Markets

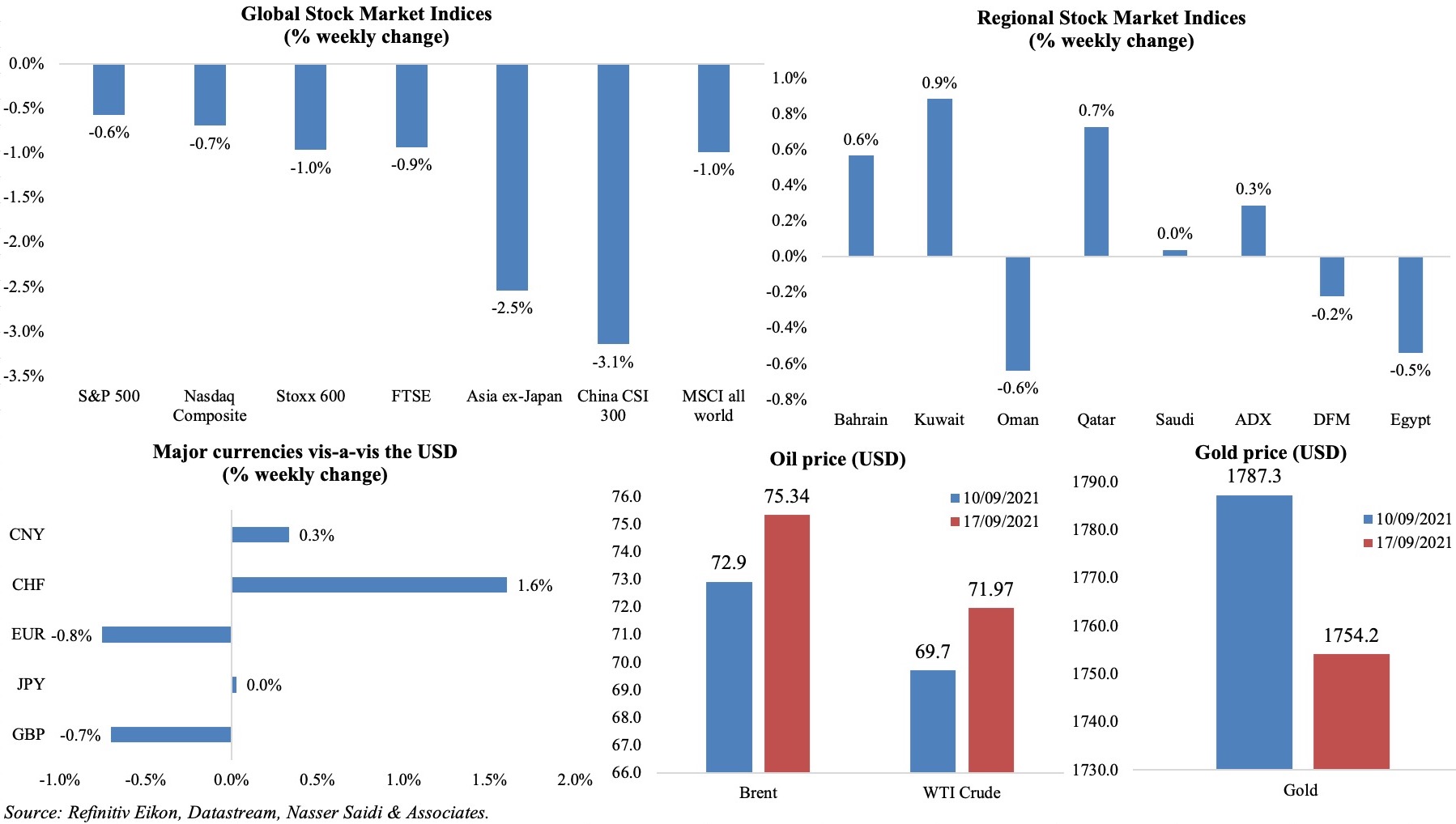

Global equity markets slipped last week mostly on worries about the Fed’s taper timeline amid fears of stalling growth in Asian markets given their battle against Covid19 cases. The S&P 500 ended below its 50-day moving average, the Stoxx600 fell for a 3rd consecutive week while Asia posted the sharpest drops among the regions; the MSCI all world index fell by 1%. Regional markets were mixed over the week: Abu Dhabi’s index posted its 4th consecutive weekly gain. Among currencies, the dollar touched a 5-month high against the Swiss Franc and rose to a 2-week high against the offshore yuan while the pound and euro dropped. Gold price edged down by 1.9% while oil prices gained around 3%+ versus the week before.

Weekly % changes for last week (16-17 Sep) from 9 Sep (regional) and 10 Sep (international).

Global Developments

US/Americas:

- Inflation in the US moderated to 5.3% yoy in Aug, from July’s 5.4%; in mom terms, prices were up by 0.3%. Core inflation also slowed to 4% (Jul: 4.3%). Price of used vehicles dropped by 1.5% mom, alongside drops in airline fares and hotel rates by 9.1% and 2.9% respectively.

- Industrial production in the US rose marginally by 0.4% mom in Aug (Jul: 0.8%), partially given shutdowns related to Hurricane Ida. Overall, IP grew by 5.9% yoy and was 0.3% above its pre-pandemic levels. Capacity utilization increased 0.2ppt to 76.4.

- Retail sales in the US inched up by 0.7% mom in Aug (Jul: -1.1%), with online sales rebounding by 5.3% (Jul: -4.6%) while auto sales tumbled by 3.6% (Jul: -4.6%). Sales increased by 15.1% yoy and are 17.7% above their pre-pandemic level.

- Budget deficit for the first 11 months of the current fiscal year (i.e. till Aug) totaled USD 2.711trn: 10% lower than the deficit posted a year ago. Spending rose by 4% to USD 6.297trn in this time while receipts were up by 18% to USD 3.586trn.

- The Philadelphia Fed manufacturing survey surged to 30.7 in Sep (Aug: 19.4) though new orders (15.9 from 22.8) and employment (26.3 vs 32.6) softened.

- The NY Empire State manufacturing index accelerated to 34.3 in Sep (Aug: 18.3, and lower than the all-time high of 43 in Jun). The new-orders index jumped 18.9 points to 33.7 in Sep and the shipments index was up by 22.5 points to 26.9; prices paid and received were at or near record highs during the month.

- Michigan consumer sentiment index ticked up slightly to 71 in Sep (Aug: 70.3): consumer’s views of current conditions fell to 77.1 in Sep (Aug:5), while an indicator of expectations rose to 67.1 (Aug: 65.1).

- Initial jobless claims edged up to 332k in the week ended Sep 10th, from an upwardly revised 312k the week before, slowing the 4-week average to 335.75k (lowest level since Mar 14, 2020). Continuing claims edged down by 187k to 2.665mn in the week ended Sep 3rd.

Europe:

- Industrial production in the eurozone grew by 1.5% mom and 7.7% yoy in Jul (Jun: -0.1% mom and 10.1% yoy). Production of non-durable consumer goods rose by 3.5% mom, capital goods by 2.7%, durable consumer goods by 0.6% and intermediate goods by 0.4% while production of energy fell 0.6%.

- Trade balance in the euro area widened to EUR 13.4bn in Jul (Jun: EUR 11.9bn); Exports increased 1% mom while imports grew only 0.3%.

- German wholesale prices grew by 12.3% yoy in Aug, the highest rate since Oct 1974; costs rose across wholesale of ores, metals and semi-finished metal products (63.4%) as well as solid fuels and mineral oil products (35.5%) and raw and sawn timber (57.8%). Prices inched up by 0.5% mom.

- ILO unemployment rate in the UK slowed to 4.6% in the 3 months to Jul from the previous 4.7% reading. Meanwhile job vacancies increased to 1.03mn in the 3 months to Aug, for the first time since 2001 (when records began).

- Inflation in the UK increased to 3.2% yoy in Aug (Jul: 2%), posting the largest ever mom increase since records began in 1997. Core inflation surged as well, rising by 3.1% in Aug (Jul: 1.8%), driven up by a 4.9% rise in used car prices. Separately, both manufacturers’ raw material costs and output prices rose at the fastest rate since late 2011, with oil prices up 50%.

- UK retail sales unexpectedly slipped by 0.9% mom in Aug (Jul: -2.8%), though it remained flat in yoy terms. Spending in food stores fell (-1.2%), as residents preferred to dine out in the wake of easing lockdown rules while department store sales have dropped every month since Apr 2021 (Aug: -3.7%). Overall sales volumes are 4.6% higher than pre-pandemic levels.

Asia Pacific:

- FDI into China grew by 22.3% yoy to CNY 758.05bn (USD 117.7bn) during the period Jan-Aug. Fixed asset investment increased by 8.9% yoy in the period Jan-Aug, slowing from the 10.3% growth reported in Jan-Jul.

- Industrial production in China grew by 5.3% yoy in Aug, lower than previous month’s 6.4% uptick. Retail sales rose by 2.5% in Aug (Jul: 8.5%), posting the slowest pace since Aug 2020.

- Investment in China’s real estate development grew by 10.9% yoy in Jan-Aug, slowing down by 0.3ppts from the previous Jan-Jul reading.

- The People’s Bank of China reiterated that yuan internationalization will be “steadily and prudently” promoted, and plans are underway to further develop offshore yuan markets. Cross-border settlements in the local currency grew by 44.3% yoy to CNY 28.39trn in 2020. This accounted for 46.2% of overall cross-border settlements, touching a new high.

- Japan’s core machinery orders rebounded in Jul, rising by 0.9% mom and 11.1% yoy (Jun: -1.5% mom and 18.6% yoy). Manufacturing orders grew by 6.7%, the most since Apr.

- Trade balance in Japan moved to a deficit JPY 635.4bn in Aug (Jul: JPY 11.6bn surplus) as exports advanced by 26.2% (though easing from 37% uptick in Jul) while imports grew by 44.7% (Jul: 28.5%)

- Japan’s PPI grew for the 6th straight month to 5.5% yoy in Aug, from July’s nearly 13-year high of 5.6%, given higher commodity prices; it remained flat in mom terms (Jul: 1.1%).

- Wholesale price inflation in India rose marginally to 11.39% in Aug (Jul: 11.16%), thanks to surges in fuel (+26.09%), primary (6.2%) and manufactured products (11.39%) among others. Retail price inflation eased for the 3rd consecutive month to 5.3% yoy in Aug with softer upticks in food (+3.11% from 3.96%) and transport (+10.24% from 10.54%) while costs rose for fuel (+12.95% from 12.38%), clothing (6.84% from 6.46%) and housing (+3.9%).

- Singapore plans to set up a SGD 1.5bn fund, backed by Temasek, to invest in its high-growth companies and IPOs.

Bottomline: Markets are eagerly waiting for the major central bank meetings this week including the Fed (in light of the recent job creation and easing inflation numbers), the Bank of Japan (battling Covid19 and its exports reeling under supply disruptions) and the Bank of England (with heightened inflation readings). The Fed move is important especially in the context that global debt rose to a new record high in Q2: overall debt levels grew to USD 296trn at end-Jun, up USD 36trn above pre-pandemic levels; furthermore, almost a third of the countries in the IIF study saw an increase in household debt in H1 of this year. The preliminary PMI readings for a few countries will also be out later this week, giving an insight into how supply disruptions and rising input costs are affecting output. If these show a sustained easing off highs seen earlier this year, there might be cause for concern.

Regional Developments

- Bahrain’s EDB revealed that the country received USD 492mn in tourism capital investment last year, mainly from UAE’s Emaar and property developer Eagle Hills.

- Egypt’s exports surged by 49.2% yoy to USD 3.61bn in Jun while imports were marginally higher by 0.9% to USD 6.55bn, allowing for the trade deficit to fall by 27.8% to USD 2.49bn.

- The Financial Regulatory Authority in Egypt issued new listing amendments on the Exchange: under the new regulations, companies looking to list must now offer a minimum 1% of the total free-float market cap (instead of being required to offer a minimum number of shares) and listed companies will be required to have a free-float market cap of a minimum 0.5% of EGX’s total free-float market cap.

- Egypt’s central bank left interest rates unchanged at the 7th consecutive meeting: the overnight deposit rate, overnight lending rate, and rate of the main operation remain at 8.25%, 9.25%, and 8.75% respectively.

- Bloomberg reported, citing Egypt’s oil minister, that Egypt’s natural gas would be delivered to Lebanon through Jordan and Syria within 3 months while some formalities including funding request are completed.

- Remittances into Egypt increased 29.6% yoy to USD 8.1bn in Apr-Jun 2021, according to the CBE; in comparison remittances were up by 13.2% to USD 31.4bn in 2020-21.

- Egypt plans to merge its income tax and VAT office starting Sep, as part of its streamlining process and to accelerate the move to digitizing the tax system.

- Iraq and the UAE discussed, as part of ways to boost economic relations, a proposal to set up an Emirati-Iraqi business council in cooperation with the Federation of UAE Chambers of Commerce and Industry.

- Lebanon’s finance ministry disclosed that the BDL would receive USD 1.135bn on Sep 16th in IMF’s Special Drawing Rights (SDRs). Separately, a new contract was signed with Alvarez and Marsal to conduct a forensic audit of the central bank; a report will be submitted to the government within 12 weeks after starting work.

- Lebanon is facing a “third mass exodus” wave, according to a report by the Crisis Observatory at Lebanon’s American University of Beirut. Based on a survey completed last year, 77% of Lebanese youth stated that they were considering and seeking to emigrate.

- In the IMF’s latest Article IV report for Oman, growth is expected to recover in 2021 – expanding by 2.5% (vs a contraction of 2.8% in 2020), thanks to a recovery in the non-oil sector activity (1.5%). As the fiscal balance plan is implemented, fiscal deficit is not only expected to narrow to 2.4% of GDP in 2021 (2020: 19.3%), but also move into surplus in 2022. Total government debt is expected to decline to 70.7% of GDP this year and further to about 47% of GDP in 2026. More: https://www.imf.org/en/Publications/CR/Issues/2021/09/10/Oman-2021-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-Executive-465431

- Islamic finance in Oman increased by 12.3% yoy to OMR 4.6bn in Jan-Jul this year. Deposits increased by 16.4% to OMR 4.2bn while outstanding credit rose by 4.3% to OMR 27.3bn. The non-financial corporate sector received the lion’s share of the total private sector credit (46.6%), followed by the household sector (45.2%) at end-Jul.

Saudi Arabia Focus

- Saudi Arabia’s GDP grew by 1.8% yoy in Q2 2021 (Q1: -3.0%), with the non-oil private sector reporting a 11.1% uptick, after rising by 4.4% in Q1. Investment (GFCF) and private consumption expenditure were key drivers contributing to GDP growth in Q2. Given the base effects, both surged in Q2, private consumption by 22.1% and investment by 18.3%.

- Inflation in Saudi Arabia eased to 0.3% yoy in Aug (Jul: 0.4%), the lowest in 14 months, but is coming off the highs in the same period last year due to the VAT hike to 15%. Food inflation continued to rise, up by 2% yoy and 0.8% mom in Aug (Jul: 1.4% yoy) while sectors like transport (-0.32% mom) and clothing (-0.32% mom) showed weaker inflation. Separately, wholesale price index surged by 12% yoy and 0.7% mom in Aug (Jul: 11.9% yoy).

- The Saudi Crown Prince launched the Human Capability Development Programme last week: part of the Vision 2030 reforms, the goal of the program is to change education and teach global values. It includes a total of 89 initiatives under the 3 main pillars (a) to develop a resilient and strong educational base; (b) prepare for the future labour market locally and globally; and (c) provide lifelong learning opportunities.

- Net income of Saudi Arabia’s insurance sector plummeted by 59.2% yoy in Q2 this year: operating income dropped to just SAR 74mn from SAR 709mn while premiums increased by 8.1% to SAR 9.4bn.

- Saudi Arabia’s crude output grew by 547k barrels per day (bpd) mom to 9.474mn bpd in Jul and oil exports rose to the highest since Jan, according to the Joint Organisation Data Initiative.

- The public offering of ACWA Power saw requests from private institutions exceeding some 81.2 million shares within minutes into the offering (that ends on Sep 27th). the shares are being sold in a range of SAR 51-SAR 56 per share or an 11.1% stake making the listing value at upto USD 11bn – the biggest offering in Saudi since the Aramco listing.

- Saudi Arabia’s defense spending will focus on acquisitions as well as R&D over the next decade to meet its aim of creating 100k jobs for citizens as part of the local military industry. The Head of the Saudi General Authority for Military Industries disclosed that localization rates had been doubled to over 8% in 2020 (within a span of less than 4 years).

- To support local products and raise their contribution to boost the non-oil economy, the Local Content and Government Procurement Authority issued a list of 28 items that government contractors should buy only from national companies. This includes meat, poultry, fish and dairy products; few sectors like military, health and education are also being considered.

- The Saudi Ministry of Hajj and Umrah revealed that 10 million pilgrims have successfully performed Umrah since Oct 4th last year and that 12k+ visas have been issued since Aug 10 this year when pilgrims from other countries were permitted to visit.

- With an aim to localizing pharmaceutical industries, Saudi is in negotiations with Pfizer and AstraZeneca to produce vaccines in the Kingdom. According to the deputy minister of industry and mineral resources, there are 40 Saudi factories working in the drug manufacturing sector, with three or four factories ready to manufacture directly with these companies.

- The Royal Commission in Yanbu signed an agreement to build a factory to produce wind power generation towers: with an estimated cost of about SAR 145mn, launch is expected at end-Jun 2023 and around 145 new jobs will be created.

- The number of workers in Saudi Arabia’s accommodation and food services activities sector dropped by 11% qoq to 386,400 in Q1 2021 while the number of Saudis dropped by 13% to 78,300 during the period.

- Government ministers in Saudi Arabia are now barred from joining the boards of companies, according to an amendment to a ministerial decree, reported Bloomberg.

UAE Focus![]()

- UAE’s non-oil foreign trade touched AED 1.4trn in 2020: non-oil exports rose by 10.1% yoy to AED 254.6bn while non-oil imports and re-exports accounted for 56% and 26% of the total trade volume. China remained the top trade partner (AED 174bn), followed by Saudi Arabia (AED 104bn), India (AED 102.5bn), US (AED 80.2bn) and Iraq (AED 53bn).

- UAE’s trade with Israel is expected to climb to more than USD 1trn in the next 10 years, reported Bloomberg, citing the economy minister. More than 60 MoUs have been signed with Israel, and bilateral trade currently stands at about USD 600-700mn.

- The minister of state for foreign trade, in an online interview with Reuters, revealed that the UAE is planning “very aggressive, quick work and quick negotiations” to conclude economic agreements and trade deals within a year with 8 countries it wants to deepen ties with (including the UK, India, Turkey and South Korea among others).

- The Dubai Financial Market will launch new equity futures contracts today (on Sep 19): this will be on individual stocks of 3 listed companies Dubai Investments, DFM Company and Shuaa Capital. This brings the total number of contracts to 33 on individual stocks of 11 listed companies and will support in the diversification of investment opportunities.

- ADNOC Drilling has been given an equity valuation of USD 10bn: ADNOC will sell a minimum 7.5% stake in the IPO of ADNOC Drilling at AED 3 (USD 0.6262) per share, raising at least USD 750mn in the deal.

- Reuters reported (citing sources) that the UAE central bank is studying ways to replace the local interbank rate, in a bid to align with international standards.

- The UAE central bank issued new guidelines to financial institutions on anti-money laundering practices – this includes banks’ developing internal procedures and putting in place indicators to identify suspicious transactions in addition to regularly screen databases and transactions against names on a list by the UN Security Council or UAE government. One month has been given to demonstrate compliance with these requirements.

- UAE’s passenger traffic grew by more than 3 times to over 2.5mn in Aug versus a year ago; about 45,953 flights were recorded in the month. Website “Wego” registered over 500k searches for flights and hotel reservations for Dubai during the 6-month period of the Expo

- New business licenses issued in Dubai accelerated by 54% yoy to 5885 in Aug; of these 59% were for professional and 40% for commercial activities.

- The Emirates Nuclear Energy Corp revealed that the second unit of the Barakah plant has been connected to the national grid; it will add a further 1400 MW of clean energy capacity to the UAE grid. Once completed there will be 4 reactors in total with a capacity of 5600 MW.

- Entry to the Expo 2020 will require visitors to be either vaccinated or have a negative PCR test in the previous 72 hours, according to the updated regulations. Additionally, Abu Dhabi has canceled COVID-19 testing requirements to enter the emirate from elsewhere in the UAE.

Media Review

Five questions facing the Bank of England

https://www.ft.com/content/144460b0-887a-408f-89b6-e629cadd617f

The World Bank Group to discontinue Doing Business report

Lebanon’s path back from the brink of collapse: Dr. Nasser Saidi

https://oecd-development-matters.org/2021/09/15/lebanons-path-back-from-the-brink-of-collapse/

Economic Crisis in the Anthropocene

https://www.project-syndicate.org/podcasts/economic-crisis-in-the-anthropocene-2021-09

Is China already the world’s most dominant economy?

Powered by: