Weekly Insights 3 May 2024: Oil sector drags down GDP in Saudi Arabia; monetary expansion in UAE & KSA

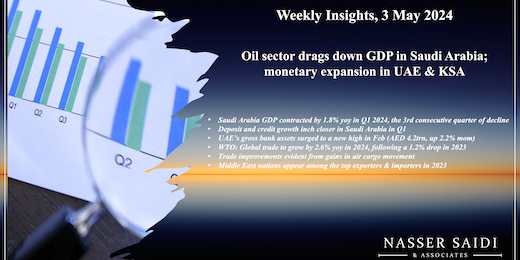

1. Saudi Arabia GDP contracted by 1.8% yoy in Q1 2024, the third consecutive quarter of decline

- Preliminary data showed that Saudi Arabia’s real GDP shrank by 1.8% yoy in Q1 2024, declining for the 3rd consecutive quarter (but at a slower pace than Q4’s 3.7% decline), as oil sector activity fell (-10.6%). The OPEC+ decision to reduce oil output has played into these numbers: Saudi has decreased its oil output (to around 9mn barrels per day vs a capacity of around 12mn bpd); Aramco has also shelved plans to raise production capacity further to 13mn bpd. Non-oil sector grew by 2.8% in Q1 this year, slower than the 4.2% gain recorded in Q4 2023. Growth was also propped by a 2% rise in government sector activity (Q4: 3.1%).

- In qoq terms, however, GDP rebounded in Q1: an uptick in oil sector activity (2.4% qoq) supported the overall 1.3% qoq growth (Q4: -0.6%) while non-oil sector expanded by 0.5% (Q4: 1.4%).

- Various indicators including PMI data (56.5 in Q1 2024) and contracts awarded (Saudi accounted for more than 50% awarded in the GCC in Q1 2024) continue to show support for non-oil sector growth alongside strong domestic demand. We believe that growth will recover, driven by non-oil sector activity, but growth will be at a slower pace compared to recent years.

- At the WEF event this week, the Saudi finance minister confirmed that projects might be adapted (“downscale some” and “accelerate others”) to fit with the ongoing economic and geopolitical scenarios: a commendable move trying to prioritise projects versus trying to divert its existing revenues to achieve all targets (i.e. lack of fiscal discipline).

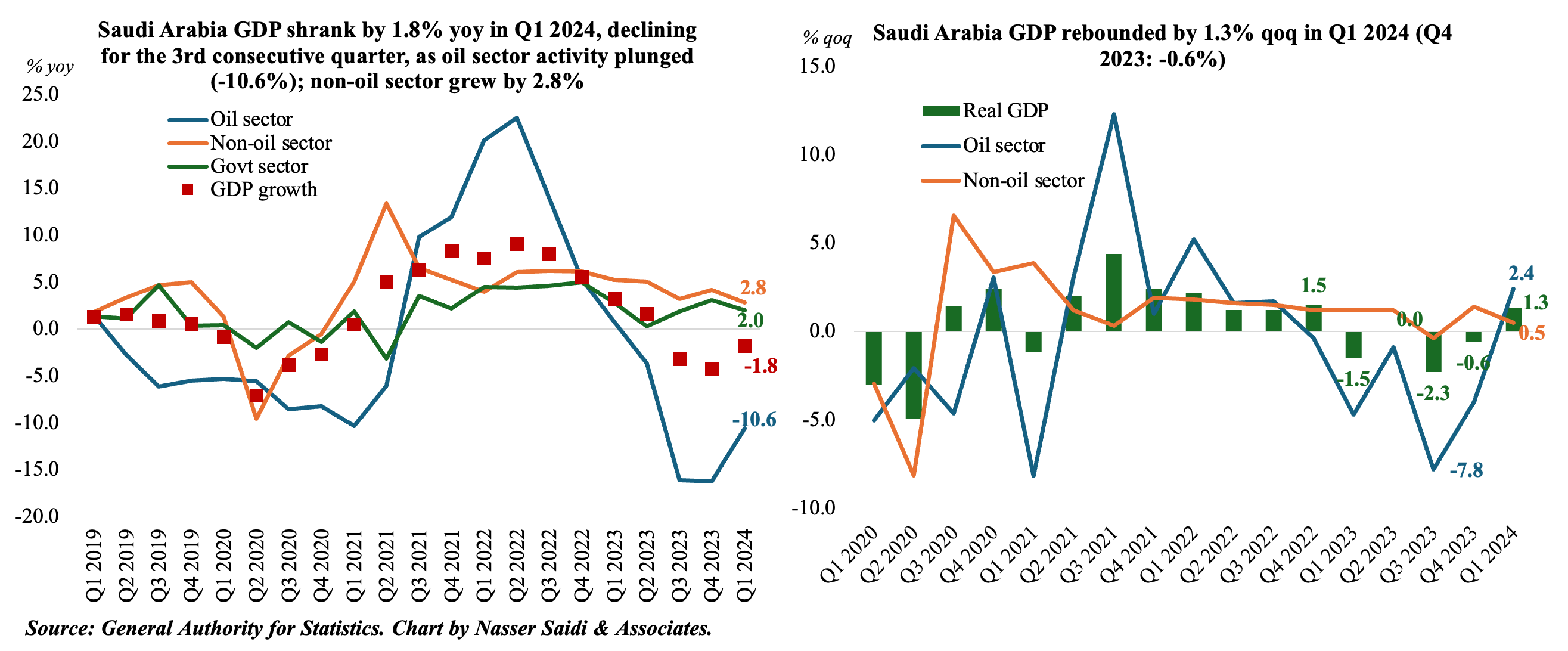

2. Deposit and credit growth inch closer in Saudi Arabia in Q1; government deposits declined in yoy terms for the 13th month in a row in Mar; Net Foreign Assets surged to SAR 1.628trn in Mar, the highest since Jan 2023

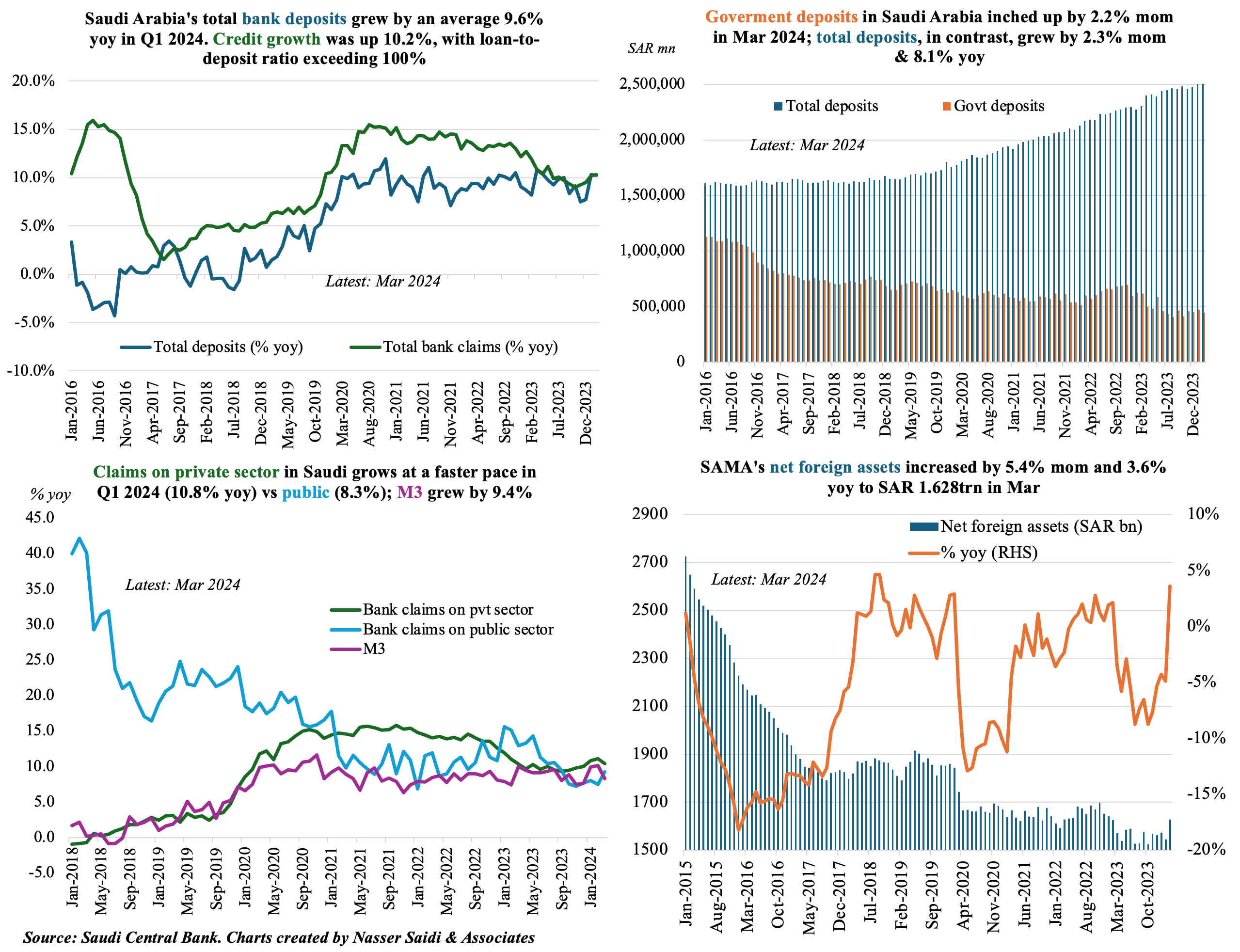

3. UAE’s gross bank assets surged to a new high in Feb (AED 4.2trn, up 2.2% mom). Deposits grew by 2.7% mom & 16.3% yoy in Feb, thanks to a healthy 2.0% mom & 20.4% uptick in resident private sector deposits. Overall domestic credit grew by 4.7% yoy as credit to individuals grew 8% yoy. Monetary base expanded by 2.7% mom to AED 688.7bn, driven by the rise in currency issued

4. WTO: Global trade to grow by 2.6% yoy in 2024, following a 1.2% drop in 2023

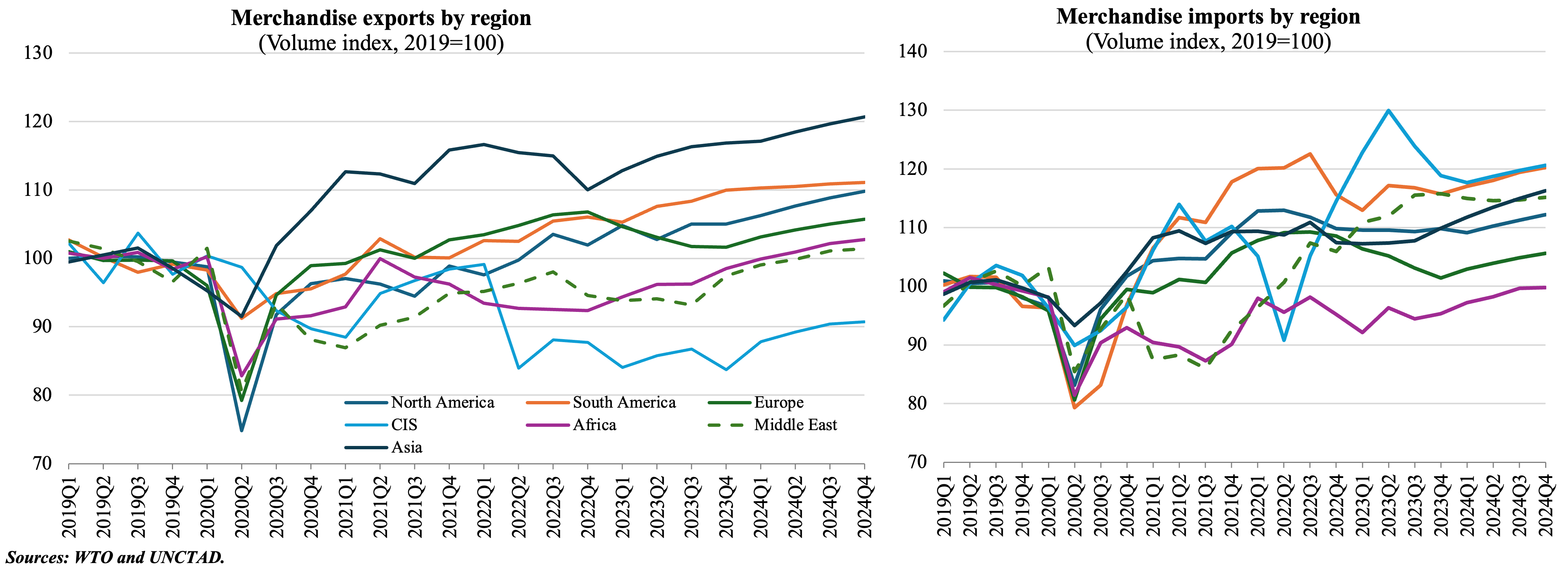

- Global trade volume declined by 1.2% yoy in 2023, following an expansion of 3% in 2022 (despite the war in Ukraine). In 2023, imports demand fell in most regions (partly due to falling commodity prices such as natural gas) except for the fuel-exporting Middle East & CIS regions while export volumes were lower in Europe and Asia (due to weaker demand).

- Merchandise trade volume growth is forecast to grow by 2.6% in 2024 and expand further by 3.3% in 2025: lower inflation is expected to lead to a rebound in consumption + interest rate cuts would stimulate investment spending.

- Trade volumes by region (chart below) shows data till Q4 2023 and estimates till end-2024: exports from Asia have plateaued but at a high level (+17% in Q4 2023 vs 2019 average) while North America and Europe have posted increases since 2019 of just 5% and 2% respectively. CIS region posted the lowest growth in exports but in contrast recorded the largest increase in imports (19% between 2019 and Q4 2023); Middle East & South America also saw gains of 16% during this period while Africa posted a decline since 2019 (-5%). In 2024, Africa’s exports are expected to grow the fastest (5.3%) while Europe lags (1.7%).

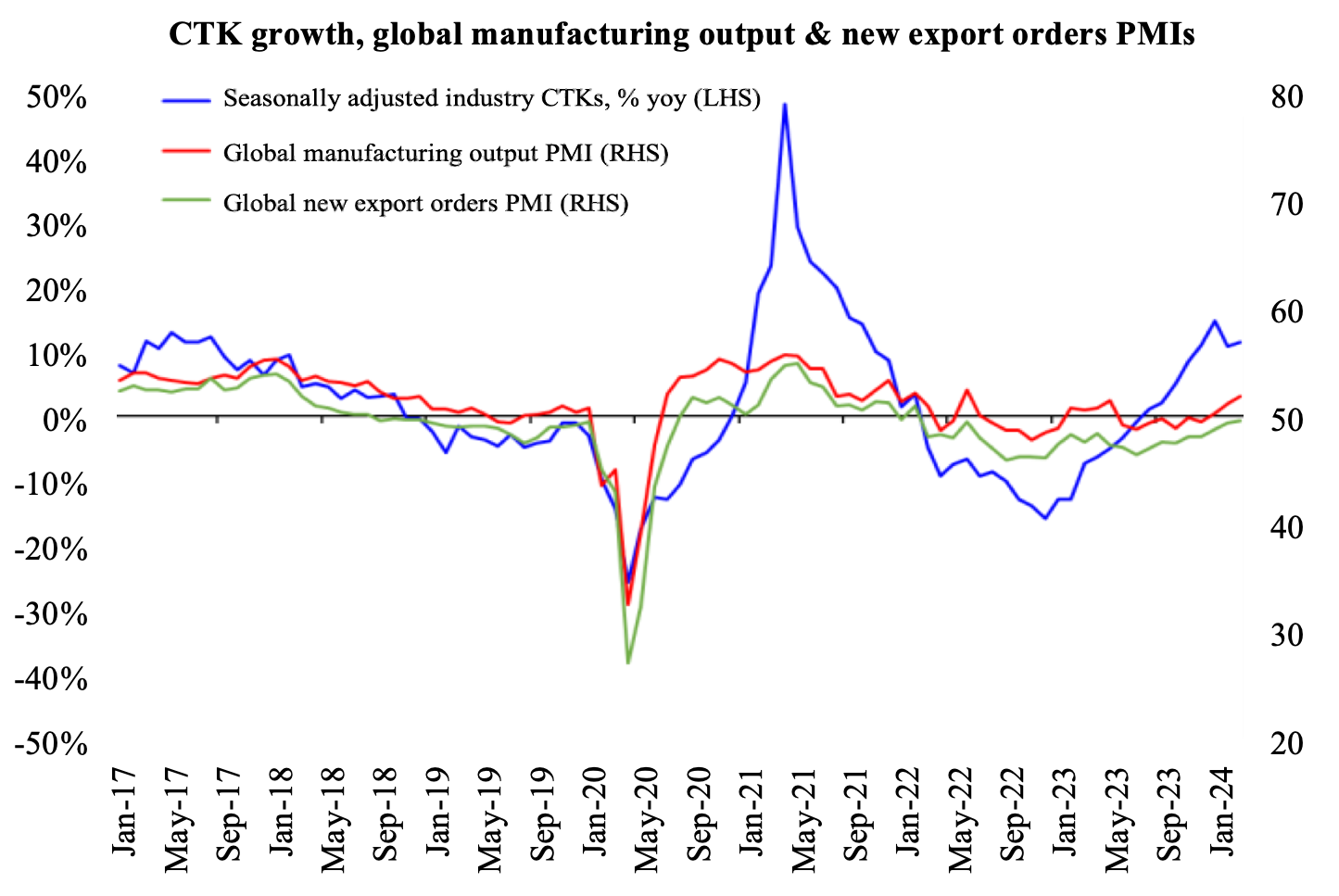

- New export orders from PMI data can be taken as a proxy for trade in the short-term. Recent indicators seem to suggest improving conditions in the beginning of 2024.

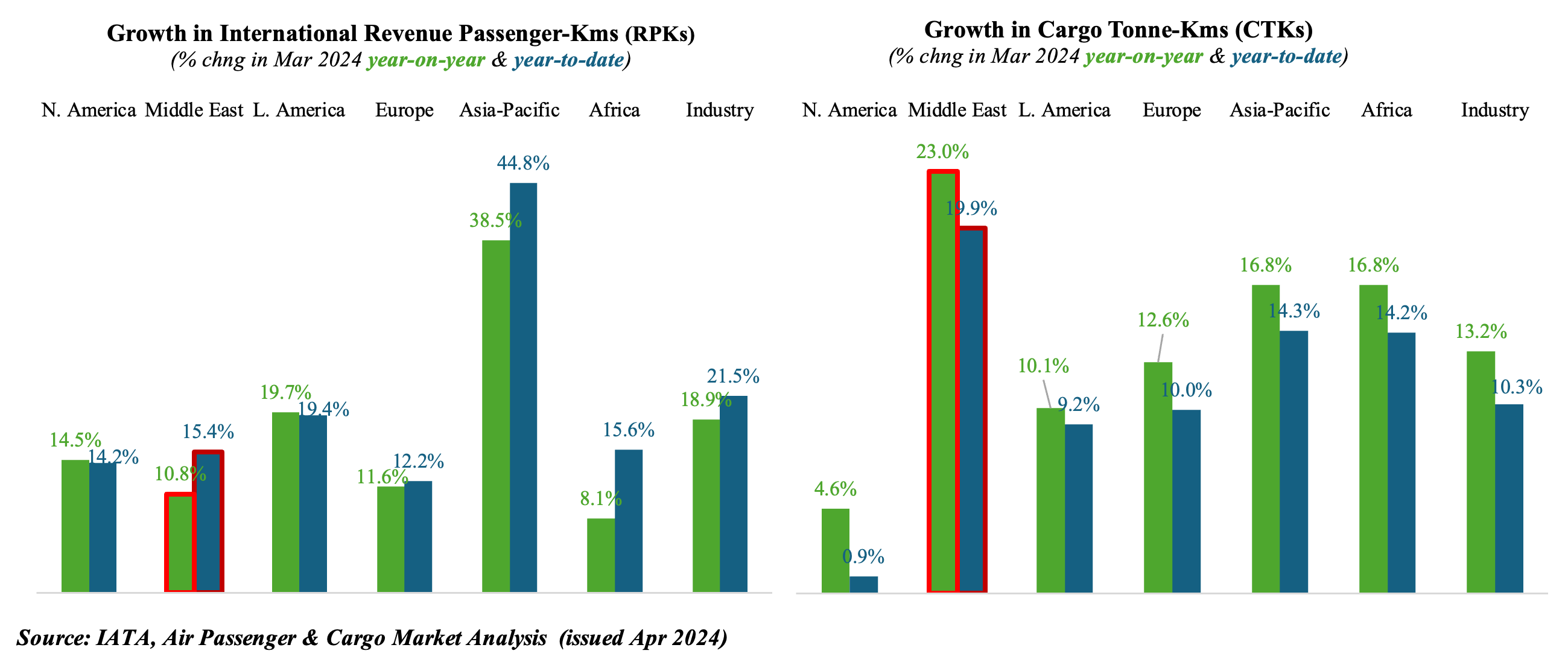

5. Trade improvements evident from gains in air cargo movement; commercial services trade to benefit from air / travel & tourism recovery

- Cargo demand has been resilient: air cargo traffic in Q1 surpassed records seen in Q1 2021.Cargo tonne-kms (CTKs) grew by 11.4% yoy in Mar (also the 4th month of double-digit growth). Global trade and cargo recovery go hand in hand (as can be seen with new export orders). Middle East & African carriers grew most in Mar, benefitting from the disruptions in Suez and Panama Canals.

- On the other hand, passenger traffic remains positive (13.8% yoy in Mar), largely due to resilient international traffic. Middle Eastern airlines grew their international revenue passenger-kilometers (RPKs) by 10.8% yoy in Mar.

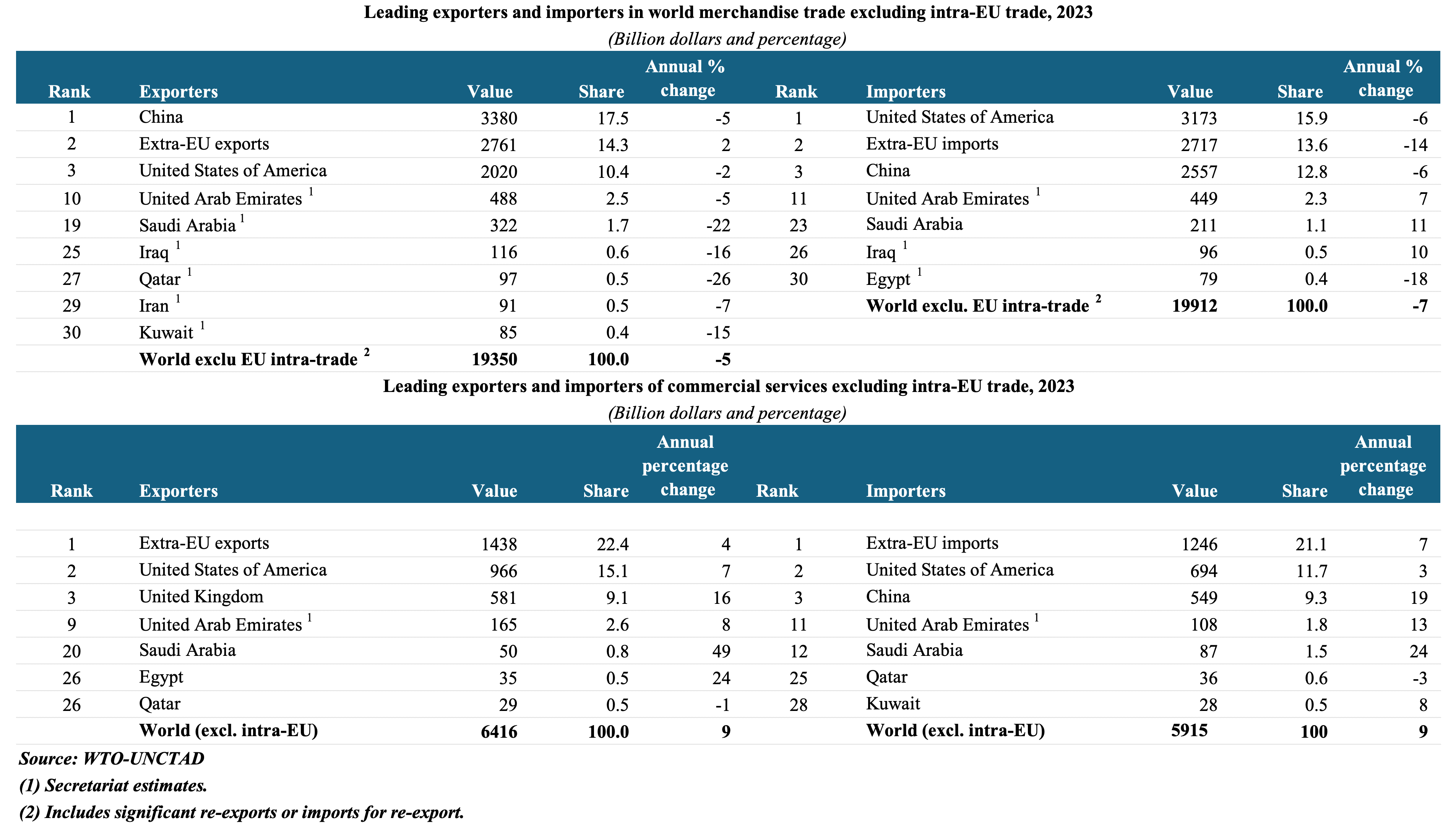

6. Middle East nations appear among the top exporters & importers in 2023

- The increase in commercial services trade partly offset the contraction of goods trade in 2023: global commercial services trade jumped by 9% yoy to USD 7.54trn.

- Oil exporters UAE and Saudi Arabia are among the leading exporters & importers, even in commercial services trade; excluding intra-EU trade, their rankings are higher & includes more nations from the Middle East.

Powered by: