Saudi GDP, budget deficits & monetary stats. UAE PMI & school enrolments.

Weekly Insights 3 Nov 2023: Domestic demand reigns key in Saudi Arabia & UAE as the former shows impact of decline in oil production

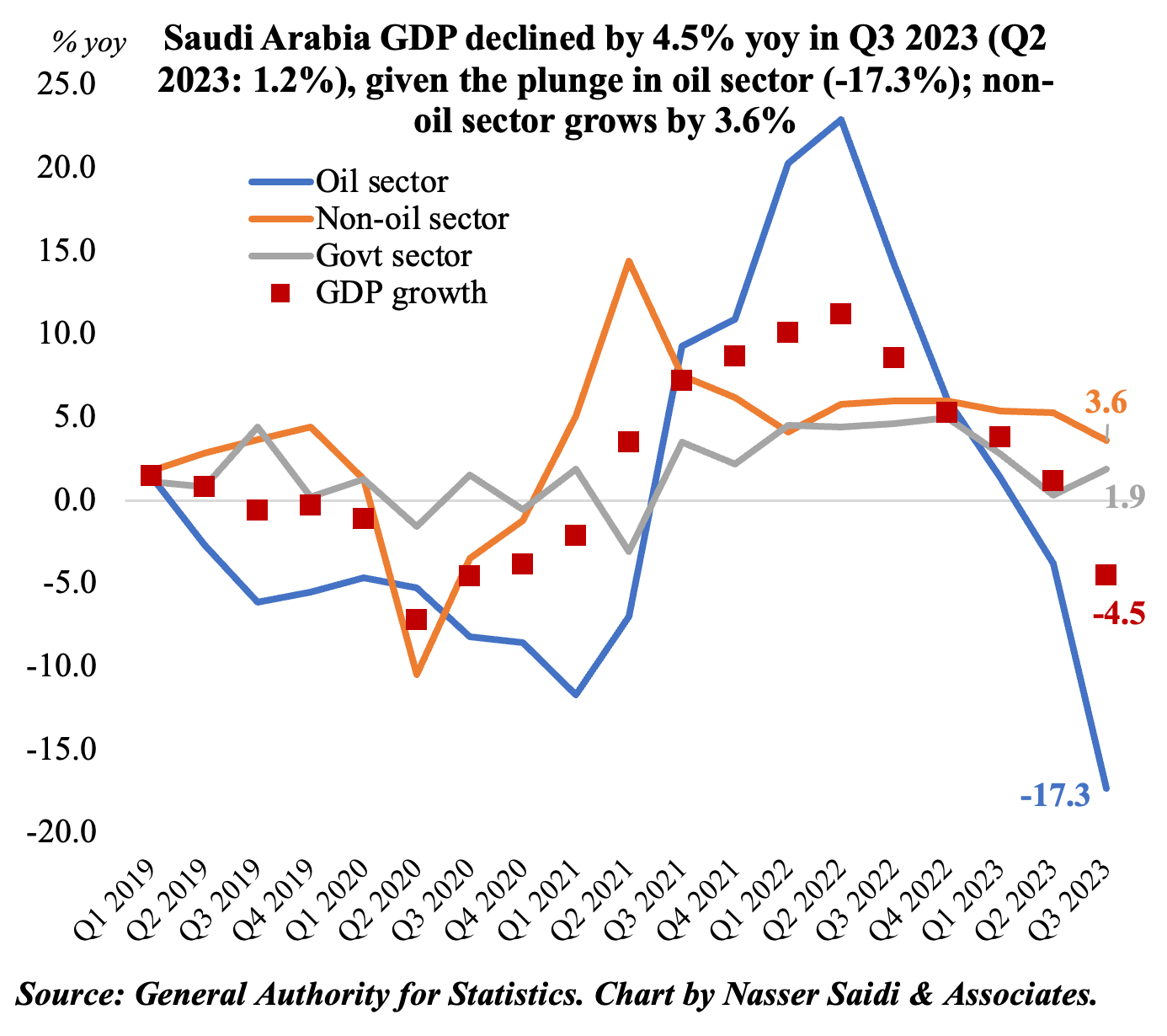

1. Saudi Arabia GDP fell by 4.5% yoy in Q3 2023 (Q2: 1.2%), as oil sector activity plunged (-17.3%)

- Saudi Arabia’s real GDP fell by 4.5% in Q3 2023, according to preliminary data, dragged down by the sharp plunge in the oil sector (-17.3% yoy from Q2’s 3.8% drop). The extension of a voluntary cut of 1mn barrels per day till rest of the year implies dips in the oil sector growth.

- Non-oil sector grew by 3.6% in Q3, though the pace has been slowing in recent quarters (it has averaged 4.8% this year vs an average of 5.3% in Jan-Sep 2022). Non-oil sector growth has been supported by the strong domestic demand. Meanwhile, government spending grew by 1.9%.

- The IMF forecasts overall GDP and non-oil sector growth of 0.8% and 5% respectively for this year.

- The government is standing by their Jan 2024 deadline for international firms to move their regional HQs to Riyadh – local presence is required to secure government contracts- which should result in a slight uptick in non-oil sector activity going forward.

- Pipeline of megaprojects will continue to support non-oil activity. According to MEED, the total value of Saudi contract awards in 2022 (USD 24bn) more than doubled compared to 2021 (USD 11.9bn). This will continue given the number of mega and giga projects in the pipeline (of close to USD 1trn projects planned, only about USD 50bn has been awarded).

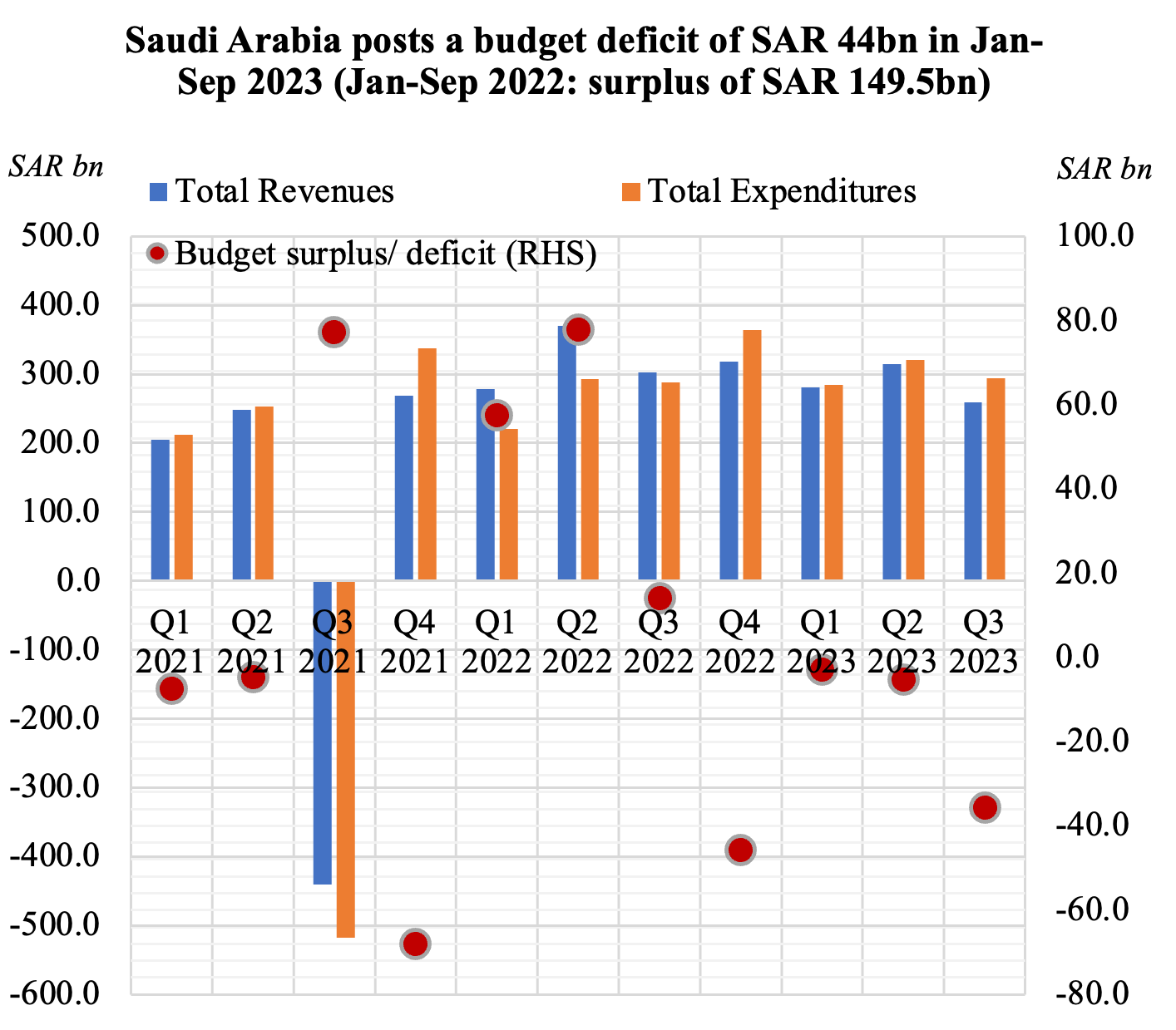

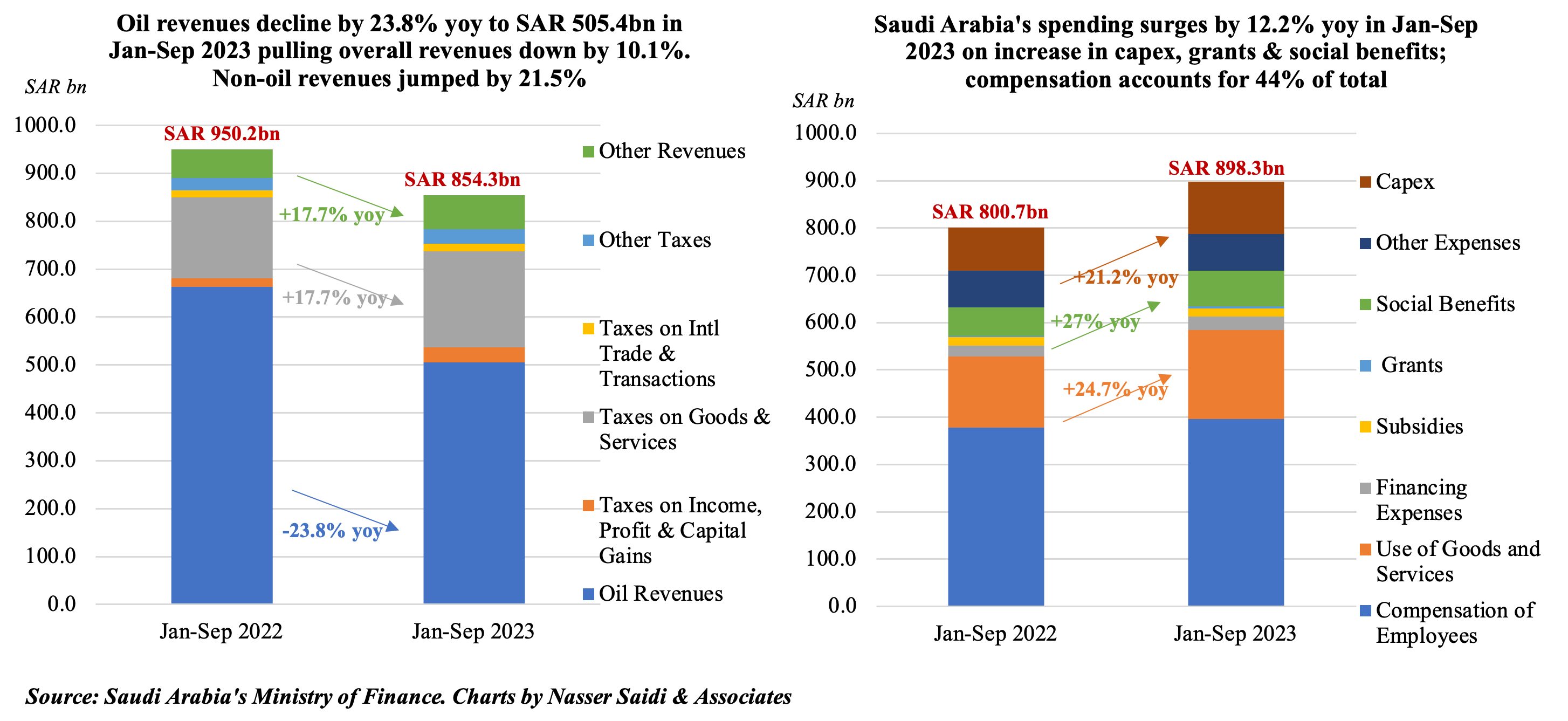

2. Saudi Arabia posts a deficit of SAR 44bn in Jan-Sep 2023 on lower oil revenues

- Saudi posted a 23.8% yoy drop in oil revenues in Jan-Sep 2023, resulting in a decline in overall revenues (-10.1% to SAR 854.3bn till Sep) while non-oil revenues were up by 21.5%.

- Bulk of non-oil revenues came from tax on goods & services (up 18% yoy to SAR 199.5bn in till Sep). The largest gain was recorded for taxes from income, profit and capital gains (82% yoy to SAR 32.1bn till Sep). In Q3 2023 alone, oil and overall revenues fell by 36% yoy and 14% respectively.

- Spending rose by 12% yoy to SAR 898.3bn in Jan-Sep, with all items posting gains except for subsidies (-9% yoy to SAR 17.5bn) and other expenses (-0.2% to SAR 77.2bn)

- Compensation of employees grew by 5% to SAR 396.6bn in Jan-Sep 2023 and accounted for 44% of total spending. Grants more than doubled to SAR 4.0bn in Jan-Sep, while capex grew by 21% to SAR 110.7bn.

- Overall deficit fell to SAR 43.9bn in Jan-Sep 2023. Last month, the finance minister had stressed that the country would spend within its “fiscal space” and were not worried about deficits.

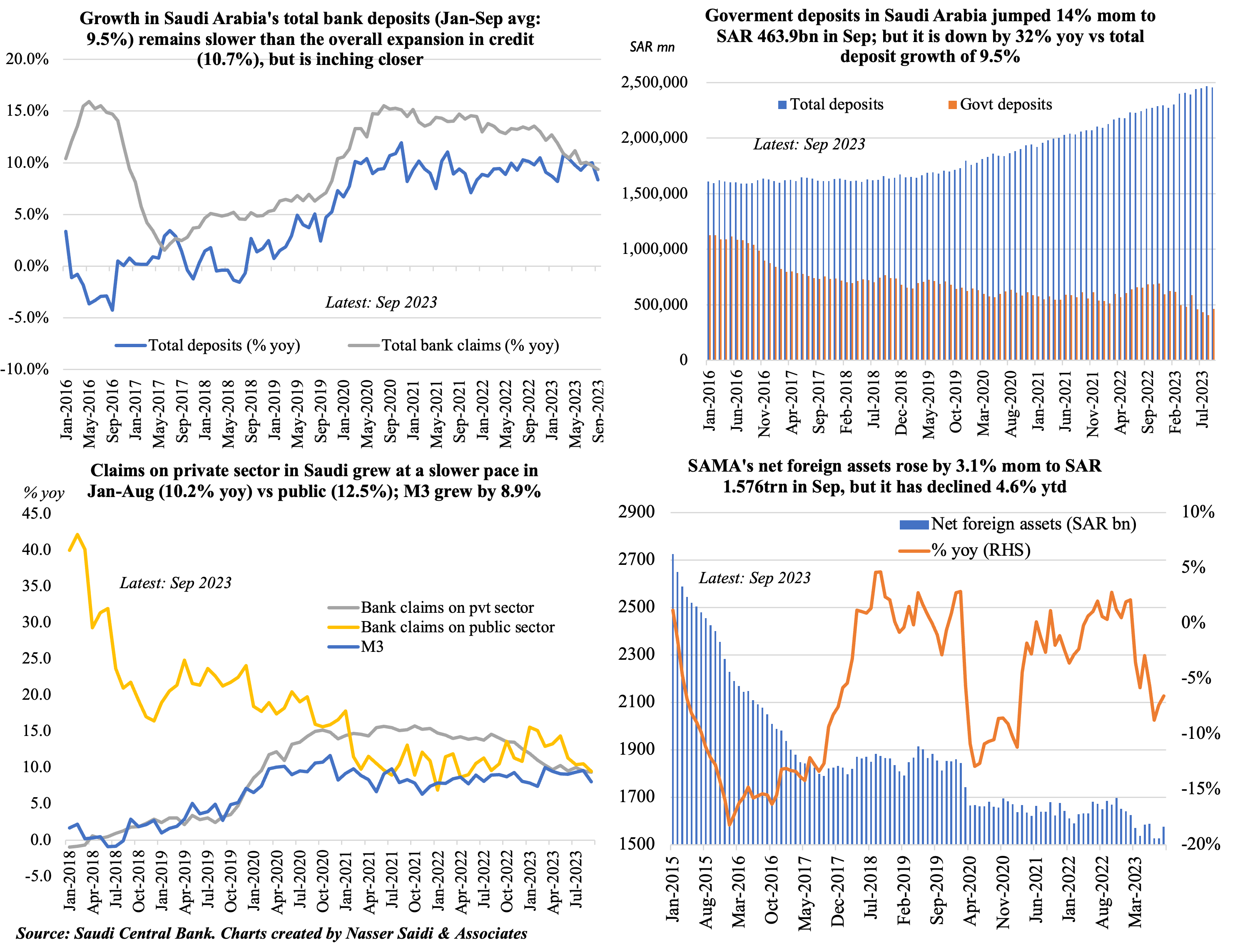

3. Gap between deposit & credit growth in Saudi Arabia narrows; govt deposits jumped by 14% mom in Sep 2023; Net Foreign Assets ticked up in month-on-month terms, but down for 7 straight months (in % yoy)

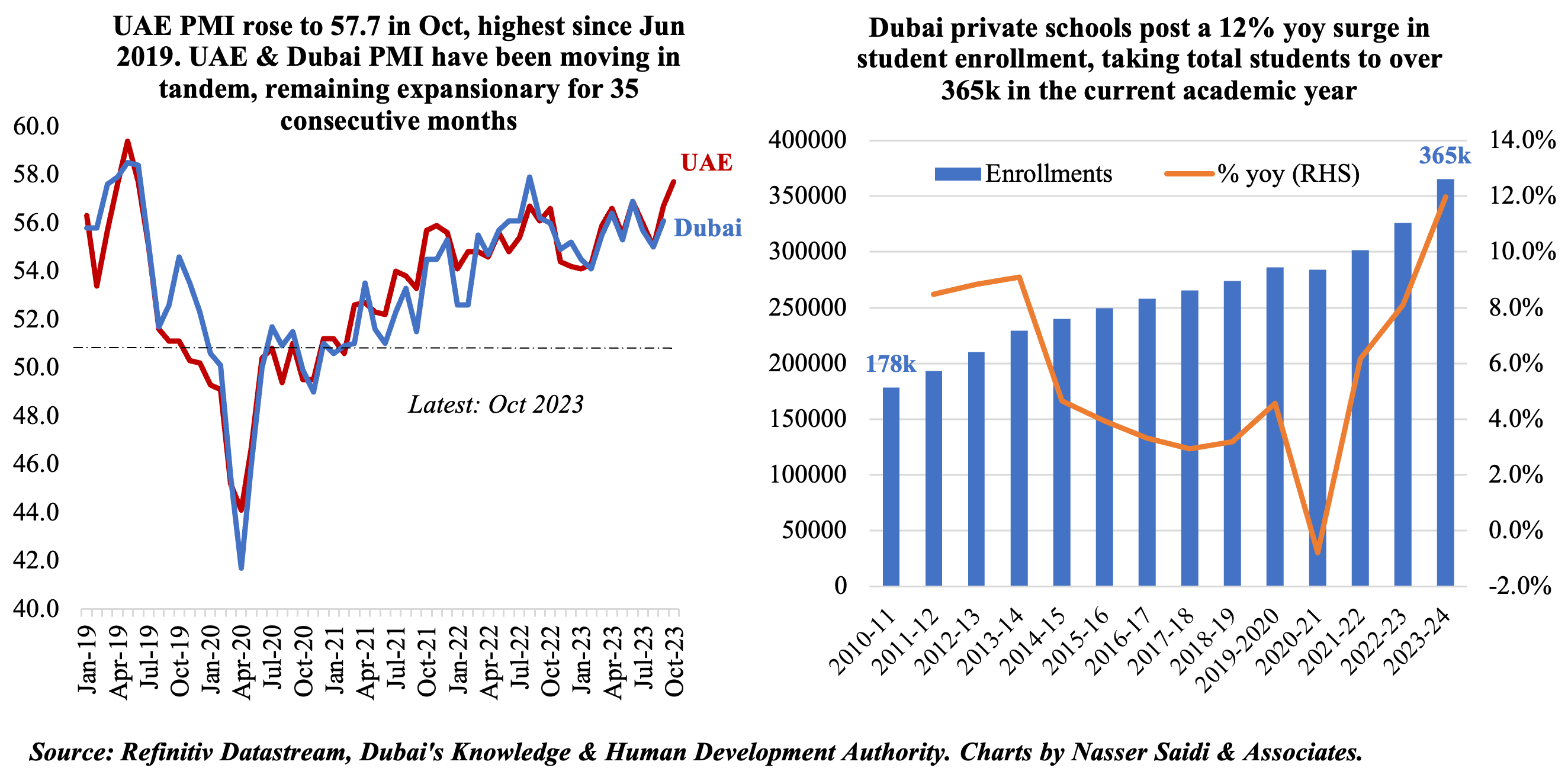

4. UAE PMI jumps to 57.7 in Oct, the highest since Jun 2019. Dubai private school enrolments for the current academic year reinforce attractiveness of the emirate

- This week, the UAE Minister of Economy disclosed that UAE’s non-oil sector grew by 5.9% yoy in H1 2023. Today’s UAE PMI release indicates a robust non-oil sector growth reading in Q3 as well. UAE PMI increased to 57.7 in Oct (Sep: 56.7), supported by new orders (which also posted the strongest growth since Jun 2019).

- Inflationary pressures are ticking up: input prices rose to a 15-month high, due to higher fuel and raw material prices as well as a “modest uptick in wages” to retain staff. Output prices were raised in Oct, for the first time in one and a half years “albeit only fractionally as discounting efforts remained wide”, according to S&P Global.

- Strong demand expectations showed up in optimism for the 1-year ahead outlook: it was the second-highest since Mar 2020. Both UAE and Dubai PMIs have been moving in tandem, so one can expect a similar increase in Dubai PMI (when issued next week): would be worthwhile to see if there are any major changes in the tourism sector rhetoric (given the Israel-Palestine conflict backdrop): Q4 usually sees a jump in tourists.

- Dubai announced a 12% yoy increase in private school enrolment for the current academic year. This provides a good proxy for activity in the emirate. There was a sharp decline during the academic year 2020-21 (when schools were functioning online, and there was an outflow of expats), but the robust pace of growth in the following years highlight the success of the many structural reforms introduced during the period. The number of students have more than doubled since 2010-11 & schools have increased from 127 to 220 (in the 2023-24 academic year).

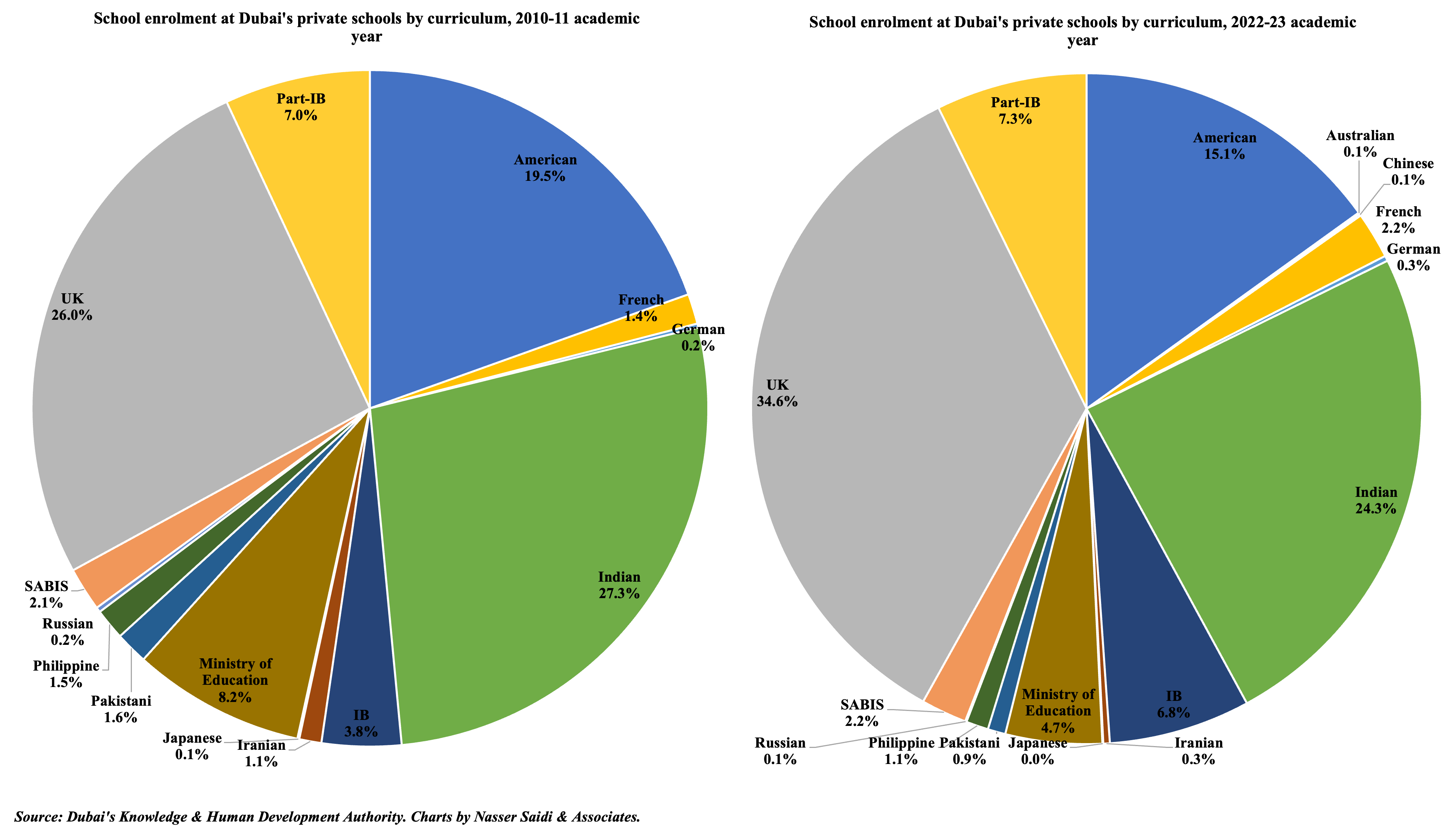

5. A breakdown of school enrolments in Dubai by curriculum

- The largest share of private school students in Dubai are enrolled in British curriculum schools: share rising to more than 1/3-rd of the total in 2022-23 (from 26% in 2010-11); the number of British schools also increased to 75 in 2022-23 (from 40 in 2010-11). Indian and American curriculum schools are sought after as well, with shares at 24% and 15.1% in 2022-23 respectively.

- Students enrolled in IB schools have increased (from a share of 3.8% in 2010-11) to 6.8% of total last year (in 17 schools from 8 in 2010-11). Some schools which have a partial-IB curriculum along with others (UK, US, Indian) which are captured under part-IB.

- Australian and Chinese schools have opened in the emirate after the pandemic. Meanwhile, enrolment at the Ministry of Education schools has remained almost stagnant around the 15k mark, resulting in a decline in their overall share.

Powered by: