Markets

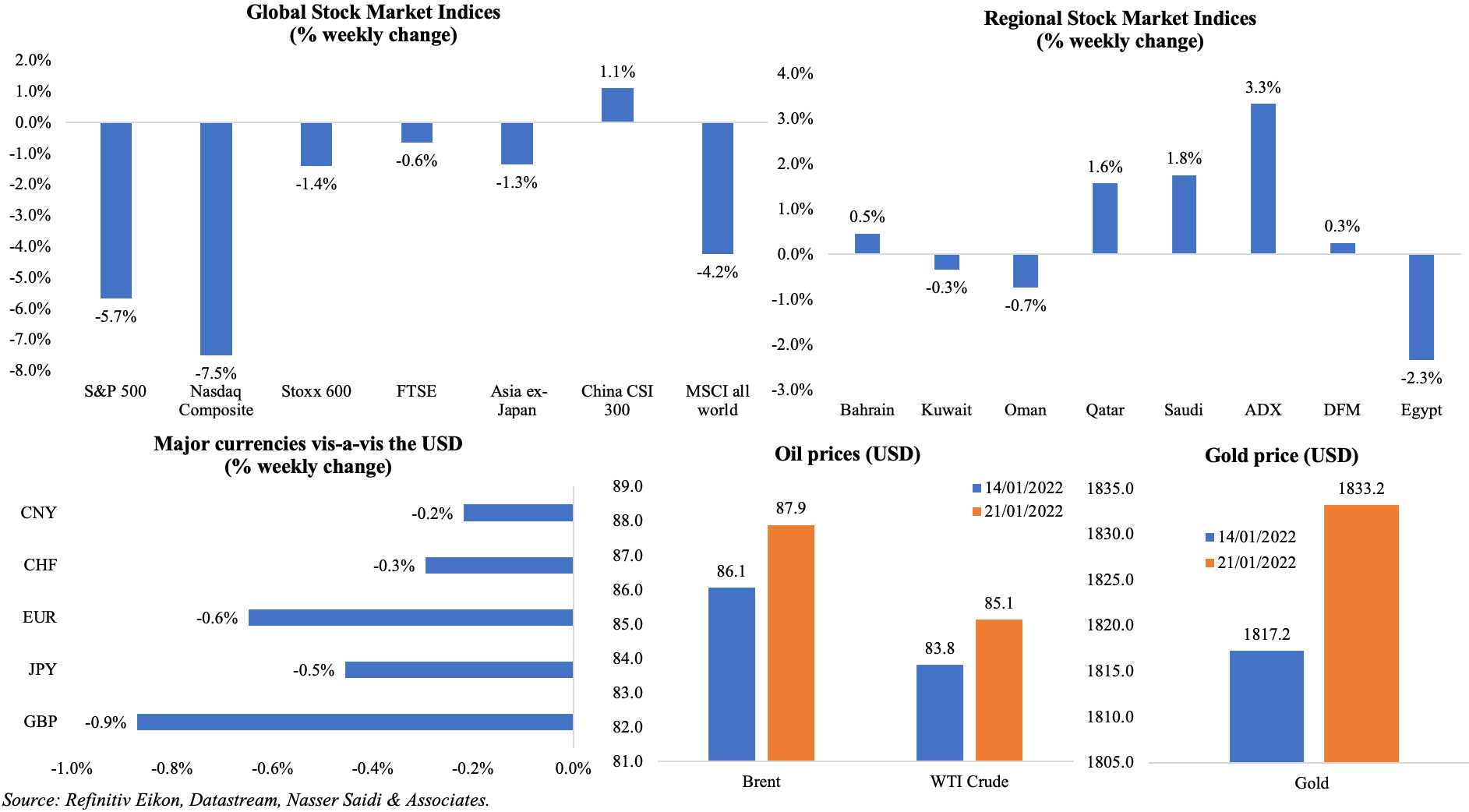

Most equity markets closed in the red ahead of the Fed’s meeting this week: a few weak corporate earnings results (e.g. Netflix) sent stocks tumbling in the US while China benefitted from its central bank’s diverging monetary policy vis-à-vis the Fed. Among regional markets, Saudi was at a 15-year high (as of Thursday) while despite the drone attacks last Monday, the ADX and DFM closed on a positive note. Both the euro and the pound slipped vis-à-vis the dollar while safe-haven currencies are expected to gain as risks increase. Oil prices touched seven-year highs during the week, but fell afterwards; geopolitical risks supported the rise in gold price; Bitcoin fell to a 6-month low after investors moved out of more speculative assets.

Weekly % changes for last week (20 – 21 Jan) from 13 Jan (regional) and 14 Jan (international).

Global Developments

US/Americas:

- The NY Empire State manufacturing index tumbled to -0.7 in Jan (Dec: 31.9), after 18 months of expansion, after drops in new orders (-5 from 27.1) and shipments (1 from 27.1).

- The Philadelphia Fed manufacturing survey inched up to 23.2 in Jan (Dec: 15.4): orders increased while employment held steady.

- Building permits in the US increased by 9.1% mom to 1.873mn in Dec, an 11-month high. For the full year 2021, permits accelerated 17.2%. The 30-year fixed-rate mortgage averaged 3.45% during the week ending Jan. 13, the highest since Mar 2020. Housing starts were up by 1.4% mom to a 9-month high of 1.702mn. Housing starts totaled 1.595mn in 2021, up 15.6% from 2020.

- Existing home sales fell by 4.6% mom to a seasonally adjusted 6.18mn in Dec. A total of 6.12mn homes were re-sold in 2021, up by 8.5% yoy, the most since 2006. House prices stood at an average USD 346,900 last year, up by 16.9% yoy.

- Initial jobless claims increased to 286k in the week ended Jan 14th, the highest since the week of Oct 16th last year, and up from the previous week’s 231k; the 4-week average stood higher at 231k. Continuing claims increased by 84k to 1.635mn in the week ended Jan 7th.

Europe:

- The ZEW economic sentiment for Germany surged to 51.7 in Jan (Dec: 29.9) while the current situation reading worsened, slipping to -10.2 from -7.4. The eurozone’s economic sentiment index jumped to 49.4 in Jan, from 26.8 the month before. The current situation indicator fell to a new level of -6.2, dropping 3.9 points from Dec 2021.

- The harmonized index of consumer prices in Germany stood at 5.7% yoy in Dec, confirming the provisional estimate. Producer price index increased by a record high 24.2% yoy and 5% mom in Dec (Nov: 19.2% yoy and 0.8% mom), largely due to the increase in energy prices (+69% yoy and 15.7% mom).

- Inflation in the eurozone was confirmed at 5% yoy and 0.4% mom in Dec, with energy prices (25.9%) the biggest contributor. Core CPI was up by 2.6% yoy and 4% mom.

- Inflation in the UK rose to 5.4% yoy in Dec (Nov: 5.1%), the fastest annual rate in almost 30 years, driven by the higher cost of clothes, food and footwear. Core CPI inched up to 4.2% from 4% the month before. PPI readings eased: input prices were up by 13.5% in Dec (Nov: 15.2%) while output prices stood at 9.3% (Nov: 9.4%).

- UK consumer confidence index fell 4 points to -19 in Jan, the lowest reading since Feb 2021.

- Retail sales in the UK fell by 3.7% mom and 0.9% yoy in Dec, following strong growth in Nov. Excluding fuel sales, retail was down by 3.6% mom and 3% yoy. Non-food stores sales tumbled by 7.1%, fashion and sports equipment store sales fell by 8% and sales at department stores were down by 6%.

- Unemployment in the UK slipped to 4.1% in the 3 months to Nov from the previous reading of 4.2%. Job vacancies rose to a record 1.247mn in the 3 months to Dec (prev: 1.119mn). Average earnings eased in the 3 months to Nov, compared to a year ago: including (excluding) bonus, average earnings were up by 4.2% (3.8%), slower than the previous month’s reading of 4.9% (4.3%).

Asia Pacific:

- The People’s Bank of China lowered mortgage lending benchmark rates to provide additional stimulus to the economy: the one-year prime loan rate was lowered by 10 basis points to 3.7% (following a 5bps cut in Dec) and the five-year prime loan rate by 5bps to 4.6%, the first cut since Apr 2020.

- GDP in China grew by 4% yoy in Q4, the slowest pace in 18 months, bringing the full year growth to 8.1%. Industrial production grew by 4.3% in Dec (Nov: 3.8%) while retail sales was up by just 1.7% yoy in Dec (Nov: 3.9%). Fixed asset investment grew by 4.9% in the full year 2021 (Jan-Nov: 5.2%).

- The Bank of Japan left interest rates unchanged and ruled out policy tightening while raising the inflation forecasts to 1.1% for the year beginning in Apr (from 0.9% previously). High commodity costs are expected to drive prices in the year, while in the fiscal year 2023 inflation (estimates at 1.1%) will be due to strong demand and rising inflation expectations.

- Inflation in Japan increased to 0.8% yoy in Dec (Nov: 0.6%). Excluding fresh food, inflation was unchanged at 0.5% (the fastest pace in nearly 2 years) while excluding both food and energy, prices were down by 0.7%. Electricity bills surged by 13.4% yoy in Dec, the fastest pace since 1981, on top of a 22.4% spike in gasoline costs.

- Exports from Japan increased by 17.5% yoy in Dec, slower than the rise in imports (+41.1%), but both hit record highs in terms of their value in yen. Merchandise trade deficit touched JPY 582.4bn in Dec. Japan reported a trade deficit of JPY 1,472.2bn for the full year 2021, the first in two years and following a JPY 3bn surplus in 2020.

- Japan core machinery orders jumped by 11.6% yoy and 3.4% mom in Nov (Oct: 2.9% yoy and 3.8% mom). The government raised its assessment on machinery orders for the first time in six months, saying they showed signs of picking u

Bottomline: All eyes are on the Fed meeting this week to see if a rate hike is signaled for March (markets have currently priced in a hike in March, followed by another 3 hikes this year). This week also sees earnings results from big tech and financial names (like Blackstone, Apple, Tesla, Microsoft etc), updated IMF forecasts for global economic growth (Jan 25th) as well as the preliminary PMI readings for Jan. With Omicron numbers hitting new records across many European nations, it is highly likely that PMI readings will show a drop (even though restrictions were not as severe as before). PMIs should also provide an insight into supply chain delays and surges in input/ output prices. Meanwhile geopolitical risks are rising with a potential Russia-Ukraine war and escalation in the conflict in Yemen (attacks on the UAE and Saudi).

Regional Developments

- Property deals in Bahrain boomed in 2021: the value of real estate transactions surged by 46% to USD 2.8bn in 2021 while number of transactions were up by 35% to 26,136.

- Egypt posted a primary surplus of EGP 3.2bn (USD 204.34mn) in Jul-Dec, largely due to the 15.7% rise in tax revenues, according to the finance minister.

- The central bank of Egypt’s financial stability report disclosed that foreigners accounted for 22.6% of Egypt’s treasury bills issuances in H1 2021, up from 7.8% in H1 2020. The report also revealed that the apex bank will allow banks to launch digital lending services via mobile wallets in 2022 in a bid to improve financial inclusion.

- Egypt has reportedly given a green light to the finance ministry to initiate the process for the issuance of sovereign sukuk.

- A USD 1bn financing agreement was signed between Egypt and South Korea, with a duration of 5 years from 2022 to 2026. Bilateral trade between the two nations rose by 23.6% yoy to USD 1.9bn in Jan-Oct 2021.

- The Suez Canal expansion will be completed in Jul 2023 (after two years of work), according to the chairman of the Suez Canal Authority. According to plans, the southern-most part of the canal will be widened 40 metres eastward and deepened to 72 feet (from 66 feet). Separately the chairman also disclosed that revenues from the Canal are expected to touch USD 7bn this year (from USD 6.3bn in 2021).

- Egypt signed two oil exploration agreements worth USD 506mn with TransGlobe Energy Corporation and Pharos Energy; the agreements cover exploration in the Eastern and Western deserts, in addition to financing of new investments for research and production of crude oil.

- Kuwait’s total fiscal revenues in Apr-Dec 2021, at KWD 11.5bn (USD 38.1bn), surpassed the total revenue collected in the last fiscal year Apr 2020 – March 2021 (KWD 10.52bn). Oil revenues accounted for 88% of the total revenue collected in the first 9 months of 2021. Given the sharp rebound in oil prices, there has been a significant improvement in fiscal balance: a deficit of KWD 682.4mn was recorded in Apr-Dec 2021, down from the KWD 10.8bn deficit last year.

- Jordan will sign a deal with Lebanon and Syria this week, to supply Lebanon with electricity.

- Lebanon’s draft budget for 2022 forecasts a 30% deficit and includes an advance for the state-owned power company of up to a maximum of LBP 5.25trn, to pay off a fuel purchase deficit, interest and loans instalments. Reuters reported, citing official sources, that the budget applies exchange rates ranging between LBP 15–20k per dollar for operating expenses (vs the official rate of LBP 1500). The cabinet is expected to convene today (its first meeting in more than 3 months) to discuss the budget.

- Lebanon will start virtual talks with the IMF from this week; the government hopes to reach an initial agreement for financial support between Jan-Feb though no clear recovery plan has been released yet.

- Lebanon’s central bank will continue to allow commercial banks to purchase an unlimited amount of USD on its Sayrafa platform rate. While this intervention led the pound to appreciate, it remains an unsustainable policy leading to a continuing depletion of foreign reserves.

- During a visit to Beirut (the first by a senior Gulf Arab official since the diplomatic rift), Kuwait’s Foreign Minister provided 12-point proposals to Lebanon’s PM (including tightening border controls to prevent drug smuggling and stepping up security cooperation among others), and “asked that Lebanon not be a platform for any aggression”. The President tweeted that the country was keen to want “the best relations” with the Gulf States and revealed that the proposals would be discussed before an appropriate response was announced.

- Oman’s budget deficit narrowed sharply to OMR 1.22bn (4% of GDP) in 2021, according to preliminary estimates. This compares to a deficit of OMR 4.4bn in 2020. In the 2022 budget, deficit is estimated to be slightly higher at OMR 1.55bn (4.9% of estimated GDP).

- Reuters reported that Oman was in talks with regional banks to refinance a USD 2.2bn loan to increase its size and at better terms; the 15-month tenor loan was taken last year had a 1-year extension option.

- Oman signed a strategic framework agreement with Britain’s BP aimed at collecting data about renewable energy in Oman, according to a tweet from Oman’s energy ministry.

- Amid risk of a Russian invasion of Ukraine and given concerns about a drop in gas supplies, US is in talks with Qatar and other gas exporters to secure alternative seaborne LNG cargoes. Gas stocks are at a record low for this time of year.

- Qatar’s foreign ministry disclosed that an agreement had been signed to ensure gas supply to Gaza power plant. Qatar will establish an escrow account and cover the costs of gas supply and generating electricity through Gaza’s power plant.

- The Gulf electricity interconnection project has enabled Gulf countries to save USD 3bn since the establishment of the Gulf Cooperation Council Interconnection Authority in 2019.

- Mergers and acquisition deals that had any MENA involvement jumped by 57% yoy to USD 109bn in 2021, according to Refinitiv data. Saudi Arabia saw USD 27.3bn worth of M&A activity, accounting for half of the targeted M&A deals in the region. Investment banking fees in the region grew by 3% yoy to USD 1.4bn (the 2nd highest total ever).

Saudi Arabia Focus

- Saudi Arabia’s Nov oil production and exports reached its highest levels since Apr 2020, according to Joint Organisations Data Initiative. Crude oil exports grew by 116k barrels per day or 1.7% mom to 6.95mn bpd in Nov.

- Government deposits with the Saudi Central Bank fell by SAR 74.7bn (or 2.4% yoy) to SAR 358bn during Dec. This the largest monthly drop of government deposits with the central bank since Nov 2016 (when it fell by SAR 90.3bn). Preliminary data also showed that net foreign assets held by the Saudi Central Bank dropped by 2% mom to SAR 1.64trn.

- Saudi Arabia’s oil minister stated that OPEC+ “have done a lot in bringing about stability” in global energy markets. Separately, he also that that it is the prerogative of the US government whether or not to release supply from its strategic petroleum reserves.

- Oil exports from Saudi Arabia to China, at 87.58mn tonnes, accounted for 16% of overall oil imports into China in 2021. Russia’s oil exports to China fell by 4.7% to 79.65mn tonnes, but remained second largest (15%). Oil from Iraq, Oman and Angola stood at 10%, 9% and 8% of China’s total crude oil imports.

- The real estate price index for Saudi Arabia inched up by 0.9% yoy in Q4, given the uptick in residential land prices (+1.7%). Commercial and agricultural real estate prices declined by 0.7% and 0.2% respectively.

- Saudi Arabia’s digital security firm Elm, owned by PIF, plans to raise up to USD 820mn via an IPO. It plans to sell 24mn shares at an indicative price of SAR 113 to 128 per share.

UAE Focus![]()

- The UAE energy minister reiterated the nation’s commitment to support OPEC+ and disclosed that the nation will “continue” to “increasing supply of 400k bpd” while not worrying about short term spikes in oil prices or predictions of oil prices at USD 100. He also stated that international oil companies should continue to invest in hydrocarbons. He further revealed that UAE plans to establish a power market platform to facilitate the export of electricity.

- The UAE, which is currently implementing 7 hydrogen-related projects, aims to capture around a quarter of the global hydrogen market with hydrogen produced both by electrolysis and from natural gas according to the nation’s energy minister.

- The UAE central bank announced a currency swap agreement worth AED 18bn (USD 5bn) with Turkey to boost the latter’s foreign currency reserves.

- ADNOC announced, after the drone attacks on its oil facility last Monday, that its business continuity plans had been activated to ensure uninterrupted supply of oil to all customers.

- Masdar signed a deal to develop a green hydrogen production plant in the UAE with France’s Engie and Fertiglobe. The facility will have up to 200MW capacity and is expected to be operational by 2025.

- The chairman of DP World revealed that it would take 1-2 years for economic recovery after the pandemic is over, given vulnerabilities in the global supply chain.

- Spending in the UAE is now above pre-pandemic levels, according to the payments processor Network International. International and domestic spending volumes were up by 104% and 17% yoy in Dec; this was 12% and 17% respectively above pre-pandemic levels.

Media Review

Rising IPO tide could lift all Gulf boats

https://www.reuters.com/markets/asia/rising-ipo-tide-could-lift-all-gulf-boats-2022-01-20/

Lebanon’s middle class squeezed by crisis

Frankly Speaking: Saudi Arabia can be a leading oil exporter while also fighting climate change, says deputy minister for environment

https://www.arabnews.com/node/2010286/saudi-arabia

Dubai population to surge to nearly 6m in 20 years amid urban transformation

Can China create a world-beating AI industry?

https://www.economist.com/business/2022/01/22/can-china-create-a-world-beating-ai-industry

Dr. Nasser Saidi’s CNBC Arabia interview on Lebanon’s recent banking, exchange rate developments and negotiations with the IMF