Weekly Insights 9 Dec 2021: GCC growth is rebounding

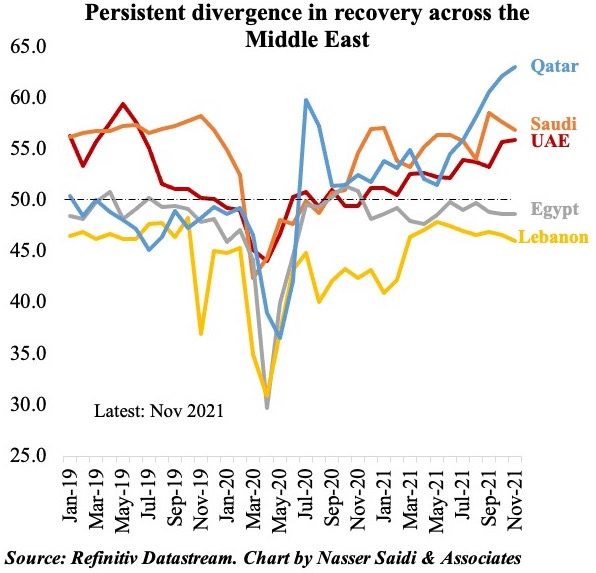

1.Divergence in PMIs persist: GCC PMIs at 50+, Egypt stays below-50 for the 12th month

- Non-oil sector has been supporting economic recovery in the GCC

- Recent structural reforms (announced in Saudi & the UAE) will likely boost non-oil sector performance further

- Qatar, Saudi Arabia and UAE PMI readings have stayed above 50 since Dec 2020. The rapid rollout of vaccines (& now booster shots) have supported positive sentiment. UAE’s Expo and Qatar’s upcoming World Cup preparations have raised confidence.

- While Egypt’s businesses reported inflationary pressures and supply shortages, businesses in the GCC had been holding back on passing higher costs to consumers to remain competitive: this is now changing

- Inflation will likely tick up in the coming months: in Sep, UAE inflation increased by 1.19% (Aug: 0.55% yoy, when it increased for the first time since Dec 2018; see slide #4)

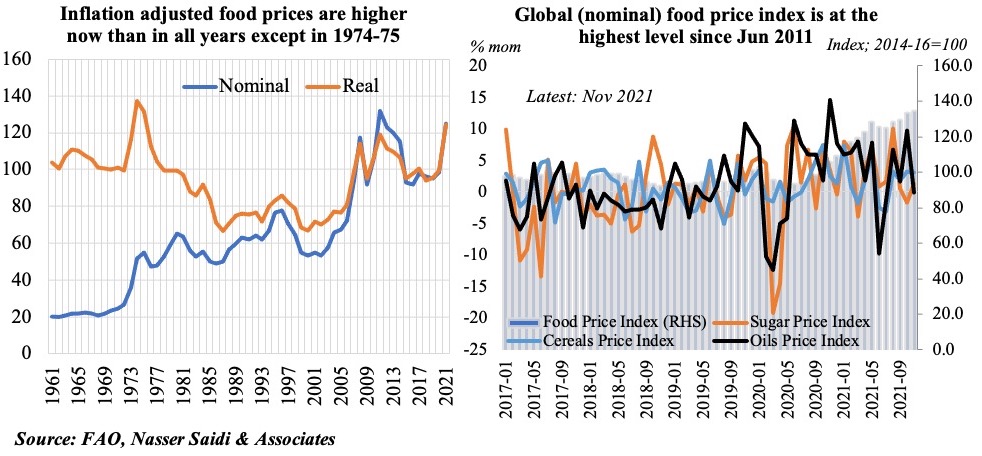

2. Inflation adjusted food prices are higher now in all years except in 1974-75

- Food prices in Nov 2021 have increased to the highest level since Jun 2011, according to the FAO. This was the 4th straight monthly increase in the value of the index

- Rising fuel prices and shipping costs, strong demand amid tight supplies (given weather changes) and labour shortages (during the harvest season) are some factors leading to the rise in prices

- Interestingly, if we compare real vs. nominal food prices, the only time it was more expensive to buy food was in 1974-5 (just after 1973’s oil surge). Note that 2011 was when the Arab Spring took place following protests about food inflation

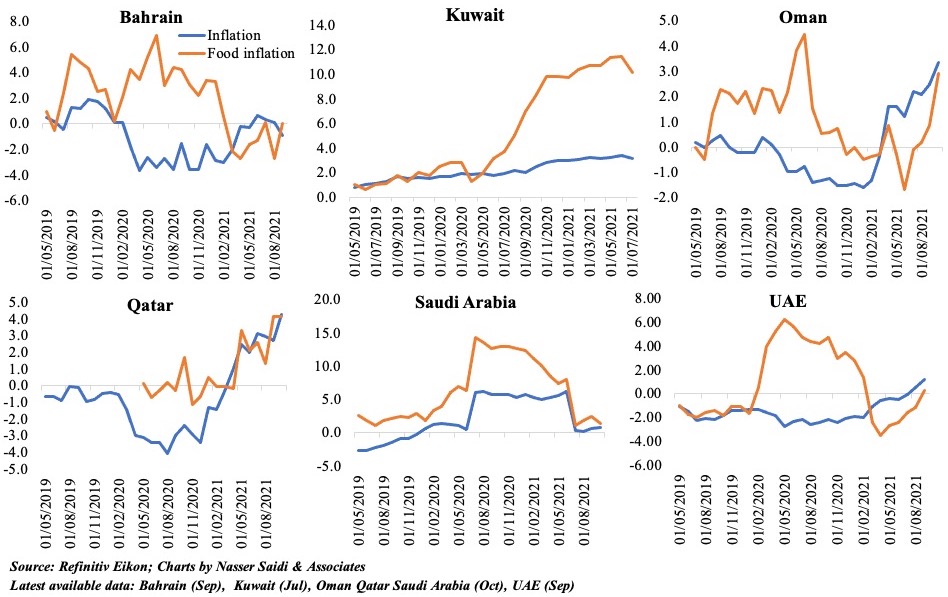

3. Food prices are rising at much faster pace than headline inflation in most GCC nations

(Saudi prices in yoy terms are much lower now given VAT hike from Jul 2020; Bahrain will see a surge starting 2022 when VAT is hiked to 10%)

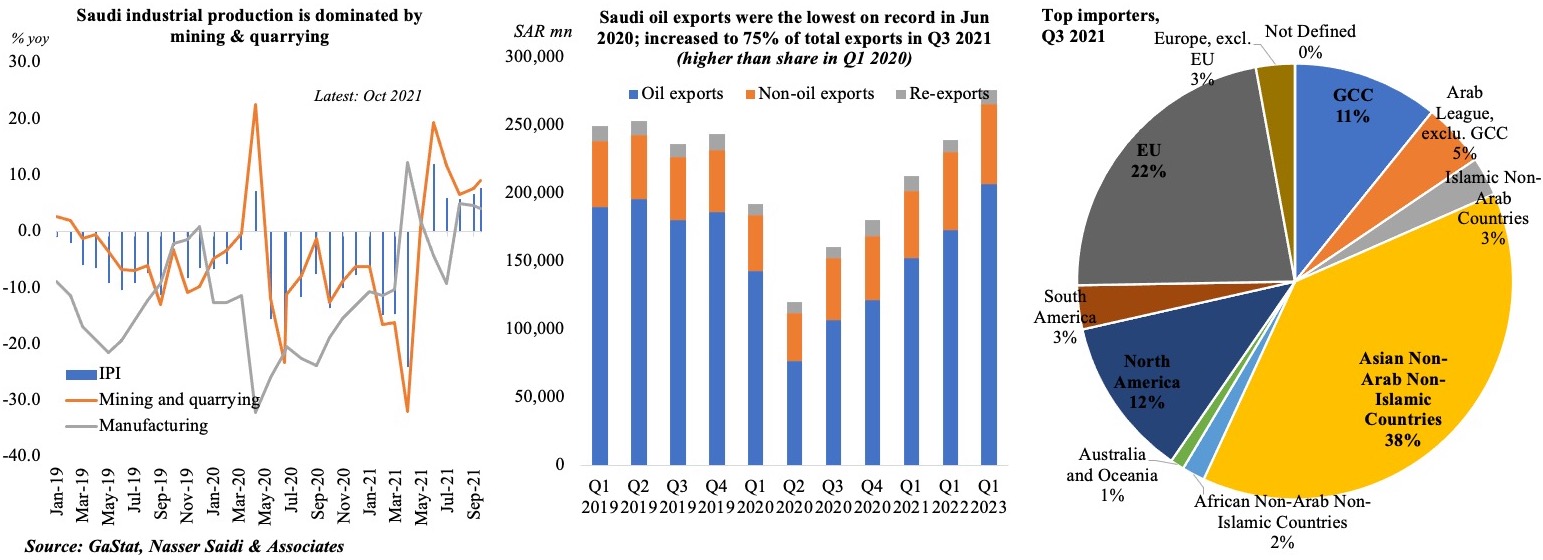

4. Mining & Quarrying Dominate Industrial Production in Saudi Arabia. Oil exports accounted for three-fourths of exports in Q3 2021 & Asia remains the top destination

- With OPEC+ deciding to raise crude supply by 400k bpd every month, it is little wonder that Saudi Arabia has been raising its oil production levels

- This is clearly reflected in the industrial production data. IP data released this morning shows mining and quarrying growth at 9% yoy in Oct, rising for the 6th straight month

- Saudi oil exports have been increasing, accounting for a very high 75% of total exports. As for major destinations of its exports, Asian nations account for the largest proportion (38%), followed by the EU (22%), North America (12%) and the GCC (11%)

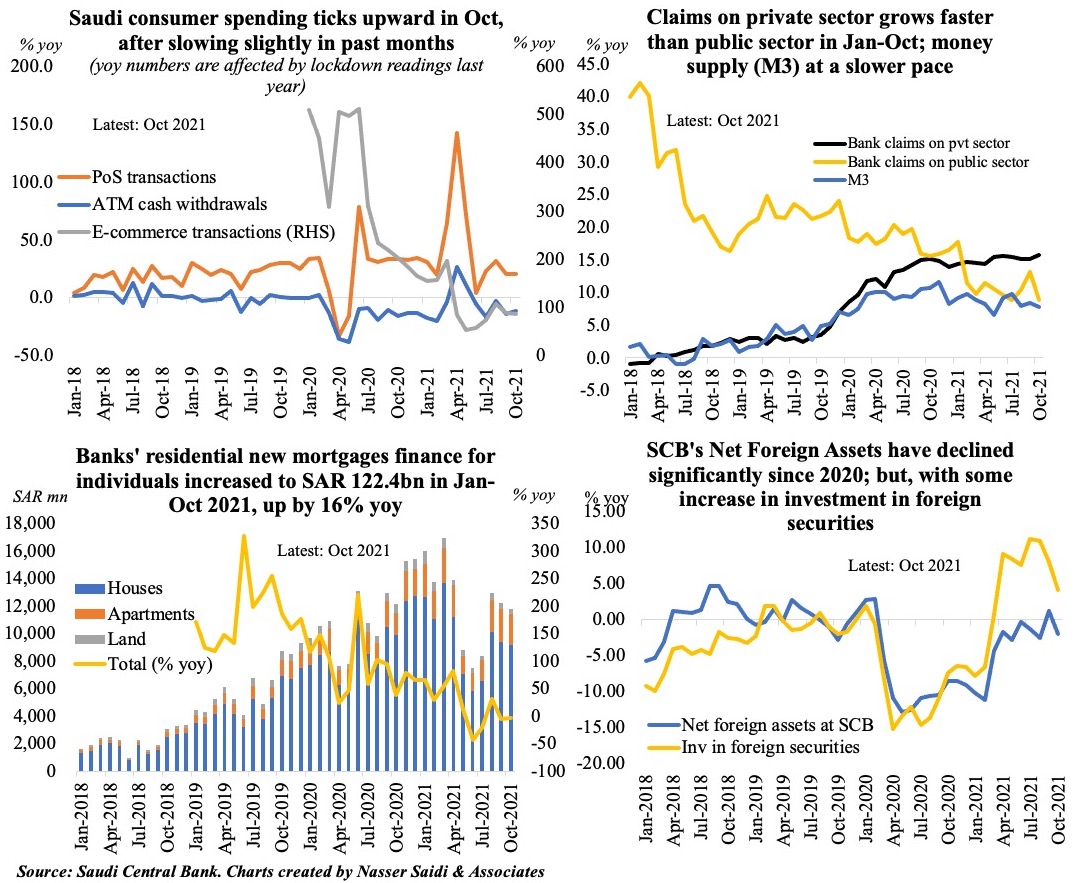

5. Consumer spending & loan growth rise in Saudi Arabia. Mortgage finance has come offs the highs seen in H2 2020, but still remains strong

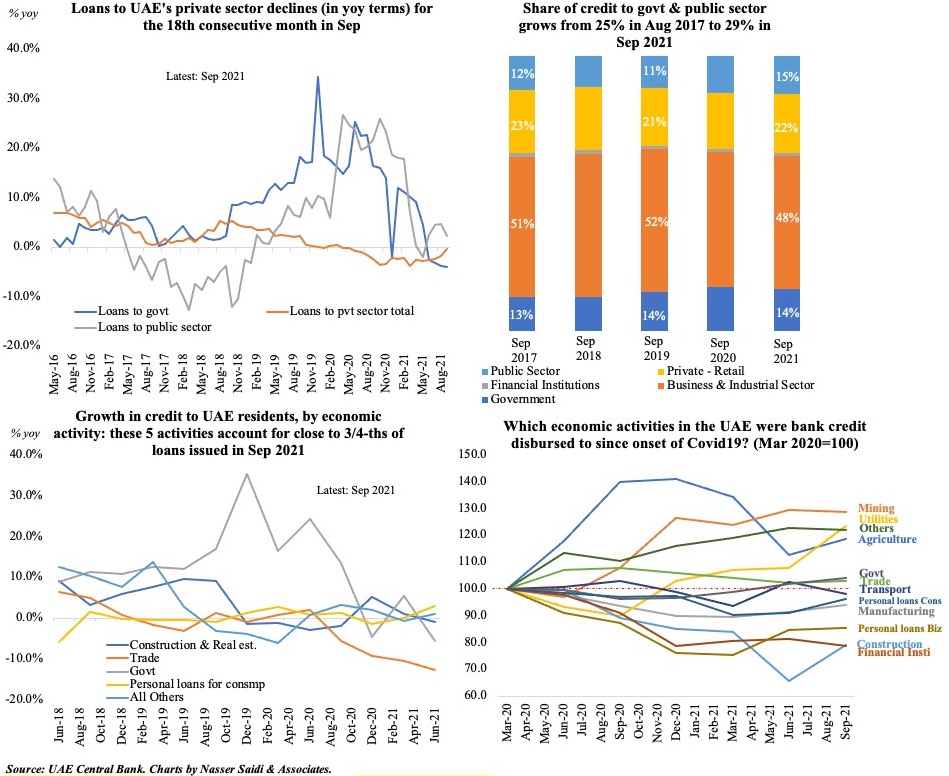

6. Disbursement of UAE bank credit

- In yoy terms, loans to private sector fell for 18th straight month in Sep. But it rose by 0.6% mom

- Share of public sector & govt has increased

- 5 activities accounted for almost 75% of loans issued in Sep 2021