Download a PDF copy of the weekly economic commentary here.

Markets

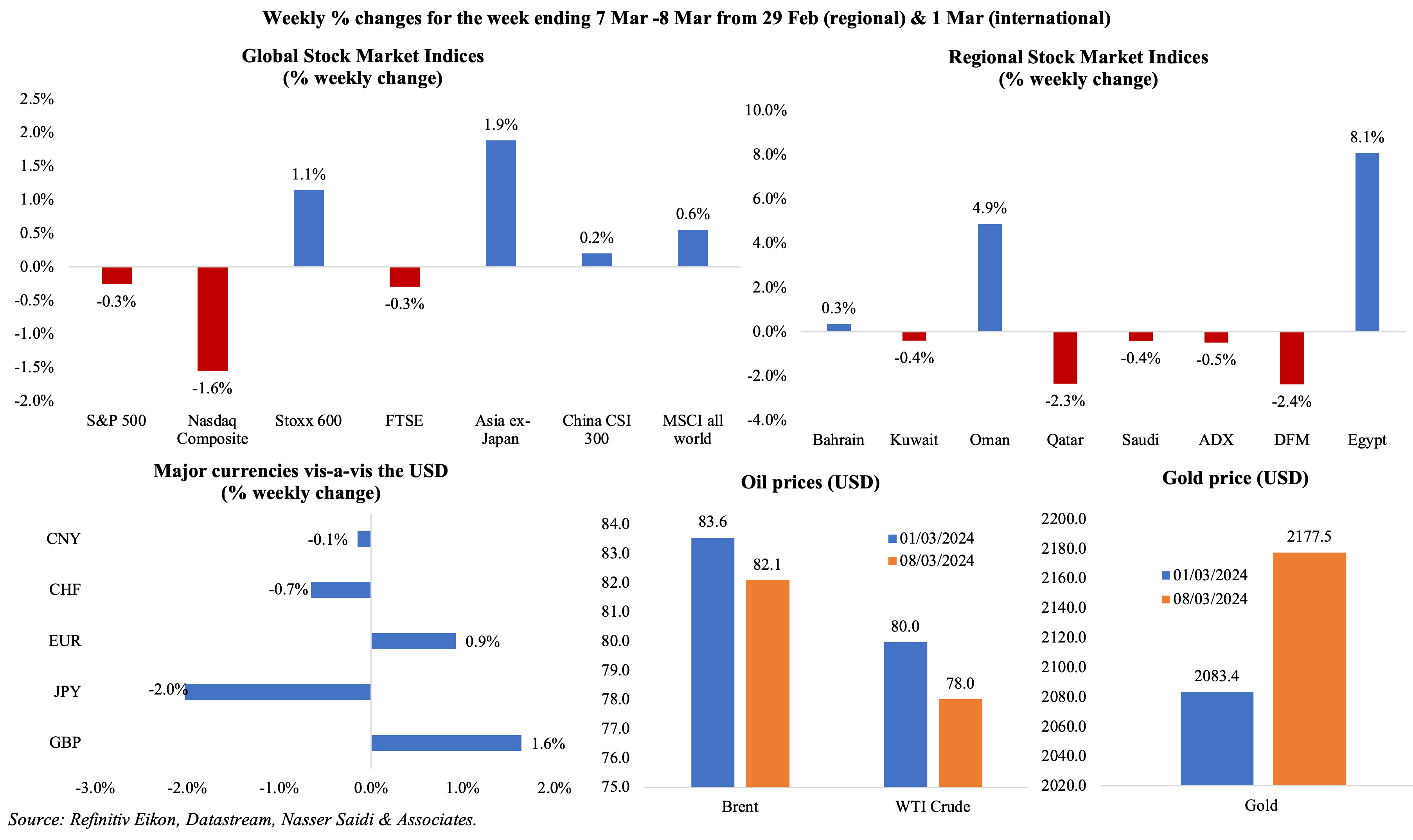

Expectation of interest rate cuts (in the US & Europe) led to stock market rallies last week: though US markets ended in the red, it followed record rallies and profit taking; both MSCI’s index of stocks around the globe and Stoxx600 also posted record-highs. Egypt gained the most among regional markets, thanks to the currency float and IMF agreement. In a week that saw the dollar index decline, the Japanese yen rose against the greenback after reports about BoJ considering a potential rate hike. Both Brent and WTI prices were down compared to a week ago despite OPEC+’s extended production cuts, while gold price kept clocking in new record highs (as expectations increased for interest rate cuts).

Global Developments

US/Americas:

- Fed Beige book indicated a slight increase in economic activity, with “expectations for stronger demand and less restrictive financial conditions over the next 6 to 12 months”.

- US non-farm payrolls rose by 275k in Feb (Jan: 229k), with unemployment rate inching up to 3.9% (Jan: 3.7%). Labour force participation rate held steady at 62.5%, and the average weekly hours worked increased from 34.1 to 34.3. Private sector in the US added 140k jobs in Feb (Jan: 111k), with most created at restaurants and hotels, construction, transportation and in financial services sectors.

- JOLTS job openings were 8.863mn in Jan (Dec: 8.88mn); there were 1.45 job openings per every unemployed person in Jan (much lower than the 1.82 recorded a year ago).

- US goods and services trade deficit widened to USD 67.4bn in Jan (Dec: USD 64.2bn), the most in 9 months. Exports inched up by 0.1% to USD 257.2bn, with capital goods exports the highest on record; imports rose by 1.2% to USD 263.4bn. Deficits with China and the EU stood at USD 22.9bn and USD 18.1bn respectively.

- S&P Global services PMI in the US edged lower to 52.3 in Feb (Jan: 52.5), with output rising for the 13th month in a row and input costs eased to the slowest since Oct 2020. Composite PMI rose to 52.6 (Jan: 51.4), the highest since Jun 2023.

- ISM services PMI slipped to 52.6 in Feb (Jan: 53.4), with new orders increasing to 56.1 (Jan: 55) while employment contracted (48 from 50.5) and prices paid fell to 58.6 (Jan: 64).

- Initial jobless held steady at an upwardly revised 217k in the week ended Mar 1st, and the 4-week average slipped by 750 to 212.5k. Continuing jobless claims increased by 8k to 1.906mn in the week ended Feb 23rd, the highest reading since Nov.

Europe

- The ECB left interest rates unchanged at a record 4% and hinted at a first cut probably in Jun (depending on data including inflation and wage growth), as inflation inches towards ECB’s 2% target. The ECB forecasts inflation at 2.3% this year (from 2.7% in its previous forecast) and 1.9% in mid-2025. GDP in the eurozone is expected to grow by 0.6% this year.

- Composite PMI in the eurozone remained under-50 in Feb, though rising to an 8-month high of 49.2 in Feb (Jan: 47.9). France and Germany remained in contractionary territory while Ireland and Spain posted expansions. Services PMI inched up to 50.2, crossing the 50-mark for the first time since Jul 2023, supported by stronger demand and sales performance.

- Producer price index in the eurozone fell by 0.9% mom and 8.6% yoy in Jan, thanks to the plunge in energy costs (-21.3% yoy) while intermediate goods costs fell by 5.8% and price increase slowed for capital goods (2.1% from Dec’s 2.8%) and non-durables (2.0% vs 3.3%).

- Sentix investor confidence in the eurozone gained 2.4 points to -10.5 in Mar, the highest since Apr 2023. Expectations index rose to -2.3 (Feb: -5.5) while the current situation index also rose (to -18.5 from -20).

- Exports from Germany rebounded by 6.3% mom in Jan to an 11-month high of EUR 135.6bn, with exports to the EU and China up by 8.9% and 7.8% respectively while that to the UK plunged by 8.1%. Imports were up by 3.6%, widening the trade surplus to EUR 27.5bn.

- German factory orders plunged by 11.3% mom in Jan (Dec: +12%): this was the sharpest fall in 6 months.

- Industrial production in Germany expanded by 1% mom and 5.5% yoy in Jan. IP mom growth was the most since Feb 2023, supported by upticks in intermediate and consumer goods (up by 4.4% and 4% respectively) while capital goods fell by 2.1%. The auto sector dropped by 7.6% in Jan, while production of food and chemicals grew (5.9% and 4.7% respectively).

- German producer price index increased by 17.8% yoy in Jan though compared to Dec, the index slipped 1%. Energy prices caused the uptick in yoy terms (32.9%) and excluding energy costs, the index was up 10.7%.

- Retail sales in the eurozone fell for the 16th straight month in Jan (-1% yoy), while in mom terms, it inched up by 0.1%. The uptick compared to Dec was a result of sales of food, drinks and tobacco (+1%) while fuel was up 1.7% (the largest rise since Aug 2022).

- Germany’s composite PMI edged up to 46.3 in Feb (prelim: 46.1), contracting for the 8th month in a row, thanks to the severe drop in manufacturing PMI. Albeit below-50 for the fifth straight month, services PMI rose to 48.3 (Jan: 47.7): it was dragged down by decline in export sales and as input costs rose to a 10-month high.

- UK’s pre-election “budget for long-term growth” saw a reduction in national insurance contributions (by 2 percentage points) alongside an increase in other tax hikes (e.g., business class flights, vaping products, scrapped tax breaks for owners of holiday lettings) and an abolition of the “non-dom” tax regime (which allowed wealthy UK residents who had “domicile” abroad to avoid paying tax on foreign income).

- UK’s composite PMI edged up to 53 in Feb (Jan: 52.9), the fastest growth since May 2023, and input costs rose in both manufacturing and services sectors. Services PMI slipped by 0.5 points to 53.8: alongside higher new orders, output remained robust.

- Retail sales in the UK (reported by the British Retail Consortium) rose by 1.1% yoy in Feb (Jan: 1.2%), as sales of non-food items were down by 2.5% in the 3 months to Feb (the largest 3-month decline since 2022).

Asia Pacific:

- Inflation in China rose to 0.7% yoy in Feb (Jan: -0.8%), rising for the first time in 6 months potentially ending the deflationary period, as food and travel prices ticked up ahead of the Lunar New Year holidays. Producer price index fell for the 17th month in a row, down 2.7% yoy in Feb (Jan: -2.5%).

- Exports from China grew by 7.1% yoy in Jan-Feb, driven by the electronics sector; exports to the US grew by 5% yoy in Jan-Feb (Dec: -6.9%) while exports to Russia grew by 12.5%. Imports increased by 3.5% (Jan: 0.2%), leading to a wider trade surplus (to USD 125.16bn from Jan’s USD 75.34bn).

- China’s Caixin services PMI stood at 52.5 in Feb, slightly lower than Jan’s 52.7: export orders increased the most in 8 months while new orders growth held almost steady.

- China forex reserves unexpectedly increased to USD 3.226trn in Feb, up by USD 6.5bn. Its gold reserves rose to USD 148.64bn (Jan: USD 148.23bn).

- Japan GDP grew by 0.4% yoy and 0.1% qoq in Q4 (Q3: -0.3%), an upward revision from provisional data showing a decline (0.4% yoy and 0.1% qoq). Business investment was revised upwards (2% qoq vs initial estimate of -0.1%), as was capital expenditure (2% qoq from 0.1% fall) while private consumption fell by 0.3% qoq (vs provisional estimate of a 0.2% drop).

- Inflation in Tokyo accelerated to 2.6% in Feb (Jan: 1.8%), as the effect of government fuel subsidies lessened. Excluding food and energy, prices eased (3.1%, the slowest pace since last Feb, and from 3.3%) while excluding just fresh food, prices rose to 2.5% (from 1.8%).

- Japan’s services PMI edged up to 52.9 in Feb, from the flash reading of 52.5, expanding thanks to domestic and tourism demand. Input costs eased while output costs inflation was the strongest in six months.

- Japan’s flash coincident index slipped to 110.2 in Jan (Dec: 116), the lowest reading since Oct 2021. The leading economic indicators also inched lower, to 109.9 in Jan (Dec: 110.5).

- Overall household spending in Japan fell by 6.3% yoy in Jan (Dec: -2.5%), the sharpest drop since Feb 2021. Lower purchases of new cars led to a decline in spending on autos (-30.4%) while expenditure on food fell 2.7% (falling for the 16th month in a row).

- India signed a free trade agreement with the 4-nation EFTA Europe bloc consisting of Switzerland, Norway, Iceland and Liechtenstein: the commitment includes reductions of import tariffs on industrial products by India, in return for India receiving USD 100bn in investments over the next 15 years.

- Retail sales in Singapore rebounded by 1.3% yoy in Jan (Dec: -0.5%), thanks to the massive 37.3% jump in sales of motor vehicles while food and alcohol sales grew 8.5%. In mom terms, sales fell by 0.7% mom (Dec: 0.1%).

Bottom line: JP Morgan global composite PMI jumped to an 8-month high, on stronger new orders; 11 of the 15 nations (for which composite readings are available) showed an expansion in Feb while Germany and France posted sub-50 readings. China’s National People’s Congress, which ends today, last week announced a stable 5% growth target for this year without shining any light on stimulus plans. Japan’s revised GDP numbers for Q4 were positive versus a negative reading before that had placed it in a technical recession. While markets are pricing in rate cuts in Jun from the Fed and the ECB, Bitcoin is once again in the limelight: after rallying for 5 consecutive days, it set another record after topping USD 70k last week. Data spotlight will be on inflation this week (such as in Germany, India and US) as well as the UK’s labour market statistics and GDP numbers. Lastly, presidential elections are to happen in Russia this week while Portugal’s Sunday’s election saw the centre-right party win (the far-right however secured 18% of the vote, up from 7% in 2022).

Regional Developments

- Bahrain attracted USD 2.4bn in investments from 9 major projects in 2023, following the introduction of its Golden Licence Policy; these projects are expected to create 3000 new jobs.

- The Central Bank of Egypt (CBE) hiked rates by 600 bps and floated the currency, promising to allow market forces to set the EGP value; there had been three devaluations since 2022 (but with the CBE fixing the exchange rate). Egypt also secured the IMF deal – to the tune of USD 8bn (increase from USD 3bn), with another potential USD 1.2bn loan for environmental sustainability (subject to review). Egypt is the is the IMF’s second-biggest debtor after Argentina: as of March 7th, total IMF credit outstanding debt that Egypt owes stood at USD 14.6bn (or 981bn special drawing rights).

- Egypt’s finance minister expects primary budget surplus to rise to above 3.5% in the fiscal year starting Jul 2024(from about 2.5% in the current year). Land sales and the IMF deal will support lowering the deficit. Primary balance does not include interest payments (which accounts for more than 50% of total spending).

- Moody’s upgraded Egypt’s outlook to positive (from negative) and affirmed foreign currency ratings, following news of Egypt’s IMF funding and large devaluation. S&P has a ratings update on Egypt scheduled for Apr 19th, though internal discussions were confirmed as ongoing following the ADQ investment two weeks back.

- Non-oil sector PMI in Egypt moved down to 47.1 in Feb (Jan: 48.1), the lowest in 11 months, dragged down by new orders (fell at the fastest pace since Mar) and output (to 44.3 from 46.6). Weak demand conditions saw domestic sales drop significantly amid inflationary pressures (highest in 13 months).

- Inflation in Egypt surged to 35.7% yoy in Feb (Jan: 29.8%), the highest since Oct 2023, as food and beverage prices rose (50.9%) as did transport and communication (17.6%) and housing (10%) – likely reflecting the hike in metro, internet and electricity prices from Jan. Core inflation ticked up to 35.1% (Jan: 29%). This reflects Feb data, prior to the current devaluation.

- Egypt is beginning the process for airport privatisation: according to a Cabinet Statement, it is set to issue an international tender for operating Egyptian airports, including Cairo International Airport.

- The Ministry of Finance in Egypt aims to raise EGP 459.5bn by issuing 26 T-bills and bond tenders in Mar, as part of the government’s plan to borrow EGP 1.647trn from the domestic market in Q3 of fiscal year 2023-24. As of Jan 2024, the outstanding balance of local treasury bills and bonds had reached about EGP 4.966trn.

- Egypt plans to invest EGP 81.4bn in the electricity and energy sector in the 2023-24 fiscal year, disclosed the Ministry of Planning and Economic Development. Separately, Daily News Egypt reported that Saudi Arabia’s Industrialization and Energy Services Company (Taqa) plans to quadruple investments in Egypt’s energy sector over the next two years.

- Kuwait spent about KWD 1.5bn on projects and economic affairs during the first 9 months of the 2023-2024 fiscal year, representing 52.5% of total budget allocations for these projects. Spending on oil & gas projects in the same period stood at 82.4% of its total estimated costs.

- Kuwait’s official reserves declined by 1% yoy to KWD 14.62bn in 2023.

- PMI in Lebanon dipped slightly to 49.1 in Feb (Jan: 49.4), on weak demand and rising security concerns while business confidence fell to a 7-month low and input and output cost readings held close to Jan’s 28-month low.

- Oman’s central bank reported a 0.1% yoy uptick in total foreign assets to OMR 6.73mn (USD 17.49mn) at end-2023. M2 grew by 13.1% to OMR 23mn, private sector deposits rose by 10.6% to OMR 19.2mn while loans and financing increased by 4.3% to OMR 30.47mn.

- The Public Authority for Special Economic Zones and Free Zones (OPAZ) in Oman revealed that its economic zones, free zones and industrial zones volume of committed investments increased by OMR 3.5bn in 2023, taking the cumulative investment to approximately OMR 19bn. Special Economic Zone at Duqm accounted for a total investment of OMR 6bn by 2023.

- Oman has attracted investments worth OMR 20mn (USD 52mn) in its space sector over the past two years, according to a senior official at the ministry of transport, communications, and information technology. Work is ongoing on on five to six space projects out of a planned total of 14, including a space cloud partnership, a space accelerator, a public satellite and a global space conference.

- Qatar PMI moved up to 51 in Feb (Jan: 50.4), thanks to increases in output and employment. Output prices fell for the 4th month in a row and at the strongest rate in two years.

- Qatar posted a budget surplus of QAR 43.1bn in 2023, less than half 2022’s QAR 89bn surplus, after revenues declined by 14.5%. The surplus is still higher than what was budgeted for the year 2023 (QAR 29bn). Overall revenues in 2023, at QAR 254.4bn, were 11.6% higher than the 2023 budget, but 14.5% lower in yoy terms. Expenditures inched up by 1.2% yoy in 2023 and were 6.2% higher than the budgeted amount; share of wages and major capex were each close to one-third (31.2% and 32.7%) in Q4 2023.

- Qatar’s trade surplus narrowed by 28.1% yoy to QAR 17.5bn in Jan 2024, as exports fell (9.1% to QAR 20.9bn) while imports surged 38.3% (to QAR 13.4bn). China was the top exports destination (share of 24.2%) followed by South Korea (13.5%) and India (13.1%).

- Green bond issuances in the Arab region reached USD 6.8bn by Oct 2023, up 40% from 2022, according to the Arab Monetary Fund, with UAE and Saudi Arabia accounting for more than 90% of the total size.

- Saudi Aramco and UAE’s ADNOC are in talks to invest in LNG projects in the US (currently the largest exporter of LNG, overtaking Australia and Qatar), reported Reuters. With banks’ ESG regulatory requirements becoming more stringent, LNG projects in the US have been on lookout for investors. LNG capacity in the US is expected to almost double in 4 years.

- Saudi Aramco and ADNOC are also moving ahead with a plan to extract lithium – a critical mineral given its use in the manufacturing of batteries – from brine in their oil fields, reported Reuters. Saudi Arabian Mining Company (Ma’aden) is also working to extract lithium from seawater.

- Global SWF data indicates that GCC sovereign wealth funds continue to be heavily invested in the US. For example, of ADIA’s assets 52% are in the US versus 5% in China while Kuwait Investment Authority has 33% in the US and 2% in China.

- Total value of projects pipeline across the GCC is estimated at USD 1.68trn in 2024 (2023: USD 1.38trn), according to CBRE, with Saudi Arabia accounting for USD 1.06trn. UAE’s share stands at 24.1% of the total (USD 409bn) while Oman, Kuwait, Qatar and Bahrain account for 5.2%, 3.2%, 2.9% and 1.3% respectively.

Saudi Arabia Focus

- Saudi GDP contracted by 0.8% yoy in 2023, as a result of a plunge in oil sector activity (-9% yoy). Non-oil and government sector activity grew by 4.4% and 2.1% respectively; the transport, storage and communication sector and the wholesale and retail trade, restaurants and hotels sector grew by 7.3% and 7%. In Q4 2023, GDP declined by 4.3% yoy and 0.6% qoq. The moving chain methodology was used to calculate real GDP for Q4 2023 and 2023 and will be used going forward. This methodology uses the weights and prices of the year preceding the year of measurement.

- Saudi Arabia’s non-oil PMI rose to 57.2 in Feb (Jan: 55.4), supported by output (to 61.5, the fastest since Sep), new orders (to 62.2 from 60.5 in Jan) and employment which rose at one of the sharpest paces in 8 years; services and construction sectors drove growth. Both input and output price inflation cooled – the latter on increased competition.

- Industrial production in Saudi Arabia inched up by 0.3% mom in Jan, thanks to a 1.1% rise in manufacturing while mining & quarrying activity inched up by 0.1%. In yoy terms, however, IP fell by 8.8% in Jan, dragged down by the mining & quarrying sector (-14.3%). The Ministry of Industry and Mineral Resources, in a bid to reduce financial burden on businesses, decided to waive customs duties on certain manufacturing products from Apr 1st.

- Saudi Arabia transferred to the PIF an 8% stake in Aramco, worth around USD 163.6bn. The PIF previously held a 4% stake since 2022 and indirectly another 4% (which was transferred to Sanabil, fully owned by PIF, in 2023). Separately, Aramco’s net profit fell by 24.7% to USD 121.3bn in 2023 (still the second-highest profit on record), given lower oil prices and volume, but increased its dividend by 30% to USD 97.8bn.

- Saudi Arabia will launch a national strategy for space and a space company, revealed the Minister of Communications and Information Technology on the sidelines of the LEAP conference. In addition to space exploration, the nation’s strategy will also focus on space telecommunications (to connect the unconnected world), (to localise) navigation and carbon reduction (track emissions via earth observation).

- The LEAP conference held in Saudi Arabia last week, saw 215k visitors attending (25% yoy), and announced projects and investments worth USD 13.4bn. Investments worth USD 888mn were set to support the local start-up & venture capital sector, with focus on industries such as digital payments, e-gaming and AI.

- Around 26,690 Saudi citizens joined the local employment market for the first time during the month of Feb, and the total number of citizens working in the private sector rose to more than 2.34mn, reported the National Labour Observatory (NLO). It was also disclosed that the number of Saudis with 20+ years of experience in the private sector stood above 123k.

- Aramco announced the launch of a generative AI model: called the Aramco Metabrain AI, it has 250bn parameters, and was trained on 7trn datapoints from the company’s history.

- Neom will produce its first green hydrogen this year, disclosed the CEO of Neom Green Hydrogen Company. NGHC is expected to produce 8 tonnes of green hydrogen a day during the launch this year and aims to produce 600 tonnes per day by end-2026.

- Amazon Web Services, Amazon’s cloud division, plans to invest more than USD 5.3bn and launch data centres in Saudi Arabia in 2026.

- Singapore’s Temasek Holding, which is evaluating bids for the sale of Pavilion Energy’s assets, has shortlisted Aramco as one of the firms to purchase the assets. The unlisted firm posted a profit after tax of USD 438mn for the year to March 2023.

UAE Focus![]()

- UAE PMI rose to 57.1 in Feb (Jan: 56.6), thanks to an uptick in output to 64.6 (Jan: 62) which was the highest reading since Jun 2019 and a boost in employment to a 9-month high. Stiffer competition led to new orders inching lower to 60.4 (Jan: 61.9), and firms offering price cuts (charge discounting was reportedly the most since Sep 2020).

- Dubai will impose a 20% annual tax on foreign banks, except those that are DIFC-licensed. The corporate tax rate will be deducted from the annual tax of 20% if the foreign bank pays tax under the Corporate Tax Law.

- Dubai’s Parkin, which manages public parking operations in the emirate, set the price range for its IPO at AED 2.0 to 2.1(USD 0.57) per share. This places valuation of the firm at AED 6.3bn, and the final price will be announced on Mar 14.

- Abu Dhabi Global Market (ADGM) disclosed a 32% increase in the number of firms at the financial free zone last year to 1,825. Assets under management also surged last year, by 35%, with 102 asset managers managing 141 funds at ADGM as of end-2023.

- The Dubai Multi-Commodities Centre (DMCC) reported a 25% yoy increase in new Chinese companies setting up in the free zone to a total 852 last year. DMCC is now home to over 14% of the estimated 6,000 Chinese businesses based in the UAE.

- Etihad Airways posted net profits for 2022 and 2023 (of AED 92mn and AED 525mn respectively, following losses since 2016) and is improving its transparency, governance, and balance sheet to be ready for an IPO (probably as early as this year, reported Bloomberg). In a bid to improve transparency, the airline will publish a 2023 annual report by mid-Apr for the first time ever: this will also include details of pandemic-related government support.

- ADNOC’s use of more than 30 AI tools across processes ranging from field operations to corporate decision-making resulted in the generation of USD 500mn of additional value in 2023 and prevented up to 1 million tons of carbon dioxide emissions.

- Value of transactions through the UAE Fund Transfer System (UAEFTS) grew by 35% yoy to AED 17.16trn (USD 4.63trn) in 2023, according to central bank statistics. Of the total, AED 11.018trn were interbank transfers and AED 6.14trn transfers between bank customers.

- The UAE expects 36,000 Emiratis to join the private sector workforce this year, and an investment of USD 1.7bn has been approved to achieve this target. Last year, nearly 42k Emiratis joined the private sector taking their total number to 92k, according to the Emirati Talent Competitiveness Council.

Media Review

Diversification strategies paying off for GCC economies (comments from Dr. Nasser Saidi)

https://www.arabnews.com/node/2473996/business-economy

Aramco sees China demand growing, eyes more investments

https://www.reuters.com/business/energy/aramco-chief-sees-healthy-chinese-demand-looking-more-investments-2024-03-10/

Countries That Close Gender Gaps See Substantial Growth Returns

https://www.imf.org/en/Blogs/Articles/2023/09/27/countries-that-close-gender-gaps-see-substantial-growth-returns

World Bank’s Women, Business and the Law 2024 report shows massive, wider-than-expected global gender gap

https://www.worldbank.org/en/news/press-release/2024/03/04/new-data-show-massive-wider-than-expected-global-gender-gap

For 50 years the story of oil has been one of matching supply with increasing demand

https://www.economist.com/special-report/2024/03/11/for-50-years-the-story-of-oil-has-been-one-of-matching-supply-with-increasing-demand

Powered by: