This week’s “Weekly Insights” is on the state of equity markets in the region, with a focus on the UAE.

Markets

As the coronavirus spread to 26 countries outside mainland China, US and European markets posted a weekly loss, as did the MSCI index tracking global stock markets; Asian stocks largely fell (except in China). Regionally, markets mostly ended positive on higher oil prices. Qatar’s Doha Bank posted its biggest intra-day rise since May 2009, after a supplementary release mentioned a 5-year strategic plan for the bank. Safe haven assets like government bonds and gold gained: yield on the 30-year US Treasury hit a record low while gold price increased to its highest in more than 7 years. Among currencies, dollar touched a near 3-year high versus the euro and a 10-month high vis-à-vis the yen (FX chart: tmsnrt.rs/2egbfVh). Oil prices rose on worries of global energy demand and China’s recovery prospects amid supply disruptions.

Global Developments

US/Americas:

- Housing starts in the US dropped by 3.6% mom to a seasonally adjusted 1.567mn in Jan from an upwardly revised 1.626mn in Dec (the highest since Dec 2006). Building permits surged by 9.2% mom to 1.551mn in Jan – the highest level since Mar 2007 – thanks to gains in both single and multi-family housing segments. Existing home sales declined by 1.3% mom to a seasonally adjusted 5.46mn units in Jan. The 30-year fixed mortgage rate is at an average of 3.47%, the lowest since Oct 2016.

- Markit manufacturing PMI eased to 50.8 in Feb (Jan: 51.9) while services PMI slipped to 49.4 (53.4). Composite PMI slipped below the 50-mark, posting 49.6 in Feb vs Jan’s 53.3.

- Producer price index edged up by 0.5% mom in Jan (Dec: 0.2%), posting the biggest gain since Oct 2018, while the core PPI grew by 0.5% mom and 1.7% yoy.

- Initial jobless claims increased by 4k to 210k in the week ended Feb 14. The 4-week moving average of claims fell by 3,250 to 209k.

Europe:

- German ZEW economic sentiment slipped sharply to 8.7 in Feb (Jan: 26.7) while current situation also worsened (-15.7 from -9.5 the month before), as fears of disruption in the export-intensive sectors (due to the coronavirus epidemic) took hold.

- ZEW indicator of economic sentiment for the euroarea declined to 10.4 in Feb, from 25.6 the month before, while the indicator of the current economic situation went down by 0.4 points to -10.3.

- German manufacturing PMI improved to 47.8 in Feb from Jan’s low of 45.3; while new domestic orders increased, foreign orders fell at the fastest rate for 3 months. Services PMI slowed to 53.3 from the previous month’s 54.2, bringing down the composite PMI a notch to 51.1 (51.2).

- EU manufacturing PMI remained below 50 in Feb, but rose to 49.1 from 47.9 the month before (in spite of expectations of a dip thanks to the coronavirus scare). Services PMI picked up as well (52.8 from 52.5), thereby pushing the composite PMI up to 51.6 from 51.3. In France, however, the flash manufacturing PMI dropped to 49.7 in Feb (Jan: 51.1) as a result of a dip in airplane production and supply chain issues.

- UK manufacturing PMI climbed to a 10-month high of 51.9 in Feb from the 50-point mark the month before. Services PMI eased to 53.3 from 53.9.

- EU inflation declined by 1% mom in Jan (Dec: 0.3%), with core inflation falling by 1.7%.

- UK unemployment rate remained steady at 3.8% in the 3 months to Dec. The average weekly wages (including bonuses) reached their highest levels since before the financial crisis – rising to GBP 512 in the three months to Dec. Excluding bonus, average earnings growth decelerated to 3.2% from 3.4% in Dec.

- UK inflation edged up to a 6-month high of 1.8% in Jan (Dec: 1.3%), thanks to an increase in energy prices (+4.7% yoy). Core inflation also increased, rising to 1.6% from 1.4% the month before. Producer price index increased by 2.1% yoy in Jan (Dec: 0.9%), implying some price pressures for consumers going forward.

- UK retail sales bounced back in Jan, rising by 0.9% mom and 0.8% yoy; sales at food retailers grew by 1.7% while department stores reported a 1.6% increase in sales.

Asia Pacific:

- China’s PBoC cut its benchmark lending rates: one-year loan prime rate was lowered to 4.05% from 4.15%, and the five-year rate to 4.75% from 4.80%. Expected, as the nation deals from the repercussions of the coronavirus outbreak, this rate cut followed an earlier move (in the week) to lower the interest rate on its one-year medium-term lending facility (funds that PBoC lends to financial institutions) to 3.15% from 3.25%.

- China’s FDI grew by 4% yoy to CNY 87.57bn in Jan (Dec: 5.8%), with FDI in high tech industries up 27.9% to CNY 31.35bn (or 35.8% of total FDI).

- China’s new yuan loans accelerated to CNY 3.34trn in Jan (USD 476.97bn) from CNY 1.14trn in Dec, supported by corporate loans (rising to CNY 2.86trn from Dec’s CNY 424.4bn). Money supply growth eased in Jan, rising by 8.4% yoy vs the previous month’s 8.7%. Outstanding yuan loans grew 12.1% yoy compared with 12.3% growth in Dec.

- Japan GDP shrank by 1.6% qoq in Q4 (Q3: 0.4%) – this is the biggest contraction since 2014. It posted a more severe 6.3% plunge, at an annualized rate. A dip in growth was expected on weaker domestic demand following Oct’s sales tax hike and aftermath of Typhoon Hagibis.

- Japan’s industrial production decreased by 3.1% yoy in Dec (Nov: -3%), according to the government’s final estimate; in mom terms, it increased 1.2%.

- Japan’s machinery orders tumbled by 12.5% mom (the fastest pace since 2018) and 3.5% yoy in Dec, from 18% mom and 5.3% yoy uptick the month before. Core machinery orders fell by 12.5% mom in Dec – the largest drop since Sep 2018.

- Japan’s trade deficit widened to JPY 1.31trn in Jan (from an upwardly revised JPY 154.6bn in Dec). Exports and imports were down by 2.6% and 3.6% respectively (Dec: -6.3% and -4.9% yoy). Japan’s trade balance with Asia turned red for the first time in a year with a deficit of JPY 567.86bn.

- Japan inflation eased to 0.7% yoy in Jan (Dec: 0.8%). Core CPI edged up to 0.8% (0.7%) while core-core CPI (excluding food and energy) slipped to 0.8% (0.9%)

- Japan manufacturing PMI slipped further to 47.6 in Feb (Jan: 48.8) – the sharpest deterioration since late 2012. The flash services PMI came in at a seasonally adjusted 46.7 from the previous month’s 51, its lowest reading since Apr 2014.

- Singapore GDP increased by 0.6% qoq and 1% yoy in Q4, slightly above flash initial estimates, bringing full year 2019 growth to 0.7% (2018: 3.4%) – the slowest since the 2009 financial crisis. Economic growth this year is expected at 0.5% – the mid-point of a new estimated range of between -0.5% and 1.5%, according to the Ministry of Trade and Industry.

Bottom line: The virus spreading to 26 nations across the globe is raising questions about the economic impact. As many nations/ cities close borders (e.g. Iraq and Kuwait close Iran borders after a spike in cases in the latter; northern Italian towns closed schools and businesses), the economic impact will depend on how far the virus spreads and how fast. The International Air Transport Association’s initial forecasts are that global airline revenues could take a near-$30bn hit in 2020 due to the coronavirus, which is negatively impacting passenger demand – though some countries seem to have been relatively unaffected (see chart – https://econ.st/2VcNOAg – is that a result of cases being undetected or undiagnosed till date?)

Regional Developments

- Imports into Bahrain declined by 11% yoy to BHD 4.98bn in 2019; the top 10 nations – China (BHD 777mn), Australia (BHD 352mn), UAE (BHD 349mn), Saudi Arabia, Brazil, US, Japan, India, Germany and UK – accounted for 68% of the value of imports during the period. Exports meanwhile edged up by 0.5% yoy to BHD 2.298bn.

- Bahrain collected BHD 250mn from VAT last year, versus an estimated BHD 150mn (as per the budget).

- A new Royal decree in Bahrain imposes pay cuts for public servants who are found to be guilty of violations. There will be no suspension from work.

- Egypt’s GDP grew by 5.6% yoy in Jul-Dec 2019, supported by the wholesale and retail sector (a contribution of 14.7% to GDP), followed by the industrial sector (12.6%), and the agriculture, forestry and fishing sectors (12%).

- Egypt’s central bank held its overnight deposit rate unchanged at 13.25% and its overnight lending rate (also unchanged) at 12.25%.

- Interest paid by Egypt’s government grew by 28.7% yoy to EGP 267.19bn during H1 2019-2020 (Jul-Dec 2019). The country is expected to pay EGP 971bn worth of interests and installments during the financial year (EGP 596bn interests and EGP 375bn installments).

- Government spending on employee salaries and compensation in Egypt increased by 12.2% yoy to EGP 147.22bn in H1 2019-2020. Additionally, public expenditure on health and education grew by 20% and 14% yoy respectively during this period.

- Remittances into Egypt advanced by 12.1% yoy to USD 11.1bn during Jul-Nov 2019; in Nov alone, it grew by 6.8% to USD 2bn. The central bank disclosed having received more than USD 12bn in cash flows since Jan 2020.

- Egypt lowered its spending on fuel subsidies drastically by 67.2% yoy to EGP 9.87bn in H1 2019-2020. By quarter, spending slowed to EGP 2.87bn in Q2 from Q1’s EGP 7bn.

- Egypt currently operates 7 investment zones with total investments of EGP 29.5bn, spanning 800 projects and with 75k employees, according to the General Authority for Investment and Free Zones. A further 11 zones are being built and are expected to create about 208k jobs and attract EGP 78bn in investments.

- Egypt hired a group of 4 banks as it prepares to become the first country in the MENA region to issue sovereign green bonds. Of these – De3utsche Bank, Citi, HSBC and Credit Agricole – the latter will also act as advisors for the issue.

- Iraq‘s prime minister-designate disclosed, in a televised speech, the formation of a politically independent cabinet, while also calling for the Parliament to hold an extraordinary session on Monday to give a vote of confidence. They need 166 of 329 MPs to vote in favour of the proposed cabinet and plan.

- Jordan announced the 5th executive package for improving business services – the focus of this package is to improve e-government tools i.e. to reduce time and effort by digitalising information and online transaction services to citizens.

- Tourism revenue in Jordan accelerated by 11.4% yoy to JOD 361.8mn in Jan 2020, thanks to the 12.1% rise in tourists (to 487,900). Saudi Arabia, Iraq and Palestine visitors accounted for 14.4%, 6.4% and 4.7% of total tourism income.

- Kuwait’s budget deficit touched KWD 2.3bn (USD 7.52bn) in Apr 2019-Jan 2020, after 10% of revenue was deposited to the Future Generations Fund’s reserve. Revenues shrank by 15.99% to KWD 14.29bn (90.4% of total revenue estimated for the 2019-2020 financial year) while expenses surged by 10.3% to KWD 15.13bn (67.2% of estimated spending for FY).

- Inflation in Kuwait advanced by 1.68% yoy in Jan, with telecom prices rising 4.4% while housing costs picked up by 0.68%.

- Credit growth in Kuwait remained steady in 2019, rising by 3% yoy compared to 4.2% the year before, largely due to a 9% rise in credit to non-bank financial institutions. Both business lending (4.3% from 2018’s 5.1%) and credit to households (5% vs 6%) weakened.

- Kuwait’s parliament approved a draft law to establish a sharia board to oversee banking and Islamic finance.

- The draft law to privatize Kuwait’s electricity sector will not be ready in the current cabinet, as its legal aspects and organizational structures are still being studied, revealed the minister of oil and minister of water and electricity.

- Kuwait and Saudi Arabia have begun trial oil production from the jointly-operated Wafra and Khafji oilfields: production from the Neutral Zone is expected to reach 550k bpd by end of this year.

- The IMF team are in Lebanon (Feb 20-23), as meetings progress on providing broad technical advice “exclusively”; no financial assistance has been requested from the Fund.

- S&P Global and Moody’s downgraded Lebanon deeper into junk territory: S&P lowered Lebanon’s ratings to CC/C from CCC/C with a negative outlook. Moody’s cut Lebanon’s government issuer rating to Ca from Caa2; downgraded senior unsecured medium-term note programme rating to (P)Ca from (P)Caa2; long-term foreign currency bond and deposit ceilings have both been lowered to Ca from Caa1 and Caa3.

- Reuters reported that Lebanon had formed a committee (on Wed) – including ministers, government officials, a central bank representative and economists – to prepare an economic recovery plan.

- Lebanon was expected to review proposals (last Fri) from firms bidding to be its financial and legal advisers – for its 2020 Eurobond maturities and its overall Eurobond portfolio. No updates have yet been provided, though a quick decision is expected.

- Lebanon’s dollar bonds fell to record lows last week – some as low as 29 cents on the dollar – after the Speaker’s comments that debt restructuring was an “ideal solution”.

- Inflation in Oman edged up by 0.43% yoy in Jan, after a 1.93% rise in food and beverage prices alongside an increase in education (2.18%) and hotels and restaurants costs (1.03%). Vegetable and non-alcoholic beverages prices were up by 7.47% and 13.56% respectively.

- The 100% ownership under Oman’s new Foreign Investment Law will not be applicable on 37 businesses (that are mostly Omani-operated small businesses) like translation, photocopying services, tailoring, laundry, vehicle automotive repairs, manpower and recruitment services, hairdressing and salon services and taxi services among others.

- Oman’s oil output touched 958,270 barrels per day (bpd) in Jan; oil exports were down by 17.88% mom to 756586 bpd.

- Saudi Arabia is projected to see an upturn in growth this year, thanks to the non-oil sector, disclosed the central bank governor at a G20 meeting.

- Inflation in Saudi Arabia rose by 0.4% yoy in Jan as prices of food and beverages picked up by 2.2% alongside a 3.3% dip in housing and utilities costs.

- Saudi Arabia plans to introduce new franchising laws “within a few weeks”, according to the chairman of the Franchise Committee.

- Saudi Arabia’s crude stockpiles fell by 11.8mn barrels to 155.199mn barrels in Dec while crude exports remained unchanged at 7.373mn barrels per day in spite of a drop in production (9.594mn bpd from 9.89mn bpd in Nov).

- Saudi Aramco plans to invest USD 110bn to develop unconventional gas reserves in Saudi Arabia’s Jafurah field. Estimated to hold 200trn cubic feet of wet gas, the phased development of the field could raise production to 2.2trn cubic feet by 2036 if fully completed.

- Average steel prices in Saudi Arabia increased by 4.38% yoy to SAR 2550.2 per tonne in Jan – the highest since Sep 2019. Average cement prices grew to a 38-month high of SAR 13.33 per bag (+4.9% yoy).

- GCC witnessed 4 IPOs in Q4 2019, raising a total of USD 26bn, with the energy industry leading the pack. The quarter also saw ICBC’s two bond listings in Nasdaq Dubai – at USD 4.6bn from 9 issuances, this is highest value of conventional bond listings on the exchange by any overseas issuer.

- More than USD 23bn in hotel construction contracts are scheduled to be awarded in the region between now and 2023, according to MEED. Saudi Arabia and UAE have contracts worth USD 9bn and USD 7.6bn respectively in the pipeline, followed by Oman (USD 2bn) and Egypt (USD 1.9bn).

UAE Focus

- It has been a year since the launch of Abu Dhabi’s Ghadan 21 initiative, and more than 50 initiatives are underway to attract and support small businesses. Achievements include Hub71 (the technology centre) with 39 startups, the Abu Dhabi Climate Initiative, the AED 535 Ventures Fund and so on. (More: https://www.docdroid.net/ehbTqvl/ghadan21.pdf)

- Abu Dhabi government plans to issue tenders worth AED 10bn under the public-private partnership (PPP) model to support infrastructure investment in the emirate.

- Abu Dhabi’s non-oil trade declined by 6.1% yoy to AED 194.43bn in Jan-Nov 2019, as non-oil exports slide by 11.4% to AED 52.51bn alongside a 9.8% dip im imports.

- S&P Ratings kept its outlook for Sharjah stable, but downgraded the long-term foreign and local currency sovereign credit ratings to “BBB” from “BBB+”. Separately, Moody’s changed its outlook from “negative” to “stable” but downgraded the long-term currency issuer ratings to Baa2 from A3, due to rising debt burden and weaker than expected financial strength.

- DP World announced that it would delist from Nasdaq Dubai and return to private ownership. The company has about USD 9.9bn in debt maturing in 2022 and a further USD 1.1bn due in 2026.

- Dubai Economy’s latest Q1 survey results reveal that 60% of businesses are optimistic about business conditions this year (vs 58% in Q4 2019), with 56% responding that they expect a rise in commercial activity given the Expo.

- Abu Dhabi is expected to add 28k residential units between 2020 and 2023, adding to the current 258k units, according to CBRE.

Weekly Insight on UAE/ GCC equity markets

Three news snippets were out last week: 1. Delisting of DP World; 2. Questions over the ownership structure and governance of NMC Health (the Middle East’s largest hospital operator and largest private healthcare provider in the UAE) 3. Drake & Scull’s allegations of embezzlement and fraud.

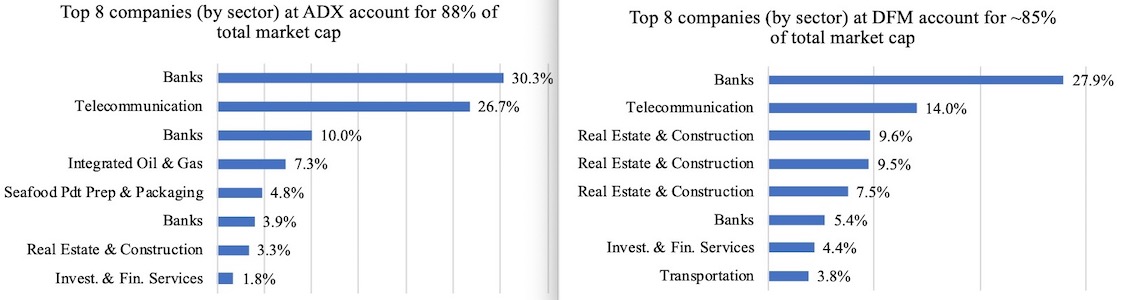

Last year, the Aramco IPO brought much cheer to regional equity markets alongside the inclusion of Saudi Arabia into emerging market indices (following UAE and Qatar previously, Kuwait to be included this year). However, markets in the GCC – in spite of many financial liberalization measures – continue to be sidelined by global investors. To a large measure, these markets generally continue to be illiquid, with a large retail investor base, and remain highly concentrated in a few sectors (banks, real estate and insurance).

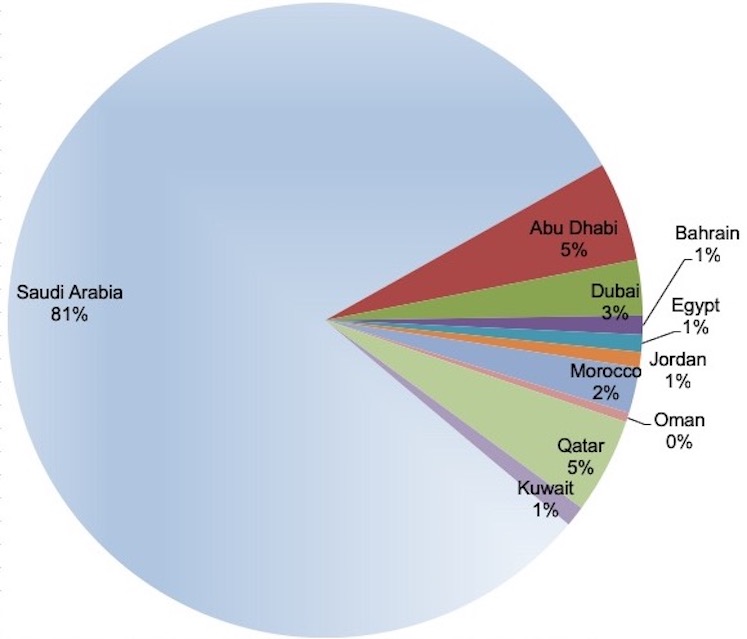

A key point to highlight is that of size: take the example of UAE, with a population of just over 9 million and a nominal GDP of around USD 400bn. It is currently home to 3 stock exchanges (Abu Dhabi Securities Exchange, Dubai Financial Market, and Nasdaq Dubai; a fourth has already been announced at the recently created Dubai Future District). With a combined UAE market cap of just under 10% within MENA exchanges (in a pie dominated by Saudi Arabia), perhaps consolidation should be the name of the game.

Chart 1. Market Cap across major MENA stock markets

Source: Thomson Reuters Eikon, Nasser Saidi & Associates. Data as of Feb 20, 2020

In addition to consolidation, diversifying the sectors would have been the next best move. Ideally, the Aramco IPO should have opened the road to other privatisations in Saudi Arabia and across the region – a move that would have attracted private capital, new tech and resulted in job creation, all leading to greater openness and increased economic diversification. However, the current delisting of DP World (Nasdaq Dubai’s biggest listing) seems to have thrown a spanner into the works. In being taken over by the parent company Port and Free Zine World, the company will once again become fully government owned. This move also comes at a time when the UAE government was actively encouraging family-owned enterprises to list (through changes in its Agency Laws), and this is unlikely to provide any comfort to the many families in the region nor to businesses that were planning to IPO in the immediate future.

Chart 2. Top 8 stocks (by sector) at ADX and DFM account for ~85% of total market cap

Source: Thomson Reuters Eikon, Nasser Saidi & Associates. Data as of Feb 20, 2020

The other point to highlight is an important one of governance. Transparency and disclosure are an important component prior to any company going public. The case of NMC Health (where the complex shareholdings of top investors continue to remain a mystery) and Drake and Scull (where embezzlement and fraud accusations are being traded) not only highlights governance issues and transparency, but also call into question the standards of regulatory due diligence and risk review process. We do hope that the UAE’s latest corporate governance code offers some comfort to foreign investors looking to invest in the country!

Media Review

Dr. Nasser Saidi’s interview on Lebanon, UK’s new finance minister & corporate governance: Dubai Eye’s Business Breakfast show 18.02.2020

https://omny.fm/shows/businessbreakfast/nasser-saidi-associates-18-02-2020

WTO’s goods trade barometer signals further weakening of trade into first quarter

https://www.wto.org/english/news_e/news20_e/wtoi_17feb20_e.pdf

China’s manufacturing supply chain pummelled from all sides in efforts to restart

https://www.scmp.com/economy/china-economy/article/3051534/coronavirus-chinas-manufacturing-supply-chain-pummelled-all

The White Swans of 2020: Roubini

https://www.project-syndicate.org/commentary/white-swan-risks-2020-by-nouriel-roubini-2020-02

Are oil and gas turning into stranded assets? FT Podcast

https://www.ft.com/content/07dcd8d7-9492-4dfc-a54f-10c4b62cd558

Powered by: