Markets

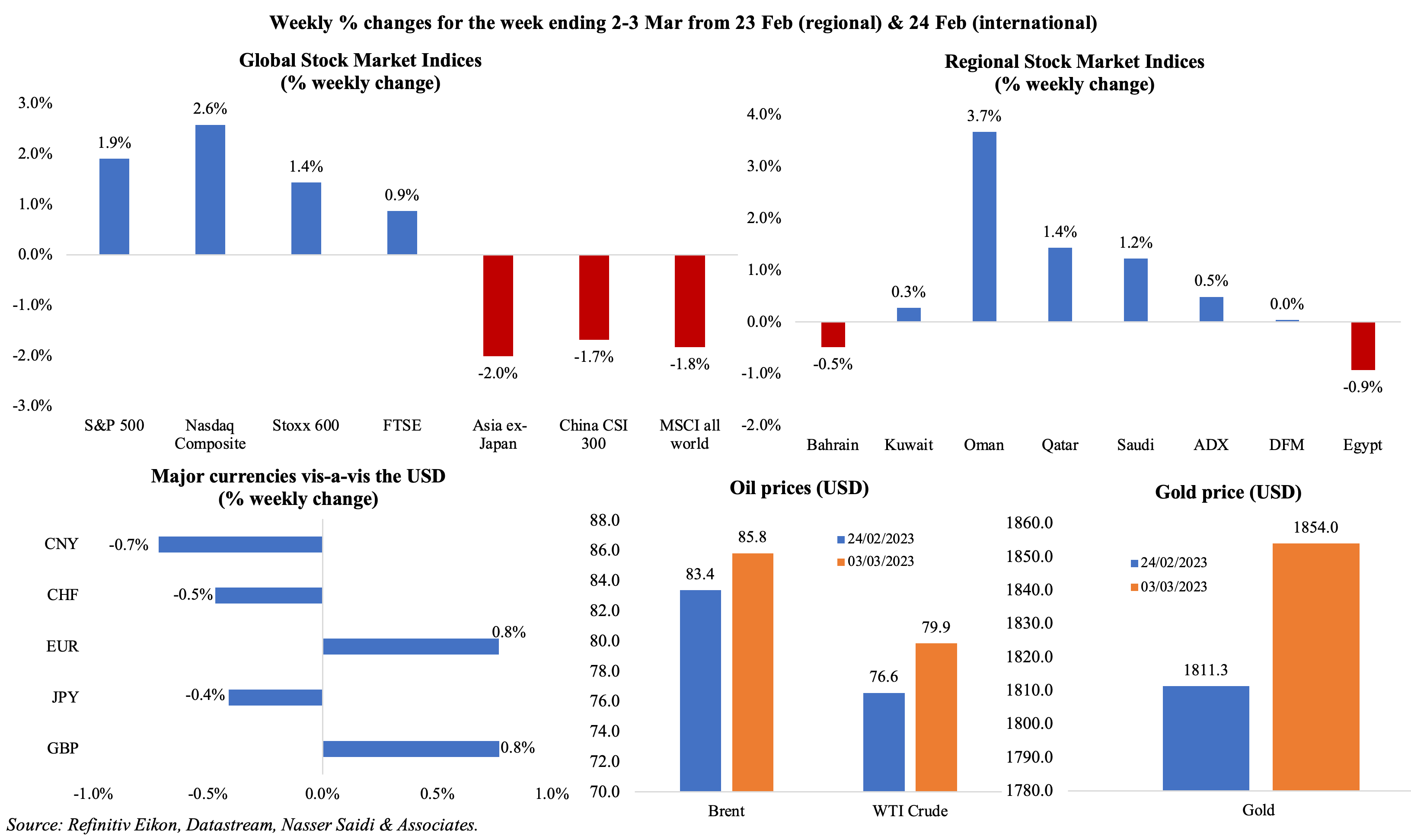

US and European equity markets posted strong gains last week even while bond yields were at multi-year highs (on rate hike expectations) while Asian stocks underperformed global peers. Regional markets were mostly positive, supported by the rise in oil prices, while Abu Dhabi gained ahead of the ADNOC gas IPO. Sterling gained against the greenback thanks to a post-Brexit Northern Ireland trade deal with the EU, while the dollar slipped from the 2.5 month high versus the JPY. Oil prices gained last week, recovering after Reuters reported that UAE was not planning to exit OPEC (as WSJ reported); gold price ticked up to USD 1854 an ounce.

Global Developments

US/Americas:

- Durable goods orders fell by 4.5% mom in Jan (Dec: 5.1%), the largest decline since Apr 2020. Capital goods orders slipped by 12.8% while non-defence capital goods orders rebounded by 0.8% in Jan (Dec: -0.3%).

- Goods trade deficit in the US widened to USD 91.5bn in Jan; imports grew by 3.4% (to USD 265.3bn) and exports up by 4.2% (to USD 173.8bn).

- S&P Case Shiller home price index increased by 4.6% yoy in Dec, down from Nov’s 6.8% gain. Prices were up by 5.8% in the full year 2022, but below the 18.9% uptick in 2021.

- Pending home sales grew by 8.1% mom in Jan: this was the largest increase since Jun 2020. In yoy terms, sales declined by 24.1%.

- Dallas Fed manufacturing business index worsened to -13.5 in Feb (Jan: -8.4): this is the 10th straight month of negative readings, with new orders index down to -13.2 (below zero for the 9th month in a row) and production down from 0.2 to -2.8.

- Chicago PMI unexpectedly slipped to 43.6 in Feb (Jan: 44.3): new orders sub-index rose by 3 points while employment and output sub-indices fell by 4.7 and 10.2 points respectively.

- Richmond Fed manufacturing Index slipped further to -16 in Feb (Jan: -11), with shipments falling to -15 (from -3) and new orders weak at an unchanged -24.

- ISM manufacturing PMI edged up to 47.7 in Feb (Jan: 47.4), supported by new orders (47 from 42.5) while employment slipped (to 49.1 from, 50.6) and prices paid inched up to 51.3 from 44.5 the month before.

- ISM services PMI inched down slightly to 55.1 in Feb (Jan: 55.2): new orders and employment index increased to 62.6 (the highest level since Nov 2021, and from 60.4) and 54 (from 50) respectively while prices paid dipped to 65.5 (from 67.8).

- US S&P composite PMI rebounded to an 8-month high of 50.2 in Feb (Jan: 46.8). Manufacturing PMI declined to 47.3 (Jan: 47.8), as new orders remained subdued (but higher than Jan’s 46.9) while services PMI rebounded to 50.6 after contracting for 7 straight months.

- Non-farm productivity increased by 1.7% qoq in Q4 (below the initial estimate of 3% rise); unit labour costs rose 3.2% qoq (Q3: 1.1%), thanks to a 4.9% rise in hourly compensation.

- Initial jobless claims declined for the third straight week, down by 2k to 190k in the week ended Feb 25th, and the 4-week average inched up by 1.75k to 193k. Continuing jobless claims slipped by 5k to 1.655mn in the week ended Feb 18th, below pre-pandemic levels.

Europe:

- Inflation in the eurozone softened to 8.5% in Feb (Jan: 8.6%), as energy price inflation slowed to 13.7% (the slowest since Jun 2021) and food, alcohol and tobacco prices rose by 15% (the fastest on record). Core inflation however increased to 5.6% from 5.3%.

- Composite PMI in the eurozone increased by 1.7 points to 52 in Feb, the strongest reading since Jun 2022, as overall new businesses rose for the first time since May. Manufacturing stayed under the 50-mark for the 8th month in a row, clocking in 48.5 in Feb, lower than Jan’s 48.8 while services PMI jumped by 1.9 points to 52.7, an 8-month high.

- Economic sentiment indicator in the euro area stood at 99.7 in Feb (Jan: 99.8). Consumer confidence recovered in the eurozone by 1.7 points to a 1-year high of -19.

- Preliminary (harmonised prices) inflation in Germany unexpectedly inched up to 9.3% in Feb (Jan: 9.2%), with energy and food prices higher by 19.1% and 21.8% respectively.

- German manufacturing PMI unexpectedly edged lower to 46.3 in Feb (from the preliminary estimate of 46.5 and Jan’s 47.3) on declines in new orders and export sales, but output rose for the first time in 9 months. Services PMI increased by 0.2 point to 50.9 in Feb, the fastest expansion since Jun.

- Exports from Germany rebounded by 2.1% mom in Jan (Dec: -6.3%) – exports to the US and UK were up by 3.1% and 7.8% respectively – while imports declined by 3.4% (Dec: -5.6%), widening trade surplus to EUR 16.7bn (Dec: EUR 10bn).

- Unemployment rate in Germany remained unchanged at 5.5% in Jan while the number of unemployed edged up by 2,062 to 2.509mn. Unemployment rate in the EU was stable at 6.7% in Jan and down from 6.9% in Jan 2022.

- Manufacturing PMI in the UK remained below-50 but rose to a 7-month high of 49.3 in Feb (Jan: 47), as production volumes increased amid reductions in new orders and input costs eased. Services PMI rebounded to 53.5 in Feb (48.7), posting the fastest pace since Jun 2022. Composite PMI moved up to 53.1 in Feb, after shrinking for 6 consecutive months.

Asia Pacific:

- At the annual session of China’s National People’s Congress, a modest 5% economic growth target was set for this year alongside a budget deficit target of 3% of GDP (2022: 2.8%) with the budget including a 7.2% hike in defence spending. The government will also take steps to minimize risks in the property sector and move to making the nation self-reliant in tech while the central bank provides “forceful” support for development.

- China’s NBS manufacturing PMI increased to 52.6 in Feb (Jan: 50.1), the highest reading since Apr 2012, as new export orders rose for the first time since Apr 2021. Non-manufacturing PMI jumped to 56.3 from 54.4 the month before, recording the fastest gain since Mar 2021. This pushed the composite PMI up to 56.4 (Jan: 52.9).

- Caixin manufacturing PMI in China moved back to expansionary territory (since Jul 2022), rising to 51.6 in Feb (Jan: 49.2), thanks to expansion in output, new orders (fastest pace since May 2021) and employment (up for the first time in 11 months). Caixin services PMI increased to 55 in Feb (Jan: 52.9), as new export growth rose to a nearly 4-year high.

- Core consumer inflation in Tokyo slowed to 3.3% in Feb (Jan: 4.3%) but remains above the BoJ’s 2% target. Excluding both food and energy, inflation inched up to 3.2% (Jan: 3%), the fastest yoy pace since Aug 1991.

- Japan leading economic index was confirmed at 97.2 in Dec (Nov: 97.7), the lowest since Dec 2020, while the coincident index inched up to 99.1 (from the flash estimate of 98.8).

- Unemployment rate in Japan eased to a 3-year low of 2.4% in Jan (Dec: 2.5%). The jobs-to-applications ratio was unchanged at 1.35 for the fourth consecutive month.

- Japan’s manufacturing PMI slipped to 47.7 in Feb compared to Jan’s 48.9, but higher thank the preliminary reading of 47.3. Output and new orders fell the most in 2.5 years while export orders fell at the steepest rate in 31 months.

- Industrial production in Japan declined by 4.6% mom and 2.3% yoy in Jan (Dec: 0.3% mom and -2.4% yoy). IP posted the biggest drop in 8 months in mom terms, largely due to the decline in motor vehicles as well as electronic parts and devices.

- Retail sales in Japan jumped by 6.3% yoy in Jan (Dec: 3.8%): this was the largest acceleration since May 2021. Large retailer trade jumped by 5.3% (3.6%).

- India’s GDP grew by 4.4% yoy in Oct-Dec 2022 (prev: 6.3%; and 13.2% in Apr-Jun), with manufacturing sector declining for the 2nd straight quarter (-1.1%) while growth in the agriculture and mining sectors rose.

- Infrastructure output in India grew by 7.8% yoy in Jan (Dec: 7.4%); in Apr-Jan, output rose by 7.9%.

- Retail sales in Singapore fell by 9.4% mom and 0.8% yoy in Jan: this was the first yoy decline since Feb 2022 and in mom terms the sharpest fall since May 2020. The latest hike in GST and high inflation rates likely contributed to the slowing sales.

Bottom line: The Global Composite PMI rose to 52.1 in Feb, with output and new orders crossing the 50-mark after 6 months, thanks to a demand boost from reduced cost pressures, improving supply chains and reopening of China. While stronger than expected inflation was seen in France and Spain, composite PMI readings in Europe indicates the possibility that a recession could be avoided (for now). This week’s US payrolls data will be important to watch given other indicators of a continuing tight labour market (jobless claims and PMI data among others).

Regional Developments

- Bahrain’s national-origin exports declined by 8% yoy to USD 941mn in Jan: Saudi Arabia, US and UAE were the top export destinations, together accounting for 47.8% of the total. Aluminium alloys were the top export product, valued at USD 352mn. Imports ticked up by 4% to USD 1.2bn: originating from China (USD 185mn), UAE (USD 116mn) and Brazil (USD 114mn).

- Passenger traffic at Bahrain’s international airport more than doubled (125% yoy) to 6.9mn in 2022. However, this was still 29% lower than pre-pandemic traffic (2019: 9.6mn).

- PMI in Egypt inched up slightly to 46.9 in Feb (Jan: 45.5), as output and new orders fell, but at a slower pace than in Jan, while employment fell at the fastest rate in 9 months.

- Egypt raised domestic petrol prices by more than 10% while keeping diesel prices unchanged in its latest quarterly review. The President announced a package of measures following the fuel hike including a rise in wages and pensions for civil servants to increasing the tax exemption allowance and increases to social safety net cash payments.

- The President of the Egyptian Sovereign Fund disclosed in an interview that it will agree with investors on a case-by-case basis regarding valuation of assets in either USD or EGP.

- Qatar and Egypt are examining the possibility of setting up a joint investment fund. The two nations also signed a deal to remove double taxation on income and prevent tax evasion.

- In a bid to save energy, Egypt will use daylight saving time this summer after a gap of 7 years. Starting from the last Friday of April, Egypt will set it clocks one hour forward.

- Egypt’s foreign minister met with Syria’s President and Turkey’s foreign minister, with the aim “primarily humanitarian” in the aftermath of the earthquake – this is the first visits to Syria and Turkey in a decade by an Egyptian diplomat.

- Kuwait’s crown prince re-appointed Sheikh Ahmad Nawaf al-Sabah as PM, tasking him with nominating a cabinet. It has been more than a month since the government resigned.

- PMI in Lebanon inched up to a 4-month high of 48.8 in Feb (Jan: 47.7): employment rose for the first time since Jul alongside price hikes – overall input costs rose at the fastest rate in over 2.5 years and output prices rose at the second-fastest pace on record.

- Lebanon plans to triple import tariffs in local currency by adjusting the “customs USD rate (which remains substantially below the market rate) – the second time in 3 months – in a bid to “secure additional revenues”.

- Lebanon’s central bank stated that USD would be sold at a rate of LBP 70,000 per dollar from March 2nd, but the official exchange rate – re-valued on Feb 1st- was still LBP 15,000. This announcement came after the exchange rate touched an all-time low of LBP 90,000 for the dollar in the parallel market.

- Oman’s energy ministry tweeted that it was preparing to offer a new batch of oil and gas concession areas by end-Q1 2023. It is also planning a new batch of mining concession areas in commodities like chromite, copper and limestone among others.

- Passenger traffic in Oman’s airports increased to 9.88mn in 2022: arrivals surged by 133% and departures by 109%. Indians, Bangladeshis and Pakistanis were the top travellers using the Muscat International Airports.

- The earthquakes in Turkey caused about USD 34.2bn in direct physical damage in Turkey, equivalent to about 4% of its output in 2021, according to the World Bank. Reconstruction needs could “run as high as two to three times” the estimates of physical damage. Additionally, physical damage amounted to about USD 5.1bn in Syria.

- Five GCC nations accounted for 94.4% of Japan’s crude oil imports in Jan: Saudi Arabia and the UAE provided 43.9% and 34.2% respectively of crude oil imports. Japan resumed buying oil from Russia – 0.9% of total oil imports.

Saudi Arabia Focus

- Eight companies across 4 industries in Saudi Arabia (including Aramco and SABIC) launched 12 projects worth SAR 192bn (USD 51.2bn) in investments, as part of the government’s Shareek program (which was announced in 2021). By 2030, these firms would invest a total of SAR 120.23bn, resulting in the projected creation of more than 64k jobs and adding more than SAR 466.83bn to GDP.

- Saudi Arabia’s PMI touched an 8-year high of 59.8 in Feb (Jan: 58.2), with new orders rising to 7 (the most since Sep 2014, and from Jan’s 65.3) and output up to 65.6 (from 63.6) amid employment rising at the second-fastest rate in 5 years. Input costs meanwhile increased, especially in services and construction.

- Merchandise exports from Saudi Arabia grew by 6.4% yoy to SAR 342.4bn in Q4, largely due to the surge in oil exports (13.2% yoy to SAR 31.7bn). Compared to Q3 2021, exports fell by 14.5%. Imports meanwhile increased by 29.9% yoy and 5.6% qoq to SAR 193bn in Q4.

- Money supply (M3) in Saudi Arabia grew by 7.9% yoy in Jan (Dec: 8.1%). Total bank deposits grew by 8.7% yoy,despite a fall in demand deposits (-3.4%) while government deposits jumped (16.6%). Private sector loans were up by 11.9% yoy in Jan following a 12.6% uptick in Dec while claims on the public sector jumped by 15.6%.

- Net profit of Saudi-listed banks jumped by 18% yoy to SAR 6.41bn (USD 1.7bn) in Jan, before zakat and tax. Total assets of these banks were up by 12% to SAR 3.61trn.

- Productivity growth rate in Saudi Arabia touched 4.9% in 2022, the highest among G20 nations, according to the International Labour Organization (ILO). This follows productivity growth rates at -6.3% in 2020 and 4.4% in 2021.

- Saudi Arabia’s minister for industry and mineral resources disclosed that up to 15 new factories using modern technologies were to be built: three advanced factories for manufacturing vital medicines and medical vaccines, four for assembling aircraft components, and eight for metal forming. The national strategy aims to produce up to 800k tons of specialized chemicals by 2035, and boost exports of advanced technology products six-fold.

- NEOM Green Hydrogen Co. signed finance agreements with several financial institutions amounting to USD 8.5bn to finance its clean energy facility: the total investment cost is funded by a combination of long-term debt and equity.

- Saudi Arabia’s ACWA Power signed investment agreements to construct 2 solar plants with a total capacity of 1.4 GW and three power storage systems with a combined capacity of 1.2 gigawatts in Uzbekistan. The project worth USD 2.5bn will see Uzbekistan will buy power from the facilities.

- Saudi Aramco has signed agreements with China’s Geely and France’s Renault to establish a new powertrain technology firm. The firm is expected to mainly focus on transmission technologies for internal combustion engines and hybrid engines as well.

- Saudi PIF increased its stake in the Tokyo-based film and animation firm Toei to 6.03% (from 5%).

- In the 5-year period spanning 2017-2021, the share of women in Saudi labour market jumped to 34.7% from 21.2% and the rate of their economic participation jumped to 37% from 17%, disclosed the Saudi Human Rights Commission President.

UAE Focus![]()

- UAE grew by 7.6% yoy in 2022, almost double the growth reported in 2021, disclosed the minister of economy at the Investopia conference held in Abu Dhabi last week. UAE’s foreign trade grew by 17% yoy to AED 2.2trn (USD 599bn) in 2022.

- PMI in the UAE inched up to 54.3 in Feb (Jan: 54.1, a 12-month low): in spite of strong growth in demand, new orders increased only the smallest degree since Sep 2021 while new export orders fell for the 3rd straight month. Input prices rose to the highest since Jul 2022, given the higher costs of raw materials and shipment fees.

- UAE and Turkey signed a Comprehensive Economic Partnership Agreement to promote bilateral economic and trade relations. The aim is to increase bilateral trade to USD 40bn in the next 5 years from USD 18.9bn recorded in 2022 (+40% yoy). Turkey is currently UAE’s 6th largest non-oil trade partner.

- ADNOC increased the stake being offered in its gas businesses to 5% based on “significant investor demand” and the retail tranche was increased to 12% of the offering (from 10%). The share price was set at AED 2.37 (near the top end of the range), with ADNOC raising around USD 2.5bn from the IPO (orders of over USD 125bn were received, implying an oversubscription of over 50 times); listing/ trading will commence Mar 13th.

- Deposit growth in the UAE (an average of 9.8%) outpaced credit growth (4.5%) last year. Savings deposits grew by 1.7% yoy and demand deposits were up by 7% yoy in Dec. Loans to the private sector increased by 3.8% in 2022, while loans to the public sector surged by 15%. Personal loans for consumption accounted for 23%of total loans as of Dec 2022, followed by construction and real estate (18%) and government (12%). SME lending has fallen off pandemic-highs, down to AED 83.3bn disbursed as of Dec 2022.

- The Central Bank of the UAE’s balance sheet grew by 8.1% mom to a record-high AED 554.99bn.

- UAE and India are holding “technical discussions” to finalise a rupee-dirham trade arrangement, according to the UAE Ambassador to India.

- The Wall Street Journal report that the UAE is considering leaving OPEC is not true, reported Reuters citing two sources with direct knowledge of the matter. Oil price had fallen almost USD 2 a barrel after the WSJ report was published.

- Petrol price in the UAE increased by up to 1.4% mom in March (following almost 10% hike in Feb) while diesel price fell by 7.1% to AED 3.14 per litre. This will be reflected in upcoming inflation readings (directly via transport prices and indirectly into other segments).

- UAE’s Masdar plans to invest USD 1.2bn in British battery storage technology, disclosed the CEO at the International Energy Week conference.

- Budget airlines flydubai reported record profits of USD 327mn in 2022, up 43% yoy while revenues surged by 72% yoy to USD 2.5bn.

Media Review

Wage-price spiral risks are still contained: IMF

https://www.imf.org/en/Blogs/Articles/2023/02/24/wage-price-spiral-risks-still-contained-latest-data-suggests

Interpreting China’s unambitious growth target

https://www.economist.com/china/2023/03/05/interpreting-chinas-unambitious-growth-target

How Singapore Impresses

https://www.project-syndicate.org/commentary/singapore-success-result-of-multiculturalism-not-authoritarianism-by-kaushik-basu-2023-03

Apocalypse then: lessons from history in tackling climate shocks

https://www.ft.com/content/33e66ae3-dac2-4cc0-b859-79edc7dd07dd

Gordon Ramsay’s Egypt Street-Food Pick Is Getting Harder to Afford

https://www.bloomberg.com/news/articles/2023-02-26/gordon-ramsay-s-egypt-street-food-pick-is-getting-harder-to-afford

Powered by: