Middle East PMIs. Saudi industrial production. UAE trade. Oman tourism. MENA IPOs.

Weekly Insights 10 Nov 2023: GCC’s robust macroeconomic performance despite regional challenges

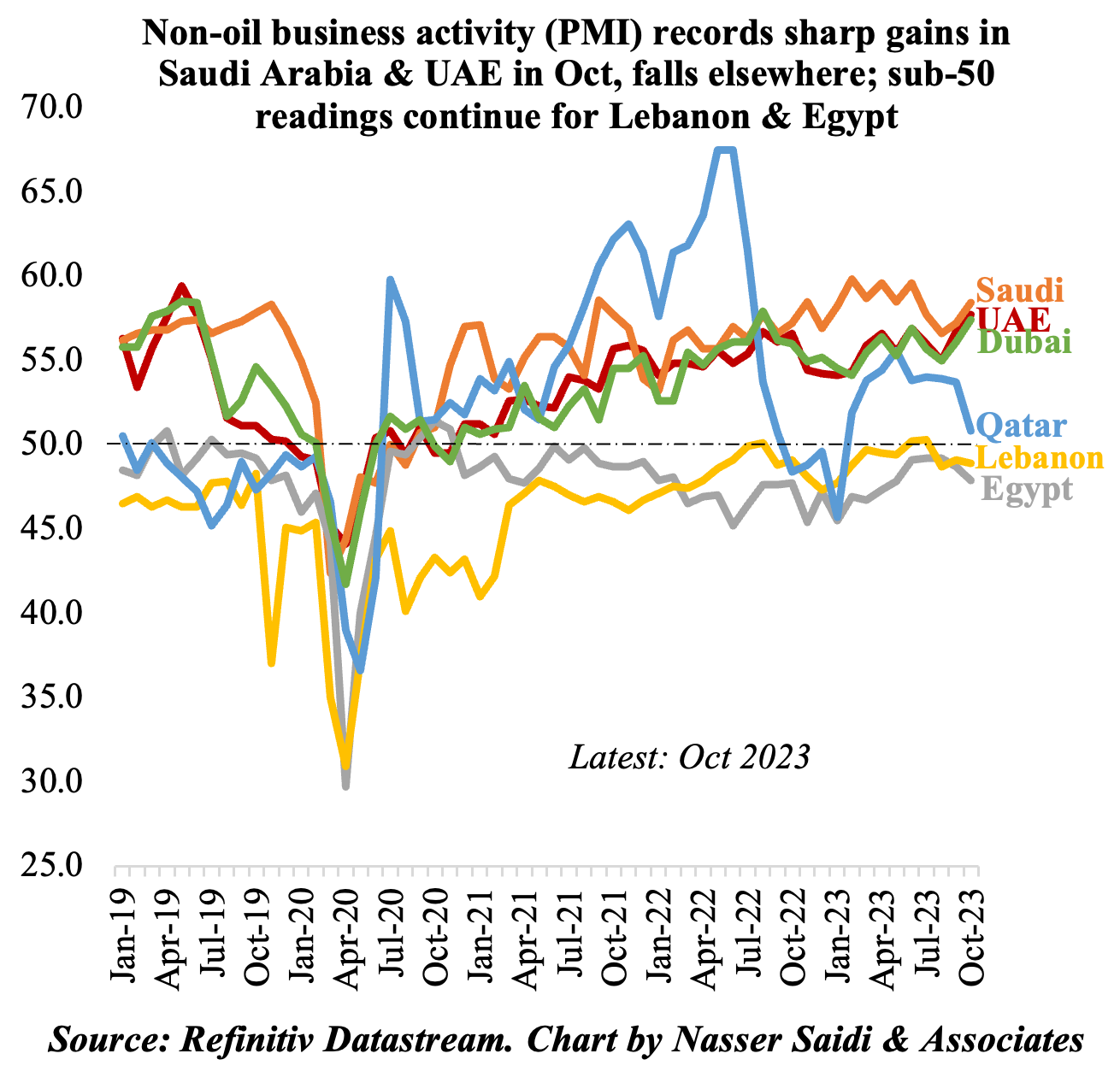

1. Saudi Arabia & UAE PMIs post gains in Oct; dampened activity in both Egypt & Lebanon

- GCC nations continue to report expansionary readings for non-oil sector PMI in Oct while both Egypt & Lebanon remain in contractionary territory (former for the 35th consecutive month).

- New orders have supported the uptick in Oct for all GCC nations, with new orders in UAE reporting the strongest growth since Jun 2019. Domestic demand has been strong, and firms also reported that price discounts supported sales growth.

- The cooler months (Q4 onwards) generally see a greater influx of tourists and notably, sales have been “marked” among wholesale & retail and travel & tourism firms in Dubai. This bodes well for the coming months which include high-profile events including COP28.

- Rising input prices will be a factor to watch out for: Saudi and UAE prices rose to 12 and 15-month highs. In Qatar input prices fell for the first time this year. Firms continue to offer discounts to remain competitive: In Saudi Arabia, output prices posted the strongest drop since May 2020 and in Qatar rose at the fastest rate in 6 months. Though output prices were raised in the UAE for the first time in 1.5 years, it was “only fractionally”. However, this is not a sustainable practice, considering firms’ revenues & profit margins.

- Hiring component in Saudi Arabia’s PMI surged to a 9-year high and Qatar reported increased recruitment by construction & manufacturing firms while Dubai reported only a slight increase (weakest in over a year).

- Egypt continues to be affected by rising inflation, currency weakness and supply shortages (given import controls): new orders posted a faster decline and employment shrank as well. Despite conflict in the region, sentiment improved to the highest this year. Lebanese firms meanwhile reported order cancellations due to security concerns, and a decline in international sales.

- Ongoing Israel-Gaza war adds a layer of uncertainty to businesses outlook, though for now, there seems to be limited concerns.

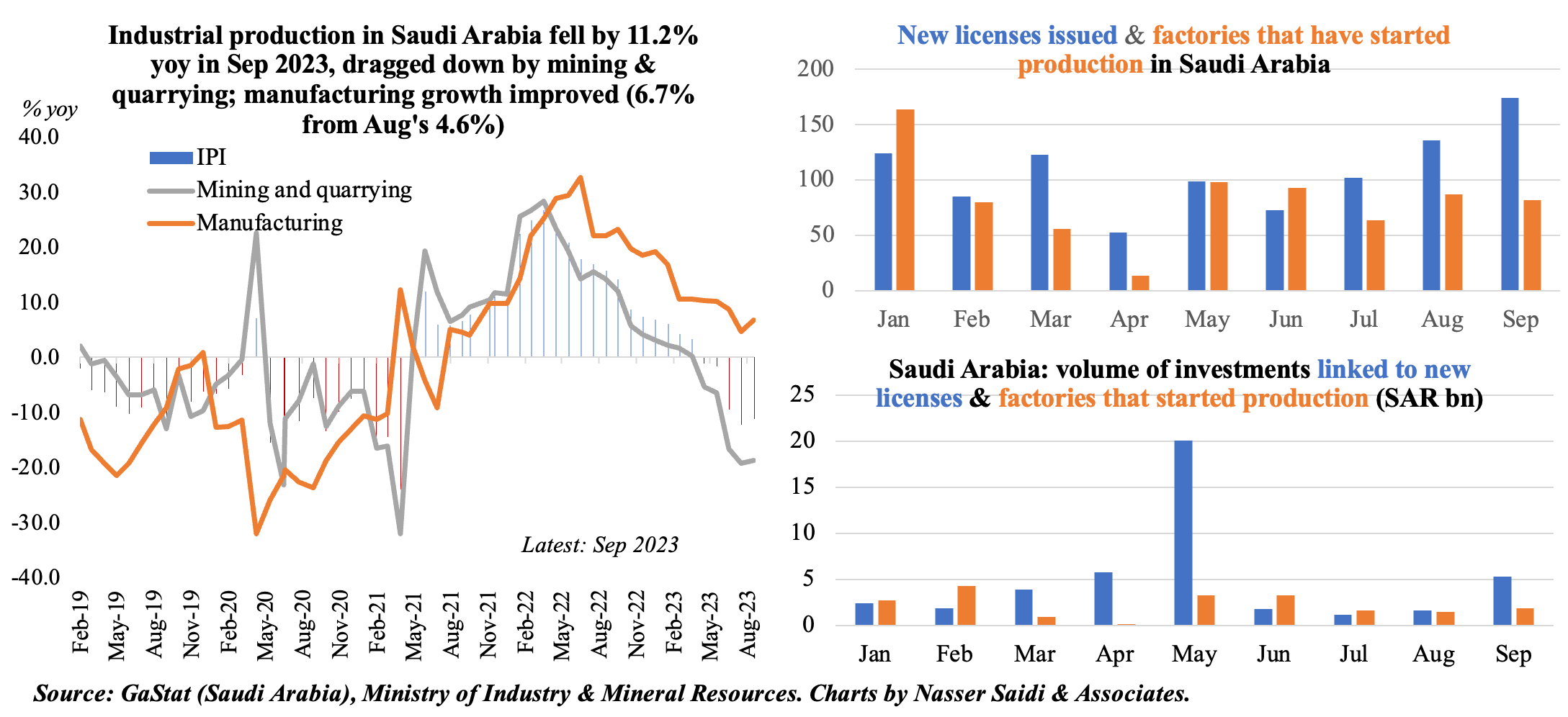

2. Saudi Arabia’s industrial production propped up thanks to growth in manufacturing; new industrial licenses & factories will support

- Industrial production (IP) in Saudi Arabia fell by 11.2% yoy in Sep (Aug: -12.2%), the fifth month in a row of declines, largely due to the plunge in mining & quarrying activity (-18.7% from Aug’s drop of 19.3%). In mom terms, IP rebounded in Sep, up by 0.8% (Aug: -0.3%). Overall IP has declined by an average 1.7% this year.

- Manufacturing activity has been slowing, with its average dropping to 10.8% in Jan-Sep 2023 (vs 22.9% in Jan-Sep 2023). This compares to a drop of 6.6% in mining & quarrying in Jan-Sep compared to a gain of 19.8% in the same period a year ago.

- There are positive signs for increase in non-oil sector activity in the future. Saudi Arabia’s PMI, at 58.4 in Oct, was the highest reading since Jun, supported by growth in new orders (4-month high) and employment growth (most since Oct 2014). The issuance of new industrial licenses and setup of factories also increased: 174 new licenses were issued in Sep, raising the total permits issued this year to 969, together committing to about SAR 44bn in investment. Meanwhile, 82 factories started production in Sep, bringing the total number of existing factories at end-Sep to 11,273, with an investment volume estimated at SAR 1.498trn.

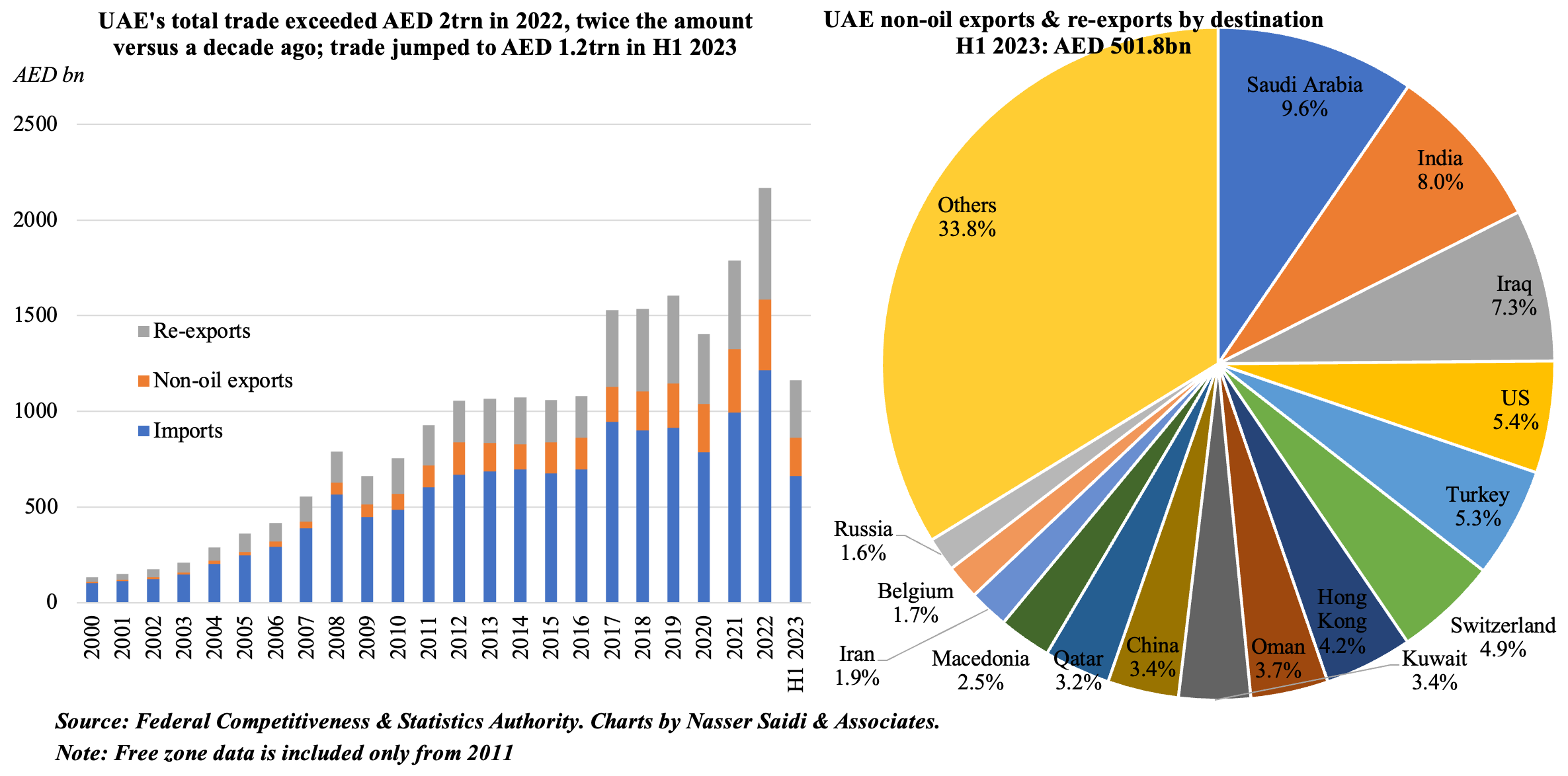

3. UAE’s non-oil foreign trade clocks in at AED 1.2trn in H1 2023, more than half of trade in full year 2022

- Non-oil trade has expanded significantly in H1 2023, rising to AED 1.16trn, and compares to AED 2.2trn in 2022.

- In H1 2023, re-exports accounted for more than ¼-th of total trade (AED 302bn), while non-oil exports (excluding re-exports) clocked in at AED 200bn. A breakdown by category shows that among non-oil exports (including re-exports), pearls, stones & precious metals top the list, with a share of close to one-third of the total, followed by machinery, sound recorders et. al (23%) and base metals (8.8%).

- Top 10 non-oil exports destinations (including re-exports) together account for more than 50% of total in H1 2023, of which 3 are GCC nations, and includes both India and China (remember that this is excluding oil!).

- UAE’s CEPAs contribute towards the non-oil trade expansion. Turkey is a good example of the success of CEPA: it is the fifth largest destination for UAE’s total non-oil exports, accounting for 5.3% of the total in H1 2023 (from 3.1% and 1.8% in 2022 & 2021 respectively).

- Though 6 CEPAs have been signed, those signed recently with Georgia and Cambodia are yet to be ratified. More CEPAs are in the pipeline: 4-6 agreements are expected to be completed by end-2023. These will support UAE’s ambition to raise non-oil trade to AED 4trn and non-oil exports to AED 800bn by 2031.

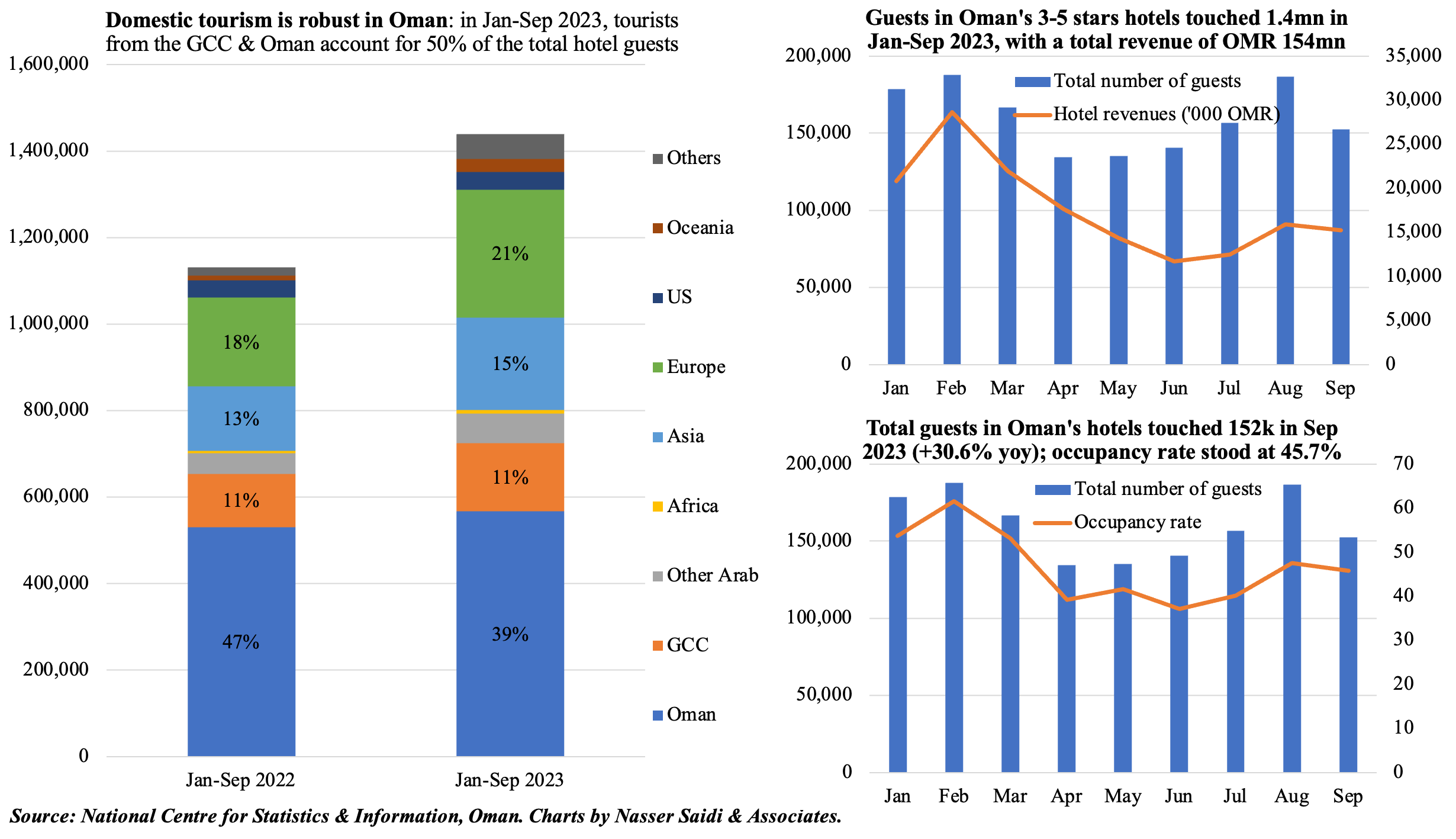

4. Oman tourism boosted by domestic travel

- Oman’s tourism index report shows that about 9mn visitors arrived into the country by end-Sep and around 6.2mn departed.

- About 4mn guests stayed at 3-5 stars hotels in Oman during Jan-Sep 2023 (+27.3% yoy), raising OMR 154mn in revenues (+26.4%).

- A breakdown of guests’ origins indicate that domestic travel is very strong in the country, with Omanis accounting for close to 40% of total guests in Jan-Sep (+6.9% yoy), followed by Europeans (+43.4% yoy to 295k persons). GCC residents’ visits have remained steady, accounting for about 11% of the total in Jan-Sep of both 2022 and 2023.

- Hotel occupancy during Jan-Sep this year has risen to 46.2% (from an average 41.9% in the same period last year): the highest occupancy rates were recorded in Feb this year.

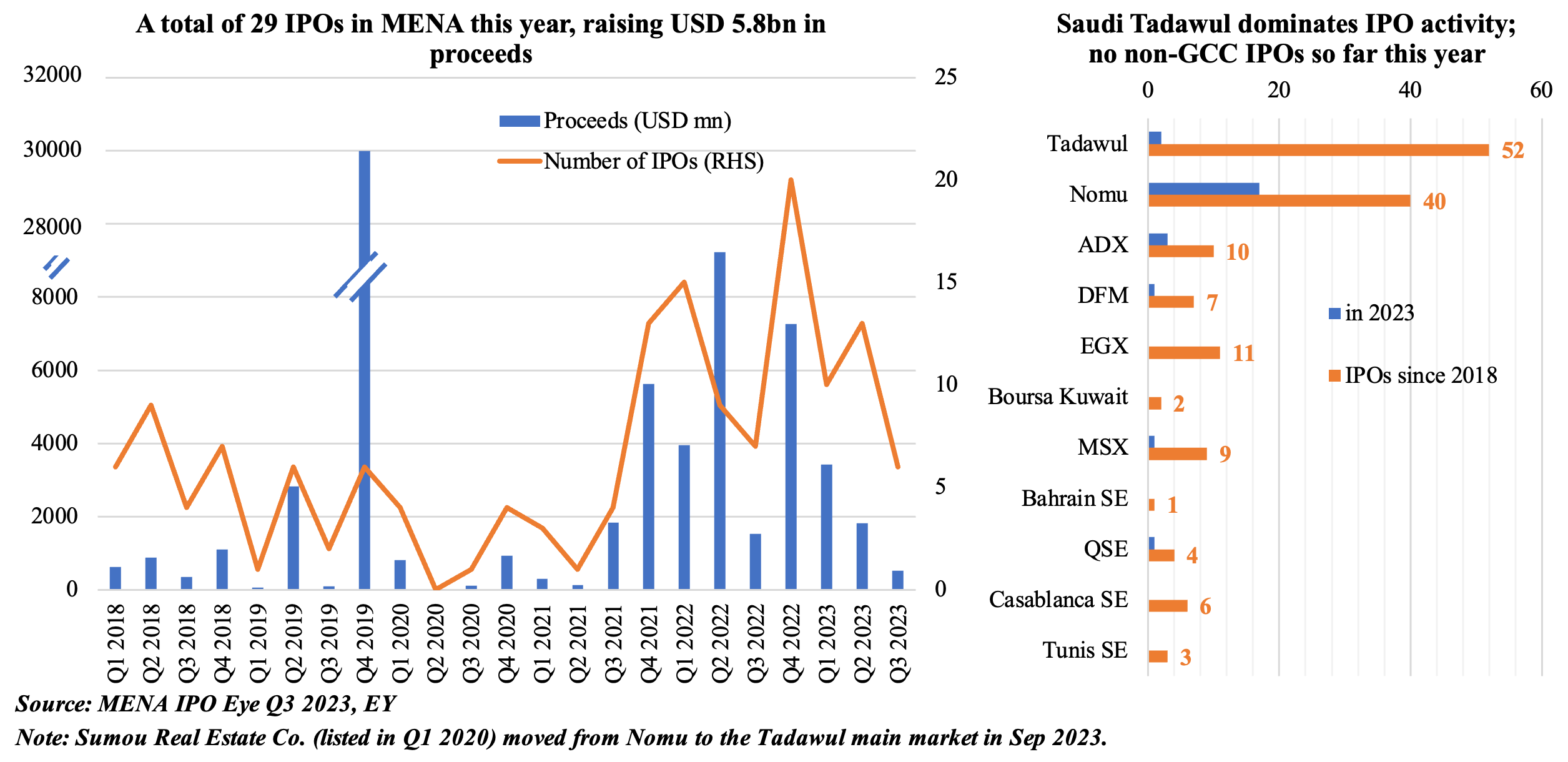

5. MENA IPO market sees 6 listings in Q3, taking the total this year to 29. Tadawul & Nomu are the most active exchanges

- IPOs in the MENA region stood at 6 (-14% yoy) in Q3 2023, raising USD 523mn in funds (-66%). This brings the total this year to 29 IPOs raising USD 5.8bn.

- Saudi Arabia’s Tadawul and Nomu have been the most active exchanges for listing this year, and despite an initial surge, none of the non-GCC exchanges have any IPOs listed this year.

- Both Saudi Arabia and UAE have an IPO pipeline: around 27 companies in Saudi have announced plans to list on Tadawul; Dubai’s Roads and Transport Authority is likely to privatise Dubai Taxi in Nov and private entities such as supermarket chains Spinneys & Lulu have plans for 2024; Bahrain’s Investcorp is listing on ADX.

- There has been a concerted push towards privatisation by the region’s govts (to diversify, raise revenues & boost capital markets). Once Egypt’s elections are over, and reforms implemented (including exchange rate), expect more privatisation moves from state-owned entities. There remains a risk that the current geopolitical conflict could put a dampener on investor sentiment & IPO activity.

Powered by: