Weekly Insights 19 Apr 2024: Growth in MENA to rise in 2024, but will remain divergent amid geopolitical risks

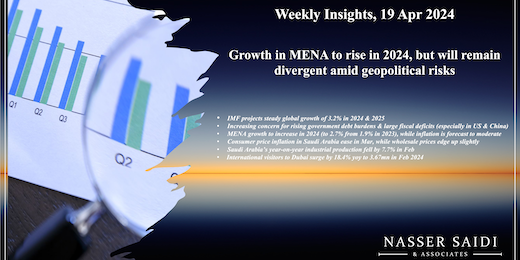

1. IMF projects steady global growth of 3.2% in 2024 & 2025

- Global economic growth is forecast to remain at a constant 3.2% for three years (2023 – 2025), rising from 2.3% in 2022. Growth in emerging market economies (EMEs) is projected to be steady at 4.2% in 2024 and 2025, driven by India (6.8% and 6.5% in 2024 and 2025) and China (4.6% and 4.1%, affected by a property sector downturn). Many EMEs have benefited from the US-China trade tensions.

- Inflation is estimated to decline from 6.8% in 2023 to 5.9% in 2024 and further to 4.5% in 2025, in part thanks to a decline in energy prices and goods inflation. However, services inflation has remained relatively high, and ongoing geopolitical tensions are risk factors. Advanced nations are expected to return near pre-pandemic inflation rates in 2025, a year before EMEs do.

- A widening of the current conflict in the Middle East could have a major impact on regional and global growth and recovery. Sustained tensions could lead to a broad flight to safety / capital outflows from the region. Potentially higher oil prices and stronger dollar will not help central banks in their current fight against inflation and affect monetary policy moves – thereby derailing growth. Broader risks could also stem from China’s longer-than-expected recovery and debt sustainability worries.

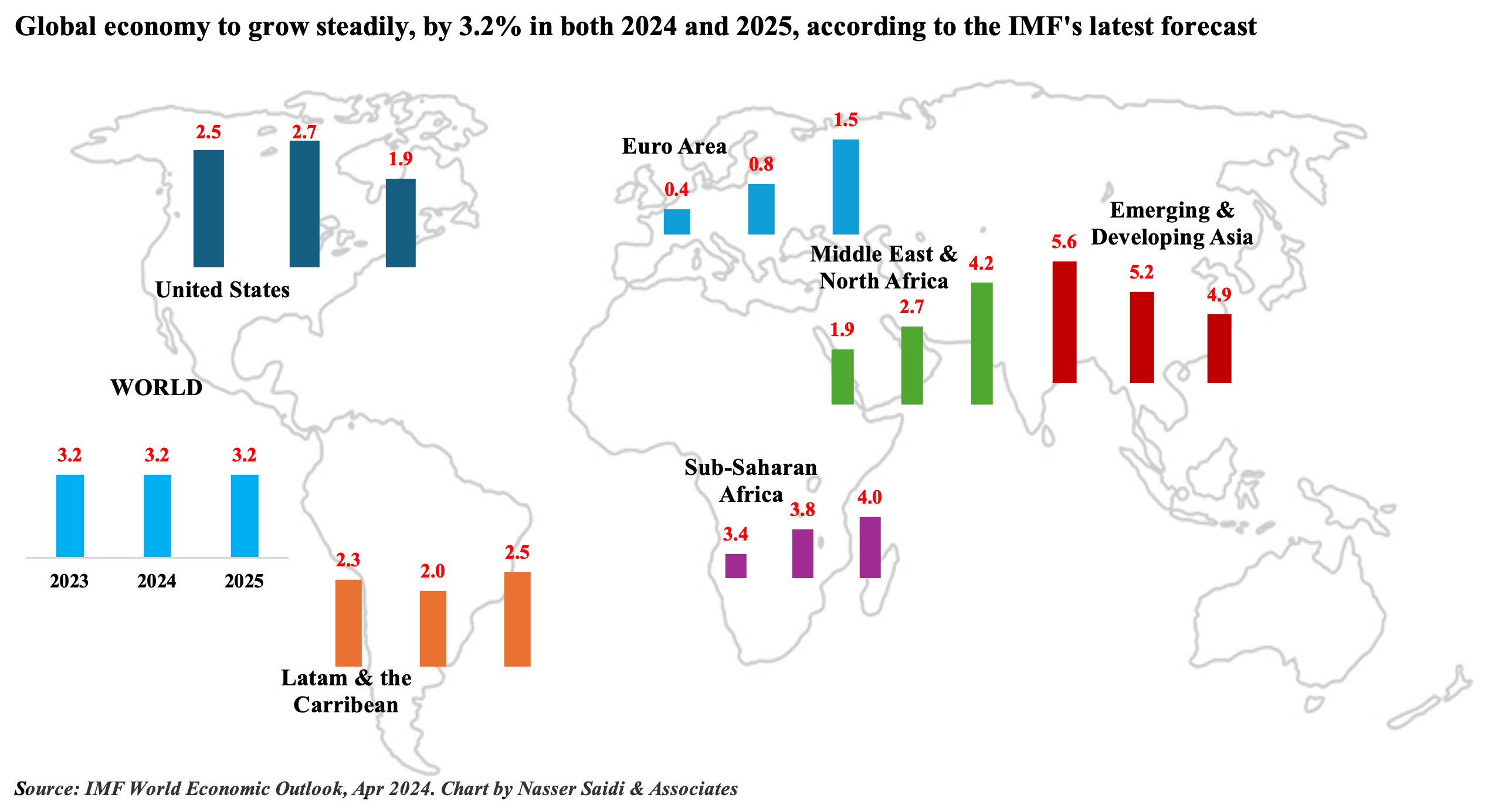

2. Fiscal risks are growing with rising government debt burdens & large fiscal deficits (especially in the US & China)

- IMF’s Fiscal Monitor report highlighted that though global fiscal deficits are projected to decline in 2024 (to 4.9% of GDP from 5.5% last year), the risk of fiscal slippage is higher in 2024 given a record number of elections globally.

- Global public debt is estimated to rise to close to 100% of GDP by 2029, and will be driven by US and China. Public debt in these two economies is projected to nearly double by 2053 under current policies! This compares to global public debt of 93% of GDP in 2023, about 9 percentage points (ppts) above the pre-pandemic level.

- Oil producers posted much lower fiscal balances in 2023 (surplus 0.4% of GDP) and moving into a deficit this year (-0.2% of GDP).

- The report also expanded on global interest rate spillovers, stating that tighter financial conditions could raise risks elsewhere: 1ppt spike in US rates is associated with to a 90bps rise in long-term nominal rates in other advanced economies and an uptick of 1ppt in EMEs.

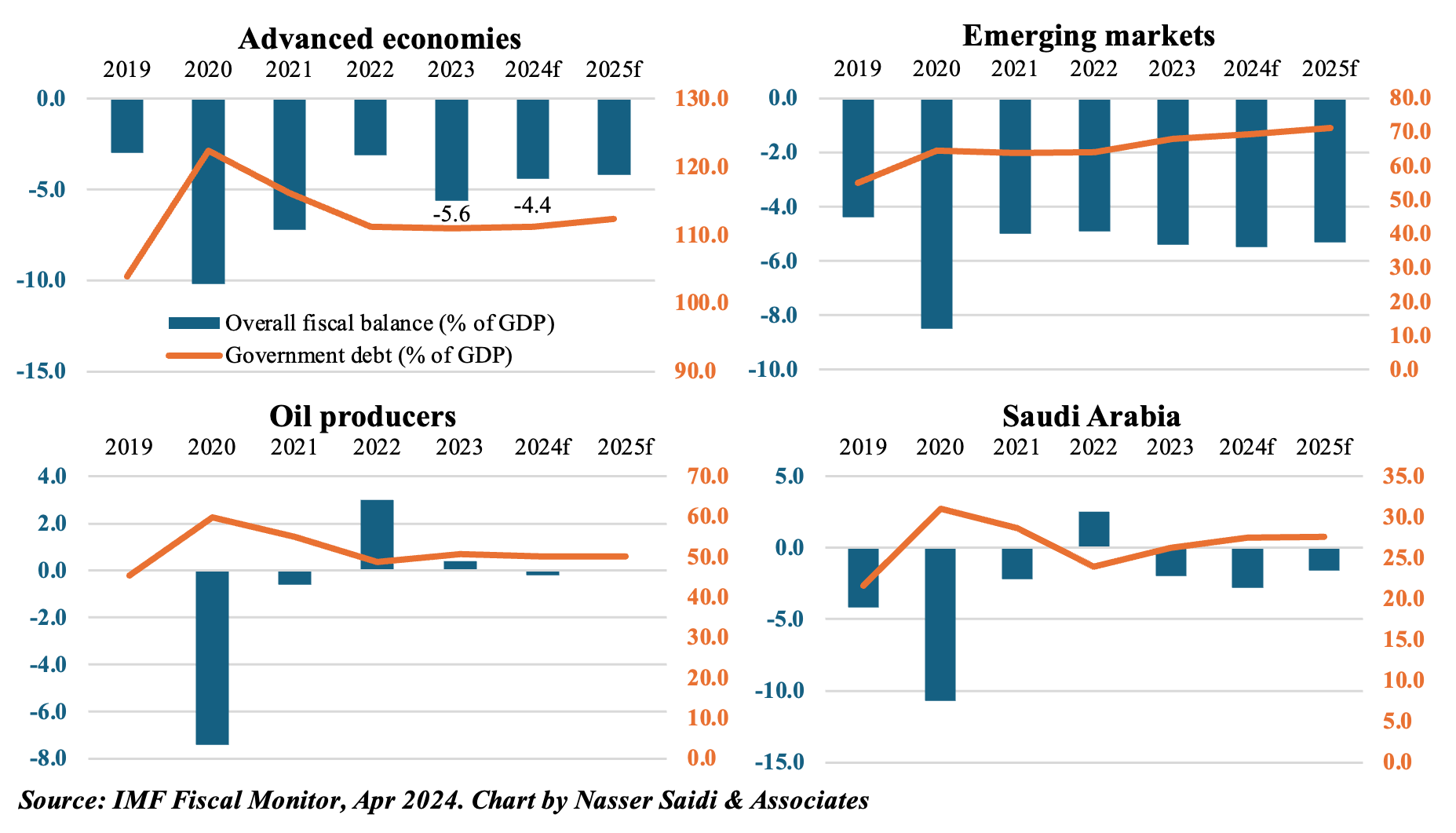

3. MENA growth to increase in 2024 (to 2.7% from 1.9% in 2023), while inflation is forecast to moderate

- Economic growth is expected to edge up in the MENA region in 2024, but with wide disparity between the GCC nations and the resource-poor MENA nations.

- Voluntary oil production cuts and lower oil prices have affected growth in the GCC though non-oil sector activity has been robust.

- Conflict in Gaza. In addition to the loss of lives, displacement of population, lack of electricity/ water/ health/ education facilities, a report from the UN-World Bank estimates infrastructure damages in Gaza at USD 18.5bn during the first four months of the war. Security risks in the Red Sea has seen trade via the Suez Canal drop by 50% yoy in Jan-Feb 2024

- Growth prospects in 2025 and beyond will be affected by geopolitical developments and uncertainty related to existing conflicts.

- Inflation has started to ease, partly due to monetary policy tightening and lower energy costs. In some countries, it remains markedly high (e.g. Egypt, Lebanon)

- Many GCC nations have been practising fiscal consolidation => improving the non-oil fiscal balances (as % of non-oil GDP).

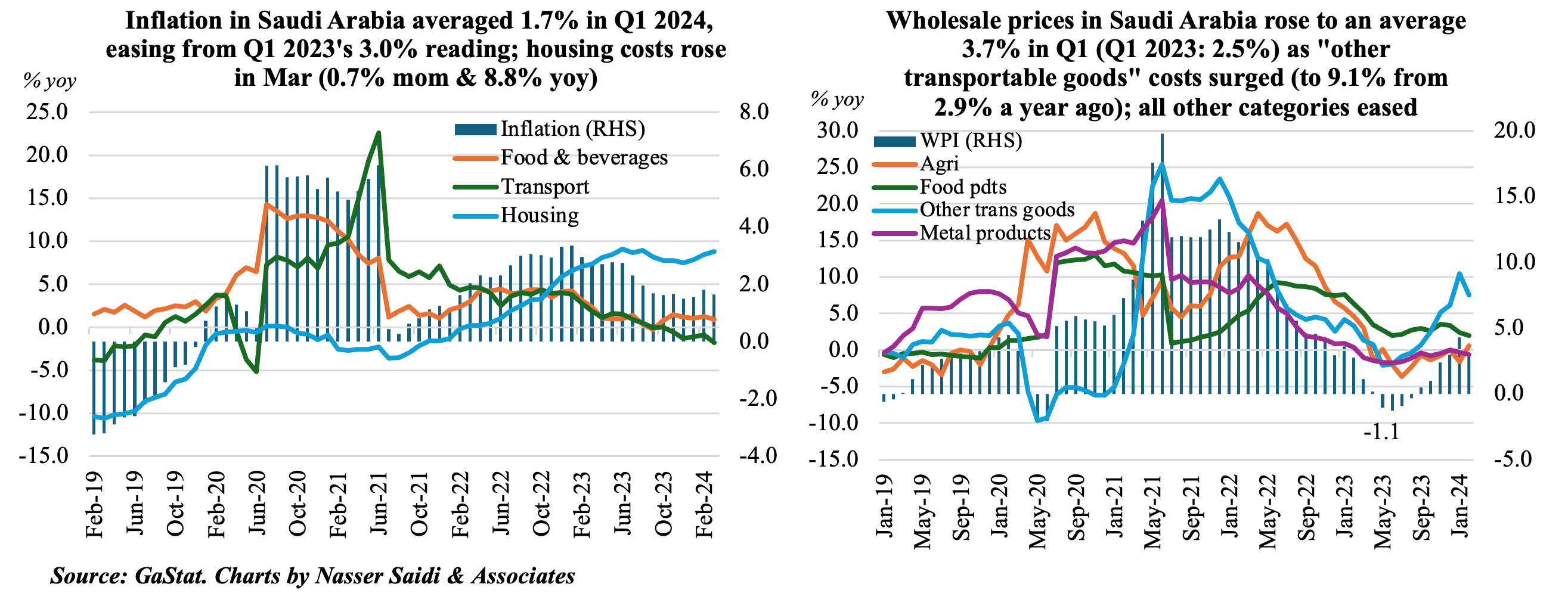

4. Consumer price inflation in Saudi Arabia eased in Mar, while wholesale prices edge up slightly

- Consumer price inflation in Saudi Arabia eased to 1.65% yoy in Mar (Feb: 1.8%), thanks to lower food and recreation costs (0.9% and 0.7% respectively). Meanwhile, the “housing, water, electricity, gas and other fuels” category (which account for one-fourth of total weighting of the basket) accelerated by a further 8.8% in Mar (Feb: 8.5%), with housing rents alone surging 10.5% (from 10%). Inflation in Q1 averaged 1.7%, much lower than 3% a year ago; housing costs during this period rose by 8.4% from 7% a year ago. Going forward, housing will remain an important driver of prices. Demand is bound to surge given the government’s initiatives (such as the long-term visas and establishment of regional HQs) alongside giga-projects – but housing supply is still limited.

- Wholesale prices in Saudi Arabia jumped to 3.8% in Mar (Feb: 3.1% and Jan’s 15-month high 4.3%), largely due to the surge in the “other transportable goods” category (9.2% from 7.5% in Feb). Deflation increased in ores & minerals category (-2.2% vs -2% in Jan) as well as in metal products, machinery & equipment (-0.7% from Feb’s -0.6%). Prices in Q1 averaged 3.7% this year, with most categories showing deflationary readings alongside a decline in food costs (2.3% from 6.3% in Q1 2023) while other transportable goods price surged.

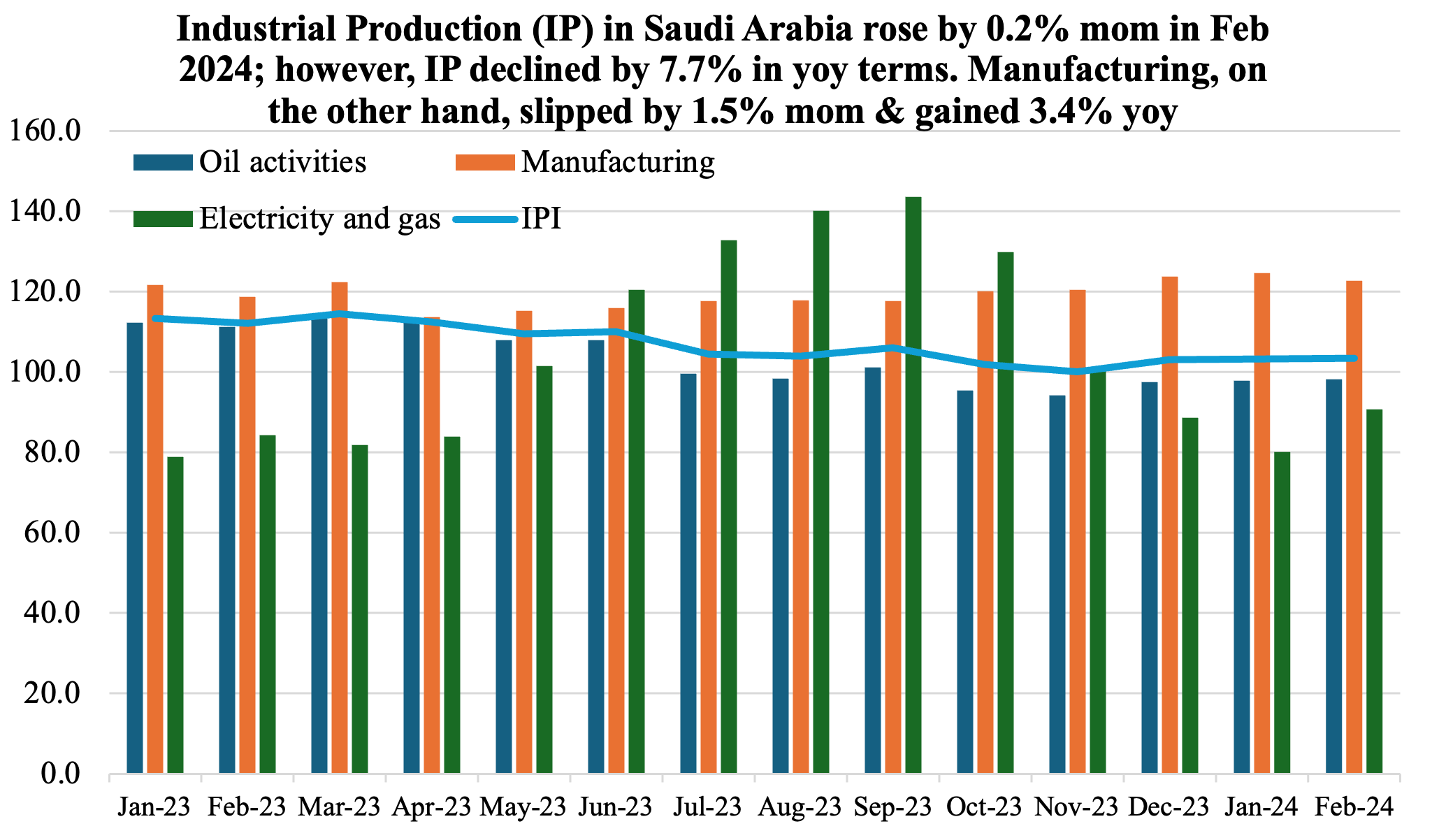

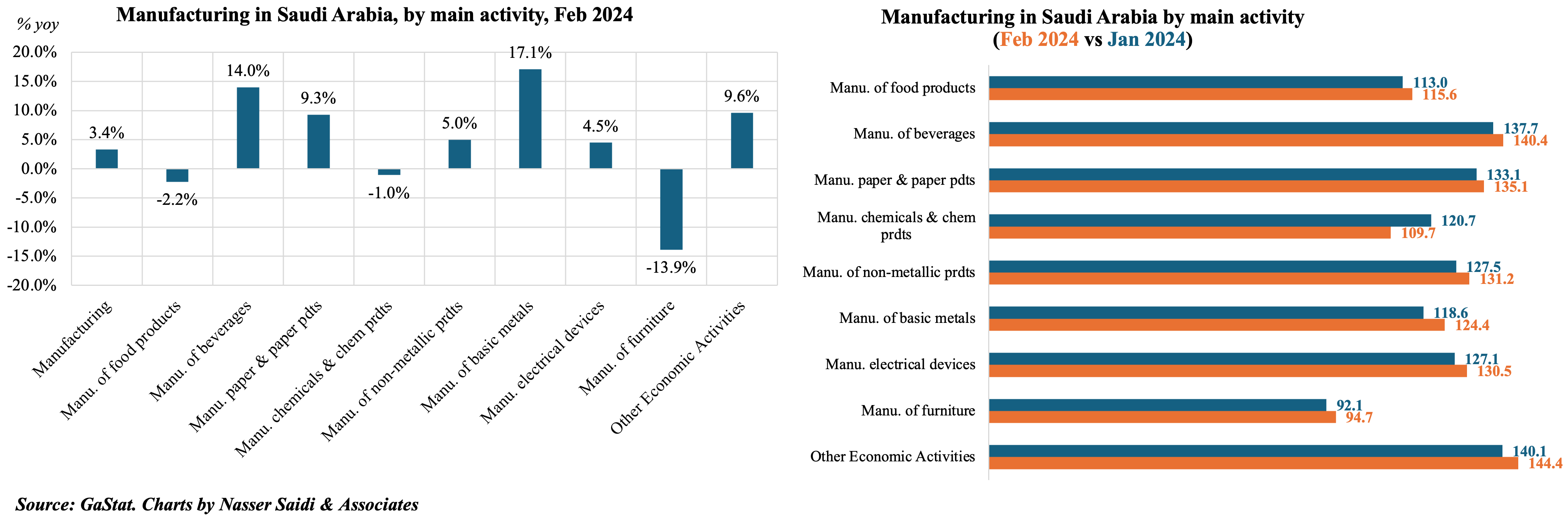

5. Saudi Arabia’s year-on-year industrial production fell by 7.7% in Feb, dragged down by oil activities; but, manufacturing gains by 3.4%

- Industrial production in Saudi Arabia inched up by 0.2% mom in Feb, thanks to a 0.3% gain in oil activities while manufacturing slipped by 1.5%. In yoy terms, however, IP fell by 7.7% in Feb, dragged down by the oil activities (-11.7%). The new IP readings have used 2021 as the base year (i.e. 2021=100).

- Non-oil manufacturing sector grew by 3.4% yoy in Feb 2024, with the manufacture of basic metals the fastest growing (17.1% yoy) alongside manufacture of beverages (14.0%) & other economic activities (9.6%).

- Positive signs for increase in non-oil sector activity in coming months. Ministry of Industry & Mineral Resources disclosed that 270 new industrial licenses had been issued this year (in 2023, a total of 1379 new licenses were issued); new investments in the mining sector is also increasing, in a bid to accelerate exploration and development.

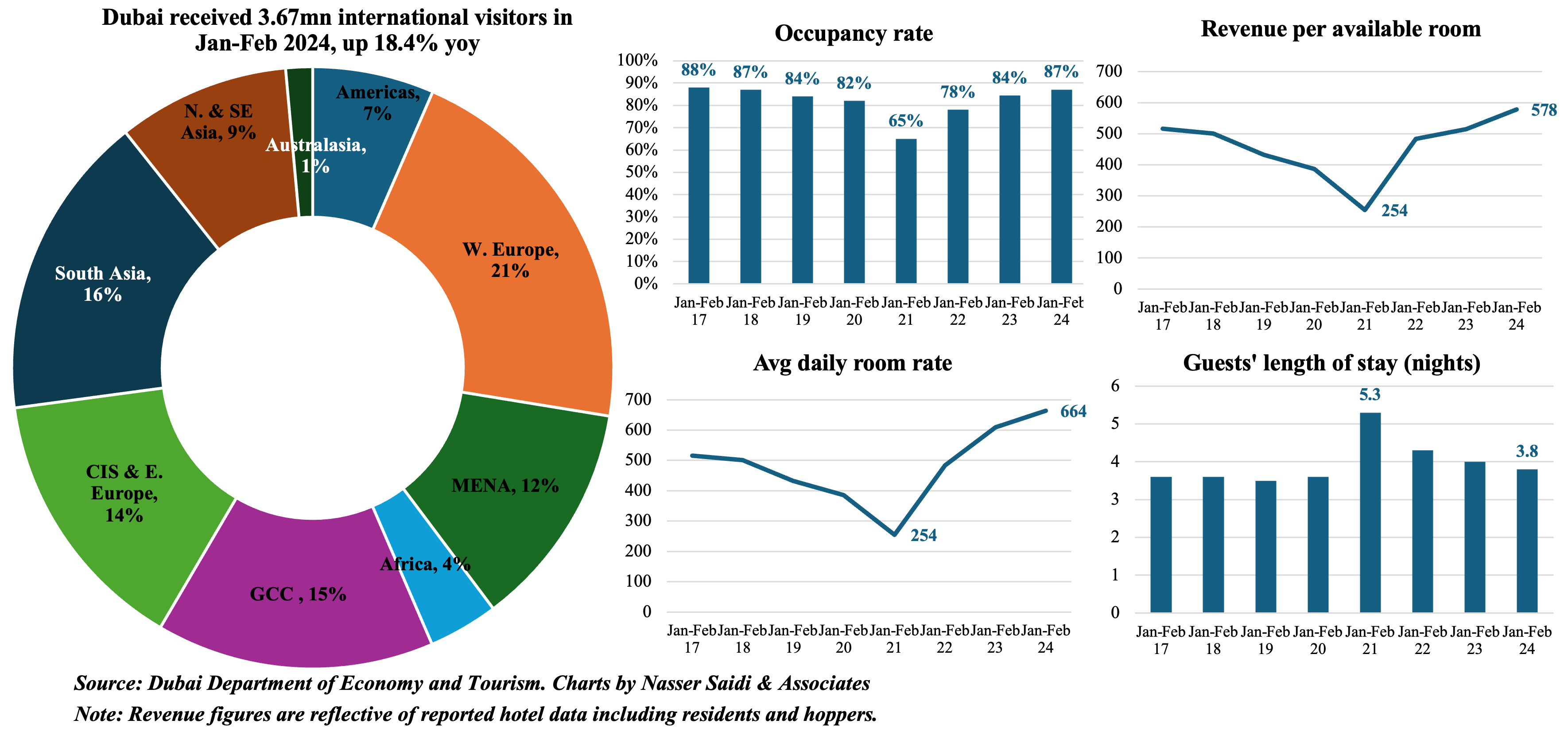

6. International visitors to Dubai surge by 18.4% yoy to 3.67mn in Feb 2024

- Visitors into Dubai grew by 18.4% yoy to 3.67mn in the first two months of 2024: this was 12.2% higher compared to Jan-Feb 2019.

- Regional composition of tourists broadly unchanged: GCC & MENA regions together accounted for 997k visitors (or about 27% of the total) this year while Western Europe and South Asia accounted for the largest shares at 21% and 16% respectively.

- At end-Feb 2024, there were 151,269 hotel rooms (+2% yoy) across 826 establishments (+2% yoy) in Dubai. Hotel occupancy rate at 87% was higher than in 2019; revenue per available room in 2024 remains the highest for Jan-Feb (AED 578 vs previous Jan high of AED 516 in 2017) while room rates have crossed AED 660 and length of stay has inched slightly lower (-5% yoy to 3.8, though higher than 3.5 in Jan-Feb 2019). Furthermore, occupied room nights jumped by 7% yoy to 7.78mn in Jan-Feb 2024.

- The uptick in Dubai PMI in Feb had shown a significant uptick in activity in the travel and tourism sector; anecdotal evidence suggests an uptick in footfall in the city during the extended holidays for Eid; upcoming events (concerts, and business events such as the Arabian Travel Market) are also expected to attract regional and international visitors.

Powered by: