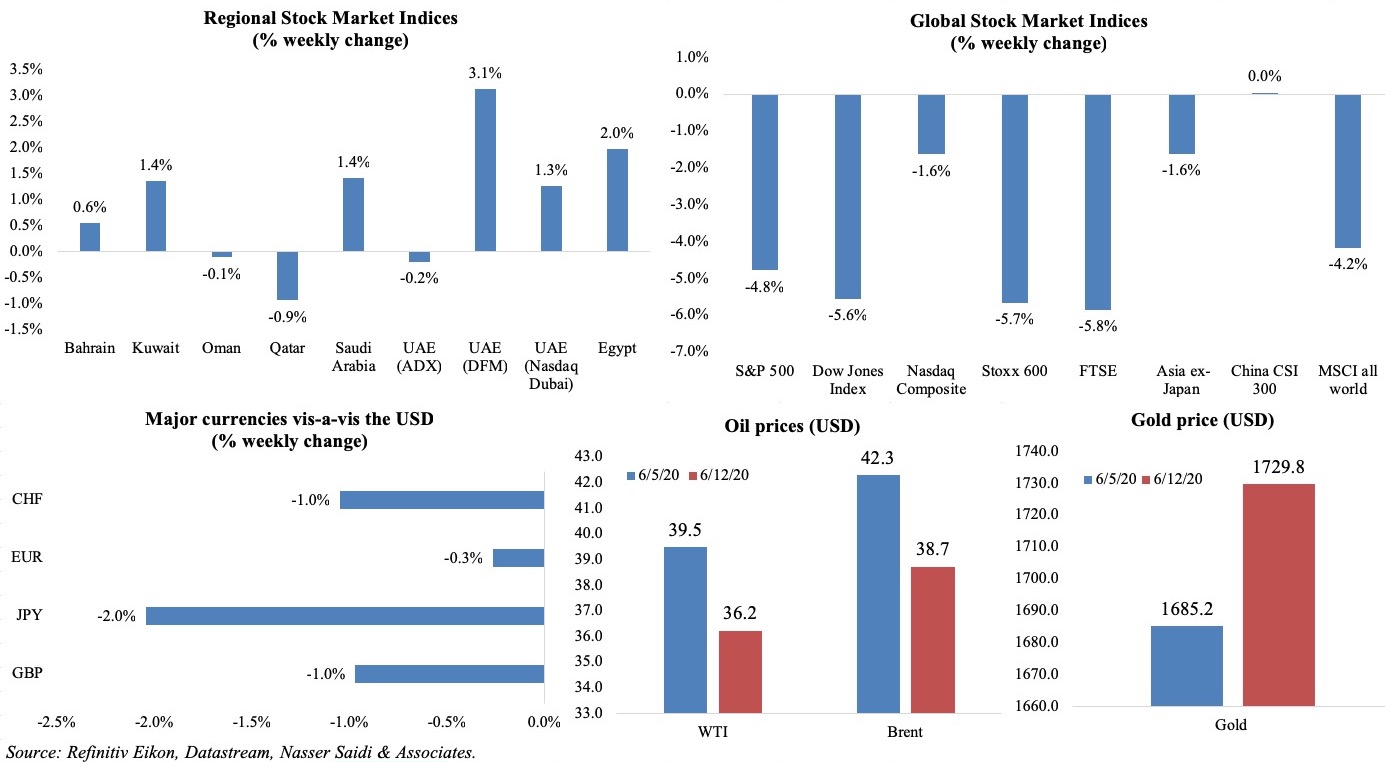

Renewed fears of the pandemic resulted in a sell-off on June 11th – all three major U.S. stock indexes posted their worst day since mid-Mar; the Vix rose above 40, its highest close since Apr 23 (Vix: tmsnrt.rs/2Yl9tGo). S&P ended the week down 4.8% (the worst in 3 months) while European and Asian markets also closed lower versus the week before (world stocks market cap loss: tmsnrt.rs/30zdOIL). Regional markets were mixed, with Dubai and Saudi exchanges the better performers. Demand for the dollar increased and major currencies fell vis-à-vis the greenback. Oil prices fell following 6 weeks of gains on concerns about excess supply (US crude inventories surged to a record high, disclosed the EIA) while gold price posted its biggest weekly gain since Apr. (Graphs in the last section.)

Global Developments

US/Americas:

- The latest Fed projections indicate that by 2022, unemployment would still be 5.5% (much higher than pre-Covid19 levels), with core inflation at 1.7% (lower than the 2% target), with no rate increases till at least end-2022. Mr. Powell’s dovish remarks included statements like “not even thinking about thinking about raising rate hikes”.

- The National Bureau of Economic Research (NBER) declared that the US economy officially fell into recession in Feb, ending a 128-month economic expansion (the longest on record).

- Inflation in the US eased for the third consecutive month to 0.1% yoy in May (Apr: 0.3%) while core CPI edged down to 1.2% (the smallest gain since Mar 2011) from 1.4% the month before. In mom terms, prices dropped by 0.1% after declining 0.8% in Apr (the largest fall since Dec 2008). Fuel prices declined (-3.5%) offsetting the food price hike (+0.7%).

- US producer price index rebounded in May, rising by 0.4% mom (Apr: -1.3%), on higher food (+6%) and energy (+4.5%) costs; in yoy terms, PPI declined by 0.8% (Apr: -1.2%). Excluding food and energy, core PPI rose by 0.1% mom and slipped by -0.4% yoy.

- Initial jobless claims fell to 1.5mn in the week ended Jun 5, pushing the 12-week total to 44mn. Continuing claims declined to 20.9mn in the week ended May 30 from 21.5mn before.

Europe:

- Eurozone Q1 GDP contracted by 3.6% qoq and 3.1% yoy, upwardly revised from previous estimates of 3.8% qoq and 3.2% yoy. The lockdown (only 2-3 weeks of the quarter) resulted in a 4.7% qoq dip in household consumption during Q1 while by industry, services saw a 6.8% qoq drop.

- German industrial production dropped at almost double the pace in Apr, declining by 17.9% mom following an 8.9% drop in Mar; IP fell by 25.3% yoy in Apr – the biggest ever fall since records began in 1991. The auto industry saw output collapse by -74.6% due to supply chain disruptions versus consumer goods’ fall of 8.7%.

- Exports from Germany plummeted by 24% mom in Apr (Mar: -11.7%) while imports slumped by 16.5% (Mar: -5%), narrowing trade surplus to EUR 3.2bn from EUR 12.8bn in Mar. In yoy terms, exports dived by a staggering 31.5% – the biggest drop since 1950. Trade with its European peers declined drastically (exports were down by 48.3% and 40.1% to France and Italy respectively) while exports to China (in comparison) was down by only 12.6%.

- Eurozone industrial production tumbled by a record 17.1% in Apr (Mar: -11.3%), as containment measures continued to be in place. Output fell across most of the largest nations: Spain (-21.8%), France (-20.1%), Italy (-19.1%), Germany (-18%). Durable consumer goods production fell almost 28% in Apr, while capital goods output was down 27.3%.

- UK GDP declined by a record 20.4% mom in Apr, bringing the GDP contraction to 10.4% in the 3 months to Apr (vs the previous 3-month period). Industrial production fell by a record 20.3% mom in Apr, dragged down by transport (car production was down by 28.3%) while pharma expanded by 15.4%.

Asia Pacific:

- China imports shrank by 16.7% yoy in May (weakest since Jan 2016) alongside a dip in exports by 3.3% yoy, thereby improving the trade surplus to USD 62.93bn from Apr’s USD 45.33bn. Exports were supported by textiles (+41% mom) and medical supplies (+38%).

- Consumer price index in China eased to 2.4% yoy in May (Apr: 3.3%); overall price declined by 0.8% mom, with food prices down by 3.5% in May. Excluding food and energy, core CPI rose by 1.1% yoy. Producer price index continued to fall, posting a 3.7% dip in May following Apr’s 3.1% drop). Factory prices of production materials dropped 5.1% in May, dragging down the overall PPI by 3.79 ppts.

- China’s new yuan loans decreased to CNY 1.48trn (USD 209.47bn) in May from the previous month’s CNY 1.7trn while money supply growth remained flat at 11.1% yoy. Growth of outstanding total social financing, a broad measure of credit and liquidity, quickened to 12.5% yoy in May (Apr: 12%). Foreign exchange reserves edged up to USD 3.102trn in May from USD 3.091trn the month before.

- Japan’s Q1 GDP posted a 0.6% qoq decline, shrinking less than initial estimates (-0.9%), thanks to stronger figures of capital spending. The economy contracted by an annualized 2.2% in Q1: capital spending rose 8% qoq on an annualized basis versus initial estimates of -2.1%.

- The final estimates of Japan’s industrial production plunged by 9.8% mom and 15% yoy in Apr versus the preliminary estimate of -9.1% mom and -14.4%

- Japan core machinery orders declined to a 6-year low in Apr: down by 12% mom and 17.7% yoy to JPY 752.59bn (Mar: -0.4% mom and -0.7% yoy). Orders from overseas, seen as an indicator of future exports, dropped 21.6% to JPY 689.45bn.

- Data on South Korea’s exports for the period June 1-10 looks promising: exports surged by 20.2% yoy, with gains reported across semiconductors (+22.6%), mobile devices (+35.8%) and medical items (+136.7%).

- Industrial production in India slipped by a record 55.5% yoy in Apr: output slumped across sectors, led by manufacturing (-64.2%), with items like consumer durables (-95.7%) and capital goods (-92%) recording the highest contraction. The National Statistical Office stated that it is not appropriate to compare the latest IIP data with previous months, given that a majority of firms reported zero production given the lockdown.

- India’s consumer food price index rose by 9.28% yoy in May (Apr: 10.5%). Overall headline retail inflation was not released for the 2nd consecutive month given suspension of price collection.

Bottom line: As the Covid19 cases continue to rise globally (~7.8mn confirmed) – US tops the list followed by Brazil, Russia and India (the latter recording more than 10k cases in a day on Friday) – alarms have been sounded on the economic impacts from Covid19: according to the World Bank and OECD, growth is estimated to contract globally by 5.2% and 6% respectively this year, followed by a slow recovery. Estimates would be more severe should countries be hit by a second wave: Beijing reported a fresh Covid19 cluster while in Iran, Egypt and Saudi Arabia, numbers are still ticking up as restrictions are gradually eased. In Europe where economic activity has resumed (and the tourism sector is scheduled to open up to tourists from June 15th), high frequency data (e.g. Google Mobility data related to work, entertainment, shopping etc.) suggests a slow recovery. The UK – which confirmed it will not extend the Brexit transition period – has both the BoE policy meeting and post-Brexit trade talks on the agenda this week.

Regional Developments

- Bahrain plans to reopen schools in Sep, with classes in government schools starting on Sep 16 and administrative staff returning Sep 6th.

- Bahrain’s ruler increased monthly allowances by 20% for 11k orphans and widows sponsored by the Royal Humanitarian Foundation.

- Egypt registered the highest daily rise in Covid19 cases in nearly two weeks last Fri.

- GDP in Egypt is estimated to decline to 4% in the fiscal year 2019-20, stated the minister of finance (while the IMF forecast 2% growth). Total revenues have slid by around EGP 124bn given the ongoing Covid19 epidemic.

- Egypt’s government has spent EGP 63bn (USD 3.89bn) of the total EGP 100bn allocated to deal with the Covid19 outbreak. An additional EGP 11bn was allocated to support the health sector across all governorates.

- Annual urban consumer price inflation in Egypt slowed to 4.7% in May (Apr: 5.9%), as food prices declined by 0.3% yoy; core inflation slowed to 1.5% in May (Apr: 2.5%).

- Egypt raised electricity prices by 17-30% (average hike of 19.1%); the remaining electricity subsidy will be phased out over the next 3 years (i.e. until the fiscal year 2024-25). The additional 3-year subsidy is estimated to cost EGP 26.7bn.

- Gold reserves in Egypt increased to a record USD 3.8bn in May, rising by 2.73% mom. Foreign reserves fell by 2.8% mom (more than USD 1bn) to USD 36.003bn in May.

- Automotive sales in Egypt declined by 46.7% mom and 22.4% yoy in Apr; passenger cards were down 49.8% mom and 26.4% yoy.

- Egypt has granted airlines a 50% discount on landing and parking fees, and a 20% discount on ground services at airports in South Sinai, Hurghada and Matrouh.

- After opening to domestic tourists last month at reduced capacity, Egypt’s seaside resorts are planning to open for foreigners from July 1st. Public beaches and parks are to remain shut till end-Jun.

- Jordan’s King ordered all army and security agencies’ personnel be granted an additional service year upon the termination of their service.

- Kuwait’s inflation ticked up by 1.85% yoy in Apr: telecoms prices increased by 5.44%. In mom terms, inflation declined by 0.09%, with food costs down by 1.63%.

- Kuwait Petroleum Corporation will stop hiring expats for the remainder of 2020 and 2021, while the number of special contracts for foreign workers would be cut.

- Lebanon will reopen the Beirut International Airport for commercial flights from Jul 1 while private flights will resume Jun 24; traffic will be at 10% of capacity from a year ago.

- With the Lebanese pound falling to 5,000 to the dollar last week from about 4,100 a week prior, to stem the flow Lebanon’s central bank will inject dollars into the market from Mon, disclosed the President. Earlier in the week, the central bank announced that a new electronic trading platform would be opened on June 23 to unify the price of dollars on the parallel market. Volatile currency movements have been a result of four factors: uncertainty among currency traders about government economic policy; the printing of currency to cover a growing fiscal deficit due to falling tax receipts; the economic impact of coronavirus; and panic in the exchange market in neighbouring Syria, where business people are anticipating the impact of new US sanctions this week.

- Lebanon agreed to use the government’s financial loss figures as a starting point in discussions with the IMF.

- Tax revenues in Lebanon declined by 12.5% yoy in Q1 this year, with customs and VAT revenues falling by 51.5% and 42.3% respectively. About 72.5% of income tax collected came from taxes on interest payments (on bank deposits) vs 54.6% a year ago.

- Oman announced development projects worth OMR 300mn (USD 779.26mn) to support economic growth. No further details were provided.

- The Dhofar Governorate in Oman will be closed from 12 noon of June 13 until July 3 for tourism. Salalah, in Dhofar, is usually seen as a “summer capital” given the monsoon season.

- The head of Oman’s biggest sovereign wealth fund – State General Reserve Fund – was appointed as head of the new Omani Investment Authority (replacing the existing SWFs).

- Hotel revenues in Oman tumbled by 24% yoy to OMR 54.2mn during Jan-Mar, according to the National Centre for Statistics and Information. Hotel occupancy rates fell by 25% to 51.3 (vs 68.4 in the same period last year) while total guests dropped by 19.5% to 389.6k.

- Oman’s Ministry of housing has issued regulations banning expats from ownership of land and real estate in specified places except for the integrated tourism complexes.

- Qatar’s government entities have been directed to reduce costs of non-Qatari employees by 30% as of Jun 1st – either via salary cuts or layoffs – according to a finance ministry document, reported Reuters.

- Qatar will ease restrictions in 4 phases from June 15th: phase 1 will see some mosques reopening and few flights departing while phase 2 (starting Jul 1) will allow for partial reopening of restaurants; phase 3 (beginning Aug 1) will permit resumption of flights from low-risk nations and reopening of malls while phase 4 will allow normal operations to resume in all mosques and expansion of flights.

- Saudi Arabia reopened mosques 40 minutes before Fri prayers starting Jun 12th except for in Makkah and Jeddah. The country will also resume professional sports activities starting Jun 21st.

- Saudi Arabia’s trade surplus narrowed by 38.3% yoy and 32.5% qoq to SAR 73.74bn (USD 19.64bn) in Q1 2020. Oil exports fell by 21.9% (to USD 40bn) and non-oil exports by 16.5% during the quarter while imports declined by 4.4%. China remained the top trading partner: top export destinations were China, Japan and India while import destinations were China, US and the UAE. In 2019, trade surplus had fallen by 25.5% yoy to SAR 439.43bn, as merchandise exports dipped by 11.2% to SAR 980.69bn and imports rose by 5.3%.

- Trade between Saudi Arabia and the GCC nations (excluding Qatar) fell by 14% yoy to SAR 18.84bn (USD 5.01bn) in Q1 this year. UAE accounted for 65.3% of this volume, while Bahrain and Oman together clocked in almost 25%.

- Industrial production Index in Saudi Arabia ticked up by 7.04% yoy and 11.35% mom in Apr (Mar: -3.29% yoy), thanks to a 22.5% yoy (and 23.3% mom) increase in mining and quarrying activity (oil & gas).

- Value of contracts awarded in Saudi Arabia declined by 8% yoy to SAR 45.2bn (USD 12bn) in Q1, though the value was up 28% qoq, according to the US Saudi Business Council.

- Expats in private and public sector enterprises in Saudi Arabia was 6.48mn at end-2019, accounting for 76.8% of the total workforce, according to the General Authority for Statistics.

- Dubai, ranked 23rd globally, is the most expensive city in the Middle East for expatriates, according to Mercer’s 26th Annual Cost of Living Survey 2020. Riyadh (31), Abu Dhabi (39) and Beirut (45) were other contenders in the list topped by Hong Kong, Ashgabat and Tokyo.

UAE Focus

- Dubai PMI increased to 46 in May (Apr: 41.7), as declines in both output and new orders softened; fall in employment was the slowest since Feb. Businesses revealed weak consumer demand and slow market response to the easing of restrictions.

- Net foreign assets held by the UAE national banks grew by 17.5% to AED 79.8bn in Jan-Apr from end-Dec, according to the central bank.

- UAE’s non-oil trade grew by 4.4% yoy to AED 1.603trn in 2019: exports, at AED 231.23bn, accounted for 14.4% of total trade volume while imports stood at 58% of the total.

- In an interview with Bloomberg, UAE’s minister of infrastructure development disclosed that economic recovery is likely to be U- or V-shaped while also stating that the country had a pipeline of AED 20bn worth federal infrastructure projects, including AED 7bn in state-sponsored housing programmes.

- Abu Dhabi introduced a new initiative to allow for faster issuance of business licenses: the new e-contract and e-signature system will ease the process of obtaining a license for one-person and limited liability companies.

- In line with the stimulus packages announced earlier, licensed businesses in Abu Dhabi – with activities listed as restaurants, entertainments and tourism (except hotels) – can now apply for a 20% refund on rents of commercial properties, according to the Abu Dhabi Department of Economic Development.

- Fitch affirmed the emirate of Ras Al Khaimah’s long-term foreign-currency issuer default rating (IDR) at “A” with a stable outlook.

- Remittances from UAE increased by 7.8% yoy to AED 41.4bn in Q1, with top destinations India (37.8%), Pakistan (11.4%), Philippines (7%), Egypt (6.6%) and the US (3.6%).

- UAE continues to reopen: from Jun 14th, Dubai government entities will operate at 100% of their capacity while in Sharjah, around 30% of government employees will resume work from offices. Dubai World Trade Centre is planning to restart events and exhibitions in H2 this year.

- Abu Dhabi’s hotels saw an increase in occupancy rates to 55.2% in May (Apr: 47.3%), according to STR estimates, though the average daily rate and revenue per available room were down by 26.2% (to AED 251.4) and 22.1% (to AED 138.88) respectively.

- The value of real estate transactions in Dubai touched AED 20bn in Q1, according to the Dubai Land Department.

- Euromonitor estimates that consumer spending in the UAE will recover only by late 2021.

- Airline woes continue: Emirates and Etihad airlines have extended pay cuts for staff until Sep (in some cases reduction of basic salaries by 50%); Emirates laid off over 1k employees last week; flydubai has extended indefinitely its reduced pay for employees, while also placing many pilots on unpaid leave for a year.

Weekly Insights

What policy changes do the GCC nations need to implement to support medium- to long-term growth?

The GCC nations are not out of the woods, as a flattening of the curve has yet to happen when it comes to Covid19 confirmed cases. There are however nodes of optimism as the number of recoveries outpace the confirmed cases in a few. Stimulus packages across the GCC have a few measures in common – rate cuts, liquidity enhancing measures, deferring of loans/ credit card payments as well as support for SMEs and affected sectors in addition to direct support for sectors decimated by the outbreak (tourism, hotels & hospitality and airlines to name a few). The effectiveness of these policies remains unknown (for now), given scant data releases.

After almost 2 months of lockdowns, the nations are phasing their recovery plans, with Dubai (UAE) the most aggressive, having reopened its malls to full capacity to opening beaches, parks, restaurants/ hotels, gyms and so on as well as the public sector signaling a “safe to go to work” with the return to full capacity at offices starting today.

The current economic situation underscores the need to create a new development model. Going forward, three broad policy measures should support economic growth:

- Monetary policy: Most GCC nations are pegged to the dollar and follow the Fed’s interest rate moves, limiting the use of other instruments of monetary policy (e.g. open market operations) and restricting independent policy moves from the central banks (other than stimulus packages to increase liquidity). What can the central banks do in addition to support the economies? Two innovative ways of providing support could be through:

- The establishment of central bank swap lines, with an option for the larger central banks to tap the Fed or People’s Bank of China (PBoC): this will act as a means for regional central banks to tap additional funding;

- Monetise debt by issuing of T-bills: this is necessary to support the private sector due to the lack of a local currency debt markets and central banks’ limitations to conduct open market operations.

- Fiscal policy: most of the GCC governments are still highly dependent on oil revenues and as the current situation highlights, it is not a sustainable long-term model.

- First and foremost is the need to move away from pro-cyclical policies: i.e. increasing government spending during a period of higher economic growth and reducing spending during recessionary periods. Additionally, allow for deficit financing, along with the institution of fiscal rules for long-term fiscal sustainability.

- Rationalize government spending: this could be undertaken either by reducing the size of government (e.g. reducing public sector wage bills) or by removing subsidies. The most detrimental policy is when governments reduce capital spending during times of distress – as has been seen in many GCC nations in the recent weeks.

- Diversify government revenues by raising non-oil fiscal revenues and increasing the efficiency in collection. Some GCC nations have introduced VAT and excise taxes in the recent past, but raising taxes or introducing new taxes during this period will likely be detrimental (i.e. reduce consumption, lower business/ consumer sentiment). However, it might be opportune to revisit the vast number of fees charged on consumers/ businesses toward fewer broad-based taxes thereby easing business and living costs.

- Public investment towards infrastructure projects, education and health programs as well as green/ clean technologies will support job creation and economic growth. The governments can take the first step to ensure a project pipeline, focusing on public-private partnerships (also providing additional incentive to the private sector & SMEs to join). The development of local currency debt and mortgage markets to finance housing and long-term infrastructure projects will also support growth.

- Establishment of social safety nets/ protection programs/ pensions scheme. With a high concentration of expat population, many of whom are facing either layoffs or salary reductions, a medium- to long-term policy could be to introduce social safety nets and/ or a pension scheme to reduce financial burdens. For an employee, a contribution towards a pension fund would ensure sufficient savings (in case of job losses/ retirement) and for employers, this provides them with an “investment fund” and support end-of-service/ gratuity payments (especially critical if companies undertake massive layoffs, as is the current case).

- Structural reforms (a non-exhaustive list):

- Greater role of the private sector: The government needs to support the private sector via privatisations and PPPs. Supporting SMEs are another way to ensure greater private sector activity: however, this needs strong governmental support via digitization of processes, reduction in business costs, methods / incentives to ensure timely payments from clients, removal of multiple fees and hidden costs and so on.

- Efficacy of the regulatory/ legal infrastructure to implement bankruptcy/ insolvency measures. Develop insolvency frameworks to support out-of-court settlement, corporate restructuring and adequately protect creditors’ rights.

- Ability to attract and retain foreign workforce: the current situation highlights the transitory nature of work in the region. Job losses are forcing many skilled expat residents to leave the country given the linkages of the residency visa with jobs/ sponsors. While UAE and Saudi Arabia have introduced a longer-term visa policy, the implementation has been slow and selective. A permanent residency would attract and retain a foreign workforce which can also contribute significant economic gains (retained earnings, higher consumption levels, investments in the real estate sector etc).

- Work from home policies: the one positive side-effect of the current crisis has been the realization that working from home is a feasible option. Companies can then offer flexible work options (employees can stay at cheaper locations, save on rents and commute) as well as reduce office space (rents are a significant expense for businesses).

- Availability of additional data points in a timely manner: for example, information on the retail sector or SMEs would help understand the extent of impact of the current crisis. Given evidence that lending to GREs maybe crowding out private sector lending (Chart 2 in insights last week), the central bank should maintain bank-level daily flow data (and maybe publish weekly numbers) on new loans to corporates/ SMEs.

Media Review

Robinhood traders are betting against veteran billionaire investors… and winning?!

https://www.ft.com/content/dd6c7674-d0ed-4865-82ed-48ee169bc6cc (long read)

https://markets.businessinsider.com/news/stocks/robinhood-traders-betting-stocks-against-veteran-investors-winning-buffett-icahn-2020-6-1029289894

Expats depart Dubai: bad news for the economy

https://www.bloombergquint.com/business/expats-are-leaving-dubai-and-that-s-bad-news-for-the-economy

Which Economic Stimulus works?

https://www.project-syndicate.org/commentary/stimulus-policies-must-benefit-real-economy-not-financial-speculation-by-joseph-e-stiglitz-and-hamid-rashid-2020-06

Europe to reopen to tourists

https://www.ft.com/content/6b41bce2-ab17-11ea-a766-7c300513fe47

Market Snapshot as of 14th June 2020

Weekly % changes for last week (11-12 Jun) from 4th Jun (regional) and 5th Jun (international).

Powered by: