Markets

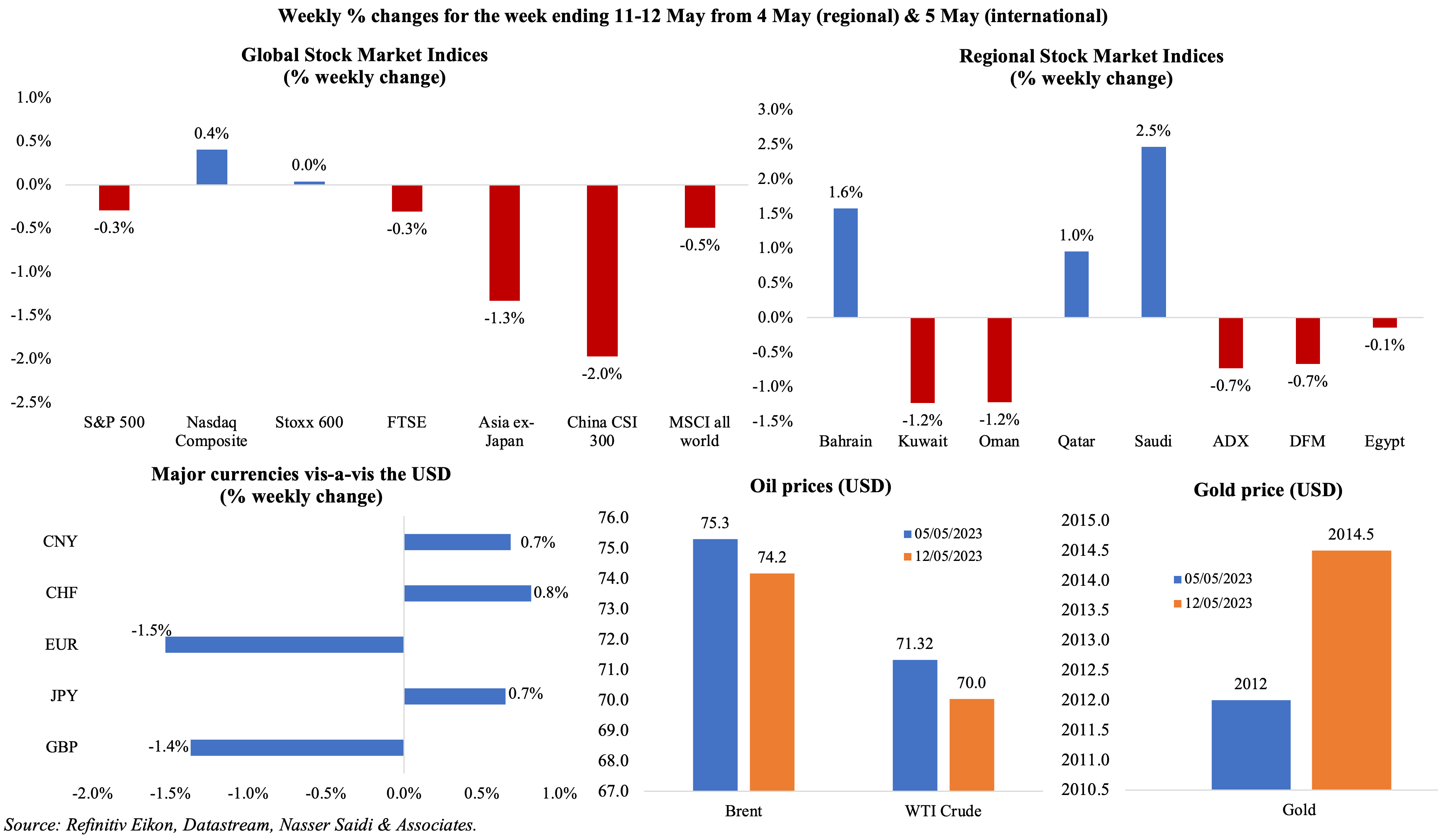

Equity markets were in the doldrums and mostly down, as investors focused on the economic outlook and jitters related to US debt ceiling discussions; while China clocked in a weekly loss of 2% given various data releases indicating a weaker-than-expected recovery, Japan’s Nikkei climbed to its highest since Nov 2021 on a string of positive earnings results. Regional markets were mixed, with Saudi gaining the most on strong earnings performance. The dollar strengthened versus the euro and GBP and also posted its biggest weekly gain since Sep. Oil prices declined for the 4th week in a row, down by around 1.5%, on a stronger dollar and concerns about weak demand (from the US and China). Gold price is near its all-time high, as the US debt standoff continues unresolved, raising global uncertainty.

Global Developments

US/Americas:

- US inflation eased to 4.9% yoy in Apr (Mar: 5%), the lowest level since Apr 2021. In mom terms, airline fares (-2.6%) and hotel costs (-3%) were lower alongside a moderation in shelter costs (0.4%) while used car prices inched up (4.4%). Core inflation eased to 5.5% (Mar: 5.6%).

- Producer price index in the US ticked up by 0.2% mom and 2.3% yoy in Apr (Mar: 2.7%): this was the smallest yoy rise since Jan 2021. About 80% of the monthly PPI gain can be traced back to a 0.3% gain services cost, the largest monthly increase since Nov 2022. Excluding food and energy, prices were up by 0.2% mom and 3.2% yoy (vs 0.2% mom and 3.4% yoy in Mar).

- US budget balance moved to a surplus USD 176bn in Apr, the first budget surplus since Apr 2022. Revenues declined by 26% to USD 639bn while outlays also fell by 17% (to USD 462bn). This widens the budget deficit in the period Oct-Apr to USD 925bn (+157% yoy).

- The Michigan consumer sentiment index fell to a 6-month low of 57.7 in May (Apr: 63.5), given declines in both expectations (53.4 from 60.5) and current economic conditions (64.5 from 68.2). The 5 year-inflation expectation was 3.2%, the highest since 2011, and up from Apr’s 3%.

- Initial jobless claims increased to the most since Oct 2021, rising by 22k to a seasonally adjusted 264k in the week ended May 5th, as the 4-week average was up by 6k to 245.25k (highest since Nov 2021). Continuing jobless claims climbed by 12k to 1.813mn in the week ended Apr 28th.

Europe:

- Sentix investor confidence in the eurozone further declined in May, falling to to -13.1 (Apr: -8.7), with declines in both the current situation (to -7.0 from -4.3) and expectations (-19, the lowest since Dec 2022, and from Apr’s -13 reading).

- Industrial production in Germany dropped by 3.4% mom in Mar (Feb: +2.1%), dragged down by the important automotive sector (manufacture of motor vehicles and parts declined by 6.5%, reversing Feb’s 6.9% gain). In Q1, IP was 2.5% compared to the previous quarter.

- GDP in the UK grew by 0.1% qoq and 0.2% yoy in Q1. Business investment grew by 3.2% yoy in Q1 while household consumption was up by just 0.2% (slowest in 2 years). In mom terms, GDP fell by 0.3% in Mar: industrial output and manufacturing were both up by 0.7% mom in Mar while the larger services sector fell by 0.4%. Compared to pre-Covid Q4 2019, output was 0.5% lower in Q1 2023.

- The Bank of England hiked the bank base rate by 25bps to 4.5%, the 12th consecutive hike, taking borrowing costs to their highest level since 2008. The BoE expects inflation to halve from current levels to around 5% by end-2023; it also does not expect UK to fall into a recession this year.

- UK’s like-for-like retail sales grew by 5.2% yoy in Apr (Mar: 4.9%) while Barclays disclosed that consumer spending on payment cards rose by 4.3% yoy during the month.

Asia Pacific:

- China’s imports contracted by 7.9% yoy in Apr while exports grew by 8.5% (slower than Mar’s 14.8% rise). This widened the surplus to USD 90.2bn (Mar: USD 88.2bn). The drop in imports raise concerns about domestic demand, and exports to major trading partners was also weak (growth to ASEAN, China’s largest export partner, slowed to 3.5% from Mar’s 35.4%).

- Inflation in China eased sharply to 0.1% in Apr (Mar: 0.7%), the slowest rate since Feb 2021; food inflation slipped to a 13-month low of 0.4% while non-food prices also eased (0.1% from 0.3% in Mar). Producer price index declined -3.6% yoy in Apr (Mar: -2.5%), the 7th straight month in a row of deflation, and the steepest decline since May 2020. This should translate into export prices.

- New loans disbursed in China tumbled to CNY 718.8bn in Apr, less than one-fifth of Mar’s CNY 3.9trn. Money supply grew by 12.4%, slower than Mar’s 12.7% gain. Growth of outstanding total social financing, a broad measure of credit and liquidity, was at 10% in Apr, unchanged from the previous month.

- Japan’s overall household spending declined by 1.9% yoy in Mar (Feb: 1.6%), the second decline posted this year. Spending fell for education (-16.7%), housing (-5.5%) and furniture & household utensils (-4.2%) among others.

- Preliminary estimate of the leading economic index in Japan slipped to 97.5 in Mar (Feb: 98.2) while the coincident index remained unchanged from the previous month at 98.7.

- Current surplus in Japan stood at JPY 9.23trn for the fiscal year 2022 (Apr 2022-Mar 2023) – the lowest level since fiscal year 2014, largely due to the widening trade deficit (JPY 18.06trn). The current account surplus had widened to CNY 2.28trn in Mar.

- Retail inflation in India eased to an 18-month low of 4.7% in Apr (Mar: 5.66%), with food price index easing to 3.84% (Mar: 4.79%).

- India’s industrial output grew by 1.1% yoy in Mar (Feb: 5.6%) with manufacturing output inching up by 0.5% (Feb: 5.3%) while the mining output increased by 6.8%. In the financial year 2022-23 (that ended in Mar), industrial output grew by 5.1% yoy.

Bottom line: Last week’s data did not inspire confidence about economic recovery – be it the US consumer sentiment at a 6-month low, UK’s GDP or China’s imports and new loans plunging. Inflation in the US eased in Apr (for the first time in 2 years), but this week’s releases on industrial production, retail sales and housing starts will be closely watched for a read on growth; in the EU, it will be the Q1 GDP release and business confidence / sentiment readings. On the politics/elections front, a presidential election run-off is expected in Turkey towards end of the month as neither candidate has reached the 50% threshold and in a state election in southern India, the opposition Congress party emerged victorious (it had won just one state election since Dec 2018).

Regional Developments

- The Business Confidence Index in Bahrain indicated more optimism among investors, with the reading up to 103.84 in Q1 2023 (Q4: 101.99) and only 5.99% expecting “unfavourable” business expectations.

- Bahrain and Singapore’s courts signed cooperation agreements to establish a court for transnational commercial disputes (for dispute resolution, arbitration, and mediation) called the Bahrain International Commercial Court (based on the Singapore model).

- The Tourism Ministry in Bahrain forecasts tourism spending to reach BHD 2bn (USD 5.35bn) in 2026, double that of the target in 2022, with inbound tourists rising to 14mn.

- Annual urban inflation in Egypt eased, for the first time since Jun 2022, to 30.6% in Apr (Mar: 32.7%) alongside core inflation slowing to 38.6% (Mar: 39.5%). Food inflation had inched lower to 54.7% from Mar’s 62.9% surge. The May reading is likely to rise given the hike in diesel prices (+14%) earlier this month.

- Egypt’s finance ministry announced the sale of a 9.5% stake (162.2mn shares) in state-controlled Telecom Egypt for EGP 3.75mn (USD 121.6mn); another 0.5% stake is being offered to the firm’s employees till May 25th. This will reduce the government’s stake in the firm to 70% (20% is on the Egyptian Exchange). The Ministry statement did not make clear how much of the sale went to foreign investors given the objective of raising foreign exchange.

- Moody’s placed Egypt’s B3 issuer rating (with a stable outlook) for both local and foreign currencies under review for a downgrade. During the review period, focus will be on the state’s ability to complete asset sales (announced as USD 2bn by Jun) and the capacity to increase net international reserves in line with quantitative IMF program objectives.

- Egypt and Oman will sign a double taxation avoidance agreement in Cairo this month, supporting the expansion of bilateral economic relations and tax cooperation. This was announced following a meeting of the two nations’ finance ministers.

- Fitch affirmed Jordan’s long-term foreign-currency issuer default rating at BB- with a stable outlook. Fitch estimates debt to slow to 93.1% in 2024 (from a peak of 95.2% of GDP in 2022) and cited Jordan’s weak growth, domestic and regional political risks, and current account deficit as higher than similarly rated peers.

- Lebanon’s caretake energy minister disclosed that the consortium led by TotalEnergies will start drilling for oil and gas off the coast in the beginning of Sep. He stated that if a discovery is made, it would be known before end of the year.

- Oman posted a budget surplus of OMR 450mn at end-Q1 2023: total revenue was up by 6% yoy while spending grew by 4%. Net oil revenue touched OMR 1.7bn in Q1 2023, up 9% yoy, as oil prices averaged USD 85 per barrel (higher than the USD 78 in Q1 2022. The Ministry of Finance disclosed that more than OMR 325mn had been paid to the private sector; a further OMR 1.1bn was repaid in loans, bringing total public debt to OMR 16.6bn (USD 43.1bn) at end-Q1 2023.

- Deposits in Oman’s banking sector grew by 4.6% yoy to OMR 27.1bn at end-Mar 2023 while credit disbursed rose at a faster pace of 6.9% to OMR 29.9bn at end-Mar; credit to the private sector rose by 6.8% to OMR 25.1bn.

- The Central Bank of Oman issued government treasury bills worth OMR 14mn (USD 36.41mn), through 2 tranches of OMR 10mn (with a maturity of 28 days) and OMR 4mn (with a maturity of 91 days).

- Oman’s population is projected to reach 8.7mn by 2040, as per a report from the National Centre for Statistics and Information, from 4.5mn in 2020. It expects expat population to surge (+50%) by 2040, and forecasts an overall annual increase of 1 million every five years, from 2025 to 2040.

- Revenues of 3 to 5-star hotels in Oman surged by 50% yoy to OMR 73.4mn at end-Mar 2023 as occupancy rates touched 56.4%. The number of hotel guests were up 25.6% to 522,753 till end-Mar.

- Passenger traffic in Qatar’s Hamad International Airport posted a 44.5% increase to 10.31mn in Q1 2023. The busiest destinations in Q1 were London, Bangkok, Dhaka, Manila and Jeddah.

- According to fDi Markets,UAE, Saudi Arabia and Qatar were the top 3 nations globally with the largest increase in the number of FDI projects for the period since the outbreak of Covid compared to the 3 years prior (Q2 2020-Q1 2023 vs Q2 2017-Q1 2020).

- Saudi Arabia, UAE, South Africa, Egypt and Qatar were the top five countries attracting FDI into the Middle East and Africa in 2022, according to a report issued during the Annual Investment Summit in the UAE. Saudi attracted funds into tourism, Egypt to its renewable energy programs and Dubai into software and IT services, business and professional services (BPS) and financial services. (Access the report- https://www.investmentmonitor.ai/news/fdi-into-the-middle-east-and-africa-region-in-2022/)

- Companies in the Middle East raised USD 3.4bn in Q1 2023 from 10 IPOs, according to an EY report. This was nearly 16% of IPO proceeds generated globally where 299 firms went public raising USD 21.5bn. However, compared to a year ago, the number of IPOs and value in the Middle East were down by 33% and 14% respectively.

- Saudi Arabia’s King invited Syria’s President to attend the Arab League summit on May 19th, reported Syria’s state media.

- Oman and Etihad Rail signed an MoU with Brazilian mining firm Vale to explore using the rail service to transport iron ore and its derivates between Oman and the UAE (connecting the firm’s industrial complexes).

- The Middle East is leading the global recovery in airline passenger traffic: it stands at 93% of pre-COVID-19 levels currently, according to the IATA. The region set to grow by 4.2% annually through to 2040.

Saudi Arabia Focus

- Industrial production in Saudi Arabia grew by 4.1% yoy in Mar (Feb: 6%), with mining & quarrying and manufacturing up by 1.6% and 10.5% respectively. In Q1, manufacturing grew by 15.5% though the overall industrial production index was dragged down by the dip in mining and quarrying activity (2.3% in Q1 2023 vs 21.2% in Q1 2022 and 7.3% in Q4 2022).

- Red Sea Global, a PIF subsidiary, is planning to raise funds from the market and is currently studying options of an IPO or a real estate investment trust fund, according to the CEO.

- Saudi Aramco’s planned IPO of its energy trading unit has seen slow progress and is likely to be postponed, reported Reuters and Bloomberg.

- Saudi Arabia’s Morabaha Marina Financing Company, an independent non-bank finance institution, is planning sell a 30% stake and raise up to USD 83.4mn in an IPO offering.

- Saudi Arabia’s Ministry of Industry and Mineral Resources announced the launch of a new Industrial Business Accelerator and Incubator Initiative to address the needs of SMEs and industrial project owners.

- Railway passenger traffic in Saudi Arabia more than doubled to 2.22mn in Q1 2023 (+104% yoy). Volume of goods transported using the rail network was up 7% to 5.83mn tons.

- Saudi Arabia completed a new facility to increase grain storage capacity to 3.5mn tons from 2.6mn tons in 2016, reported Al-Eqtisadiah. The Ministry of Environment, Water and Agriculture disclosed that food security strategy had lowered barley imports by over 50% to 4.8mn tons (from 10mn in 2016).

UAE Focus![]()

- UAE central bank, in its Annual Report 2022, forecasts GDP to grow by 3.9% and 4.3% in 2023 and 2024, slower than 2022’s 7.6% gain. OPEC+ production cuts are reflected in thesharp decline in oil GDP. Non-oil GDP is expected to remain resilient in 2023 and 2024, growing by 4.2% and 4.6% respectively (though lower than 2022’s estimated 6.6%). The report also disclosed that the UAE Funds Transfer System (UAEFTS) processed 74.5mn transactions (+23.1%) in 2022 worth AED 4.9trn (+26.9%) for retail transfers. The full report is available at https://www.centralbank.ae/media/lo1hqqbj/cbuae-annual-report_2022_a4_e.pdf

- Abu Dhabi’s economy grew by 9.3% in 2022(2021: 7.2%), supported by growth in both oil (+10.2% vs 2021’s 0.2% drop) and non-oil sectors (8.4% vs 2021’s 7.2% uptick). The contribution of the non-oil sector highlights the success of its diversification efforts. Fast-growing sectors which had a high contribution to growth were manufacturing (9.67% yoy), construction (7.6%) and financial activities (7.4%).

- GDP in Sharjah grew by 5.2% yoy to AED 136.9bn in 2022, thanks to an uptick in the non-oil sector (+5.2% to AED 133.4bn). Wholesale & retail trade and manufacturing were the highest contributors to growth (24% and 16.7% respectively).

- Dubai’s PMI rose to an 8-month high of 56.4 in Apr (Mar: 55.5), supported by new orders rising at the second-quickest rate in nearly four years. Travel & tourism and wholesale & retail sector gains rose to an 8- and 6-month high respectively, with respondents also reporting a decline in costs (supporting sales in the future). Overall selling prices dropped at the sharpest rate since 2019 and business confidence for future activity eased to a 4-month low.

- ADNOC is offering a 15% stake in its logistics unit (ADNOC Logistics & Services) IPO: the subscription period for the share offering is May 16-24th and it is expected to list on the Abu Dhabi exchange on June 1st. This is ADNOC’s 2nd IPO this year – it raised USD 2.5bn in Mar from its gas business.

- The UAE-India bilateral non-oil trade increased by 7% yoy to USD 45.5bn in the 11 months since the CEPA came into effect on May 1st 2022. In Q1 this year, total bilateral trade was up by 5.4% yoy and 24.7% qoq to USD 13.3bn.

- Bilateral trade between France and the UAE grew by 16.8% yoy to AED 29.44bn (USD 8bn) in 2022, according to data from FCSA.

- The Abu Dhabi industrial investment journey will be announced “very soon”, disclosed a senior official from the Abu Dhabi Department of Economic Development, providing incentives for investors to obtain their license and beyond, in a bid to support the Abu Dhabi Industrial Strategy.

- The UAE Minister of Climate Change and Environment called for prioritising the phasing out of fuel emissions, as opposed to the production of oil, gas and coal. She stated that phasing out production would hurt nations that either depend on it for revenues or those that cannot easily replace it with renewable sources. Instead, it would be favourable to use capture and storage technologies to phase out fossil fuel emissions while supporting renewable energy.

- FT reported that SoftBank is in its last stage negotiations to sell asset manager Fortress Investment Group to Mubadala for up to USD 3bn.

- The CEO of Coinbase disclosed that the firm is considering UAE as a potential hub for the Middle East, Africa and Asia.

- In Q1 2023, Dubai International Airport (which is connected to 234 destinations) welcomed around 21.3mn passengers (+55.8% yoy & 95.6% of pre-pandemic levels). India, Saudi Arabia, UK and Pakistan were the top destination nations. In 2022, the airport had clocked in 66mn passengers and revised upwards the 2023 forecast to 83.6mn.

- CBRE’s Dubai Residential Market Snapshot showed that real estate transactions in Dubai hit a new high of 36,946 deals in Jan-Apr 2023 (+43.2%). In Apr alone, transactions were up by 16.2% to 7615 (though falling from Mar’s record high), driven by a 42.5% rise in off-plan market sales. Average apartment sales rates across Dubai are 15.6% below the 2014 record-highs while average villa sales rates are 2.7% above the 2014 peak.

Media Review

Listening to Arab Youth

https://www.project-syndicate.org/commentary/arab-youth-survey-identifies-needed-reforms-by-jihad-azour-2023-05

Arabs bring Syria’s Assad back into fold but want action on drugs trade

https://www.reuters.com/world/middle-east/arabs-bring-syrias-assad-back-into-fold-want-action-drugs-trade-2023-05-09/

US could start buying oil for reserve after June sale, energy secretary says

https://www.reuters.com/business/energy/us-could-start-buying-oil-reserve-after-june-sale-energy-secretary-2023-05-11/

The aviation industry wants to be net zero—but not soon

https://www.economist.com/business/2023/05/14/the-aviation-industry-wants-to-be-net-zero-but-not-soon

Early Lessons from the Recent Banking Turmoil

https://www.imf.org/en/Publications/fandd/issues/Series/Analytical-Series/cafe-econ-early-lessons-from-the-recent-banking-turmoil

Powered by: