Markets

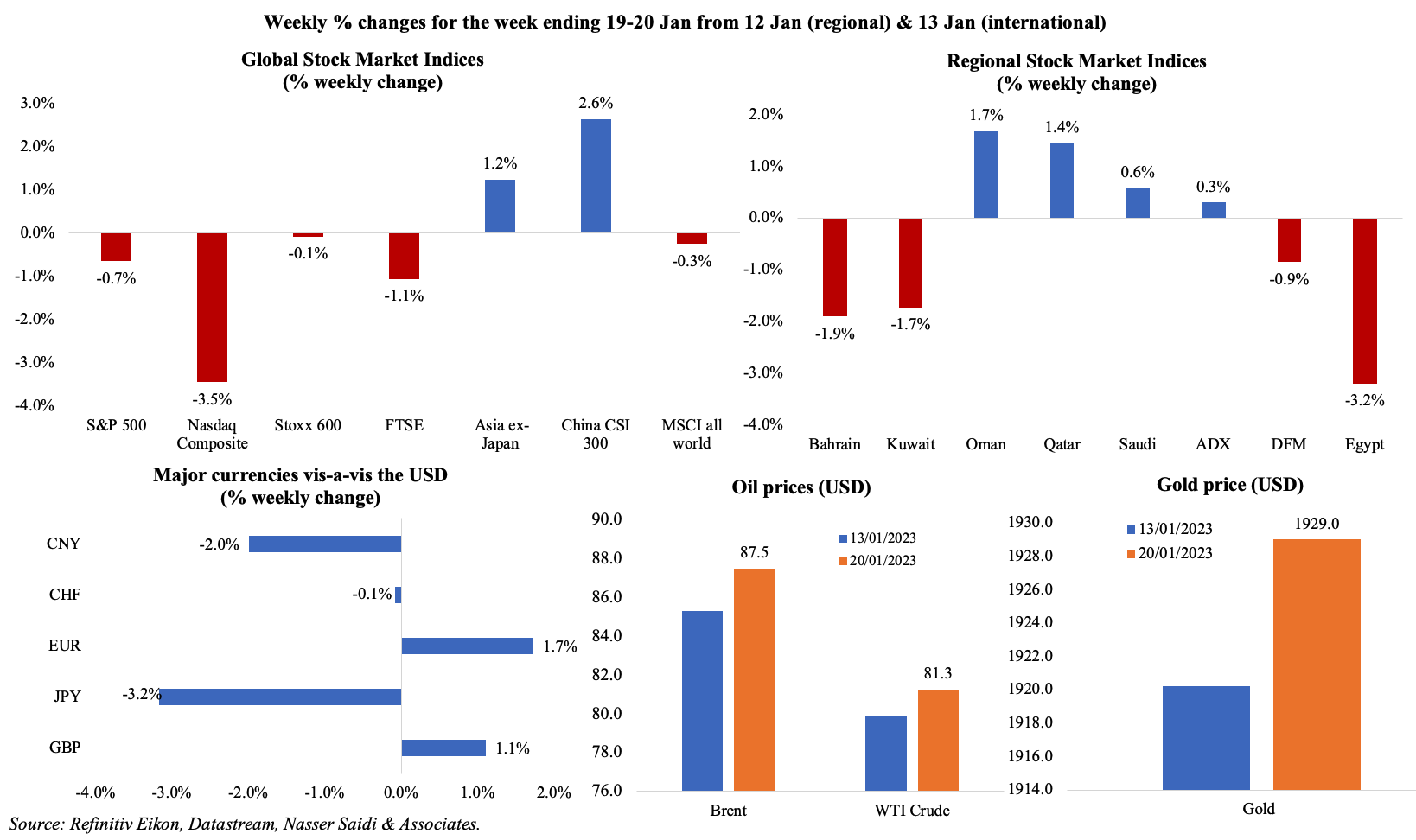

Global equity indices rose sharply on Fri, though posting losses for the week (including the MSCI all world index), as investors focused on the earnings season and remained cautious about upcoming central bank meetings; regional markets were mixed, with Egypt continuing with losses. On the currency front, the USD gained against the yen on BoJ’s remarks about continuing with the ultra-loose monetary policy, while the euro gained ground (on falling gas prices and easing recession fears) while sterling slipped towards end of the week on weak retail sales data. Oil markets gained for the 2nd consecutive week, thanks to expectations of rising Chinese demand for oil in addition to potential slowdown in the pace of Fed’s rate hikes as well as the Russian price caps. Gold price also gained last week, with the price rising to a 9-month high before closing lower.

Global Developments

US/Americas:

- Fed Beige book showed that businesses expect “little growth in the months ahead” amid moderating inflation, while employment was growing at a “modest to moderate” pace and wage pressures remain elevated.

- Producer price index inflation in the US slipped to 6.2% yoy in Dec (Nov: 7.3%) as costs of energy products and food decreased by 7.9% and 1.2% respectively. Core PPI was up by 4.6%, following a 4.9% rise in Nov.

- US retail sales tumbled by 1.1% mom in Dec (Nov: -1%), the biggest drop since Dec 2021: sales at gas stations showed the largest declines (-4.6%) while food and beverages stores sales were flat.

- Industrial production in the US fell by 0.7% mom in Dec, faster than the upwardly revised 0.6% drop in Nov, the biggest drop since Sep 2021. Durable and non-durable manufacturing fell by 1.1% and 1.5% respectively.

- NY Empire state manufacturing index plunged to -32.9 in Jan (Dec: -11.2), the lowest since May 2020, with massive declines in both new orders (-31.1 from Dec’s -3.6) and shipments (-22.4 from Dec’s 5.3). Input price rise slowed and selling price rise moderated.

- Philadelphia Fed manufacturing index inched up to -8.9 in Jan (Dec: -13.7), the 5th consecutive negative reading. The new orders index rose 11 points but remained negative at -10.9, and the shipments index climbed 12 points to 11.1 after turning negative in Dec.

- Building permits and housing starts fell to the lowest levels since mid-2020. Building permits fell by 1.6% mom to 1.33mn in Dec, with single family permits falling by 6.5% to 730k (the lowest since Apr 2020). Overall housing starts declined by 1.4% mom to a rate of 1.382mn units in Dec, though single-family housing starts rebounded by 11.3% to a seasonally adjusted 909k units (the highest level since Aug).

- Existing home sales fell by 1.5% mom to a seasonally adjusted 4.02mn in Dec, the lowest level since Nov 2010. Home resales fell 17.8% to 5.03mn units in 2022, the lowest annual total since 2014 and the sharpest annual decline since 2008.

- Initial jobless claims dropped for the third consecutive week, lower by 15k to 190k in the week ended Jan 14th: this was the lowest reading since Sep, and the 4-week average fell by 6,500 to 206k. Continuing jobless claims rose by 17k to 1.647mn in the week ended Jan 7th.

Europe:

- Inflation in the eurozone was confirmed at 9.2% yoy in Dec, from Nov’s 10.1% reading. The highest contribution to the annual euro area inflation rate came from food, alcohol, and tobacco (+ 2.88 ppts), followed by energy (+2.79 ppts), services (+1.83 ppts) and non-energy industrial goods (+1.70 ppts). The lowest readings were in Spain (5.5%), Luxembourg (6.2%) and France (6.7%) while the highest was recorded in Hungary (25%).

- Germany’s ZEW economic sentiment increased by 40.2 points to 16.9 in Jan (Dec: -23.3), returning to positive territory since Feb 2022. The current situation also improved, to -58.6 from -61.4 in Dec. The ZEW economic sentiment for the eurozone rose to 16.7 in Jan from -23.6: indicator of the current economic situation inched by 2.6 points to -54.8 and inflation expectations fell by 4.4 points to 83.7.

- Wholesale prices in Germany fell by 1.6% mom in Dec, following the 0.9% drop in Nov. In yoy terms, prices rose by 12.8% (Nov: 14.9%), with the prices of mineral products up by 22.8% (the largest impact in the WPI).

- German producer prices slowed to 21.6% yoy in Dec (Nov: 28.2%), posting the lowest level since Nov 2021, driven lower by energy prices (41.9% in Dec from 140% in Aug). In 2022, producer prices for commercial products rose 32.9% yoy – the highest annual average change since the survey began in 1949.

- Inflation in the UK inched lower to 10.5% in Dec (Nov: 10.7%), as petrol and diesel costs fell while food prices were up by 16.8% (reaching the highest since 1977) and cost of plane travel rising by 44.1% (the largest recorded rate since Jan 1989). Core consumer price index was unchanged at 6.3%.

- Retail sales in the UK unexpectedly declined by 1% mom in Dec (Nov: -0.5%), with a continued divergence between sales volumes and values (given high inflation levels). Compared to pre-Covid, total retail sales were 13.6% higher in value terms, but volumes were 1.7% lower.

- Unemployment rate in the UK remained unchanged at 3.7% in the 3 months to Nov. Average earning excluding bonus inched up, rising by 6.4% (vs 6.1% in the 3 months to Oct).

Asia Pacific:

- China’s GDP grew by only 2.9% yoy in Q4, slowing from the 3.9% gain in Q3, bringing the full year growth to 3% (much lower than the official target of 5.5%).

- Industrial production in China grew by 1.3% yoy in Dec (Nov: 2.2%), the weakest pace in 7 months. For full year 2022, IP grew by just 3.6% compared to the 9.6% growth in 2021. Retail sales fell for the 3rd straight month, down by 1.8% yoy in Dec, less than the 5.9% plunge recorded in Oct. Investment in fixed assets increased 5.1% during Jan-Dec 2022.

- China also posted its first population decline in 60 years: it fell by 850k to 1.41175bn in 2022. The birth rate was the lowest since records began more than seven decades ago: at 6.77 births for every 1,000 people, down from 10.41 in 2019.

- The People’s Bank of China injected a record amount of cash this week, reported Bloomberg, adding a net CNY 1.97trn (USD 291bn) to ensure liquidity ahead of the week-long Lunar New Year holiday. It also kept benchmark lending rates unchanged for a 5th month: the 1-year loan prime rate was left at 3.65% while the 5-year LPR was left at 3.65%.

- The Bank of Japan left policy rates unchanged at the latest meeting, opting for an ultra-loose monetary policy and maintaining its yield curve tolerance band.

- Core inflation in Japan surged to a new 41-year high of 4% yoy in Dec – the 9th consecutive month of exceeding the BoJ’s 2% target. Core-core CPI, excluding both fresh food and energy costs, was 3.0% higher in Dec (Nov: 2.8%).

- Industrial production in Japan rebounded by 0.2% mom in Nov (from the flash reading of -0.1% and Oct’s -3.2%). In yoy terms, IP edged down by 0.9%, the first drop in 4 months.

- Exports from Japan increased by 11.5% yoy in Dec (Nov: 20%), recording the slowest growth in 2022, as shipments to China fell for the first time in 7 months. Imports meanwhile grew by a faster 20.6%, resulting in a deficit (for the 17th consecutive month) of JPY 1.45trn (USD 11.29bn). For full year 2022, trade deficit stood at JPY 19.97trn, the second straight deficit and the largest since 1979.

- Wholesale price inflation in India eased to a 22-month low of 4.95% yoy in Dec, lower than Nov’s gain of 5.9%. The easing was largely due to the fall in prices of food articles and crude petroleum.

Bottom line: As the earnings season gets underway, a common rhetoric from firms seems to be the need to rein in spending in the backdrop of a potential recession amid higher interest rates and rising inflation which constrain consumer demand; major tech and other high-profile firms announced job cuts. Key developments last week were the Bank of Japan’s status-quo on its ultra-loose monetary policy, as well as the US government touching its USD 31.4trn borrowing limit. There seems to be a glimmer of hope that Chinese demand is back on track: ANZ analysist pointed to a 22% rise in road congestion across 15 key cities since the start of this year; the Economist calculated an increase in traffic volume between 7-19 Jan (“travel rush” period ahead of the Chinese New Year) of 24% compared to an equivalent period in 2022, 117% higher than in 2021 and 12% higher than in 2019. Lastly, this week’s flash PMIs will be dissected for signs of recession and inflation risks – following a contraction in global business activity for the 5th month running in Dec.

Regional Developments

- Exports from Egypt increased by about 20% yoy to around USD 53.8bn in 2022 (from USD 45bn in 2021), according to the Prime Minister.

- With inflation surging to 5-year highs, Egypt announced that discounted bread will also be provided to persons who are not enrolled in its bread subsidy programme. About 70mn of its 104mn citizens avail the bread subsidy, and this decision could increase the amount of bread sold by the government by up to 10% according to the supply minister.

- Egypt’s central bank disclosed that foreign investors transferred more than USD 925mn into the forex market in the period 11-13 Jan after the currency depreciated sharply.

- Egypt signed a USD 1.5bn financing agreement with the International Trade Finance Corporation (ITFC) to fund commodity imports including grains and petroleum, reported CNBC Arabia. This follows a similar agreement last year and brings the total ITFC financing amount to USD 14.5bn so far.

- Iran’s currency fell to a record low against the dollar on Saturday: the dollar was selling for about 447,000 rials on Saturday (vs 430,500 the day before).

- Inflation in Kuwait eased slightly to 3.15% yoy in Dec (Nov: 3.18%), thanks to slower increase in prices (housing and recreation, for example) while food and beverages costs continued to rise (7.5% from 6.7%) alongside restaurants and hotels (3.5% from Nov’s 2.3%).

- Project deals in Kuwait surged by 688% yoy to KWD 383mn in Oct-Dec, following a near 20-year low in Q3, according to a report from the National Bank of Kuwait. For the full year 2022, total value of awarded projects was down by 46.6% yoy to KWD 832mn – the second lowest reading since 2005.

- Lebanon’s central bank set a new rate of LBP 15,000 to the USD for withdrawals from dollar-denominated bank deposits – representing a haircut of around 70%. Furthermore, a withdrawal ceiling of USD 1600 per month in Lebanese pounds was set for account holders.

- Lebanon needs to pay arrears, a minimum of some USD 1.8mn, to regain its voting rights at the UN. This is the 2nd time in 3 years that voting rights were lost due to unpaid contributions.

- Oman’s oil and gas drilling firm Abraj Energy Services is planning an IPO, with an aim to list up to 49% of its shares on the Muscat Exchange in March. The firm is the largest drilling contraction in Oman, with a market share of 30%.

- The energy ministry revealed that Oman has started natural gas and condensate production from the Mabrouk field: production is expected to rise to more than 0.5bn cubic feet per day of gas by mid-2024.

- Inflation in Qatar surged to 5.93% yoy in Dec, driven by an uptick in recreation & culture costs (25.36%), housing & utilities (11.9%) and restaurants & hotels (10.1%) among others.

- MENA debt issuance touched USD 37.3bn in 2022, the lowest full year total since 2011, according to Refinitiv data. Saudi government was the largest debt issuer in MENA last year, raising USD 5bn. Saudi also topped in the issuance of Islamic bonds, at USD 2.5bn (out of a regional total of USD 12.2bn, a 7-year low).

- International arrivals in the Middle East climbed to 83% of pre-pandemic numbers last year, according to the UN World Tourism Organisation.

- Hotel pipeline activity in the Middle East saw an uptick at end-2022: according to STR, about 238,635 hotel rooms were under contract in the region in Dec, up 1.1% yoy. The bulk of the construction is taking place in Saudi Arabia (17.1% of total) and the UAE (11.5%).

Saudi Arabia Focus

- The Saudi Crown Prince launched the Events Investment Fund, that will conceptualize, finance, and oversee the development of more than 35 venues by 2030. According to the Saudi Press Agency, the fund aims to deliver its first asset by 2023.

- Saudi Arabia is changing its way of providing support to its allies – from giving grants and deposits unconditionally previously to imposing conditionality and “need(ing) to see reforms” – according to the finance minister.

- SAMA has reduced the minimum paid-up capital for finance firms specialized in supporting SMEs to SAR 50mn(USD 13.3mn): this is expected to attract more investors into the SME sector and more SME-specialised finance companies.

- The CEO of NEOM disclosed that nearly 20% of infrastructure works in NEOM had been completed, with works progressing as per schedule.

- Crude oil exports from Saudi Arabia fell by 6.3% mom to a 5-month low of 7.28mn barrels per day in Nov, according to JODI. Crude production had fallen to 10.47mn bpd in Nov (Oct: 10.96mn bpd) while domestic crude refinery throughput decreased by 19k bpd to 2.66mn bpd.

- Saudi Arabia remained China’s largest source of crude oil in 2022 (87.49mn tonnes of crude, on par with 2021), followed by Russia (+8% to 86.25mn tonnes).

- The Saudi Ministry of Investment signed a USD 1bn investment agreement to manufacture specialized agricultural chemicals in the country with the Indian firm UPL.

- Saudi Arabia’s National Development Fund approved financing and support worth over SAR 135bn (USD 36bn) in 2022: this includes financing agreements for NEOM’s green hydrogen production plant and Saudi electric car company CEER among others.

- Saudi Arabia’s Human Resources Development Fund (Hadaf) disclosed that it supported 400k Saudis get private sector jobs in 2022 while more than 1.49mn persons benefitted from training and guidance programs.

- Real estate prices in Saudi Arabia increased by 1.6% yoy in Q4 2022, thanks to an uptick in residential property values (+2.6% yoy).

- Saudi Arabia reduced the cost of comprehensive insurance for overseas Umrah performers by 63% to SAR 87.

UAE Focus![]()

- The UAE and India are in early discussions to trade non-oil goods in Indian rupees, according to the UAE Minister for Foreign Trade. India, the second largest trade partner of the UAE, has already signed a CEPA to accelerate bilateral trade to USD 100bn in the next five years or so. If this comes through, a similar discussion could be initiated with other large trading partners (especially developing nations that could be looking to lower transaction costs).

- UAE pledged to invest USD 30bn in South Korea’s industries: though no official plans were specified, this is expected to be directed at nuclear power, defence, hydrogen and solar energy industries, among others. Investments are to be led by the sovereign wealth funds including Mubadala.

- Sales of marine fuels (or bunkers) eased 1.5% yoy to about 7.7 million tonnes in 2022 at Fujairah, the third largest bunkering hub globally. It is expected to ease further in 2023 because of softening demand for container ships.

- The UAE launched 11 clean energy projects worth AED 159bn (USD 43bn) in 2022, according to the Minister of Energy and Infrastructure. UAE’s clean energy production totalled 7,035.75MW in 2021, with its contribution to the total energy mix reaching 19.63% in 2021 (renewable energy was 12% and peaceful nuclear energy at 7.55%).

- UAE-based Masdar and ADNOC are undertaking a joint feasibility study with BP to explore the production of sustainable aviation fuel in the UAE alongside other products like renewable diesel and naphtha, using municipal solid waste and renewable hydrogen. The region’s “first commercial scale production capacity in Abu Dhabi” can be expected if the results of the study are positive, according to Masdar.

- UAE-based companies will be required to attest import invoices with a value of AED10k and above from Feb 1st onwards. The attestation will be done electronically and will cost AED 150 per invoice. Exemptions are applicable to personal imports, imports from the GCC and those into free zones among others.

- Real estate transactions in Dubai touched a record high of AED 528bn (USD 143bn) in 2022, up 76.5% yoy. More than 86k residential transactions were registered, much higher than the previous record of 80k in 2009. Furthermore, Dubai also saw the completion of 55 real estate projects (+57% yoy) worth AED 11.9bn (+8%) last year and a further 350 projects are currently being developed.

Media Review

Unrest and unsettled leaders bode ill for the Middle East in 2023

https://www.ft.com/content/71447fef-7d65-4a00-86bd-046505c657fb

Davos 2023: Riyadh city developing fast with eye on Expo 2030 bid

Nature-based solutions in cities are the future of the fight against climate change

https://www.weforum.org/agenda/2023/01/climate-change-cities-nature-based-solutions-wef23/

Dr. Nasser Saidi on the CNN Business Arabic podcast, discussing likelihood of a global recession and persisting inflation

Powered by: