Weekly Insights 1 Mar 2024: Rising importance of non-oil exports in UAE & Saudi, alongside regional investments

1. UAE’s massive investment in Egypt: too big to fail

- UAE announced a massive USD 35bn investment in Egypt’s Ras El Hekma peninsula: work on building the “next generation city” is expected to begin in early 2025. Egypt’s government will have a 35% stake in the project.

- This investment will offer a breather for Egypt’s forex/ liquidity woes, with the amount to be disbursed within two months. The Egyptian Pound strengthened post-deal, gaining about 20% on the parallel market (touched EGP 70 in early-Feb); official rate is steady at EGP 30.89 per USD.

- Reports suggest similar deals are being planned for land in South Sinai: potentially targeting Saudi & Qatari investors.

- Additional funding implies that the central bank will have sufficient FX buffers to prevent a sharp fall against the dollar if there’s a move to a flexible exchange rate.

- This supports the “Egypt is too-big-to-fail” stance, seen previously when GCC nations supported in 2022 after a significant capital outflow (after the war in Ukraine started).

- However, there has been a change: funding has been provided as investments (this time round to build a tourism and financial centre) or subject to reform conditionalities like state asset sales (vs instances of payments with no conditionalities previously).

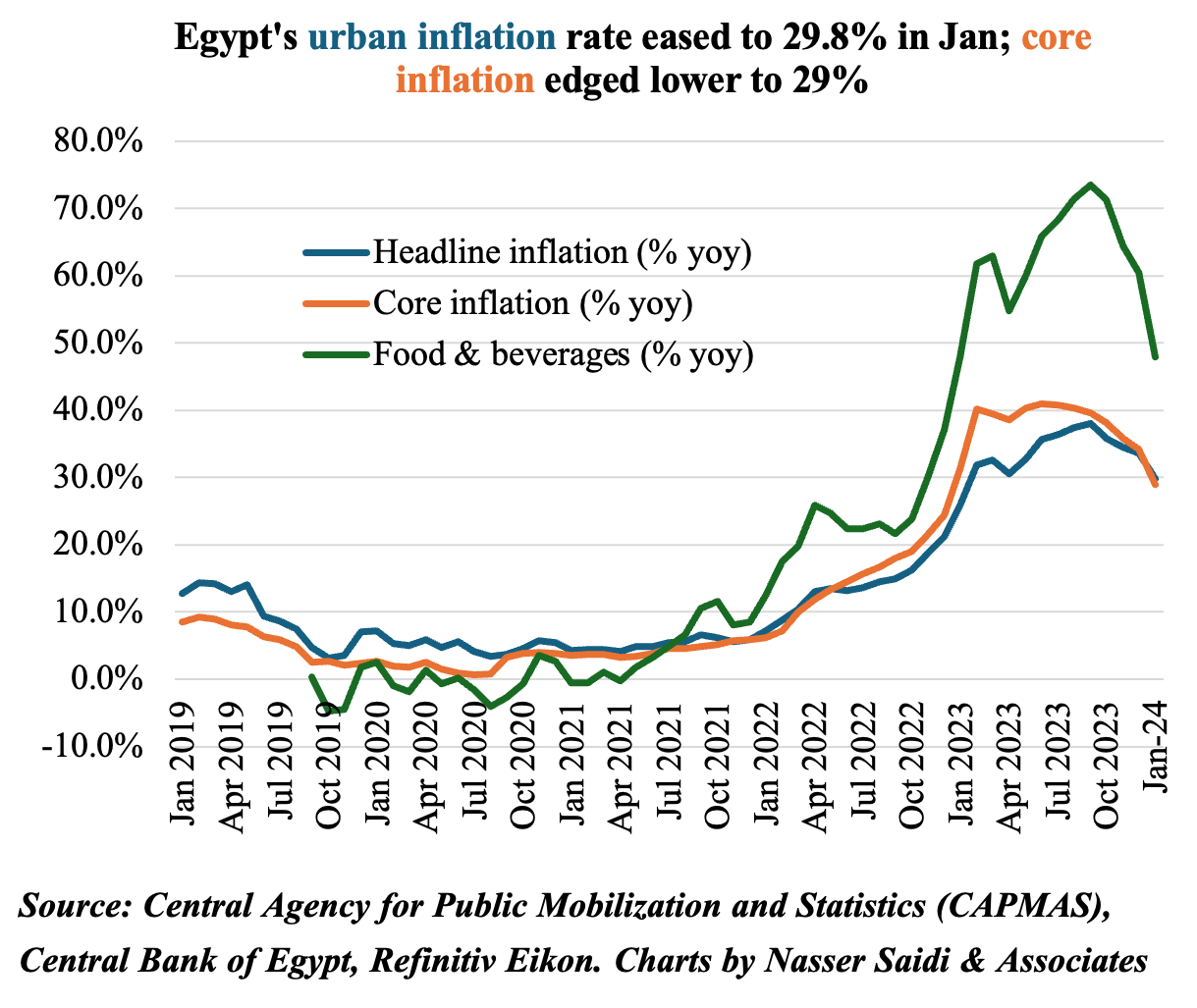

- Meanwhile, macroeconomic woes continue:

- Inflation eased to 29.8% in Jan (Dec: 33.7%). Even as core inflation slipped to 29% (Dec: 34.2%), food prices surged by 47.9% though lower than the previous month’s 60.5% surge.

- Debt burden has been rising: debt service accounted for 60.3% of Egypt’s total expenditure in Jul-Sep 2023; in the 2024-25 fiscal year, Egypt must repay $29.23 billion in external debt service.

- IMF’s augmented financing package will be available “within weeks”, revealed IMF’s MD, after key issues had been resolved in its review of the USD 3bn loan program.

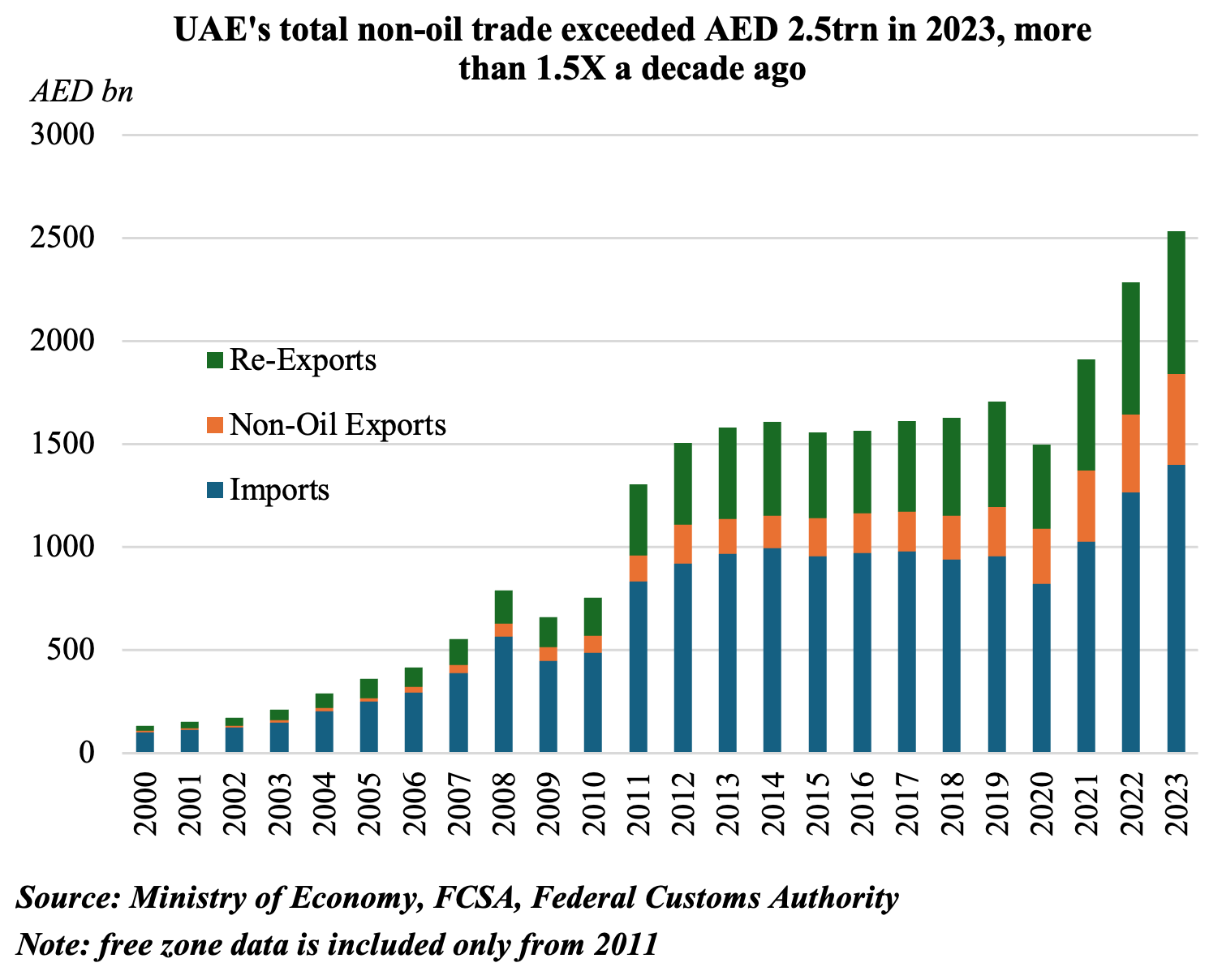

2. UAE non-oil foreign trade of goods & services cross a record AED 3.5trn

- UAE’s non-oil goods trade jumped to a record-high AED 2.574trn in 2023, 1.5-times the reading in 2019 (of 1.71trn). This was supported by the sharp rise in non-oil goods exports – which at AED 441bn (16.7% yoy) was more than double non-oil goods exports in 2018. Re-exports and imports grew by 6.9% and 14.2% respectively (to AED 690bn and AED 1.4trn). Trade in services reached a record high AED 967bn last year, with services exports standing at AED 587bn.

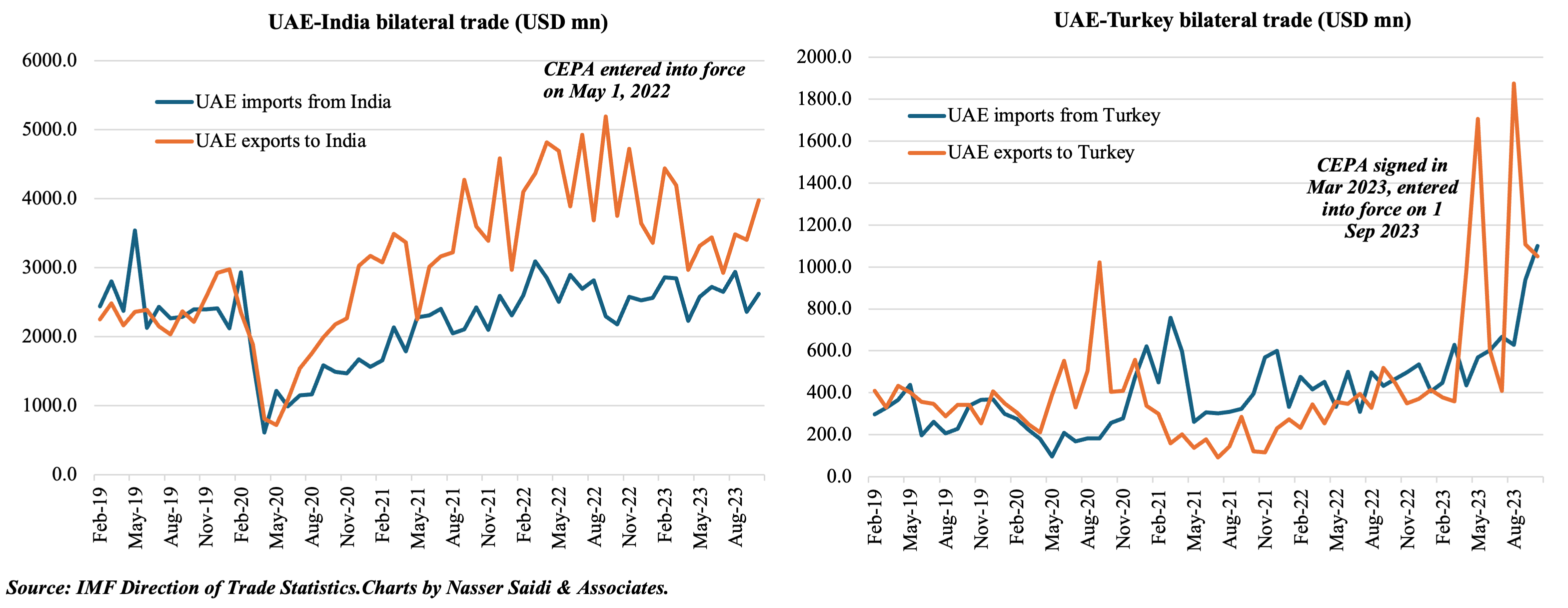

- Impact of CEPAs with Turkey & India. Non-oil exports to Turkey accounted for 60% of total in Aug-Dec 2023 (CEPA came into force in Sep). Trade with India (CEPA enforced from May 2022), grew by 3.9% in 2023, accounting for over 7.6% of total trade.

- Non-oil exports to top 10 partners grew by 26.9%; China was the top trade partner, followed by India, US, Saudi Arabia, and Turkey.

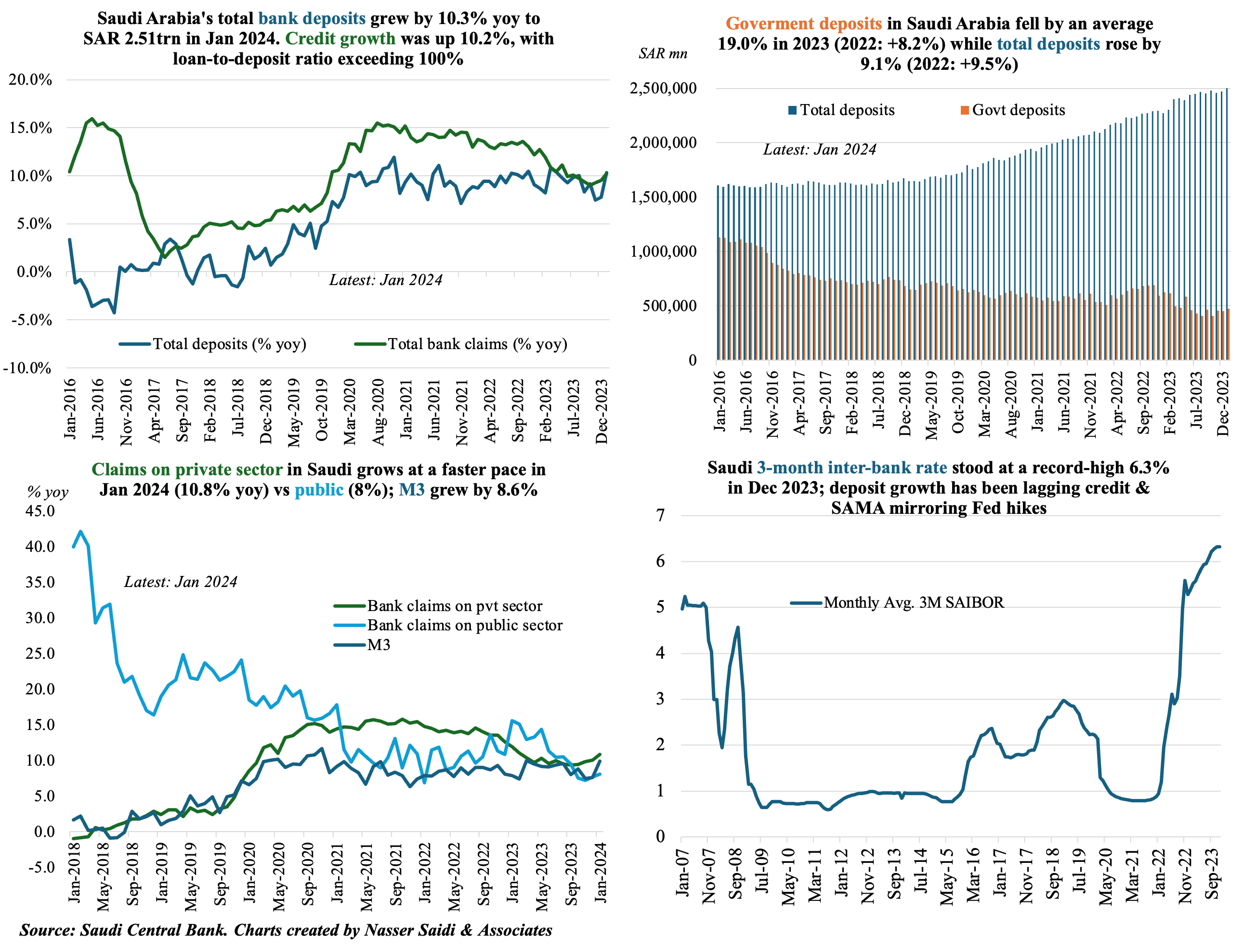

3. In the first month of 2024, growth of deposits and credit sync in Saudi, even as govt deposits fall by 24.4% yoy; loan to- deposit ratio exceeds 100%; 3-month SAIBOR touches record-high 6.3% in Dec

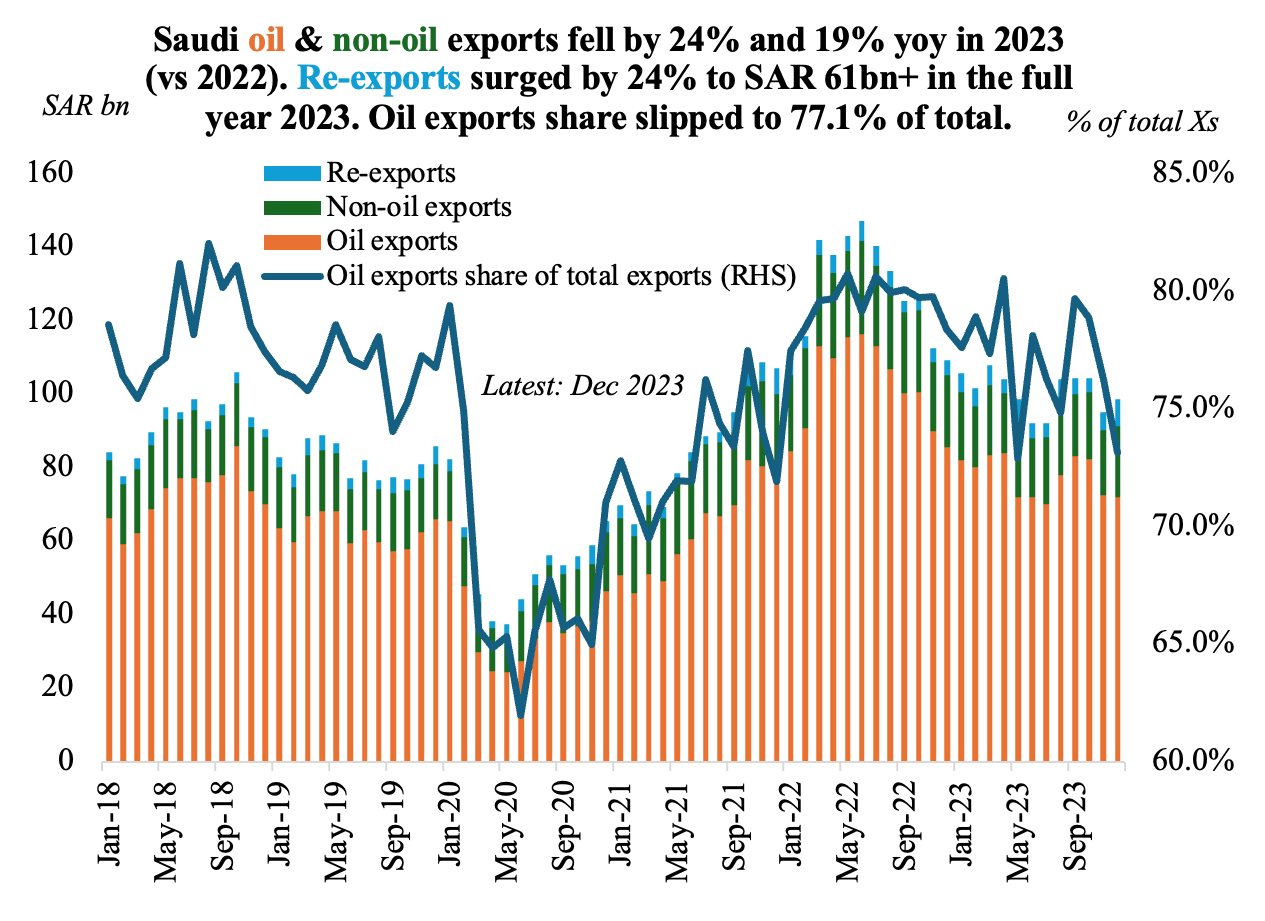

4. Exports & imports fall in Saudi Arabia during the last month of 2023

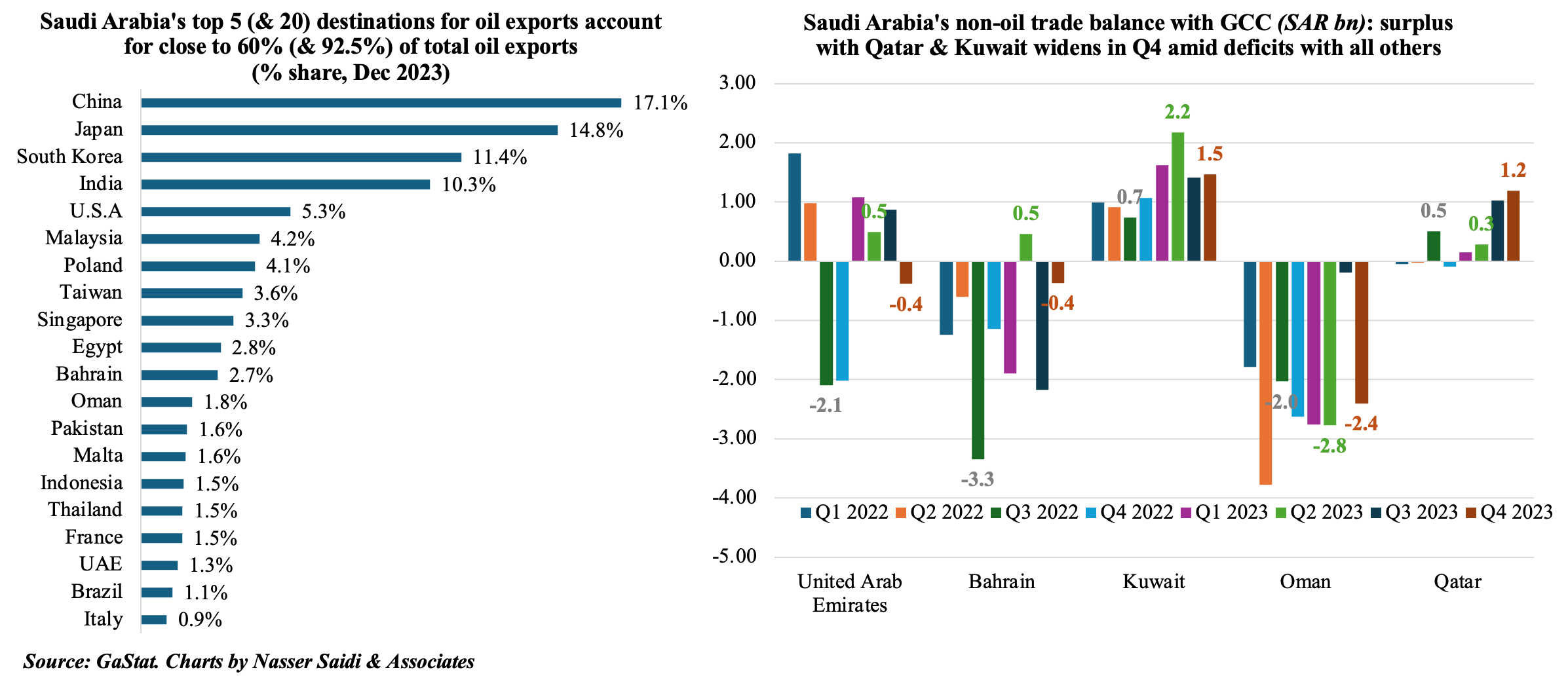

- Saudi Arabia’s overall exports fell by 9.7% yoy to SAR 98.5bn in Dec, partly due to the drop in oil exports (-15.8% yoy to SAR 72bn). Oil exports share in total exports slipped to 73.1% in Dec.

- Non-oil exports also fell, by 3.0% yoy to SAR 19.2bn (close to one-fifth of total exports). Re-exports, which accounts for 7.4% of total exports, grew by 88.2% yoy and 51.4% mom to SAR 7.3bn.

- Imports fell by 7.1% yoy and 10.1% mom to SAR 60.4bn.

- Overall trade surplus widened in Dec (after falling for two consecutive months) to SAR 38.2bn. It plunged by 14% yoy.

- China was the top trade partner in Dec: accounting for 15% of overall exports and 21% of total imports.

- Oil exports to the top 5 destinations (China, Japan, South Korea, India & US) accounted for 58.9% of total oil exports in Nov; 96.3% for top 30.

- Non-oil trade balance with GCC showed a mixed picture in Q4: surpluses with Qatar and Kuwait widened; deficit widened in Oman but narrowed in Bahrain. UAE moved from surplus in Q3 to deficit.

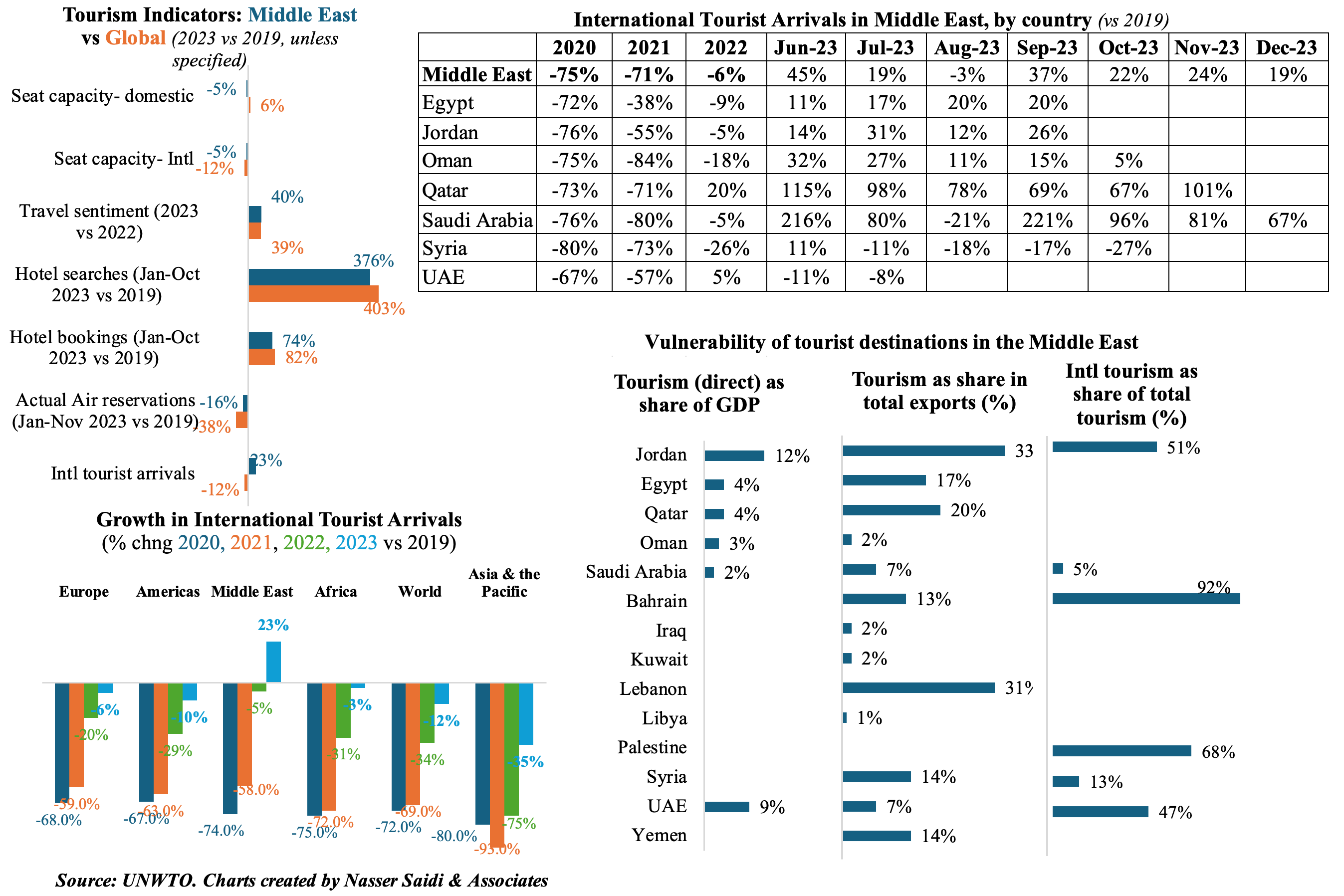

5. Trade in services to benefit from the tourism surge: Middle East international tourist arrivals rose by 23% in 2023 vs 2019. It is the only region to cross pre-pandemic levels. Saudi & Qatar post substantial surge in visitor arrivals.

Powered by: