Markets

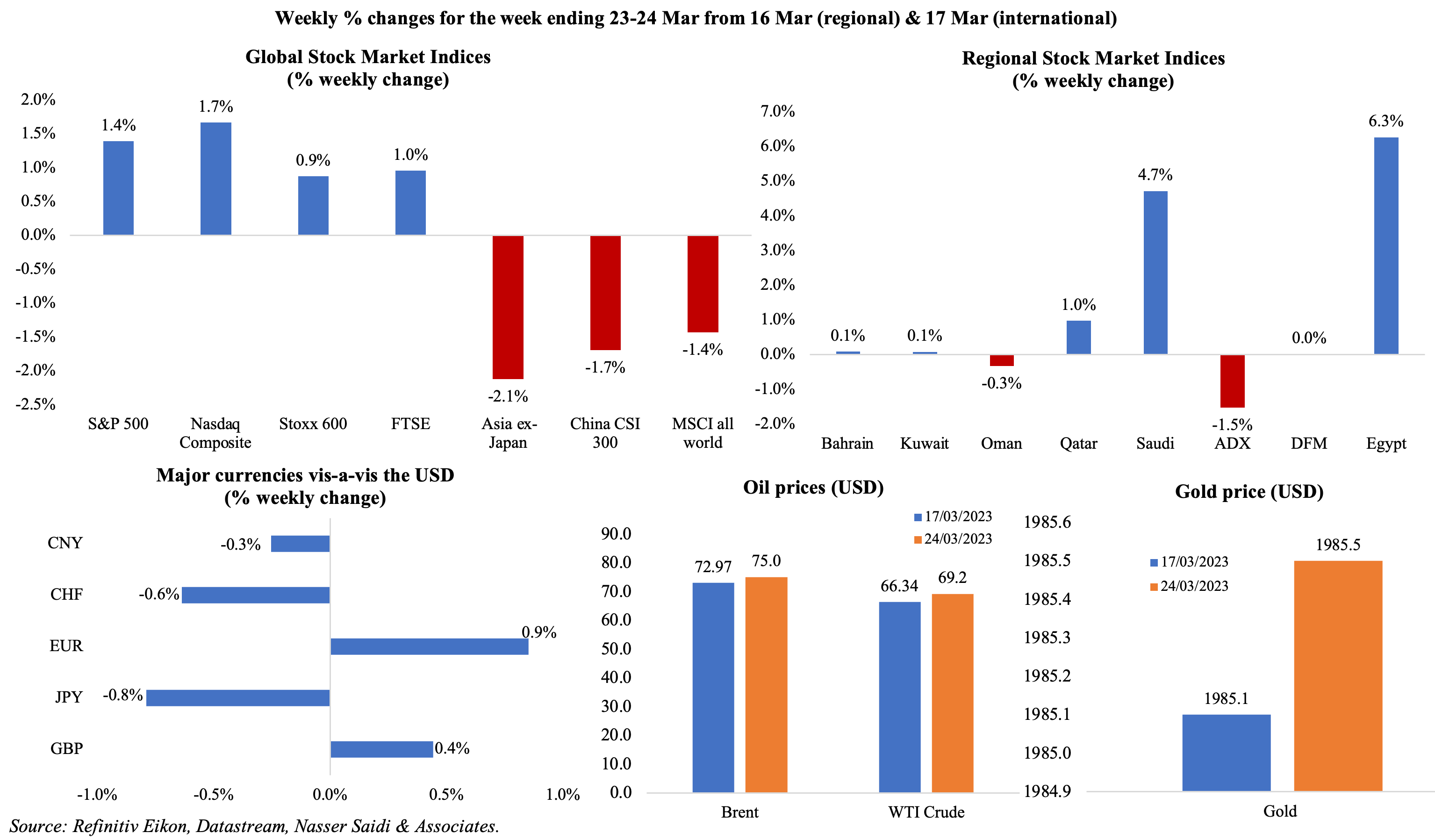

Banking stocks have taken a beating since the SVB and Credit Suisse saga, with contagion fears presenting itself towards end of last week as shares of lenders like Deutsche Bank took a tumble. US markets ended gaining as companies in tech sector performed well this month, while Asian markets ended in the red. Regional markets were mixed with oil prices and banking stability affecting investor sentiment; Egypt and Saudi Arabia posted the biggest weekly gains. Amid the volatility in equity markets, there was a strong demand for safe-haven assets: JPY rose to a seven-week high of 129.65 per dollar on Friday and gold price inched higher. Oil prices slipped to a 15-month low last Monday before recovering; Brent and WTI gained by 2.8% and 4.3% compared to the week before.

Global Developments

US/Americas:

- The Fed raised interest rates by 25bps to the current 4.75%-5% in the latest meeting. Overall, the apex bank has raised rated by 475bps since last Mar. The banking system was labelled “sound and resilient” and the Fed signalled a potential end to the aggressive rate hikes – it dropped the phrase “ongoing increases”, and instead opted to state that “some additional policy firming may be appropriate” to lower inflation to the 2% target, providing itself with flexibility to respond to inflation and financial market events.

- Durable goods orders fell by 1% mom in Feb, dragged down by the 6.6% mom drop in civilian aircraft and orders for transportation equipment (-2.8%). In yoy terms, orders rose by 2.3%, the smallest gain since 2020. Non-defence capital goods orders inched up by 0.2% mom (Jan: 0.3%).

- S&P’s flash US manufacturing PMI remained below-50 in Mar, though expanding to 49.3 (Feb: 47.3) while the service sector PMI clocked in a 11-month high of 53.3 (Feb: 50.6). Goods producers recorded the first rise in production since Oct 2022 and new orders returned to growth amid an uptick in selling price inflation.

- The Kansas City Fed manufacturing production index recovered to 3 in Mar (Feb: -9), the highest reading since Jul 2022. Separately, Chicago Fed national activity index dropped to -0.19 in Feb (Jan: +0.23), though the 3-month average improved to -0.13 (from -0.27).

- US current account deficit narrowed to USD 206.8bn in Q4, but still roughly 3.2% of current GDP (down from Q3’s 3.4%), supported by a reduced deficit on secondary income and a larger surplus on services.

- Existing home sales rebounded in Feb, rising by 14.5% mom to a seasonally adjusted 4.58mn: this was the largest uptick since Jul 2020 and followed 12 consecutive monthly declines. New home sales surprisingly rose for the 3rd month running, up 1.1% mom to 640k units in Feb; new median house price up 2.5% yoy to USD 438,200. Home sales seem to be benefitting from the falling mortgage rates (in line with the dip in US Treasury yields).

- Initial jobless claims unexpectedly fell by 1k to 191k in the week ended Mar 18th with the 4-week average edging down by just 250 to 196.25k. Continuing jobless claims increased by 14k to 1.694mn in the week ended Mar 11th; continuing claims have averaged 1.674mn so far this year, below pre-pandemic average.

Europe:

- Preliminary manufacturing PMI in the eurozone slipped to a 4-month low of 47.1 in Mar (Feb: 48.5) while services sector PMI improved to 55.6 (Feb: 52.7), the strongest expansion since May 2022. Composite PMI for France and Germany increased for the second month running, while the rest of the eurozone’s composite index jumped to a 11-month high of 55.5.

- Germany’s flash manufacturing PMI fell to 44.4 in Mar, a 34-month low (Feb: 46.3), with new orders continuing to decline. Though services PMI was up 3 points to 53.9, growing wage demands and rising borrowing costs kept services price inflation high.

- The ZEW economic sentiment index for Germany fell to 13 in Mar from Feb’s 28.1 and the current situation sub-indicator worsened to -46.5 (Jan: -45.1). The eurozone’s index also reflected the decline, slipping to 10 from Feb’s 29.7 while the current situation indicator stood at -44.6 (down 3 points from Feb).

- ECB’s consumer confidence index for the euro area inched lower by 0.1 point to -19.2 in Mar: this remains near the highest reading in almost a year. In the EU, consumer sentiment was almost unchanged at -20.7.

- Producer price index in Germany fell for the 5th month running in Feb, down by 0.3% mom. In year-on-year terms, producer prices were up 15.8%, a 17-month low, with energy costs up by 27.6% (Jan: 32.2%) alongside an increase in prices of intermediate goods and non-durable consumer goods by 8.6% and 17.9% respectively.

- Trade deficit in the eurozone (in seasonally adjusted terms) narrowed for the 5th consecutive month to EUR 11.3bn in Jan (Dec: EUR 13.4bn, from Aug’s peak of EUR 46.1bn).

- Current account surplus in the eurozone widened to EUR 17bn in Jan (Dec: EUR 13bn), thanks to a doubling of the goods trade surplus alongside a small drop in services trade surplus.

- The Bank of England hiked interest rate for the 11th consecutive time, lifting it by 25bps to 4.25%, the highest rate since Oct 2008. Seven of the nine MPC members voted for the rate hike; the BoE expects inflation to “fall significantly” in Q2 given the fall in energy prices and extension of the Energy Price Guarantee for another 3 months.

- Inflation in the UK inched up to 10.4% in Feb (Jan: 10.1%), as food and non-alcoholic drinks prices rose (18%, the highest since 1977) as did inflation in the services sector (6.6% from Jan’s 6%). Core inflation jumped to 6.2% from Jan’s 5.8% gain. Producer price index declined in mom terms on both the input and output side (0.2% and 0.3% respectively).

- UK’s preliminary composite PMI reading edged lower to 52.2 in Mar from Feb’s 8-month high reading of 53.1. Manufacturing PMI slipped to 48 in Mar (Feb: 49.3) while services PMI remained above-50 for the second month running (52.8 from Feb’s 53.5), supported by an acceleration in new orders (fastest since Mar 2022).

Asia Pacific:

- The People’s Bank of China left its benchmark rates steady for the 7th straight month in Mar: the one-year loan prime rate was left at 3.65% and the 5-year LPR at 4.3%.

- Core inflation in Japan (excluding fresh food prices) eased to 3.1% in Feb (Jan: 4.2%), as government subsidies on electricity and gas prices kicked in. Excluding food and energy, inflation rose by 3.5%, the fastest uptick since Jan 1982.

- Japan’s preliminary manufacturing PMI improved to 48.6 in Mar (Feb: 47.7), staying below-50 for the 5th consecutive month, with output and new orders shrinking but at a slower pace while input cost inflation slowed to the lowest since Aug 2021.

- Inflation in Singapore edged down to 6.3% yoy in Feb (Jan: 6.6%) while core inflation held at a 14-year high of 5.5%. Food inflation was unchanged at 8.1% while services inflation eased slightly to 3.9%.

Bottom line: Banking contagion fears remained the main story last week. Central bank meetings focused more on fighting persistent inflation than the banking crisis – with the Fed, the Bank of England and Norges Bank raising rates by 25bps alongside the Swiss National Bank’s 50bps hike. The Fed Chair also warned that banking stress could trigger a potential credit crunch. The flash PMI readings across major economies highlighted that the recovery was being driven by the services sector rather than manufacturing, with new orders for goods falling across the four largest developed economies on average for a tenth consecutive month. There is increasing evidence of rising prices in the services sector (thanks to rising wages and higher borrowing costs) and recovery in consumer demand might be negatively affected by rising interest rates – not boding well in the near-term, especially considering contagion worries.

Regional Developments

- Most GCC central banks raised interest rates in line with the Fed’s 25bps hike, given the peg to the dollar.

- Bahrain grew by 4.2% yoy in Q3 while current account surplus for the full year 2022 widened to BHD 2.57bn (USD 6.7bn) from BHD 978.5mn in 2021. This was disclosed during the central bank’s board meeting.

- The IMF disclosed that preparations for the first review of Egypt’s economic reform program has begun, with the dates for the review mission yet to be confirmed.

- The World Bank approved a new country partnership framework for Egypt, providing USD 7bn in financing to support green and inclusive developments in the country for a period from 2023 to 2027.

- Reuters reported that the sale of a stake in Telecom Egypt has been suspended given current market conditions. It was disclosed earlier this month that a 10% stake sale was being planned; the government owns 80% of the entity.

- Egypt’s Suez Canal revenues surged by 40% yoy to USD 2.08bn in Q1 2023. The Suez Canal Authority also disclosed a 19% increase in ships to 5,534 and 16% increase in net tonnage to 320mn.

- Egypt’s Suez Canal economic zone and Abu Dhabi ports will partner to develop projects in the ports within the zone, according to a statement by the former.

- Iraq renewed a contract to provide the Egyptian General Petroleum Corporation with 4mn barrels of Iraqi crude oil in Jun and Aug.

- The IMF, in its concluding statement of the Article IV Mission, stated that “Lebanon is at a dangerous crossroads, and without rapid reforms will be mired in a never-ending crisis”. Though a staff level agreement was signed almost a year ago, Lebanon has yet to meet the conditions to secure a full program. The need for a market-determined exchange rate was stressed by the IMF, while also stating that the revised banking secrecy law needs to be amended again to “address outstanding critical weaknesses”.

- Lebanon’s central bank governor on Tuesday revealed plans to sell unlimited amounts of USD to stop the devaluation of the LBP in the parallel market that could mean a depletion of remaining international reserves. A new rate of LBP 90,000 per dollar was set on the central bank’s exchange rate platform (from 70,000 on Mar 1st).

- Inflation in Oman stood at. 1.9% yoy in Feb (Jan: 1.9%), with the price of food and non-alcoholic beverages up by 5.08% and that of furniture and household equipment up 3.83%, followed closely by restaurants and hotels (3.79%).

- Population of Oman crossed 5mn, with expatriate population accounting for 42.38% of the total, according to the NCSI.

- Rakiza infrastructure fund, backed by PIF and the Asia Infrastructure Investment Bank, disclosed that it had raised USD 1bn to invest in 3 projects in Oman – a 30% stake in telecom firm Omantel’s passive tower assets, a majority stake in Khazaen Fruit and Vegetable Central Market, and an estimated 31% stake in the Oman International Container Terminal in the Port of Sohar – and is close to signing several deals in Saudi Arabia.

- Oman’s Civil Aviation Authority disclosed that new runway at the Muscat International Airport is expected to be completed by end-2023; current development projects at the airport is estimated to cost over OMR 21mn (USD 54.4mn).

- The World Bank’s Rapid Damage and Needs Assessment report estimates Syria’s recovery and reconstruction needs following the earthquake damages to be USD 7.9bn over 3 years. The Bank also expects real GDP output to contract by 5.5% this year.

- Healthcare spending in the GCC is estimated to touch USD 135.5bn in 2027, up by 5.4% per year from 2022, according to report from Alpen Capital. While UAE is expected to post the highest CAGR, at 7.4% per year, Saudi and UAE together will together account for close to 80% of GCC healthcare spending in 2027.

- Despite of oil prices touching a 15-month low on Monday last week, OPEC+ is likely to stay put on its decision of output cuts.

Saudi Arabia Focus

- The foreign minister of Saudi Arabia and Iran have agreed to a bilateral meeting in the month of Ramadan. The two ministers have spoken twice by phone and preparations will be underway to reopen embassies and consulates.

- The number of investment funds in Saudi Arabia grew by 25% yoy to 941 in Q3 2022, revealed the CMA; public funds reached 255 (Q3 2021: 256) and private funds stood at 686 (a year ago: 495).

- The Saudi National Bank’s investment in Credit Suisse formed less than 0.5% of its total assets, and hence has no impact on SNB’s profitability or on its “growth plans and forward-looking 2023 guidance”, according to SNB’s bourse filing.

- Saudi Arabia issued 46 new mining licenses in Jan 2023, down 33% mom, according to the ministry of industry and mineral resources. There are 2,230 valid mining licenses as of end-Jan, with building materials quarry licenses at 1,331.

- The Deputy Minister of Industry and Mineral resources disclosed that there are now more than 10k industrial facilities in Saudi Arabia, an increase of 50% since the launch of Vision 2030 (in 2016). About 1023 factories started operations in 2022.

- Saudi Venture Capital launched a USD 80mn “Investment in Fintech VC Fund” in partnership with the CMA and the Financial Sector Development Program. The Saudi VC market had captured USD 987mn in funding in 2022 (+72% yoy).

- India and Saudi Arabia plan to create an “investment bridge” for accelerating pending bilateral investment projects and facilitating investors. Opportunities for bilateral investment exchanges were discussed in areas including renewable energy, pharmaceuticals and food security among others.

- Saudi Arabia has hosted over 120mn persons at events in the past 4 years, according to the chairman of the General Entertainment Authority.

- Saudi Arabia welcomed 2.4mn visitors in Jan and 2.5mn in Feb, according to the minister of tourism. He also disclosed that the ministry had spent SAR 400mn+ to train more than 100k citizens, with 10,400 persons receiving their training abroad.

- Real estate rental deals in Saudi Arabia almost doubled to SAR 76bn (USD 20.2bn) in 2022, with commercial rent transactions accounting for 53.8% of the total. Riyadh (with its 470k residential units and 181k commercial units) saw the highest number of rent deals valued at SAR 24.7bn, followed by Jeddah (SAR 17bn) and Makkah (SAR 4.9bn).

- NEOM Airlines will be ready to fly by end-2024, giving passengers “a completely different travel experience” with its “futuristic and efficient” service, according to the CEO.

UAE Focus![]()

- Inflation in Dubai inched up to 4.9% yoy in Feb, after easing the month before to 4.6%. The uptick in Feb was largely due tohigher costs of food (6.3% in Feb from 5.5% in Jan) and housing & utilities (4.9% from 4.4%) while transport prices eased significantly (4.4% in Jan-Feb vs an average of 22.13% in 2022). Recreation (22.63% in Jan-Feb vs 23.4% in 2022) and restaurants & hotels (4.4% from 6.5%) costs have also eased this year compared to 2022.

- ADNOC is planning to list its marine and logistics subsidiary (ADNOC Logistics & Services) by June, reported Reuters. The company, created in 2016, delivers crude oil, refined products, dry bulk and LNG from Abu Dhabi to its international customers.

- Moody’s affirmed UAE’s Aa2 long-term local and foreign currency issuer rating citing the federal government’s low debt levels. It also affirmed Abu Dhabi’s As2 rating and maintained its stable outlook, thanks to its strong balance sheet and net creditor position.

- Abu Dhabi’s Hub71 tech ecosystem raised AED 4.5bn collectively in venture capital for over 200 startups and created more than 900 jobs by end-2022. In 2022 alone, 9 of the 51 startups onboarded by Hub71 each raised more than AED 36.7mn in funding.

- UAE aims to secure 50% of some basic food requirements from local farms and producers by end-2023, with the objective of increasing this to 100% by 2030, revealed the minister of climate change and environment.

- Bilateral non-oil trade between the UAE and Pakistan grew by 30% yoy to AED 25.7bn in 2022. At an official meeting to plan trade and investment cooperation, it was disclosed that UAE is Pakistan’s leading investment partner in the region and fifth globally, as of end-2021.

- The UAE central bank launched its digital currency implementation strategy, signing new deals with cloud computing company Group 42 Cloud and financial digitization provider R3. The first phase, to be done in 12-15 months, will see the soft launch of mBridge (to facilitate real value cross-border central bank digital currency transactions).

- Oman and the Etihad Rail Company have invited construction bids to undertake civil works for the 303-km railway network connecting Sohar to Abu Dhabi.

Media Review

“China and the Middle East: old friends in a new era”: UBS interviews Dr. Nasser Saidi

https://monocle.com/radio/shows/the-bulletin-with-ubs/441/

A New Order in the Middle East?

https://www.foreignaffairs.com/china/iran-saudi-arabia-middle-east-relations

What to read to understand banking crises

https://www.economist.com/the-economist-reads/2023/03/24/what-to-read-to-understand-banking-crises

Google just launched Bard, its answer to ChatGPT—and it wants you to make it better

https://www.technologyreview.com/2023/03/21/1070111/google-bard-chatgpt-openai-microsoft-bing-search

IPCC’s 6th Assessment Report – summary for policymakers

https://report.ipcc.ch/ar6syr/pdf/IPCC_AR6_SYR_SPM.pdf

Powered by: