Weekly Insights 8 Mar 2024: Will Egypt’s central bank move restore confidence? Muted impact from rising costs & supply chain pressures in the region

1. Egypt central bank’s interest rate hike, currency float & IMF agreement

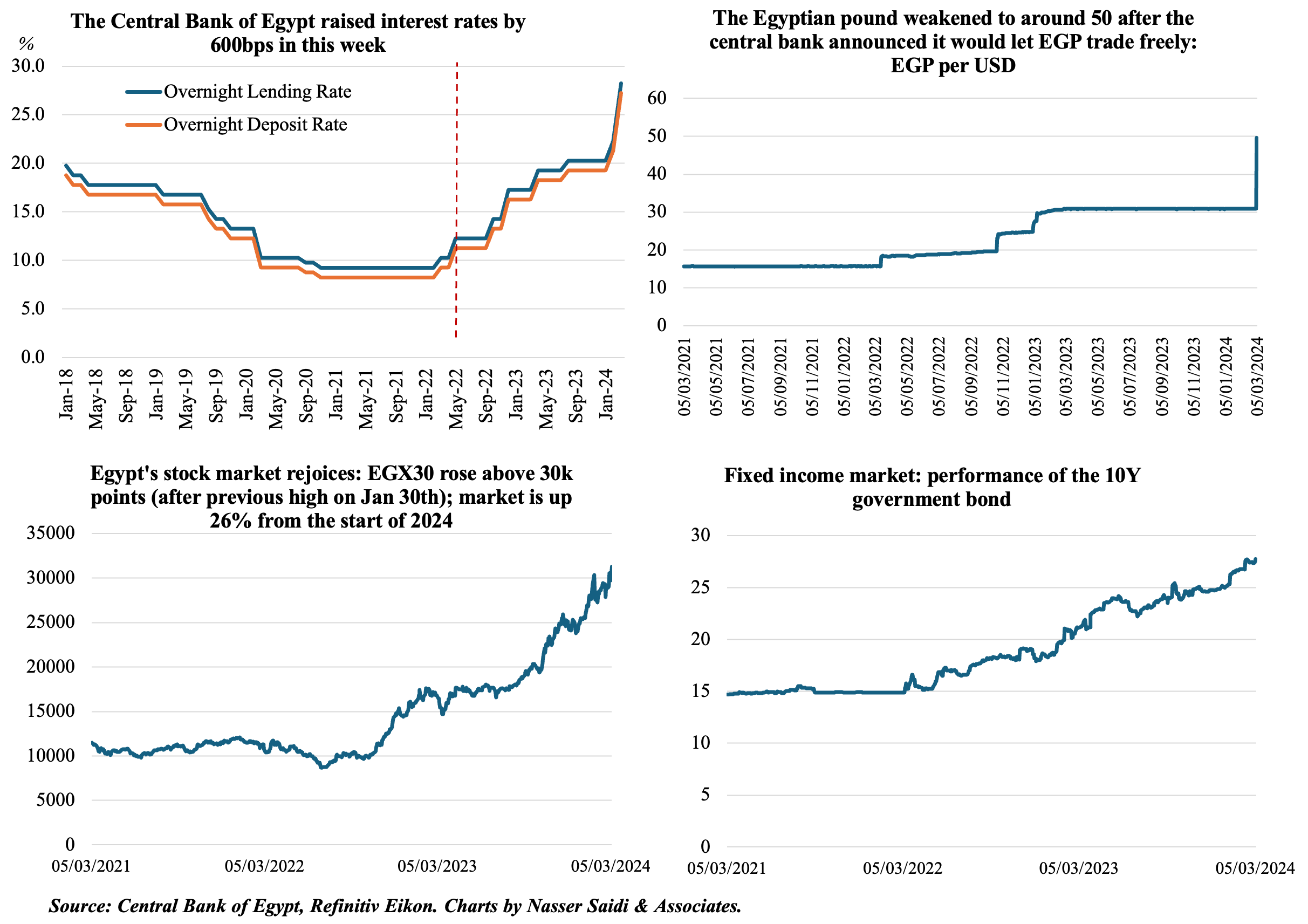

- The Central Bank of Egypt (CBE) hiked rates by 600 bps and floated the currency, promising to allow market forces to set the EGP value; there had been three devaluations since 2022 (but with the CBE fixing the exchange rate).

- Egypt also secured the IMF deal – to the tune of USD 8bn (increase from USD 3bn), with another potential USD 1.2bn loan for environmental sustainability (subject to review). Egypt is the is the IMF’s second-biggest debtor after Argentina: as of March 7th, total IMF credit outstanding debt that Egypt owes stood at USD 14.6bn (or 981bn special drawing rights).

- This follows UAE’s announcement previous week of a massive USD 35bn investment in Egypt’s Ras El Hekma peninsula. The funding (an initial payment already completed) will provide the central bank with some comfort (i.e. not allowing the currency to fall sharply).

- The exchange rate settled at close to EGP 50 per USD yesterday, from the prior official rate of EGP 30.9 (remaining so for almost a year, amid almost double that on the black market). Equities have surged (to above 30,000 – a number crossed previously on Jan 30th); CDS spreads have declined.

- Investor concerns will be reduced: expect increase in FDI, capital inflows and remittances.

- There will be an adjustment period. But, it will be necessary to continue with fiscal policy reforms & structural reforms (including privatisation & PPP)

- We believe that regional support (from UAE, KSA and others) + IMF conditionalities can be a model for other regional interventions => supportive of regional stability.

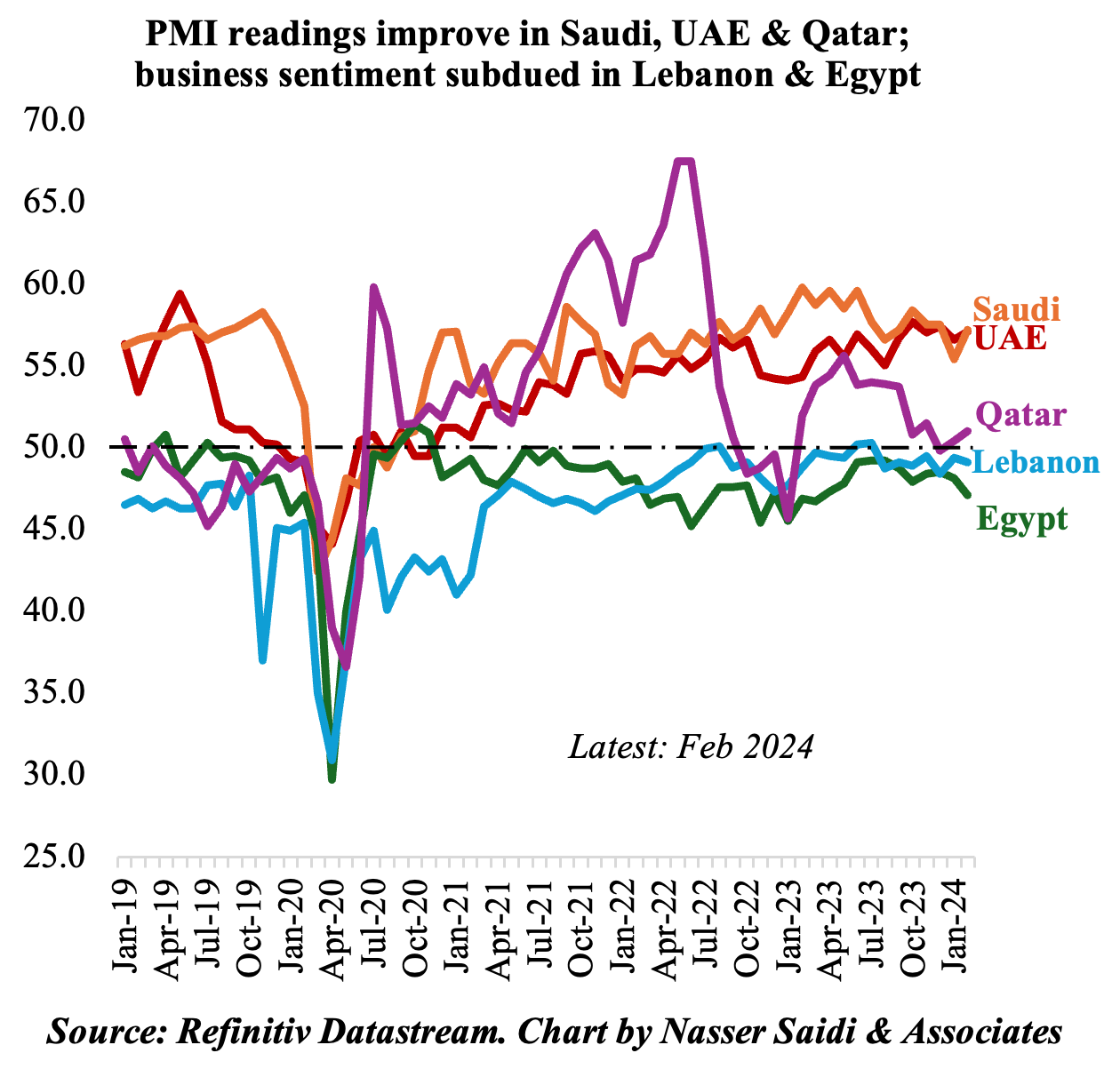

2. Improved PMIs in the GCC; Egypt & Lebanon PMIs decline further

- Saudi, UAE and Qatar posted improved non-oil sector PMI readings in Feb, thanks to a recovery in output. Saudi’s uptick in output stemmed from increased demand & tourism uptick; UAE posted the strongest growth in output since Jun 2019 (though competitive pressures are reportedly rising); Qatar’s increased output can be traced to new customers.

- Employment was another highlight: in Saudi it posted the fastest increase in almost 8 years; in the UAE it rose to a 9-month high as hiring accelerated.

- Egypt, in its 39th straight month of contractionary headline readings, recorded the steepest decline in PMI since Mar 2023 thanks to weak demand (leading to drops in new orders and output) and drop in employment. Recent rate hikes, move to flexible exchange rate and IMF loan are likely to improve business confidence and herald positive effects in the medium-term.

- In Lebanon, new business fell amid security concerns (especially so from overseas clients) and business confidence is at a 7-month low. Inflationary pressures however seem to be restrained, with readings close to Jan’s 28-month low.

- In Saudi Arabia and the UAE, firms are opting to absorb rising costs. Saudi businesses reported lowering fees to combat rising competition. UAE firms’ price reductions were the most since Sep 2020 (during Covid). In general, input prices were higher due to wages and purchase costs: in Egypt it rose to the highest in 13 months (partly due to shipping disruptions and dollar shortages).

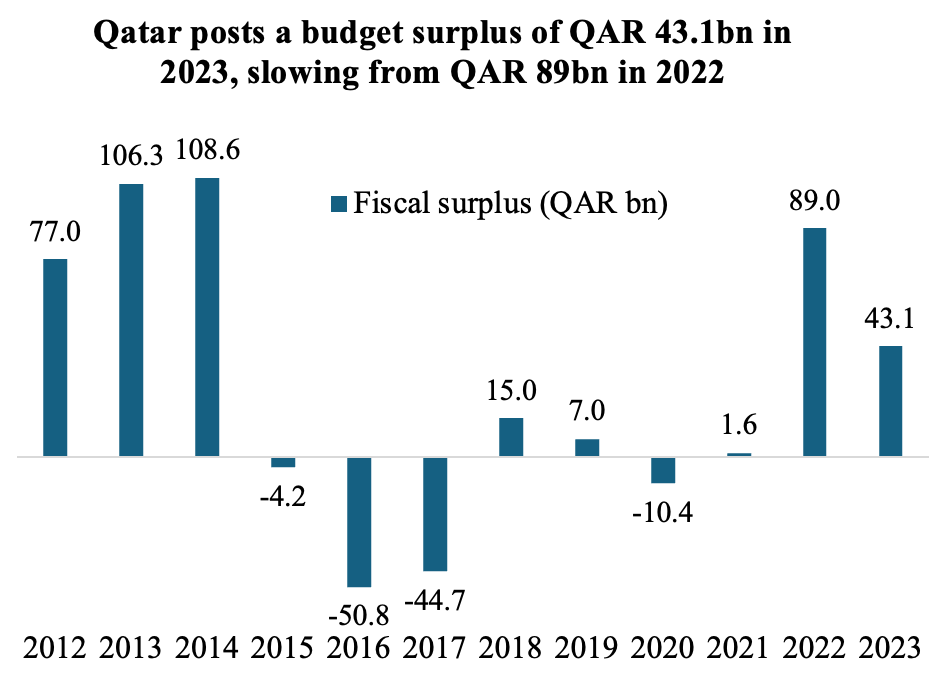

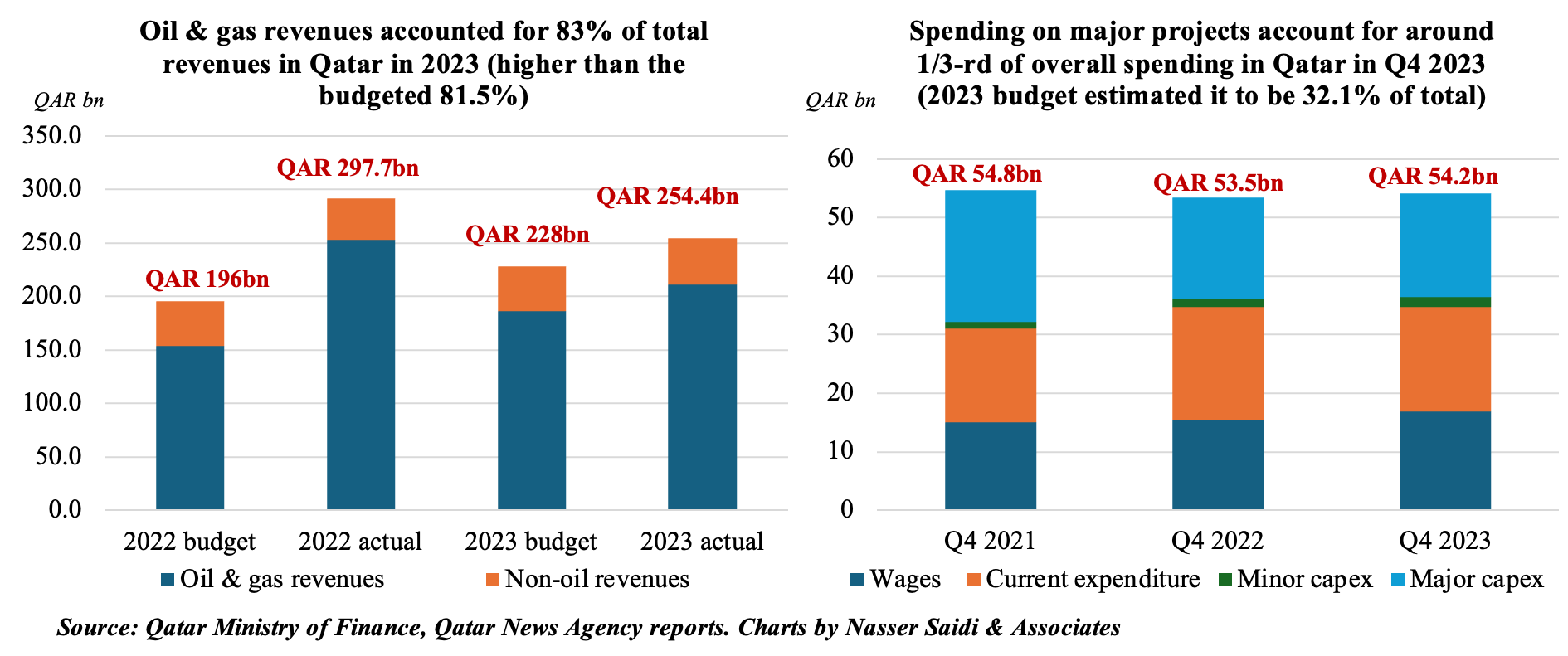

3. Qatar’s fiscal surplus narrows sharply in 2023;O&G is 83% of total revenues

- Qatar posted a budget surplus of QAR 43.1bn in 2023, less than half 2022’s QAR 89bn surplus, after revenues declined by 14.5%.

- The surplus is still higher than what was budgeted for the year 2023 (QAR 29bn). A breakdown by quarter indicate that the largest surpluses were in Q1 (QAR 19.7) and Q3 (QAR 12bn) while Q4 saw the lowest (QAR 1.4bn).

- Overall revenues in 2023 were 6% higher than the 2023 budget, but 14.5% lower in yoy terms. Hydrocarbon and non-hydrocarbon revenues were higher by 11.6% and 13.7% respectively.

- Expenditures inched up by 1.2% yoy in 2023, and were 6.2% higher than the budgeted amount. Share of wages and major capex were each close to one-third (31.2% and 32.7%) in Q4 2023, with major capex winding down from higher shares seen in the pre-World Cup construction phase.

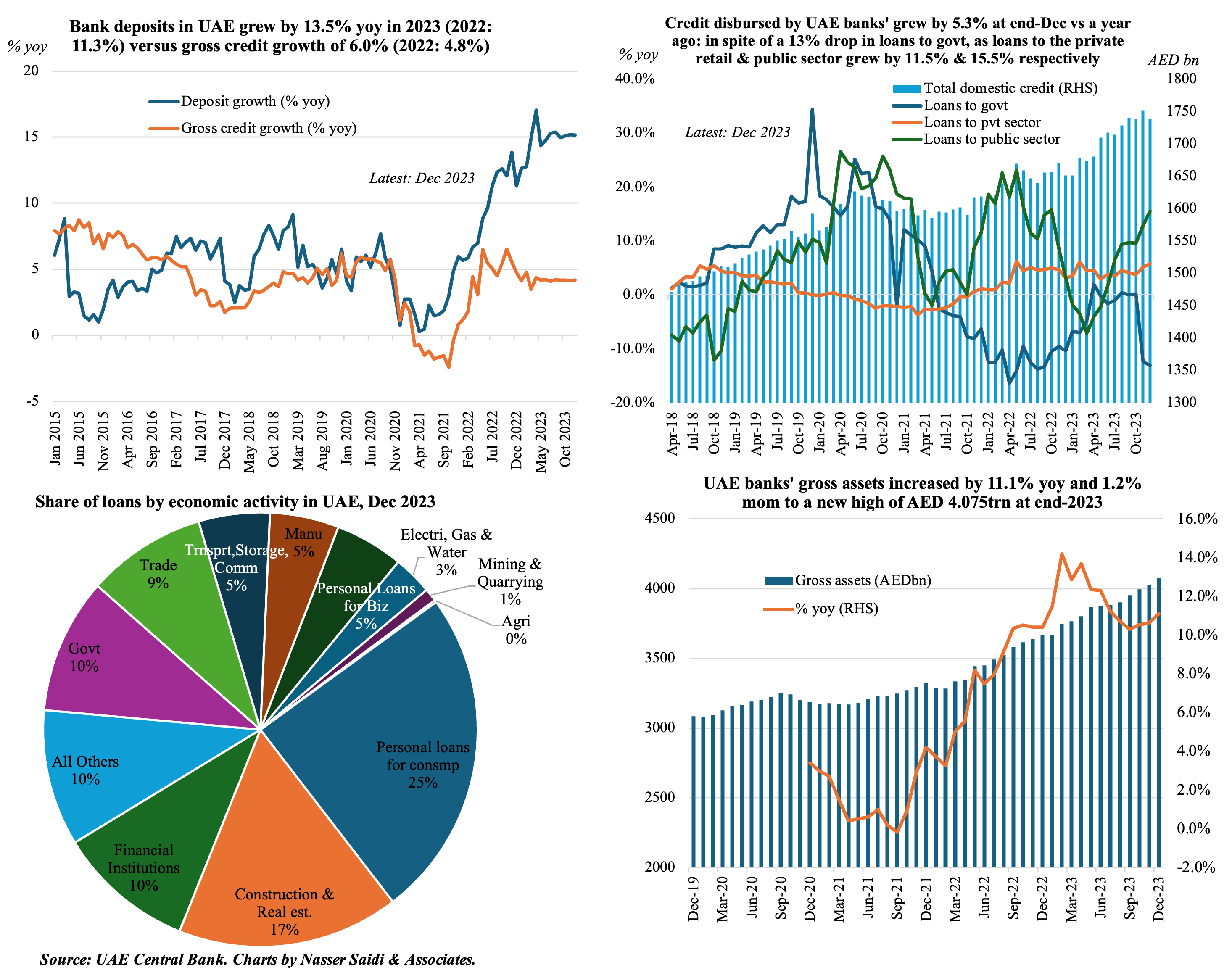

4. UAE bank assets rose to new highs in Dec. Deposits grew 13.5% at end-2023, thanks to a healthy 20.8% uptick in resident private sector deposits. Overall domestic credit grew by 5.3% while credit to the government plunged by 13% ytd to AED 184bn. Personal loans for consumption purposes accounted for 1/4-th of total loans disbursed in Dec, construction was another 16.5% & share of services-related sectors trade, transport & storage sectors together was another 14.2%.

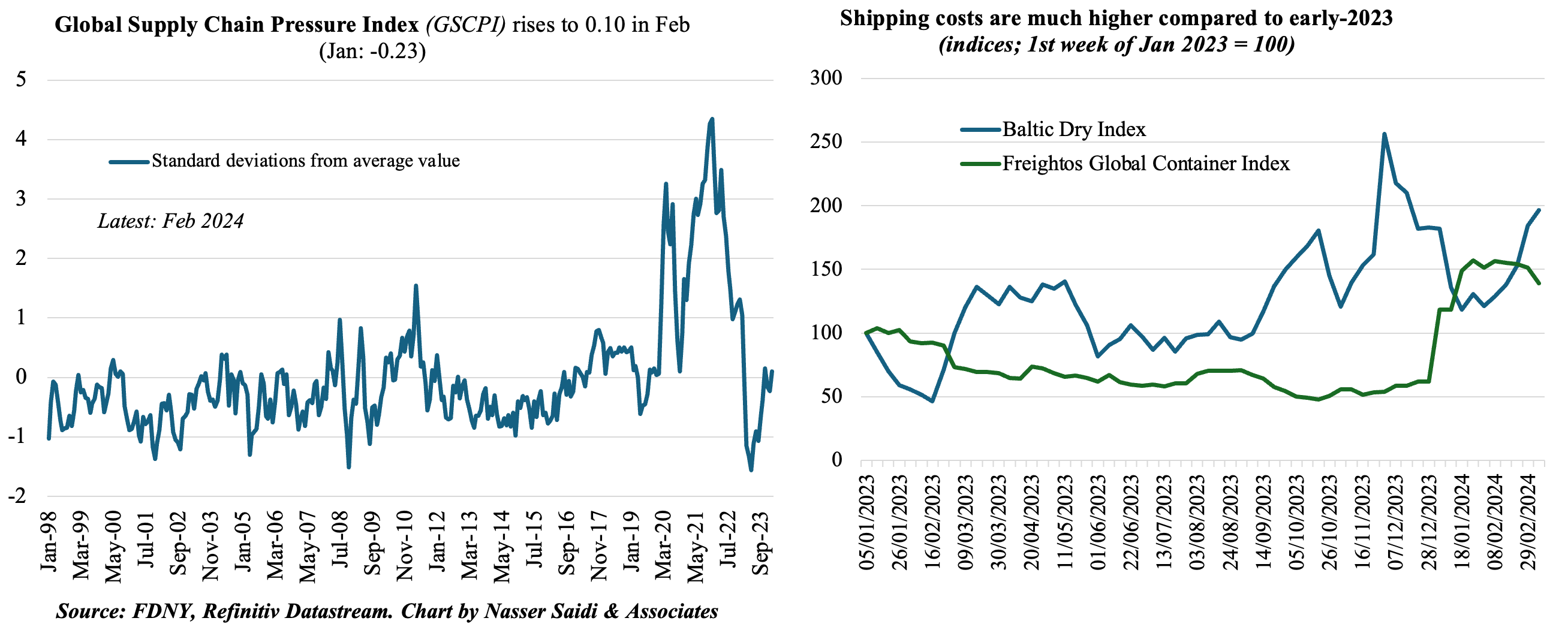

5. Global supply chain pressures surge in Feb; trade diversions lead to rise in shipping costs & delays and air cargo records growth

- The Fed’s Global Supply Chain Pressures Index (GSCPI) inched up to a positive reading of 0.10 in Feb, indicating higher than normal supply chain pressures given the ongoing military action in the Red Sea and shipping disruptions (leading to delays and higher costs). GSCPI had previously registered a positive reading in Nov 2023.

- According to the IMF’s PortWatch platform, about 1,700 ships carrying 145mn tons of goods have been diverted since mid-Dec, and daily transit trade volumes are estimated to have fallen 56% yoy from Feb 1st to Feb 25th.

- Container rates in some sectors have increased: The average composite Drewry’s World Container Index is USD 3,526 per 40ft container for the year-to-date (till March 7th), about USD 830 higher than the 10-year average rate of USD 2,697 (which was inflated by rates during the 2020-22 Covid period).

- Demand for air cargo has been rising, thanks to Red Sea delays + narrowing gap between air cargo and container shipping rates (though the former is still much more expensive). Global air cargo demand (cargo-tonne-kilometers or CTKs) grew by 18.4% yoy in Jan, the highest annual growth since summer of 2021, according to IATA. The Middle East–Europe trade lane experienced exceptional growth in international CTKs of 46.1% yoy in Jan, and the Middle East-Asia segment was up 27.5% (partly supported by demand resulting from shipping constraints).

Powered by: