Markets

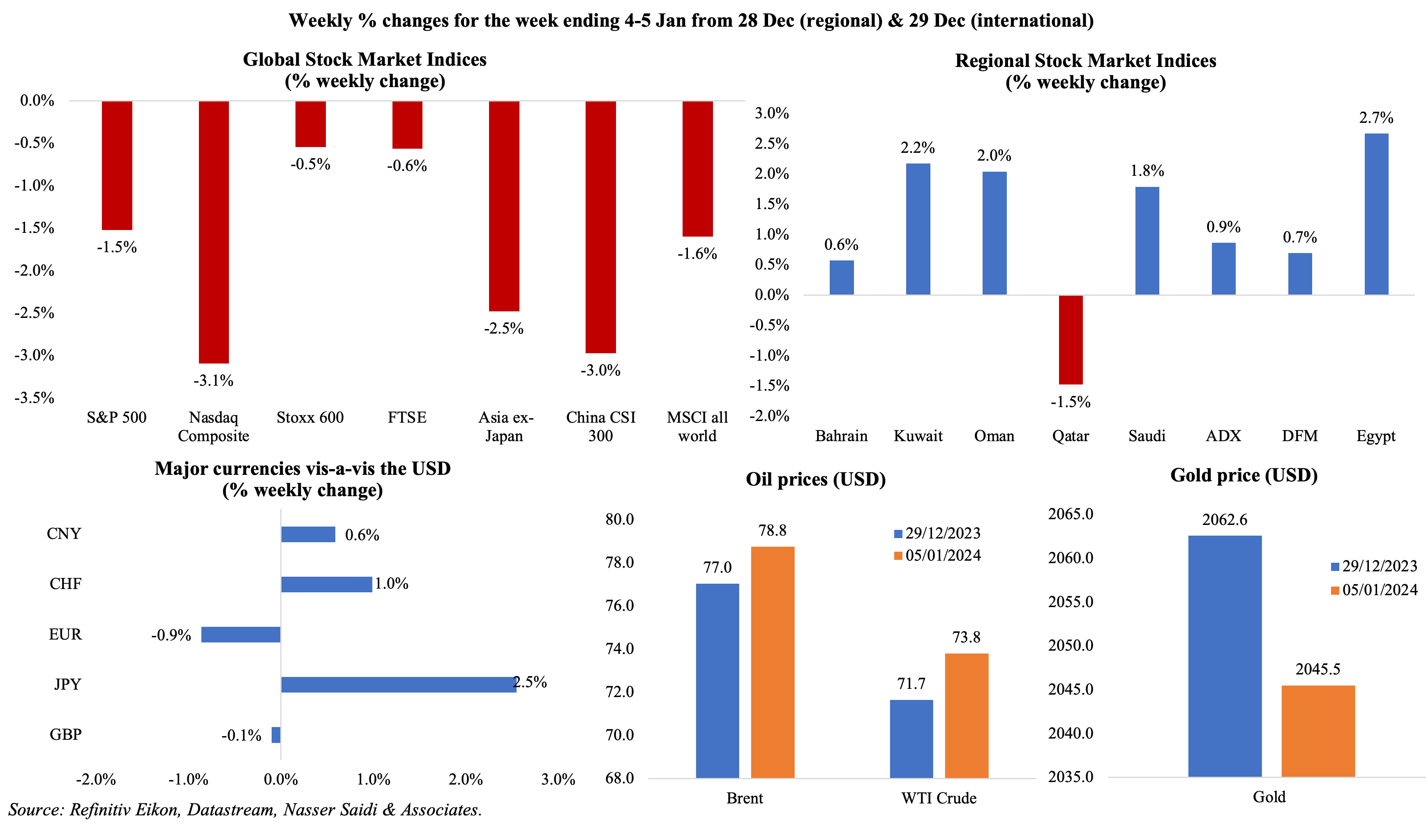

Most equity markets ended the first week of 2024 in the red, as strong US jobs data and hawkish Fed comments raised doubts on early rate cuts and are likely to come in later than previously expected; in Europe, inflation reading was onlyslightly lower than expectations causing investors to rein in expectations for a rate cut in March. Regional markets were mostly higher as oil prices rose (on concerns over supply interruptions). The euro fell 0.9% on the week, following 3 consecutive weeks of increases, while the dollar gained vis-à-vis the yen (its best weekly gain since Jun 2022). Oil prices ticked up, partly due to rising tensions from the Israel-Hamas war and supply concerns (ships were being diverted away from the Red Sea), while gold price declined compared to a week ago.

Global Developments

US/Americas:

- Non-farm payrolls rose by 216k in Dec (Nov: 173k), with the continuing strong labour market leading to lower expectations of an interest rate cut at the upcoming Mar meeting. Total job gains reached 2.7mn in 2023 (2022: 4.8mn), corresponding to an average monthly gain of 225k. Unemployment rate in the US was steady at 3.7% in Dec, while wages increased (4.1% from Nov’s 4% gain). Labour force participation rate slipped to 62.5% (Nov: 62.8%), the lowest reading since Feb.

- Private sector jobs in the US increased by 164k in Dec (Nov: 101k), the biggest gain in four months, led by leisure and hospitality (59k). The report also showed slowing wage growth, at 5.4% in Dec (Nov: 5.6%) while job changers saw earning rise by 8%.

- JOLTS job openings declined to 8.79mn in Nov (Oct: 8.852mn), the lowest reading since Mar 2021 and layoffs were the lowest since Dec 2022. There were 1.4 job openings per person (Oct: 1.36).

- Factory orders rebounded by 2.6% mom in Nov (Oct: -3.4%), posting the biggest monthly gain since Jan 2021. Orders for civilian aircraft and transport equipment surged by 80.1% and 15.3% while orders for non-defence capital goods inched up by 0.8%.

- S&P Global manufacturing PMI was revised down to 47.9 in Dec (from a preliminary reading of 48.2 and Nov’s 49.4), as both domestic and external demand showed weakness, and this was reflected in the output and new orders readings. Additionally, both cost burdens and selling prices increased.

- ISM manufacturing PMI increased to 47.4 in Dec (Dec: 46.7), thanks to an increase in employment (48.1 from 45.8) while new orders slipped (to 47.1 from 48.3) and manufacturing prices paid fell (to 45.2 from 49.9).

- ISM services PMI slipped to 50.6 in Dec (Nov: 52.7), the lowest reading since May, with a decline in both new orders (52.8 from 55.5) and employment (43.3, the lowest since Jul 2020, and from Nov’s 50.7) while prices paid fell to 57.4 (from 58.3).

- Initial jobless claims fell by 18k to a two-month low of 202k in the week ended Dec 29th, and the 4-week average inched down by 4,750 to 207.75k. Continuing jobless claims declined by 31k to 1.855mn in the week ended Dec 22nd.

Europe

- Inflation in the eurozone moved up to 2.9% yoy in Dec (Nov: 2.4%), following 6 months of consecutive declines. Core inflation slipped to 3.4% (Nov: 3.6%) while services inflation remained flat at 4% and fresh food prices rose by 6.7% (Nov: 6.3%). Producer price index fell by 8.8% yoy in Nov (Oct: -9.4%).

- Manufacturing PMI in the eurozone surpassed the preliminary reading (of 44.2) and clocked in 44.4 in Dec, with output and employment declining for the 7th month in a row. Composite PMI moved up to 47.6 (from 47) thanks to services PMI up to 48.8 (from 48.1) as demand for services declined and employment slowed.

- Germany’s manufacturing PMI rose to an 8-month high of 43.3 in Dec (from the preliminary reading of 43.1 and Nov’s 42.6 reading). Though PMI was firmly contractionary, below-50, there were a few positive signs: new orders fell the slowest in 8 months and business expectations were positive for the first time since Apr. Composite PMI stayed in contractionary territory for the 6th straight month though moved up to 47.4 (from a preliminary of 46.7), thanks to gains in the services PMI (49.3 from Nov’s 48.4).

- The harmonised inflation rate in Germany rose to a 3-month high of 3.8% in Dec (Nov: 2.3%) due to base effects. Food prices eased (4.5% in Dec from Nov’s 5.5%) while core inflation fell (to 3.5% from Nov’s 3.8%).

- German retail sales dropped by 2.5% mom and 2.4% yoy in Nov (Oct: 1.1% mom and -0.1% yoy). It was the biggest mom decline since Apr 2022 and non-food sales fell by 3.6%.

- Unemployment rate in Germany remained steady at 5.9% in Dec. The number of unemployed people in Germany increased by 191k to 2.6mn in 2023 compared to 2022.

- UK manufacturing PMI slipped for the tenth month in a row in Dec, to 46.2 – both from the preliminary estimate of 46.4 and Nov’s 7-month high of 47.2. Composite PMI moved up to 52.1 (from a flash estimate of 51.7 and Nov’s 50.7) as services PMI rose to 53.4 (from 52.7) –latter supported by an increase in output and new work for the 2nd consecutive month.

Asia Pacific:

- China’s Caixin manufacturing PMI inched up to a 4-month high of 50.8 in Dec (Nov: 50.7), with output growing the most in 7 months and new orders rising at the fastest pace in 6 months. Services PMI rose to 52.9 in Dec (Nov: 51.5), rising for the 12th month in a row, with new orders grew the most in 7 months.

- Japan’s manufacturing PMI was revised up to 47.9 in Dec (prelim: 47.7), on lower output and new orders while foreign sales shrank the most in 6 months (given lower orders from export markets including China and Europe).

- GDP in Singapore grew by 2.8% yoy and 7% qoq in Q4 (Q3: 1.1% yoy and 5.6% qoq). Q4’s annual growth was the fastest rate of growth since Q3 2022. For the full year 2023, the economy grew by 1.2%, a slower pace from the 3.6% growth in 2022.

- Singapore retail sales grew by 2.5% yoy in Nov, reversing Oct’s 0.1% drop; online sales accounted for 15.2% of the total, given the online shopping events (Singles Day, Black Friday).

Bottom line: Global headline PMI, covering both manufacturing and services, edged up for a second month in the row in Dec (to 51 from 50.5 in Nov) though PMI data showed a mixed picture across nations. Eurozone’s dismal data stood alongside modest expansions in the US and the UK while India and China posted accelerated gains. Meanwhile, the re-routing of ships away from the Red Sea could result in an uptick in freight costs (transport from Chinese ports to Europe have soared: USD 2600+ at end-Dec from USD 562 in early-Oct) and shortages (the longer detour adds 10-14 days of travel) that threatens to raise inflation. So far however, there has been limited cause for concern. Watch out for inflation data this week, from the US (it could ascertain whether the Fed are in a position to cut rates as early as Mar – we think it unlikely) to Tokyo and China, the latter facing deflationary pressures.

Regional Developments

- Bahrain’s Parliament approved legislation to impose a 2% tax on expat remittances: this will be reviewed & voted on by the Shura Council. Though the government called such a tax unfair and unconstitutional, by law, it needs to draft the legislation within 6 months.

- PMI in Egypt inched up to 48.5 in Dec (Nov: 48.4), but remained contractionary for the 37th month in a row, as new orders sub-index slipped to 46.9 (Nov: 47.3) alongside a drop in output (46.7 from 47.2). Business confidence rose to 55.1 from Nov’s lowest-ever reading of 50.9.

- Egypt’s current account deficit narrowed to USD 2.8bn in Jul-Sep 2023 from a year ago, according to the central bank. Net FDI inflows fell by USD 1bn to USD 2.3bn in Jul-Sep.

- Net international reserves in Egypt inched up to USD 35.219bn at end-Dec: this follows readings of USD 35.101bn and USD 35.173bn in Oct and Nov respectively.

- Egypt’s subsidies topped EGP 342bn annually, revealed the PM, with bulk of it towards bread (EGP 91bn versus less than EGP 50bn before 2021) and petroleum products (EGP 90bn). This was disclosed as some price hikes were announced: electricity prices were raised by 7.8-20.8% for households (depending on usage) and around 20% for industries while heavily subsidised Cairo metro ticket prices were hiked by up to 20%. The PM stated that raising electricity prices would lower the sector’s annual losses to EGP 75bn from EGP 90bn.

- As a result of the disruptions in the Red Sea, shipping volume in the Suez Canal dropped by 28% yoy between Dec 24th and Jan 2nd, according to the IMF’s PortWatch platform.

- The IMF will resume negotiations with Egypt within the next few weeks on the delayed reviews of the USD 3bn loan program, disclosed the IMF’s Director of the Middle East and Central Asia department.

- UAE’s AD Ports Group signed an agreement to build, develop, operate and maintain terminals for passengers and cruise lines at Egypt’s Red Sea ports (of Hurghada, Safaga and Sharm El Sheikh).

- Kuwait’s emir appointed Sheikh Mohammed Sabah al-Salem al-Sabah as the new prime minister, following the 20th Dec resignation of his predecessor. The new PM was formerly the minister of foreign affairs and deputy PM but had resigned from both roles in 2011.

- Lebanon’s PMI declined to 48.4 in Dec (Nov: 49.5), partly given the impact from the Israel-Hamas (e.g., affecting tourism during the year-end holidays) and sharp declines in output & new orders.

- Oman’s new budget forecasts a deficit of OMR 640mn (USD 1.66bn) this year, or 1.5% of GDP, based on an average oil price of USD 60 per barrel. Oil revenues are projected to touch OMR 4.9bn in 2024 (2023 estimate: OMR 6.9bn), with non-oil and total revenues standing at OMR 520mn and OMR 11.01bn respectively. Expenditure is forecast to rise by 2.6% to OMR 11.65bn. Oman also expects to repay OMR 1.6bn in debt in 2024; public debt has dropped to 35% of GDP in 2023 from nearly 70% of GDP in 2020.

- Population in Oman grew by 1.2% yoy to cross 5mn at end-2023. Omanis, at 2.236mn, account for 56.7% of the total population.

- Non-oil exports from Oman to Saudi Arabia grew by 25.5% yoy to OMR 774mn until Sep 2023. In Sep along, the value of Oman’s non-oil exports surged by 44% to OMR 101.9mn.

- Oman, as part of its decarbonisation strategy, plans to have 22k electric vehicles on the road by 2030 and raise the number of EV charging infrastructure to 350 public chargers.

- Qatar’s foreign trade surplus narrowed by 36.3% yoy and 12.1% mom to QAR 16.7bn in Nov 2023. Total exports fell by 28.6% yoy and 8.8% mom to QAR 26.5bn, with China topping the list of destinations (accounting for 20.4% of total exports).

- Qatar welcomed over 4mn visitors in 2023, a 5-year high. Tourists from Saudi Arabia topped the list (25.3% of total arrivals), followed by India (10.4%), Germany (4.1%), UK (3.9%) and Kuwait (3.5%). Building up on the momentum from the FIFA World Cup 2022, Qatar’s tourism sector also benefitted from streamlined visa procedures and calendar of events.

- Japan’s imports of Saudi crude oil touched 33.27mn barrels or 42.7% of total imports. Of the total 77.89mn barrels of oil Japan imported in Nov, 73.68mn barrels was supplied by Arab nations. UAE, Kuwait and Qatar accounted for 37.6%. 9% or 4.7% of the total.

Saudi Arabia Focus

- Saudi Arabia PMI remained unchanged at 57.5 in Dec, as output sub-index was stable at 61 while new orders surged (to 68.3 from 66.3) on increased demand. Strongest uptick was reported in manufacturing.

- Saudi Arabia’s Annual Borrowing Plans for 2024 was approved by the finance minister: the country needs roughly SAR 86bn in financing this year to balance the books. Financing was estimated to be around SAR 45bn in 2023, when it raised about SAR 48bn (including in pre-funding transactions in 2022). The ministry also predicts deficits of USD 20-30bn over the next 3 years. By end-2024, total debt portfolio is expected to amount to SAR 1.115bn or 26% of GDP.

- FDI into Saudi Arabia surged by 29.13% yoy to SAR 7.99bn (USD 2.13bn) in Q3 2023, according to SAMA data. During the same period, Saudi investment in foreign nations dropped by 8% to SAR 17.21bn.

- About 158 industrial licenses were issued in Saudi Arabia in Oct, up 97.4% yoy, with food manufacturing sector accounting for 31 of these permits followed by the non-metallic minerals industry (21) and non-ferrous metal manufacturing. The number of existing factories touched 11,388 with an investment of SAR 1.5trn (USD 400bn).

- The Saudi Authority for Industrial Cities and Technology Zones (Modon) announced plans for 10 new development projects across six industrial cities, valued together at over SAR 538mn (USD 145mn). This will be launched alongside national companies, with an aim to create opportunities for “value chain initiatives and bolster local content”.

- Saudi pharma manufacturer Avalon Pharma received an approval to offer 6mn shares (or 30% of its issued share capital) via an IPO on the main market Tadawul.

- E-commerce firms in Saudi Arabia jumped by 24% yoy to 37,481 in Q4 2023, according to the Ministry of Commerce, with Riyadh topping the list (with 15,074 registrations). Separately, commercial registrations grew by 23% yoy to 95,863 in Q4 2023.

- Saudi Arabia’s Zakat, Tax and Customs Authority advised firms to file tax returns on time to avoid being charged a 1% fine for unpaid taxes every 30 days after the due date. Companies that are subject to withholding tax have till 10th Jan to file returns.

- Spending by tourists in Saudi Arabia surged by 53% yoy to a record high of SAR 102.6bn in Jan-Sep 2023 while outbound travellers spent SAR 64.8bn.

- The Riyadh Season in Saudi Arabia attracted 12mn visitors – the target for the entire 120 days season – within the halfway mark (of 60 days). The inaugural edition in 2019 had attracted over 7mn visitors.

- Jeddah’s King Abdulaziz International Airport reported a record-high of 42.7mn passengers in 2023 (+36% yoy). Cairo-Jeddah was among the busiest global route, with 4.8mn seats, while Riyadh-Jeddah was the most demanded domestic route (7.8mn seats).

- Saudi Aramco’s hiking of feedstock and fuel prices will affect production costs and hence earnings of Saudi firms. Aramco raised retail diesel prices by 53% to SAR 1.15 (USD 0.31) per litre for 2024, its third hike since 2016; natural gas and other fuels are also to rise.

UAE Focus![]()

- UAE PMI increased to 57.4 in Dec (Nov: 57), thanks to a robust output index (unchanged at 63.9) while new orders sub-index moved up to 63 (Nov: 60.5). New sales pipelines and enquiries have strengthened business confidence readings.

- Non-oil GDP in the UAE increased by 5.9% yoy in Jan-Sep, announced UAE’s PM and Ruler of Dubai while chairing the UAE Cabinet’s first meeting of the year. It was also revealed that 2023 was one of the “most active” years with a total of 73 federal laws bring issued.

- Abu-Dhabi listed IHC announced the formation of a new holding company 2PointZero that will hold a USD 27bn portfolio: the portfolio will be transferred from Royal Group (IHC’s biggest shareholder with a 61% stake) after getting regulatory approvals.

- Dubai released a AED 208bn (USD 56.64bn) ten-year strategy to make the emirate one of the top-ranked in terms of standard of living. Plans also include to double the number of Emirati families and triple the number of citizens working in the private sector by 2033.

- Dubai announced a new law to set up a company Parkin to oversee the development, management, and investments in public and private parking spaces in the emirate. The law mandates that ownership of the Government of Dubai in Parkin will not fall below 60%. The firm will also invest in parking lots and handle commercial activities related to them.

- Sharjah’s 2024 budget estimates spending at a record-high AED 40.832bn, up 16% yoy, with about 26% of the budget goes towards wages. Revenues are forecast to increase by 5% compared to 2023, with tax revenues estimated at 9% of revenues.

- Sharjah International Airport’s AED 1.24bn (USD 337.62mn) terminal expansion project has been initiated: this is expected to be completed by 2027.

- The number of UAE citizens working in the private sector stood close to 92,000 at end-2023, up 157% from the launch of the Nafis program in Sep 2021.

Media Review

Egypt plans expansion of new capital as first residents trickle in

https://www.reuters.com/world/africa/egypt-plans-expansion-new-capital-first-residents-trickle-2024-01-04/

Giga-projects squeeze liquidity for Saudi banks

https://www.agbi.com/articles/giga-projects-squeeze-liquidity-for-saudi-banks/

China stumbles but is unlikely to fall by Eswar Prasad: IMF Finance & Development

https://www.imf.org/en/Publications/fandd/issues/2023/12/China-bumpy-path-Eswar-Prasad

What happened to the artificial-intelligence investment boom?

https://www.economist.com/finance-and-economics/2024/01/07/what-happened-to-the-artificial-intelligence-investment-boom

Powered by: