Markets

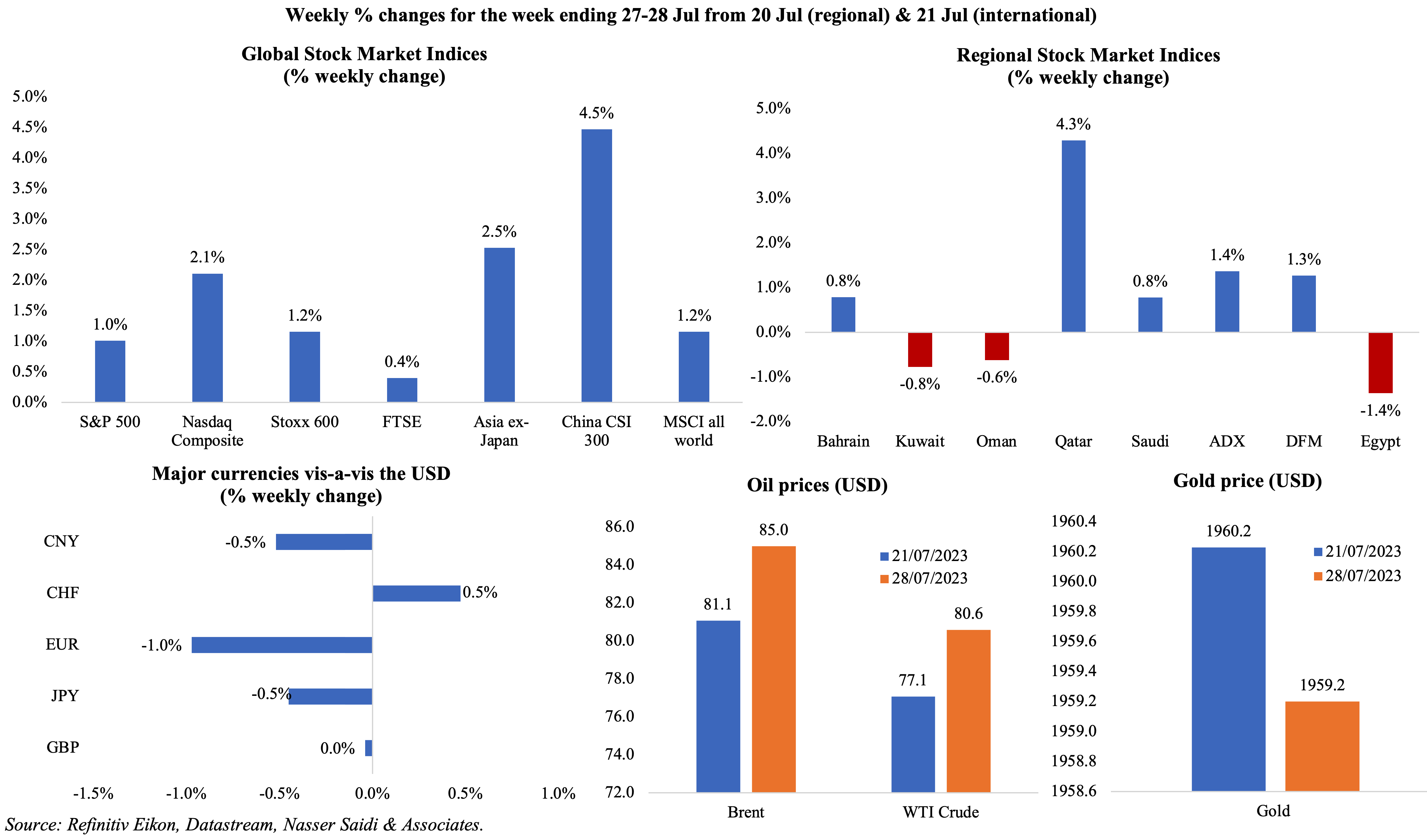

Global equity markets were mostly higher at the end of last week: US markets ended on a positive note given signs of slowing inflation (and led by tech stocks), while European markets touched a 17-month high on Thursday after the ECB did not close the door on the possibility of a pause at the next meeting. Japanese banking stocks surged 4.6% to an eight-year high after the BoJ adjusted its yield curve control scheme, while the MSCI All Country Index gained some 17% year-to-date. Regional markets were mixed with Qatar gaining the most (thanks to a jump in petrochemicals) while UAE markets posted weekly gains of around 1.4% on optimism of interest rate pauses in the offing. The yen was most volatile following the BoJ decision. Oil prices posted the 5th consecutive weekly gain on tighter supply while gold prices inched slightly lower to USD 1959.2 an ounce.

Global Developments

US/Americas:

- Fed raised the federal funds rate by 25bps to a new 5.25%-5.5% target range, the highest level in 22 years. The FOMC stated that inflation remained “elevated” and that it would “continue to assess additional information and its implications for monetary policy”. Fed Chair mentioned during the press conference that the FOMC would “take a data-dependent approach” as to whether more rate hikes were needed.

- Preliminary estimates showed the US GDP grew at a 2.4% annualised rate in Q2 (Q1: 2%). Consumer spending rose at a 1.6% pace (Q1: 4.2%) while government spending added to growth and a measure of domestic demand increased at a 2.3% rate (Q1: 3.2%).

- PCE price index rose by 0.2% mom in Jun (May: 0.1%), with food prices down by 0.1% and energy products prices up 0.6%. PCE was up by 3% yoy in Jun, the smallest gain since Mar 2021 (May: 3.8%) while core PCE eased to a 20-month low of 4.1% (May: 4.6%). Personal income grew by 0.3% mom in Jun (May: 0.5%) while spending increased at a faster pace of 0.5% (May: 0.1%), resulting in the personal saving rate declining to 4.3% (May: 4.6%).

- Durable goods orders grew by 4.7% mom in Jun, the most since Jul 2020 and following May’s 1.8% gain. Transportation equipment jumped by 12.1%, supported by non-defence aircraft and parts (69.4%); non-defence capital goods orders excluding aircraft, a proxy for business spending, rose by 0.2% (May: 0.5%).

- US goods trade deficit narrowed to USD 87.8bn in Jun (May: USD 91.3bn). Exports were up to USD 162.5bn in Jun (+USD 0.4bn from May) while imports were at USD 250.3bn (lower by USD 3.6bn compared to May).

- Richmond Fed manufacturing index dropped to -9 in Jul (Jun: -8), with shipments and new orders indices falling slightly. Kansas Fed manufacturing activity plunged to -20 in Jul (Jun: -10), staying in negative territory for the 4th straight month. Chicago Fed national activity index declined to -0.32 in Jun (May: -0.28), with three of the four categories posting negative contributions.

- S&P Global composite PMI in the US moved to a 5-month low of 52 in Jul (Jun: 53.2). Manufacturing PMI improved in Jul, albeit remaining below-50 (49 from 46.3): while total new orders increased further, export conditions worsened. Services PMI continued to drive growth (52.4 from Jun’s 54.4): new business from abroad rose at the fastest pace since May 2022 even as domestic demand lost some momentum given higher interest rates.

- S&P Case Shiller home price indices fell by 1.7% yoy in May, the same as the yoy decline in Apr. Regional disparities were striking, with 10 cities posting higher prices in yoy terms and another 10 reporting lower prices.

- New home sales fell by 2.5% mom to 697k in Jun (May’s pace was highest since Feb 2022); houses under construction made up 60.2% of inventory. Pending home sales grew by 0.3% mom in Jun, the first increase since Feb; in yoy terms, declining by 15.6%.

- Michigan consumer sentiment index was revised down to 71.6 in Jul (from preliminary reading of 72.6 and Jun’s 64.4), the highest reading since Oct 2021. The 5-year consumer inflation expectation inched lower to 3% (from 3.1% in the previous month) while the one-year inflation expectation stayed put at 3.4%.

- Initial jobless claims dropped by 7k to 221k in the week ended Jul 21st, the lowest since Feb, and the 4-week average fell by 3.75k to 233.75k. Continuing jobless claims fell by 59k to 1.69mn in the week ended Jul 14th, the lowest level since late-Jan. The Fed Chair had pointed to the labour market being “very tight”, also stating that some softening of labour market conditions would be needed for inflation to ease further.

Europe:

- The ECB raised interest rates for the 9th consecutive time, raising its benchmark deposit rate by 25bps to 3.75%, a rate last seen in 2001 (when the euro was launched). The ECB remains concerned about domestic price pressures including rising wages, warning that inflation was still expected to remain “too high for too long”.

- Composite PMI in the eurozone fell by one point to 48.9 in Jul, the lowest since Nov 2022, as demand conditions worsened. Manufacturing PMI worsened to a 38-month low of7 (Jun: 43.4), with new orders plunging at one of the fastest paces since 2009 alongside a decline in input costs (also the most since 2009). Services PMI inched slightly lower to a 6-month low of 51.1 (from 52).

- Economic sentiment indicator in the euro area slipped for the third month in a row to 94.5 in Jul (Jun: 95.3), the lowest reading since Oct 2022. The EDI deteriorated most in France (-2.3 points), Germany (-2.1) and the Netherlands (-0.9). Consumer confidence in the euro area rose by 1 point to -15.1 (in line with the preliminary estimate) while business confidence slipped to -0.09 (Jul: +0.06).

- Germany economy stagnated in Q2, with GDP flat in qoq terms (Q1: -0.1% and Q4: -0.4%); in yoy terms GDP declined by 0.2% in Q2, following a 0.5% drop in Q1. According to Destatis, household final consumption expenditure stabilised in Q2, following the previous 2 quarters.

- Preliminary estimate of inflation (HICP) in Germany eased to 6.5% in Jul (Jun: 6.8%), the lowest level since Feb 2022. Core inflation fell to 5.5% from Jun’s 5.8%. Non-harmonised inflation fell to 6.2% in Jul (Jun: 6.4%), with food inflation remaining high (+11% yoy).

- Germany’s composite PMI fell below-50 in Jul for the first time since Jan, with the preliminary reading at 48.3 (Jun: 50.6). Manufacturing PMI plunged to 38.8 (from 40.6), with output falling at the sharpest rate since Nov 2022; the sector also reported the first drop in employment since Jan 2021. Services PMI inched lower to 52 from 54.1 the month before.

- German Ifo business climate index fell for a third consecutive month in Jul, with the reading slipping to 87.3 (Jun: 88.6). Bleak readings were also seen in the current assessment and expectations, registering declines of 2.4 and 0.3 points to 91.3 and 93.7 respectively.

- GfK consumer confidence index in Germany improved in Aug, rising to -24.4 from the previous month’s -25.2 reading. Income expectations increased to the highest since Feb 2022, optimism increased about lower inflation (-5.1 from -10.6 in Jul) and the propensity to buy improved (-14.3 from -14.6).

- UK manufacturing PMI fell to a 38-month low of 45 in Jul (Jun: 46.5) while services PMI slipped to 51.5 from 53.7. A marginal growth in business volumes in the services sector was offset by manufacturing sales. New export orders declined the most since Nov 2022 across both sectors. Composite PMI as a result eased to a 6-month low of 50.7 from 52.8 in Jun.

Asia Pacific:

- The Bank of Japan left interest rates unchanged; however, it shocked markets by opting for “greater flexibility” and relaxing its cap on bond yields: BOJ would offer to buy 10Y government bonds at 1.0% in fixed-rate operations, instead of the previous 0.5% rate.

- Inflation in Tokyo stood at 3.2% in Jul, unchanged from Jun’s reading. However, excluding food and energy, prices rose to 4% (Jun: 3.8%). Excluding fresh food, prices slowed to 3% from Jun’s 3.2%, but remains above BoJ’s target of 2% for the 14th consecutive month.

- Preliminary reading of Japan’s manufacturing PMI slipped slightly to 49.4 in Jul (Jun: 49.8) as both output and new orders scaled back while business sentiment remained at the joint-second highest level seen since the start of 2022. Composite PMI remained unchanged at 52.1, as services business activity index eased marginally to 53.9 (from Jun’s 54).

- Japan’s leading economic index clocked in at 109.2 in May, lower than the preliminary reading of 109.5 but higher than Apr’s final reading of 108.1. The coincident index however inched up to 114.3, the highest since Sep 2022 (preliminary estimate: 113.8, Apr: 114.2).

- GDP in South Korea grew by 0.6% qoq in Q2 (Q1: 0.3%), the biggest quarterly growth since Q2 2022. Exports fell by 1.8% and imports at a faster pace of 4.2% while government spending was down by 1.9%, the most since early 1997. In yoy terms, GDP growth stayed at a 0.9% gain, same as the previous quarter.

- Inflation in Singapore eased to 4.5% yoy in Jun (May: 5.1%), as food and energy prices moderated. Core inflation slowed to 4.2% from May’s 4.7% uptick. Core inflation is expected to average 3.5-4.5% and headline inflation is forecast to range between 4.5-5.5% this year.

- Industrial production in Singapore rebounded in Jun, up by 5% mom (May: -3.5%). In yoy terms, IP fell for the 9th consecutive month (-4.9%) but improving from May (-10.5%).

Bottom line: IMF forecasts global economic growth to fall to 3.0% in 2023, following 3.5% growth in 2022, with growth supported by emerging markets. In general, manufacturing remains weak alongside stronger services sector activity, as can be seen in last week’s preliminary PMI results. Across the EU, Germany and the UK, manufacturing PMI readings fell to a 38-month low while new export business also declining. The housing and real estate market in the US is weaker, reflecting the impact of higher interest rates. This week the Bank of England meets, with markets expecting a 25bps hike given the signs of inflation slowing down. Central banks are for now concerned about tight job markets and rising wages, wage-push inflation, particularly in the labour-intensive services sector; central bank heads have left the policy direction for the coming meeting ambiguous citing it would depend on data (this week’s employment figures will be key as well as GDP data from the eurozone).

Regional Developments

- The IMF estimates growth in the MENA region to decline to 2.6% in 2023 (2022: 5.4%), with the growth revised down from the previous edition of the World Economic Outlook (issued in Apr). This was largely due to Saudi Arabia’s revised down growth forecast (1.9% in 2023), given the oil production cuts and the projected decline in oil prices (-21% in 2023). In 2024, growth is forecast to increase to 3.1% in MENA and 2.8% in Saudi Arabia.

- GCC central banks increased key interest rates by 25bps, mirroring the Fed’s hike, given the dollar peg. However, Kuwait and Bahrain left two rates out of four unchanged.

- Bahrain plans to increase FDI by more than USD 2.5bn by end-2023, disclosed the Deputy PM, following a record USD 1.1bn recorded in 2022.

- Kuwait posted a fiscal surplus of KWD 6.4bn in 2022-23, driven by the surge in oil revenues (64.7%) alongside a 2.6% drop in spending. Revenues grew by 54.7% yoy to KWD 28.8bn, with oil and non-oil revenues accounting for 87.1% and 12.9% of total revenues respectively. Expenditures fell by 2.6% yoy to KWD 22.4bn, about 5% lower than the 2022-23 budget estimate.

- Lebanon was unable to choose a successor for the central bank governor after political disputes led to a lack of quorum. The most senior of the vice governors will step into the post as per the law. The vice governors have proposed various measures going forward including phasing out the exchange platform and introducing a law to allow the Central Bank to lend the government up to USD 1.2bn over a 6-month period.

- Oman introduced major changes to its labour law: this includes part-time work options, Omanisation as well as extended leaves for maternity, paternity and taking care of sick family.

- Oman Investment Authority signed a MoU with Saudi Arabia’s PIF to unlock investment opportunities in the region. This follows the recent establishment of PIF-owned Saudi Omani Investment Co. (that plans to invest up to USD 5bn in Oman). Bilateral trade between Oman and Saudi surged by 123% yoy to USD 7.01bn in 2022.

- Indian tourist arrivals in Oman surged by over 235% yoy to 355k in 2022: the country is the second largest source market for Oman. Oman welcomed around 2.9mn tourists last year.

- Qatar’s money supply grew by 3.6% yoy in Jun (May: 6.5%).

- Qatar Investment Authority is in talks to buy a minority stake in India’s Reliance Retail, reported FT. A USD 1bn investment for a 1% stake places the value of the business at around USD 100bn.

- Trade surplus in Qatar narrowed by 4.4% mom and 42.3% yoy to QAR 17.4bn (USD 4.77bn) in Jun. Exports fell by 3.5% mom and 32% yoy to QAR 26.8bn, declining because of the fall in petroleum gases (-29.7%), crude and non-crude petroleum exports (-26.4% and -46.9% respectively). China was the top destination for exports, with its share at 20.1%.

- Qatar’s Free Zone Authority and Qatar Development Bank signed an agreement to enhance investment climate and strengthen its position as a regional investment destination.

- Qatar will provide Ukraine with USD 100mn in humanitarian aid to support health, education and de-mining, revealed Ukraine’s PM. Also included in the discussions were global food security and the Black Sea grain deal.

- Artificial intelligence will contribute USD 135bn to Saudi Arabia in 2030, or 12.4% of GDP, according to a PwC report. UAE will see the largest impact in terms of share to GDP: 14% of GDP or valued at USD 96bn. Overall, AI could add USD 320bn to the Middle East. More: https://www.pwc.com/m1/en/publications/potential-impact-artificial-intelligence-middle-east.html

- UAE improved its ranking in Kearney’s Global Services Location Index to 21st globally (up 4 places) in a list topped by India, China and Malaysia. Egypt’s ranking slipped 8 places to 23rd while Morocco gained 12 places to 28th. Jordan (39), Saudi Arabia (67), Qatar (74), Kuwait (76), Oman (77) and Lebanon (78) were new entrants to the list. More: https://www.kearney.com/service/digital/gsli/2023-full-report

- The Press Trust of India reported that more than 66% of the total 13.4mn NRIs live in the GCC (data as of March 2022). The highest number of NRIs are in the UAE (3.41mn) followed by Saudi Arabia (2.59mn).

- The Arab Investment and Export Credit Guarantee Corporation (Dhaman) reported a 74% increase in the number of FDI projects to 1617 in Arab nations in 2022; investment costs increased by 358% to USD 200bn. UAE topped the list of projects, with around 923 last year while renewable energy sector accounted for 60% of investment costs.

Saudi Arabia Focus

- US national security adviser and other senior officials met with Saudi Arabia’s Crown Prince last week (hot on the heels of the Blinken’s recent visit); one of the topics under discussion was a deal to normalise ties between Saudi Arabia and Israel.

- The Wall Street Journal reported that Saudi Arabia plans to host Ukraine talks in August, bringing together Western states and major developing nations including India, Indonesia, and Brazil among others. Britain, South Africa, Poland and the EU are among those who have confirmed attendance.

- Saudi Arabia’s GDP slowed to 1.1% in Q2 (Q1: 3.8%) according to preliminary estimates. The decline in oil production resulted in a decline in oil sector activity (-4.2% vs Q1’s 1.4% gain) while non-oil sector growth ticked up by 5.5% (Q1: 5.4%) alongside government services showing a 2.7% uptick.

- Saudi Arabia’s exports fell by 32% yoy and 6.7% mom to SAR 97.1bn in May – this is the lowest since Sep 2021. The fall in exports stemmed from oil exports, which plunged by 38% yoy and 14.1% mom, mainly on lower prices. Imports increased sharply: 9% yoy to SAR 67.7bn, led by machinery & mechanical appliances and vehicles (22% and 17% respectively of total imports).

- FDI into Saudi Arabia increasedby 10.2% yoy and 12,4% qoq to USD 2.1bn in Q1 2023. This is the highest reading since Q2 2021 when the Aramco deal had led to a massive surge (to USD 13.8bn).

- MISA reported an increase in newly issued foreign investment licenses in Q1 2023: 23% qoq to 1346. Construction licenses accounted for 1/4th of licenses, not surprising given the mega/ giga projects in the pipeline, while manufacturing continues to attract investments (1/5th share of licenses).

- SAMA granted licenses to Fas Finance to provide consumer microfinance solutions and to BNPL company Tabby to run its post-paid payment solutions (Saudi’s fifth authorised BNPL solution provider).

- July Sukuk issuance in Saudi Arabia grew by 8.36% mom to SAR 2.63bn (USD 700mn). In Jun the total bid amount received was SAR 2.5bn and in May it was SAR 4.33bn.

- The Saudi Central Bank and the Hong Kong Monetary Authority signed a MoU to develop bilateral ties. Discussions also centred on strengthening collaboration in financial infrastructure development, open market operations, monetary policy and Fintech.

- The Saudi Authority for Industrial Cities and Technology Zones (MODON) disclosed a 23% surge in investment from the private sector to SAR 2.77bn (USD 738mn) in Q2 2023. The food sector secured the most contracts in Q2 (17%), followed by mining (at 9%).

- Saudi Arabia’s Manara Minerals (a JV between the Saudi Arabian Mining Company and PIF) secured a 10% share in Brazil-based Vale Base Metals Ltd, enabling the former to have access to supply chains across strategic minerals, including nickel, copper, and cobalt.

- In a bid to support local exporters and manufacturers in Saudi Arabia, more than 203k certificates of origin documents were issued this year till 30th This is part of Saudi’s objective to increase non-oil exports to GDP to 50% by end of the decade (from 16%).

- Saudi Arabia’s housing market posted an 8% yoy uptick in apartment-linked mortgages in May, according to Knight Frank. Cost of borrowing is rising and in Riyadh alone, average apartment prices went up by 10% from Jan-Jun 2023. Apartments are still a relatively more affordable option compared to villa ownership.

- Saudi Arabia moved up 8 places to 16th internationally in Lloyd’s List global shipping ranking, attributing the increase to the handling over 10.43mn containers at its ports in 2022.

- Saudi Public Investment Fund established the Saudi Tourism Investment Co., or Asfar, to drive investments in tourist destinations and projects in the country.

- Saudi Arabia established the “International Centre for Artificial Intelligence Research and Ethics”, to be based in Riyadh.

UAE Focus![]()

- UAE’s federal revenues declined by 6.6% yoy and 19.2% qoq to AED 115.6bn in Q1 2023. Taxes accounted for 55% of total revenues, underscoring the government’s efforts to diversify source of revenues (away from oil). Spending fell at a faster pace, resulting in a narrowing of net operating balance to over AED 23bn.

- In June, inflation in Dubai eased to 2.1% yoy(May: 3.1%), the lowest reading since Jan 2022. Upticks were seen in housing & utilities (a record-high 5.94% from 5.74%) and restaurants & accommodation (4.87% from 4.56%). June saw slower increases in food prices (3.9% from May’s 4.8%) and furnishings (7.7% from 8.2%) alongside sharper declines in transport prices (-13.9% from -7.1%) and recreation (-4.4% from -1.2%).

- UAE central bank’s credit sentiment survey shows ahealthy credit appetite, despite of the steady increase in interest rates in line with the Fed (given the dollar peg). Growth in demand for business loans was robust in Q2 2023 (though lower than Q1): net balance of +21.8 vs Q1’s +23.4. Personal loans demand jumped to +24.4 in Q2 2023, with highest reading since Jun 2014. Credit cards and housing were the most significant segments.

- The Dubai government is exploring the implementation of common law within its free zones to support its position as a global economic hub.

- Abu Dhabi real estate sector posted a 363% yoy increase in FDI to AED 834.6mn in H1 2023, reported WAM. Separately, Abu Dhabi’s Department of Municipalities and Transport disclosed that total real estate transactions in Abu Dhabi posted an increase in number (41% yoy to 10,557 transactions) and value (106% yoy to AED 46.33bn) in H1 2023. There were 3827 mortgage transactions worth AED 2124bn.

- Luxury home prices in Dubai increased by 11.2% yoy to an average of USD 800 per square foot in H1 2023, the highest price jump in this segment across 30 cities tracked by Savills. Hong Kong is still the world’s most expensive prime residential property, with an average of USD 4,110 per square foot, more than one-and-a-half times that of the second-most expensive market – New York at USD 2,670 per square foot.

- According to real estate firm CRC, India, Norway, UK, France and Russia were the top buyers of commercial real estate in Dubai in Q2 2023. Dubai Land Department reported a jump in commercial sales by 22% yoy to 3080 in Q2, with value rising by 101% to AED 21.385bn.

- Crypto exchange Rain revealed that its Abu Dhabi entity obtained a license to operate a virtual assets brokerage and custody service for clients in UAE. This enables the firm to offer institutional clients and some retail clients the ability to buy, sell and store virtual assets.

- The UAE has joined the Global Biofuel Alliance as part of its effort to reduce its carbon footprint, disclosed the minister of energy and infrastructure. UAE has been investing in biofuels with multiple waste-to-energy plants (either operational or under-development), providing clean energy, reducing emissions and diverting waste from landfills.

- The number of UAE nationals employed in private companies increased by almost three-fold to more than 80k, compared to 27k in 2018, as of July 26th.

Media Review

IMF: Global Economy on Track but Not Yet Out of the Woods

https://www.imf.org/en/Blogs/Articles/2023/07/25/global-economy-on-track-but-not-yet-out-of-the-woods

China closes research publication gap with the US

https://www.ft.com/content/5e56b8d5-baae-40eb-a1e1-53e44f0249f5

Japan PM’s Middle east trip and foundations for hydrogen supplies

https://www.reuters.com/business/energy/japan-pm-laid-foundations-hydrogen-supplies-with-middle-east-trip-2023-07-27/

Lebanon’s central bank leadership uncertainty

https://www.reuters.com/world/middle-east/lebanons-central-bank-faces-uncertainty-without-appointment-new-governor-2023-07-28/

https://www.reuters.com/world/middle-east/lebanons-veteran-central-bank-chief-leaves-post-with-legacy-shreds-2023-07-30/(with Dr. Nasser Saidi’s comments)

Powered by: