Download a PDF copy of the weekly economic commentary here.

Markets

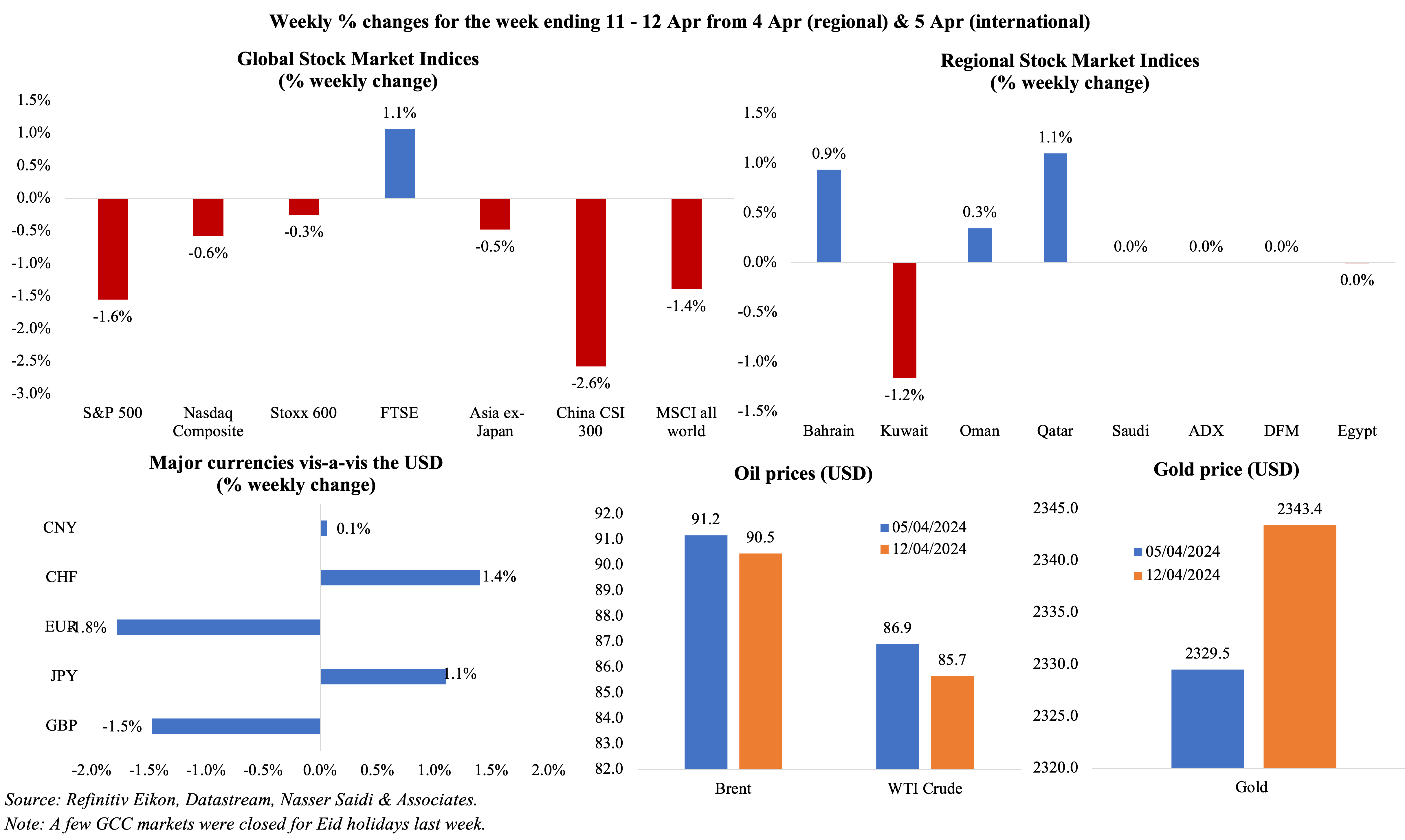

Major equity markets fell last week, with the S&P 500 and MSCI all world index clocking in its biggest 1-day drop since end-Jan and Nov respectively on Friday – the declines were a combined result of inflation and central bank outlooks as well as escalating geopolitical tensions. As of end-last week, most markets (that were open) in the region posted gains; Kuwait’s index was dragged down by industry and finance sectors. Geopolitical risks and possible delays in rate cuts led to a dollar rally (USD posted its best weekly performance since 2022); vis-à-vis the greenback, the JPY touched a 34-year low last week before rebounding while the euro and GBP fell to a 5-month low. Oil prices ended the week slightly lower (partly due to expectations of weaker demand amid calls that the Fed interest rate cut could take longer to materialise). The safe-haven asset gold saw its price edge up. (The chart below is for weekly changes as of end of Friday last week).

Since the air strikes on Israel by Iran over the weekend, which occurred without major damages, markets have calmed: oil prices have dipped slightly while major equity markets (S&P 500, Stoxx, FTSE and China’s CSI) advanced alongside gold prices.

Global Developments

US/Americas:

- Inflation in the US increased to 3.5% in Mar (Feb: 3.2%), the highest since Sep and well above the Fed’s 2% target. Energy costs accelerated (2.1% vs Feb’s 1.9% drop) and so did transportation costs (10.7% from 9.9%) while food and shelter stayed put at 2.2% and 5.7% respectively. Core inflation, excluding food and energy, held steady at 3.8%.

- US producer price index rose to 2.1% yoy in Mar (Feb: 1.6%), the most since Apr 2023. PPI eased in month-on-month terms, rising by a relatively slower 0.2% (Feb: 0.6%), pushed up by cost of services (+0.3%). Core PPI moved up to 2.4% versus Feb’s 2.1% reading.

- FOMC minutes indicated that Fed officials remained concerned about the “persistence of high inflation”e. that it was not slowing as quickly as expected. With Mar inflation clocking in at 3.5%, the market is expecting the first rate cut (of 2 this year) only in Sep.

- NFIB business optimism index slipped to 88.5 in Mar (Feb: 89.4), the lowest level since Dec 2012. One-fourth of the owners reported inflation as the primary concern for operations.

- Michigan consumer sentiment index dipped lower to 77.9 in Apr (Mar: 79.4), with declines in both current conditions (to 79.3 from 82.5) and expectations (77 from 77.4). The 1- and 5-year inflation expectations rose to 6-month highs of 3.1% and 3% respectively (from Mar’s 2.9% and 2.8%).

- Initial jobless claims dropped by 11k to 211k in the week ended Apr 5th while the 4-week average edged lower by 0.25k to 214.25k. Continuing jobless claims moved up by 28k to 1.817mn in the week ended Mar 29th, the highest level since Jan.

Europe

- ECB held the benchmark deposit rate unchanged at 4% for the fifth meeting in a row, while clearly signalling rate cuts up ahead. The ECB stated that it “would be appropriate” to lower rates if inflation was inching closer to its 2% target “in a sustained manner”.

- Sentix investor confidence in the euro area improved to -5.9 in Apr (Mar: -10.5), the highest level since Feb 2022 as the expectations index turned positive (5 from Mar’s -2.3) alongside an increase in current situation (-16.3 from Mar’s -18.5).

- Exports from Germany dropped by 2% mom in Feb while imports grew by 3.2%. Exports to the EU and euro area declined by 3.9% and 3.6% respectively. Trade surplus narrowed to EUR 21.4bn (Jan: EUR 27.5bn).

- German industrial production increased by 2.1% mom in Feb (Jan: 1.3%), largely driven by output in construction (+7.9%), automotive (+5.7%) and chemical industry (4.6%) while energy production fell by 6.5%. In yoy terms, IP fell by 4.9%.

- UK GDP grew by 0.1% mom in Feb (prev: 0.3%), supported by a rebound in industrial and manufacturing production (1.1% and 1.2% respectively from declines of -0.3% and -0.2% in Jan). The construction sector output fell sharply (-1.9%) while services were up by only 0.1%.

- Like-for-like retail sales in the UK accelerated by 3.2% yoy in Mar (Feb: 1%), the strongest growth since Aug, partly supported by sales ahead of the Easter holiday weekend.

Asia Pacific:

- Inflation in China slipped to 0.1% in Mar (Feb: 0.7%), as non-food inflation eased (0.7% from 1.1%) and transport costs fell (-1.3%). Core inflation slowed, easing to 0.6% in Mar (Feb: 1.2%). Producer price index fell further in Mar, to -2.8% from Feb’s -2.7%.

- Exports from China fell by 7.5% yoy in Mar alongside an unexpected 1.9% drop in imports, narrowing the trade deficit to USD 58.55bn in Mar. In Q1 2024, both exports and imports grew by 1.5% yoy.

- Money supply (M2) in China grew by 8.3% yoy in Mar. New loans surged in Mar, more than doubling to CNY 3090bn from the month before, taking the Q1 reading to a total of CNY 9.46trn. Outstanding yuan loans grew by 9.6% (Feb: 10.1%)

- China forex reserves increased to USD 3.246trn in Mar (Feb: USD 3.226trn) and gold reserves rose to USD 161.07bn (Feb: USD 148.64bn).

- Japan’s labour cash earnings grew by 1.8% yoy in Feb (Jan: 2%), the highest gain in 7 months. Inflation adjusted wages fell by 1.3% yoy, down for the 23rd consecutive month.

- Current account surplus in Japan widened to JPY 2644.2bn in Feb (Jan: JPY 457bn), posting a surplus for the 13th month in a row, largely due to a narrowing trade deficit. Primary income surplus stood at JPY 3.3069trn.

- Industrial production in Japan declined by 0.6% mom and 3.9% yoy in Feb; motor vehicles output plunged by 8.1% (Jan: -15.9%) while transport equipment excluding motor vehicles fell by 6.9% (Jan: -1.6%). Separately, machine tool orders fell by 8.5% yoy in Mar, lower compared to Feb’s 8% drop.

- Producer price index in Japan inched up by 0.2% mom and 0.8% yoy in Mar; the yoy increase was the highest since Oct 2023.

- The Bank of Korea left interest rates steady at 3.5% for the 10th meeting in a row, as inflation stayed higher than the target 2% level (3.1% in Mar following Feb’s 3.2% reading). However, wording in its latest statement was slightly changed as “keep restrictive monetary policy stance for sufficient period” from a “sufficiently long period” from previous statements – indicating a possible easing in H2.

- Unemployment rate in Korea rose to 2.8% in Mar (Feb: 2.6%), with the number of unemployed persons increasing by 6.2% yoy to 892k persons. Labour force participation rates rose by 0.2% yoy to 64.3% in Mar.

- Retail inflation in India inched lower to a 10-month low of 4.85% in Mar (Feb: 5.09%), as food prices cooled (8.52% from Feb’s 8.66%) while housing inflation dropped to 2.77% (Feb: 2.88%). Core inflation remained steady at 3.5%.

- Industrial output in India grew by 5.7% yoy in Feb (Jan: 3.8%), with the manufacturing sector gaining by 5% (Jan: 3.2%) and mining output up by 8%. Consumer durables output expanded by 12.3%, while growth in capital goods production eased to 1.2%. Cumulative industrial output stands at 5.9% for the period Apr-Feb.

- Singapore’s GDP grew by 0.1% qoq and 2.7% yoy in Q1 (Q4: 1.2% qoq and 2.2% yoy), thanks to services sector growth (1.2% qoq and 3.2% yoy, largely given a 50% yoy surge in tourists in Q1 to 4.35mn) while both construction and manufacturing contracted in qoq terms (-2.9% and -1.7% respectively).

- The Monetary Authority of Singapore kept monetary policy steady, leaving the slope, level, and width of the policy band unchanged.

Bottom line: The IMF-World Bank meetings are scheduled this week while the world watches whether the weekend’s air strikes on Israel by Iran (following an attack on Iran’s consulate in Syria earlier this month) result in any further actions/ reactions. Rising tensions can lead to higher oil prices and benefit the dollar (as a safe-haven asset) – both of which would result in keeping inflation further higher, creating more headaches for central banks’ monetary policy. As it stands, the Fed is expected to lower rates much later this year, while the ECB seems set for a June cut (unless upcoming data indicates otherwise). This week sees the release of China’s Q1 GDP and UK inflation data while India begins its parliamentary elections process (which will run for 44-days, in 7 phases, with initial results expected in early-June).

Regional Developments

- Bahrain GDP grew by 2.4% yoy to BHD 13.66bn (USD 36.24bn) in 2023, with non-oil sector growing by 4.03%. Among non-oil sectors, growth was highest in hotels and restaurants (8%), followed by government services (6%) and financial projects (5.7%). In Q4, overall growth stood at 4.61%, largely owing to the non-oil sector’s 5.14% uptick.

- Inflation in Egypt eased to 33.3% yoy in Mar (Feb: 35.7%), as costs eased in food (45% from Feb’s 50.9% surge), transport (16.2% from 17.6%) and housing (9.7% from 10%). Core inflation lessened to 33.7% (Feb: 35.1%).

- Egypt posted its 40th straight month of readings below-50, at 47.6 in Mar (Feb: 47.1), pulled down by the second-sharpest drop in output for 14 months and a sharp decline in new orders given lower consumer spending (which can be traced to inflation and volatile EGP market). In positive signs, new exports increased for the first time since Dec 2022 and employment increased for the first time in 2024, but business expectations worsened.

- IMF’s USD 8bn financial program to Egypt will be tied to continuing with currency flexibility policy. The first USD 820mn was approved for immediate disbursal earlier this month, and the second tranche of USD 820mn will be disbursed by end-Jun once a review is completed; reviews are scheduled for every 6 months. IMF’s approval grants Egypt access to the Resilience and Sustainability Fund via which the nation can secure very low-cost, long-term financing specifically earmarked for climate-related projects, totaling USD 1.2bn.

- Balance of payments deficit in Egypt touched USD 409.6mn in H1 of the fiscal year 2023-24 (Jul-Dec 2023), compared to a surplus of USD 599.1mn in H1 of the previous fiscal year. As per the central bank, current account deficit in Jul-Dec 2023 widened to USD 9.6bn from USD 1.8bn a year ago. In Oct-Dec 2023, tourism revenues rose to USD 3.3bn (Oct-Dec 2022: USD 3.2bn) while revenues from the Suez Canal rose to USD 2.4bn (vs USD 1.97bn). Remittances during the final quarter of 2023 fell to USD 4.93bn (from USD 5.5bn) while FDI rose to USD 3.21bn (from USD 2.43bn).

- Egypt posted a primary surplus of EGP 416bn or 3% of GDP during the 9-month period Jul 2023-Mar 2024, revealed the finance minister. This compares to a surplus of EGP 50bn (or 0.5% of GDP) a year ago. Public revenues surged by 57.1% yoy to EGP 1.453trn, driven by a 122.9% jump in non-tax revenue while tax revenues were up by 41.2%. Expenditures grew by 50.8% to EGP 2.323trn, resulting in a deficit of 5.42% of GDP (vs. 5.4% a year ago).

- Egypt’s National Council of Wages approved a 71.43% increase in the minimum wage for private sector workers to EGP 6,000. This is the fifth increase in 2 years, and follows an increase in Jan (when it was raised to EGP 3500 from EGP 3000).

- Tourism revenues in Egypt clocked in at USD 7.8bn in Jul-Dec 2023, and compares to USD 7.3bn in the same period a year ago. Tourist nights rose by 6.1% yoy to 83.2mn nights and arrivals ticked up by 14.7% to 7.8mn tourists. Separately, Asharq Business reported a 4% yoy increase in tourist arrivals to 3.7mn in Q1 2024, citing a government official. Flows to Sharm El-Sheikh fell by 20% yoy during this period.

- Egypt’s net international reserves increased to USD 40.361bn at end-Mar from USD 35.31bn at end-Feb.

- Ahram Online newspaper reported that Egypt government has allocated two plots of land for the development of Ras El-Hekma international airport by UAE’s ADQ.

- Iraq signed 12 MoUs with Saudi Arabia for cooperation in a “number of quality investment projects” in the former. Separately, Abu Dhabi Ports Group signed a deal aimed at developing Iraq’s Al-Faw Grand Port and its associated economic zone. More in the Media Review section.

- Kuwait’s new parliament largely resembles the outgoing one post-elections: it has only 11 new members out of a total 50 elected MPs, with opposition candidates winning 29 seats. The election was the third since 2022 and fourth in 5 years.

- Kuwait’s central bank has cleared and registered five new fintech firms: four of them to provide online transaction services and one to operate e-payment system services.

- Lebanon’s PMI recovered to 49.4 in Mar (Feb: 49.1), even as new order shrank for an 8th month in a row and new export business dropped at the quickest pace since Dec 2022.War and continued political uncertainty led firms to have a pessimistic 12-month ahead outlook.

- Oman’s top 5 ports handled 93.2mn tonnes of cargo in 2023, up 1.5% yoy. Also disclosed was a 4.3% rise in the number of berthed ships to 11,005. Furthermore, 229 cruise ships brought 599k passengers to the terminals in 2023, versus 205k tourists from 87 ships in 2022.

- Producer price index for the industrial sector in Qatar rose by 1.03% mom in Feb, though in yoy terms, it fell by 8.6%. The month-on-month uptick was partly supported by a 1.95% increase in manufacturing and a 0.9% uptick in mining & quarrying.

- Qatar’s international reserves grew by 5.2% yoy to QAR 247.4bn in Mar, despite a decline in balances held by foreign banks (to the tune of QAR 10.77bn). Gold reserves surged by QAR 5.48bn to QAR 26.75bn at end-Mar.

- The central bank revealed that bonds and sukuk maturing for Qatar’s government this year amounts to QAR 20.3bn (USD 5.5bn). Government bond repayments this year stands at QAR 14.45bn while sukuk due stands at QAR 5.85bn.

- Bilateral trade between Qatar and India has crossed QAR 65bn (USD 18bn+), disclosed the Ambassador of India to Qatar at an event.

- Tourism arrivals in Qatar grew by 53% yoy to 596k international visitors in Feb; this follows about 703k arrivals in Jan (up 106% yoy). The nation crossed 4mn visitors in 2023.

- A report by the UN-World Bank estimates infrastructure damages in Gaza at USD 18.5bn during the first four months of the war. The damages are estimated to be equivalent to 97% of the combined GDP of the West Bank and Gaza in 2022 and left 26mn tons of debris and rubble. The World Bank noted that over a million people are without homes and that 75% of the population is displaced.

- According to Wamda, Saudi start-ups received almost half of venture funding in Q1 2024. Saudi firms secured USD 224mn out of a total USD 429mn raised in MENA, followed by the UAE and Egypt (at USD 39mn and USD 7mn respectively); software as a service providers, fintech and e-commerce sectors were the major beneficiaries by sector.

- Flights from UAE to Saudi Arabia surged in Mar, rising by 13% mom to 383, driven by demand during Ramadan. It was also disclosed that flydubai increased its service to Saudi Arabia to support the Hajj season: up 40% to 130 weekly trips in Mar (Feb: 93); Emirates and Etihad airlines increased its weekly trips to 67 and 77 (22.2% mom) respectively in Mar.

- Remittances from Saudi Arabia and UAE to Pakistan crossed over USD 125mn during Ramadan. From Saudi, remittances were up to more than USD 70mn from USD 54mn in Feb while from the UAE, USD 55mn was sent compared to USD 39mn in Feb. Remittances into Pakistan totalled USD 3bn in Mar, the highest since Apr 2022, according to the central bank.

Saudi Arabia Focus

- Saudi Arabia’s PMI moved down to 57 in Mar (Feb: 57.2), even as output rose to 62.2 (the strongest since Sep 2023, and versus Feb’s 61.5). Foreign demand growth (in month-on-month terms) sustained for the first time since mid-2023 and employment remained higher than the series average. Costs-wise,Saudi firms reported input cost inflation at an 8-month low, which could be traced back to weakening wage pressures while selling prices fell to a 6-month low.

- Industrial production in Saudi Arabia inched up by 1% mom in Feb, supported by increased manufacturing activity (1.2% mom). In yoy terms, IP fell by 7.7%, driven by a decline in mining and quarrying activity.

- The Saudi industrial sector reported a 63% yoy increase in new investments (or SAR 15bn) in 2023, according to the annual report from the Saudi Authority for Industrial Cities and Technology Zones (Modon). Funding amounted to a total of SAR 415bn, across 891 projects, while new manufacturing establishments and the number of producing factories grew by 13% and 6% respectively.

- Commercial registrations in Saudi Arabia grew by 59% yoy to 104k in Q1 2024, bringing the total number of registrations to over 1.45mn. Certificates issued to women accounted for 44% of the total while young Saudis accounted for 38% of the total commercial registrations.

- According to the Saudi Capital Market Authority, asset management activity revenues of capital market institutions in Saudi Arabia grew by 58.6% yoy in four years to SAR 4.2bn in 2023. Investment funds in the country grew by 11.7% to 1285 as of end-2023 (vs 2019).

- Saudi Arabia’s Riyad Bank is considering an IPO of its investment banking unit, Riyad Capital. The bank is partly owned by the PIF (21.75%) and government of Saudi (10.39%).

- Bloomberg reported an update to NEOM’s The Line project: under the revised mid-term objectives, The Line is expected to accommodate less than 300k residents by 2030 (versus 1.5mn forecast previously) on the 2.4km slated for completion.

- China became the top greenfield foreign direct investor in Saudi Arabia in 2023, with investments surging 1020% yoy to USD 16.8bn. The US and UAE followed closely with amounts of USD 2.7bn and USD 2.67bn respectively while Kuwait (USD 937bn) and Hong Kong (USD 796mn) rounded up the top 5.

- The number of entertainment event organisation firms in Saudi Arabia rose by 34% yoy to 9445 in Q1 2024, with Riyadh topping the list (4301 permits) followed by Makkah (2888).

- SAMA disclosed that the share of retail consumer electronic payments in Saudi Arabia jumped to 70% of total transactions in 2023, versus 62% in 2022. Total transactions processed in 2023 stood at 10.8bn compared to 8.7bn in 2022.

- Saudi Arabia and Pakistan will expedite the USD 5bn investment package which was previously agreed upon.

- IMD’s Smart City Index placed Riyadh 25th globally, rising five spots since 2023. Other cities in Saudi were also on the list: Makkah ranked 52nd, Jeddah and Madinah were 55th and 74th while Al Khobar was ranked 99th.

- Saudi Arabia will host the WTA Finals from 2024-26: the season finale which features the top eight singles players and doubles teams offers a record prize money of USD 15.25mn this year, with increases expected in the coming years.

UAE Focus![]()

- UAE PMI inched lower slightly by 0.2 points to 56.9 in Mar: new orders (61.5 from 60.4) and output (62.7) grew supported by robust demand. UAE firms’ higher inflows were associated with rising client spending and marketing campaigns. However, increased competition & plans to retain customers saw selling prices fall at the sharpest rate in 3.5 years.

- The UAE central bank lowered its GDP forecast for 2024 to 4.2%(compared to its earlier forecast of 5.7% for 2024, issued in Dec 2023). Growth in 2024 will be dragged down by a slower growth in the non-oil sector (4.7%, from 5.9% in 2023).

- UAE bank assets ticked up by 0.8% mom to new highs in Jan.Deposits grew by 0.7% mom & 13.7% yoy in Jan, thanks to a healthy 0.9% mom & 15.7% uptick in resident private sector deposits. Overall domestic credit grew by 5.3% despite a drop in credit to the government (-12.3%). The apex bank’s foreign assets surged by 38.8% yoy to AED 695.04bn.

- Inflation in the UAE, according to FCSA data, eased to 1.6% yoy in 2023, from 4.8% in 2022. This was largely due to the declines in transportation costs (-5.6% in 2023 from 22.95%), recreation & culture (0.4% from 12.96%), and food & beverages (3.8% from 7.2%). Other categories like housing (35.1% weight in the basket), education and insurance & financial sector costs have increased. A breakdown by quarter, however, shows a slight easing in Q4 in housing & utilities (3.3% from 3.7% in Q3).

- Real GDP in Abu Dhabi grew by 3.1% yoy in 2023(2023: 9.1%), supported by robust non-oil sector activity. The contribution of the non-oil sector stood at 53.4% of the total last year. Non-oil growth surged, touching AED 154.32bn in Q4 (4.1% yoy & 0.4% qoq): this was the highest quarterly non-oil GDP reading since 2014, crossing the previous high in Q2 2023 (AED 154.04bn). The financial sector grew the most in 2023 (25.5% yoy) while the manufacturing sector, which contributed 8.8% to total GDP in 2023 (the largest share), grew by 4.9% (2022: 16%); construction sector grew by 13.1% in 2023.

- Abu Dhabi’s private sector grew to AED 338.9bn in 2023, up by 35% compared to 2016, it was disclosed at the second edition of Al Multaqa quarterly meetings organised by the Abu Dhabi DED. Family-owned businesses in Abu Dhabi represent 50% of companies in the construction sector, 60% in the finance sector, 80% in the wholesale trade sector and 70% in the transportation sector.

- Population in Dubai grew by 25,776 to 3.68mn in Q1 2024, according to the Dubai Statistics Centre. Since Jan 2021, there has been an average increase of 6900 new residents every month.

- Abu Dhabi’s Lunate disclosed having bought a 40% stake in the entity that leases ADNOC oil pipelines from private equity firms BlackRock and KKR; terms of the deal nor value was not disclosed. The two PE firms had bought it for USD 4bn in 2019.

- A 49% stake in Dubai’s ICD Brookfield Place was acquired by Abu Dhabi’s Lunate and Saudi’s Olayan Group with each of the entities owning 24.5% of the tower. Though no financial disclosures were made, the companies stated that the deal was one of the biggest commercial real estate transactions globally since 2020. (An interesting viewpoint on the deal: https://www.agbi.com/opinion/finance/2024/04/frank-kane-icd-brookfield-place-dubai/)

Media Review

Economic diversification is the GCC’s top priority: Dr. Nasser Saidi’s op-ed in AGBI

https://www.agbi.com/opinion/economy/2024/04/economic-diversification-is-the-gccs-top-priority/

Gulf Arab states test waters with Iraq investment

https://www.reuters.com/world/middle-east/gulf-arab-states-test-waters-with-iraq-investment-2024-04-03/

A Weak, Uneven Global Recovery

https://www.project-syndicate.org/commentary/why-global-economic-recovery-is-faltering-despite-lower-inflation-by-eswar-prasad-and-caroline-smiltneks-2024-04

The 2020s: Turbulent, Tepid or Transformational? Policy Choices for a Weak Global Economy, Speech by IMF’s MD

https://www.imf.org/en/News/Articles/2024/04/sp041124-outlook-global-economy-policy-priorities-kristalina-georgieva

World Bank set to issue up to USD 1bn in debut hybrid note this year

https://www.reuters.com/business/finance/world-bank-set-issue-up-1-bln-debut-hybrid-note-this-year-2024-04-02/

How fast is India’s economy really growing?

https://www.economist.com/finance-and-economics/2024/04/11/how-fast-is-indias-economy-really-growing

Powered by: