Markets

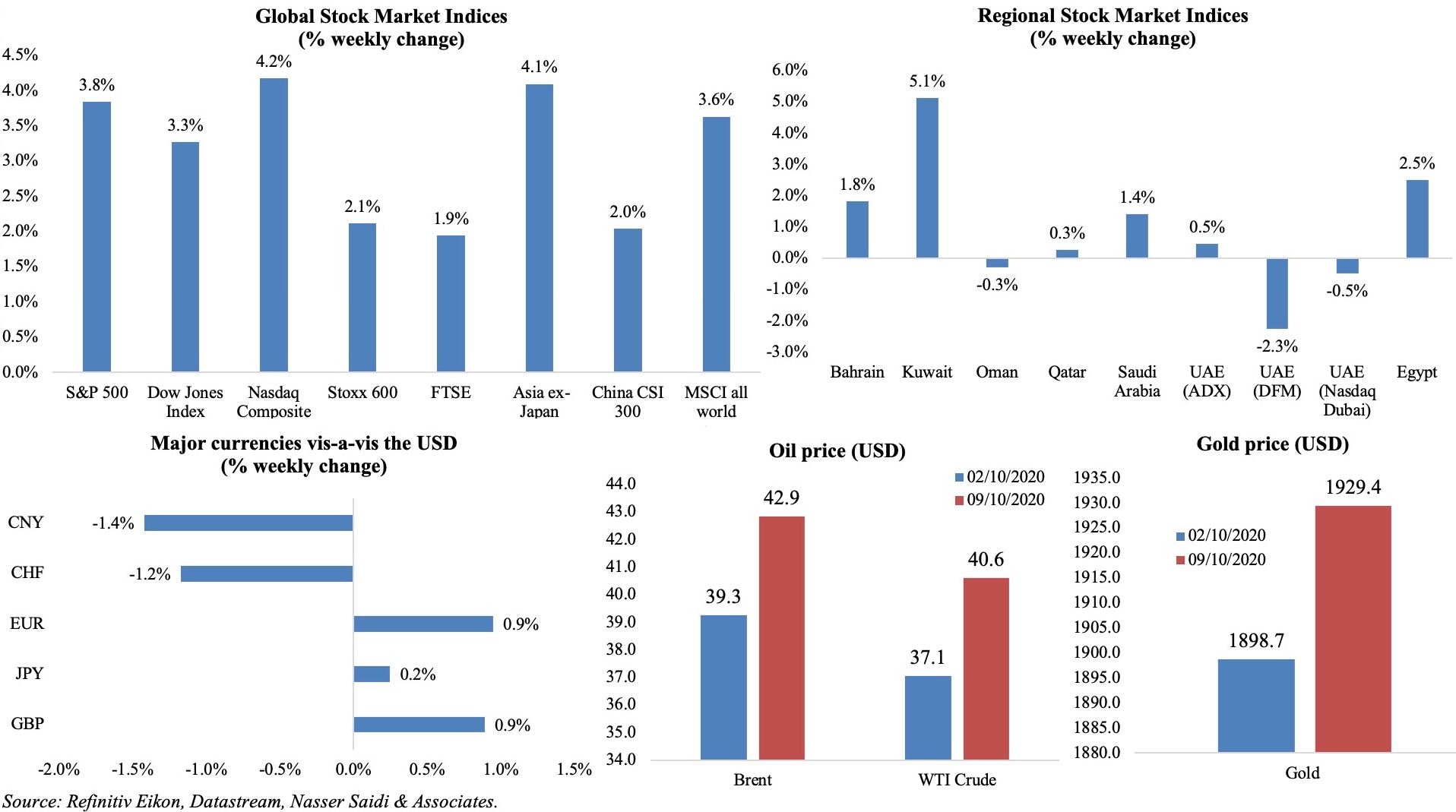

Stock markets had a good week: US ended higher on the revival of fiscal stimulus talks (in spite of Trump’s announcements ranging from Tuesday’s shelving talks, followed by aid to certain sectors and the latest “Go Big!”) while in Europe, Stoxx 600 marked a 2.1% rise – the largest since Aug, in spite of glum economic data; as China’s data indicate a rebound from the Covid19 crisis, markets were up 2%. Regional markets were mixed, with Kuwait gaining the most given clarity on the succession plan, as well as the central bank’s commitment to the strength of the dinar. The dollar weakened while onshore renminbi posted its biggest one-day rise (aided by foreign demand for Chinese assets and expectations of improved relations with the US under Biden) since 2005. Oil prices increased (amid concerns of supply as Hurricane Delta approaches), as did gold prices.

Weekly % changes for last week (8-9 Oct) from 1st Oct (regional) and 2nd Oct (international).

Global Developments

US/Americas:

- ISM services PMI rose for the 4th consecutive month to 57.8 in Sep (Aug: 56.9), with new orders surging to 61.5 (Aug: 56.8) and employment rebounding to 51.8 (Aug: 47.9).

- US trade deficit hit a 14-year record high of USD 67.1bn in Aug (Jul: USD 63.4bn). Imports increased by 3.2% to USD 239bn while exports increased by 2.2% to USD 171.9bn. Trade deficit with China declined by USD 9bn to USD 26.4bn in Aug.

- Initial jobless claims fell to 840k in the week ended Oct 3, from an upwardly revised 849k the week before. Continuing claims declined by a million to a seasonally adjusted 98mn in the week ended Sep 26.

Europe:

- German factory orders increased by 4.5% mom in Aug (Jul: 3.3%), but in yoy terms orders were down by 2.2%. Foreign orders (+6.5%) supported the pickup, thanks to demand from the euro area (+14.6%) and others (+1.5%), while domestic orders inched up by 1.7%.

- Industrial production in Germany contracted by 0.2% mom in Aug (Jul: 1.4%); in yoy terms, IP plunged by 9.6%. Production of intermediate goods increased, though both consumer and capital goods production declined by 1.3% and 3.6% respectively. Automotive sector production was a major drag, declining by 12.5% mom.

- German exports increased for the 4th consecutive month, rising by 2.4% mom in Aug (Jul: +4.7%) while imports increased by 5.8% mom (Jul: 1.1%). Trade surplus narrowed to EUR 15.7bn in Aug (Jul: EUR 18bn).

- Germany services PMI slipped to 50.6 in Sep (Aug: 52.5), but it was still the only country in the eurozone to register a growth. Composite PMI ticked up to 54.7 (Aug: 54.4), supported by the fast increase in factory output (fastest since Dec 2017).

- In the eurozone as well services were a drag on the overall economy: PMI dropped to 48 (Aug: 50.5) and composite PMI fell by 1.5 to 50.4. Spain’s case is telling: as the country battles with fresh Covid19 restrictions, services PMI fell to a 4-month low of 42.2 in Sep (Aug: 47.7).

- Retail sales in the eurozone grew by 4.4% mom and 3.7% yoy in Aug (Jul: -1.8% mom), with Aug online sales up 24% yoy.

- GDP in the UK slowed to 2.1% in Aug, following growth rates of 6.6% in Jul and 9.1% in Jun. GDP is 21.7% higher than its lowest ebb during lockdown in Apr, when the economy contracted by 19.5%, but remains 9.2% below pre-pandemic levels.

- Markit services PMI in the UK fell to 56.1 in Sep (Aug: 58.5), the lowest reading since Jun. Growth in new business eased as the Eat Out to Help Out scheme was withdrawn and some additional restrictions were imposed.

- UK’s industrial production inched up by just 0.3% mom in Aug (Jul: 5.2%): while manufacturing picked up by 0.7% (vs 6.9%), the largest boost came from construction (+3%, though lower than Jul’s 17.2% surge).

- The UK government will pay 67% of the salaries of employees – if their companies have to close due to Covid19 restrictions – up to a maximum of GBP 2,100 (USD 2,730) a month. The scheme will begin Nov 1st and run for 6 months.

Asia Pacific:

- Caixin services PMI accelerated to 54.8 in Sep (Aug: 54), posting the 5th consecutive month of increase – supported by a rise in total new business though export work continued to decline.

- China’s foreign exchange reserves fell to USD 3.143trn in Sep (Aug: USD 3.165trn), following increases in the previous 5 months. Gold reserves stood unchanged at 62.64mn ounces at end-Sep.

- Domestic tourism picks up in China during the Golden Week holiday: tourism sites were visited by 637mn domestic tourists (79% of last year’s total) and revenues stood at CNY 466.56bn (USD 68.7bn) versus CNY 650bn last year. However, this is much better compared to the last long holiday period over May 1-5 this year which saw just 115mn tourists and revenues of CNY 47.56bn.

- Japan’s preliminary leading economic index increased to 88.8 in Aug (Jul: 86.7), the highest since Feb, while the coincident index edged up to 79.4 (78.3).

- Japan’s savings rate increased to the highest level in 2 decades: on average, people saved 44% of their income in Jan-Aug this year, up from 33% in the same period last year.

- Current account surplus in Japan narrowed by 1.5% yoy to JPY 2.102trn in Aug, but at the slowest pace since the pandemic began. Goods trade was in surplus for the 2nd consecutive month (JPY 413.2bn) as the fall in imports (22%) outpaced the decline in exports (15.5%).

- India’s services PMI rose for the 5th straight month, but remained below-50, with the index at 49.8 in Sep (Aug: 41.8). Overall new business declined for the 7th consecutive month.

- The Reserve Bank of India left interest rates unchanged:repo rate and reverse repo rate are at 4.0% and 3.35% respectively. Repo rates have been lowered by 115bps since late Mar.

- Singapore retail sales inched up by 1.4% mom in Aug, but fell 5.7% yoy (Jul: 27.2% mom and -8.5% yoy), in the second month of reopening after the circuit breaker.

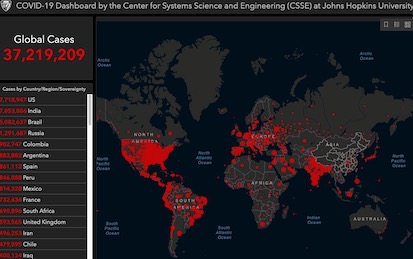

Bottom line: Covid19 cases are surging across many parts of the globe, and new restrictions are being enforced – be it from UK and Spain in Europe to Jordan and Oman in the Middle East. With economies not having fully recovered from the initial lockdown period, it is little wonder then that the latest PMI data from Europe show a dip in the services sector. Separately, with the US election date approaching fast, the Vix volatility index (sometimes referred to as the “fear gauge”) dropped to the lowest level in 3 weeks, on the declining likelihood of a contested election as Biden widened his lead (FiveThirtyEight signaled that Biden’s lead increased to 9.8 ppts from 7.1 at end-Sep). Politics continue to be in the limelight in UK as well, with the state of Brexit negotiations to be evaluated during the EU Summit (Oct 15-16). Last, but not the least, IMF-World Bank meetings are on this week: be prepared for revisions to economic growth numbers and a push for further debt relief (especially given the World Bank’s scathing finding that the pandemic could push an extra 150mn people into extreme poverty by 2021).

Regional Developments

- About 140k Bahrainis (working in nearly 24k firms) received wage support from the government during Apr-Sep. Over the next 3 months, wages of about 23k persons from 4000 firms will be supported (receiving 50% of their wages from the government).

- Bahrain’s trade is inching back to pre-pandemic levels, with Jun levels the highest since Mar. Bilateral trade with Saudi Arabia was up 52.45% yoy to USD 262.9mn in Jun while trade with UAE rose to USD 139.6mn. Overall trade with the GCC touched USD 2.9bn in H1.

- Bahrain set up a specialized office – the Financial Crimes and Money Laundering Prosecution Office, headed by a public advocate – to tackle financial crimes and money laundering.

- Egypt’s PMI increased to 50.4 in Sep (Aug: 49.4) – the first 50+ reading since Jul 2019 – thanks to an expansion in both output and new orders, while employment also grew to the highest in 10 months.

- Annual urban consumer price inflation in Egypt edged up to 3.7% in Sep (Aug: 3.4%); food costs edged up 0.3% mom.

- Net foreign reserves in Egypt inched up by 0.15% mom to USD 38.425bn in Sep.

- Egypt’s foreign debt declined for the first time in more than 4 years: external debt in Q1 2020 declined by 1.2% qoq. The ratio of short-term debt to total external debt decreased to 9.3% in Q1 2020 (vs 11.7% in Q1 2019).

- Fuels prices in Egypt will be left unchanged for 3 months; a similar decision was taken at the previous meeting of the pricing committee in Jul.

- About 66.2% of salaried employees in Egypt have permanent jobs: the ratio is 87.7% among females and 62.2% among males. As of end-2019, labour force in Egypt accounted for 42.2% of total population.

- Taxpayers in Egypt have until Oct 15 to pay their taxes in order to be exempt from paying 90% of the additional late payment fees. The waiver drops to 70% if paid between 16 Oct to 14 Dec and to 50% if paid between 15 Dec and 12 Feb next year.

- Egypt’s Ministry of Manpower revealed that about EGP 273.46mn is currently being disbursed to 1915 tourism entities affected by the crisis (employing close to 125k persons). This is the 2nd and 3rd batch of payouts, following the first installment of EGP 208.87mn.

- No Covid19 cases were detected in tourists visiting Egypt during the last 3 months –around 300k persons from 15 nations – disclosed a spokesperson for the government.

- Egypt’s Ministry of International Cooperation disclosed that it had obtained USD 500mn in finance this year: this was used to support the health sector during the Covid19 outbreak.

- USAID signed a deal to provide Egypt with an additional USD 22.8mn as part of the five-year Inclusive Economic Governance bilateral assistance agreement.

- The Iranian rials touched a new low vis-à-vis the dollar, after US imposed fresh sanctions targeting 18 banks. The dollar was selling for as much as 304,300 rials on the unofficial market on Sat, from 295,940 on Fri.

- China Machinery Engineering Corporation was awarded a USD 210mn contract to construct a cement plant in Erbil, Iraq. Construction is expected to last 30 months from initiation.

- Jordan’s GDP dropped by 3.6% yoy in Q2 2020, with hospitality the most affected (-13.4%), followed by transport, storage and communication (-9.2%).

- Value of shares bought by non-Jordanian investors on Amman bourse was JOD 73.5mn or 10% of overall trading value during the period Jan-Sep this year.

- Volume of real estate trade in Jordan dropped by 29% yoy to JOD 2.257bn in Jan-Sep, with apartment sales down by 13% during this period.

- Following the appointment of a new Emir in Kuwait, the new Crown Prince took oath of office in Parliament last week (the Parliament’s term ended on Oct 8). Both the Emir and Crown Prince are brothers of the late ruler.

- Inflation in Kuwait increased by 0.43% mom and 2.18% yoy in Aug. Food prices posted the highest uptick (+5.02%), followed by cigarettes and tobacco (+3.29%) and clothing (3.26%).

- The Central Bank of Kuwait established the Higher Committee of Shariah Supervision – with members appointed for a 3-year term – to advise on Shariah compliance of its financial transactions with Islamic banks and financial institutions as well as propose general guidelines for products and services.

- PMI in Lebanon inched up to 42.1 in Sep (Aug: 40.1): new orders and output continued to decline, and businesses cite ongoing disruptions related to the Beirut port explosion and difficulties in securing USD.

- Lebanon’s caretaker PMI disclosed that USD 4bn had been spent so far in 2020 on subsidizing food, medicine, flour and wheat imports.

- An official source informed Reuters that Lebanon has about USD 1.8bn of its foreign exchange reserves available for subsidies; this could be stretched for 6 months if support for some subsidies was removed. Separately, Lebanese authorities are expected to create a special fund to help the needy families at a cost of USD 100mn a month.

- Consultations for forming the new government in Lebanon will begin on Oct 15, disclosed the President. Former PM Saad Hariri stated that his candidacy to reclaim the position was not off the table, emerging as the only confirmed figure in the running.

- Oman will re-impose nighttime lockdown from Oct 11 till 24th; the Supreme Committee also decided to prohibit the use of beaches till further notice.

- The number of SMEs in Oman increased by 12.4% yoy to 45706 as of end-Aug; Muscat topped the list with 33% of registered SMEs.

- Qatar PMI fell to 51.4 in Sep (Aug: 57.3) while the employment sub-index rose to a 6-month high; however, PMI averaged 56.2 in Q3 2020 – the highest quarterly average till date.

- Qatar increased the number of areas where non-Qatari individuals/ companies could own properties to 9 from the 3 before; the government will also grant residency to owners of property worth at least QAR 730k (USD 200k) as well as their families.

- PMI in Saudi Arabia increased to 50.7 in Sep after dropping to 48.8 in Aug and rising for the first time since Feb. Both new orders and output posted readings above 50 and employment fell at the softest pace since Mar.

- Value of contracts awarded in Saudi Arabia declined to SAR 11bn (USD 2.9bn) in Q2, bringing the value of contracts awarded in H1 to SAR 56.2bn (almost half value in H1 2019).

- Cement sales in Saudi Arabia increased by 23.5% yoy to 4.58mn tonnes in Sep 2020.

- Private sector firms in Saudi Arabia that are still affected by Covid19 repercussions need to inform the General Organization for Social Insurance of beneficiaries of SANED financial compensation: only 50% of Saudi workers will be provided wages by the government. Separately, the Covid19 related procedures within the Labour Law (reduction of salary with corresponding reduction in working hours, placing employee on paid annual leave, unpaid leave etc.) has been extended to 9 months from the start date (Apr 6th).

- Saudi Arabia’s schools will continue distance learning until the end of the first term of the educational year in

- Gold production in Saudi Arabia increased by 158% to 12,353kg at end-2019 compared to 5 years prior.

- In the 12th Annual ASDA’A BCW Arab Youth Survey, 46% of respondents chose UAE as the country they would like to live in, followed by the US (33%) and Canada (27%). The reasons for choosing UAE included safety and security (44%), work opportunities (36%) and salary packages (32%) among others.

- Extreme poverty in the MENA region increased to 7.2% in 2018 – the latest year for which data is available – up from 3.8% in 2015, according to World Bank. Extreme poverty is defined as living on less than USD 90 a day.

UAE Focus

- PMI in the UAE increased to 51 in Sep (Aug: 49.4), posting the highest reading in 11 months. Mildly higher exports sales were reported, cost burdens increased for the 5th consecutive month and discounting efforts – highest since Dec 2019 – helped to stimulate demand.

- UAE central bank, in a bid to support digital transformation strategy for public services, will allow government entities in Dubai and their customers to access the central bank’s direct debit service to facilitate customers’ payments through different banks.

- The UAE announced that issuance of entry and work permits for employment in government and semi-government entities will be resumed.

- Dubai issued a new building code that streamlines building rules also creating a unified set of standards for construction – all aimed towards lowering construction costs.

- The Etihad Credit Insurance issued over 1,400 revolving credit guarantees for a total exposure amount of AED 6bn, covering AED 4bn worth of non-oil exports in H1 2020.

- Dubai house prices – for apartments and villas – stood at a decade low of AED 896 per square foot in Sep versus 2010 when prices averaged AED 898 per square foot.

- LNG exports from UAE grew by 7.6% yoy to a total 1.4mn tonnes in Q2 2020. UAE’s LNG exports accounted for 1.6% of global LNG exports in Q2 and 5.5% of total Arab LNG exports.

Media Review

COVID’s Impact in Real Time: Finding Balance Amid the Crisis

https://blogs.imf.org/2020/10/08/covids-impact-in-real-time-finding-balance-amid-the-crisis/

Public Investment for Recovery

https://blogs.imf.org/2020/10/05/public-investment-for-the-recovery/

An Interview with Nouriel Roubini – Project Syndicate

https://www.project-syndicate.org/say-more/an-interview-with-nouriel-roubini-2020-10

Young Arabs look to emigrate as pandemic wrecks economies

https://www.ft.com/content/349a60db-6b12-4210-a2f1-019b3e38c280

Powered by: