Weekly Insights: PMIs for Jun point to a V-shaped recovery, but is that the case? GDP data for Q1 were released in both Saudi Arabia and Dubai – affecting the latter more, not surprising given its higher degree of diversification. Last but not the least, a quick look into why the Lebanese pound hit close to 10,000 vis-à-vis the dollar in the black market last week.

Markets

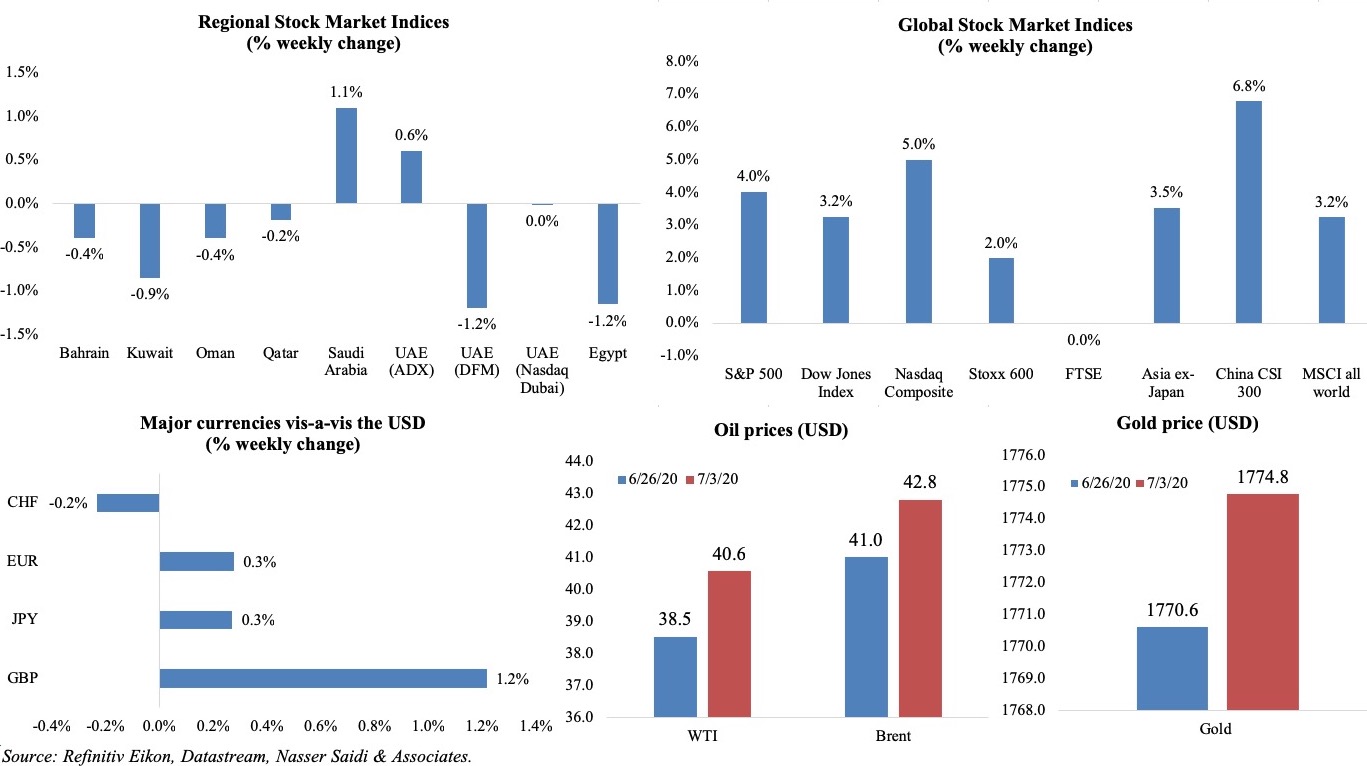

Stock markets in the US gained after a major uptick in non-farm payrolls; Stoxx 600 posted gains while Asian markets touched 4-month highs as China’s PMIs continued to rise; China’s CSI 300 closed at the highest level in 5 years and 6.8% higher compared to a week ago. Regional markets were mostly down, with Saudi Arabia and Abu Dhabi gaining ground, after the former extended government stimulus measures and the latter was supported by Taqa’s asset-transfer deal making it the 3rd largest publicly traded company by market cap in the UAE. Major currencies were little changed except for the GBP, which rose against the dollar on some positive economic data while Brexit negotiations continue unresolved. Oil prices gained compared to a week ago though concerns are rising given Covid19 resurgence (especially in the US, the largest consumer of oil) and gold price edged up by 0.2% on its safe haven status. (Graphs in the last section.)

Global Developments

US/Americas:

- Non-farm payrolls in the US surged by 4.8mn in Jun (May: 2.7mn), posting the largest-ever single month gain. However, the economy has recovered only just over a third of a historic plunge of 20.787mn jobs in Apr. Average hourly earnings dropped to 5% yoy from 6.6% the month before, as more low-wage earners returned to jobs (in mom terms, it decreased by -1.2% from -1% in May). Unemployment rate fell to 11.1% in Jun (May: 13.3%), as states reopened after a lockdown period, and thanks to a decline in those on temporary layoffs.

- Initial jobless claims eased to 1.427mn in the week ended Jun 27 – the 15th consecutive week that filings were above 1mn; more than 48mn have filed for unemployment insurance over the past 15 weeks. Continuing claims increased by 59k to 19.29mn in the week ended Jun 20.

- Factory orders rebounded by 8% mom in May (Apr: -13.5%), supported by the demand for transport equipment (+82% vs -48.9% in Apr) led by vehicles and defense aircraft. Orders for non-defense capital goods, excluding aircraft, rose 1.6% in May, down from the prior estimate of a 2.3% rise.

- US ISM manufacturing PMI increased to 52.6 in Jun (May: 43.1), after 3 straight months of declines, and posting the strongest reading since Apr 2019. New orders sub-index jumped to 56.4 in Jun (May: 31.8), the highest since Jan 2019, while employment remained below-50 (42.1 from May’s 32.1).

- Markit PMI stayed below 50, with the Jun reading at 49.8 from May’s 39.8, thanks to gains in output, employment and new orders.

- Pending home sales in the US surged by a record 44.3% mom in May, following the 21.8% dip the month before. In yoy terms, sales were down 5.1% (Apr: -33.8%). The average rate on the 30-year fixed mortgage started May around 3.2%, according to Mortgage News Daily; by the start of Jun it was falling below 3%. S&P Case Shiller home prices increased by 4% yoy in Apr (Mar: 3.9%).

- Chicago PMI improved to 36.6 in Jun from May’s 38-year low reading of 32.3. Production and new orders saw gains, while supplier delivery and employment declined; further, only 18% of respondents were planning to expand their workforce.

- ADP employment change stood at 2.37mn in Jun, from an upwardly revised 3.07mn in May. Small businesses hiring had picked up in Jun, with leisure and hospitality adding 916k jobs.

Europe:

- Business climate in the eurozone eased to -2.26 in Jun (May: -2.41) and economic sentiment improved to 75.7 from the previous month’s 67.5 while consumer confidence stayed flat at -14.7.

- German Markit manufacturing PMI increased to a 3-month high of 45.2 in Jun (May: 36.6). A similar increase was observed at the EU level, with the PMI rising to 47.4 from May’s 39.4.

- Markit services and composite PMI in Germany improved to 47.3 (May: 32.6) and 47 (a 4-month high vs May’s 32.3) respectively. The EU Markit services and composite PMI strengthened to 4-month highs of 48.3 (30.5) and 48.5 (31.9) respectively. France was the best-performing country overall.

- Inflation in the Euro area stood at 0.3% yoy in Jun (May: 0.1%), according to early estimates of the HICP, while the core CPI eased to 0.8% from the previous month’s 0.9%. Prices of food, alcohol and tobacco increased by 3.1% (May: 3.4%) while energy prices fell by 9.4% (May: -11.9%).

- Inflation in Germany increased by 0.9% yoy and 0.6% mom in Jun (May: 0.6% yoy and -0.1% mom); annual HICP advanced to 8% yoy in Jun (May: 0.5%).

- German retail sales improved by 13.9% mom in May (Apr: -6.5%), supported by online sales (+28.7%); yoy growth rates were also higher (3.8% in May from Apr’s -6.4%).

- With an additional 69k persons out of work, unemployment rate in Germany inched up to 6.4% in Jun (May: 6.3%). Separately, EU unemployment rate grew to 6.7% in May (Apr: 6.6%).

- UK GDP declined by 2.2% qoq and 1.7% yoy in Q1 (Q4: -2% qoq and -1.6% yoy) – the largest fall since 1979. The services sector shrank by a record 2.3% while total business investment dropped by 0.3% qoq.

- Markit Manufacturing PMI in the UK rose to 50.1 in Jun – above-50 for the first time since Feb – from May’s 40.7; though business sentiment touched a 21-month high, new export businesses fell for the 8th consecutive month. Services PMI surged to 47.1 (May: 29), with business expectations rising to a 4-month high, while the Composite Output Index rose to 47.7 in Jun (May: 30).

Asia Pacific:

- China’s NBS manufacturing PMI inched up to 50.9 in Jun (May: 50.6); though new export orders are still below-50, the sub-index has been rising for 2 straight months (42.6 from 35.3 in May). Non-manufacturing PMI increased to 54.4 in Jun (May: 53.6).

- China’s Caixin manufacturing improved to a 6-month high of 51.2 in Jun (May: 50.7), thanks to an increase in domestic demand while new export orders continue to fall. Services PMI increased to a 10-year high of 58.4 (May: 55), with new businesses rising to 57.3 (May: 55.8) and new export businesses expanding on foreign demand (in contrast to manufacturing).

- Japan’s Tankan’s large manufacturing index slipped to -34 in Q2, the lowest reading since Jun 2009, from -8 in Q1, with non-manufacturing also showing a similar dip (-17 from 8 the previous quarter). Outlook also worsened, for both large manufacturing (to -27 from -11) and non-manufacturing (-14 from -1).

- Japan retail trade inched up by 2.1% mom in May, though down by a massive 12.3% in yoy terms. Data showed a substantial drop in spending on items like cars, clothing and general merchandise.

- Industrial production in Japan declined by 8.4% mom in May, following Apr’s 9.8% dip, as weak global demand continued amid depressed domestic spending. Production at major automakers slumped 62% yoy in May, following a 55% decline in Apr.

- Industrial output in Korea plunged by 5.6% yoy and 1.2% mom in May: production of semiconductors rose by 10.8% mom, while auto output declined by 21.4% given supply chain disruptions.

- India’s fiscal deficit widened to INR 4.66trn in Apr-May (Apr: INR 2.795trn), close to 60% of the budgeted annual target for the fiscal year Apr 2020-Mar 2021, as spending was increased to tackle the ongoing pandemic. Current account balance improved to USD 0.6bn surplus in Jan-Mar 2020 – after more than a decade – and from the USD 2.6bn deficit the previous quarter, thanks to a marginally lower trade deficit at USD 35bn alongside a 16% rise in net invisible receipts (higher remittances and a rise in investment flows).

- Markit manufacturing PMI in India increased to 47.2 in Jun (May:30.8): output and new orders fell at slower rates, while new export orders fell for a 4th consecutive month. Services Business Activity Index rose to 33.7 in Jun (May: 12.6), remaining below-50 for the 4th successive month, and with a sharp fall in new orders as consumption declined. The Composite PMI Output Index increased to 37.8 in Jun, up from 14.8 in May.

- Retail sales in Singapore plummeted by 21.5% mom and 52.1% in May (Apr: -21.3% mom and -40.3% yoy), largely due to the imposed “circuit breaker” measures. Excluding motor vehicles, retail sales fell 45.2%, lower than the 32.5% in Apr.

- PMI in Singapore improved, but stayed well below-50, with a reading of 48 in Jun (May: 46.8). The electronics sector PMI remained under 50 for the 5th consecutive month, but rising 1.4 points to 47.6.

Bottom line: Though many economic indicators have shown a recovery from the dismal drops in lockdown months, beware of equating this to a V-shaped recovery. Look at annual changes not month to month changes. Global manufacturing PMI rose by a record 5.4 points to 47.8 in Jun, with 15 of 32 countries signaling expansions. However, global supply chain disruptions continue: average vendor lead times lengthened for the eleventh consecutive month and stocks of raw materials and finished goods at manufacturers fell again. As China’s PMI numbers show, growth has been driven by domestic demand rather than foreign; a silver lining is that the resurgence of Covid19 clusters does not seem to have dampened demand. The second half of the year started with Covid19 continuing to grab headlines: US dominates number of cases (with record highs reported in Florida and Texas), with Brazil and Russia close behind. While in the US many states are scaling back plans to reopen, the UK eased restrictions, opening restaurants, theme parks, galleries and hotels among others; closer home, many nations in the Middle East have opened airports for international travel, with Dubai opening for tourists starting July 7th. The EU are yet to agree on the EUR 750bn Covi19 recovery fund proposal while in the US, the question remains whether various stimulus measures will be extended (the Paycheck Protection Program has already been extended till Aug). Stimulus measures are driving up global debt, but a sudden rolling back could be detrimental to the economies and growth.

Regional Developments

- The IMF expects GCC growth to shrink by 7.6% this year (from -2.7% dip forecast in Apr 2020), given the impact of low oil prices and the Covid19 crisis. Last week, the IMF had revised down Saudi growth to -6.8% (from -2.3%), which SAMA’s governor stated to be “more pessimistic” than theirs.

- Stimulus measures in Bahrain to be extended: the government will pay 50% of salaries for insured citizens employed in the private sector (in firms most affected by Covid19) in addition to bearing citizens’ domestic electricity costs for their primary residences. The cost is estimated at BHD 70mn and between BHD 12-15mn respectively for the two measures.

- Bahrain’s Labour Market Regulatory Authority will reduce by 50% the fees levied on the issuance and renewal of work permits. The hardest hit businesses will be exempt from paying fees during Jul-Sep.

- Egypt’s currency appreciated vis-à-vis the greenback, supported by positive news like support from the IMF (to the tune of USD 5.2bn), rise in foreign investments in Egyptian T-bills and the resumption of international tourism (albeit at select pockets within the country).

- Egypt reported a trade deficit of USD 2.36bn in Apr: exports declined by 32.3% to USD 1.84bn while imports’ value plummeted by 40.1% to USD 4.19bn.

- FDI flows into Egypt grew by 11% to USD 9bn in 2019, according to UNCTAD, making it the largest FDI recipient in Africa. Overall FDI flows to Africa was down by 10% to USD 45bn while flows into North Africa was down 11% to USD 14bn.

- Egypt’s President approved a 14% hike in pensions effective Jul 1st.

- A CAPMAS survey highlights the impact of Covid19 on jobs in Egypt: about 61.9% of employees aged 15-64 were affected by workplace changes, with about 26% losing their jobs. About 55.7% of citizens noted that their work hours fell, while many reported declines in salaries (87.9% of those aged 15-24 and 56.5% of those aged 55-64).

- ENI made a new gas discovery in offshore Egypt: the well, discovered a single 152 metres thick gas column, and will be explored with the aim of “fast tracking” production.

- A gold deposit with estimated resources of 1 million ounces was discovered in Egypt. The government plans to invest more than USD 1bn to develop the deposit over the next decade.

- To comply with the OPEC+ cuts, Iraq will reduce crude oil exports from its southern terminals (mainly Basra Light flows) in Jul: planned exports will be around 1.53mn barrels per day (bpd), from 3.1mn bpd planned in Jun.

- According to the oil ministry, Iraq’s oil exports fell to 2.8mn barrels per day (bpd) in Jun, from 3.21mn bpd in May, with exports from its southern Basra terminals totaling 2.7mn bpd. Oil revenues touched USD 2.86bn in Jun, with an average price per barrel of USD 33.9.

- Jordan issued a double-tranche Eurobond last week at competitive rates – USD 500mn at 4.95% over 5Y maturity and USD 1.25bn at 5.85% over 10Y maturity – and it was oversubscribed by more than 6.25 times, attracting bids worth over USD 6.25bn.

- Jordan’s minister of finance disclosed that the government had injected USD 705.2mn into the private sector during the ongoing Covid19 pandemic, to increase liquidity.

- The World Bank approved a USD 374mn project to provide cash support to 270k underprivileged and vulnerable households in Jordan.

- Kuwait’s National Assembly committee approved that a draft law proposing a quota for expatriates is constitutional. The bill – which proposes a quota system, e.g. that Indian expat community should not exceed 15% of the national population – will now be referred to the committee for consideration.

- Kuwait will partially resume commercial flights (which have been suspended since Mar) from Aug, at 30% capacity i.e. with a maximum of 100 flights and 10k passengers a day. Phase 2 and 3 will begin in Feb and Aug 2021 respectively with 60% and full capacity respectively.

- Lebanon’s PMI rose to 43.2 in Jun (May: 37.2), though plagued by slumps in output and new orders amid signs of demand weakness. The rate of workforce contraction reported its quickest pace since Mar while new export orders declined for the 4th month in a row; input prices soared.

- Talks with the IMF are on hold, disclosed Lebanon’s finance minister, while a “unified approach” is being discussed to define and calculate losses in all sectors. Earlier in the week, another member of the negotiating team announced his resignation. A parliamentary fact-finding committee stated that losses in the system were between a quarter and half the amount set out in a government recovery plan that was submitted to the IMF.

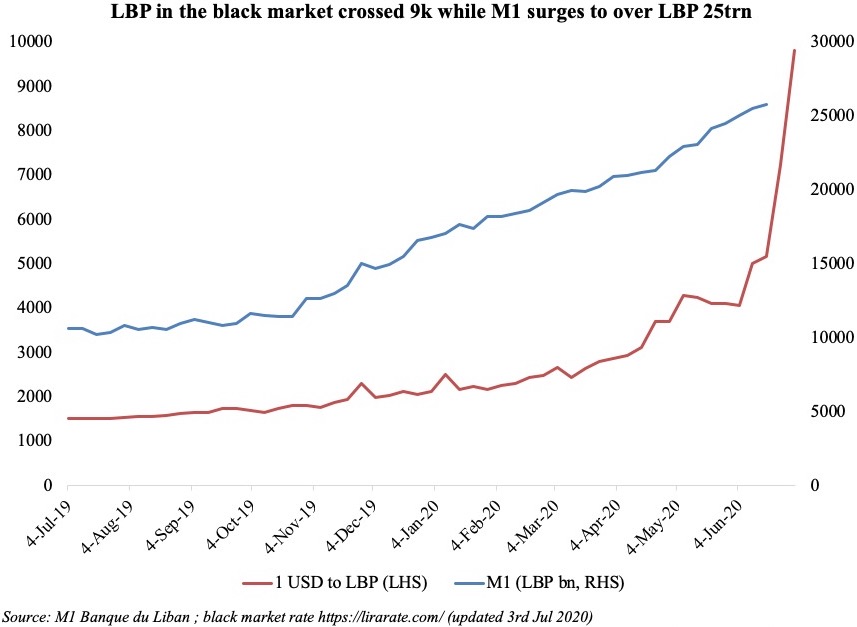

- The dollar rate on the black market in Lebanon had reached LBP 10k on Thursday before declining to an average LBP 8200 on Fri (after the reopening of the airport and the central bank’s pledge to provide lenders with foreign currency to finance imports).

- Importers in Lebanon will be supplied with dollar banknotes to buy goods from abroad at a rate of LBP 3,200. The Economy Ministry will also subsidize 280 consumption items at this rate “within days”, and “close to USD 100mn will be injected by the central bank each month to subsidize the basic food items”.

- Lebanon’s banks will ease limits on dollar transfers, which were imposed last Nov, revealed the chairman of the Association of Banks in Lebanon.

- Banque du Liban’s board of directors decided to reduce the interest rates to zero percent on the banks’ mandatory reserves and on the financial engineering transactions.

- Oman is in talks with international and regional banks for a USD 2bn bridge loan, reported Reuters. Previous talks were put on hold at the onset of the Covid19 pandemic.

- The Central Bank of Oman raised OMR 56mn by issuing Treasury bills. The interest rate on the Repo operations with the CBO is 0.5%.

- Oman Tax Authority started to apply a 100% selective tax on alcoholic beverages from Jul 1st; it was temporarily reduced to 50% prior to this hike, and the tax is not applicable at duty-free shops.

- Oman launched a new tax card system from July 1, replacing the tax certificate currently in use: this will be proof of the registration for any taxpayer from the tax Authority. A copy of the card will be requested by when issuing contracts or undertaking any transaction.

- In line with its compliance to OPEC+ cuts, Oman notified its crude oil customers of a cut of about 10% in allocations for Sep loading and delivery.

- The value of real estate transactions in Oman fell by 19.5% to OMR 878.9mn at end-May. Of these, OMR 586mn worth transactions were mortgage deals.

- SMEs registered at the Public Authority for Small and Medium Enterprises Development (Riyada) in Oman increased by 11.97% yoy to 44,197 firms at end-May 2020.

- Tourists into Oman grew by 8.14% yoy to more than 2.5mn in 2019: this included 1.4mn from the GCC, 436k from India (+21.8% yoy) and 107k form China (+141%).

- Oman’s citizens account for 59.3% of the total population as of Jun 26th this year, while expats stood at 1,864,442 (40.7% of total).

- Qatar pledged USD 100mn in humanitarian assistance to Syria, bringing the total assistance to USD2bn till date, according to the foreign ministry.

- Saudi Arabia’s economy shrank by 1% yoy in Q1 (Q4: 1.7%), largely due to the dip in the oil sector (-4.6%) while the non-oil sector grew by 1.6%. A sharper downturn can be expected in Q2, especially as lockdown measures were strictly imposed during this period.

- Non-oil sector PMI in Saudi Arabia shrank again in Jun, dropping to 47.7 from May’s 48.1, with faster reductions in business activity and new work, as firms adjusted to cautious consumer spending. Employment fell at the fastest pace since the survey began in Aug 2009.

- Saudi Arabia announced the extension of several government initiatives to support the private sector: this includes unemployment insurance for Saudi employees, postponing VAT payments, accelerating VAT refunds, suspending fines related to recruitment and partial exemption from the financial compensation for the expiring visas of residence among others. The government has so far rolled out 142 initiatives to support individuals, private sector enterprises and investors since the outbreak of the pandemic worth SAR 214bn (USD 57bn).

- The 15% VAT came into effect in Saudi Arabia from Jul 1st: there was an anticipatory increase in retail sales days before this came into effect, especially after the lockdown measures were eased. VAT will also be applied goods imported via online platforms.

- Saudi Arabia raised SAR 8.495bn (USD 2.27bn) in Islamic bonds or sukuk in Jun, according to the finance ministry.

- SAMA’s latest report shows that 155,893 mortgage loans (+19% yoy) worth a total of SAR 7.8bn (+39%) were offered by financing institutions in May 2020.

- Remittances from Saudi Arabia increased by 5.37% yoy to SAR 55.48bn (USD 14.79bn) in Jan-May 2020. In May, remittances surged by 18.4% yoy and 20.8% mom to SAR 11.83bn.

- Saudi Arabia plans to open 38 tourist sites in seven tourist destinations by 2022, revealed the minister of tourism, from 15 sites in four tourist destinations ready currently.

- According to IATA, Middle East airlines posted a 98% decrease in traffic in May, versus a 97.3% dip in Apr.

UAE Focus

- UAE merged some ministries and departments today (Jul 5th), in a bid to make the government “flexible, fast and able to keep up with changes”. Some of the changes included a phasing out of government services within 2 years (becoming digital portals instead), merging 50% of federal authorities or adding them to ministries, and merging ministries among other changes. A strong emphasis has been placed on “agile government”, digital policies and food security, with a self-imposed time limit of one year to meet the new priorities.

- UAE non-oil sector activity strengthened to 50.4 in Jun (May: 46.7), recording the 1st rise in output since Dec. While firms are reporting an increase in activity as lockdown eased – output rose at the strongest pace since Oct 2019 and new orders grew at the fastest since Aug 2019 – cost cutting is prevalent and the employment sub-index dropped to 46.4 (May: 48.7).

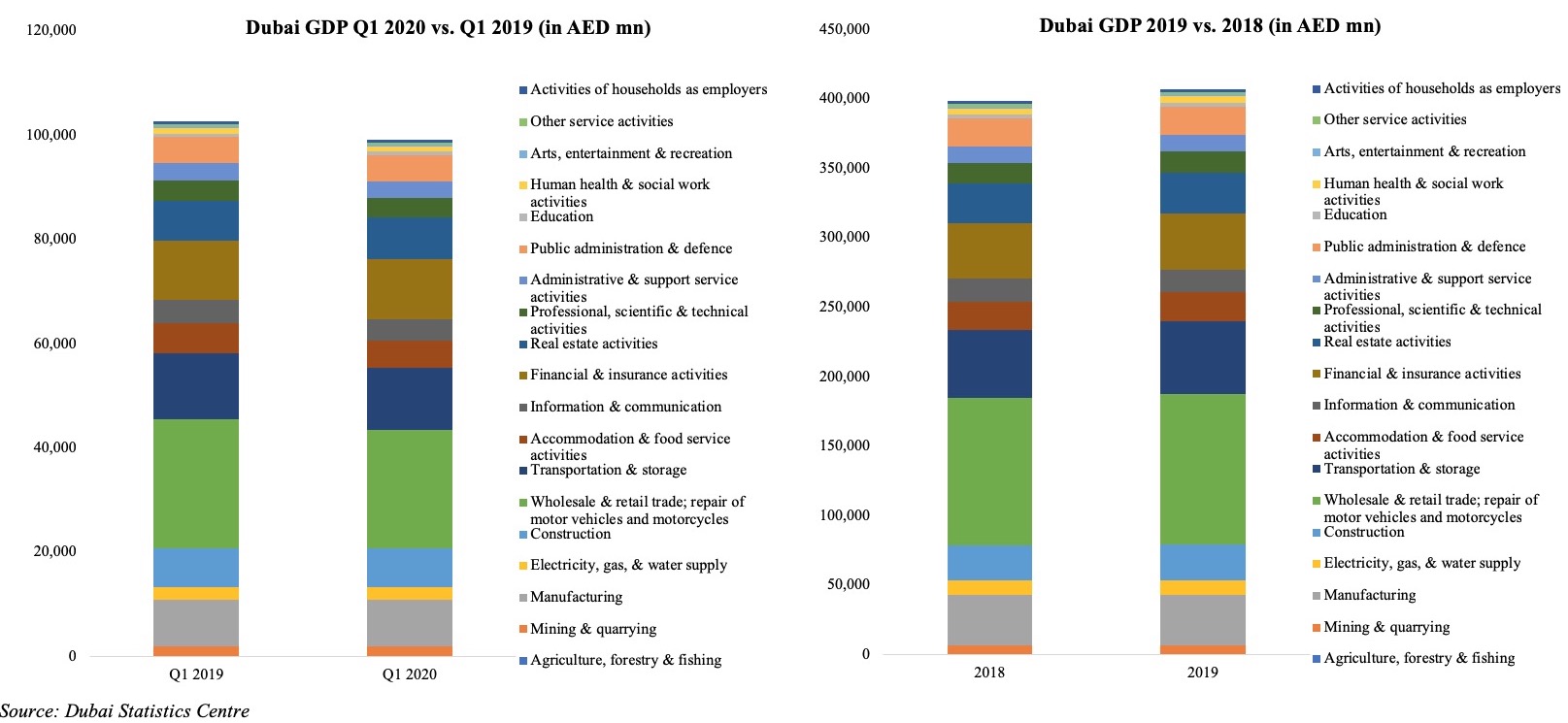

- Dubai’s GDP declined by 3.5% yoy in Q1 2020, versus 2.2% growth in full year 2019, as Covid19 affected businesses in the emirate’s key tourism and business sectors. Real estate, finance and manufacturing sectors reported growth in Q1.

- Dubai World repaid the final USD 8.2bn of the debts, two years ahead of the agreed schedule. The payment came through the emirate’s own funds, dividend payments from the portfolio companies that together make up “Dubai Inc.” and a loan from Dubai Islamic Bank. This is a sound, pre-emptive move by Dubai given economic and financial market uncertain prospects. This is a time where cash-flow management should be the top priority for businesses and that is driving Dubai World’s actions.

- Abu Dhabi Department of Economic Development announced a new coalition project to support micro-, small- and medium-sized enterprises operating in highly-skilled fields, particularly “science, healthcare, information technology and innovative solutions” via mortgages from leading banks.

- UAE issued 4201 new licenses in Jun, bringing the total number to 652,885. Dubai represented 46% of total licenses issued in the UAE while shares in Abu Dhabi and Sharjah touched 22.3% and 12.9% respectively.

- Dubai reported an 83% yoy surge in e-commerce business licenses (to 1947) issued in H1 this year. Lifestyle coaching topped the list of online activities being sought through DED licenses during H1 this year, followed by marketing services through social media.

- Dubai will open the city to international tourists from Jul 7th:

- UAE Cabinet approved an additional AED 320mn (USD 87mn) budget for national universities for the 2020-2021 academic year.

- Damac’s chairman is considering buying out minority shareholders to take the USD 1.1bn listed company private, reported Reuters.

- Emirates airline disclosed that the firm had processed close to 650k refunds amounting to over AED 1.9bn (USD 517mn) over the past two months.

- Abu Dhabi postponed retirement subscriptions payment for private sector employers for further three months starting as of Jun 2020 until Aug 2020 without charging any additional fees to such entities.

- According to Wealth-X’s latest report, the number of billionaires in UAE declined to 47 last year, from 55 in 2018, with their wealth dropping to USD 163bn (vs 2018’s USD 165bn). Globally, the number of billionaires rose 8.5% to 2,825 in 2019, while combined wealth up 10.3% to USD 9.4trn.

Weekly Insights: Charts of the Week

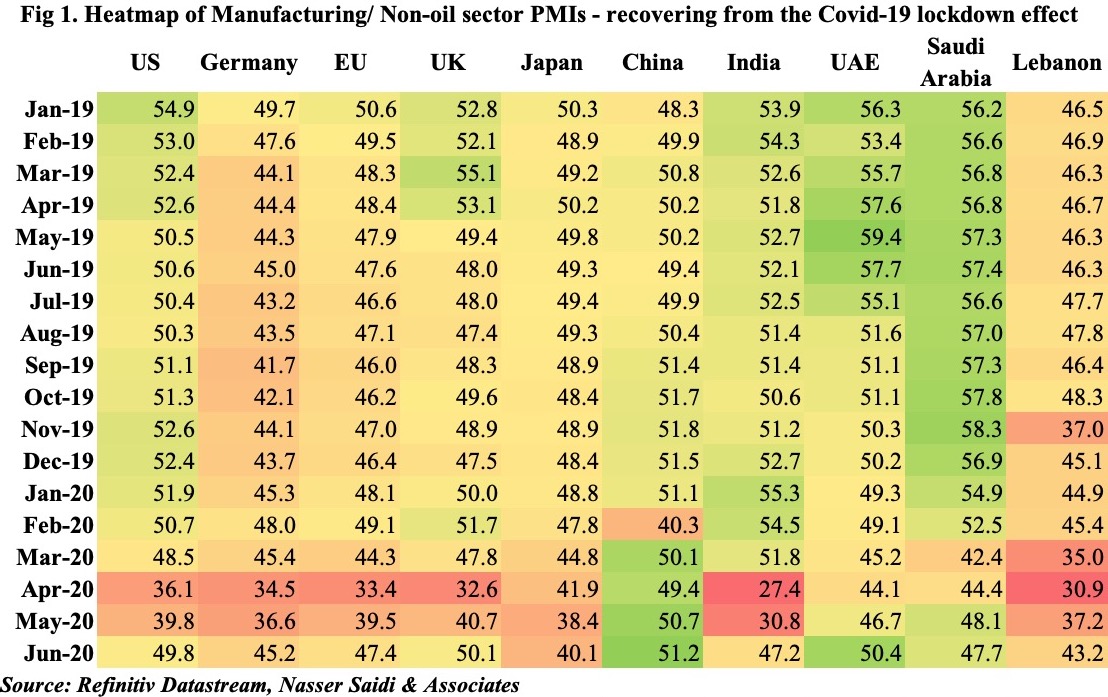

Fig 1. PMIs are recovering after the lockdowns imposed during the Covid19 outbreak

The PMI readings have improved across the board in Jun, except in Saudi Arabia, as nations ease restrictions after near-complete lockdowns. While business activity has picked up, supply chain disruptions are still widespread, export orders have struggled to increase given the lack of external demand and employment has been slow to pick up (given cost-cutting measures). China’s higher domestic demand has supported activity. Re-emergence of Covid19 cases could potentially derail the improvement in PMIs.

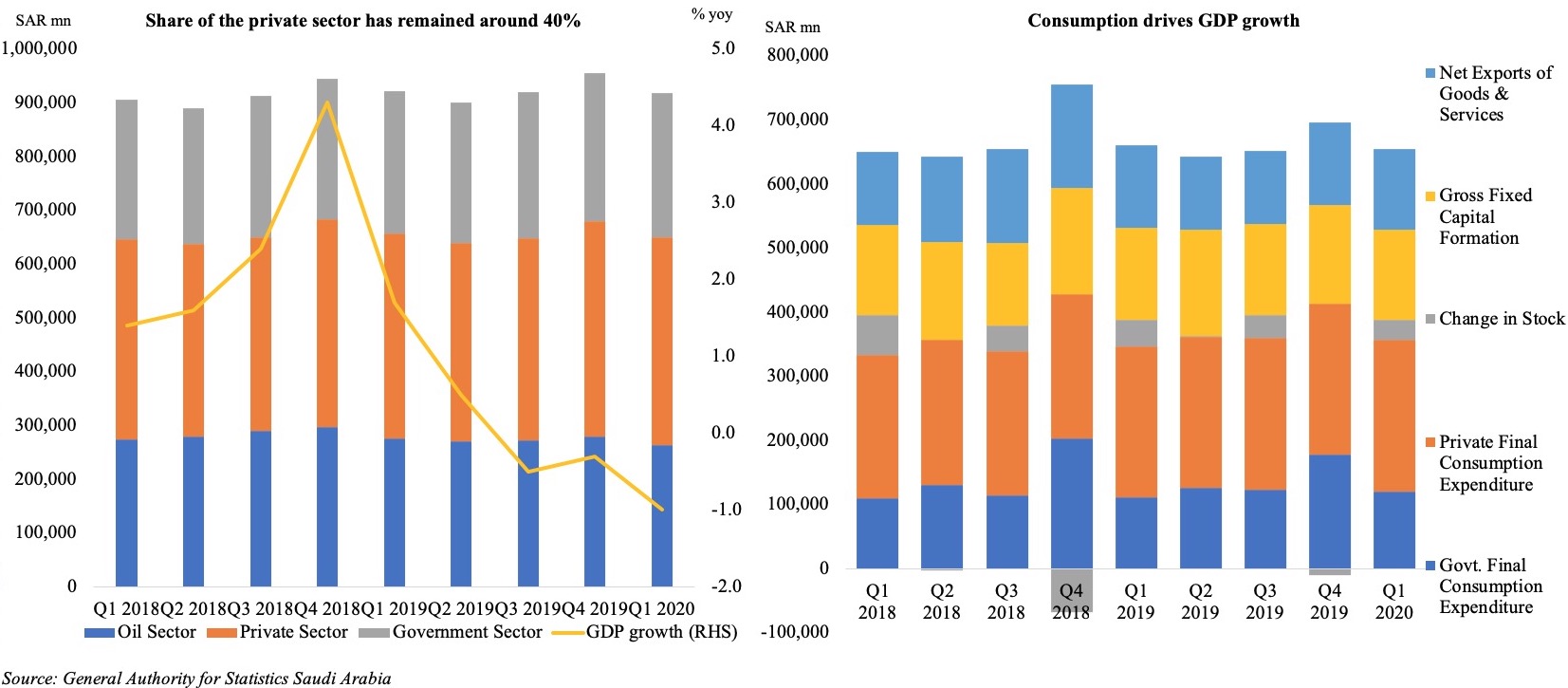

Fig 2. Saudi Arabia’s GDP posts a decline of 1% yoy in Q1 this year

GDP in Saudi Arabia declined by 1% yoy and -4.5% qoq in Q1 this year. The share of the private sector stands at around 40% of total GDP, implying that the country stands to lose directly from both lower oil prices and the immediate impact on services (including trade and tourism) due to Covid19. In Q1, yoy growth rates declined in mining, manufacturing and agriculture, while other sectors witnessed a slowing in activity – e.g. construction slowed to 2.2% growth vs Q4’s 7.7%, growth in wholesale & retail trade, restaurants & hotels almost halved to 4.8%, while finance eased to 1% growth (Q4: 5.6%). GDP by component reveals that while shares of government consumption and investment declined in Q1 (from close to 50% in Q4 to 40% in Q1), personal consumption expenditure and net exports gained.

Going forward, oil GDP will decline further given compliance to the OPEC+ production cuts while non-oil GDP are likely to be negatively affected by the VAT hike (lowering consumer spending, affecting wholesale and retail trade) as well as the reduction in capital spending (affecting construction sector).

Fig 3. Dubai GDP declines by 3.5% yoy in Q1 2020, after posting 2.2% growth in 2019

The Dubai emirate is not dependent on oil, as evidenced by the share of mining and quarrying at just under 2% of total GDP. In Q1 this year, economic growth shrank by 3.5%, partially affected by Covid19 and the subsequent lockdown (mid-Mar). Majority of the economic sectors posted substantial declines: most visibly in accommodation and food services/ tourism (-14.83% yoy), arts, entertainment and recreation (-10.04%) and wholesale and retail trade (-7.5%). Together, wholesale and retail trade, transportation and storage and financial activities account for close to 50% of total GDP (in 2019): the former two sectors were dragged down by Covid19.

The impact will be more pronounced in Q2, given the lockdown effect (lower consumer demand and spending) in addition to the seasonally slower activity during the month of Ramadan.

Fig 4. Lebanon’s runaway exchange rate and inflation

A dangerous inflationary spiral has gripped Lebanon with the currency’s value against the dollar nosediving as much as 80%. Inflation is on the rise and reached an annual 56% in May, according to Lebanon’s Central Administration of Statistics. The World Bank forecast in Nov that close to half the population could live below the poverty line if situation worsened, while food poverty is estimated to affect 22% of the population (the situation is worse for the Syrian refugee households in the country).

The current downfall of LBP can be traced back to several factors. 1. Given the collapse of the long-maintained peg, there is no anchor for expectations of the future value of the Lebanese pound. 2. Monetary financing of budget deficits. Lebanon’s fiscal deficit increased 26.9% in the first four months of the year to USD 1.75bn from the year-earlier period. With the government unable to borrow from the markets, the central bank is financing the growing budget deficit and, increasingly, a growing proportion of government spending. 3. Informal capital controls, payment and transfer restrictions has led to a stop of transfers and remittances from Lebanese expatriates (in 2019, remittances accounted for 12.9% of GDP). 4. Deep recession means decline in income and demand for money. Covid19 and the lockdown has deepened the loss of government revenue from VAT, from customs and from tourism and further deepened the recession. 5. Developments in Syria including the impending implementation of the Caesar Act. (More: https://www.thenational.ae/business/economy/to-halt-lebanon-s-meltdown-its-imperative-to-reform-now-1.1043805)

Media Review

Covid19 is here to stay. People will have to adapt.

https://www.economist.com/leaders/2020/07/04/covid-19-is-here-to-stay-people-will-have-to-adapt

https://www.economist.com/graphic-detail/2020/07/04/how-speedy-lockdowns-save-lives

Priorities for the COVID-19 Economy

https://www.project-syndicate.org/commentary/covid-2020-recession-how-to-respond-by-joseph-e-stiglitz-2020-06

To halt Lebanon’s meltdown it is imperative to reform now

https://www.thenational.ae/business/economy/to-halt-lebanon-s-meltdown-its-imperative-to-reform-now-1.1043805

How public assets can help revive Lebanon

https://ftalphaville.ft.com/2020/06/29/1593437142000/How-public-assets-can-help-revive-Lebanon/

Market Snapshot as of 5th Jul 2020

Weekly % changes for last week (2-3 Jul) from 25th Jun (regional) and 26th Jun (international).

Powered by: