Markets

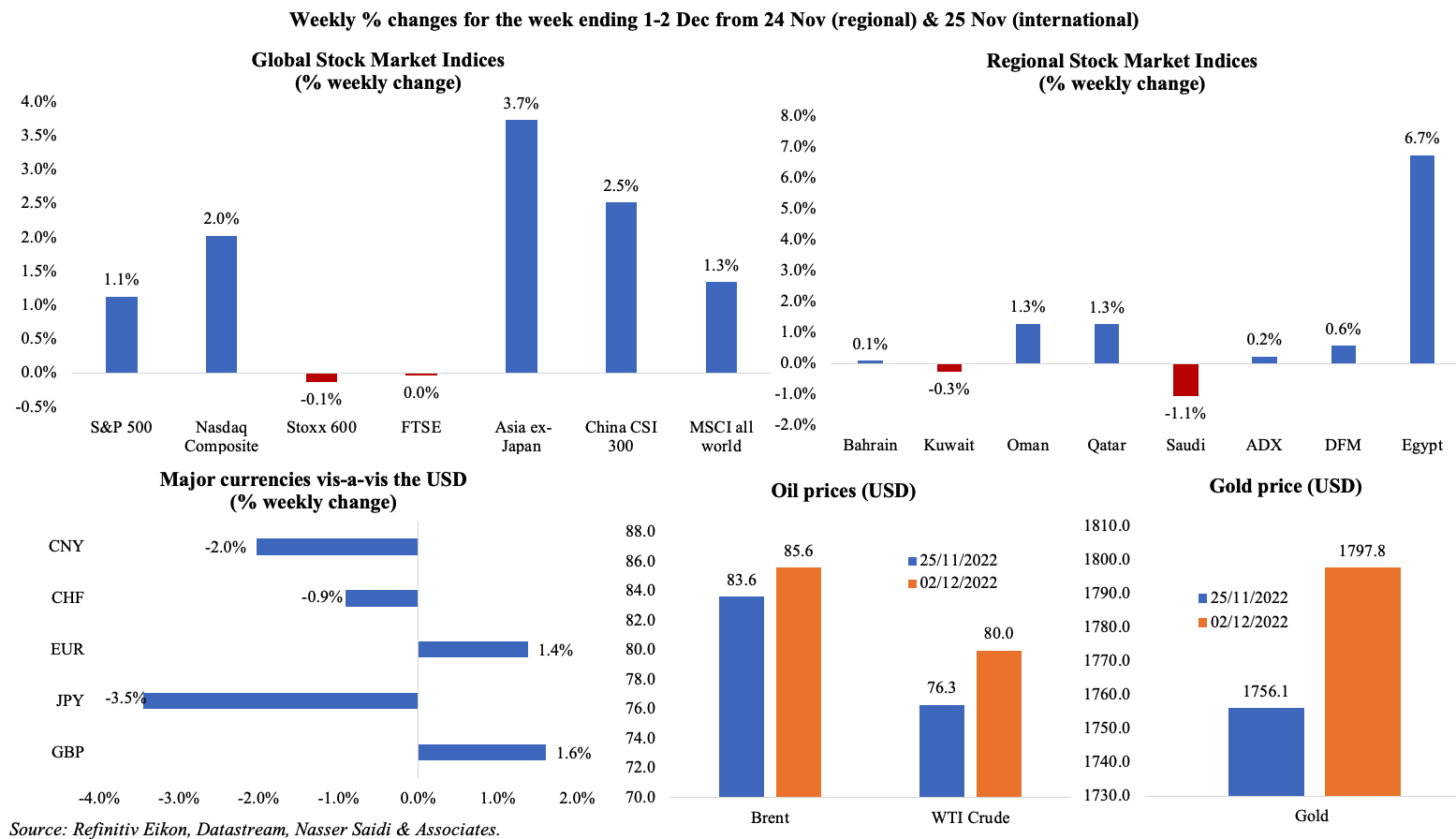

US equity markets posted second consecutive weekly gains following hints from the Fed about slowing the rate hikes though payrolls data will likely add some pressure. Major European equity markets ended slightly in the red. MSCI Emerging markets index had their best month since 2009 as Chinese and Asian markets turned around thanks to signs of easing Covid restrictions in China. Risk views however remain varied, as the global yield curve inverted for the first time in two decades. Regional markets were mixed, with Egypt the best performer amongst them. Oil markets remained a focus during the week with the decision on the Russian oil price cap (decided at USD 60 per barrel), as well as the OPEC+ meeting (oil output levels will remain steady).

Global Developments

US/Americas:

- GDP in the US rebounded by a stronger annualised rate of 2.9% in Q3, from an initial estimate of 2.6% and Q2’s 0.6% drop. In qoq terms, GDP grew by 4.3%. The gains in growth were largely due to upward revisions in consumer and business spending growth as well as exports, while residential investment dragged for the 6th straight quarter.

- Personal income increased by 0.7% mom in Oct (Sep: 0.4%), the most in a year. Spending grew by 0.8% (Sep: 0.6%), thanks to increase in purchases of motor vehicles, furniture and recreational goods. The saving rate dropped to 2.3%, the lowest since Jul 2005 (Sep: 2.4%). Personal consumption expenditures price index rose by 0.3% mom and 6% yoy, the smallest yoy gain since Dec 2021; core PCE price index rose by just 0.2% (Sep: 0.5%).

- Non-farm payrolls grew by 263k in Nov (Oct: 284k), the lowest in a year, with biggest gains recorded in leisure/ hospitality (+88k) and education/ healthcare (+45k). Unemployment rate remained unchanged at 3.7%. Average hourly earnings unexpectedly grew by 0.6% mom (the highest since Oct 2021) and 5.1% yoy. Labour force participate rate edged down to 62.1% (Oct: 62.2%).

- Private sector jobs in the US increased by 127k in Nov (Oct: 239k), according to ADP, posting the smallest gain since Jan 2021. While leisure and hospitality added 224k jobs, this was offset by losses across manufacturing (-100k), professional and business services (-77k) and financial activities (-34k) among others.

- JOLTS job openings fell by 353k to 10.334mn in Oct (Sep: 10.687mn), the 16th straight month with job openings staying above 10mn. There were 1.7 job openings per available worker for the month, down from a 2:1 ratio a few months ago.

- Goods trade deficit in the US widened to USD 99bn in Oct (Sep: USD 92.7bn), as exports declined by 2.6% to USD 173.7bn.

- ISM manufacturing PMI slipped to 49 in Nov (Oct: 50.2), falling below-50 for the first time since May 2020, as new orders declined to 47.2 (Oct: 49.2) and employment index declined to 48.4 (Oct: 50). Prices paid eased to 43 from 46.6 the month before.

- S&P Global’s US manufacturing PMI was revised up to 47.7 in Nov, from a preliminary reading of 47.6, but falling below-50 for the first time since Jun 2020. The headline reading was dragged down by declines in output and new orders amid weak domestic and external demand. The silver linings were the improvement in supply chains for the first time since Oct 2019 as well as the slowest rise in input costs in 2 years.

- Chicago PMI plunged to 37.2 in Nov (Oct: 45.2), the lowest reading since May 2020 and the third consecutive month of contractionary readings. Dallas Fed manufacturing business index improved to -14.4 in Nov (Oct: -19.4) as prices paid for raw materials fell to 22.6 (from 32) though new orders sank to -20.9 (from -8.8), remaining negative for the 6th straight month.

- S&P Case Shiller home price index eased in Sep, rising by 10.4% yoy (Aug: 13.1%). It fell by 1.2% mom in Sep, the third consecutive monthly decline.

- Pending home sales tumbled by 4.6% mom and 37% yoy in Oct (Sep: 31% yoy): this is the sharpest yoy decline ever. Mortgage rates are now off recent 20-year highs, but at around 6.48%, it remains higher than the 3.18% average recorded in the same period a year ago.

- Initial jobless claims fell by 16k to 225k in the week ended Nov 25th, with the 4-week average inched up by 1,750 to 228.75k. This could partially be due the recently announced tech layoffs as well as the slow hiring season close to the holidays and year-end. Continuing jobless claims rose by 57k to 1.608mn in the week ending Nov 17th, the highest since Feb.

Europe:

- Preliminary estimates for inflation in the eurozone eased to 10% yoy in Nov from the record high Oct reading of 10.6%, down for the first time in 17 months. Core inflation remained unchanged at 5%. Inflation slowed in Germany (11.3% from 11.6%), Italy (12.5% from 12.6%) and Spain (6.6% from 7.3%) but was unchanged in France at record-high 7.1%.

- Eurozone’s manufacturing PMI stayed below-50 for the 5th month in a row in Nov: it was revised down to 47.1 from a preliminary reading of 47.3, but higher than Oct’s 46.4 (which was the lowest since May 2020). Data showed a reduction in output volumes as well as a sharp decline in new orders (as demand weakened). The report also highlighted that “supplier delivery times lengthened in Nov to the smallest extent since Aug 2020” (implying a shift to a buyers’ market).

- Manufacturing PMI in Germany moved up to 46.2 in Nov (Oct: 45.1), with firms reporting weakening of demand and drop in new orders; input cost inflation fell to a 23-month low while the survey’s delivery times index clocked above 50-mark for the first time in almost 2.5 years.

- Producer price index in the eurozone decreased by 2.9% mom in Oct (Sep: 1.6%). In yoy terms, it slowed sharply to 30.8% (Sep: 41.9% and Aug’s record 43.4%), with energy costs up by 65.8% (Sep: 108%). Core producer prices rose by 14% yoy in Oct (Sep: 14.5%).

- Exports from Germany declined by 0.6% mom in Oct, the second consecutive month of decline. Exports to the US, its largest trade partner, fell by 3.9% while exports to rest of EU were down by 2.4%. Imports fell a sharper 3.7%, thereby widening the surplus to EUR 6.9bn.

- Retail sales in Germany shrank by 2.8% mom (the biggest mom decline this year) and 5% yoy in Oct. Sales at groceries declined by 1.2% and non-food by 4.5%. However, retail sales were 1.8% higher than in pre-pandemic Oct 2019.

- Eurozone’s unemployment rate slowed to a new record-low of 6.5% in Oct (Sep: 6.6%), with a 142k decline registered in number of jobless persons (the largest drop since Nov 2021).

- Unemployment rate in Germany inched up to 5.6% in Nov (Oct: 5.5%), with unemployed persons increasing by 17k to 2.43mn alongside a decline in vacancies.

- Business climate in the euro area slipped to 0.54 in Nov (Oct: 0.74), the lowest since Mar 2021. Consumer confidence in the euro area rose by 3.6 points to -23.9 while in the EU as well there was an improvement (+2.8 points).

- Economic sentiment indicator in the euro area improved by 1 point to 93.7 in Nov, after 8 months of declines, as services sentiment improved (to 2.3 from 2.1) while industrial and construction sectors confidence slipped to -2 and 2.3 (from -1.2 and 2.6 respectively).

- UK manufacturing PMI increased to 46.5 in Nov (Oct: 46.2): intermediate goods were the weakest performing sector, recording the steepest declines across output, new orders and employment. Input price inflation, though easing, remained above the long-run average.

Asia Pacific:

- China loosened its Covid restrictions after a week of protests: announcements in multiple cities have included reduction in mass testing, removing need for test results to access supermarkets/ parks/ public transport as well as allowing isolation at home for positive cases and close contacts. More announcements are expected to follow, though concerns remain as to the rates of vaccination (especially among the elderly). Importantly, foreign vaccinations are still not approved in China.

- China’s NBS manufacturing PMI slipped to 48 in Nov (Oct: 49.2), the second consecutive month of below-50 readings, and as the pace of decline increased across output, new orders and export sales. Non-manufacturing PMI dropped to 46.7 in Nov (Oct: 48.7), the steepest decline since Apr: new orders contracted (42.3 from 42.8), employment sub-index declined further (45.5 from 46.1) and confidence fell to a 7-month low of 54.1.

- Caixin manufacturing PMI in China unexpectedly inched up to 49.4 in Nov (Oct: 49.2), while remaining sub-50 for the 4th month in a row.

- Industrial production in Japan fell by 2.6% mom in Oct (Sep: -1.7%), as per preliminary estimates. Output declined across multiple categories including production machinery (-5.4% in Oct from Sep’s 1.8% dip) and electronic parts and devices (-4.1 from 0.4%) among others. In yoy terms, IP growth slowed to 3.7% from Sep’s 9.6% gain.

- Manufacturing PMI in Japan stood at 49 in Nov, contracting for the first time since Jan 2021 and lower than Oct’s 50.7. Output and new orders led the decline, down the most since Aug 2020 and export orders were negatively affected by rise in Covid cases in partner nations.

- Unemployment rate in Japan remained unchanged at 2.6% in Oct while the jobs to applicants’ ratio inched up to 1.35 (from 1.34), the highest reading since Mar 2020.

- Retail sales in Japan increased for the 8th successive month, rising by 4.3% yoy in Oct (Sep: 4.8%), thanks to the full reopening of tourism (Oct saw almost 500k visitors, more than twice as many in Sep). Large retailer sales growing by an unchanged 4.1%.

- India’s GDP expanded by 6.3% yoy in Jul-Sep, almost half of the 13.5% gain recorded in the Apr-Jul quarter, dragged down by weak manufacturing activity but supported by government capital spending on infrastructure (+40%). Private consumption was up by 9.7% yoy and capital formation was up by 10%. The Reserve Bank of India forecasts overall growth at 7% for the full year 2022-23 (ending in Mar).

- Fiscal deficit in India widened to INR 7.58trn in the period Apr-Oct or 45.6% of annual estimates. Receipts and overall spending were at 60.7% and 54.3% respectively of the budget target for the year.

- Infrastructure output in India slowed to a 20-month low in Oct, growing by just 0.1% (Sep: 7.9%). For the period Apr-Oct, infrastructure output rose by 8.2%.

Bottom line: Global manufacturing PMI fell to 48.8 in Nov (Oct: 49.4), the lowest level since 2020, with the underlying message being weak demand amid a renewed fall in employment. Extremes were evident with Asian nations reporting higher production volumes (except in China and Japan) while Europe reported the steepest downturns. With more central bank meetings from the Fed, the ECB and Bank of England left before the end of the year, and questions related to peak interest rates, markets are unlikely to remain calm especially in the backdrop of China’s easing restrictions. It is important to note that even though easing is underway, it will take a while before “normalcy” is achieved (perhaps Q2 or even as late as Q3 2023), especially given the low levels of vaccination among the elderly and with Chinese New Year festivities in Jan 2023.

Regional Developments

- OPEC+ made no changes to its existing oil policy, i.e. will continue reducing oil production by 2mn barrels per day, or about 2% of world demand, from Nov until end-2023. This came in the backdrop of the weak global growth alongside G7 and Australia joining the EU nations’ agreed price cap of USD 60 on Russian oil (this was not discussed during the OPEC+ meeting). The price cap is expected to be reviewed every two months, starting mid-Jan.

- Economic growth in Egypt was 4.4% yoy in Q1 2022-23, according to a cabinet statement. Unemployment rate rose to 7.4% yoy from 7.2% in the same quarter a year ago. The minister of planning revealed that a growth rate of 5% is expected in the current fiscal.

- Egypt’s net foreign assets fell by EGP 109.9bn (USD 4.47bn) to a negative EGP 551.0bn in Oct, after the currency devaluation. NFAs were at EGP 248bn in Sep 2021, before the decline began.

- Saudi Arabia extended the term for a USD 5bn deposit made to Egypt’s central bank in March, though the duration of the extension was not disclosed.

- Egypt’s central bank halted a financing scheme launched in 2019, which enabled private sector firms to establish lines of credit at a reduced interest rate of 8%. With markets interest rates at about 19% now, the beneficiaries of the scheme will be allowed to pay back their loans at the 8% rate but new loans will be given only at the current market determined rates.

- The government of Egypt allocated total investments worth EGP 49.5bn to the development of the petroleum and mineral resources sector under the 2022-23 plan.

- Egypt’s agriculture ministry announced that the nation would start exporting agricultural products to the Philippines following five years of negotiations.

- Egypt’s government and UAE firm AMEA Power have agreed to build a 560megawatt solar park and 505MW wind farm in a USD 1.1bn deal. The deal is supported with debt and equity financing from the IFC as well as several development and commercial banks. Construction is expected to start in Dec 2022, with completion dates after 18 and 30 months for the solar plant and wind farm respectively.

- The CEO of Egypt’s sovereign fund disclosed that deals will be awarded to build 21 water desalination plants next year, as part of the first USD 3bn phase of a programme.

- Egypt’s Suez Canal revenues are likely to touch USD 7.8bn at the end of 2022, according to the Chairman of the Suez Canal Authority.

- Kuwait’s Ambassador to Jordan disclosed that Kuwait is the top investor in Jordan, with KWD 5.5bn (USD 18bn) in investments. He also noted that the two nations have signed 73 joint agreements to enhance existing economic relations.

- Lebanon’s caretaker government was expected to meet this week after more than 6 months, reported Reuters. However, there is no mention of financial reforms on the agenda which includes health, education and other matters.

- Inflation in Lebanon increased by 158.5% yoy and 14.6% mom in Oct, with inflation at three-digit yoy levels for the 28th consecutive month. Prices are up across the board, with cost of healthcare nearly up fourfold, restaurants, hotels and education costs up three times and that of clothing, footwear as well as recreation costs up by 2.5 times compared to a year ago.

- S&P Global Ratings upgraded Oman’s credit rating from “BB-”to “BB”, with a stable future outlook citing improved fiscal performance and commending the nation’s efforts to reduce indebtedness.

- Qatar signed and agreed two sales and purchase agreements to export 2mn tonnes LNG annually to Germany for at least 15 years from 2026. The former’s energy minister stated later that there is no limit to the amount of LNG that can be shipped to Germany. Germany is constrained by plans to reduce gas consumption from mid-2030s to meet its goal to become carbon-neutral by 2045.

- Two million Hayya cards have been issued to attend the Qatar World Cup, revealed FIFA. Saudi Arabia topped the list of visitors followed by India, the US, the UK and Mexico.

- US state department approved the potential sale of an anti-drone system to Qatar – a deal valued at USD 1bn. Negotiations have not yet been concluded nor a contract signed yet.

- IATA disclosed that Middle East carriers saw a 15% yoy rise in passenger traffic in Oct, though air cargo volumes dropped by 15% yoy during the month.

- Americana Restaurants IPO’s listing and trading process will commence across the UAE and Saudi exchanges on Dec 12th.

Saudi Arabia Focus

- Saudi Arabia announced the discovery of two natural gas fields in the country, in turn adding to its overall natural gas reserves (Saudi accounted for 3.2% of total proved natural gas reserves in 2020, according to BP Statistics).

- Saudi PIF raised a new USD 17bn 7-year senior unsecured term loan, aligning with its “medium-term capital raising strategy and its 2022 Annual Capital Raising Plan”. A USD 11bn 5-year loan arranged in 2018 will be repaid early, according to the PIF statement.

- Foreign reserve assets in Saudi Arabia fell by SAR 15.75bn to SAR 1.74trn in Oct (vs Sep); in yoy terms, foreign reserve assets grew by 3%.

- Saudi Arabia extended the term of a USD 3bn deposit it made to Pakistan’s central bank. The central bank’s reserves stood at around the USD 7.5bn mark by 25th Nov, not sufficient to meet even a month of imports. Pakistan’s finance minister disclosed that an IMF review for the release of its next tranche of funding has been pending since Sep.

- Saudi Arabia issued permits for 725 industrial projects in Jan-Sep 2022, worth an accumulated SAR 1.37trn (USD 265bn), according to data from the Ministry of Industry and Mineral Resources. In Sep alone, permits were issued for 79 industrial projects worth an estimated SAR 3.1bn with up to 1,882 licensed workers.

- Saudi Aramco’s base oil subsidiary Luberef expects to raise up to SAR 4.95bn (USD 1.32bn) from its IPO. The company plans to sell nearly 30% of its issued share capital (or 50.045mn shares), at between SAR 91 and 99, and a minimum of 75% will be offered to institutional investors.

- Plans were revealed to transform the Saudi Riyadh airport into a hub with 6 parallel runways, accommodate up to 120mn travellers by 2030, and act as the base of its new airline RIA. The new King Salman International Airport (which will include the current King Khaled airport) is expected to contribute USD 7.2bn annually to the non-oil economy, create 103k direct and indirect jobs, handle 185mn travellers and process 3.5mn tons of cargo by 2050.

- Saudi Arabia is offering investment opportunities worth USD 6trn in the travel and tourism sector through to 2030, revealed the tourism minister at the World Travel and Tourism Council (WTTC) Global Summit. Separately, the CEO of WTTC stated that WTTC members will invest USD 10.5bn in Saudi Arabia’s tourism sector.

- The Tawteen program’s second edition plans to create more than 170k new jobs in Saudi Arabia: of these, 30k jobs will be in the tourism sector alone and another 15k in the trade sector among others.

- ACWA Power and a PIF unit agreed to develop the largest solar power plant in the Middle East: the 2,060-megawatt project is expected to be ready by Q4 2025 and aims to generate power for 350k homes.

- The world’s first commercial shipment of blue ammonia is bound for South Korea from Saudi Arabia. The Vessel Seasurfer, carrying 25,000 metric tons of low-carbon blue ammonia, is expected to reach its destination between Dec 9th and 13th.

- PIF-owned Saudi Entertainment Ventures (Seven) plans to invest SAR 50bn (USD 13.3bn) to develop 21 integrated entertainment destinations in 14 cities. The firm added that construction on the first entertainment destination started in the Al Hamra district of Riyadh.

- Saudi Arabia’s defence ministry signed a MOU with Spanish state-owned Navantia to build multi-mission combat ships for the Saudi Navy. The company will “localize up to 100% of naval shipbuilding, integration of combat systems, and ship maintenance”.

- Saudi Arabia presented the country’s bid to host the World Expo 2030 in Riyadh during a general assembly of the Bureau of International Expositions last week. Other candidates in the run include South Korea (Busan), Italy (Rome), Ukraine (Odesa) and Russia (Moscow).

UAE Focus![]()

- UAE announced that it would move forward ADNOC’s 5mn barrels per day production capacity expansion to 2027, from the previously announced 2030, to meet global energy demand. The firm will also boost investments to USD 150bn over the next 5 years. The Board also decided to create ADNOC Gas as a separate entity effective from Jan, consolidating its two gas businesses, with plans to float a minority stake in the company in 2023 on the Abu Dhabi Stock Exchange.

- The UAE Federal Decree Law No. 37 of 2022 on family businesses will come into force in Jan 2023: included are the formation of a “Family Business Dispute Resolution Committee” in each emirate (as such disputes are the main causes for termination of family businesses), clarity on procedures and controls to follow in the event of bankruptcy/ insolvency of one of the partners, allowing more flexibility in number of partners, and providing existing partners priority right to buy shares of other partners in case of fellow partners’ bankruptcy among others.

- Passenger traffic in Abu Dhabi airports grew by 250% yoy to 4.7mn passengers in Q3 2022. The airports received 10.98mn passengers till end-Sep, equivalent to the total in 2020 and 2021 combined, and it is expected that it will total more than 15mn passengers in 2022.

- Dubai Airports post-pandemic recovery was supported by the rise in traffic growth between Saudi Arabia and Dubai (18% of total traffic), according to the Dubai Airports CEO. He also disclosed that that point-to-point traffic numbers to the city were 119% over and above pre-pandemic levels in Dec 2021.

- ADGM’s Financial Services Regulatory Authority launched an AI initiative to support in the field of regulatory compliance. The ADGM’s OpenReg initiative provides a “training ground” where specialists, stakeholders and the data science community have access to FSRA’s AI models, data and research to create AI-enabled RegTech tools.

- Petrol prices in the UAE were decreased by 2 fils (AED 0.2) in Dec across the various categories.

- Etihad Rail has reached an agreement with petrochemical company Borouge to transport 1.3mn tonnes of polyolefins annually from its petrochemical complex in Al Ruways Industrial City via rail for export. The use of Etihad Rail will reduce the time required to transport Borouge’s products to 4 hours (vs 12 hours via other modes of transport).

- The UAE’s President, in his capacity as the ruler of Abu Dhabi, ordered the disbursement of housing loans worth AED 3bn to 1900 citizens. Altogether, total value of housing packages disburse1d this year stands at around AED 7bn to more than 4k beneficiaries.

- The Ruler of Dubai approved the Dubai Countryside and Rural Areas Development Master Plan, spanning an area of 2,216 square kilometres: the plan will protect natural reserves and archaeological sites while creating unique tourist experiences in such destinations (like scenic routes, sky diving, hot air balloons, safari trips etc).

Media Review

The humbling of Xi Jinping

https://www.ft.com/content/71bf8a5d-3816-450b-bbfb-ec320b0dba0d

The unavoidable crash

India’s e-rupee launched on a pilot basis from Dec 1

Saudi Central Bank Steps Up Efforts to Ease Liquidity Crunch

Why the World Cup’s first stage has been surprisingly even

Powered by: