Saudi trade. UAE monetary stats. UNCTAD’s Global trade estimates. UNCTAD Productive Capacities Index. WEF Global Gender Gap.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 23 Jun 2023: Recovery in Global Trade; Productive Capacity & Gender Equality are a long-term challenge in MENA

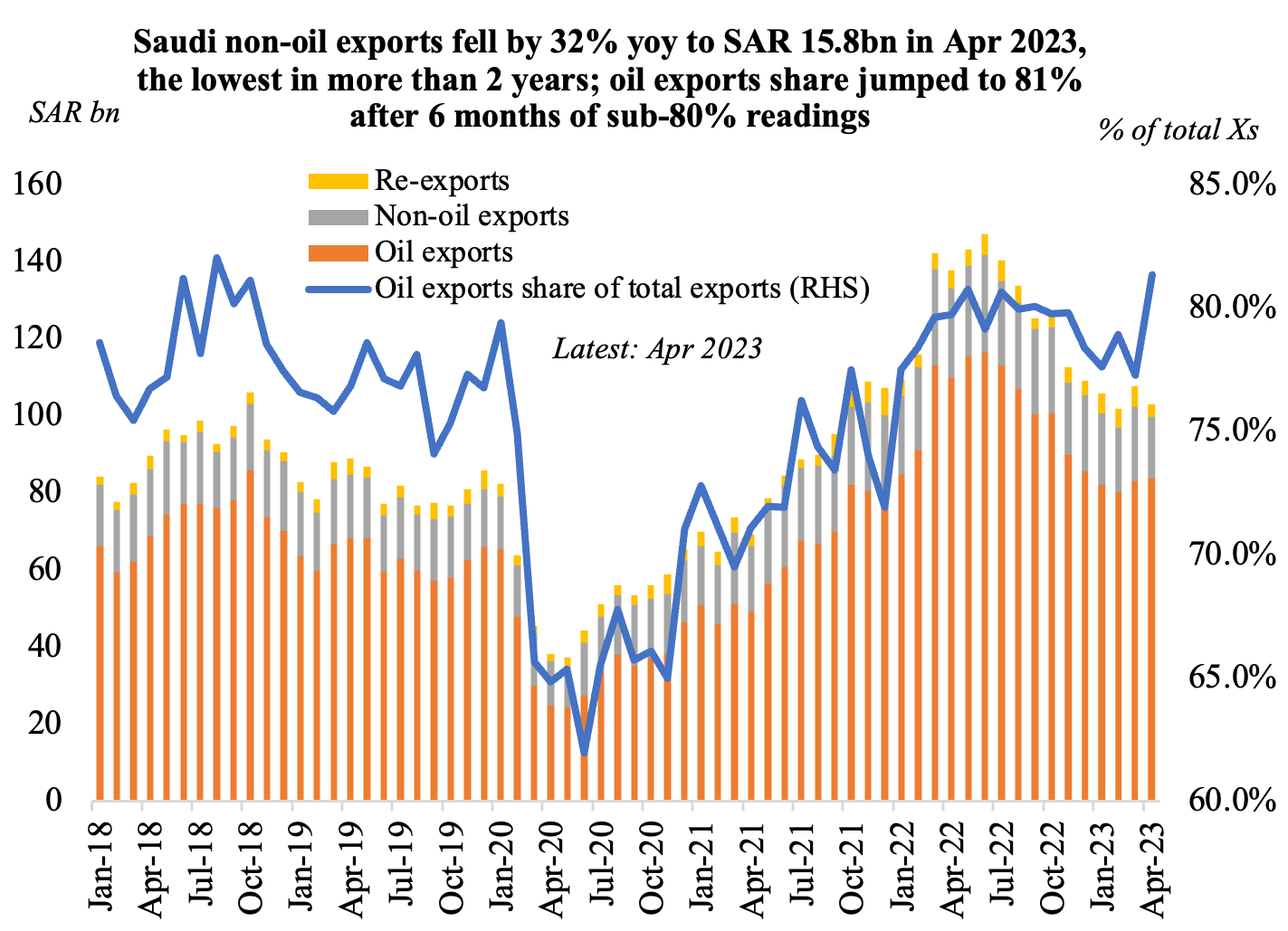

1. Saudi Arabia’s goods exports declined in Apr 2023

- Saudi Arabia’s exports fell by 25.2% yoy and 4.2% mom to SAR 103bn in Apr. The fall in exports stemmed from oil and non-oil exports, which were down by 24% and 32% respectively.

- The share of oil exports to overall exports increased to 81.3% in Apr, a range not seen in the previous 6 months.

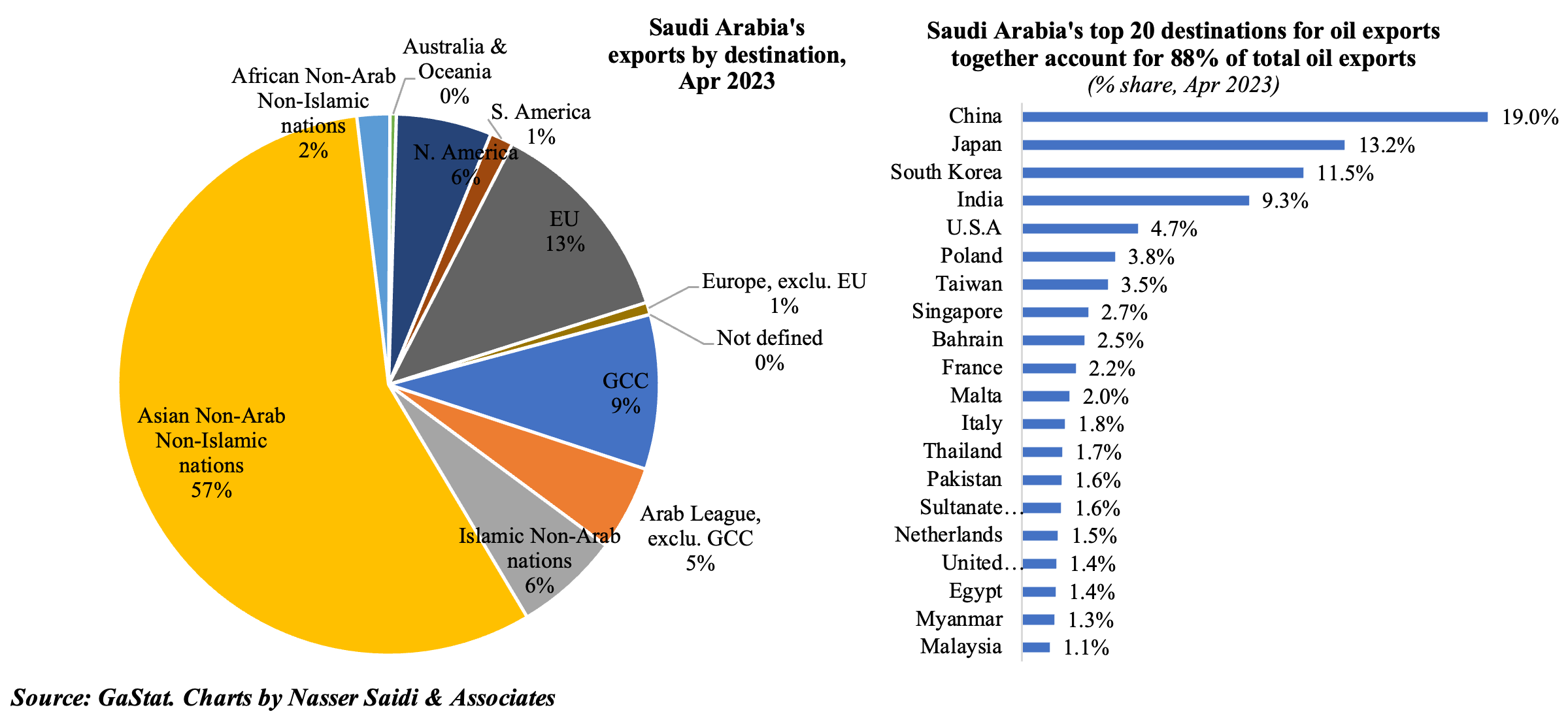

- Oil exports to the top 5 destinations (China, Japan, South Korea, India and the US) accounted for 57% of the total oil exports and for the top 20 it was at ~88%.

- Most exported non-oil good (including re-exports) was chemicals & allied products (34.6% of outbound trade).

- Imports declined sharply in mom terms (-16% mom to SAR 57.9bn).

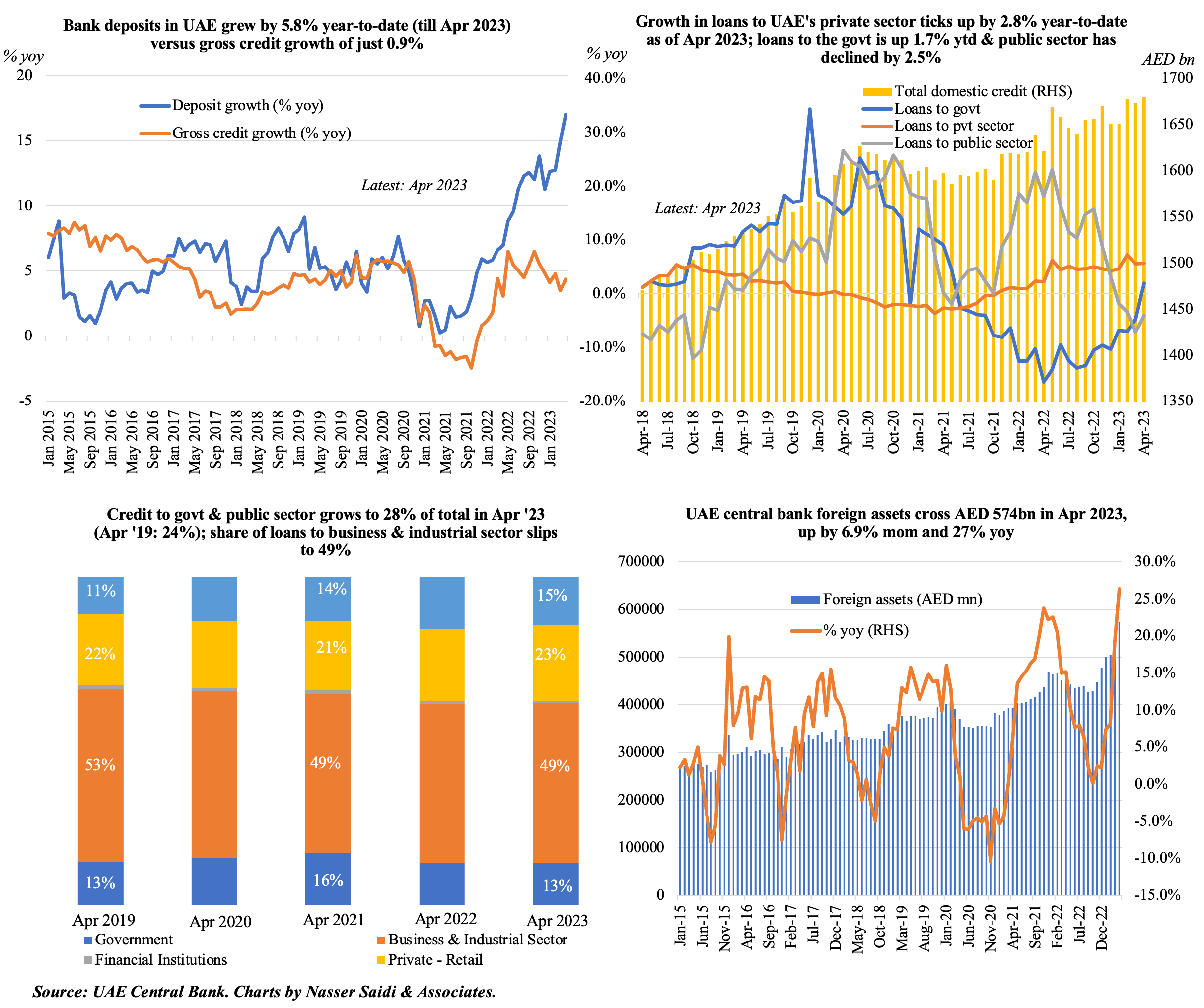

2. UAE central bank expects GDP to grow by 4.3% next year (no change from previous estimate); CBUAE foreign assets jumped to a record high of AED 574.18bn in Apr; bank deposits continue outpacing gross credit growth

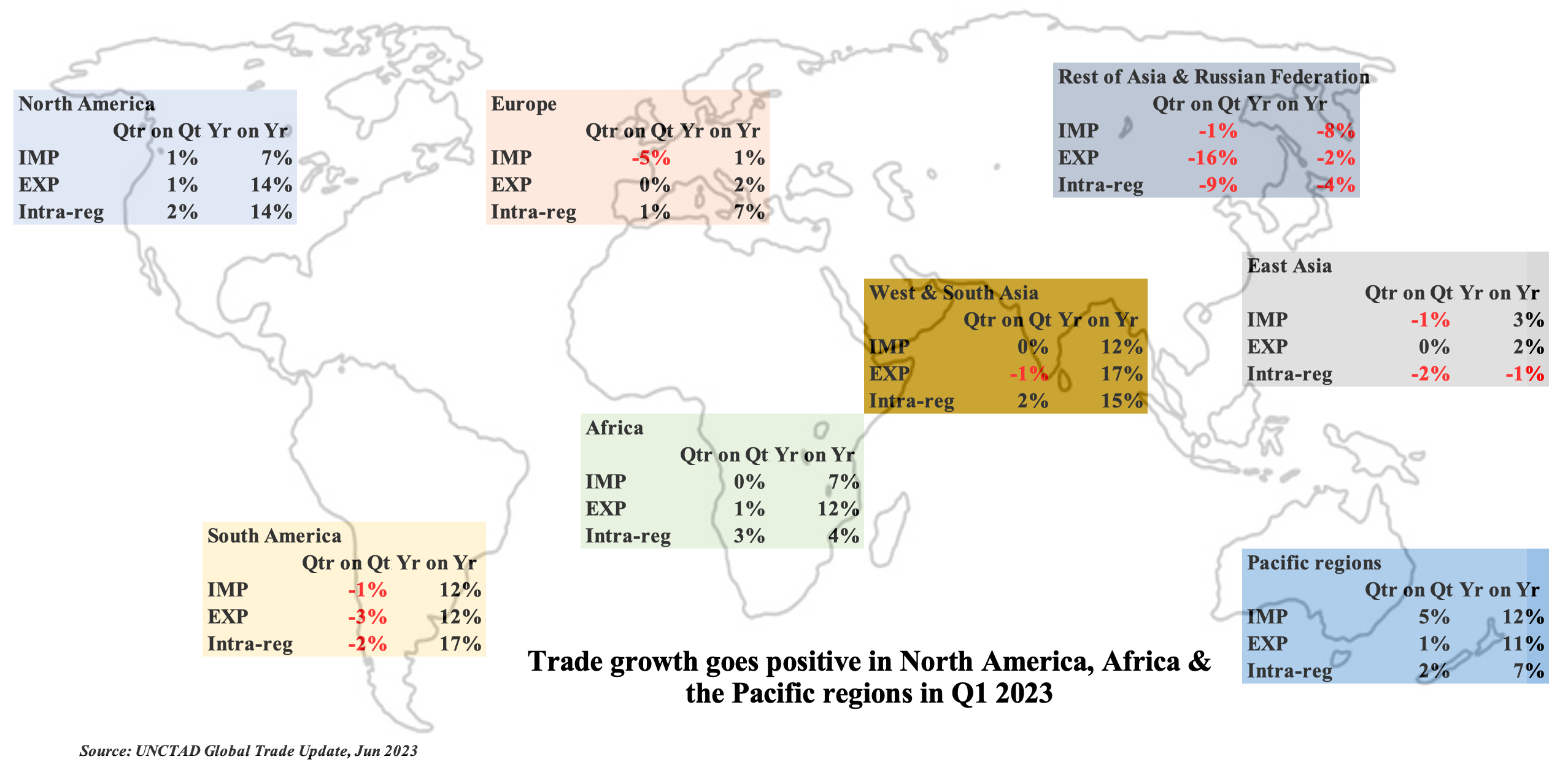

3. Global trade growth turns positive in Q1 2023 following H2 2022’s downturn: UNCTAD

- UNCTAD estimates global trade in goods and services rebounded by about 2% qoq in Q1 2023. Goods trade added about USD 100bn (or 1.9% qoq) in Q1 2023 & another USD 50bn (or 2.8% qoq) came via the increase in trade of services. However, trade is expected to remain weak in Q2 2023.

- What factors are likely to support trade growth? Low shipping costs, increasing demand for services (ICT, travel and tourism).

- Risk factors that could derail trade growth: geopolitics (including Russia-Ukraine conflict), weaker-than-expected global economy, inward-looking trade policies & rising restrictiveness, slowing industrial output (as evidenced by PMI), inflationary pressures.

- Regional trade growth has been positive across most regions in Q1 2023: The Asian region including Russian Federation witnessed the sharpest year-on-year drops in Q1. In qoq terms, imports dropped the most in Europe and South America while exports dropped in West & South Asia as well as South America (in addition to the Asian region including Russian federation). In qoq terms, intra-regional trade within Africa grew the most (3%), outperforming all other regions.

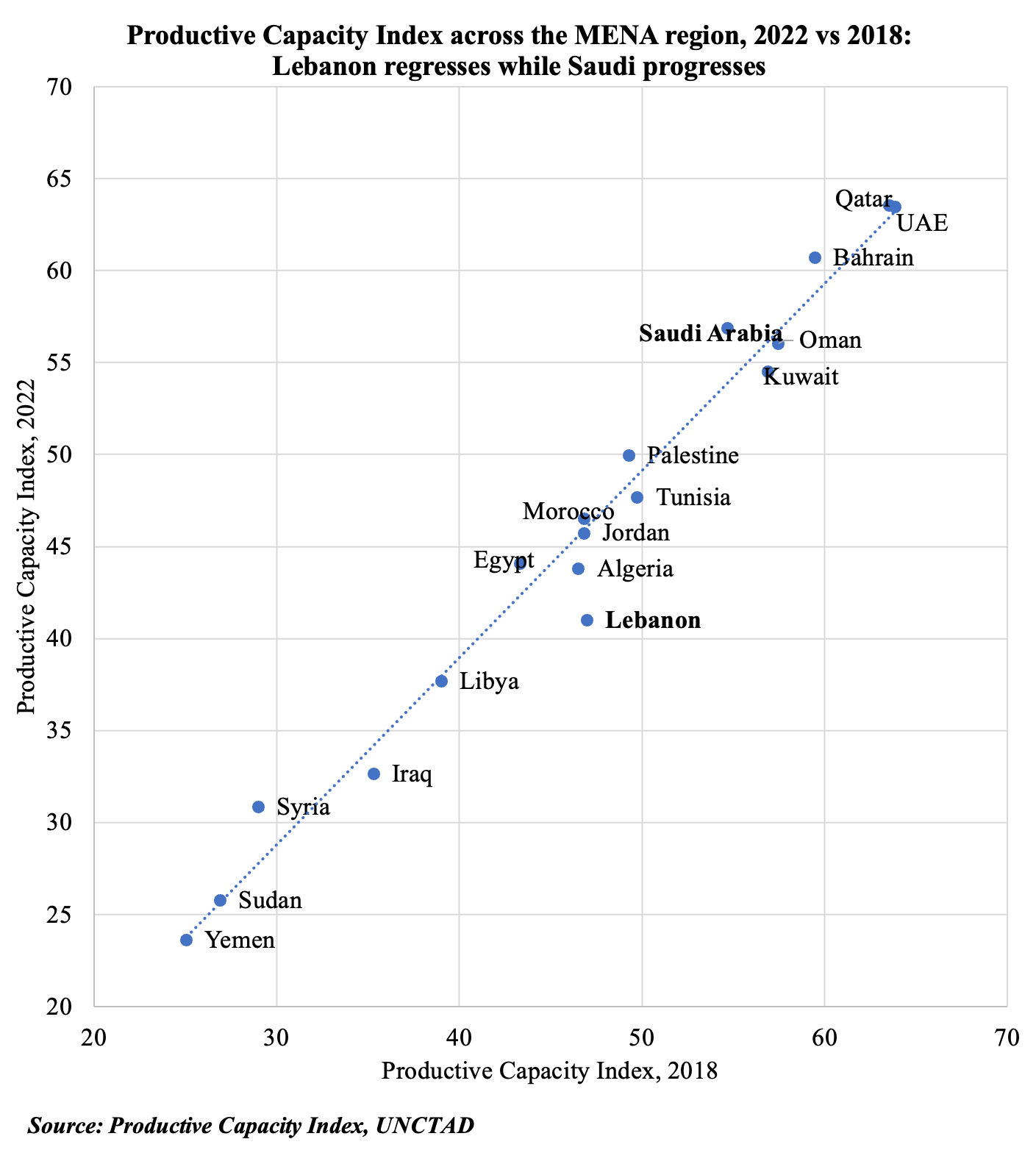

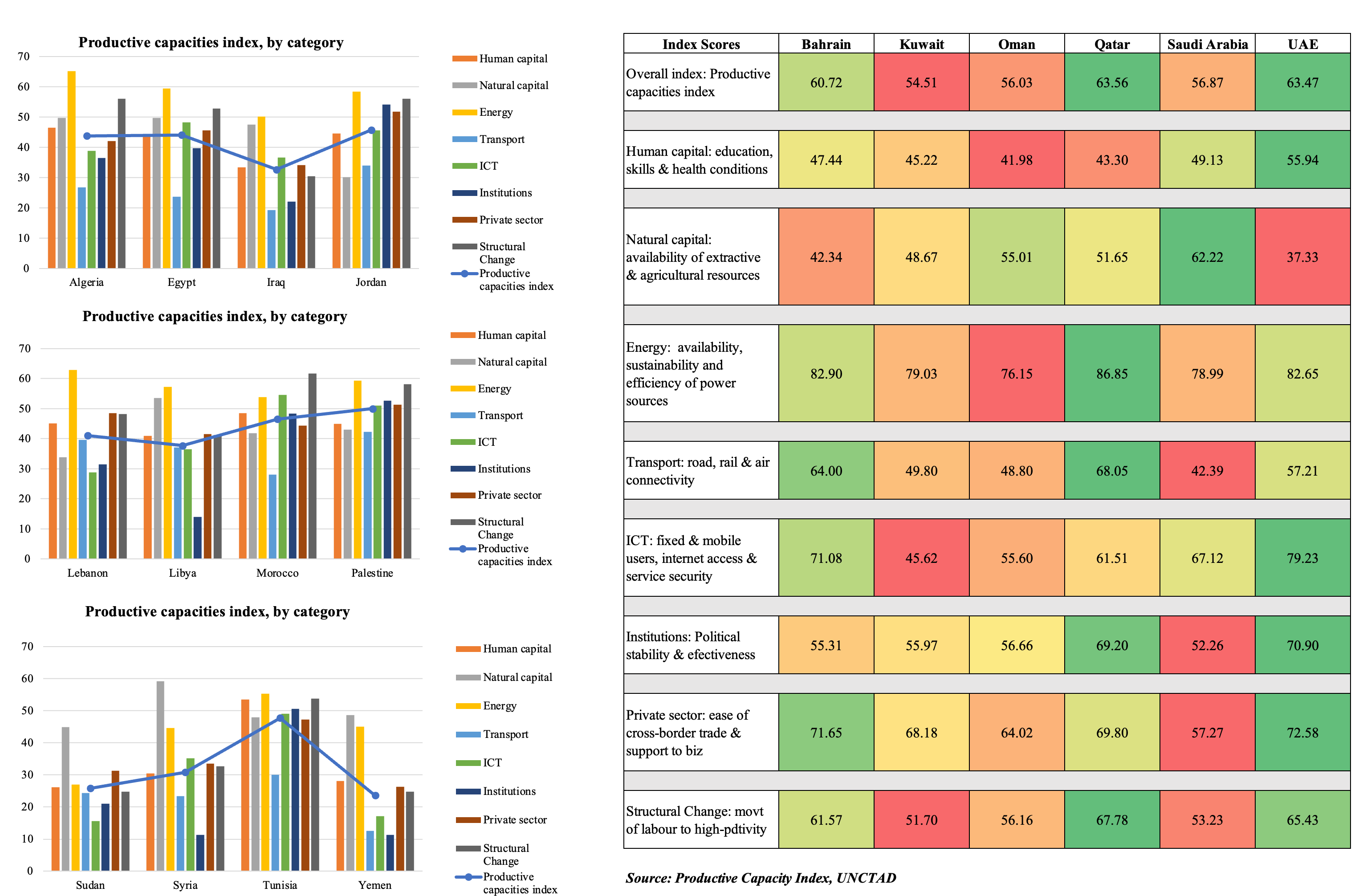

4. UNCTAD’s Productive Capacities Index

- UNCTAD this week issued a new Productive Capacities Index, to better measure “economic progress” beyond GDP.

- It measures 8 key areas – natural capital (i.e. availability of extractive & agricultural resources), human capital, energy (availability, sustainability and efficiency of power sources), ICT, structural change (e.g. movement of labour), transport, private sector (ease of cross-border trade & support to businesses) and institutions.

- Understandably, the more developed economies have higher capacity scores (a list topped by Denmark, Australia and the US) while by region, Asia and Latin America perform better than Africa.

- Qatar, UAE and Bahrain are top in the region with Syria, Sudan and Yemen the bottom three in 2022.

- The chart tracks whether the MENA region nations have improved their overall performance in 2022 (vs 2018). Saudi Arabia’s progress is quite notable while Lebanon has regressed.

- Among the GCC nations, Qatar and the UAE each have each performed best in 4 of the 8 categories. UAE outperforms Qatar on human capital, ICT, institutions and also the private sector.

- More about the index: https://unctadstat.unctad.org/EN/Pci.html

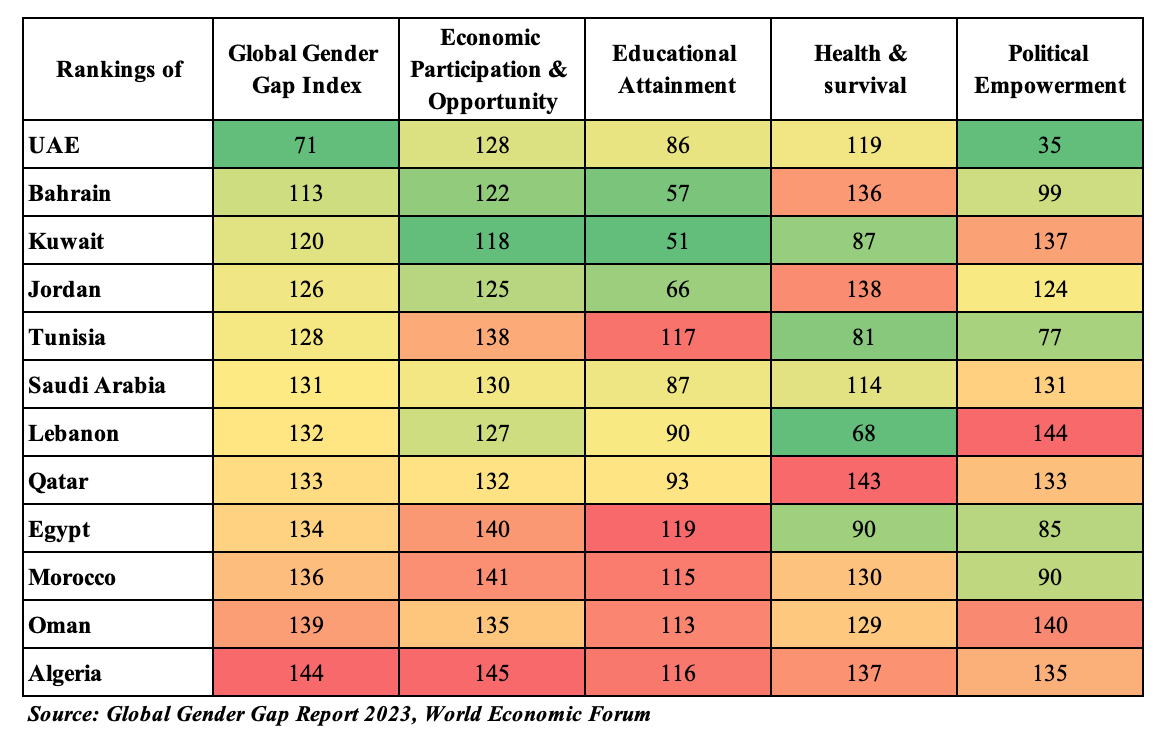

5. It will take the MENA region 152 years to achieve gender equality (at the current rate of progress): WEF

- World Economic Forum’s Global Gender Gap 2023 report places Middle East & North Africa at the bottom of the regional groupings: not only has the region received a low 62.6% parity score, it also posted a decline from the previous edition of the report. At the rate of progress since 2006, it will take MENA 152 years to achieve gender parity.

- No country has yet achieved gender parity, though Iceland (ranked top) has closed more than 90% of its gender gap. The UAE and Bahrain are on top of the list in the region (achieving parity of 71.2% and 66.6% respectively), while Morocco, Oman and Algeria are at the lowest in the list.

- UAE stands out in the political empowerment sub-category wherein the indicators include % of women in parliament (where it ranks 1st) and women in ministerial positions (where it ranks 81st) among others.

- Educational attainment is one of the areas where progress could be achieved in the MENA region: at the global level, it is estimated that it will take only 16 years for equal educational attainment. In MENA, five of the 12 nations are ranked between 110-120, many dragged down by low literacy rates.

Powered by: