Weekly Insights 30 Sep 2022: GCC Economic Recovery is Increasingly Supported by the Non-Oil Sector

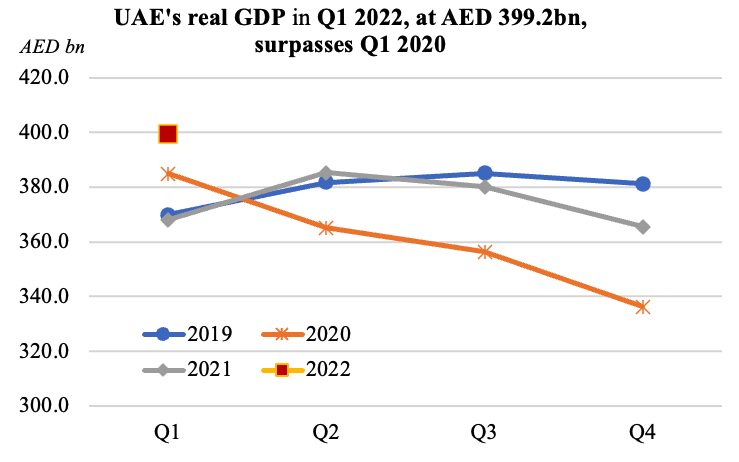

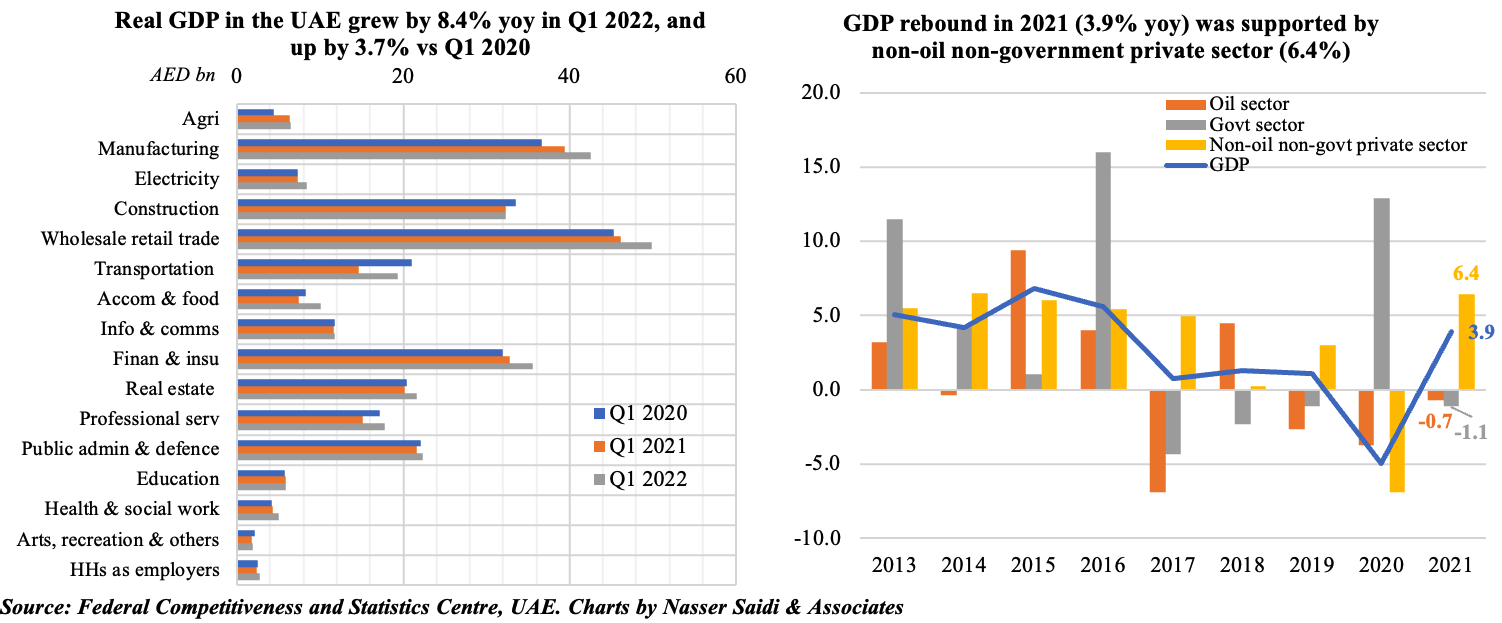

1. UAE GDP recovers to 2019 levels

- Real GDP in the UAE grew by 8.4% yoy to AED 399.2bn in Q1 2022, supported by non-oil sector recovery. Even compared to Q1 2020 (just prior to pandemic lockdowns), GDP was higher by 3.7%

- Mining & quarrying accounted for 27% of overall GDP in Q1 2022, with other major contributors being trade (12.5%), manufacturing (10.7%), finance (8.9%) and construction (8.1%)

- The expansion in Q1 2022 is a continuation of the GDP recovery post-Covid, driven by the non-oil sector (as can be seen from monthly PMI readings as well)

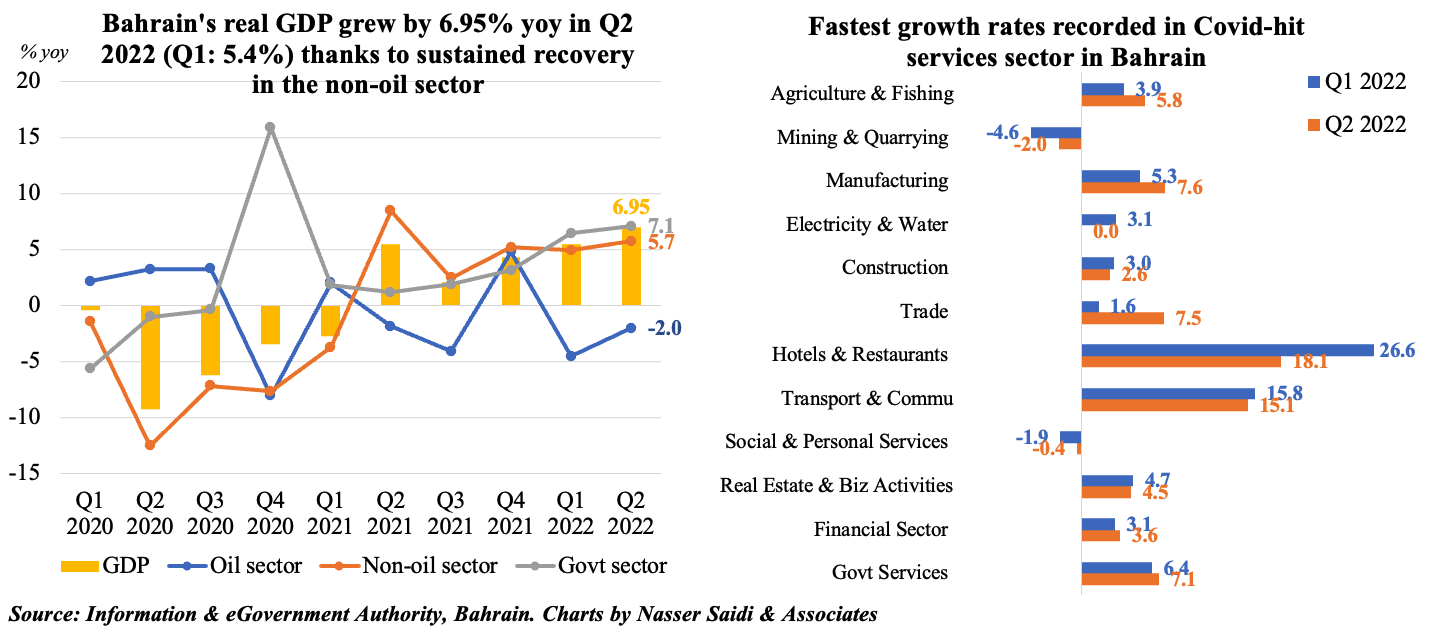

2. Bahrain GDP grows by 6.95% on Q2, thanks to non-oil sector recovery (especially Covid-hit sectors)

- Bahrain grew by 6.95% yoy in Q2 2022, following a 5.4% rise in Q1. Non-oil sector is the main contributor to growth (62% of total GDP in Q2), followed by the oil sector (18%)

- Among the non-oil sectors, Covid19 hit sectors continue to recover at a faster pace, given the easing of restrictions: hotels and restaurants grew by 18.1%, followed by transport & communication (15.1%)

- Though oil sector growth remains negative versus a year ago, the higher oil price will help Bahrain lower its fiscal deficit (to 3.3% of GDP in 2022 from 2021’s 11.1%, IMF estimates) and gross debt levels (116% in 2022 from 129% in 2021)

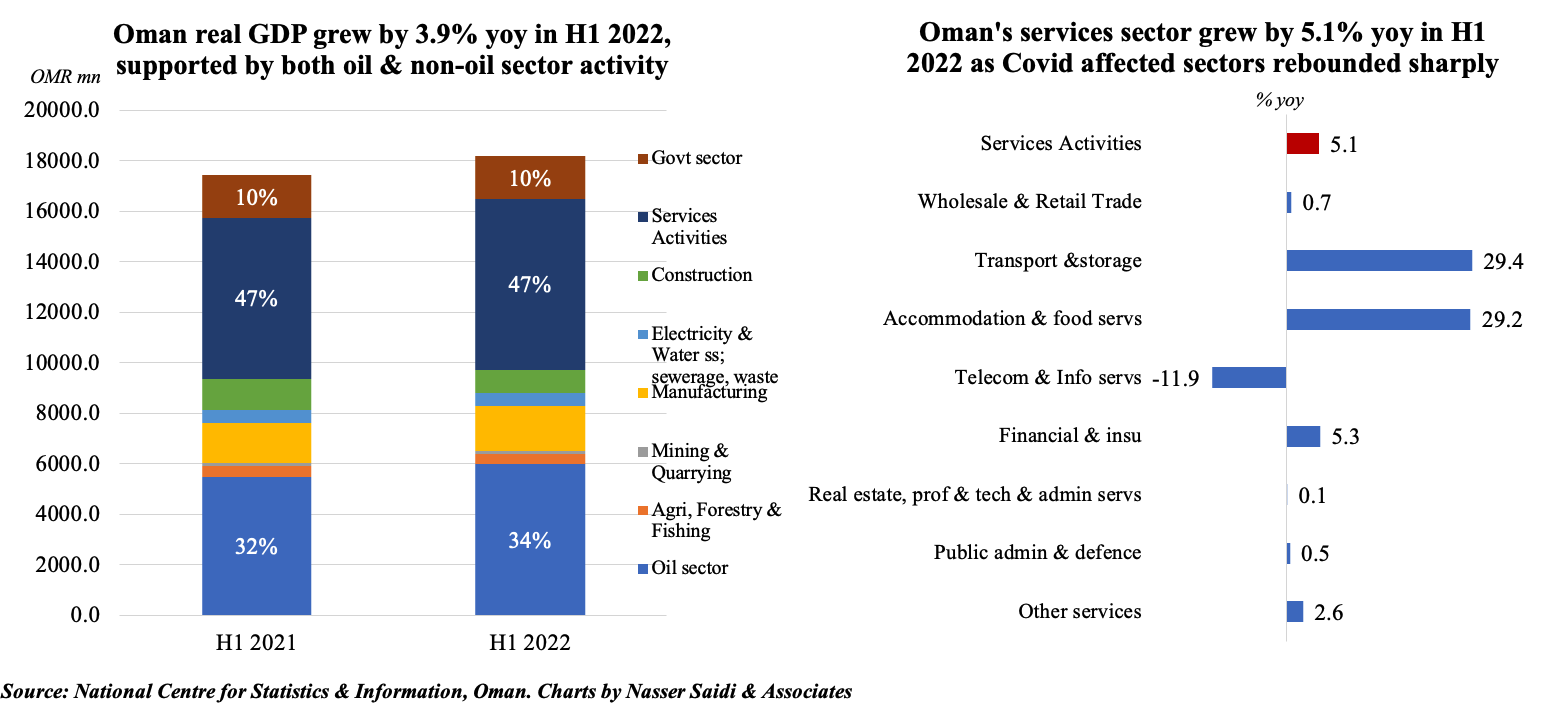

3. Non-oil sector led recovery in Oman, causes overall GDP to grow by 3.9% in H1 2022

- Oman’s GDP growth was visible across all major sectors – oil (9.2% yoy) and services activities (5.1%) – while construction posted a decline of 27.5%

- Stimulus packages rolled out to support Covid19 hit sectors had a positive impact: within services, transport and storage and accommodation and food services both grew by 29% yoy in H1 2022

- Higher oil prices have enabled Oman to improve its fiscal balances: it posted a budget surplus of OMR 1bn in Jan-Jul, as revenues gained by 53.5% yoy. Furthermore, the country was able to reduce its total public debt to OMR 18.4bn as of end-Aug, down by OMR 2.4bn from end-2021.

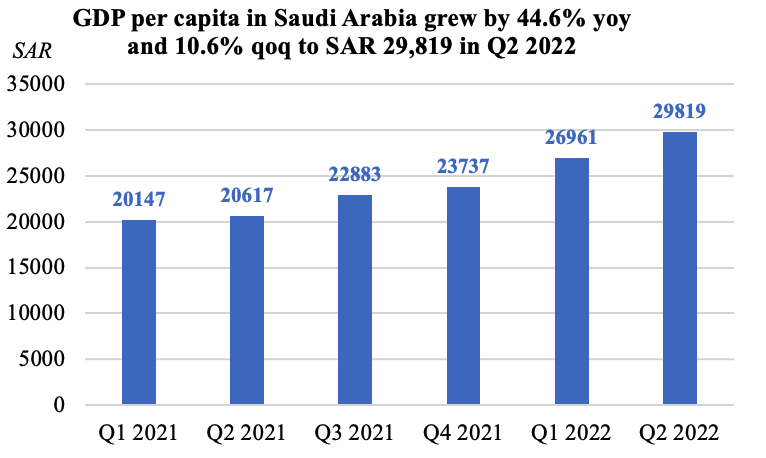

4. Indicators of economic recovery in Saudi Arabia: per capita GDP, oil exports and consumer spending

Saudi Arabia’s GDP per capita surged to SAR 29,819 in Q2 2022 – the highest level in years

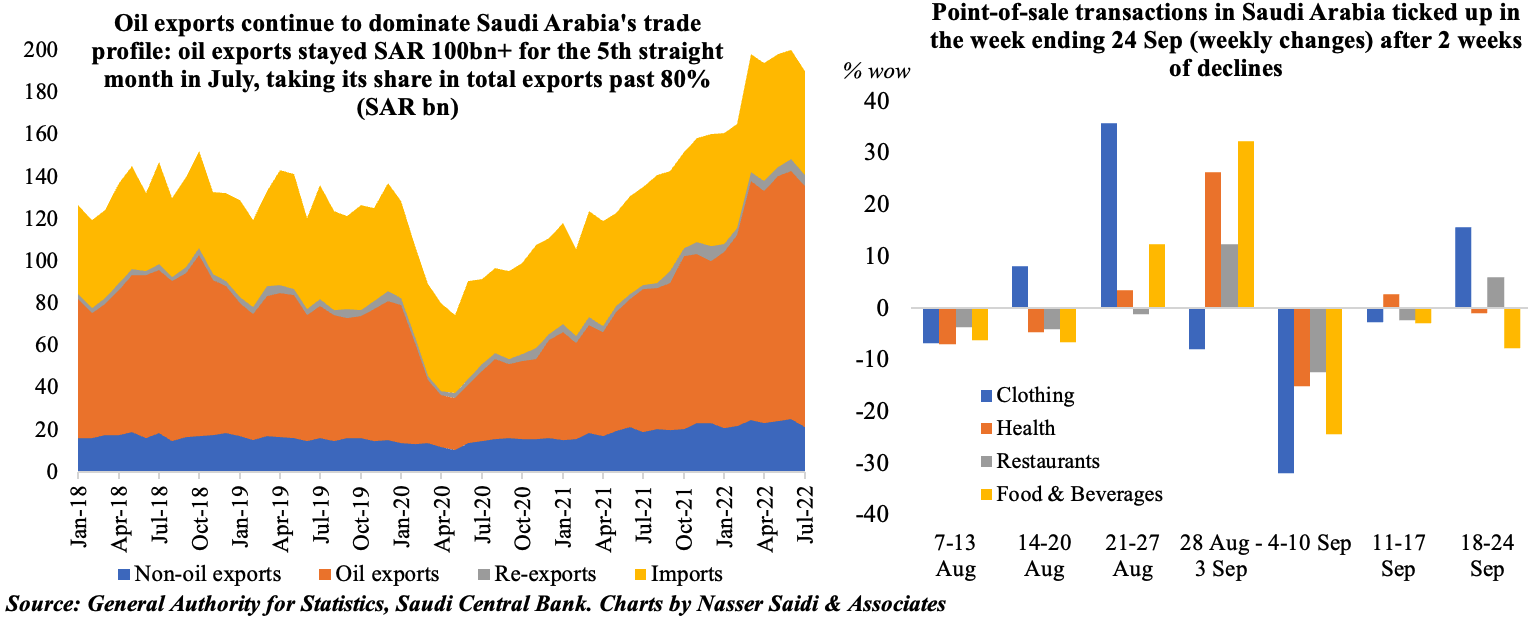

Saudi Arabia’s GDP per capita surged to SAR 29,819 in Q2 2022 – the highest level in years- Oil exports, with its value surpassing SAR 100bn for the 5th consecutive month in Jul, continued to drive overall exports and foreign trade: its share accounted for 80% of total exports

- Consumer spending (proxied by PoS transactions) has shown some interesting trends in Aug-Sep: (a) PoS rose in the week ended 24 Sep, after falling for 2 weeks; (b) start of the new school year saw value of transactions in education account for around 7% of the total in the 2 weeks of Aug 21 – Sep 3. Since then, it has declined to less than 1%; (c) Share of restaurants and food and beverages stood close to 15% each

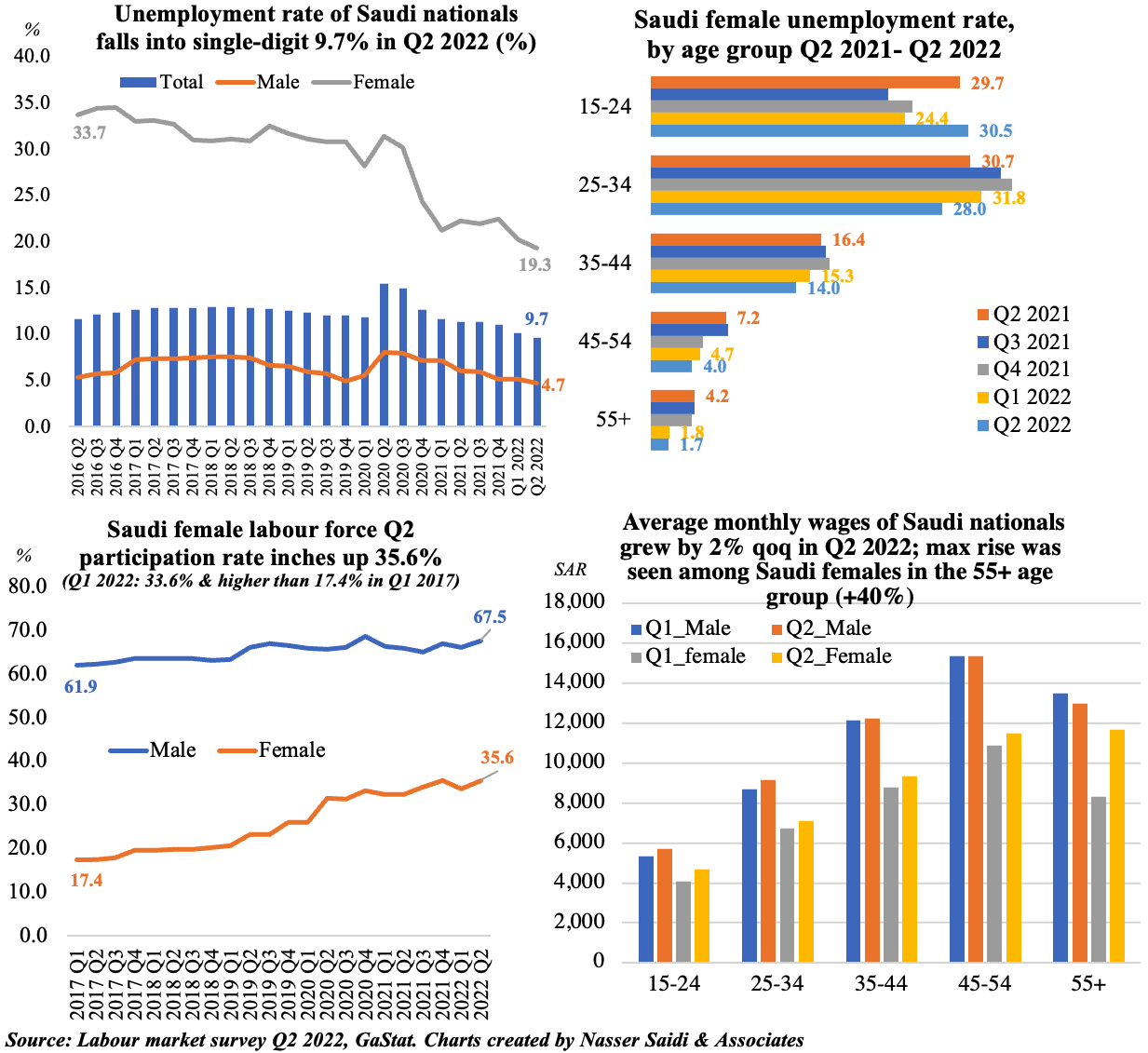

5. Saudi Arabia’s citizens’ unemployment rate slips to 9.7% in Q2 2022

- Overall Q2 2022 unemployment rate was 5.8% (Q1: 6%)

- Saudi nationals’ unemployment rate declined to 9.7% in Q2, lowest on record, with Saudi female U rate down to 19.3% (Q4 2016: 34.5%)

- Rising workforce participation rates

- Evidence of strong wage gains: average monthly wages grew by 2% qoq among nationals & by 6% among expats (citizens earn on avg 2.5X more than expats)

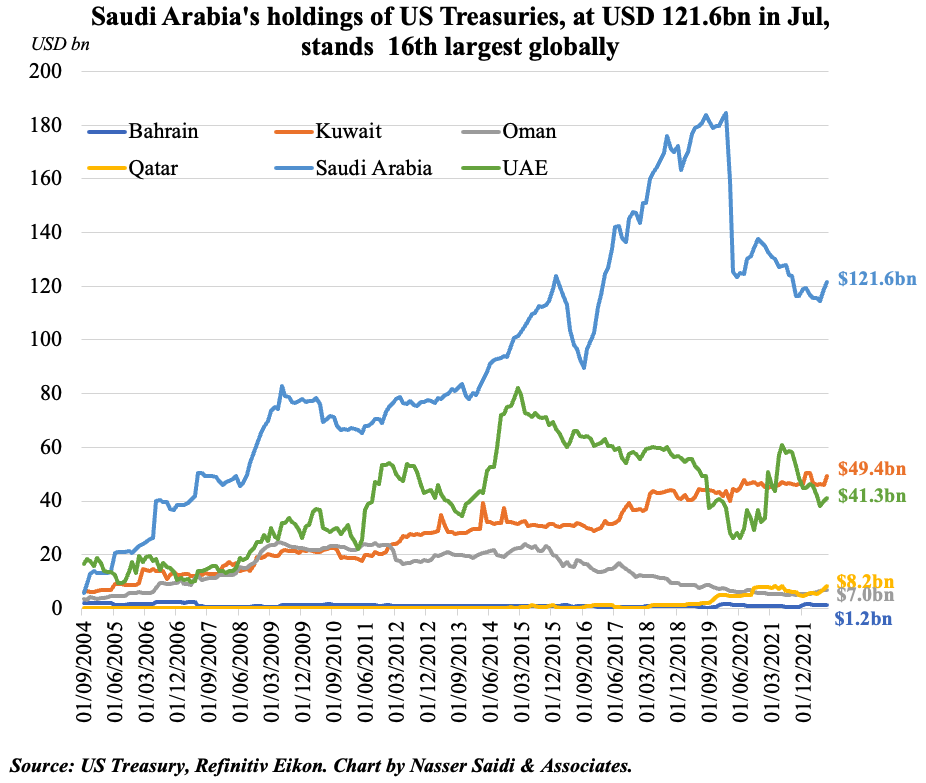

6. Holdings of US Treasuries in the GCC grew by 3.2% from end-Dec 2021 to Jul 2022

- Saudi Arabia is the 16th largest investor in US Treasury bonds globally as of Jul 2022 (USD 121.6bn)

- While this pales in comparison to the top of the list Japan (USD 1.234trn) and China (USD 970bn), it is still highest among the GCC

- GCC nations, excluding Bahrain and the UAE, have increased their holdings compared to end-2021.Max increase was from Qatar: +71.6% ytd to USD 8.2bn. Overall, GCC holdings of US Treasuries grew by 3.2% to USD 228.7bn as of Jul

- Recent global central banks’ decisions to aggressively raise rates to combat inflation contributed to selling of Treasuries

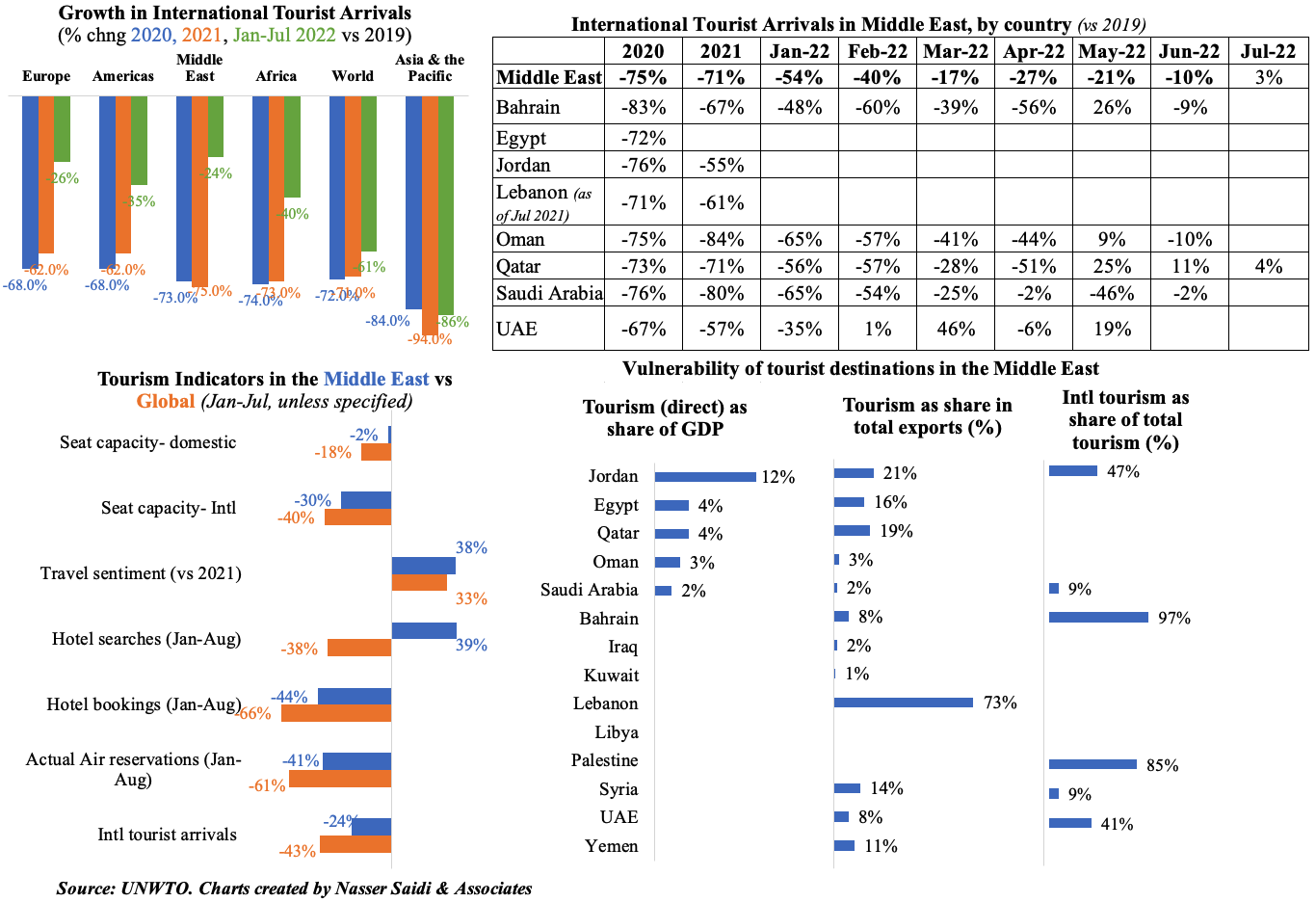

7. International tourism is back to 60% of pre-pandemic levels in Jan-Jul 2022; pace of tourist arrivals fastest in the Middle East (4X vs Jan-Jul 2021); various proxy indicators show ME performance better vs global avg; vulnerability of some destinations in ME remain high