Markets

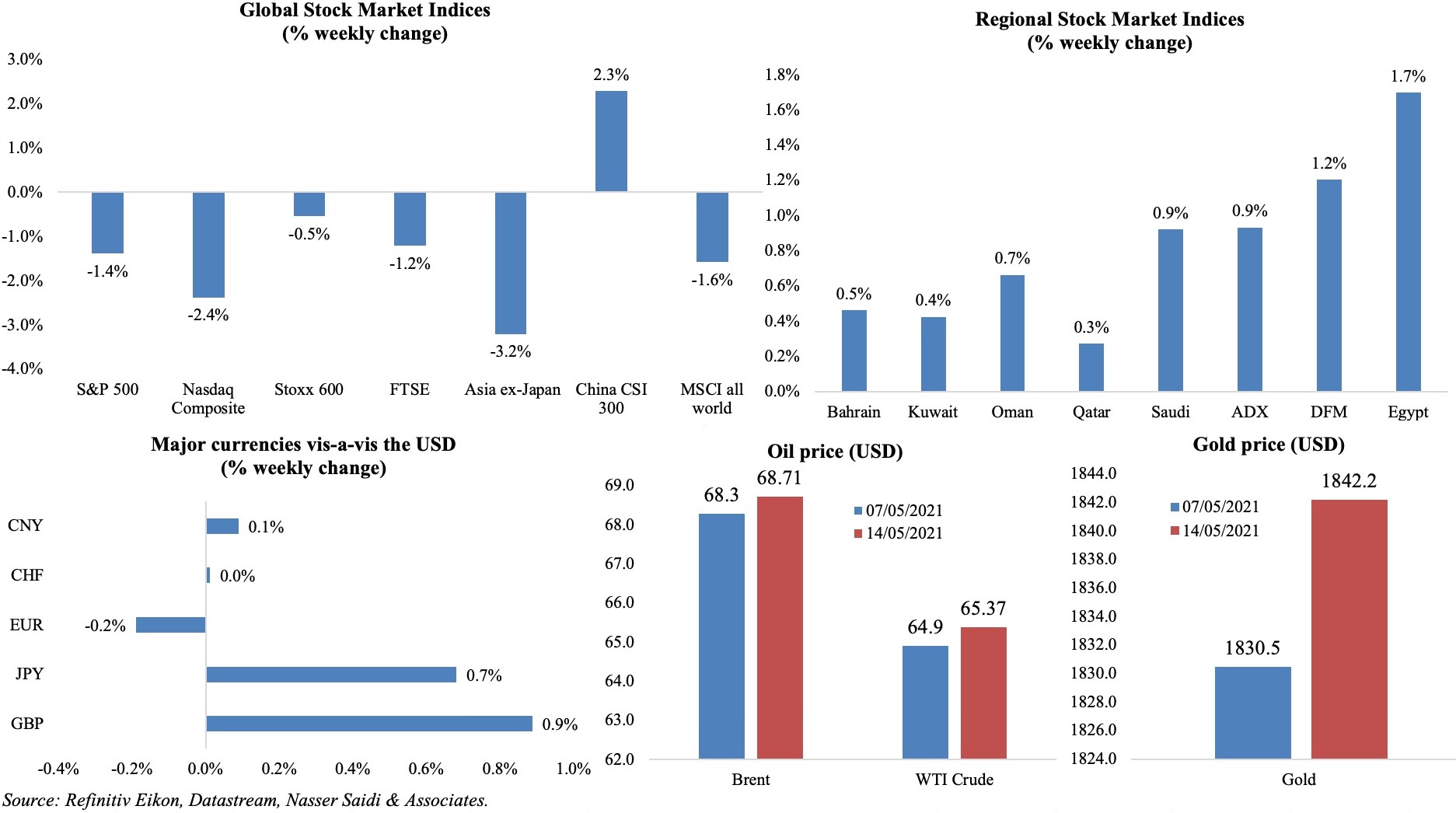

Most global equity markets closed the week in the red, as inflation worries added to investors jitters, in spite of the current spike being labelled transitory by central bankers and the Fed implying that there would be no immediate moves to tighten monetary policy. Many regional markets were closed for the Eid holidays and saw thin trade ahead of the holidays. Among currencies, the dollar weakened, and the pound gained (thanks to a more hawkish stance from the Bank of England). The rally in commodities continued: oil prices inched closer to USD 70 mark given continuing geopolitical risks amid global recovery prospects while gold price was up by 0.6% from a week ago.

Weekly % changes for last week (13-14 May) from 6 May (regional) and 7 May (international).

Global Developments

US/Americas:

- US inflation increased by 0.8% mom and 4.2% yoy in Apr, as energy prices increased by 25% yoy. Core inflation rose by 0.9% mom and 3% yoy. The yoy increase in overall inflation was the highest since Sep 2008 and the monthly gain in core inflation was the highest since 1981.

- Producer price index in the US increased by 0.6% mom and 6.2% yoy in Apr, raising inflationary pressures further. Core producer prices (excluding food and energy) increased by 0.7% mom and 4.1% yoy in Apr. While a base effect is a key reason for the yoy jump, some prices have also been rising in mom terms: steel products prices were up by 18.4% and food prices up 2.1%.

- Retail sales in the US remained flat in Apr (0% mom after Mar’s upwardly revised 10.7% surge); sales excluding autos, gas, building materials and food services dropped by 1.5%.

- Industrial production in the US increased by 0.7% mom in Apr, as manufacturing edged up by 0.4% (Mar: 3.1%) and utilities grew by 2.6%. Capacity utilization rose to 74.1 (Mar: 73.8).

- Michigan consumer sentiment index unexpectedly slipped to 82.8 in May (Apr: 88.3) – the lowest reading since Feb. Consumers’ expected inflation rate for the next year increased to 4.6% in the May report versus 3.4% in Apr.

- Initial jobless claims declined to 473k in the week ended May 8th from an upwardly revised 507k the week before. The 4-week average fell to 534k – the lowest level since Mar 2020. Continuing claims fell to 3.655mn in the week ended May 1 from a revised 3.7mn the prior week.

Europe:

- German ZEW survey showed a significant improvement in economic sentiment to 84.4 in May (Apr: 70.7), the highest reading since Feb 2000. The current situation reading also edged up, rising by 8.7 points from Apr to -40.1.

- The Eurozone’s ZEW survey showed the economic sentiment indicator surging to 84 in May (Apr: 66.3). The indicator for the current economic situation climbed 14.1 points to a level of -51.4 (compared to Apr).

- Industrial production in the eurozone inched up by 0.1% mom and 10.9% yoy in Mar. Again, base effects meant that the yoy increase was the largest on record. In mom terms, increases in production of non-durable consumer goods (1.9%), energy (1.2%) and intermediate goods (0.6%) were offset by declines in output of capital (-1.0%) and durable consumer goods (-1.2%).

- Sentix investor confidence in the Eurozone jumped to 21 in May (Apr: 13.1) – the highest since Mar 2018. The current situation, at 6.3, was the highest since May 2019, while the expectations index hit an all-time high of 36.8.

- UK GDP contracted by 1.5% qoq in Q1 – when economy was largely in lockdown – led by declines in services and production output. In Mar, growth stood at 2.1% mom, about -5.9% below its pre-pandemic peak in Feb 2020, and 1.1% below initial recovery peak in Oct 2020.

- Trade deficit in the UK widened to GBP 2bn in Mar, as imports increased by 8% (to GBP 50.11bn) and exports grew at a slower 5.8%. UK exports to the EU fell 18.1% qoq in Q1 while imports from the EU were down 21.7%.

- UK industrial production increased by 3.6% yoy in Mar – the first annual gain in 2 years and the strongest since Oct 2017. Monthly production grew by 1.8% mom, largely driven by manufacturing (2.1%) and mining and quarrying (2.5%).

Asia Pacific:

- China’s inflation declined by 0.3% mom in Apr (Mar: -0.5%) and increased by 0.9% yoy – the highest reading since Sep 2020 – largely due to gains in non-food prices. Producer price index surged by 6.8% – the fastest pace in more than 3 years.

- New loans in China eased to 1.47trn in Apr from Mar’s CNY 2.73trn. Money supply increased by 8.1% yoy in Apr (Mar: 9.4%). Outstanding yuan loans grew 12.3% vs 12.6% in Mar. FDI into China surged by 38.6% yoy to CNY 397.07bn (USD 61.45bn) in Jan-Apr.

- Japan’s overall household spending increased by 6.2% yoy and 7.2% mom in Mar – the biggest gain since Sep 2019.

- Japan’s current account surplus widened to JPY 2.65trn in Mar: goods account surplus climbed to JPY 9.831trn, with exports up by 16.6% yoy while imports increased by 3.1%, while the services account deficit narrowed to JPY 471bn from JPY 1.11trn.

- Industrial output in India increased by 22.4% yoy in Mar, after contracting by 3.4% and 0.87% in Feb and Jan, largely due to low base effects from a year ago.

Bottomline: The Israel-Palestine conflict continues to grab news headlines globally: a continued long drawn escalation in violence will likely send oil prices north of $70 a barrel. The UN Security Council meeting today will be eagerly watched for tones of a potential ceasefire, as truce efforts so far have not been successful. As Covid19 cases continue to surge unabated in India, a new wave in South-East Asia (Singapore has gone into a month-long lockdown and Taiwan imposed new restrictions to contain a sudden surge in community transmission) adds to the worry of a global recovery. The only solution seems to be effective distribution of vaccines across the globe: with the WHO’s recent approval of Sinopharm and given UAE’s capacity to produce a million doses per month, it can be distributed across the region and via Covax within a few months. Meanwhile, with restrictions being lifted across many nations (with large percentage of vaccinated persons), safe travel corridors/ vaccine passports seem to be the buzzwords heading into the summer holidays. Amid inflation worries and potential taper tantrums, the IIF revealed that global debt declined for the first time in 10 quarters to USD 289trn in Q1 this year – but the drop was largely due to mature markets as EME debt rose by USD 0.6trn to a record high of more than USD 86trn. This cloud of debt could come under pressure as interest rates are gradually increased, making it harder for sovereigns and corporates to service debt obligations (leading to bankruptcies / insolvencies).

Regional Developments

- Bahrain-origin exports grew by 59% yoy to BHD 295mn (USD 778mn) in Apr, with Saudi Arabia, Egypt and UAE the top destinations for these exports. Imports increased by 26% yoy to BHD 457mn, with Brazil, China and the UAE the top 3 nations.

- The central bank of Bahrain has entered an instantaneous cross-border payment trial in collaboration with JP Morgan and Bank ABC; this collaboration could potentially be extended into a central bank digital currency plan.

- About 65.1% of card transactions (both debit and credit) in Bahrain were contactless for the 4th consecutive month in Apr. Central bank data also indicate that real-time electronic fund transfers surged more than four-fold in Apr.

- Bahrain and the UAE have adopted a safe travel corridor for vaccinated travelers, without the need for quarantine in either country.

- Egypt’s annual urban consumer inflation declined to 4.1% in Apr (Mar: 4.5%); in mom terms, inflation edged up by 0.9% from 0.6% in Mar, thanks to increase in food prices, as well as clothing (+1.9%) and transportation (+5.2%).

- Trade deficit in Egypt narrowed to USD 3.34bn in Feb, down 1.2% yoy. Exports declined by 2% yoy to USD 2.69bn while imports declined by 1.6% to USD 6.03bn. Some imports increased in Feb 2021: petroleum products (+1%), passenger cars (23.9%), raw materials of iron or steel (6.7%) and medicines and pharmaceuticals (14.9%).

- Unemployment rate in Egypt inched up to 7.4% in Q1 (Q4: 7.2%), while urban unemployment rate decreased to 11.1% (Q4: 11.4%). The estimated size of the workforce was down by 2.3% qoq to 29.284mn (with males accounting for 82.6% of the total).

- Credit facilities provided by banks operating in Egypt grew by 16.9% to EGP 2.573trn in the first eight months of the fiscal year 2020-21.

- Egypt announced the extension of its domestic tourism initiative till end of May: this includes the unified prices for return airfares to key tourism hotspots within the country.

- After inbound flights were resumed on Jul 1st 2020 to three governorates, Egypt received more than 2.5mn tourists. Vaccination of tourism sector workers in two governorates – Red Sea and South Sinai – is expected to be completed soon.

- Egypt’s health ministry confirmed the receipt of more than 1.7mn doses of AstraZeneca vaccine through the COVAX initiative (after having received 854k doses in Apr). The number of vaccine doses received total 5mn including multiple batches of Sinopharm.

- Egypt’s minister of health disclosed that the first shipment of raw materials required for the manufacture of the Sinovac vaccine will be received on 18th May. The aim is to produce 2mn doses of the vaccine by end-Jun.

- Iraq, which completed nearly 81% of its preparations for linking with the GCC electricity network, will resume work on the common power grid (via Kuwait) as soon as a financing agreement is reached with GCC funds. Iraq expects work to begin within a month and the first phase of the project is estimated to supply Iraq with 500 megawatts of electricity by 2022.

- About 17k persons were scheduled to travel during the Eid holidays from the Kuwait airport, which is operating at 10% of its capacity; 349 flights were expected to touchdown at the airport during the period 12-16 May and the most favoured destinations were Dubai, Riyadh, Doha, Bahrain, Turkey and Egypt via transit flights.

- The EU is preparing to draw up sanctions on some politicians in Lebanon who are viewed as blocking the formation of the government, reported Reuters.

- Turkey’s Karpowership, which provides electricity to Lebanon from two barges, shutdown supplies to the country over payment arrears (estimated at upwards of USD 100mn). Each of the barges has a capacity of 202 MW, and the contract is to supply 370 MW. (To put in perspective, Lebanon was generating only 1300 MW, including the Turkish supplies of 370 MW while peak demand in 2020 was 3,500 MW).

- Lebanon’s central bank revealed that talks were ongoing with local banks to develop a mechanism that would allow depositors access to their funds (up to USD 25k). Many questions remain: will it be subject to a haircut, where would dollar banknotes come from etc.

- Oman ended its nightly curfew (banning the movement of people and vehicles between 7pm to 4am) though shops and commercial activities are still banned from 8pm until 4am.

- LNG shipments from Qatar to the UAE has resumed, with the Al Ghariya tanker discharging the cargo at Jebel Ali on May 13th after leaving Ras Laffan in Qatar on May 10th – the first such shipment since mid-2017. Monthly exports of condensate have resumed between the 2 nations: Qatari condensate exports to the UAE jumped to 1.7mn barrels in April, up from 287k barrels in Feb.

- Qatar’s Emir met with the Saudi Crown Prince in Saudi Arabia last week, the former’s first visit since the rift ended, where talks were held on “bilateral relations and the means to enhance them in different fields”.

- Remittance flows to the MENA region increased by 2.3% yoy to about USD 56bn in 2020, revealed the World Bank. The uptick was largely due to strong remittance flows to Egypt (+11% to a record high of nearly USD 30bn) and Morocco (+6.5%). However, Djibouti, Lebanon, Iraq, and Jordan posted double-digit declines. Outward remittances from the UAE fell by 3.9% to USD 43bn while from Saudi Arabia it increased by 11% to USD 35bn. More: https://www.knomad.org/sites/default/files/2021-05/Migration%20and%20Development%20Brief%2034_0.pdf

- Tourism in the MENA region will not return to pre-pandemic levels until 2023, according to the IIF. Partial information for Q1 2021 shows that the number of tourist arrivals to the MENA countries stood at just 25% of what they were in Q1 2020.

Saudi Arabia Focus

- Saudi Arabia’s preliminary Q1 GDP estimates show that the economy shrank by 3.3% yoy, dragged down by the oil sector (-12%) while the non-oil sector expanded by 3.3%.

- New factory licenses issued in Saudi Arabia grew by 27.9% yoy to 307 in Q1; this represents a total investment of SAR 17.72bn (USD 4.73bn) during the period, up 428.6% yoy. The total number of industrial establishments in Saudi Arabia stands at 9958.

- The Saudi SMEs loan guarantee program ‘Kafalah’ helped 1621 businesses in Q1 2021, reported Al Eqtisadiah, with guarantees increasing to SAR 2.9bn (+150%) and financing reached SAR 3.6bn. Sectors that benefitted include wholesale and retail trade, construction, accommodation services, food, and manufacturing industries.

- Cargo volumes at Saudi ports increased by 8.25% yoy to more than 609k containers in Apr. In Q1, about 2.5mn containers were handled, a 16% rise compared to a year ago.

- Saudi businesses that have not filed their excise tax returns for Mar and Apr by May 15th will have to pay a fine worth 5% of the amount for every 30 days of delay.

- Saudi Arabia will supply full volumes of crude as requested by at least four Asian refiners in Jun, reported Reuters.

- With Saudi Arabia’s travel ban to be lifted from May 17th, an online travel marketplace Wego reported a 52% rise in international flight searches and a 59% increase in international hotel searches. Egypt topped the list for the flight search destinations, followed by Philippines, Morocco, Jordan and Turkey.

UAE Focus![]()

- Dubai’s non-oil PMI climbed to 53.5 in Apr (Mar: 51), with both output and new orders growth at pre-Covid trends. Travel & tourism firms recorded the “most notable bounce in performance” and the employment sub-index also rose to 50.6 (from 49.7).

- FDI into the UAE accelerated by 44.2% yoy to nearly USD 20bn (AED 73.45bn) in 2020, largely due to Adnoc’s various transactions (worth ~AED 62bn) including the monetization of some of its non-core assets and investments into a natural gas pipeline among others.

- The Abu Dhabi government announced, via Twitter, the establishment of a council to review regulatory legislation for free zones and create a database for businesses using them.

- Dubai’s real-estate sector is passing through a boom phase: according to Property Finder, a total 4,832 property transactions worth AED10.97bn were undertaken in Apr, with off-plan transactions up by 12.9% mom and hitting a 14-month high.

- The Abu Dhabi government granted housing loans and exemptions worth AED 2.21bn (USD 600mn) to 1,656 Emiratis; the first disbursement this year was during Eid al Fitr.

- The Ajman Free Zone reported a 33% yoy rise in new companies registered in Q1 2021. The education and technology sectors saw growth of 39% and 23% respectively, in line with the emirate’s vision statements.

- The “Invest in Dubai” platform, which was launched in the beginning of Feb and enables integrated business setup, issued a total of 3464 commercial licenses and licenses 485 activities. The average age of the investors was 37 years, with the 26-35 age group representing 37% of investments followed by the 36-45 age group at 35%.

- According to the Emirates Tourism Council, UAE’s tourism sector is in a recovery mode, with average hotel occupancy close to 63% in Q1 2021 and average length of stay in hotels up by 27.6% yoy to 4.3 nights.

- The UAE has so far administered over 11.45mn doses, vaccinating over 73% of eligible groups and with plans to vaccinate 100% of all eligible groups by end of the year. Furthermore, the emergency use of Pfizer vaccine for the 12-15 age group has been approved.

- Safe travel corridors are the way forward: UAE announced safe travel corridors with Bahrain, Greece and Seychelles meaning that vaccinated travelers will not be required to quarantine upon arrival.

Media Review

The summer of inflation: will central banks and investors hold their nerve?

https://www.ft.com/content/414e8e47-e904-42ac-80ea-5d6c38282cac

Positive IMF assessment seen as vote of confidence in Saudi reform strategy (with comments from Dr. Nasser Saidi)

https://www.arabnews.com/node/1856281/business-economy

The Israel-Palestine conflict

https://www.nytimes.com/2021/05/14/opinion/bernie-sanders-israel-palestine-gaza.html

https://www.economist.com/leaders/2021/05/13/only-negotiations-can-bring-lasting-peace-to-israel-and-palestine

Taming the Wave of Small and Medium Enterprise Insolvencies: IMF

https://blogs.imf.org/2021/04/02/taming-the-wave-of-small-and-medium-enterprise-insolvencies/

Not all pledges are created equal: how 2030 emissions commitments compare

https://www.ft.com/content/e025643a-c90f-4b07-ad08-01b81af5a4f0

Annual renewable capacity additions increased 45% to almost 280 GW in 2020, the highest yoy increase since 1999: IEA

https://www.iea.org/reports/renewable-energy-market-update-2021