Saudi crude oil exports & production. Oman fiscal surplus. Saudi inflation. Middle East airlines & outlook.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 19 August 2023: Oil production declines, lowering revenues, amid easing inflation & resilient air transport

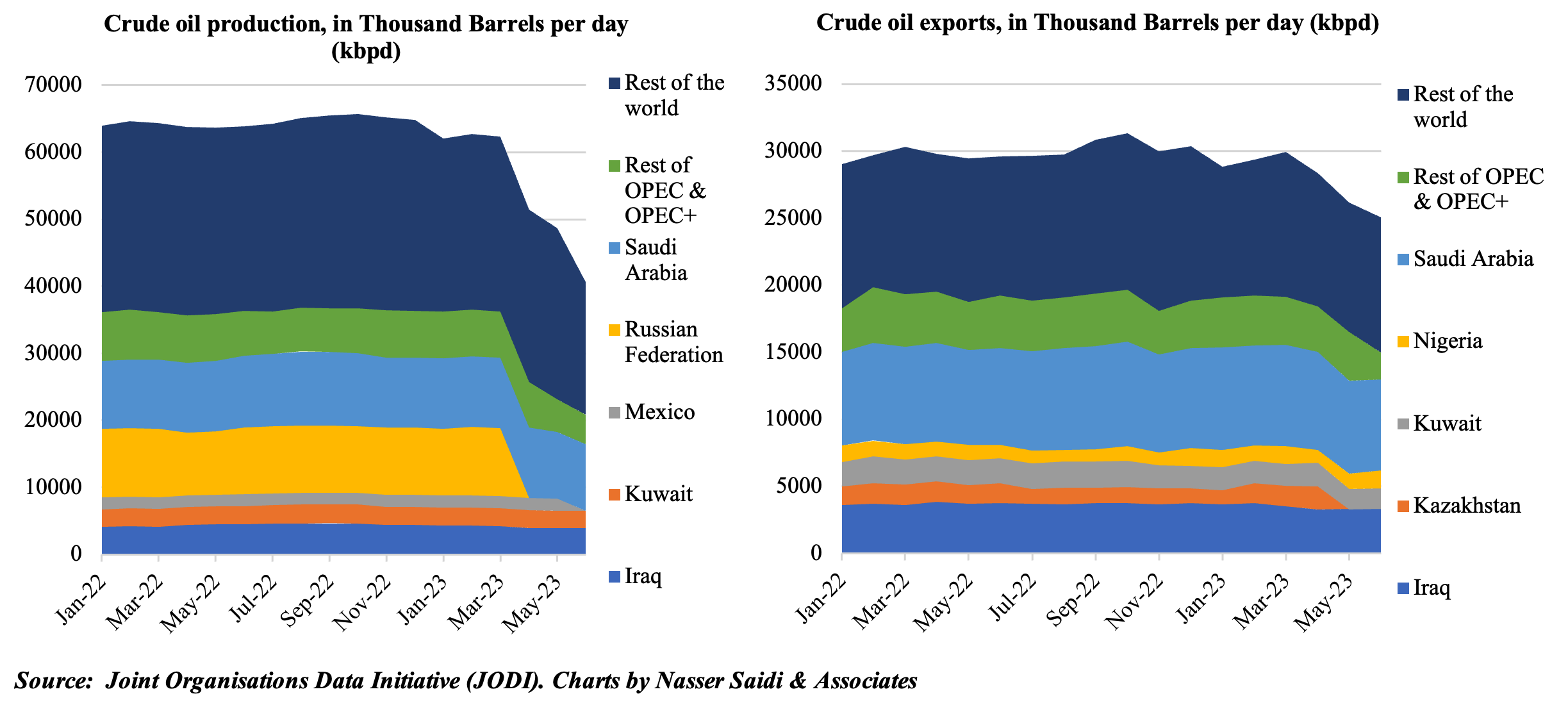

1. Saudi Arabia’s crude oil production and exports fell in Jun, contributing to tighter global oil supplies

- Figures from the Joint Organizations Data Initiative (JODI) show the massive decline in crude oil production following the additional voluntary cuts: Saudi oil production declined to 9.956mn barrels per day (bpd) in Jun (May: 9.959mn bpd); together OPEC and OPEC+ nations’ oil production slipped to 20.88mn bpd in Jun (May: 23.14mn bpd) according to available estimates.

- Combined crude oil exports of OPEC& OPEC+ nations have also declined: to 14.97mn bpd (May: 16.5mn bpd). However, there are variations across nations: while Saudi exports fell to a 21-month low of 6.8mn bpd in Jun (May: 6.93mn bpd), exports from Iraq and Nigeria inched up to 3.34mn bpd (May: 3.31mn bpd) and 1.31mn bpd (May: 1.15mn bpd) respectively.

- India and China together import more than 80% of Russian crude oil: amid sanctions from the West, Russia’s deep discounts were welcomed. India imported 4mn bpd from Russia as of mid-Aug (lower than Jul’s 1.9mn bpd, given Russia’s voluntary cut of 500k bpd), about 46% of the total Russia oil exports, while China accounted for another 40% (Source: Vortexa).

- Weak and deteriorating Chinese data and a potential higher-interest-rates-for-longer scenario add uncertainty to the growth outlook and oil demand, as oil supply remains tight and the USD strengthens.

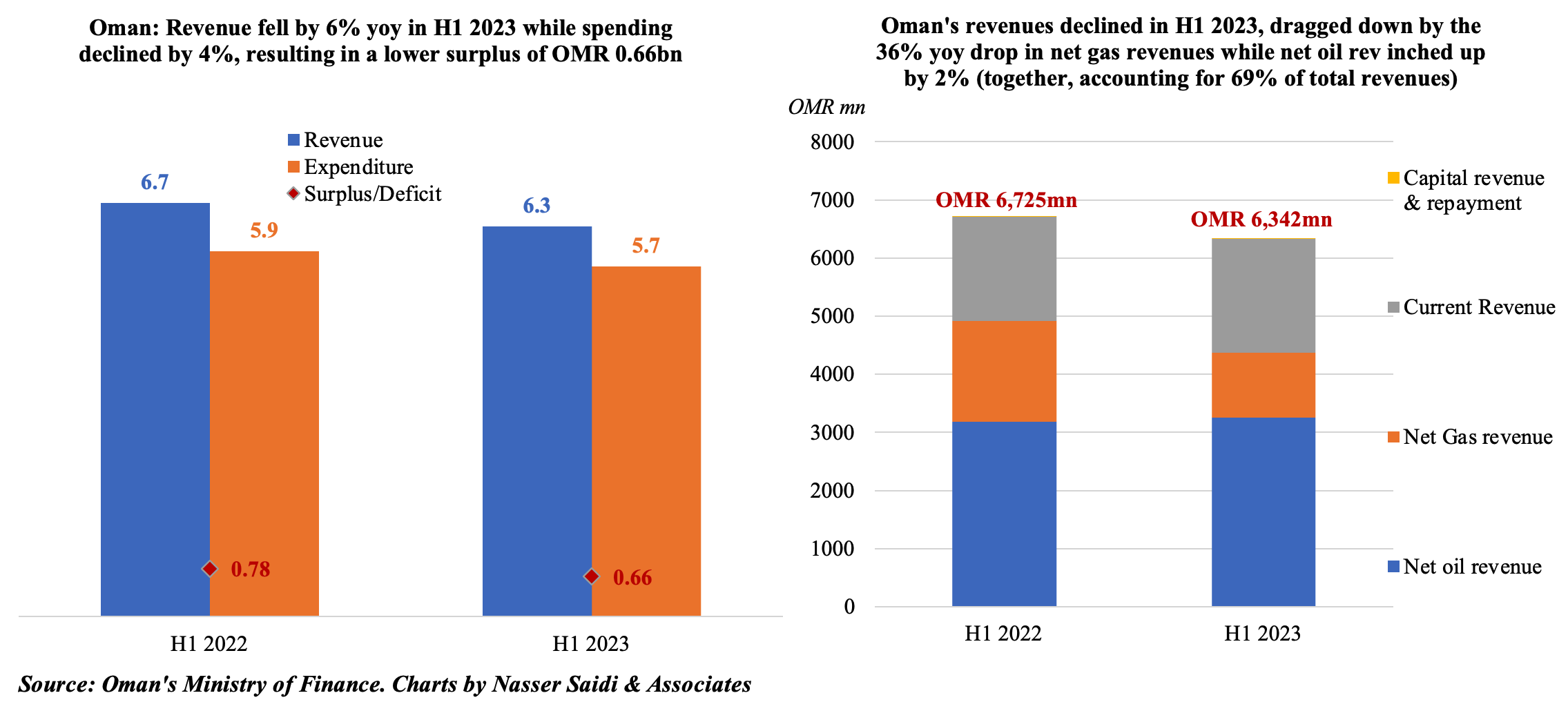

2. Oman’s fiscal surplus touches OMR 656mn in H1 2023

- Oman posted a budget surplus of OMR 656mn at end-Jun 2023: total revenue decreased by 6% yoy to OMR 6.3bn while spending fell by 4%. This compares to a projected deficit of OMR 1.3bn as per the 2023 budget.

- While oil production increased by 2% to 1.061mn barrels per day at end-H1 2023, oil price fell by 5% to USD 83, leading to a 2% increase in net oil revenue to OMR 3.3bn in H1 2023.

- Net gas revenues tumbled by 35.5% to OMR 1.12bn (largely due to “the deduction of gas purchase and transport expenses from total revenue collected from Integrated Gas Company” according to the ministry). But together net oil and gas revenues accounted for close to 70% of total public revenue, making it more vulnerable to volatility in the oil & gas markets.

- Spending was lower in H1 2023, as a result of a 10% yoy decline in both current and development expenditures while oil and transport sector subsidies amounted to OMR 155mn and OMR 54mn respectively in H1 2023. At end-Jun, development expenditure touched OMR 383mn, about 43% of total development spending allocated for 2023.

- Oman repaid more than OMR 1.5bn against public debt, lowering total public debt to OMR 16.3bn(vs OMR 20.8bn in 2021).

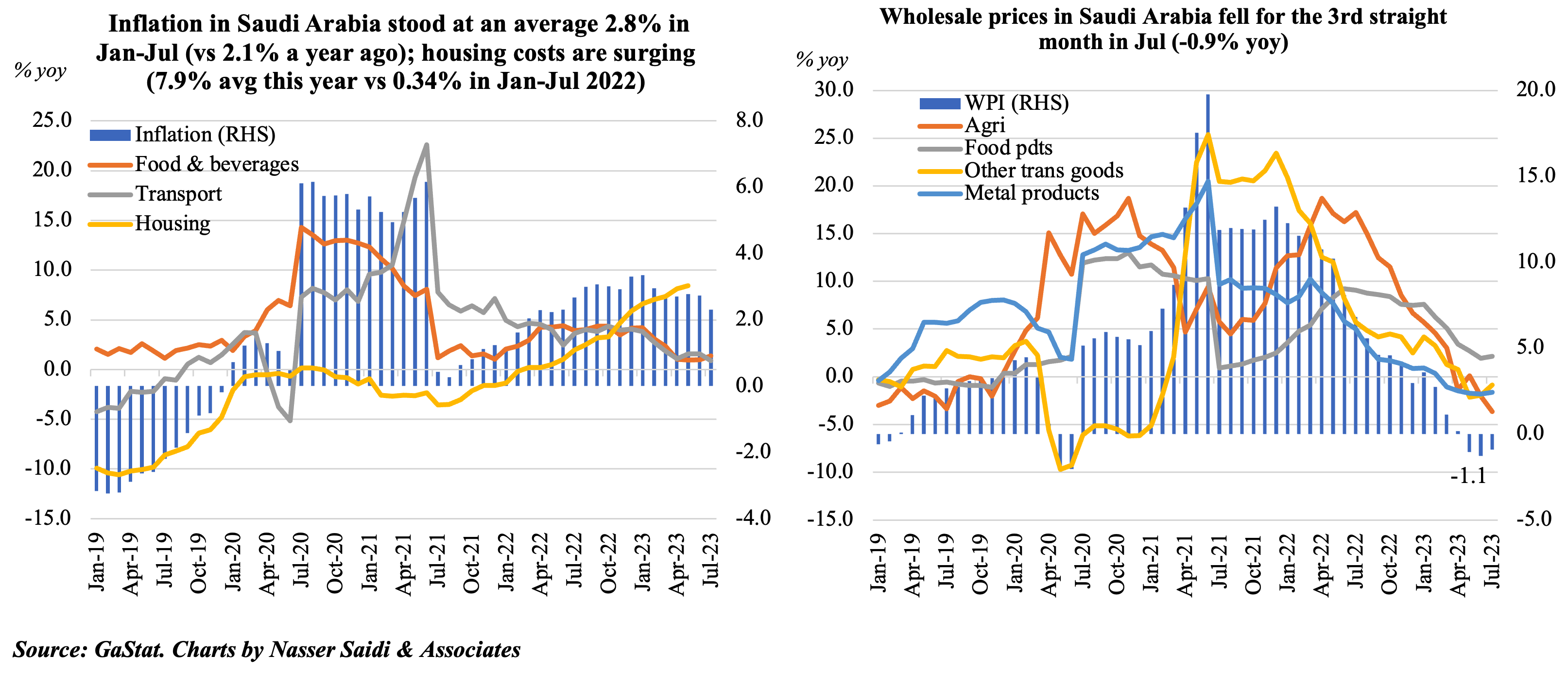

3. CPI in Saudi Arabia eased in Jul, while wholesale prices declined for the third month in a row

- Consumer price inflation in Saudi Arabia eased to 2.3% yoy in Jul (Jun: 2.7%), driven by higher housing costs (8.64%). Overall housing rents surged (10.3% yoy) alongside apartments rents (21.1%), given higher demand for expatriate accommodation. Inflation is Saudi Arabia remains one of the lowest in the GCC/ MENA region.

- In the period Jan-Jul 2023, consumer inflation had inched up to 2.8% versus 2.1% in the same period a year ago. Housing & utilities costs have climbed by 7.9% (from 0.34%) and restaurants & hotels costs are up by 5.4% (from 3.7%) with easing food prices (2.0% versus 3.5%) and transport costs (1.9% from 4.1%).

- Wholesale prices in Saudi Arabia fell in Jul, declining for the third month in a row, with declines seen in 3 of the five categories. WPI plunged to 0.6% in the Jan-Jul 2023 period, from the double-digit 10.25% surge a year ago. The declines softened in Jul: other transportable goods (-0.9% from -1.9% in Jun) and metal products (-1.6% from -1.8%); ores and minerals saw prices edge up to 0.07% from Jun’s 0.8% dip while food prices were up 2.1% (Jun: 1.96%).

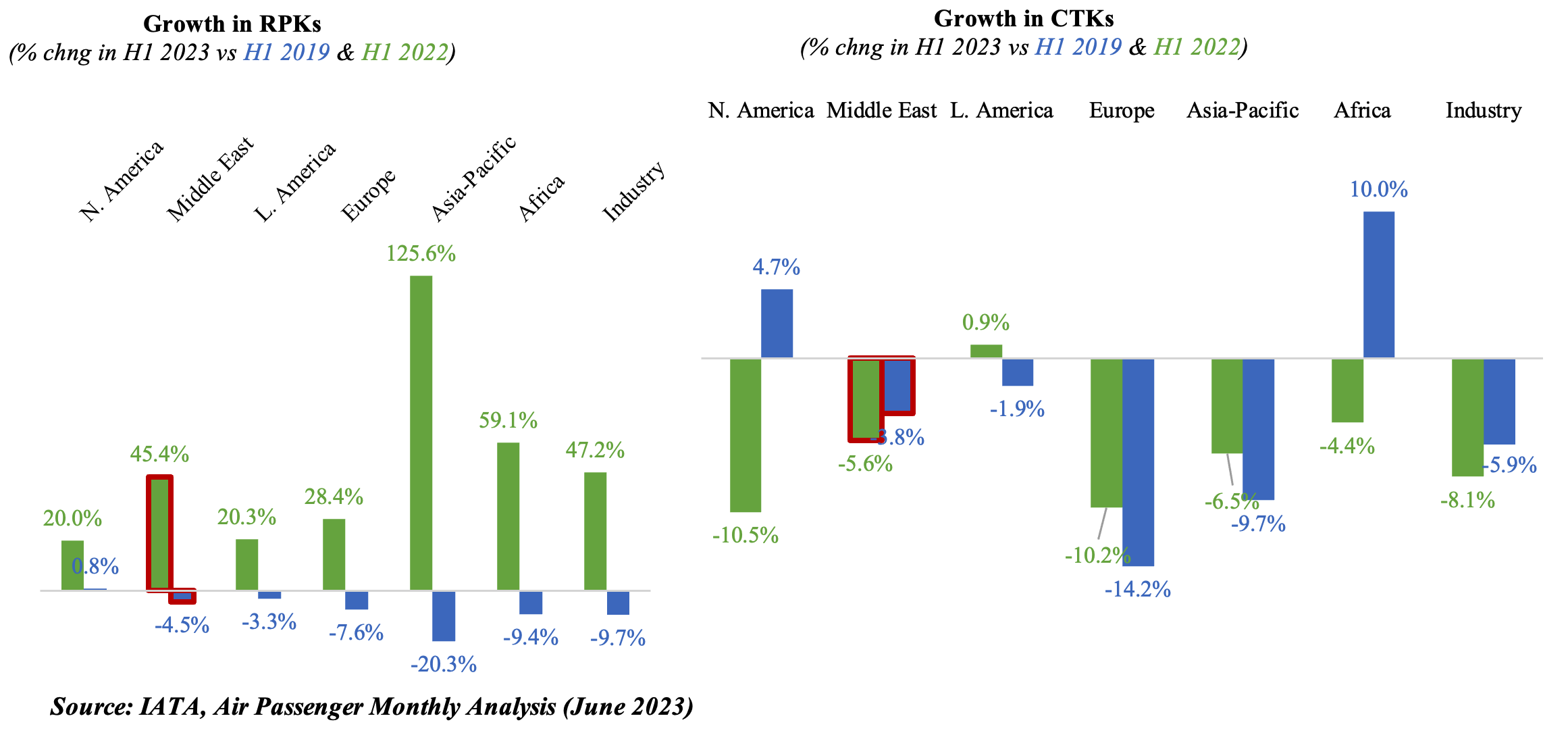

4. Middle East airlines highlight a strong first half in 2023, supported by buoyant pent-up demand while cargo pulls back slightly

- Revenue passenger kilometres (RPKs) in the Middle East grew by 45.4% yoy in H1 2023 but remained below 4.5% of Q1 2019 levels. International RPKs also grew but remained 4.2% below pre-pandemic levels.

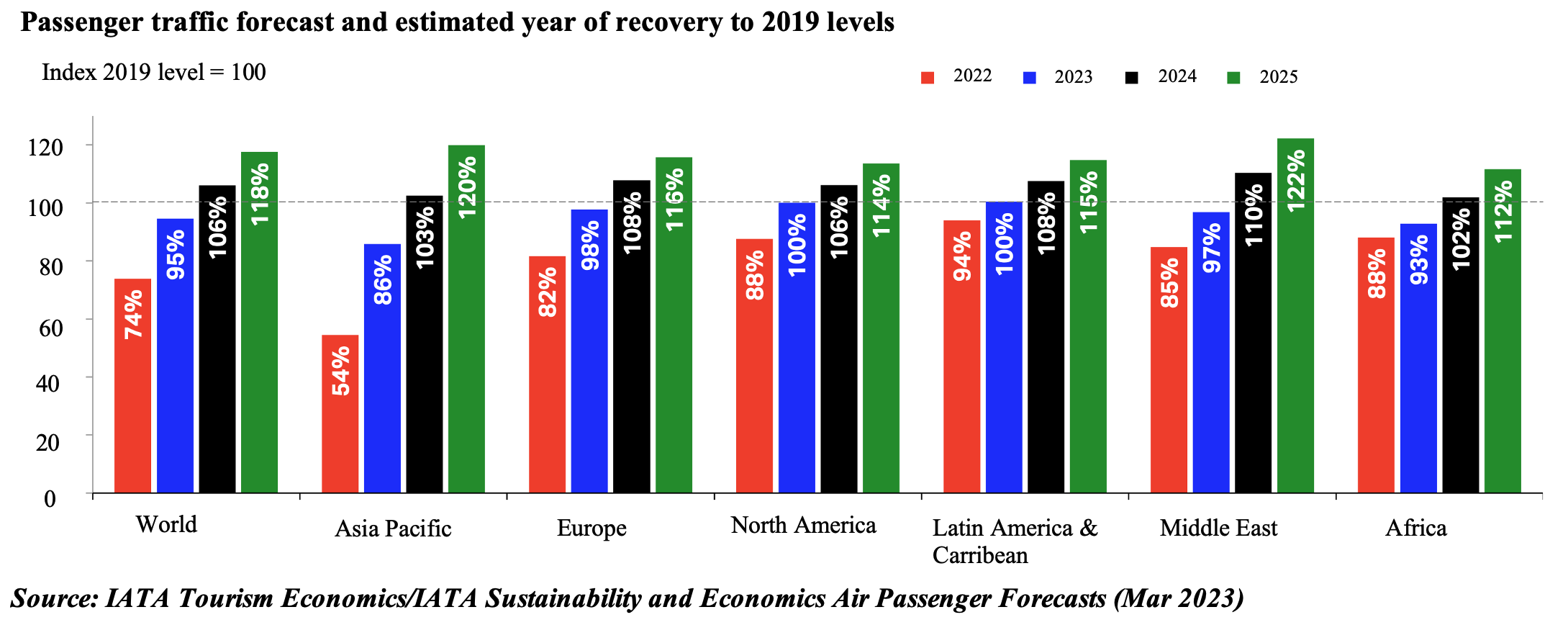

- Passenger traffic recovery is expected to cross 2019 levels in 2024 in the Middle East; North America & Latin America to recover in 2023.

- The decline in cargo activity meanwhile is reflective of the global slowdown. However, global cargo demand fell by 3.4% in Jun, the smallest decline since Feb 2022.

- Year- to-date cargo tonne-kilometers (CTKs) in the Middle East were 5.6% below last year’s level (3.8% below 2019). Major trade route areas connecting Middle East-Asia and Middle East-Europe saw yoy growths, with CTKs rising by 1.8% & 2.1%, respectively.

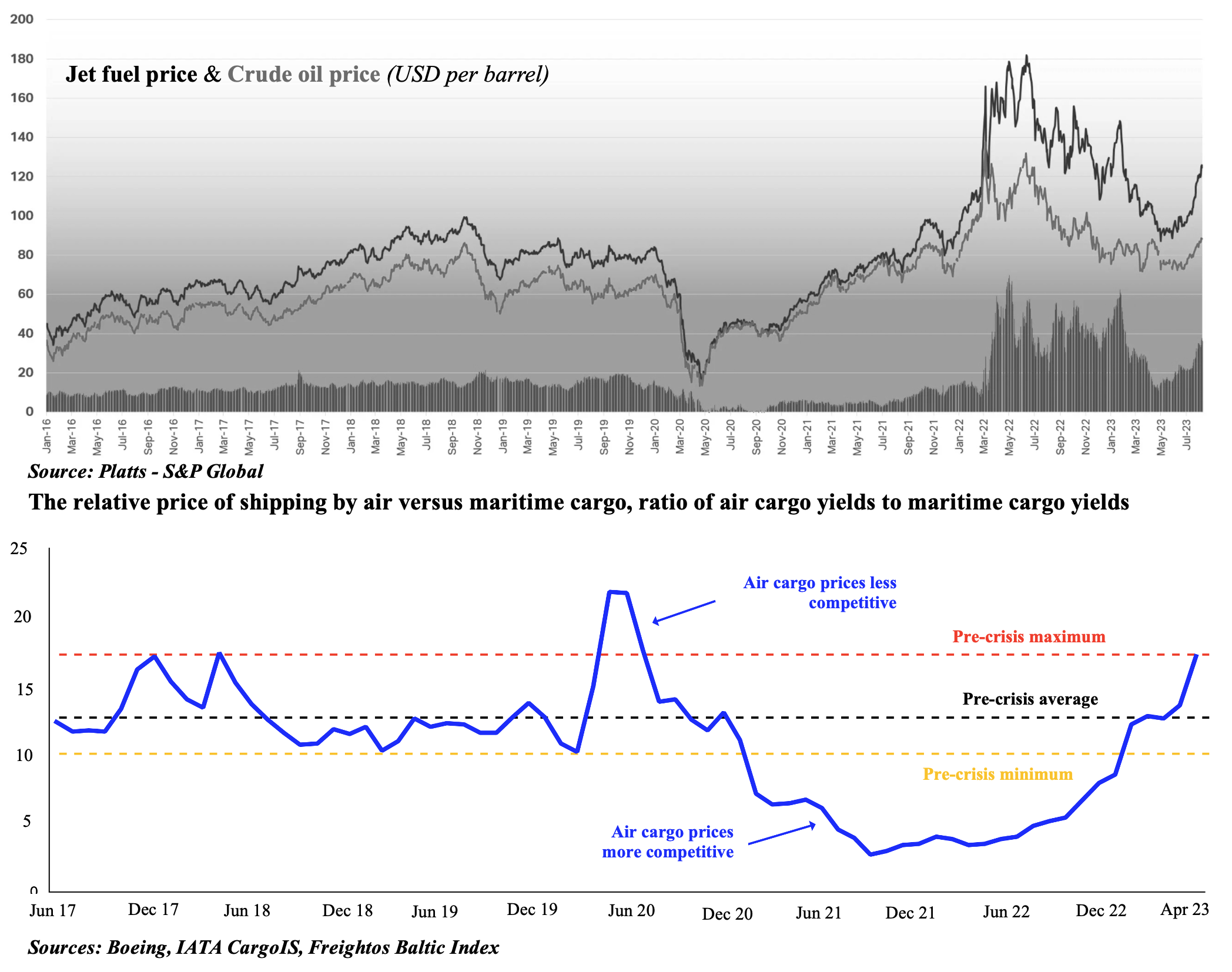

5. Pressures on airlines’ operating costs ticking up again in 2023; air cargo lost its recent relative price advantage over ocean shipping

Fuel accounts for a large share of airline costs; together with labour costs, it makes up around 50% of total costs. IATA expects Middle East carriers to post a net profit of USD 2bn this year, at a 3.8% margin.

Powered by: