Middle East PMIs. GDP growth in Bahrain & Abu Dhabi. GCC inflation. Saudi Arabia’s monetary, labour market & fiscal balance stats.

Weekly Insights 6 Oct 2023: Non-oil sector props up GDP growth in the GCC as inflation eases; but growth is slowing

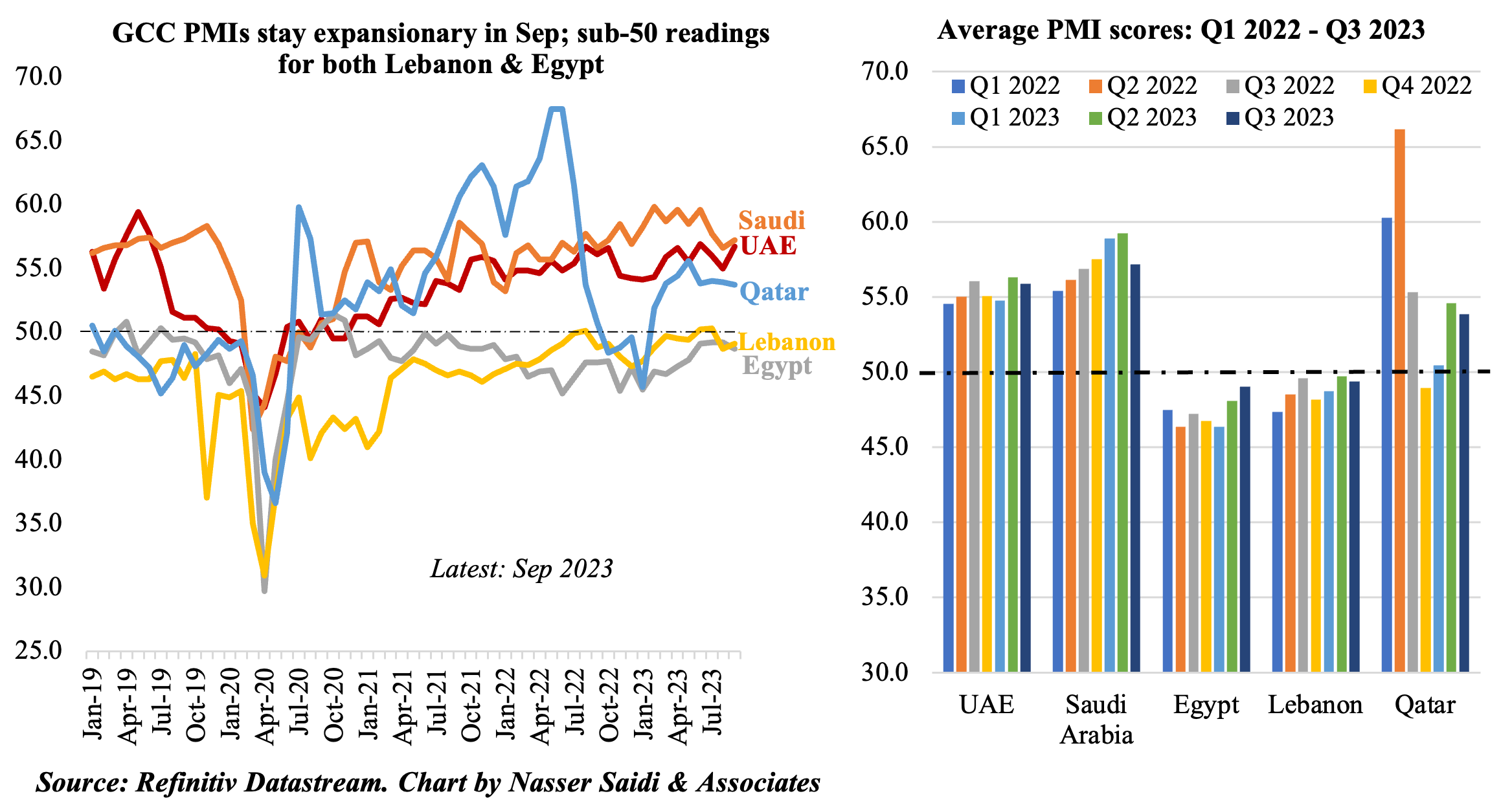

1. Middle East PMIs moderate in Sep & Q3: GCC stays expansionary; Egypt & Lebanon remain contractionary

- GCC nations post expansionary readings in Sep: Saudi and the UAE for the 37th & 34th month in a row & Qatar for the 8th. However, quarterly readings of all 3 nations have eased in Q3.

- Egypt & Lebanon, affected by currency depreciation, high inflation, weak domestic demand & economic uncertainty among other factors, remain contractionary. Subdued orders from abroad dampen sentiment.

- Domestic demand has been driving the expansion story in the GCC: in UAE new orders were the highest since Jun 2019.

- However, the external demand picture has been mixed: while in Saudi export sales fell for the 2nd month in a row in Sep, UAE firms reported new export orders at an over 4-year high.

- Rising input prices have been a clear concern across most nations in Sep, with Saudi respondents citing high raw material prices and rising wages. In Qatar, firms raised selling prices for the first time in 5 months while in Saudi, firms dropped selling prices for the second time in 3 months, in a bid to gain a competitive edge.

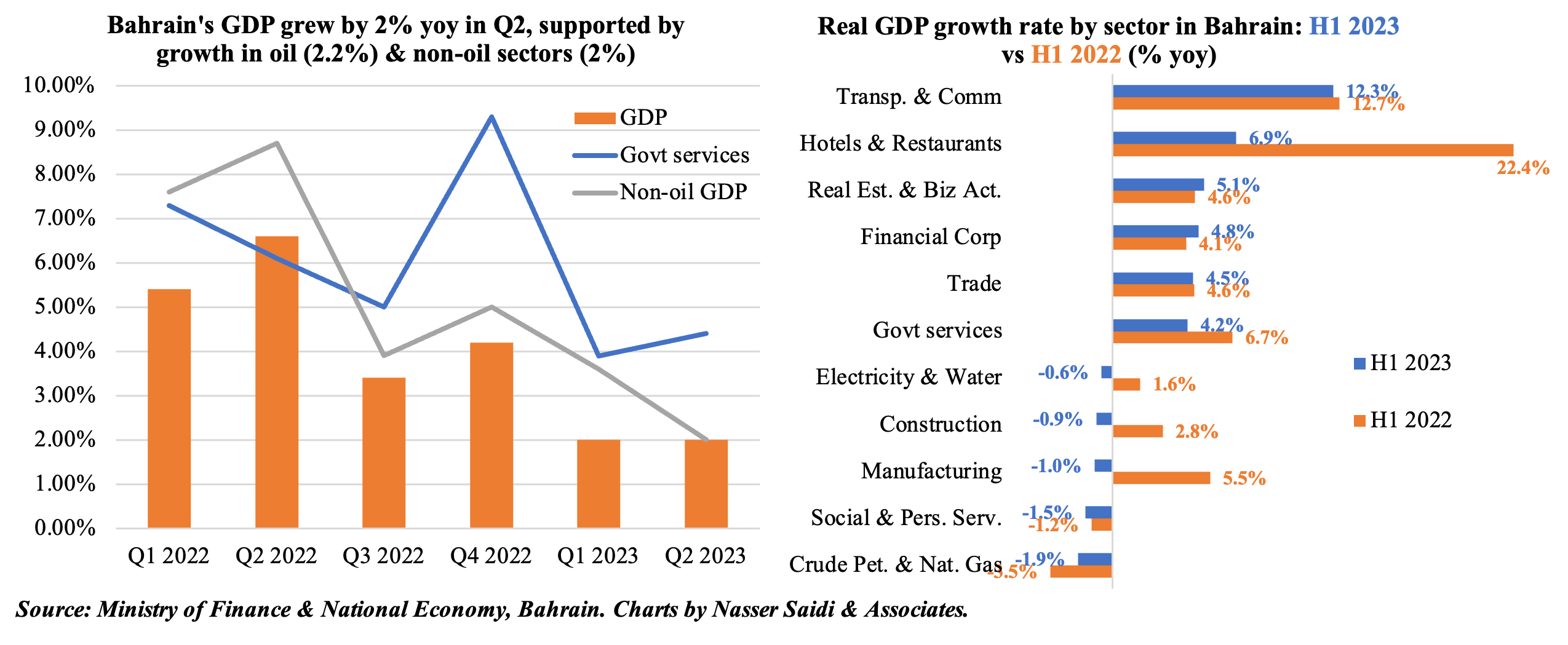

2. Bahrain’s GDP grew by 2% yoy in Q2 2023 & H1 2023, thanks to non-oil sector growth (H1: 2.8%) as oil sector contracts (H1: -1.9%)

- Real GDP in Bahrain grew by 2% in Q2 2023 (Q1: 2%), with non-oil and oil sectors up by 2% and 2.2% respectively (Q1: 3.6% & -5.9% in the non-oil and oil sectors). In H1 2023, overall growth stood at 2% yoy (slower than H1 2022’s 6%).

- Growth is expected to moderate in 2023, driven more by non-oil sector growth than oil sector (the oil sector accounted for just 17.1% of real GDP in Q2 2023).

- Growth in H1 2023 was highest in the transportation sector (12.3% in H1 2023), followed by hospitality (6.9%) and real estate (5.1%) sectors – highlighting the growing importance of tourism and greater mobility in the post-Covid era.

- In terms of contribution to growth to real GDP in Q2 2023, financial sector tops the list (17.3%), followed by crude petroleum & natural gas (17.1%), government services (14.1%) and manufacturing (13.6%).

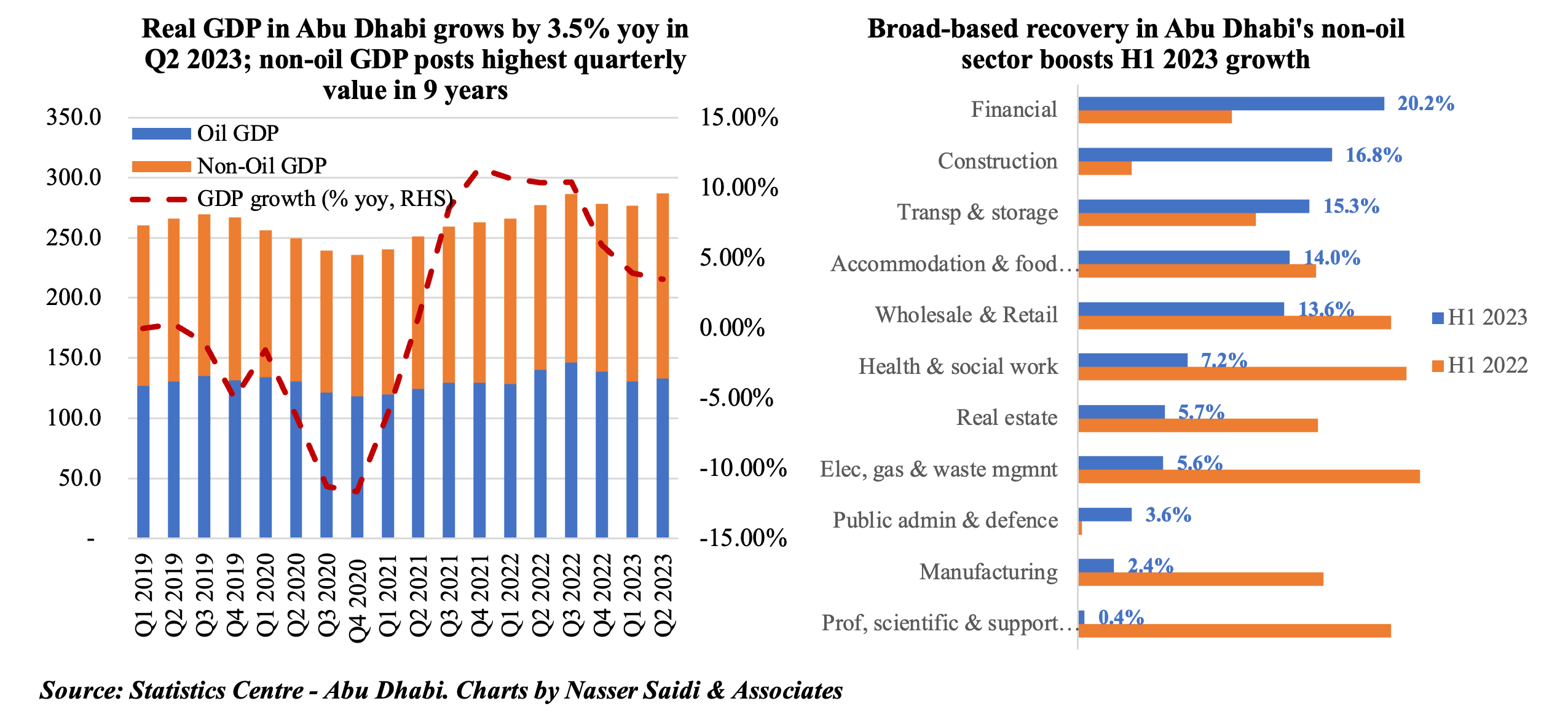

3. Abu Dhabi’s real GDP grew by 3.5% yoy in Q2 2023, driven by a surge in non-oil sector activity

- Real GDP in Abu Dhabi grew by 3.5% yoy in Q2 (Q1: 3.9%), bringing the half year growth this year to 3.7% (H1 2022: 10.5%), with the contribution of the non-oil sector at 53.7% of the total.

- Non-oil growth surged, touching AED 154.11bn in Q2 (12.3% yoy & 5.5% qoq): the highest quarterlynon-oil GDP reading since 2014, crossing the previous high in Q1 2023 (AED 146.12bn). This stands in contrast to oil GDP which fell by 5.2% yoy to AED 132.9bn in Q2 from lower oil prices and production cuts.

- The financial sector grew the most in Q2 (29.8% yoy – the fastest pace since 2014), followed by construction (19.1%) and transportation & storage (16.9%). The surge in financial sector activity underscores the attractiveness of ADGM as a global financial centre: ADGM reported a 35% yoy growth in H1 2023, given the rise in investment firms & hedge funds setting up operations.

- A breakdown of activity by sector for H1 2023 shows that the biggest gains were recorded in financial sector (20.2% yoy), construction (16.8%), transport & storage (15.3%), accommodation & food services (14%) and wholesale and retail trade (13.6%).

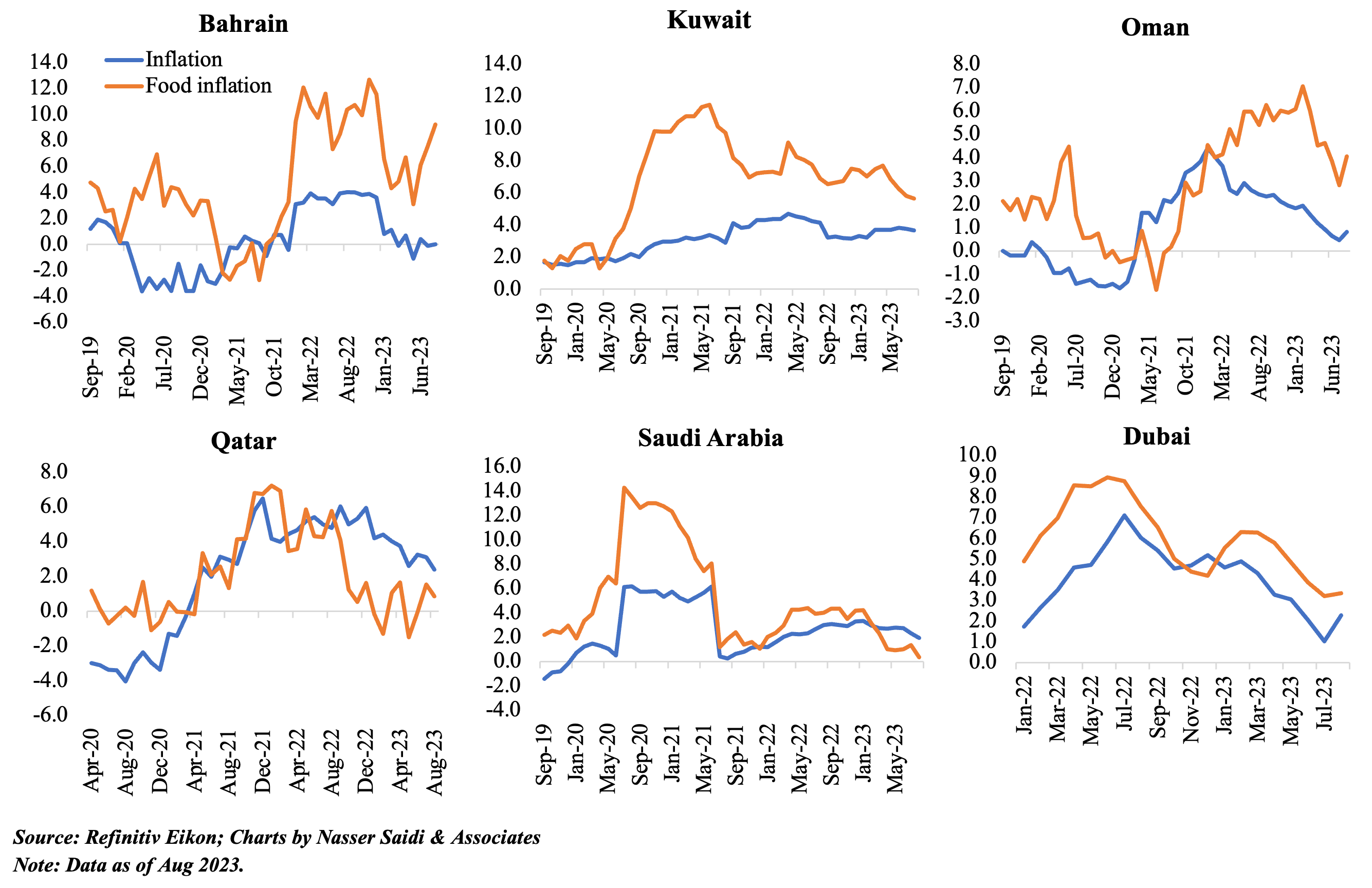

4. Inflation is easing from recent highs in the GCC. While food prices are ticking up in a few, housing costs continue to drive up prices in Dubai & Saudi Arabia

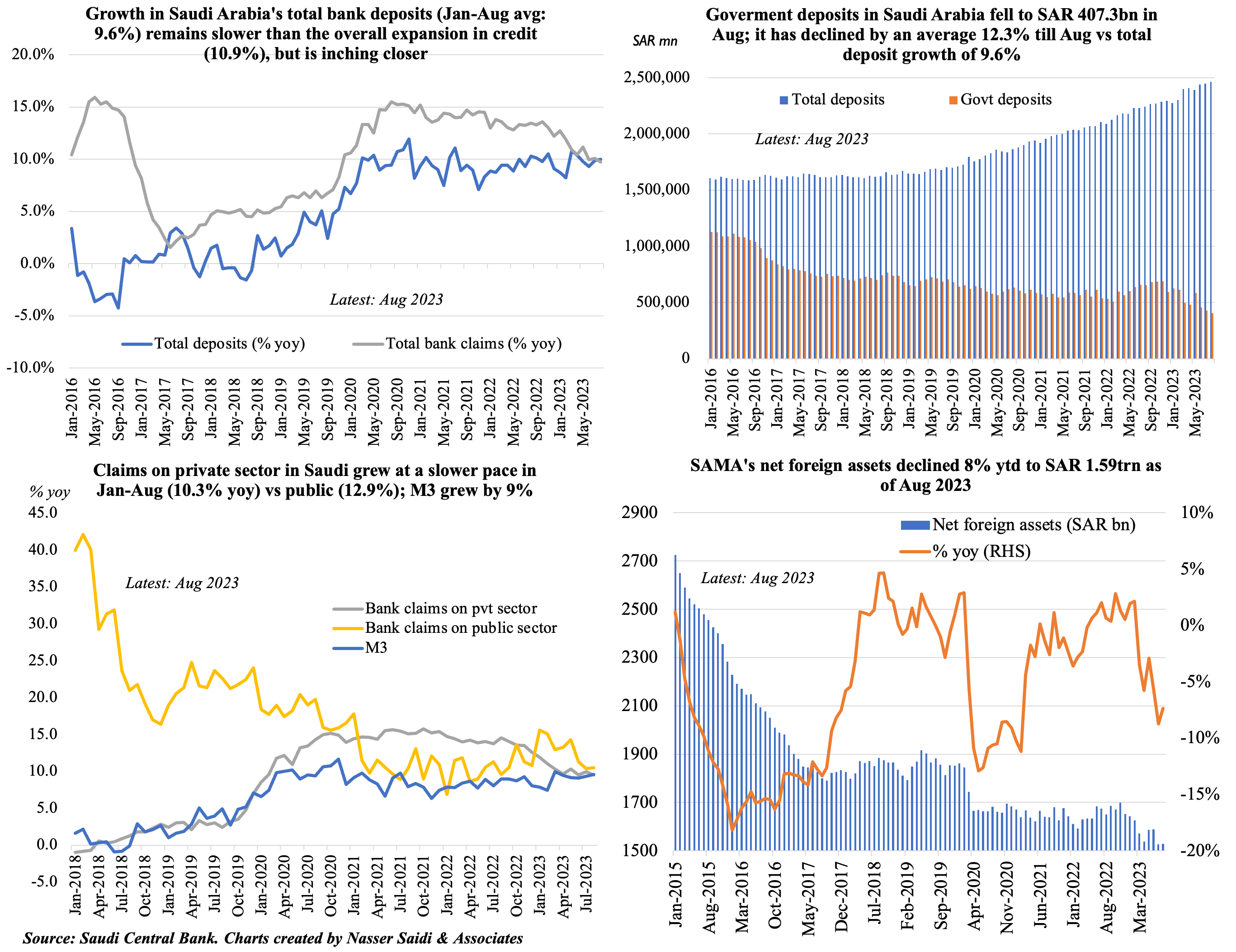

5. Deposit & credit growth in Saudi Arabia stood at 10% yoy in Aug, narrowing in recent months; govt deposits fell by 12.3% yoy in Jan-Aug 2023 while net foreign assets fell to SAR 1.59bn in Aug (-8% ytd)

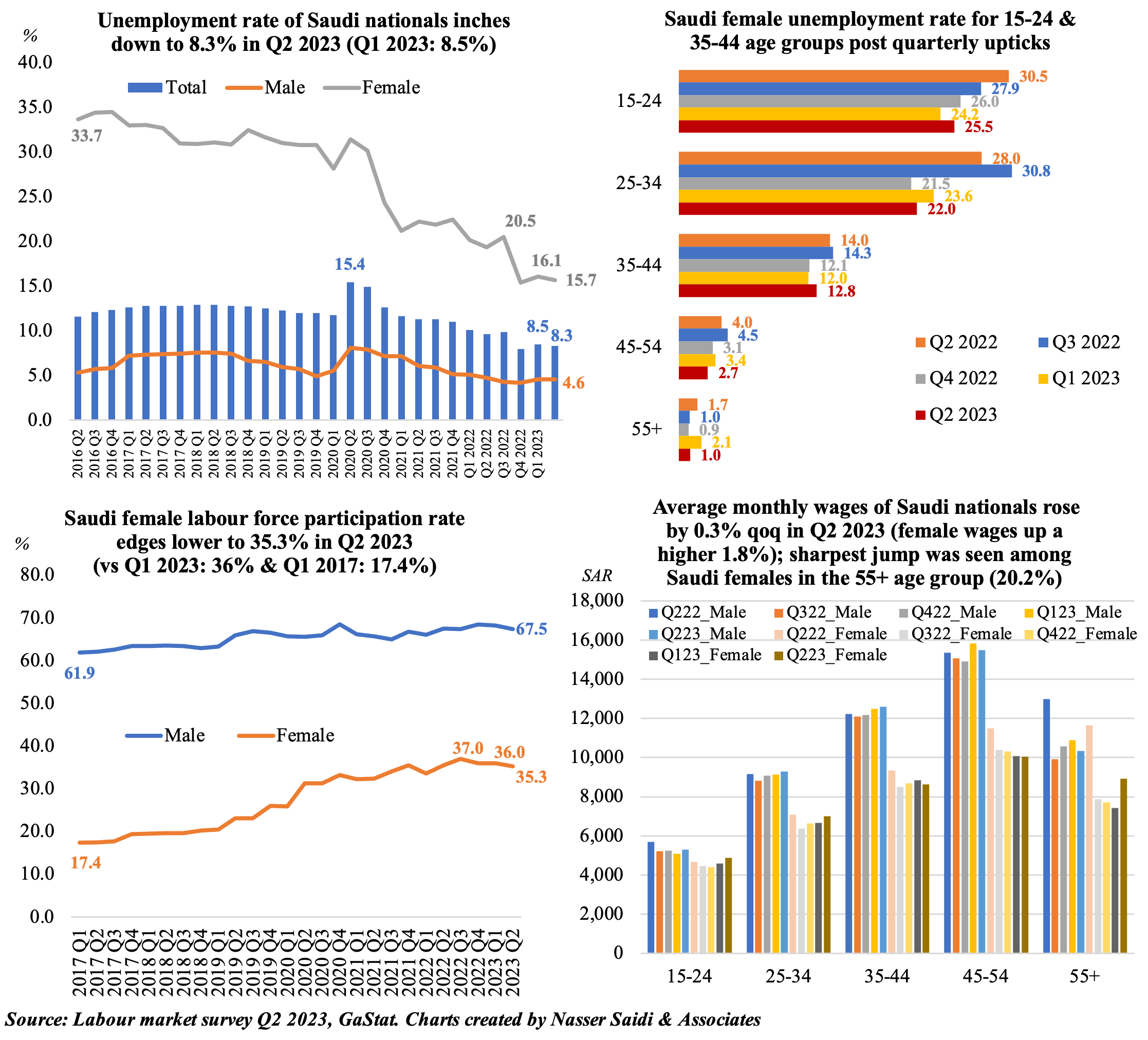

6. Unemployment rate of Saudi citizens fell to 8.3% in Q2 2023

- Unemployment in Saudi Arabia (inclusive of expats) also declined to 4.9% in Q2 2023 (Q1: 5.1%). Saudi citizens unemployment rate also eased: 3% in Q1 (Q4: 8.5%).

- Saudi female unemployment rate slipped to 15.7% in Q2 (half of 31.4% in Q2 2020); under-24 & 35-44 age groups saw quarterly upticks in rates (5.3% and 6.3% qoq respectively).

- Female labour force participation was a tad lower at 35.3% in Q2.

- Females’ wages grew by 1.8% qoq to SAR 7,859 in Q2), with wages of 55+ driving growth (20.2% qoq to SAR 8,934). However, the male-female wage gap remains highest in 35-54 age groups: when men earn 1.5X vs women.

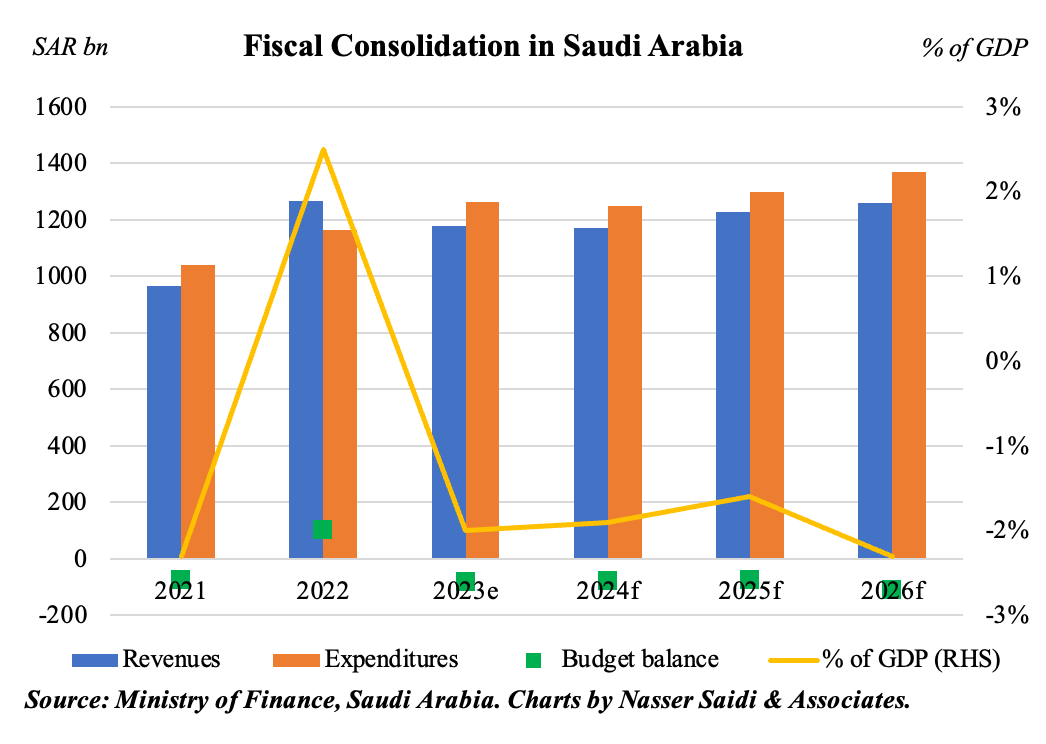

7. Saudi Arabia moves into fiscal deficit territory from 2023

- Saudi Arabia’s fiscal balance is estimated to have moved into a deficit of SAR 82bn in 2023 (2.0% of GDP vs a budgeted surplus of 0.4% of GDP), given the oil production cuts and subsequent drop in oil revenues.

- In 2024, revenues and spending are budgeted to fall by 0.7% and 0.9% respectively, thereby narrowing budget deficit to SAR 79bn (1.9% of GDP).

- Diversification efforts will support non-oil revenue generation in Saudi Arabia.

- Consolidation remains a keyword as spending is budgeted to grow at a slower pace than revenues in 2025. Financing deficits will be done via an annual borrowing plan; also “access[ing] global debt markets to enhance the kingdom’s position in international markets”.

- The pre-budget statement document also highlights the critical role of the PIF: by end of FY 2025, the PIF aims to inject up to SAR 1trn into new projects domestically, contribute SAR 1.2trn to non-oil GDP cumulatively through its companies’ portfolio & create 1.8mn jobs.

- Additional policy steps can further support fiscal consolidation, including: (a) phase out fuel/ electricity subsidies (IMF estimates Saudi fossil-fuel subsidies at USD 253bn or 27% of GDP in 2022, split roughly equally between explicit & implicit subsidies); (b) rein in public sector wage bills, by offering incentives for job creation in the private sector; and (c) diversifying non-oil revenue sources (e.g. introduction of property taxation) among others.

Powered by: