Markets

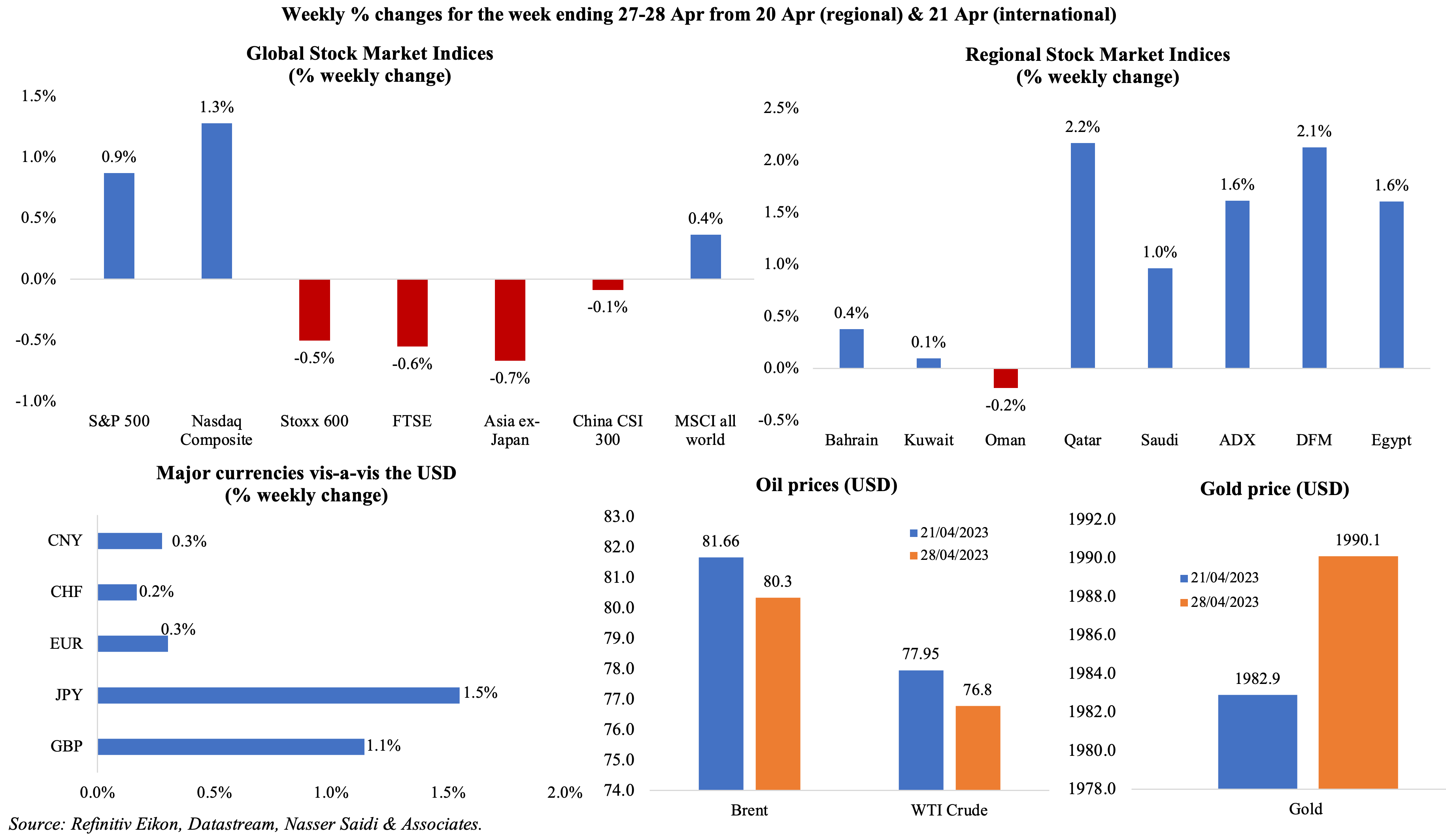

US equity markets posted weekly gains, thanks to strong earnings (especially tech) though many firms warned of slowdowns ahead (including Amazon). Markets in Europe and Asia were subdued though Japan’s Nikkei 225 touched an 8-month high (+12% year-to-date) after BoJ’s move; the yen weakened to its lowest in 6 weeks with investors expecting a continued dovish stance from the BoJ under Governor Ueda. Gains in most Middle East markets stemmed from positive corporate earnings results (especially banking sector in the UAE). Though there were signs of rising fuel demand amid declining crude output, uncertainty about the impact of interest rates on demand led to oil prices declining for the 2nd week in a row. Gold gained after 2 straight weeks of losses.

Global Developments

US/Americas:

- GDP in the US grew at a 1.1% annualised rate in Q1 (Q4: 2.6%), as per an advance estimate. Private inventory investment posted the first decline since Q3 2021 while consumer spending surged at a 3.7% annualized rate, after rising at a 1.0% pace in Q4. Core personal consumption expenditure price index rose by 4.9% (Q4: 4.4%).

- US labour department’s employment cost index, which tracks wages and benefits paid by private and public sector employers, rose 1.2% qoq in Q1 (Q4: 1.1%). But, inflation-adjusted wages for all workers were unchanged in yoy basis (Q4: -1.2%).

- Initial jobless claims fell by 16k to a seasonally adjusted 230k in the week ended Apr 21st, with the 4-week average down by 4k to 236k. Continuing jobless claims slipped to 1.858mn in the week ended Apr 14th, from a downwardly revised 1.861k the week before.

- The US banking sector continues to display turmoil and weakness. With the FDIC having to take over First Republic Bank and then selling it to JP Morgan, the third major bank failure in 2023, and with 70% of its deposits uninsured.

- Personal income grew by 0.3% mom in Mar, thanks to solid wage gains, while personal spending was flat. The saving rate jumped to 5.1% (Feb: 4.8%), the highest since Dec 2021.

- Durable goods orders rebounded by 3.2% mom in Mar (Feb: -1.2%), supported by the demand for transportation equipment (+9.1%) while demand for vehicles was down by 0.1%. Non-defence capital goods orders excluding aircraft fell by 0.4%, slower than Feb’s 0.7% drop.

- Goods trade deficit in the US narrowed to a 4-month low of USD 84.6bn in Mar (Feb: USD 93bn) as exports rose (by USD 4.9bn to USD 172.7bn) while imports declined to USD 257.3bn largely due to a fall in industrial supplies and capital goods.

- Dallas Fed manufacturing business index deteriorated to a 9-month low of -23.4 in Apr (Mar: -15.7), with the new orders index remaining negative for the 11th month in a row and the outlook uncertainty index up to 24.7 versus the average reading of 16.9.

- Richmond Fed manufacturing index fell to -10 in Apr (Mar: -5), with higher interest rates affecting business activity negatively. Shipments moved to -7 from 2 in the previous month while new orders worsened (-20 from -11 in Mar).

- Kansas Fed manufacturing activity plunged to -21 in Apr (Mar: 3), the lowest since May 2020, driven by non-durable goods plants (printing, plastics, paper and food manufacturing).

- Chicago Fed national activity index remained unchanged at -0.19 in Mar with 3 of the 4 sub-categories making negative contributions.

- Chicago PMI improved in Apr though remaining below the 50-mark for the 8th straight month: it moved up 48.6 (Mar: 43.8). However, the non-seasonally adjusted Chicago PMI rose to 50.8, crossing 50 for the first time since Aug 2022.

- Michigan consumer sentiment index moved up to 63.5 in Apr from Mar’s 62 reading, thanks to increases in both current conditions (68.2 from Mar’s 66.3) and expectations (up by 1.3 points to 60.5). The one- and five-year inflation expectation inched up to 4.6% and 3% respectively from 3.6% and 2.9% earlier.

- S&P Case Shiller home price index posted a modest increase of 0.4% yoy in Feb (Jan: 2.6%), following 7 months of declines, and stands at 6.6% below its peak.

- Pending home sales unexpectedly fell by 5.2% mom in Mar, the first time since Nov 2022. New home sales rose for the 4th consecutive month in Mar, increasing by 9.6% mom to 683k, driven by the uptick in sales of single-family houses (683k from 623k in Feb).

Europe:

- GDP in the eurozone grew by a marginal 0.1% qoq and 1.3% yoy in Q1 (Q4: flat in qoq terms, 1.8% yoy). The highest qoq growth rate in the member states was recorded in Portugal (+1.6%) while Ireland and Austria posted declines (-2.7% and 0.3% qoq respectively).

- Q1 GDP in Germany was unchanged in qoq terms (Q4: -0.5%); in yoy terms, it grew by 0.2% (Q4: 0.3%). While final consumption expenditure of both government and households declined, there were positive contributions from exports and capital investment. The government raised its growth forecast for 2023 to 0.4% (from a previous forecast of 0.2%).

- Preliminary estimate of the harmonised index of consumer prices in Germany eased to 7.6% in Apr (Mar: 7.8%), the lowest inflation rate since Mar 2022.

- Business climate in the Euro area slipped to 0.54 in Apr (Mar: 0.68). Consumer confidence inched up to -17.5 (Mar: -19.1), the highest reading since Feb 2022.

- German Ifo business climate index rose to 93.6 in Apr (Mar: 93.2), thanks to improved expectations (to 92.2 in Apr from 91) while current assessment was down by 0.4 point to 95. While manufacturers optimism increased regarding future developments, services providers pessimism about months ahead has started to grow.

- Germany’s GfK consumer confidence survey showed less pessimism in May, edging up to -25.7 from -29.3 the month before: the highest since Apr 2022, thanks to an increase in income expectations (up 13.6 points to -10.7) and propensity to buy rising for the 3rd straight month.

- Unemployment rate in Germany remained unchanged at 5.6% in Apr though the number of people out of work increased by 24k to aa seasonally adjusted 2.567mn. The government expects an unemployment rate of 5.4% in 2023 and 5.2% in 2024.

Asia Pacific:

- China’s NBS manufacturing unexpectedly fell under-50 in Apr, to 49.2 from the previous month’s 51.9, as both new orders and buying activity shrank (to 48.8 and 49.1 respectively). Export sales also fell (47.6 from 50.4) while input costs declined after rising for 7 months.

- Non-manufacturing PMI in China eased to 56.4 in Apr (Mar: 58.2), remaining in expansion territory for the 4th consecutive month. While foreign sales rebounded to 52.1 (Mar: 48.1), new orders rose at a slower rate (56 from Mar’s 57.3).

- The Bank of Japan kept rates unchanged at the latest meeting (the first with Ueda as governor) and refrained from revising its yield curve control measures. Like the Fed and the ECB before, the BoJ also dropped part of its forward guidance which stated it “expects short- and long-term policy interest rates to remain at their present or lower levels”. The BoJ expects core consumer prices to fall below its 2% target this year.

- Core inflation in Tokyo (excluding fresh food) increased to 3.5% in Apr (Mar: 3.2%), staying above the BoJ target for the 11th month in a row. Headline inflation also inched up to 3.5% from 3.3% in Mar. Excluding food and energy, prices were up by 3.8% (Mar: 3.4%), the highest since 1982.

- Industrial production in Japan grew by 0.8% mom in Mar (Feb: 4.6%) while in yoy terms, IP fell by 0.7% (Feb: -0.5%). In fiscal year 2022 that ended in March, industrial output contracted 0.2% from the previous year.

- Unemployment rate in Japan rose to 2.8% in Mar (Feb: 2.6%), with jobs to applicants’ ratio inching lower to 1.32 (Feb: 1.34). For the fiscal year 2022, unemployment rate stood at an average of 2.6%, down by 0.2 ppts from the previous year, while there were 131 job openings for every 100 job seekers.

- Japan’s retail sales grew by 7.2% yoy in Mar (Feb: 7.3%), supported by upticks in automobiles (21%) and other retailers (16.7%); sales rose by 0.6% mom (4th consecutive month of growth). Large retailer trade grew by 3.2% yoy, slower than Feb’s 4.7% gain.

- Leading economic index in Japan inched up to 98 in Feb (Jan: 96.7), the highest since last Oct, with the services sector growing the second highest in over 9 years while manufacturing shrank. Coincident index slipped to 98.6 from Jan’s 99.2.

- Infrastructure output in India grew by 3.6% yoy in Mar (Feb: 7.2%), the slowest increase in 4 months. In the period Apr 2022-Mar 2023, infrastructure output was up by 7.6%.

- GDP in South Korea expanded by 0.3% qoq in Q1 (Q4: -0.4%), supported by private consumption (+0.5%), while capital investment fell by 4%. In yoy terms, GDP grew by 0.8% yoy (Q4: 1.3% yoy).

- Inflation in Singapore eased to 5.5% in Mar from 6.3% the month before, thanks to lower private transport inflation while food inflation eased (to 7.7% from 8.1%). Core inflation, excluding private transport and accommodation costs, eased for the first time since Oct 2022: clocking in 5% in Mar versus Feb’s 5.5%.

- Industrial production in Singapore rebounded by 9.3% mom in Mar (Feb: -12.5%). In yoy terms, IP fell for the 6th straight month (by 4.2%, improving from the 9.7% drop in Feb). Excluding the volatile biomedical manufacturing cluster, factory output fell 6% yoy in Mar.

- Advance estimates indicate that unemployment rate in Singapore edged lower to 1.8% in Q1 (Q4: 2%) despite retrenchment numbers expected to rise to 4000 (Q4: 2990). Total employment has surpassed its pre-pandemic level by 3.9% in Q1.

Bottom line: Both the Fed and the ECB are likely to raise rates at meetings this week by 25bps, especially as inflation continues to remain much higher than target levels (despite recent easing); in the US, rising wage gains add to the case for a Fed hike. The ECB has key inflation and bank lending data to be released ahead of the May 4th meeting – this could affect the consensus of 25bps hike. Separately, JP Morgan will be taking over First Republic after the Federal Deposit Insurance Corporation (FDIC) auction. While First Republic is the second-biggest bank measured by assets to fail in US history, it begs the question how many more small and regional banks are yet to see a run on their deposits.

Regional Developments

- Egypt’s PM disclosed that nearly EGP 30bn (USD 980.3mn) would be allocated to support exports in the next fiscal year, up from the previously allocated EGP 8bn. He also reiterated commitment to the IPO program, stating that the aim is to reach 25% of the target in H1 2023.

- S&P revised Egypt’s outlook to negative while affirming its long and short-term foreign and local currency sovereign credit ratings at “B/B”, seven notches above default level. This was largely due to the ongoing surge in inflation, potential for further currency depreciation and growing external financing needs.

- Japanese investments in Egypt surged by 98.7% yoy to USD 73.7mn during the fiscal year 2021-22. Meanwhile, volume of bilateral trade dropped by 26.3% to USD 1.1bn in 2022.

- Kuwait’s inflation rose to 3.7% in Mar: this is the highest since Aug 2022. Food inflation was up by 7.5% while housing and transport costs rose by 2.6% and 3.1% respectively.

- Inflation in Lebanon surged to 264% yoy in Mar, more than doubling since end-2022 (122%) with food inflation rose at a much faster pace of 352%. Lebanon has seen costs rise across all categories: monetary financing of government deficits, the recent devaluation of the pound in Feb and forex shortages have led to the 33rd consecutive month of hyperinflation.

- Non-oil sector in Oman is expected to grow by 2.4% in 2023 (2022: 2%), according to the Institute of International Finance (IIF). IIF also expects improvement in non-oil revenues and restrained spending to offset the decline in oil export revenues.

- Qatar’s trade surplus narrowed to QAR 21.3bn in Mar (by 19.6% yoy and 7.2% mom) as exports declined by 15.5% yoy to QAR 30.9bn while imports dipped by 4.6% to QAR 9.6bn.

- India is planning to link its power grid with Saudi Arabia and the UAE via undersea cables, disclosed India’s Union Minister for Power and Renewable Energy; he also stated that the India-UAE agreement is in its final stages.

- Saudi Arabia and the UAE together accounted for more than 80% of the total oil imported by Japan in Mar. Imports from the Arab region accounted for 96.6% of Japan’s Mar oil imports.

- Total value of GCC contracts awarded grew by 54.7% yoy to USD 29.9bn in Q1, according to a Kamco Invest report. Saudi projects rose by 17.9% to USD 13.3bn in Q1 while in the UAE project awards more than doubled to USD 10bn. Saudi Arabia accounted for 44.6% of the contracts awarded in the region; along with UAE and Qatar, this share rose to 84.1%.

- Refinitiv reported that the value of announced mergers and acquisitions transactions with any MENA involvement slumped 65% yoy to USD 8.3bn in Q1 2023. Saudi Arabia, UAE and Egypt were the most targeted nations in the quarter. The number of deal announcements also declined by 26%.

Saudi Arabia Focus

- Saudi Arabia’s achievements through 2022 (since the launch of Vision 2030) highlighted in the Annual Report indicates a potential to outpace Vision 2030 goals. Saudi surpassed target of non-oil exports to non-oil GDP by 6.3ppts (25% in 2022); SME loans as a share of bank loans stood at 8% (versus baseline of 2%); achieved 59.5% of local content in the oil and gas sector (vs targeted baseline of 37% in 2022); percentage of university graduates joining the labour market within 6 months of graduating reached 32% (vs the target of 13.3%). Link to the report is in the Media Review section.

- On the occasion of the 7th anniversary launch of Saudi Vision 2030, the PIF’s governor disclosed that its assets under management exceed SAR 2trn while plans are underway to create 1.8mn direct and indirect jobs.

- Investments in Saudi Arabia’s industrial sector crossed SAR 495bn (USD 132bn) in the 7 years since Vision 2030 was launched and about 193k jobs have been created within the sector. The mining sector has seen the issuance of 1,330 new licenses since Oct 2022 (when the first auction for new mining explorations was held), attracting SAR 120bn+ in investments.

- Debt trading value in Saudi Arabia surged by 76% qoq to SAR 7.04bn in Q1 2023; the total number of transactions also jumped by 83% to 7760. Saudi citizens owned the lions share, 98.8% of total or SAR 520.7bn.

- Saudi Arabia’s Real Estate Development Fund deposited SAR 933mn (USD 248mn) in Apr into Sakani accounts to support Vision 2030 housing goals.

- About 2.05 million Saudis and expatriates joined the Saudi employment market during the last 15 months, according into Saudi Gazette. Over 255k Saudi women joined the labour market during this period while the number of expats crossed 1.62mn.

- Saudi Arabia targets to have 315k new hotel rooms by 2030, according to Knight Frank: to give a comparison, the UAE currently has around 200k keys (including 140k in Dubai).

- Firms in Saudi Arabia that paid more than SAR 150mn (USD 39.9mn) in VAT during 2021 or 2022 are now required to integrate their e-invoicing systems with the Fatoora platform – an electronic invoicing project in Saudi Arabia.

- Parcel delivery companies in Saudi Arabia saw deliveries surge by 56% yoy to over 14mn shipments during Ramadan.

UAE Focus![]()

- The UAE and Cambodia have concluded negotiations for a Comprehensive Economic Partnership Agreement (CEPA), 6 months after starting the process, reported WAM. UAE’s non-oil trade with Cambodia grew by 31% yoy to over USD 401mn last year while bilateral FDI touched almost USD 4mn at end-2020.

- The UAE announced the launch of a AED-denominated Islamic Treasury Sukuk (T-Sukuk) with a benchmark auction size of AED 1.1bn. The T-Sukuk will be issued initially in two, three and five-year tenures followed by a 10-year sukuk at a later date. This will support the central bank’s liquidity management, strengthen the local currency bond market, while also assisting in the establishment of a AED profit curve.

- The UAE Ambassador to India revealed that the CEPA with India that came into effect from May 1st last year has been successful: “We have already exceeded USD 40bn in non-oil trade, USD 80bn in oil trade and the target is USD 100bn by 2027”. UAE is India’s third-largest trading partner and its second-largest export destination.

- UAE’s economy minister disclosed that the UAE has managed to address many of the Financial Action Task Force’s 58 original concerns (when it placed the nation on the “grey” list) and has around 15 left.

- The UAE Federal Tax Authority’s board was presented with the comprehensive FTA report: it was highlighted that the number of VAT registrants reached 351,514 alongside 1,549 registrants for excise tax and 467 tax agents.

- The UAE finance ministry has clarified residency rules for implementation of corporate tax: non-resident persons will be liable to pay tax when they either have a permanent establishment in the Emirates or derive state-sourced income.

- Petrol prices in the UAE will increase by 5%+ mom in May while diesel price will be lower by 4% to AED 2.91.

- Private sector firms in the UAE (with more than 50 employees) have been given June 30th as the deadline for achieving the half-yearly Emiratisation target of 1% of skilled jobs.

- Etihad Airways CEO disclosed plans to triple the number of passengers it carries to 30mn by end of this decade while also nearly doubling its fleet to 140 planes.

- ACWA Power has been given an approval by Abu Dhabi’s electricity and water company to begin work on the 2nd phase of the Al Taweelah desalination project. This will result in the plant achieving its full capacity of 909,200 cubic metres per day.

Media Review

The ECB’s inflation dilemma: can Lagarde silence her critics again?

https://www.ft.com/content/8b54c759-ff4a-4f08-a182-c999b6344a52

Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank

https://www.federalreserve.gov/publications/files/svb-review-20230428.pdf

UAE government’s guide to generative AI

https://ai.gov.ae/wp-content/uploads/2023/04/406.-Generative-AI-Guide_ver1-EN.pdf

Yuval Noah Harari: ‘I don’t know if humans can survive AI’

https://www.telegraph.co.uk/news/2023/04/23/yuval-noah-harari-i-dont-know-if-humans-can-survive-ai/

Saudi Arabia’s Vision 2030 annual report – achievements through 2022

https://cdn.sanity.io/files/xbpx4t4v/production/3edb3fe2ed7b465189e55bef49bcdc77aa8eb0de.pdf

https://www.arabnews.com/node/2293926/business-economy

Powered by: