Markets

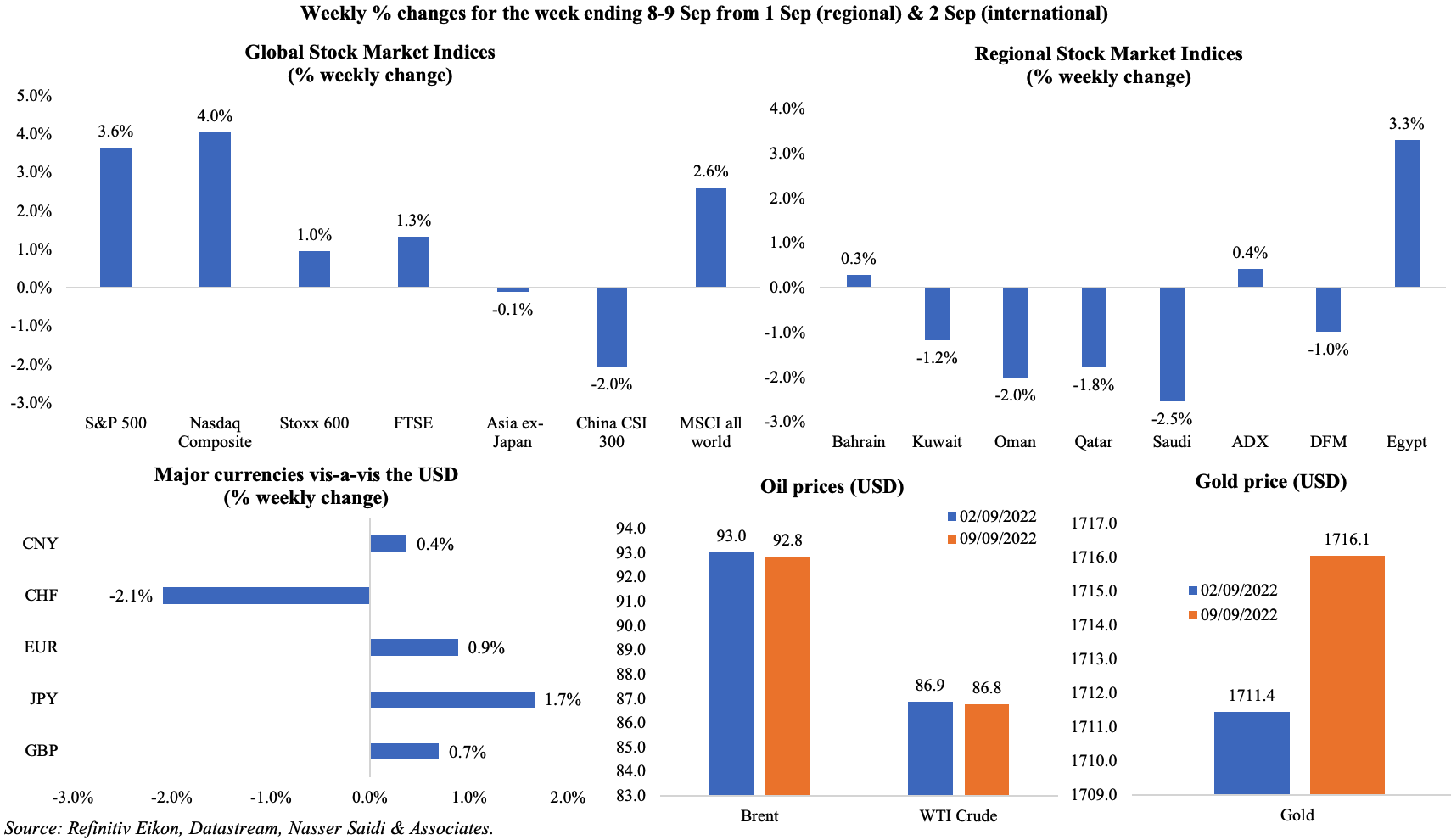

Equity markets in the US posted gains last week (the first in 4 weeks), as did Europe and UK while Asian markets had a rough week. Regional markets were mostly down, mirroring the volatile oil prices: Abu Dhabi gained on Fri as oil prices rose while Egypt’s gain was partially supported by an influx of international investors. Among currencies, the euro climbed to a 3-week high vis-à-vis the dollar (rising to above parity); during the week, the dollar touched a 24-year and 37-year high against the JPY and GBP respectively. Gold inched up a 0.3% gain from the previous week while oil prices were slightly lower (the nominal OPEC+ production cut was offset by fresh lockdowns in China).

Global Developments

US/Americas:

- Overall trade deficit in the US narrowed for a 4th straight month to USD 70.6bn in Jul (-12.6% mom), thanks to record-high exports of USD 259.3bn (+0.2%) while imports declined (by 2.9% to USD 329.9bn). Goods trade deficit however widened to USD 91.1bn in Jul (Jun: USD 89.1bn) while services surplus increased to USD 20.4bn.

- ISM services PMI edged up to 56.9 in Aug (Jul: 56.7), supported by an uptick in new orders index (61.8 from 59.9) and business activity (60.9 from 59.9) amid a rebound in employment (50.2 from 49.1) while prices paid eased to 71.5 (the lowest since Jan 2021, and Jul’s 72.3).

- S&P’s composite and services PMI both recorded the sharpest contraction since May 2020 in Aug: composite PMI slipped to 44.6 from a preliminary reading of 45 and Jul’s 47.7; services PMI declined to 43.7 from Jul’s 47.3 with weak domestic and foreign demand as new orders fell at the sharpest rate in over 2 years.

- Initial jobless claims declined by 6k to 222k in the week ended Sep 2nd, a 3-month low, lowering the 4-week average to 233k. Continuing jobless claims rose by 36k to 1.473mn in the week ending Aug 26th, a nearly 5-month high.

Europe:

- The ECB raised rates by 75bps to tackle inflation (and despite growth concerns), the highest level since 2011. The last 75bps increase was in 1999: as a technical adjustment to smooth the euro’s launch. Lagarde stated that there will be “further hikes in the next several meetings”, “but also probably less than five”. The ECB lifted its growth forecast for 2022 to 3.1%, while slashing its prediction for 2023 to 0.9% and lowering 2024’s to 1.9%.

- Eurozone GDP grew by 0.8% qoq and 4.1% yoy in Q2 (higher than initially expected), thanks to the contributions by consumer and government spending. A breakdown by nation shows that Germany grew by a meagre 0.1% while Netherlands grew by the most (2.6%).

- Services PMI in the eurozone fell below-50 to 49.8 in Aug (Jul: 51.2), as weak demand resulted in new orders falling the most since Feb 2021. Composite PMI declined to 48.9 from the preliminary reading of 49.2, with the decline most evident in Germany.

- Germany’s services PMI slipped to 47.7 in Aug (Jul: 49.7), the second straight month of sub-50 readings and the sharpest fall since Feb 2021. As a result, the composite PMI also declined to 46.9 from Jul’s 48.1, with employment growth the lowest since Mar 2021.

- Industrial production in Germany edged down by 0.3% mom in Jul from Jun’s upwardly revised 0.8% uptick, and the drop was seen across consumer (-2.4%), capital (-0.8%) and intermediate goods (-0.6%). In yoy terms, IP was down by 1.1%.

- Factory orders in Germany dropped by 1.1% mom in Jul (Jun: -0.3%): domestic orders were down by 4.5% and from the euro area by 6.4% though foreign orders outside of the eurozone increased by 6.5%.

- Sentix investor confidence in the eurozone plunged to -31.8 in Sep (Aug: -25.2); the expectations index tumbled to -37.0, the lowest since Dec 2008.

- Retail sales in the euro zone rebounded by 0.3% mom in Jul; in yoy terms, sales fell by 0.9% following a larger 3.2% drop the month before.

- UK services PMI clocked in 50.9 in Aug, dropping from Jul’s 52.6, posting the slowest pace of expansion in 18 months; employment growth remained resilient. Composite PMI slipped to 49.6 in Aug, below-50 for the first time in 18 months (Jul: 52.1) and employment saw the smallest uptick in hiring since Mar 2021.

Asia Pacific:

- Inflation in China eased to 2.5% yoy in Aug (Jul: 2.7%), with slower growth in prices of both food (6.1% in Aug vs Jul’s 6.3%) and non-food (1.7% vs 1.9%) items. Producer price index touched an 18-month low of 2.3% (Jul: 4.2%), thanks to falling prices of energy and raw materials.

- Money supply in China grew by 12.2% yoy in Aug (Jul: 12%) while new loans nearly doubled to CNY 1250bn (USD 180.63bn) from Jul’s CNY 679bn. Broad credit growth slowed, with growth of outstanding total social financing slowing to 10.5% (Jul: 10.7%).

- China’s Caixin services PMI stood at 55 in Aug (Jul: 55.5), the third consecutive month of growth; export orders however fell for the 8th straight month.

- Exports from China increased by 7.1% yoy in Aug, slowing from Jul’s 18% gain, while imports grew by a marginal 0.3% (dampened by weak domestic demand and consumption). Trade surplus narrowed to USD 79.39bn from a record USD 101.26bn in Jul.

- Japan’s GDP expanded by an annualised 3.5% in Q2, and up by 0.9% qoq. Private consumption grew by 1.2% and capital spending by 2%.

- Japan’s services PMI stayed below-50 for the first time since Mar, clocking in 49.5 in Aug (Jul: 50.3), as the recent spike in Covid cases weakened demand. Employment inched up at the weakest pace in 7 months.

- Overall household spending in Japan eased in Jul, rising by 3.4% yoy, from the previous months 3.5%: with pandemic restrictions removed (vs Jul 2021), hotel expenses grew by 55% and transport fees by 48%. In mom terms, however, spending declined by 1.4%, as consumers stayed away from shops due to the recent increase in Covid cases.

- Leading economic index in Japan declined to 99.6 in Jul (Jun: 100.4), the lowest reading since Feb 2021. In contrast, the coincident index improved to 100.6 (Jun: 99.2) – the highest since Sep 2019 – thanks to the lifting of pandemic restrictions.

- Japan’s current account balance moved back into a surplus of JPY 229bn (USD 1.6bn) in Jul (Jun: -USD 132.4bn); given the high energy prices and weakening yen, this is the smallest Jul surplus on record. Trade deficit stood at JPY 1.21trn.

- Singapore retail sales rebounded by 0.6% mom in Jul (Jun: -1.4%); in yoy terms, sales were up by 13.7%, easing from the previous month’s 14.9% growth. Excluding motor vehicles, sales expanded by 18.1% yoy and 0.5% mom.

Bottom line: The various PMI releases showed economic activity (i.e. JP Morgan Global Composite Output Index) contract in Aug, for the first time since Jun 2020; excluding the lockdown period, the reading was the lowest since Jun 2009. Meanwhile, the OPEC+ meeting’s small production cut, which did not create many waves in the market in the backdrop of the Iran nuclear deal talks (not very promising given recent official statement from France, UK and Germany questioning Iran’s intentions) and fresh Chinese lockdowns. The Fed meets this week, and the magnitude of the hike will likely be heavily influenced by the inflation print (out on Tuesday); the BoE meeting has been shifted to Sep 22nd following the Queen’s passing.

Regional Developments

- Bahrain attracted USD 52mn in venture capital last year, up 167% yoy, according to MAGNiTT. Startup funding in the Middle East grew by 138% to USD 2.5bn, with UAE (USD 1.1bn), Saudi Arabia (USD 548mn) and Egypt (USD 502mn) the largest recipients.

- Egypt PMI stayed below-50 in Aug for the 21st consecutive month though it improved to 47.6 from Jul’s 46.4. Though in contractionary territory, both output (up 2.2 points to 45.8) and new orders (+2 points to 45.1) sub-indices gained. However, confidence is slipping, as future output expectations fell to 53.5 (Jul: 56.1) – the second lowest reading in a decade.

- Annual urban inflation in Egypt rose to 14.6% yoy in Aug (Jul: 13.6%), the highest reading since Nov 2018, driven by higher food and energy prices. Food and beverage costs grew (23.1%), but core inflation also inched up (16.7% from 15.6%).

- Egypt increased the customs dollar price to EGP 19.31 – its highest level in history. This will result in an uptick in prices of imported goods, further adding to inflationary pressures.

- The government of Egypt launched a new “pre-proposal” fund to support government enterprises to list on the exchange, according to the minister of planning and economic development.

- The Central Bank of Egypt sold three-month treasury bills at an all-time high value of EGP 61.8bn (USD 3.2bn); banks had offered EGP 170.8bn for the short-term bills.

- Revenue from the Suez Canal surged by 32.4% yoy to USD 744.8mn in Aug, thanks to a rise in number of transited vessels (+13% to 2125) and net tonnage (+16% to 127.8mn tons).

- Iraq hiked its crude oil output by 67k barrels per day (bpd) to 4.651mn bpd in Aug, in line with the OPEC+ quota. However, exports fell by 62k bpd, indicating that the extra supply went into internal consumption and storage.

- The head of Iraq’s state oil marketer SOMO disclosed having received requests to increase quantities of crude oil exports to Asia (specifically India and China) in spite of them getting Russian oil at discounted prices.

- Lebanon’s PMI improved to 50.1 in Aug, the highest since Jun 2013, as activity improved thanks to spending from summer tourists and expats alongside a decline in employment and concerns about inflation and operating conditions.

- Lebanon’s caretaker tourism minister disclosed that more than 1.5mn tourists visited the nation during summer season, bringing in almost USD 4.5bn in revenues. Passenger traffic at the Rafik Hariri International Airport grew by 35% yoy and 58% ytd till Aug.

- Iran’s ambassador to Lebanon proposed an Iranian “gift” of fuel to Lebanon which could be used to run the nation’s power plants. A Lebanese technical delegation is expected to visit Iran to discuss the offer.

- Oman’s Ministry of Commerce, Industry and Investment Promotion disclosed that the number of commercial registrations for investors from GCC amounted to 7,068 by end of Q1 2022. UAE and Saudi Arabia had 3405 and 1259 commercial registrations respectively.

- Qatar PMI eased to 53.7 in Aug (Jul: 61.5) even as output and new orders increased; strong demand led to firms hiking output charges at the quickest rate in 8 months. Sentiment meanwhile was at the strongest in over 2 years, given optimism over this year’s World Cup.

- Reuters reported (citing 5 sources) that the Qatar Central Bank has instructed banks not to engage in any swap deals (for QAR or USD) with external entities; prior permission is required to conduct such transactions. However, the QCB has denied taking any such action.

- According to the World Gold Council, Qatar Central Bank was the largest buyer of gold in Jul, adding 15 tonnes to its reserves (largest monthly increase on record). This brings total gold reserves at 72 tonnes (10% of total reserves) this is the highest on record in tonnage terms.

- Qatar awarded its first PPP sewage treatment project worth USD 1.48bn contract: this is to develop, design, build, finance and procure a 150k cubic meter per day sewage treatment work.

- In anticipation of receiving more than a million visitors during the World Cup, Qatar announced it would reopen the Doha International Airport this week.

- Oil from the GCC accounted for 97.7% of Japan’s total crude oil imports in Jul. UAE crude topped with 33.99mn barrels (41.9%), followed by Saudi Arabia (28.47mn, 35.1%).

- MENA startups witnessed a 260% mom increase in funding in Aug: about USD 378mn was raised across 33 deals, according to Wamda. This brings investment year-to-date to USD 2.2bn (+29% yoy). Most funded were fintech (68% of total), e-commerce and ad-tech firms.

- The World Travel and Tourism Council expects a pickup in demand over the next several years, resulting in the creation of 3.9mn jobs in the Middle East alone (or 3.1% of global total).

Saudi Arabia Focus

- GDP in Saudi Arabia grew by 12.2% yoy in Q2, the highest growth since Q3 2011, supported by both oil (22.9% yoy and 4.4% qoq) and non-oil (8.2% yoy and 4.5% qoq) sectors. Among the non-oil sector,wholesale and retail trade, restaurants and hotels notched up the highest gains (16.4% yoy & 19% qoq) followed by construction (8.8% yoy & 8% qoq, not surprising given multiple mega projects).

- Saudi Arabia’s non-oil sector PMI rose to 57.7 in Aug (Jul: 56.3), the highest since Oct 2021, thanks to domestic demand and uptick in new orders. Input cost inflation slowed to a 3-month low, allowing firms to give extra discounts to nudge spending.

- Industrial production in Saudi Arabia grew by 17.7% yoy in Jul, driven by mining (14.1% yoy) and quarrying as well as manufacturing (32.6%).

- New industrial licenses issued in Jul declined by 67% mom to 30; total licenses issued till Aug stands at 531. The number of existing and under construction factories reached 10,685 as of end-Jul, with investments amounting to SAR 1.367trn (USD 363.3bn).

- The Saudi Industrial Development Fund disclosed that it approved a total of 930 loans valued at over SAR 75.4bn (USD 20bn) since launch 6 years ago, with SMEs accounting for 79% of loans. This year till Jul, about 60 loans were approved, valued at over SAR 6.2bn.

- Saudi Arabia’s minister of finance announced investments of more than SAR 700bn (USD 186.66bn) towards the development of the green economy and job creation. Initiatives have been launched to reduce carbon emissions by more than 278mn tons annually.

- US Treasuries held by Saudi Arabia increased to USD 119.2bn in Jun (May: USD 114.7bn): this is the highest month-on-month rise since Aug 2020.

- Aramco disclosed that Saudi Arabia lowered October official selling prices for its flagship Arab light crude it sells to Asia by nearly USD4 a barrel, the first reduction in four months.

- Saudi PIF plans to issue debt green bonds as soon as this week or potentially in Oct (depending on market conditions), reported Reuters.

- A report from KAPSARC expects oil demand growth in Saudi Arabia to moderately decelerate to 20k barrels per day (bpd) in 2023 from this year’s projection of 24k bpd.

- The King Abdulaziz Port in Dammam posted a new record in Aug, handling 199,609 TEUs (twenty-foot equivalent units) of containers. Ongoing upgrades to the port is expected to increase its capacity to handle up to 105mn tons annually.

- The chairman of Saudi Esports Federation revealed that almost two-thirds of Saudis consider themselves regular gamers, indicating the potential for the country’s esports market – which is forecast to expand by more than 250% in the next 8 years. Separately, the Saudi National Development Fund approved a grant worth SAR 300mn (USD 79.8mn) to finance the gaming and esports sector.

- Knight Frank disclosed that Saudi Arabia is to become the world’s biggest construction site, with USD 1.1trn investment.

UAE Focus![]()

- It was disclosed at the UAE Cabinet meeting that real GDP grew by 8.4% yoy to AED 399bn in Q1 2022 and foreign trade expanded by more than 50% yoy to AED 1.06trn in H1 2022. Tourism revenues amounted to AED 19bn in H1 2022, with tourism’s contribution to the economy increasing to 12%.

- The UAE approved a federal law on public-private-partnership regulating the partnership between the federal authorities and the private sector. The PPP Law encourages private sector participation in strategic “developmental, economic and social” projects, also enhancing competitiveness.

- UAE non-oil sector activity improved to the highest since Jun 2019 in Aug, with the PMI reading up to 56.7 (Jul: 55.4), thanks to a sharp increase in new orders though new export business was the weakest since Jan 2022. Business confidence was at a 17-month low in Aug, given global recessionary fears.

- Dubai PMI jumped to a 38-month high of 57.9 in Aug (Jul: 56.4), with travel and tourism posting the highest growth followed by wholesale and retail. The rate of job creation was the fastest seen in the year to-date while business expectations slipped to the weakest since May.

- Dubai’s toll operator Salik plans to sell 20% stake via an IPO: 1.5bn shares will be offered at a nominal value of AED 0.01 and subscriptions will remain open during Sep 13-21. It reported core earnings of AED 800mn (USD 217.82mn) in H1 2022, up 25.5% yoy and could potentially introduce dynamic pricing at a later stage (i.e. higher toll rates for peak hour usage).

- The Khalifa Industrial Zone Abu Dhabi (KIZAD) is planning to build a 25k sqm electric vehicle assembly facility to be operated by smart electric firm NWTN. NWTN’s operations will have an annual capacity of 5k-10k units of semi knocked down EVs initially before expanding to 50k units.

- The Dubai International Financial Centre (DIFC) reported a 22.2% yoy rise in total firms to 4031 in H1 2022. The number of fintech and innovation firms grew by 23% to 599.

- Dubai granted provisional approval to crypto firm Blockchain.com to operate in the emirate: the firm is a crypto exchange and offers users a crypto wallet.

- The number of firms in the car rental industry in Dubai grew by 23.7% yoy from 1087 firms in H1 2021. A total of 78,000 vehicles were registered in this period, up 11.8%.

Media Review

The world is almost back to pre-covid activity levels

Whither the ESG Revolution?

Ethereum’s switch to a greener system: revolution or hype?

https://www.ft.com/content/88518bc5-3af4-41c3-99b5-c0cd0ba69ab9

The Ascent of CBDCs

https://www.imf.org/en/Publications/fandd/issues/2022/09/Picture-this-The-ascent-of-CBDCs

Liz Truss’s £150bn energy plan puts Bank of England on the spot

https://www.ft.com/content/c83d4926-c7f1-4b47-85a8-9f045f1c7fb3