Download a PDF copy of the weekly economic commentary here.

Markets

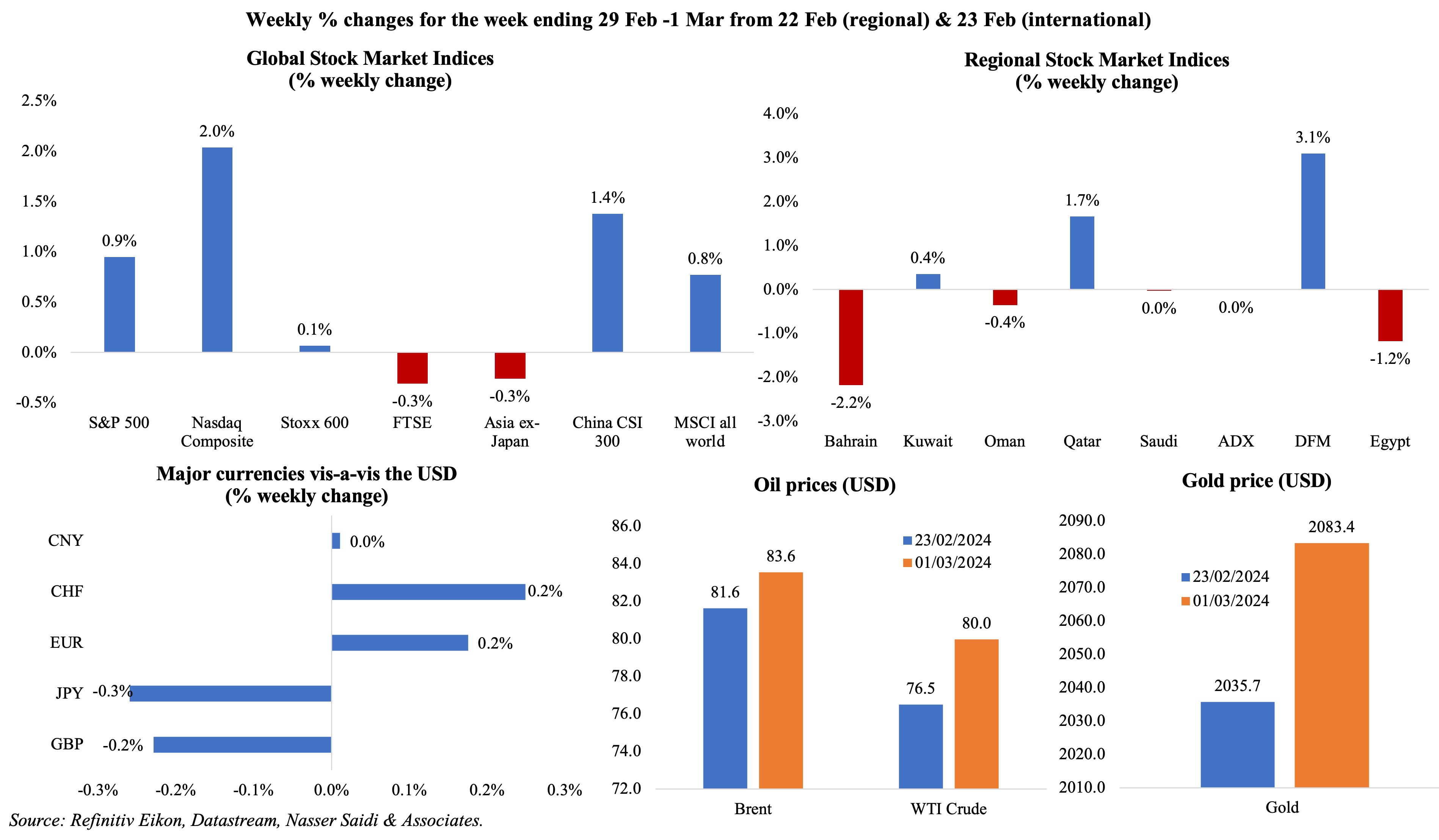

Equities markets were mostly up, with some touching record highs (including the S&P 500 thanks to a tech rally and Nikkei). The picture was more mixed in regional markets, as geopolitical tensions and oil market uncertainty weighed on performance. Dubai’s DFM index, which inched to a 9-year+ high, gained 3.1% during the week (the most since Nov). The dollar gained against the JPY (BoJ governor said it was too early to call inflation as close to meeting the BoJ’s target sustainably) while losing vis-à-vis the euro. Oil prices settled higher ahead of the OPEC+ decision while gold price nudged up to a 2-month high (+2% week-on-week to USD 2083.4).

Global Developments

US/Americas:

- US GDP grew at an annualised pace of 3.2% in Q4 (revised down slightly from the previously reported 3.3% pace), with consumer spending rising at 3% (prev: 2.8%) and exports adding 0.69 percentage point to GDP growth.

- Personal spending increased by 0.2% in Jan (Dec: 0.7%) while personal income rose by 1% (Dec: 0.3%), the most in a year, causing the saving rate to rise to 3.8% (Dec: 3.7%). PCE inflation ticked up 2.4% yoy in Jan, posting the smallest increase since Feb 2021; core PCE meanwhile climbed by 2.8%, the slowest uptick since Mar 2021 (Dec: 2.1%).

- Durable goods orders fell by 6.1% mom in Jan (Dec: -0.3%), the most since Apr 2020, largely due to a plunge in commercial aircraft bookings (-58.9%). Non-defence capital goods orders excluding aircraft rebounded by 0.1% (Dec: -0.6%); though it plunged 19.4% yoy.

- S&P Global manufacturing PMI in the US rose to 52.2 in Feb (preliminary: 51.5 and Jan: 50.7), the fastest growth since Jul 2022, supported by upticks in output (fastest pace since May 2022) and new orders (strongest pace of growth in 21 months) while new export orders expanded for the first time in 3 months.

- ISM manufacturing in the US slipped to 47.8 in Feb (Jan: 49.1), clocking in below-50 for the 16th consecutive month, as new orders fell (49.2 from 52.5) as did employment (45.9 from 47.1) while manufacturing prices inched up at a slower pace (52.5 from 52.9). Separately, Chicago PMI declined to 44 in Feb (Jan: 46), staying below-50 for the third month in a row.

- Goods trade deficit in the US widened slightly to USD 90.2bn in Jan (Dec: USD 89.1bn), as imports grew by 1.1% yoy, a much faster pace than exports 0.2% gain.

- New home sales grew by 1.5% mom to 661k in Jan, with median new house price at USD 420,700 (-2.6% yoy). Pending home sales fell by 4.9% mom in Jan (Dec: 5.7%), the largest drop since Aug 2023; mortgage rates were cited as the main reason for the drop in sales.

- S&P Case Shiller home price index increased for the 11th consecutive month in Dec, rising by 6.1% yoy (Nov: 5.4%). Home prices are likely to gain further when mortgage rates trend lower.

- Multiple manufacturing indices recorded improvements in Feb: Richmond Fed manufacturing index rose to -5 in Feb, better than Jan’s reading of -15, thanks to upticks in new orders (-5 from -16 in Jan) and employment (7 from -15). Separately, Dallas Fed manufacturing business index improved to -11.3 in Feb (from Mar’s 8-month low of -27.4), with new orders recording its first positive reading since May 2022. Kansas Fed manufacturing activity moved up to 3 in Feb (Jan: -17), the highest since Aug 2023, thanks to improvements in both productions and new orders indices.

- Michigan consumer sentiment index decreased to 76.9 in Feb (Jan: 79.6), following three monthly increases. The 1-year expectation for inflation inched up to 3% (from 2.9% in Jan) while the 5-year inflation expectation remained unchanged at 2.9%.

- Initial jobless claims increased by 13k to 215k in the week ended Feb 23rd, up from a5-week low last week, and the 4-week average slipping by 3k to 212.5k. Continuing jobless claims rose by 45k to 1.905mn in the week ended Feb 16th, the highest reading since Nov.

Europe

- Consumer inflation in the eurozone eased to 3.1% in Feb (Jan: 3.3%), driven by food, alcohol and tobacco (4%) and services (3.9%) while energy prices fell (-3.7%). Core inflation clocked in at 3.1%, the lowest since Mar 2022.

- Manufacturing PMI in the eurozone slipped to 46.5 in Feb (Jan: 46.6), with output and employment dropping for the 11th and 9th straight month, new orders inflows declining the least since Mar 2023 and input prices falling at the slowest rate in almost a year.

- Harmonised index of consumer prices in Germany eased to 2.7% yoy in Feb (Jan: 3.1%), while core inflation stayed put at 3.4%. Food prices were up 0.9% yoy, staying below the headline inflation number for the first time since Nov 2021.

- Germany’s manufacturing PMI fell to 42.5 in Feb (Jan: 45.5), as output and new orders slowed on weaker demand. Output fell the most since Oct 2023 and employment fell the most since Aug 2020.

- German retail sales fell by 1.4% yoy and 0.4% mom in Jan (Dec: -1.6% mom & -4% yoy), the third straight month of declines, as high inflation and interest rates weakened demand.

- GfK’s consumer confidence index in Germany stood at -29 in Mar (Feb: -29.6), thanks to income expectations rising to a more than 2-year high (-4.8 from -20) while economic prospects held relatively steady (-6.4 from Feb’s -6.6).

- German unemployment rate stood unchanged at 5.9% yoy in Feb, the highest level since May 2021; the number of unemployed individuals rose by 11k to 2.713mn. Unemployment rate in the eurozone slipped to 6.4% in Jan (Dec: 6.5%), the lowest level since the start of the eurozone in 1999.

- UK’s manufacturing PMI edged up to a 10-month high of 47.5 in Feb (Jan: 47), but remained in contractionary territory for the 12th straight month. Four of the subcomponents were below-50 – output, new orders, stocks of purchases and employment which decreased the most since Jun 2020 – while input cost inflation hit an 11-month high.

Asia Pacific:

- China manufacturing PMI edged down to 49.1 in Feb (Jan: 49.2), partly affected by the Lunar New Year holidays, amid weaker new orders (49, the 11th consecutive month of contraction) as well as declines in foreign sales (46.3 from 47.2) and employment (47.5 from 47.6). Caixin manufacturing PMI inched up to 50.9 (Jan: 50.8), the most since Aug 2023, thanks to production upticks (most since May 2023), new order growth and foreign sales.

- Non-manufacturing PMI in China increased to 51.4 in Jan (Dec: 50.7), in spite of weaker new orders (46.8 from 47.6) and employment (steady at 47).

- Inflation in Japan eased to 2.2% yoy in Jan (Dec: 2.6%). Excluding food and energy, prices inched lower to 3.5% (Dec: 3.7%). Excluding fresh food, prices were up by 2%, in line with the central bank’s target and slower than Dec’s 2.3% gain.

- Japan’s manufacturing PMI dropped to 47.2 in Feb (Jan: 48), the ninth month in a row of sub-50 readings, and sharpest fall since Aug 2020. New orders and output contracted the most in a year while foreign sales also declined amid employment dropping the most since Jan 2021.

- Industrial production in Japan shrank by 7.5% mom and 1.5% yoy in Jan. The month-on-month drop was the steepest since May 2020 while the yoy reading was the 3rd in a row. Production of motor vehicles plunged by 17.8% mom (Dec: 1.1%), while general-purpose & business-oriented machinery and electrical machinery & information & communication electronics equipment fell by 12.6% and 8.3% respectively (Dec: 9.2% and 3.9%).

- Japan’s retail trade rose by 2.3% yoy in Jan (Dec: 2.4%), rising for the 23rd month in a row. Sales for non-store retail industries and pharmaceutical & cosmetics grew the most (7.1%) while large retailer sales were up by 3%.

- Unemployment rate in Japan eased to 2.4% yoy in Jan, the lowest since Jan 2023. Jobs to applications ratio was 1.27, meaning there were 127 job openings for every 100 job seekers.

- India’s GDP grew by a strong 8.4% yoy in Oct-Dec (Jul-Sep: 7.6%), the highest in 6 quarters, supported by manufacturing (11.6%) and gross fixed capital formation (12.2%) while the agricultural sector contracted 0.8%. The growth of gross value added moderated to 6.5% during the quarter, leading to a high divergence between GDP and GVA.

- Manufacturing PMI in India inched up to 56.7 in Feb (Jan: 56.5), thanks to an uptick in output and new orders while business sentiment rose to the highest since Dec 2022.

- Industrial production in Singapore rebounded by 1.1% yoy in Jan (Dec: -2.4%) while excluding the volatile biomedical manufacturing (which fell 25.9%), IP rose by 5.4%.

Bottom line: Feb PMI data for the manufacturing sector continued to fall in Europe and Asia, though the overall global manufacturing PMI returned to expansionary territory (50.3 from Jan’s 50). New orders globally rose for the first time in 20 months, thanks to a relatively stable export orders, but shipping woes are affecting costs (alongside rising wages). This week is also crucial from a politics perspective – given the US Presidential election primaries (“Super Tuesday”), a potential partial government shutdown in the US, and China’s National People’s Congress meets starting Tuesday (where the 2024 growth target will be announced, while being under pressure to rollout measures to support expansion) – and also considering the central bank meetings including the ECB (easing inflation readings have raised hopes for rate cuts, but services inflation remains too strong). At the WTO meetings, a decision was taken to continue to exempt e-commerce from tariffs for two more years though no agreement was reached to limit subsidies for overfishing.

Regional Developments

- OPEC+ members confirmed the extension of the voluntary oil output cuts of 2.2mn barrel per day (bpd) into Q2: Saudi will cut voluntarily 1mn bpd through end-Jun while Russia will cut production and exports by an extra 471k bpd.

- Bahrain’s national-origin exports fell by 2% yoy to BHD 350mn (USD 929mn) in Jan while imports jumped by 15% to BHD 535mn, causing a deficit of BHD 51mn. Saudi Arabia, UAE and US were the top export destinations while China was the top import market (15% of total).

- Egypt received a first batch of the USD 35bn funding pledged by the UAE, disclosed the President, and a part of that was transferred to the central bank.

- Despite regional tensions, tourist arrivals into Egypt grew by 6% yoy in the first 50 days of 2024, according to the Minister of Tourism and Antiquities. In 2023, the country had received a total of 14.91mn persons.

- Egypt signed seven MoUs to develop green hydrogen and renewable energy projects in the Suez Canal Economic Zone. The projects are expected to see an investment of about USD 12bn during the pilot phase and another USD 29bn in the first phase of development.

- Bloomberg reported that BP was planning to invest USD 1.5bn to develop gas projects and drilling in Egypt over the coming 3-4 years.

- Kuwait will hold elections for the National Assembly on April 4th, after the parliament was dissolved in mid-Feb. Applications for membership in the National Assembly will be open from today (Mar 4th) and will be accepted until Mar 13th.

- Kuwait’s fuel oil exports surged in Feb, to a record high of 720k metric tons (158k barrels per day), rising for a second month in a row, according to ship tracking data firm Kpler. LSEG data places Feb exports at about 516k tons, the highest since Mar 2016.

- Expatriates in Kuwait remitted a total KWD 33.35bn (USD 108.3bn) over the past 7 years, as per central bank data. In Jan-Sep, remittances fell by 29.67% yoy to KWD 2.979bn.

- Oman climbed 39 positions to rank 56th globally in the 2024 Index of Economic Freedom, with its score rising to 62.9 out of a total 100. Among the MENA region nations, UAE tops the list (ranked 22), followed by Qatar (28), Bahrain (54), Saudi Arabia (69) and Kuwait (90) among others.

- Qatar Investment Authority, with its “Fund of Funds” program, plans to invest over USD 1bn in venture capital funds internationally and regionally, revealed Qatar’s PM.

- Inter-Arab trade stands at USD 700bn, representing 10-11% of global trade, disclosed the secretary-general of the Union of Arab Chambers.

Saudi Arabia Focus

- Saudi Arabia money supply grew by 9.9% yoy to touch SAR 2.72trn in Jan (Dec: 7.6%), driven by a surge in banks’ term and savings accounts (+31%). Total bank deposits grew by 10.3% yoy to SAR 2.51trn while credit growth was up 10.2%; claims on private sector grew at a faster pace of 10.8% versus claims to the public sector (8%). Net foreign assets fell by 4.3% yoy to SAR 1.572trn.

- Saudi PIF plans to tap the debt market again, with the sale of a senior, unsecured 7-year sukuk, following its successful (more than 5-times over-subscribed) USD 5bn issuance in Jan. Size of the offering has not yet been disclosed.

- The number of industrial units in Saudi Arabia increased by 10% yoy to 11,549 in 2023, according to the Ministry of Industry and Mineral Resources, and were set up with an investment of SAR 1.54trn (USD 48.4bn). Separately, production began in a total of 1,058 factories last year, with investments amounting to SAR 45bn.

- SMEs in Saudi Arabia grew by 3.1% qoq to 1.3mn in Q4 2023, according to Monsha’at; of this 43.7% are based in Riyadh (571,298 SMEs) and employ over 3mn persons. The report also focused on the prospects for the gaming sector given the over 23.5mn gaming enthusiasts in the country; it is expected that 39k jobs will be created in the local gaming sector by 2030.

- Saudi non-oil exports to the GCC surged by 42% yoy to SAR 20.8bn in Q4 2023, largely due to the surge in re-exports. UAE accounted for 67% of non-oil trade from Saudi Arabia in Q4 while re-exports accounted for 55% of total non-oil trade to the GCC.

- Office rents in Riyadh surged by 20.7% yoy in 2023, according to CBRE, because of the increased demand given various programs including the move of regional HQs to the country. Rents also increased in other cities in Saudi: Jeddah saw Grade A and B office rents rise by 19.7% and 1% respectively while in Damman and Khobar it was up by 7.4% and 7.2%.

- The digital economy in Saudi Arabia contributed 14% to Saudi GDP in 2022, according to a recent report. The survey finds that nearly half of all establishments (48%) invested in cloud computing services with information and communication activities share the highest (68.3%). In terms of electronic purchases, 18.5% of firms placed orders for goods and services online: once again, information and communication establishments led this group (40.1%).

- Saudi restaurant sales surged by 13.66% to SAR 89.3bn (USD 23.8bn) in 2023, according to central bank data. The average transaction per operation witnessed a 9% decline to SAR 35 in 2023 (2022: SAR 38.4).

- Saudi Arabia announced a new educational visa program “Study in Saudi Arabia” for attracting international students to enrol in Saudi universities.

- According to the Vice Minister of Tourism, women account for nearly 45% of the total 925k individuals currently working in the Saudi tourism sector.

- Environmental projects in Saudi Arabia are expected to receive investments to the tune of over SAR 6bn (USD 1.6bn) until 2030, revealed the Deputy Minister of Environment, Water, and Agriculture. Since the Saudi Green Initiative was launched in 2021, 77 initiatives have been activated across three targets (emissions reduction, afforestation, and land and sea protection).

- Saudi Arabia launched its bid to host the 2034 World Cup, and full bids are to be submitted in Jul. The 2030 tournament will be combinedly hosted by Morocco, Portugal and Spain.

- Saudi Aramco completed the acquisition of a 100% equity stake in Chile’s Esmax Distribución, a leading downstream fuels and lubricants retailer.

UAE Focus![]()

- UAE is forecast to grow by 5% in 2024, with non-oil growth projected at 4.7%, according to the Minister of Economy. He also disclosed that more than 73% of the economy now comprises of the non-oil sector.

- UAE’s federal assets grew to AED 481.5bn in 2023, according to the UAE’s Deputy PM and Minister of Finance. He also revealed that the country had adopted 15 federal laws, 62 regulatory decisions, and nine major national projects in the finance sector.

- Malaysia’s trade minister revealed that the nation plans to conclude a Comprehensive Economic Partnership Agreement (CEPA) with UAE by end-Jun this year. He also stated that the ASEAN-GCC FTA negotiations had not seen much progress.

- UAE and Peru will initiate trade talks later this year, as per the announcement on the sidelines of the WTO meeting last week. This follows moves to open an embassy in the UAE this year and an aviation pact last year. Bilateral trade between the two nations stood at just over USD 1bn in 2023, with most of it gold exports from Peru to the UAE.

- Dubai government will sell a 24.99% stake in Parkin, a firm that operated about 179k paid parking spaces as of end-2023 and oversees public parking operations across Dubai. The IPO is expected to debut next month, and funds will go to the Dubai Investment Fund (Parkin’s sole shareholder).

- UAE Federal Tax Authority set deadlines for corporate tax registrations, and will impose a AED 10k (USD 2700) fine on firms that miss the registration deadline.

- Emirates Development Bank (EDB)’s contribution to the UAE’s industrial GDP surged by 80% yoy to AED 4.3bn in 2023, according to a senior official. EDB aims to contribute AED 10bn to UAE’s GDP by 2026. Total loans financed by EDB rose to AED 8.7bn since the strategy was launched in 2021.

- Knight Frank’s “The Wealth Report” finds that luxury residential property prices in Dubai surged by 15% in 2023, in contrast to the falling trend in most major cities (such as London and New York – now 8% and 17% lower than their most recent peaks).

- The UAE ranked 10th globally in the Brand Finance Soft Power Index 2024, for the second year running. The country was ranked 1st in “strong and stable economy” indicator, 3rd in “future growth potential” and 10th overall in both “internationally admired leaders” indicator and “affairs I follow closely” among others.

- The DG of the UAE’s General Civil Aviation Authority disclosed that UAE airports welcomed more than 134mn passengers in 2023, with forecasts of 140mn this year. The 134mn passengers included 38mn arrivals, 37.8mn departures and 58.3mn transit passengers.

- ADNOC announced a formal closure of the acquisition of a 24.9% stake in Austrian oil and gas group OMV; no financial terms were disclosed.

Media Review

UAE’s Grey list removal is milestone for investor confidence: opinion by Dr. Nasser Saidi

What was agreed at WTO negotiations in Abu Dhabi?

https://www.reuters.com/world/what-was-agreed-wto-negotiations-abu-dhabi-2024-03-02/

https://www.arabnews.com/node/2470246/business-economy

How the G20 Can Build on the World Economy’s Recent Resilience

What’s Behind the US Stock-Market Disconnect?

A golden age for stockmarkets is drawing to a close

Powered by: