The article titled “Why nations must diversify their economies to avoid stagnation” appeared in the print edition of The National on 22nd February 2023 and is posted below.

Why nations must diversify their economies to avoid stagnation

Nasser Saidi & Aathira Prasad

The Global Economic Diversification Index tracks, measures and compares progress in diversification based on 25 indicators

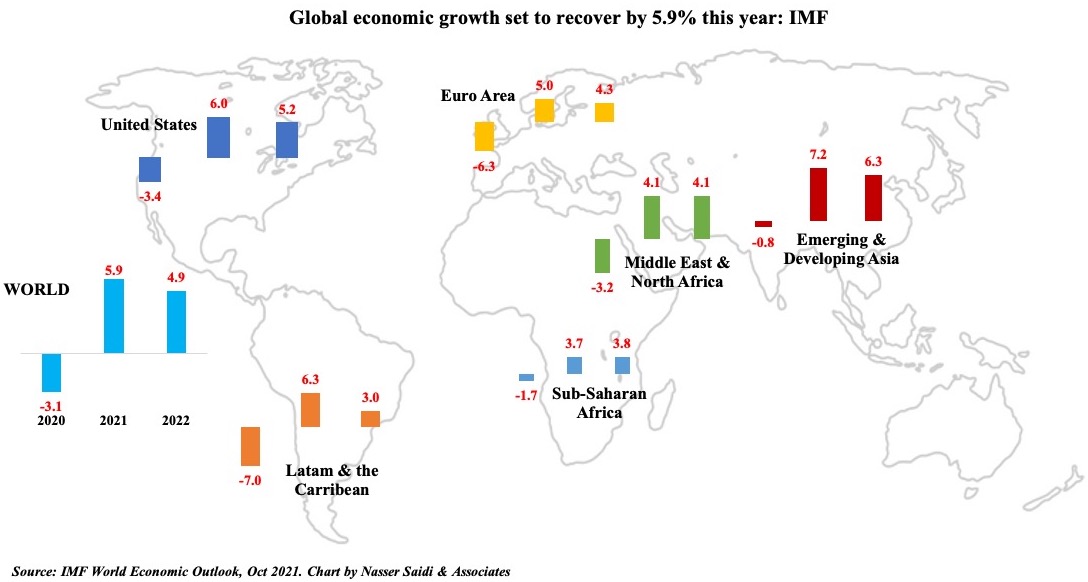

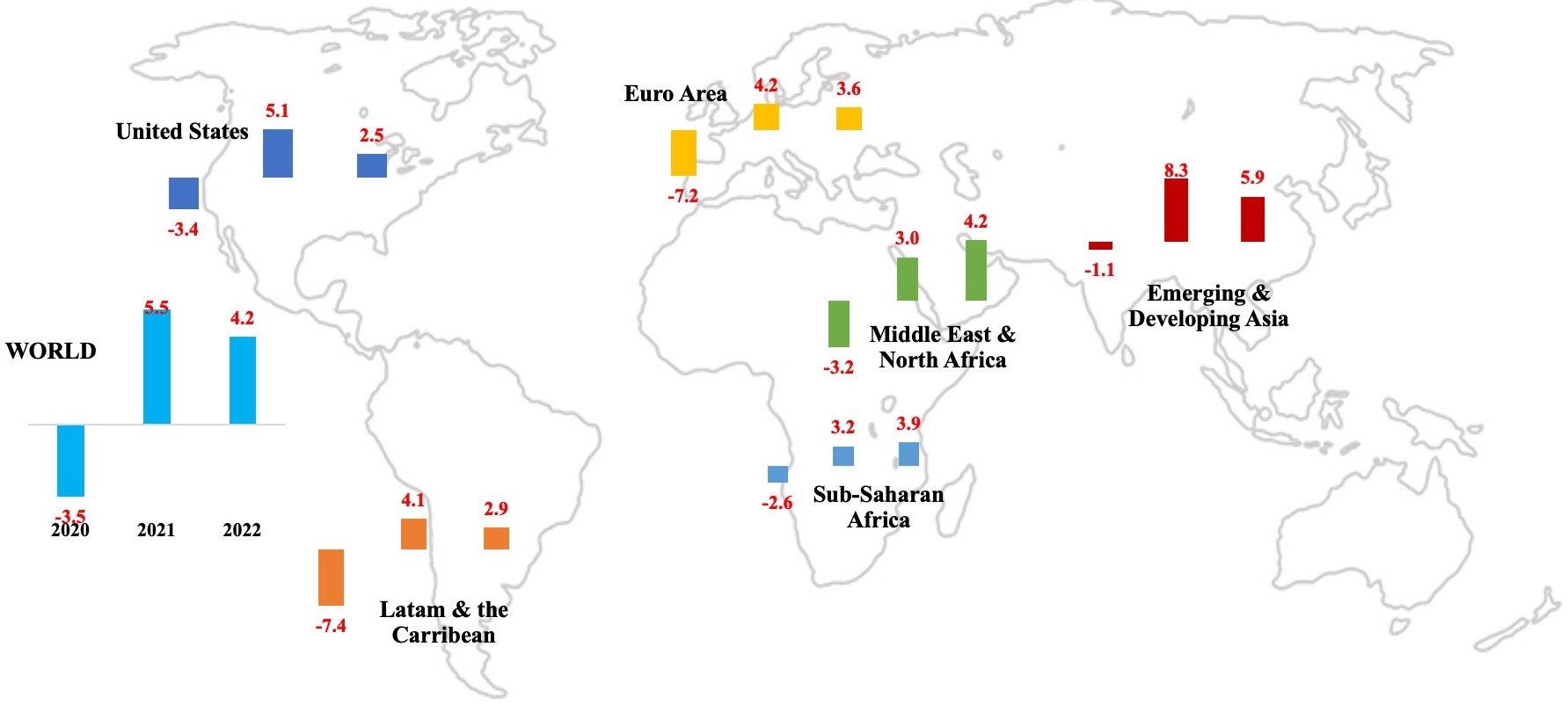

Economic growth in nations with an abundance of natural resources tends to be lower and more volatile.

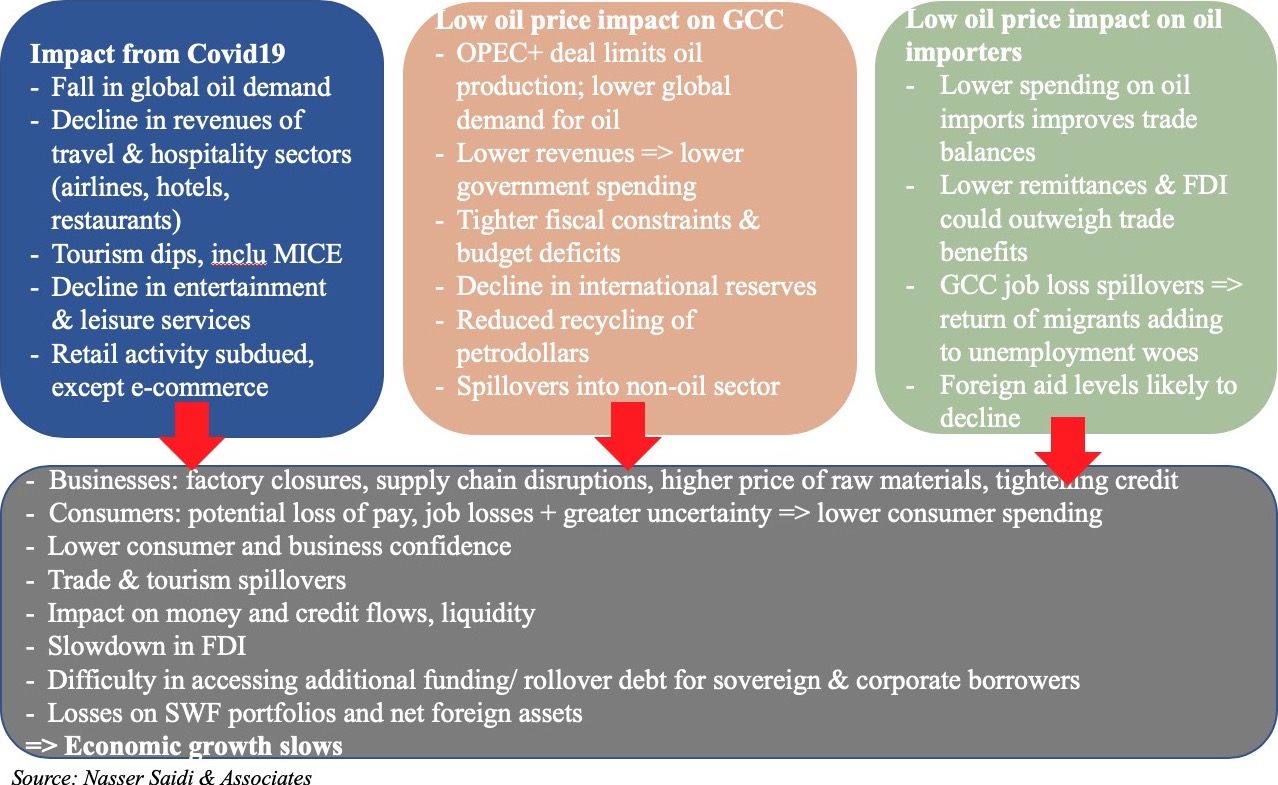

Diversifying activity from an over-dependence on natural resources — such as oil, minerals or commodities — allows countries to harness resource rents as an engine of growth, rather than a barrier to economic development, avoiding the “resource curse”.

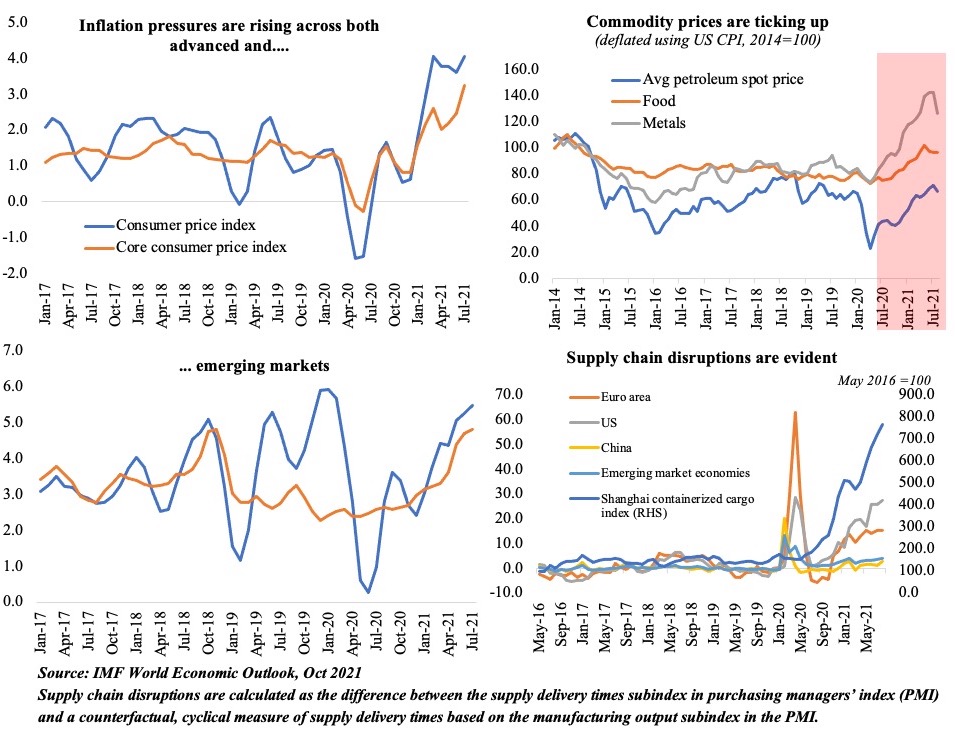

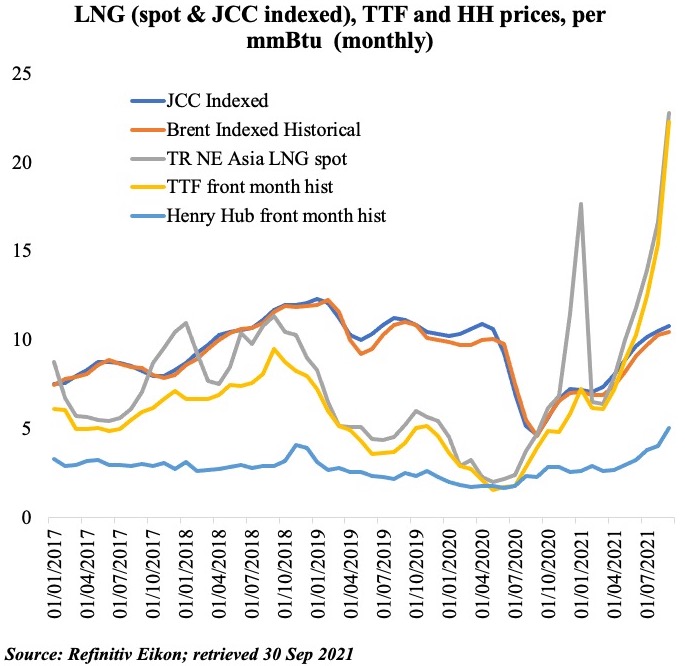

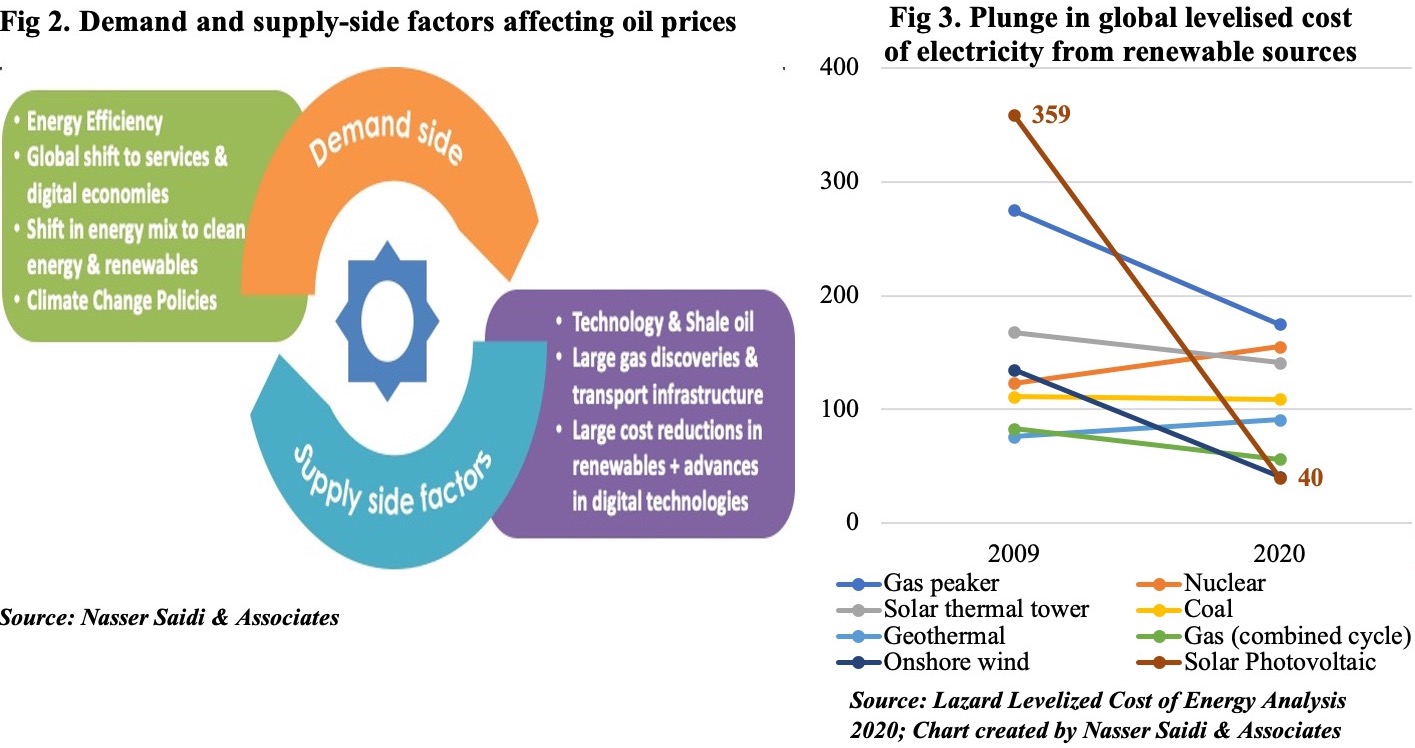

For fossil fuel-dependent countries, ambitious global decarbonisation commitments (UN Cop climate summits, net zero emissions) and energy transition plans to address climate change have added to the urgency of economic diversification, given that oil and gas accounted for 31.89 per cent and 21.34 per cent of global greenhouse gas emissions in 2021.

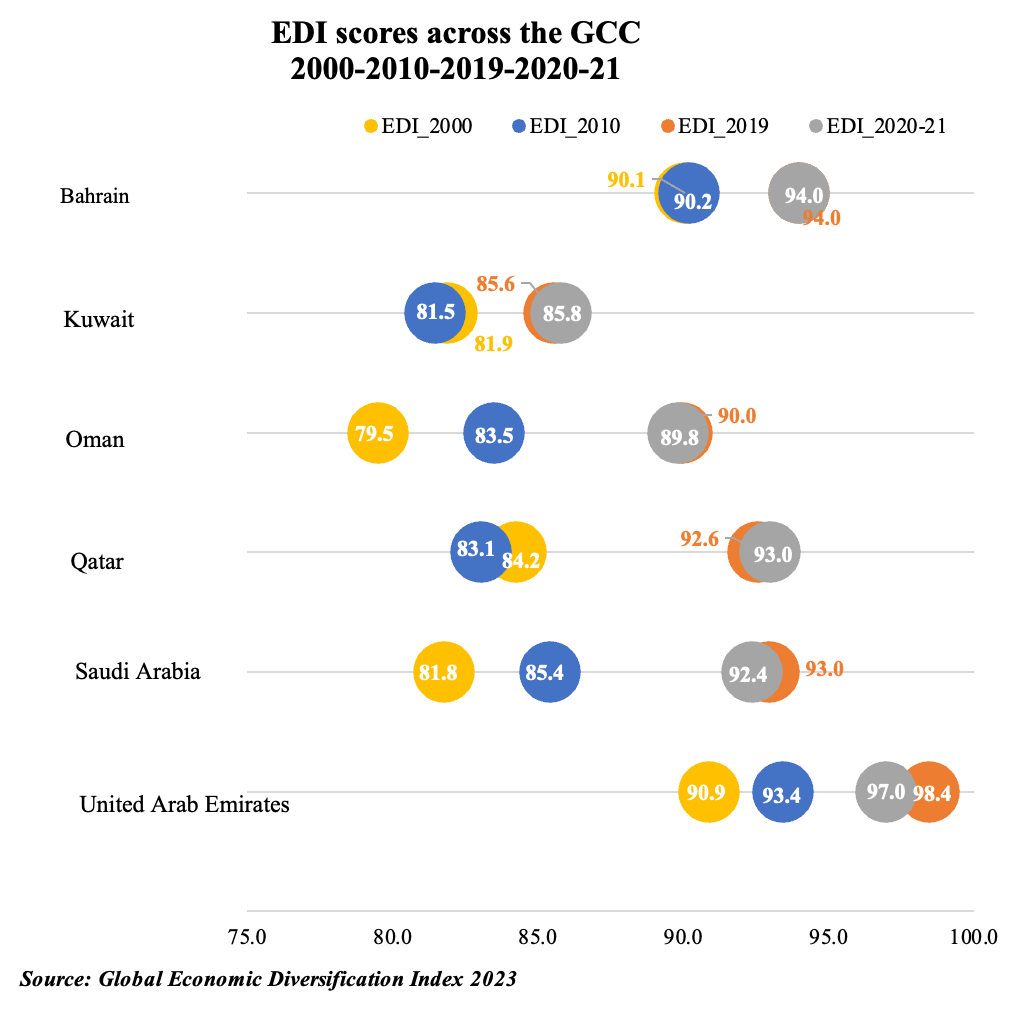

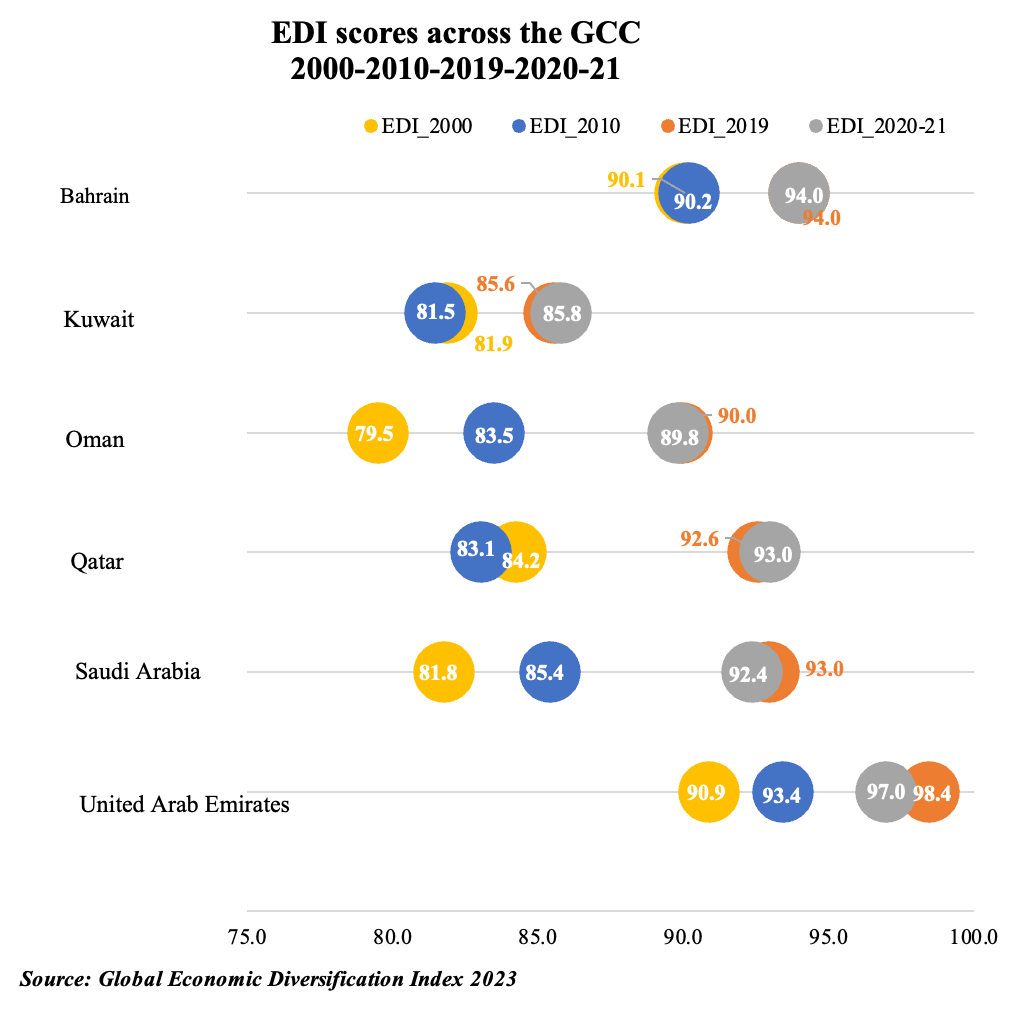

With economic diversification a policy imperative in the Middle East, nations can turn to the Global Economic Diversification Index (EDI) to track their performance over time, undertake peer comparisons and measure the gap with higher-ranked nations.

The EDI identifies and examines 25 economic indicators, analysing and combining three main dimensions of diversification — output, trade and government revenue — across 105 nations for the period 2000-2021.

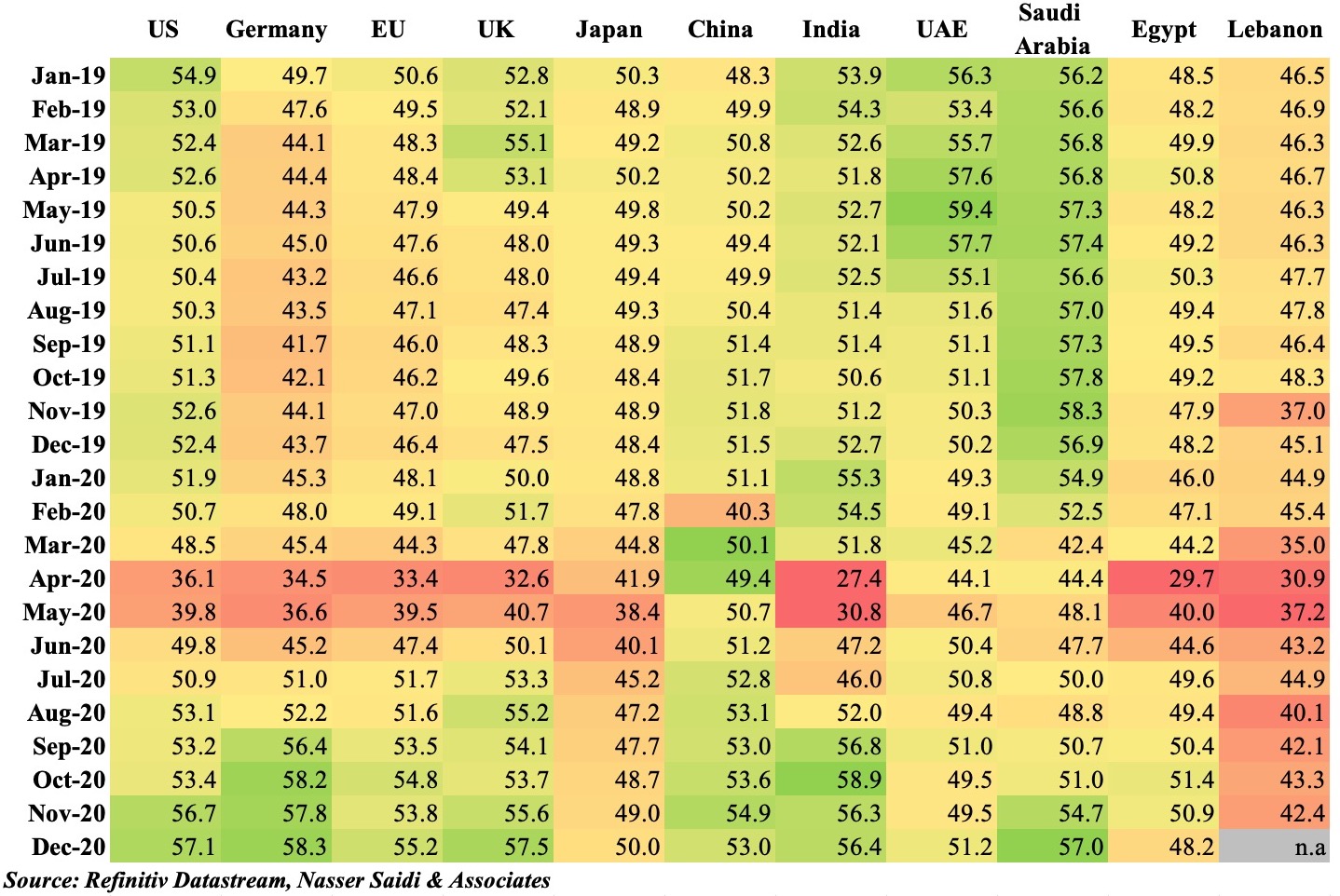

The top-ranked nations have maintained their standing over time, with the US, China and Germany ranking highest in 2021.

What are the major lessons and outcomes? First, there is a positive correlation between EDI and gross domestic product per capita (but being a high-income country does not imply a high economic diversification score) and, secondly, the higher the share of resource rents in GDP, the lower the EDI score.

Third, countries do not need to take a traditional industrialisation route: services and financial services led Singapore and Switzerland to rank highly alongside industrialised nations such as Germany and the UK.

Fourth, innovation and adoption of new technology is an essential ingredient for greater diversification, with many top performers also in World Intellectual Property Organisation’s [WIPO’s] Global Innovation Index, and, finally, size need not be an impediment to economic diversification (“small” Ireland, the Netherlands and Singapore rank high).

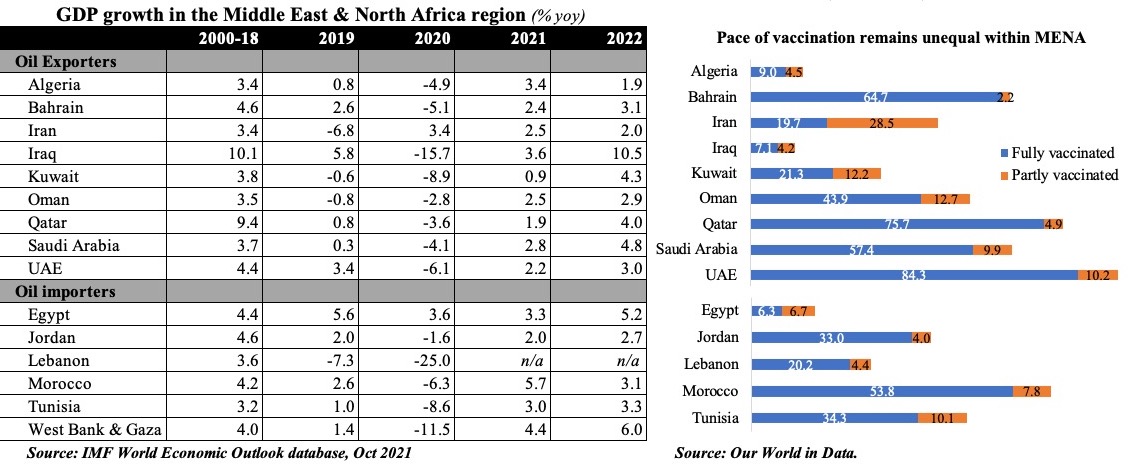

GCC economic diversification

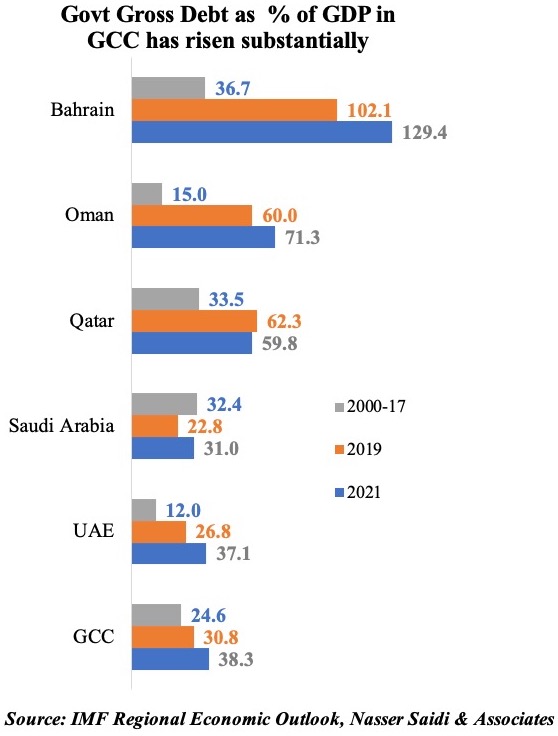

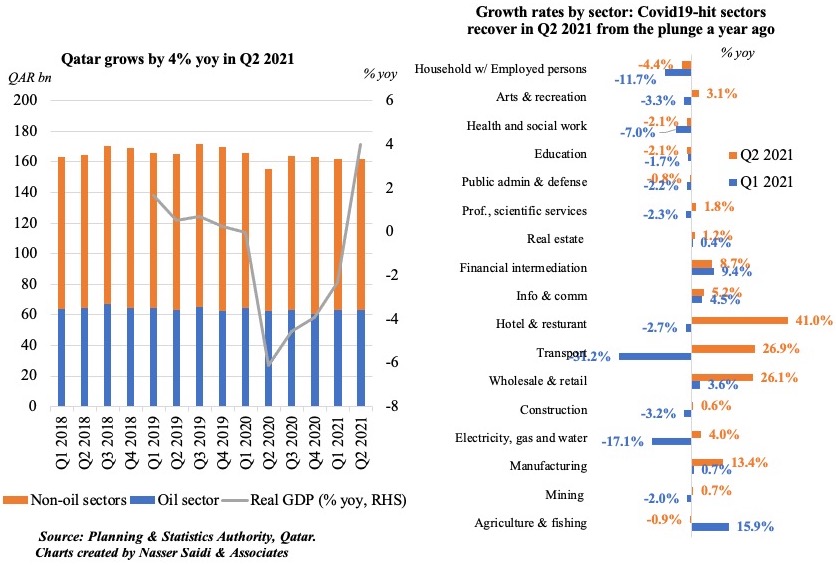

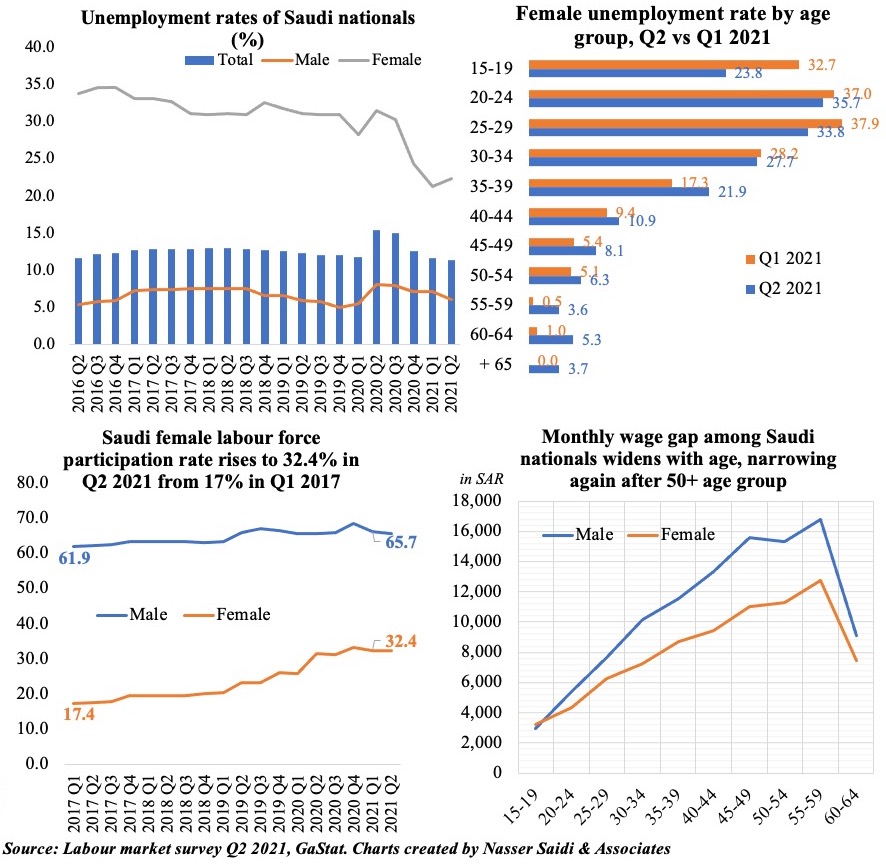

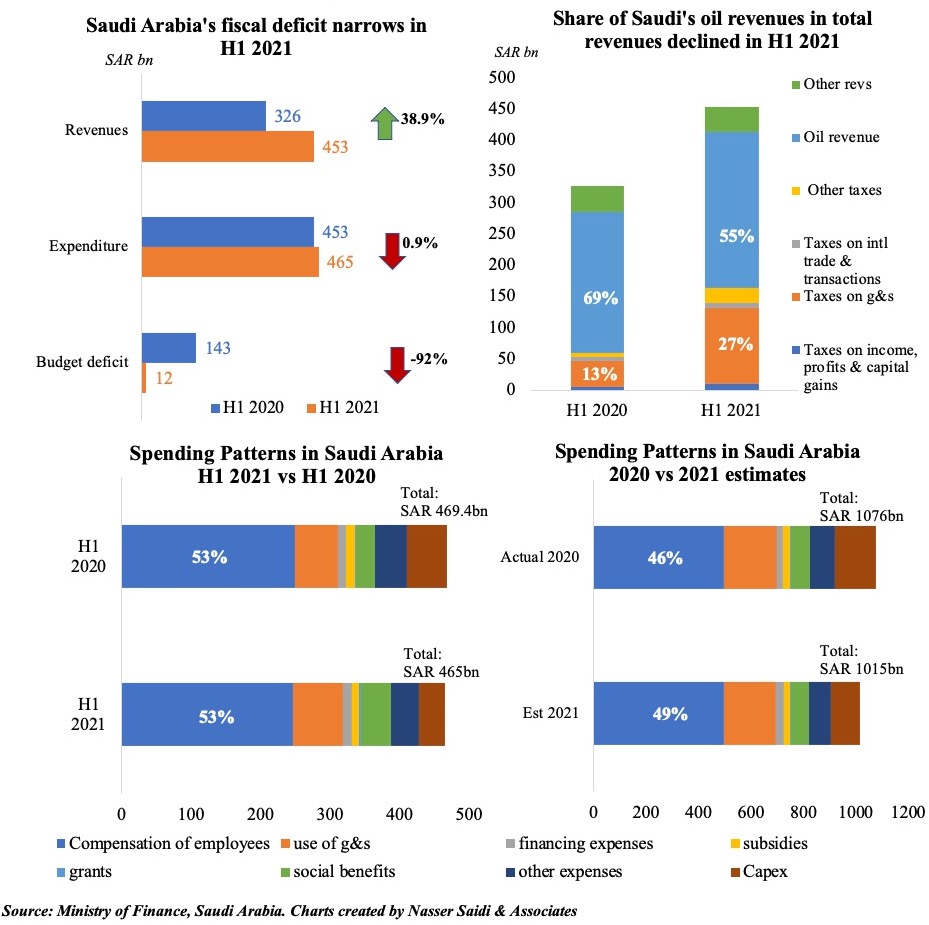

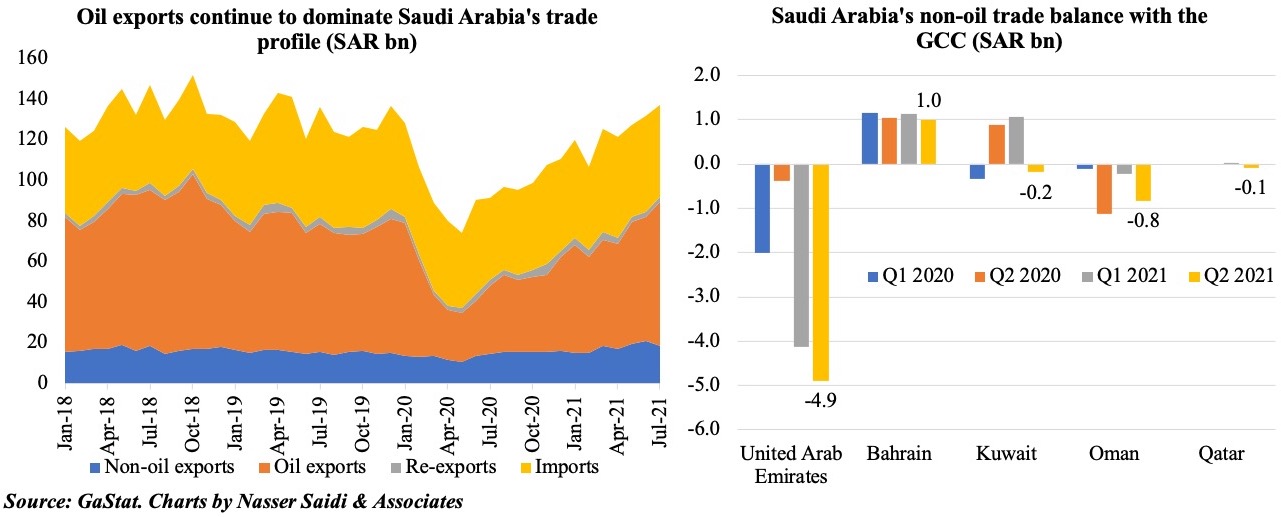

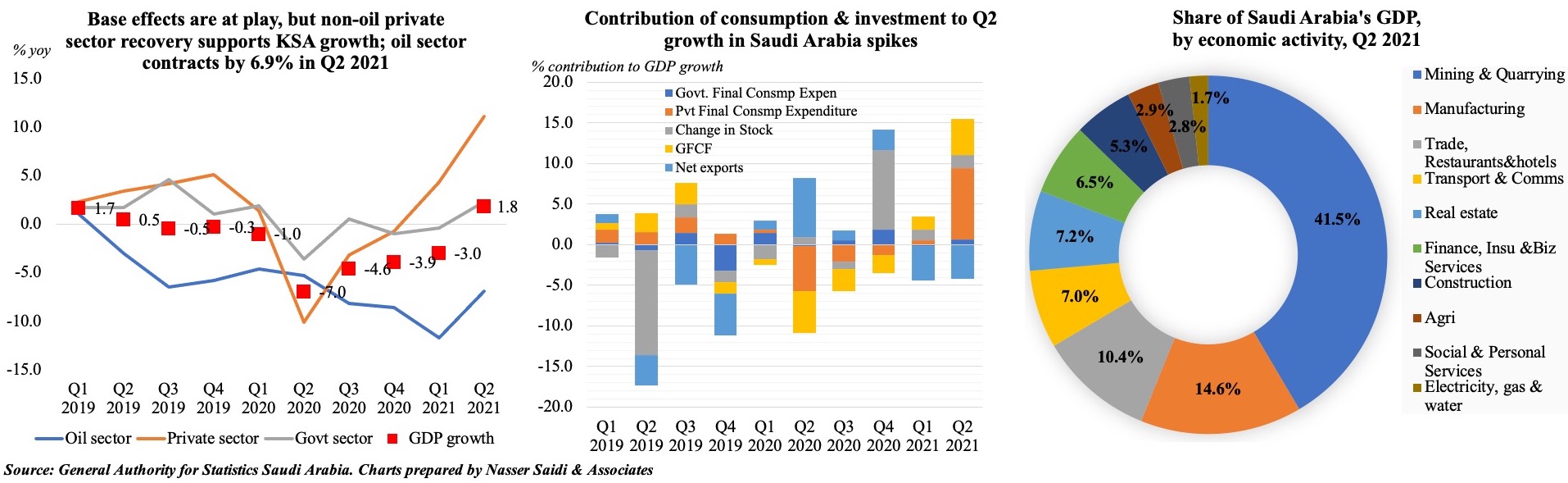

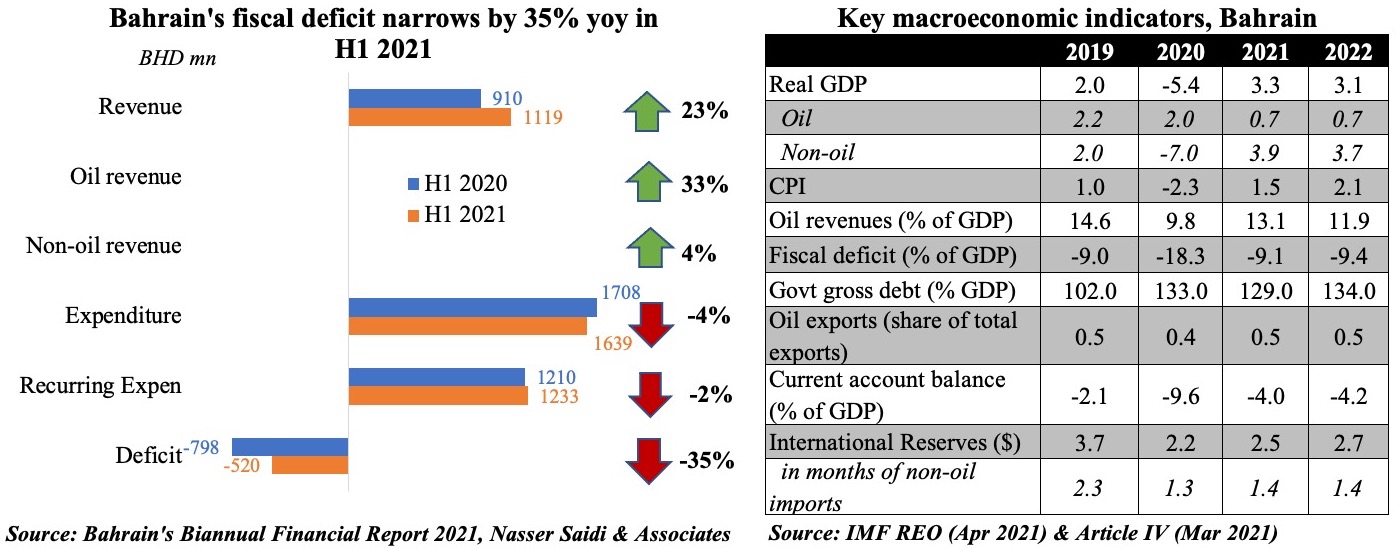

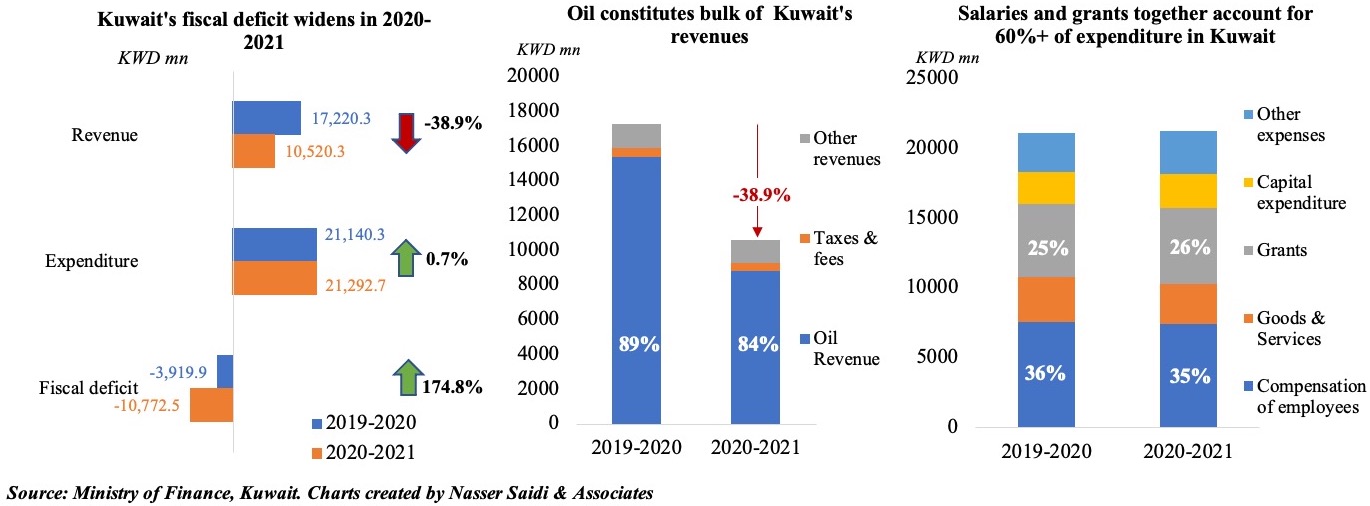

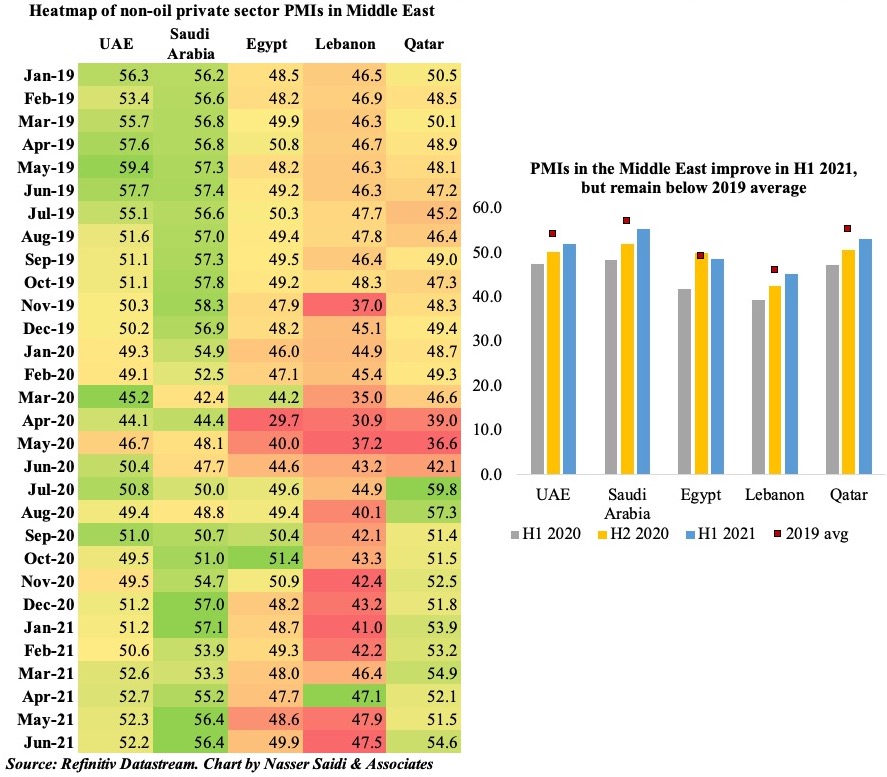

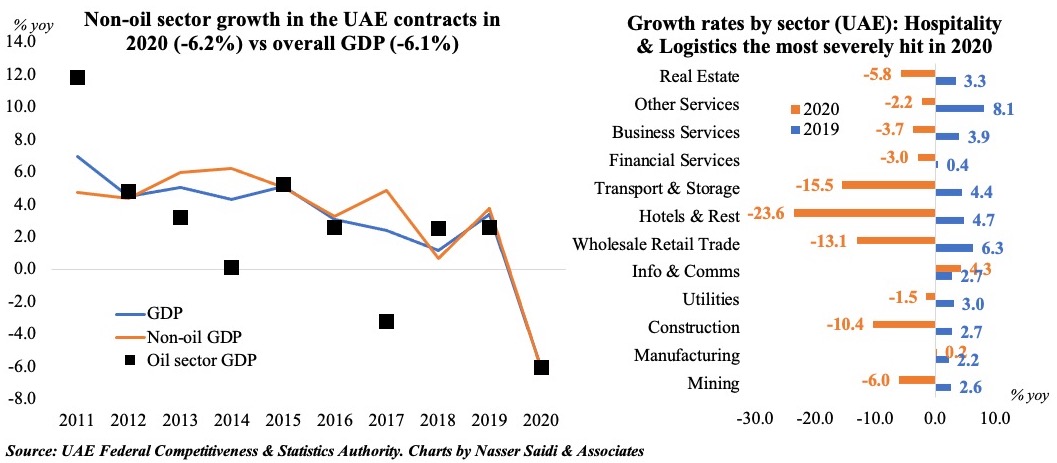

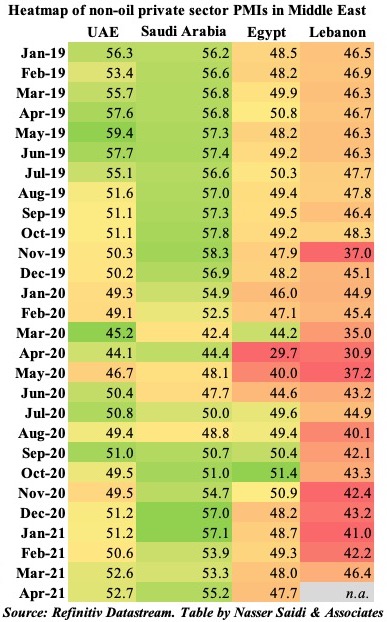

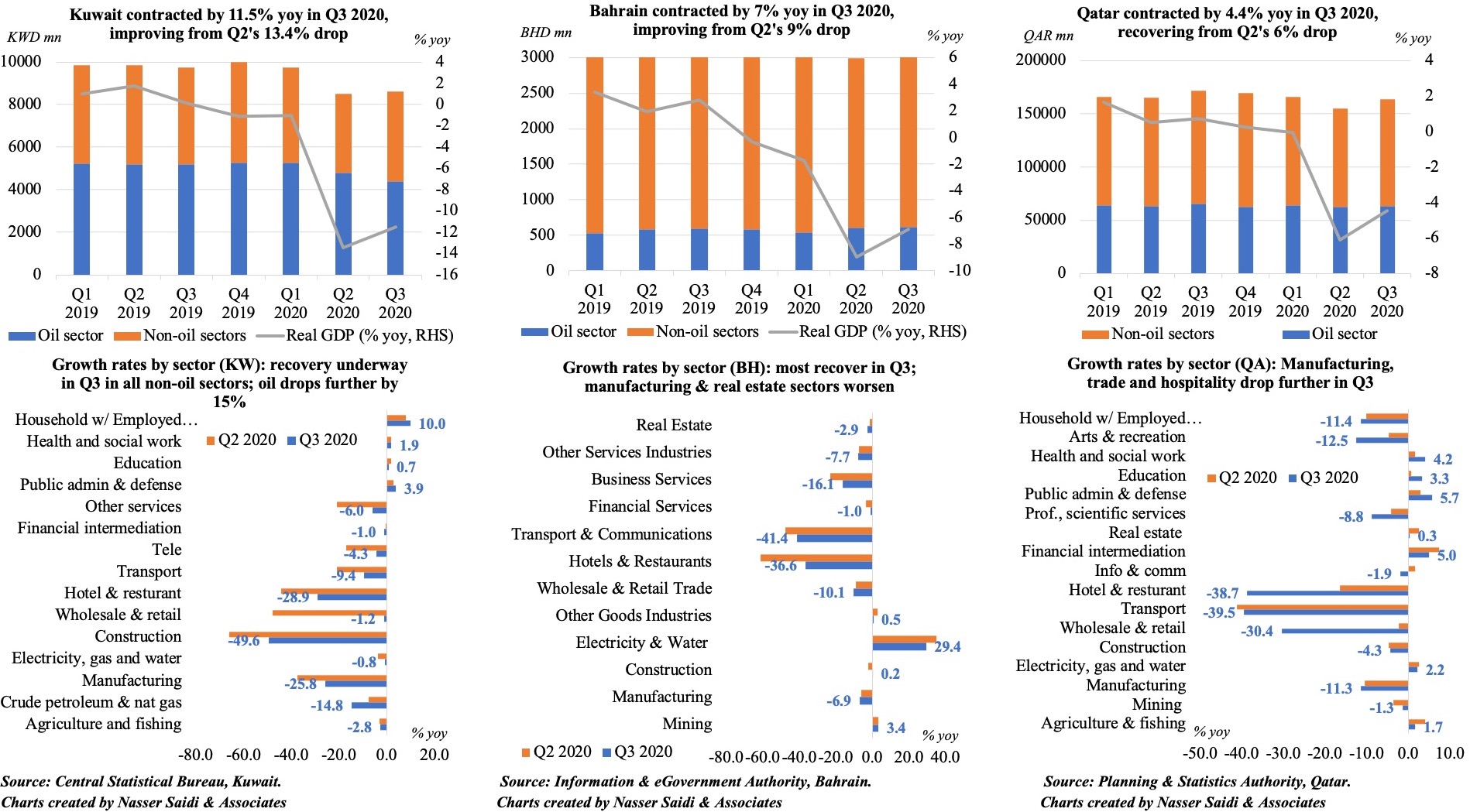

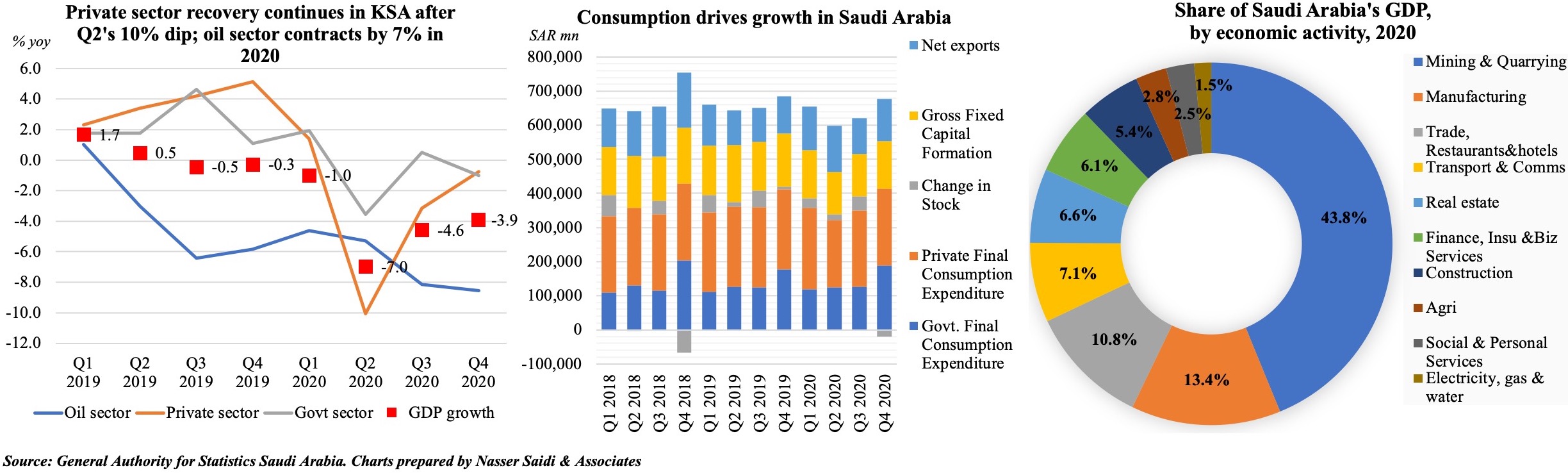

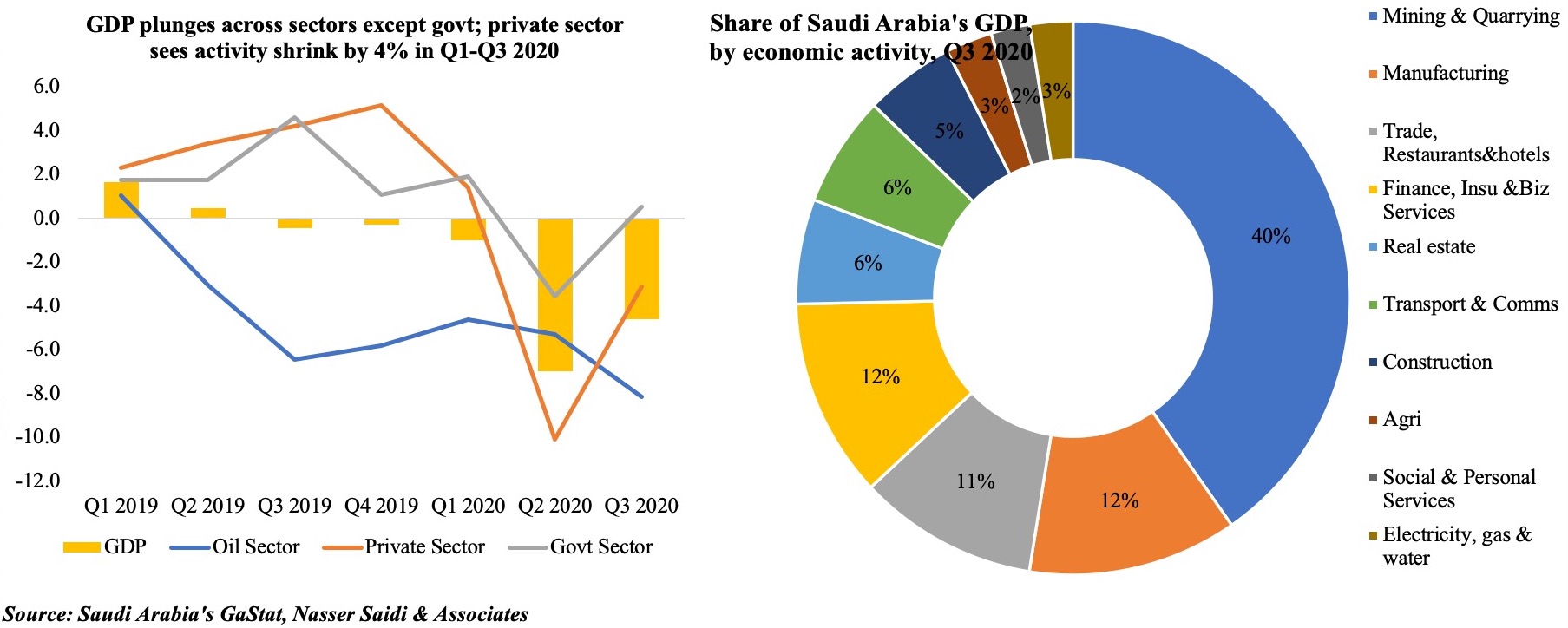

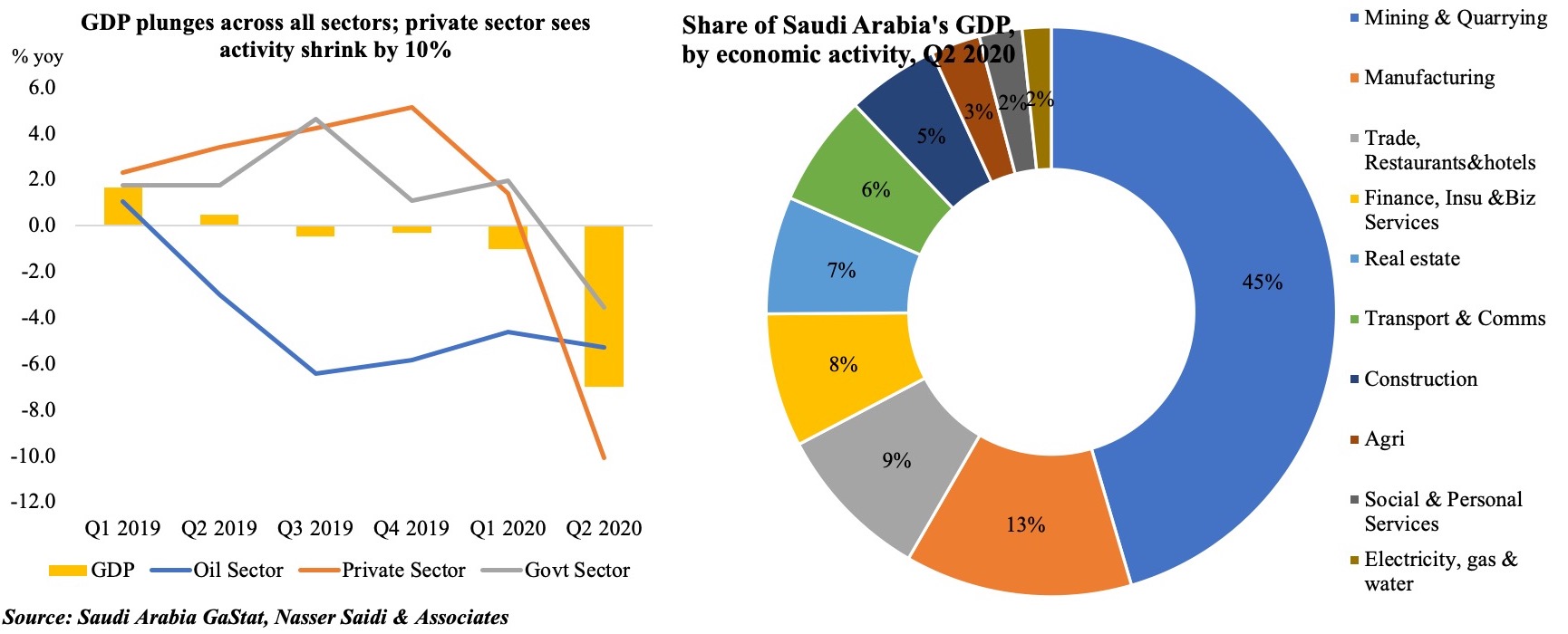

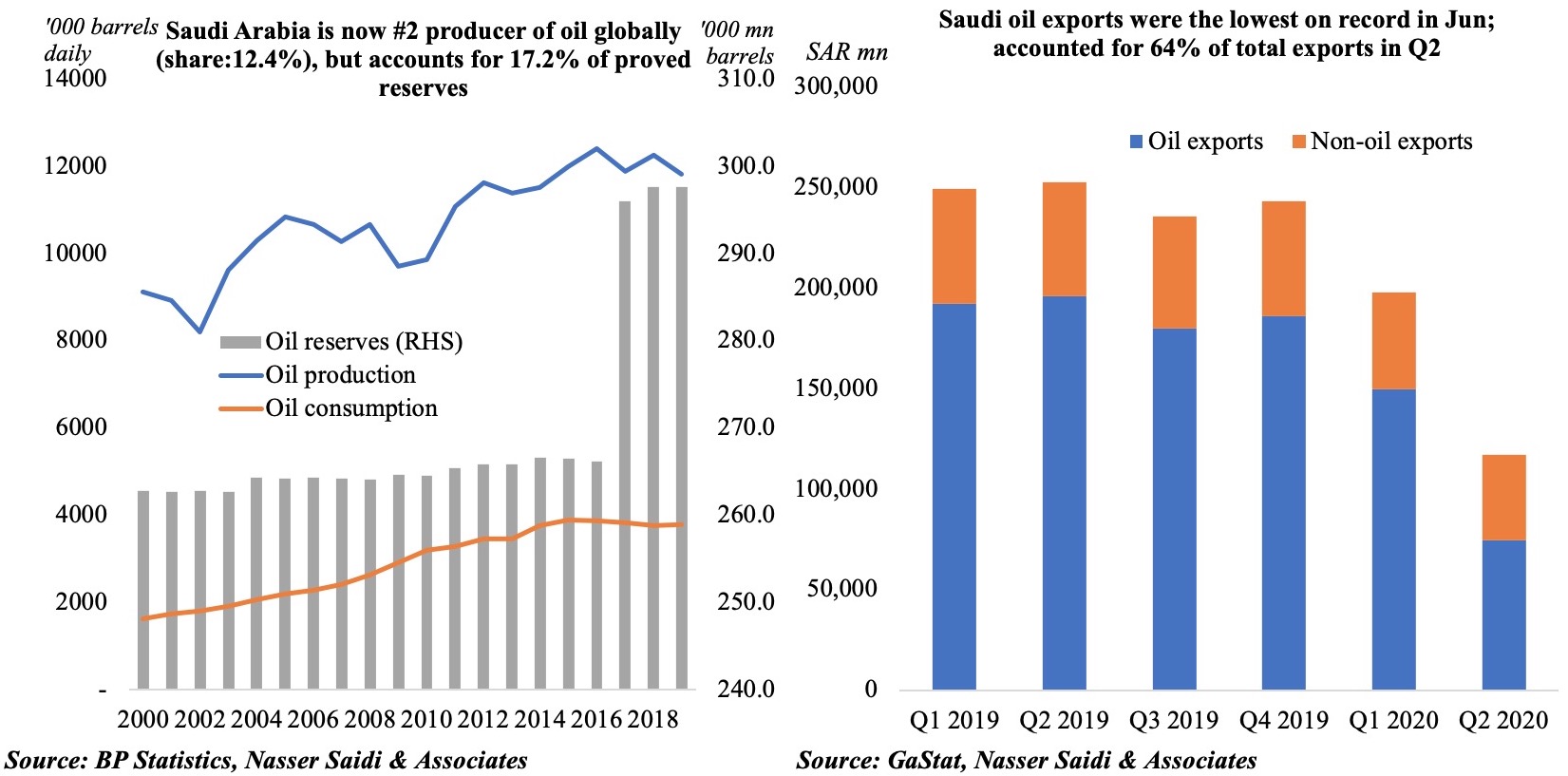

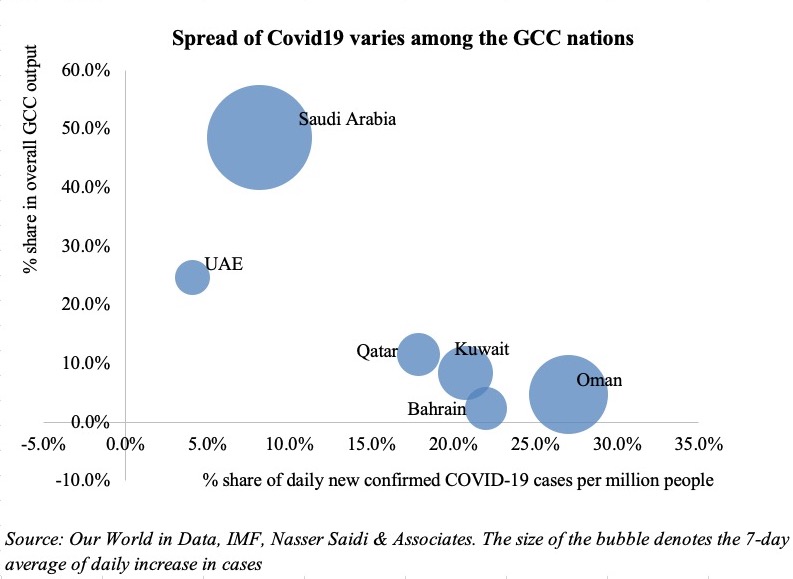

While the non-oil sector has grown in the GCC, the oil sector continues to dominate, accounting for more than 40 per cent of GDP in most countries.

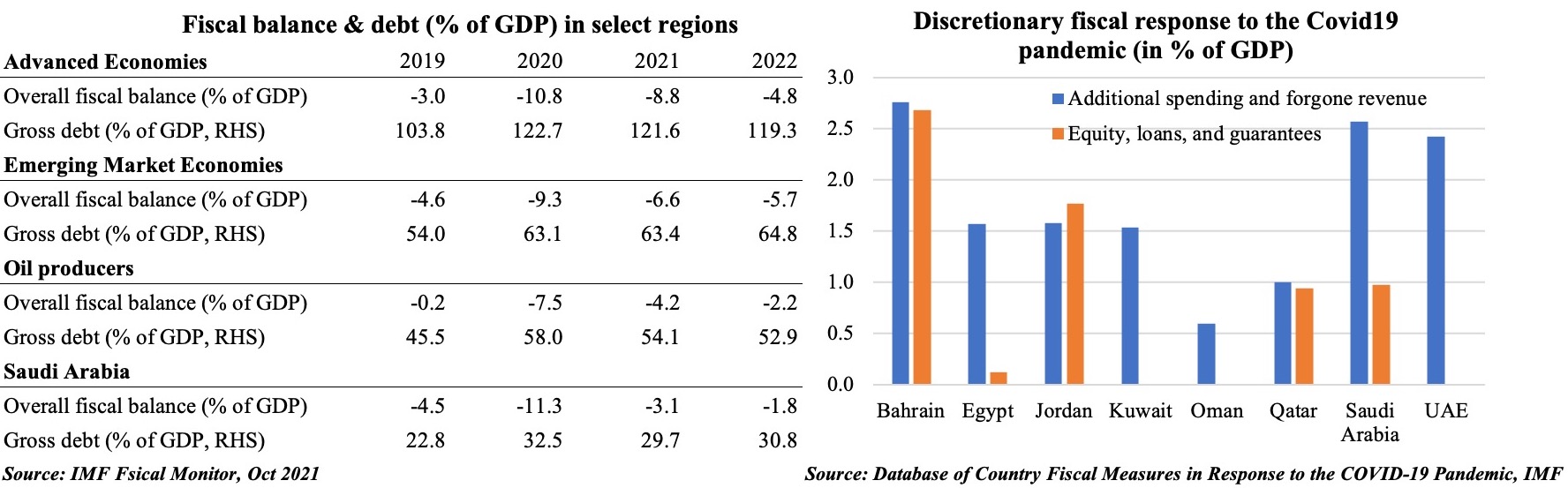

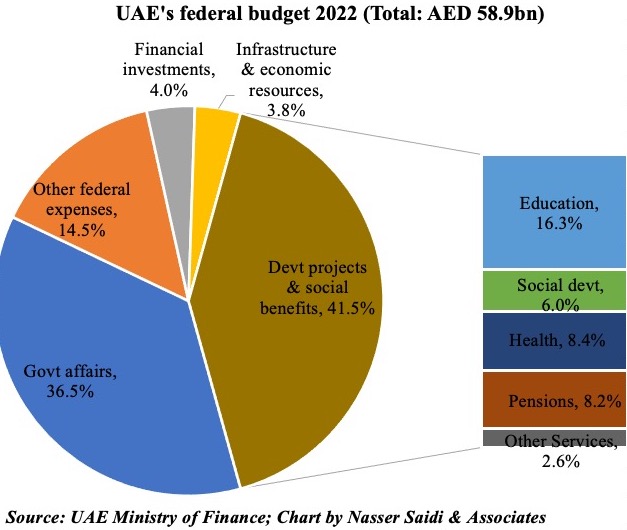

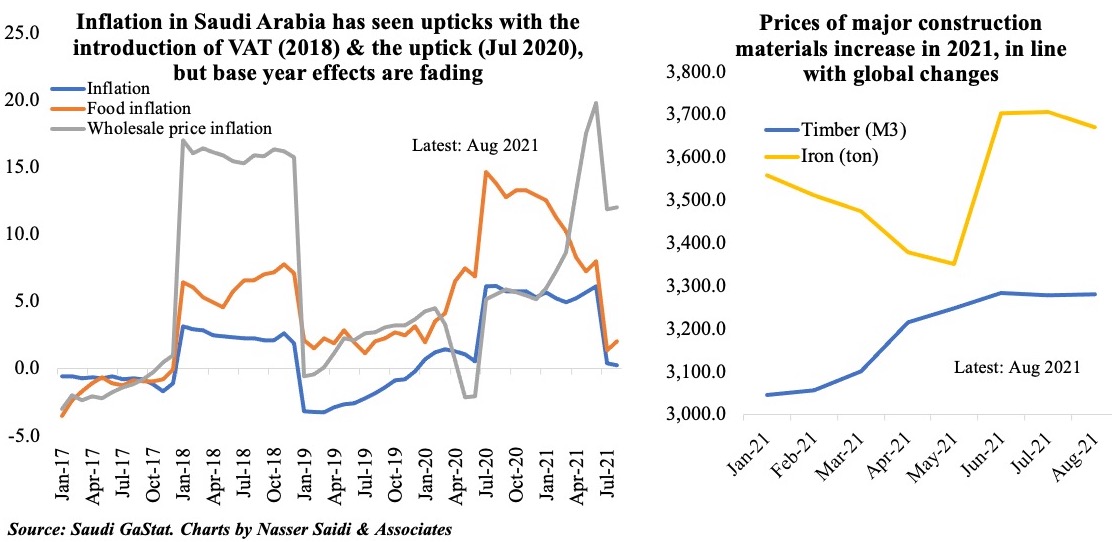

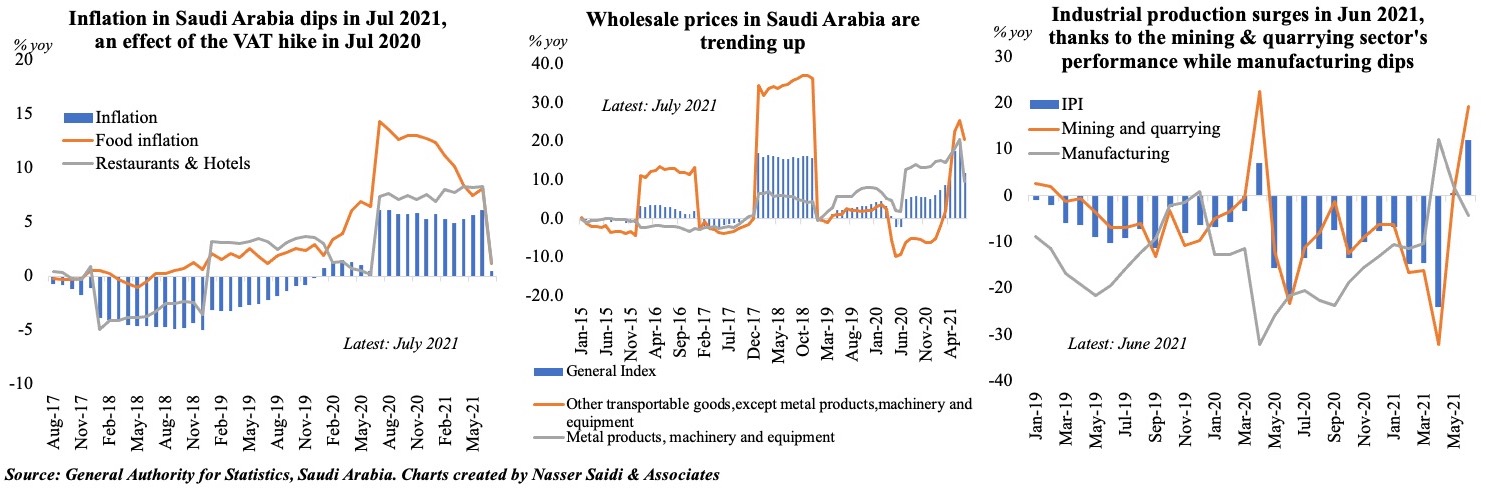

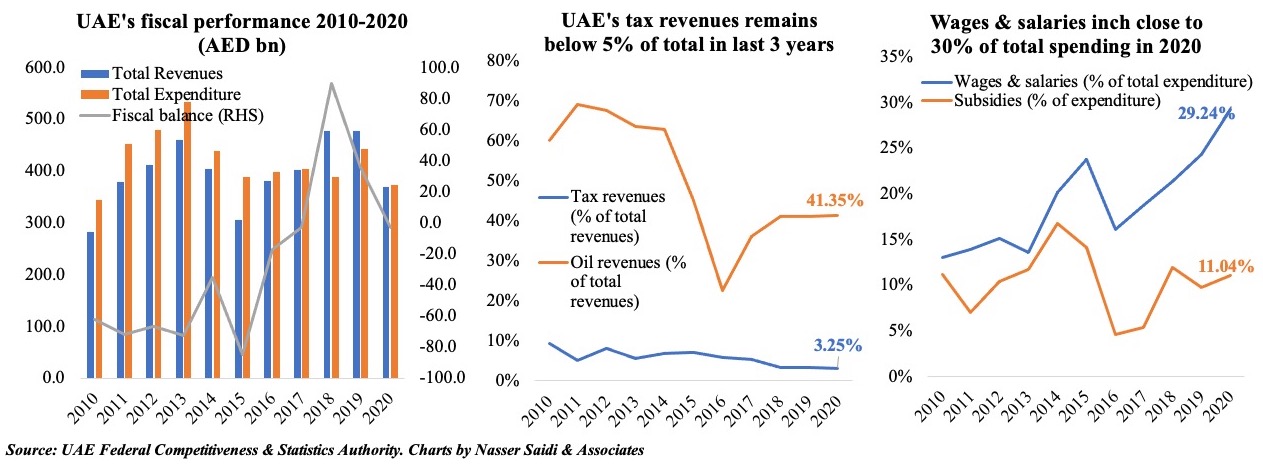

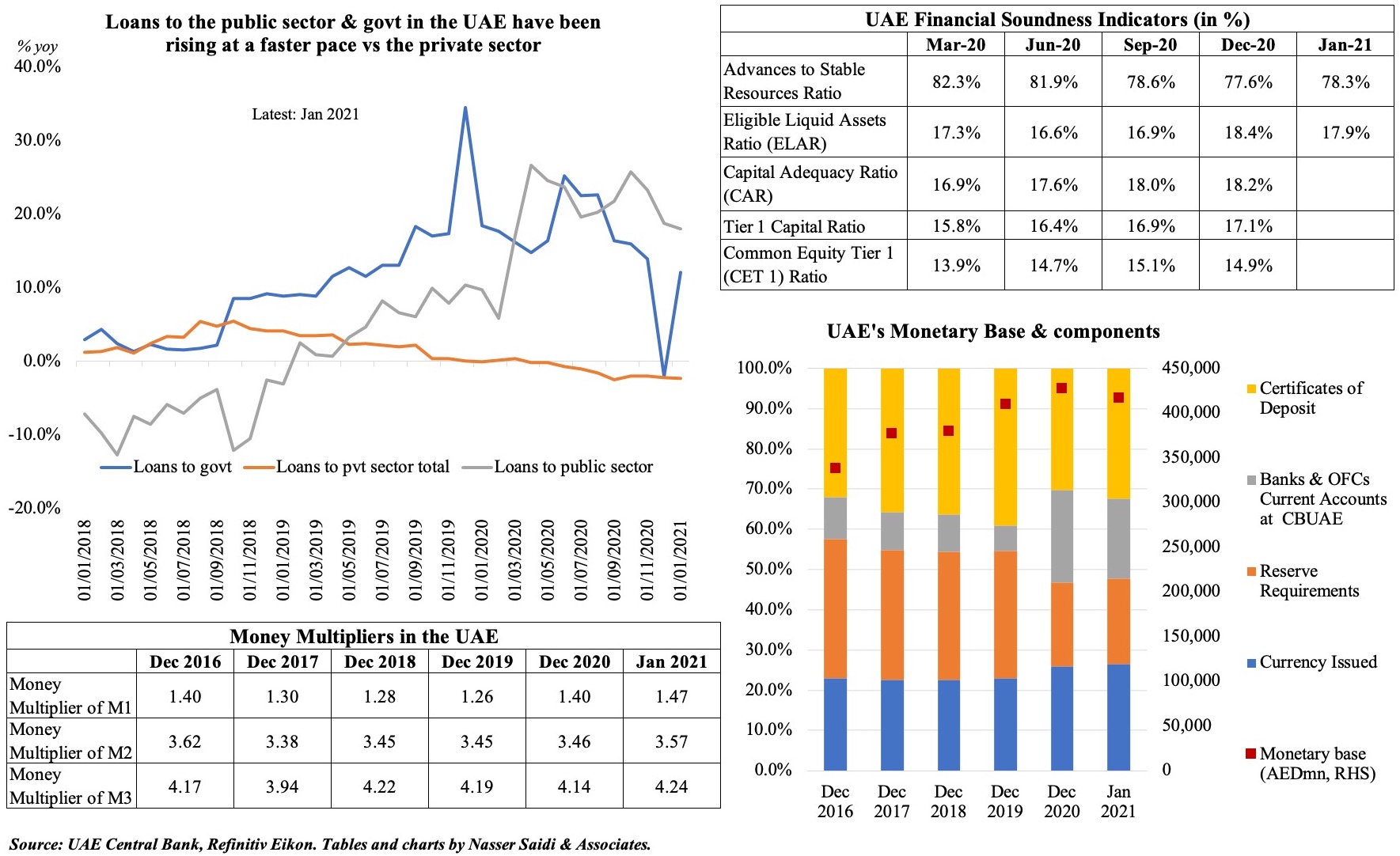

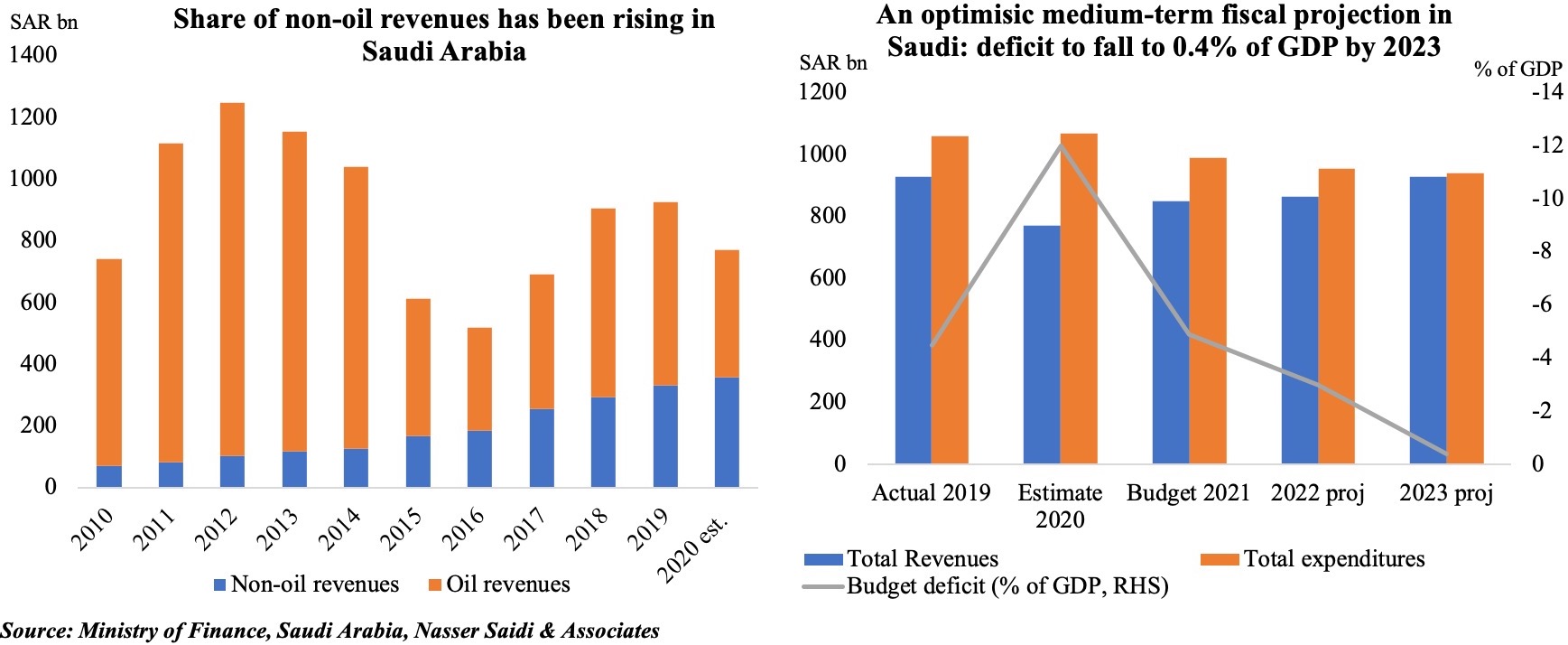

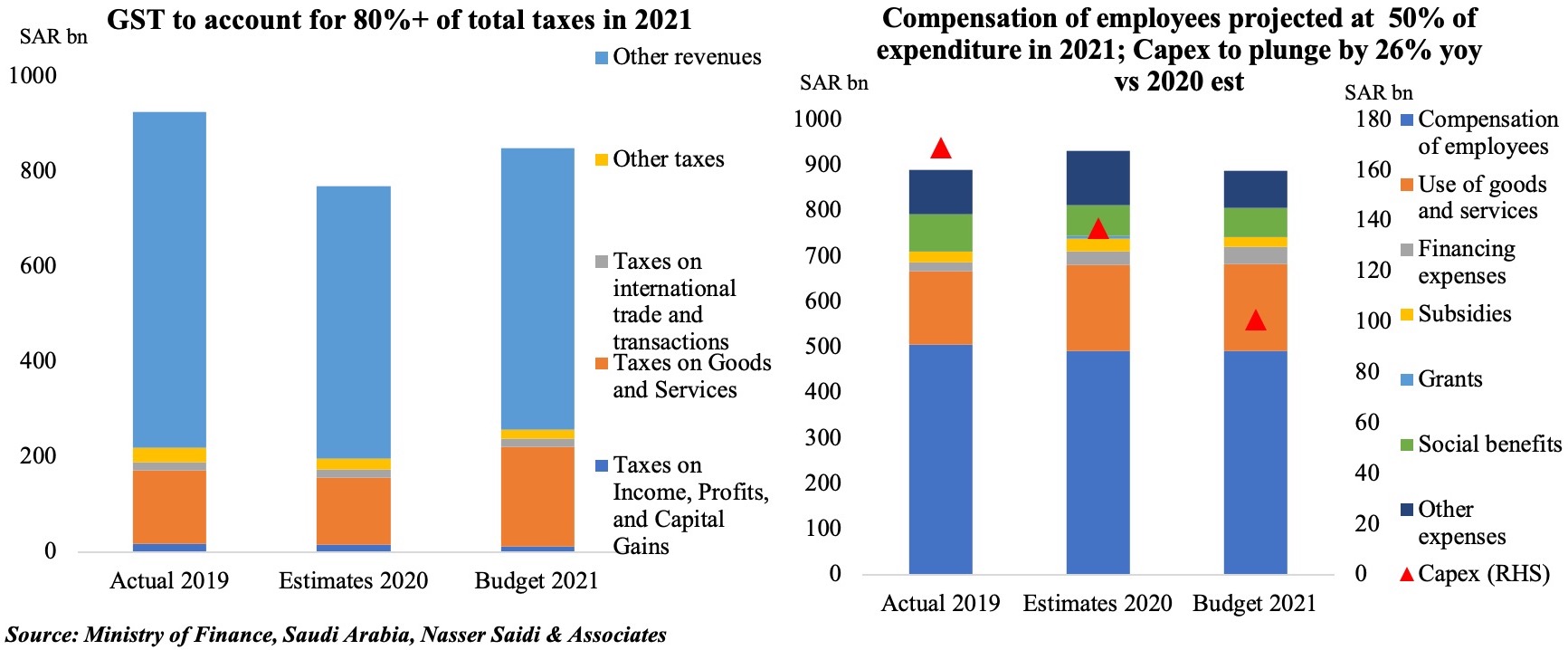

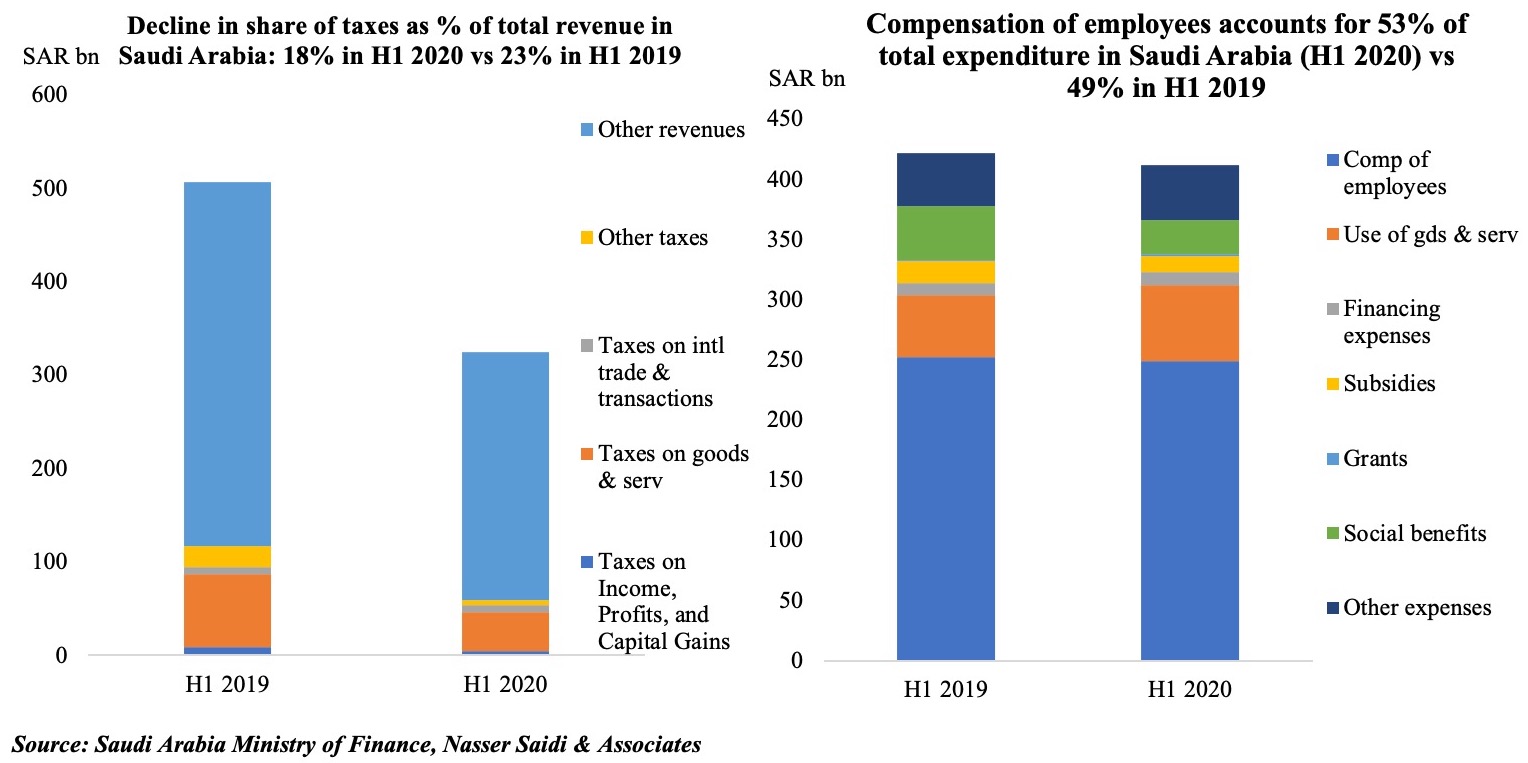

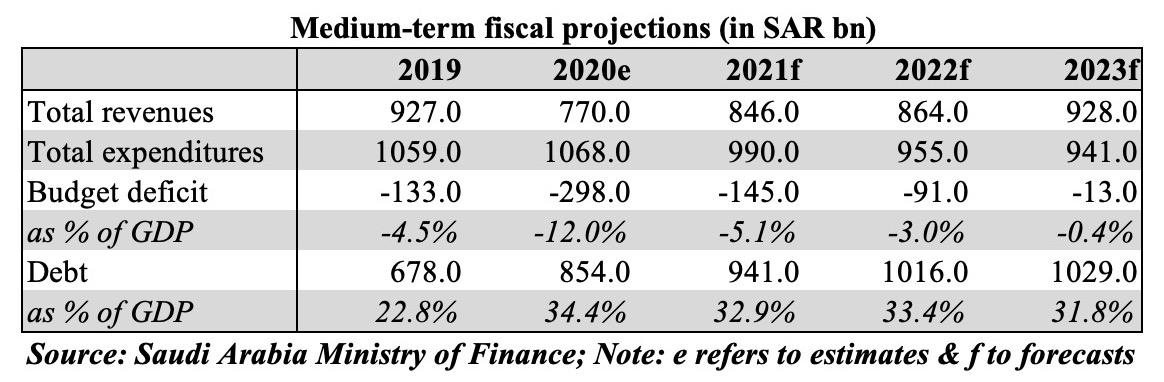

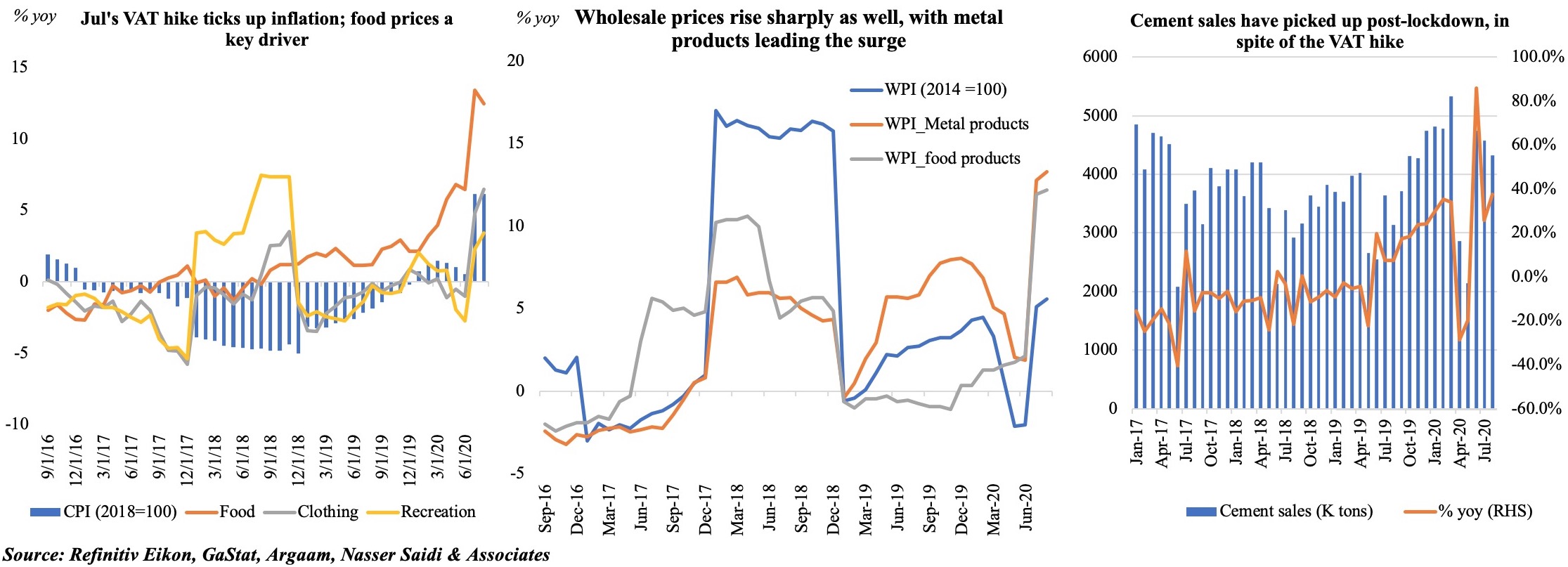

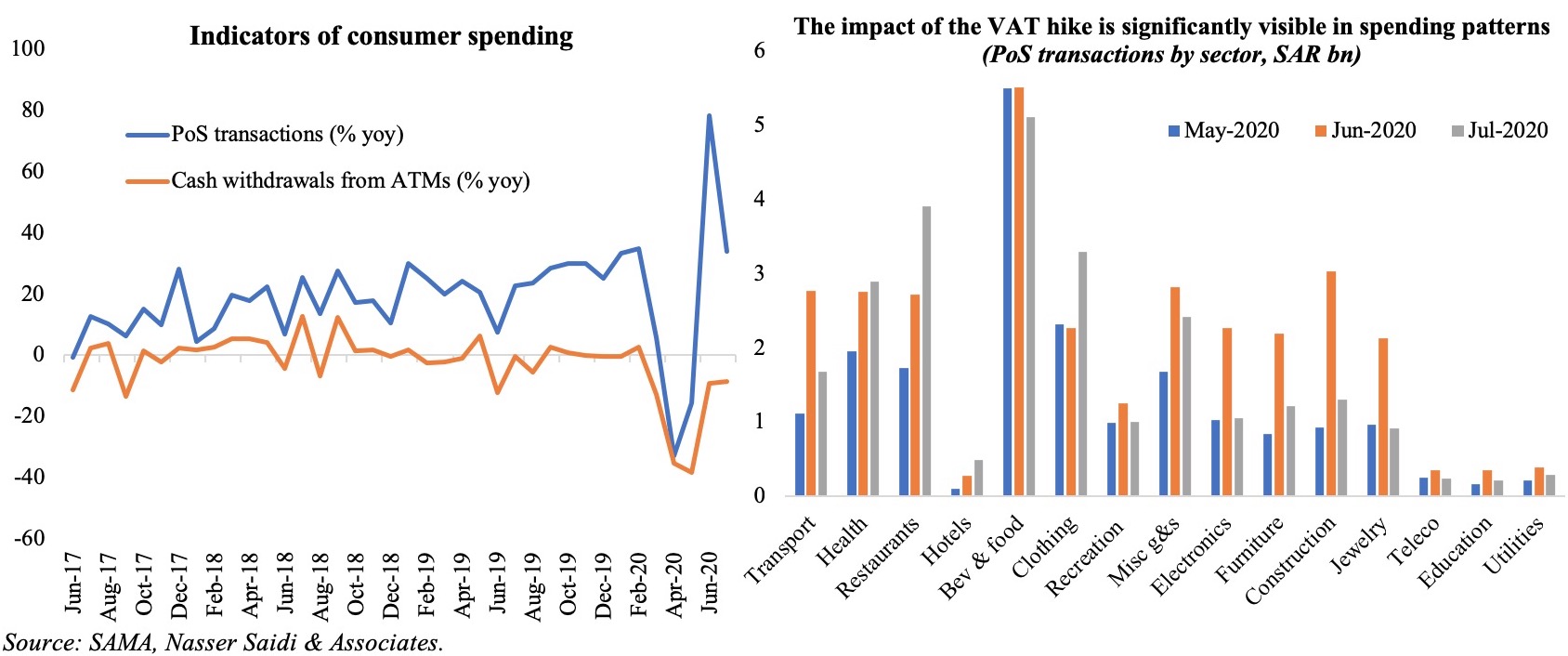

In the past decade, there has been a concerted effort to diversify revenue and support fiscal sustainability, with the introduction of VAT and excises taxes (with the UAE introducing corporate tax this year and Oman studying a proposal for income tax).

However, consumption taxes remain a small share of total revenue in comparison to oil and gas in the nations that have introduced VAT, while Qatar and Kuwait have yet to introduce consumption tax.

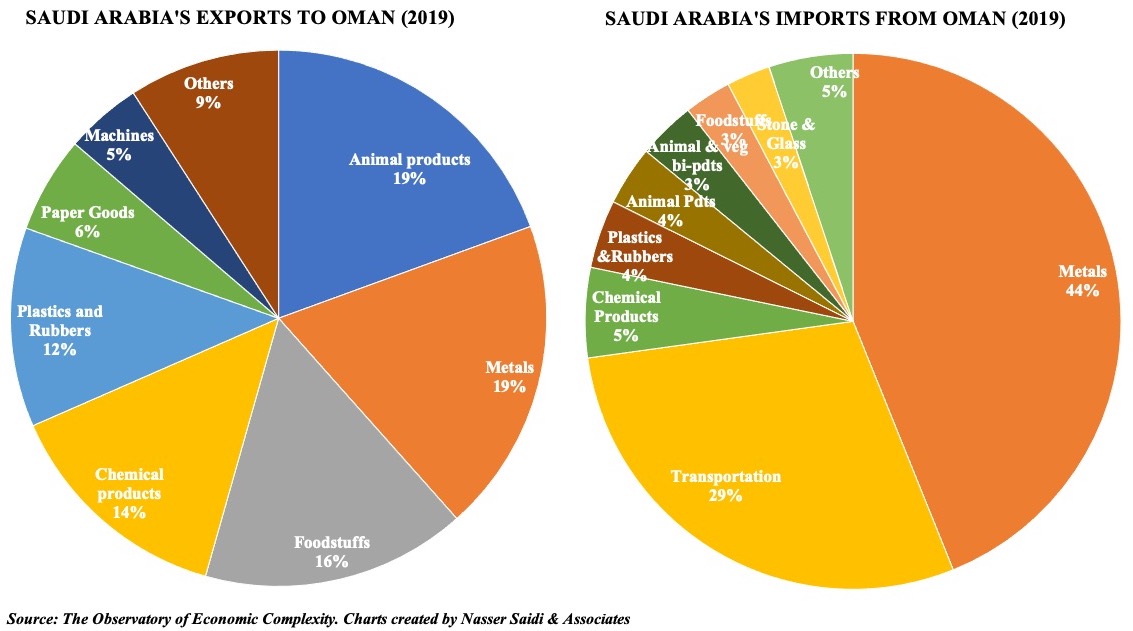

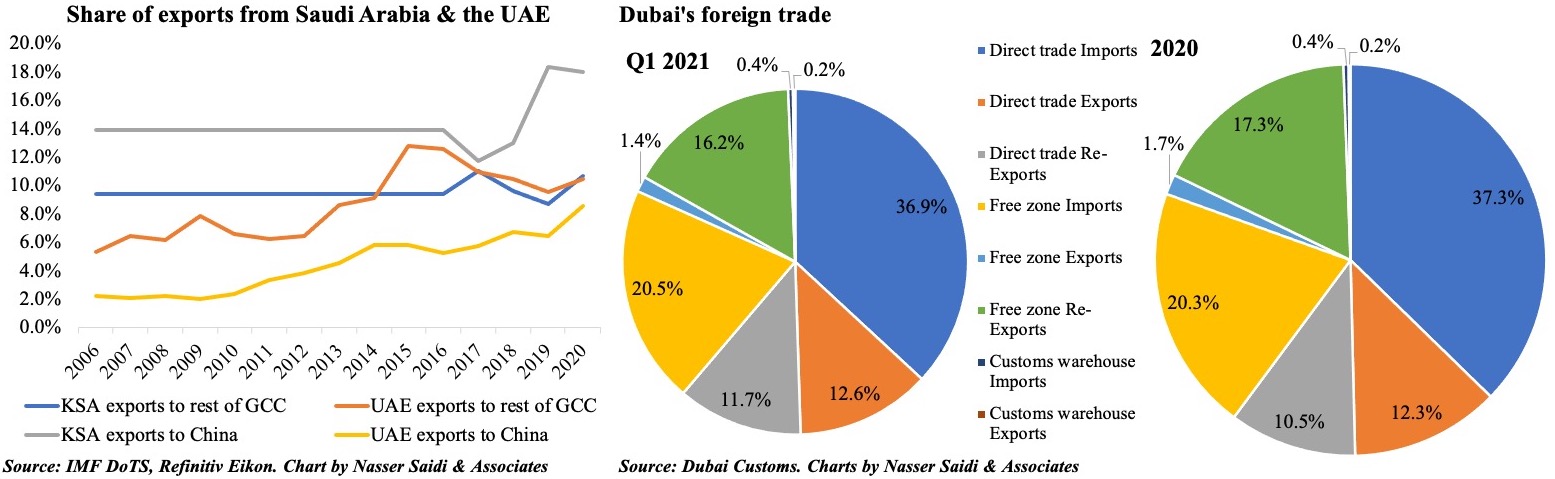

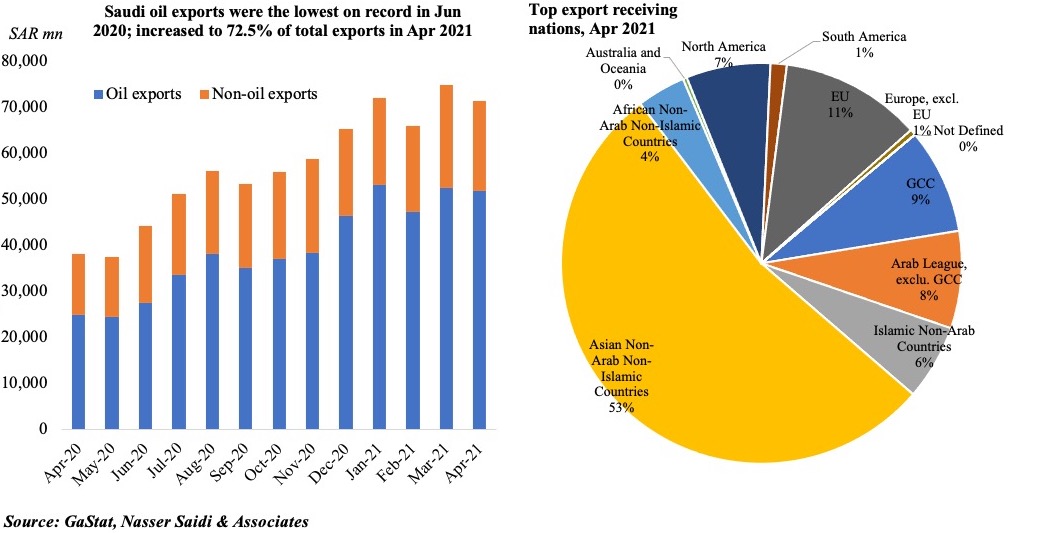

At present, trade is also heavily reliant on exports of oil and gas and their derivatives such as petrochemicals.

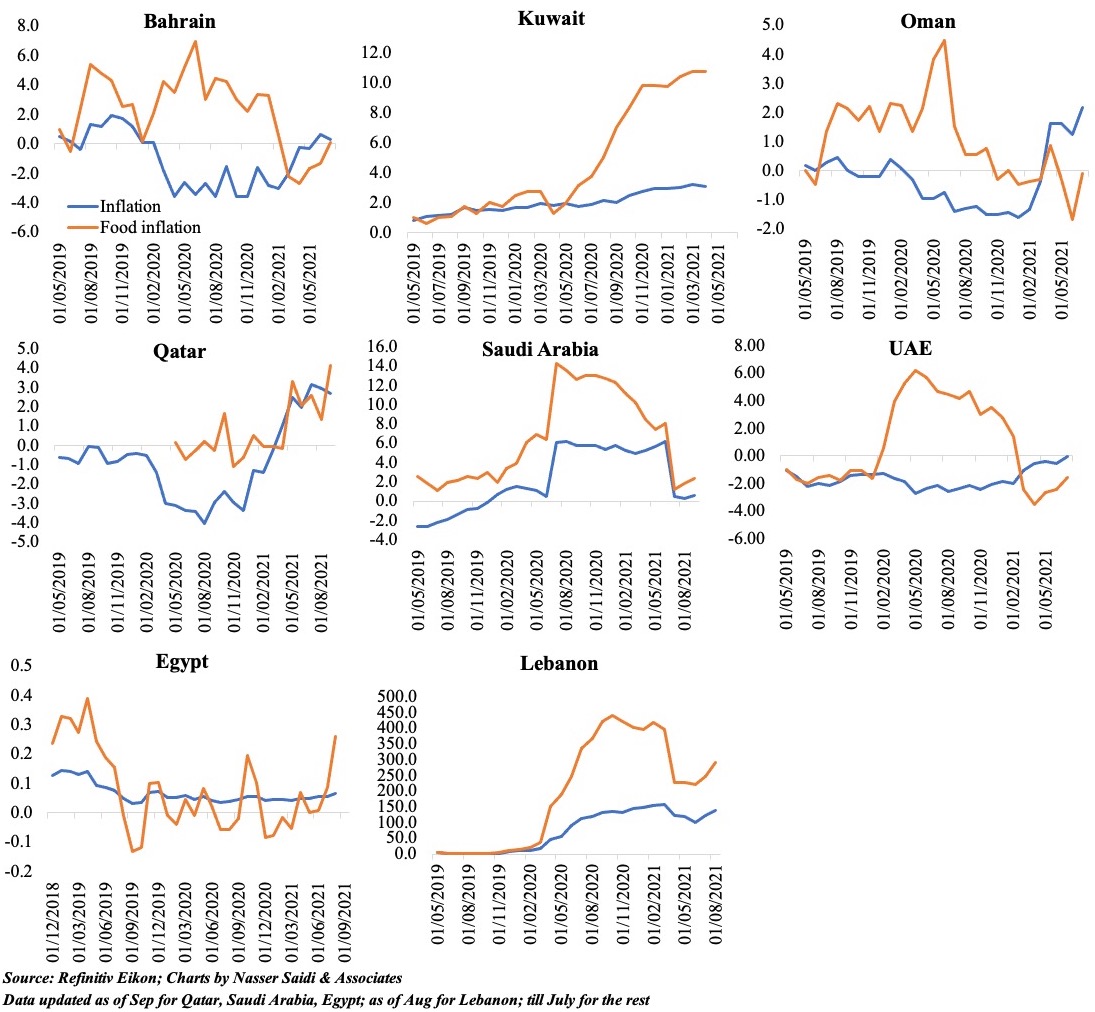

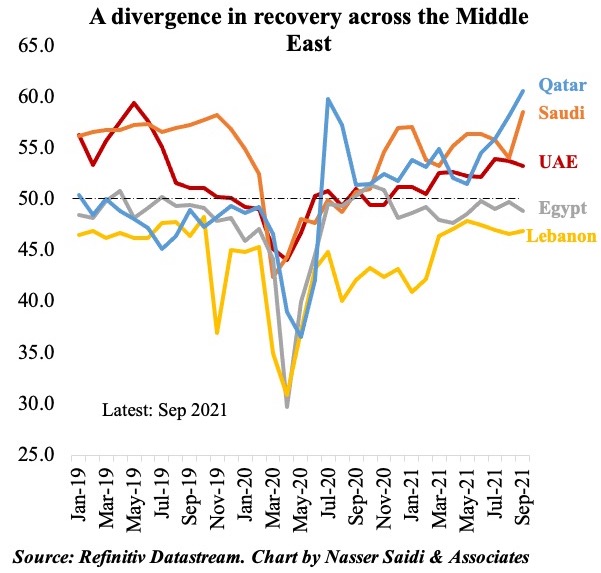

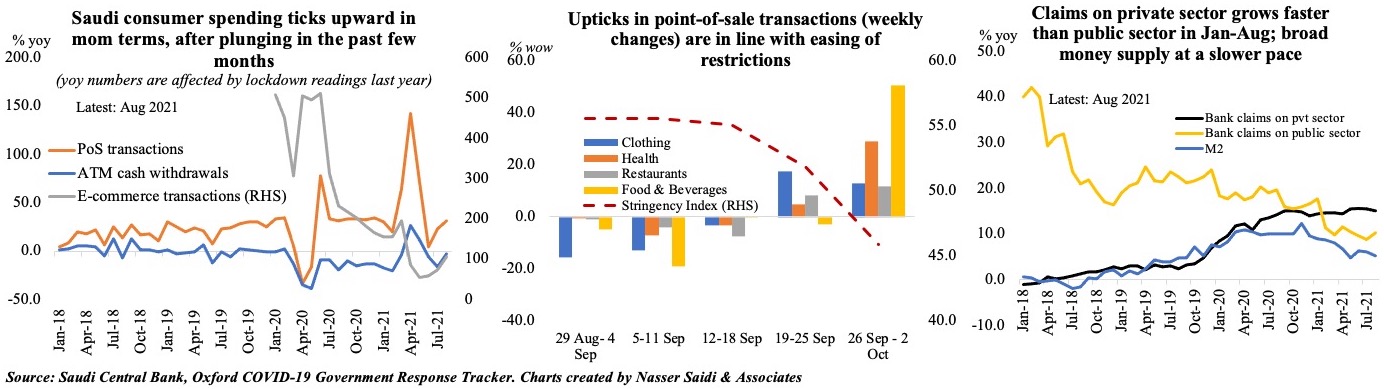

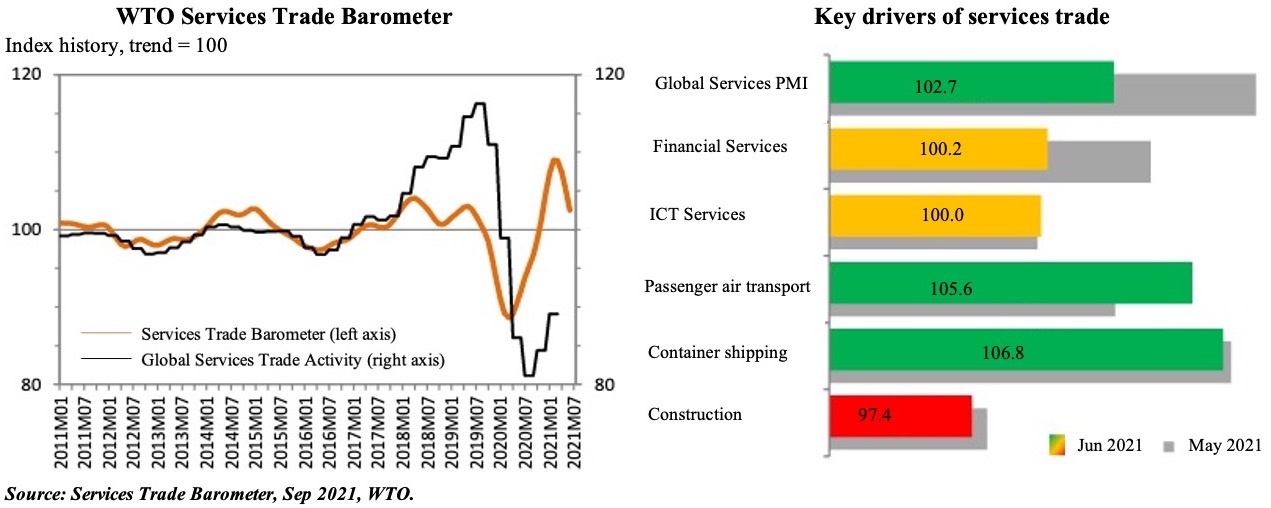

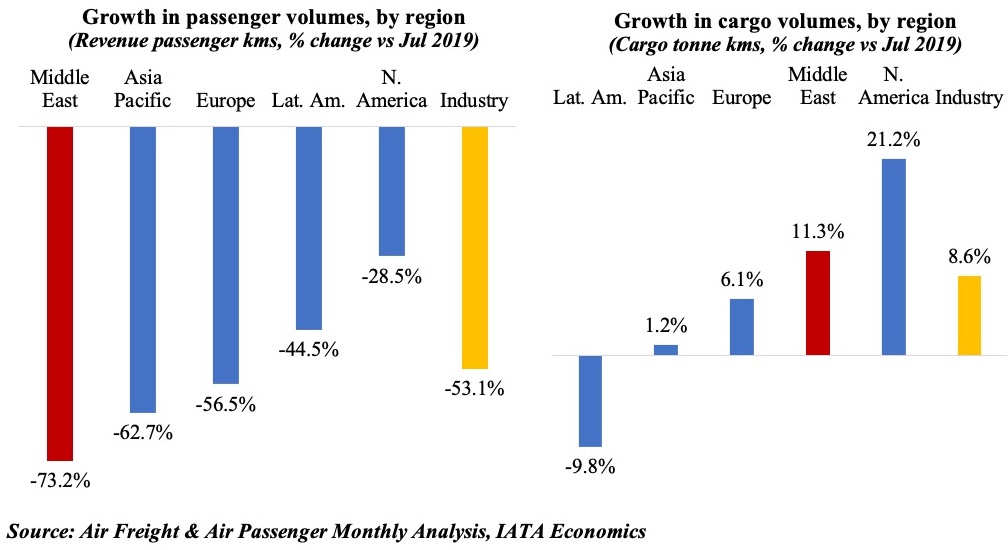

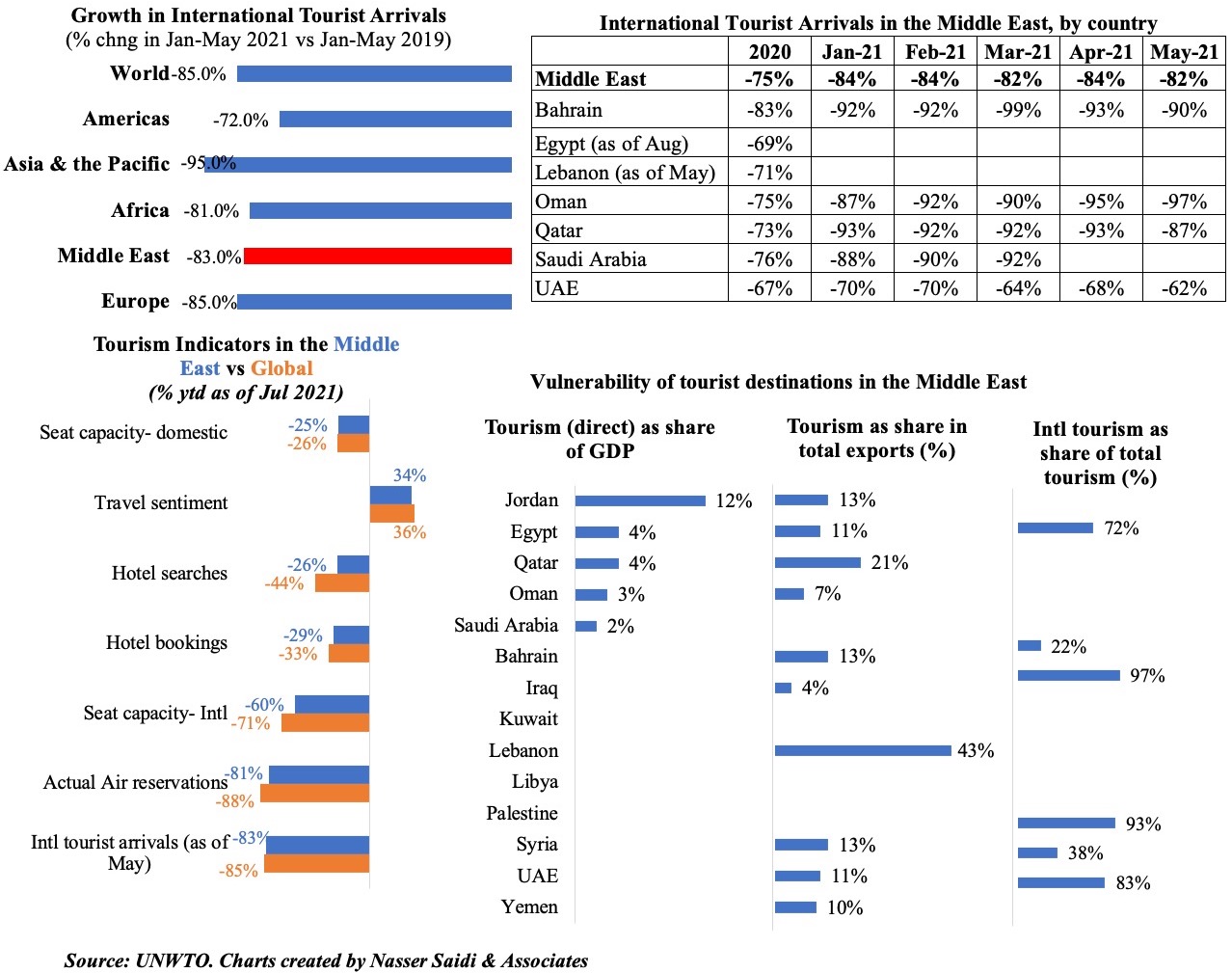

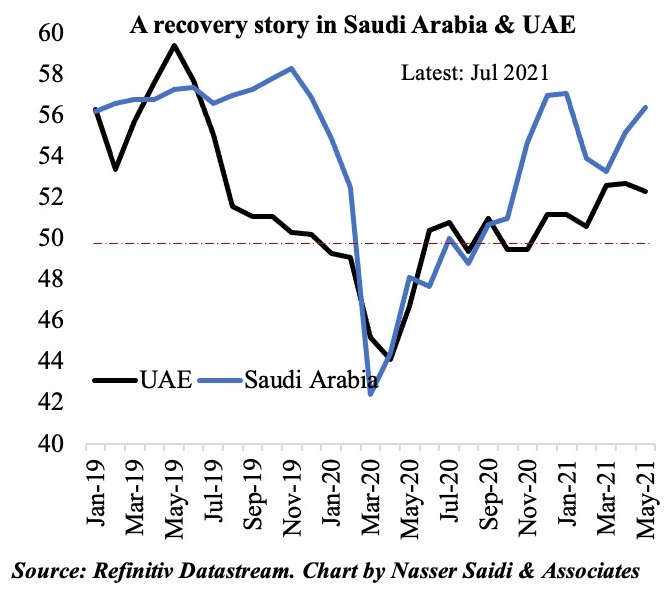

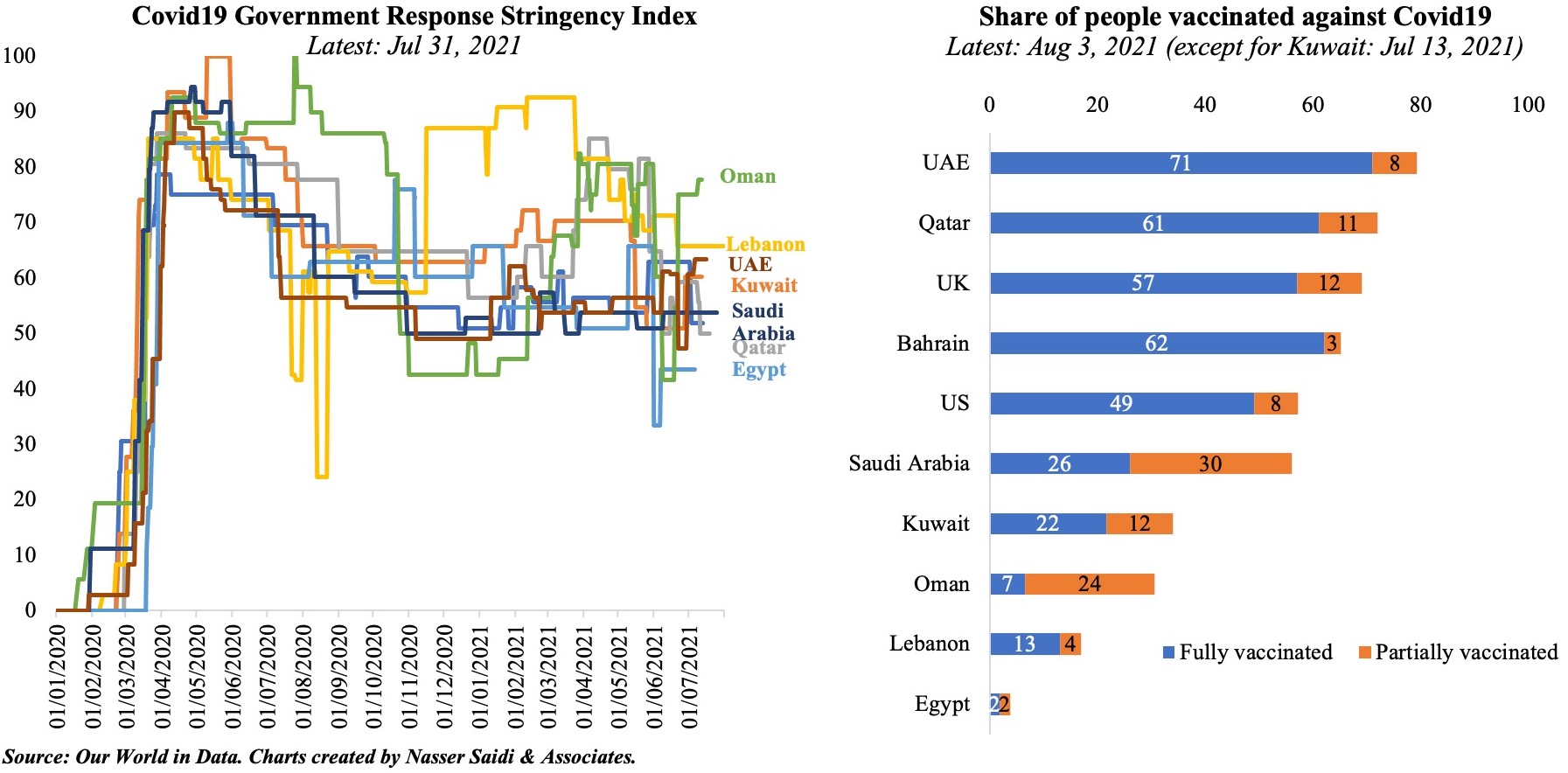

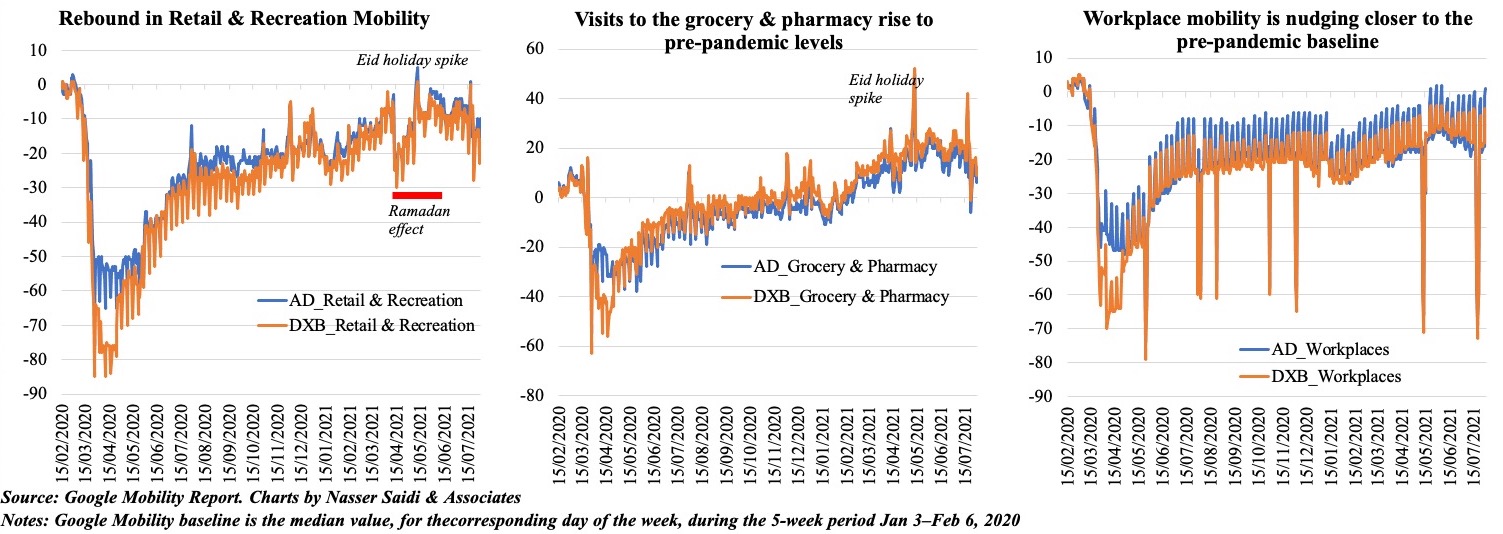

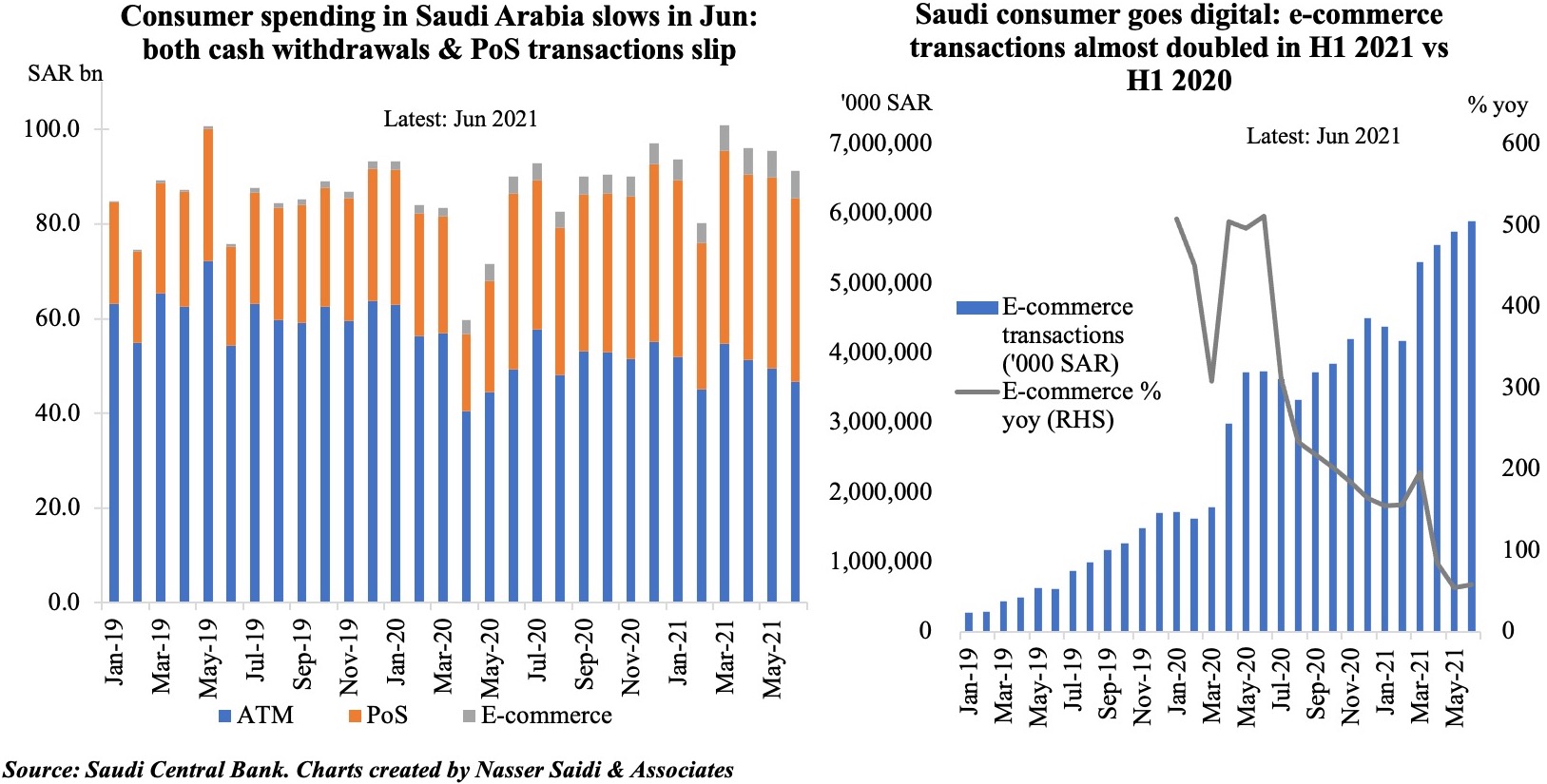

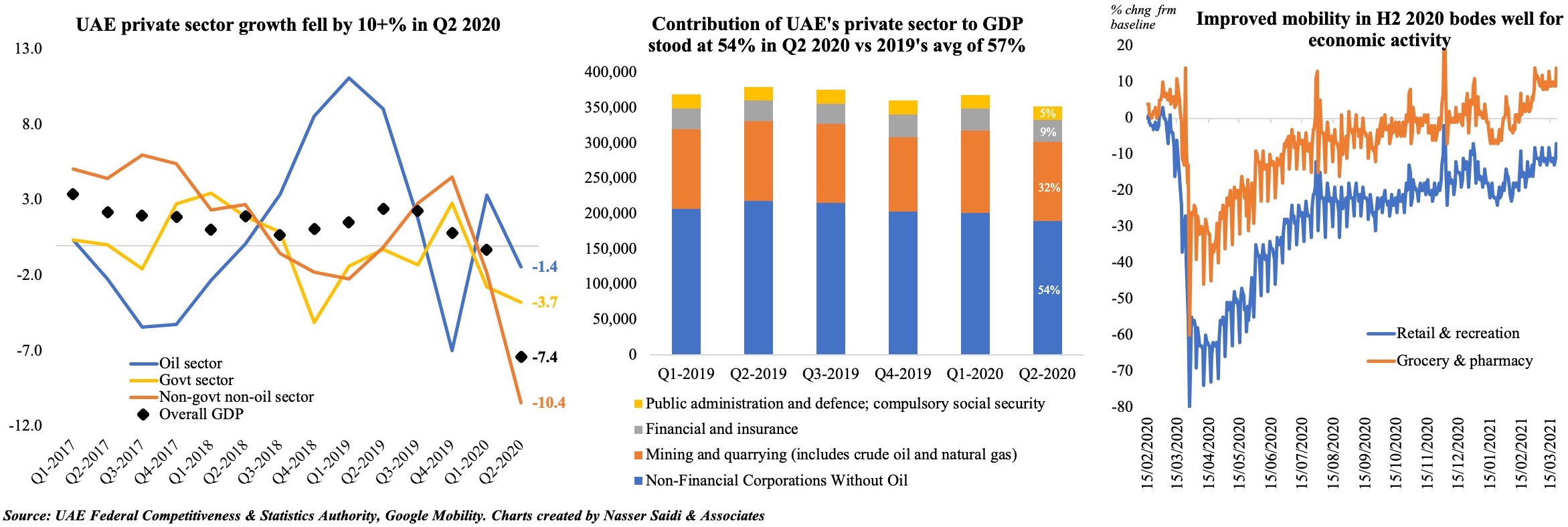

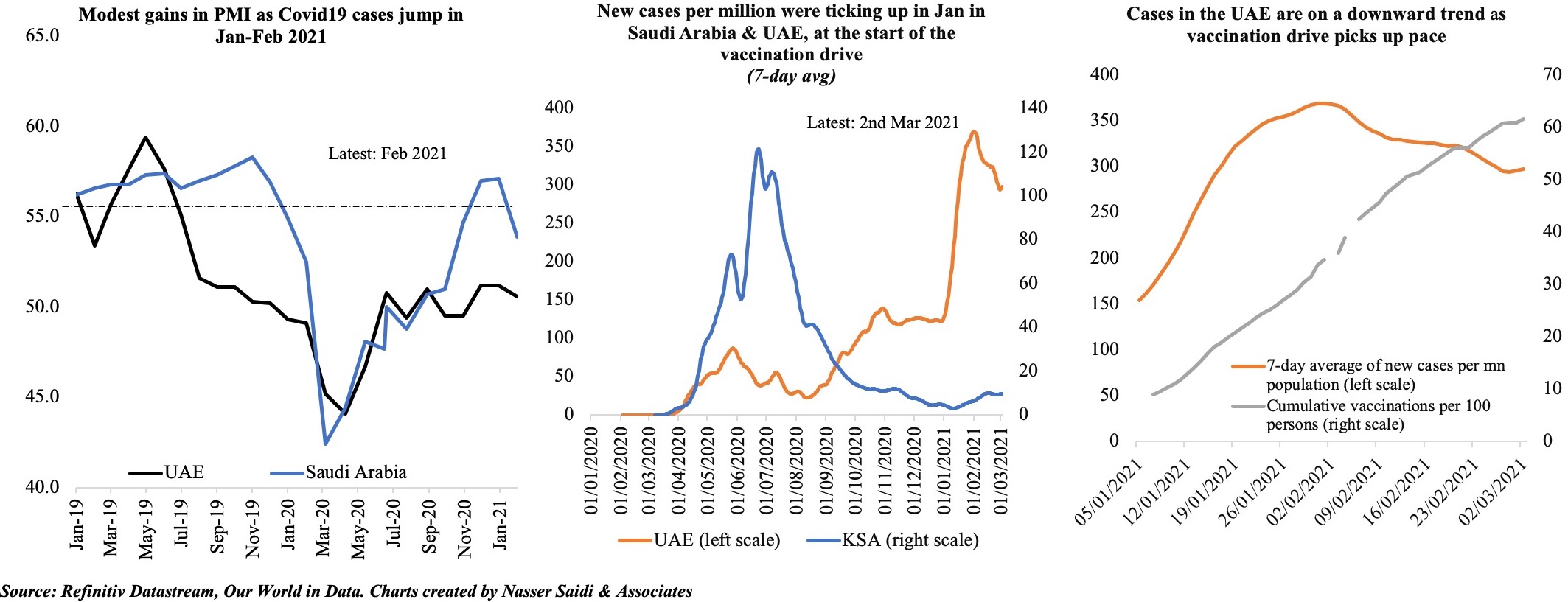

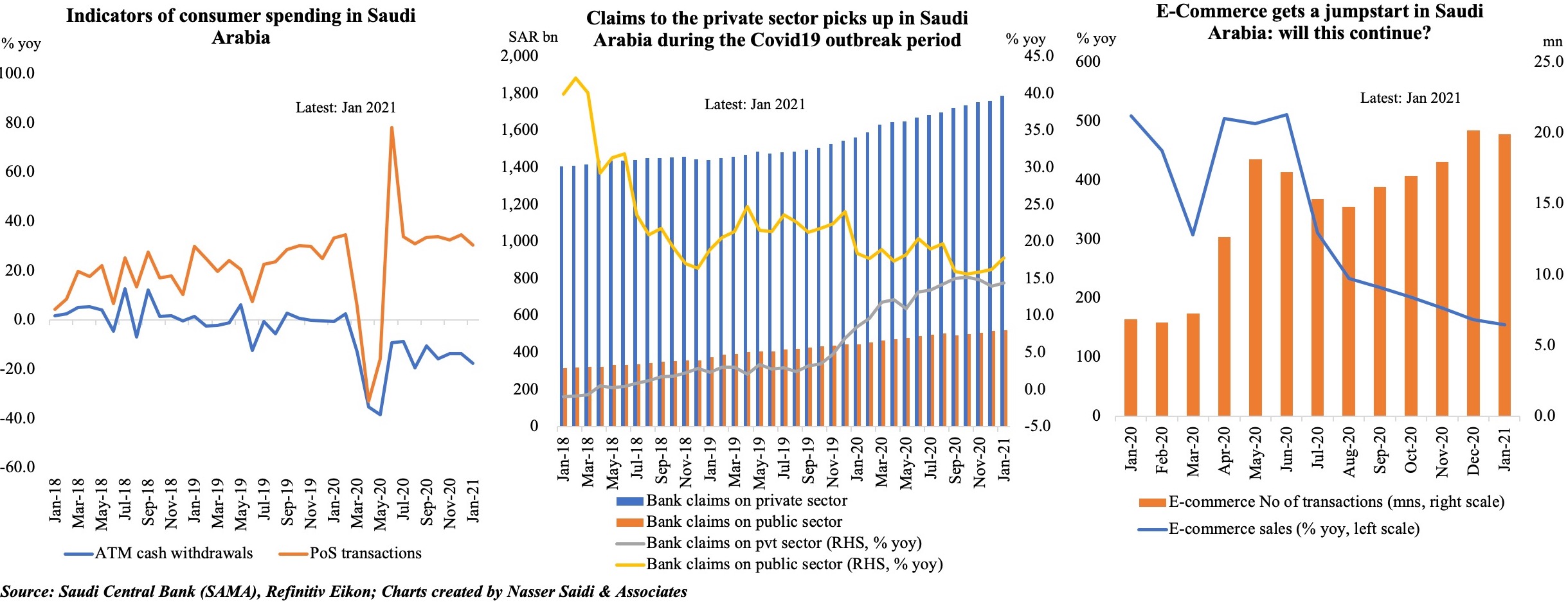

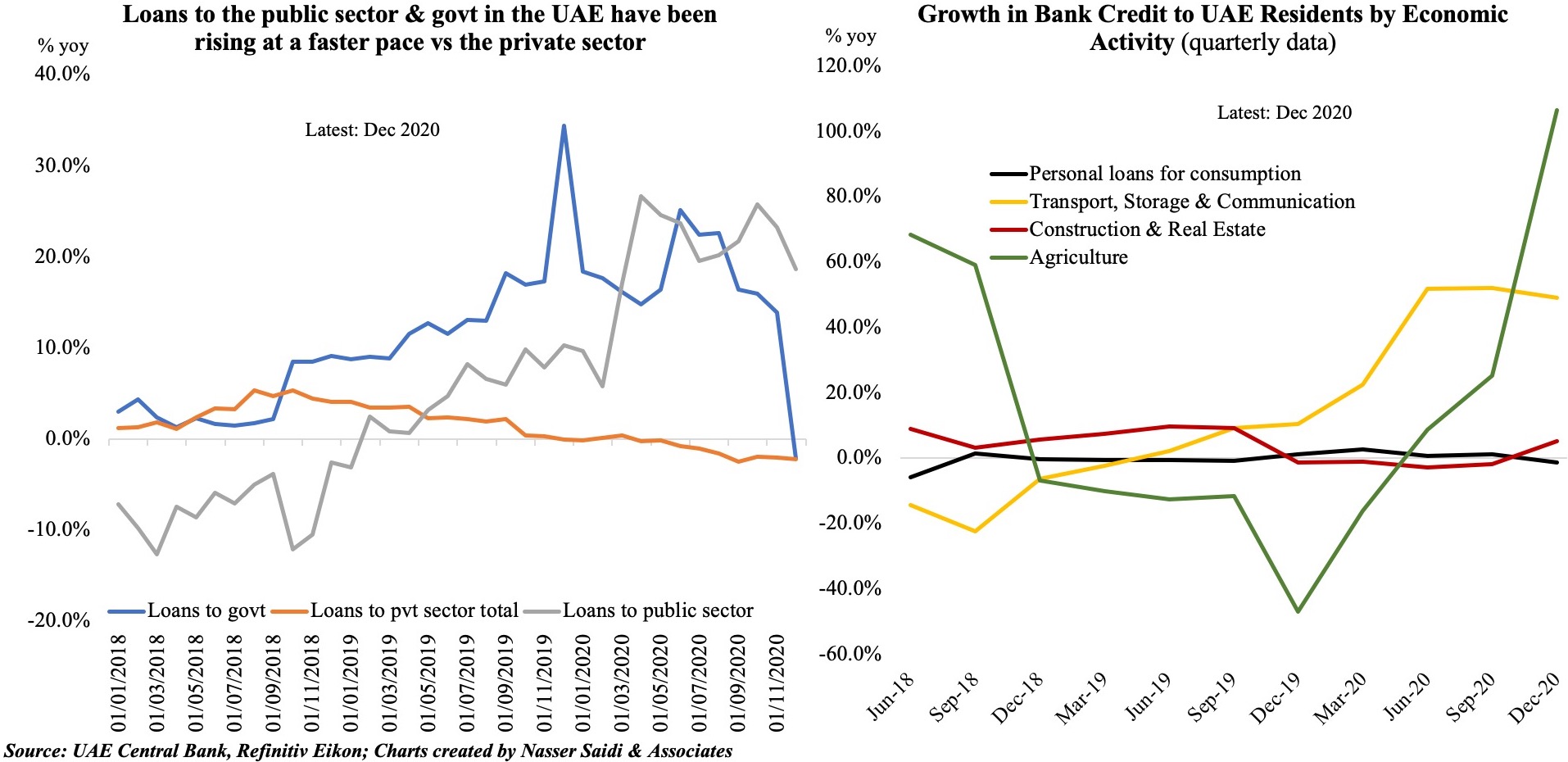

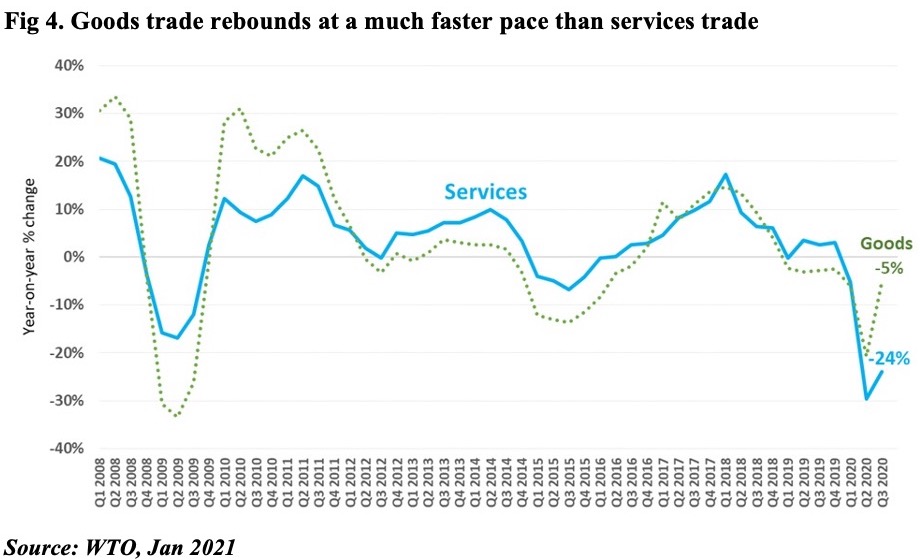

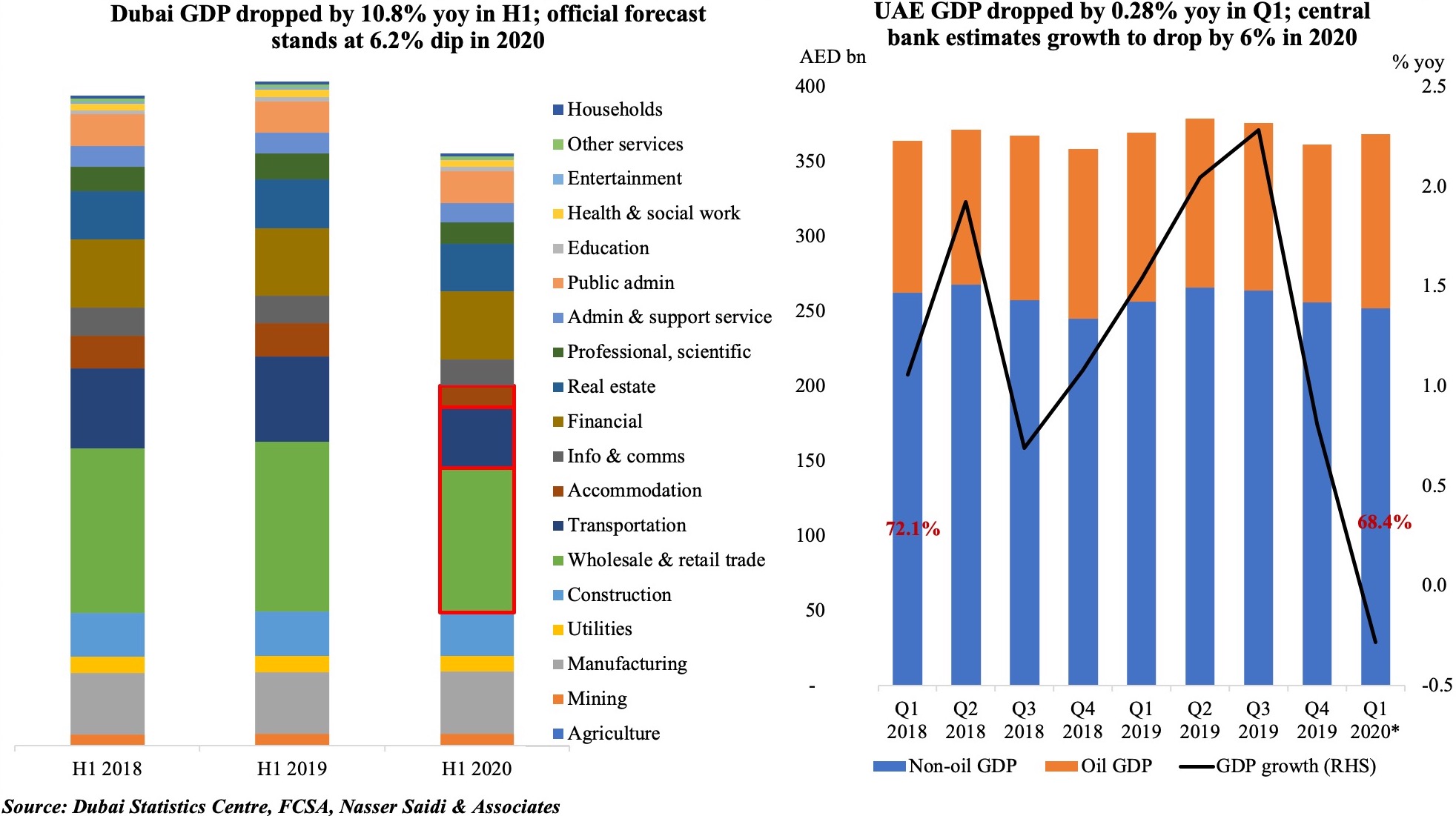

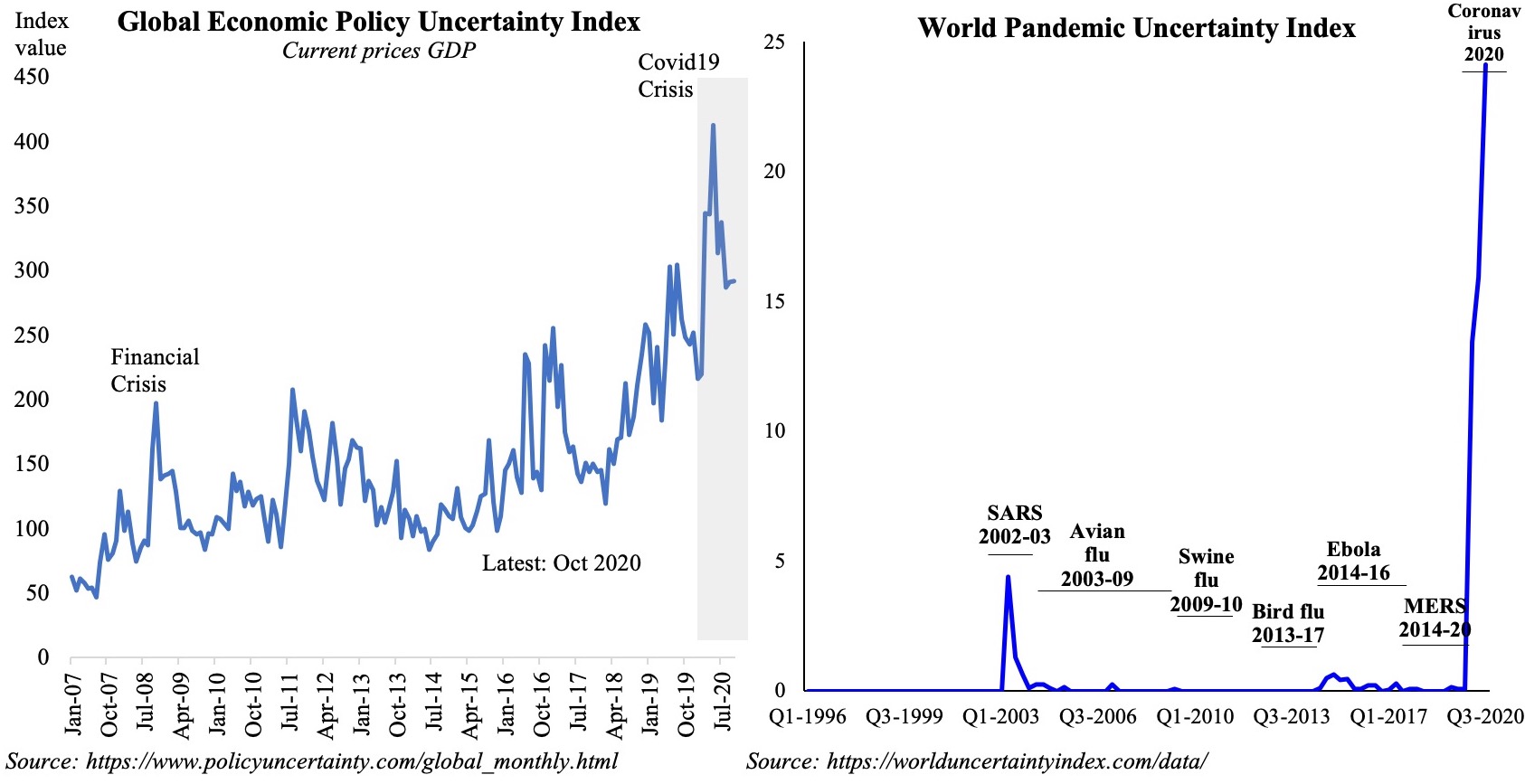

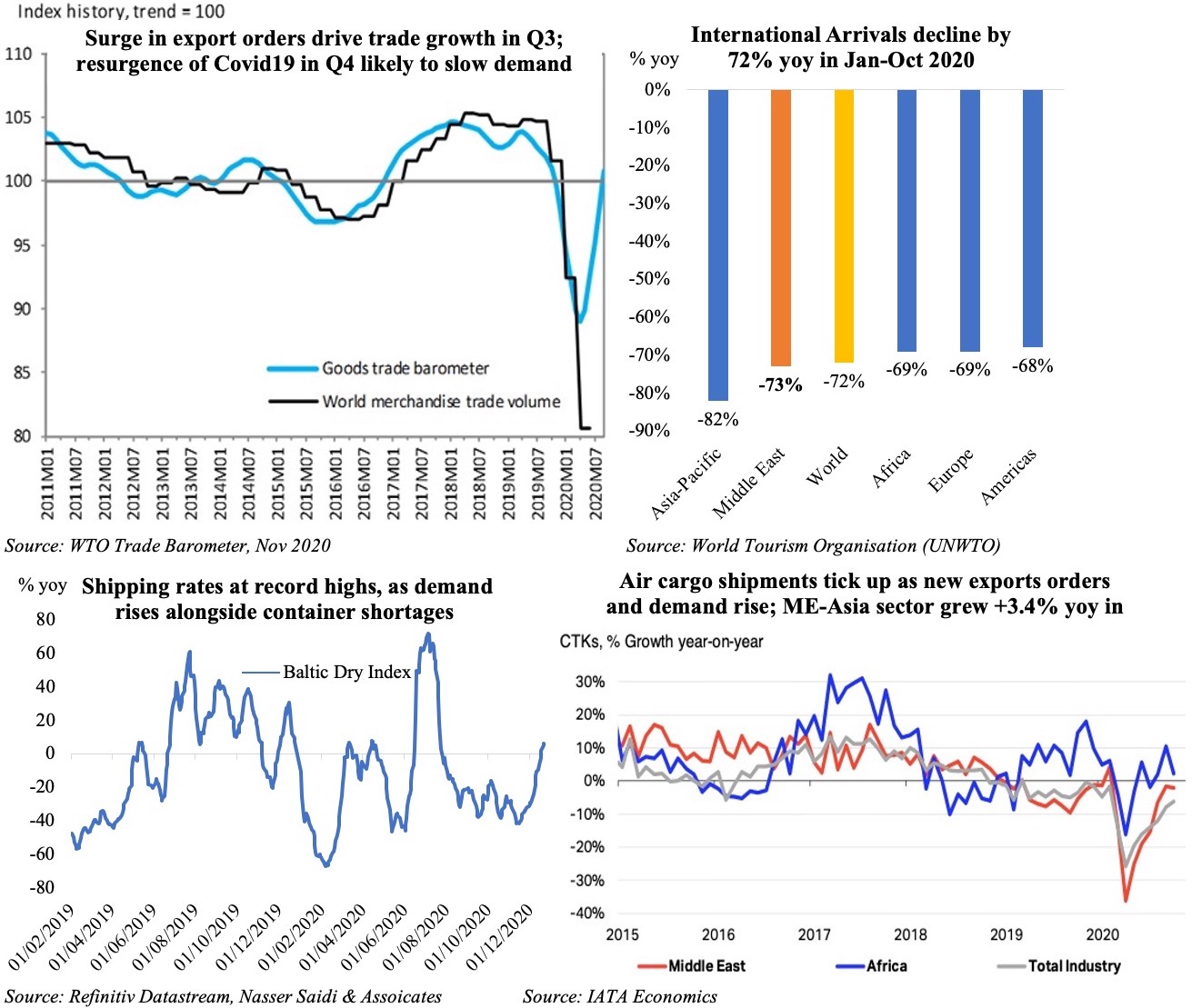

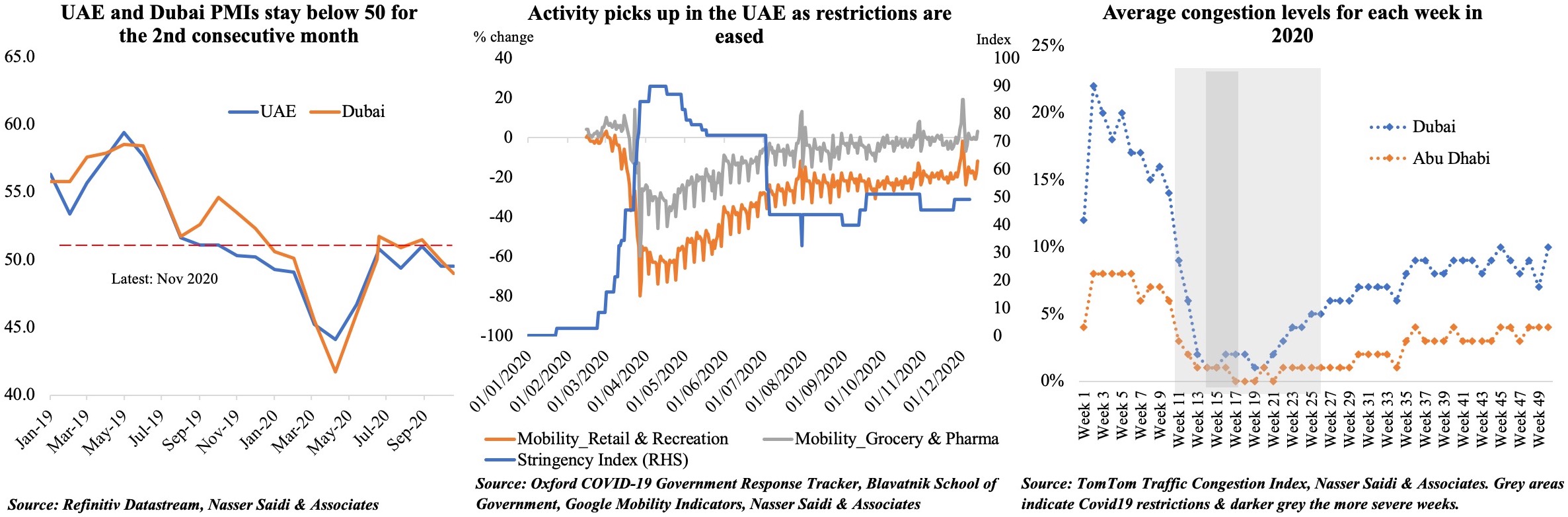

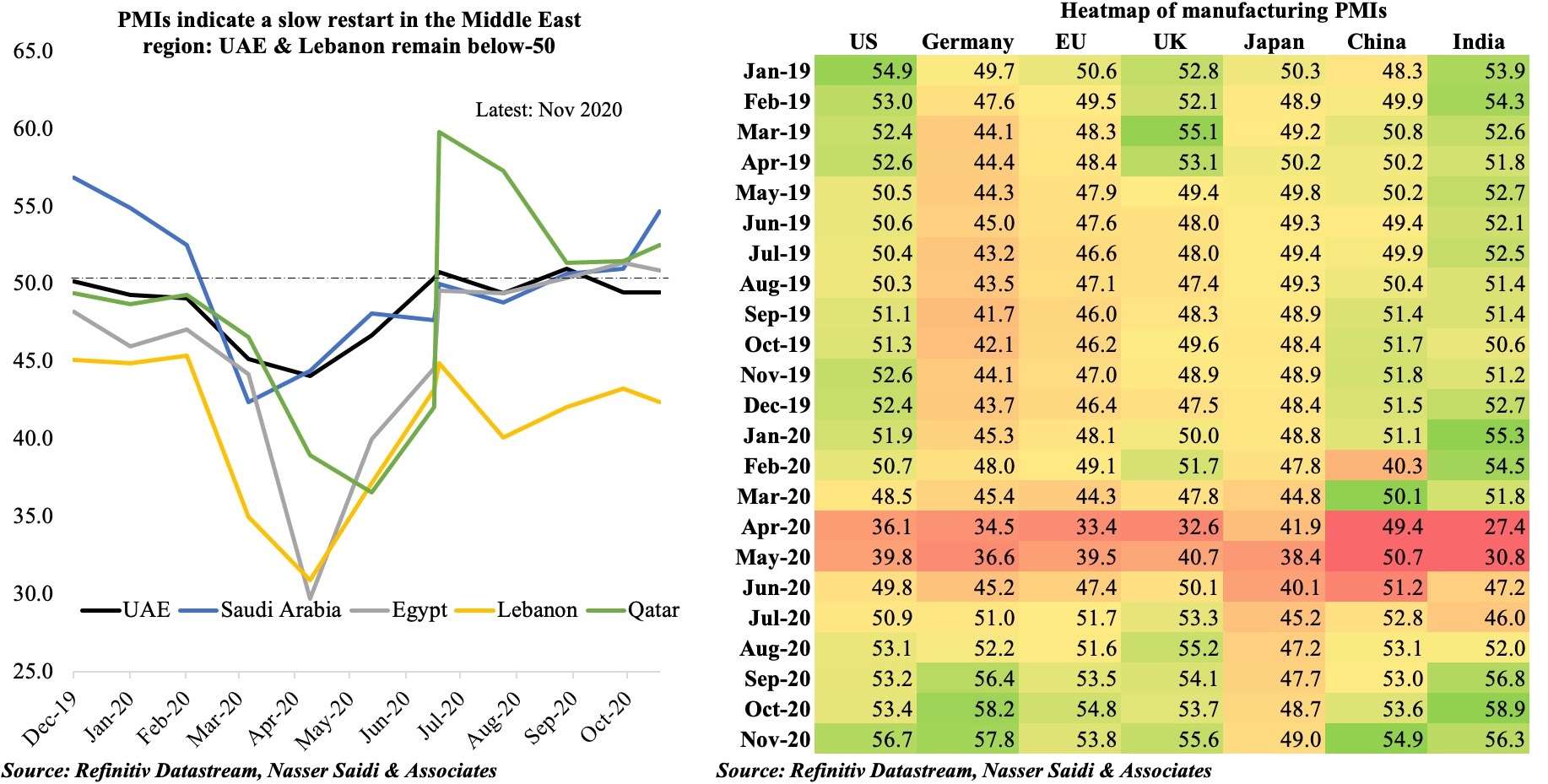

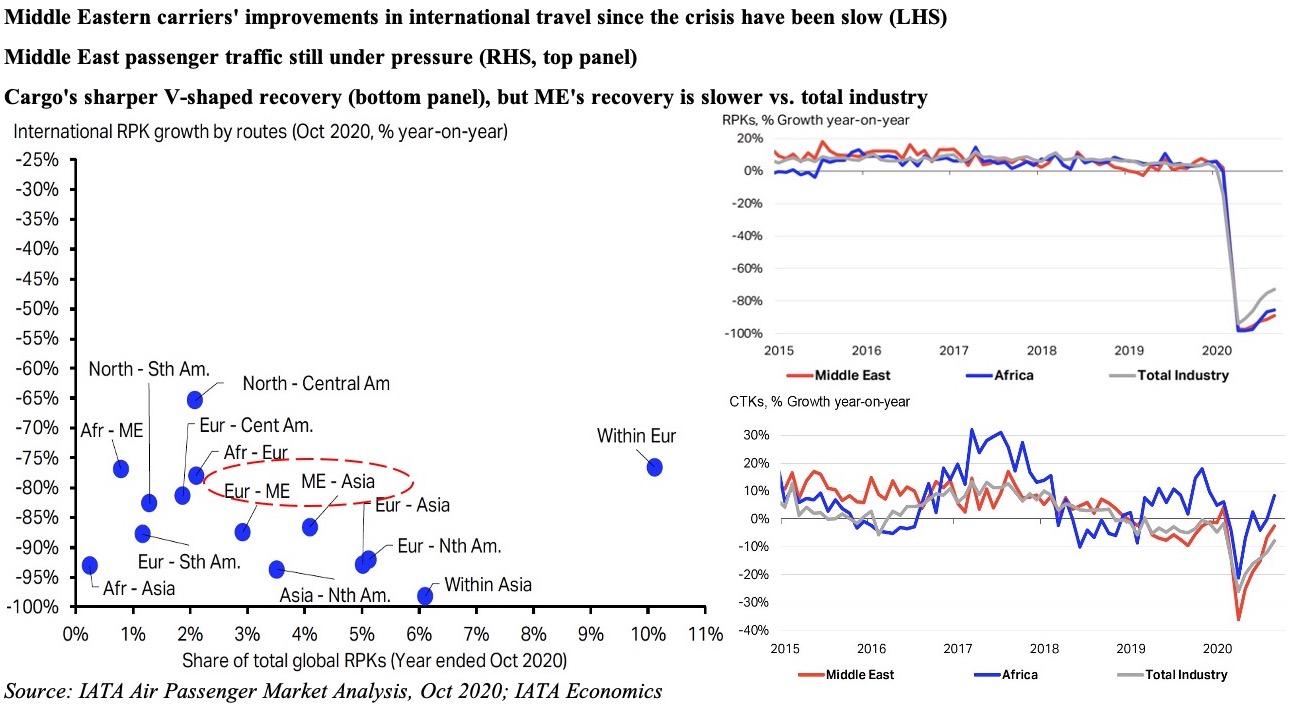

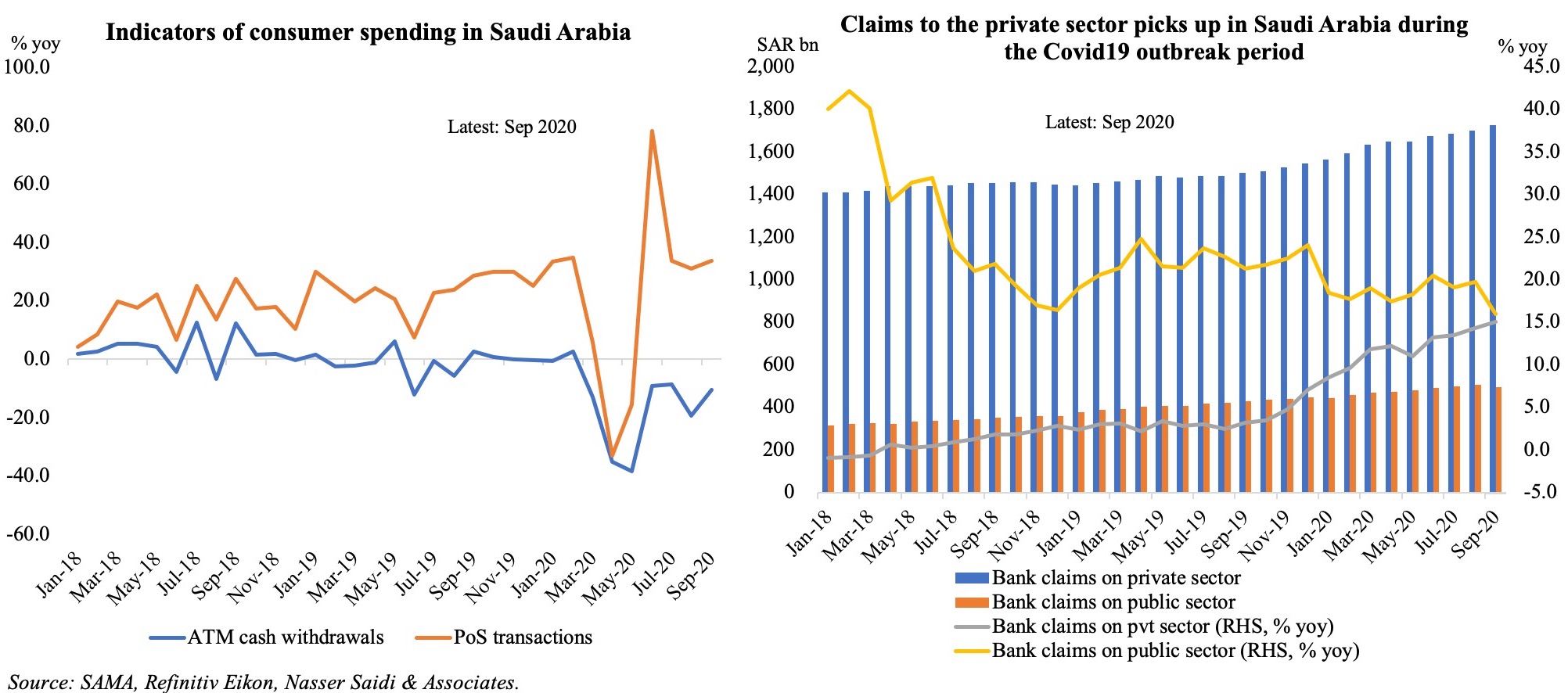

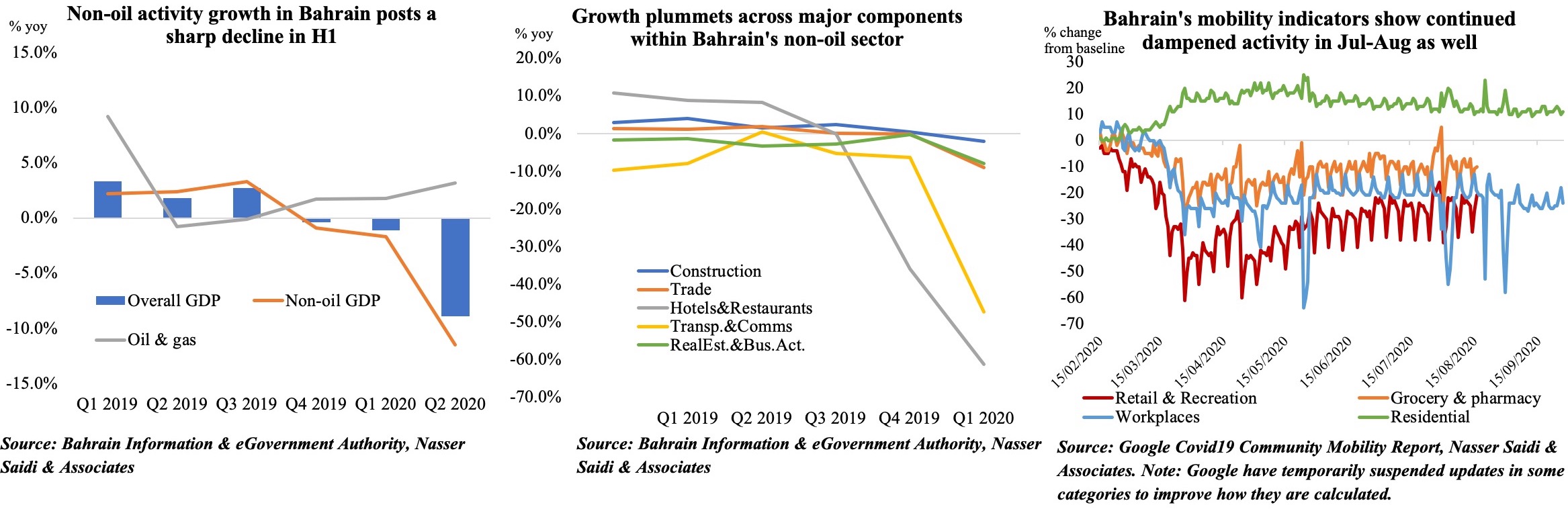

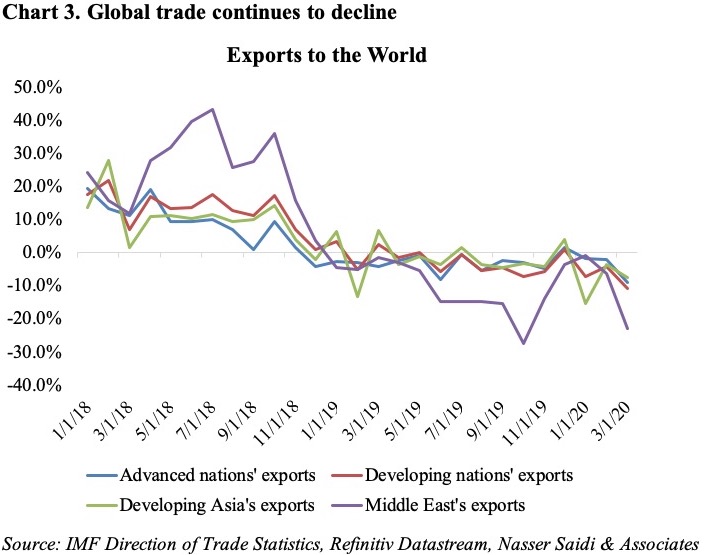

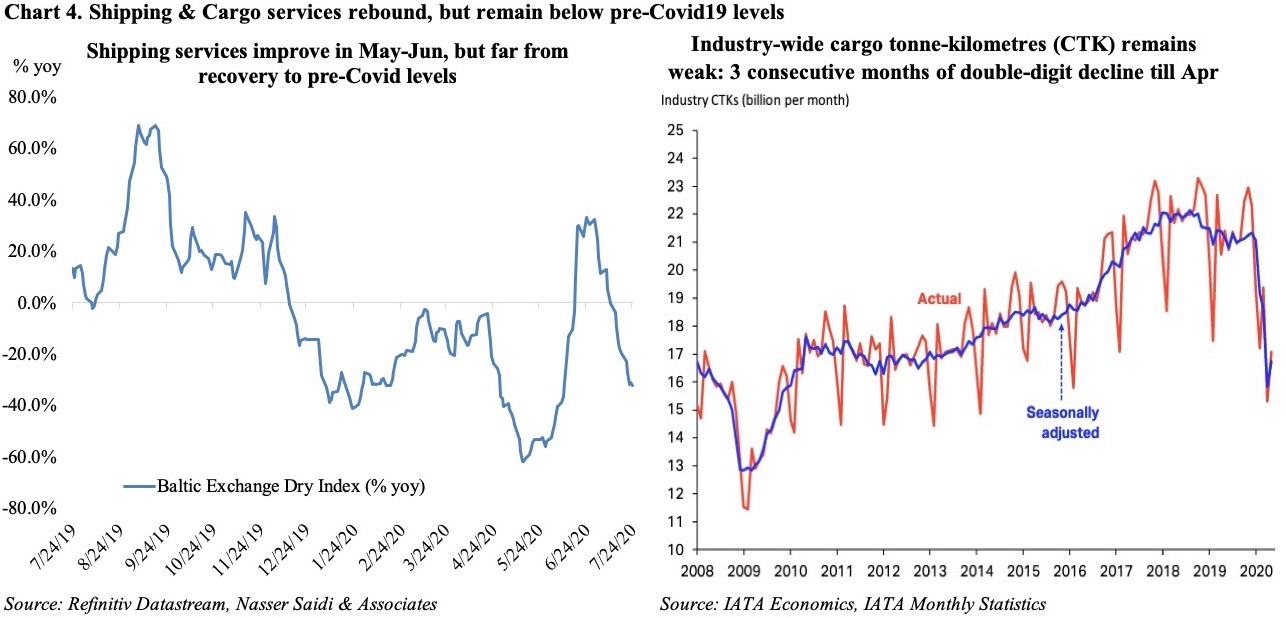

The coronavirus was a game-changer. To shift from over-dependence on commodities, the GCC (and others) have diversified into services-based sectors such as tourism, trade, logistics and transport. But these were affected in the initial Covid-19 year, leading to a reassessment of diversification strategies.

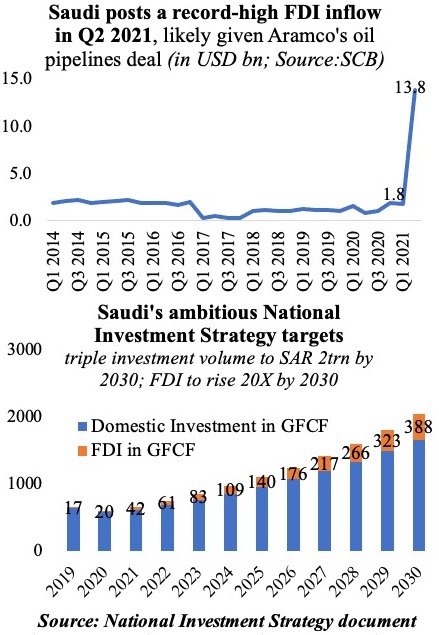

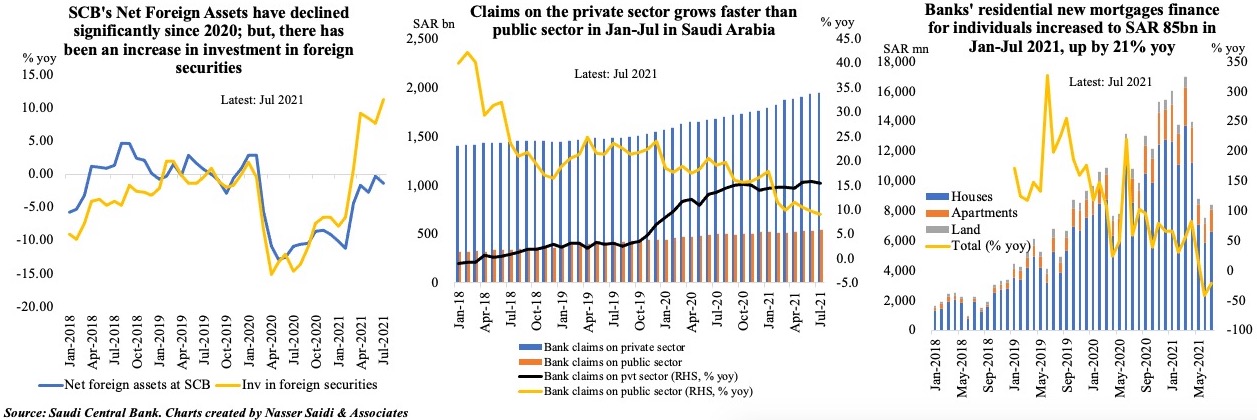

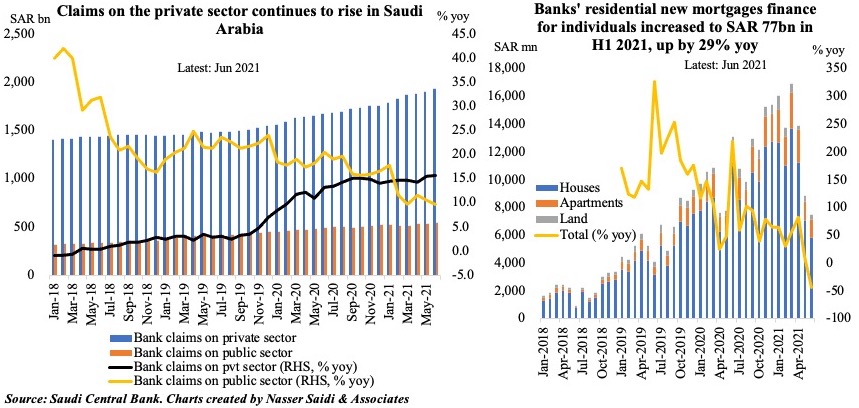

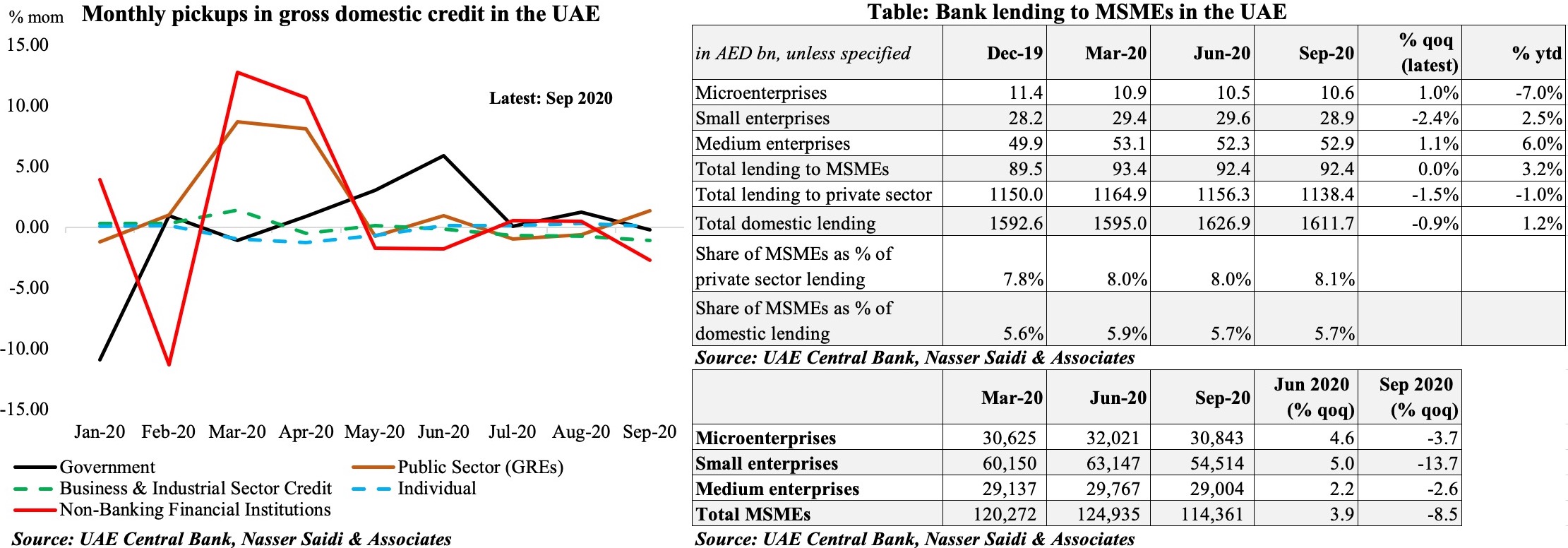

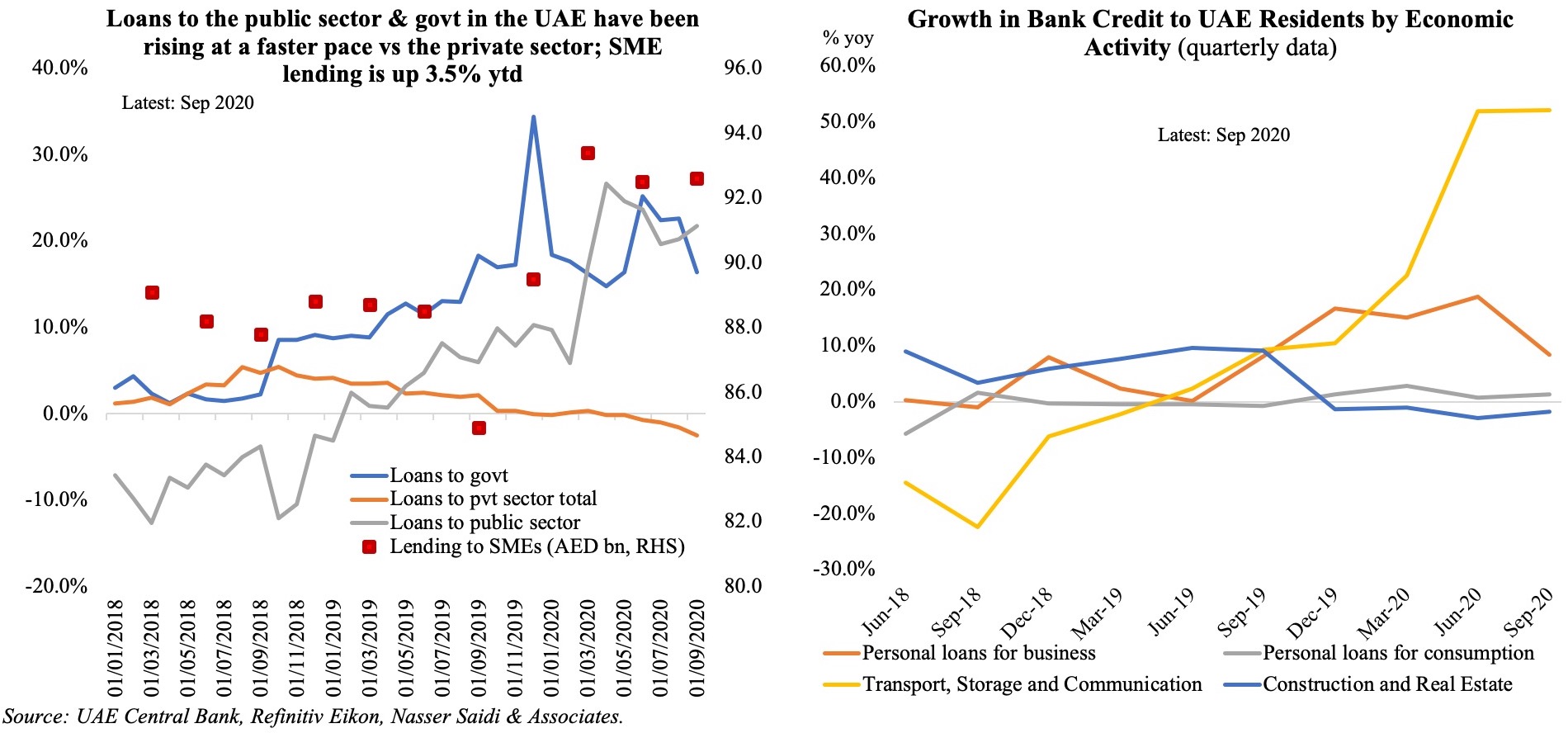

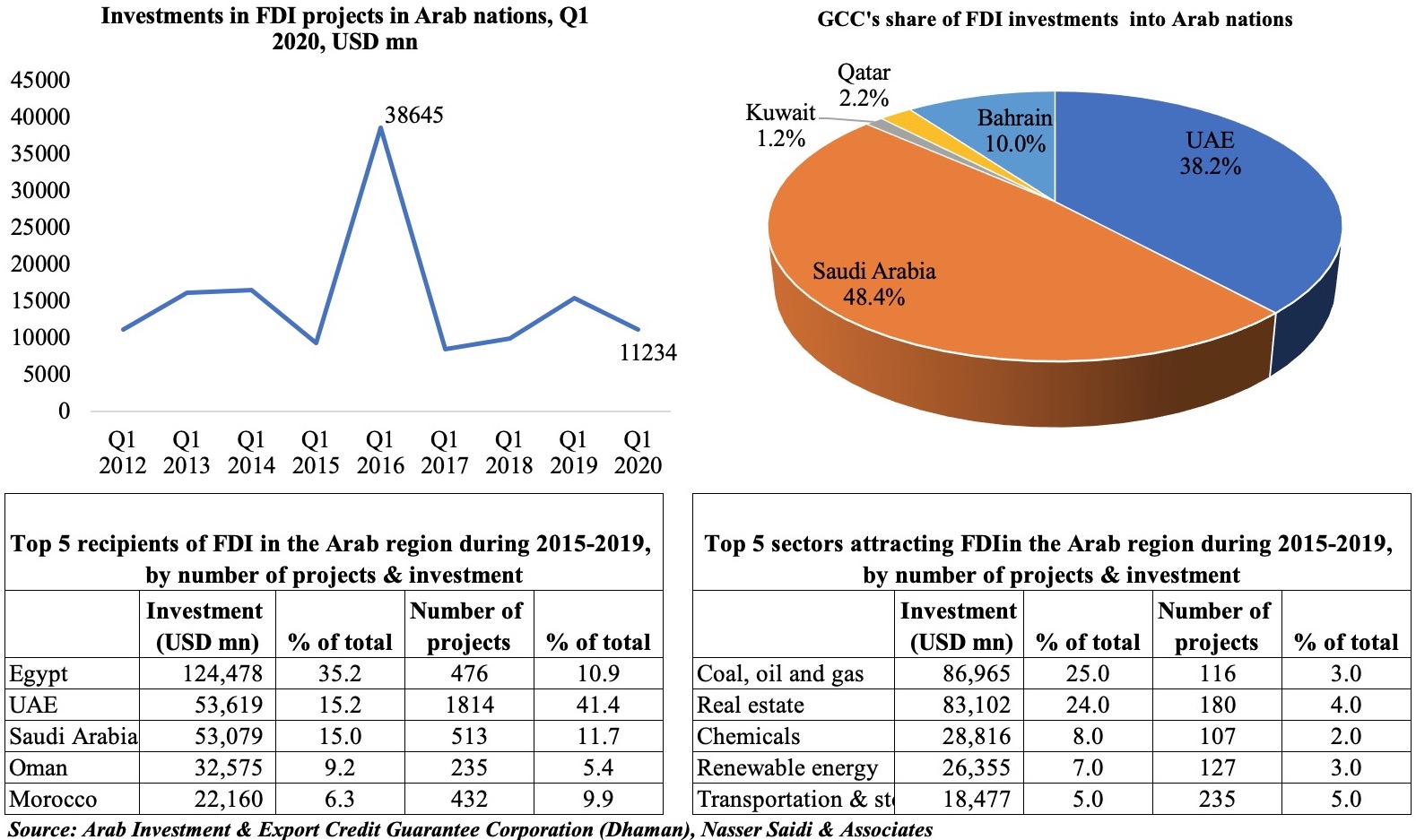

The pandemic has galvanised policymakers into action to support FDI flows, labour mobility liberalisation, privatisation and structural reforms.

Economic diversification 2.0

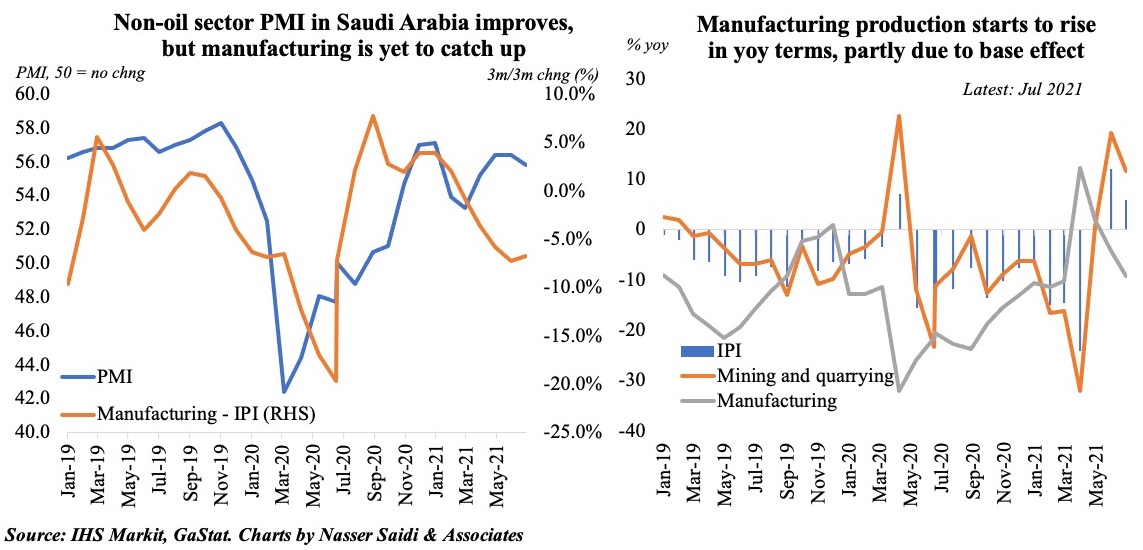

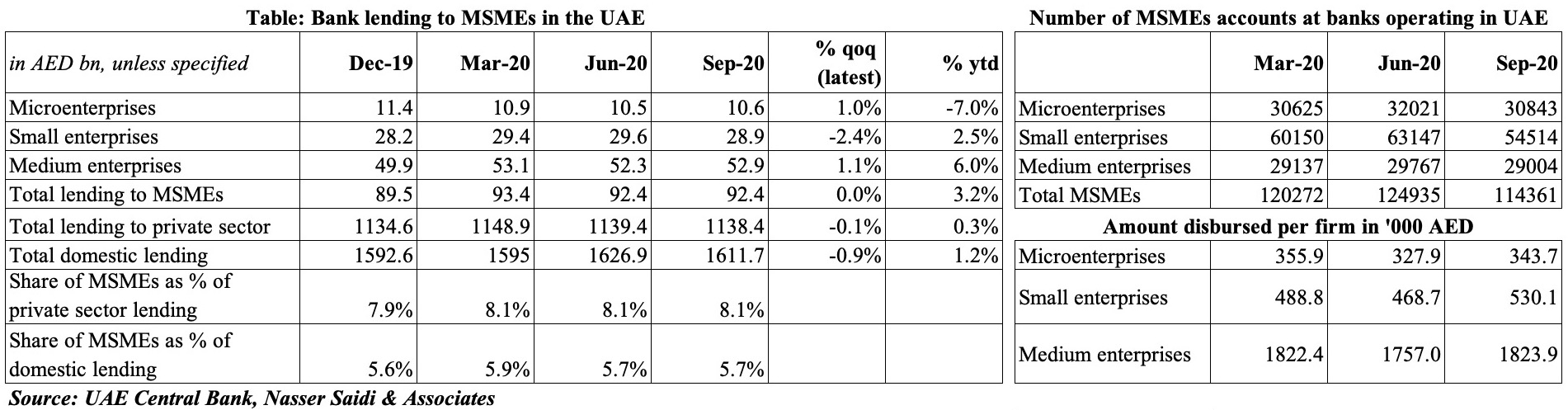

On the output side, there is greater opportunity in moving towards knowledge-based and innovation-led activities, creating space for private sector activity (especially in the tradables sector), and developing industrial policies and clusters, with local procurement strategies fostering job-creation at small and medium enterprises.

Incentivising policies supporting the diffusion of new technology (such as electric transport systems or robotics), alongside a push for investment into new sectors, including digital economy, clean energy and climate technology, and increasingly general purpose tech such as artificial intelligence, will also support diversification.

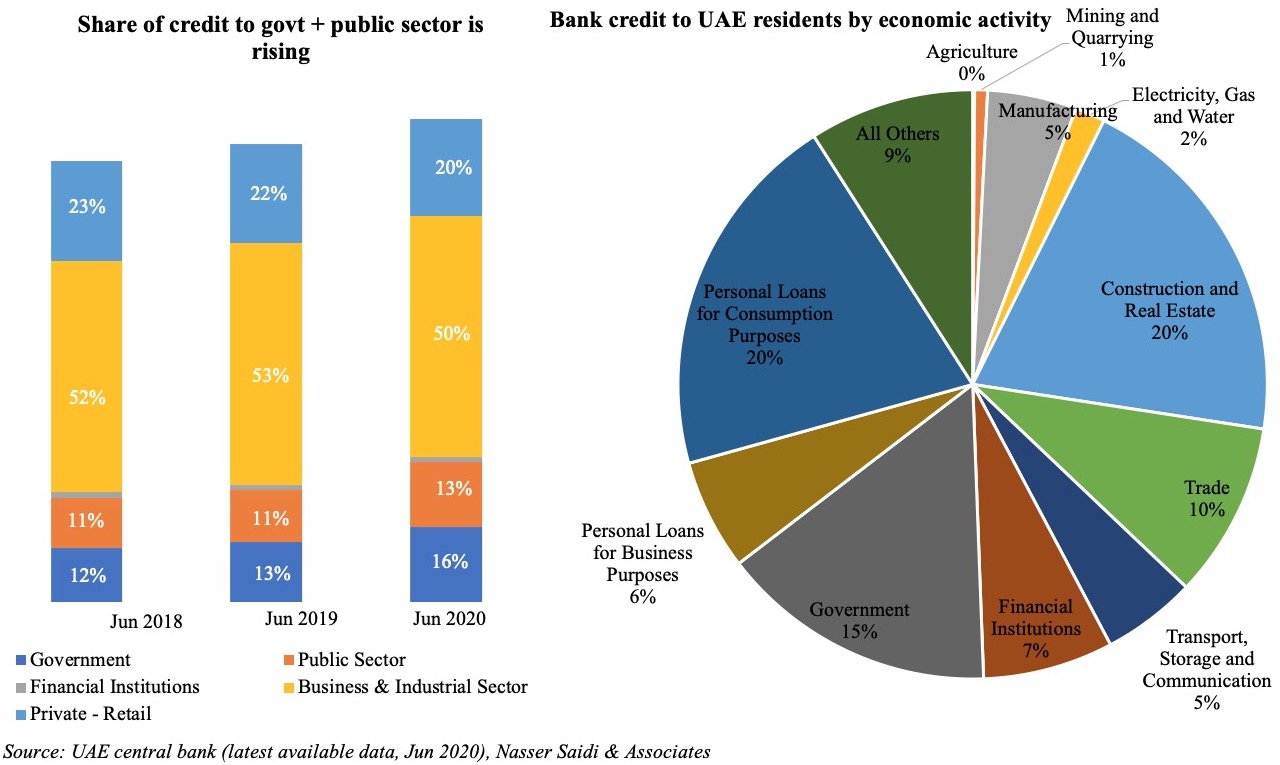

The continuing privatisation of state-owned assets and enterprises allows for the opportunity to “de-risk” fossil fuel assets, with the added advantage of raising revenue, developing and diversifying financial markets, and attracting both domestic and foreign investment and technology.

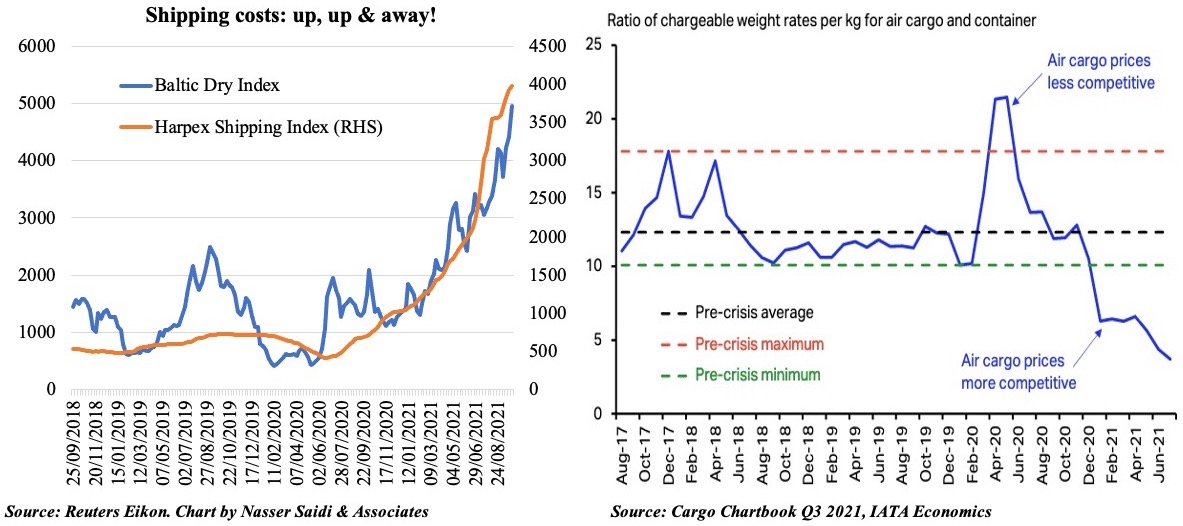

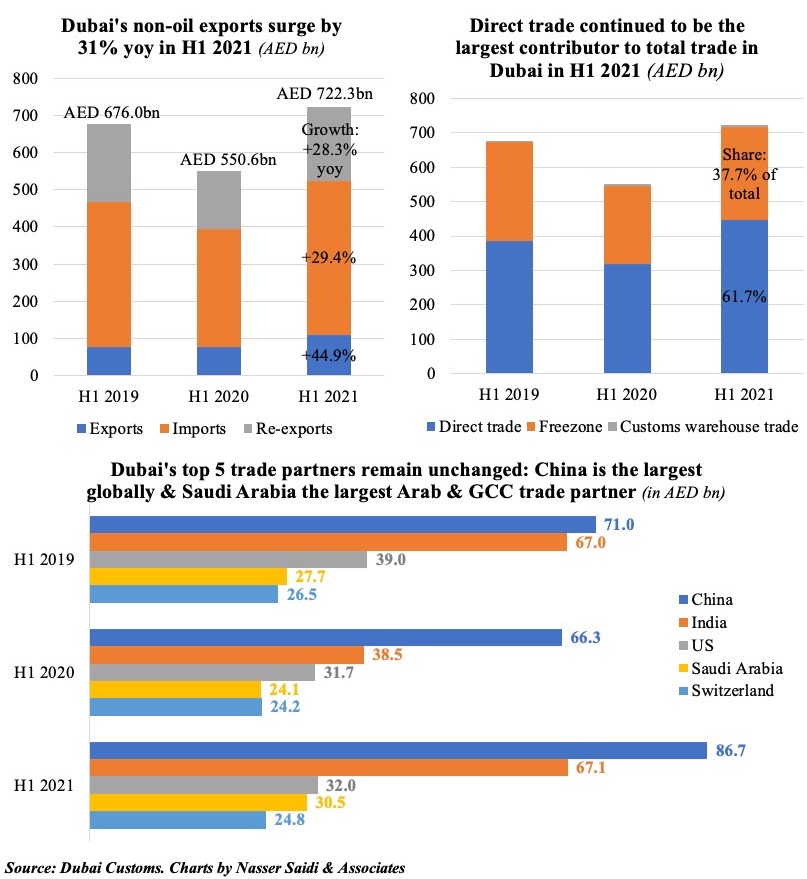

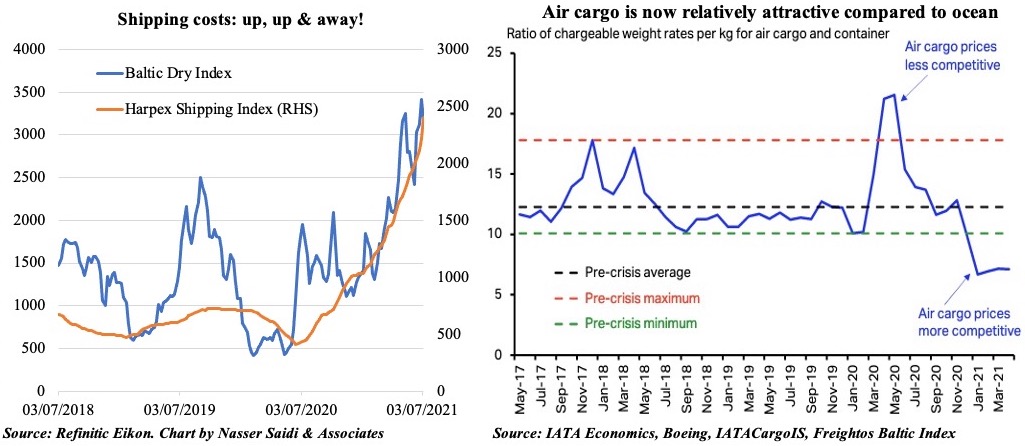

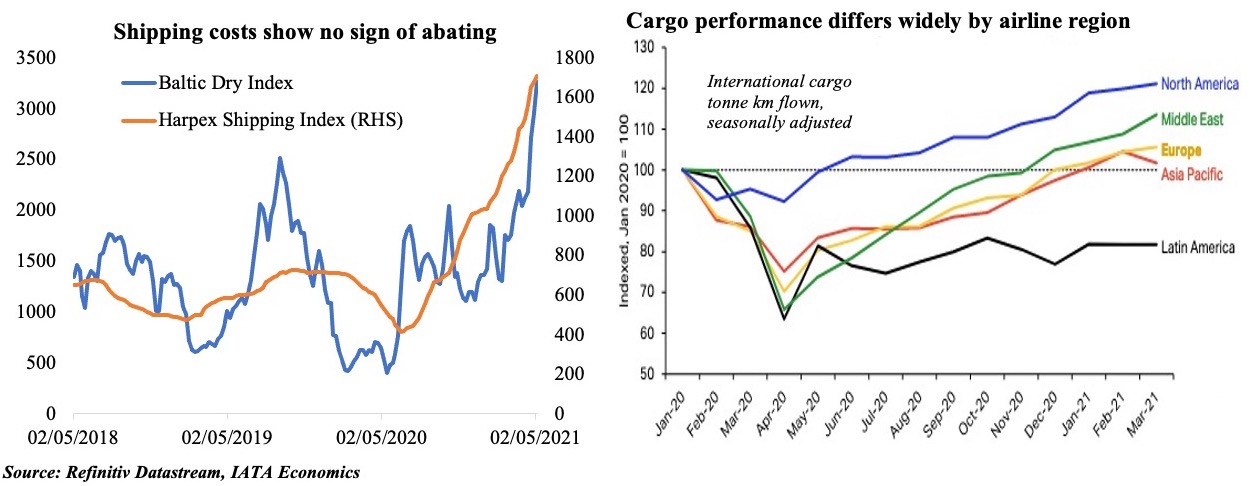

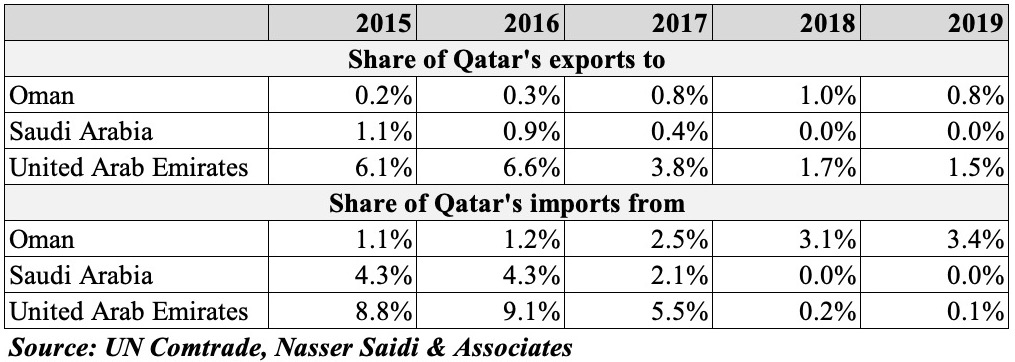

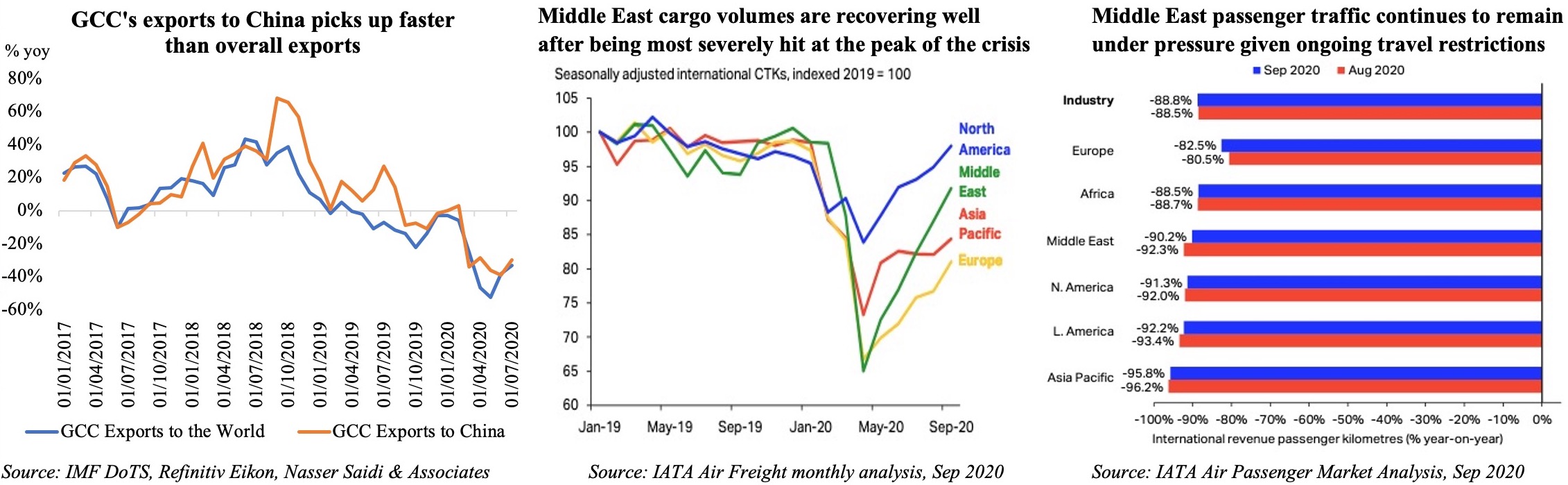

The pandemic underscored the need for trade diversification — both in terms of products and trade partners — and of supply chains.

The GCC will also benefit from the enactment of new “deep trade agreements”, including the broad category of services, such as digital services (e-services, e-commerce and digital finance), beyond the limited scope of trade in goods.

With the shift in global economic geography towards Asia, a China-GCC free-trade agreement (under negotiation since 2004) is a strategic priority, given that China is the main trade and economic partner of the region and would integrate the GCC into Asian supply chains.

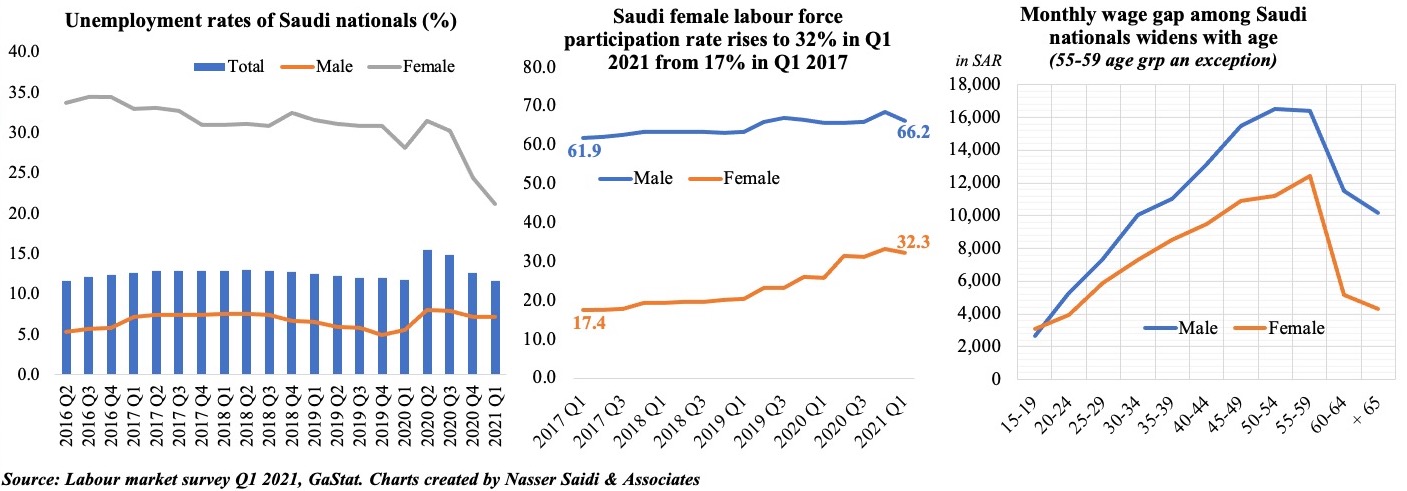

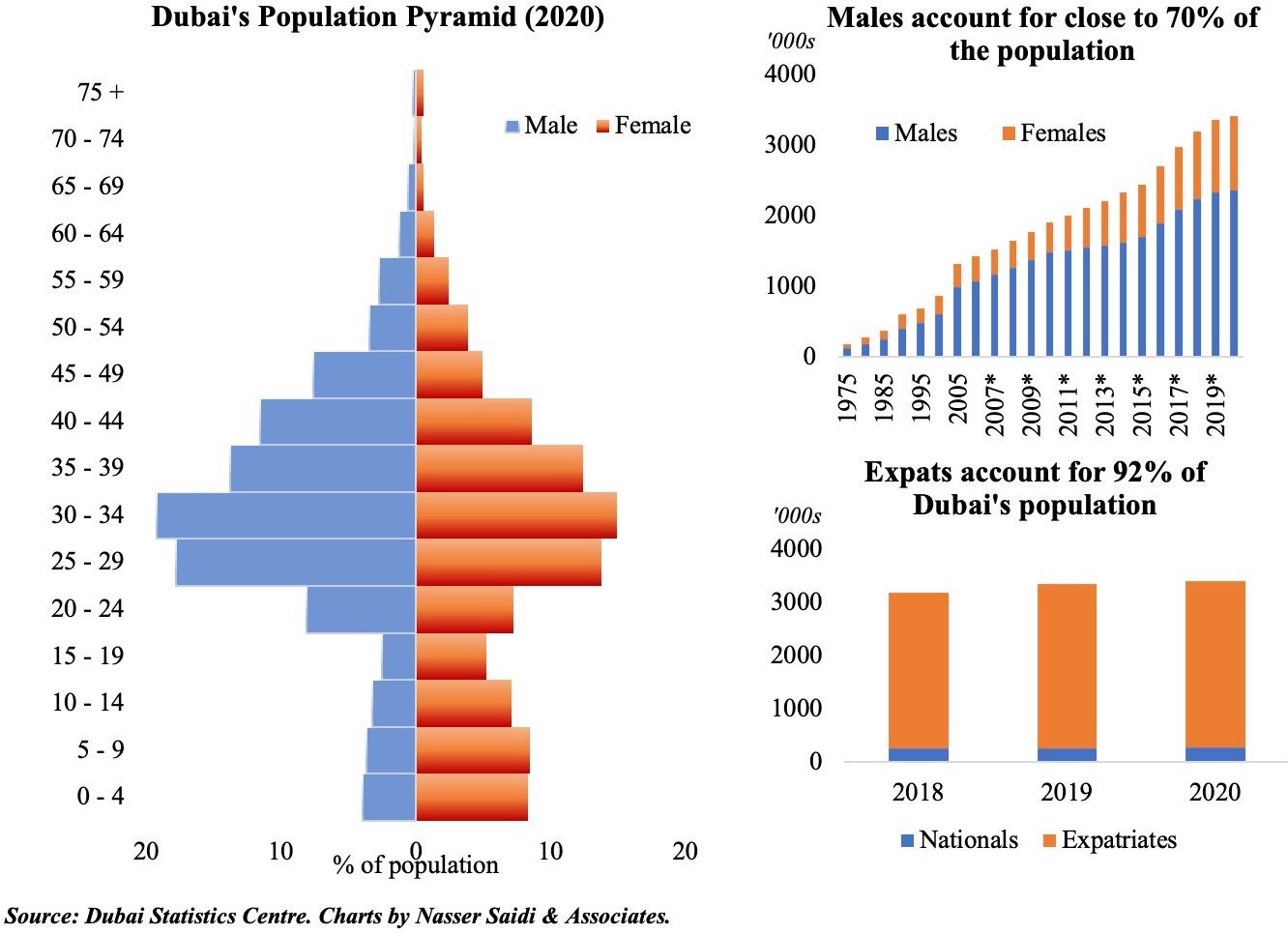

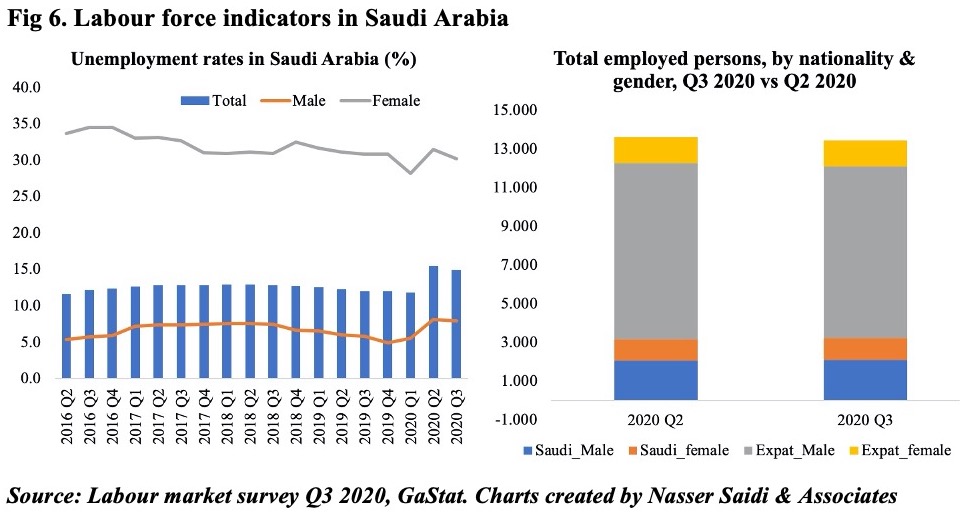

Trade reforms, when complemented by structural reform, including in the labour market, will lead to greater skill diversity in the workforce, enabling mobility and lower transition costs, job creation and raising productivity growth.

The pandemic has galvanised policymakers into action to support FDI flows, labour mobility liberalisation, privatisation and structural reforms

Additionally, policy reforms will encourage private sector activity by lowering the costs of conducting business, thereby encouraging private and foreign investment, and promoting competitiveness and capital market development (including the development of a yield curve, a domestic corporate bond market), with a focus on climate finance and funding the green economy as part of energy transition policies.

Economic diversification leads to more balanced and stable economies, and is key to inclusive economic development and sustainable job creation.

The EDI is a tool that enables evidence-based policymaking and informs the design of strategy and policy measures, allows for the evaluation of policies’ impact and effectiveness, and enables monitoring of policy outcomes, as well as helps to identify problem areas. It enables policy research aimed at identifying strategies and policies that foster and those that hinder diversification.

Resting on current diversification achievements is insufficient. Commodity dependent nations need to sustain economic/structural reforms and innovate to catch-up faster with the frontrunners.

The Global Economic Diversification Index 2023 was released last week by the Mohammed Bin Rashid School of Government (MBRSG) at the World Government Summit. The report was developed in cooperation with Salma Refass and Fadi Salem (MBRSG) and Ben Shepherd (Developing Trade Consultants).