Oman 2024 budget. Saudi IP. Dubai tourism. Middle East airlines. Global supply chains. Short- & long-term risks.

Weekly Insights 12 Jan 2024: Tourism & trade grow, but are geopolitical risks and supply chain pressures & inflation in the offing?

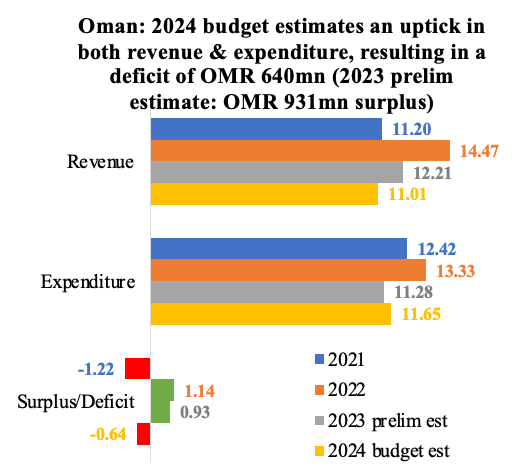

1. Higher revenue notwithstanding, Oman expects deficit of OMR 640mn in budget 2024

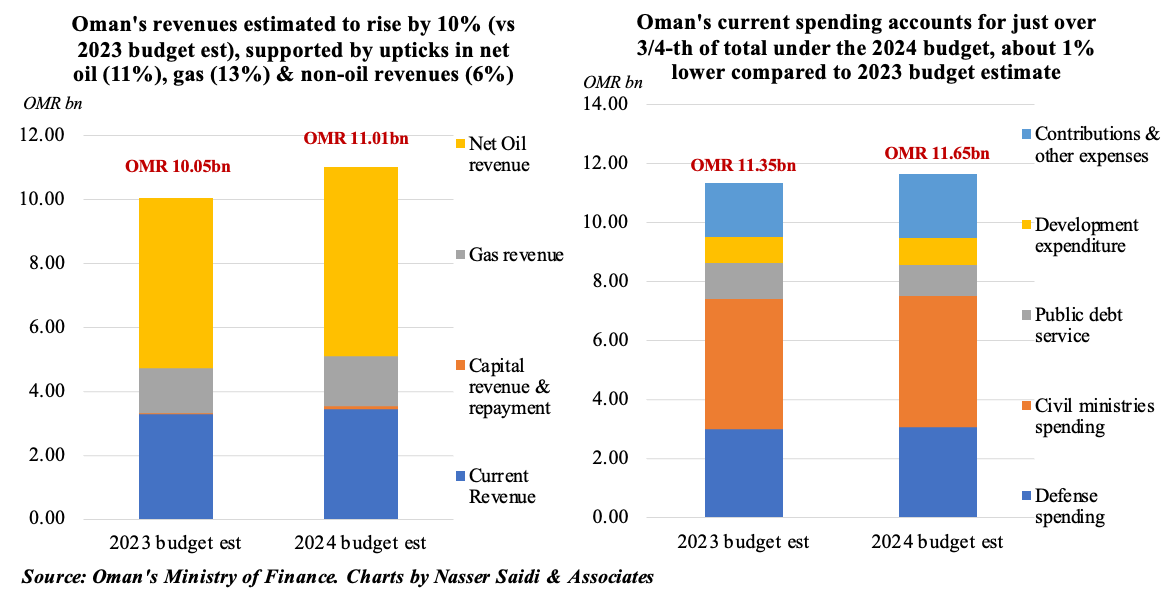

- Oman’s budget 2024 estimates an increase in both revenues & expenditure (by 10% and 3% compared to 2023 budget), leading to a deficit of OMR 640mn. While it is a narrower deficit vs 2023 budget deficit (of OMR 1.3bn), it is a step down from 2023’s preliminary estimate of a surplus OMR 931mn.

- Net oil & gas revenues accounts for two-thirds of Oman’s 2024 budget revenues. Both are higher compared to 2023 budget numbers, but lower versus preliminary 2023 figures (by 14 % & 21% resp). Non-oil revenues are estimated to rise to OMR 3.52bn, thanks to a rise in both current & capital revenues (5% & 30% respectively vs 2023 budget estimates).

- Overall expenditure is estimated to edge up slightly (3.0%): declines in current spending (-1%) and public debt service (-13% to OMR 1.05bn) are not sufficient to cover the 19% uptick in contributions & other expenses (to OMR 2.18bn).

- Current spending accounted for 75% of total spending in the 2024 budget. Furthermore, the finance minister also disclosed that fuel subsidies will continue in 2024.

- The 2024 budget estimates an average oil price of only USD 60 a barrel and the government expects to pay back OMR 1.6bn debt this year.

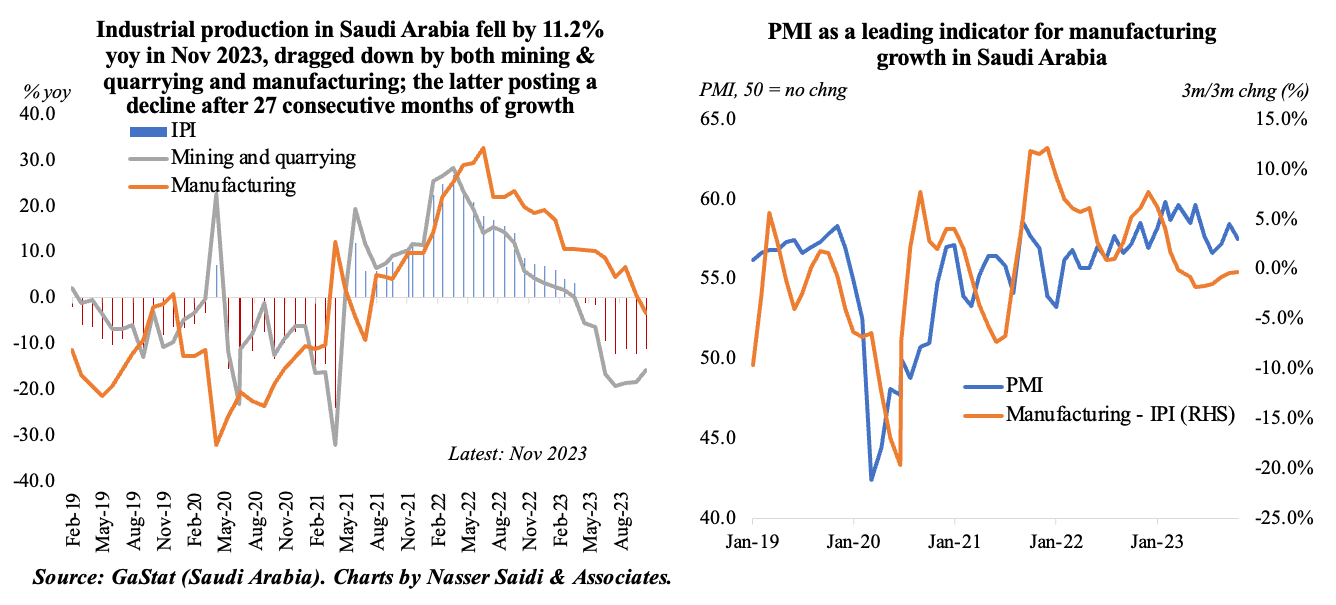

2. Saudi Arabia’s industrial production weakens in Nov; manufacturing declines. However, PMI & new industrial licenses provide positive signs

- Industrial production (IP) in Saudi Arabia fell by 11.2% yoy in Nov (Oct: -12.3%), the 7th consecutive month of declines, largely due to the plunge in mining & quarrying activity (-15.8% from Oct’s drop of 18.4%) as oil production was reduced to 8.8mn barrels per day.

- Manufacturing growth also declined in Nov (-3.3%) after registering positive growth for 27 months in a row. Manufacturing activity had been slowing, with its average dropping to 8.6% in Jan-Nov 2023 (vs 22.6% in Jan-Nov 2022). This compares to a drop of 8.5% in mining & quarrying in Jan-Nov compared to a gain of 17.8% in the same period a year ago.

- However, there are positive signs for an increase in non-oil sector activity in the next few months. Saudi Arabia’s PMI clocked in at 57.5 in Dec, supported by new orders (“particularly within the manufacturing sector”, rise in both business activity and exports) and pace of sales growth (among the quickest registered in the past 9 years, thanks to new clients & strong demand).

- The issuance of new industrial licenses and setup of factories also increased: 158 new licenses were issued in Oct, raising the total permits issued this year to 1,127, together committing to about SAR 44bn in investment. Meanwhile, the total number of existing factories at end-Oct stood at 11,388, with an investment volume estimated at SAR 1.5trn.

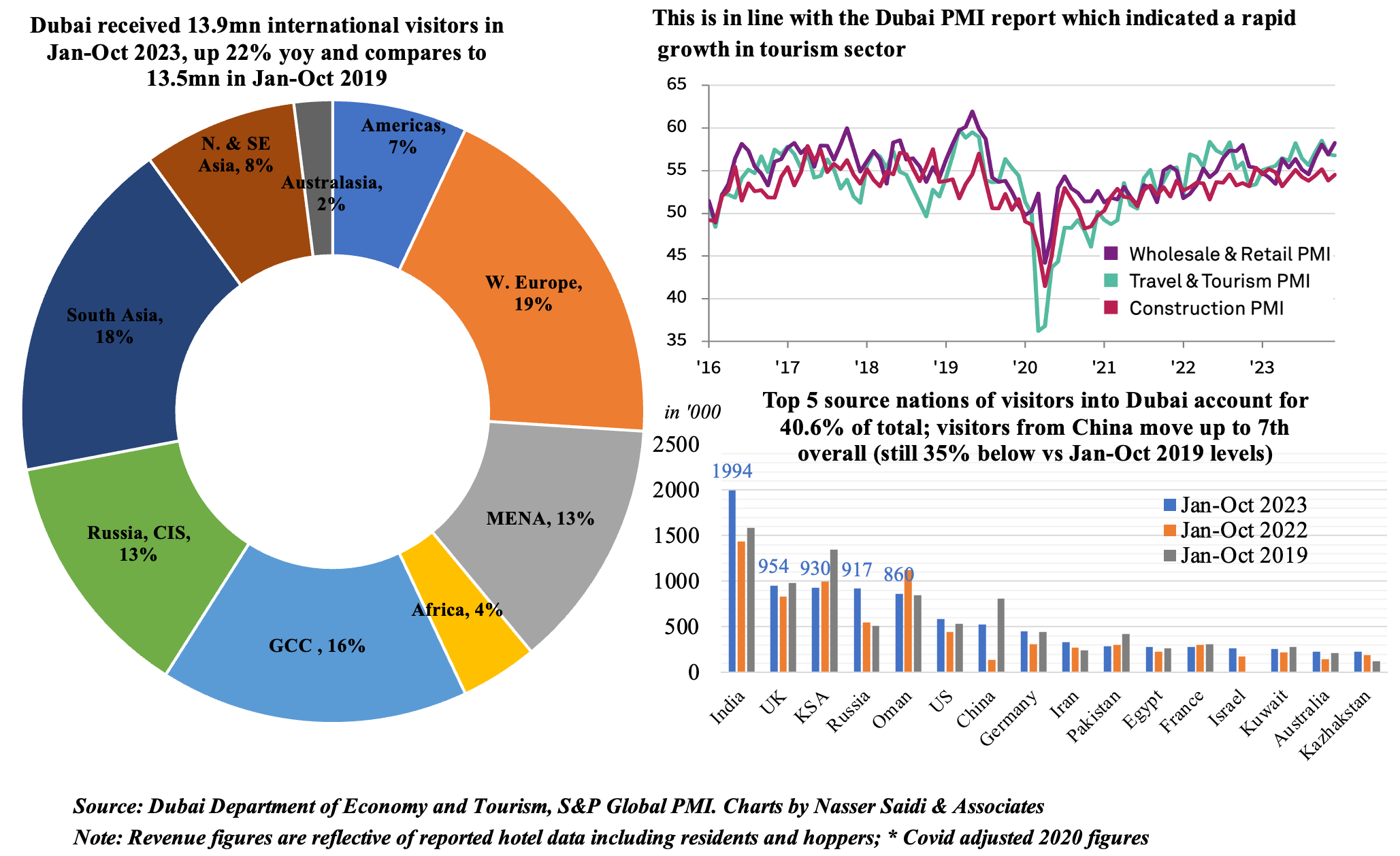

3. Dubai’s 13.9mn international visitors in Jan-Oct was up 22% yoy & 3% higher vs Jan-Oct 2019

- Regional composition of tourists remained broadly unchanged: South Asia accounted for close to one-fifth of visitors and GCC at 16%.

- India remains the top source nation for tourists, while China retains the 7th spot. Saudi Arabia and Oman are the third and 5th largest source nations while Russia is the 4th largest. Occupancy rate at 76% crossed pre-Covid levels while revenue per available room remains high (AED 373 vs AED 295 pre-Covid); room rates have fallen (-3.6% yoy to AED 488) & so has length of stay (3.8 from 4.0). The month of Nov is likely to see a further uptick given the Formula 1 race in Abu Dhabi and initial days of COP28 among others.

- Dubai’s PMI jumped to a 16-month high of 57.7 in Dec (and also the second-highest in 4.5 years), with new orders supporting the uptick (the second-quickest pace since mid-2019). According to S&P Global, 30% of respondents noted an improvement in orders and the upturn was strong in the travel & tourism sector; however, competition for market share is still an issue with the continuing fall in output prices.

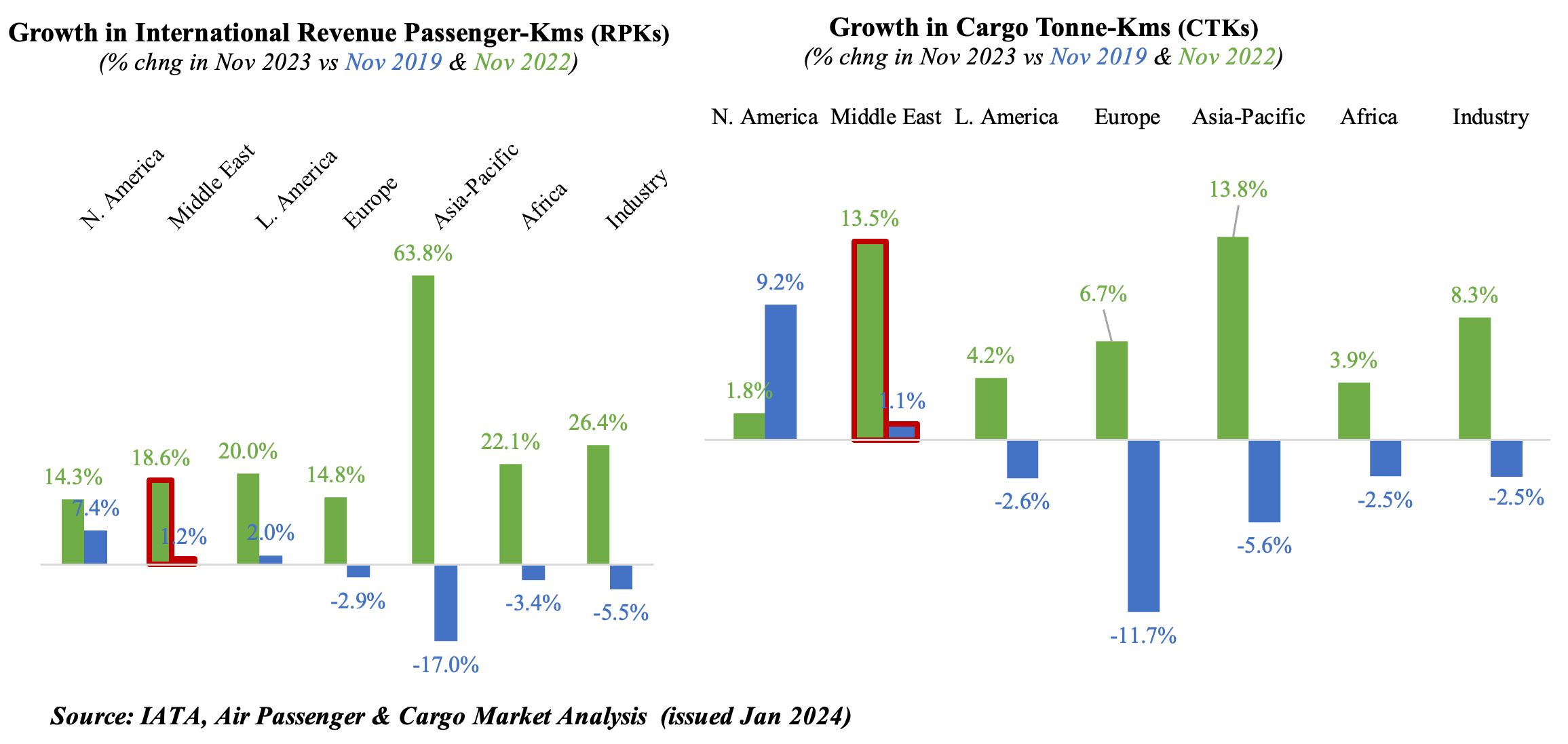

4. Middle East airlines continue their impressive run in Nov 2023

- International revenue passenger kilometres (RPKs) in the Middle East grew by 18.6% yoy in Nov, also surpassing their pre-pandemic RPKs levels. In comparison, global international RPKs are still lower than pre-Covid levels; North America leads with 7.4% growth versus 2019 while Middle East and Latin America were at 1.2% and 2% respectively. The gap between the Middle East-Asia route area (which had been recovering at a fast pace for the past few years) saw the gap narrow with the Asia and the Southwest Pacific route (which began accelerating in early 2023)

- Cargo activity accelerated in Nov, thanks to increase in cross-border trade: rising by 8.3% yoy, this was the highest growth of cargo tonne-kilometres (CTKs) since Dec 2021. Middle East registered a 13.5% yoy growth in international CTKs. Compared to Nov 2019, only the Middle East & North America recorded a positive growth in CTKs. The Middle East –Europe trade growth posted its fourth consecutive month of growth in Nov (+23.5% yoy), also heading CTK growth across all major trade corridors; the Middle East – Asia trade lane expanded by 12%.

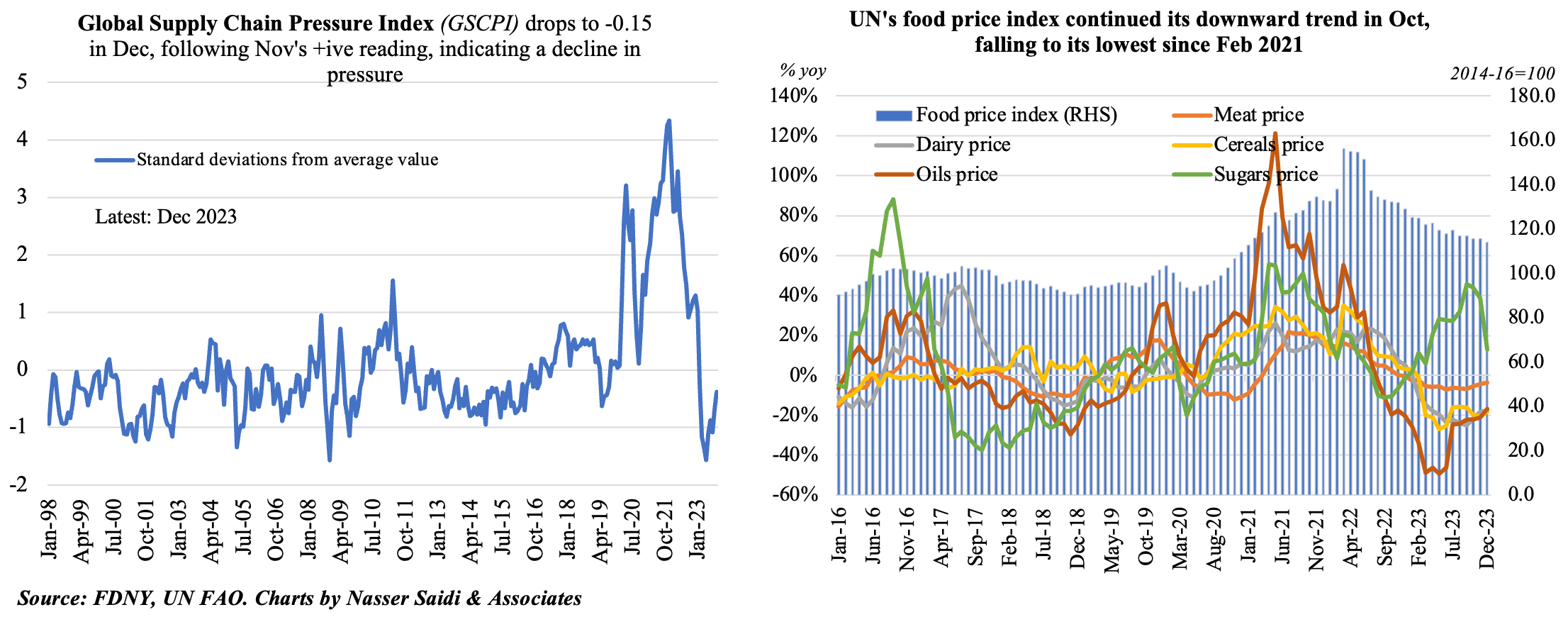

5. Global supply chain pressures dropped in Dec, but expect shipping rates to jump, raising inflation concerns

- The Fed’s Global Supply Chain Pressures Index (GSCPI) readings fell to -0.15 in Dec from Nov’s 0.13 reading. The negative reading means that the standard deviations are below index’s historical average, implying global supply chain conditions have returned to “normal” or declining inflationary pressure.

- However, as a result of Houthi attacks, carriers are announcing avoiding the Red Sea shipping route: vessel volume in the Suez Canal has fallen 61% to an average of 5.8 vessels per day.

- This will cause global shipping container rates to rise. There has already been some evidence of an uptick in freight costs – transport from Chinese ports to Europe have soared: USD 2600+ at end-Dec from USD 562 in early-Oct. MSC (the largest ocean carrier) will raise container rates from mid-Jan: e.g. rate will be USD 5,000 for US West Coast routes and USD 7,300 for routes to the Gulf of Mexico.

- Furthermore, the longer detour adds 10-14 days of travel – this will add to the cost of freight & also result in delays in receiving goods, thereby raising concerns of inflation.

- For now, UN’s food price index has shown a decline in 2023. The headline index fell to 118.5 points in Dec, the lowest since Feb 2021, given declines in cereals, vegetable oils and meat while sugar prices were higher in yoy terms, though it has been easing (13% in Dec, versus 39% in Nov).

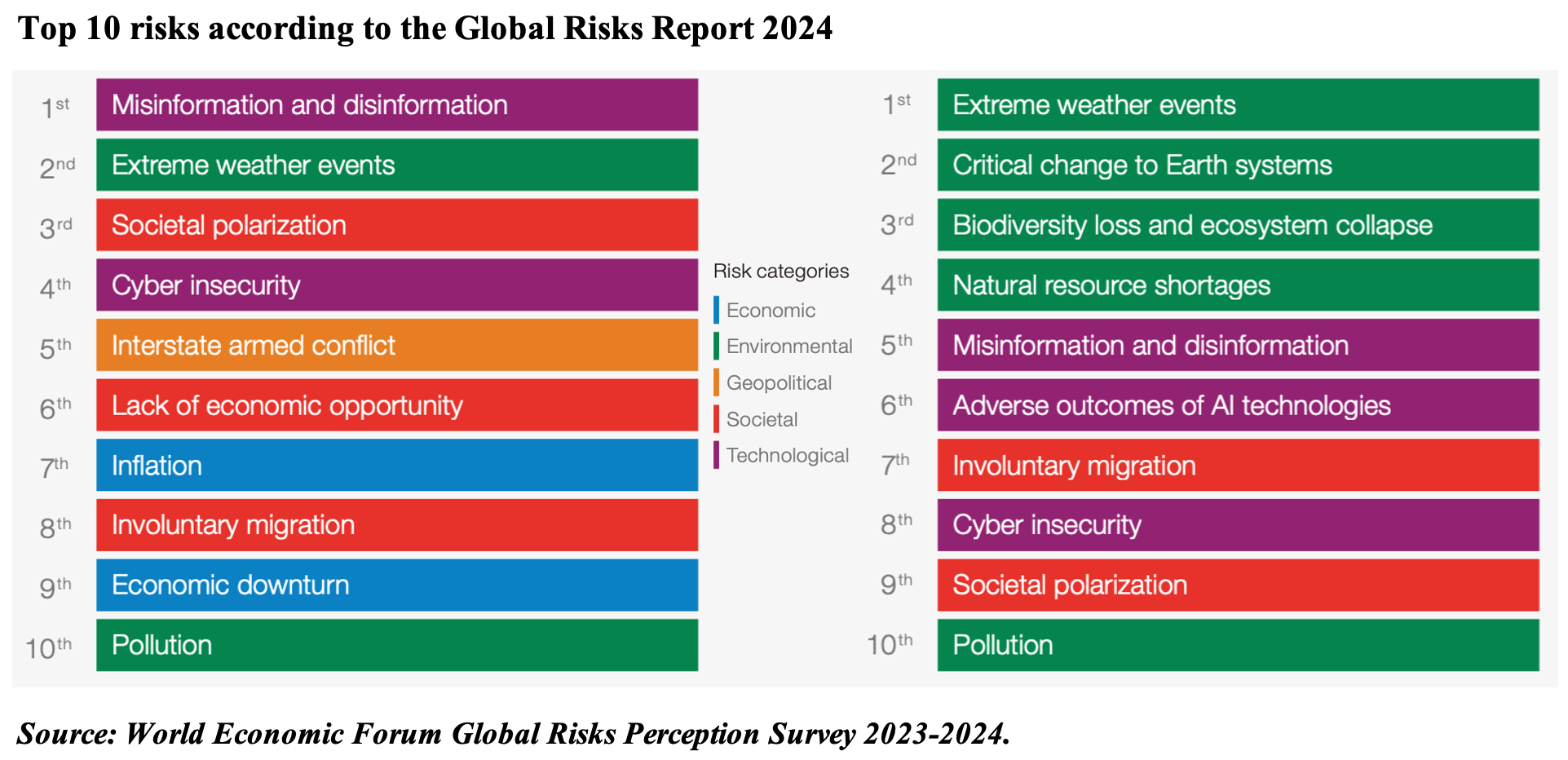

6. The Global Risks 2024 report highlights the rising concerns about extreme weather & other environmental risks

- The World Economic Forum’s Global Risks 2024 report, which compiles responses of 1400 global risks experts surveyed in Sep 2023, finds a negative outlook in the short-term, with the biggest concerns being (AI generated) misinformation/ falsified information, extreme weathers and societal polarisation. The first is worrisome especially in the context of 2024 being the biggest election year (with 64 nations holding various elections). In this context, even a few curve balls can catch the global economy by surprise – some, geopolitically riskier than others. Some 42% of respondents believe the rising costs of living will still be a problem in 2024, with 33% anticipating an economic downturn.

- Longer-term, it is not surprising that environmental concerns occupy the top spots. However, there still remains a question of urgency. It is important that these environmental risks are clearly prioritised and addressed NOW to not run the risk of a worser scenario later.

- Separately, two thirds of the respondents expect a multipolar or fragmented world order to emerge in the next decade, but in which “middle and great powers contest, set and enforce regional rules and norms”. (Read the opinion piece “GCC can emerge as ‘Middle Powers’ in second Cold War” penned by Dr. Saidi)

Powered by: