Markets

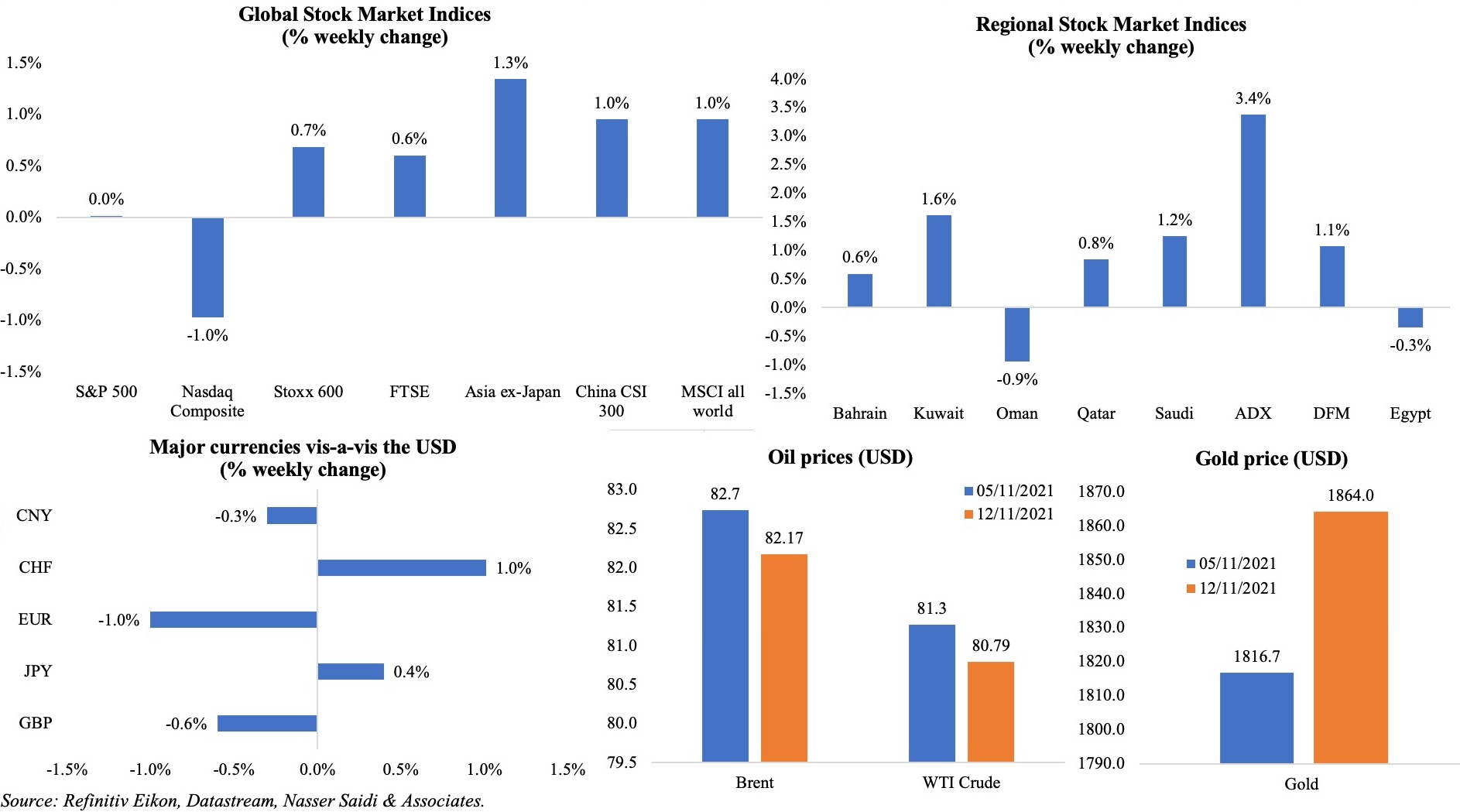

Most equity markets ended on a positive note last week: US Nasdaq regained after posting a 1.7% drop on Wednesday while the S&P 500 is less than 1% from peak; European shares, closed higher for the 6th consecutive week, and touched new records given strong earnings performance (STOXX, Germany’s DAX, France’s CAC40). However, the key question being asked is whether the rising inflationary pressure would tip the Fed to tighten monetary policy earlier than anticipated. Regional markets were mostly up, with Dubai and Abu Dhabi leading the gains with the latter touching a new record high on Thursday. The dollar strengthened: the euro dropped to its weakest against the dollar since Jul 2020 and the British pound fell to its lowest since Dec 2020. Gold prices gained by 2.6% – the biggest weekly gain in 6-months, while oil prices fell for a third consecutive week on a stronger dollar.

Weekly % changes for last week (11 – 12 Nov) from 4 Nov (regional) and 5 Nov (international).

Global Developments

US/Americas:

- Inflation in the US increased by 0.9% mom in Oct (Sep: 0.4%) while core CPI was up by 0.6% (Sep: 0.2%). In yoy terms, headline and core inflation rose to 6.2% and 4.6% (from 5.4% and 4% in Sep) – the highest since Dec 1990 and Aug 1991 respectively. Used vehicle prices surged again, rising by 2.5% on the month and 26.4% for the year; fuel prices were up by 12.3% mom and energy prices overall were up by 4.8%.

- US producer price index ticked up by 0.6% mom in Oct, standing at 8.6% yoy – the highest annual pace in nearly 11 years. Core PPI ticked up to 6.8% yoy, rising by 0.4% mom (Sep: 0.2%). Almost one-third of the increase in goods prices was attributed to gasoline prices (+6.7%).

- Budget deficit in the US declined by 42% yoy to USD 165bn in Oct. Receipts increased by 19% yoy to USD 284bn (thanks to a 18% and 39% hike in individual and corporate tax receipts to USD 214bn and USD 21bn respectively) while spending dropped by 14% to USD 449bn.

- Initial jobless claims fell to a new pandemic-low of 267k in the week ended Nov 5th, down by 4k from the previous week, and staying below the 300k mark for the 4th consecutive week; the 4-week average slipped to 284.75k. Continuing gained to ~2.6mn in the week ended Oct 29th.

- The JOLTS report showed that a record 4.4m Americans quit their jobs in Sep while the number of job openings remained near a record high of 10.438mn. The largest quits in Sep came from arts, entertainment, and recreation (+56k), other services (+47k), state and local government education (+30K) while it decreased in wholesale trade (-30k).

Europe:

- German exports fell for a second straight month in Sep, down by 0.7% mom, though slower than Aug’s 1.2% drop. Imports inched up by 0.1%, to record a higher trade surplus of EUR 13.2bn in Sep. Compared to Feb 2020, export are still down by 0.3% though imports are up by 7.8%. Current account balance meanwhile stood at EUR 19.6bn, widening from Aug’s EUR 11.8bn, but much narrower than the EUR 25bn recorded in Sep 2020.

- Industrial production in the Eurozone fell by 0.2% mom for a 5.2% annual increase in Sep – declining for the second consecutive month, given supply chain constraints. Industrial output was dragged by a decline in capital goods production, which fell by 0.7% mom.

- The ZEW economic sentiment index for Germany climbed up to 31.7 in Nov (Oct: 22.3), rising for the first time since May; however, the reading for current situation worsened, dropping to 12.5 from 21.6 the month before.

- In the Euroarea, the ZEW economic sentiment index nudged up by 4.9 points to 25.9 in Nov, rising again for the first time since May. Inflation expectations have declined sharply, with the indicator at -14.3 points, a decrease of 31.4 points compared to Oct.

- Sentix investor confidence in the eurozone improved to 18.3 in Nov (Oct: 16.9). The indicator rose for the first time since Jul 2021 despite a fall in the current situation (to 23.5 in Nov from 26.3 in Oct).

- The preliminary reading of UK GDP increased by 1.3% qoq in Q3 (Q2: 5.5%): it still 2.1% below its pre-crisis level in Q4 2019. In mom terms, GDP grew by 0.6% in Sep (Aug: 0.4%). Services sector reported the fastest growth (+1.6% over the quarter) given a 30% surge in business for hotels and restaurants. Meanwhile, manufacturing output and construction fell, by 0.3% and 1.5% respectively.

- Industrial production in the UK fell by 0.4% mom in Sep (Aug: +0.8%), with drops across all production sectors: electricity and gas (-1.6%), oil and gas (-0.9%), mining & quarrying (-0.8%) and manufacturing (-0.1%). Industrial output is 1.4% short of its pre-pandemic levels.

Asia Pacific:

- Inflation in China jumped to 1.5% in Oct (Sep: 0.7%), driven by the 16.6% mom increase in vegetable prices. The producer price index rose to 13.5% (Sep: 10.7%), posting the biggest monthly jump since 1995, and was largely due to the 103.7% yoy rise in the coal mining sector as well as factory production cuts.

- Money supply in China climbed by 8.7% yoy to CNY 233.6trn in Oct (Sep: 8.3%). New loans fell to CNY 826.2bn in Oct, sharply down from Sep’s CNY 1660bn. Outstanding yuan loans grew by 11.9% yoy – though at the lowest since May 2002. New mortgage loans increased to CNY 348.1bn in Oct, up by CNY 101.3bn from Sep.

- Japan’s leading economic index slipped to 99.7 in Sep (Aug: 101.3) – the lowest reading since Feb. The coincident index fell to 87.5 from 91.3 in the month before.

- Current account surplus in Japan narrowed to JPY 1033.7bn in Sep (Aug: JPY 1503bn). With exports up by 16.1% and imports surging by 41.6%, goods account surplus plunged to JPY 229.9bn in the month while services shortfall widened to JPY 257bn from JPY 208.3bn.

- India’s industrial production stood at 3.1% in Sep, slipping from Aug’s 11.9%, partly due to base effects. Manufacturing was up by 2.7% while mining and electricity outputs were up by 8.6% and 0.9% respectively.

Bottomline: COP26 wrapped up in disappointment, with a last-minute objection (from India and China) resulting in weaker commitments to phase out coal use and end fossil fuel subsidies. The final deal set rules for carbon markets, but fell short of rolling out a global carbon tax or rolling out sufficient support for developing nations’ energy transitions. Now, with inflation showing no signs of abating in the US, eyes will be on the UK inflation print out this week (estimated to be at a decade high); the Bank of England will also be looking at labour market data before deciding on a rate hike (especially in view of the ongoing Brexit dispute with the EU). Separately, Covid19 cases are on the rise again in Europe and with harsh winter months setting in, some nations are already imposing partial lockdowns. It remains to be seen if there will be another global wave or spillovers given the relatively lower travel restrictions/ quarantine requirements internationally.

Regional Developments

- Bahrain and UAE plan to establish a joint investment fund “to invest in promising opportunities and projects in both countries and beyond”.

- Bahrain is in the process of qualifying developers for its metro project: the project, which will include 20 stations over 29 kms and 2 tracks, will be implemented and operated by the private sector for up to 35 years while being monitored by the transport ministry. The plan envisages train linkage with Saudi Arabia in the future.

- Urban inflation in Egypt declined to 6.3% yoy in Oct (Sep: 6.6%), driven down by non-food inflation which fell to 3.7% (Sep: 4.6%); clothing, education and rent sub-categories fell.

- Egypt’s central bank approved regulations allowing for instant electronic payments between bank accounts via mobile phones. This will not only allow money transfers instantly but also for the topping up of prepaid cards and e-wallets.

- Exports to the EU from Egypt surged by 38% yoy to USD 4.74bn in Jan-Aug 2021. The region is “Egypt’s biggest trading partner”, according to the minister of trade and industry.

- Egypt announced the reduction of several fees on trading in securities: this includes abolishing a stamp duty on stock market transactions for resident investors, reducing tax on profit realized in new offerings by 50% for first two years and lowering taxes for retail investors participating in stock funds to 5%. In addition, fees on trades on the stock market, payments to the Financial Regulatory Authority, fees to the state-run Misr for Central Clearing, Depository and Registry and fees to the Investor Protection Fund have also been lowered.

- Iraq’s external public debt has fallen to USD 20bn, according to the prime minister’s adviser for financial affairs. Iraq’s foreign debt was USD 133bn in Sep 2020.

- Kuwait’s budget deficit touched a record high of KWD 10.8bn (USD 35.5bn) in 2020-21 fiscal year, widening by 174.8% compared to a year ago. Revenues plunged by 39% to KWD 10.5bn (of which oil revenues were down by 42.8% to KWD 8.8bn), while spending ticked up by 0.7% to KWD 21.3bn.

- Kuwait’s government submitted its resignation to the Emir last week: it is the second resignation in the past 12 months. This followed the issuance of two decrees for an amnesty for several convicted citizens, including prominent opposition politicians.

- Kuwait Airways reported profits of KWD 5mn (USD 16.5mn) in Sep 2021, compared to a loss of KWD 10mn in Sep 2019.

- Oman has capped motor fuel prices at Oct rates till end-2022, with the government bearing the cost difference due to any increase in prices. Furthermore, various fees related to doing business was reduced including setting up and renewing company licences, organising tourist camps, and the issuing or renewal of permits for organisations that provide essential services.

- Qatar’s Ministry of Finance revealed that a fiscal surplus of QAR 0.9bn was recorded in Q3 2021. While revenues grew by 20.6% yoy in Q3, revenues from the energy sector accounted for 87.7% of total income in the quarter. Oil and gas revenues grew by 34.6% yoy to QAR 41.3bn in Q3. On the expenditure side, more than one-third went towards major projects including 2022 World Cup.

- S&P affirmed Qatar’s “AA-/A-1+” long- and short-term foreign and local currency ratings, with a stable outlook.

- IMF expects GCC’s foreign reserves to increase by USD 300-350bn in the next three years.

- The MENA region saw 4 IPOs in Q3 2021, raising a total of USD 1.836bn, according to EY: this compares to a single IPO valued at USD 115.9mn in Q3 2020. Saudi Arabia led the IPO activity. Year-to-date, there have been 8 IPOs worth USD 2.261bn.

Saudi Arabia Focus

- Saudi Arabia’s preliminary Q3 GDP show the economy expanded by 6.8% yoy, thanks to a 9% yoy uptick in the oil sector while non-oil sector activity eased (+6.2% vs Q2’s 11.1%). Higher demand for oil globally, rise in oil production (as agreed under OPEC+) and higher oil prices supported the uptick

- Industrial production in Saudi Arabia increased by 6.5% yoy in Sep. Higher mining and quarrying production (+7.6% yoy) was supported by an increase in oil production to 9.6mn barrels per day (bpd) from 8.9mn bpd a year ago. The manufacturing component within the IPI (22% weight in overall index) eased slightly to 4.6% (Aug: 5%).

- Saudi Arabia sold USD 3.25bn in dual-tranche bonds in its third international offering this year: the order book reached over USD 11bn. Separately, Reuters reported that Saudi was in negotiations with banks to amend the terms of a USD 16bn loan due in 2023; duration of the new facility could also be reduced.

- Saudi Tadawul will offer up to 30% of its total offered shares of 36 million to individual subscribers: the subscription process for individuals will begin on Nov 30th for three days while the order book for institutions will start from Nov 21-26.

- Saudi Arabia granted citizenship to “outstanding” expats – those with a selection of distinguished talents with unique expertise and specialisations.

- Non-Saudis will be allowed to invest in real estate funds in Makkah and Madinah, according to the Saudi CMA.

- Saudi Arabia launched a regulatory sandbox initiative for government technical companies. The sandbox will help raise the efficiency and quality of digital platforms while harmonizing government procedures and strengthen the partnership between the government and private sector, according to the governor of the Digital Government Authority.

- The number of investors in Saudi public funds increased by 5.2% qoq and 14.8% yoy to a record high of 402,163 by end-Q2. Investors for ETFs jumped by 17.7% to 7040 investors; REITs investors grew by 13.9% qoq to 178,065.

- Demand for high-quality offices increased in Riyadh, thereby driving up the Grade A office lease rates by 2.9% yoy as of end-Q3 2021, according to a report by Knight Frank.

- The average daily rate at Saudi hotels increased by 9.9% yoy in Jan-Sep 2021 while revenue per available room (ReVPAR) ticked up by 1%. ReVPAR growth rates were highest in Jeddah (54.9%) while in Khobar and Riyadh it rose by 13.8% and 1.5% respectively. Occupancy levels still remained down by 3.4% yoy during the period, owing to the sharp declines in Makkah and Medina (-11% and -1.1% respectively).

- With the latest deposit of SAR 1.9bn (USD 506.5mn) into Saudi Arabia’s Citizen Account Program, the total number of beneficiaries reached 10.5mn, and the total amount paid into the program crossed SAR 107bn (since Dec 2017).

- Shariah compliant financing grew to more than USD 430bn in Saudi Arabia by end-Q2 2021, according to the central bank governor. Total volume of Shariah compliant deposits also rose to USD 433bn during the period.

UAE Focus![]()

- UAE’s ministry of economy disclosed that growth currently exceeds pre-pandemic levels in trade, investment, number of new companies, work permits and economic revenues. Furthermore, it was revealed that the first phase of implementation of the 33 initiatives launched last Jul has been completed and that the second phase is 50% complete.

- Dubai PMI surged to 54.5 in Oct (Sep: 51.5) as new orders rebounded; anecdotal evidence, including from hospitality and retail sectors, indicate an increase in tourism activity since the start of the Expo, which bodes well for recovery.

- Abu Dhabi’s new decree will allow for non-Muslims to marry, divorce, get joint child custody, and inheritance under civil law: it had previously been based on Shariah principles. A new court, operating in both Arabic and English, will be set up to handle non-Muslim family matters.

- The Abu Dhabi Securities Exchange and Department of Economic Development have submitted a regulatory framework proposal allowing for the listing of special-purpose acquisition companies (SPACs) to the Securities and Commodities Authority.

- UAE will allow government entities to create their own development funds, with an aim to increase productivity and flexibility of government work.

- UAE’s energy minister stated that the OPEC+ will be able to increase oil supply should there be a market demand. He also highlighted that oil and gas would be needed to ensure reliable supplies of energy during the transition period toward clean energy, and that insufficient investments in oil and gas would lead to higher prices. Separately, it was also revealed that the UAE invested in 71 different projects worth USD 5.64bn in Africa.

- Improvements of road and transport infrastructure in Dubai has saved nearly AED 220bn (USD 60bn) in time and fuel wasted due to traffic congestions during the period 2006-2020, according to the Chairman of Dubai’s Roads and Transport Authority. The total investment for the improvement totalled only AED 140bn in comparison.

- Real estate transactions in Sharjah touched 16,781 in Q3 2021, valued at AED 5.7bn.

- In the period till Nov 7th, a total of 2,942,388 visits were recorded at the Dubai Expo. This is about 7 times the number of visits in the first 10 days.

- UAE aims to become home to 20 so-called unicorns by 2031, stated the Minister of State for Entrepreneurship and SMEs at a conference.

- Emirates Airlines received AED 2.5bn (USD 681mn) in state support in H1 2021, raising the total support it received since the pandemic began to close to USD 3.8bn. The airline reported a loss of AED 5.8bn was reported in Apr-Sep, down from the AED 12.6bn loss in the same period last year. Revenues increased by 86% to AED 21.7bn, thanks to the rise in passenger numbers (to 6.1mn from 1.5mn a year ago).

- UAE plans to list Dubai’s “Salik” road toll system on the financial market, tweeted the nation’s finance minister. Earlier in the week, Reuters reported that Dubai Holding was weighing an IPO of the business park operator TECOM Group. It has a portfolio of 10 business parks where around 6,500 businesses employ a total workforce of 95,000.

- The Syrian Ministry of Electricity and a group of UAE firms will establish a photovoltaic power plant in the Damascus countryside with a capacity of 300 MW, reported the Syrian News Agency. This came days after the visit of a high-level UAE delegation to the country.

Media Review

The reinvention of the Saudi economy is going slower than planned

Americans Are Flush With Cash and Jobs. They Also Think the Economy Is Awful: NYT

https://www.nytimes.com/2021/11/06/upshot/inflation-psychology-economy.html

Saudi Companies Suspend Commercial Dealings with Lebanon

https://english.aawsat.com/home/article/3288506/saudi-companies-suspend-commercial-dealings-lebanon

World’s first digital trade financing pilot between MLETR-harmonised jurisdictions